Published: March 13, 2024

KTX is a decentralized derivatives protocol designed to provide leveraged trading opportunities on major trading pairs such as $BTC, $ETH, $BNB, and $MNT with up to 100x leverage. The protocol is live on BNB Chain, Mantle, and Arbitrum, offering spot swaps and perpetuals trading with zero-price impact swaps and minimal slippage.

Users can trade on-chain and enjoy a permissionless experience with no KYC requirements. Prices are aggregated from 7 whitelisted exchanges and brought on-chain using custom price oracles.

Derived from GMX v1, KTX allows traders to rent liquidity from a liquidity pool by charging a borrowing fee to offer leverage for traders, compensating liquidity providers with 70% of protocol fees and $esKTC rewards. Introducing a borrowing fee also prevents traders from opening both long and short offsetting positions that take up pool capacity without paying any fees.

$KLP acts as the counterparty to traders on KTX by essentially providing the liquidity that traders borrow for their leveraged positions. When traders make a profit, it means they’ve effectively borrowed assets from the $KLP pool and profited from their trades. Conversely, when traders incur losses, it implies that the $KLP pool has earned because it’s essentially the provider of the borrowed assets. In this setup, $KLP holders are like the house in a casino, since traders are charged a borrowing fee to keep their positions open.

An analogy to understand this is by envisioning a casino where players place bets against the house. When a player wins, the casino pays out the winnings, but when a player loses, the casino keeps the bet. Similarly, on KTX, when traders make profits, they gain from the market movements, but when they lose, the $KLP pool earns from their losses. Holding $KLP tokens is akin to being the house in the casino, as $KLP holders ultimately profit from traders’ losses and have an edge through the fees they collect.

One of the standout features that differentiates KTX from other exchanges is its gamified approach and incentives. This is achieved with frequent rewards programs to incentive activities such as trading, providing liquidity, or through referral programs.

KTX rewards page displays multiple opportunities to engage in rewarding campaigns and activities that allow users to accumulate points from activities they perform in the protocol. Additionally, more mini-games will be added over time.

KTX features a trading engine with a liquidity pool, margin trading, and spot swaps.

KLP is a liquidity pool consisting of 50% stablecoins and 50% volatile assets. The allocation of the assets depends on the network being used (Mantle, Binance Chain, or Arbitrum).

Depositors provide their liquidity and act as market makers for the trading activity that takes place on the platform, both for perpetuals and spot trading. In exchange, liquidity providers receive 70% of the platform fees distributed in $ETH or $BNB and also earn $esKTC rewards.

$KLP operates as an index tracking composite assets and allows depositors to mint $KLP tokens to participate in liquidity at any time. Since liquidity and TVL can scale with no upper limit, the token supply is unlimited.

$KLP Price is determined by Total Value of Assets / Total Supply of KLP, influenced by asset price fluctuation and Trader Profit & Losses.

$KLP Price = Total Value Assets in KLP / Total Supply of KLP

Liquidity providers are the counterparty to traders, and depending on the direction they will be settled on one asset or another.

Because of this design, LPs in the $KLP pool are exposed to price movements in the underlying assets. Hence, the value of their holdings are sensitive to price fluctuations – a decline in the price of the underlying assets in the pool would negatively impact LPs’ holdings.

As a result, LPs are inherently long the assets in the $KLP pool. One way to protect and hedge this risk is by shorting those assets in their respective weightages within the pool. This would create a delta-neutral position that should help them balance their portfolio, offsetting the impact of price changes.

Note that external protocols might as well choose to build on top of KTX in order to offer strategy vaults that build up a neutral position with a 1-click deposit.

As an example of a long trade, consider an entry price of $10,000 with 1 $BTC as collateral and 50x leverage, equivalent to 50 $BTC. This could result in one of the following scenarios:

As an example of a short trade, consider an entry price of $10,000 with 1,000 $USDT as collateral and 50x leverage, equivalent to 50,000 $USDT. This could result in one of the following scenarios:

Since $KLP takes the opposite side of traders, it acts as the counterparty to swaps on the pool. Therefore, the pool’s performance is inversely linked to the profits/losses of traders.

During strong trending markets (bull/bear), Open Interest (OI) tends to skew to one side, with traders piling up on the long or short side of the market. For example, it is expected to see a market skew with many traders on the long side during a bull market.

LPs can adopt a strategy mirroring traders’ trades to hedge against adverse movements in Trader PnL, ensuring a payment structure characterized by low risk and high return potential. This aligns with LPs’ objectives of optimizing returns while managing market exposure.

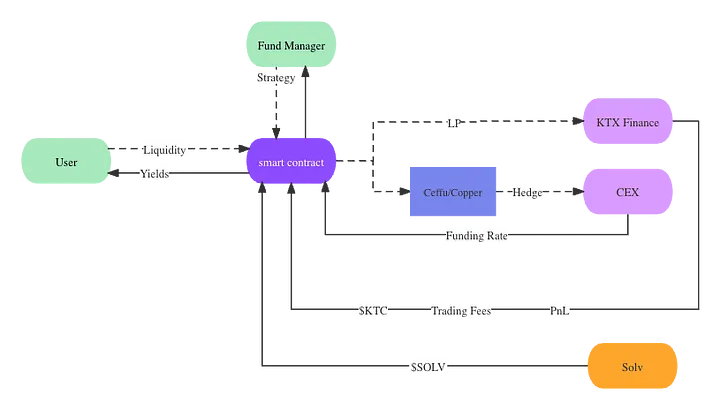

In addition to that, KTX is working with several institutional trading houses and market makers to help LPs achieve market-neutral returns.

Decentralized and non-custodial platforms like Solv Protocol offer active asset management strategies with a focus on constructing LP-centric funds to create diverse yield opportunities. For instance, with their Delta Neutral KTX pool. $KLP holders can hedge against their exposure from the underlying volatility of the $KLP assets like $BTC, $ETH, etc.

KTX offers leveraged trading opportunities on major trading pairs such as $BTC, $ETH, $BNB, or $MNT with up to 100x leverage.

Before opening a position, traders should familiarize themselves with 7 concepts that will have an impact on their trading performance: collateral management, leverage, trading pairs, order types, trading settlement, limits to open interest, and liquidations.

The collateral management system on KTX is tied to the direction of the trader’s position. Collateral for long trades is in the respective trading pair’s native currency, while short trades are denominated in stablecoins and settled in $USDT.

Note that from a user standpoint, this complexity can be abstracted away in the backend. For instance, if you are a user who only has $USDT in their wallet and you would like to go long $ETH, you can deposit $USDT as collateral and it will be swapped to $ETH through a swap aggregator before initiating the trade.

KTX offers up to 100x leverage. Leverage is offered to traders by allowing them to borrow capital from the protocol to build up larger positions. For instance, traders requesting 10x leverage would be able to open a $10,000 position with only $1,000 in collateral. This is achieved by borrowing assets from the KLP pool and paying a borrowing fee in return.

Position Leverage = Position Size/ Position Collateral

During the lifetime of a position, the collateral value will fluctuate based on both asset price changes, and the borrowing fee. In the event of an adverse condition where the leverage of the traders increases beyond the initial leverage, the position will be available for liquidation.

Trading pairs vary based on the network, with different pairs available on Mantle, BNB Chain, and Arbitrum.

Market orders and limit orders are available, with complex orders allowing simultaneous position opening and limit order setting.

Note that order execution of limit orders is not guaranteed, as that will depend on specific market and liquidity conditions:

Users can also open a position and set take-profit and stop-loss levels in one click via complex orders.

Long trades are physically settled in the respective asset, while short trades are cash settled in $USDT.

Open Interest reflects the total size of outstanding (not settled) perpetual positions, with limits determined by the total value locked in the protocol.

Long and short open interest is restricted by the assets staked within the $KLP pool and stablecoins staked respectively.

The reason why these caps to Open Interest are necessary is because the maximum amount of Open Interest that can be supported is limited by the protocol’s Total Value Locked (TVL). Because of how settlement works on KTX, traders are the counterparty of the liquidity pool and they will always be paid out in the event of a windfall.

Pool Utilization = Open Interest / Assets in KLP

Liquidations are triggered when asset prices move adversely against the user, automatically closing the position to prevent further losses. A liquidation fee incurred upon triggering, with conditions based on position collateral and leverage.

Traders can utilize $KLP liquidity for spot swaps, exchanging one asset for another within the $KLP pool. One notable feature is that spot swaps on KTX are characterized by zero slippage, distinguishing it from other Automated Market Makers (AMMs) that rely on a constant-product formula for pricing, such as Uniswap’s x*y=k.

Users incur a swap fee ranging from 0.20% to 0.80%, depending on how asset balances change post-swap. For instance, consider the scenarios below:

KTX was conceptualized in the aftermath of the FTX collapse, with the aim to democratize access to derivatives trading for the masses without sacrificing core features such as user experience, speed, and security. The vision is to solve some of the drawbacks caused by counterparty risk, increased regulatory scrutiny, and a single point of failure.

KTX, as a fork of GMX v1, inherits its core functionalities while striving to further improve the user experience and expand its reach across multiple chains, including BNB Chain, Mantle, and Arbitrum.

The primary motivation behind the project’s creation is to provide traders with a decentralized platform where they can efficiently trade perpetual futures with leverage, benefiting from features like low slippage, diverse asset offerings, and seamless integration with other DeFi protocols.

KTX operates in the DeFi derivatives sector, specialized in perpetual futures, aiming to attract users seeking leveraged trading opportunities in crypto. Perpetual futures are derivative contracts that allow traders to speculate on the price of an asset without holding the underlying or enforcing its delivery on a specific maturity date.

Unlike traditional markets, crypto markets are still dominated by spot trading, with derivatives volume representing a lower share of the total. Most notably, the majority of the perps trading volume takes place on Centralized Exchanges (CEXs), with a minority of it on DEXs like dYdX, Aevo, GMX, Vertex, or KTX among others.

Popular centralized exchanges include Binance, Coinbase, Upbit, OKX, and Kraken. They offer simple-to-use interfaces with tutorials, support, and intuitive trading designs, enhancing the trading experience for users. Users can easily conduct trades from fiat to crypto (or vice versa) using debit cards or bank transfers. However, the drawback involves custodial risks, KYC enforcement, and regulatory challenges.

One of the advantages of DEXs over CEXs is that decentralized protocols can pass their revenue onto token holders. As more volume migrates from CEXs to DEXs, the value captured by their token holders increases, usually triggering a re-rate in their valuation, enhancing the value of token incentives as trading volume rises.

From a trader’s perspective, trading perps on KTX differs from traditional exchanges, with long traders renting asset upside and short traders renting stablecoin upside. $KLP holders, acting as counterparties, earn fees and profit when traders lose and vice versa.

Unlike traditional perps exchanges, KTX users don’t directly buy or sell tokens. Instead, they deposit collateral to take long or short positions. Profits are paid in stablecoins for short positions or in the pair’s token for long positions. However, it is important to note that the $KLP pool allows for spot swaps with zero price impact.

Fees generated by the platform are distributed: 70% to $KLP holders in $ETH (Arbitrum and Mantle) or $BNB (BNB Chain), and 30% to $KTC stakers, who are also rewarded with $esKTC tokens and multiplier points.

Centralized exchanges (CEXs) currently hold a significant advantage in terms of user adoption and liquidity. However, recent incidents have highlighted the growing demand for self-custody and transparency offered by DeFi platforms like KTX.

The decentralized derivatives market has seen remarkable growth and innovation since 2021. Different platforms have emerged with unique approaches to architecture and features.

One approach involves order book-based perpetuals. These platforms use a combination of on-chain and off-chain order books to reduce latency and gas costs. Sometimes they require their own application-specific chain or L2 rollup.

Another model is virtual automated market makers (vAMMs), which decouple market structure from spot prices, allowing for independent price discovery. While this can create arbitrage opportunities, it may also lead to unexpected price movements due to shallow liquidity.

Most recently, intent-based architectures are gaining more traction, offering an RFQ system where professional market makers establish peer-to-peer bilateral agreements with traders, bypassing oracles. Intents aim to revolutionize transaction execution, enabling users to express desired outcomes while specialized third parties handle transaction creation complexities. This model bypasses on-chain order books, protecting against front-running and enhancing throughput, but requires an off-chain escrow system and the intervention of market makers hedging their inventory in other venues such as CEXs.

One differentiating factor of KTX versus other models and competitors is the use of the $KLP model, which allocates 70% of all trading fees to liquidity providers and 30% to $KTC stakers. This mechanism not only incentivizes participation as LPs or token holders but also simplifies the earnings structure. This passive income structure allows $KLP holders to benefit from trading fees without the need for active position management, as well as reward $KTC token holders who stake their tokens.

Furthermore, the $KLP token offers diversified exposure by representing an index of various assets involved in swaps and leverage trading. This diversification is a key strength in reducing volatility but also enables composability across DeFi, offering a yield-bearing asset for other protocols in DeFi to build on top. The dynamic nature of $KLP yields, which varies with trading activity, presents an opportunity for liquidity providers and integrating projects to capitalize on periods of high market volatility. Such periods may lead to enhanced returns, adding an attractive dimension to the $KLP’s investment profile.

Additionally, the use of oracles for pricing makes it possible to offer zero-price impact for traders while still allowing them to keep custody over their assets.

All things considered, the key value proposition of the $KLP model is that it finds a sweet spot by becoming a destination for LPs to earn yield, protocols to build on top, and traders to open swaps with zero-price impact and minimal slippage.

KTX offers a decentralized derivatives protocol that enables leverage trading in a self-custodial way, allowing users to act as either traders or liquidity providers. Users enjoy a permissionless experience without the need for usernames or passwords.

One of the major advantages of KTX lies in its composability, enabled by tokenizing its liquidity pool in the $KLP token. This allows other projects to build applications on top, offering delta-neutral strategies, yield auto-compounders, delta hedging for option protocols, social trading…

Moving forward, KTX will expand its operations to become more than a perps DEX, also offering casino games. This gamified approach is already reflected on KTX’s blindbox games and rewards, but the project contributors will double down on these efforts to further gamify the platform and incentivize user retention. Note that sports betting will not be offered, but rather the emphasis will be on games like Aviator and similar.

KTX aims to become a leader in the gaming sector of Arbitrum, allowing users to actively engage in games, trade, stake $KTC, deposit into $KLP… all in one platform. All of this process will be gamified, allowing users to earn points that grant access to blind boxes, lottery events…

One strategic advantage of KTX is that it can tap into the Southeast Asian market, with countries like Vietnam, Indonesia, and the Philippines, all of which have seen huge growth in both gaming and crypto. This is where the $KLP pool shines, offering a liquidity vault for on-chain games that require a counterparty vault and on-chain settlement.

Another benefit of the $KLP is the added flexibility that comes with offering dynamic incentives to players and allow LPs to earn fees as a result. These incentives are transparent and rewarded on-chain, with no hidden jackpots or leaderboards.

Moreover, the addressable market is not only limited to games. Thanks to the composability of $KLP, KTX is also working with other DeFi projects specialized on building money markets, yield aggregators, vaults…

Even though GMX has transitioned to a model that relies on isolated GM pools in GMX v2, KTX still fosters the former design pioneered by v1. The reason for that is because of the composability benefits.

The ease of integrating $KLP compared to GM pools stems from its simplified structure, with just one pool to integrate with, unlike GM pools with multiple independent pools. Dynamic fees like price impact and adaptive funding fees pose challenges for protocols building on GM pools, whereas $KLP fees are fixed and predictable, facilitating strategy development. This simpler environment fosters partnerships and enables the creation of additional building blocks on top of KTX.

Furthermore, in KTX losses are socialized to all $KLP holders, meaning that LPs bear the brunt when traders profit, albeit traders losing more often than winning, resulting in solid yields for $KLP holders. Conversely, in the GM model, trader profits (and LP losses) are borne by liquidity providers in specific GM pools, exposing them to unnecessary and higher risks.

As a result, $KLP’s multi-asset pool spreads out profits more effectively among LPs when traders win, offering a sustainable model. Investing in $KLP is akin to owning the entire casino, unlike specific slot machines in GM pools.

Despite strong competition from platforms like DYDX, Aevo, Hyperliquid, or Vertex, GMX and KTX differentiate themselves through their revenue-sharing model.

Token rewards are distributed to both liquidity providers and stakers, offering incentives for long-term engagement. Moreover, the platform distribution of revenue in “real yield,” paid out in tokens like $ETH appeals to users seeking sustainable returns in native assets.

While this might make trading more expensive for traders, this is also a compelling value proposition for liquidity providers, allowing them to own a share of the “casino’s house”.

KTX is deployed on BNB Chain, Mantle, and Arbitrum. $KTC tokens can be traded on FusionX and Merchant Moe on the Mantle network, PancakeSwap on the BNB Chain, and Uniswap on Arbitrum

On KTX, trading operates differently compared to traditional margin trading platforms. There are two trading sides: going long and going short. However, users on KTX engage in a reverse borrowing process:

On KTX, $KLP token holders effectively rent out their exposure to traders. When traders profit, $KLP holders incur losses, and vice versa. This dynamic arises because $KLP token holders represent a multi-asset liquidity pool, where their returns are tied to the performance of the assets in the pool.

However, it’s essential to note that while it appears traders are renting liquidity from the $KLP pool, this liquidity is not actually rented out. Instead, when the position is closed:

As a result, $KLP holders benefit when traders incur losses and experience losses when traders make profits.

There are 3 types of users involved in participating in the protocol: traders, liquidity providers, and $KTC stakers.

The target users will be traders who want leverage and close to zero slippage trading, as well as liquidity providers who want to earn “real yield” on their assets.

Liquidity providers can earn “real yield” from trading fees paid out by traders. They deposit assets into the $KLP pool, and this capital is used to underwrite leveraged positions and be the counterparty to traders.

The $KLP pool is a multi-asset pool, representing an index of assets used for swaps and leverage trading. It can be minted using any index asset and redeemed for any index asset.

Minting and redemption prices are calculated based on the total worth of assets in the index, including profits and losses of open positions, divided by the $KLP supply.

Note that $KLP tokens are specific to the network they are minted on and cannot be directly transferred between networks.

$KLP holders profit when leverage traders incur losses and vice versa. Past PnL data, price charts, and other statistics can be viewed in KTX’s statistics page.

To engage in trading, users deposit collateral, select the desired leverage, and open a long or short position on the asset they choose.

After initiating a trade, you can manage your position under the Positions list, where you can adjust collateral, monitor profits and losses, and set stop-loss or take-profit orders as needed.

As a trader on KTX, you should be mindful of the liquidation price, which automatically closes a position if breached.

Additionally, understand that orders are not guaranteed to execute under certain conditions, and fees include a spread for stablecoin depegging scenarios. It’s essential to exercise caution, understand the risks involved, and regularly monitor your positions.

The sections below provide a tutorial and walkthrough guide showing users how to perform different actions based on what role they want to play in the platform.

Margin Trading on KTX allows users to speculate on the directionality of asset prices in the KLP pool with leverage.

Orders are not guaranteed to execute in various scenarios, including instances where the mark price doesn’t reach the specified price or when no keeper picks up the order for execution.

For long positions, when choosing a different collateral asset than the token that is going to be traded, a swap fee will be charged in order to prevent deposits from being used as a zero swap fee. This swap fee does not apply to shorts or when withdrawing collateral from existing positions, regardless of whether they are longs or shorts.

Note that even though offers zero price impact due to the use of an oracle-based pricing model, there is a possibility that the price of an asset changes during the period of time from when a trader initiates a position and when this transaction is executed on-chain. This might lead to potential price discrepancies between the initially submitted trade details and the final confirmation. This difference between the expected price and the actual execution price is called slippage. By default, this value is set to a maximum allowed slippage of 0.3%, but users can increase it up to 1% depending on their tolerance.

Once positions are opened, users can track their performance and PnL under the “Positions Tab”.

During the lifetime of a position users can:

Note that closing a position manually does not automatically cancel the take-profit or stop-loss orders that may be associated with it – the user would need to manually cancel them.

The Liquidation Price is also shown to inform users of the price level at which their position will be automatically closed. This price will change over time because of the borrowing fee that users pay to get leverage from the $KLP pool, making it critical to monitor on a relatively frequent basis.

When liquidations occur, if there is any collateral remaining after deducting losses and fees, this amount will be returned to the user.

Depositing assets into the $KLP liquidity pool is the equivalent of providing liquidity or purchasing $KLP, which simply means minting $KLP in the liquidity pool to represent your position and share of the pool as a liquidity provider. Similarly, selling $KLP is the equivalent of burning $KLP, representing a withdrawal of assets from the pool and reducing the supply of $KLP tokens.

Users can specify the amount of $KLP they want to buy or sell and the transaction will be executed based on the market price and available liquidity. The amount of fees that is paid can be lowered by entering the position with assets that the pool is currently underweight in, contributing to balance the pool and bring it closer to the target ratios.

Liquidity providers ($KLP holders) are rewarded with 70% of trading fees paid out in $BNB, or $ETH on BNB Chain, Mantle, and Arbitrum respectively. They are also rewarded with esKTC tokens.

Users can stake $KTC, $esKTC, or $KLP to claim a share of protocol fees and claim or compound their $esKTC or Multiplier Points.

The utility and benefits of each token is described in more detail in the tokenomics section

$esKTC stands for escrowed $KTC, and is vested to actual $KTC tokens every second linearly over a period of one year.

In order to vest $esKTC into $KTC tokens, the paired tokens (either $KTC or $KLP) that were used to earn the original $esKTC rewards need to be staked.

The first step in this process is to unstake the $esKTC rewards that you have earned from staking.

Next, you will deposit into either the $KTC Vesting Vault or the $KLP Vesting Vault to vest your $esKTC.

After entering the desired amount of tokens that you want to vest, the UI will display the corresponding amount of $KTC or $KLP tokens that you need to keep staking. This is the “Reserve Amount”.

On the backend, trading on KTX operates as follows:

KTX offers a trading platform for spot swaps and perpetual futures.

Traders engage with the pool with liquidity providers acting as counterparties, generating trading volume and paying fees that contribute to the protocol’s revenue.

In exchange for the risk being taken, liquidity providers receive a portion of the trading fees as compensation.

Token holders can stake their $KTC tokens to capture a share of the trading fees.

Trading volume generates margin trading fees (position, borrowing, and liquidation fees), spot swap fees, and $KLP minting/burning fees.

These fees constitute the protocol’s revenue, which gets distributed to liquidity providers and $KTC stakers.

Hence, the protocol’s success is driven by trading volume, assets under management, and the fees generated.

Users can save on fees by depositing assets that contribute to improving the pool’s stability, getting it closer to the optimal allocation for a given asset.

The protocol shares revenue with both $KTC and $KLP token holders. The total fees are distributed after deducting referral rewards and the cost of keeper bots, which are responsible for monitoring prices and executing limit orders. Keeper costs are usually around 1% of the total fees.

KTX utilizes a dual-token model to enhance its ecosystem’s functionality and liquidity. This model comprises $KTC (KTX Community Tokens), and $esKTC (escrowed $KTC) tokens, which are a vested representation of the former.

$KTC is the utility token of the platform, allowing token holders to participate in staking and earn 30% of the protocol trading fees (paid out in $BNB, or $ETH on BNB Chain, Mantle, and Arbitrum respectively).

The maximum supply is set to $100M tokens.

$KTC stakers are also rewarded with:

Liquidity providers receive $KLP (KTX Liquidity Pool Tokens) tokens representing their share of the liquidity pool. This allows them to act as counterparty to traders on the platform. As compensation for this risk, they are rewarded with 70% of the trading fees generated on the platform, paid out in $BNB, or $ETH on BNB Chain, Mantle, and Arbitrum respectively.

Unlike $KTC, the supply of $KLP is unlimited, since the TVL of the platform scales as more capital is added to the pool and there is no upper bound to cap this supply. Hence, KLP functions like an open-ended index fund, tracking its composite assets and allowing depositors to mint $KLP tokens at any time to join the liquidity pool.

Since liquidity providers are the counterparty to traders, the price of $KLP will reflect the PnL of the pool – that is the gains or losses of traders. Therefore, the price of each unit is determined by dividing the total value of the assets in the pool by the total $KLP supply, reflecting asset price fluctuations and trader profit & losses.

$KLP price = Total Value Assets in the Pool / Total KLP Supply

$KLP holders are also rewarded with $esKTC tokens, undergoing a linear conversion to $KTC over a one-year period.

$esKTC tokens share similarities with $KTC tokens, representing utility within the platform. The key distinction is that they are an escrowed version of $KTC – they cannot be sold until they undergo gradual conversion to actual $KTC tokens over a one-year period.

The linear unlocking mechanism ensures the controlled distribution of $KTC tokens. This constitutes 30% of the $KTC total supply.

$esKTC tokens can be staked, offering equivalent rewards to staking $KTC, enabling compounding rewards over time.

When users want to access the actual $KTC tokens, they will start a vesting period with a one-year duration. Note that in order to vest $esKTC into $KTC tokens, the paired tokens that were used to earn the $esKTC rewards need to be staked with the $esKTC.

For example, consider a user who owns 100 $KTC and earns 10 $esKTC over one month. To convert those 10 $esKTC into 10 $KTC tokens, 100 $KTC tokens need to be staked along with the 10 $esKTC.

At any point during the vesting period, users can claim their portion of $esKTC tokens that have been converted to $KTC. However, the $esKTC tokens and their paired tokens reserved for vesting cannot be unstaked or sold until the vesting period concludes.

Users can also remove tokens from the Vesting Vault by withdrawing all tokens and pausing the vesting conversion. However, partial withdrawals are not supported. The full withdrawal process removes all tokens from the Vesting Vault and, therefore, users should plan accordingly before giving up on their rewards.

Token emissions and reward rates are evaluated on a monthly basis and are subject to changes.

Multiplier points are a reward mechanism designed to benefit long-term holders without contributing to token inflation (which would dilute the value of their holdings).

Users receive Multiplier Points when staking $KTC tokens at a fixed Annual Percentage Rate (APR) of 50%. Each Multiplier Point earns the same amount of $ETH/$BNB rewards as a regular $KTC token, ensuring proportional fee rewards for long-term holders.

There is a Boost Percentage that represents the extra reward amount based on the ratio of Multiplier Points to total staked $KTC and esKTC.

Multiplier Points are automatically staked to earn fee rewards, providing an additional avenue for increasing returns. The “Compound” button on the Earn page facilitates this process.

Users must ensure that their $KTC and esKTC tokens are staked for Multiplier Points to be effective. Unstaking $KTC or $esKTC tokens results in the proportional burning of Multiplier Points. This burn applies to the total amount of Multiplier Points, including both staked and unstaked Multiplier Points.

For example, if 1000 $KTC are staked and 200 Multiplier Points have been earned, unstaking 500 $KTC would burn 100 Multiplier Points.

The strategic distribution of $KTC, KLP, and esKTC tokens is crafted to support the ecosystem’s health, ensuring a balanced introduction of tokens to foster long-term viability and growth.

KTX.Finance has a token emission schedule designed to incentivize participation and foster protocol growth.

Yearly Emissions: Starting in 2024, the protocol has 13.7% of the total token allocation, increasing to 32% in 2025. This progressive design propels the platform’s growth phase. In 2026, emissions are at 23% before moderating to 14% in 2027 and 2028, concluding at 3.3% in 2029. This structure fosters initial adoption and ensures future ecosystem stability.

Allocation and Schedule:

KTX features incentive programs of 3 types: reward campaigns, $KTC staking and fee rebates, and referral programs.

The Rewards Page allows users to earn points based on their activity and participation in mini-games.

This allows users to accumulate Arcade points and open blindbox rewards. These will become increasingly more useful as more minigames are introduced to the platform.

Staking $KTC also allows users to earn fee rebates and staking yield with a tier-based system, where the user’s VIP level is determined by the amount of $KTC staked.

Rebates are calculated based on the lowest amount of $KTC staked within a week. The distribution takes place on a weekly basis and is retrospective. For example, rebates for week 1 will be distributed in week 2.

From a trader’s perspective, users should be aware of market volatility, the amplified effect of leverage on potential profits and losses, and liquidation risks when an account’s balance falls below the liquidation threshold due to adverse price movements.

Liquidity providers are the counterparty to traders’ positions, experiencing losses when traders are profitable and take assets out of the liquidity pool. $KLP holders are also exposed to the price fluctuations of the underlying assets in the basket, which can affect the value of their LP tokens and impact their overall returns. Furthermore, if the liquidity pool becomes imbalanced, it may end up with disproportionate amounts of different assets. Therefore, LPs may incur higher losses compared to holding the assets individually.

In addition to that, users of the platform are exposed to smart contract risk as well as platform risk from off-chain components such as oracles and network keepers. Inaccurate or manipulated price feeds from oracles could lead to incorrect trading decisions or losses for traders, while downtime of network keepers might result in certain types of orders (limit stop-loss, take-profit) not being executed. Nonetheless, KTX uses a custom Oracle aggregating prices from 7 different exchanges, minimizing risks through diversified data sources. For major assets like $BTC/$ETH/$BNB/$SOL/$LINK/$ARB, prices are retrieved from Binance, Gate, Kucoin, Bybit, and Coinbase. For assets like $MNT, CEXs like Bybit and DEXs like Uniswap and Agni Finance are used.

Other risks include market skew and the potential depletion of the $KLP pool. The former can occur on the short side during significant market downturns when prices drop rapidly. When this happens, profitable short traders withdraw stablecoin profits from the $KLP pool, reducing its size. Losses incurred by the $KLP pool directly affect liquidity providers ($KLP holders), leading to a decrease in Total Value Locked (TVL). As $KLP acts as the counterparty for traders, sustained profitability among traders can deplete the liquidity pool.

These risks highlight the dependency of the protocol’s success on the assumption that most traders will incur losses over time, emphasizing the importance of risk management strategies and ongoing assessment of market conditions for both traders and liquidity providers on the platform.

Security measures encompass rigorous smart contract audits, protocol upgrades, and community-driven risk management strategies.

KTX is a fork of GMX v1, whose code was audited by ABDK and Quantstamp.

The codebase also underwent a comprehensive audit by MetaTrust. The audit was conducted on February 25, 2023, scrutinizing the protocol core contracts, revealing 2 critical, 2 low risk, and 4 informational issues, with critical and most informational issues promptly addressed.

The contracts are openly accessible on GitHub, reflecting a commitment to transparency and community collaboration.

The main attack vectors derive from front-running and/or oracle manipulation. Traders may exploit time delays in transaction execution to front-run trades, impacting the fairness and efficiency of the platform. For example, they might move the price of the asset in the CEX that provides the oracle feed for KTX and use that information to trade and reduce the profitability of liquidity providers.

To protect against oracle manipulation, price checks are enforced at the smart contract level. Each price update stores the percentage change for the update and the percentage change of the oracle price since the last update. This way, if the cumulative percentage change over a period of time exceeds the cumulative change in oracle prices, the spread between the keeper price and oracle price will be automatically updated.

A similar incident to what occurred on a previous GMX price manipulation attack could potentially happen on KTX, particularly if there is a significant disparity in liquidity between on-chain DEXs like KTX and CEXs. This risk stems from the manipulation of off-chain prices on CEXs, which could be exploited by traders to profit from the low slippage feature of KTX.

For example, consider the following scenario:

To mitigate such risks, KTX implements a cap on open interest, limiting the maximum exposure traders can have on the platform at any given time. This measure can help to prevent excessive manipulation and potential fund depletion from the pool. Additionally, continuous monitoring of price oracles and enhancing the platform’s security protocols could further safeguard against similar exploits.

The reliance on oracles and off-chain infrastructure carries risks in the form of potential price manipulation on the underlying source, although this is mitigated by using multiple data sources from diverse exchanges.

Downtime in off-chain infrastructure might also alter the expected behavior of the platform, with some orders not being timely executed.

Low liquidity of the assets presented in available trading pairs increases the risks of oracle manipulation, making it easier to move the price of the asset on the spot markets that feed the oracle price. However, this is mitigated by only listing trading pairs that satisfy a minimum requirement.

Note that flash loans do not have an impact on swaps or traders, since the minting and redeeming of $KLP is settled using the oracle price and is not dependent on liquidity pool balances or liquidity pool composition parameters.

Even if the changing fees for swaps were dependent on pool composition, the maximum benefit from a flash loan would be a zero-fee swap which adjusts the $KLP token index toward the desired token weights.

KTX is a project incubated by ByteTrade Lab. The team member of KTX.Finance are doxxed and the team is led by experienced professionals from various sectors. Key members include:

KTX raised $4M in a seed round led by Hashed, backed by investors such as ByteTrade Lab, AlphaLab Capital, CRIT Ventures, Trinito, GSG Asset, Kucoin Ventures, Sky9 Capital, NexGen Venture, and Ouroboros Capital.

KTX was incubated by ByteTrade Lab, headquartered in Singapore, raised $50M in Series A financing in June 2022 from investors such as Susquehanna International Group (SIG) Asia Venture Capital Fund, INCE Capital, BAI Capital, Sky9 Capital, BlueRun, and PCG.

How does pricing work on KTX?

What oracle does KTX use?

How do stop-loss and take-profit orders work on KTX?

Why are limit orders not guaranteed to be executed on KTX?

What is $KLP?

What are the risks associated with being a liquidity provider?

How does the rebalancing of the basket of $KLP assets work on KTX?

How can one obtain $KTC and $KLP tokens?

What are the benefits of staking $KTC instead of just holding?

What is the “Boost Percentage” displayed on the Earn Page?

What are Multiplier Points on KTX?

What is the difference between $KTC and $esKTC?

Will I lose my Multiplier Points if I unstake my $KTC?

Why does KTX favor the GMX model with a multi-asset pool instead of the Gains model using a single stablecoin vault?

KTX allows users to generate unique referral codes that are valid across all chains, simplifying the user experience and engaging its user base with different incentives and benefits. .

Referrers earn 10% of the referred users’ fees and referred users receive a 5% trading discount.