Disclaimer: Please note that Chronos Finance appears to be inactive. The project’s peak Total Value Locked (TVL) was $260 million on May 7th, 2023; however, this figure has since plummeted to $570k on March 18th, 2024. Additionally, there has been no activity on the project’s Twitter account, the Discord link provided on their website is invalid, and their Telegram group has not seen any new messages since July 2023. There are no recent developments or updates from the team, indicating a cessation of active project management. This document is maintained for historical and educational purposes only, and readers are advised to exercise caution and consider this information when reviewing the details that follow.

Chronos is a decentralized community-driven liquidity layer and ve(3,3) AMM on Arbitrum. The ve(3, 3) primitive, combined with a maturity-adjusted return profile, addresses the challenges of incentivizing liquidity providers and making their deposits “sticky” within the protocol pools.

As a Dex, Chronos supports a hybrid engine that implements a different swap algorithm depending on whether the user is swapping volatile assets or correlated assets.

Compared to the vAMM, the sAMM model allows for greater imbalances between the two assets before traders start noticing a significant price impact

Chronos has reached a partnership with Firebird Finance by which their dynamic swap engine is powered with a routing engine that automatically seeks out the best path for executing a trade across all available pools.

Introduced in the V2 upgrade, advance orders such as Limit orders and Time-Weighted Average Price (TWAP) orders were introduced, in collaboration with Orbs Network.

A limit order is an order to buy or sell with a restriction on the maximum price to be paid (with a buy limit) or the minimum price to be received (with a sell limit). If the order is filled, it will only be at the specified limit price or better.

An TWAP is the measure of an asset’s average price over a predetermined period of time. TWAP can be calculated for any specified time duration. TWAP trading seeks to optimize a trade’s average price while executing over a specified time period.

Users that provide liquidity to Chronos receive LP tokens that represent their shares in a given liquidity pool. These LP tokens can be staked on the platform to make users eligible for CHR emissions, with the base emission rates being determined by the votes on Chronos gauges by veCHR holders.

At the beginning, the Masterchef contract developed by Sushi, was a critical piece of infrastructure for DeFi protocols. This allowed users to stake their LP tokens in the Masterchef to earn rewards in the form of inflationary “governance tokens”. The larger the liquidity position, the more LP tokens the user receives and the more inflationary rewards he or she earns from staking. However, this defeats the original goal of the Solidly model, which is to incentivize users to provide liquidity and keep it in the protocol for long periods of time.

Chronos utilizes an upgraded Masterchef contract called the Reliquary, created by the Byte Masons. This mechanism allows liquidity providers to earn boosted rewards from emissions over time. This way, the longer the liquidity remains staked in the protocol, the higher the CHR percentages per epoch those LPs will get.

As a smart contract system, the Reliquary is optimized to improve the distribution of token incentives by giving both users and developers fine-grained control over their token emissions and distribution.

The Reliquary is a DeFi primitive that seeks to find a middle-ground between bonding and liquidity mining. The outcome is analogous to a variable rate that increases in convexity over time. As a result, liquidity providers earn more incentives the longer their liquidity remains within the protocol.

With a maturity-adjusted mechanism, Chronos solves the following problems:

This is achieved by distributing rewards across maturity tranches, each of which represents a length of time that entitles a user to receive a certain level of incentives. This is accomplished without dilution, consistently distributing identical allotments of rewards to the pool regardless of the number of people in any given tranche.

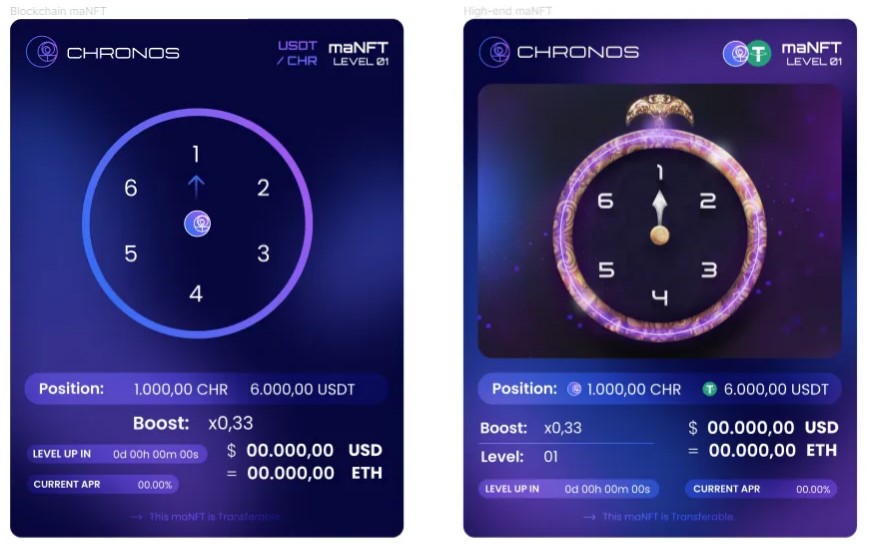

Upon staking LP tokens on Chronos, users receive a maNFT (maturity-adjusted NFT) that tracks the amount of tokens that have been provided as well as the amount of time that they have been staked.

Staked positions earn an emission boost for up to 6 epochs, with the maximum boost being 2x and accruing linearly at 0.33x per epoch. After 6 epochs, the maNFT is considered fully mature, and will continue earning CHR at the maximally boosted rate into perpetuity or until being unstaked.

Unlike veNFT, there is no associated lock-up period for maNFTs and users can unstake and withdraw their liquidity from the pool at any time they want. However, doing so comes at the expense of losing out on any emissions boost that has been earned up to that point. maNFTs are also tradeable on secondary NFT marketplaces.

maNFTs grant the following benefits to LPs:

Concentrated Liquidity (CL) was introduced in the V2 upgrade, in collaboration with Dyson Money as the Concentrated Liquidity Manager (CLM).

Liquidity provided to a CL pool through the Chronos front end will be routed to a Dyson vault.

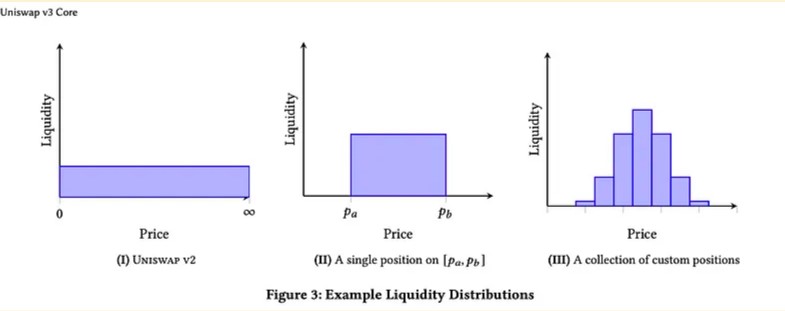

First introduced by Uniswap v3, CL aims to boost capital efficiency and to make up for the inadequacy of the original x*y = k formula underlying the standard automated market maker model.

Within the new model, liquidity can be allocated to a price interval, resulting in what is called a CL position. LPs can open as many positions in the pool as they wish, thereby creating unique price curves aligned with their personal view of the market using what are known as range orders.

Chronos has optimized the V3 model with the following:

By locking CHR for veCHR, users get access to voting rights. This allows them to direct their voting powers in order to allocate CHR emissions to protocol gauges.

Gauges control the rate of CHR emissions that go to each liquidity pool. Those pools that receive more votes earn a greater allocation of CHR incentives for that epoch.

Each epoch lasts 7 days, and by the end of each epoch, all bribes and trading fees are collected and distributed to voters. Users only earn fees and bribes from the pools they have voted for, and they must participate in each voting round.

New gauges are manually added by the Chronos team, although users can request the addition of custom gauges by filling a Google form or through Discord.

Bribes are the incentives provided by external protocols who have partnered with Chronos. By giving rewards in their native tokens, partner protocols can incentivize (“bribe”) veCHR holders to vote for their pool.

Chronos bribes’ marketplace is permissionless and open to the public, meaning that any third-party protocol or individual can add bribes for any trading platform on the platform. However, only whitelisted tokens can be offered as bribes.

Bribes can be made at any time during the epoch and are held in escrow for the duration of the epoch for which they have been offered.

There are no rebases for user’s veCHR positions. The reasoning behind this is to reach a more fair distribution that does negatively impact later entrants in the ecosystem. This takes into consideration the importance of long-term sustainability and aims to make Chronos an attractive venue for protocols who seek to become involved post-launch.

Chronos contemplates rebases as additional inflation that, instead of going to liquidity providers, is being redirected to veToken holders. However, veToken holders do not contribute to the flywheel effect in the same way as LPs, who are the actual engine of the economy. As a result, rebases often introduce more inflation than is necessary to support the flywheel.

Chronos’s zero anti-dilution model has been designed to promote a range of positive economic forces:

Despite the zero-rebase model, Chronos recognizes the risk that is being taken by veCHR lockers as early adopters. As a result, Chronos has set aside 5% of the CHR initial supply (2.5M tokens) as an airdrop bonus for users who lock over 1,500 CHR for 2 years. These users also receive 20% of their locked position as a bonus veCHR NFT.

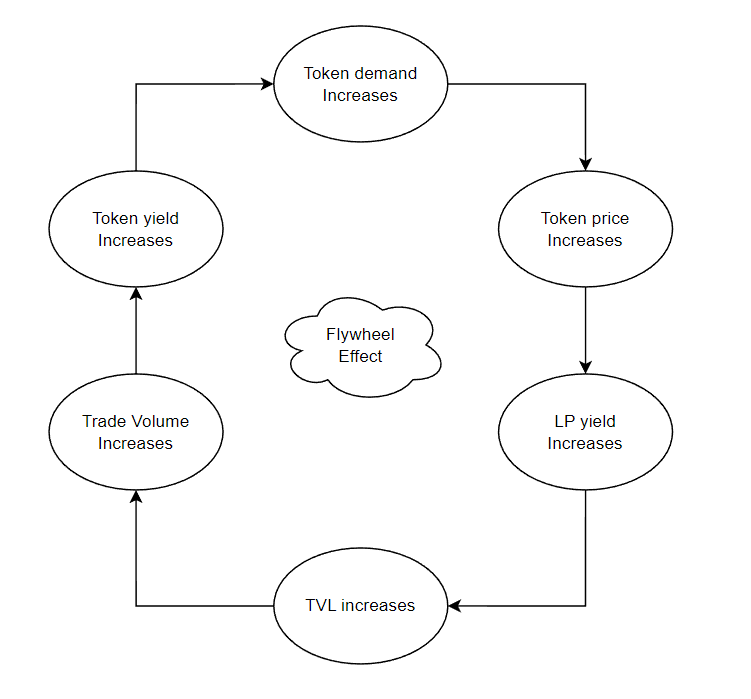

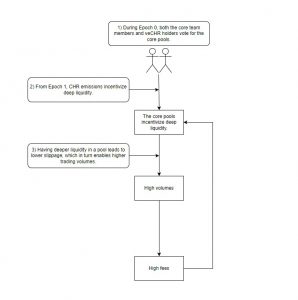

The Chronos flywheel is the term used to reference a self-sustaining cycle that drives the platform’s growth as the protocol continues to grow and enhance its liquidity.

As more liquidity enters the protocol and the TVL increases, so will the depth of liquidity in the protocol pools. This will reduce slippage and attract more traders. As a result, the trading fees accumulated by the protocol will increase, attracting more users to lock CHR into veCHR.

However, a counter-cyclical effect can spiral out when the price of CHR decreases, which causes the veCHR APR to increase when the revenue stays the same. This lower price with the same revenue makes CHR more attractive and, eventually, buyers will step in to take advantage of the pricing opportunity, which stabilizes the price of CHR again and establishes a new point of equilibrium. From this new starting point, the flywheel effect can resume.

While other Solidly forks can negatively suffer the impact of the DEX token price falling, liquidity being withdrawn, and APRs decreasing, Chronos attempts to overcome these challenges with maturity-adjusted LPs. This helps to mitigate the negative effect of volatility and favors “sticky liquidity”, since emissions are boosted based on the maturity of a LP position. This ensures that liquidity providers are adequately rewarded and that they are incentivized to maintain their liquidity even during volatile periods.

By ensuring that liquidity remains within the ecosystem, Chronos manages to stabilize the price of CHR even during counter-cycles where the token price decreases, forcing the APR to increase and making it more attractive to take new positions. This is also beneficial for LPs, since the resiliency of the CHR price makes their yield returns more sustainable.

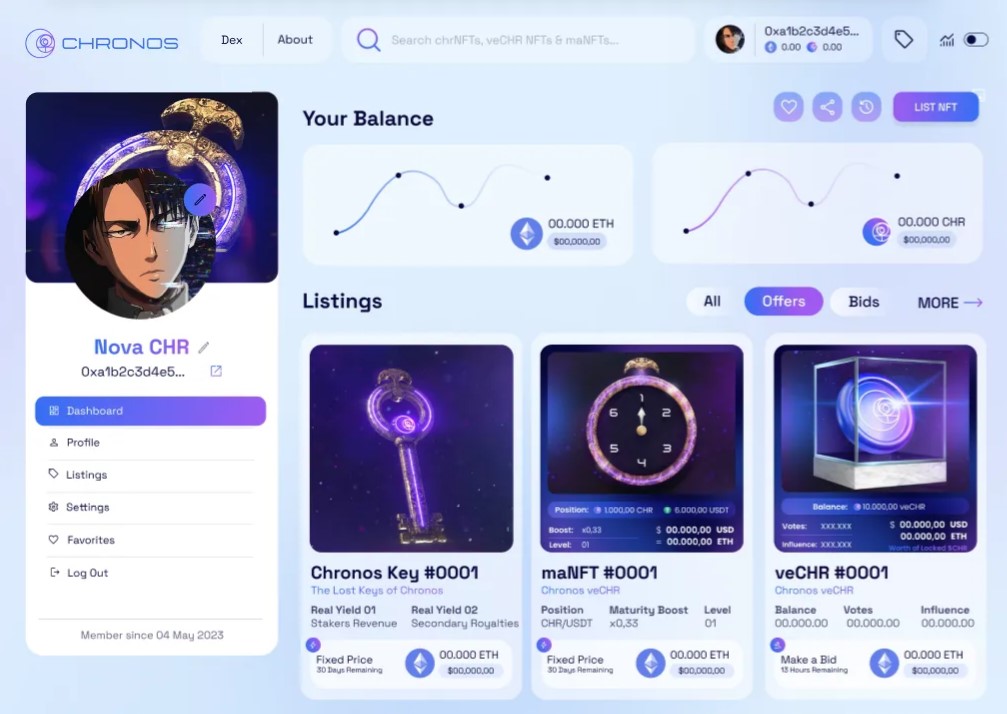

The inhouse NFT marketplace was introduced as part of the V2 upgrade.

Establishing its autonomy and enhancing the user experience is paramount for Chronos, as it operates at the forefront of financial NFTs, with its chrNFTs and maNFT being core products. As such, an in-house NFT marketplace allows Chronos to customize the UI to integrate the relevant data required by the community for ease of usage.

Data cards allow the display of CHR balance, voting power, USD, and ETH equivalent value and the unlock time.

Frictionless OTC transactions of maNFT’s mature LP positions, which would carry a premium based on the additional rewards they are receiving.

The first version of the marketplace supports chrNFT and veCHR listings while the second version will accommodate maNFTs, widening the scope of assets that users can trade and invest in. Because maNFTs are receiving a significant contract update in V2, Chronos has broken out this marketplace feature until the migration is complete.

The integrated marketplace plays a vital role in achieving these goals by strengthening their comprehensive solution and minimizing reliance on external factors, such as additional royalties.

A collaboration with Muon Network, the referral system is aimed at attracting more users to the platform while driving up trade volumes and thereby increasing revenue. While DiBS has been active with fees being routed to it, the campaign has not been initiated by Chronos. It has been mentioned that the accumulated will be used for Marketing or Incentives otherwise.

Chronos Finance was established with the aim of becoming an essential component of the Arbitrum ecosystem. By serving as Arbitrum’s liquidity layer, Chronos aims to position itself as a dependable gateway for both current and future ecosystem participants and protocols seeking stable liquidity incentives. This objective is to be achieved by implementing a ve(3,3) model that encourages long-term liquidity and attempts to align the incentives of token holders and liquidity providers.

By design, the ve(3, 3) model also targets these issues through its incentives and fee structure:

As the price of CHR increases, so does the APR for veCHR holders, which attracts more liquidity and demand for the CHR token. As time goes on, an equilibrium is reached where the yield of buying and locking CHR creates a support for the token price while ensuring that LPs have access to a sustainable source of yield from CHR emissions.

Even though the original ve(3, 3) design tackles some of the shortcomings of traditional Dexes, Chronos introduces a novel approach that accounts for maturity-adjusted LP returns and no-rebases for long-term sustainability.

In the past, the Masterchef contract developed by Sushi was the go-to alternative for DeFi protocols to bootstrap their liquidity. Users staked their LP tokens in the Masterchef to earn rewards in the form of inflationary “governance tokens”. The larger the liquidity position, the more LP tokens the user would receive and the more inflationary rewards they would earn from staking. However, this defeats the original goal of the Solidly model, which is to incentivize users to provide liquidity and keep it in the protocol for long periods of time. As a result, the Masterchef is a great tool to attract liquidity in the short term, but it loses effectiveness when it comes to keeping that liquidity within the protocol for longer periods of time. This attracts “mercenary capital” who seek out high APR and sell the inflationary rewards they earn.

The next iteration of that primitive was to offer single-stake vaults for users to stake their governance tokens. This way, instead of selling, they would stake them to earn more rewards from inflation. Even though this reduced the negative impact of “mercenary capital”, it simply postponed the unavoidable. As soon as token prices started to decrease, the returns were not attractive any more, and users would withdraw their holdings, divest their liquidity, and look for more lucrative opportunities elsewhere.

With the release of veCRV, the ve token model was born. Users were asked not only to stake, but also to lock their positions for a predefined duration in exchange for being given control over the platform’s gauges. In return for locking their tokens, users gained voting power that allowed them to vote on what pools should benefit from receiving token emissions. This way, the pools that received more votes would receive a higher proportion of rewards, and these rewards could then be locked to increase the user’s voting power.

However, the ve token model had the inconvenience that locked positions were not liquid and users could not exit until the end of the locking period. As an alternative, the ve(3, 3) model was born. By tokenizing ve positions as NFTs, users are still incentivized to lock their emissions for an extended period of time while still having the option to sell their position and transfer their voting rights by selling their position on a secondary NFT marketplace.

In order to become a liquidity layer, Chronos built its Dex with the goal of incentivizing liquidity for external protocols while making it efficient for traders to swap assets. From an external protocol point of view, it is hard to find a balance when it comes to token emissions:

By building on top of the ve(3, 3) primitive, Chronos can offer 3 alternatives for external protocols to bootstrap their liquidity:

For the DEX itself, all of the alternatives above are beneficial, since participants in the ecosystem have an incentive to lock their emissions, which helps defend the price of the native token and maintain its utility as an incentive.

However, while the ve(3, 3) system is very effective at attracting token liquidity, it has its drawbacks when it comes to keeping capital stationary. For instance, as the APRs change from one epoch to the next, liquidity providers simply move their capital to the pools that generate the highest returns. As a result, liquidity is not “sticky” and does not remain in one pool for extended periods of time. These fluctuations make it difficult for protocols to accurately predict what their liquidity needs will be and what incentives they need to offer to help them reach their goals.

When the token price goes down, the APR for liquidity providers goes down as well, which decreases TVL and makes it less attractive for users to lock their tokens, since their expected income is lower. When this happens, rather than letting the market absorb the token’s worth in connection with the Total Value Locked (TVL) and protocol income, TVL exits the protocol and abolishes the counter-cyclical effect which secures the token price and sustains the incentives for liquidity providers. This is a fundamental flaw in the original Solidly design and that Chronos is aiming to solve with a maturity-adjusted mechanism.

Chronos relies on the ve(3, 3) model to align the incentives of all participants, while it introduces the Reliquary as the mechanism by which it will attempt to align liquidity providers with the long-term success of the protocol. Similar to other ve(3, 3) Dexes, Chronos lets users deposit liquidity, receive LP tokens, and stake those LP tokens to earn CHR rewards. Upon staking LPs in the Reliquary, users will receive maNFT that will track how long they have provided liquidity for and boost their rewards accordingly.

In Chronos, maturity-adjusted liquidity positions earn boosted CHR emissions over time – 0.33x per epoch for 6 epochs – before maxing out at a 2x boost after 6 weeks. Following a period of 6 weeks, the rate of growth in profits from these maNFTs will plateau and will remain at the raised rate until the user decides to withdraw their liquidity.

There are no locking requirements for maNFTs, and users are free to withdraw their liquidity at any time with no penalty. By doing so, they will be simply forfeiting any boost they have earned up until that point. For instance, in the event that a user chooses to take out their liquidity and transfer it to a different pool, they can do so, but they will enter that pool at the non-amplified rate.

Users can also sell their NFTs on secondary marketplaces. In doing so, instead of withdrawing their assets, users can sell their veNFTs at a premium for having kept them locked for a long period of time. This allows potential buyers to realize increased yields instead of providing liquidity themselves.

Overall, Chronos LP positions can become liquidity bonds that carry the underlying yield while they appreciate over time. Besides, liquidity providers who mature their positions will be more inclined to remain within the same pool in the Chronos ecosystem. The reason for that is because abandoning their LP position comes at the cost of time, which plays a big role in the protocol, since LPs are rewarded for the duration of their liquidity within the protocol.

There is currently no roadmap available, as V2 has recently been accomplished.

The ve(3, 3) model pioneered by Solidly can be explored from multiple angles: monetary policy, inflation, capital investment, governance…

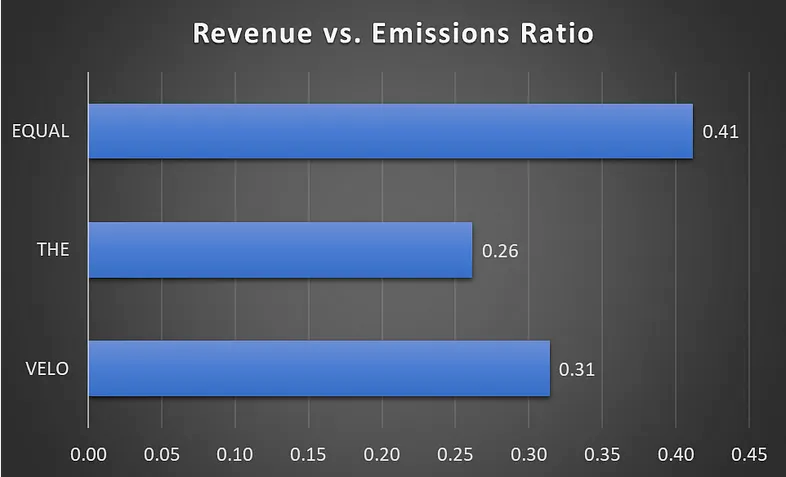

When the AMM performance is equal, Dexes compete against each other from the lens of a monetary policy that should aim to pull in as many liquidity providers as possible. At the same time, inflation of the native token is required to keep the economy moving as well as to decentralize the distribution of governance power. In this context, token emissions might be greater than the revenue generated by the protocol, but that should necessarily indicate that the emissions are unsustainable. This has been one of the key turning points when it comes to implementing the ve(3, 3) design, whether it is with a full-rebase, a partial rebase, or a zero-rebase model.

Rebasing is an attempt to remove or lower the impact of inflation from veToken holders, however, this inflation can be used to incentivize all actors to behave in the interest of growing the economy. For instance, if veToken holders are guaranteed not to be diluted, they no longer have to vote for gauges, which is an unproductive use of capital. This creates a problem where veToken voters can direct emission to unproductive pools. On the opposite side, under a zero-rebase model, veToken holders are disincentivized from voting for unproductive pools, since their voting power will diminish over time. Even if they were to follow that behavior, they would have to add more capital either via bribes or buying and locking.

It is not necessarily a death sentence for projects if they have an inflationary scheme. If their LP base produces plenty of revenue from trading fees, they won’t have to shell out incentives or accumulate veTokens themselves.

Zero-rebase models attempt to bring together everyone’s interests towards the enduring success of the economy. If the pool isn’t productive to the protocol, projects are forced to spend more in bribes. This also explains why under a rebasing model, projects can make a one-time investment and incentivize their pool into perpetuity, even when it is not productive to the economy. As time goes by, this creates a concentration of power in the earliest and largest entrants in the ecosystem, making it uneconomical for new participants to join in.

With rebasing, inflation is removed from veToken holders, which might reverse the positive outcomes of inflation and lead to a series of negative side effects such as:

As the APYs are projected over longer periods of time, there is a divergence with rebasing models where they underperform relative to a zero-rebase implementation.

When the real APYs of veTokens are compared, rebasing shows a negative correlation with APYs: the more rebasing , the lower the APYs. For instance, the image below shows that a 100% rebasing project needs to grow revenue 38% faster than a no-rebasing alternative.

This happens because rebasing adds more inflation to the system, even if it attempts to protect against dilution. Since rebasing adds more inflation to the locked veToken supply, over time it reduces the economic value of locking tokens. Therefore, rebasing pushes the cost of inflation away from veToken voters onto the new token buyers, thereby breaking the value proposition of the token to kickstart an “economic flywheel”.

The image above does not account for rebasing in the APY calculation, since doing so would represent “paper” gains as realized PnL. However, rebases do not add economic value to the ecosystem and cannot be realized into real profits.

veToken holders benefit from two main sources of revenue: swap fees and bribes; and in turn direct token emissions to LPs. This creates the flywheel effect such that the more revenue coming into the veToken, the more attractive it is as an investment, which sustains the emission rewards for LPs whose deposits make trading possible.

The economy grows in this cycle of drawing in liquidity, and that liquidity will generate more and more fees over time, which in turn attracts more TVL.

Emissions are the key differentiator from one fork to another. Since the Solidly system motivates LPs through token emissions, token inflation is unavoidable. Generally, these patterns initiate with hefty outflows to bootstrap the project and then taper off over time as the protocol grows. In any case, if token emissions stop, LPs can never again be incentivized to enter the economy, and the economic activity stops.

At the beginning, most Solidly forks get between $0.2 and $0.5 in revenue back for every $1 they spend in emissions.

However, even if expenses outpace revenue in the initial stages of the protocol, this is not indicative of a death spiral where lower TVL leads lower volume, which decreases the revenue from fees, which in turn lowers the APY, the price of the native token falls, which further brings the TVL lower…

This happens because the emissions token value is greater than the revenue generated because the value of the native token goes beyond having just strict value accrual. It also has value in the form of governance to direct emissions, as a LP pair, for pricing future growth, for speculative trades, and for other use cases across the DeFi landscape of any given chain. These factors carry a premium value over the strict 1:1 relationship with the accrued revenue. This dynamic propels the ecosystem and permits the Solidly ve system to enhance the liquidity of external projects.

The fact that the value of token emissions is greater than the revenue is also what makes protocol bribing effective, where $1 of bribes > $1 of LP incentives.

The success of the Reliquary as a way to attract “sticky liquidity” will largely mark the success and adoption of Chronos as well. In fact, many competitors have faced difficulties when it comes to sustaining the “flywheel” during periods of high volatility. When the Dex token falls, TVL might flee away from the protocol as a result of decreasing APRs. With the price of the Dex token down and TVL fleeing, it gets harder to stabilize the price of the DEX token and restart the flywheel.

For reference, it is fairly common to see Solidly forks go through 3 states: uptrend, downtrend, sideways. First, the protocol experiences an uptrends as the ve(3, 3) starts working during the first days of the protocol. Usually, the share increase in the price action of the native token will result in higher incentives for LPs and an increasing TVL.

However, while a massive success in attracting liquidity is highly beneficial for the protocol, it is often the case that liquidity is not “sticky” enough and the token price ends up experiencing a downtrend along with the TVL.

Similar to how TVL was lagging in its follow-up to the token’s price on the way up, the downtrend in the token’s price will be preceded by increasing withdrawals of TVL on the way down. For instance, the image below shows that rather than observing investors stepping in to absorb the selling pressure, the opposite occurred. Instead of allowing the market to support the token price, LPs started to withdraw their liquidity as their yields (denominated in the native Dex token) started to decrease.

Over time, a new point of equilibrium is found, where both TVL and price action stabilize and find an area of support. The image below shows how the recovery of the token’s price does not take place until the TVL finds a bottom.

In an uptrend, the ve(3, 3) flywheel is very powerful in attracting liquidity to the Dex. However, in a downtrend, it is often the case that the token’s price will not find support until the TVL starts to bottom out. This shows how the correlation between price and liquidity can create a negative feedback loop as well. This often occurs with a 2-day lag, which shows the importance of having mechanisms in place in order to ensure that liquidity remains in the ecosystem even during periods of high volatility.

Chronos has adopted a maturity-adjusted liquidity incentives model to promote long-term liquidity and give enough time for the price of CHR to be supported in times of market volatility. This measure intends to recover TVL as soon as possible in order to achieve a stabilization effect as investors will be incentivized and rewarded for keeping their liquidity on the platform.

Upon launch, Chronos will face the competition of other Dexes on Arbitrum, with Ramses Exchange, Sterling Finance, 3xcalibur, and SolidLizard being also protocols that rely on the ve(3, 3) model. One of the key differences is that Ramses provides a 5% weekly rebase to offset dilution and increments this % by 1% each epoch up to a cap of 25%. Similarly, Solidlizard also implements a 30% weekly rebase, while Sterling Finance follows a zero-rebase model.

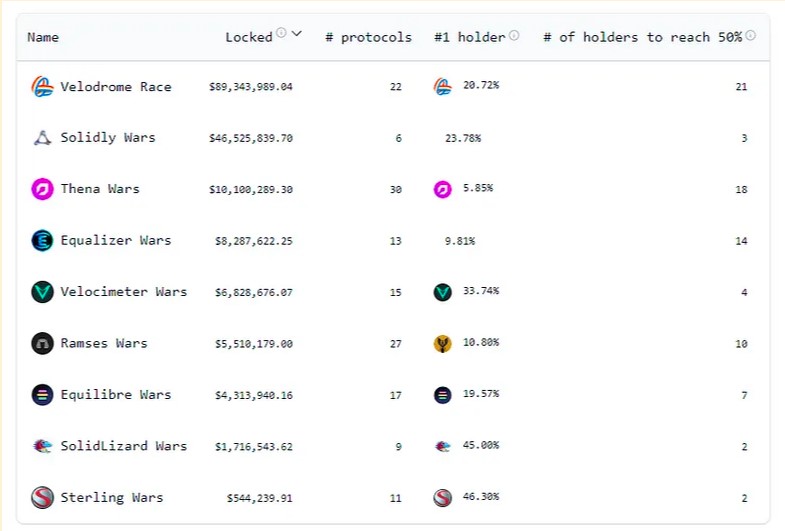

Nonetheless, ve(3, 3) AMMs are starting to gain traction across all chains, especially in terms of revenue and fees.

Concentrated liquidity pools that follow the Uniswap V3 model present challenges for long-tail assets, which creates a market for traditional vAMM and sAMM pools. At the same time, the competition between Uniswap V3 liquidity providers can be overcome with managed concentrated liquidity pools on ve(3, 3) exchanges that allow for more profitable LP positions and increased TVL through incentive alignment and the presence of a bribes market. Similarly, the greater impermanent loss on Uniswap V3 pools can be offset by increased yields to LPs in the form of token incentives by ve(3, 3) models.

Over time, the adoption of ve(3, 3) Dexes has mapped out exactly according to the “startup curve”, with an initial enthusiasm around the original Andre Cronje implementation, and then spending most of the 2022 period in the “trough of sorrow”, while in 2023 the underlying idea is starting to find product market fit and scaling a lot quicker, as evidenced by the number of forks across multiple chains.

Besides, April 1st 2023 marked the expiration of Uniswap’s v3 Business Source Licensed, which means that projects can now fork the actual codebase. This details a concentrated liquidity pool model where LPs allocate their capital within specific price ranges, whereas in Uniswap v2 pools, the liquidity was scattered evenly along the invariant curve given by xy=k.

By concentrating liquidity within specific and more active price ranges, LPs can increase capital efficiency and earn higher returns on their liquidity. However, this is not a one-size-fits-all model, since it greatly increases the cost of managing on-chain liquidity and gives up its pricing power.

Pricing power refers to the fact that for any asset that can be listed in multiple exchanges, both CEXs and DEXs, typically only 1 will have dominance in terms of pricing, which will often be the one with the most uninformed order flow, while the price on other exchanges will be arbitraged accordingly.

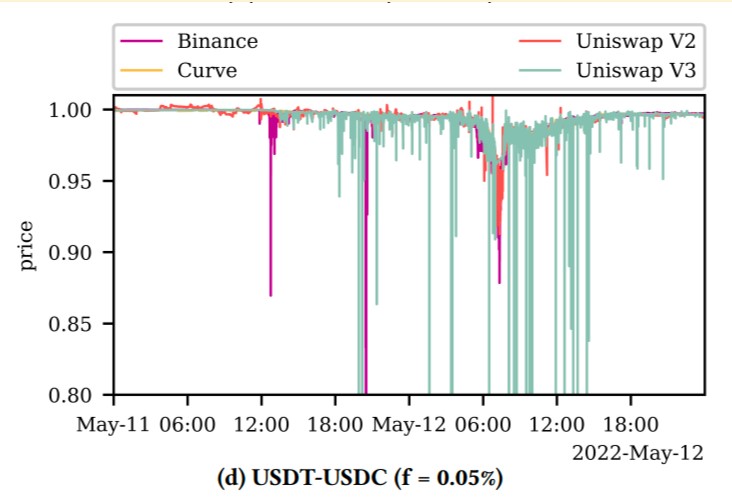

The Uniswap v3 concentrated liquidity model does not work optimally during periods of high volatility, which sets it at a disadvantage, since reliable exchanges are expected to operate effectively in all market scenarios. In contrast, ve(3, 3) models utilize a constant product AMM for volatile pairs while using the stableswap invariant for correlated assets that maintain more consistent functionality even in extreme market conditions. For instance, during the UST collapse and crisis of LUNA, liquidity quickly dried up and kept hitting price ranges where there was not sufficient liquidity. This proved that the Uniswap v3 model suffers from pricing inefficacies during sudden price drops.

When it comes to long-tail assets, liquidity providers in a Uniswap V3 model also face a number of challenges:

If passive LPs provide liquidity in a greater range, active LPs operating in a tighter range will earn a disproportionately greater amount of trade fees, taking away from the passive LP profits.

This proves that while it may be profitable to LP in a concentrated liquidity position, most LPs either do not make money or lose money, and only a very small portion of most competitive and sophisticated LPers are making profits. This competition discourages LPs from providing liquidity, which leads to an overall decrease in TVL.

Toxic flow exposure from arbitrage activities. This is because users are expected to trade in the primary exchange, which increases the toxic order flow in secondary exchanges that lack pricing power. This way, arbitrageurs take cues from the primary source of pricing information and can take advantage of LPs in the price discovery process of other AMMs.

For instance, according to the Alastor Uniswap Fee Switch Report dated November 14, 2022, over 70% of Uniswap V3 trading volume is driven by algorithms, making it less sticky and more susceptible to shifts in pricing power.

With the majority of the volume coming from algorithmic trading strategies, without maintaining pricing power and status, trade volumes can easily shift away to other primary exchanges. Because trade volumes are the driving force behind LP incentives, this can lead to a death spiral where LPs are less incentivized, which leads to lower liquidity and a decrease in TVL, higher slippage for traders, lower trading volume, lower fees, and LPs are less incentivized to provide liquidity.

In contrast, ve(3,3) exchanges maintain their pricing power as the primary source of price information (at least for long tail assets), ensuring a more stable and sustainable ecosystem. As long as pricing power is maintained, it is less susceptible to shifting trade volumes.

ve(3, 3) dexes offer an alternative to the dominance of blue-chip assets in a Uniswap v3 environment. Since ve(3,3) provides an effective marketplace for new projects to source liquidity through the incentives and bribes market, it becomes the default pricing dominant exchange on these long-tail assets. At the same time, the ve(3, 3) model is also better able to incentivize liquidity providers within both a V2 pool and a concentrated liquidity pool. This leads to more sustainable returns for LPs, which can offset the negative impact of concentrated liquidity.

Given that the ve(3,3) model changes the incentive structure to LPs to a pro-rata model, it can effectively sustain larger TVL without some of the negative consequences of concentrated liquidity.

Because the ve(3,3) model can solve these issues with Uniswap V3 pools, it is possible that they also become the deepest sources of liquidity for blue chip short-tail assets, and establish pricing power. The reason for that is because the ve(3, 3) model is not about the swap technology itself, but about the incentives alignment between protocols, liquidity providers, traders, and users. It is the unique combination of profitability, sustainability, and tokenomics. For example, Solidly ve(3,3) exchanges earn 100% of trade revenues, while Uniswap earns 0%. What’s more, without pricing power, LPs suffer more from toxic flow, and are less incentivized to provide liquidity. If Uniswap now takes a cut on top of this, it further discourages LPs.

Overall, the ve(3,3) tokenomics are designed to protect the platform against competition, maintain a balanced distribution of governance power, and incentivize continuous participation in the ecosystem.

Chronos has deployed on Arbitrum with the goal of becoming a core piece of the chain’s infrastructure, similar to Thena on the Binance Chain, Equalizer on Fantom, Solidly on Ethereum mainnet, and Velodrome on Optimism.

As a layer 2, Arbitrum inherits Ethereum’s security model while offering scalability, high transaction speed, low cost, and robust security. The existing ecosystem and adoption of native Arbitrum projects was also kept in mind for making the decision.

All Solidly forks rely on a system that attempts to align the incentives of 4 types of users:

Using an upgraded version of the MasterChef contract, the Reliquary, Chronos can offer the following advantages to LPs:

Protocols incentivizing liquidity benefit from having more predictable liquidity conditions for their native tokens, which makes them more resilient to price volatility. This can lead to a more stable and liquid market for their token, making it more attractive to traders and investors.

veCHR voters and chrNFT stakers enjoy the benefits of:

Chronos aims to create a dynamic in the market where the incentives of all participants are aligned so that all of them can reap the rewards from being active in the ecosystem:

Protocols with a veCHR allocation can deploy their own liquidity on Chronos in order to farm CHR tokens. These protocols can then lock the proceeds as veCHR in order to increase their share of the total veCHR supply.

Under the Solidly model, loyalty is expressed in the consistent accumulation of the native token and the locking into veTokens. This is what allows protocols to sustain their liquidity on-chain at an effective cost. These rewards are streamed and available for claiming as soon as they accrue.

Since token inflation is necessary for the system to work, the revenue growth would have to either match or exceed the inflation rate to be a good long-term investment and be considered a profitable business. Besides, given that token emissions taper off into a tail-end emission schedule, growth requirements will taper off as well.

Coingecko: https://www.coingecko.com/en/coins/chronos-finance

Chronos fee structure for swaps attempts to find a sweet spot such that traders can access a great execution price while the protocol can still generate significant revenue for veCHR voters. This will lead to an increase in both locking and token incentives for liquidity providers.

The transaction fees on protocol pools can be used strategically to capture maximum revenues for veCHR voters.

Inflation plays a big role in the economy of a Solidly fork in order to incentivize economic growth:

Since all token emissions are “pre-paid” before minting, viewing token emissions as a cost might be indicative of a wrong framework. Gauge weight votes direct token emissions, and to vote, it is required to own the token and lock it for its ve representation, or bribe veToken holders to vote. Either way, the token enters circulation.

As projects pre-pay every token as a cost of liquidity, it can be argued that token emissions are a cost for those protocols to maintain the on-chain liquidity for their native tokens, rather than being a cost to the veToken itself. This is supported by the fact that external protocols must continually re-invest in order to support their liquidity by buying and increasing their ve positions.

It can be argued that this is where the opportunity for Dexes lies: even though inflation rates might be high at the beginning, they can be matched with revenue growth over time.

As soon as inflation rates taper to zero, the long-term economics of Solidly forks should be sustainable and necessary to bootstrap initial liquidity and kick off the “flywheel effect”.

CHR is the utility token of the platform and is used to incentivize users to add liquidity and stake their LP tokens on the platform in order to earn revenue from token emissions.

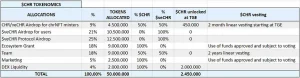

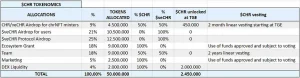

There will be 50M CHR tokens available at launch and more will be emitted into circulation over time.

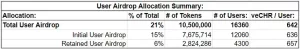

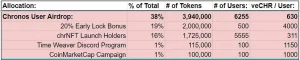

The allocation to the Arbitrum ecosystem will go to the top liquidity providers as an incentive for them to use their veCHR to vote on the pools where they provide liquidity. These airdrops will go to the top 250 largest liquidity providers (excluding protocol owned liquidity and treasury funds).

The largest portion of the user airdrop (38%) will go to Chronos community members. These various initiatives aim to reward engaged community members and raise awareness of the Chronos launch event.

10% of the user airdrop will be reserved for future campaigns

There will be an initial circulating supply of 2.45M liquid CHR tokens at launch.

CHR holders can vote-escrow their tokens and receive veCHR in exchanges. This veNFT grants them voting power to cast votes on which gauges should receive CHR emissions for a given epoch or voting round.

The maximum lock period is 2 years and veCHR positions can be split, merged, and sold on the secondary market.

veCHR holders can:

The voting power of a veCHR position linearly decreases over time until reaching zero at the end of the lock period. In order to preserve voting power, users must consistently renew their lock duration.

The Lost Keys of Chronos is a 5,555 items NFT collection where each item entitles the owner to multiple revenue streams, exclusive delta-neutral strategies, and a dedicated role within the community. The minting event took place on March 29, 2023 starting at 4pm UTC.

The funds from the sale are allocated as follows:

Holding chrNFT grants the following benefits:

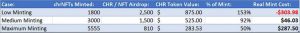

The fewer chrNFTs are minted, the higher the proportional amount of swap fee revenue that will be distributed to chrNFT holders.

Ignoring the CHR token value after the airdrop, the base mint price of 0.325 ETH can be used to calculate annual return profits and break-even points for chrNFTs.

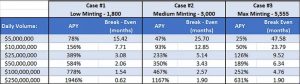

Based on daily volumes, it is possible to calculate the daily fees that will be accrued per staked chrNFT.

The example below assumes a 90% stake rate and a 20% fee split, which will taper down over time.

The estimates above only take trading fees into account. However, chrNFTs also have royalties as a source of revenue, where 1% goes to the revenue distribution pool for all staked chrNFTs, and 2% goes to the original chrNFT minter in perpetuity.

On March 29, 2023, the Lost Keys of Chronos sold out in just 12 hours, allowing the protocol to raise more than $2.8M. All 5,555 chrNFTs were minted by a total of 1901 individuals.

Users who hold chrNFTs when Chronos launches will receive a bonus reward. All chrNFT holders will share an airdrop of 1,725,000 veCHR where each chrNFT will get 310 veCHR locked for 2 years.

The OpenSea market for chrNFTs was deactivated and chrNFTs are currently tradable on Tofu NFT, Zonic, and Wen Moon Market.

The Lost Keys of Chronos was officially the #1 NFT collection on Arbitrum in the first week of April 2023

Using the CHR governance token and locking into a veCHR position, users can make proposals that dictate governance decisions related to protocol upgrades, changes to the economic model, additional features…

The codebase of Chronos Finance is an adaptation of Thena’s code, which at the same time was derived from Velodrome, a Solidly fork whose development started when Solidly smart contracts were open-sourced in March 2022.

There have been no security-related incidents involving Solidly smart contracts since their initial deployment on Fantom in February 2022.

The major distinctions between Solidly’s/Thena’s implementations and Chronos’s codebase are the Reliquary shift for the Masterchef agreement, tokenomics, and how outflows are implemented (no rebases).

Chronos also has a bug bounty program with ImmuneFi.

Rewards are distributed based on the Immunefi Vulnerability Severity Classification System V2.3. This is a simplified 5-level scale system with separate scales for Smart Contracts and Websites/Apps, with rewards for Smart Contract as follow:

All treasury funds and contract modifications are dependent on the team’s Gnosis Safe multisig wallet.

| Owner | Address |

| Dani (lead developer) | 0x0062b3152bdb9868e600319Fc52c9D00A16aA3ff |

| Atile (CTO and cofounder) | 0x5980343eEDB99Bf92A108D99848168E575C99344 |

| Satsy (CMO and cofounder) | 0xdB433De4c56571E6bFc3B7c0A111fA07BbC502dc |

| 0xCronos (CEO and cofounder) | 0xA0e23865A0A7d7eBFc6bB9D9BAd839BF98C3b16A |

In the contract chrNFT the role _owner has authority over the following functions:

Any compromise to the owner account may allow the hacker to take advantage of this authority.

On January 4, 2024, Dyson Money was exploited and all vaults were paused, affecting Chronos CL pools.

On January 18, 2024, Dyson provided a summary of the event, including full compensation to affected users.

The only affected pools were Chronos’s CL pools, and the cause of the exploit was a flash loan, with the following factors attributed:

Without substantial deposits from other users, the pools remained vulnerable to manipulation. By exploiting these weaknesses, the attackers were able to artificially inflate the value of a certain deposited asset through a carefully orchestrated flash loan attack.

The timeline of the attack was as follow:

By the nature of CL models, even small directional trades can significantly sway internal valuations when liquidity remains limited. The outsized flash loan-fueled swap achieved an exaggerated effect. And in the absence of organic counter-balancing flows from a broader user base, the inflated state persisted enabling share exploitation.

In total, Dyson estimated an approximate $148,000 worth of funds were extracted in this attack before automatic safeguards halted the affected vaults. A full compensation plan was effected with the final payout delivering 100% value replacement sent within 30 days post-submission window closure.

Chronos is a community-owned protocol that raised no funds from VC investments. The initial chrNFT sale offered equitable access for the community while facilitating an airdrop to the community and protocol partners to decentralize holdings and maximize community engagement. The chrNFT sale acted like a fundraiser mechanism, with 60% of proceeds providing initial liquidity to CHR and 40% funding platform development. The minting event took place on March 29, 2023 starting at 4pm UTC.

The initial capital raise was the result of a 5,555 chrNFTs sale.

All chrNFT minters are guaranteed to be included in the CHR airdrop. 9% of CHR’s initial supply (4.5M tokens) will be distributed to chrNFT minters in equal proportions of CHR (vested linearly over 8 weeks) and veCHR (locked for 2 years).

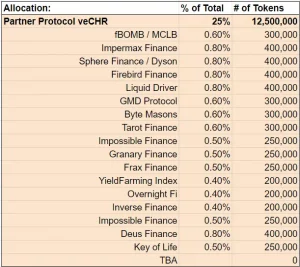

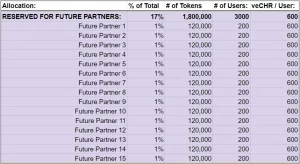

18% of CHR’s initial supply (9M tokens) will be airdropped to partner protocols in the form of veCHR locked for 2 years. These protocols will then be able to use their veCHR allocation to vote to direct CHR incentives to strategic pools on Chronos.

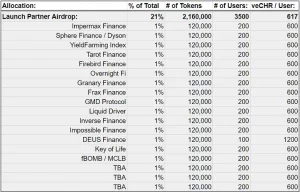

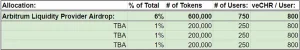

21% of the initial supply (10.5M tokens) will be airdropped to members of the Arbitrum community in order to incentivize their participation in the protocol and ensure the decentralization of the protocol. This will be achieved by distributing tokens to users and partner protocols in the form of veCHR locked for 2 years.

5% of the initial supply (2.5M tokens) will be used to reward early adopters that lock CHR for veCHR for the maximum 2-year duration.

In order to be eligible, users must lock a minimum of 1,500 CHR to veCHR for the maximum period. These users will unlock a bonus airdrop equivalent to 25% of their secured veCHR position as long as supplies exist, in the form of additional veCHR.

As a ve(3, 3) liquidity layer, Chronos acknowledges the importance of collaboration and partnerships with third-party protocols. These protocols will offer bribes in order to attract liquidity providers. By collaborating with other protocols in the Arbitrum ecosystem, Chronos can also expand its reach and help to drive growth and adoption of its platform.