Published: April 09, 2024

Cartesi emerged in 2018 with a proposition that seemed ahead of its time. Today, despite its unique value proposition it has lagged behind other players in the Ethereum rollup ecosystem such as Polygon, Arbitrum, and Optimism among others. While competitors have managed to create an ecosystem with hundreds of projects and meaningful mindshare on the Ethereum developer community, the Cartesi ecosystem is still non-existent with barely any actual dApp in production. However, that doesn’t mean that we should fully dismiss an opportunistic chance to bet on a project that currently ranks in the top 300 by market cap, is listed on all major exchanges, and features a very low supply overhang.

We are currently experiencing a market with overheated valuations where Venture opportunities are becoming more intricate due to the large valuations relative to the opportunities that can be accessed in the liquid markets – where you can bet on working projects and not give up on your liquidity being subject to cliff and vesting terms.

Contrary to being perceived merely as a Rollup-as-a-Service (RaaS) provider, Cartesi is an actual pioneer in offering infrastructure for application-specific rollups that can operate on top of a Linux environment – leveraging years of open-source intelligence and developer tooling. Not only can developers use the programming language of their choice, but Cartesi also overcomes the restrictive barriers of the Ethereum Virtual Machine (EVM), EVM+, and WASM.

If someone came up with the idea and started pitching an “application-specific rollup provider with dedicated computing resources and a Linux runtime, all while maintaining the integrity and settlement capabilities of Ethereum through optimistic rollups”, we are sure that multiple theses would start being released about how this could set a new standard for innovation and unlock unprecedented possibilities in dApp creation and functionality.

However, with $CTSI we are swimming against the current in terms of strong on-chain metrics, large community support, financial backing, and ecosystem development. Being aware of this and keeping this in mind at all times we can understand the reasons behind this bet and adapt in real-time as market conditions change. Our thesis aims to ride a valuation gap with low selling pressure and supply overhang. This is a relative value trade seeking to capitalize on the spread closure between existing and easily accessible liquid tokens like $CTSI and new players entering the market and riding the “modular thesis” narrative at multi-billion valuations.

The cherry on top that could speed up a rerating would be a killer app that makes the most out of the underlying infrastructure and enables use cases that aren’t possible or offered anywhere else, such as a fully on-chain casino or sports fantasy game. Unfortunately, we don’t expect this to happen anytime soon. Instead, what we can do is await is the announcement of strategic partnerships with large teams like Espresso, Celestia, and EigenLayer among others – all of which can significantly enhance the attractiveness and usability of Cartesi Rollups.

Cartesi is an Optimistic Rollups framework for building application-specific rollups with a Linux environment. It provides dApps with a dedicated CPU and rollup where developers can use the libraries, programming languages, and tools they are already familiar with. Any package or library that is available for Linux can be used by developers to break free from the limitations of the EVM, EVM+, or WASM, alleviating the limitations of writing code that runs on-chain by performing more complex computations off-chain and that can be verified on-chain.

By integrating a Linux runtime environment, Cartesi offers a vast design space fueled by years of open-source intelligence, solving for the limitations of the EVM and the relatively short track record of environments like Solana’s SVM or the MoveVM. The emphasis on Linux means that the protocol eliminates the need for developers to navigate the steep learning curve of new programming languages, thereby opening up blockchain development to a broader audience.

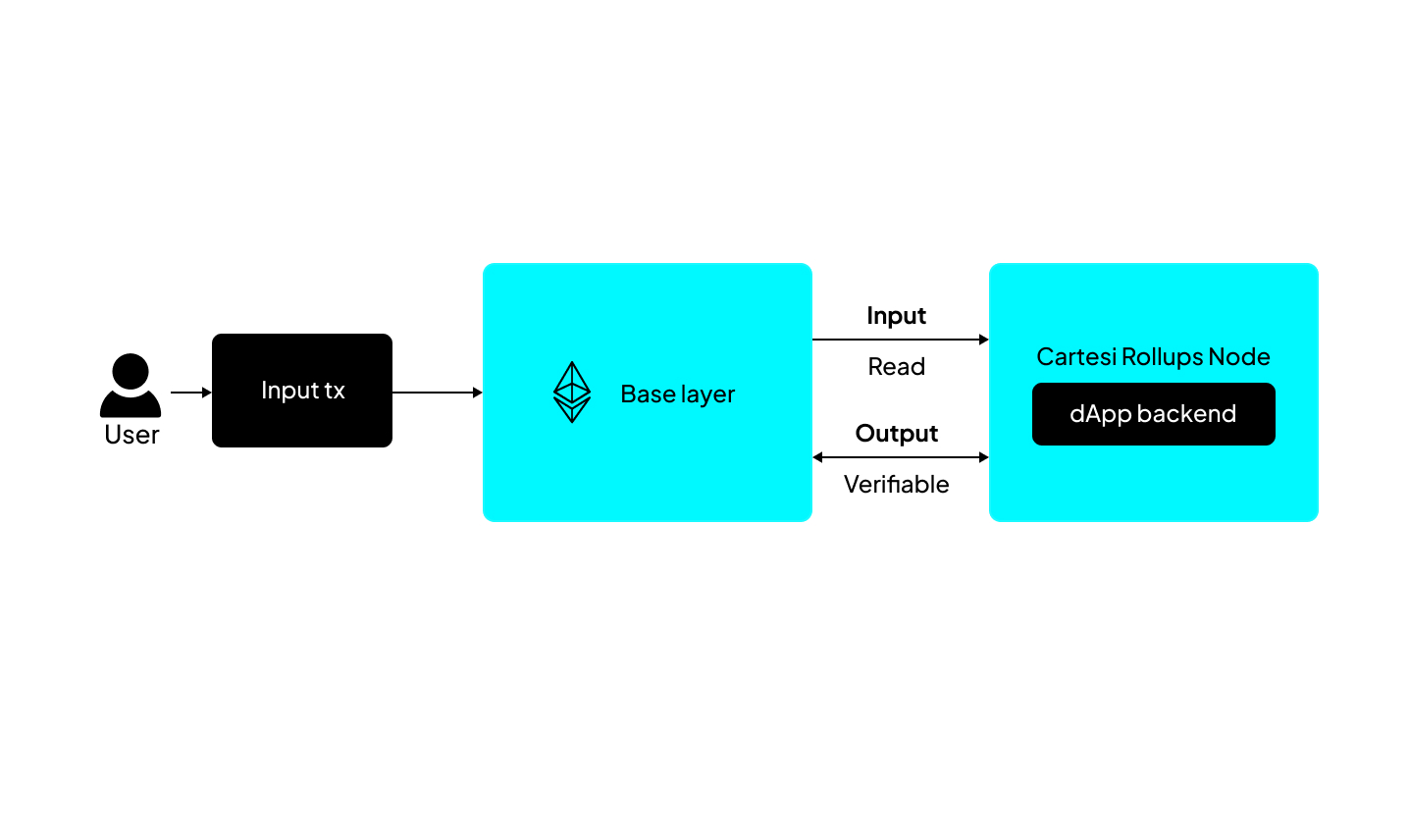

A dApp running on Cartesi Rollups is composed of both on-chain and off-chain components. This is what turns Cartesi into an Optimistic Rollups framework. At its core lies the Cartesi Machine, a virtual machine (VM) that hosts a complete Linux OS for executing each dApp’s back-end as a conventional Linux application. This setup encapsulates the application’s state and makes its logic verifiable on-chain through interactive fraud proofs that ensure the integrity of off-chain computations.

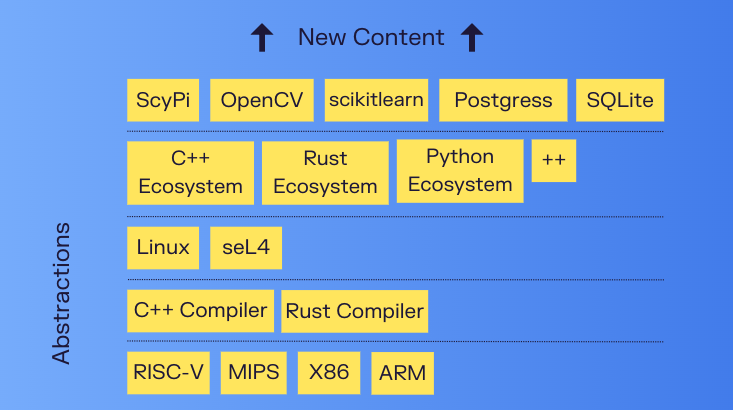

Cartesi’s core innovation is anchored in the Cartesi Virtual Machine. Emulating a RISC-V instruction set architecture (ISA) is crucial for offering Linux compatibility, which is the leading and most used operating system. This compatibility grants dApp developers access to an extensive range of code libraries and tools, enabling dApps that rival traditional software in design flexibility, user experience, and efficiency, all verifiable on-chain. The choice of RISC-V positions Cartesi distinctively against alternatives like WASM and custom ISAs, which struggle with consistency and reproducibility across different operating systems. RISC-V’s direct support for Linux sidesteps these challenges, offering a seamless, high-performance environment for blockchain applications. This commitment to leveraging existing, efficient, and open-source solutions is what enriches the developer experience and could unlock use cases that aren’t achievable on any other chain.

To understand the significance of this it is worth highlighting Ethereum’s pursuit of a rollup-centric roadmap to increase transaction throughput and reduce fees. Unlike other rollups, what makes Cartesi different is that it was designed to solve not the scalability crisis, but rather the innovation and development crisis.

Software development thrives on the abstraction and compositional use of existing knowledge. Due to their recency and novelty, in Ethereum and other blockchain environments, the absence of a rich development environment forces developers to start from scratch, hindering the creation of complex dApps due to a lack of accessible, pre-existing content and tools. Unlike the EVM, which is limited by its inability to leverage the vast array of Web2 open-source development due to its unique coding requirements, Cartesi integrates a Linux environment. This integration allows developers to access mature, battle-tested libraries and a broad spectrum of programming languages and tooling.

While the EVM and similar rollup solutions like Arbitrum and Optimism offer cost and speed efficiencies, they do not substantially enhance design flexibility, remaining constrained by the foundational limitations of Ethereum smart contracts. These constraints force developers to make compromises (usually attempting to reduce gas costs) that can impact code quality and security. Alternatives like EVM+ and WASM, despite allowing the use of traditional programming languages, still fall short as they cannot fully leverage existing open-source libraries and tools without a complete operating system infrastructure, limiting their effectiveness in addressing the core challenges faced by dApp developers. Cartesi’s approach not only opens up new avenues for innovation but also provides a more flexible and powerful platform for dApp creation, overcoming the inherent limitations of previous blockchain development environments.

The whitepaper was published in July 2018, and the core team of contributors consists of experienced software engineers and mathematicians like Erick de Moura, Augusto Teixeira, Diego Nehab, and Felipe Argento, and business operators like Colin Steil and Marco Mirabella.

The token’s journey began with a seed sale in August 2017, where 2% of the total token supply was allocated at a price of $0.005 per token, raising $100,000. This early phase was followed by a private sale in April 2019, with 5% of the supply sold at $0.01 per token, resulting in $500,000 raised. A strategic sale in December 2019 priced the token at $0.03, raising $200,000 for 0.67% of the supply.

The Launchpad sale marked a significant step, offering 10% of the supply at $0.015 per token and raising $1.5 million, setting the initial circulating supply at 19% upon Binance listing. The distribution also includes 15% to the team, 2% to advisors, 40% to the foundation, and a 25% mining reserve.

Overall, the total amount raised was $2.3 million. The next and final unlock event is happening on April 23, amounting to 2.14% of the total supply with ~$5 million in tokens going to the team. After that, 75% of the supply will have been distributed, with the remaining 25% allocated to the mining reserve.

With all investors being fully vested and the team about to finish its period, we can deduce that the largest overhang of selling pressure might be over. When it comes to the team we can hypothesize that perhaps there is very little incentive for them to innovate moving forward, or that they are still confident in the mission they started more than 5 years ago and have the ambition to force a token repricing. It will be worth keeping an eye on market making agreements.

To get more clarity on the situation that the protocol treasury might be in we can have a look at the Cartesi Foundation, which has been recently attending most relevant conferences and increasing their marketing expenses collaborating with prominent media brands like Bankless.

The Cartesi Foundation plays a pivotal role in advancing the ecosystem, operating as a non-profit organization dedicated to fostering adoption and ecosystem growth. It accomplishes this by providing funding and resources to developers, thereby extending the network’s reach. This is often done via grants and hackathons with $CTSI incentives.

The Foundation is also responsible for the maintenance of Cartesi’s digital presence across various platforms such as the official website, Discord, governance forums, Telegram channels, and Reddit. A significant part of the Foundation’s activity involves funding and organizing events designed to engage and expand the community. These events range from ETHGlobal, hackathons, and meetups to educational workshops through the Cartesi Community Grants Program.

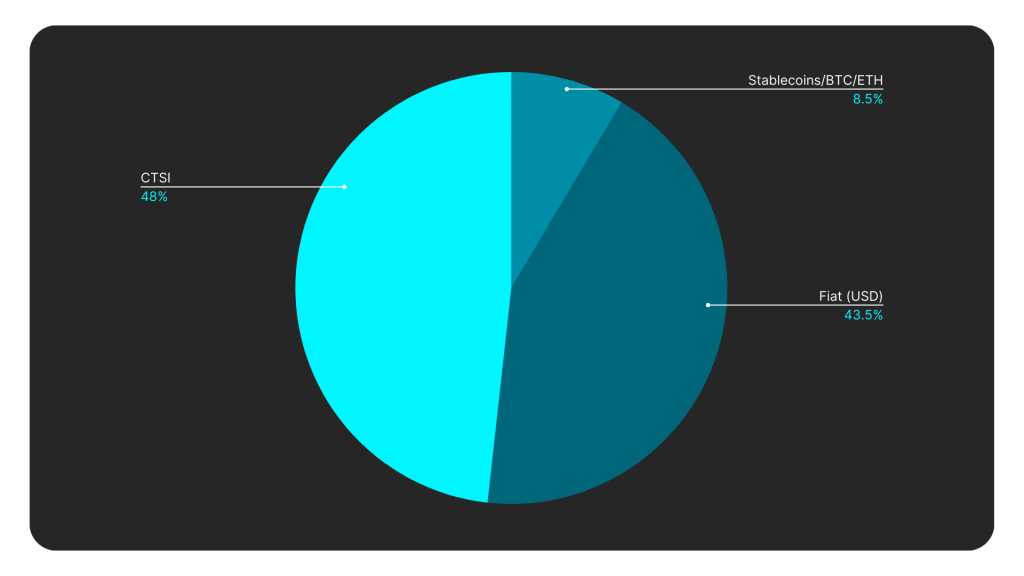

Most importantly, the Cartesi Foundation is the actual admin of the protocol treasury, which includes the fully unlocked $CTSI Foundation reserve, directing funds and resources towards various initiatives within the ecosystem. This management is transparent, with the most recent report published in 2024 revealing a runway of 6 years and 10 months, including all assets, and 3 years and 7 months when excluding $CTSI holdings. To be specific, the Foundation’s assets are 48% $CTSI holdings, 43.5% fiat holdings, and 8.5% in non-CTSI crypto holdings (the majority of which is $stETH, $USDC, and $DAI). In 2023, the Foundation’s expenditure was allocated across ecosystem grants (17%), core R&D unit grants (35%), core company grants (20%), and Cartesi Foundation Initiatives, Operations, and Marketing (28%).

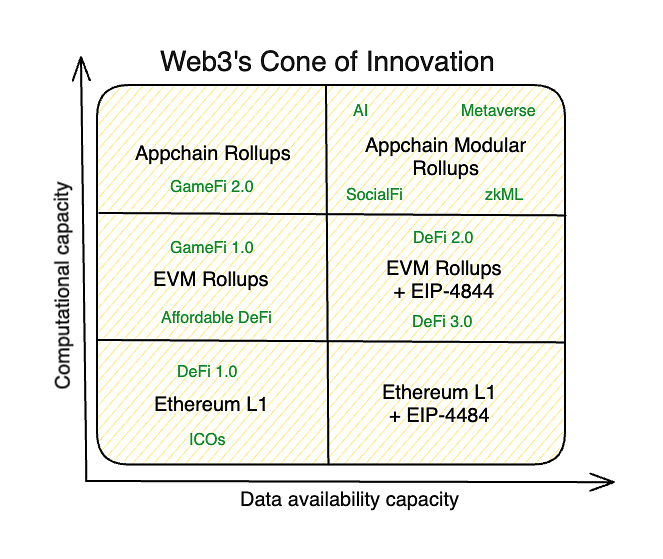

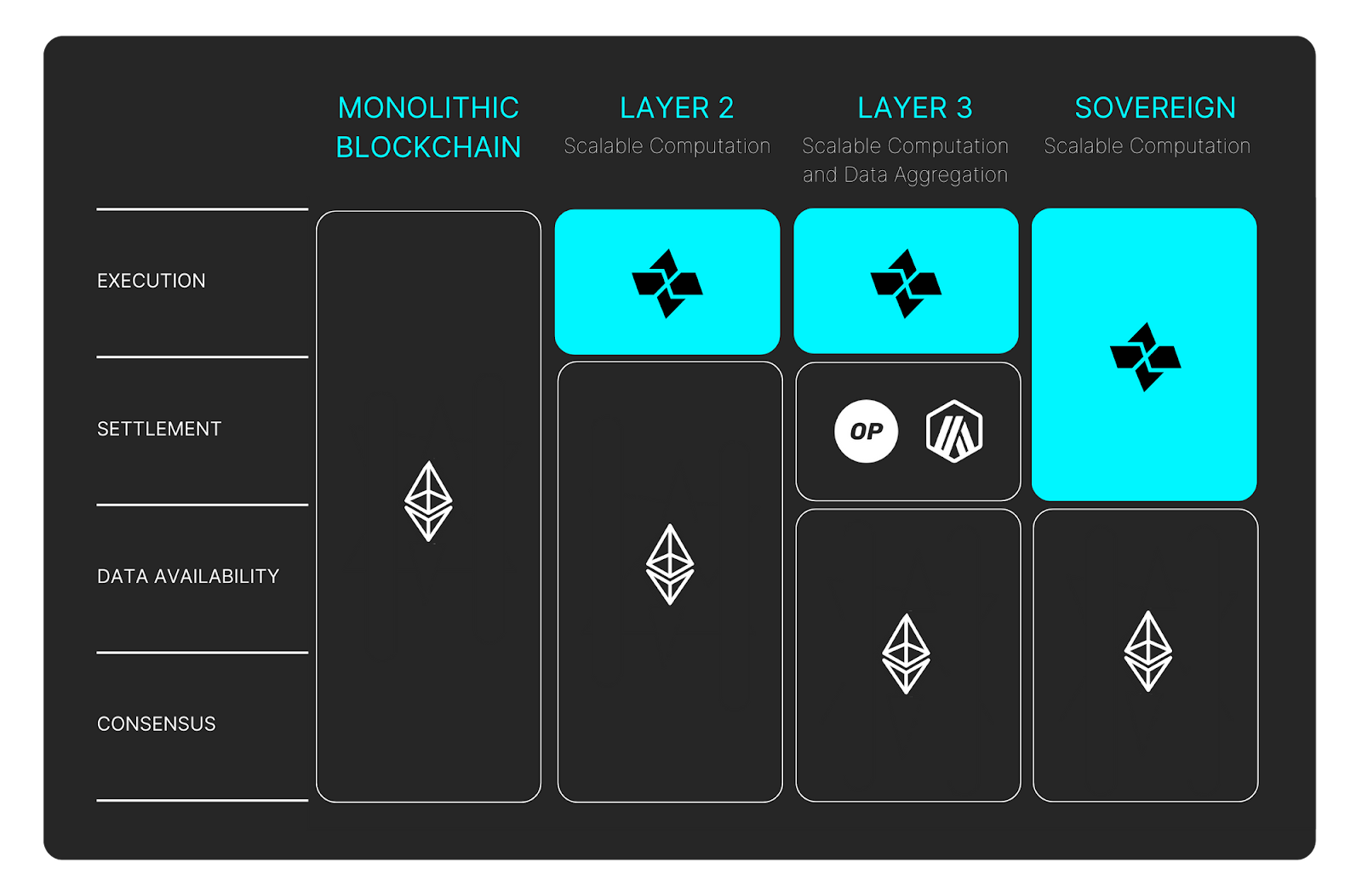

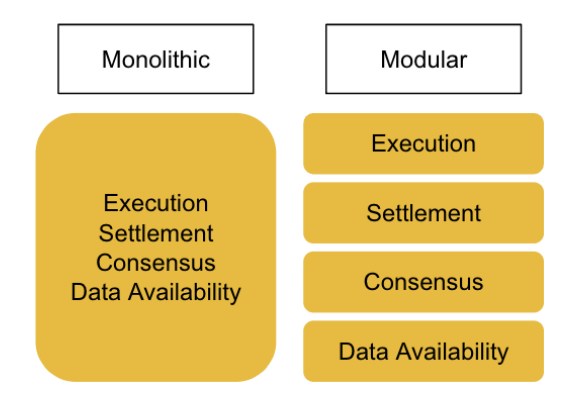

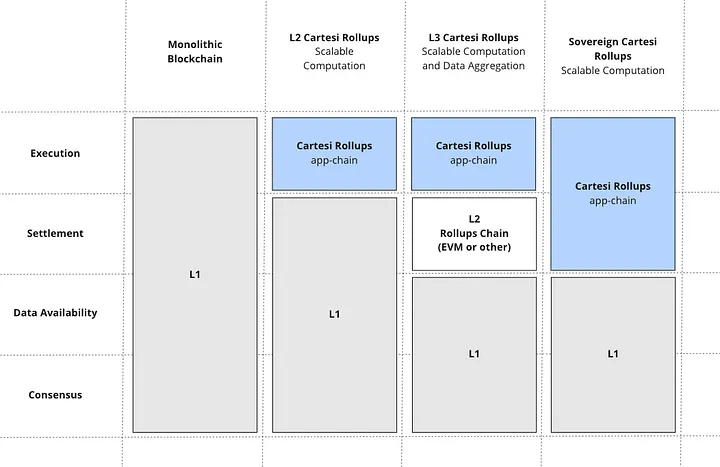

Ethereum’s rollup-centric roadmap is driven by the shift towards modularity and a diversity of execution environments. This evolution underscores the industry’s pivot from monolithic to modular architectures, where functions such as sequencing and data availability (DA) are decoupled from the core blockchain, enhancing efficiency and scalability. Modular blockchains seek to optimize one or more of the four core functions, which are Execution, Settlement, Data Availability (“DA”), and Consensus. Out of those, Cartesi excels at execution.

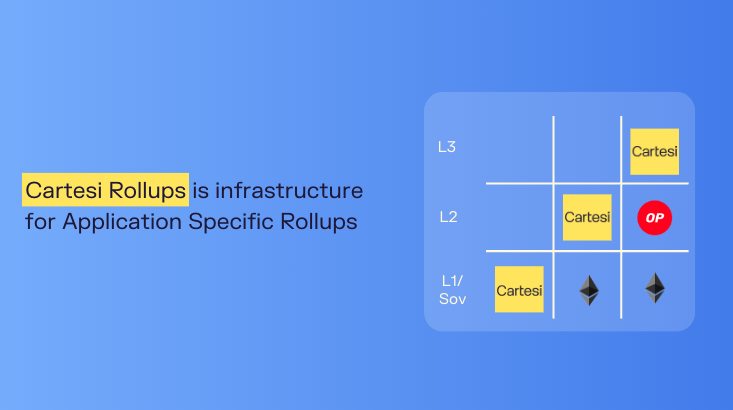

As Ethereum unbundles its original monolithic architecture, Cartesi emerges as a pivotal player in this new paradigm, offering versatility and allowing Cartesi rollups to be deployed as L2s, L3s, or sovereign rollups. This results in a more customizable tech stack that can integrate specialized layers like Celestia, EigenDA, or Avail for DA, or use Ethereum or other L2s for settlement.

Rollups are responsible for execution, helping to offload complex computations off-chain and making it verifiable on-chain by posting compressed data to a settlement layer. As computation happens off-chain, developers can leverage alternative Virtual Machines (AltVMs) to avoid the limitations of the EVM. These AltVMs can be EVM+, the Solana VM (SVM), the MoveVM etc. A Virtual Machine (VM) is simply a program that is able to emulate all the work being done on a computer – think of it as a digital version of a computer that includes all the components of a physical computer (CPU, memory…), but that exists entirely in a virtual setting.

The Cartesi VM, built on the RISC-V open standard, emulates a complete computer system, including an operating system like Linux. This is the main differentiating factor versus other alternatives. This breakthrough allows web3 developers to utilize a vast array of existing code libraries and tools, offering a dedicated CPU for each dApp, thereby avoiding resource competition between dApps.

This architecture makes it simpler and more appealing for We2 developers to start developing dApps on-chain. They can access decades of code libraries, programming languages, and tooling without having to learn new abstractions or design paradigms.

Cartesi started building rollups in 2018 before the term was even popular. It wasn’t until December 2021 when Vitalik’s Endgame article came out convincing the Ethereum community that it should pursue a rollup-centric roadmap.

Back in the day, alternative L1s and “Ethereum killers” sprung up, often recycling the EVM or tweaking some functionalities, most often related to DA. Recognizing the limitations and tradeoffs of each design, Cartesi understood that blockchain scaling was about specialization and modularity, allowing projects to excel by focusing on what they do best.

This modular approach was not about following trends but about fundamentally rethinking how blockchain components could excel individually and synergize collectively to unlock new levels of scalability and developer utility. By advocating for application-specific optimistic rollups, Cartesi aimed to offer a holistic solution that not only enhanced scalability but also expanded programmability and the tooling ecosystem for developers.

Since the start the vision was clear: to pave the way for a modular blockchain ecosystem where developers could focus on the business logic of their applications and not waste resources on highly technical topics related to execution environments or data availability.

Despite smart contracts being around for nearly a decade, finding life-altering use cases or significantly boosting economic output remains a challenge. Innovations like Uniswap and overcollateralized lending have introduced permissionless trading and lending, yet they grapple with issues of security and capital efficiency. Ethereum’s struggle for mass adoption persists amidst high gas fees and security vulnerabilities.

Meanwhile, generalized rollups and L2 solutions don’t fully address these problems, partly due to EVM’s inherent flaws and their one-size-fits-all nature, leading to competition for resources among dApps and inefficiencies. Not only that, but as more L2s enter the market, liquidity gets even more fragmented, which is a large problem considering that they can’t rely on battle-tested interoperability solutions yet.

Even after EIP-4844, one under-discussed issue is that EVM-compatible rollups fall short in achieving the necessary computation scalability to complement Ethereum’s significant data availability advancements. As more applications deploy on and share the same VM they compete for limited CPU capacity, creating a zero-sum game where only a few applications can thrive, leaving the rest with congestion issues and higher gas costs.

Application-specific rollups, particularly when combined with a Linux runtime environment, present a solution by offering a tailored space for dApps, optimizing for security, efficiency, and functionality. This contrasts with the limited capabilities and speed of decentralized computing models, which restrict developers to niche programming languages and complex solutions for simple features.

Cartesi offers a pathway out of this conundrum, providing an execution environment where developers can work with the tools and libraries they are already familiar with. Application-specific rollups diverge from the shared VM paradigm and offer applications their own dedicated CPU. As we transition from Ethereum Layer 1 to EVM rollups and further to dedicated appchains, we see an expansion in computational capacity.

But still, even beyond the sheer scale of computational and data capacity, developers grapple with another significant challenge, which is the lack of mature development environments, characterized by inadequate software tooling and libraries. While this has improved over time with Solidity and developer frameworks like Foundry, the scenario starkly contrasts with the traditional software development realm, where extensive libraries across various programming languages enable developers to build complex applications.

The EVM has been the backbone of Ethereum’s smart contract and other EVM-equivalent environments, but it comes with inherent limitations that stifle innovation and complexity in dApp development.

By design, regardless of the actual execution environment, blockchains are in the business of selling blockspace – this is a limited resource which can experience high (if not infinite) demand. Competition for blockspace, driven by finite resources and associated gas costs, leads developers to prioritize gas optimization over software functionality. This has resulted in design compromises that affect code readability and security.

On the one hand, traditional Layer 2 (L2) solutions like Arbitrum and Optimism offer a partial relief by reducing gas costs but do not significantly enhance design flexibility due to the persistent bidding dynamics and inherent limitations of the EVM. On the other hand, other alternatives focus on EVM-alternatives like EVM+ or WASM and can offer the ability to write smart contracts in traditional programming languages like Rust or Python, but they only provide marginal improvements to the dApps design experience. The reason for that is because they can’t realistically support a fully-fledged infrastructure to host an operating system (OS). Without the benefit of an OS, dApp developers lose access to decades of open-source software development.

Cartesi addresses these challenges by integrating a complete Linux OS, enabling developers to use a wide range of programming languages and libraries, thus transforming the dApp development landscape. Cartesi Rollups, which are application-specific and offer interactive dispute resolution, provide a scalable and secure environment for dApps, overcoming the computational and design limitations of the EVM. This approach not only enhances computational scalability but also opens up a new realm of possibilities for dApp functionality and developer creativity. By allowing each dApp to operate on its dedicated CPU and supporting the Linux runtime, applications can achieve the same level of complexity and efficiency as traditional Web2 applications, without compromising on decentralization or security. This paradigm shift enables developers to focus on innovation rather than infrastructure.

In gaming, Cartesi enables complex and interactive gameplay previously unattainable on blockchains by offloading heavy computations off-chain. In DeFi, Cartesi allows for sophisticated on-chain financial analyses and real-time risk assessments, overcoming the EVM’s limitations in processing power and accessibility to open-source libraries (currently being outsourced to risk managers like Chaos Labs or Gauntlet, whose job happens in closed doors). For NFTs, Cartesi facilitates true on-chain ownership by enabling the entirety of an NFT, not just the deed, to be stored on-chain. In AI, Cartesi aims to merge AI’s pattern recognition with blockchain’s verifiability, creating a common ground for AI and blockchain to interact through the Linux OS. This integration supports traditional AI development tools and libraries, and paves the way for more complex, secure, and innovative blockchain applications.

Key to Cartesi’s innovation is the provision of a boundless design space for developers. This is achieved by offering each dApp a dedicated CPU and Linux runtime where developers can access a comprehensive suite of open-source libraries and programming languages within a fully-fledged operating system environment.

This capability not only facilitates the exploration of new dApp functionalities beyond traditional EVM limitations but also supports the deployment of Cartesi rollups as L2, L3, or sovereign solutions. With this approach Cartesi can foster a positive-sum game philosophy, adding value to underlying chains without strictly competing for market share.

By deploying each dApp in its own high-performance rollup chain, Cartesi fosters an environment where there’s no resource cannibalization among dApps, preventing network gentrification and paving the way for a new class of dApps that were previously untenable on existing chains, each with their unique developer experience and design patterns.

Currently trading 80% below its all-time highs from three years ago, listed on major exchanges, and with low dilution ahead, we believe that there is upside potential to bet on $CTSI as a liquid token that will allow us to front-run the “modular” narrative before other players like Movement, Eclipse, Hyperlane etc. enter the market at multi-billion valuations right upon token launch.

Current non-EVM L1 chains like Aptos and Sui command FDVs in the tens of billions, while most recent raises for AltVM L2s are reaching 9-figure valuations as well. The price has been consolidating for more than 2 years, and only recently broke out in 2024 as this phenomenon became more apparent.

Based on what we have seen so far we are pessimistic that Cartesi will manage to develop an ecosystem comparable to those of other L2s like Arbitrum, Optimism, or Base. From an infrastructure perspective we are confident that Cartesi could host appchains featuring casinos, sports betting sites, complex DeFi applications, and even fantasy games. However, it is not enough to distribute 5-figure grants to multiple projects or a maximum of $1M in prizes for hackathon winners to start building a startup that survives in the long run and manages to win meaningful market share. For reference, you can check for yourself the adoption rates of its leading projects, which include Ultrachess, Productive, Aetheras, Dazzle, UXBoost, and Rives.

Even though the Foundation initiatives can attract a couple of projects building PoCs, they just cannot compete against the large incentives programs of competing L1s and L2s. It is also very unlikely that VCs and other investors recommend their portfolio companies to build on Cartesi, since the liquidity and users simply aren’t there. However, we have seen it already with tokens like $TAO, where interest and attention increase when something is hard to understand and the majority of participants can’t wrap their heads around how it works but they can draw easy associations like “$TAO and AI” or “$CTSI and Linux”.

While pivotal for innovation, Cartesi’s emphasis on developers has left it relatively obscure to the broader market. Contrast this with another L2 like Polygon, which also started its journey before 2020 and has aggressively pursued partnerships with large brands like Nike, Reddit, or Starbucks. The project’s academic inclination, characterized by a team with numerous PhDs, may contribute to its theoretical rather than practical appeal, potentially hindering adoption.

Cartesi’s lower visibility raises concerns about its mainstream popularity. In addition to that, the absence of clear mechanisms for measuring fee revenue or cash flow complicates its valuation, making this investment more speculative in nature. Our thesis is primarily based on potential market revaluation rather than intrinsic value generation.

The $CTSI token is only used for staking, which only offers benefits in terms of governance and some extra utility enabled by node providers like Sunodo, although the latter is barely noticeable for end users.

The token currently features a 35% staking ratio with a 21 % projected APR. We don’t see this changing any time soon unless radical measures are taken to make staking more attractive. Otherwise the main use case will continue being simply holding the token for speculative reasons.

Despite being available on major exchanges like Kraken, Binance, and Coinbase, Cartesi’s limited adoption and traction after several years raise questions about its market fit and demand. The risk of delisting due to underperformance or insufficient volume adds to these concerns. That being said, we might as well see unexpected market making deals that might artificially move the token price, as there is still 25% of the supply in the treasury that might be loaned out for such purpose.

Also, the EVMs network effects and widespread familiarity with its developer tooling present a formidable barrier to converting existing Web3 developers. Cartesi’s strategy may need to pivot towards attracting Web2 developers, a significantly larger and potentially more receptive audience – although if they were interested in Web3 they would have joined the space already.

Nonetheless, there is a slight chance that things can change if they are successful with their latest BD efforts and marketing push, which primarily consists of sponsorships and partnerships with prominent players in the “modular narrative” such as Celestia, Espresso, or EigenLayer.

In conclusion, Cartesi’s journey since 2018 highlights a pioneering yet challenging path. Despite its innovative proposition of a blockchain-based Linux operating system and application-specific rollups, Cartesi has not yet achieved the adoption seen by contemporaries like Polygon, Arbitrum, or Optimism.

Currently positioned outside the main developer mindshare on Ethereum and ranking in the top 300 by market cap, Cartesi’s opportunity relies on the token being bid on all major CEXs due to its low supply overhang and the excessively large valuations of upcoming players in the “modular narrative”.

We are in an overheated market where liquid investing can offer better risk-reward than Ventures opportunities at excessively large valuations. Even though the project has gone unnoticed and the adoption rate is quite disappointing, it still offers an innovative vision that has caught the attention of important players like Celestia, Espresso, and EigenLayer.

Revelo Intel has never had a commercial relationship with Cartesi and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.