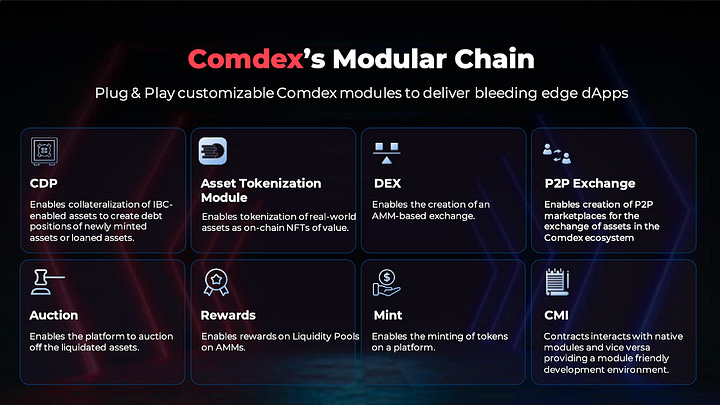

Comdex is an infrastructure layer for the Cosmos ecosystem. Comdex was built to facilitate the seamless deployment of DeFi applications in the Cosmos ecosystem as well as to enable multi-chain communication and capital transfers between the CeFi and DeFi realms. To fulfill its mission, Comdex offers plug & play customizable modules such as:

Developers can build applications on Comdex by putting together different modules that enable specific functionalities. This simplifies and speeds up the development of new applications in the Comdex ecosystem, since developers can reuse common functionality that is used in most applications, such as asset whitelists, custom pools, liquidations, price oracles…

Each of the modules enables developers to deploy products built on top of them by using customizable parameters. For instance, using the asset module and the vault module, it is possible to tokenize assets on-chain and then collateralize them to generate liquidity or debt through minting synthetic assets (such as stablecoins).

The asset module enables the creation apps, genesis tokens, assets, pairs, and vaults:

The auction module holds the key functionality for creating/managing auctions. It supports 3 different types of auctions:

The bandoracle module is used to fetch asset prices.

Packets are relayed every 20 blocks, which means that prices are updated every 20 blocks as well.

The collector module is used by protocols to collect revenue and accumulate earnings from protocol fees. These fees can then be used by the protocol for a variety of use cases: revenue share, insurance…

ESM stands for Emergency Shutdown Module. This is triggered by protocols when they are facing an emergency, such as an economic attack, a hack, or any other kind of security incident.

To execute an emergency shutdown and gracefully stop protocol functionality, token holders can burn their governance token until they reach a target amount that will allow them to execute the transaction.

The lend module enables collateralized borrow-lending activity of whitelisted assets. Users can deposit IBC-enabled assets in a whitelisted pool and start earning interest on their assets. Similarly, borrowers can deposit assets and enable their use as collateral in order to take out loans that they will repay with interest. A portion of the interest payments will go to lenders, and another portion will be kept by the protocol as revenue (which will often go to the collector module).

The liquidation module handles liquidations when the collateral requirements of borrowers do not satisfy a specific health factor. This is achieved in Comdex by creating a locked vault to which the vault owner will have no access. Next, liquidators will be able to access those funds in exchange for repaying the borrower’s debt.

The liquidity module enables the creation of liquidity pools that facilitate the execution of AMM traders, orderbook-based exchanges, and farming activities. This module supports features such as creating liquidity pools, adding/removing liquidity, market/limit orders, or farming and claiming rewards.

Locker modules allow users to deposit funds in a vault in order to earn rewards on their deposit. These rewards are often distributed by an implementation of the collector module. The revenue is distributed on a block basis and is calculated as a fixed annual rate.

The market module sets the price fetched from the bandoracle module on any given market.

Rewards are distributed by the rewards module by keeping track of a starting timestamp, and a pre-specified duration. Protocols can choose to enable both internal and external rewards to their applications as well as to whitelist access to specific assets.

Apps use the tokenmint module to mint a genesis supply for their own tokens. Only one governance token can exist for an app, while multiple non governance token can be used within an app.

The vault module holds core functionality to support the creation and management of CDPs (collateralized debt positions). Vaults are created by locking up a whitelisted asset and drawing out assets. In combination with the bandoracle module, the vault will keep track of the collateralization ratio of any given position. This way, whenever the collateralization ratio of the position falls below the minimum threshold value, a liquidation event will be triggered.

Given the focus on bridging CeFi and DeFi, Comdex has the potential to build more customizable and generalized modules that facilitates meeting the requirements of centralized parties. This will speed up the process of tokenizing RWAs on-chain.

Future modules will facilitate the representation of ownership and exchange of physical assets, like precious metals and commodities, without the limitations of mobility. The core objective is to provide a seamless flow of capital across assets. On-chain assets will serve as the representation of off-chain assets that remain under the custody of a trusted intermediary.

The ID and RFT modules could be used together for use cases where the identity of users who modify asset properties must be stored immutably.

Comdex was born with the mission of bridging DeFi to CeFi and allowing for the tokenization and digital exchange of real-world debt and assets. This would increase the global accessibility of investment vehicles to the common investor.

Back in 2018, Comdex was built to streamline and tokenize the commodities trading industry. However, the design space was constrained by the absence of DeFi primitives in the Cosmos ecosystem. Over time, Comdex has transitioned from a close-ended enterprise-focused blockchain ecosystem to a layer 1 blockchain on Cosmos. By building a modular chain, its goal is to make it easier for developers to be onboarded and start building applications that support IBC-enabled assets. This will allow the project to access the aggregate liquidity of IBC-enabled chains.

Comdex was founded in 2018 and deployed in Cosmos in order to fulfill the scalability and privacy requirements for its Enterprise Trading Platform, which ended up going live 1 year later.

In 2020, due to regulatory hurdles associated with cross-border fiat payments rails (e.g., in-person KYC/AML) and the lack of native DeFi primitives on Cosmos, the team shifted its focus and started building out the Comdex chain. By Q4 2021, Comdex’s mainnet was ready and the native CMDX token was deployed.

The Comdex Mainnet went live on 20th November 2021 with a 100,000,000 CMDX genesis supply. 12.5% of the genesis supply (12,500,000 CMDX) was in circulation as of the launch of CMDX.

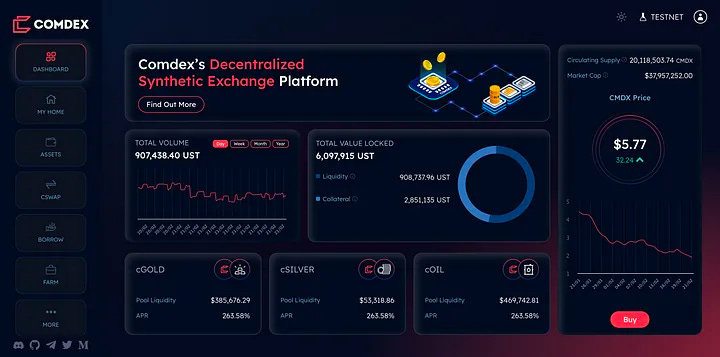

Comdex’s initial suite of products includes Harbor Protocol, a CDP platform that supports the CMST stablecoin, cSwap, a hybrid orderbook-based AMM DEX, and Commodo, a decentralized money market protocol. These 3 initial primitives were deployed between November 2022 and January 2023. Over time, the ecosystem will grow to support a wider range of applications, such as synthetics, trade financing, perpetual futures, the launch of Comdex’s validator arm Zenscape…

Apart from building the ecosystem, Comdex will also seek to attract more real-world commercial and financial activity. ShipFi will play an important role on that front, as it will facilitate the creation and exchange of trade finance debt.

On May 22 2023, Comdex published its roadmap update for 2023, including key objectives and quarterly checkpoints.

Key objectives include:

Apart from the key objectives, quarterly checkpoints include:

Apart from the roadmap, the team is also exploring other options to increase on-chain security through integrations such as Interchain Security or the Alliance model, which will provide a strong benefit for Comdex and its growing ecosystem of products. The team will publish a detailed outline of Comdex’s plan to fortify chain security once these details are finalized.

The team is also dedicated to creating opportunities to attract new users. The proposed EVM module will play a crucial role in enticing new developers to join the ecosystem. Since most blockchain developers specialize in Solidity, facilitating their onboarding process becomes an effective strategy to foster new use cases and ultimately bring in new users to the ecosystem.

Comdex is an ecosystem that offers services, such as its Enterprise Trade Platform or Zenscape, and that supports applications built on top of its L1 chain, such as Harbor Protocol or cSwap.

As a layer-1 sovereign chain in the Cosmos ecosystem, Comdex benefits from the interoperability of IBC. This gives it a competitive advantage for the expansion and adoption of their overcollateralized stablecoin, CMST. Potentially, given that the overcollateralized model for stablecoins has been battle-tested for years, CMST could fill the gap left by UST after the collapse of Terra.

The modular architecture of Comdex makes it a great candidate for bootstrapping a full-fledged DeFi ecosystem (dex, money market, CDPs, synthetics…) and developer environment. At the same time, being present in the Cosmos ecosystem can allow Comdex to achieve a larger user base and greater scale in terms of liquidity.

Comdex also launched with a vision to democratize and revolutionize the commodities trade industry by building a sovereign layer-1 chain that enabled the bridging of capital assets across the DeFi and CeFi ecosystems.

When it comes to the competitive landscape in the Cosmos ecosystem, Comdex is competing with Canto, Kava, and Kronos to fulfill the gap left by Terra. These competitors also offer a full-fledged DeFi ecosystem based on an underlying PoS blockchain that can offer core DeFi primitives such as a Dex, a lending market, and a decentralized stablecoin. One of the key differences is in their stablecoin offerings. Cronos does not offer a native stablecoin, while Canto’s NOTE is not actually a stablecoin, but a unit of account around the dollar whose stability is determined by lending rates. Kava features USDX as their own overcollateralized stablecoin.

Chains that are similar to Comdex in the Cosmos ecosystem are Canto and Kava.

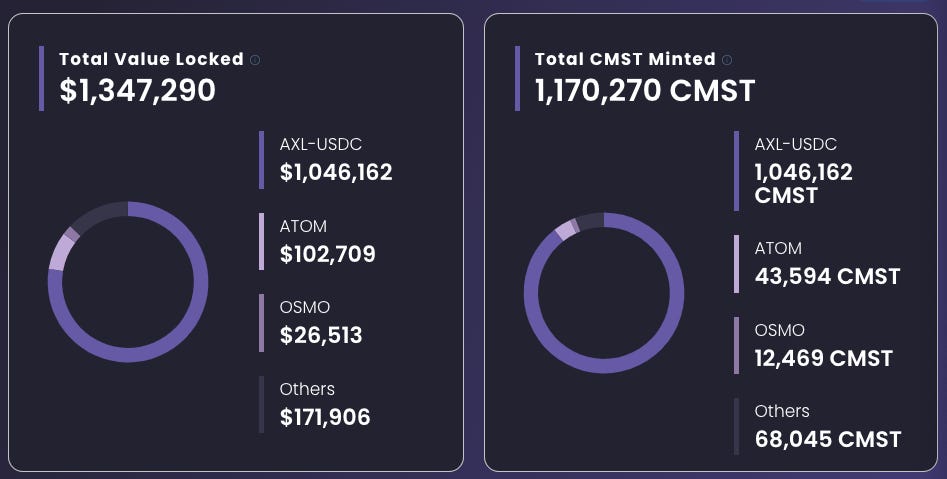

In terms of TVL, Comdex contains around $2m in the chain, with 3 dApps in total.

Canto contains around $119m in the chain, with 12 dApps in total.

Kava contains around $245m in the chain, with 86 dApps in total.

CMST is a stablecoin by Harbor Protocol, while NOTE is a stablecoin (or unit of account) on Canto.

The Harbor Protocol contains around $1m in TVL, which makes up half of Comdex’s TVL.

Canto lending, which is where NOTE can be borrowed, contains around $36m TVL, which makes up 30% of Canto’s TVL.

Abhishek Singh (CEO) and Siddarth Patil (COO) are the founders of Comdex. Abhishek Singh is an Engineer by trade. Prior to founding Comdex, he was working as a Business Intelligence Consultant. Siddarth was working in Investment Banking, Wealth Management, and Management Consulting. Now the Comdex team has 30 members.

The Comdex chain is a Tendermint-based and IBC-enabled layer1 blockchain built with the Cosmos SDK.

Comdex supports the permissionless entry of new validators through its Validator Delegation Program, which runs in 6 month cycles where Comdex delegates up to 3,000,000 CMDX per validator.

It takes on average > 33% of the voting power to halt a Cosmos chain. With a Nakamoto Coefficient of 13, Comdex is one of the chains with the highest Nakamoto coefficient in the Cosmos ecosystem. See reference comparison below with major layer one chains.

The Nakamoto Coefficient is a measure of decentralization in a blockchain network. It represents the minimum number of entities (nodes or validators) that would have to collude together to successfully slow down or block any respective blockchain.

When it comes to building applications, developers are required to whitelist both their applications and supported assets through governance. This will give them access to all of the modules supported by Comdex in order to deploy decentralized applications in a live environment.

As of Q1 2023, Harbor dominates the TVL with more than half of the liquidity. The dominance of Harbor is expected to decrease as the chain grows and more protocols are deployed on it.

Validators can contribute to the Comdex ecosystem in multiple ways:

In order to be eligible for participation in Comdex’s Validator Program, participants must meet the following requirements:

Harbor Protocol in an Interchain Stablecoin protocol that allows for the creation of CDPs by locking whitelisted collateral assets in order to mint CMST, which is an IBC-enabled fully-collateralized stablecoin native to the Comdex ecosystem.

Composite, CMST, is a stablecoin designed to represent purchasing power and each unit is soft-pegged to 1 USD. Its mechanism design follows the MakerDAO standard that is applied to DAI: CMST can be permissionlessly minted as a debt against an overcollateralized CDP (Collateral Debt Position) that backs its value.

In the Harbor Protocol, 1 CMST is always treated as 1 USD. However, in secondary markets this value might deviate from its peg due to the influence of supply and demand forces. The peg is stabilized through a monetary policy enforced by the Locker Savings Rate (LSR) module. This way, every unit of CMST that is minted accrues a stability fee on it until debt is repaid. Similarly, every unit of CMST that is locked in the LSR module will earn rewards.

The Harbor Protocol consist of 3 primary modules:

The minting process of CMST starts by opening vaults by depositing collateral. Each vault will be classified based on the collateral asset and the vault’s risk type. Every time a vault is opened, a unique vault ID is linked to a wallet address and interest will start accruing every block. The interest rates will vary across asset types and vault risk types, with the riskier vaults having the higher interest rates. Once a CDP is opened, users can withdraw collateral, add collateral, draw more debt, or repay debt. To close the vault, the debt must be repaid in full with interest and the locked collateral will be transferred to the user’s wallet.

When debt is repaid, the interest is transferred to the Collector. This is the module where all the fees and protocol revenue get accumulated. The collector earns revenue from liquidation penalties, stability fees, drawdown fees and stablemint fees. The only deduction comes from the LSR variable interest rate that is accrued by users who lock their CMST in the Locker module.

When the Collector module surpasses a threshold, the excess revenue in CMST tokens is used to purchase HARBOR tokens via an auction process and burned in order to reduce supply.

With the Earn feature, users can deposit CMST in the LSR module and earn interest that is compounded and added back to the module. The Locker module allows CMST holders to earn variable interest on their principal by locking CMST into the Locker Vault. LSR is the term used to define the interest rate that is applied in the Locker module. This interest rate is compounded per block. The primary goal of this module is to maintain CMST’s peg.

The Locker Savings Rate and the stability fees are used in tandem in order to balance the supply and demand of CMST.

Users can also interact with the Stablemint feature, which allows them to profit from arbitrage opportunities by swapping between USDC and CMST in exchange of a transaction fee calculated as a percentage of the transaction value being traded. By swapping CMST for other whitelisted stablecoins rather than borrowing it, users help to stabilize the peg.

Harbor Protocol also iterates over the MakerDAO model and implements a ve(3, 3) scheme where users can lock HARBOR tokens (up to a maximum of 4 months) in return of a veHARBOR balance (veNFT)which gives them access to governance rights and voting power on key protocol parameters such as the distribution of rewards.

CMST borrowers on Harbor are rewarded with HARBOR emissions

In order to encourage CMST adoption, 50% of the total supply is distributed to users in the form of emissions over roughly six years.

In order to prevent dilution, veHARBOR holders receive a weekly rebase.

The amount of HARBOR locked as veHARBOR and the inflation rate of HARBOR emissions have an inverse relationship. For instance, if only 0% of the HARBOR in circulation is locked, all emissions will go to vault owners, but if 100% of the HARBOR is locked, emissions will go entirely to veHARBOR lockers.

The goal behind the ve(3,3) feature is to offer an incentive for users to lock HARBOR in order to reduce the circulating supply, reduce the emissions, and consequently, have fewer HARBOR tokens circulating on the market.

Also, holders of veHARBOR participate on weekly voting rounds to decide what vaults should receive emissions during a particular week. External protocols can also benefit from this mechanism by incentivizing the minting of CMST by providing additional token incentives to veHARBOR holders.

The protocol earns revenue through stability fees (interest on CMST), drawdown fees, stablemint fees, and liquidation fees. These fees are routed to the collector module, which collects all of the fees. This module has a surplus and a debt threshold. When the system surplus exceeds the threshold, it indicates that the system is expanding. As a result, all fees collected above the threshold are used to buy back and burn Harbor tokens from the supply via surplus auctions. On the other hand, when the system is contracting, and the surplus module falls below the threshold, there is a requirement for CMST to be pegged, and Harbor tokens are minted.

cSwap is an orderbook interchain DEX built on Comdex. As an IBC-enabled DEX, cSwap offers cross-chain markets and combines mechanisms of both AMM-based liquidity pools and orderbook-based systems. This allows for features such as limit orders and equal-weighted pools that facilitate trading with minimal fees.

Similar to most liquidity pools, there are no bonding periods for liquidity providers, and they deposit and withdraw their liquidity at any time. However, cSwap differentiates itself by integrating an orderbook that keeps track of buy and sell orders.

cSwap’s orderbook features both limit and market orders:

This exchange model offers composability, capital efficiency, and concentrated liquidity, which benefits both market-making and sophisticated trading strategies.

Users can deposit tokens into the liquidity pools in order to start earning trading fees and token incentives. After depositing, liquidity providers get a receipt in the form of LP tokens that represent their contribution to the pool.

There are two types of pools in cSwap:

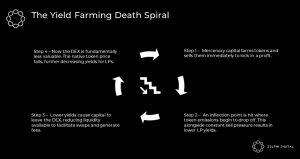

In order to protect the incentives token against “mercenary farming” (the practice by which some users farm and collect rewards and then they sell them as soon as the yield starts to decrease), Comdex suggests a general model that can be used by any protocol, and cSwap is an example of this. Under this economic model, users must provide some kind of assurance or collateral in the token that is being rewarded in order to be eligible for earning rewards and maximizing the yield they are earning. This way, the tokens are received by users who are already providing liquidity to the protocol, which incentivizes them to provide more liquidity and farm more rewards, rather than selling them on the open market.

The incentives are directly proportional to the liquidity provided in that incentive token pool. For example, assuming an incentive token XYZ, a user would need to provide liquidity to the XYZ/CMDX pool in order to maximize their rewards on other protocol-wide pools. As a result, it would be in the user’s best interest not to dump the incentive token they are earning, since that would directly impact their LP position in the XYZ/CMDX pool.

The goal behind this design is to prevent a yield farming “death spiral” where high yields initially attract liquidity providers. Experience shows how this brings in “mercenary farmers” who capture the high yields and then sell immediately and leave the pool as soon as emissions drop off. As capital abandons the systems, both fees and APR incentives go down, which makes the DEX less valuable as a whole on top of negatively impacting the price performance of the native token.

Following the example above, with the XYZ token being used as incentive, the token would be provided as liquidity mining rewards to LPs on the Dex. When those tokens are solely used for rewards, they would be sold on the open market, since those tokens would have no actual utility. In order to avoid this scenario, an alternative mechanism would attempt to keep the token as a central point to the ecosystem, such that anyone who wants to maximize their yield would need to have exposure to this token.

One alternative is to lock the rewards token for weeks/months, similar to the ve model pioneered by Curve. For instance, the master pool, i.e. the CMDX/XYZ pool would be the core pool of the ecosystem and would be used as the reference for the distribution of incentives. Users would then be able to lock liquidity for a longer timeframe and earn liquidity mining rewards proportional to their share in the pool and the timeframe they have locked liquidity for. This would make this pool the center of liquidity and lock increasing amounts of CMDX for the DEX.

This offers a series of advantages over the original ve token locking model:

The rewards received by users may be in the form of APYs or any other sort of incentives and will depend on:

Overall, this concept of ve-locking promotes long-term liquidity provisioning and governance benefits in a user-friendly way, such that users can deploy capital in a specific way to their strategies. In addition to that, the LPs of this pool would also be able to direct incentives to certain pools, just like the veCRV holders.

Original forum proposal: https://forum.comdex.one/t/the-incentivization-plan-for-our-upcoming-dex/287

To be eligible for internal rewards, users must provide as much liquidity in the child pool as they have in the master pool. This means that users who deposit assets into the master pool can receive only external rewards, while users who provide equal amounts of liquidity in both the master and the child pool (either one child pool or multiple child pools) can earn additional internal rewards.

In other words, those that provide liquidity to both the child pool and master pool are eligible for receiving pool fees, external rewards, and internal fees (in the form of CMDX). However, providing liquidity to only a child pool or master pool will disqualify one from receiving internal rewards.

Both of these rewards are created with the rewards module on-chain. Any pool on cSwap can be a master pool or a child pool at the same time, depending on the rewards created for the pool. Besides this classification, cSwap also supports traditional external incentives.

Tradable assets must be first whitelisted onto cSwap through the Asset module on Comdex. Users can propose assets through governance proposals. As an alternative, it is also possible to whitelist asset pairs by paying a pair creation amount to the protocol in a permissionless manner.

When a pair of assets are deposited in a liquidity pool, they will support trading with a constant-product AMM (x*y=k). The price of the asset changes as a result of changes in token balances.

Because of the AMM design, there is risk of impermanent loss. Due to the use of the constant product formula, the ratio of the assets in the pool changes every time there is a swap. As a result, the extent of impermanent loss is proportional to the volatility of the assets in the pool.

Users that place limit orders can specify the amount, price, and duration of their orders. Once placed, the order will remain active until it is either filled in full, partially filled, or it expires. This AMM and orderbook system combination is what makes cSwap a hybrid dex.

Since the constant-product formula is inefficient for an AMM where two correlated assets (assets that trade at similar values) are traded, cSwap supports range pools as well. These pools work by using concentrated liquidity between two price points. This helps LPs to allocate their capital within a custom price range rather than uniformly along the entire price curve from 0 to infinity. Range pools offer several benefits with respect to traditional AMM pools such as:

Range pools have an amplification factor (A) that determines a pool’s tolerance for the imbalance between the assets within it. Higher values of A means that trades will incur slippage sooner as the assets within the pool become imbalanced.

In cSwap, the A factor is a measure of how much more liquidity a ranged pool can provide in a specific price range compared to a basic pool with the same amount of capital. The smaller the price range, the higher the amplification factor. For instance, a ranged pool with a price range of [0.95, 1.05] will have a higher amplification factor than a range with a price range of [0.9, 1.1]. The reason for that is because liquidity concentrated in smaller price ranges leads to more efficient trading with less slippage.

The A factor for any given pool depends on the assets that will be traded on it. Also, it is worth noting that it is not possible to modify the A factor of a pool after deployment. For a ranged pool where P is the current price, the A factor is calculated as:

CMDX is the governance token on the cSwap dex. Stakers of CMDX will be eligible for voting on various on-chain proposals such as dex upgrades, fee changes, protocol parameters, and incentivization strategies for various liquidity pools.

Every time there is a swap, the protocol charges a 0.3% swap fee that is returned to liquidity providers. There is also a liquidity pool creation fee for asset pairs that don’t have a pool yet. This fee is charged in CMDX and is currently set to be $2,000 CMDX, although it can be changed via governance.

cSwap V2 was introduced on August 2, 2023.

V2 includes innovative features and enhancements done to create a strong DEX that addresses the community’s needs and desires. The new features includes:

Additionally, there have been enhancements to the structuring and incentive plans, which includes:

Commodo is a borrow-lending IBC-native platform built on Comdex. Users can deposit collateral in order to access debt from a lending pool and borrow protocol assets. Lenders can supply assets to the protocol’s lending pool in order to make them accessible for borrowers and collect floating interest rate payments without having to negotiate terms such as loan maturity, interest rates, or collateral requirements with a peer or counterparty.

Contrary to most money market protocols, where a lending pool determines interest rates dynamically based on the utilization rate of the assets, Commodo implements a distinct architectural design with cPools and transit assets. This is achieved by using Comdex’s modules: lend module, asset module, oracle module, liquidation module, and auctions module.

There are 2 predominant ways to build a permissionless and decentralized money market in DeFi:

Money in markets in Commodo are called cPools. Depositors can lend Cosmos-ecosystem assets and, in the future, interchain-enabled assets, in order to earn yield on their deposits. These assets are borrowed by borrowers who access overcollateralized loans and pay a dynamic and variable interest based on the supply and demand of that asset.

Commodo’s architectural model ensures that money markets have deep liquidity and that the impact on asset prices volatility is isolated across cPools without damaging the overall health of the protocol. Transit assets serve the role of bridging isolated money market cPools.

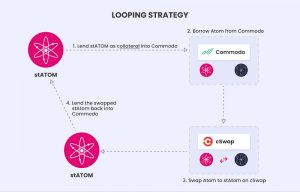

The term cPools stands for connected pools. These are isolated money markets that are bridged through transit assets. Users can create money markets for any asset by pooling it with a transit asset. On Commodo, these transit assets currently are CMST and ATOM. Every cPool contains a paired asset and two transit assets (e.g. an asset like OSMO would have an OSMO-ATOM-CMST cPool).

Since all cross-pool borrowing activity routes through transit assets, these assets must be liquid enough across the ecosystem, hence the choice of CMST and ATOM.

With this model, transit assets ensure limits on multiple asset pairings to prevent liquidity fragmentation (often seen in isolated pool models) and protect the protocol from single-asset market volatility (often seen in pooled liquidity models).

To borrow assets, the user must deposit the transit asset to the cPool and borrow the desired asset as per the defined maximum LTV (loan-to-value) ratio of the deposited asset.

Depositors can borrow assets across cPools by using their deposits as collateral for borrowing a transit asset. The borrowed transit asset then gets deposited as collateral into the cPool of the desired borrowing asset.

This allows for a variety of use cases:

Interest rates are dynamic and depend on the supply and demand of the assets. Deposits can earn an interest rate by lending assets to Commodo, and borrowers can take on debt by borrowing assets and paying an interest rate to lenders. Underneath each pool, an algorithmic interest rate model will minimize liquidity risk and maintain an optimal utilization rate across cPools.

Utilization = Total assets borrowed / Total assets supplied

An utilization rate close to 100% means greater liquidity risk. To prevent this, the interest rate models will target an optimal utilization rate.

R0 is the base, R1 is slope 1, and R2 is slope 2. These parameters are determined for each asset by an evaluation and a risk assessment process.

The protocol does not guarantee liquidity; instead, it relies on interest rate models that incentivize liquidity:

Users can borrow at both variable and stable rates in CMST. The variable rate may change after every action (deposit, withdraw, borrow or repay), but remains constant for users who borrow with a stable interest rate. When it comes to new loans, the stable rate may vary depending on each interaction in order to better suit the protocol’s present condition (liquidity available, depositors APY). This means that the stable interest rate will be fixed for a user unless rebalancing conditions are triggered. When that happens, stable rates are rebalanced as follows:

The reason for introducing a stable rate is to offer more predictability for borrowers and help them plan their finances in advance by anticipating their costs.

The APY for depositors is calculated as:

; where U is the utilization rate of the asset and Rf is the reserve factor (the percentage that is kept by the protocol and that is allocated to the reserve pool).

The reserve pool acts as insurance in case of any unknown attack/circumstances that cause the protocol to accumulate bad debt.

The Commodo treasury receives half of the Reserve pool funds, while the remaining half is used to buy back CMDX tokens that are distributed to CMDX stakers.

When users deposit assets on Commodo, they will receive cTokens as a receipt of their deposit. cTokens are collateral tokens that are used by the protocol to calculate interest that is accrued over time. Similar to LP token, cTokens represent a claim for a portion of the cPool’s total tokens. Since cTokens accrue interest, the amount of cTokens held by a user will increase over time (similar to Aave’s aTokens).

For example, if you deposit 1 ATOM, you will get 1 cATOM token. As the pool accumulates interest, your cATOM token balance will increase correspondingly. Whenever the user chooses to redeem their cATOM holdings, they will receive 1 ATOM plus the accrued interest, say 1.045 ATOM (0.045 being the ATOM earned from the interest rate).

Users can borrow from the protocol using cTokens as collateral, where the borrowing power of cTokens will be determined by the LTV of the underlying asset.

Note that any interest you earn as a depositor will offset the interest rate that you pay as a borrower.

To calculate the amount of interest accrued by each position, the protocol uses an index-based system that gets updated with every user interaction with an asset.

When a position’s health factor drops below 1 (a user’s outstanding debt exceeds their borrowing capacity), it is subject to liquidation. In that scenario, an auction of the liquidated position will recover the borrowed funds to maintain the solvency of the protocol.

On Commodo, liquidations are triggered when a user’s collateral is not enough to satisfy the requirements of an outstanding loan. This happens when the borrower’s health factor drops below 1.

Liquidations can happen when either the value of the user’s collateral asset decreases, or when the value of the user’s borrowed assets increases. In either scenario, if the user is unable to raise their health factor to be above 1, their position will be opened up for liquidation. When this happens, the protocol calculates the amount of debt that the user owes and that debt will be repaid through an auction. Anyone can repay the borrowed amount in return for earning a liquidation bonus . A liquidation penalty is also charged from the user’s collateral. Both the liquidation bonus and the liquidation penalty will depend on the asset that is used as collateral (refer to Commodo’s Risk Assessment parameters).

Commodo measures each asset based on both market risk (quantitative) and project risk (qualitative) to ensure that both liquidity conditions as well as the quality of the codebase and protocol audits can be integrated in the protocol according to a series of asset-specific parameters.

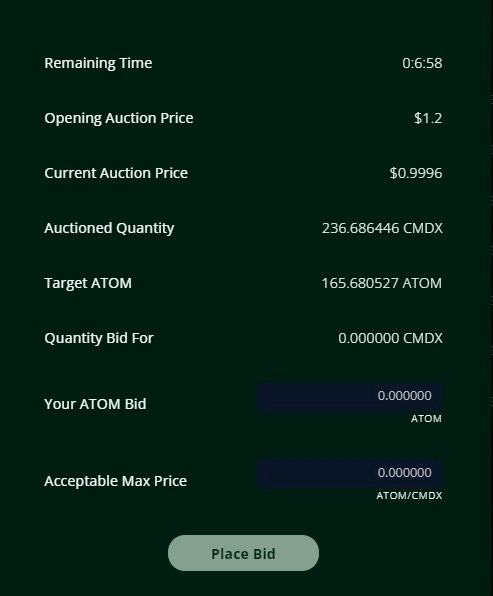

Auctions on Commodo follow a Dutch Auction model with instant settlements. The auction starts at an initial price that will decrease over time. The starting price is the liquidation price multiplied by a buf parameter, where the buf parameter is a configurable percentage (usually set at 15%). Once the auction starts, users can bid for the collateral assets as per the bidding price. This way, users can choose to purchase the collateral asset at a price they find profitable relative to the external market price of the asset.

Auctions have 5 hours during which the debt can be repaid. Outstanding debt is repaid through further auctions until all outstanding debt is entirely repaid.

The auction stops once the position is healthy, meaning the health factor of the position is above or equal to 1 (after the debt repayment). The remaining portion of the user’s collateral remains and can continue to be utilized as collateral on the protocol.

Dutch auctions on Commodo reset on two conditions:

As an example, a user borrowing $500 OSMO with $1,000 CMDX collateral and the following parameters:

The user’s health factor is calculated as:

Health Factor = Collateral Value * Liq. thresholdBorrowed asset value = 1,000 * 55%500= 1.1

Next, if the collateral decreased in value to $800:

Health Factor = Collateral Value * Liq. thresholdBorrowed asset value = 800 * 55%500= 0.88

The health factor of the position drops below 1 and the position is sent for an auction. To calculate how much of the borrowed asset needs to be repaid, the following formula is used:

[Collateral value – (1+Liq.penalty + Liq.bonus)* X] * Liq.thresholdBorrowed asset value – X1

Solving for X on the equation above returns the minimum amount of OSMO that needs to be repaid to bring the position back to a health factor above 1. In the example above, that would return $151.8 OSMO. Hence, a minimum of ~$152 worth of OSMO needs to be repaid. In return, $167.2 worth of CMDX collateral will be released (includes the liquidation penalty and the liquidation bonus).

This returns a health factor of:

Health Factor = Collateral Value * Liq. thresholdBorrowed asset value = (800-167.2) * 55%500-152= 1.0011

To be eligible for boosted rewards on Commodo for borrowing CMST and ATOM, a user must have provided liquidity on the CMDX-ATOM Master Pool on cSwap.

The amount of incentives provided is dynamically adjusted depending on the minimum amount of CMST/ATOM that is borrowed from each cPool as well as the liquidity provided in the cSwap master pool by CMST/ATOM borrowers.

Rewards are distributed in CMDX tokens and are directly sent to the user’s wallet on a daily basis.

For example, a user who has deposited $100 in the cSwap Master pool would be eligible for boosted rewards of up to $100 on each borrowed position.

Governance proposals can suggest the onboarding of new assets, changes in interest rates models, and protocol management parameters. In order to participate, users must hold the CMDX token. To raise new proposals, there is a requirement to lock up CMDX tokens, which will get unlocked after the voting period.

Comdex’s Enterprise Trading Platform facilitates cross-border trading of physical commodities and RWAs (Real-World Assets) using digital assets as collateral. The vision of Comdex Enterprise is to revolutionize the rudimentary process of global commodity trades by minimizing settlement times and maximizing efficiency.

The Commodity Trade Industry is one of the largest industries in the world, with trillions of goods exported globally every year. In fact, every manufacturing industry in the world economy is directly or indirectly influenced by the availability of various industrial commodities and their live prices. This global interdependence means that commodity trading plays a huge role in global economic sentiment due to its influence on international supply chains as well as in the GDP of multiple economies.

Comdex Enterprise offers solutions in:

These offerings result in notable benefits when it comes to reduced settlement time, KYC, AML and member checks between trading parties, and optimized trading workflows where critical information can be streamlined in a secure and tamper-proof manner.

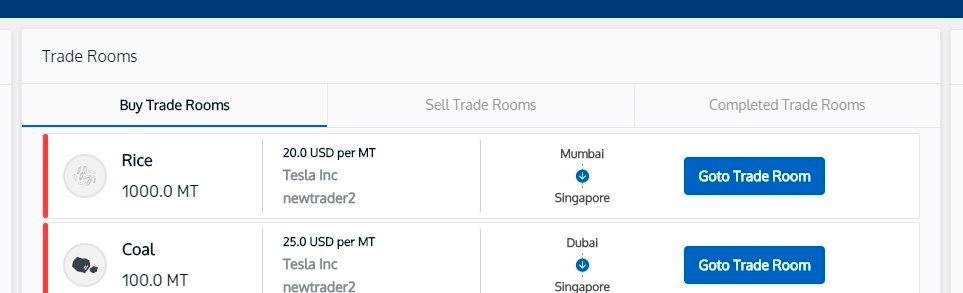

In Comdex Enterprise Trade, a trading room gives the buyer and a seller the opportunity to trade and negotiate in real-time. When the terms of the negotiation are agreed upon by both parties, they will be able to sign a contract and exchange the necessary documents that are required to execute the trade.

Comdex has on-boarded ~18 organizations and facilitated $160M in trade volume. For the most part, these are small to medium organizations in Southeast Asia.

Enterprise Trade was the first platform launched by Comdex. In the past, it onboarded 18 organizations from across Southeast Asia as the initial set of clients on the platform, which processed over $160M of commodity tokenization. However, the long term vision of the platform is to facilitate payment settlements and financing powered by CMST. Nonetheless, CMST is still in its nascent stages and doesn’t have enough of a track record for enterprise/institutional adoption yet.

cAsset is a synthetics protocol that allows traders to gain exposure to synthetic assets on-chain. This will allow users to trade commodities and make bets on their price action without having to worry about the associated logistical friction that comes with it.

There are 4 different types of commodities:

Due to their inability to provide yield, commodities are often considered a conservative allocation to any investment portfolio. However, due to their low correlation to traditional financial assets, they are attractive to traders and often allow investors to hedge the potential downside of their capital allocations to bonds or stocks. Additionally, the fact that commodities are scarce physical assets with limited supplies, also makes them an attractive hedge against inflation.

By merging the concept of synthetic assets with decentralized technology, cAsset aims to become a trading platform that revolutionizes how market participants engage in commodity commerce. Users will be able to trade, borrow, and farm synthetic goods from the convenience of a personal device.

With on-chain synthetics, the risk of counterparty risk and rehypothecation is significantly reduced. Users have unrestricted access to buy, sell, and swap their synthetics assets at any time they choose. Besides, the transparency of the blockchain makes it possible to audit the lifecycle of any tradeable asset, making rehypothecation almost impossible.

Comdex launched cAsset’s devnet in 2022 with a CDP model (similar to the design used in Harbor). The outcome of this proof-of-concept helped the team to realize the difficulties associated with trading synthetic assets in low liquidity conditions, which make it harder for those tokenized representations to maintain the peg. The devnet was taken down and the project is currently on a research and development stage before release.

ShipFi is a platform that allows for the tokenization and exchange of real-world investment vehicles for trusted stablecoins.

This functionality serves 3 main purposes:

When someone provides liquidity to an investment vehicle listed on ShipFi using a stablecoin, the user receives a fungible token that represents ownership over that deposit. Next, the user can stake the LP tokens in order to receive stablecoin earnings as well as SHIP token incentives.

SHIP is the native token of the platform and plays a role in both the governance of the protocol as well as being part of the incentives system.

As investment vehicles on ShipFi will be conducting off-chain transactions once they are deployed, it is critical for the protocol to maintain the provenance of the real-world data involving the investment vehicle. This is achieved with a Proof of Deployment system that keeps track of all transaction records and legal documents involving all investment vehicles.

Unlike in traditional finance, investors in trade finance debt products offered in ShipFi can liquidate their positions in real-time, since the ownership of the representative tokens will be traded on a secondary market.

In the past, Comdex completed a full end-to-end integration with Western Union’s payment interface. The major obstacle faced during this challenge was the fact that commodities trading organizations had to undergo KYC/AML processes in person in Singapore. This process was not completed due to the presence and current situation of the Covid pandemic at the time.

ShipFi is expected to serve as the financing piece in Comdex’s commodities platform. As a result, it is largely dependent on the achievement of the CMST liquidity milestones and it being adopted as the payment engine for Enterprise Trade.

Zenscape is Comdex’s validator arm, which serves the purpose of increasing Comdex’s participation and visibility in the overall Cosmos ecosystem.

In coordination with Comdex, Zenscape provides infrastructure support services such as:

Zenscape currently validates 10 Cosmos chains, including Osmosis, Umee, and Akash.

Comdex does not have any Angel, VCs or seed round raises. Instead, regular users took part in the Liquidity Bootstrapping Program (LBP). In an LBP the project provides liquidity to a specialized pool on a DEX (in this case Osmosis). Anyone who wants to participate, can participate, regardless of portfolio size.

Users can become validators, meaning that they can operate validator nodes that help secure the network. In exchange for securing the network, validators are paid in the CMDX token.

People that cannot or do not want to operate validator nodes can participate in the staking process and contribute to the security of the Comdex chain as delegators. The requirement to be a delegator is to hold CMDX and send a delegate transaction specifying the number of CMDX tokens that they want to bond to a validator node. Later on, if the delegator wanted to get its assets back, it would submit an “unbond transaction”. When that happens, delegators are forced to wait 3 weeks before they can retrieve their assets.

Delegators share the revenue of their validators. Similarly, they are also exposed to the same risks. In terms of revenue, validators can choose to apply a commission on the income that is distributed to delegators.

Validators are incentivized to participate in staking to earn revenue from:

The total revenue generated in the chain is divided among validators’ staking pools according to the validator weights. After that, the rewards are distributed within each validator’s staking pool in proportion to each delegator’s stake. A commission on the delegator’s revenue will be applied before the distribution (this is the validator commission).

Staking CMDX entitles validator nods to earn network rewards immediately. Stakers can then send a transaction to claim their rewards at any point in time. These rewards come from transaction fees, and newly issued tokens from inflation.

Coingecko (CMDX): https://www.coingecko.com/en/coins/comdex

Coingecko (CMST): https://www.coingecko.com/en/coins/composite

Coingecko (cSwap exchange): https://www.coingecko.com/en/exchanges/cswap

Not yet live.

Not yet live.

No info available.

The cost for Zenscape’s validation fees are unknown, but can be approximated by understanding the costs of running nodes, which is around $300-500 on a monthly basis, depending on the rented servers or cloud providers used.

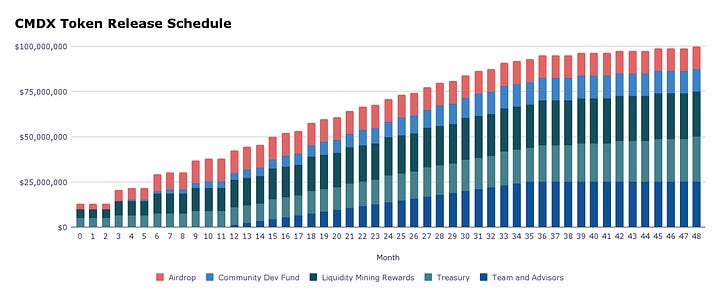

Comdex costs in emitting tokens are split into the following tokenomics, with 100,000,000 CMDX minted at genesis and unlocked for 48 months.

The cost to run a validator is approximately $300-$500 a month, depending on the rented servers or cloud providers used.

The CMDX token is inflationary in nature with an inflation of 30% set for the first year and a subsequent reduction of 25% in the inflation rate in each with the maximum supply capped at 200,000,000 CMDX.

CMDX is the native token of the Comdex chain. It plays 3 critical roles in the ecosystem:

The CMDX token is inflationary in nature with a target inflation rate set to be 30% during the first year and a subsequent reduction of 25% every year after that.

The maximum supply is capped at 200,000,000 CMDX and is distributed as follows. At genesis, 100,000,000 CMDX were minted and unlocked for 48 months with the following distribution:

Composite is the stablecoin of choice in the Comdex stablecoin. It is meant to represent purchasing power by having a soft peg to the US dollar. Its design is inspired by MakerDao’s implementation of DAI, which allows CMST to be minted in a permissionless manner with an over-collateralized whitelisted asset.

Since CMST is built on the Comdex chain, it benefits from IBC and can accept a wide range of IBC-enabled assets as collateral, given that liquidity conditions are satisfied.

CMST can be integrated into Comdex’s Enterprise Trade network in order to settle transactions of Real-World assets represented as NFTs. As the adoption of tokenized RWAs increases, Comdex can allow for the minting of CMST by collateralizing with these NFTs to create liquidity for CeFi participants.

Total supply: 1,000,000,000

$HARBOR emissions started on July 10, 2023.

The HARBOR airdrop was claimable on December 5, 2022. Comdex airdropped 150M HARBOR tokens, which is the equivalent of 15% of the supply. This airdrops was split in two components:

Snapshot taken on October 24, 2022.

The Whale cap across each chain was kept at 50,000 HARBOR tokens.

Given that Harbor is meant to serve an important role for the Cosmos ecosystem, similar to the role of MakerDAO on Ethereum, the token was distributed to 23 different communities. This would ensure a fair distribution of the governance power that will be used for determining the future adoption of CMST.

The more efficient governance is for CMST, the greater its stability and adoption will be, which will lead to increased economic activity for the ecosystem as a whole.

Governance in Comdex is done via proposals, utilizing Mintscan by Cosmosation.

Votes are based on the CMDX token, and the holders have voting power based on their quantity of CMDX token at the time of the proposal snapshots.

Comdex leverages the Cosmos SDK as an alternative approach to security based on the notion of object capabilities. While no framework can completely protect developers from introducing bugs and security breaches in their codebase, application-specific chains might offer more recoverability and self-healing mechanisms in case something goes wrong. This is not the case with other blockchains, whose entire attack surface relies on the Virtual Machine they are built on top of. As a result, the security analysis is simple in application-specific chains, since developers do not have to worry about the interactions between the application and the mechanics of the Virtual Machine.

Social engineering attacks might expose delegators to attack vectors in the form of phishing or spearphishing. Both of these attacks are responsible for approximately 95% of security breaches at the individual level.

The liquidity conditions for CMST in order to power commodities trades and financing are largely dependent on regulatory scrutiny. As a result, the development time is largely influenced by the difficulties and time constraints associated with obtaining the appropriate regulatory clearances and licenses.

In order to keep validators honest in running the consensus of the chain, there is a slashing mechanism that is used to disincentivize bad behavior. Whenever a slashing incident occurs, a portion of the validator’s stake will be burned (the amount depends on the severity of the misbehavior). Examples of misbehavior include node downtime or double-signing.

Any protocol user is exposed to a series of risks associated with owning a vault:

Commodo runs mechanism design studies in order to ensure proper parameters and protect the protocol against fundamental risk and attack vectors.Every whitelisted asset is evaluated and analyzed using the protocol’s risk framework, which determines the optimal interest rate model to be used by each asset.

After assessing each of these parameters, each asset is given a weighted average score in order to set LTV, liquidation threshold, liquidation bonus, interest rate curve, and collateral assets.

The reserve pool acts as insurance in case any black swan event or security incident negatively impacts the platform. A portion of the interest paid by borrowers is allocated to the reserve pool based on the reserve factor of the asset.

The Commodo treasury receives half of the reserve pool funds while the remaining half is used to buy back CMDX tokens that are distributed to CMDX stakers.

There is also an emergency shutdown mechanism that is triggered during serious emergencies or security breaches. Once this trigger is initiated, the prices for all collateral assets are immediately frozen along with other features of the platform, such as lending, borrowing, repaying or withdrawing assets.

Comdex uses the CosmWasm smart contract framework in order to enable interoperability through IBC. CosmWasm incorporates safeguards against common attack vectors. For instance, CosmWasm protects users from any untrusted contract that seeks to exploit an external call function (reentrancy attack).

CosmWasm also ignores any smart contract that causes integer overflows/underflows, which protects against vulnerabilities that allow the attacker to retrieve an excessive amount of tokens.

In CosmWasm, all smart contract code functions have public visibility by default.

If one of the HTTP ports open to the Internet is not protected against man-in-the-middle attacks, a malicious attacker can present an altered state of the network to that given validator node and force it to behave incorrectly from a networking perspective. This has an impact at individual node level, since it can lead to the slashing of the node’s tokens.

On August 19, 2023, Harbor Protocol encountered an exploit, resulting in a drain on a portion of the funds sitting in the stable-mint and $stOSMO, $LUNA and $WMATIC vaults.

On August 25, 2023, an incident report was published, with an estimated loss of $250k.

The exploiter manipulated the prices of three collateral assets, $Luna, $stOsmo, and $wMATIC on cSwap which is an AMM built on Comdex. The exploiter inflated the prices of these assets on cSwap. Harbor protocol on the Comdex chain, which is a protocol for minting the $CMST stablecoin, accepts $Luna, $stOsmo, and $wMATIC as collateral to mint the $CMST stablecoin.

The oracle on Harbor was using cSwap as one of the sources of price feeds. The exploiter inflated prices and borrowed $CMST from these three asset vaults at higher collateral prices. Harbor has a stablemint that works similarly to PSM on Makerdao, essentially users can mint $CMST 1:1 with the stablemint using other stablecoins. The exploiter then used the borrowed $CMST to swap it 1:1 into the $axl.USDC from the stablemint or swap the $CMST to stablecoins on Crescent.

The attacker leveraged the Secret network to divert the funds, making it challenging to trace them once they transition into the Secret network. The team has reached out to MEXC and Simpleswap to pinpoint the perpetrator and resolve the situation.

Comdex has been audited by Oak Security, Cyberultron Consulting and CredShield Technologies.

The team has informed of an Immunefi bug bounty program to be launched soon.

Comdex is a fair-launch project that held no VC funding round and launched the CMDX token with an LBP on Osmosis.

The Syndicate Marketplace is a platform that incentivizes protocol governance through the use of bribes, a model that incorporates and builds upon Redacted Cartels hidden hand marketplace to bribe liquidity. This is achieved by creating a secondary market that incentivizes veHARBOR holders to delegate their voting power to the Syndicate and receive rewards in return.

Protocols deposit “bribes” into the marketplace and these rewards are then distributed to the veHARBOR holders who have delegated their voting power to the Syndicate. It has three features comprising of the following:

Version 1 of Project Syndicate is expected to launch in Q2 2023, including the Syndicate marketplace and Shadow, a subsidiary of Syndicate that lets users directly select the rewards they want from each offered bribe.Future upgrades include the following:

Some of the most notable partnerships include:

Falcon wallet: https://www.falconwallet.app/