Published: June 16, 2023

Key Points

On-chain derivatives are one of the few verticals that have found product-market-fit in DeFi. Regardless of market conditions, derivatives allow traders to speculate or hedge their positions. 2022 saw the failure of CeFi giants like BlockFi or Celsius, and centralized exchanges like FTX. In 2023, there are many who now recommended staying away from Binance following the SEC’s allegations against the company. Now more than ever, the adoption of decentralized derivatives exchanges seems inevitable.

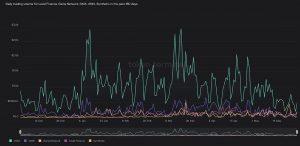

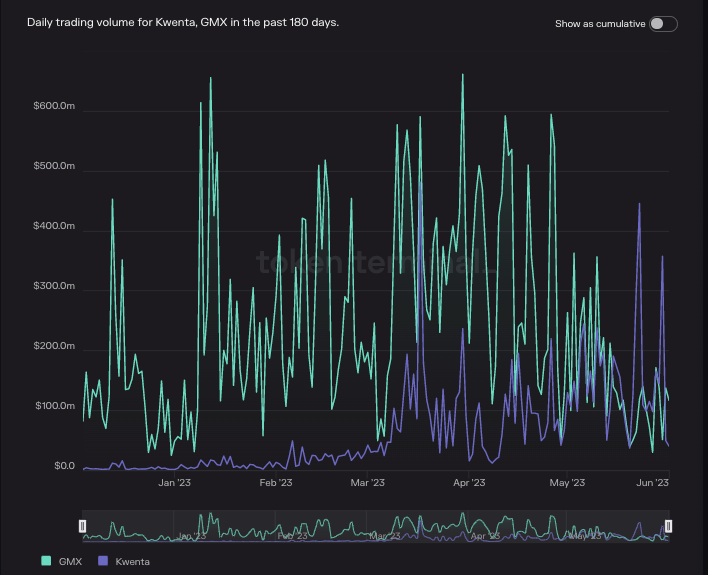

2/ In a significant shift, @Kwenta_io, the perps DEX powered by @synthetix_io, surpassed @GMX_IO for trading volume, cementing its position as a dominant player in DeFi.

Kwenta's exceptional performance and market share demonstrate its growing popularity. pic.twitter.com/bZYgoF95oB

— Messari (@MessariCrypto) May 26, 2023

Even though DyDx still dominates trading volume and shows no signs of weakness, especially after the migration to their own app-chain on Cosmos is complete in the upcoming months, GMX still leads when it comes to fee generation, but new platforms built on top of Synthetix like Kwenta are showing signs of strength.

Both GMX and Synthetix provide support for spot and perpetual futures markets. Up until now, CEXs have dominated spot and derivative traded volume because of the following reasons:

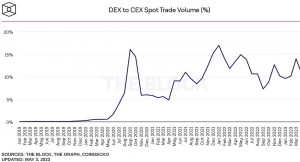

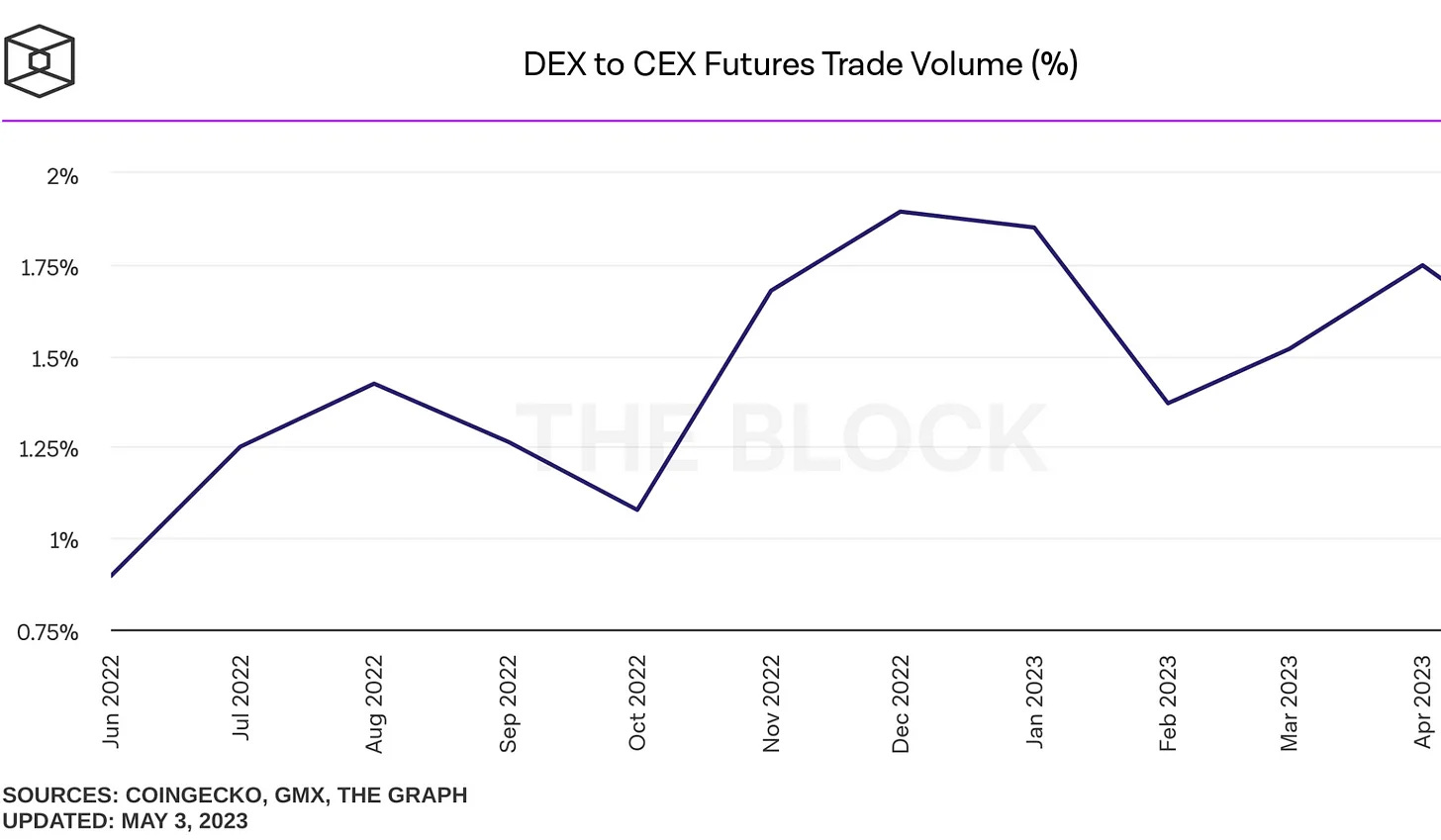

But since 2020, DEXs have already started to take market share from CEXs as they become more competitive in pricing with lower fees.

Moreover, derivative DEXs are poised to experience significant growth due to the fact that derivative trading volumes are 355% the size of the spot market. Derivative DEXs are still in their infancy. With a larger overall market to capture, this gives derivative DEX developers more opportunities to siphon volume from CEXs.

Both Synthetix and GMX are examples of how powerful composability is in crypto. Synthetix’s liquidity powers multiple derivatives on top of it, such as options, perps, and prediction markets. GMX’s $GLP has been key for the overall growth of the Arbitrum ecosystem through integrations with protocols like Rage Trade, Jones DAO, and Dopex among others.

Synthetix V3 is a liquidity engine that provides the building blocks for powering any on-chain financial instrument. This approach is akin to a B2B model where external protocols can tap into the existing liquidity in Synthetix’s liquidity pools. This is not limited to perpetual futures trading. Rather, any type of derivatives can be built on top of v3: options (Lyra), perpetuals (Kwenta), prediction markets (Thales), sports betting (Overtime), dynamic vaults (Polynomial), hedge funds (dHedge)…

When it comes to launching new derivatives markets, protocols are faced with a cold-start problem for bootstrapping initial liquidity. Oftentimes, protocols provide incentives to attract new users. However, it is not uncommon for those users to end up abandoning the ecosystem as soon as the rewards start to dry out. This rings true across the board in crypto, not just in the derivatives space. Much of the capital in crypto is mercenary and will flow where it can earn the most reward.

Synthetix v3 aims to solve this by being composable. New protocols do not have to bootstrap liquidity from zero. Instead, they can tap into Synthetix’s liquidity and build financial instruments on top. In turn, all the activity generated on those markets will accrue revenue for the underlying liquidity providers on Synthetix. This is a very compelling value proposition for Synthetix’s stakers since this will be a new and potentially large source of revenue that can accrue back to the token. It’s also an enticing offer for partner protocols. They can now cut down on their operating expenses with lower incentives, which come in the form of inflationary emissions of the project’s governance token. These projects can also charge less fees and be more competitive in the market.

GMX v2 is expanding its operations to allow for the trading of synthetic assets. Up until now, traders on GMX have only been able to trade GLP index tokens. These include the likes of $ETH, $BTC, stablecoins ($FRAX, $DAI, $USDC, and $USDT), and some blue-chip assets like $UNI or $LINK. This is not really competitive when compared to the dozens or potentially hundreds of assets that can be traded on CEXs. But it isn’t just centralized providers that GMX is competing with. The project has also been competing against up-and-coming projects like Gains Network, which offers greater levels of leverage up to 150x, versus GMX’s maximum of 50x. As well as exposure to tokenized assets like stocks, commodities, or forex markets. Not only that, but as time went by, new protocols (like Level Finance, or El Dorado Exchange) started to emerge with either forks or very similar models to GLP, which ended up taking market share away from GMX (and even generating more fees and trading volume).

Unlike Synthetix V3, the development of GMX v2 is more of a necessity rather than an overall improvement and novel DeFi primitive. The key improvements are related to risk management features for liquidity providers.

GMX v2 will facilitate the onboarding of new assets, and the speed of assets listing can make or break a derivatives protocol, think about the impact of assets being listed on Binance for example. As an example, if GMX managed to list $PEPE perpetuals before it went mainstream, it would capture a lot of volume and fee revenue during that time.

The new version will support both spot and perpetual futures trading, where each market is created by specifying a long collateral token, a short collateral token, and an index token. For instance, the ETH/USD market would use:

The long collateral token is used to back long positions, while the short collateral token is used to back short positions.

This allows for the creation of synthetic markets that are backed by an asset other than the underlying. For example, the SOL/USD market could be enabled by using $SOL as the index token, $ETH as the collateral backing the longs, and a stablecoin like $USDC as the short token.

When it comes to trading, one of the most prevalent criticisms is the fact that AMM liquidity pools like GLP provide an inferior trade execution than orderbooks. In fact, CEXs are not a necessary condition for DEXs to exist. However, protocols like GMX still rely on oracles for pricing based on the exchange rate on major CEXs. In this scenario, the fact that trades have no price impact is detrimental for market makers. It impedes them from executing their market-making strategies as they would normally do in a CEX.

Both Synthetix and GMX will be able to access low-latency oracles in their respective new versions. This means that if the price changes on the CEX provider, market makers will have less time to pick up the order on the DEX and profit from the price difference. This should bring fees down over time. But still, the fact that traders need to pay a borrowing fee on GMX leads to an overall bad user experience. On top of that, traders are also competing against a liquidity pool. This is why GMX is analogous to the house in a casino, where the competitive advantage for LPs comes from the fees they charge. Despite GMX’s dominance in the market, the lack of a funding rate is a concern. As the discrepancies between long and short positions are forced to become the counterparty to GLP liquidity providers, the pool ends up taking a loss when traders are profitable.

On the opposite side, protocols that implement a funding rate do not suffer from that problem. This is because the funding rate will determine whether the longs pay the shorts or vice-versa. Up until now, Synthetix’s time-based funding model has proven to be very effective to keep open interest at healthy and balanced levels over time, all while $SNX stakers can continue earning from trading fees. This model provides LPs with an overall better risk-reward payoff. However, it is also worth noting that a time-based funding rate model is more favorable for LPs than it is for traders. This might end up disincentivizing trading volume when open interest stays skewed for a relatively long period of time.

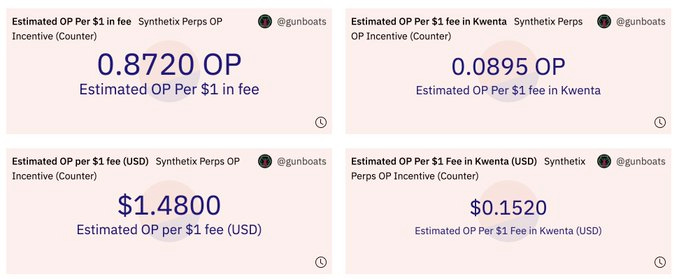

The main frontend for perpetuals trading using Synthetix is Kwenta. Kwenta is currently responsible for ~99% of the total volume generated on the Synthetix Perps V2 engine. The platform has been experiencing significant growth in trading volume over the past month after the introduction of Synthetix OP incentives. Every week, Synthetix distributes 300K $OP to perp traders, this is worth $500k at current prices, and the incentives program will run until September. In other words, it is possible for traders to get paid to trade. Right now, for every $1 of trading fees that you pay, you get at least $1.48 back.

Furthermore, $KWENTA stakers also receive rewards based on their trading activity. This makes it the platform with the lowest fees, deepest liquidity, and sustainable rewards (not subsidized by their own native token).

But when it comes to incentives, the tailwinds for Synthetix don’t end up here. Additionally, escrowed SNX incentives will be added with the release of V3 to yield a more impactful feedback loop. Ideally, 5-10m SNX should be allocated to this incentive program over time. The primary reason for keeping inflation in V3 is to ensure there is a mechanism to bootstrap liquidity for permissionless pools. Based on recent yields, the Treasury Council is earning ~$5M per year, and if 100% of this was allocated to buybacks, it would take about ten years to complete. Nevertheless, if trading volume increases over the next few years, this timeline would be reduced significantly. So far, instead of burning these tokens, the DAO is considering distributing the remaining SNX to stakers pro rata. This way, this SNX can be used for incentives and can equate to a 3% inflation rate for three years if distributed completely.

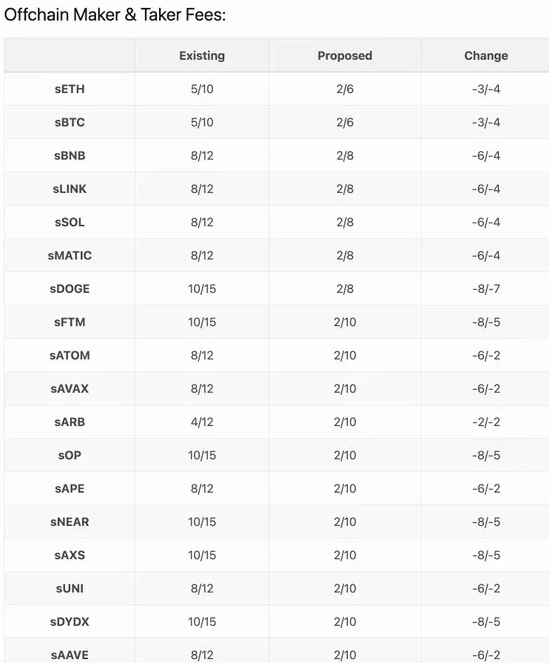

Not only that, but Synthetix also lowered the trading fees significantly. The fees for $ETH, $BTC, and many other pairs are now as low as 0.02%. Combined with a time-based funding rate model, this provides a user experience that is quite close to a CEX. As a result, Synthetix perps are among the most competitively priced in the DeFi space. Rather than charging 30-40 basis points for a trade, fees for major pairs (ETH and BTC) are now as low as 0.02% for makers and 0.06% for takers – comparable to most centralized exchanges.

Synthetix stands out for its delta-neutral debt pool, which enables the automation of delta-neutral strategies and allows for the exchange of funding between longs and shorts. In the end, the purpose of funding on Synthetix perps is to reach a 50/50 skew (longs vs shorts), which results in keeping the debt pool delta-neutral. This is not the case in the current version of GMX, where GLP holders are encouraged to hedge their positions.

In addition to funding, Synthetix also has a price impact function that incentivizes the opening of positions opposite the skew and prevents oracle manipulation that would otherwise make low liquidity assets impossible to list.

These characteristics have contributed to the recent success of Kwenta. Kwenta has grown continually since its launch, reaching 28.6% market dominance on March 17th. Last month, volume started to surge and surpassed GMX on certain days.

This culminated in a significant shift where Kwenta ended up surpassing GMX’s trading volume and fee revenue.

Currently, GMX has the highest open interest limit and supports the most volume. That is because a high limit attracts whales and large positions, although this could impose a higher risk for LPs if there is not enough liquidity to pay for the traders’ PnL.

The new structure with short, long, and index tokens is highly beneficial for traders. Traders will get to choose what asset they want to keep their collateral in when trading synths. For instance, in the SOL market, traders will be able to enter long and keep their collateral in either ETH or USDC. In the event that ETH is used as collateral, traders would be able to get exposure to the price of both ETH and SOL. Additionally, traders could also open a USDC position to speculate on SOL’s upward movements.

To understand the implications of this novel approach, we can take the example where a trader enters a short position in the ETH/USD with ETH as collateral, effectively making it possible for the trader to earn funding fees on a delta-neutral position.

Given the composability of GLP and the number of protocols that have built strategies on top of it in the past, it is expected to see further growth in the GMX ecosystem as a whole. More specifically, this new model offers a rather simple method for constructing delta-neutral strategies on top of every LP market, whether this is done discretionarily or through delta-neutral vaults offered by third parties.

Perpetual trading platforms were among the first ones to promote the “real yield” narrative. They also showed that it is possible for the protocol to generate actual profits that are greater than the amount of value emitted as token incentives. However, there is no free lunch and yield comes at a price. As a counterparty to a platform’s traders, you are essentially the house of the trades, but you still stand the chance to lose money.

Both Synthetix and GMX plan to enable the creation of permissionless markets in their respective upgrades. This is a big improvement for decentralized derivatives as a whole, making it possible for protocols to even front-run the asset listings on centralized exchanges.

One of the key improvements, also implemented by both protocols, is the isolation of risk for liquidity providers. Moving forward, liquidity providers will be able to choose the pools/markets they want to be exposed to. This allows users to isolate their risk based on their own risk profile, market fee structure, or expected volume and fee revenue.

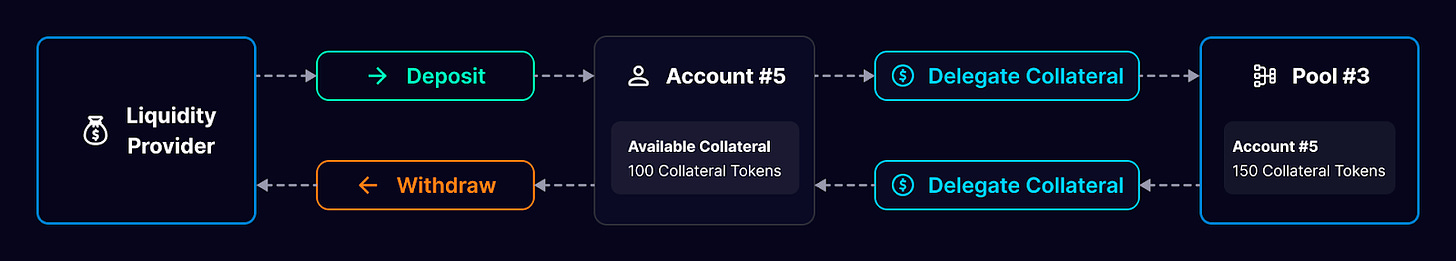

In order to deposit collateral into the protocol, users must first create an account, which will be represented as an ERC-721 NFT. This makes it possible for users to transfer the account between wallets. Additionally, accounts can also delegate permissions to addresses other than the owner. This is beneficial in terms of security as well, since a user could own the account with a hardware wallet and interact with the protocol with a hot wallet with reduced permissions for activities like claiming rewards, or managing liquidity positions.

The most important feature to keep in mind for liquidity providers is that providing liquidity to pools is a two-step process. First, the user must deposit collateral, and second, the user will delegate the collateral to a pool. This creates (deposit and delegate) or updates (delegate) a liquidity position.

By delegating liquidity to a pool, the deposit will only back that specific market, meaning that the LP will not be exposed to other markets. This will also be important for LPs down the line, since it is not recommended for them to delegate to markets that have not been approved by governance, due to increased risk.

When a delegation is providing liquidity to markets, the performance of these markets can positively or negatively impact the debt associated with the position as well. Performant markets will reduce the debt of liquidity providers over time.

Once the collateral has been delegated, a liquidity position is created or updated. This enables the LP to mint snxUSD and associate a certain amount of debt to their liquidity position. Next, the protocol will track the amount of collateral and debt of the position. This way, the protocol can assign a collateralization ratio to existing positions. The collateralization ratio will then represent the relationship between the value of the collateral associated with the liquidity position and the amount of debt it is responsible for (expressed as a percentage). For example, a collateralization ratio of 200% means that the value of the collateral is two times the amount of debt it is backing.

The value of the collateral is measured and calculated based on the price reported by the oracle systems, which use both Chainlink and Pyth Network, and the value of debt is represented by the amount of snxUSD. Users can mint snxUSD by depositing more collateral, or burn it by removing collateral. It is worth noting that snxUSD can also be used to repay loans by “burning” it. This decreases the debt of a position by $1 per each unit of snxUSD that is burned, regardless of whether this debt was accrued from minting snxUSD or from debt distributed to it by a market.

If a liquidity position’s collateralization ratio falls below the minimum ratio, the position can be liquidated. When this happens, the collateral and debt associated with the position are distributed pro-rata among all of the other liquidity positions participating in that pool. A fixed amount of the collateral is also provided to liquidators (typically bots) as an incentive for their service.

GMX v2 will deprecate the GLP model that originally made it so popular. Similar to Synthetix, liquidity providers will be able to choose the markets that they want to contribute liquidity to. In return, they will earn trading fees from those markets. As a result, each market will have its own fee structure and liquidity providers will have the option to choose whatever market suits their risk profile best. This is an improvement with respect to the GLP model of V1, which exposes liquidity providers to all of the assets within the pool (stablecoins, BTC, ETH, UNI, and LINK).

With the new trading structure, it is worth noting that there might be scenarios where the index price might soar while the collateral asset backing the market remains stable. In these scenarios, the protocol ensures solvency through auto-deleveraging. This mechanism ensures that profitable positions will be adjusted to ensure that the profits and losses of that specific market do not surpass the total amount of value supporting the pool.

Auto-deleveraging is a risk-management mechanism such that if an insolvent position cannot be liquidated at a price better than the bankruptcy price, the system will automatically deleverage the opposing position from the trader with the highest ranking at the bankruptcy price of the liquidated order.

When it comes to pricing, each market will have its own funding fees, borrowing fees, and price impact functions. This provides a high degree of flexibility to support the addition of new assets like stocks, forex, or commodities.

Similar to how markets built on top of Synthetix, like Kwenta, work, GMX v2 now introduces funding fees as a way to assist in reducing substantial imbalances within pools. When there are too many open long positions, the funding fees will go to the short side and vice-versa. In spite of the addition of funding fees, borrowing fees will still be present in order to ensure that participants avoid taking unnecessary positions. Borrowing fees are paid to liquidity providers and help to prevent users from opening both long and short positions to take up pool capacity without paying any fees. As mentioned above, this cost adds up over time and can liquidate positions even during a flat market.

The fact that GMX relied on external oracles for pricing swaps was one of the major concerns in v1. This introduced a possible attack surface where traders could manipulate an asset’s price on the centralized exchanges that feed the price to the oracle, and then open a position on GMX to profit from the price they just manipulated. This problem was solved by introducing caps on open interest. In GMX v2, changes in open interest can affect prices for traders. When opening positions that disproportionately imbalance the open interest, traders may experience a negative price impact. Similarly, if opening a position restores the open interest balance, traders experience a positive impact on price. This creates an incentive to keep the open interest in a balanced state.

GMX v2 will also replace its in-house oracles, which calculate the median price from the top 3 exchanges for leverage trading. GMX will become an exclusive partner of Chainlink and will get access to their low-latency oracles in exchange for 1.2% of the total fees. This will also make it possible to support stop losses, take-profit, and limit orders, which were not guaranteed in v1 due to chain congestion, causing keepers to overlook orders and not execute them in time.

All things considered, two-sided funding fees and the redefined open interest model will definitely help to solve the challenges associated with GLP in V1, where the exposure to the PnL of traders often resulted in a very skewed open interest imbalance.

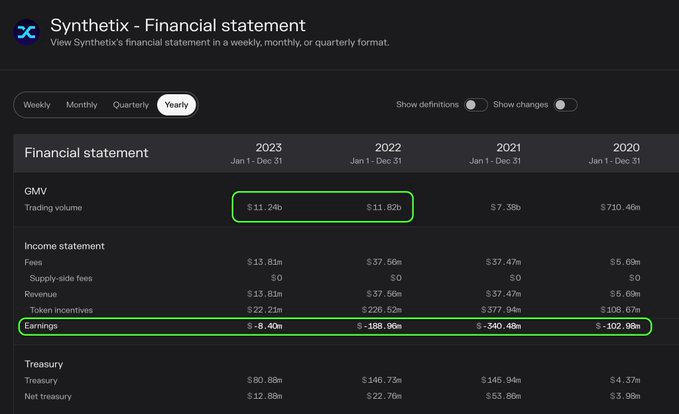

The trading volume in 2023 is going to surpass 2022 soon. Even though Synthetix itself is still unprofitable, the trend is improving.

Currently, Kwenta generates revenue through an incentive program run by Synthetix. Although the Volume Source Fee Program has only been live for 2 months, Kwenta has been receiving a 5% rebate in SNX from fees generated by Perps V2 during this time, which has earned the Kwenta DAO 144,000 SNX to date; this is currently being held in the treasury awaiting a proposal for the DAO’s usage.

GMX benefitted from structural tailwinds during the bear market, especially after the collapse of centralized giants like BlockFi, Celsius or FTX. The protocol managed to survive a 70% market drawdown in 2022 followed by a 60% upswing in 2023.

Synthetix has already declared its intentions to go cross-chain and start the process of expansion by deploying on Ethereum layer 2s. For instance, snxUSD is integrated with Chainlink’s CCIP in order to allow for secure and decentralized cross-chain transfers between networks with a Synthetix deployment. I

Once a liquidity position has been created on Synthetix by providing collateral, liquidity providers can proceed to take out an interest-free loan of snxUSD by minting it on any of the supported chains (as long as their collateral ratio does not drop below the issuance collateral ratio).

In the near future, Kwenta will be deployed to Arbitrum as well, where it will compete directly against GMX.

When it comes to GMX, it will continue its operations in Avalanche and Arbitrum, while other chains are explored for the foreseeable future.

On the one hand, unlike other blue chip protocols like Yearn or Compound, which have kept on working on making their products more efficient, Synthetix has taken a step forward and pivoted to find real product market fit. This is achieved with a cross-chain strategy and through an unprecedented level of composability that enables options, perpetual futures, prediction markets…

On the other hand, GMX v2 sets out to solve 3 problems: the creation of new markets, risk management for LPs to avoid excess exposure to the overall PnL of traders, and minimize the skew in open interest. These are mostly improvements in terms of risk management. Whether GMX will maintain its dominance is yet to be seen. While traders will now have access to new markets, the focus of v2 has been to improve the LP experience, making it safer and more capital efficient. There is still room for improvement in the UX for traders. This could be achieved with cross-chain margin, margin on unrealized PnL, or multi-collateral margin, although it is possible that these features get implemented down the line through a collaboration with Rage Trade.

Revelo Intel has never had a commercial relationship with Synthetix or GMX and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.