Published: July 11, 2023

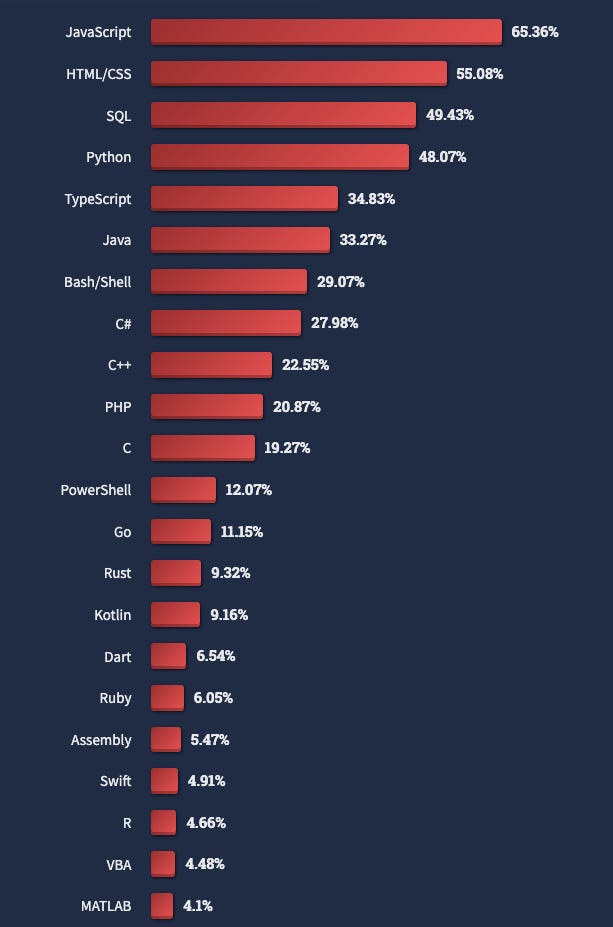

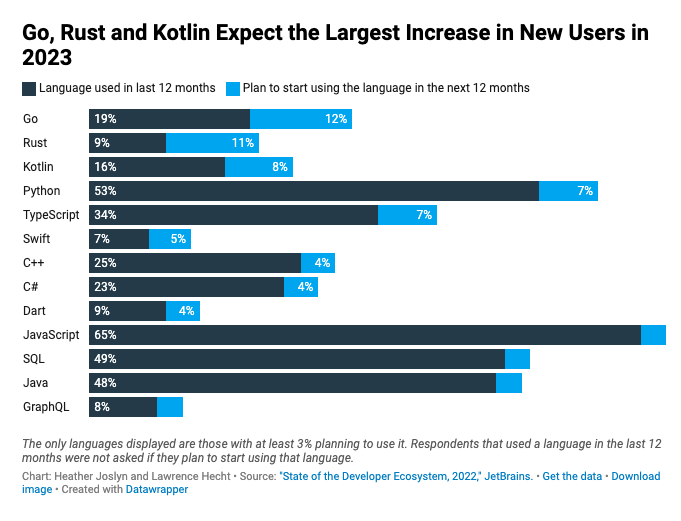

Agoric is a PoS blockchain built on Cosmos. The main attraction of Agoric is that it enables smart contracts to be written in JavaScript, the most used programming language outside of Web3. Even though Solidity has been widely adopted as the primary programming language for writing smart contracts on the Ethereum Virtual Machine (EVM), the language has some major problems and deficiencies that might be hindering the adoption of blockchain technology and onboarding new developers. As a matter of fact, 2022 marked JavaScript’s tenth year in a row as the most commonly used programming language, as per Stackoverflow’s 2022 developer survey.

The programming language used by a layer 1 blockchain is critical for onboarding both developers and users. This is the first point of contact for coders to build applications that users will enjoy. Having a broad ecosystem of developers is key for new-generation blockchains like Agoric since it expands the scope of opportunities and innovation that can take place in the ecosystem.

Most EVM chains capitalize on the fact that they can onboard Ethereum developers to their chains. For instance, development teams can just take their Solidity code and deploy it on another EVM chain with very few changes.

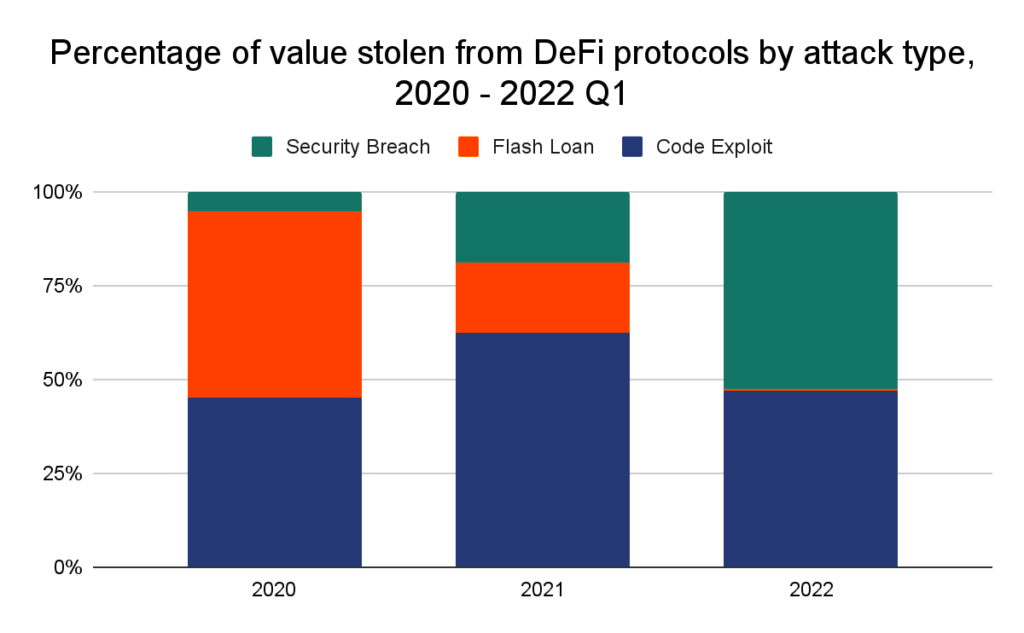

However, Solidity and the EVM have a steep learning curve for developers with a web2 background since it is only used for interacting with smart contracts that are deployed on an EVM chain, and there is no such thing in Web2. The complexity of the EVM, as well as the lack of formal verification, increases the risk of vulnerabilities and exploits in smart contracts. In fact, formal verification is crucial for ensuring the correctness and security of smart contracts. Without it, developers have to rely on manual code audits, which can be time-consuming and prone to human errors. Besides, Solidity has been associated with several high-profile security vulnerabilities and smart contract hacks, such as reentrancy attacks, integer overflows/underflows, and logic bugs.

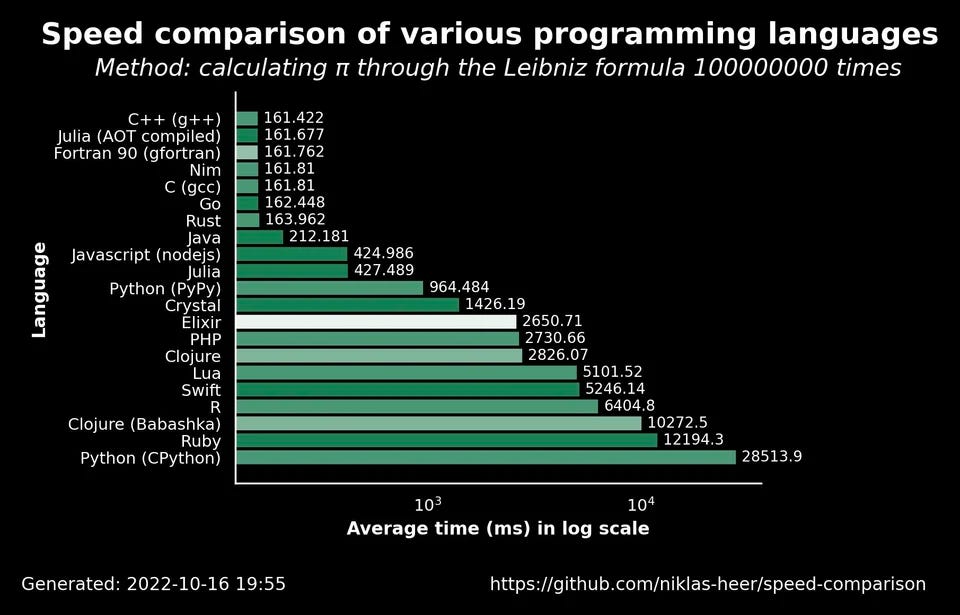

While it may not be the fastest-growing programming language, Javascript is still expected to see many new developers onboarded. Currently, many of the most popular blockchains in crypto are EVM networks. These EVM networks utilize smart contracts written in Solidity. Vyper is another language used to write EVM code and smart contracts, but most dApps utilize Solidity. While other non-EVM/Solidity blockchains exist, they generally are tackling different problems and use different solutions.

The approach that Agoric takes is to utilize JavaScript for writing smart contracts, which provides a couple of key benefits:

Agoric is seeking to scale infrastructure and competitive systems that differentiate themselves from programmability, safety, composability, and interoperability. Agoric smart contracts are written in Hardened Javascript—a secure subset of the world’s most popular programming language—rather than Solidity, WASM, or Rust. This is important because <0.1% of the world’s ~27M developers write web3 code, and Agoric opens the door to the 17.4M of all developers that write JS code. While Hardened JS is slightly different from typical JS, experienced developers can pick up Hardened JS and produce credible code in ~1-2 weeks. In fact, the Celo team was able to deploy contracts 4x faster when writing them in Hardened JS vs. Solidity].

Competitors in the non-Solidity blockchain space include:

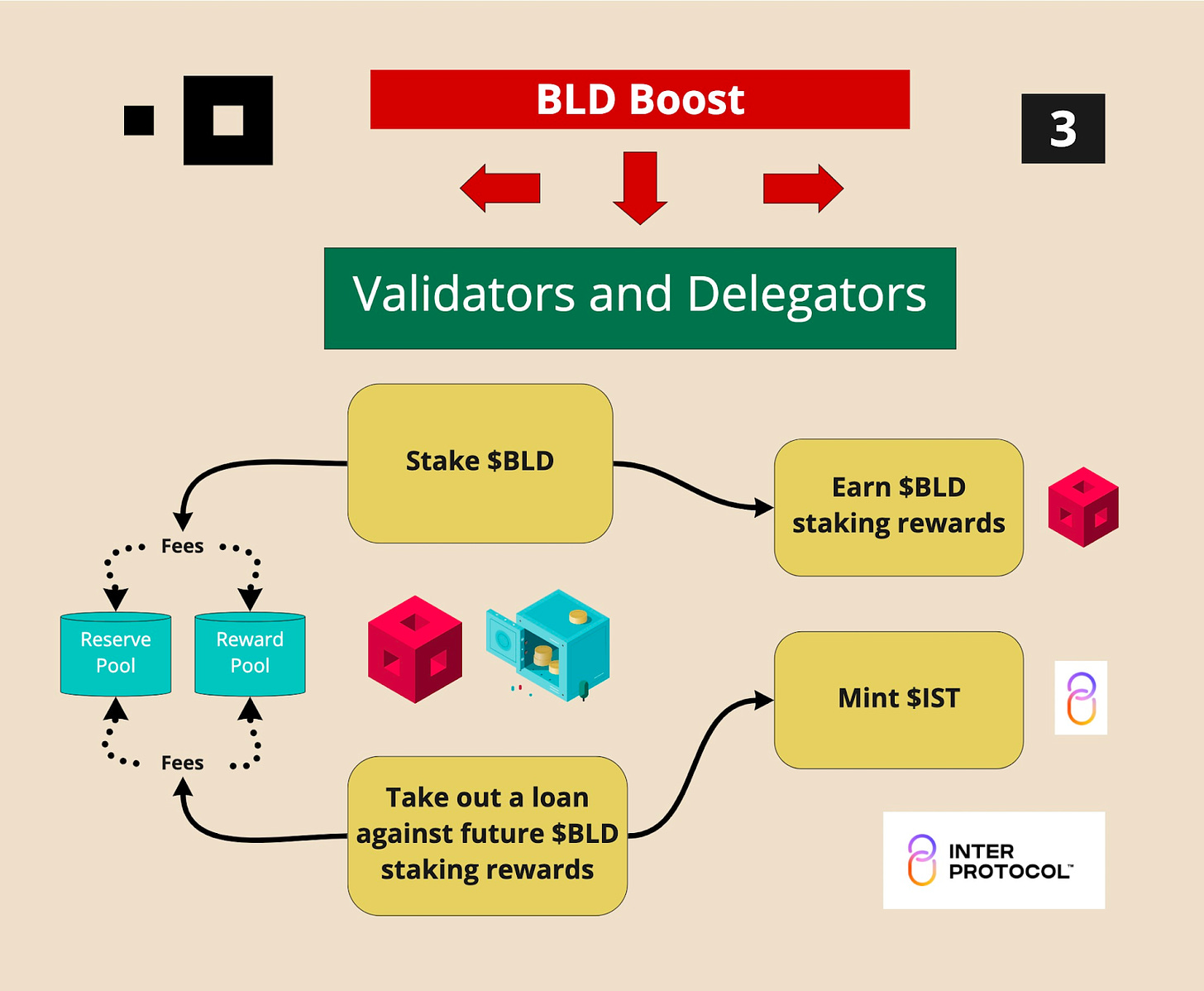

So, how do investors capitalize on Agoric’s JavaScript smart contracts? The most obvious way to invest in Agoric is to buy the native token, $BLD. BLD has a market cap of ~$68mm and an FDV of ~$150mm. It’s been almost one year since the BLD TGE, and the token is down 80% from its high, sitting ~$0.12, down from ~$0.63. The main utility of $BLD is that it is the native staking token of the Agoric blockchain. By staking BLD, Agoric validators contribute to the security of the network. Users can also delegate their BLD holdings to validators for a 3-10% commission. Both delegators and stakers are entitled to governance rights as well.

The second token of Agoric blockchain is $IST, a stablecoin partially backed by $BLD that is used to pay gas fees. It is a USD-pegged currency that maintains the peg with the support of an over-collateralization mechanism that draws its inspiration from Maker DAO.

There are a few main catalysts right now for Agoric and $BLD

Agoric’s upcoming Mainnet-1B upgrade represents a major milestone, introducing an array of new features like an enhanced Agoric VM, an oracle network, and a set of Hardened JavaScript smart contracts designed to bolster @inter_protocol Vaults.

Learn more:https://t.co/5VcOWNMYED

— Agoric (@agoric) May 23, 2023

Agoric does this by utilizing Hardened JavaScript for the blockchain’s smart contracts. The main idea behind Hardened JavaScript is that it can simplify practices that lead to improved security as a result.

JavaScript is definitely not the language seeing the newest adoption. If one had to take a guess, JavaScript being dethroned by another language could be possible. More and more people, especially in developing countries are using internet services from mobile devices. As this trend continues, the industry could see an increase in developer demand for programming languages used for mobile. Android actually changed its official app programming language from Java to Kotlin. But for now, Javascript has the largest pool of developers that could potentially be onboarded to crypto.

This is especially true considering that there are very limited applications for Kotlin to be used in the context of crypto. Many DeFi applications do not prioritize a mobile presence. There is some evidence that this is changing, with Uniswap releasing their IOS app on April 13. This is significant, as Uniswap is considered one of the cornerstone protocols in crypto. The Solana Saga smartphone was also recently released, another example of mobile crypto adoption. There are other examples to support mobile moving up on the priority list for crypto developers. But in general, crypto lives on desktop through wallet extensions and websites. This could change sometime in the future with newer crypto innovations like Gaming and AR/VR prioritizing mobile experiences more compared to DeFi.

It is estimated that Solidity, the dominant programming language in crypto, has around 200k active developers who use the language globally. Now compare this with JavaScript, which has an estimated 17.4 million developers globally…

If you have the view that the DeFi and crypto ecosystem will expand far beyond the EVM, then it makes sense to think that other programming languages will proliferate. Founders and developers will use a particular language for a reason.

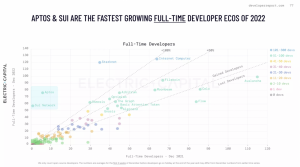

For example, the Move language, used by Aptos and Sui, is a programming language initially developed at Facebook. The language was built specifically for smart contracts.

Rust is the next most popular programming language in crypto behind Solidity, most known for being used in the Solana ecosystem. The Solana ecosystem, especially at its peak, was known for being a good place to start in crypto for new users. Whether users were interested in DeFi or NFTs, Solana provided a user-friendly and intuitive experience. Excluding Solana’s confusing block explorer, users experience snappy transactions, an easy-to-use wallet in Phantom, and more.

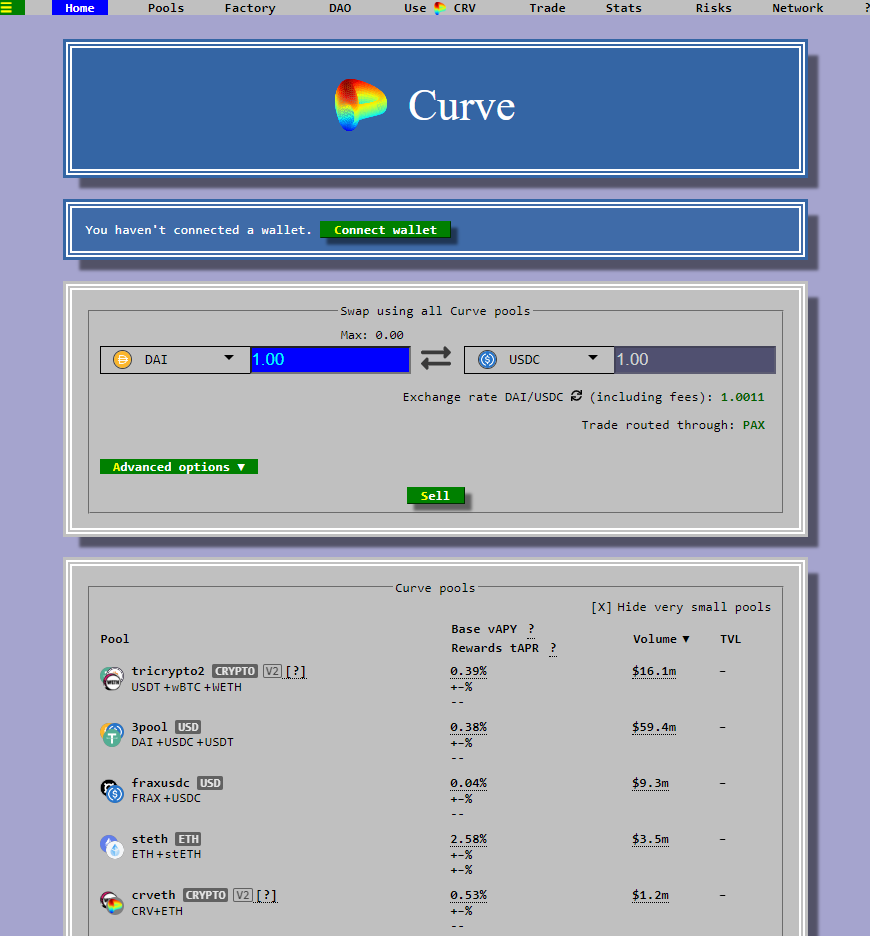

Rust, the programming language behind Solana, is one of the most used programming languages in the world. It’s estimated that there are almost 3 million or more active Rust developers. Is it a coincidence that the primary blockchain built on the most popular programming language in DeFi was also the most user-friendly? That’s for you to decide, but it would make sense that an ecosystem built on a more esoteric language like Solidity would result in developers who are primarily building for themselves, or fellow DeFi enthusiasts that are similar to them. Crypto is notorious for its confusing UX. One of the bluechip Defi projects, Curve Finance was commonly criticized for its retro UI and ultimately decided to provide an alternative UI focused on attracting new users.

At the end of the day, bringing new liquidity on-chain is primarily dependent on attracting retail. Since they may not care about things like decentralization, or security as much as DeFi enthusiasts, retail often flocks to where an easy-to-use UX is. The majority of people who own crypto have never gone onchain, and just hold or trade funds on a CEX.

If popular programming languages are correlated with dApps that have a good UX, keeping an eye on ecosystems like Agoric, NEAR, or even Solana may be a good idea.

As we mentioned above, there are other players in the EVM-alternative category, most notably Solana. Following the collapse of FTX, a lot of Solana’s DeFi ecosystem was negatively impacted.

Aptos and Sui are finding their footing in the market, although they can be seen as targeting a different demographic of developers.

The primary competitor to Agoric is NEAR. NEAR also allows for smart contracts to be deployed using JavaScript. Recently this year, the team launched their ‘Blockchain Operating System’ or BOS initiative. Basically, this initiative introduces a concept very similar to the reusable components that Agoric has been promoting as a solution to developer UX issues. BOS aims to make it easy for both users and developers to use crypto for the first time. It went live in late April.

There are a couple of interesting things BOS does that Agoric does not. One is their specific emphasis on onboarding new users. NEAR claims that people will be able to log into dApps with accounts, and not have to interact with crypto. Some other offerings from the BOS include a decentralized content moderation system, a search function for developers, gateways, and more. While emphasizing effort to add these features doesn’t mean they will actualize materialize, it’s good to see teams planning these kinds of things.

So what sets Agoric apart from NEAR? There are several key distinctions, which we will outline:

It is also worth noting that hardened Javascript is one of the several dedicated smart contract languages promising a safer development environment for smart contracts. However, hardened Javascript is not Javascript, and most libraries on the web are not Hardened JS-conformant. This means they cannot be used by smart contracts. The inability to use most libraries might mitigate the advantage of reusing a popular language like JavaScript. This is a selling point of Move, as the programming language was designed specifically with smart contracts in mind.

An increasing number of enterprises are becoming large technology platforms that are keen to rely on the transparency and security of blockchains for their operations. At Revelo, we believe that the peak of an “API” economy is yet to come, and this will only be achieved by incorporating established and battle-tested technologies such as Javascript. In order to fulfill this vision, there is a need to 10x the number of active developers who are developing the smart contracts that will run the economic activity of the future.

Solidity is still the domain of highly specialized developers and security audit firms. Through a robust API economy, Agoric can expand the developer ecosystem by multiple orders of magnitude. This will be achieved by bringing JavaScript, one of the most popular programming languages in the world as a first-class language for smart contract development.

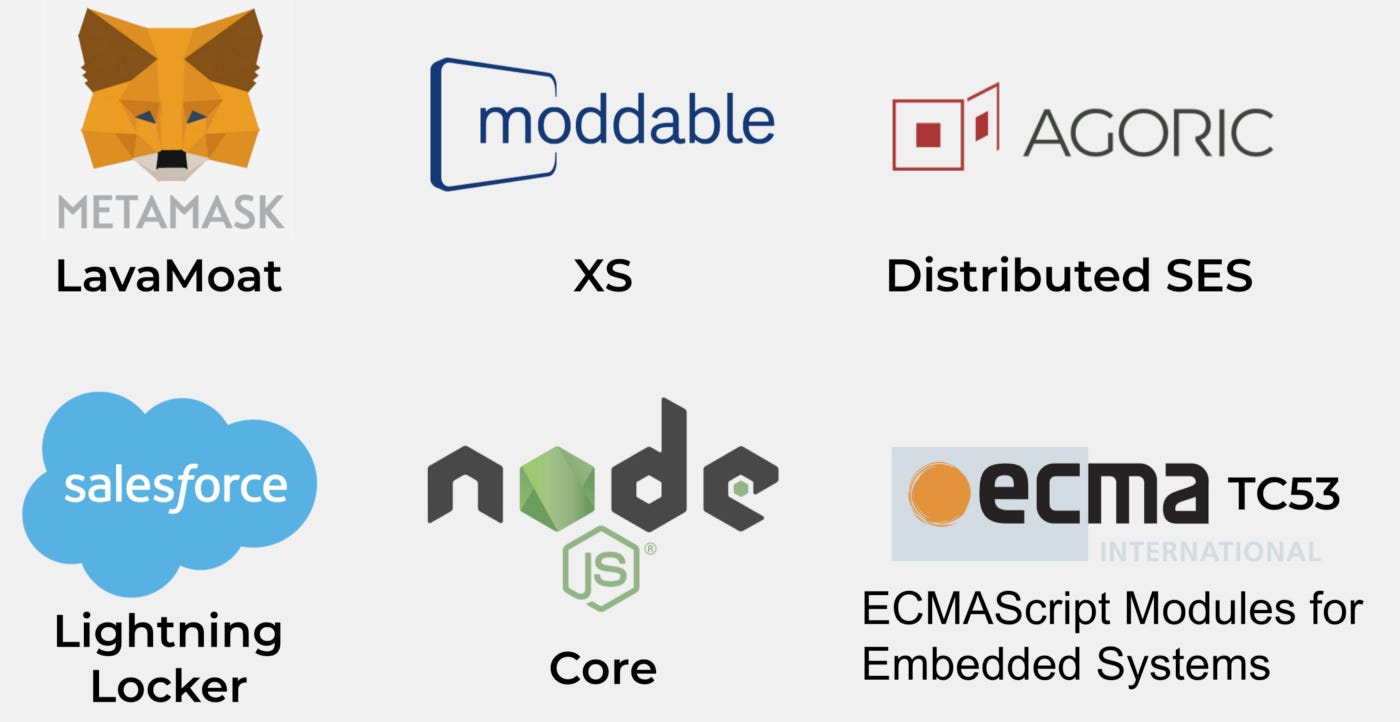

Not only will Javascript enhance developer adoption, but it will also realize the vision of DeFi composability and “money legos”. The Agoric framework enables an exponential expansion in the reusability of safe and secure code modules. Much like Node.JS and NPM contributed to the explosion of the popularity of JavaScript, Agoric’s framework contains both an NPM-like modular reusability as well as a security framework for JavaScript that has already been in production at salesforce.com.

The Agoric team offers decades-long experience in secure/distributed electronic currency and smart contracts. All these years of research culminated in the development of Hardened JavaScript, the Agoric Virtual Machine, the Electronic Rights Transfer Protocol, the Zoe smart contract framework, and the Inter Protocol.

In fact, the Agoric team has experience working on smart contracts since before the Bitcoin whitepaper was even published. For example, take this seminal paper called Capability-based Financial Instruments by Mark Miller from October 2001, published at the 4th International Conference on Financial Cryptography. It cites the seminal work of Nick Szabo in 1997 entitled Formalizing and Securing Relationships on Public Networks.

In addition to that, Agoric chief scientist Mark Miller is also one of the key creators and contributors to Javascript along with Brendan Eich. CEO Dean Tribble is also well-known. He co-designed the negotiation process and contract for the first smart contracting system, AMiX. As a Principal Architect at Microsoft, he also co-designed the Midori distributed object-capability operating system.

As the crypto markets evolve, the thesis for a multichain and interoperable future becomes stronger. Agoric is built using the Cosmos SDK and the Tendermint blockchain engine. Current Agoric users and builders consist of those in or adjacent to the Cosmos ecosystem. This is notable, as different blockchain ecosystems have different demand trends. Numerous projects have found significant increases in adoption and usage from simply deploying on a different chain. Cosmos is a distinct community from Ethereum and the current reigning L2 and EVM chains that are receiving most of the attention in crypto at this time.

Currently, one of the main differences between Cosmos and other chains is that there is a lack of stablecoin options. Recently, Circle announced they would be bringing native $USDC to the Cosmos ecosystem. This is big news, as for a long time Cosmos depended on the now-defunct $UST as the primary stablecoin of the ecosystem. Being a non-EVM chain, many of the traditional options like $USDC or $USDT weren’t available on Cosmos. The collapse of $UST was a big blow to the Cosmos ecosystem, heavily impacting DEXs like Osmosis. ~7% of all liquidity on Osmosis was tied to Terra Luna and $UST. Following the collapse of Luna, Cosmos has mostly recovered. However, a clear stablecoin choice has not been established.

Today, evolving bridging technology makes it easier to create Cosmos-compatible instances of these popular stablecoins. One popular example of this is $axlUSDC, a wrapped version of $USDC available on Cosmos. In the past, wrapped tokens and bridges have been susceptible to exploits and hacks. This makes a native version of $USDC on Cosmos that is deployed by Circle themselves a more reliable option.

We're excited to bring USDC to @Cosmos! USDC is expected to launch on @noble_xyz soon, stay tuned for details. #IBC https://t.co/eqU8wno43F

— Circle (@circle) March 28, 2023

Despite Circle confirming that $USDC is coming to Cosmos, not everyone accepts this as the end of the stablecoin discussion. Some figures in the Cosmos ecosystem have expressed demand for a stablecoin that is more decentralized. One of the main criticisms of $USDC is that Circle can freeze tokens at will. The company can also choose to blacklist accounts that interact with these tokens. The Cosmos ecosystem is comprised of people and projects that often convey ideals of blockchain sovereignty and decentralization. The demand for a decentralized stablecoin within Cosmos is significant. This is where $IST comes in.

$IST is the native stablecoin of Agoric. $IST is short for ‘Inter Stable Token’, the token minted by Inter Protocol, In addition to being a decentralized stablecoin, it also serves as the Agoric blockchain’s gas token. Stablecoins are very important in DeFi. Having one or multiple reliable stablecoin options in a blockchain ecosystem is a significant factor that contributes to growth.

But $IST is a stablecoin, you can’t invest in it and profit, even if demand does increase. In addition to this, Agoric’s $BLD governance token is not a listed collateral type to mint $IST directly. While this may be a good thing for the health and sustainability of Inter Protocol and $IST, it doesn’t directly help the case for $BLD. The thesis for a $BLD investment is the unique properties around Inter Protocol governance. Inter Protocol and Agoric are pretty intertwined. $IST is the gas token used to pay fees on Agoric. Meanwhile, $BLD is the token staked to secure the Agoric Network. It is also the governance token of both Agoric and Inter Protocol. This creates two main areas of interest for $BLD, as investors may wish to gain exposure to Inter Protocol, Agoric, or both. The reality is most of the token’s action will probably come from people speculating on Agoric as a network. But having governance power over an up-and-coming decentralized stablecoin in the Cosmos ecosystem is not something to be understated.

Now, when it comes to the decentralized stablecoin space on Cosmos, $IST is not the only option people have. One primary competitor in the decentralized stablecoin space is $SILK. The main attraction of this stablecoin is that it is private. $SILK is backed by a basket of ‘bluechip’ crypto assets and Fiat currencies. There are actually incentives that are live for those who LP $SILK with $IST or $BLD on ShadeSwap, the primary DEX on the Shade privacy network. $SILK is currently the most adopted decentralized stablecoin in the Cosmos ecosystem, with a market cap of ~$3.3M.

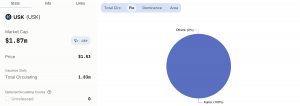

The other decentralized stablecoin competing with $IST is $USK. $USK, the stablecoin launched by Kujira, This is due to the token’s launch, which included significant incentives for LPs. The demand for the stablecoin caused it to go above peg. Despite many speculators predicting a fall below peg, $SILK has remained above the $1.03 price to this day. It has actually climbed higher, currently sitting ~$1.056. $USK has a higher marketcap compared to $IST, coming in at ~$1.8M to $IST’s ~$1M.

Something to keep an eye on is that $USK and $SILK alike are both significantly overpeg, hovering around the ~$1.03 range. $SILK is even more overpeg, sitting at nearly ~$1.06. $IST on the other hand, currently sits right at $1.00.

The main draw of Agoric’s Mainnet-1B upgrade is the introduction of $IST Vaults.

In addition to the introduction of $IST vaults, the Mainnet-1B upgrade to Agoric introduces benefits including:

As mentioned above, the community does have a lot of input when it comes to determining what sorts of assets can and can’t be used to mint $IST. Unsurprisingly, using liquid staked $ATOM as collateral for minting is a topic being discussed in the governance forums. $ATOM is the official token of the Cosmos Hub and the token that holds the most weight in the entire Cosmos ecosystem. There is a strong emphasis from the Cosmos Interchain Foundation and many in the Cosmos community to make $ATOM a reliable token that projects can depend on, a sort of reserve currency. Many efforts have been made over the years to see more value accrue to the token and to encourage projects to integrate $ATOM. One such effort is the advent of liquid staking. Liquid-staked $ATOM comes in multiple varieties, just as $ETH LSTs do. Unlike $ETH, $ATOM is still quite inflationary, with the current inflation rate coming in at ~17%.

This is significant, as there is a great opportunity cost to depositing $ATOM to mint $IST. The reality of staking is that stakers aren’t simply rewarded for securing the network or depositing their tokens. Their share of the network remains more or less the same. So it isn’t that stakers are necessarily rewarded, but that people who don’t stake are punished. They have their share of the network, whether it is Cosmos, Ethereum, or another blockchain, diluted. So while a high APR for staking may seem great for stakers, the primary takeaway is that it is harmful for non-stakers.

This is more and more true the higher the percentage of tokens staked is. $ATOM boasts a very high staking rate, at ~70%. This is very high, especially compared to $ETH’s ~20% stake rate. Respective of the distinct ecosystem valuations obviously, there is a lot more to gain by enabling staked $ATOM deposits than staked $ETH deposits. There is also some pressure to enable staked token deposits, as both $USK and $SILK stablecoins accept $stATOM as collateral.

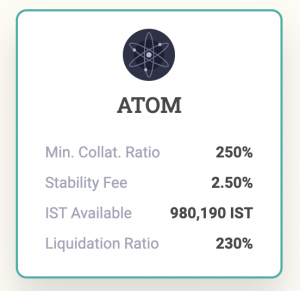

In addition, there are some specific parameters that compound to increase the opportunity cost of depositing $ATOM.

There is a stability fee of 2.50% when depositing. More importantly, the minimum collateral ratio is 250% AKA an LTV of 40%. Some users may think that this is too low. Whether or not this ratio should be adjusted is a different topic. But considering that the current APR for staking $ATOM is ~20%, any $ATOM deposited is losing out on ~50% in rewards. This could be mitigated if a user minted the maximum allotted amount, and then converted the $IST into $ATOM and staked it. But they would only be getting 40% of the yield they could be getting by foregoing a deposit and staking their initial $ATOM stack instead.

Many blockchains turn to incentive programs as a way to attract developers. Agoric makes it a priority to attract developers not necessarily with token airdrops or monetary incentives, but with an easy UX. Of the non-EVM blockchains, only NEAR and Agoric are focusing on JavaScript-compatible smart contracts. JavaScript smart contracts give an outlet for the largest developer pool in existence to onboard into crypto. Should a mass arrival of Javascript developers occur, there will surely be money to be made with the facilitating protocols and their adjacent ecosystems. While some features of NEAR’s BOS initiative look promising, Agoric is the shinier object. For those looking to bet on JavaScript developer immigration into crypto, $BLD probably has more upside potential.

While JavaScript smart contracts are Agoric’s main selling point, other factors could help boost $BLD price. Agoric is built on Cosmos tech and is heavily plugged into the Cosmos ecosystem. Should $ATOM and the surrounding chains under the Cosmos umbrella receive attention from investors, $BLD stands to gain by association. To help fill the gap left by $UST, Agoric’s $IST stablecoin has put its name in the hat as a potential decentralized stablecoin option for Cosmos. As the gas token for Agoric, the adoption of this stablecoin could uniquely bring more eyes to $BLD.

Revelo Intel has never had a commercial relationship with Agoric and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.