Up to date as of February 26, 2024

Tapioca is the first fully cross-chain permissionless money market for long-tail assets. As a protocol, Tapioca allows users to lend and borrow assets between different networks, basically defragmenting liquidity and achieving higher levels of capital efficiency by being interoperable. Currently, 12 EVM networks are supported, but more non-EVM compatible chains will also be integrated in the future.

Tapioca is a LayerZero omnichain money market across 12 EVM networks. Omnichain composability allows users to lend and borrow assets across chains, creating frictionless liquidity (not fragmented across chains) and more capital efficiency. Thanks to this cross-chain functionality, more lending and borrowing opportunities open up for users to generate real yield on their assets regardless of the network the original assets are on.

By using the generalized cross-chain messaging framework of LayerZero, Tapioca can become the decentralized liquidity layer of DeFi and empower users of many chains.

There are several features of Tapioca that make it stand out. Besides its cross-chain functionality, which is both capital efficient and convenient for users, Tapioca is introducing the Yieldbox, which is a vault similar to SushiSwap’s BentoBox, except that it can also receive deposits of NFTs, rebase tokens, and risk-isolated strategies. On top of the Yieldbox, they’ve also built Singularity, a dApp that enables higher leverage via isolating risk, so that the risk of assets within one market has no effect on the risk of another market.

Tapioca is also introducing the first omnichain stablecoin, USD0, which will also be non-algorithmic, overcollateralized, and censorship-resistant. Being omnichain by using LayerZero’s messaging technology means that users won’t have to rely on a third-party bridge to move their stablecoins, or deal with fragmented liquidity.

Another unique idea being developed is the distribution of their native TAP token, which will be done by airdropping early users of the Tapioca protocol with options to buy the TAP token at a discount, rather than just airdropping tokens or introducing a liquidity mining program.

The project’s origin goes back to its first tweet on Dec 31, 2021. Tapioca’s vision lies on the premise that fragmented stablecoin liquidity across chains is a source of friction for DeFi users since they often have to wait for several minutes and/or incur slippage when transferring assets from one chain to another.

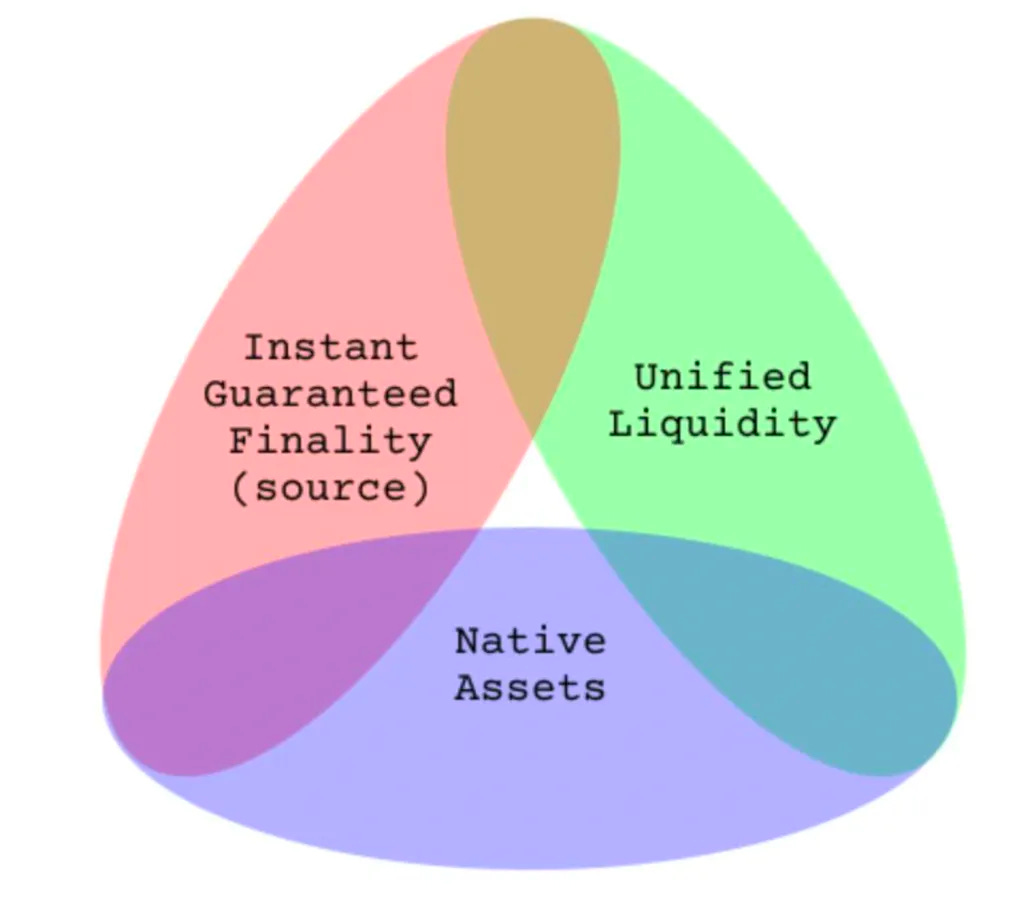

On this basis, Tapioca tackles the field of money markets and leverages the potential of the cross-chain technology provided by LayerZero. For instance, USD0 removes the friction for users to rely on bridges in order to transfer assets from one chain to another as well as to manage their borrowing and lending positions on different chains. The OFT20 standard makes USD0 the first stablecoin to be composable across multiple blockchains – solving the stablecoin trilemma of price stability, decentralization or censorship resistance, and scalability or composability.

Tapioca will be one of the first protocols to enter the market without incentivizing the usage of the protocol with a standard liquidity mining campaign.

Liquidity mining is the mechanism used by most protocols in order to attract new users and incentivize them to provide liquidity in the protocol in exchange for a token reward.

Tapioca has pioneered the concept of the DeFi monetary policy trilemma, which features sustainability, permanent value capture, and financial alignment of the invested participants.

Although some protocols like Synthetix distribute native token rewards before the beginning of DeFi summer in 2020 with their StakingRewards contract, the origin of Liquidity Mining goes back to June 16th, 2020. This is when Compound announced that protocol users who borrowed or lent assets on the platform would be rewarded with COMP tokens. This meant that these extra reward tokens could increase the returns for lenders and subsidize interest rates for borrowers. As a result of this announcement, The TVL (Total Value Locked) of Compound instantly rose 600%.

Very few of the actual protocol users ended up finding value in holding the COMP governance token and most people ended up selling the newly emitted COMP tokens they received. Only 19% of the accounts kept more than 1% of the COMP tokens they claimed, selling 99% of their liquidity incentive rewards on the market.

This practice led to an increase in operating expenses. By minting and giving away COMP tokens, Compound was renting liquidity from its protocol users. However, the costs from renting this liquidity exceeded by far the revenue that the protocol generated as a result of this practice.

Most DeFi protocols are extremely unprofitable. This is not necessarily a problem with the profits they make from fees. For example, Aave generated over $100M in revenue annualized. However, 90% of this revenue was being distributed to lenders, leaving the protocol with only 10% of $10.92M. On top of that, Aave paid out $74M in incentives to rent liquidity. This created a net loss of $63.96M for one of the largest protocols in DeFi.

MakerDAO, for instance, generated $28.61M in total revenue, all of which was accrued to the DAO (since there were no reward token dividend payouts). By not having a reward token, the protocol avoided having an operational loss and the protocol users would not be diluted in any way.

While it might be true that liquidity mining programs can be an extra incentive to attract liquidity and new protocol users, it has been proven that these practices end up attracting the wrong kind of users, who simply use the protocol to accrue the rewards and immediately sell them on the market for a profit. This creates a deep misalignment between the protocol users and the protocol itself.

Tapioca believes that once a token has an acceptable liquidity incentive design, it also requires a sound monetary policy that addresses the issue of token supply, token demand, amount of tokens in circulation… After all, liquidity mining has proven to be a cost for renting liquidity and that often attracts users who do not have a long-term stake in the growth of the protocol.

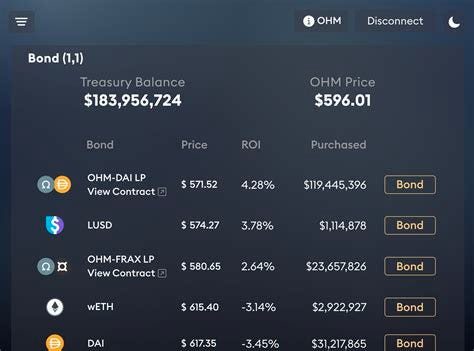

One of the first protocols that broke against the recurrent practice of liquidity mining was Olympus DAO, which came up with an alternative that would allow the DAO itself to increase its balance sheet and create POL (Protocol Owned Liquidity). This solution, known as bonding, consisted in quoting bond prices based on the protocol’s risk-free value. In other words, the DAO would sell tokens to its bonders at a discount in exchange for receiving liquidity that would remain in the protocol as POL. Because OHM tokens are cheaper by creating a bond than buying them on the open market, users are incentivized to sell their liquidity in exchange for the protocol’s native token. This would allow the DOA to grow its own liquidity. While this was an alternative model to liquidity mining, this model ended up failing due to a (3, 3) hyperinflationary mechanism that caused the OHM token to enter a price-death spiral. Eventually, the participants who controlled the majority of the OHM supply started selling the OHM tokens back for POL assets, which led to a sudden decrease in confidence in the (3, 3) model.

An alternative model was pioneered by Curve as well, the ve (vote escrowing) model. Curve realized that protocol loyalty was important for the long-term growth of the protocol, and its tokenomics required users to lock up their liquidity rewards in order to maximize the returns they could get on their LP tokens. Essentially, this created a tiered incentive structure where the more aligned you are with the long-term vision of the protocol, the more rewards you will receive. However, the problem is that Curve owns no liquidity and its investors would be diluted by inflationary CRV emissions. When the value of CRV goes down, CRV incentives are less valuable, and therefore, governance decisions on which pools should benefit from those emissions become much less valuable.

While protocols such as Convex and Redacted solve for the inefficiencies of the ve model, such as having to lock LP tokens for 4 years, Curve could capture more liquidity with veCRV incentives rather than incentivizing liquidity with their native CRV token. From the protocol’s point of view, this would be the equivalent of giving up on valuable assets that the protocol could acquire. By observing this behavior, the core team behind Tapioca realized that Curve’s permanent liquidity was because other protocols were forced to rely on Curve in order to survive (stabilize their stablecoins). This leads to the realization that Curve could simply own more liquidity from the amount of fees that the protocol generates.

Tapioca then drew the inspiration for their tokenomics from Andre Cronje’s Options Liquidity Mining. Andre realized that if users provide liquidity to Curve and claim their CRV as their liquidity mining reward, they would be implicitly exercising a call option, where the LP just exercised a CRV call option with a strike price of $0 and no expiry. Nevertheless, this does not necessarily produce any revenue for the protocol in order to use this liquidity to sustain the protocol’s operations. What Tapioca realized is that by owning its own liquidity, the protocol would have no need to incentivize it anymore.

While Tapioca will move on a similar path to Andre’s OLM, it will seek to acquire as much POL as possible with carefully pre-calculated native token inflation. Once the supply of the native TAP token is fully in circulation, the DAO would subsidize its operations from POL, and the fees and yield generated on this POL would be enough to create permanent value for the protocol. In other words, Tapioca will optimize for obtaining POL, using this POL to earn yield and acquire more POL from this yield.

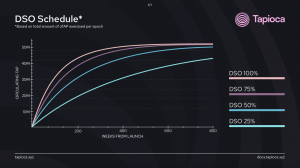

With Tapioca’s DSO (DAO Share Option) model, the protocol will manage to quantify the value it receives from its users as well as the value being given to them. Its monetary policy does not fall into the trap of getting big numbers in terms of TVL but instead takes into account a time component: the longer the liquidity is locked into the protocol, the more yield the protocol can generate and the more POL can be created.

As the protocol is still yet unlaunched and in the production stages, the roadmap is constantly changing. As of February 2023, the current milestones are:

As a protocol, Tapioca is a huge believer in the Omnichain thesis. This statement is reinforced by the explosive growth of new layer 1 chains, sidechains, and layer 2 solutions that have started to gain more market share over the past 2 years. For instance, at the beginning of 2021, Ethereum’s market share of DeFi TVL was close to 100%. However, by the end of 2021, that market share fell to 65%.

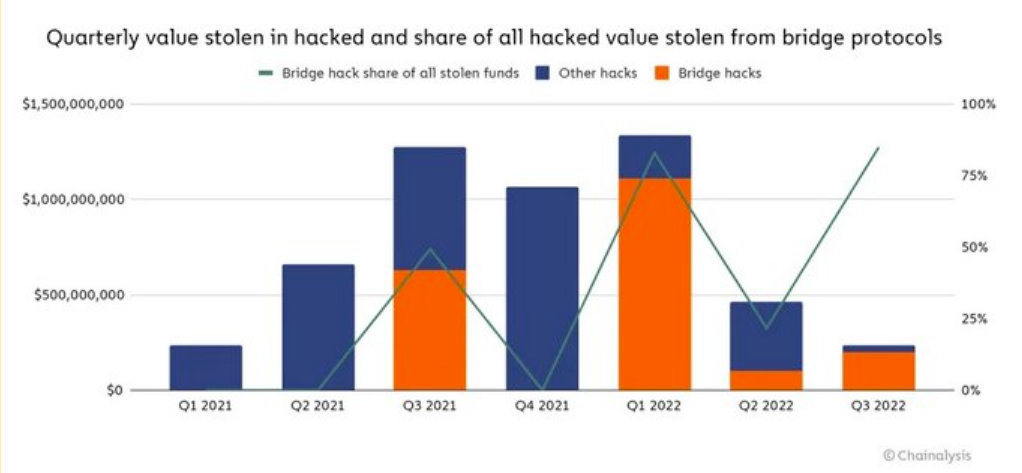

This falling market share, combined with the need for lending on alternative chains, is what inspired Tapioca to quickly fulfill the demand for cross-chain money markets with minimal infrastructure. This was achieved using LayerZero as the underlying technology. The fact that Tapioca relies on minimal infrastructure gives the protocol a competitive advantage versus other projects that rely on bridges and wrapped asset transfers, which have suffered multiple exploits over the past 2 years.

Similarly, Tapioca aims to meet the demand for long-tail assets (which make up 40% of DeFi liquidity) on money markets. Current money markets like Aave and Compound were not designed to handle risks associated with these assets. That’s why they rely on permissioned listings. Other money markets such as Alchemix and Abracadabra have also relied on permissioned systems for borrowing against preselected assets in order to borrow MIM and alUSD. The value proposition of Tapioca is to allow users to borrow against LP tokens, yield-bearing assets, and even NFTs (Non-Fungible Tokens).

Overall, Tapioca is the first money market that enables interoperability and composability across chains, reunifying the current liquidity fragmentation between different markets. Its modular architecture, combined with the technology of LayerZero allows the protocol to route messages across different endpoints validated by an Oracle on multiple chains. In fact, Tapioca does not just use Stargate to automate the process of bridging but utilizes the LayerZero messaging system to have a presence on multiple chains, such as Ethereum, Binance Smart Chain, Optimism, Arbitrum, Fantom, Polygon Matic, and Avalanche.

Since 2020, the increased TVL and network activity in Ethereum has resulted in significant gas costs as a result of the network being congested.

Due to the stress the network was being put under, Ethereum gas fees started to sharply increase while slowing down transactions on the chain. Since gas fees are not calculated based on the size of the transaction but rather on the base costs of interacting with a given smart contract at a specific point in time, whales were less affected than retail users, most of which were left out of the market, since even a Uniswap swap could cost $200 in gas fees.

As time went by, alternative chains started to emerge and gain market share, with Binance Smart Chain (BSC) being the most notable beneficiary. However, as more dApps started to be deployed on BSC, users were faced with another problem: bridging funds from one chain to another.

The bridging trilemma involves finality, security, and composability. Connecting different chains adds many layers of complexity since every network has its own set of idiosyncrasies, mechanisms, and other nuances that its developers have to deal with. This problem is not solved by wrapped assets. For example, if the smart contract controlling the USDC tokens on Ethereum that back USDC.e on Avalanche are hacked, the wrapped USDC.e tokens would have no value whatsoever (custody risk).

Up until now, most protocols have chosen to deploy their contracts on each chain they want to be present on. However, there is no way that these protocols can sync their state between the smart contracts on different chains. If they wanted to interconnect those contracts, they would have to write code for every separate bridge that exists on each of these chains. The end result would be dozens of separate codebases (more risk) with unique interfaces and nuanced security properties, which becomes an untenable value proposition.

By using LayerZero, Tapioca builds upon a communication protocol that enables smart contract executions across multiple chains. With one transaction, the protocol can send arbitrary messages from a source to a destination chain.

Under the hood, there are multiple LayerZero endpoints on each supported chain, and each of these endpoints can conduct cross-chain transactions with an infrastructure of ULN (Ultra Light Nodes).

Because of this, whenever Tapioca wishes to support a new chain, it will not need to deploy its core smart contracts to each chain. Instead, Tapioca only needs to deploy a proxy lightweight contract that will be used to send and receive messages from the newly supported chain to the host chain. This allows Tapioca to reunify liquidity, and user flows, and reduce infrastructure risk.

The user experience is largely enhanced by the novel mechanism of TOFT: the Tapioca Omnichain Fungible Token Extensible Environment. TOFT creates a universal layer of liquidity that makes token supplies elastic between networks and allows for bridging at the token level, rather than at the protocol level. For instance, a user on Binance Smart Chain could borrow against BNB, and this BNB would be wrapped into tBNB in order to be omnipresent on all supported chains. Besides, with USD0, the first omnichain stablecoin, Tapioca can de-silo liquidity by allowing users to bridge assets without relying on an intermediary protocol. While most current stablecoin offerings lack secure and trustless composability, by utilizing LayerZero OFT20 standard, USD0 will be the first censorship-resistant stablecoin that can be transported across multiple chains without the need for a bridge, wait times or fees.

Tapioca introduces the novel DeFi primitive of TOVTs, which stands for Tapioca Omnichain Vault Tokens. TOVTs are omnichain fungible tokens that represent the holder’s share of the vault they are participating in (tETH, tAVAX, tMATIC…). OFTs can be moved to any other chain supported by LayerZero with zero fees. The yield of TOVTs is the result of a collaboration with Gelato, which allows Tapioca to analyze and reposition user funds in the best-performing and whitelisted yield-bearing assets. For instance, as yields increase/decrease in specific protocols, Tapioca can seamlessly optimize the yield strategy.

By bootstrapping the protocol through its DSO (DAO Shares Options) program instead of doing so via a traditional liquidity mining incentives campaign, Tapioca manages to differentiate itself from other money markets and DeFi protocols from:

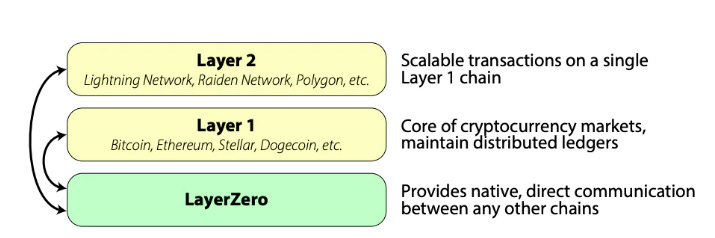

Over the past years, there has been a surge in rollups, side chains, and alternative Layer 1 and Layer 2 blockchains featuring many different architectures. The next challenge to solve in order to provide a multichain experience is interoperability.

Due to this diversity in designs, most blockchains cannot natively communicate with one another. This leads to liquidity fragmentation across multiple chains and protocols that are isolated. Besides, bridging between these chains can be expensive and insecure, which introduces an additional layer of fees, and trust.

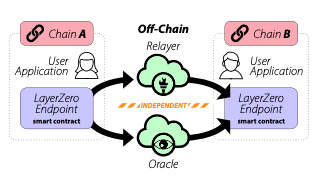

Multichain messaging presents multiple challenges that Tapioca seeks to solve using the technology of LayerZero. This approach splits the responsibility between an oracle and a relayer. The relayer submits proof of transactions, while the oracle assumes the responsibility of broadcasting the block header on which the transaction occurs.

By leveraging LayerZero, Tapioca’s goal is to solve the bridging trilemma: fast finality, shared liquidity across chains, and the ability to use native assets. Through this solution to interoperability, Tapioca is able to offer innovative use cases to the lending and borrowing space:

Supported Chains:

While LayerZero also provides support for Moonbeam, Metis, Celo… Tapioca does not plan to support these chains due to their low liquidity depth and the volatility of their network tokens.

LayerZero is an interoperability protocol that facilitates interactions and integrations between separate blockchain networks and ecosystems. The core idea relies on an infrastructure that enables the transfer of messages between two on-chain endpoints: the oracle and the relayer.

Tapioca has built all of its smart contracts with native integration of LayerZero. This is different from other protocols that deploy their applications to multiple chains and then rely on bridges and wrapped assets to move funds from one chain to another. Contrary to other cross-chain solutions like bridging, LayerZero removes the need for an intermediary protocol. LayerZero technology uses a relayer that passes the messages to an oracle, and the oracle is responsible for confirming the receipt of the message.

A relayer is an off-chain technology that fetches the proof of a specific transaction being executed in order to verify the validity of that transaction

LayerZero is a blockchain primitive that enables the deployment of applications on different chains while still allowing them to communicate with one another. The core difference between LayerZero and bridges is that LayerZero does not require any intermediary blockchains or consensus mechanisms. Because of this, LayerZero is considered a messaging protocol that allows for the seamless communication of applications across chains.

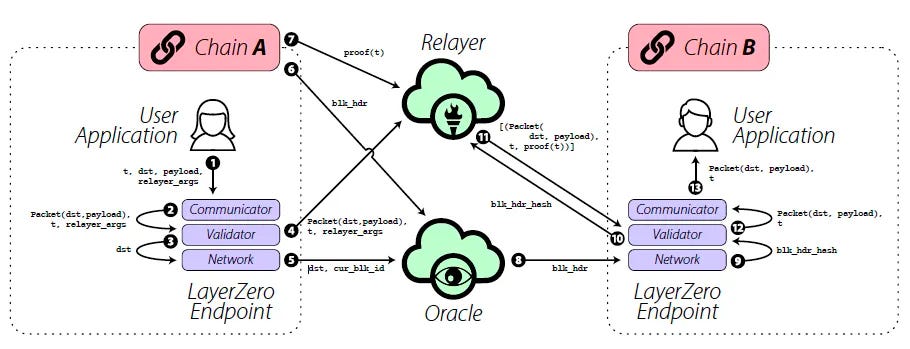

When a User Application sends a message from chain A to chain B, the message is routed through the endpoint on chain A. The endpoint then notifies the User Application specified Oracle and Relayer of the message and its destination chain.

The process consists of chain A compiling and transferring the message to LayerZero. LayerZero then shares the block ID of the request to the oracle. Subsequently, the off-chain relayer gets the content of the message while the oracle holds on to the block ID. Finally, now that the relayer has the message and the proof of the original transaction, it can prove that the request was made and passes along the block information of the original request.

Tapioca’s relayer is called the Pearlnet. The protocol will allow TAP to be staked in a DPOS (Delegated Proof of Stake) system that lets users delegate their tokens to validators who are in charge of securing the cross-chain messaging infrastructure. Whenever a validator attempts to commit any sort of harmful behavior, it will be slashed.

Tapioca’s relayer is called the Pearlnet. The protocol will allow TAP to be staked in a DPOS (Delegated Proof of Stake) system that lets users delegate their tokens to validators who are in charge of securing the cross-chain messaging infrastructure. Whenever a validator attempts to commit any sort of harmful behavior, it will be slashed.

When it comes to the Oracle infrastructure, Tapioca’s configuration will use Chainlink as the main provider. Besides, the protocol will cross-check results with other data providers in a sanity check.

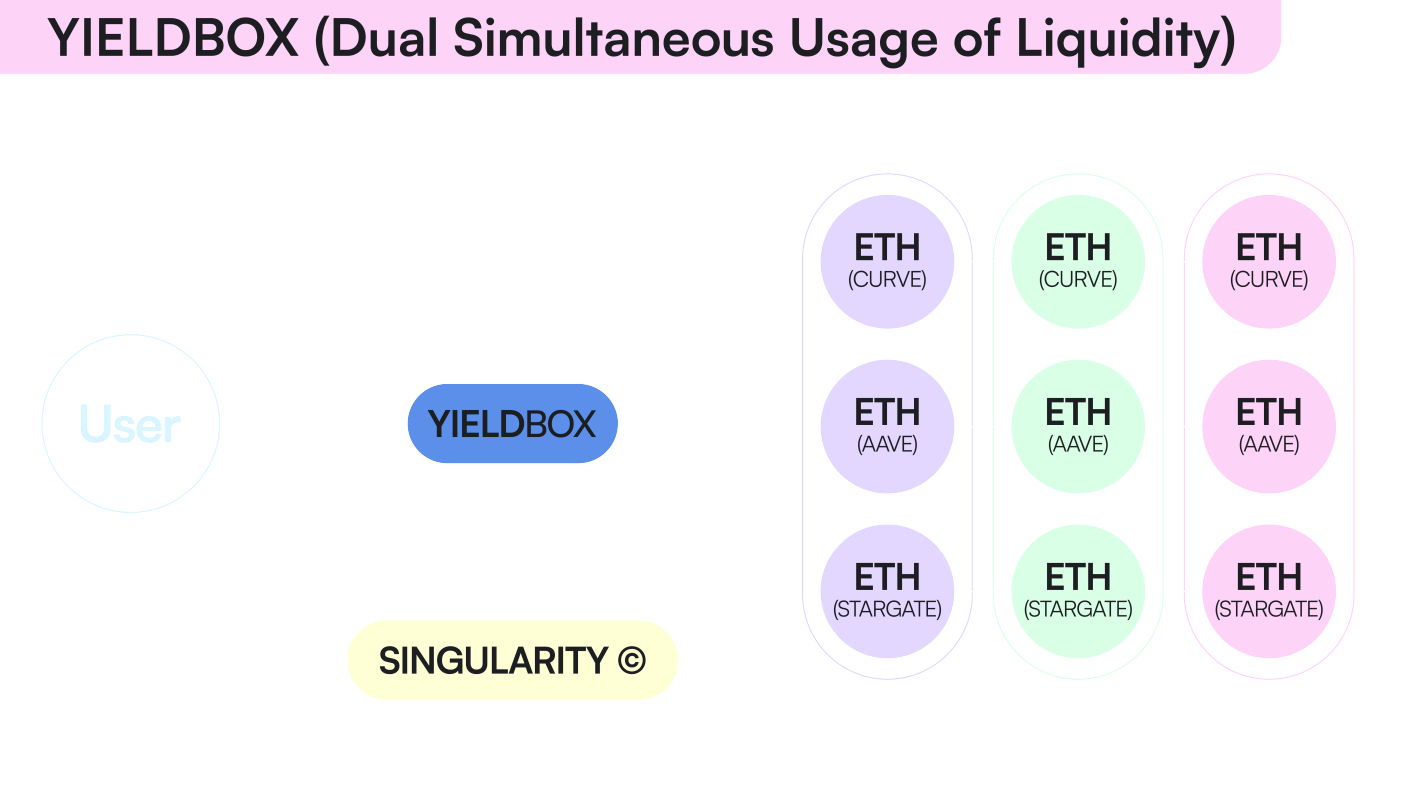

Tapioca’s Yieldbox draws its inspiration from Sushiswap’s Bentobox V2. It was developed by BoringCrypto and, compared to Sushi’s Bentobox, the key upgrade is that Yieldbox includes support for NFTs, rebase tokens, and risk-isolated yield strategies. Tokens deposited into Yieldbox may be lent out to borrowers as well as yield-generating protocols at the same time to earn interest on the principal. Yieldbox, also known as Bentobox V2 is a fork of Bentobox. Bentobox is currently being used by other protocols such as Sushiswap (with Trident) and Abracadabra (with Degenbox). Yieldbox was built with composability in mind and can support a multitude of dApps built on top of it.

The Yieldbox codebase tracks user deposits with a synthetic balance in order to account for idle funds while those same funds are being simultaneously executed on a yield strategy.

While assets are being lent to Singularity markets, a portion of the total liquidity being lent is deployed into strategies via Yieldbox (generally 20% of the total liquidity). This rebalancing of assets is automated in order to capture the best yield on multiple chains.

As an example, if a user deposited ETH directly into Yieldbox for an ETH-CRV strategy, the user would only access the yield from the ETH-CRV pool on the chain the ETH was deposited from. However, this is not the case in Tapioca, since Yieldbox is able to automate the process of moving ETH between separate yield strategies within the chains that Yieldbox has been deployed on. This automated process is powered by Gelato Network and produces what is known as “omnichain yield”.

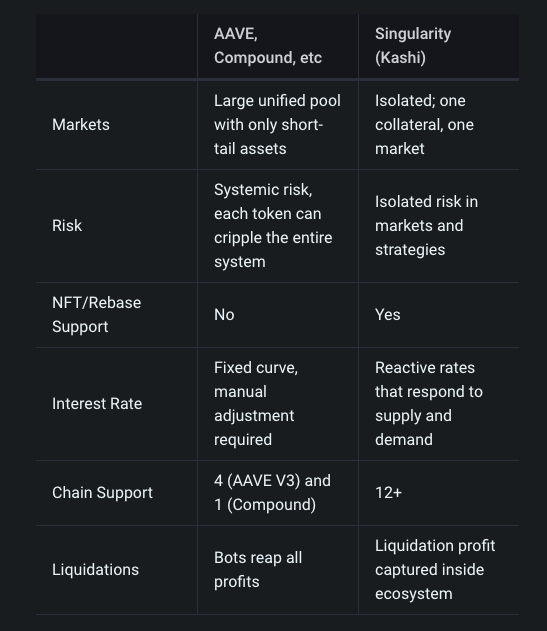

Similar to Yieldbox, Singularity is a modified version of Kashi by Sushiswap and was licensed to TapiocaDAO after it was officially phased out in January 2023.

Singularity allows users to borrow against collateral assets from multiple networks, which creates an important liquidity layer across all supported DeFi ecosystems that allows the protocol and its users to achieve unprecedented levels of capital efficiency.

Unlike most DeFi money markets, like Aave, Compound… Singularity is a dApp built on top of Yieldbox that enables isolated lending pairs. By isolating certain asset pairs, Tapioca can support lending for long-tail assets as well as higher levels of leverage. This means that the risk of assets within one market has no effect on the risk of another market. This isolated risk also applies to separate yield strategies within the same market for an asset (such as ETH in the ETH/USD0 market being lent to Yearn or Aave).

Furthermore, by isolating the risk of different lending markets, Singularity enables users to access up to 10x leverage in one click. This is not the case in the majority of money markets built in the past, where users who wanted to access leverage had to borrow in one platform in order to lend in another and then loop and repeat the process. However, because Kashi separates markets into asset pairs, it manages to achieve composability by allowing users to lend and borrow into the same market.

Singularity allows for a Maximum Collateral Ratio (MCR) of 90%, with the Base Collateral Ratio (CR) being 75%.

A collateral ratio is an indicator that represents the size of the collateral being deposited compared to the value of the loan being taken. This represents the ratio between the dollar value of the collateral in a position and the dollar value of the debt being taken.

Singularity also introduces the concept of Elastic Interest Rates. This is an innovation with respect to the prevalent lending protocols in the market. The majority of money markets set their interest rates as a function of the utilization rate, such that interest rates increase with higher utilization levels in order to disincentivize borrowers. The minimum and maximum levels in these markets, however, are fixed. Contrary to this model, by using elastic interest rates, Singularity can incentivize liquidity to fluctuate between specific ranges of utilization (e.g. 70%-80%), such that the elastic interest rate optimizes for utilization in a non-linear manner. The closer the utilization approaches one of the extremes, the faster the rate of change in the interest rate.

While the top stablecoins reach fairly high levels of utilization on Aave, dYdX, and Compound, this is not the case for volatile pairs. As an example, the utilization of ETH is usually below 20%. Singularity solves this inefficiency with elastic interest rates by attempting to target a utilization rate between 70% and 80%. When the utilization is low, interest rates decline to incentivize borrowers and reach the desired level of utilization. Similarly, when the utilization is greater than the desired threshold, interest rates increase to disincentivize borrowers and bring the utilization rate back to the desired levels.

Big Bang is a modified version of Kashi Lending that allows users to mint USD0 by supplying an accepted asset as collateral. However, unlike Abracadabra’s MIM stablecoin, there is no borrow cap or limit on the amount of USD0 that can be minted at any given time. Nonetheless, there is a debt ceiling function in place in order to limit the amount of USD0 that can be issued against a specific collateral at one time. This debt ceiling will only be present in specific markets.

In order to match supply and demand forces while still protecting the soft peg of USD0 to $1, Tapioca will rely on variable interest rates. To do this, Big Bang markets will implement a debt ratio of collateral assets in comparison to the total outstanding debt. The collateral asset of choice will be ETH and, therefore, all collateral assets will feature a debt ratio against ETH.

For example, MATIC will have a 1:2 total debt ratio against ETH. This means that if there is $100M in debt against ETH collateral on the Protocol, MATIC’s interest rate will vary linearly between 0.5% and 3%, where the minimum and maximum thresholds are predefined, reaching 3% (the maximum) as the amount of debt issued against MATIC collateral climbs to $50M.

The minimum and maximum interest rate parameters will be individually set for each Big Bang market. These parameters can also be modified by governance.

In the beginning, the ETH/USD0 market will feature a fixed interest rate of 0.5%.

Big Bang markets will use a variable borrow in order to better incentivize arbitrage opportunities:

The mint fee will linearly move between 0% and 1% in order to target a mint fee of 0.5% at USD0’s desired price of $1. This spread can also be modified, but the core team suggests that loosening these parameters is undesirable.

Peg Protection Mode can be enabled via Conservator governance on any Big Bang market in the event that a collateral asset poses a risk to the peg of USD0. When this occurs, the interest rate will be doubled from the maximum threshold set in its min/max parameters after a 72-hour delay. This delay is intended to give ample time for borrowers to repay their outstanding loans. After this initial increase, the interest rate will continue to double every 72 hours up to a maximum of 10% until fully disabled.

Overall, PPM is a mechanism design that encourages debt repayments in a specific market in order to unwind a specific collateral asset. PPM is not a desirable state for the protocol.

Big Bang markets will feature a Maximum Collateral Ratio (MCR) of 90%.

As of right now, Tapioca plans to implement the following collateral assets:

Due to the effect that Big Bang collateral assets can have on the USD0 peg, only highly decentralized and deeply liquid assets can be used as collateral to mint USD0. This is the reason why most of the initial collateral assets are gas tokens of their respective network or highly liquid staking derivatives.

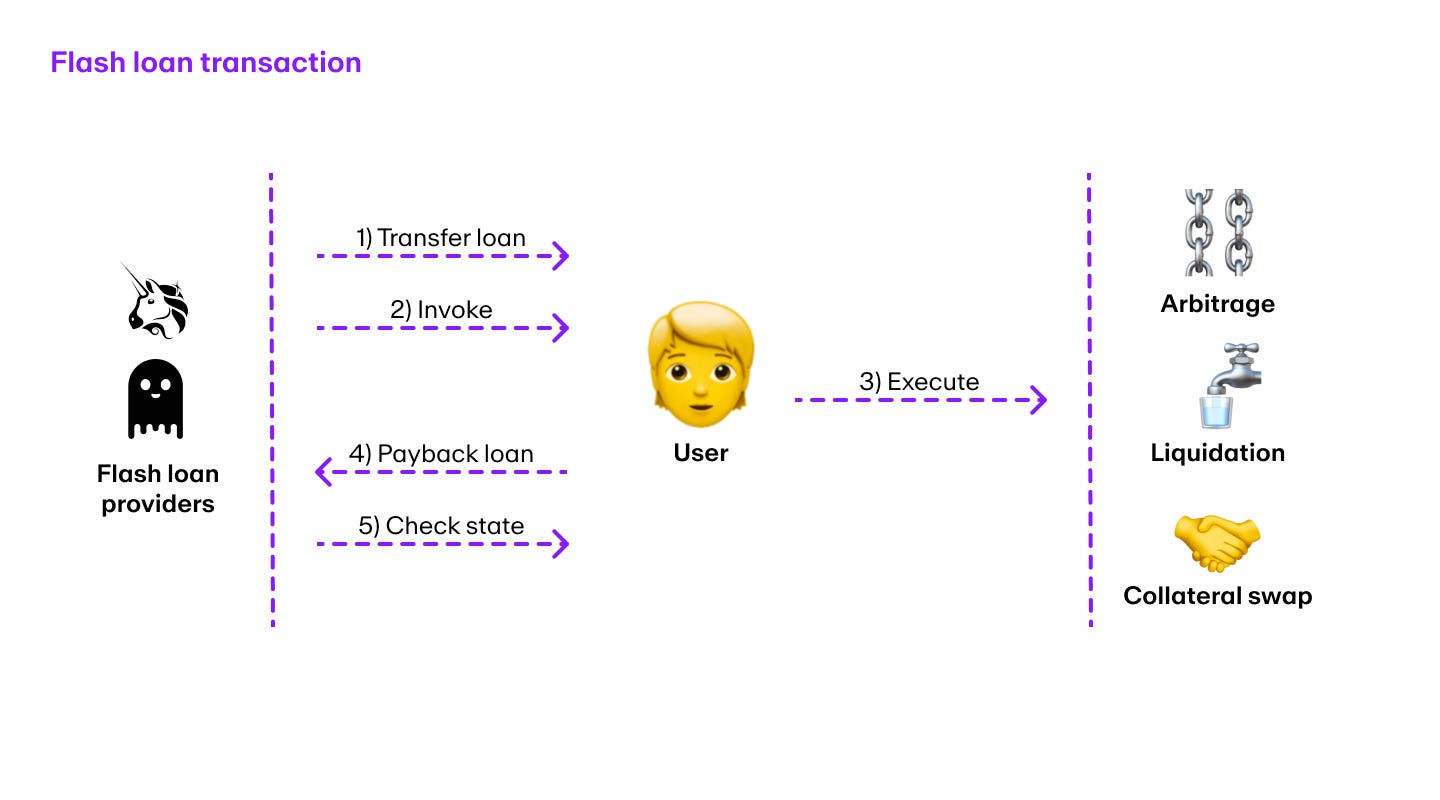

Most DeFi users are familiar with the concept of flash loans introduced by Aave. Flash loans let users borrow any amount of a given asset without pledging any collateral as long as the loan is repaid in the same transaction. When the loan is not repaid in the same transaction block, the whole transaction will be reverted. This makes flash loans very helpful for arbitrage trades, collateral swaps, and liquidations.

A flash loan is a smart contract transaction in which a lender smart contract lends assets to a borrower smart contract in an undercollateralized manner with the condition that the assets are returned, plus an optional fee, before the end of the transaction.

Tapioca’s flash mints are different from standard flash loans due to the fact that USD0 is minted during the flash-loan transaction and burnt at the end of it. This means that the size of the flash mint is not capped by an amount of liquidity in a pool, but rather by a parameter set by governance. To achieve this, Tapioca uses the ERC-3156 standard.

The ERC-3156 is a standard interface for processing single-asset flash loans. This ERC specifies interfaces for lenders to accept flash loan requests, and for borrowers to take temporary control of the transaction within the lender execution.

By using USD0 flash mints, users can profit from arbitrage between assets (without needing the principal amount to execute the arbitrage), which will make the process of liquidations more efficient, while still generating fees for Tapioca. Overall, flash minting is a resource that will allow USD0 to recover its peg almost instantaneously. Besides, due to the omnichain infrastructure of the Tapioca protocol, any supported network can take advantage of flash mints.

In the beginning, there will be a maximum flash minting cap set to 100,000 USD0 with a 0.001% fee.

Currently, most protocols handle liquidations by relying on automated bots who reap the rewards by earning a percentage bonus on the collateral amount being liquidated. This takes away rewards from actual users. In order to solve this problem, Tapioca distinguishes between open and closed liquidations:

Liquidations refer to the process by which external actors close the debt position of borrowers whose debt exceeds the dollar value of their collateral. This might happen when the collateral asset decreases in value or the borrowed debt increases in value against each other.

On Tapioca, USD0 is backed by network gas tokens (ETH, MATIC, AVAX…) or Liquid Staking derivatives (stETH, sAVAX, rETH…). Unlike other protocols where the entirety of a user’s collateral is at risk of a liquidation event, on Tapioca, each CDP is isolated, and only that individual CDP is at risk of being liquidated. This allows users to open multiple CDPs with separate liquidation prices.

A CDP is similar to a loan, where the user deposits assets as collateral and the Tapioca protocol issues a corresponding amount of USD0 according to the user’s LTV, which is based on the collateral asset.

For example, users can open two different CDPs with different collateral assets, LTVs, and liquidation prices. If the user believes that a certain asset has a greater chance of losing value in dollar terms, they can choose to borrow less USD0 from one collateral asset and borrow more from the other.

The liquidation price is the price at which a user’s collateral will be liquidated. Whenever the value of the collateral decreases to match the position’s liquidation price, the collateral will be sold to cover the user’s debt (the position will be liquidated).

In order to incentivize liquidators to close unbacked positions, Tapioca utilizes a mechanism based on dynamic liquidation incentives. Contrary to other protocols where a liquidator is limited to how much of a user’s loan it can repay, Tapioca uses a dynamic closing factor that progressively allows for larger portions of a user’s collateral to be closed as the user’s loan comes progressively closer to becoming undercollateralized.

The Loan-to-Value ratio, or LTV, is an indicator that represents the maximum borrowing power of a specific collateral asset. For example, if an asset has an LTV of 75% that means that for every unit of collateral, the user will be able to borrow 0.75 worth of that unit in USD0.

twAML, which stands for Time Weighted Average Magnitude Lock, is a strategic technology that seeks to promote economic growth within the Tapioca ecosystem while avoiding the standard liquidity programs that are used in the industry. twAML is the mechanism that oTAP relies upon in order to measure the value provided by lenders to the Tapioca protocol. twAML was designed for growth and sustainable governance practices that protect against manipulation.

twAML is used in twTAP as a token locking mechanism, as well as in Singularity markets in order to allow users to lock their lent liquidity in order to receive DSO incentives.

The goal behind liquidity mining is to capture and retain liquidity in the ecosystem, however, most precedent liquidity mining programs have failed to accrue value to the governance token of the protocol. To solve the shortfalls of liquidity mining and avoid the dilution of incentives, Tapioca implements a twAML mechanism to maximize the time that capital remains in the protocol while still generating revenue and contributing towards a governance system where the incentives of all DAO members are aligned. Following this logic, the longer the liquidity is kept in Tapioca, the more value can be accrued through loan repayments, yield performance fees…

With twAML, Tapioca is trying to solve the primary issue with liquidity mining, where users “receive something for nothing”. After all, liquidity mining programs chase TVL, but this liquidity is not locked, as LPs can withdraw at any time. These programs hope to attract as many liquidity providers as possible by giving them token incentives for free. However, this is not a sustainable practice, and, in the long run, it leaves the protocol economically disabled.

Users of today demand real yield instead of high emissions from inflationary tokens. To achieve that, twAML’s model is targeting the following goals in order to broaden the scope of Tapioca’s economic model:

Barry Fried released a google doc that allowed anyone to simulate a call option discount percentage, relative to their weight or capital locked for X hours.

Leveraging long/short assets is one of the most common use cases of a money market protocol. This is possible in Tapioca thanks to Singularity, which allows users to leverage their CDPs (Collateralized Debt Positions).

Leverage is the term used to refer to the use of borrowed funds in order to increase one’s trading position beyond what would be available from the initial collateral deposit alone.

In order to open a CDP, users need to deposit the collateral that they want to leverage. In Singularity, as long as the required collateral is deposited within the same borrow transaction, the user will be able to select the desired level of leverage (up to 3x) and borrow the corresponding amount of the desired asset. Right after depositing the collateral, the borrowed asset will be swapped for the collateral asset, which will remain in Yieldbox until the user closes the positions.

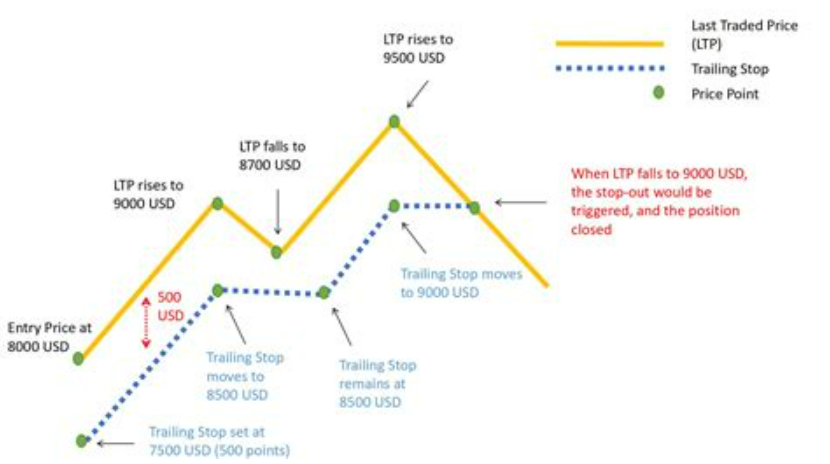

In addition to allowing for borrowing with leverage, Tapioca also allows users to set a trailing stop loss to their position through Gelato Network. Thanks to this automation, whenever the stop loss price is hit, Gelato will trigger an execution to swap the collateral asset back into USD0 in order to deleverage the positions and protect the user from the loss of its funds.

A trailing stop loss is a limit order that lets the user specify a maximum value or percentage of loss to incur on a trade. As the price rises or falls, the stop loss moves along with it. This means that the stop price follows the market price when it moves in your favor and stays in place when the market price moves against you. This is useful for locking in profits on the way up while protecting capital on the way down.

In Tapioca, users can borrow liquidity from any chain. Users who have positive expectations about the future price of an asset and they don’t want to sell that asset can deposit their tokens as collateral on a money market in order to borrow against it. By borrowing, you are able to obtain extra liquidity (productive capital) without selling your tokens.

Given that Tapioca is an omnichain money market, users can borrow against their assets on one chain while utilizing the borrowed funds on another chain.

Overall, users can

The maximum amount that a user can borrow depends on the dollar value of the tokens supplied as collateral. Different assets will have different Loan To Value Ratios (LTVs). The LTV for that asset will be used to determine how much USD0 you will receive against your collateral. For instance, if ETH has an LTV of 90% and you deposit $100 worth of ETH as collateral you will be able to borrow $90 worth of USD0.

At the beginning, there will be no debt ceiling (the maximum amount you can borrow) on any market.

Loans must be repaid in the same asset that is being borrowed, meaning that all loans would be repaid in USD0. Like in most DeFi money markets, loans are perpetual in nature and there is no fixed time to pay back a loan. Therefore, as long as the collateralized debt positions remain within the acceptable LTV ratio, the loan can remain open indefinitely.

Users must monitor the health of their loans in order to avoid being liquidated. If the health of their loan declines, they can partially or fully repay the loan, or deposit more collateral.

The interest rate will depend on the collateral ratio of the given collateral. Each asset except ETH (which has a 0.5% fixed interest rate) will have a variable rate that will constantly change within a predefined minimum and maximum rate. In Singularity markets, the interest rate will be determined by the utilization rate of the market.

The Utilization rate is an indicator of how much capital is available in a lending pool. It represents the total amount of funds being borrowed from the total amount of liquidity available in the lending pool.

As the utilization rate increases and approaches 100%, the capital becomes scarcer until when there is no more liquidity available since all the funds from the pool are being borrowed.

When capital is available, low-interest rates will incentivize borrowing

When capital is scarce, high-interest rates will disincentivize borrowing and encourage loan repayments.

Utilization rate = Total Borrows / Total Liquidity

When users lend assets on Singularity markets, they are entitled to earn yield from borrowers, as well as a portion of each lending market that will be lent out in yield strategies (usually 20-25%). This is known as dual simultaneous usage of liquidity and will allow Tapioca to offer its users much higher yields than other standard lending markets (where the only yield comes from interest payments by borrowers).

The target utilization rate inside Singularity markets is 80% so 20% of the liquidity can be lent out in yield-generating strategies. This means that 80% of the total liquidity in Singularity markets will be available for borrowing.

All assets in Singularity will autocompound the accrued fees and liquidity mining rewards they earn as well as constantly rebalance themselves across many protocols and networks in order to access the best real yields possible within a given risk tolerance.

Since Tapioca does not feature any liquidity mining programs, all the estimated yields that can be earned on the platform are the result of productive economic activities (e.g. real yield) such as lending assets to borrowers and collecting interest payments.

Tapioca is an omnichain money market that uses LayerZero technology in order to facilitate cross-chain borrowing and lending. Tapioca’s core smart contracts include Singularity, an isolated risk market borrow and lending engine, and Yieldbox, a permissionless token vault. Both of these contracts were created and licensed to Tapioca by BoringCrypto.

Tapioca will use a hard-capped fixed token supply instead of relying on a soft-cap token supply that is often removed when the incentives finish and lead to continued token inflation. Tapioca’s model will stop token inflation once it has managed to stimulate growth and accrue value that remains within the system (POL). Besides, twAML draws its inspiration from research that shows that fixed supply scarcity is more attractive to market participants.

TAP will have a pre-calculated inflation schedule so that TAP cannot be issued faster than it was predetermined. This inflation schedule would act as the maximum inflation schedule to ensure that token issuance is in alignment with the intrinsic value of the treasury. In other words, the emissions’ objective is that if POL is not captured, then TAP would not be issued.

Token incentives would seek to attract capital towards the protocol due to how important this is for a money market. The key here is to avoid destabilization from external market conditions. A “veLP” like the system was first studied as an initial approach so that users would lend capital and receive a tOLP ONFT receipt (Tapioca Ominchain Liquidity Provider Receipt) that they could then lock and receive incentives for each epoch their tOLP was locked. If implemented, this maximizes the capital available for borrowers, which in turn creates fees through debt repayments, borrowing fees, and yield performance fees. More liquidity would then lead to more revenue and more users.

This initial incentive could use bonding for accruing POL. However, bonds do not set a predictable price floor for the incentive, or an estimable trade of the capital provided for the expenditure of the incentives, as it is a constant discount against the incentives’ market price. Through this model, it is still possible to have more sell pressure from bonding practices than with regular liquidity mining. As an example, bots were programmed to buy POOL/ETH LP tokens to obtain POOL tokens at a discount from PoolTogether and sell them for a profit. PoolTogether realized that selling those tokens OTC or simply selling them on an AMM would have been more effective.

Finally, by following an issuance strategy that creates enough POL for the times when TAP incentives are no longer effective in attracting more liquidity, Tapioca would become its own capital provider for its own LP pairs using Arrakis vaults to manage the LP in combination with Tapioca’s borrow-lending markets. Lockers would then share the fees generated and receive tETH as the unit of reward while the DAO would always act in the best interest of its longevity, unlike mercenary farmers.

Due to the problems identified with a bonding approach, the team was faced with the question of how TAP could be issued without bonding. This is achieved by iterating over Andre Cronje’s Options Liquidity Mining model, which also could be reused for TAP’s airdrop. From that perspective, liquidity Mining can be looked at as a call option with a 100% discount and an infinite expiry, whereas call options set an estimable price floor such as:

TAP Price Floor = TWAP – Average discount % per Epoch

Since non-circulating TAP only enters the market when call options are exercised, the preset inflation becomes the maximum amount of TAP that can be redeemed each week instead of the actual amount of inflation that will occur. Besides, due to the nature of call options going out of the money (unprofitable to execute) and having an expiration, this mechanism ensures that incentives can be offered over a long time horizon (since TAP not redeemed through call options does not enter circulation).

Tapioca reconfigures the way call options work in the original OLM model followed by K3pr Network. oTAP call options will capture POL. This means that instead of redistributing redemptions with lockers, they will be redirected to the DAO Treasury, which will then deploy the capital into Arrakis vaults. The Arrakis Vaults would function as a decentralized market maker and the DAO Treasury would earn fees from the trading of its own tokens.

To address the issue of where the value from redemptions goes, users would receive oTAP for each epoch their tOLP was locked. When a user receives oTAP, they would redeem TAP tokens from the DAO treasury, which creates POL (Protocol Owned Liquidity). The user could then choose whether to sell tokens on the open market to lock in a profit, or whether to escrow the TAP tokens to receive shares of protocol revenue. This is achieved by using call options, which allow users to be ITM (in the money) and receive TAP tokens below their current market value.

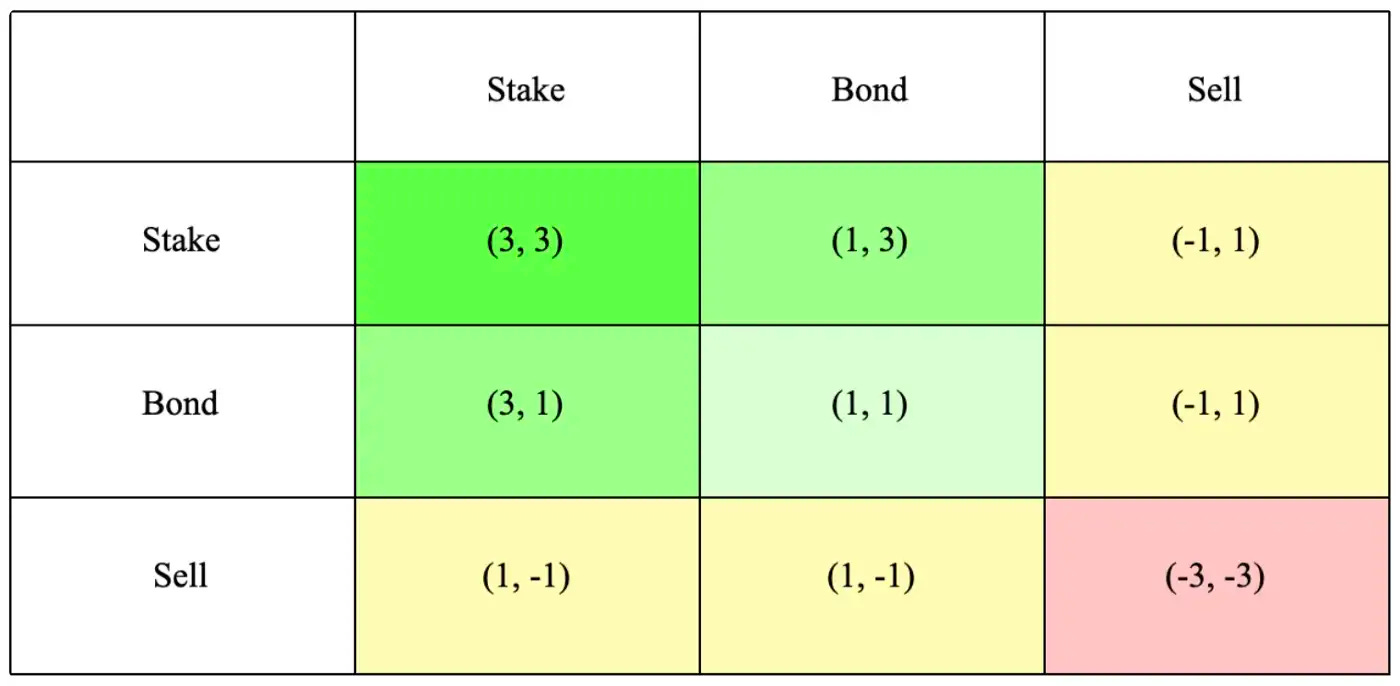

When it comes to solving for the fixed discount of K3per Network, Tapioca’s goal is to have a dynamic discount based on economic activity. This is achieved through an Average Magnitude Lock mechanism,

The Average Magnitude Lock design starts by setting two boundaries that will act as the minimum discount (5%) and the maximum discount (50%). oTAP options have an expiration of 1 week. When users lock their tOLP for any period of time they wish, AML will measure the duration and capital amount of the escrow in order to offer an appropriate discount level.

This dynamically adjusted discount works so that even during times when small time commitments receive a large discount, those users are still incentivized to lock their liquidity for longer in order to lock the maximum discount possible.

For instance, when many users are locking capital and the protocol is capturing more value, the system will start giving increasingly lower rewards to each subsequent user for the average time commitment. Similarly, when the amount of users locking liquidity decreases and the system receives less capital, the amount of incentives will increase in a decaying manner until it reaches a point where users begin locking new capital again.

AML is an effective tool for creating competition between market participants as well. Users will compete against each other to achieve a better discount. For example, if one users locks 100USD0 for one year and receive a 30% discount and another user locks the same amount for the same duration and receives half the discount, 15%, the second user is both intrinsically (profit) and extrinsically (competitiveness) incentivized to double the lock time in order to reach the same discount as the first user. Because of this, AML differs from traditional liquidity mining programs in that it creates a Player vs Player environment instead of a Player vs System environment.

When analyzing the way most liquidity mining programs work, it becomes very obvious that all users follow the same simple strategy: yield farming. This simple yield farming strategy simply consists in supplying capital, receiving rewards, and then withdrawing the liquidity and selling rewards for a profit. Unlike an environment of pure strategy, these practices do not incentivize users to study the market in order to come up with a procedure that provides the best payoffs given their specific circumstances.

Tapioca’s AML is based on Game Theory, a field of study that seeks to understand the behavior of human psychology and explain their decision-making process when it comes to comparing the benefits of self-interest and cooperation.

In economic theory, the Nash equilibrium is used to illustrate that decision-making is a system of strategic interactions based on the actions of the other players. When players no longer need to change their strategies, they have reached the Nash equilibrium.

The Nash equilibrium is a part of game theory that models economic behaviors

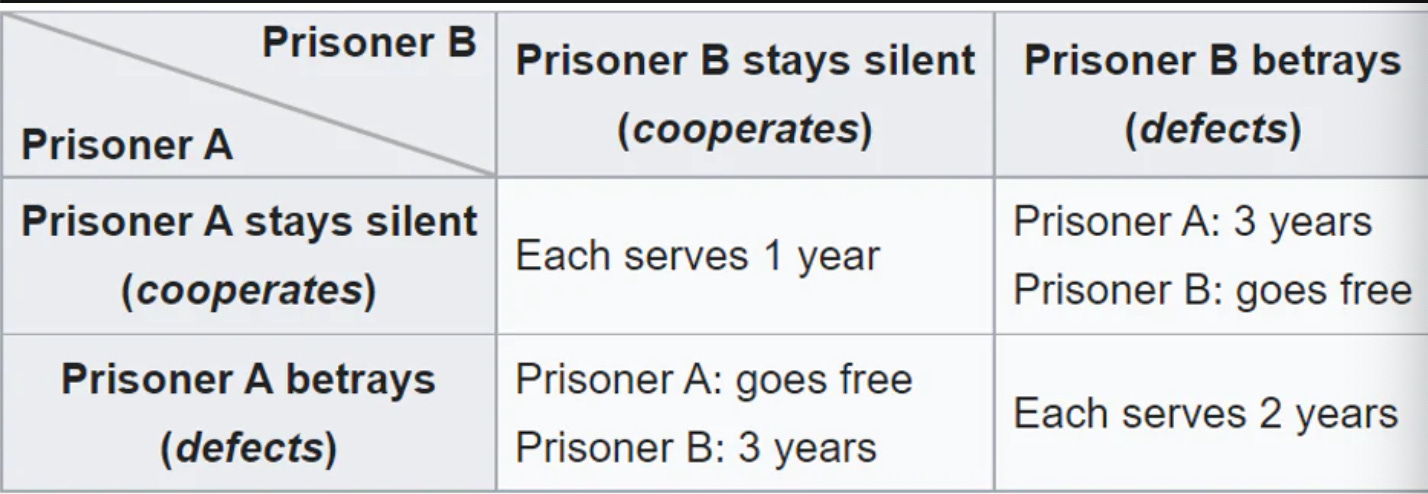

Game theory scenarios such as the prisoner’s dilemma lead to a counterintuitive decision-making paradox where the rational decision is to blame the other prisoner in an act of self-interest, while the optimal decision is for the prisoners to cooperate and remain silent in an act of collective interest. However, most individuals will almost always act in self-interest, and will rarely choose the optimal strategy.

Unlike in the prisoner’s dilemma, game theoretical systems such as (3, 3) introduced by Olympus allow the participants to communicate and, in theory, reach a consensus to continue cooperating (staking) in an optimal strategy. By staking, OHM holders are essentially cooperating to withhold OHM supply from the market, therefore raising the OHM price and increasing OHM’s market capitalization.

However, at the beginning of (3,3), the profit motivation to sell is small, and the participants’ self-interest would be aligned with the system to cooperate and increase the value of OHM through staking. But as participants continue choosing the optimal choice to stake and the potential profit starts increasing and players start deviating from their original strategy and start acting in their self-interest to sell (-3 + -3 = -6).

Once it becomes better to deviate from the optimal strategy, the Nash Equilibrium is lost. This is where a second concept from game theory is introduced, the Subgame Perfect Nash Equilibrium (SPNE).

A Nash equilibrium is said to be subgame perfect only if it has Nash equilibrium in every subgame of the game.

As an infinitely repeated Prisoner’s Dilemma, Olympus achieves the Nash Equilibrium. However, it fails to achieve SPNE like the Prisoner’s dilemma. As the game goes on into many sub-games, it becomes better to deviate from strategies and act against the collective interest of OHM.

When applying game theory to situations like Prisoner’s Dilemma, it is possible that, in theory, the outcomes are not optimal, since there can be better outcomes for all participants than what theory states.

An outcome is Pareto Optimum if you cannot find another outcome that simultaneously improves the payoffs of both players.

In (3,3), the solution of cooperative staking (+6) does not constitute a Pareto Optimums, since the two participants would be better off if they were to betray the collective and sell (-6) during the later stages of the game.

The ultimate goal behind twAML was for it to focus on achieving a level of Pareto Efficiency that would align the incentives of the players and the system itself, ensuring that all participants receive outcomes that improve the payoffs of all actors and the system itself.

Pareto Efficiency implies that the incentives of the protocol are allocated in the most economically efficient manner (but that does not imply fairness) such that there is no outcome that increases at least one player’s payoff without decreasing anyone else’s.

With twAML, when one player chooses to escrow their capital for the duration required to maximize their incentives (oTAP) discount, the next player applying the same escrow arrangement would receive half the reward as the player before. This is a variant of Rubinstein’s bargaining model.

In twAML, both the optimal (collective outcome strategy) and the rational (self-interest strategy) strategy is to lock enough capital for the amount of time necessary to receive an equitable reward. Because of this, twAML also reaches the Subgame Perfect Nash Equilibrium.

When the lock time becomes perceived as too long to receive a reward level that is perceived as equitable, the system will decrease the lock time required to receive an equitable reward until allocative efficiency is reached again. In this case, what users view as an equitable reward at the individual level does not matter, since the collective always decides what is in the best interest of themselves and the system itself.

Like oTAP, twTAP (Time-Weighted Escrowed TAP) employs AML as well. The only difference is that the boundaries are not from 0.05 to 0.5 (minimum and maximum discounts in oTAP), but from 0.1 to 1.0. This is the ratio of twTAP that is received as an input, where the twTAP output is given by AML (TAP amount + time duration).

An analogy would be that, during the Curve wars, users would have to lock for longer than 4 years to get the best outcome, while during periods of recession, users could lock for shorter amounts of time to get the best outcome.

Both oTAP and twTAP are transferable and represented as LayerZero ONFT-721, which allows for the creation of secondary markets to trade locked positions while still forcing the underlying TAP to remain illiquid for its escrow duration.

Pearlnet utilizes LayerZero V2, allowing OApps to control their own modular verification network. Specifically, Pearlnet is a DVN (Decentralized Verification Network); it is a customized configuration of the default LayerZero omnichain configuration. This approach was taken with the goals of maximizing decentralization and minimizing the role of any trust in other protocols. It is made possible by the highly customizable nature of LayerZero.

Pearlnet utilizes LayerZero V2, in comparison to the previously implemented Pearlayer, which utilized LayerZero V1. It will launch initially as Pearlnet Epsilon, using a 4-of-7 multisig, in addition to Polyhedra zkLightClient, and Google Cloud, in a 1-of-2-of-3 configuration design. Specified messaging libraries will be used in a defined configuration. The process of upgrading Pearlnet Epsilon to Pearlnet will require a vote to pass, with a 60-day timelock completing after a successful vote.

While Tapioca’s core smart contracts are only deployed on Arbitrum, Yieldbox is deployed on many chains. Tapioca uses proxy contracts on all supported chains outside of Arbitrum in order to pass cross-chain messages from one chain to another. When it comes to pricing, Tapioca relies on Chainlink’s custom price feeds as well as Uniswap V3’s TWAP to support LayerZero infrastructure. These Oracles work in tandem with Tapioca’s Relayer and the only way for an exploit to occur would be if there was a collusion between the Oracle and the Relayer.

Let’s take an example of a user who requests to deposit MATIC on Polygon in order to borrow funds on Arbitrum:

If there was any contention to the validity of the message between the Oracle and the Relayer, the smart contract would be paused and the borrow transaction would not be committed on Arbitrum.

Pearlnet utilizes LayerZero’s Pre-Crime security mechanism, which is responsible for running a series of assertions on a locally forked blockchain in order to verify that every cross-chain message being delivered will never result in a compromised state. If any of these assertions were to fail, Pearlnet would not deliver the message to the Tapioca Protocols, preventing a possible attack altogether.

For example, one invariant of Pre-Crime is Asset Circulation Equivalence; the global supply of USD0 is never increased or decreased outside of Big Bang & Flash Mint Engines.

A portfolio page will be implemented for users to gather data about various aspects of their positions on Tapioca, which includes:

The Tapioca DAO Treasury is where all the Tapioca DAO-owned assets will be stored. These assets will include a share of Tapioca’s protocol revenue as well as funds obtained through exercised call options to the DSO program.

The Tapioca Treasury will also collect 20% of the total protocol revenue, which will come from performance fees on the yield generated by Singularity and Yieldbox. This will build POL (Protocol Owned Liquidity) for the Tapioca DAO.

By building POL, Tapioca eliminates the need for incentivizing liquidity with aggressive liquidity mining programs that are not sustainable in the long run. Besides, by building its own treasury, Tapioca removes the possibility that other third parties profit from its ecosystem and capture the value generated by Tapioca. This will ensure that users are always able to swap USD0 on all supported networks in a seamless manner regardless of market conditions and external events.

When it comes to protocol revenue and long-term sustainability, Tapioca does not emit TAP tokens for free. Instead, Tapioca issues oTAP, an American-style call option that allows the protocol to acquire POL (Protocol Owned Liquidity). Under this premise, lenders with oTAP can buy TAP tokens from the DAO at a discount.

Every week, a percentage of platform fees are distributed to twTAP lockers in the form of ETH. twTAP also allows liquidity providers to boost their oTAP call option discount up to 1.5x as well as boost their Singularity loan’s LTV ratio up to 15% from a base of 75%.

Tapioca also collects 20% of the total protocol revenue, which will come from performance fees on the yield generated by Singularity and Yieldbox.

The Tapioca Treasury will be funded by:

As a protocol, Tapioca captures fees generated from the use of the services it provides. 80% of these fees are distributed to twTAP lockers weekly, while the remaining 20% is captured by the Tapioca Treasury.

While gas costs vary from chain to chain, a user’s gas composition when interacting with Tapioca will be made out of:

Gas = Receiving smart contract overhead + proof costs + lzReceive

lzReceive refers to LayerZero’s implementation in order for smart contracts to handle incoming messages from a source chain.

Although the core smart contracts of the protocol have been deployed to Arbitrum, Tapioca users do not need to have gas on Arbitrum to be able to interact with the protocol. Instead, users simply need to have a sufficient amount of gas on the origin network.

There are currently 14 core contributors listed by TapiocaDAO, with the following salaries:

The non-salary costs amount to:

The team has stated that these costs are taken from Pearl Labs’ operating budget (bootstrap costs).

Liquidity mining is the practice by which decentralized applications incentivize users of a protocol to deposit assets into its smart contracts in exchange for rewarding them with token rewards. Although it was started by Synthetix StakingRewards, this practice was made popular by Compound in 2020, when it boosted lenders’ returns on lent liquidity with COMP tokens from inflation. Giving away native protocol tokens to users is an operating expense. Many refer to this cost as a customer acquisition cost in order to attract liquidity and bootstrap a protocol in its early days.

While directing token emissions towards early users might incentivize them to keep their liquidity in the protocol, the passing of time has shown diminishing returns on these practices. Usually, what happens is that short-term liquidity providers manage to accrue a fair amount of rewards during a short period of time and, as soon as the amount of rewards starts to decrease, they sell the tokens on the open market. These users are vulgarly known as “liquidity locusts” or “mercenary farmers”.

Liquidity locusts are enabled by being able to receive something for practically nothing. This leads to a declining price in the native token being emitted. Once these rewards dry up and/or the value of the token has declined sufficiently, liquidity leaves the protocol. Therefore, liquidity mining fails to create any meaningful reward in terms of liquidity “stickiness” (liquidity that, once deposited, remains in the ecosystem for a long time). This shows that liquidity disappears when incentives cease. Because of this, aggressive liquidity programs often have a detriment on token prices.

The concept of Options Liquidity Mining was first introduced by Andre Cronje in 2021 to be applied to Keep3r Network. Since Keep3r was an experimental protocol at that time, the concept of Options Liquidity Mining did not get much traction. Now, however, with the advent of protocols working with on-chain options, Tapioca is leading the efforts to implement options as part of its liquidity mining program.

Tapioca introduces a new practice by which instead of rewarding users with TAP emissions at a price of $0, lenders will receive oTAP, a LayerZero 0NFT721 (NFT) position that represents a call option. When lenders exercise these options, 50% of the process will go towards building Protocol Owned Liquidity for the Tapioca DAO, and the remaining 50% will go to veTAP lockers.

Call options are financial contracts that grant the option buyer the right but not the obligation to buy an asset (TAP tokens) at a specific price and within a prespecified time period.

As Tapioca has no liquidity mining programs, all TAP tokens were “pre-mined”, which means that the tokens held by the DAO are not circulating.

TAP is Tapioca’s governance token and the “heart” of the Tapioca DAO token economy, which include 6 sub-protocols;

TAP was crafted in order to support a sustainable and fairly distributed economy that can experience long-term growth and economic value retention. The end objective of the DAO is to reach a ubiquitous distribution of the TAP token in order to facilitate the decentralized governance of the Tapioca DAO.

The TAP token utilizes the LayerZero OFT20 standard. Because of this, TAP is transferable to any supported network without a bridge and has an elastic supply across all chains.

TAP tokens may only be acquired through the DAO Share Options (DSO) program and Pearl Labs does not purport TAP to have any value whatsoever. This lack of function is intentional, the token is designed to be “time weighted”, which can be thought of as ‘locked’. Upon time weighting, TAP transforms into twTAP, a LayerZero ONFT-721.

100,000,000 tokens can enter circulation, making up the finite supply. There will never be more than 100,000,000 $TAP tokens.

The TAP token distribution was crafted in collaboration with the community in order to achieve an equitable distribution of the initial supply.

TAP has a fixed supply of 100,000,000 tokens and will be distributed over a period of at least 6 years. Once the total supply is in circulation, no additional TAP tokens can ever be created. The genesis supply is 7,630,000.

The TAP distribution is as follows:

The genesis supply is 7,630,000. 83% of the Genesis supply will be allocated to the Tapioca community, of which:

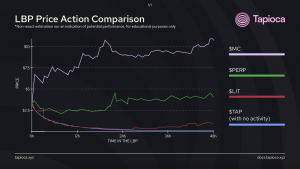

A Liquidity Bootstrapping Pool, or LBP, is a liquidity pool that allows protocols to issue their native tokens while targeting a fair distribution among its participants. The mechanism consists in pairing the protocol token with another token and attempting to reach a fair market price by adjusting the weights of the two tokens during the duration of the LBP event.

LBP events are widely used due to their relatively low capital requirement and because of their ability to favor a broad distribution of tokens as well as facilitate price discovery.

twTAP stands for Time-Weighted TAP, which is a LayerZero 0NFT-721. twTAP can only be minted by locking TAP. twTAP is based on Tapioca’s twAML or time-weighted average magnitude lock.

The benefits for twTAP holders include:

twTAP also allows liquidity providers to boost their oTAP call option discount up to 1.5x as well as boost their Singularity loan’s LTV ratio up to 15% from a base of 75%.

Upon locking TAP, twAML receives TAP as an input as well as a time-weight in order to mint a certain amount of twTAP at a certain point in time.

oTAP is a LayerZero 0NFT-721 token that serves the purpose of acting as an economic growth incentive used in the DSO (DAO Share Option) program. This is an alternative to running a liquidity mining program.

Lenders are eligible to receive oTAP call option incentives by locking tOLP (or Tapioca Omnichain Liquidity Provision) receipt tokens.

oTAP is an American-style call option, with discounts ranging from 0% to 50% (excluding twTAP boosting) depending on the time commitment and the current free market value of time.

Options offer the right but not the obligation to purchase an underlying asset in a set period of time at a fixed price.

An American call option is an options contract that allows holders to exercise their option rights at any time as long as it is before or on the day of expiration. The difference with European options is that the latest only allows for execution on the day of the expiration.

Recipients of oTAP may exercise oTAP in order to OTC (over the counter) purchase TAP at a discount from the DAO, which can then be sold on the spot market for a guaranteed profit.

oTAP is distributed weekly and has a 1week expiration. When oTAP is distributed, the spot price of TAP serves as the reference for coming up with the strike price of the option. Lenders receive an ITM (in the money) call option to purchase TAP based on their given discount.

One oTAP is redeemable for one TAP up until expiry.

The strike price of an option is the fixed price at which the owner of the contract can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

An option is in the money when its value or its strike price is favorable compared to the market price (i.e if you can buy at a discount compared to the market price, or sell at a premium to the spot market price).

The Tapioca airdrop will use American options via oTAP in order to expand its user base and distribute TAP tokens among its most valuable users with the goal of decentralizing governance and incentivizing usage of the protocol.

The majority of airdrops rely on a simple strategy that consists of sending free tokens to wallet addresses that have interacted with the protocol. This method is known for leading to multiple negative consequences when it comes to creating a long-term user base. Among its main problems we can identify:

Outside of Uniswap, the same applies to other protocols that have followed a similar practice, like 1inch, Hop Protocol, Optimism, Ethereum Name Service, or Looksrare. Each of them saw more than 90% of the airdrop recipients selling their tokens as soon as they received them. For example, nearly 50% of users who received OP tokens never used the chain after the airdrop. This shows that the OP airdrop failed to incentivize usage of the network (and thus generate revenue from fees).

When it comes to airdrops, one of the most well-known problems arises from sybil attacks by which a small number of network actors try to game the system and gain an outstanding share of influence over a protocol, usually by participating with multiple wallets that belong to the same entity.

Protocols preventing sybil attacks often impose restrictive measures that can end up harming legitimate protocol users and community members.

Tapioca addresses this issue by disincentivizing behaviors that seek to game the system. The reason for that is that TAP tokens are not being given away for free. Instead, there is an associated cost that discourages sybil attackers. TAP tokens must be purchased and, while the option airdrop allows for purchasing TAP tokens at a discount, even if these tokens are later on sold on the open market, those users are still providing liquidity to the Tapioca DAO. Furthermore, this allows community members to get discounted tokens from the protocol in order to further support its growth through the Tapioca Guild. Besides, since users are purchasing TAP, they are showing confidence in the long-term growth of the protocol.

The earlier a user enters the TAP LBP, the higher their discount will be on TAP via oTAP call options.

1,500,000 oTAP out of the total 2,500,000 oTAP tokens were distributed to LBP participants such that each LBP participant could be weighted 10:3 in terms of airdrop allocation. This means that if a user purchased 10,000 TAP during the LBP, they would have received 3,000 oTAP at the end of the LBP event.

The strike price of the oTAP call options was based on the final LBP price and these options will carry an expiration of 72 hours.

The Tapioca Guild received the second phase of the options airdrop, with its strike price-weighted against the price of TAP 72 hours after the completion of the LBP.

750,000 TAP was to the Tapioca Guild in the form of oTAP call options with a 72 hours expiry:

Pearl Club NFT holders who received their NFTs from their participation in the beta testing phase of the protocol will be eligible to receive the second phase of the oTAP call option airdrop distribution.

250,000 TAP will be allocated for holders of Pearl Club NFTs in the form of oTAP call options with a 72-hour expiry.

The third and final phase of the option airdrop distributed oTAP tokens to twTAP lockers, who received oTAP call options proportional to the amount of TPA not redeemed from the entire airdrop allocation 72 hours after the completion of the phase two distribution. These lockers received a proportional share of the remaining oTAP in relation to their total share of the twTAP metagovernance pool, bearing a 33% discount and a 72-hour expiry.

For example, if there were 500,000 unclaimed TAP tokens by the end of phase 2, a user who locks TAP purchased at the LBP and that has a 10% share of the global twTAP metagovernance pool received 50,000 oTAP with a 33% discount to the spot price of TAP with a 72-hour expiry.

Tapioca distributed 5,000,000 TAP tokens (5% of the total supply) via a Balancer Liquidity Bootstrapping Pool that lasted for 72 hours. The LBP event was used to distribute governance tokens to the broader community in order to achieve as much decentralization as possible while still triggering price discovery for the TAP token.

The reason for distributing tokens with an LBP event is because of its capital efficiency. By using a small portion of tokens to initiate the pool, Tapioca was able to optimize for a fair distribution of its native token. The reason why this fair distribution occurs is that the linear step-down function of the LBP creates a constant downward pressure on the price, balancing upward buy pressure and ideally keeping the price oscillating around its market value. This has two most notable benefits:

After the LBP concluded, the proceeds were transferred to the Tapioca DAO Treasury. These funds will be used to seed initial liquidity for the TAP and USD0 tokens.

Participants who purchase TAP at $2.00 or higher were also eligible for the Options Airdrop.

Users were able to take part in the LBP event with USDC from Arbitrum, Optimism, Ethereum, Avalanche, and Polygon.

Before the LBP the valuation of TAP was $0.44 per TAP token, which resulted in a $44M fully diluted valuation.

The starting price of the TAP LBP was $3.52. The commonly advised setup for an LBP is to set up the starting price at 4x the expected end price based upon final weightings. In this case, the weightings would suggest an end price of $0.88, which is 2x from the last round.

The TAP token is not issued as part of a liquidity mining program. For that reason, the only way to receive TAP tokens is from the DAO itself. This is achieved by participating in the DSO or Dao Shares Options program.

DAO Share Options are an iteration of Andre Cronje’s Options Liquidity Mining. However, contrary to the original model implemented in Keep3r Network, Tapioca does not value TVL (Total Value Locked), and instead values permanent liquidity capture in the form of Protocol Owned Liquidity (POL). This rather simple change modifies the dynamic between capital providers and the Tapioca dAO itself. For that reason, Tapioca features no liquidity mining programs and instead relies on oTAP in order to incentivize the long-term growth of Tapioca’s POL.

The inspiration for the name of DSO comes from ESO, which stands for Employee Stock Options, which is a type of equity compensation granted by companies to their employees. This is a commonly used method by companies to create a loyal relationship between a company and its employees in order to increase the productive outcome of the company. In the same way, the goal of the DSO program is to create a loyal and symbiotic relationship between lenders and the Tapioca DAO.

Out of the money is an expression used to describe an option contract that only contains an extrinsic value and has no intrinsic value. An OTM call option will have a strike price that is higher than the spot market price of the underlying asset, while a put option will have a strike price that is lower than the market price of the underlying asset.

Due to the design of American options, each week there will be TAP tokens that will not be redeemed via oTAP call options. This TAP will simply remain in the House of the Commons until it is redeemed, which will allow the DSO program to run well past 4 years.

tOLPs are receipt tokens to lenders that lend liquidity to Tapioca. This receipt is a LayerZero ONFT-721 that can be locked via twAML to receive DSO incentives.

LayerZero is an interoperability protocol that facilitates interactions and integrations between separate blockchain networks and ecosystems. The core idea relies on an infrastructure that enables the transfer of messages between two on-chain endpoints: the oracle and the relayer.

Tapioca has built all of its smart contracts with native integration of LayerZero. This is different from other protocols that deploy their applications to multiple chains and then rely on bridges and wrapped assets to move funds from one chain to another. Contrary to other cross-chain solutions like bridging, LayerZero removes the need for an intermediary protocol. LayerZero technology uses a relayer that passes the messages to an oracle, and the oracle is responsible for confirming the receipt of the message.

A relayer is an off-chain technology that fetches the proof of a specific transaction being executed in order to verify the validity of that transaction

LayerZero is a blockchain primitive that enables the deployment of applications on different chains while still allowing communication with one another. The core difference between LayerZero and bridges is that LayerZero does not require any intermediary blockchains or consensus mechanisms. Because of this, LayerZero is considered a messaging protocol that allows for the seamless communication of applications across chains.

When a User Application sends a message from chain A to chain B, the message is routed through the endpoint on chain A. The endpoint then notifies the User Application specified Oracle and Relayer of the message and its destination chain.

The process consists of chain A compiling and transferring the message to LayerZero. LayerZero then shares the block ID of the request to the oracle. Subsequently, the off-chain relayer gets the content of the message while the oracle holds on to the block ID. Finally, now that the relayer has the message and the proof of the original transaction, it can prove that the request was made and passes along the block information of the original request.

Tapioca’s relayer is called the Pearlnet. The protocol will allow TAP to be staked in a DPOS (Delegated Proof of Stake) system that lets users delegate their tokens to validators who are in charge of securing the cross-chain messaging infrastructure. Whenever a validator attempts to commit any sort of harmful behavior, it will be slashed.

When it comes to the Oracle infrastructure, Tapioca’s configuration will use Chainlink as the main provider. Besides, the protocol will cross-check results with other data providers in a sanity check.

Tapioca Omnichain Fungible Tokens, TOFTs, are liquid LayerZero OFT20 omnichain asset wrappers that represent the underlying non-omnichain asset. Tapioca uses this design in order to issue tAssets that will be used as collateral on Tapioca markets. tAssets are strictly 1:1 backed by omnichain assets.

An OFT (Omnichain Fungible Token) is a LayerZero token standard that allows assets to seamlessly move between all supported chains with no added cost.

When there is a cross-chain asset transfer, the token is burned on the source chain and then minted on the destination chain, all directly through the token contract. Because of this, tAssets have an elastic supply on a per-chain basis while still having a fixed total supply of all circulating tokens across all chains. This makes liquidity composable instead of leading to liquidity fragmentation across chains.

There is no need for bridges and, therefore, wrapped assets do not need to act as receipts for assets that are not supported on a specific chain. Instead, tAsset wrappers are supported on all chains present in LayerZero. On a similar note, since there is no need for a bridge, this removes the extra barrier for users to pay a fee for moving their assets. Besides, bridges also introduce the additional problem of having slow finality.

By having transfers built directly into the contract, users can forgo paying an additional bridge provider on a per-transaction basis. With TOFTs, there are no exit fees, performance fees, mint fees… TOFTs only incur fees when being lent in Singularity markets and have no added fees besides the normal gas costs to wrap and unwrap them.

Among the benefits of OFTs stands out its ability to avoid liquidity fragmentation across many chains. To avoid this fragmentation that results from protocols being deployed to multiple chains, Tapioca provides users with a way to access one unified token across many chains. For example, tGLP combines GLP on Arbitrum and Avalanche into one liquid asset.