Published: August 7, 2023

If there are two market sectors that have managed to find PMF (product-market fit) in crypto, those are stablecoins and liquid staking derivatives. Out of the two tokens discussed in the following report, only Frax can compete in both verticals.

$FXS is at the same price as it was 1 year ago, right after the collapse of Terra Luna, which caused systemic damage to the entire stablecoin sector. With such a massive improvement in terms of fundamentals and operating across multiple market sectors, Frax might be undervalued considering all of the protocol revenue streams and value accrual venues for its token holders.

On the one hand, the ongoing developments in the Frax ecosystem and with many catalysts on the horizon ($frxBTC, $frxETH v2, Fraxchain, Frax v3, BAMM…) turn $FXS into a high conviction bet over the next 6-12 months. There also may be an RWA narrative brewing for Frax. Founder Sam Kazemian’s recent proposal outlined a plan to partner with a custody provider that could enable yield to be earned from RWAs, including US T-bills.

On the other hand, $RPL is underperforming the global market in terms of price action and the unsatisfactory yields of $rETH. At the same time, $RPL fundamentals remain stronger and can only get better, accumulating an increasing number of stakers over time.

Liquid staking and stablecoins are not necessarily mutually exclusive. This is evidenced by Frax’s dual token design and approach to Ethereum staking. First, stablecoins provide stability and serve as a reliable store of value within the volatile crypto market. Second, liquid staking derivatives enable users to unlock the liquidity of their staked assets, allowing them to participate in additional opportunities while maintaining their staking positions.

An investment thesis on $FXS is simple: there is an asymmetric risk-reward in buying $FXS due to the valuation support at current levels and the high likelihood of significant incremental value that the market is likely to attribute to the token in the next 6-12 months. The report sees relatively less downside in $FXS compared to other tokens as it now enjoys valuation support post the passing of FIP-256 (more aggressive buybacks of $FXS below $5).

For Rocket Pool, there is a clear divergence in terms of growth of $ETH being staked on the protocol, and the price continuing to bleed. However, the recent underperformance of $RPL can be attributed to the unsatisfactory yield of $rETH.

The most obvious observation is the fact that 1 unit of $ETH in $sfrxETH will always have a higher yield than one unit of $ETH on $rETH, $stETH, or $cbETH. Arguably, there is only one number that drives most decisions to hold one liquid staking token over another, and that number is yield.

Not only that, but it is also worth noting that Frax sits on a stack of 3.65M $CVX – the highest among protocols that own $CVX. Additionally, $sfrxETH charges the same or lower fees vs. major liquid staking providers.

While TVL and APY are inversely correlated, more TVL for Frax translates into more revenue from fees. In fact, the market dynamics also play in favor of Frax’s dual token design, since market actors have an incentive to arbitrage the yield that they can get on their $frxETH holdings by moving capital from the sfrxETH vault to the Curve pool and vice-versa.

From a network perspective, there are two major fundamental properties that accrue value to Ethereum: decentralization and security. Without decentralization at the PoS level, Ethereum’s mission to become a credibly neutral and censorship-resistant settlement layer could be undermined.

There are critical consensus thresholds that pose a threat to Ethereum:

There have been multiple discussions around how much is too much, with a general consensus that any given liquid staking provider should not control more than 20% of the total $ETH staked. Presently, Lido controls ~30% of the total $ETH staked and ~85% of the liquid staking market.

Lido is the most dominant player by far, with consistently over 70% of the liquid staking sector market share, currently sitting at ~85% market share. Followed by $cbETH, this reinforces the fact that the market cares little about decentralization, which is the main driver of Rocket Pool’s branding. Following Coinbase, Rocket Pool’s $rETH dominates 8.5% of the liquid staking market on Ethereum.

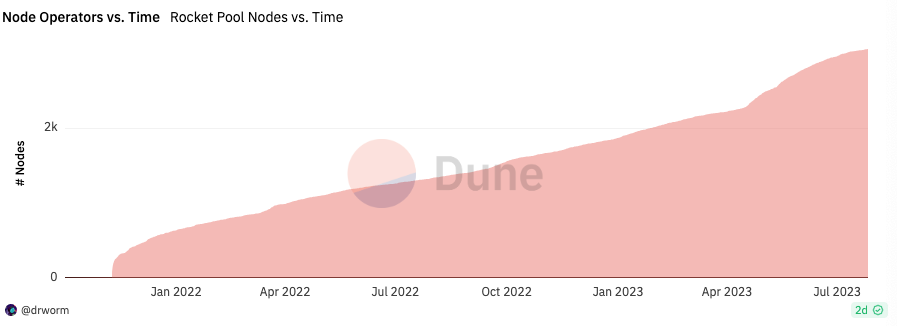

In terms of market share, $frxETH currently represents 2%, which is significantly lower than Rocket Pool. Rocket Pool’s market share has been stagnant after experiencing significant growth in Q1 2023 in anticipation of the Atlas Upgrade, which can be observed in the chart below.

Meanwhile, the adoption of $frxETH is prone to be driven by upcoming catalysts in Frax’s offerings, namely Fraxchain and $frxETH v2. This presents a tailwind scenario and a headwind for Rocket Pool, especially after the overall disappointment with $rETH’s returns after the Atlas upgrade, which lowered the minimum $ETH requirement from 16 $ETH to 8 $ETH.

In other words, the Atlas upgrade is now a thing of the past, whereas the outlook for Frax is forward-looking. Not only that but in Frax Ether V2, the minimum requirement will be 4 $ETH, half of Rocket Pools.

While $frxETH V1 is optimized for liquidity and yield, $frxETH v2 introduces a paradigm shift that improves capital efficiency at the same time. Unlike Rocket Pool’s minimum requirement of $ETH for node operators, Frax will create a lending market where only a minimum of 4 $ETH is required.

Namely, the next iteration for $frxETH will optimize for validator performance and decentralization, both of which have been the main strengths of Rocket Pool up until now. Nonetheless, Frax already shows an impressive effectiveness rating. The only criticism is that it is operated by their team.

With V2, this will drastically change. The goal is to attract the best validators, which in turn will result in better yields for the user. This might make it unattractive for hobbyists or solo stakers, but in the end, when it comes to liquid staking, it is the risk-adjusted yield that matters.

Frax Ether V2 introduces a novel mechanism to attract the most performant validators nodes, which can be measured in terms of MEV revenue, low hardware costs, high internet speed, block propagation, or attestation responses among other factors.

In order to measure the adoption and market penetration this can reach, we will consider two scenarios:

With V2, Frax will no longer charge a fixed fee for validators. Instead, it will introduce a dynamic rate. Effectively, this is the result of three key realizations:

This makes it possible to determine the performance cap of any liquid staking protocol, which is achieved by finding the true LTV of the 32 $ETH loan that is required in order to participate in staking.

As an example, in Rocket Pool, $ETH is staked for $rETH, meaning that $ETH is lent out to node operators in return for a receipt in the form of $rETH. Therefore, node operators are borrowing 32 $ETH to run a validator and paying interest to lenders.

The same applies to Lido, with the only difference being that the borrow side is currently permissioned.

Just like a lending market, Frax Ether V2 requires a minimum amount of $ETH collateral (or other collateral in the future – if veFXS holders approve) to borrow a validator. The withdrawal address and asset custody remain decentralized, on-chain, and immutable. And just as in a money market, interest is paid directly from Ethereum’s PoS cash flow.

This makes it possible to avoid charging a fixed fee and increase competitiveness altogether. Interest rates are set by market forces based on the utilization rate. If it’s cheap to borrow a validator, node operators can validate, pay the interest to lenders & keep the spread/MEV/tips etc., which is extremely profitable for sophisticated node operators.

Similarly, when interest rates spike and it is unprofitable to operate, it makes sense to eject and repay the debt until the rates wind down and capturing the spread becomes profitable again.

This results in $frxETH v2 being an $ETH stablecoin backed by validator debt without any compromise whatsoever on capital efficiency: idle $ETH in validators is transferred to the Curve AMO to improve liquidity and increase earnings.

In fact, the utilization rate already takes into account this market operation and is self-rebalancing. Loans will not be taken when interest rates exceed profits, while cheap $ETH loans relative to staking rewards will attract operators who want to increase their profits.

The design of $frxETH v2 is not only pragmatic but also more agnostic than any other LST: anyone can run whatever kind of validator or client software they like with their borrowed validator as long as the LTV remains healthy and interest is being paid. Hence, one could also run a Rocket Pool Minipool in parallel.

The adoption and growth of liquid staking tokens is the most important driver of revenue for the underlying issuer. Out of all possible integrations, money markets accepting a liquid staking token as collateral present the best opportunity to increase the supply. Notably, the primary lending markets on Ethereum, Aave and Compound, were quick to accept $stETH as collateral. This propelled a new demand for leverage from looping: stake or swap $ETH into $stETH, supply $stETH as collateral, borrow $ETH, rinse and repeat.

The next natural candidates to be accepted as collateral were $cbETH and $rETH respectively. Currently, $sfrxETH is only accepted as collateral on Fraxlend. This is another bullish catalyst for Frax, and Rocket Pool has already capitalized on it. This suggests more upside for Frax.

Critics argue that, despite Frax’s $WETH replacement program, $frxETH has not been successful in replacing $ETH. However, if there is one thing that the Frax team has shown, it is that it can adapt to whatever market conditions that they must confront. This was proven after the collapse of $UST and $LUNA, which taught the lesson that $FRAX should be at least 100% backed, instead of the original fractional reserve design where $FXS was also used to back the stablecoin. Similarly, even if $frxETH cannot compete against $WETH’s Lindy effect, there is one place where it will face no competition: Fraxchain, where $frxETH will be used as the gas token.

Fraxchain will be the catalyst that kicks off Frax’s coiled spring. It will be a hybrid EVM-compatible rollup where $frxETH is used to pay for gas – which means more yield for $sfrxETH, as every $frxETH that onboards to Fraxchain reduces the available supply eligible to stake as $sfrxETH.

More specifically, this is a re-rating catalyst that is not priced in yet. When we look at low activity layer-2s, we notice that they manage to capture at least > $100M in market cap. While this only represents ~25% of $FXS’s market cap, things change when we start comparing with the likes of application-specific chains like Injective, which experienced a 7x return YTD and $400M gain in market cap.

What’s more, Fraxchain will allow the usage of Frax native assets for gas and is not necessarily restricted to $frxETH, meaning that $FRAX, $FXS, $FPI… can also be used.

The largest Ethereum layer-2s, Arbitrum and Optimism currently make $159,000 and $82,000 in 7-day average fees.

Zooming out and looking at other alts we can come up with more conservative estimates.

In the hypothetical scenario of making $5,000/day, which is in the range of Fantom, this would put Fraxchain’s revenue at ~$1.8M/year. In a bullish time period, it is not far-fetched to estimate that this amount can more than 5x.

Additionally, FraxFerry was built to circumvent any risk of native Frax assets being compromised in the event of bridge hacks, while also contributing to expanding the supply of assets across multiple chains.

The Rocket Pool community is known for its avid support of the decentralization ethos. This has been emphasized on multiple occasions, such as when a proposal was passed signaling that the protocol would self-limit its staking if it were to become large enough. However, Lido still managed to dominate with permissioned validators, even refusing to self-limit and indirectly aiming to become a monopoly.

Not only that but there are also multiple concerns around Rocket Pool’s multisig. As a matter of fact, the pDAO is an EOA owned by the team and that, if it were compromised, it could perform actions such as:

Even if the oDAO can deploy a change to override the effect, the protocol would still be exposed for at least 7 days, causing massive financial and market damage from which the protocol might not recover. In this regard, there is currently work being done to mitigate this risk.

Coincidentally, Frax is also paving the way towards decentralization through frxGov, which will get rid of all the current concerns regarding the power of the team’s multi-sig. In fact, this centralized control and active management has been helpful to save capital on multiple occasions. One example of this was during the Nomad bridge hack, where Frax intervened faster than Nomad itself and managed to rescue part of the funds.

For the most part, multisigs undermine the censorship-resistance ethos of crypto. One example of this is the arrest of OKX’s CEO, Star Xu in 2020, which caused the exchange to not be able to process withdrawals until he was released from house arrest.

With FraxGov, Frax will no longer face the issue where the signatures of core team members are required to execute the proposals voted by veFXS holders. This, combined with the fact the Frax V3 will cause $FRAX to be pegged to the $USD instead of to $USDC, should alleviate the concerns around the recent regulatory scrutiny.

However, this still presents an issue nowadays. The protocol is also highly dependent on external protocols, with their respective smart contract risk and liquidity concerns. Regardless, this is also one of the reasons why Frax is building its own Dex (Fraxswap), money market (FraxLend), and bridge (Frax Ferry) among other things.

In addition to that, there is a dependency on the Frax technical team executing discretionarily. The most recent events, with the hack of Curve pools as a result of a bug in the Vyper compiler is an example of this.

No funds were lost by the protocol and, in the worst case scenario of $CRV or $CVX going to 0, the collateral ratio would drop by ~2%.

Collateral Ratio = Protocol Assets (Owned + Lent)Total Liabilities

Collateral Ratio = $762M + $66M$882M=93.8%

Assuming the worst-case scenario, the protocol would have lost:

This would result in:

Collateral Ratio = $745M + $64M$882M=91.7%

As far as liquid staking is concerned, Frax is currently more competitive than Rocket Pool in terms of fees, 10% vs 14%. This fee structure makes it possible to allocate 90% of all staking yield to $sfrxETH stakers in the form of $frxETH. The remaining 10% is split between the Frax Protocol treasury (8%) and an insurance fund to cover slashing events (2%). Eventually, the 8% distribution will be distributed back to $FXS holders.

With currently ~$450M in TVL, an average APY of 5%, and 8% of the yield going to the treasury, this results in $1.8M that will eventually accrue to $FXS. While this amount might seem underwhelming, if $frxETH catches up to $rETH’s TVL of $1.5B in staked $ETH, the revenue accrual is expected to 4x and stay close to the $8M mark.

But there are more sources of revenue beyond liquid staking, the largest of them being AMOs, which are the Algorithmic Market Operations that ensure peg stability for Frax’s assets and earn yield by deploying PoL (Protocol-Owned Liquidity) assets across a series of DeFi strategies.

This results in a positively balanced and self-sustaining balance sheet that amounts to a net balance of $98,388,059.

With the expectation of Fraxchain in 2024, this balance sheet will now account for one extra source of revenue.

The merits of Rocket Pool’s achievements cannot be understated. The protocol has recently reached 3,000 node operators across the globe. With that number of independent node operators, Rocket Pool can directly bootstrap the Eigenlayer network validator set itself. No other entity has such a network of independent nodes to enable this.

The number of active addresses has been increasing, and the fundamentals remain strong.

More protocols keep integrating $rETH as collateral, such as Raft, Prisma Finance, and Morpho’s Aave-V3 optimizer. This cannot be overlooked. In fact, it can be argued that Lido is #1 because being the first to market turned it into the most integrated LST in DeFi.

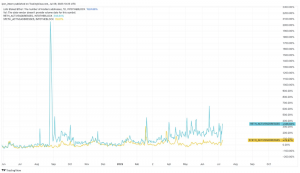

In favor of Rocket Pool, it is also worth noting that there is an implicit buy pressure on $RPL by stakers who need to hold it and that continuously stretches the already thin supply. The fact that staked $ETH continues to increase while the token keeps bleeding cannot be overlooked either.

This asymmetry is perhaps the most relevant metric to be on the watch out for. One could go short $RPL to hedge against market risk. However, this is not indicative that the trade necessarily expects $FXS to go up while $RPL simultaneously goes down. Instead, it is important to look at the spread, and there might be opportunities to flip bullish on $RPL as well. In that scenario, and with the fundamentals remaining equally strong, it is recommended to look at another venue that helps to hedge market risk.

There has been a significant selloff after the Atlas upgrade, signaling a “buy the rumor sell the news event”.

In terms of recent governance changes, one should not overlook the secondary effects of RPIP-25 & RPIP-10, which passed on July 17. With this, the inflation towards the oDAO is being reduced. Of the annual (low) 5% $RPL inflation, 15% had gone to the oDAO (see oDAO charter). After this change, this will largely be redirected to the pDAO, financially doubling its budget – the Incentive Management Committee will have twice the capital to incentive liquidity for $rETH LPs and $RPL liquidity, enabling broader DeFi integrations.

Currently, inflation is split up 70% to Node Operators, 15% to pDAO, and 15% to oDAO. Moving forward, inflation will be set as follows:

The rationale is that payments to the oDAO must cover ongoing expenses and initial expenses, should help keep members eager to serve in their role, and should mitigate the chance of bribery.

More $RPL for $rETH LPs leads to more liquidity and integrations, which generates more demand for $rETH, incentivizing more node operators to launch Rocket Pool validators.

Wallet integrations will play an important role as well, and Ledger is in the process of onboarding $rETH. This opens up the opportunity for referral programs. In the past, referral programs were instrumental in growing $stETH share and may be a great avenue for Rocket Pool to explore as well.

Ethereum staking yields keep making new lows, and the influx of staked $ETH since Shanghai has already started to slow down significantly. While there are other value drivers for $ETH, this is not a good place to be for liquid staking providers. This worst case, however, is inevitable.

As the staking ratio increases, currently at only ~17%, and more participants start claiming their piece of the pie, the pro-rata yield share will inevitably decrease. For reference, Solana and the Cosmos Hub have a staking ratio of ~70%, Cardano and Avalanche of ~62%, and Polygon ~38% (source: staking rewards).

Staking yield is ultimately a race to the bottom that might lead their respective token holders with no ability to grow. This is particularly bad for the fee capture of $LDO and $RPL, but not necessarily for Frax, which can rely on the increasing supply of $FRAX, $FPI, $frxETH, the future release of $frxBTC, and the launch of Fraxchain.

Frax can rely on multiple revenue streams beyond its liquid staking services and has many catalysts on the horizon, like Fraxchain and Frax v3. This cascade of new products can drive significantly more growth in value accrual metrics than Rocket Pool. In fact, Rocket Pool can only compete in the liquid staking sector.

The extra revenue from Frax having its own app chain cannot be understated, especially when Rocket Pool is only competing in a winner-takes-all market sector where the power law is pointing at Lido as the clear winner.

The fact that Rocket Pool has the lowest yield out of all major LSTs as well as the higher fees (14%) could make it an unappealing and overextended bet at this point.

Revelo Intel has never had a commercial relationship with Frax Finance or Rocket Pool and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.