Retro Finance

Overview

Retro Finance is a friendly fork of Thena on Polygon. The protocol is a decentralized exchange (Dex) and automated market maker (AMM) that introduces ve(3, 3) tokenomics to serve as a liquidity incentivization and revenue generation solution for protocols operating on the Polygon network.

As a friendly fork of Thena.fi, Retro collaborates with the Thena team to exchange ideas and features while maintaining a solid foundation for long-term success. The protocol features concentrated liquidity and its ve(3,3) model incorporates Stabl Labs’ $CASH yield-bearing stable index token, providing additional benefits and bribe revenue to veRETRO voters.

ve(3, 3)

Beyond the original ideas from Solidly, Retro Finance incorporates a unique combination of DeFi concepts to create its ve(3,3) mechanism. The mechanism is designed to incentivize and align the interests of the protocol participants. Two main components influencing the mechanics are Vote-Escrow and the (3,3) game theory.

- Vote-Escrow: Inspired by Curve Finance’s Vote-Escrow mechanism, Retro Finance encourages long-term token holding by rewarding users who lock their tokens for voting and governance purposes. By locking their tokens in vote-escrow contracts, participants gain additional governance power, which enables them to influence the decision-making process within the protocol.

- (3,3) Game Theory: The (3,3) game theory, popularized by Olympus DAO, plays a significant role in Retro Finance’s mechanics. This game theory aims to align incentives by rewarding behaviors that benefit the protocol’s long-term success. Key behaviors include providing liquidity and holding tokens for extended periods, as these actions contribute to the stability and growth of the Retro ecosystem.

The result is the development of the ve(3,3) mechanism, a combination of both Vote-Escrow and (3,3) game theory. Participants who lock their tokens as $veRETRO holders are entitled to various rewards and benefits.

- Liquidity providers receive $RETRO emissions

- Locked $veRETRO holders receive protocol fees, bribes, veRETRO rebases, and governance power.

This comprehensive reward system fosters an ecosystem where participants are incentivized to actively support Retro’s success and long-term viability.

Liquidity Pools

Retro Finance offers two distinct pool types to accommodate different asset pairs:

- Concentrated Liquidity Pools enhance capital efficiency for volatile asset pairs. By consolidating a significant amount of liquidity in a concentrated manner, CL pools provide increased market depth and tighter spreads. This results in more favorable prices for traders, reducing slippage costs and enhancing overall trading efficiency. Ultimately, concentrated liquidity not only benefits individual traders but also fosters a healthier swaps market, generating organic fees for veRETRO voters.

For volatile pools, Retro utilizes a fork of UniSwap V3 concentrated liquidity pools, with a suite of automated liquidity managers (ALMs) as partners to streamline the management of liquidity for users.

To streamline liquidity management, the platform partners with automated liquidity managers (ALMs) such as Gamma and Ichi. These ALMs automate and optimize liquidity provision, making it more accessible and efficient for liquidity providers. By actively monitoring and adjusting liquidity positions, these managers help participants maximize their returns while minimizing their exposure to impermanent loss risks.

A distinguishing feature of Retro Finance is its use of multiple active liquidity managers, moving away from reliance on a single provider. This approach offers several advantages, including enhanced decentralization, increased resilience, and reduced risk of manipulation or market distortions. Utilizing multiple liquidity managers provides a wider range of strategies, expertise, and market insights, promoting healthy competition and innovation in the liquidity provision ecosystem.

To incentivize liquidity provision in concentrated liquidity pools, Retro Finance leverages Merkl, developed and maintained by Angle Labs. Merkl allows incentivizers to distribute emissions flexibly and efficiently, tailoring rewards based on various factors such as liquidity volume, price ranges, or specific token holders.

Liquidity providers can receive token rewards from incentivizers without incurring additional risk or requiring further smart contract interactions, retaining custody of their liquidity while earning incentives.

The integration of Merkl supports incentives in any ERC-20 token on various supported Automated Market Makers (AMMs), ensuring compatibility with multiple chains and liquidity management platforms. Moreover, Merkl imposes a low maintenance fee on distributed incentives, making it cost-effective for Liquidity Providers to utilize the platform.

This system, combined with the integration of multiple-position liquidity managers, empowers liquidity providers with a seamless and rewarding experience, further contributing to the overall efficiency of Retro Finance’s liquidity provision mechanism.

Liquidity Pools Rewards

Retro Finance offers liquidity providers income in the form of $oRETRO rewards.

- The protocol allocates 85% of $RETRO emissions to liquidity providers, which are then distributed based on the results of periodic veRETRO gauge voting as $oRETRO.

- The remaining 15% of $RETRO emissions are locked as veRETRO and added to the veNFTs (Non-Fungible Tokens) of existing veRETRO holders.

This distribution mechanism ensures that rewards are fairly distributed among liquidity providers, and mitigates the dilution of their positions. At the same time, this incentivizes long-term token holding and participation in the governance process.

Annual Percentage Rate (APR)

The APR for liquidity providers on Retro Finance is determined based on the price of the $RETRO token and the votes received by the liquidity pool. This APR represents the potential annualized return that liquidity providers can earn on their provided assets.

For example, let’s consider a WMATIC-$CASH liquidity pair, which might display an APR range of 12% ~ 30%. This range indicates the minimum and maximum APR that a liquidity provider can expect to receive as rewards for providing liquidity to that specific pair.

On the Vote page of Retro Finance, two key APR metrics are displayed:

- Current APR: This metric shows the APR that the liquidity pool is currently generating in the current epoch.

- It provides liquidity providers with real-time information about the current reward rate.

- Expected APR: The expected APR is a prediction of what the APR will be in the next epoch, based on the votes that the veRETRO gauge has received.

- It offers liquidity providers an estimation of the potential future rewards they can anticipate if they continue to provide liquidity to the pool.

These APR metrics are essential for liquidity providers as they allow them to make informed decisions about participating in specific liquidity pools, enabling them to choose the most attractive opportunities based on potential rewards and market conditions.

Stabl.fi / Retro Finance Partnership

The partnership between Retro and Stabl.Fi brings automatic bribes to all Retro liquidity providers (LPs) that include Stabl.Fi’s flagship token, $CASH, in their liquidity pools. For example, LPs providing liquidity in a MATIC/$CASH pair will receive automatic bribes every epoch based on $CASH’s daily rebases. This establishes a baseline level of bribes within the Retro ecosystem, regardless of any external bribes.

This feature of automatic bribes offers several advantages for the Retro ecosystem:

- Incentives During Bearish Periods: During more bearish periods in the market, when protocols and individuals might be less willing to post bribes, the automatic bribes from $CASH’s daily rebases provide incentives to veRETRO holders. These incentives help maintain active participation in governance and liquidity provisioning, even in challenging market conditions.

- Enhanced Bribing Mechanism: Automatic bribes complement external bribes that may be offered by third parties. By adding more bribes on top of external ones, both the bribing parties and veRETRO holders benefit. This synergy reinforces the overall liquidity and vibrancy of the Retro ecosystem.

- Supercharging the ve(3,3) Flywheel Effect: The combination of ve(3,3) mechanics with the automatic bribes from $CASH’s rebases creates a powerful flywheel effect within the Retro ecosystem. This dynamic mechanism aligns incentives, encourages long-term holding, and bolsters the overall growth and sustainability of the protocol.

In return for this powerful benefit of automatic bribes, Retro Finance allocates 10% of all trading fees to the Stabl Labs Overcollateralization Treasury. The funds in this treasury are utilized to boost the yields of the $CASH token and support other initiatives.

This arrangement not only benefits Stabl.Fi and Retro but also provide advantages for all stakeholders in the Retro ecosystem. Increased $CASH yields resulting from the treasury allocation translate to higher auto bribes within the ecosystem. This, in turn, reinforces the overall rewards structure, enhances the appeal of participating in Retro’s liquidity pools, and promotes a healthy and self-sustaining ecosystem.

$CASH

$CASH is the native token of Stabl.Fi, is a protocol known for introducing a yield-bearing stable indexcoin. Unlike conventional yield-bearing stablecoins (YBS), $CASH sets itself apart by significantly enhancing the capital efficiency of each $CASH token and offering an additional layer of security through overcollateralization. The design of $CASH is made possible by leveraging external revenue streams to benefit both $CASH token holders and liquidity providers (LPs).

Symbiotic Partnership and Ecosystem

$CASH benefits from a symbiotic partnership with Stabl.Fi and Retro, fostering a collaborative ecosystem. The Stabl.Fi ecosystem consists of two treasuries—the $CASH Treasury and the OC Treasury—which work in synergy to optimize yields and protect the interests of token holders.

How $CASH differs from traditional Yield-bearing stablecoins (YBS)

With Stabl.Fi, having an external treasury makes it possible to achieve higher yields.

Traditional yield-bearing stablecoins (YBS) typically rely solely on the farming of collateral stablecoins to generate yield. In contrast, $CASH sets itself apart by leveraging an external treasury owned by Stabl Labs, called the Overcollateralization Treasury (OC Treasury). This treasury actively farms in higher-yielding strategies, including non-collateral stable farming and even non-stablecoin farming strategies. As a result, $CASH holders benefit from higher yields compared to traditional YBS tokens.

This offers advantages like:

- Increased Yield Potential: $CASH holders enjoy the advantage of higher yields, making it more attractive for investors seeking improved returns on their stablecoin holdings.

- Diverse Revenue Streams: The use of non-collateral stable farming and other strategies diversifies revenue sources, reducing reliance on a single type of farming and potentially improving overall stability.

Enhanced Security and Insurance Policy.

In the traditional YBS model, collateral is always maintained at a 1:1 ratio, but this can leave protocols vulnerable to riskier strategies and potential undercollateralization. $CASH addresses this concern by designating the OC Treasury as an “insurance policy.” In the event of unforeseen events in DeFi that result in losses, the OC Treasury can be used to compensate and protect $CASH holders, providing an additional layer of security.

The advantages of this model are:

- Risk Mitigation: The presence of an insurance policy in the form of the OC Treasury provides greater confidence to $CASH holders, knowing there are reserve funds available to address potential losses.

- Protection Against Undercollateralization: Unlike traditional YBS models, which may suffer from undercollateralization in the event of risky strategies, $CASH is supported by a reserve fund, preventing depegging and losses for token holders.

$CASH Treasury

The $CASH Treasury plays a pivotal role in the Stabl.Fi ecosystem, providing a secure and conservative approach to yield generation for $CASH token holders. When users deposit stablecoins into the Stabl.Fi DApp, these stablecoins are directed to the $CASH Treasury, which operates to safeguard the collateral and generate yields through well-established strategies.

Farming Strategies

Within the $CASH Treasury, 100% of the collateral stablecoins (USDC/USDT/DAI) are held in a 1:1 ratio to the circulating supply of $CASH tokens. To ensure the utmost safety and stability, the $CASH Treasury adopts only the most conservative farming strategies, primarily utilizing established protocols like Aave and Compound. These tried-and-true farming strategies protect the $CASH collateral from exposure to market impacts or any experimental approaches.

Yield Distribution

The yield generated from these stablecoin farming strategies is thoughtfully allocated to serve the interests of $CASH holders and the overall ecosystem:

- 85% as $CASH Rebase or Autobribes: A significant portion of the yield, amounting to 85%, is distributed as $CASH rebases to $CASH token holders. This rebase mechanism adjusts the supply of $CASH tokens based on the accrued yield, providing holders with a proportional increase in their token holdings. For $CASH tokens that are part of Retro liquidity pools (LPs), the yield takes the form of auto bribes, further incentivizing participation in governance and liquidity provision.

- 15% to the Overcollateralization Treasury: The remaining 15% of the yield is directed to the Overcollateralization Treasury, reinforcing the insurance policy and security measures for $CASH holders. This treasury serves as a reserve to safeguard against potential risks or losses, providing an additional layer of protection and peace of mind to investors.

Benefits of the $CASH Treasury

- Security and Stability: Token holders can be confident in the security of their investment, knowing that the $CASH Treasury implements risk-averse strategies and protects the collateral from market volatility.

- Predictable and Fair Yield Distribution: The yield distribution mechanism ensures that $CASH holders benefit from the generated yield in a fair and predictable manner, fostering trust and satisfaction among the community.

- Enhanced Ecosystem Resilience: The Overcollateralization Treasury provides a buffer against potential risks, bolstering the resilience and longevity of the $CASH ecosystem.

Overcollateralization Treasury

The Overcollateralization (OC) Treasury established by Stabl Labs offers significant advantages to $CASH holders and Retro, employing a diverse range of higher-yielding strategies. This treasury incorporates a basket of assets, including non-collateral stablecoins (such as $MAI, $FRAX, $USDR) and even non-stablecoin assets like $MATIC and $ETH. The OC Treasury’s unique approach enables $CASH holders to access attractive yields from volatile or less established assets while maintaining the stability of being 100% collateralized in traditional stablecoins.

Yield Distribution

The yields generated by the OC Treasury are distributed in a manner that aligns with the interests of $CASH holders, Retro, and the broader Stabl Labs ecosystem:

- 60% to $CASH Holders: The majority of the OC Treasury’s yields, comprising 60%, are directed to $CASH holders. This allocation rewards $CASH holders with an enhanced share of the treasury’s generated yield, providing them with additional incentives for holding and participating in the $CASH ecosystem.

- 25% Autocompounded to Grow Treasury: A portion of the yields, constituting 25%, is autocompounded back into the OC Treasury. This strategic reinvestment helps the treasury grow over time, bolstering its capacity to generate even higher yields for the benefit of $CASH holders and other stakeholders.

- 15% to $STABL Token Holders: A share of the OC Treasury’s yields, equivalent to 15%, is directed to $STABL token holders. STABL is a governance token held by Stabl Labs, and this allocation rewards STABL token holders for their contribution to the governance and success of the ecosystem.

External Revenue Sources

The OC Treasury is fueled by external revenue streams, further enhancing the treasury’s capacity to generate attractive yields:

- 10% of Retro Trading Fees: A portion of the trading fees collected on the Retro platform, amounting to 10%, is channeled into the OC Treasury. This revenue contribution originates from trading activities on the Retro decentralized exchange, contributing to the treasury’s overall growth and profitability.

- 15% of Yields from the $CASH Treasury: An allocation of 15% of the yields generated by the $CASH Treasury is redirected to the OC Treasury. This inter-treasury flow further complements the ecosystem’s efficiency, ensuring that the OC Treasury benefits from the yields generated within the $CASH Treasury.

- 50% of Revenue from $oRETRO Call Options: The OC Treasury receives 50% of the revenue generated from $oRETRO call options. These call options are utilized as the emission token for Retro, and the revenue sharing arrangement strengthens the financial synergy between Retro and the OC Treasury.

Benefits of the OC Treasury

The Overcollateralization (OC) Treasury stands as a critical component of the Stabl Labs ecosystem, offering a wide array of benefits:

- Diversification and Yield Enhancement: The diversified strategies employed by the OC Treasury allow $CASH holders to enjoy attractive yields from a variety of assets while maintaining the stability of traditional stablecoins.

- Optimized Yields: The strategic distribution of yields benefits $CASH holders, $STABL token holders, and the treasury itself, fostering a sustainable and thriving ecosystem.

- Strengthened Financial Synergy: The OC Treasury’s revenue sources, including Retro trading fees and $oRETRO call options, further strengthen the partnership and mutual benefit between Retro and the $CASH ecosystem.

Minting / Redeeming $CASH

Minting and Redeeming $CASH are essential features of the Stabl.fi DApp that allow users to convert their stablecoins into $CASH and vice versa, offering seamless access to compounding yield.

Minting $CASH

Users can convert their existing stablecoins, currently including $USDC, $USDT, and $DAI, into $CASH through the “Minting” feature on the Stabl.fi DApp. Upon completing the minting process, $CASH tokens are deposited into the user’s wallet. Notably, $CASH begins accruing compounding yield immediately after minting, providing users with an attractive incentive for participation.

For the privilege of minting $CASH, users are subject to a 0.10% mint fee. This fee is deducted from the stablecoins deposited during the minting process, reflecting the cost associated with converting stablecoins to $CASH.

Redeeming $CASH

Users have the flexibility to convert their $CASH back into stablecoins whenever desired, utilizing the “Redeem” feature of the Stabl.fi DApp. By redeeming $CASH, users can easily access their underlying stablecoin holdings, ensuring liquidity and responsiveness to changing market conditions.

Upon redemption for stablecoins, users are charged a 0.25% exit fee. This fee is deducted from the redeemed amount and serves as compensation for the costs involved in converting $CASH back to stablecoins.

Mint and Redeem Fee Distribution

The mint and redeem fees collected during these processes are sent to $STABL token holders. $STABL is a governance token held by the Stabl Labs team, and this revenue-sharing arrangement benefits $STABL token holders for their contribution to the governance and development of the ecosystem.

Benefits of Minting and Redeeming $CASH

- Compounding Yield: Minted $CASH tokens start earning compounding yield immediately, providing users with a passive income opportunity.

- Liquidity and Flexibility: Redeeming $CASH allows users to access their underlying stablecoins at any time, ensuring liquidity and flexibility in managing their holdings.

- Supporting $STABL Governance: Mint and redeem fees contribute to the governance and sustainability of the Stabl Labs ecosystem, benefiting $STABL token holders.

$CASH as an Indexcoin

$CASH is distinguished as a yield-bearing stable indexcoin rather than a traditional yield-bearing stablecoin (YBS) due to two key factors:

- Peg Derived from Underlying Collateral: Unlike YBS, $CASH does not maintain its own peg but derives its peg from an index of the underlying collateral. The $CASH Treasury’s reserves consist of stablecoins like USDC, USDT, and DAI. The peg of $CASH is essentially determined by the weighted average price of these stablecoins held in the $CASH Treasury.

- Yield Calculation via Capital Efficiency Index (CEI): $CASH yields according to a unique index called the Capital Efficiency Index (CEI). The CEI is calculated by summing up the trailing 7-day yields from both the Overcollateralization (OC) Treasury and the $CASH Treasury and then dividing it by the 7-day yields solely from the $CASH Treasury. The formula is as follows:

The Capital Efficiency Index is a valuable metric as it gauges the efficiency of each $CASH token in generating yields above what a stablecoin can typically yield in conservative farming strategies. $CASH offers the power of high-yielding and potentially riskier or volatile assets, while still maintaining the security and stability associated with “traditional” stablecoins through conservative farming strategies.

Example of CEI calculation

For illustration, let’s consider the following data:

- $$ value of yields from OC Treasury given to $CASH holders over 7 days: $1,500

- $$ value of yields from $CASH Treasury given to $CASH holders over 7 days: $900

In this example, the Capital Efficiency Index is 2.67x. This indicates that each $CASH is yielding 2.67 times the rate it would yield with the collateral alone.

$CASH in Retro LPs

In Retro LPs, $CASH tokens that are held within the liquidity pools undergo a unique process where their daily yields are converted into bribes for the LP pairs. This conversion mechanism ensures that liquidity providers and veRETRO holders benefit while contributing to the overall growth and success of the Retro ecosystem.

Yield Conversion Example

Consider a MATIC/$CASH liquidity pool on Retro with a total value locked (TVL) of $2M. Assuming $CASH is yielding at 10% Annual Percentage Yield (APY), the default bribe amount calculation would be as follows:

$2M TVL / 2 ($CASH represents half of the pair) = $1M $CASH in the LP

$1M $CASH * 10% APY = $100K yields per year

$100K / 52 weeks per year = $1,923 per epoch in $CASH bribes

These $CASH bribes are then added to any external bribes that are placed on the specific pair, contributing to the overall incentives for liquidity providers and veRETRO holders.

Reasoning for Yield Conversion to Bribes

The decision to send $CASH yields from LPs to bribes is driven by several key factors that benefit all stakeholders involved:

- Liquidity Providers Benefit: By converting $CASH yields into bribes, liquidity providers gain enhanced rewards compared to traditional $CASH rebases. The mechanism incentivizes them to participate in liquidity provision, ultimately leading to greater earnings.

- veRETRO Holders Benefit: More bribes in the Retro ecosystem result in higher rewards available for veRETRO holders. The increased number of bribes creates additional earning opportunities for veRETRO voters, aligning their interests with the success of the protocol.

- Retro’s Success: The overall benefit extends to Retro itself. With increased bribes and more reasons for holding RETRO tokens in veRETRO, there is a higher percentage of locked RETRO, which supports the $RETRO token’s price. This, in turn, leads to higher APRs for liquidity pairs, attracting more Total Value Locked (TVL) to the platform and fostering a positive flywheel effect.

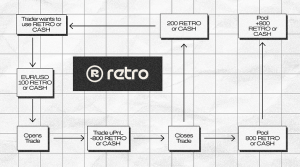

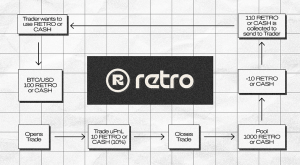

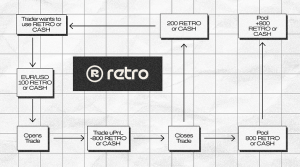

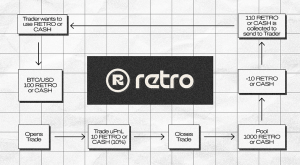

ARCADE

Arcade is a perpetual DEX (Decentralized Exchange) introduced by Retro Finance. It is designed to provide a new and unique trading option for users in the DeFi space, while also serving as another source of real bribes for veRETRO holders.

Arcade operates as a counterparty pool mechanism where users can trade against the $RETRO or $CASH pool. Liquidity providers deposit their $RETRO or $CASH into the vault and earn 30% of the trading fees paid by traders. The poolers’ principal gains or losses are based on the profit and loss of the traders.

For example, if traders make a profit of 100 $RETRO or $CASH from their trades, the pool will lose 100 $RETRO or $CASH to pay the traders. Conversely, if traders suffer a total loss of 200 $RETRO or $CASH from their trades, the pool will gain 200 $RETRO or $CASH paid by the traders.

Traders using Arcade can open positions against the pool using $RETRO or $CASH as collateral instead of relying on traditional stablecoins like $USDC or $WETH. The platform utilizes the UniDex oracle network to price trades by aggregating data from various price oracles, including centralized exchanges (CEXs), data providers, and oracle solutions like Chainlink. When a trader closes a trade, their collateral, which is in the form of $RETRO or $CASH, is returned to them along with any profit or loss earned from the trade.

Arcade’s trading pairs are not limited to crypto-to-crypto pairs but also include pairs like BTC/USD, EUR/USD, XAU/USD, and XAU/BTC, allowing traders to access a variety of trading options.

One of the notable features of Arcade is that it uses coin-margined contracts, meaning that 1 $RETRO or $CASH equals 1 $RETRO or $CASH for the trade, regardless of the price volatility of $RETRO or $CASH itself. This provides a more straightforward and familiar trading environment for Retro community members without the need to convert their assets to other currencies.

By providing perpetual trading options and further utility to $RETRO and $CASH tokens, Arcade aims to support the overall sustainability of the ve(3,3) ecosystem and contribute to Retro’s bribe ecosystem from the start of emissions. As part of Retro Finance’s commitment to building a sustainable ve(3,3) DEX in the DeFi space, Arcade marks the beginning of a new chapter for the protocol.

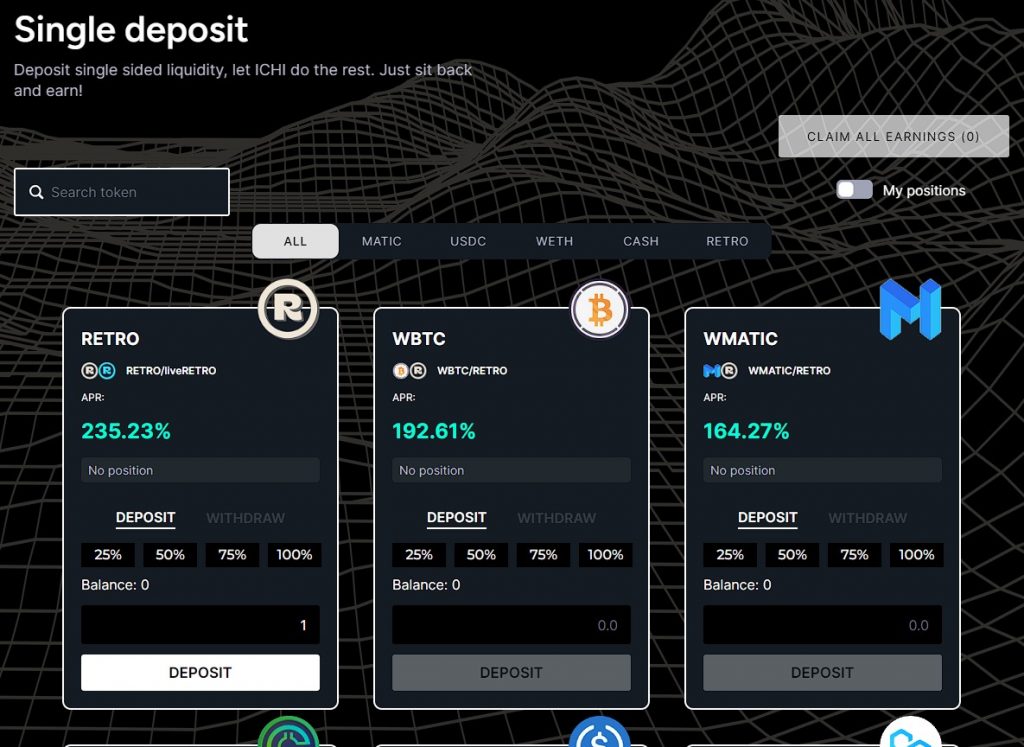

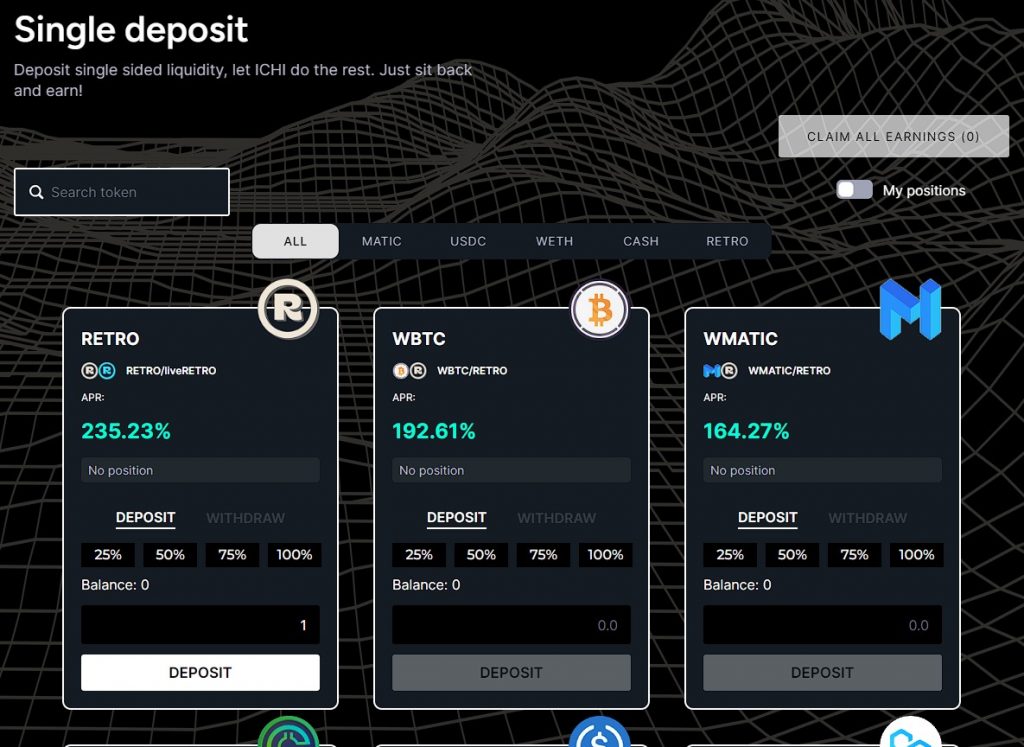

Single Deposit Vaults

Single deposit vaults were introduced on October 6, 2023, in collaboration with Ichi Foundation.

Ichi is an automated vault management protocol that provides convenience to protocols and users.

Retro users will be able to deposit single-sided liquidity into the vaults, and Ichi will manage the entire process.

Why the Project was Created

The motivation behind creating Retro Finance stems from the desire to innovate and address certain inefficiencies and challenges present in the traditional yield-bearing stablecoin models.

The team behind Retro Finance recognized that existing yield-bearing stablecoins often faced a trade-off between higher yields and higher security. Some protocols would prioritize higher yields by venturing into riskier farming strategies, potentially exposing users’ collateral to higher risks. On the other hand, protocols that chose safer strategies would offer yields that might not be appealing enough to attract significant Total Value Locked (TVL) from users.

To overcome these limitations and provide a more efficient and secure solution, the Retro Finance protocol was conceptualized. By leveraging the power of $CASH as a yield-bearing stable indexcoin, Retro Finance could offer an innovative approach that combined the attractive yields from diverse assets with the safety provided by traditional stablecoins in conservative farming strategies.

The introduction of the Capital Efficiency Index (CEI) further enhanced the efficiency of each $CASH token, allowing it to yield above what a stablecoin could typically yield in conservative farming strategies. This unique mechanism allowed $CASH to provide substantial yields to its holders while maintaining a peg derived from the underlying collateral.

Moreover, the collaboration with Stabl.Fi and the symbiotic partnership with $CASH enabled Retro Finance to create a robust ecosystem that rewards liquidity providers, veRETRO holders, and the protocol itself. By sending $CASH yields from LPs to bribes, liquidity providers and veRETRO holders could enjoy increased rewards and incentivization, contributing to a thriving and dynamic platform.

Ultimately, the motivation behind creating the Retro Finance protocol was to provide a more efficient, secure, and rewarding DeFi ecosystem that stands apart from traditional yield-bearing stablecoins. By combining cutting-edge tokenomics, strategic partnerships, and innovative governance mechanisms, Retro Finance seeks to foster a vibrant and sustainable ecosystem that benefits all stakeholders involved. The project’s aspiration is to become a leading decentralized exchange and automated market maker on Polygon, incentivizing liquidity provision, and maximizing gains for users and the protocol alike.

The Origin Story

The creation of Retro Finance came after the shutdown of a former project called Satin Exchange. Satin Exchange, though filled with innovative features, encountered numerous issues and setbacks post-launch. These issues included smart contract problems, frontend bugs, communication challenges, and an unvested seed private round that affected early supporters’ confidence.

Despite the difficulties faced, the team behind Satin Exchange demonstrated resilience and the willingness to learn from their mistakes. They recognized the need for innovation and risk-taking to drive progress in the DeFi space. The team made organizational and structural changes, bringing on new development talent and collaborating with Thena to create a more refined product on Polygon.

The new protocol, Retro Finance, embraces a ve(3,3) dynamic that aims to incentivize liquidity providers, reward former $SATIN holders in the transition, and introduce planned innovations more gradually. The relaunch is expected to address previous pain points and provide users with a better experience, including features like LP staking for voting, a stable token with auto bribes, and a stablecoin 4Pool.

A Friendly Fork of Thena

A friendly fork refers to a collaborative process between two projects where one project (the forking project) uses the codebase of another project (the original project) as a starting point to create a new and improved version of its own platform. Unlike a traditional fork, which may not involve the original developers and can be done without their permission or support, a friendly fork involves a closer relationship and cooperation between the two teams.

In the context of the Satin Exchange’s situation, they have decided to pursue a new direction and create a “friendly fork” with Thena on the Polygon blockchain to launch Retro Finance. In this process, Thena, the original project, will provide the codebase, including API and frontend, to Retro’s new development team. This access to Thena’s codebase is typically not available in open-source platforms, making it a significant advantage for the forking project. With this codebase, Retro Finance can be developed rapidly, leveraging Thena’s user experience and saving time on development.

In return for using Thena’s codebase, the Thena team will receive initial voting power on Retro Finance. The two teams will also collaborate on building roadmaps and features in parallel, allowing them to share work and expedite future additions and improvements.

The friendly fork enables Retro to bring a clean, optimized product to the market quickly and adopt the proven ve(3,3) model used by Thena. With the time saved on initial development, Retro can then integrate more innovative features incrementally. Moreover, Retro v2 will gain access to features from Thena, such as concentrated liquidity pools, that were not available in the former Satin Exchange.

Sector Outlook

A decentralized exchange (DEX) is a trading platform that operates without a central authority or intermediary, facilitating the direct exchange of cryptocurrencies between users on a peer-to-pool basis. To do that, DEXs utilize smart contracts on blockchain platforms to automate and secure the exchange process. The smart contracts act as intermediaries, holding the funds of users involved in a trade until the conditions are met.

DEXs offer benefits such as increased security and user control but also have limitations, including lower liquidity and potential delays due to blockchain confirmation times. To address the liquidity challenge, DEXs often use inflationary emission of reward tokens, and the ve(3,3) model has been popular for many DEXs because of how efficient it is to align the incentives of traders, liquidity providers, and token holders.

The ve(3,3) DEX model involves two types of tokens: the governance token and the voting escrow token. Holders of the governance token can obtain voting power and rewards by locking or “escrowing” their tokens for a specified period. This incentivizes long-term commitment and participation in the governance of the DEX, discouraging short-term speculation. The specifics of the ve(3,3) model may vary depending on the DEX’s platform or protocol.

To ensure long-term sustainability and avoid major mistakes, some DEXs use a trial-and-error approach with adjustments over time. However, a mathematical model can provide insights into the effects of different adjustments and help users make better decisions for themselves and the DEX.

The ve(3, 3) DEX Model

A ve(3,3) DEX operates with two types of tokens: the native $DEX token and the locked version called $veDEX. $DEX tokens can be earned in return for providing liquidity on the DEX or bought on the exchange. When $DEX tokens are locked for a specific period, they become $veDEX tokens, which grants voting power.

Note that $DEX is a general name to refer to all DEXs implementing this particular model and does not apply to any specific protocol.

The initial distribution of tokens includes allocations for liquidity providers, early partners, airdrops to attract users, and reserve funds for promotional activities and the team. The DEX rewards liquidity providers with $DEX tokens emitted according to a fixed schedule, and some emissions are directed towards $veDEX holders as a rebase to prevent dilution.

Users receiving $DEX tokens have several options: sell, deposit in liquidity pools for more emissions, hold, or lock as $veDEX for voting power. Voting allows directing emissions to specific LPs and gives access to fees and bribes. Protocols bribe to compete for emissions towards their native LPs and attract retail liquidity providers. Retail users compete for bribes, fees, and emissions.

The locking of $DEX tokens into $veDEX tokens is incentivized to discourage selling and maintain price stability. Voting and bribing are repeated every week (epoch). This complex interplay between LPs, protocols, and retail users ensures liquidity and engagement in the ve(3,3) DEX.

Potential adoption – The ve(3, 3) Endgame

The ve(3,3) Endgame refers to the ultimate goal and desired outcome of a ve(3,3) DEX (decentralized exchange). The endgame revolves around creating a sustainable and efficient ecosystem that generates real yields for stakeholders through trading fees and bribes earned by veToken holders.

The conceptual flywheel represents the positive feedback loop that drives the growth and success of the ve(3,3) DEX.

- Bribes Incentive: The DEX offers bribes to veToken holders for voting in favor of specific liquidity pools or protocols. These bribes act as an incentive for users to buy and lock up the native token ($RETRO) to earn greater bribe rewards.

- Increased Demand for $RETRO: As more users buy and lock up $RETRO to participate in the voting and earn bribes, the demand for $RETRO increases, leading to a rise in its price.

- Higher APRs for LPs: The higher price of $RETRO leads to higher APRs (Annual Percentage Rates) for liquidity providers (LPs) in the Retro ecosystem. This benefits LPs as they earn more rewards for providing liquidity to the platform.

- Increased TVL and Liquidity: Higher APRs and attractive incentives encourage more liquidity to come into the protocol, increasing the Total Value Locked (TVL) in the DEX.

- Higher Volume and Lower Slippage: With increased TVL, there is less slippage (price impact during trades), making the platform more attractive to traders. As a result, more trading volume flows through aggregators like 1inch, Paraswap, Kyberswap, and Firebird.

- More Trading Fees for veToken Holders: Higher trading volume generates more trading fees for veToken holders. This gives them more reason to lock up their veTokens and support the flywheel by participating in the governance and voting processes.

The ve(3,3) DEX’s success relies on this flywheel functioning smoothly, creating a self-reinforcing cycle where various stakeholders benefit, leading to further growth and adoption of the platform. However, it’s important to note that maintaining this flywheel requires a well-balanced and sustainable tokenomics model, efficient governance mechanisms, and continuous innovation to address challenges and ensure the ecosystem’s long-term viability.

The Cycle of ve(3, 3) DEXes

Since the introduction of the original Solidly DEX, various variations of the ve(3,3) model have been launched with different degrees of success. The ve(3,3) DEXs typically go through a macro-level cycle, which includes three main stages:

- Face-melting pump and euphoria: At the beginning of the launch, there is high excitement and optimism. Liquidity is heavily incentivized through the emission of the governance token, leading to high initial APRs (Annual Percentage Rates) on ve(3,3) DEX liquidity. This attracts liquidity providers, raising Total Value Locked (TVL), volume, and fees. The high voting APRs also attract true believers who lock their governance tokens, expecting perpetual real yields from the rewards generated.

- Catastrophic crash and ve(3,3) death spiral: Despite the initial hype and high APRs, a significant portion of liquidity providers, known as “mercenary” farmers, are focused solely on maximizing short-term profit. They sell their rewards immediately to capture profits and have no interest in locking their tokens for the long term. The presence of mercenary liquidity eventually outpaces the locking of tokens, reaching a tipping point. At this stage, the token price starts to decline, leading to lower liquidity APRs, reduced voting APRs, and a cascade of selling and liquidity withdrawals. This results in a ve(3,3) death spiral, causing the token price, TVL, and ecosystem-wide returns to plummet.

- Slow bleed into oblivion: After the crash, the token price continues to slowly decrease. Some liquidity providers try to salvage whatever profits they can, but sentiment remains low, and the protocol loses confidence and value over time. The ve(3,3) DEX may still operate but at a much-reduced scale compared to its peak, and the glory days of the initial pump are not seen again.

How Retro Addresses Mercenary Liquidity

The previous sections discussed the challenges faced by ve(3,3) DEXs due to the presence of mercenary liquidity, which often leads to dramatic price pumps followed by crashes within the first few months of launch. The volatile price action and negative market sentiment associated with ve(3,3) tokens have raised concerns about the long-term sustainability of the model.

To tackle this fundamental issue, some protocols have implemented improvements to increase voter APR and bring more value to veToken holders who commit locked liquidity to the protocol. Two significant improvements are Concentrated Liquidity (CL) and Autobribes. Concentrated liquidity pools, introduced by UniSwap v3, offer greater efficiency, higher trading fees, and sustainable income for veToken lockers. Autobribes, provided by native tokens like $CASH in Retro, offer a perpetual source of bribes to veRETRO holders independent of external partners’ support.

Despite these improvements, the core challenge remains: mercenary liquidity continues to dominate ve(3,3) DEXs, and the practice of locking governance tokens remains a dealbreaker for many farmers seeking short-term profits.

To address this dilemma, Retro Finance uses the concept of oTokenomics as a potential solution. Instead of emitting liquid tokens as liquidity incentives, oTokenomics incentivizes liquidity providers through the emission of call option tokens (oTokens). These oTokens can be converted to liquid tokens by paying a certain percentage of the token price in another currency (e.g., MATIC or USDC), effectively granting the holder the option to purchase the token at a discounted price.

The revenue generated from oTokens can be used to support the DEX’s overall sustainability, and a portion can be directed to the overcollateralization Treasury, boosting $CASH yields and protocol-wide bribes for veRETRO holders. In this model, mercenary liquidity effectively contributes to the ecosystem by supporting the veToken holders, even if they are intent on selling their rewards.

Liquidity providers can also choose an alternate path by converting earned oTokens to veTokens, unlocking voter rewards. While the conversion to veTokens is free, opting for oTokens provides an additional incentive to veToken holders. This shift in emissions logic aims to transfer value from mercenary liquidity to loyal veToken holders, increasing sustainability and supporting token price.

Potential Impact of oTokenomics

- The oToken model may discourage some liquidity providers, leading to a short-term impact on TVL. However, those providers were likely to sell the majority of their token rewards, so the model benefits those who are willing to lock their veTokens.

- Higher liquidity APRs can still attract mercenary liquidity, and a portion of their profits would be transferred to veToken holders through the option system, enhancing sustainability and supporting token price.

- The oTokenomics approach aligns the interests of loyal veToken holders with the success of the protocol, making them more likely to commit their liquidity for the long term.

Chains

Retro has deployed on Polygon with the goal of becoming a core piece of the chain’s infrastructure, similar to Thena on the Binance Chain, Equalizer on Fantom, Solidly on Ethereum mainnet, and Velodrome on Optimism.

Using the Protocol

All Solidly forks rely on a system that attempts to align the incentives of 4 types of users:

- Liquidity providers deposit their assets into a liquidity pool in order to receive the emissions of the DEX’s native token. In exchange for these emissions, all trading fees earned through swaps are sent out to the veToken voters who voted for that specific pool.

- veToken voters govern the emissions of the Dex’s native token. Since they collect revenue from swap fees, they are incentivized to vote for the most profitable pools (the ones that generate the most volume).

- Traders execute swaps in the liquidity pools by paying for a swap fee.

- Protocols need liquidity for their tokens so that users can buy their tokens with deep liquidity and low slippage conditions. To do that, projects can bribe veToken holders to vote for their LP pair. Protocols do this because they are also highly incentivized to accumulate governance power by accumulating veTokens in order to direct emissions to their own pools.

UsersveRETRO gauge voting

- Liquidity providers have an incentive to provide liquidity to the pools with the highest emissions. Emissions are distributed in the form of oRETRO

- veRETRO voters have the incentive to vote for pools that generate the most protocol revenue, which will be pools with the most trading volume since these pools are the ones generating the most fees.

- Traders benefit from better liquidity conditions, which favor low-slippage trades.

- Protocols benefit from a public liquidity layer where they can easily incentivize voters to vote and attract liquidity for their pools via bribe incentives. This allows external protocols to direct $RETRO emissions for veRETRO holders as a source of income without having to sacrifice their native token with token excessive emissions.

Business Model

As a ve(3, 3) Dex, the business model of Retro Finance revolves around creating a decentralized liquidity layer and governance protocol that incentivizes various stakeholders to actively participate in the ecosystem and aligns their interests.

- Liquidity Provision and Emission Rewards: Retro Finance encourages liquidity providers (LPs) to contribute to the protocol by providing liquidity to various trading pairs. LPs are rewarded with emissions in the form of $oRETRO tokens, which they can use or sell in the market. The emission rewards are distributed based on the ve(3,3) mechanics, combining Olympus DAO’s rebase mechanism and Curve’s vote-escrowed model. LPs can also receive additional bribes from third parties by staking their LP tokens in gauges, further incentivizing their participation.

- veRETRO Governance: The veRETRO token is used for governance within Retro Finance. Any $RETRO holder can vote-escrow their tokens and receive veRETRO (also known as veNFT) in exchange. veRETRO holders have the power to vote for gauges, which determines the allocation of $RETRO emissions and swap fees. This gives veRETRO holders a say in the direction of the protocol and the ability to incentivize certain pairs or strategies.

- Partnership with Stabl.Fi: Retro Finance has a symbiotic partnership with Stabl.Fi, is a protocol that offers a next-generation yield-bearing stable indexcoin called $CASH. This partnership provides mutual benefits, with $CASH LPs in Retro receiving automatic bribes from $CASH’s daily rebases, and 10% of Retro trading fees being sent to the Stabl Labs Overcollateralization Treasury to boost $CASH yields. This integration enhances liquidity and incentivizes LPs to participate in the ecosystem.

- Fee Structure and Trading: Retro Finance’s fee structure is designed to keep trading fees low, benefiting traders and promoting higher trading volumes. The fee distribution mechanism ensures that veRETRO voters receive the majority of the trading fees, creating incentives for them to support high-volume pairs and promote liquidity.

- Tokenomics and Emission Control: Retro Finance carefully manages its tokenomics and emissions, with a weekly emission decay of 2% and varying veRETRO rebases. This ensures a balanced distribution of $RETRO tokens and provides long-term incentives for participants.

- Ecosystem Grant: A portion of the initial supply is dedicated to an ecosystem grant fund, which supports projects that aim to accelerate the growth of Retro Finance. This fund can be used to incentivize lockups, LPs, and other projects that contribute to the protocol’s development.

Revenue Streams

- Liquidity providers (LPs) of pairs that consist of both tokens whitelisted by Stabl Labs to be staked in gauges and receive $oRETRO emissions rewards do not receive swap fees. Instead, the profits expected by these LPs are solely derived from the $oRETRO emissions they earn. This setup incentivizes LPs to participate in gauges and benefit from emissions.

- veRETRO holders, who play a vital role in governance by voting to incentivize specific gauges with emissions, receive swap fees from the liquidity pairs they voted for. This mechanism creates an incentive for veRETRO holders to vote for gauges that generate the highest volume in swap fees.

Wrappers

Wrappers are wrapped tokenised representations of veRETRO that are liquid. They allow users to enjoy ve(3,3) yields while still remaining in a liquid token.

$liveRETRO

$liveRETRO is the wrapper for Retro Finance’s governance token.

It allows users to enjoy yields gained from veRETRO positions, while still remaining liquid.

- $RETRO to liveRETRO

- Mint $liveRETRO without fees.

- Locks 100% of received $RETRO into veRETRO.

- veRETRO to liveRETRO

- Dynamic fee (30% to 70%), contingent on liveRETRO/$RETRO pool weight.

- Weekly mint capped at 15% of initial epoch supply.

- liveRETRO for veRETRO

- Incurs a 3.5% conversion fee.

Fees, bribes, and rebases earned will be converted to $liveRETRO

Fees and bribes:

- 81.5% for liveRETRO single Staking pool

- 10%: Automatically used to bribe the pool liveRETRO/$RETRO

- 8.5% for mxLQDR (soon qLQDR) holders

Economics

Fee Breakdown

- Stable pairs: 0.01% trading fee

- Volatile pairs: 0.2% trading fee

The distribution of trading fees is as follows:

- 90% of swap fees go to veRETRO voters

- 10% of swap fees are converted to stablecoins and sent to the overcollateralization (OC) Treasury to increase the yielding power of $CASH.

This fee structure empowers veRETRO holders to incentivize swap fees over total liquidity and provides them with the ability to direct the allocation of $RETRO emissions. By doing so, veRETRO holders can actively influence the direction and growth of the Retro Finance ecosystem.

For liquidity pools that are not whitelisted to be staked in gauges, they will receive all the swap fees they generate but will not receive $RETRO emissions. Similarly, liquidity providers who do not stake their LP tokens in gauges will receive the swap fees but will not earn $RETRO emissions. This arrangement encourages LPs to consider the benefits of staking their LP tokens and participating in gauges to access additional incentives and rewards.

Tokenomics

- $RETRO — ERC-20 utility token of the protocol

- $oRETRO — ERC-20 call option token of the protocol

- $veRETRO — ERC-721 governance token in the form of an NFT (non-fungible token)

$RETRO

$RETRO is the native token of Retro Finance. As the protocol’s utility and governance token, $RETRO plays a central role in governing the platform, incentivizing participation, and providing various benefits to its holders.

- Governance and Voting Rights: As a governance token, $RETRO holders have the power to participate in the decision-making process of the Retro Finance ecosystem by locking into veRETRO. They can propose and vote on protocol upgrades, changes to parameters, new features, and other matters that affect the platform’s development and functionality. The voting power of $RETRO holders is directly proportional to the number of tokens they hold, giving them a say in shaping the future of the protocol.

- Liquidity Mining and Incentives: Retro Finance uses a liquidity mining mechanism to incentivize users to provide liquidity to the protocol’s decentralized exchange (DEX). Liquidity providers (LPs) who contribute assets to the liquidity pool and lock them into ve(3,3) positions receive $RETRO tokens as rewards. These incentives are designed to attract liquidity to the platform, ensure a smooth trading experience, and enhance the protocol’s overall value proposition.

- Fee Sharing: A significant portion of the fees generated on the Retro Finance platform is shared with $RETRO token holders. Traders who execute transactions on the DEX pay trading fees, and a percentage of these fees are distributed among veRETRO holders. This fee-sharing mechanism provides a source of passive income for ve(3,3) participants, encouraging long-term token locking and supporting the protocol’s sustainability.

- Utility in Arcade Perpetual DEX: $RETRO serves as collateral in the Retro Arcade, the platform’s own perpetual DEX. Traders can use $RETRO as collateral for their trades, enabling them to open positions and speculate on various trading pairs without having to convert their tokens to stablecoins like $USDC or $WETH. This integration further drives utility and demand for $RETRO within the Retro Finance ecosystem.

- Participation in Token Sales and Airdrops: Token sales and airdrops are common ways to distribute new tokens or launch new projects within the DeFi space. As a ve(3,3) participant holding $RETRO, users may be eligible to participate in these events and receive new tokens or benefits, further enhancing the value and utility of their $RETRO holdings.

- Staking and Yield Farming Opportunities: Beyond liquidity mining, Retro Finance may offer additional staking and yield farming opportunities for $RETRO holders. These incentives could encourage users to lock their tokens for specific periods or participate in different farming pools to earn additional rewards.

Overall, $RETRO plays a vital role in the Retro Finance ecosystem by aligning the interests of participants, providing governance capabilities, and fostering a vibrant and engaged community. As the protocol evolves and introduces new features, the utility and value of $RETRO are expected to grow, making it a fundamental component of the Retro Finance DeFi ecosystem.

$veRETRO

veRETRO is a key component of Retro Finance’s governance system, allowing $RETRO token holders to actively participate in the decision-making process and receive rewards from trading fees and $CASH rebases. By vote-escrowing their $RETRO tokens, holders receive veRETRO (also known as veNFT), which represents their governance power and entitles them to various benefits within the protocol.

- Voting and Governance: Any $RETRO token holder can vote-escrow their tokens to receive veRETRO. This veRETRO (veNFT) acts as a representation of their voting power in governance matters. Additional tokens can be added to the veRETRO NFT at any time, allowing users to increase their influence in the governance process.

- Rewards from Trading Fees: veRETRO holders are entitled to receive 85% of the trading fees generated by the gauges they have voted for. These fees are distributed on a regular basis, providing a source of income to veRETRO holders based on their voting allocations.

- Rewards from $CASH Rebase: veRETRO voters also receive 85% of the $CASH rebase for the pairs they vote for, in the form of auto bribes. This means that if they vote for pairs containing a significant amount of $CASH, they will receive a larger share of $CASH revenue during the week compared to smaller $CASH pairs or pairs without $CASH.

veRETRO Specifications

- ve(3,3) Mechanics: veRETRO operates on a ve(3,3) mechanics, skillfully combining elements from Olympus DAO’s rebase mechanism and Curve’s vote-escrowed model. This fusion creates an incentive structure that aims to align the interests of participants and encourages active engagement in the governance process.

- Anti-dilution Level: To safeguard veRETRO holders from dilution and ensure a fair distribution of veRETRO over time, an anti-dilution level is imposed, capping dilution at 15%. This mechanism enhances the integrity of veRETRO’s value and aims to preserve the voting power of long-term holders.

- Gauge for $RETRO Rewards: Retro Finance provides a dedicated Gauge that allows participants to earn $RETRO rewards based on their veRETRO weekly voting allocation. This approach ensures that active participants in governance are duly rewarded for their contributions.

- Bribes for Incentivized Voting: The governance system incentivizes active voting and engagement by enabling third parties to offer custom amounts of tokens as bribes to veRETRO holders. These bribes incentivize participants to vote for specific proposals or decisions, enhancing overall governance participation.

- Maximum Lock Period: veRETRO tokens can be locked for a maximum period of 2 years. This promotes long-term commitment to the protocol and encourages holders to actively participate in the governance process.

- Farming Boost: To further incentivize liquidity provision in liquidity pools, veRETRO holders who participate as liquidity providers receive a Farming Boost, increasing their emissions and rewards.

- Flexibility and Liquidity: veRETRO positions offer flexibility, allowing holders to merge, split, and sell their veRETRO tokens on the secondary market. This liquidity and tradability ensure that veRETRO holders can manage their positions according to their preferences and market conditions.

Voting Mechanisms

- Epoch Duration: The voting process operates on epochs lasting 7 days. After each epoch, rewards in the form of bribes and trading fees are distributed to veRETRO holders based on their voting allocations.

- Rewards from Chosen Gauges: veRETRO holders only earn rewards from the gauges they have actively voted for. This mechanism encourages active participation and decision-making within the protocol.

- Claiming Rewards: Trading fees and bribes are claimable as a lump sum after the next epoch has ended (n+2). This ensures a structured and timely reward distribution process.

- Weekly Voting Requirement: To be eligible for fees and bribes, veRETRO holders are required to participate in weekly voting, demonstrating their ongoing commitment to the governance process. However, an optimizer can be utilized to automate voting, exempting holders from weekly voting obligations.

- Pre-Approval of Votes: Retro Finance plans to introduce pre-approval of votes, offering an additional layer of convenience and efficiency for participants to manage their voting preferences.

- Flexibility in Voting: veRETRO holders have the freedom to change or reset their votes at any time, enabling them to adapt to changing circumstances and align their positions with the evolving needs of the protocol.

- Vote Weight Reset: At the beginning of each epoch, vote weights reset, necessitating veRETRO holders to vote again in each epoch to continue earning fees and bribes. This ensures continuous active engagement and participation.

$oRETRO

$oRETRO is a call option token utilized as the emission token for the Retro Finance protocol. This token serves a dual purpose in rewarding liquidity providers while providing holders with specific rights and benefits.

- Rewarding Liquidity Providers: As an emission token, $oRETRO is instrumental in incentivizing liquidity providers in the Retro Finance ecosystem. Liquidity providers who participate in the protocol’s gauges receive $oRETRO emissions directed to their respective gauges. These emissions serve as the primary source of rewards for liquidity providers, encouraging active participation and the provision of liquidity to the protocol’s various liquidity pools.

- Rights and Benefits for Holders: Beyond its role in liquidity provider rewards, $oRETRO confers specific rights and benefits to token holders, making it an attractive asset to possess. Holders of $oRETRO tokens enjoy the following privileges:

- Discounted Rate for $RETRO Tokens: Each $oRETRO token represents a call option that enables its holder to purchase 1 $RETRO token at a discounted rate.

- Lock for veRETRO: Holders of $oRETRO also have the option to lock their $oRETRO tokens in a 1:1 ratio to receive veRETRO (voting escrowed $RETRO).

- Exercising the Call Option: $oRETRO holders can exercise their call option rights by converting their $oRETRO tokens into $RETRO tokens at the discounted rate. To do so, they simply need to pay with specified tokens, such as $MATIC, $CASH, $MAI, or $WETH, based on the available options and prevailing market conditions.

- Market Exit Option: Apart from the various rights and benefits provided, $oRETRO holders also have the freedom to exit their positions by selling their $oRETRO tokens in the open market. This market exit option ensures liquidity and accessibility for holders who may choose not to exercise their call option or seek to realize their investment at any given time.

$bveRETRO

Bribe veRETRO, or $bveRETRO, was introduced on August 24, 2023.

It is the same as $oRETRO, but can only be exercised as max-locked veRETRO and not any liquid form such as $RETRO.

The token was created to essentially use a small % of emissions to influence the loyal users to vote for blue chip pools and add this veRETRO position as a small “boost” to increase voting efficiency on the core pools.

This also helps with reducing selling pressure, as the % of emissions as $bveRETRO can only be sold as veRETRO at a market discount.

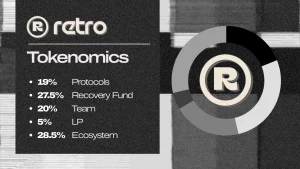

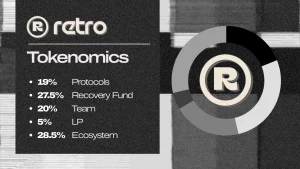

Initial Token Distribution

The allocation of $RETRO tokens has been strategically planned to ensure the success and growth of the Retro Finance protocol while incentivizing various stakeholders.

- veRETRO Protocol Airdrop (19%): A portion of the initial supply, 19%, has been allocated for an airdrop to protocols that demonstrate a commitment to engaging with Retro’s liquidity layer. Factors such as committed Total Value Locked (TVL), trade volumes, and product offerings were considered when selecting protocols for the airdrop. The aim is to create a diverse and active ecosystem of protocols on Retro.

- Recovery Fund (27.5%): 27.5% of the initial supply was distributed to $SATIN holders from Satin Exchange. Users can migrate their $SATIN to SATIN V2 receipt tokens to receive their share of the $RETRO Recovery Fund. The distribution will be in the form of 50% $RETRO and 50% veRETRO.

- Ecosystem Grant (28.5%): A substantial portion, 28.5%, has been allocated to an Ecosystem Grant fund. This fund will support a wide range of projects that aim to accelerate Retro’s growth. Grants may be used to incentivize lockups, liquidity providers, and support various projects related to smart contract development, marketing, and business development.

- Team (20%): 20% of the initial supply has been allocated to the core team to align their interests with the long-term success of Retro. The team allocation is split between veRETRO and $RETRO vested tokens. This approach ensures that team members participate in the upside of the protocol while promoting a long-term-oriented approach.

- Initial Liquidity Providers (5%):

- 5% of the initial supply has been allocated to initial liquidity providers, who have paired their tokens with $CASH and/or $MATIC to provide sufficient liquidity at launch. This allocation ensures a smooth and efficient market for users to engage with Retro.

Emissions

$RETRO emissions are driven by the ve(3,3) dynamics, attempting to align the interests of various stakeholders, including veRETRO holders, liquidity providers (LPs), traders, and protocols.

- veRETRO holders are incentivized to vote for pools with the highest trading volumes or those receiving bribes from protocols. Voting for high-volume pools increases the fees generated for veRETRO holders while voting for pools with bribes helps bootstrap liquidity and create a flywheel effect for the incentivizing protocol.

- Liquidity Providers (LPs) are incentivized through “Real Yield” based metrics. The emissions they receive are driven by the actual yield they provide to the protocol.

- Traders benefit from the liquidity provided by LPs, resulting in low slippage during trades.

- Protocols benefit from the cooperation-oriented liquidity layer provided by Retro. They can access capital-efficient trading conditions for their tokens, and they have the opportunity to incentivize their liquidity provision through bribes offered to veRETRO holders.

Emissions Specifications:

- Weekly emissions at inception: 2,600,000 $oRETRO

- Weekly emissions decay: 2% (decrease in emissions over time)

- Weekly team wallet allocation: 2.5% (reserved for the core team to support development and long-term engagement)

- Weekly veRETRO rebase: Initially set at 30% for the first 90 days after launch and then reduced to 15% thereafter.

- Emissions for liquidity providers: Initially set at 67.5% for the first 90 days post-launch, and increased to 82.5% thereafter. This allocation ensures liquidity providers receive a substantial share of emissions as an incentive for providing liquidity to the Retro protocol.

Governance

$RETRO token holders have the right to participate in the decision-making process of the protocol. Proposals for changes to the platform, such as upgrades, parameter adjustments, new features, or integrations, can be submitted by any community member with a sufficient amount of $RETRO tokens.

When a proposal is submitted, it undergoes a community-driven discussion phase. This allows $RETRO holders and other stakeholders to debate the merits, potential risks, and implications of the proposal. It’s an open and transparent forum where the community can express their opinions, ask questions, and offer insights.

Following the discussion phase, the proposal enters the voting stage. $RETRO token holders can cast their votes on-chain to express their support or opposition to the proposal. The voting mechanism is typically based on a simple majority or other predefined voting rules, depending on the protocol’s governance design.

If a proposal receives enough support, it is deemed successful, and the protocol’s developers or core team will implement the changes as outlined in the proposal. This could involve deploying new smart contracts, updating parameters, integrating new features, or making adjustments to the platform’s functionality.

Participating in governance can also be incentivized through governance rewards. Retro Finance may allocate a portion of the protocol’s revenue or token emissions to reward active governance participants. This encourages more stakeholders to engage in the decision-making process and ensures a vibrant and active governance community.

To ensure efficient decision-making, Retro Finance may set specific timelines for the voting process. There might be minimum participation requirements (quorums) to validate the outcome of a vote. For instance, if a vote fails to reach the required quorum, the proposal might be revisited or amended before being voted on again.

Risks

As with any decentralized finance (DeFi) protocol, Retro Finance is exposed to certain risks that users and stakeholders should be aware of. While the team behind Retro Finance may take measures to mitigate these risks, it’s essential for participants to exercise caution and conduct thorough research before engaging with the protocol.

- Smart Contract Risk: Retro Finance is built on smart contracts. If there are bugs, vulnerabilities, or security flaws in the smart contracts, malicious actors may exploit them to compromise the protocol’s security and funds.

- Impermanent Loss: Liquidity providers on Retro Finance may experience impermanent loss, which occurs when the value of assets in a liquidity pool diverges over time. This can lead to a reduction in overall returns compared to simply holding the assets.

- Market Volatility: Rapid and unpredictable price fluctuations of assets, including $RETRO and $CASH tokens, can affect the value of staked assets and rewards.

- Governance Risks: While governance empowers the community, it also carries the risk of contentious decision-making or manipulation. Large token holders or external actors may attempt to influence governance decisions in their favor, potentially impacting the protocol’s direction.

- Liquidity Risks: Inadequate liquidity can impact trading and swapping within the platform, leading to slippage and reduced user experience. Lower liquidity also exposes the protocol to potential market manipulation.

- Centralization Risks: Although Retro Finance aims to be decentralized, some aspects of the protocol may be influenced by the decisions of the core team or major stakeholders, which could potentially lead to centralization concerns.

- Economic Risks: Changes in tokenomics, inflation rates, or emission schedules can impact the value and utility of $RETRO and $CASH tokens.

Security

While no system can claim to be completely immune to risks, Retro Finance strives to maintain a high standard of security through various practices and audits.

Audits

As Retro Finance is a friendly fork of Thena Finance, the underlying forked code has been audited by PeckShield previously.

Smart Contract Security Audit – August 26, 2022 – Shellboxes

- Medium – 3 (2 Resolved, 1 Mitigated)

- Low – 5 (5 Resolved)

Retro, together with Thena, has also undergone an audit by OpenZeppelin.

Retro/Thena Audit – June 26, 2023 – OpenZeppelin

- Critical – 1 (1 Resolved)

- High – 4 (3 Resolved, 1 Partially Resolved)

- Medium – 9 (6 Resolved, 1 Partially Resolved)

- Low – 12 (7 Resolved, 3 Partially Resolved)

- Notes & Additional Information – 19 (13 Resolved, 3 Partially resolved)

Bug Bounty

While there is no official bug bounty program, bugs can be reported to the team via the appropriate discord channel.

Team

The team consists of the Stabl Labs team along with external members. There is no official list of team members.

Additionally, according to the documents, the multi-sig consists of:

Project Investors

There are no seed or presale rounds for Retro Finance, and no fund-raising was held. Instead, a migration of the older $SATIN holders was held, with the conversion rate being:

- ~366.21 SATIN : 1 RETRO

- 50% $RETRO and 50% veRETRO locked for 2 months

Additional Information

Partnerships and integrations

As a DEX, Retro has multiple partners and integrations. These include:

- Thena Finance – A ve(3,3) DEX that is the native liquidity layer on BNB.

- Polygon Labs – A development and growth team for the Polygon networks. Supporting the adoption of Polygon networks and the ecosystem on Polygon.

- Gamma – A protocol for active liquidity management and market-making strategies.

- QiDao – Creator of $MAI; Overcollateralised, Decentralised, Resilient Stablecoin since 2021.

- PaintSwap – PaintSwap is a state-of-the-art open decentralized NFT marketplace supporting all NFTs on Fantom, and fNFTs on multiple chains.

- Frax Finance – Frax Protocol issues the most innovative stablecoins in crypto & builds cross-chain infrastructure for them.

- Liquid Driver – Governance Blackhole & On-Demand LaaS.

- Lido – Staking made easy.

- Beefy Finance – The Trusted Yield Optimizer. The easiest way to earn more crypto.

- Coin98 Wallet – A DeFi wallet service.

- 1inch – DeFi aggregator service.

- Angle Protocol – A capital-efficient, decentralized, over-collateralized stablecoin protocol behind $agEUR.

- ICHI – Retro has optimized its $RETRO pools and enabled single-sided liquidity provision exclusively via Yield IQ vaults. With Yield IQ’s single-sided liquidity provision, users can now save their $RETRO tokens and lock them for veRETRO, while still earning fees from the pool. This approach allows users to enjoy boosted returns and additional incentives on top of fees.

- Horiza – A fork of Retro and Zero launching on Arbitrum.

- Blueprint – A fork of Zero launching on Ethereum.

FAQ

- What is the supply cap for $RETRO?

- What are the locking durations?

- $RETRO can be locked for 2 weeks, 6 months, 1 year, or 2 years.

- When does an epoch end?

- An epoch starts and ends every Thursday at 00:00 AM UTC. You can track the epoch timer on the website or with the Epoch Bot on Discord.

- Do I have to vote every week?

- Currently, yes.

- You can only claim your rewards if you vote every week, even if you vote for the same gauge.

- Do I have to claim my veRETRO rewards every week?

- No. They will accumulate if you leave them.

- Do I lose my rewards if I merge/split/transfer my veRETRO?

- No, rewards are tied to the user’s wallet.

Community Links