Dopex is an options protocol that introduces DeFi primitives such as SSOV Options (Single Staking Options Vaults), Liquidity Pool Options (LPO), and Atlantic Options. Dopex also introduces features such as staking yield, collateral borrowing, risk minimization mechanisms, and efficient pricing to arbitrage market opportunities.

As a decentralized options protocol, Dopex aims to minimize losses for options writers while maximizing gains for options buyers by improving the overall liquidity.

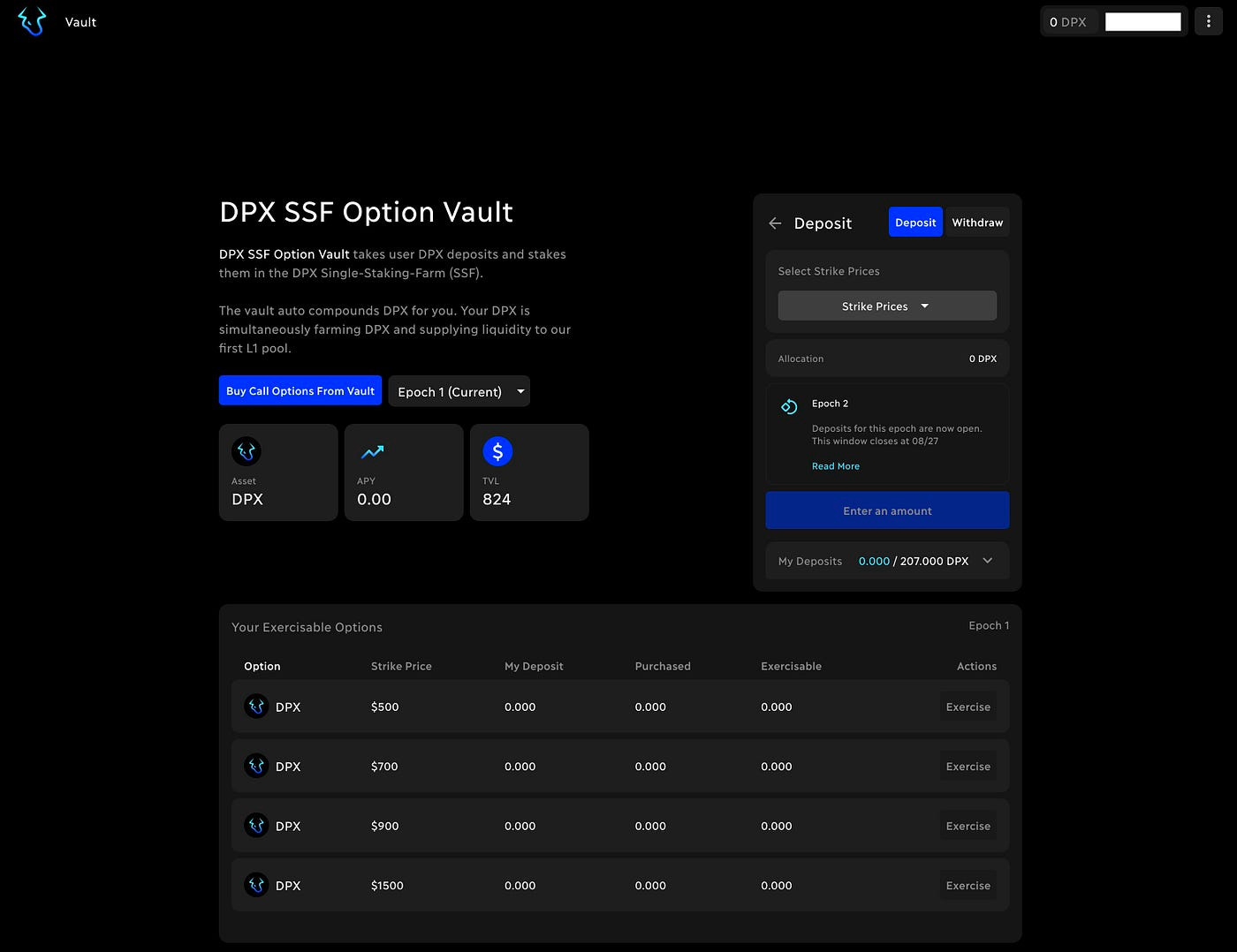

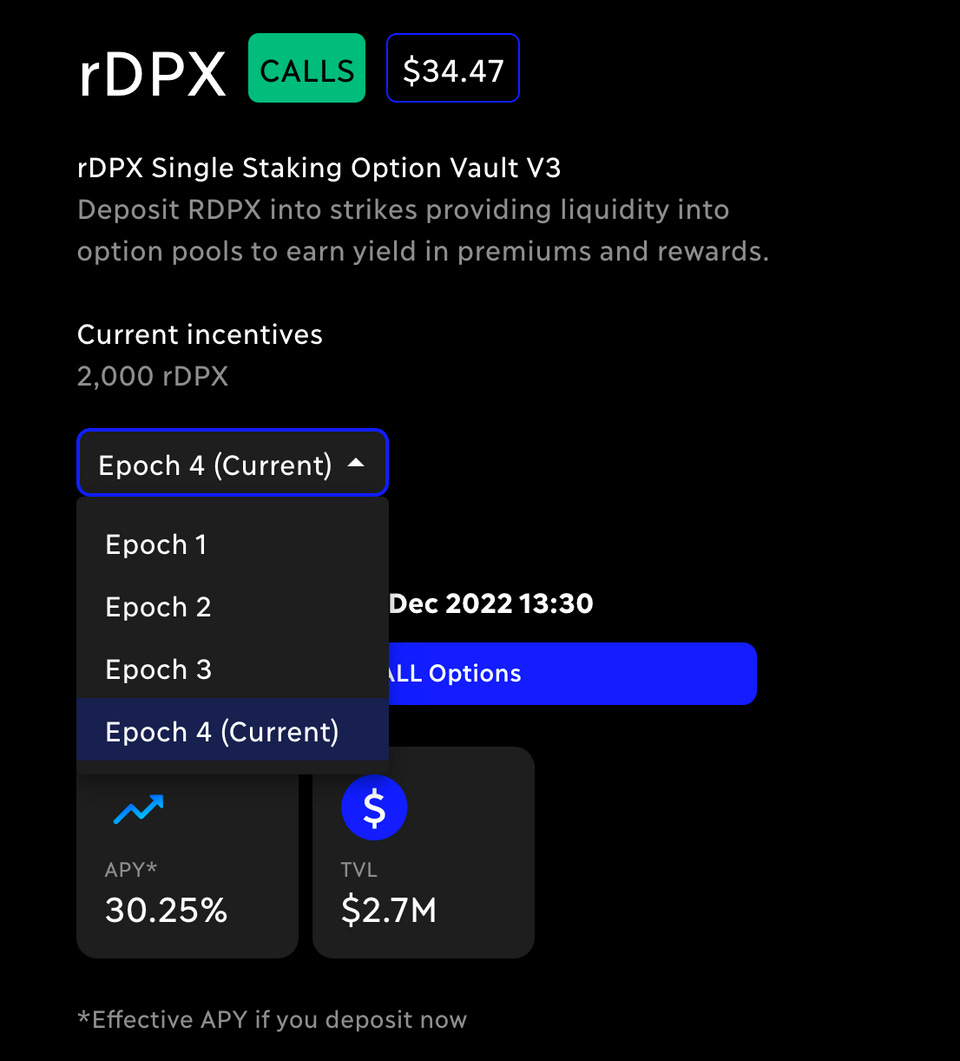

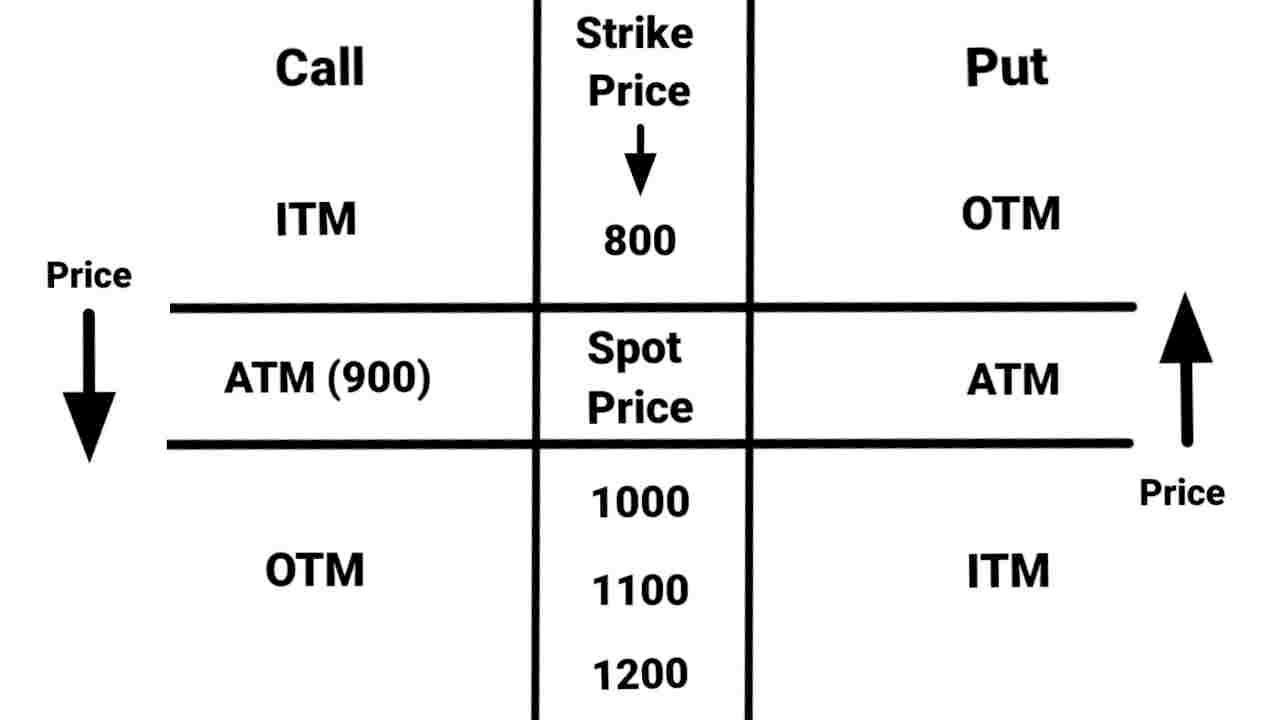

SSOVs allow users to lock up tokens for a predefined length of time in order to earn a yield on their assets. With SSOVs, users can deposit their assets into a staking contract that will then sell covered calls or put options to buyers at fixed strike prices that they select for different expiries. SSOV options are either ATM, OTM, or far OTM.

Options sellers write (create) calls and put options contracts where each contract will have a specific strike price and expiry date. These contracts are then sold to options buyers. The cost of buying these options contracts is referred to as the “premium”. The price of the premium is relative to the time remaining on the contract, the implied volatility, and the current price of the underlying asset.

The SSOV depositors will receive yield proportional to how close ATM strikes are being locked into. These users don’t lose any USD notional value. However, there is a chance that they might end up losing a percentage of their staked assets.

A trader wanting to buy a call option with a strike price that is lower than the current market value of the underlying asset will have to pay a significantly higher price for the contract. The reason for this is that the contract is ITM (“in the money”) and has intrinsic value.

In situations when the token rapidly increases in price, the depositors will lose potential upside. In the case that call buyers are in net profit at the end of the epoch, depositors will lose their staked tokens, but they will make a profit in USD notional.

Notional value is the total underlying amount on which a derivatives trade is based.

If SSOVs do not get enough usage for a token, close-to-expiry calls will be so cheap that they will incentivize large buy orders to take place close to expiry. This often leads to buyers attempting to front-run each other by buying calls at high premiums, which results in more yield being generated for depositors.

| Attribute | Value |

| Style | European |

| Expiries | Monthly, weekly, quarterly |

| Expiry time | Friday, 8:00 a.m. UTC |

| Settlement | Cash-settled |

| Margin requirements (options writing) | Fully backed by collateral.

|

| Option token standard | ERC20 |

The difference between European and American options is that European-style options can only be exercised at expiration, while American-style options can be exercised at any time prior to expiration.

By default, all options are auto-exercised on expiry and can be settled at any time at the user’s discretion.

Settlements on options exercises don’t require the underlying asset-net settlements.

Upon settlement, the PnL (Profit & Loss) of the option is calculated. If the value is positive, then the exercise can go through, the option token is burnt, and the PnL is transferred to the user to settle the contract.

PnL calculation for calls:

PnL = ((Price – Strike) * Amount) / Price

PnL calculation for puts:

PnL = (Strike – Price) * Amount

Where Price is the current spot price of the asset and the Amount is the number of options being exercised.

Normally, with options trading, the owner of the option can exercise the option at expiry to buy the corresponding amount of the underlying asset. For instance, if you had ETH call options at a strike price of $1,000 and ETH was trading at $1,200, then the trader could exercise the option at maturity to buy ETH at $1,000. However, that’s not exactly what happens with SSOVs. Instead, if the option matures ITM (where the market price is above the strike price – for call options), the trader can settle them for the difference between the market price and the strike price, as denominated in the underlying asset ((1,200 – 1,000) / 1,000 = 0.2 ETH)

As a depositor to the value, your total ETH balance is not protected, but the USD value is. For example, if you deposit 1 ETH at a $1,000 strike price, you will either get back 1 ETH or 1,000 worth of ETH. In both scenarios, you will also get all the premiums that you earned along the way.

This is what makes Dopex SSOV deposits different from selling covered calls. You don’t lose your entire principal amount if the calls you are selling end up ITM. Instead, you only lose the difference.

There are four big points on CLAMMs for LPs:

For traders, CLAMM provides the following benefits:

The Option AMM is the 2nd arm of the Dopex V2 upgrade and is catered to more sophisticated options traders — offering partial collateralization, portfolio margin, rebates, and LP level delta hedging.

LPs in OAMM simply deposit single-sided liquidity per market. Whereas traders deposit margin into their portfolios and can instantly trade against OAMM liquidity with portfolio margin enabled. This allows traders to open positions with a fraction of the margin required, as well as long/short option positions matching collateral requirements against each other. As long as the maintenance margin for a user’s portfolio does not go >80% and the LP doesn’t hit its liquidity cap — users can open positions in a far more capital-efficient manner in comparison to Dopex v1.

Option AMM will provide weekly and monthly expiries, however, positions could be exercised anytime (at a fee + spread)

Dopex does not require a price discovery mechanism for pricing options. The reason for that is that it prices options accurately by coordinating oscillations in implied volatility to major CEXes, which is where the majority of the options volume flows. This feature solves the problem of inconsistent demand and high variance on-chain for evaluating the implied volatility parameter of the Black-Scholes formula. This is a problem faced by on-chain AMMs, which might end up overpricing or underpricing options in periods of low/high volatility.

Dopex pricing uses the Black-Scholes model, which takes the following inputs:

Out of the 5 inputs given to the pricing model, 4 of them are known by market participants. The only input that is not observable is implied volatility.

Since traders have no explicit information about implied volatility, when they are trading options, what they are really trading is implied volatility.

One of the incorrect assumptions made by the original Black Scholes model is that implied volatility is constant across all strikes within the same expiry. In practice, different strikes have different values of implied volatility, where the difference is driven by supply and demand on each strike. This phenomenon is known as the volatility smile.

The volatility smile is a common graph shape that results from plotting the strike price and implied volatility of a group of options with the same underlying asset and expiration date.

Implied volatility raises when the underlying asset of an option is further out of the money, or in the money, compared to at the money.

When options with the same expiration date for the same underlying asset have different strike prices, the tendency for the graph of implied volatility is to show a smile.

Dopex factors in the possibility of extreme events occurring in the pricing of options by setting further OTM IV to higher levels than ATM options. This is achieved with an enriched version of the traditional volatility smiles approach. This method uses implied volatility and Chainlink price feeds so that the price data can be used in a function that retrieves a volatility smile graph based on realized volatility (volatility of past price action).

SSOVs allow users to lock up tokens for a predefined length of time in order to earn a yield on their assets. With SSOVs, users can deposit their assets into a staking contract that will then sell covered calls or put options to buyers at fixed strike prices that they select for different expiries. SSOV options are either ATM, OTM, or far OTM.

Options sellers write (create) calls and put options contracts where each contract will have a specific strike price and expiry date. These contracts are then sold to options buyers. The cost of buying these options contracts is referred to as the “premium”. The price of the premium is relative to the time remaining on the contract, the implied volatility, and the current price of the underlying asset.

The SSOV depositors will receive yield proportional to how close ATM strikes are being locked into. These users don’t lose any USD notional value. However, there is a chance that they might end up losing a percentage of their staked assets.

A trader wanting to buy a call option with a strike price that is lower than the current market value of the underlying asset will have to pay a significantly higher price for the contract. The reason for this is that the contract is ITM (“in the money”) and has intrinsic value.

In situations when the token rapidly increases in price, the depositors will lose potential upside. In the case that call buyers are in net profit at the end of the epoch, depositors will lose their staked tokens, but they will make a profit in USD notional.

Notional value is the total underlying amount on which a derivatives trade is based.

If SSOVs do not get enough usage for a token, close-to-expiry calls will be so cheap that it will incentivize large buy orders to take place close to expiry. This often leads to buyers attempting to front-run each other by buying calls at high premiums, which results in more yield being generated for depositors.

| Attribute | Value |

| Style | European |

| Expiries | Monthly, weekly, quarterly |

| Expiry time | Friday, 8:00 a.m. UTC |

| Settlement | Cash-settled |

| Margin requirements (options writing) | Fully backed by collateral.

|

| Option token standard | ERC20 |

The difference between European and American options is that European-style options can only be exercised at expiration, while American-style options can be exercised at any time prior to expiration.

By default, all options are auto-exercised on expiry and can be settled at any time at the user’s discretion.

Settlements on options exercises don’t require the underlying asset-net settlements.

Upon settlement, the PnL (Profit and loss) of the option is calculated. If the value is positive, then the exercise can go through, the option token is burnt, and the PnL is transferred to the user to settle the contract.

PnL calculation for calls:

PnL = ((Price – Strike) * Amount) / Price

PnL calculation for puts:

PnL = (Strike – Price) * Amount

Where Price is the current spot price of the asset and the Amount is the number of options being exercised.

Normally, with options trading, the owner of the option can exercise the option at expiry to buy the corresponding amount of the underlying asset. For instance, if you had ETH call options at a strike price of $1,000 and ETH was trading at $1,200, then the trader could exercise the option at maturity to buy ETH at $1,000. However, that’s not exactly what happens with SSOVs. Instead, if the option matures ITM (where the market price is above the strike price – for call options), the trader can settle them for the difference between the market price and the strike price, as denominated in the underlying asset ((1,200 – 1,000) / 1,000 = 0.2 ETH).

As a depositor to the value, your total ETH balance is not protected, but the USD value is. For example, if you deposit 1 ETH at a $1,000 strike price, you will either get back 1 ETH or$1,000 worth of ETH. In both scenarios, you will also get all the premiums that you earned along the way.

This is what makes Dopex SSOV deposits different from selling covered calls. You don’t lose your entire principal amount if the calls you are selling end up ITM. Instead, you only lose the difference.

Yield farming or liquidity farming is the act of lending or staking a crypto asset into a liquidity pool in order to receive rewards, such as interest payments, or incentives from token inflation.

Option Liquidity Pools are a system built on top of Dopex SSOV. They are pools where users can purchase SSOV option tokens at an implied volatility discount in exchange for providing anytime exit liquidity to option buyers. In other words, OLPs allow buyers of SSOV options to exit their positions at any time in exchange for a discounted price.

Options liquidity pools allow buyers of options to exit and sell their positions at any time. In doing so, they will sell their positions at a discount to option liquidity providers. This way, LPs will be able to set a discount at which they are comfortable buying those options. Once the order is executed, Dopex swaps the buyer and the seller’s assets using its standard pricing model while applying a discount.

OLPs solve many of the problems of SSOVs, such as:

This is achieved by:

For example, if you are an option buyer, since you are buying European options on Dopex, with OLPs you will not have to wait until expiration and will be able to take profits at any time before expiry. Because of that, your bet on directionality can be right at any time throughout the epoch and you will be able to take profits without sacrificing an option’s time value (theta). This allows for taking profits on both put/call options as well as purchasing discounted positions, which creates arbitrage opportunities interacting with external protocols.

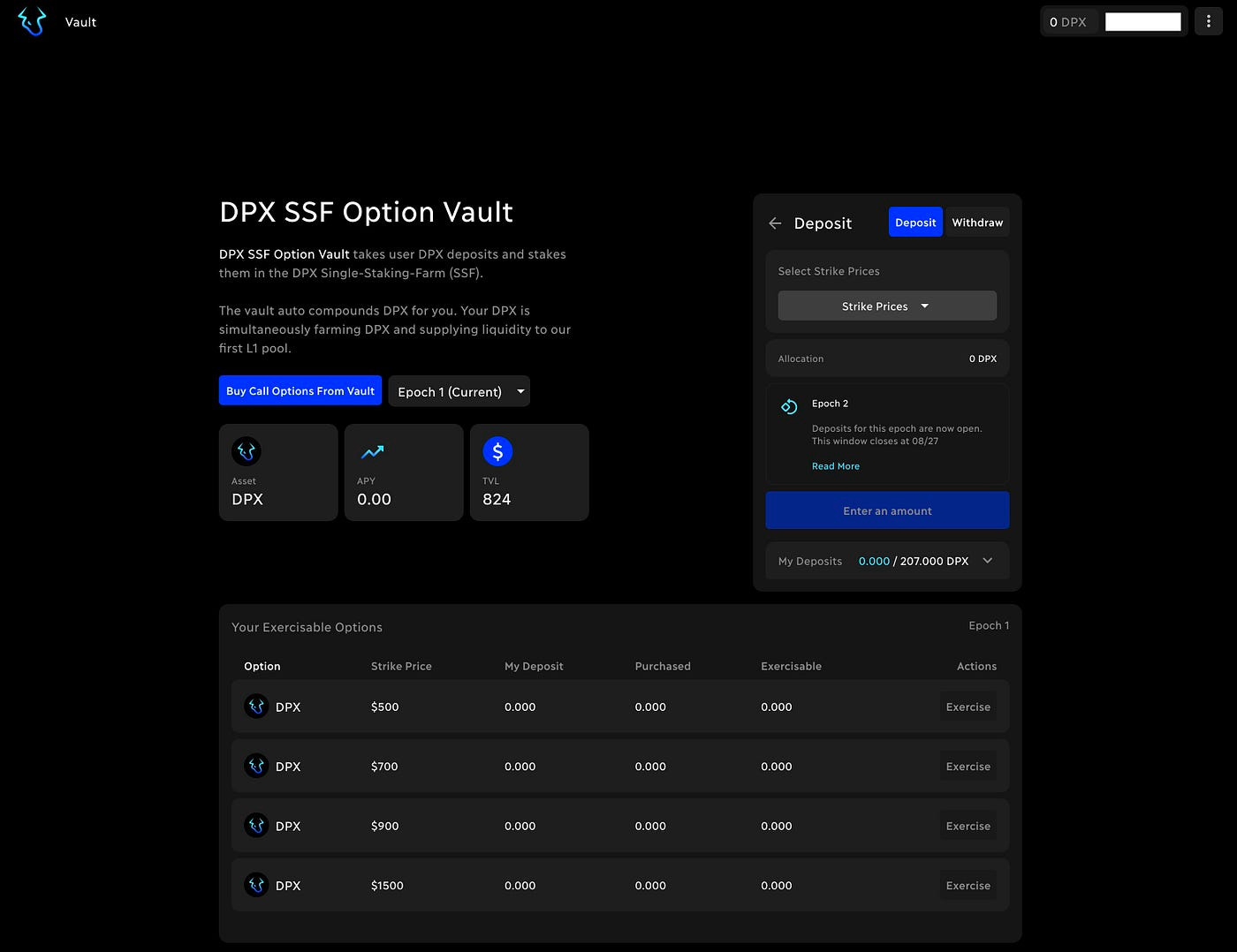

Atlantic options are a DeFi primitive that improves the capital efficiency of assets deposited as collateral. This allows for use cases such as insurance products, liquidation protection for positions on perpetual futures, bond insurance, set protocol-wide price floors…

With Atlantic options, buyers can borrow the underlying collateral within an option. This is a Defi primitive that greatly improves composability by being integrated into use cases such as:

Like European options, Atlantics have fixed expiry dates. The difference is that the collateral within these vaults is dynamic and can be used while the options contracts are open. Dopex Atlantics allows this collateral to be moved out from the option contract by depositing the underlying token. This underlying token can be withdrawn at any time as long as the collateral is returned.

Anytime that collateral is used in this manner, a funding fee is paid to the option writer based on the time elapsed and by deducting a fee from the underlying token. If there is a liquidation, the underlying token is transferred to the option writer while the collateral is moved to the protocol that is using that option (e.g. to GMX if an Atlantic put option is being used by traders as liquidation protection).

On expiry, the collateral being used is closed – either with no settlements or partial settlements (the option writer gets part of the underlying in return for the collateral being used), and the remaining underlying and collateral become available for withdrawal by both the option writer and the option buyer.

Other use cases include:

Atlantic option writers are token holders looking to buy tokens at prices below market or who want to provide insurance while earning a premium and collecting funding on their locked stables within a defined period of time.

When it comes to pricing, Atlantic options are priced at a premium to regular options due to the higher degree of capital efficiency they provide. The premium is calculated using Black-Scholes pricing with the implied volatility calculated as realized volatility at a premium, where this premium is a function of the remaining supply of options in the pool and the time to expiry, up to a maximum multiplier cap. Anytime that capital is unlocked from the option, a funding fee is paid inversely proportional to the percentage of capital remaining in the Atlantic option pool up to a maximum funding fee set by governance.

Atlantic pools have fixed expiries and allow option writers to specify a maximum strike price they want to write puts at. As for buyers, they can choose to buy puts at any strike they choose as long as there is available liquidity. Besides, option writers can deposit assets at any time during an epoch.

Due to the intervention of managed contracts, Dopex collects fees from all integrations, whether it is from insurance, no liquidation perceptual positions, no liquidation bonds, capital raises…

Dopex’s TZWAP allows anyone to create an on-chain TWAP (Time-Weighted Average Price) order split by intervals and tick sizes (order sizes) that can automatically be filled by bots for a fee.

Users choose the tokens they want to swap, the batch size (how the order will be split between time intervals), and the order will then be routed through swap aggregators like 1inch. These orders can be removed at any time by the user.

Using Dopex’s Time-Weighted Average Price feature is especially useful to execute large orders that might significantly move an asset’s price. This will be used mostly by large traders, DAOs, or treasuries who are looking to convert tokens without leaking a lot of information to the market as a result of the trade execution.

In DeFi, bonding is a known way for treasuries to raise funds in exchange for giving out the native protocol token at a discounted rate. This allows DeFi protocols to earn capital that they can use to fund operations, extend runway…

Dopex offers bonds to purchase DPX at a discount. These users can supply their stablecoins to Dopex in return for getting DPX at a 20% discount (redeemable after 1 week from the bond purchase) while helping the protocol to fund its operations.

This is a service that Dopex is offering to its partners, utilizing European-covered call options. These European (Fixed Expiry) covered call options are conceived to be slightly ITM, enabling users to extract a minimum intrinsic value at distribution through our secondary market.

This flexibility caters to merc capital looking for quick exits, as they can trade and exit their position whenever desired while protocols have the flexibility to determine the ITM percentage they’d want to allocate to the options which they can set to discourage quick exits while offering long-term believers the potential to receive greater returns as the derivative’s price increases.

In this way, the service allows the composability to cater to both short-term and long-term investors along with an options market for the protocol token, a new incentive model for the protocol to use, and co-marketing.

The service provides the following core benefits.

Usage of the service requires there to be emission/treasury tokens along with a viable Chainlink price feed.

Tztokchad, the founder of Dopex, got interested in option protocols after using Deribit and realizing the shortcomings associated with low liquidity, the bid-ask spread, margin requirements… In 2019 Dopex started building the protocol. A few players were tackling this vertical on the market, and there was an asymmetric opportunity to find a product-market fit with a user-friendly UX that could offer an improvement over both CEXs and decentralized protocols.

During the actual development of the protocol, decentralized exchanges had multiple shortcomings in terms of liquidity, such as unfair pricing for buyers, LPs being squeezed out of their assets on volatile weeks where the options flow goes against their sells, multiple arbitrage opportunities that were hard to capitalize on due to the high cost of gas fees on Ethereum, significant slippage when rolling over options to different strikes/prices…

Dopex was built to solve those problems by:

The team completed the rollout of Dopex v2 upgrade in December 2023, which included the following changes:

The team has also mentioned that a new roadmap will be published moving into 2024.

Dopex consists of a Community / Design and Engineering team. The team has not been doxxed and consists purely of anons.

DeFi options are a relatively new and unexplored market. The main difference between trading options in traditional finance vs. trading crypto options is that the crypto markets are permissionless and run 24/7. Besides, crypto markets are typically more volatile, meaning that prices tend to rise and fall more frequently and sharply. This benefits traders in the sense that they stand to potentially achieve better returns if they predict the future price movements in the market (there will be a greater difference between the spot and the strike price). At the same time, SSOVs are a retail-friendly alternative for users who want to earn yield in a passive way. However, despite their simplicity, SSOVs can be way too inflexible for more sophisticated traders.

One of the advantages of European-style options is that they have fixed expiries, which allows for greater composability in other DeFi applications. This also allows for rolling over contracts from one epoch to another. Besides, secondary markets can help buyers who would like to offload their positions prior to expiry – which solves the problem of not being able to exercise at any time. Hedging European options is also easier considering the majority of the current options flow is in European-style options.

The composable nature of Dopex makes it a great product to integrate with other DeFi platforms in order to achieve unprecedented levels of capital efficiency against which not even centralized providers will be able to compete. This efficiency can be aggregated over the broader ecosystem and automated to achieve complex yield-optimizing strategies that can be carried out autonomously. One notable use case of this is the integration with Jones DAO, a protocol that is specifically built for users who want their deposits to be automated and earn yield in a passive way.

Atlantic options are also an example of a product offered by Dopex that has found product market fit, especially in the Arbitrum ecosystem. High-leveraged perpetual futures are the largest crypto-native product, especially because most crypto users like to speculate on the price action of assets with position sizes that are far greater than what they could afford without leverage. However, the problem with these leveraged perpetual positions is that they expose traders to an additional risk of having their positions liquidated. Usually, a wick in the price of an asset is enough to fully close an existing position. Plenty of leveraged longs are liquidated this way.

One of the largest trends since the outbreak of COVID-19 has been the entry of retail investors into options, especially in US equities. This market was previously considered the bastion of highly experienced quant traders and hedge fund analysts. The volume of single stock options rose over 68% in 2020 from 2019 and rose another 35% in 2021 from 2020. In contrast to the institution-dominated crypto options market, over 25% of the total stock options volume stems from retail. This shift was facilitated by brokers who provided a clean and easy-to-understand user interface, along with a commission-free structure and an effective referral program. When it comes to crypto, the adoption of options markets has been lagging due to the high gas costs of Ethereum as well as the low speed of transactions. Besides, the oracles that were used were still in their infancy, and pricing options on-chain proved to be relatively difficult. Part of that was due to the relative immaturity of the crypto markets, the constant volatility, and the lognormality of the price distribution.

It was not until early 2020 that the first options protocol became fairly popular, Opyn v1. Opyn v1 offered fully-collateralized American-style ETH put options. LPs deposited collateral, and wrote options by minting an option token that would be sold in return for a premium. However, these sellers suffered from a relatively illiquid market that exposed them to impermanent loss from the option’s theta decay (loss of value in an option from the passage of time). Next, Hegic entered the market with a dual liquidity pool design that split the liquidity for put and call options. Besides, Hegic also differentiated between LPs and option sellers: the former could deposit collateral but did not have a say in what the latter selected.

Despite fixing the issues around theta decay and impermanent loss, Hegic was a layer-1 protocol and suffered from high gas costs. In December 2020, Opyn V2 was launched and integrated Chainlink oracles as part of European cash-settled options, among other improvements in capital efficiency.

One of the advantages of Dopex is that they are targeting retail investors, rather than institutions. This way, they can tackle a nascent and emerging market that will benefit from lower liquidity conditions and that will mature alongside the broader DeFi options sector. Nonetheless, the value proposition of Dopex is the onboarding of retail users and DeFi-native institutions to SSOV-style weekly and monthly European options. This way, Dopex will seek to rival centralized exchanges like Deribit.

Nevertheless, for an AMM to underwrite options and buy them back, it needs to be hedged. This is a challenging technical implementation as the pool needs to calculate risk for its LPs while pricing options and finding ways to hedge its exposure through spot or futures products. Delta hedging has become more widely adopted to hedge AMM LPs’ capital. In addition to hedging, the focus has shifted toward improving collateralization and capital efficiency. While conventional market makers employ a variety of hedging instruments to limit capital inefficiency, and on-chain CLOB protocols have implemented partial collateralization and cross-margining, any such mechanisms have been widely absent from options AMMs and structured option protocols.

The current landscape for on-chain options can be divided into 4 categories: Automated Market Makers (AMMs), Central Limit Order Books (CLOBs), infrastructure, and structured products:

Overall, the major headwinds for this market sector are inefficient pricing, unsatisfactory and unpredictable returns for LPs, a limited range of maturity dates and strike prices across a small set of underlying assets, and a lack of hedging instruments. Comparing the adoption and TVL of different options products, CLOBs have struggled the most, mostly due to the difficulties and limitations of on-chain performance.

On the one hand, when markets are in a strong uptrend, vaults that sell covered call options significantly underperform holding the underlying token (because when the strike price is considerably exceeded, the yield received from selling call options is much smaller than the returns from holding the underlying). On the other hand, in a downtrend market, the option premiums become smaller than the value that is lost as the underlying asset decreases in price. As a result, option sellers are exposed to the unlimited downside in exchange for restricted upside.

Structured products and DOVs also lead to misaligned incentives between off-chain market markets and vault depositors. Market makers try to purchase volatility as cheaply as possible from the vaults while depositors want strategies that outperform the market on a risk-adjusted basis.

Often, these option vaults don’t have a secondary market for offloading inventory and are constrained to selling to the highest bidding market makers. This leads to inefficient price discovery and causes option contracts to be underpriced. While market makers in a CLOB-based system can dynamically reprice their quotes, LPs on an AMM need to rely on calibrated formulas encoded into smart contracts. Besides, these AMMs use the underlying asset to collateralize the contract while not using any hedging strategies. Because of that, LPs on AMM accumulate a high degree of exposure to the underlying asset, and their payoffs are correlated to the price movements of the asset in the spot market. In other words, LPs are exposed to liabilities and are not adequately compensated for the risks they are taking.

The main difficulty lies in hedging, where the pool needs to calculate risk for its LPs and price options accordingly, while also finding ways to hedge its exposure through spot or futures products. While the hedging of AMM LPs’ capital has become more common, further development is required as these protocols charge high taker fees for LPs to make money since hedging can be expensive. Although delta hedging helps refine LP payoffs, it doesn’t fully eliminate risk. Instead, it allows LPs to derive profits from an AMM’s core business—market-making for implied volatility and capturing spreads.

On-chain order books can use recent advances in blockchain scaling solutions to address their performance concerns, as well as utilize privacy-preserving cryptographic techniques to prevent individual user order and position tracking. Hybrid order books can also leverage their inherent composability with on-chain primitives, such as DOVs, to enhance liquidity. As these primitives continue to improve, implementing both architectures will become simpler, and there may be a turning point where the benefits outweigh the trade-offs compared to centralized alternatives.

Although options are highly flexible and critical instruments for transforming risk, their present utilization in DeFi has significant room for improvement.

Compared to its competitors on the Arbitrum chain, Dopex has the highest TVL at $29.1m, with Lyra coming in next at $20m on Arbitrum with its remaining $12m on the Optimism network

The competitors for Dopex can be broadly separated into 2 categories, being decentralized protocols and centralized exchanges.

Opyn provides powerful investment strategies for DeFi, built on squeeth, a perpetual options system that allows for unbounded upward leverage and no liquidation of long holdings

They provide a range of similar products and utilize a reverse Dutch auction mechanism that is thoughtfully designed, enabling partial collateralization, which is similar to Atlantic Options. However, as the majority of its TVL is on the Ethereum mainnet, the majority of users will have to deal with latency and gas fees that are uncompetitive when compared to Arbitrum.

Opyn mostly provides options based on Ethereum, whereas Dopex’s SSOVs cover options on a wide range of major alternative layer-1 blockchain networks, as well as additional products like gOHM.

Lyra

Lyra operates on the L2 Optimism layer and is likely the most comparable rival to Dopex. The system trades options in a similar way to Dopex, but the underlying assets may differ.

Hegic

Despite being the first to implement the liquidity pool model in DeFi options, Hegic is currently not considered a significant rival to Opyn or Dopex. Hegic’s reputation declined significantly after two significant smart contract bugs happened in Q2 2020, where a typo caused $30,000 worth of ETH to become permanently frozen in a smart contract, and a bug enabled risk-free arbitrage.

Ribbon Finance

Ribbon operates as a structured product protocol, which is different from Dopex. Dopex’s SSOVs require users to choose a strike price, while Ribbon allows its users to set and forget. Ribbon uses its deposits to underwrite options on another protocol (Opyn), whereas Dopex writes options on its own protocol. If Ribbon has a counterpart in the Dopex ecosystem, it would be JonesDAO, which more closely resembles a structured product.

In terms of open interest (OI), options products are still significantly underutilized relative to futures, with only $400 million compared to $20 billion. To provide further context about the potential growth of options, the notional value of outstanding derivatives for equities was $610 trillion as of June 2021, whereas the current figure for the crypto market is only $11 billion.

Deribit

Dopex is not currently viewed as a direct competitor of Deribit in the short to medium term, mainly because Deribit’s primary customer base comprises institutions that employ seasoned professionals with decades of experience to trade for them. The benefits offered by Dopex, such as anonymity, unrestricted access, a user-friendly interface for retail traders, and so on, are not the aspects that experienced traders seek in derivatives platforms. Dopex’s primary customer base consists of retail traders and institutions that are less stringent, such as DAOs looking for a yield on their treasury assets.

At present, Deribit is the dominant player among options exchanges. Liquidity can be an issue for options products due to the fragmentation of expiry and strikes, but Deribit has managed to build a substantial moat around liquidity. However, Deribit only offers options for BTC, ETH, and SOL, and liquidity is significantly lacking for more extreme expiries and strikes. Furthermore, Deribit accounts are coin-margined, which can make managing options positions difficult as users effectively have to trade in a BTC/ETH/SOL-denominated account rather than a USD-denominated one. To address this issue, users can synthetically convert their account to USD by shorting Deribit perps, but this requires an additional execution step. Finally, Deribit is not available in certain regions, particularly the United States.

dYdX

dYdX is a decentralized exchange that operates mostly on the Ethereum layer-1 blockchain but has recently expanded to the L2 StarkEx ZKrollup. It provides services for margin trading and perpetual trading. While dYdX primarily operates on the blockchain, it is a hybrid exchange that uses servers for certain off-chain functions, such as its order book and matching engine.

Dopex is currently available on the following chains:

Options are mostly used for 3 different use cases: hedging, income, and speculation.

SSOV Page: https://app.dopex.io/ssov

Once on the OLP page, there will be two alternative use cases:

Option owners can sell their options to the pool. To do that, they need to own an ERC-721 NFT that was provided to them by Dopex when they purchased the original option in an SSOV. These users will be able to sell their options based on the available liquidity within specific strikes and the discount at which they would want to purchase.

To sell a position on a European option they are holding, they will simply click on the “Fill” button.

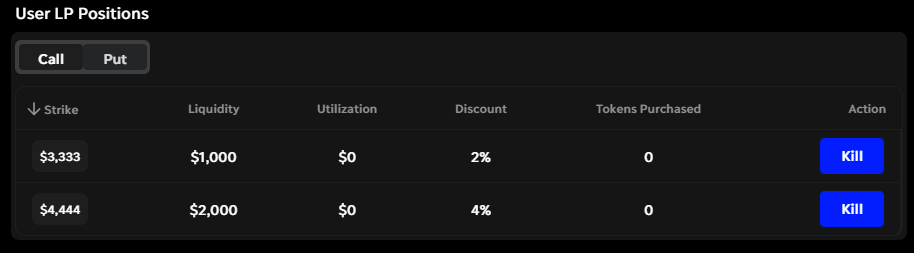

OLP liquidity providers are the ones who end up purchasing the options being sold at a pre-specified discount. First, these users will be required to provide liquidity in order to purchase a put/call at their chosen strike and discount. These deposits can be made in both stablecoins or the underlying asset.

After providing liquidity, users will be able to see their LP positions. They will then choose to withdraw their liquidity at any time by pressing the “kill” button.

Users of CLAMM can deposit either non $USDC or $USDC assets.

After selecting the Liquidity Provision function, they can click on the strikes dropdown menu to view all available strike prices.

Positions that require base asset deposits are denoted with a green arrow while $USDC deposits are denoted with a red arrow. Users can provide liquidity in multiple strikes by filling in the desired amount in the input box.

Liquidity provided can be viewed at the bottom of the page in the positions tab. Any liquidity not being utilized can be withdrawn anytime.

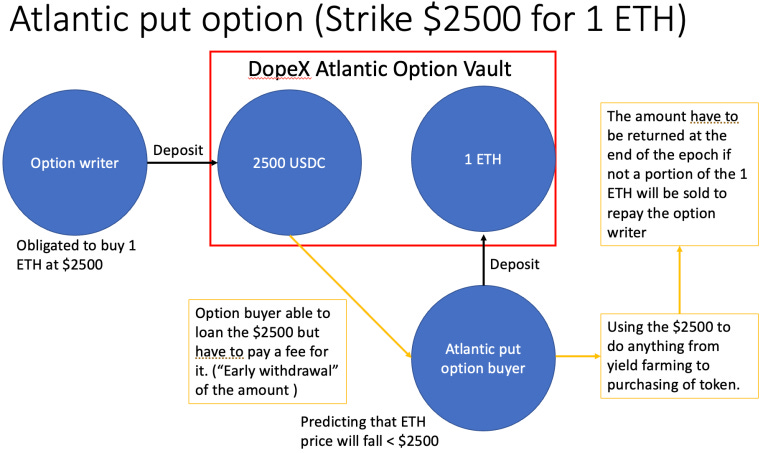

The option writers will have to determine the put option strikes that they would be happy to offer and would need to post the required collateral for that strike in order to be fully collateralized. For example, if an option with a strike of $100 will require $100 in collateral (in USD stablecoins), an option with a strike of $3,000 will require $3,000 in collateral (in USD stablecoins)…

Option writers can choose to write options for one token, multiple tokens, or fractions of tokens.

The stablecoin collateral of option writers is locked for the duration of the epoch and can’t be withdrawn until the end of the epoch. In return, option writers will collect a premium paid by option buyers. At the same time, while the stablecoin collateral remains in the vault, these funds will be used to farm additional yield in trusted DeFi protocols.

SSOV option buyers can buy options during the epoch and pay a premium to option writers. These are European options, which means that they cannot be exercised until expiry. If, at expiry, the options are ITM, the buyers will profit at the cost of writers. However, if they expire OTM, writers will collect premium payments and make a profit from the cost of option buyers.

Note that, since the introduction of SSOV v3, option buyers no longer have to wait until expiry to remove their deposit. Instead, their positions are tokenized as ERC-721 NFTs that can be bought and sold on secondary markets.

If the spot price of the underlying asset moves against the bet of the option buyer, the whole initial investment (premium) is lost. However, if the option buyer bets in the right direction, they will outperform holding the underlying asset.

LPs to OLPs can choose an underlying asset and the strike price from the available SSOV vaults that they would like to provide liquidity. They can also choose the implied volatility discount (1-100%) that will be applied to the Black-Scholes pricing formula whenever a purchase is made. For example, if ETH’s IV is 100 and the user inputs a 10% discount, the option pricing model will be calculated by using a value of 90 for IV. To be an LP the user will simply deposit their liquidity into the pool. Besides, they can close their positions at any time.

Every purchase of SSOV returns an ERC-721 NFT that represents the actual position. OLPs use this NFT as a transfer medium to swap against the orders of OLP LPs.

The OLP page displays the available liquidity at different strikes and discount tiers. This allows option token holders to sell their positions into the OLP at any time during the epoch (as long as there is enough available liquidity). In return for selling their options before expiry, they will need to sell them at a discount to OLP LPs.

As an option buyer, you are betting on the direction of an asset. For example, a user might bet that ETH will experience a volatile price action in the current month, but doesn’t know exactly when. If the user bought a European option, they would be forced to wait until expiry in order to take profits after the option contract has settled. However, thanks to Dopex’s OLPs, a user’s bet can be correct at any time throughout the epoch and, if they wanted to do so, they could cash out in profits without waiting until expiry.

Some of the most common use cases include taking profits from call/put options or purchasing discounted options.

Dopex collects fees from its option vaults. All the fees collected are distributed to DPX token holders at the end of every weekly epoch.

Process stages A

dbrDPX is a decaying bondable rDPX. Writers have to bond this dbrDPX alongside ETH within the bonding period to be compensated for the loss, incurred by an ITM contract being executed.

Process stages B

The outliers in the graph are related to the vault epoch expiries. There are peaks in transactions in the SSOV vaults and the line break in the monthly vault is the result of a change in the smart contracts used for the monthly SSOV3 vaults.

Depositors can only withdraw their funds from SSOVs upon epoch expiries of the vaults they deposited into. This is the reason why there are PnL increases on specific days. Specifically, more liquidity is provided in the higher strike prices on the monthly SSOVs while the weekly SSOVs have a more evenly distributed deposit rate.

veDPX holders receive DPX from the service fees paid by option buyers. This DPX buyback reallocates DPX to those holders that are most aligned with the protocol. Besides, yields that are paid out in ETH are more attractive to outside participants, which is a considerable demand driver. As a result, there are two main types of users who could see locking DPX as an attractive strategy: those wishing to accumulate more DPX, and those wanting to earn yield paid out in ETH.

The SSOV fee multiplier is a percentage-based multiplier that multiplies fees for OTM strikes to account for higher volatility levels.

For example, if the strike price of an asset is 2,000 and the spot price of the asset is 1,000 then the fee multiplier is calculated as:

Fee Multiplier = 1 + ((2000/1000)-1)

Final Fee = Base Fee * Fee Multiplier

Dopex uses the following fee multiplier structure:

SSOVs

Structure

ETH SSOV

Purchase → 0.10% of Underlying * Amount

rDPX SSOV

Purchase → 0.25% of Underlying * Amount

DPX SSOV

Purchase → 0.125% of Underlying * Amount

gOHM SSOV

Purchase → 0.125% of Underlying * Amount

GMX SSOV

Purchase → 0.125% of Underlying * Amount

BTC SSOV

Purchase → 0.125% of Underlying * Amount

CRV SSOV

Purchase → 0.125% of Underlying * Amount

There is no available information regarding the team’s salary or operating expenses.

However, Dopex has 24 team members and/or affiliates that are known, although if and how much they are paid is unknown too. Dopex also uses Chainlink price feeds as part of their infrastructure, which will incur additional expenses.

The total supply of DPX is limited to 500,000 tokens, with expenses emissions as follow:

While there are currently no analytics available, a rough estimation would indicate around 5,625 DPX as rewards per month since inception.

Dopex uses a dual token model where both tokens are meant to work in a synergistic manner. Both tokens are used within the protocol to improve liquidity conditions.

DPX is a limited supply token and is the primary token for Dopex to incentivize liquidity providers.

The $DPX token can be locked as $veDPX and used for voting on governance proposals and ensures that decisions are guided by the community and active users of the protocol.

Dopex collects fees for all of its products. These fees are collected and distributed to DPX token holders who lock their tokens into veDPX. This market buyback is a form of monetary policy and can be considered demand.

Furthermore, with the introduction of rDPX v2, when dpxETH is experiencing a major de-peg of < 0.85 ETH, users who hold more than 1,000 veDPX will be able to perform arbitrage via the Peg Stability Module. As a result, the demand for DPX can come from users who want to arbitrage synthetic pegs across the Dopex ecosystem as well. However, this is a weak demand driver, since the incentive to hold DPX should not be tied to peg stabilization mechanisms.

The total supply is 500,000 DPX tokens distributed as follows:

The public sale took place on June 21, 2021, and a total of 75,000 DPX tokens (15% of the total supply) were distributed. The public sale concluded after 3 days on June 24, 2021. The sale followed a linear graph that determined the final token price for every participant. This way, the final claimable amount of each participant is determined based on their share of total deposits at the end of the sale (there is front-running, and being first or last in participating does not matter).

By locking $DPX tokens into $veDPX, holders gain the right to vote on governance decisions on the protocol, earn revenue from protocol fees, boost rewards, and vote on gauge weights to pools in order to determine the amount of emissions that each pool receives.

Users can lock DPX for up to 4 years. In doing so, those users will receive a veDPX balance based on how long they lock their tokens – the longer the lock, the more veDPX the user will get. Since veDPX acts as the governance token, those that lock for longer will have more control over the liquidity distribution in Dopex. As a result, veDPX is non-transferable and cannot be redeemed for DPX until the lock duration has ended. This way, the supply of veDPX in the user’s wallet will decrease as the unlock period approaches.

The utility of veDPX is being gradually rolled out in order to support use cases such as voting on strikes for put/call pools, voting on interest rate options strikes, deciding on incentives for future products, rDPX v2 parameters…

Token emissions are paid in $DPX, with $veDPX holders receiving a pro-rated share of 10,000 $DPX during the first year of emissions.

Protocol revenue is currently converted into $DPX and distributed pro-rata to $veDPX holders. This is on top of any emissions a holder is eligible for.

The governance system allows $veDPX holders to vote on the following:

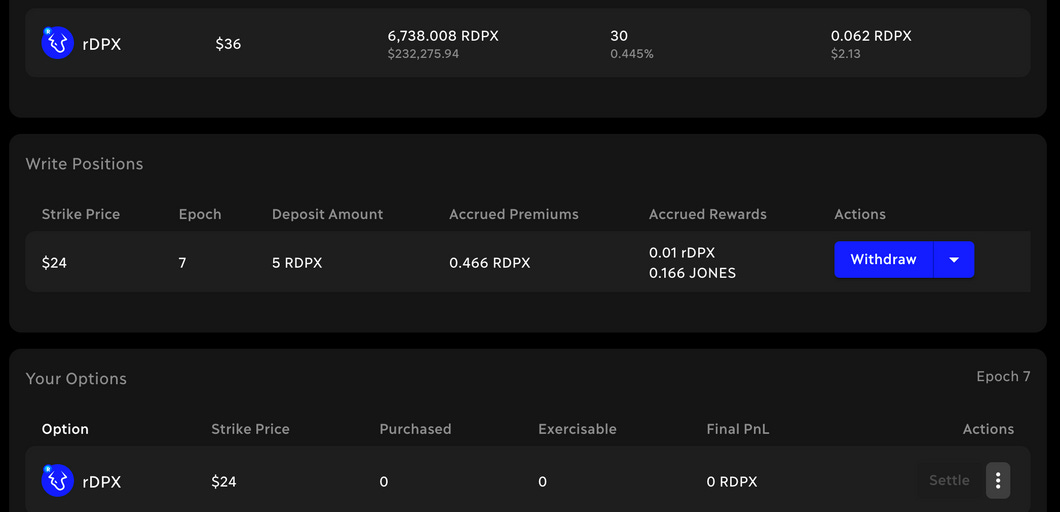

In V1, rDPX was meant to serve the purpose of mitigating the losses incurred by pool participants. This token would be minted and distributed to those participants in order to cover their losses, where the amount of tokens being minted was determined by the net value losses incurred by option writers.

Since rDPX would not have a set emissions curve, it would become more and more scarce if options buyers aren’t net profitable over time.

The utility of the rDPX token has been revamped in its V2 system upgrade. This new system allows rDPX to mint synthetic pegged assets known as Dopex Synthetic Coins (DSC). This upgrade introduces a series of mechanisms that have been developed in order to provide extra utility for the token in the form of minting synthetic assets that will be integrated into the Dopex platform over time.

Single sided staking for rDPX was introduced on December 19, 2023.

It allows users to lock $rDPX single-sided in exchange for rewards, with the option to lock for a minimum of 1 week up to 1 month with a longer lock equating to a larger share of rewards. A max-locked position would receive a 2x multiplier, down to a 1.23x multiplier for the minimum duration.

The incentives timeline is as follow:

Dopex options writers are regularly exposed to risk from losses during periods of high volatility. In order to mitigate this risk, rDPX was conceptualized as an incentives mechanism. By acting as a rebate mechanism for option writers, users could access an attractive source of passive income that could help them offset any disproportionate loss they might suffer due to tail risk events on the market.

rDPX’s bonding mechanism will enable the protocol to accumulate Protocol-Owned-Liquidity (POL) while allowing users to get discounted assets that will be vested to them over a period of time.

Bonding is a tool used by DeFi protocols to bootstrap Protocol-Owned-Liquidity (POL). With this liquidity, protocols can deploy funds to other DeFi protocols in order to earn a yield on their assets. As yield is earned on bonded assets, the backing of the bonded asset increases, which allows for additional bonding and an increasing amount of funds that can be deployed to generate yield.

The bonding mechanism will use the following equation:

X = Y *(1+D%)

Where:

Note that while D is positive, the value of the bond exceeds the value of the bonded assets, allowing bonders to turn a profit after the vesting period. As such, D acts as an internal control mechanism that drives the likelihood of users to participate based on the profit they can make from bonding.

D is a dynamically adjustable parameter to incentivize bonding when the backing is high and disincentive bonding when the backing is low (i.e. the bonding discount is adjusted to drive the user behavior to bond/not bond when the backing is high/low).

If D is too big, that means that the discount is excessive and that the protocol is risking to over-mint X compared to the growth of its Y backing, which will dilute the value of the bond token.

For any given Dopex Synthetic Coin (DSC), we can assume that it is pegged to an underlying. For example, dpxETH would be the DSC equivalent of a DSC pegged to ETH.

Theoretically, DCS can be pegged to any asset by changing the assets that are accepted during bonding as well as the denomination of the perpetual put that is purchased.

dpxETH will be used as an example in this document.

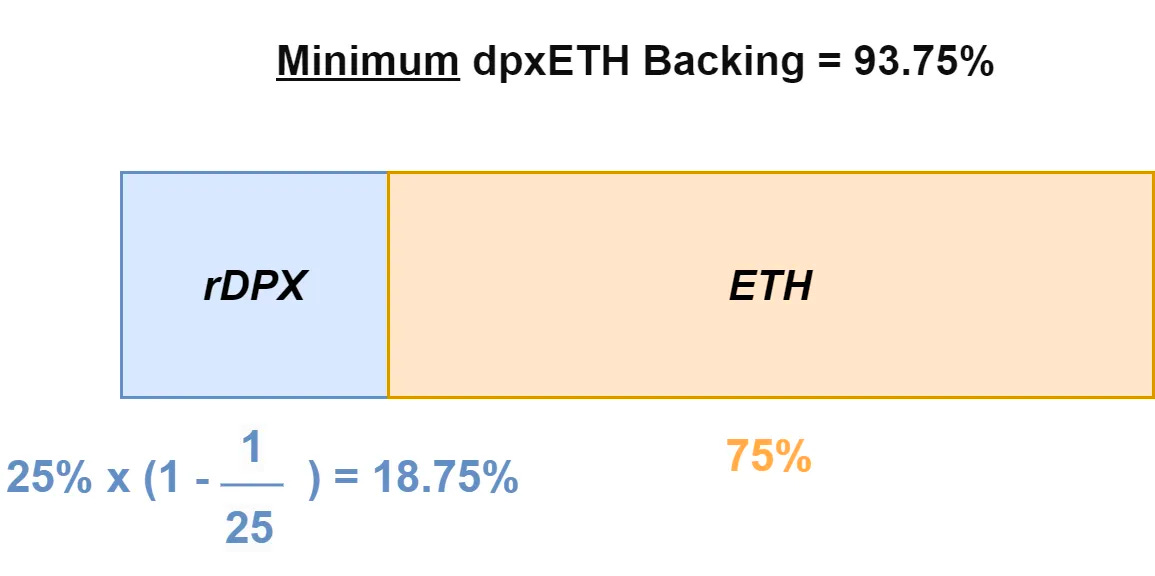

dpxETH is a synthetic asset that is minted via bonding and that aims to be pegged to 1 ETH. To mint the asset at a discount via bonding, users may use 25% rDPX. 75% ETH and a premium for 1 25% OTM rDPX-ETH denominated perpetual put that covers the rDPX amount.

Even though dpxETH is meant to be pegged to 1 ETH, it should be noted that the rDPX component of its backing may fluctuate in value relative to ETH.

The purpose of the 25% OTM rDPX perpetual put is to provide a backstop value for Protocol-Owned rDPX.

At 25% OTM, the dpxETH backing is backstopped at 93.75% of ETH’s value (0.25 * (1-0.25) + 0.75).

The bonding discount is applied using the following formula:

Bonding discount = rDPX LP Bond Discount Factor * rDPX Treasury Reserves

Where rDPX LP Bond Discount Factor is a constant that is set and updated via governance within predetermined parameters. This will allow the extent of the bonding discount (both the size as well as whether it should be positive or negative to incentivize/disincentivize bonding) to be modified based on simulations and market conditions.

The bonded assets are used to build PoL for the rDPX V2 treasury. As the dpxETH backing increases, more bonds can be issued to further grow PoL

The goal of dpxETH is to be interchangeable with ETH in the Dopex ecosystem and, eventually, across the entire DeFi landscape. The first utility of dpxETH will come from a heavily incentivized stableswap pool on Curve. This will allow Dopex to accumulate CVX and CRV token and increase its voting power in the Curve ecosystem to direct emissions and liquidity to the dpxETH/ETH gauge.

As dpxETH is more and more liquid on the market, Dopx will gradually integrate it into its ecosystem. For instance, dpxETH would be allowed as collateral for inverse straddles, SSOV calls, option perps, option scalps…

When rDPX holders choose to bond, single-sided rDPX liquidity is removed from the rDPX/ETH permissioned AMM. This creates a new rDPX/ETH ratio to be used when deploying new PoL generated from bonding to the AMM.

The amount of rDPX that is removed is based on the following formula:

rDPX Re – LP Amount = LP Tokens to bond 4rDPX supplyrDPX in LP Base LP Percent

Where:

Base LP Percent = Treasury rDPX ReservesRe-LP Factor

And:

Re – LP Factor = 0.09

For example, with a liquidity pool of 10,000 rDPX and 1,000 ETH, the re-LP process works as follows:

The result is:

The rDPX/ETH permissioned AMM is a standard 50/50 AMM that uses the constant product formula for pricing. The AMM will only be used to provide liquidity for Protocol-Owned rDPX and ETH.

Once token incentives are deprecated on other pools, the v2 AMM will become the de-facto on-chain exchange for all transactions involving rDPX.

The rDPX/ETH Perpetual Put Pool aims to create a backstop for the rDPX backing dpxETH and will work alongside Dopex Peg Stability Modules in order to provide an additional layer of security.

At the time of bonding, 25% of dpxETH is composed of rDPX. Since the value of rDPX fluctuates over time relative to ETH, there may be concerns of dpxETH being unbacked when the rDPX backing value falls relative to ETH.

rDPX/ETH-denominated perpetual puts allow the rDPX V2 system to backstop the collateral value of the rDPX backing dpxETH to the collateral value of the purchased put.

Since perpetual puts will target 25% OTM rDPX in ETH terms, the minimum backing of each unit of dpxETH is 93.75% ETH (rDPX minimum component = 0.25 * (1 – 0.25) = 18.75%; ETH component = 75%).

Options writers will be able to deposit ETH into the rDPX/ETH Perpetual Put Pool where the options will always be 25% OTM relative to the mark price of rDPX/ETH. This mark price is determined at the time of purchase, rather than at the time of deposit by the option writers.

Note that since puts are ETH-denominated, premiums and funding will be paid to writers in ETH.

Writers will be paid an initial premium at the time of bonding for the first epoch (with epochs set to 1 month). As the liquidity rolls over to future epochs, the strike prices, number of options to be purchased, and volatility will be recalculated to ensure that the ETH backing of rDPX that is provided by the perpetual put pool is sufficient to backstop the rDPX component backing of dpxETH at 18.75% (0.25 * (1 – 0.25) = 18.75%).

Premiums for future epochs are paid in the form of funding.

In the event that options expire ITM, the losses will settle against the value of the writer’s deposited ETH collateral.

As long as there is sufficient liquidity in the pool to backstop the value of rDPX, option writers may exit their positions.

In exchange for the risk they are taking, options writers are compensated with:

Since the value of the collateral backing dpxETH is backstopped by rDPX/ETH perpetual puts, its circulating supply is limited by the available put liquidity. Because of that, the circulating supply of dpxETH will target a maximum of 4 times the total ETH liquidity in the put pool. If this amount is not reached, then no additional dpxETH can be bonded until additional write-side liquidity is added to the pool.

Given dpxETH’s synthetic peg, there needs to be a Peg Stability Module (PSM) to maintain the price parity with the target asset, ETH. Initially, all the liquidity will be in a dpxETH/ETH pool on Curve. As a result, the price of dpxETH will be derived from Curve’s stableswap AMM (which means that the price of dpxETH relative to ETH will depend on the ratio of asset balances in the pool).

To mitigate the risks of de-pegging, the PSM will account for 3 levels of de-pegging:

While dpxETH > 1.01 ETH, the dpxETH minter contract will allow ETH holders to bond only to mint dpxETH. Given the arbitrage opportunity, the mispricing on Curve will then allow new minters to bond ETH to mint dpxETH and then swap dpxETH for ETH on Curve to make a profit. This will increase the supply of dpxETH in the pool and return the peg back to a normal range.

When dpxETH is slightly underpriced relative to ETH, the rDXP v2 treasury will allow veDPX holders with > 1,000 veDPX to swap ETH for dpxETH from the Curve pool.

This will make it possible for the treasury to arbitrage the price difference and increase the ETH balance in the pool to return the dpxETH price back to the range.

When dpxETH is significantly underpriced relative to ETH, veDPX holders with > 1,000 veDPX can redeem dpxETH for its underlying backing in the form of 75% ETH and 25% rDPX.

This allows veDPX holders to swap ETH for dpxETH from the Curve pool and redeem it for 1 ETH worth of rDPX and ETH in a 25:75 ratio from the treasury.

Even though the collateral backing of dpxETH and the price are closely correlated, they are dictated by distinct underlying mechanics.

The utility of the Peg Stability Module is to allow the treasury to correct de-peg scenarios that are unrelated to the dpxETH collateral value.

With v2, Dopex reinforces its vision to make rDPX the rebate token of the Dopex ecosystem. V2 achieves this by introducing a decaying bondable rDPX, dbrDPX, a system that is meant to compensate for the losses of option writers.

When options writers underwrite options that end up ITM, their deposits are used to compensate the buyers of those options. While options writers are compensated for the risk they are taking by earning a premium, they can still incur losses that are not compensated by the protocol.

The option writer rebate system has the objective of using dbrDPX to compensate for writer losses. Rebates will be distributed as a variable percentage of writer losses with a predefined maximum cap.

The rebate percentage may be adjusted by veDPX holders via governance.

dbrDPX is an ERC-721 NFT that is given to option writers depending on the rebate percentage of the vault from which they suffered the loss. The only way to realize the value of the NFT is via the standard bonding procedure, where the value of dbrDPX will reflect the required amount of rDPX.

For example, if a user dbrDPX to the value of 0.25 ETH, they can only bond it with 0.75 ETH to receive 1 dpxETH (plus the bonding discount). This ensures that no new rDPX is emitted into the circulating supply. Instead, the only emissions will remain as PoL in the v2 AMM.

Each dbrDPX will have a fixed expiration date and rebates that are not bonded within this period of time will expire worthless.

Like any other DeFi protocol, Dopex is exposed to smart contract risk. Not only are option smart contracts relatively new and complex, but the application of Options pricing models to an EVM implementation can add extra complexity and unpredictable risk exposure.

The promise of decentralization and removal of middlemen can also be perceived by many as a lack of accountability from an anonymous team. While that anonymity can function as a badge of honor in a DeFi environment, it can also allow for potentially malicious behaviors. However, up until now, the Dopex team has a long track record of protecting user funds and building innovative products, all while taking steps towards increased transparency through measures such as audits, Gnosis multisigs, decentralized governance…

The team multi-sig only requires 2/4 signers.

There are no documented hacks since launch and the code has been audited. The protocol has stood the test of time since its launch in 2021, which reduces smart contracts risk.

Dopex has had the following audits performed by Solidified and Solidity Finance.

Audit Report for Dopex – June 21, 2021 – Solidified

Smart Contract Audit Report – April 11, 2021 – Solidity Finance

Dopex SSOV Smart Contract Audit Report – February 17, 2022 – Solidity Finance

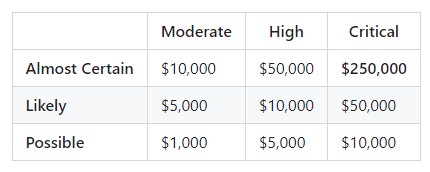

The program is a community-wide bug bounty program to involve the community in ensuring a safer platform for all, and aims to incentivize responsible disclosure and enhance the security of Dopex.

Rewards will be allocated based on the severity of the bug disclosed and evaluated and rewarded up to $250,000 and the scope, terms, and rewards at the sole discretion of the Dopex team (the “Team”).

The current bug bounty structure is as follows.

One of the reasons why Deribit has managed to dominate the options crypto markets is partially due to its cross-margin system, which allows large traders to maximize the efficiency of their capital through partially collateralizing multiple trades with the same collateral. In fact, centralized providers can afford to offer risk management measures such as backstops, partial liquidations, and insurance funds. However, decentralized offerings cannot achieve those levels of capital efficiency without exposing themselves to additional risk. That’s the reason why Dopex SSOVs are over-collateralized. In the short term, over-collateralization is likely to continue being the norm, since no decentralized protocol will be able to reach the same levels of risk mitigation as Deribit while accepting partial collateral.

In Dopex, since the entire liquidity pool is the counterparty to all written options, hedging their risk can be difficult since the pools need to be fully collateralized. As a result, Dopex can only allow for minimal options trading on margin, which is a critical feature for institutional investors.

Dopex raised 4,808 ETH during the public sale.

Dopex is also backed by the following investors which, for the most part, are angel investors and well-known “whales” in crypto circles.

The investors include:

Options are a financial derivative instrument. In traditional finance, options are a multi-trillion dollar market, where options traders often drive the movements of the stock market.

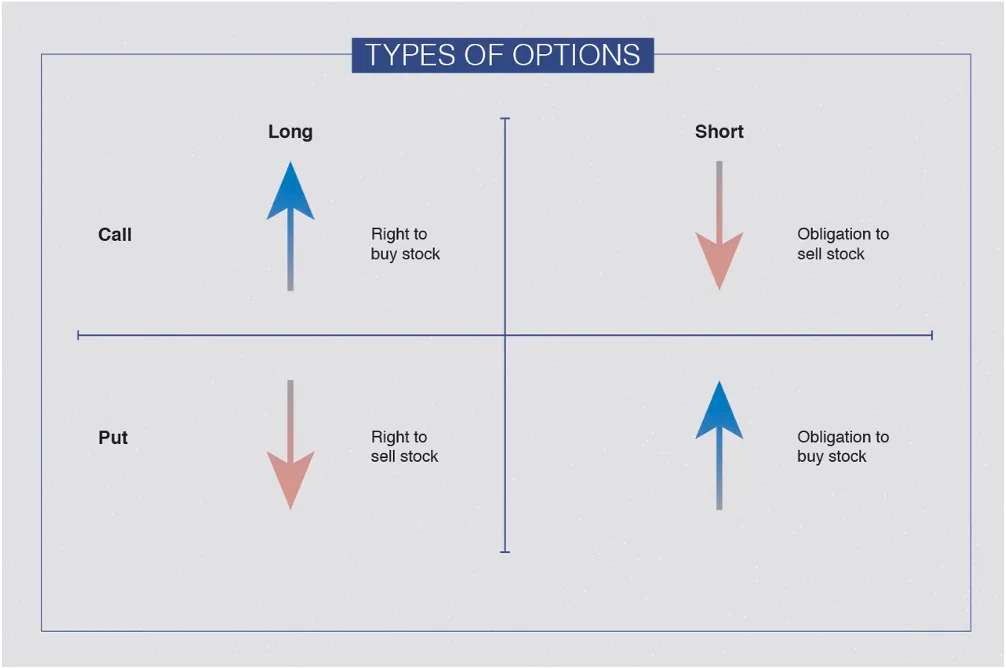

An option gives the holder the right to buy or sell a particular asset at an agreed-upon price (the strike price) at a specific date (expiration date). After the expiration date, the holder can no longer buy or sell the asset at the strike price and the option contract is worthless..There are two kinds of options:

Options can have many different strike prices and expiries, which gives traders a variety of potential hedging solutions.

Traders classify options into 3 different groups:

Payoff graphs are often used to gain an intuitive feel for options since they represent the potential PnL for long/short positions.

Short selling options mean selling first and buying later at a lower price.

The 3 biggest determining factors for determining the price of an option are:

If an option is ITM, it is said to have intrinsic value.

For example, if you buy the $80 strike call for an asset worth $100, you can immediately exercise for a $20 profit. When you buy this call, the $20 intrinsic value is baked into the price of the option (you don’t get it for free).

The more time to expiry, the more time there is for the asset to move in price and the more expensive the option is.

The price of an option is strictly increasing with respect to time.

The implied volatility (IV) of an asset expresses how much the asset is expected to move until expiration (expressed as a percentage).

The higher the IV of an asset, the more it is expected to move and the more expensive options are.

The lower the IV of an asset, the less it is expected to move and the cheaper options are.

Since the price of an asset and its expiration date are known variables, the implied volatility of the asset is the biggest driver of pricing differences between options traders.

Volatility is a measure of how much something moves. When traders discuss volatility they are referring to either of:

The market volatility of an asset is a result of price swings and refers to past or historical performance (e.g crypto is volatile, bonds are stable). This is referred to as historical or realized volatility

Historical volatility is a measure of how much the price changes over a given period of time. If an asset is expected to move 2% a day, and instead moves by 10%, it will be referred to as having a high realized volatility. Similarly, if an asset normally moves 5% per day and then moves by 2%, it will be said to have low realized volatility.

Implied volatility is the market’s expectation of how much an asset will move. This is reflected in the price of an option’s contract that expires in the future. This is an estimated number. For example, an asset with 50% implied volatility is saying that the underlying asset is expected to trade within a 50% range (high to low).

The Greeks are used to determine the price of options when there are changes to the implied volatility, the price of the asset, and the time to expiration.

There are other Greeks known as minor Greeks that, while not useful to the average trader, could be helpful for more experienced users:

The Greeks are an important skill when it comes to trading options and understanding risk. Even though the Greeks help to take the guesswork out of options trading, it is worth noting that the value of Greeks is constantly fluctuating and does not work in isolation, meaning that the movement in one Greek is likely to affect the value of others. To manage this complexity, a trader can rely on a framework like the one provided below:

It is worth noting that the Greeks are calculated using theoretical models that operate on assumptions, and therefore, they are only as accurate as the models used to quantify them.

Dopex has partnerships and integrations with the following protocols:

Dopex features a frontend registry aiming to enhance the decentralization and resistance to censorship of its system. This Frontend Registry is a place for Dopex Frontend Operators to make their existence known in order to get added to the Dopex.io Frontend Registry. This also allows the community members, to develop front-ends for the Dopex protocol and register it for others to use.

Diamond Grants are part of the Dopex Grant Program, dedicated to stimulating growth and innovation within the Dopex ecosystem. The program’s primary aim is to fund projects and ideas that will significantly contribute to improving the protocol and its ecosystem, and applicant types may include:

Diamond Grant recipients will be supported by Dopex in several ways:

Applicants can maximize their success by ensuring that their application includes supporting factors like:

To apply for a Diamond Grant, applicants should submit a proposal that includes:

The Dopex Rewards Board is a site that contains all ongoing Dopex programs, contests, and giveaways, providing users with a convenient one-stop site to follow events and tasks that they will be able to assist with.

Some examples includes: