Disclaimer: Please note that SoliSnek Finance shows significant signs of inactivity. The project reached its peak Total Value Locked (TVL) at $13.7 million on April 21st, 2023, but this figure has dramatically decreased to approximately $27k as of March 18th, 2024. Furthermore, there have been no updates or communications on both Discord and Twitter since August 2023. This document exists for historical reference and educational purposes. Readers should proceed with caution and take this context into account when exploring the information provided herein.

**With effect from August 20, 2023, Solisnek has ceased development of their main DEX functions and are focusing on completing the development of their perps platform, along with a supposed cross-chain expansion. Please see the roadmap section for more information. **

Solisnek is a decentralized and self-optimizing DEX on Avalanche built on the principles of Solidly and the ve(3, 3) model. Solisnek tweaks the original vision of Andre Cronje’s original version of Solidly (100% rebase) by adding anti-dilution mechanics (capping rebases at 20% for retail users and 70% for partners), and coming up with a veNFT maturity curve similar to the Reliquary developed by the Byte Masons. This allows veSNEK holders to benefit from increasing their voting power over time, thereby providing them with greater control over the future of the platform. Besides, Solisnek also has plans to introduce a tiered revenue-sharing stream that rewards token holders based on their contributions to the growth of the platform.

One of the key differentiators of Solisnek with respect to other Solidly forks will be the introduction of perpetual futures, which will increase the amount of fees and revenue that can be generated by the protocol.

As a Dex, Solisnek supports a hybrid engine that implements a different swap algorithm depending on whether the user is swapping volatile assets or correlated assets.

Compared to the vAMM, the sAMM model allows for greater imbalances between the two assets before traders start noticing a significant price impact

Solisnek has reached a partnership with Paraswap by which their dynamic swap engine is powered with a routing engine that automatically seeks out the best path for executing a trade across all available pools. This provides users on Solisnek with advanced routing capabilities that allow them to execute trades and enjoy the benefits of multiple DEXs without having to leave the Solisnek ecosystem (no need to manually browse and check multiple DEXs to find the best pricing).

With this integration, Solisnek assures that routing for swaps will be optimized by providing swap rates even when no liquidity is present on the exchange through the Paraswap engine. This means that it is possible for users to buy tokens even if there is no liquidity on Solisnet for those tokens. As an example, a users that wants to buy LINK through Solisnek’s frontend will still be able to do so even if there is zero LINK liquidity on Solisnek.

ParaSwap is a decentralized finance (DeFi) aggregator that allows users to trade cryptocurrencies at the most effective price at any given point in time. This is achieved by combining liquidity from a variety of decentralized exchanges and liquidity sources. With advanced algorithms and split-trading methods, ParaSwap finds the most optimal path to perform its operations and reduce slippage.

Paraswap provides features such as:

The combination of multi-hop routing and trade-splitting leads to an enhanced trading experience that ensures better price execution, lower fees, and access to deeper liquidity pools.

In addition to Paraswap, Solisnek also has integrated with other swap aggregators, such as Firebird Finance, Odos, and YieldYak as a second swap aggregator.

Following the premise of the Solidly model, the bribing system allows for fair competition and protocol growth. This is achieved by allowing external protocols to incentivize liquidity for their token pairs either by bribing veSNEK voters to vote for their pool and increase the amount of SNEK emissions they receive, or by bribing liquidity providers themselves to promote deeper pool liquidity.

Every epoch (1 week), ve SNEK holders vote on their preferred gauges in order to determine which pools should receive SNEK allocations.

Users and external protocols have the ability to offer incentives known as vote bribes in order to incentivize voters to direct emissions to their pools. As a result, the bribers are rewarded with a portion of the bribes proportional to their contribution.

Similar to vote bribes, protocols can also incentivize gauge bribes in order to incentivize LP stakers to provide liquidity for specific token pairs and increase the liquidity depth.

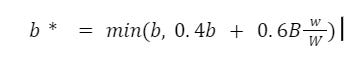

Solisnek also introduces a gauge boost of up to 2.5x multiplier for veSNEK holders, which will follow the same formula as Curve’s boost.

where b* is the weight, b is the liquidity provided by the user, B is the total liquidity of the pool, w is the amount of veSNEK held by the user, and W is the total veSNEK supply.

Gauges are pools that benefit from dynamic SNEK rewards based on the veSNEK weekly voting allocations.

veSNEK’s bell maturity curve is a modified version of the original Reliquary exponential maturity curve. The underlying idea behind the use of a bell maturity curve is that users will need to relock in order to maintain their voting power. This will give the protocol the ability to:

With this implementation, Solisnek aims to solve the following problems:

When liquidity providers stake their LP tokens on Solisnek, they will receive maNFTs (maturity-adjusted NFTs) that track the amount of tokens that have been provided as well as the amount of time that they have been staked. This way, the rewards will be distributed across maturity tranches, each of which represents a length of time that entitles a user to receive a certain level of incentives. As a result, maNFTs entitle their holders to the following benefits:

In Solisnek, 100% of swap fees go to veSNEK holders, who also benefit from weekly rebases that offer a 20% protection against dilution (during an initial evaluation stage). This value encourages decentralization and incentivizes new participants to enter the ecosystem, since the first entrants will not have a disproportionate advantage as if they were compensated with full rebases.

On May 1st 2023, a new system was put in place for partners to help prevent dilution.

The vision of Solisnek is to create a Solidly-inspired liquidity layer that becomes the liquidity backbone of Avalanche. This will create a long-term sustainable ecosystem that will make it easier to onboard new users and protocols.

With a dynamic swap engine, Solisnek also seeks to solve the shortcomings of AMMs that follow the Uni-v2 model, which often leads to suboptimal pricing across the ecosystem. The ambition is to attract higher volumes, which will increase the fee revenue that goes to veSNEK lockers, who will incentivize liquidity on those pairs where it is needed most.

The idea of compensating LPs with governance tokens while giving trading fees to vote lockers based on which gauge they vote for is a simple and yet very effective mechanism. This results in a self–optimizing DEX where stakeholders voting on gauges will redirect emissions to the pools with the higher volume (that produce the most fees) in order to optimize revenue over time.

Since the fees generated on any given pool are captured by gauge voters instead of liquidity providers, veSNEK holders will tend to favor the most productive pools, since they are the ones attracting more volume and generating more revenue from trading fees.

The Solidly model also offers solutions to common problems faced by most protocols in any given ecosystem:

By design, the ve(3, 3) model also targets these issues through its incentives and fee structure:

As the price of SNEK increases, so does the APR for veSNEK holders, which attracts more liquidity and demand for the SNEK token. As time goes on, an equilibrium is reached where the yield of buying and locking SNEK creates a support for the token price while ensuring that LPs have access to a sustainable source of yield from SNEK emissions.

In the past, Sushi’s Masterchef contract was the go-to alternative for DeFi protocols to bootstrap their liquidity. This involved users staking their LP tokens in the Masterchef and earning inflationary “governance tokens” as rewards. The more liquidity a user had, the more LP tokens they received and the more rewards they earned from staking. However, this approach went against the original goal of the Solidly model, which was to incentivize users to provide liquidity and hold it in the protocol for extended periods. As a result, the Masterchef was effective in attracting and seeding initial liquidity, but it failed to retain liquidity in the protocol over longer periods, resulting in the influx of “mercenary capital” seeking high APR and selling their inflationary rewards.

The subsequent advancement in this technique was to introduce single-stake vaults, allowing users to stake their governance tokens and earn rewards through inflation instead of selling them. While this approach minimized the detrimental effects of “mercenary capital,” it only delayed the inevitable. Once token prices began to decline, the returns were no longer appealing, prompting users to withdraw their holdings, divest their liquidity, and search for more profitable alternatives.

The ve token model emerged with the introduction of veCRV. This involved users not only staking their tokens but also locking them for a specific period in exchange for control over the platform’s gauges. By locking their tokens, users gained voting power that enabled them to vote on which pools should receive token emissions. This method ensured that the pools with more votes received a greater share of rewards, which users could then lock to enhance their voting power.

However, the ve model had a drawback in that locked positions were illiquid, and users could not exit until the end of the locking period. To address this, the ve(3, 3) model was introduced, which tokenized ve positions as NFTs. This incentivized users to lock their emissions for an extended period while also allowing them to sell their position and transfer their voting rights by selling the NFT on a secondary marketplace.

Solisnek aims to incentivize liquidity for external protocols while making it efficient for traders to swap assets by developing its DEX as a liquidity layer. However, finding the right balance for token emissions can be challenging for external protocols. Low emissions may fail to attract new capital, while high emissions can harm the token price due to excess inflation.

As a result from these learnings, Solisnek built on top of the ve(3, 3) model in order to offer 3 alternatives for external protocols to bootstrap their liquidity:

For the DEX itself, all of the alternatives above are beneficial, since participants in the ecosystem have an incentive to lock their emissions, which helps defend the price of the native token and maintain its utility as an incentive.

Despite the effectiveness of the ve(3,3) model in attracting token liquidity, it has its limitations when it comes to retaining capital in one pool. As APRs fluctuate between epochs, liquidity providers tend to shift their capital to the pools with the highest returns, making liquidity less “sticky” and difficult for protocols to predict their liquidity needs and incentives.

Furthermore, when token prices decline, the APR for liquidity providers also decreases, leading to a decline in TVL and lower expected income for users. As a result, TVL exits the protocol, causing a fundamental flaw in the Solidly design and eliminating the counter-cyclical effect that secures the token price and supports liquidity provider incentives. To address this flaw, Solisnek relies on a maturity-adjusted mechanism inspired by the Reliquary technology developed by the Byte Masons.

This way, Solisnek can align the incentives of liquidity providers with the long-term success of the protocol by allowing users to deposit liquidity, receive LP tokens, and stake those LP tokens to earn SNEK rewards. By staking LPs in the Reliquary, users receive maNFT, which tracks the length of time they have provided liquidity and boosts their rewards accordingly.

Solisnek has ceased development from August 3, 2023 onwards.

This was due to various reasons, including:

The team has set their sights on conquering a new chain and are confident in this move and excited to share that this new chain is ready to support their mission from the get-go. They have committed to providing the necessary funding to ensure optimal development.

The perps platform is expected to be released within 1.5-2 months from August 2023.

On August 20, 2023, in line with their previous announcement, $SNEK liquidity was pulled and emissions stopped at the end of the epoch. The funds would be put towards developing the perps platform.

On Avalanche, Solisnek is facing the competition of DEXs that got a first-mover advantage in the early days of the chain, such as Pangolin and Trader Joe, as well as some recent Solidly forks such as Glacier Finance, Flair Dex, or Tarina.

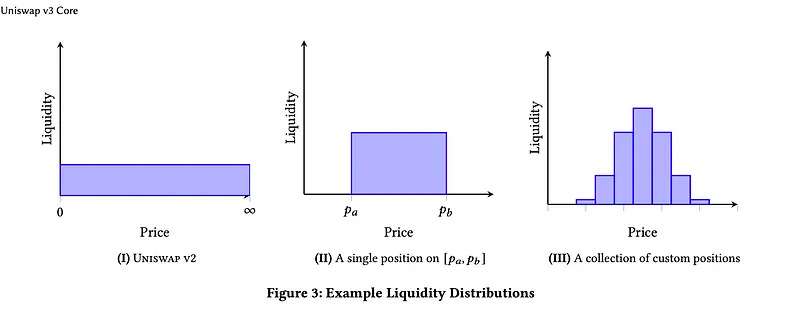

At the AMM level, while Uniswap’s v3 concentrated liquidity model can lead to more capital efficiency and requires less liquidity for trade execution than Uniswap v2 (the one used by Solisnek), it lacks composability. Solisnek leverages this composability and relies on an underlying economic design with the goal of becoming a liquidity blackhole. For instance, the protocol could leverage the idle liquidity in Uniswaps’s v2 based pools and stake the funds elsewhere (e.g building an auto compounder on top of a money market in order to maximize yield for LPs).

Some of the key differences with respect to other Solidly forks are the farming boost, the 20% dilution protection, NFT fundraising, and the maturity boost.

Protocols like Thena have seen a big boost in user growth through the implementation of a referral program. Solisnek has not publicly announced its intentions to include their own referral program. However, doing so could allow users to benefit from their sharing of links with other users in return for a 5 to 12% rebate for each trade made through the referral link. In this scenario, the rebate would depend on the tier reached by the referrer of the referral link. The higher the volume, the greater the tier.

Concentrated liquidity pools that follow the Uniswap V3 model present challenges for long-tail assets, which creates a market for traditional vAMM and sAMM pools. At the same time, the competition between Uniswap V3 liquidity providers can be overcome with managed concentrated liquidity pools on ve(3, 3) exchanges that allow for more profitable LP positions and increased TVL through incentive alignment and the presence of a bribes market. Similarly, the greater impermanent loss on Uniswap V3 pools can be offset by increased yields to LPs in the form of token incentives by ve(3, 3) models.

Over time, the adoption of ve(3, 3) DEXs has mapped out exactly according to the “startup curve”, with an initial enthusiasm around the original Andre Cronje implementation, and then spending most of the 2022 period in the “trough of sorrow”, while in 2023 the underlying idea is starting to find product market fit and scaling a lot quicker, as evidenced by the number of forks across multiple chains.

Besides, April 1st 2023 marked the expiration of Uniswap’s v3 Business Source Licensed, which means that projects can now fork the actual codebase. This details a concentrated liquidity pool model where LPs allocate their capital within specific price ranges, whereas in Uniswap v2 pools, the liquidity was scattered evenly along the invariant curve given by xy=k.

By concentrating liquidity within specific and more active price ranges, LPs can increase capital efficiency and earn higher returns on their liquidity. However, this is not a one-size-fits-all model, since it greatly increases the cost of managing on-chain liquidity and gives up its pricing power.

Pricing power refers to the fact that for any asset that can be listed in multiple exchanges, both CEXs and DEXs, typically only 1 will have dominance in terms of pricing, which will often be the one with the most uninformed order flow, while the price on other exchanges will be arbitraged accordingly.

The Uniswap v3 concentrated liquidity model does not work optimally during periods of high volatility, which sets it at a disadvantage, since reliable exchanges are expected to operate effectively in all market scenarios. In contrast, ve(3, 3) models utilize a constant product AMM for volatile pairs while using the stableswap invariant for correlated assets that maintain more consistent functionality even in extreme market conditions. For instance, during the UST collapse and crisis of LUNA, liquidity quickly dried up and kept hitting price ranges where there was not sufficient liquidity. This proved that the Uniswap v3 model suffers from pricing inefficacies during sudden price drops.

When it comes to long-tail assets, liquidity providers in a Uniswap V3 model also face a number of challenges:

If passive LPs provide liquidity in a greater range, active LPs operating in a tighter range will earn a disproportionately greater amount of trade fees, taking away from the passive LP profits.

This proves that while it may be profitable to LP in a concentrated liquidity position, most LPs either do not make money or lose money, and only a very small portion of most competitive and sophisticated LPers are making profits. This competition discourages LPs from providing liquidity, which leads to an overall decrease in TVL.

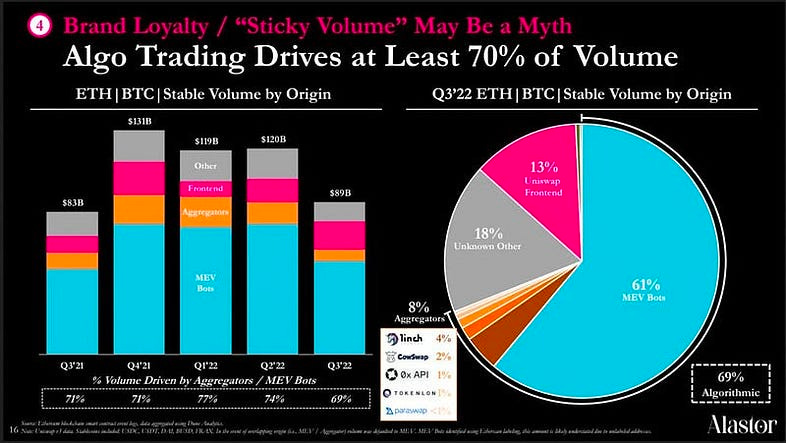

For instance, according to the Alastor Uniswap Fee Switch Report dated November 14, 2022, over 70% of Uniswap V3 trading volume is driven by algorithms, making it less sticky and more susceptible to shifts in pricing power.

With the majority of the volume coming from algorithmic trading strategies, without maintaining pricing power and status, trade volumes can easily shift away to other primary exchanges. Because trade volumes are the driving force behind LP incentives, this can lead to a death spiral where LPs are less incentivized, which leads to lower liquidity and a decrease in TVL, higher slippage for traders, lower trading volume, lower fees, and LPs are less incentivized to provide liquidity.

In contrast, ve(3,3) exchanges maintain their pricing power as the primary source of price information (at least for long tail assets), ensuring a more stable and sustainable ecosystem. As long as pricing power is maintained, it is less susceptible to shifting trade volumes.

ve(3, 3) DEXs offer an alternative to the dominance of blue-chip assets in a Uniswap v3 environment. Since ve(3,3) provides an effective marketplace for new projects to source liquidity through the incentives and bribes market, it becomes the default pricing dominant exchange on these long-tail assets. At the same time, the ve(3, 3) model is also better able to incentivize liquidity providers within both a V2 pool and a concentrated liquidity pool. This leads to more sustainable returns for LPs, which can offset the negative impact of concentrated liquidity.

Given that the ve(3,3) model changes the incentive structure to LPs to a pro-rata model, it can effectively sustain larger TVL without some of the negative consequences of concentrated liquidity.

Because the ve(3,3) model can solve these issues with Uniswap V3 pools, it is possible that they also become the deepest sources of liquidity for blue chip short-tail assets, and establish pricing power. The reason for that is because the ve(3, 3) model is not about the swap technology itself, but about the incentives alignment between protocols, liquidity providers, traders, and users. It is the unique combination of profitability, sustainability, and tokenomics. For example, Solidly ve(3,3) exchanges earn 100% of trade revenues, while Uniswap earns 0%. What’s more, without pricing power, LPs suffer more from toxic flow, and are less incentivized to provide liquidity. If Uniswap now takes a cut on top of this, it further discourages LPs.

Overall, the ve(3,3) tokenomics are designed to protect the platform against competition, maintain a balanced distribution of governance power, and incentivize continuous participation in the ecosystem.

Solisnek was deployed on Avalanche due to the market opportunity of being the first Solidly-like AMM on the ecosystem. This will allow the protocol to consolidate itself as the liquidity hub of the chain.

In order for external protocols to direct emissions to their pools, they will need to bribe veSNEK holders or buy SNEK on the open market and lock into veSNEK. This allows them to use veSNEK to vote for their pools, which will receive bribes and trading fees. The longer the locking period, the greater the veSNEK allocation.

Bribes are incentives offered to a gauge by external protocols in order to incentivize veSNEK holders to vote for their pools.

Protocols with a veSNEK allocation can deploy their own liquidity on Solisnek in order to farm SNEK emissions. These protocols can then lock the proceeds as veSNEK in order to increase their share of the total veSNEK supply.

Users can bridge their assets to Avalanche using asset bridges such as Synapse, Multichain, Stargate, the Celer Bridge, or a bridge aggregator such as Bungee Exchange.

In the Solidly model, loyalty is demonstrated through consistent accumulation of the native token and locking it into veTokens, which allows protocols to maintain liquidity on-chain at a reasonable cost. Rewards are continuously accumulated and available for claiming as soon as they are earned.

Coingecko: https://www.coingecko.com/en/coins/solisnek

Solisnek fee structure for swaps attempts to find a sweet spot such that traders can access a great execution price while the protocol can still generate significant revenue for veSNEK voters. This will lead to an increase in both locking and token incentives for liquidity providers.

The transaction fees on protocol pools can be used strategically to capture maximum revenues for veSNEK voters and can be adjusted in either direction to increase Solisnek’s competitivity and efficiency in response to market conditions. Governance can also adjust individual pools without affecting others.

The incentivization of economic growth in a Solidly fork heavily relies on inflation. As a result, token emissions cannot be viewed solely as a cost. This serves various purposes:

It is worth noting that, since all token emissions are “pre-paid” before minting, viewing token emissions as a cost might not be the correct framework. Gauge weight votes direct token emissions, and owning the token and locking it for its ve representation or bribing veToken holders to vote are necessary to vote, thereby introducing the token into circulation.

As such, token emissions are actually a cost for protocols to maintain on-chain liquidity for their native tokens, rather than being a cost to the veToken itself. This is evident by the fact that external protocols must continually re-invest to support their liquidity by buying and increasing their ve positions.

This presents an opportunity for DEXs, as even though inflation rates might be high at the beginning, they can be matched with revenue growth over time. Once inflation rates taper to zero, the long-term economics of Solidly forks should be sustainable, and they will have served their purpose of bootstrapping initial liquidity and kickstarting the “flywheel effect”.

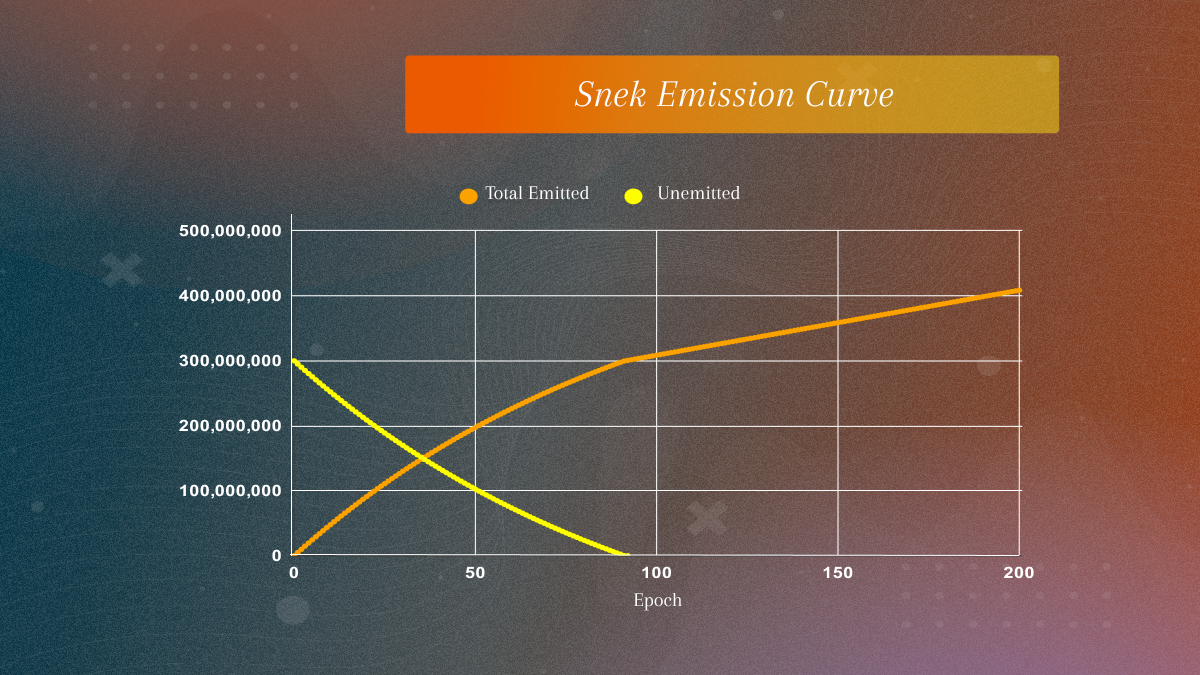

Total supply: 500,000,000

Initial supply: 200,000,000

| Category | Percent | Tokens | SNEK | veSNEK |

| LGE + seed liquidity | 4% | 20,000,000 | 100% | 0% |

| Team (9-month vesting) | 12% | 60,000,000 | 30% | 70% |

| Reserve | 6% | 30,000,000 | 100% | 0% |

| Ecosystem incentives | 9% | 45,000,000 | 0% | 100% |

| Partner allocations | 9% | 45,000,000 | 0% | 100% |

| Emissions | 60% | 300,000,000 | 100% | 0% |

The team vesting period starts on April 20 2023, where 15% will be claimable from epoch 1 with the rest of the tokens being claimable on a linear vesting schedule for the remaining period. This can be checked at the llamapay’s vesting contract.

All tokens in the reserve are held as liquid SNEK but will only be given out as max-locked veSNEK. This will be used to subsidize operational expenses such as marketing, advisors, initial liquidity incentives…

Similar to other Solidly forks, the maximum supply is uncapped. However, Solisnek introduces a decaying emission rate of 1% per epoch up to epoch 92, after which the emission rate will be 1,000,000 per epoch.

Epoch 0 emissions were manually allocated by they team

| Liquidity pool | 10,000,000 |

| Epoch 0 emission % | 1% |

| Epoch 0 emissions tokens | 5,000,000 |

| Emission decay until epoch 92 | 1% |

| After epoch 92nd, 0.2% in perpetuity | 1,000,000 / epoch |

| Rebase cap % | 20% for retail users and 70% for partners |

Full emissions schedule: https://docs.solisnek.finance/full-emission-schedule

Solisnek used a custom contract for its initial LGE, which allowed the protocol to raise funds for vital liquidity.

| Allocation of initial supply | 5% |

| Allocation in tokens | 10,000,000 |

| Raise cap in AVAX | 20,000 |

| Raise cap in USD equivalent | 340,000 |

| Desired LGE price | $0.017 (1 AVAX = $17) |

10,000,000 SNEK were allocated to the initial token sale, where users would contribute with AVAX tokens in exchange for a SNEK allocation at the end of the sale.

The price during the LGE was calculated as:

P0 =AVAX raised10,000,000 SNEK

Pmax=20,000 AVAX10,000,000 SNEK

LGE contract address: https://snowtrace.io/address/0xe1Fa7CBD4a47B0Ebef5a93a2aa9cE8EEA2694e59

The Solisnek LGE raised its cap of 20,000 AVAX in just 4 mins 40 seconds.

After the auction, the Solisnek team added an extra 10,000,000 SNEK to the AVAX raised and provided it as liquidity in the form of vAMM SNEK/AVAX. Any additional AVAX will be used for bribes, operational costs, and future development of the platform.

veSNEK is the ERC-721 NFT token that represents a vote-escrow position upon locking SNEK tokens. The primary use is for voting on liquidity pools in order to determine the SNEK emissions.

veSNEK holders are entitled to earn revenue from swap fees and gauge bribes allocated to the pools they have voted for.

veSNEK has a maximum lock duration of 52 weeks with voting power diminishing by 1.92% every week.

1,000 SNEK locked for 1 year

1,000 veSNEK

1,000 SNEK locked for 6 months

500 veSNEK

1,000 SNEK locked for 3 months

250 veSNEK

The 20% dilution protection will be present during the initial stages of the protocol and is subject to changes as the protocol grows.

Using the SNEK governance token and locking into a veSNEK position, users can make proposals that dictate governance decisions related to protocol upgrades, changes to the economic model, additional features…

Due to functionalities shared by Solidly forks, Solisnek inherits audits based on codebases that have already been battle-tested in a production environment. All functions related to operational activities are placed under the deployer’s multisig wallet, as well as being put behind a timelock mechanism. This prevents the protocol operators from upgrading anything without going through the scheduler. Since everything is behind a proxy timelock, there is no way for the core team to maliciously do anything without it being verifiable on chain for multiple hours before it can be executed.

Additionally, since Solisnek’s codebase is 99% similar to Ramses, Solisnek also inherits the same security and audits from them, that is, Peckshield’s audit done on January 30, 2022 in addition to Velodrome’s inherited code that was reviewed in a Code4rena bug bounty contest

Besides, all proxy contracts are behind a timelock mechanism.

Solisnek is a community-owned protocol that raised no funds from VC investments. The initial Liquidity Generation Event (LGE) offered equitable access for the community and raised 20k AVAX at the price of $0.0370 per SNEK.

In order to fairly distribute the issuance of tokens in the early days of the protocol, Solisnek will airdrop tokens to friendly communities as well as to community members who completed Zealy tasks (formerly crew3)

All protocol partners have freedom to decide how to distribute their airdrop allocation.

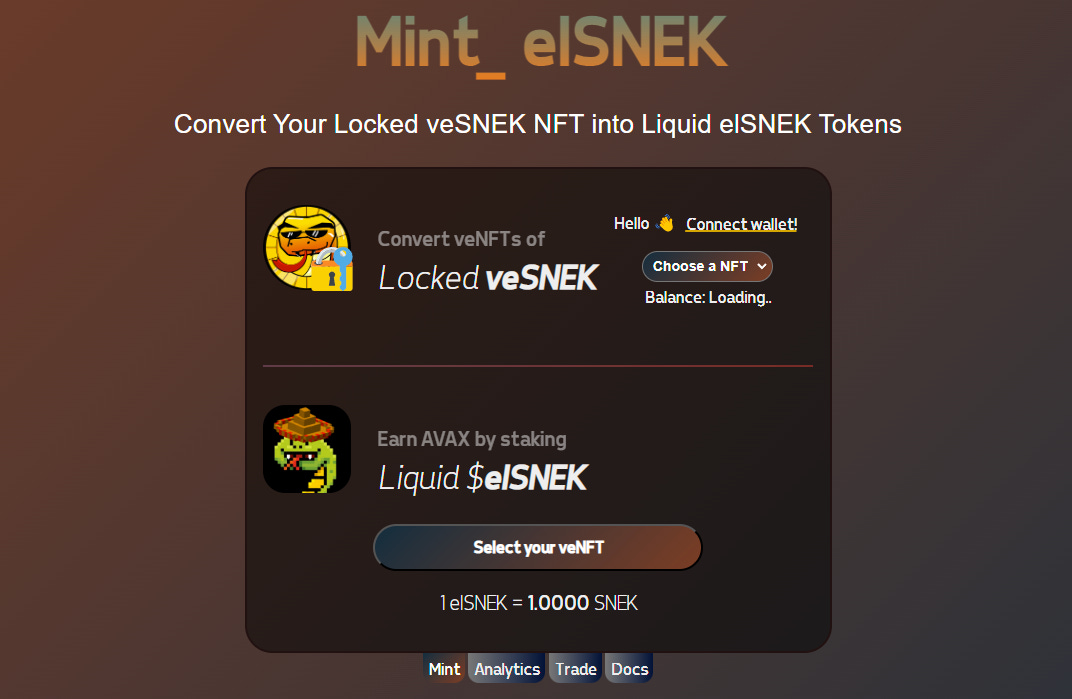

Liquid wrappers allow the locked version of SNEK, veSNEK (the SoliSnek veNFT) to be represented as a liquid veSNEK position that can be traded through a conventional Automated Market Maker (AMM) without having to commit to the traditional one-year lock-up period.

Elite has partnered with Solisnek to create a liquid wrapper for veSNEK. By using elSNEK, veSNEK holders are able to make their position liquid. Not only that, but elSNEK also acts as a permanent for veSNEK holders.

elSNEK is a liquid wrapper for the locked version of SNEK, veSNEK (The SoliSnek veNFT), which makes it possible for users to hold a liquid veSNEK position that can be traded through a conventional Automated Market Maker (AMM) like SoliSnek without having to commit to the traditional one-year lock-up period.

elSNEK staking is an option for users who wish to receive real yield in AVAX without having to swap multiple tokens to their desired one. This also allows users to access a ‘set and forget’ strategy for those voters who don’t have time to actively manage their veSNEK position(s).

elSNEK has dedicated 80% of its net yield for bribing veSNEK holders. Since elSNEK’s core pool is with wAVAX, the trading volume that takes place will pay the voters with wAVAX and elSNEK.

The supply of elSNEK is not controlled by anyone and can scale as much as SNEK itself. There are no ‘team tokens’ ‘ or ‘VC Shares’, and elSNEK can be minted at will by any SNEK or veSNEK holder in a permissionless manner.

Mint elSNEK: https://eliteness.network/el-snek

The AVAX from the voting yield is distributed as:

13.37% of all earnings (after conversion to WAVAX) from the Protocol veNFT are treated as protocol fees that are classified into 2 sections. During an initial early phase, no direct fees will be taken out of the system by Guru Network and all of the 13.37% will be allocated to acquiring PoL:

cpSNEK is a liquid wrapper powered by Champion Optimizer. cpSNEK is a synthetic and overcollateralized escrowed version of SNEK and veSNEK. Users can mint cpSNEK at a fix ratio of 1:1 from veSNEK, but it is not possible to redeem cpSNEK to veSNEK or SNEK. Champion will incentivize liquidity for the cpSNEK LP.

cpSNEK includes a burning mechanism based on a 1% transaction fee/tax involving the actions to buy/sell/add and remove liquidity.

At the start, every cpSNEK token is fully backed 1:1 by SNEK. Over time, due to the effect of the burning mechanism, when users buy/sell/add & remove liquidity of cpSNEK and generate fees, half of the fee of cpSNEK will be burnt and out of circulation. As a result, the backing ratio of cpSNEK will be above 1:1 by SNEK, and cpSNEK in the contract will become over-collateralized.

When cpSNEK is minted, the contract immediately stakes and locks the deposited SNEK or merges the deposited veSNEK into the contract with the maximum lock duration (1 year). Once the contract’s $SNEK is staked and locked into $veSNEK, it receives five benefits:

The greater the cpSNEK volume, the more fees are generated and the greater the backing ratio of SNEK will be, making each unit of cpSNEK more overcollateralized.

Users can not use cpSNEK for voting. All SNEK in Champion’s contract will be used to vote in the weekly liquidity pool incentives gauge for the pools offering the most in trading fees and bribes, or for the pools which support the cpSNEK token.

The cpSNEK contract will then harvest all trading fees, rebases and bribes from the protocol and swap those for more cpSNEK to bribe for the next epoch on Solisnek.