Published: June 22, 2023

Lido DAO (Lido) is the leading Liquid Staking protocol on Ethereum, being the most widely used protocol for staking $ETH, and its liquid token $wstETH is rapidly establishing itself as a cornerstone of DeFi.

This report takes a look at the performance of Lido over 31 days from May 14 to June 13. It will cover the key metrics of the protocol, the Liquid Staking Token (LST) landscape, the $LDO token, $stETH-$ETH correlation, and other events.

Lido opened the period with $12.09bn in TVL and closed at $12.57bn, representing a 3.9% increase in TVL for the 31-day period. This was a continuation of the previous period which also saw an increase of 5.94% in TVL

Below is a breakdown of how the TVL is allocated between the networks that Lido is located on. The contribution to the $12.56bn of TVL is as follows:

The graph below illustrates the change in TVL in the current period versus the previous one.

TVL on Ethereum opened the period at $12.09bn and experienced a $489m (4.07%) increase, closing at $12.52bn.

The increase in TVL on Ethereum can be attributed to the rise of popular DeFi LST protocols like Lybra Finance during the time period, that utilize Lido’s $wstETH, creating a demand for it in order to farm the yield on these protocols.

On other networks, there was a decrease in TVL on Moonbeam and Moonriver due to the sunsetting of Lido on Polkadot and Kusama. There was also a decrease on Solana that was correlated to the decrease in the price of $SOL.

At a protocol level, Lido TVL continues to outperform both the price of $ETH and the growth of the Ethereum network.

Over the 31-day period, $ETH deposits grew by $510m representing a 4.29% increase. The significance of the growth is that over the same time period, the total TVL of the Ethereum network decreased by $452m.

The liquid staking industry has rapidly grown to become the largest in DeFi. At the time of writing, it has a total of $19.4bn. Lido is the leader in this sector with a total of $12.5bn.

$wstETH has seen continued growth in both the current and previous 31-day period.

While competitors achieved higher growth percentages, Lido still leads the way in terms of dollar growth. The table below illustrates the size of the difference, Rocket Fuel has achieved consecutive double-digit growth percentages however, Lido continues to dominate the value capture.

The outlier in the numbers is Coinbase which has been receiving heightened regulatory attention from the SEC, which culminated in charges laid against the exchange on 6 June. The staking service offered by Coinbase was included in the charge sheet.

You can read about the SEC Press Release here.

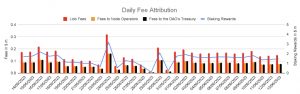

Lido charges a 10% fee on these rewards. The fee charged by Lido is allocated 50% to node operators and 50% to the DAO’s Treasury.

During the period, $stETH generated total rewards of $44.7m, a decrease of 28% from the $62m earned in the previous 31-day period.

From these rewards, Lido earned $4.7m in fees allocated as $2.35m to both the node operators and the DAO Treasury.

Compared to its competitors, Lido ranked 1st among Liquid Staking protocols for fees generated in the last 31 days.

During the period, the $LDO token opened at $1.89, and home some volatility in both directions. On June 7 it reached a high of $2.4 and a low of $1.79 on June 13, the last day of the period. The total movement for the period was a decrease of 5.31%.

The circulating market cap followed the same downtrend as the price, opening at $2.03bn and closing at $1.66bn, with a decrease of 5.09%. Lido DAO holds the 33rd rank for circulating market cap on CoinGecko.

The graph below illustrates the correlation between the price and market cap for the period, indicating that there were no significant supply-driven events and that the changes in the market cap were driven by token price volatility.

All Liquid Staking protocols experienced downward price pressure over the past 31 days. $LDO was the best performed in challenging market conditions.

It is however important to note that in the 31-day period prior to this, the token did struggle.

If we expand the range, both $LDO and $RPL (by Rocket Fuel) experienced price decreases of 24% over 62 days.

The withdrawal ratio for $stETH to $ETH is always set at 1:1. However, as the withdrawal process may require a period of 1-5 days, users who require an instant exit can only do so via the open market and have to sell at a discount.

The discount is usually insignificant after taking into account gas fees on Ethereum main-net and the buying size required for profitable arbitrage.

With the successful implementation of Ethereum’s Shapella upgrade and its unstaking feature, any significant arbitrage on $stETH has been significantly flattened. This can be seen over the current and previous 31-day periods, the largest deviation was on 6 June, where $stETH was trading at a 0.13% discount.

The chart below shows the performance of $stETH compared to $ETH

There were three significant governance proposals that closed during the 31-day period.

1. Nominate the Gas Supply Committee as a supervisor for gas expenditure

The proposal aimed to expand the role of the Gas Funder Committee and to rebrand it into the Gas Supply Committee.

The new authority is to determine the eligibility of gas expense reimbursements arising in the day-to-day operation of the protocols within an annual budget capped at 1,000 $stETH.

This was due to a recent rise in gas expenses for different operations.

The vote closed in favor of the proposal.

You can read the full details here.

2. Lido Community Lifeguards Initiative

The proposal was for Lido DAO to fund the Community Lifeguards Initiative Pilot (LEGO), which is proposed to commence within Q2/23 and last until Q4/23, at which point LEGO and the Lido DAO should consider whether this initiative is worth continuing, expanding, or sunsetting.

The initiative would identify and reward community participants who would bring together existing DAO contributors, community stakers, and the wider Ethereum staking community.

The vote closed in favor of the proposal.

You can read the full details here.

3. Lido DAO treasury to aid in the Sushi recovery (restart)

The proposal was to determine if the 39.8 $ETH that flowed into the Lido DAO Treasury, as a result of an exploited vulnerability in SushiSwap, should be returned to the impacted party.

The vote closed in favor of the proposal.

You can read the full details here.

Below are three notable news events that were published in the period.

1. Lido v2 Upgrade / Ethereum Withdrawals go live

Lido v2 is officially live on Ethereum mainnet.

Lido V2 significantly improves the Ethereum staking experience whilst pushing the Lido protocol further down the road toward increased protocol decentralization.

Lido v2 introduces two major components, withdrawals, and staking routers.

For more information, you can read about it here.

2. Further clarity for VaNOM

VaNOM is Lido on Ethereum’s Validator & Node Operator Metrics, which allows users to view a variety of metrics related to the protocol’s validator distribution across specific points in time.

Clarity has been added to stake distribution across the node operator set, in both absolute and relative terms.

In line with the goals expressed in the Lido Scorecard & Operator Set Strategy, quarterly reporting now shows the soft stake targets per Node Operator.

For more information, you can read about it here.

3. $wstETH integrated into Silo Finance

Silo Finance is a Risk-isolating money market on Ethereum & Arbitrum.

This integration unlocks further utilization for $stETH, making it more attractive to users over its competitors.

For more information, you can read about it here.

This report has highlighted the pricing trends and metrics for the period.

Lido is the largest DeFi protocol by TVL, compared to its competitors it is more than 6 times the size of its closest competitor, Coinbase’s $cbETH.

Its strength and dominance come through on almost all metrics covered in this snapshot. In addition, the market ratio of $stETH to $ETH is historically well-pegged, apart from past market forces from significant events beyond Lido’s control.

We hope this report provides valuable insights into the performance of Lido, the $LDO token, and the staked Ethereum.

Revelo Intel has never had a commercial relationship with Lido and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.