Trader Joe was initially created as the “one-stop shop” in the Avalanche network for all things DeFi. Over time, the team has come up with innovative solutions such as Trader Joe’s liquidity book, a novel AMM and DEX design with which it seeks to expand to other chains like Arbitrum One and compete with protocols such as Uniswap V3.

Their latest iteration of their DEX, the liquidity book, allows for further customization when it comes to providing liquidity. The model is based around liquidity “bins”: users can specify price ranges they want their liquidity to be used for with the assets they are supplying, rather than just supply liquidity and have a lot of it sit idly, as is the case with many DEXs. This significantly reduces impermanent loss, slippage, and fees, although it can result in higher gas prices for transactions. The liquidity book also has a unique feature; it provides users with a “receipt” token for depositing into liquidity bins, allowing for other protocols to build more use cases on top of the liquidity book.

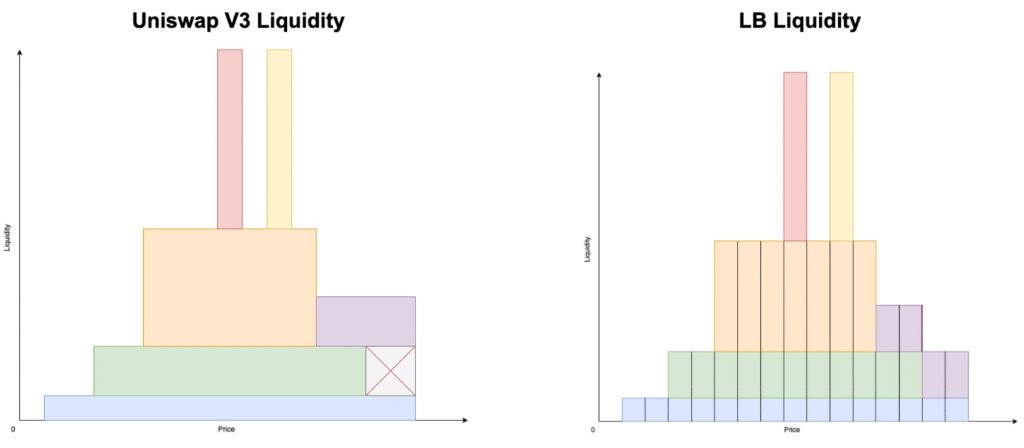

While this iteration is being introduced for blue chip assets, for much of the Trader Joe platform, users can expect all the features of a standard DEX. You can deposit assets into liquidity pools to earn rewards, and make swaps. This is Trader Joe’s primary use case. The protocol charges a 0.3% fee on swaps, with 0.25 % going to liquidity providers, and 0.05% going to JOE stakers, in the form of USDC. If uninterested in earning this fee revenue, users can instead opt to choose one of the other utilities of the JOE governance token; rJOE (rocket JOE) gives early access to DEX token launches, meaning that holding a certain amount of rJOE will give you an allocation of the token.

Trader Joe’s value proposition is to build the essential products used in DeFi and make them accessible to both newbies and veteran users. The platform features a DEX, a borrow-and-lending market (Banker Joe), a launchpad (Rocket Joe), an NFT marketplace (Joepegs), and even an NFT accelerator (Joe Studios), all in one convenient place under the Trader Joe name.

Currently, Trader Joe is seen by many as the most popular dApp in the Avalanche ecosystem; they have the most liquidity and volume in their AMM, their branding and marketing keep users engaged, and they continue to add more features, rather than being ‘just a fork’ of Uniswap V2.

Merchant Moe is a franchised fork of Trader Joe on the Mantle Network.

As a fully native DEX, Merchant Moe will be positioned to adapt to Mantle’s evolving needs. Merchant Moe will be strategically tailored to contribute towards the culture and growth of the network, ensuring true value, incentive and community alignment with the ecosystem. Merchant Moe will utilize the Liquidity Book mechanism as well as other purpose-built ecosystem featuers.

The only way to acquire $MOE tokens at the initial launch, will be through an airdrop for $JOE holders. This opportunity comes in two phases. Firstly, an initial distribution of 2.5% of $MOE’s total supply. After this initial distribution, $JOE token holders can access an extra 5% of the total supply, distributed over one year via staking. To participate in both phases, users must first move their $JOE tokens to the Mantle Network and then deposit their $JOE tokens into mJOE staking on the Merchant Moe platform.

Trader Joe was founded in June 2021 by 2 anonymous founders, 0xmurloc and Cryptofishx. The origin story was born from the ambition to create a unique trading platform that would follow a community-first approach to building. The mission was (and remains to this day) to make Decentralized Finance accessible to the “Average Joe”.

In an interview, Cryptofishx states that 0xmurloc was a family friend. Cryptofishx helped a DeFi protocol that had no developers but still managed to achieve $30m TVL on the first day of launch. After realizing that the barrier to entry for DeFi developers was low at the time, he decided to get in touch with 0xmurloc and begin building Trader Joe, a fork of Uniswap V2.

The core brand values supported the development of a one-stop-shop for all things DeFi: swap, farm, lend, borrow, participate in pre-sales… By having a lean and agile team, innovation would come by relying on the community and supporting its initiatives.

Due to the need for alternative layer 1 blockchains to have a DEX where users can swap their assets and earn from trading fees on liquidity deposits, Trader Joe experienced huge growth in its early days. Being a fork of Uniswap V2 and branding the protocol as the go-to store for all things Avalanche, the well-known constant product AMM model helped Trader Joe to experience exponential growth.

Once the DEX was launched and actively used on Avalanche, the team came up with other DeFi primitives that could increase the TTL of the protocol while maintaining a synergistic relationship with their DEX. This was the origin of Banker Joe, a borrow-lending money market with a very simple functionality that resembles the peer-to-pool model of Aave and Compound.

In 2022, Rocket Joe was launched in a very depressed market and the product did not quite find a product-market fit. However, it was a huge milestone for the team, as this allowed them to prove to themselves that they have the ability to innovate and build more complex products than just simple forks. Joepegs came next, which proved them capable of building a scalable NFT marketplace.

Over time, as the protocol introduced new products and competition on Avalanche and other chains started to increase, the team decided to come up with a more innovative AMM design that solves the drawbacks of its V1 release.

Finally, after 1 year in development, Trader Joe V2 introduced a new AMM design that fixes the inefficiencies of the x*y = k AMM design while still maintaining and improving the user experience

Over the past year, the team has grown from 2 to 40 people all over the globe and with different kinds of backgrounds. Some team members used to work as staff engineers at big tech companies like Facebook, Google, Amazon, or NVIDIA, while other members dropped out of college to work on DeFi.

Despite the protocol founder and some developers being anonymous, the team has shown its commitment to educating users and adding value to its community via multiple initiatives. One example of this is the Degen Dictionary, a breakdown of crypto terms in an easy-to-understand manner, the DeFi Safety Manual… Even the official documentation contains a section covering the basics of DeFi, such as how to set up a wallet or interact with the products offered by the platform.

Co-Founders

Quant and Research

Engineering

Marketing and Business Development

Community Team

The team has shown its willingness to help the community at all times, whether it is by being active on Discord, or by coming up with technical implementation for ideas and suggestions brought up by the community, most of which are related to NFT initiatives, NFT collections and artist spotlights, and just-for-fun satire pieces.

On a similar note, the protocol facilitates quarterly reports to its community. Besides, it also helps its users to prepare ahead of new deployments. For example, the deployment of the Liquidity Book was preceded with tutorials and guides explaining how to trade or provide liquidity in the new AMM. Not only that, but the team also shared a series of beginner and advanced strategies to manage liquidity.

The community actively supports the protocol users by developing open-source tools such as an application that helps borrowers on Trader Joe to monitor their liquidation threshold and set notifications. This application can be accessed at https://www.orbs.com/notifications-launch/

Trader Joe is primarily in the decentralized exchange sector. They’ve also branched out into the lending/borrowing sector via Banker Joe, the launchpad sector via Rocket Joe, and the NFT marketplace sector via Joepegs. They have also not stopped innovating, with the recent release of Liquidity Book as a V2 AMM release. As a native DEX on Avalanche, Trader Joe has built a loyal community along with a proven track record.

Decentralized Exchange

DefiLlama reports a total of $1,540.15 billion TVL done across DEXes, across reported chains, in 2021. In November 2022, the total DEX TVL was $104.5 billion. Of the $104.5 billion TVL, $1.6 billion was done on Avalanche. Avalanche ranks 7th compared to other chains based on DEX TVL metrics. In Avalanche, Trader Joe ranks 1st at a TVL of $77.72b, with its most similar native competitor Pangolin coming in at 7th place at a TVL of $16.4b

Lending/Borrowing – Banker Joe

Banker Joe TVL comes in at 3rd place on Avalanche at $13.86m, compared to Benqi’s $98.18m and Aave’s $305.08m. With regards to competition, it may be hard to capture Aave’s TVL due to Aave’s established reputation and safety, while Benqi allows loans via using its protocol’s liquid staked AVAX (sAVAX) as collateral, giving it an edge over Banker Joe.

Launchpad – Rocket Joe

Avalaunch, the first native protocol to offer fund-raising on Avalanche, is the biggest competitor for launching protocols, with 25 completed fund-raising as of December 2022. The protocol requires KYC prior to participation and staking of their token, XAVA, in order to gain allocation to launches. XAVA can also be locked for 3, 6, or 12 months in order to gain a multiplier on locked XAVA and special access to “gold” IDOs and airdrops.

NFT marketplace – Joepeg

On Avalanche, there are a few NFT marketplaces that are competitors to Joepegs, with Opensea being the biggest. Of note is that Joepeg is the only native NFT marketplace, which may benefit from existing community loyalty.

The following are total trading volumes based on:

NFTKEY has a total volume of $74k

NFTrade has a total volume of $94k. Opensea, one of the biggest NFT marketplaces, has done 15,697 AVAX ($189,687) worth of volume.

Joepeg has a total volume of 19,681 AVAX ($233,613) worth of volume. This is higher than Opensea and makes Joepeg the leading NFT marketplace on Avalanche.

Trader Joe is available on the following chains:

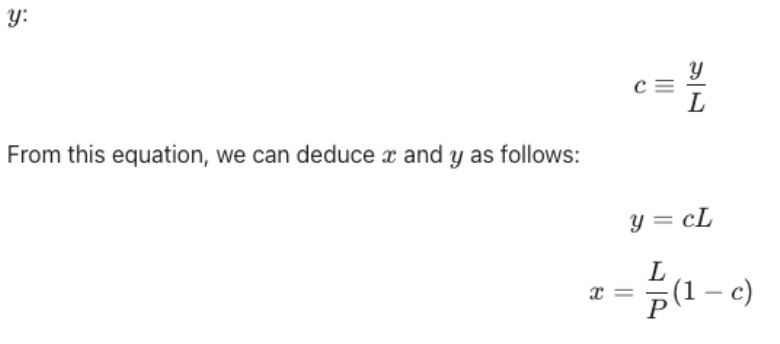

Liquidity Book is an efficient and composable AMM design that differs from the majority of Uniswap forks in how the liquidity is stacked inside the liquidity pools. Liquidity providers deposit assets into discrete price bins, each of which is assigned a specific price. Since all the liquidity is deposited into bins, LPs receive back a semi-fungible token receipt that represents their position. This is different from existing concentrated liquidity solutions.

By using discrete bins to enable concentrated liquidity in the AMM, the Liquidity Book manages to aggregate all the liquidity in a set of bins, each of which functions as a constant sum pool with its own reserves. This model uses pool reserves to calculate prices based on the active bin and the reserves being held on it. As a result, trades that occur with the existing liquidity in that bin will execute with close to zero slippage. Slippage would occur when all the liquidity in a given bin is consumed. This price impact is the result of a change to another bin that will bring in extra liquidity to facilitate trading. This feature is especially helpful for swapping stablecoins and pegged assets.

The goal of this architecture is to allow LPs to earn more trading fees while putting less capital at risk. Not only that, but traders also benefit by getting better prices and lower slippage on their trades. The model differs from existing AMMs because, instead of charging a flat base fee for all trades, it introduces a self-adjusted variable fee rate based on volatility conditions.

The additional fees collected during volatile market conditions are also an effective solution to mitigate the detrimental effects of Impermanent Loss. Impermanent Loss can be described as the cost of price discovery. Because of that, impermanent loss is highest during volatile periods. By accounting for volatility when estimating fee charges, the AMM manages to earn extra revenue that will be shared with its liquidity providers to offset the losses they experience during volatile markets.

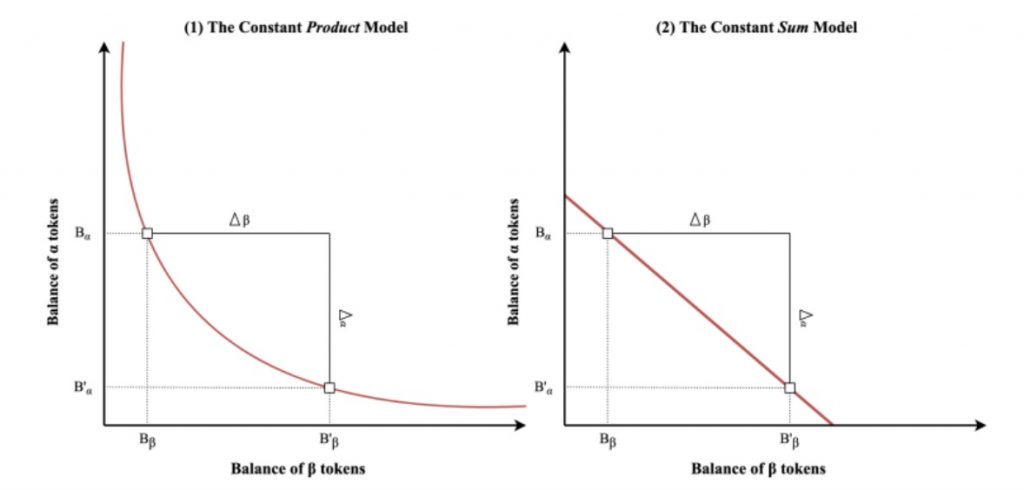

When liquidity providers deposit assets in a liquidity pool of an AMM (Automated Market Maker), they must deposit assets based on a given ratio quoted by the AMM (e.g. 50% of assets in USDC and 50% in ETH). This ratio between the assets in the pool determines the price, usually by a constant product formula (x*y = k). While this formula allows for the market to function, it can lead to impermanent loss for liquidity providers. Impermanent loss occurs when the AMM adjusts the ratio of the assets in the pool (to ensure they remain at a constant ratio in terms of value), and the liquidity provider loses out on gain from a deposited asset that outperforms the other. In other words, the liquidity provider would have made more gains if he/she had held the original assets instead of providing them as liquidity for traders.

Overall, the following features are introduced:

Slippage is the difference between the change in token price from the time you submitted a trade to the time when the trade is actually executed.

Liquidity Book vs Trader Joe AMM V1:

Trader Joe V1 started out as a fork of Uniswap V2 and, therefore, its liquidity was uniformly distributed across the entire range of possible prices, from 0 to infinity. This wasted liquidity for certain pairs where most trades occurred within a specific price range. For example, stablecoins barely fluctuate from $0.99 and $1.01.

With the liquidity book, liquidity providers can expect that their deposits will not be wasted, since they will have the freedom to provide their assets within a specified range of their choice – this is called concentrated liquidity. Following the example above, a liquidity provider can choose to only earn fees when trades on the pair occur between $0.99 and $1.01

Liquidity book vs Uniswap V3:

To allow for concentrated liquidity, the price curve is discretized into bins, a concept similar to Uniswap V3 ticks. The difference is that the Liquidity Book AMM uses the constant sum price formula instead of the constant product price formula.

Each bin in the AMM represents a single price point and the difference between two consecutive bins is the bin step. For instance, taking a USDC/USDT pair, if the current price is $1 and the bin step is 1 basis point (i.e 0.0001 or 0.01%), then the next consecutive bins on the way up are 1 * 1.0001 = $1.0001, 1.0001 * 1.0001 = $1.00020001.

Bins steps are not restricted to 1 basis point. This is a parameter set by the pool creator when deploying a new token pair into the AMM. Therefore, there can be multiple markets of the same pair that differ only in their bin step.

As mentioned above, the liquidity in each bin follows the constant sum price invariant, given by P * x + y = L, where x is the quantity of the asset X, y is the quantity of the asset Y, and L is the amount of liquidity available in a given bin. The price P is, therefore, defined by the price change of one asset with respect to the other.

Contrary to other AMMs that implement the constant product formula (P = x * y), here the price P is decoupled from the amount in reserves of X and Y. This means that given a price P and a known amount of x (or y) you cannot find y (or x).

Since the composition of the reserves x and y are independent of both the price and liquidity, an additional variable c must be introduced to describe the reserves available in the bin. This variable c is known as the composition factor, which represents the percentage of bin liquidity of the reserves of one asset. For the asset Y, this would be given as:

As we saw in the constant sum plot above the constant sum curve intercepts both the x and Y axis. What this means is that the reserves of asset X or Y can be depleted in that bin. When that happens, it is an indicator that the current prices will move to the next bin (either to the left or to the right).

Looking at the example above we could assume that the asset Y is USDC and the asset X is AVAX. The price P will then represent the amount of USDC per AVAX. Looking at the active bin we can then assume that all bins on the left will contain USDC, and all bins on the right will contain AVAX. As more people start buying AVAX, the reserves in that bin will deplete and the active bin will move to the right.

The Liquidity Book aggregates its liquidity vertically instead of horizontally. As a result, liquidity is represented as a fungible position. The receipt token for those positions is the LBToken, a new token standard inspired by ERC-1155 but removing its callbacks and other NFT-related functions.

The way the liquidity is tracked vertically is by using a three-level tier data structure where each node is a 256-bit array (uint256). Therefore, the bottom level will contain 256^3 slots, which is exactly the maximum possible number of bins, 2^24.

The execution of swaps will follow the same user experience as Trader Joe V1. Individual swaps in the liquidity book can cross one or many bins inside that pair. The trade will start on the active bin and it will consume the liquidity in that bin until it either reaches the desired swap amount or it consumes all the liquidity in that bin. When a bin gets emptied of one asset, the liquidity will be taken on the next closest bin at the exchange rate defined by that bin, which will become the active bin for that pair.

Contracts overview:

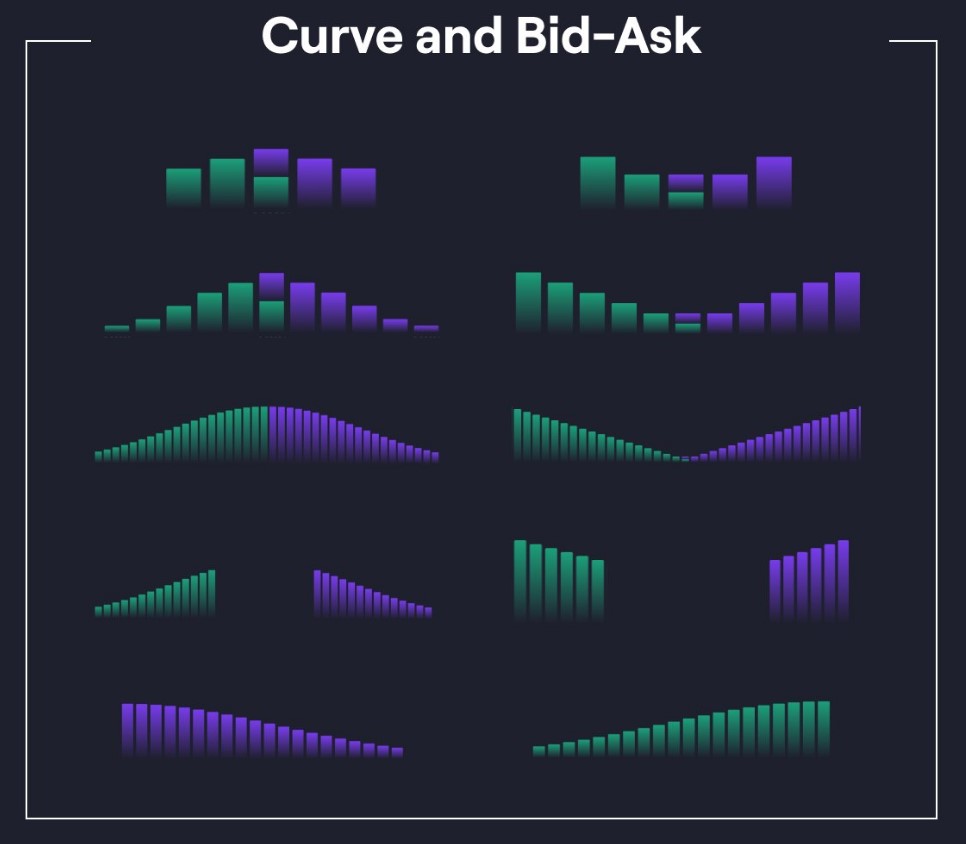

Liquidity shapes

Bin Wizard

Community members that actively use and support the Liquidity Book AMM, can unlock the Bin Wizard Role and access community perks, premium questing opportunities, and token rewards.

This role will be facilitated using Trader Joe Crew3, where successive questboards will be launched. The completion of each questboard will unlock and progress the ranks in this community segment.

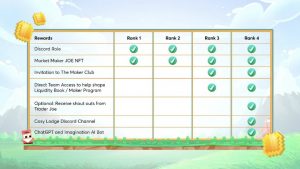

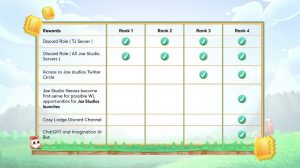

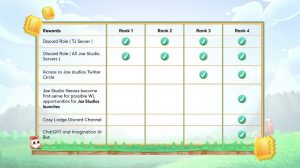

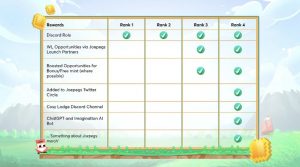

Bin Wizard Community Reward Track

Banker Joe offers non-custodial access to leverage via borrowing positions. As a lending protocol, Banker Joe offers investors the ability to borrow/lend against whitelisted assets.

The Collateral Factor is the percentage of collateral that can be borrowed against. This is similar to what is known as “Loan To Value Ratio” in other protocols. The higher the collateral ratio the more borrow limit a user can take.

Banker Joe allows users to:

Rocket Joe is the launchpad platform offered by Trader Joe. By using the technique of Protocol Owned Liquidity, this service allows other protocols to launch their tokens to their community in a distributed and fair manner.

Among the reasons for using Rocket Joe are:

In order to participate in the launch of protocols and acquire newly issued tokens, users need to hold rJOE. When rJOE is deposited into a Rocket Joe Launch, it will unlock the ability for the user to deposit AVAX tokens into that Launch Liquidity Pool. Every 100 rJOE can unlock 1 AVAX allocation. rJOE tokens are only used as credit for participation in token launches. For that reason, rJOE is a non-transferrable token and cannot be traded. Once rJOE is deposited into the Launch Pool, it will be burned.

How to get rJOE tokens: https://help.traderjoexyz.com/en/trader-joe/rocket-joe/rjoe-staking

How to participate in token launches: https://help.traderjoexyz.com/en/trader-joe/rocket-joe/participating-in-launches

As a Liquidity Launch Pool that allows protocols to issue their tokens, Rocket Joe helps by seeding the liquidity for the initial launch and initiates a process of price discovery. Protocols utilizing Rocket Joe will provide a number of tokens to the Launch Pool that will be split amongst participants who have converted their rJOE into AVAX tokens.

Rocket Joe allows for a fair price discovery process in real-time. The more AVAX that gets deposited in the Launch Pool, the higher the issuing token price will be (because more AVAX is being paired against the issuing token).

Participants have up to 72 hours to withdraw before the token launches and locks the participants into the liquidity pool. Users will usually withdraw when they believe the price of the token being issued is too high. When a user withdraws, it receives back AVAX tokens (instead of the original rJOE deposit). Users can also choose to re-enter if they wish.

At the end of the launch phase, the LP is unlocked and the tokens can be claimed from the pool.

As part of the deprecation on 18 January 2023, Rocket Joe NFTs were made claimable on 2 February 2023 for free by anyone who held rJOE tokens in their wallets, according to a snapshot 1 week prior. Rocket Joe NFTs holders will have access to exclusive benefits and roles as a part of the upcoming Community V2 program and can be traded on the Joepegs marketplace.

Details:

Claiming conditions:

Yield Farming is the activity by which DeFi protocols allow users to earn interest on their tokens:

Yields can be classified into 2 different forms

How to earn rewards from yield farming on Trader Joe: https://help.traderjoexyz.com/en/trader-joe/yield-farming The yields on Trader Joe are mostly sustainable and non-dilutive. The source of yields from the protocol comes from:

Joepegs is a decentralized NFT market that played a major role in bootstrapping the Avalanche NFT ecosystem. After a few months since launch, the total volume on the platform was 88.8K AVAX, which generated 4.2K AVAX in revenue for the protocol in Q3 2022.

Among the most popular collections, we find:

Liquidity providers on Trader JOE can manage their liquidity in the same way in both V1 and V2 (Liquidity Book). However, there are differences that must be considered before providing liquidity to a token pair.

Auto-Pools are an automated solution for liquidity management in Trader Joe’s liquidity book. Users can access by depositing tokens into an Auto-Pool and it will execute a strategy that manages the distribution of liquidity in the liquidity book.

The first auto-pools run a basic market-maker strategy:

Auto-pools enable 1-click farming strategies where users deposit assets into an auto-pool and receive a token receipt that they can use in DeFi.

The Liquidity Book AMM opens up new opportunities for liquidity providers to manage their own positions. Since users can actively deploy their assets within a price range of their choice, they can also manage their own positions based on their level of expertise and desired exposure to risk.

The protocol’s main business model began and still remains as an exchange on the Avalanche chain, with revenue in the form of a 0.3% fee from every swap. They then introduced Banker Joe (DeFi lending), Rocket Joe (protocol launchpad, Joepegs (NFT marketplace, and then Liquidity Book (next-gen AMM), all of which provide further revenue from fees. Trader Joe aims for value accrual to holders of its governance token, JOE, in the forms of:

The protocol’s position as the top exchange on Avalanche and 3rd in place based on TVL metrics is well placed to secure its revenue from exchange fees.

The protocol generates revenues via the following pipelines (see Economics > Fee Breakdown).

Banker JOE

Out of the 8% liquidation bonus, the protocol takes a 1.6% share as revenue.

There is a 0.08% flash loan fee for all markets. Out of this 0.08%, the protocol takes a portion of the fee as determined by the reserve factor of that market. For example, a reserve factor of 20% means that 0.016% will go to the treasury reserves and the remaining 0.064% will go to depositors.

The Reserve Factor is the share of the borrowing interest that is withheld by the protocol to cover scenarios where the protocol could incur bad debt as a result of untimely liquidations

Rocket Joe

Liquidity book

A share of all fees collected by the protocol is taken by the protocol and distributed to the token holders of JOE who are active on the staking contract. The maximum possible amount of fees going to JOE stakers is limited to 25% of all protocol fees. Keep reading to learn in-depth how the fees are calculated.

Swap fees are paid to liquidity providers and the total swap fee will be split on:

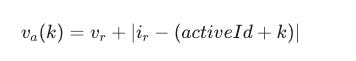

The volatility accumulator v_a(k) is the parameter responsible for keeping track of the volatility on a given pair. This indicator will keep track of:

Altogether, the volatility reference depends on the time elapsed since the last transaction (t). This will be helpful to define the lower and upper intervals of a time window:

This shows that a high frequency of trades will stack up volatility, while lower frequencies will slowly reduce the level of perceived volatility.

To calculate the volatility introduced by a trade, a reference inDEX is introduced to keep track of the ID of the current active bin before a swap is made. During times of high frequencies, the inDEX reference will keep its old value. This prevents users from manipulating fees by making lots of small transactions that simply increase and decrease the price

Afterward, the volatility accumulated for a given bin k will be used to generate the fees from swapping through this bin. This amount of fees will be allocated to the active liquidity providers of that bin.

Example:

$JOE is the governance token of the protocol and is also used as a reward for liquidity mining emissions.

There was no pre-sale or private sales of the $JOE token.

As of November 24, 2023, all 500M $JOE tokens were fully emitted. This included a 10M tokens earmarked for the treasury which been permanently locked, bringing the actual supply to 490M tokens.

The team will also continue to strategically use treasury-held $JOE tokens to support the ongoing growth of the Trader Joe ecosystem. This includes supporting initiatives such as the Liquidity Book Rewards Program and other potential ways to incentivize or foster growth, enhancing the overall Trader Joe ecosystem.

Distribution

Total supply – 500,000,000

Months to emit – 30

Liquidity Providers – 50%

Treasury – 20%

Developer team (3-month cliff) – 20%

Future investors (3-month cliff) – 10%

Similar to yield farming, staking provides an additional opportunity for JOE holders to increase the amount of rewards they earn on the protocol. Currently, there are 2 staking options for JOE:

sJOE is a Staking product that provides users with yield paid in USDC Stablecoins.

For every swap on Trader Joe, a 0.05% fee is charged and accrued by the protocol, this is converted into a Stablecoin and then distributed to the sJOE Pool every 24 hours, rewarding you with a share of all platform revenue generated.

Yields are calculated according to the following:

Fees from Liquidity Book pools are also shared to sJOE Stakers according to the following:

There are currently no deposit or withdrawal fees for sJOE, although deposit fees may be subject to future changes.

Liquidity Book Rewards Program

See Liquidity Book section for an in-depth explanation of what the Liquidity Book is about.

Market participation is required for Joe’s Liquidity Book to provide competitive asset pricing and low slippage to traders for the listed markets, much like a CEX. In order to incentivize healthy participation, bi-directional liquidity, and market uptime, Trader Joe will be rolling out incentives through the Liquidity Book Rewards Program.

The LB Rewards program will score participants based on factors that stimulate efficient markets.

MakerScore

MakerScore is calculated using:

MakerScores are calculated independently for each rewarded market over the rewarded epoch. Rewards are distributed based on each participant’s relative performance against all eligible LPs (for each market).

MakerFees

MakerFees will be also used as an eligibility filter for the rewards program. To be eligible for rewards, the provider must accrue >1% of total fees paid in the market during the epoch.

The most important market contribution of an LP is the volume that they support/generate. LPs are rewarded with fees on swaps against the liquidity that they provide, so fees can be used in place of volume as a participation metric.

MakerTVL

TVL will be sampled every minute and assigned to the below categories:

The 1-minute samples (j) will be averaged over each hour (h) to get a time-weighted average of each category for each hour. The total number of hours in each epoch is represented by N.

To encourage consistent bi-directional liquidity, only the minimum of the average bid or the average ask liquidity for each hour will be credited to the maker. This minimum value is added to the average spot liquidity to arrive at a single MakerTVL value for each hour. MakerTVL is then averaged over the duration of the epoch.

Epoch Rewards

LB Rewards are siloed by market for each epoch, and the rewards amounts will be announced prior to the epoch’s start. This way, MakerScores are calculated independently for eligible LPs, and rewards are distributed based on their proportional MakerScore in each market.

Partner Rewards

Partner rewards may also be used to incentivize liquidity in LB markets. The LB Reward program provides a market-maker scoring rubric and generic reward distribution for those incentives. Contact BD to explore partnerships.

Reward Claiming

LP rewards will be calculated off-chain and distributed through a general rewarder contract that enables vesting and collective claiming. Rewards will vest over a specified duration which will be at most the duration of the epoch. Maker scoring and rewards calculations will be completed off-chain but will be published from community review.

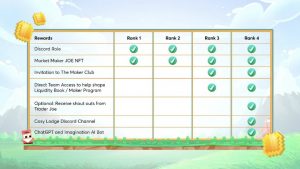

Market Maker

The Market Maker community segment can be unlocked exclusively by ranking high enough in the Liquidity Book Rewards Program. Every epoch, your score will be recorded and your rank will determine your ability to progress through the Market Maker Roles.

Participate as a Liquidity Provider (Market Maker), score high enough and gain access to The Maker Club. This role will be facilitated using Guild.xyz where each role can be unlocked pending acceptance by an allowlist that is updated following each epoch in the LB Rewards program.

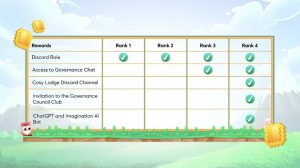

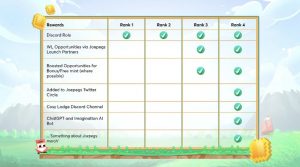

Market Maker Community Reward Track

Trader Joe has the long-term vision to become a community-governed protocol that operates as a DAO. Currently, community proposals are submitted to the project forums to discuss and clarify questions between community members. Once the proposal has been discussed and the implementation details are clear, the proposal will be voted on Trader Joe’s Snapshot.

Proposals are voted with JOEVOTE to decide the outcome. The value of JOEVOTE is given by:

To be eligible for voting the user must have JOEVOTE before the proposal is submitted on Snapshot. This prevents users from buying JOE on the open market to manipulate the results of a governance proposal. This is especially relevant to protect the protocol from possible manipulative outcomes as a result of flash loans or whales that willingly want to alter the results.

For a voting result to be considered valid, it must gain a quorum of a given number of votes (specified on a per-proposal basis).

The protocol treasury is operated via multi-sig. The members of the multi-sig should only sign transactions after the approval of the community on a governance vote that has surpassed the minimum quorum.

The team has already expressed its concerns with the current Governance systems that are present in DeFi in an article titled “Why DeFi Governance (almost) always fails”, where it points to mistakes made by other teams as a result of implementing decentralized incident-response procedures. This article goes over some examples of exploits caused by governance systems, such as Justin Sun’s attack on the COMP token, the Beanstalk exploit, the Solend account takeover, the Fei/Rari merger, or Balancer gauges misalignment. As a result, the team acknowledges the complexity of building decentralized governance structures that are resilient to exploits and bad actors.

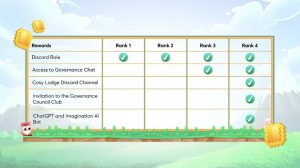

The Governance Club

Users who participate in governance by voting on proposals are able to progress through the Governance Joe ranks. The more proposals you vote on, the higher up your community governance ranking will go. If you directly propose and succeed with your proposal, you can also climb to the top ranks and be invited into the Governance Council.

In the future, council members will take a commanding role in all Governance related initiatives. This role will be facilitated using Guild.xyz (automated membership management for the platforms), where wallets that vote on Snapshot proposals are tracked directly.

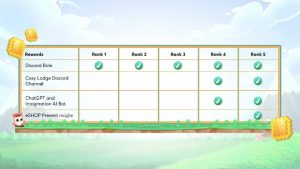

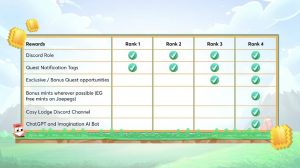

Governance Joe Community Reward Track

Interacting with any smart contract requires caution. While these risks are minimized through testing, audits, and bug bounties, there is always the risk of vulnerabilities.

Trader Joe started off as a UniSwap V2 fork, and the new features it has added since also include code from other protocols. This means exploits in these protocols could potentially cause risk for Trader Joe users as well.

In the past, situations like this have happened, and the Trader Joe team has reacted accordingly by engaging with auditors and pausing certain actions that could be at risk. When CREAM Finance was exploited in October 2021, the Trader Joe team took action, as their Banker Joe lending platform had forked code from Compound Finance and CREAM Finance. They alerted the community of any possible risks and paused borrowing.

JoeMakerV2 was also exploited from Nov-24 to Dec-02 2021. The Exploiter would deposit and extract value from LPs, reducing the expected payout yield for xJOE – The contract was forked from Sushiswap with a tweak to include ‘tx tax’ which is the ‘exploitable’ part – The exploit was discovered via immunefi bug bounty and was swiftly fixed, with the team paying out $50k to the submission of the bug bounty.

Most DEX and lending markets rely on external price feeds, usually provided by third-party services like Chainlink. Trader Joe’s V2 AMM, the liquidity book, also has its own oracle pricing mechanism to power the DEX. This is represented by the LBPair contract, which stores cumulative values as samples to determine the current active bin, the amount of volatility accumulated, and the number of bins crossed by swap. All of these parameters are intrinsic to the protocol itself. Therefore, Trader Joe’s oracle system is exposed to the same risks as the logic of its DEX, which is smart contract risk.

Given that pricing is a critical component for a DEX, we will analyze how the oracle works to detect possible points of failure or details that will reveal information about the efficiency of the pricing system.

Samples are stored in a 16-bit circular array. By default, the Oracle array only stores 2 samples to save gas costs. However, this can be extended by interacting with the contract (increaseOracleLength). Each of the samples keeps track of the bin ID, the cumulative volatility, and the cumulative number of bins crossed. When enough time has passed since the last sample (oracleSampleLifetime), a new sample is created. This algorithmic and automatic process allows the protocol to always have access to critical variables used in other components of the protocol, such as the volatility accumulator for fees.

Banker Joe, however, does rely on Chainlink price fees for oracle prices used to determine collateral ratios and liquidation levels.

When interacting with DEX and lending platforms like Banker Joe, there are 2 main liquidity risks:

Impermanent loss occurs when the price ratio of the assets that a liquidity provider has supplied to a pool changes. As a rule of thumb, the more volatile the assets in a pool, the higher the likelihood of experiencing impermanent loss. This loss is not permanent, since the price might return to its initial value at the time of deposit. However, if the price deviates and does not come back to its initial level, the loss is realized when the liquidity is withdrawn.

Users of Banker Joe must also follow best practices of risk management to avoid liquidations. Liquidations will occur if the collateral depreciates significantly. When the borrowing balance exceeds the maximum allowable borrowing limit, a portion of the borrower’s collateral will be liquidated to return the account to good standing. A liquidation is, therefore, the process of selling collateral assets to cover the protocol’s debt.

Liquidations happen when sudden price movements cause the collateral value to be lower than the borrowing value. This can also happen when the total deposit APY is lower than the total borrow APY, which means that the interest that has to be paid by a borrower is greater than the APY earned on his/her collateral.

During a loan repayment by a liquidator, the seized collateral is liquidated at an 8% discount for all markets. Out of this 8%, a 1.6% fee is taken by the protocol. The remaining 6.4% is the liquidation bonus that liquidators will earn as a reward for their service.

To avoid being liquidated from a borrowing position, users can:

Trader Joe raised $5M in a strategic sale led by Defiance Capital, GBV, and Mechanism Capital. Other angel investors include Not3Lau Capital, Coin 98 Ventures, Delphi Digital, Stani Kulechov, and the Avalanche Foundation. The round also involved strategic partners such as Avalaunch and Yield Kak.

Not3Lau Capital (Zach):

A maverick within the Avalanche ecosystem that is not afraid to challenge the status quo and take on the competition, Trader Joe is a prime example of how a Community First Defi Platform is able to capture the hearts and minds of its users. We are excited to be part of the community BRIDGING Trader Joe to new heights.

Avalaunch (Mark):

Having championed and worked with the Trader Joe team since inception, it’s an honor to support their growth in this way. With the recent explosion of the Avalanche platform, we believe they will evolve into a critical piece of application infrastructure and bolster the entire ecosystem.

Yak Man:

Trader Joe makes the entire Avalanche ecosystem stronger with a smart and beloved project. YY plans to continue supporting the platform with deep integrations using its foundational DeFi products.

C98 (Jade Vo):

Trader Joe has demonstrated its enormous growth potential on Avalanche, generating a lot of attention from users. We are pleased to join the team on their adventure to build a critical DeFi stack and enrich the whole Avalanche ecosystem, which has been blooming and has a long runway ahead of it.

Defiance (Darryl):

This raise offered us the rare opportunity to work with one of the top teams in the Avalanche ecosystem. DeFiance is delighted to support the Joe team as it continues to make strides in becoming the dominant DeFi platform on Avalanche.

Mechanism (Andrew Kang):

We believe that there remains a lot of room for growth within the Avalanche ecosystem. Mechanism is looking forward to supporting Joe to take a position at the center of that ecosystem by becoming the premier financial services and trading venue.

GBV (Leslie):

Joe is irresistible. No one ever swipes left on Joe.

Trader Joe has added several discord roles and ways to reward the community members to encourage organic growth and use of the protocol.

Bin Wizard

Community members that actively use and support the Liquidity Book AMM, can unlock the Bin Wizard Role and access community perks, premium questing opportunities, and token rewards.

This role will be facilitated using Trader Joe Crew3, where successive quest boards will be launched. The completion of each quest board will unlock and progress the ranks in this community segment.

Bin Wizard Community Reward Track

Market Maker

The Market Maker community segment can be unlocked exclusively by ranking high enough in the Liquidity Book Rewards Program. Every epoch, your score will be recorded and your rank will determine your ability to progress through the Market Maker Roles.

Participate as a Liquidity Provider (Market Maker), score high enough, and gain access to The Maker Club. This role will be facilitated using Guild.xyz where each role can be unlocked pending acceptance by an allowlist that is updated following each epoch in the LB Rewards program.

Market Maker Community Reward Track

The Governance Club

Users who participate in governance by voting on proposals are able to progress through the Governance Joe ranks. The more proposals you vote on, the higher up your community governance ranking will go. If you directly propose and succeed with your proposal, you can also climb to the top ranks and be invited into the Governance Council.

In the future, council members will take a commanding role in all Governance related initiatives. This role will be facilitated using Guild.xyz (automated membership management for the platforms), where wallets that vote on Snapshot proposals are tracked directly.

Governance Joe Community Reward Track

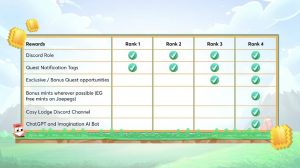

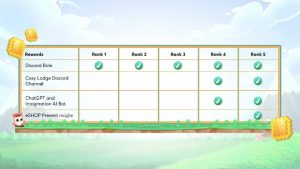

Indiana Joe Role

The Indiana Joe role is suited to users who are looking for adventure across the entire JOE ecosystem. The quests are featured on platforms such as Galxe, Quest3 or other platforms, picking up quest NFT rewards in the process. The more questing you partake in, the higher up the rankings you will climb. This role will be facilitated using Guild.xyz, where each role can be unlocked by holding a variety of Quest NFTs.

Rocket Joe Role

The Rocket Joe role is unlocked by holding a certain amount of rJOE NFTs. In the near future, Rocket Joe NFT roles will be unlocked by holding a specific rarity of NFTs within the collection (e.g. Rank 5 can be unlocked via holding a Nitro Rocket Joe NFT).

Joe Studios Hero Role

The Joe Studios role represents the Joepegs’ in-house NFT production house. Users need to collect NFTs from all the main Joe Studios Collections: Smol Joes, Rich Peon Poor Peon and Plague Game, and more.

Users can blend together multiple projects to climb the ranks of this Pepe-themed role and reach Rank 4, where they might be able to join the Dreamboat Parade.

Joepegs Hero Role

Users need to collect NFTs from some of the largest and most successful projects launched on Joepegs. They can then blend together multiple projects and hold multiple NFTs in order to increase their rank. When new collections are launched on Joepegs they may be subsequently added to the Joepegs Hero role.

Role holders are valued members of the community for their contributions and collector mentality. This community segment acts as a key target market for future projects that wish to launch on Joepegs, opening up the possibility of exclusive benefits and rewards for those who are amongst the highest ranks.

Trader Joe has integrated and partnered with other protocols and projects to enhance its DEX performance, accessibility, and experience for users.

Stargate Finance partnership

Trader Joe has multiple active communities and channels for its users. The average daily users on Trader Joe dAPP is around 4k.

Trader Joe’s Twitter and Discord are its most active communities and usually have the latest information and announcements posted

There are also community engagement activities utilizing Guild roles and Crew3 quests that grant access to different discord channels and roles.

Indiana Joe Role

The Indiana Joe role is suited to users who are looking for adventure across the entire JOE ecosystem. The quests are featured on platforms such as Galxe, Quest3 or other platforms, picking up quest NFT rewards in the process. The more questing you partake in, the higher up the rankings you will climb. This role will be facilitated using Guild.xyz, where each role can be unlocked by holding a variety of Quest NFTs.

Rocket Joe Role

The Rocket Joe role is unlocked by holding a certain amount of rJOE NFTs. In the near future, Rocket Joe NFT roles will be unlocked by holding a specific rarity of NFTs within the collection (e.g. Rank 5 can be unlocked via holding a Nitro Rocket Joe NFT).

Joe Studios Hero Role

The Joe Studios role represents the Joepegs’ in-house NFT production house. Users need to collect NFTs from all the main Joe Studios Collections: Smol Joes, Rich Peon Poor Peon and Plague Game, and more.

Users can blend together multiple projects to climb the ranks of this Pepe-themed role and reach Rank 4, where they might be able to join the Dreamboat Parade.

Joepegs Hero Role

Users need to collect NFTs from some of the largest and most successful projects launched on Joepegs. They can then blend together multiple projects and hold multiple NFTs in order to increase their rank. When new collections are launched on Joepegs they may be subsequently added to the Joepegs Hero role.

Role holders are valued members of the community for their contributions and collector mentality. This community segment acts as a key target market for future projects that wish to launch on Joepegs, opening up the possibility of exclusive benefits and rewards for those who are amongst the highest ranks.