Arcton

Overview

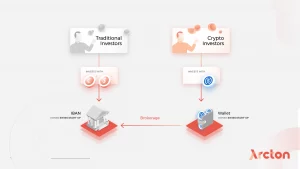

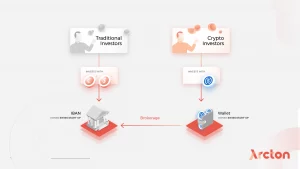

Arcton emerges as a crypto-native crowdfunding platform for startups, unveiling a novel asset class for Web 3 participants: Start-up Shares. This unique asset class is accessed via startup IPOs, effectively democratizing access to startup investments and bringing revenue from traditional companies on-chain.

Conventional investment in Web2 start-ups demands substantial capital, often around $50,000 per venture. Additionally, investors typically endure a decade-long waiting period before divesting their shares. As a result, only a mere 3% of the population can engage in this appealing asset class. This is the problem that Arcton is tackling: to make startup investing easy and accessible for retail investors.

In a startup IPO, everyone can start investing with small sums of money, starting with $100. After the raise, investors can sell their liquid shares on a DEX, which solves the illiquidity problem that is often seen when investing in startups. For instance, retail investors cannot always afford to be locked in a position for more than 10 years, and they might need to access their capital for something else.

Current trading venues have also failed to provide liquidity for startups, For instance, stock exchanges require a market cap of at least $500 million, which is out of reach for most startups. Nowadays, thanks to the Swiss DLT Bill and the advent of DEXs, there is a regulatory-compliant way to allow for shares tokenization and make startup investing more inclusive.

By building a crowd-investing platform on top of blockchain technology, Arcton addresses the challenge of trading illiquid startup shares. The vision is that everyone should be able to invest in startups with the same flexibility as if it was a publicly listed company.

Arcton achieves this with 3 notable features:

- Efficient use of blockchain technology: Arcton tokenizes startup shares, leveraging blockchain for enhanced liquidity.

- Secondary marketplace: Offering seamless trading of digital startup shares on a decentralized exchange

- Unique regulatory framework: Creating digital startup shares within the Swiss DLT Act and enabling cross-border offerings.

Arcton is reimagining crowdfunding by tokenizing startup shares and making them available for trading at any time. By democratizing startup investments through the DLT Bill, Arcton grants investors the liberty to trade shares without constraints. Digital shares have exactly the same rights as traditional shares, with the only difference being the fact that they are issued on a blockchain.

Startup IPOs

Arcton introduces an avenue for investors to engage in start-up investments through Initial Public Offerings (IPOs).

- Investors receive tokenized shares in exchange for their investments, offering exactly the same rights to traditional company shares.

- Startup shares confer dividend entitlements and participation in the event of company sale proceeds.

Arcton primarily features Web2 start-ups on its platform, and each listed startup undergoes a meticulous due diligence process to ensure quality and viability. Below you can find what the IPO process is like:

1. Tokenization: Shares are legally tokenized under Swiss Law.

2. Public Offering: Arcton opens shares to the public, providing accessibility to a wide array of investors.

3. Investment: Shareholders acquire start-up shares using USDC or FIAT (CHF or EUR), facilitating seamless investment transactions.

4. Registry Entry: The newly minted shares are registered with the Commercial Registry following approval from a Swiss notary and the Commercial Register.

5. Liquidity Pool: Start-ups establish liquidity pools on Camelot, enhancing trading opportunities for shareholders.

6. Claim and Sell: Shareholders gain the ability to claim their shares and subsequently sell them in the secondary market whenever they want.

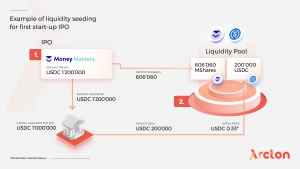

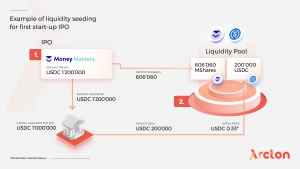

After each IPO, the startup provides the initial liquidity to the pool. As soon as the Swiss Commercial Register has entered the new shares into its registry, the pool will be created, and liquidity will be seeded.

- The creation of the new shares is visible in the Swiss commercial registry (www.zefix.ch).

- The standard approval timeline by the Commercial Register is approximately 2 weeks.

The liquidity pool can only be seeded after the shares have validly been created according to Swiss law, which requires the authorization of a public notary and the Swiss Commercial Register. This liquidity is locked, guaranteeing a stable and deep pool of funds.

Additionally, Arcton has designed an incentive program for each startup. This allows liquidity providers to earn additional rewards. Users receive additional shares of the start-up for which they provide liquidity.

When users provide liquidity, their positions are tokenized as non-fungible staked positions or spNFTs. These positions can then be deposited into the Camelot Nitro Pool in order to participate in the incentive program.

- The user creates a position, by providing start-up shares and stablecoin.

- The deposit is sent to a specific corresponding NFTPool contract, and the user receives a staking position NFT. This spNFT can be viewed as a kind of deposit receipt.

- The users can deposit their spNFT into the Camelot Nitro Pool.

- The user receives additional rewards by participating in the incentive program of the respective startup.

Arcton also addresses the issue of limited supply that is inflated later on, diluting existing holders. Unlike standard tokens, where inflation is often a big concern for investors, startup shares can only be created according to a regulated process.

Startup team members/founders’ shares are not tokenized, so they can’t sell them on the secondary market. Only the shares sold during the IPO are tokenized.

DLT Bill Compliance

The Swiss Distributed Ledger Technology Bill, or the DLT Bill, was enacted in 2021. Arcton’s digital shares adhere to this Swiss law in order to safeguard investor rights and hold issues to legal standards. More specifically, the DLT Act is applicable to every entity, whether it be a company, organization, or individual operating within the jurisdiction.

The DLT Bill defines digital securities as “electronic records that represent a claim on the issuer.” This means that they can be used to represent ownership of assets, such as shares, bonds, or derivatives. The law also provides for the creation of DLT trading facilities, which are platforms that allow for the trading of digital securities.

The introduction of this bill has effectively addressed numerous gaps in the country’s legal framework and has established greater legal security for both crypto assets and custodians in Switzerland. The Swiss Blockchain Act has far-reaching implications, particularly in the areas of tokenization, investments, and capital markets. Notably, the DLT Act provides clear definitions for electronic records and introduces a regulatory framework to ensure their proper utilization.

This legislation has paved the way for the formal creation of blockchain-based digital assets, allowing Switzerland to become the first major country to make this possible. In fact, the Bill enables the tokenization of any sort of RWA (Real World Asset). Additionally, the DLT law delineates the operational guidelines and requirements for private entities using DLT technology. For instance, it mandates that all companies operating in Switzerland disclose information about their activities to ensure transparency.

DLT Securities

Crypto regulation in Switzerland, introduced in 2021 under the DLT Law, is essential for investor trust and fraud prevention. It enables traditional securities to exist as security tokens on the blockchain, covering assets like shares and bonds. This innovation falls into three categories: processes, infrastructure, and innovation, with a focus on connecting traditional stocks with digital assets. This is known as “ledger-based securities” or DLT securities.

However, the DLT law has yet to fully meet expectations, leading to incremental improvements. The future of Swiss crypto regulation seems to favor Decentralized Finance (DeFi), which removes intermediaries and automates financial products.

To be precise, Switzerland now allows asset tokenization and tokenization of securities for asset storage, transfer, and trading. Financial institutions can directly transfer DLT securities on a blockchain, eliminating the need for traditional written documents, but requiring consent from all involved parties.

Legal Protection

Digital shares are bolstered by the robust legal framework of the DLT Bill, assuring investor protection within a regulated environment. Under the bill, all entities engaging in securities trading using DLT technology are mandated to register with the Swiss Financial Market Supervisory Authority (FINMA).

The Tokenization Process

When acquiring shares of a startup, investors receive tokenized shares. Arcton’s tokenization process underscores transparency, legal compliance, and seamless integration with Swiss law. By purchasing tokenized shares, investors become shareholders of that company.

The tokenization process involves the following steps:

- Shareholders’ Decision: Existing shareholders opt to create fresh tokenized shares, necessitating notarial validation.

- Share Issuance Contract Formation: Implementation of a share issuance smart contract, crafted to adhere to Swiss legal requirements.

- Public Offering of Shares: Shares are presented for public acquisition, broadening accessibility.

- Shareholders’ Investment: Future shareholders invest in the company through USDC or FIAT transactions.

- Registry Approval and Creation: Newly minted shares receive recording in the Commercial Registry, contingent on Swiss notary and Commercial Register endorsement.

- Incorporation into Commercial Register: The recently issued shares are formally registered in the Swiss Commercial Register.

- Claim: Investors can become shareholders by claiming their allocated share tokens.

Swiss Law and Tokenization

- Swiss law extends the privilege to Swiss companies for tokenizing their shares in accordance with the Swiss DLT Bill.

- This regulation empowers companies to tokenize shares, departing from traditional physical certificates, while retaining equal rights for these tokenized shares.

Token Distribution

In a typical start-up IPO, the distribution of tokens (shares) is structured as follows:

- Public Sale Allocation: 75%

- This segment represents shares available for public sale, allowing broad participation from investors.

- Liquidity Providers Incentive: 12.5%

- Over the span of four years, an incentive of 12.5% is allocated to Liquidity Providers.

- This incentive is designed to encourage liquidity provision and engagement.

- Protocol Owned Liquidity: 12.5%

- Reserved as initial liquidity, these shares are pre-minted.

- These shares contribute to facilitating liquidity within the ecosystem.

Following the public sale’s conclusion, the Camelot Nitro Pool is funded, initiating the liquidity mining program. Liquidity mining rewards are dispensed as additional start-up shares. These newly minted shares are generated during the public sale and categorized as treasury shares. Depositors progressively acquire start-up shares over a four-year duration, promoting engagement.

When it comes to the team allocation strategy, the startup’s team does not receive tokenized shares. Instead, team members hold non-tokenized shares, non-tradeable in the market. This approach is implemented to manage token supply in the secondary market. Hence, participation in the secondary market is limited to primary market participants (or their buyers) and liquidity miners, excluding team members.

When it comes to minting new shares, legal provisions enable companies to create new shares only under certain conditions. This includes shareholder resolutions and subscription rights offered to existing shareholders. Existing shareholders possess the right to contest this decision, as per Art. 706 of the Swiss Code of Obligations.

- Newly created shares are first extended to existing shareholders at a fair price.

- If existing shareholders do not exercise their subscription rights, these shares can be sold to new shareholders at equitable prices.

Ownership Assurance

With digital shares, ownership is unequivocally established, eliminating concerns over misplaced paper documents and providing a clear record of ownership.

Investors must possess a wallet to manage their digital shares. This wallet empowers you to directly control shares, facilitating effortless transfers and receipts.

Exits

Startup investing primarily aims to achieve an exit, which commonly involves selling the entire startup to another company within 5-10 years from the initial investment. Alternatively, startups may pursue an exit strategy by listing their shares on a traditional stock exchange, such as NASDAQ.

The process is as follows:

- Sale

- Potential buyer (Acquirer) contacts Start-up (Target)

- Acquirer and Target enter into Sale Agreement, Shareholders are informed

- Acquirer deposits the Purchase Price in an Escrow Banking Account.

- Shares are transferred to Acquirer, and proceeds are released from Escrow Banking Account to Shareholders (closing)

- Liquidity Pool is closed

- Stock Exchange Listing

- Board of Directors proposes Stock Exchange Listing

- Shareholders vote on Listing

- Shareholders transition tokenized shares to receive new shares (via a bank), tradable on a stock exchange (so-called intermediated securities).

- Liquidity Pool is closed.

- The exit function

- In startup investment contracts, a “Drag-Along Clause” is typically included to ensure that if a buyer intends to acquire all the shares of the company, all shareholders are obligated to sell their shares.

- Additionally, the share contract incorporates an exit function. This function simplifies the transfer of shares to the buyer once they deposit the purchase price into the escrow banking contract. Activation of this function is subject to meeting contractual terms, and shareholders are notified in advance before it takes effect.

- This mechanism offers a sale option as an exit strategy and guarantees that investors will receive their share of the proceeds from the transaction. Shareholders are given advance notice of the exit function’s execution, enabling them to consider selling their shares on the secondary market.

The $ARC token

The Arcton Sharedrop was introduced on October 16, 2023.

Unlike traditional airdrops that distribute utility or governance tokens, Arcton’s sharedrop rewards early backers with actual Arcton shares, granting them shareholder rights such as dividends, voting and proceeds of the sale of the company. The Sharedrop rewards Arcton’s earliest users and supporters of their first start-up IPO, Money Masters, receiving $ARC tokens as a reward.

The $ARC token is a share of MetaOne AG, the company operating the Arcton platform. By participating in the sharedrop, investors become a shareholder of MetaOne AG. The functionality of this token is defined by Swiss law.

The allocation will be as follows:

- The Sharedrop will be held from November 11th, 2023 to November 21, 2023.

- Early investors of the first startup IPO will receive the majority of $ARC shares.

- Money Masters investors will receive a linear portion of $ARC shares.

- Participants of the Zealy quests leaderboards will receive a portion of $ARC shares depending on their XP and ranking.

The $ARCH shares will only be distributed after the Money Masters shares has been released. As the sharedrop is part of a private round, a liquidity pool will not be setup, with vesting and release only 6 months after Arcton’s IPO.

Why the Project was Created

The mission of democratizing startup investments is backed by the belief that everyone should have access, not just the top 3% of wealthy individuals. By utilizing blockchain and the DLT Bill, Arcton empowers individuals to invest and trade startup shares freely. At the same time, having available liquidity to trade shares on DEXs will help to solve the liquidity problem associated with traditional startup shares. Retail investors will be able to freely trade their shares whenever they want in a permissionless manner and not have to wait years to be able to cash out.

Democratizing Access to Startup Investing

Arcton’s inception arose from dissatisfaction with existing solutions, characterized by high entry barriers, lengthy lock-up periods, and inadequate startup vetting. Additionally, the general perception of start-up investing was that they were considered risky and exclusive only to well-connected or high-networth individuals.

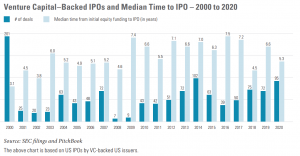

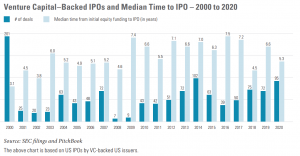

Startup investing is a high-risk and high-reward endeavor. The lengthy lock-up periods mean that participants’ funds would be stuck in times of emergencies, and they would not have any control during that period. As a result, these long periods are better suited for bigger funds and Venture Capitalists (VCs), who have a much longer timeframe when it comes to investing in startups. Historically, this has worked against retail individuals, who have a much smaller float and timeframe due to short-term necessities.

Solving the Liquidity Problem

Crowd-investing does not solve this problem either. While you might be able to invest in startups via crowd-investing platforms, this does not solve the liquidity problem. As a result, investors will still have a hard time exiting their positions and will remain locked up in their investments for a multi-year period of time. This makes it impossible for investors to have predictability or access their capital for emergencies or other uses. The opportunity cost of this loss of control can be quite high, leaving investors at the mercy of external platforms and missing out on other opportunities.

The Marketplace Void

While investing through crowdfunding platforms might look like a democratized process, this is not necessarily the case. Those investors who choose to invest in startups often end up having problems when they want to sell shares. In fact, there is no such thing as a centralized marketplace for selling illiquid startup shares.

Stock exchanges are the go-to place for liquidity, but not all companies are listed there. Not only that, but they often operate on obsolete tech infrastructure and legacy systems that result in high costs, exceeding startup budgets. In addition, there are regulatory barriers, and laws are also not caught up in most jurisdictions. Many jurisdictions only allow accredited investors to access start-up investments, compounded by geographic restrictions.

Hence, while it is possible to invest in startups via crowd-investing, the capital of investors could be stagnant for a decade or even more. As a result, the liquidity is tied to a future event – an IPO or a trade sale. For instance, the past 20 years show that the median time to exit has increased, while the number of deals has decreased, making this problem even worse.

Arcton’s Solution

With its strategic approach to startup investments, Arcton aims to disrupt the market by providing accessible and liquid startup investment opportunities, providing the following benefits to retail investors and startups:

- Startups can directly raise funds from their communities, avoiding unfavorable terms from VCs.

- Startups can adjust their terms to suit retail investors, providing shorter lock-in periods and lower cost of entries.

- Startup Shares are now liquid, on-chain, and tradable 24/7 on decentralized exchanges, allowing investors to reinvest their capital much quicker, increasing overall liquidity in the startup market.

- Investors can also provide liquidity to the Automated Market Maker (AMM) pool, receiving more shares as incentives along with trading fees, which is not possible in the traditional startup world.

- Investors can also use their shares for other strategies, such as borrowing against it, leveraging, shorting, etc.

- Investors are also entitled to dividend distributions, which make shares yield-bearing tokens.

Sector Outlook

Arcton belongs to the market sector of equity tokenization. Arcton’s approach involves transforming conventional startup equity into digital tokens, leveraging the security and efficiency provided by blockchain technology.

Present-day giants were once startups, making startups a highly successful asset class in recent times. The global venture capital industry has expanded significantly, growing 20 times to reach $580 billion since 2002. The value proposition is to democratize access to startup investing, unlocking the potential to invest in startups with as little as $100.

Some examples of well-known startup investors/venture capitalists and their assets under management (AUM) include:

- Andreessen Horowitz aka a16z – AUM of $35 billion

- Sequoia Capital – AUM of $28 billion

- Dragoneer Investment Group – AUM of $24 billion

However, it is almost impossible for retail investors to gain access to deals led by such companies (they require large sums of capital, investors remain locked for multiple years, and illiquid conditions make it harder to get an exit…).

Why Invest in Startups

Historically, startup investing offered investors big upside potential as investors would be able to get in very early to promising projects, albeit with the risks involved. Start-ups have also been outstanding asset classes, with the start-up investment market being extremely large due to how attractive successful start-ups are. This is in comparison to the total market cap of cryptocurrencies, which is tiny.

However, start-ups are a privilege reserved for the top 3% of the population. As a result, retail investors are left with only the option to invest in public markets where valuations are already high and returns are expected to decline in the coming years.

Arcton intends to disrupt this pattern, making it accessible to everyone, and allowing individuals to venture into the realm of potential breakthroughs alongside seasoned investors.

Many of today’s giants were once startups that yielded substantial returns for their early backers. Arcton offers a chance to participate in such opportunities, providing access to companies with the potential to become the next industry leaders. This is increasingly important in crypto, where tech-driven startups often take the lead and, given enough time, offer big upside potential. To put things into perspective, crypto is currently a ~$1T asset class, while companies that were once startups have now reached a similar size, like Facebook at $772B, Space X at $150B, OpenAI at $27B…

Arcton introduces a paradigm shift where investors can enter the scene at an early stage and actively partake in identifying the next big innovation. This is the major difference and big value proposition of Arcton. Usually, investments in startups are restricted to a very small percentage of rich investors. With Arcton, this will no longer be the case and, in the future, everyone will have a fair shot at betting on the companies that will unlock significant economic value.

- Discovery of Innovators: Discover and invest in startups with groundbreaking concepts poised to revolutionize industries.

- Fostering Growth: Contribute capital that helps startups expand, bringing their visions to life.

- Shared Success: Reap the benefits of astute investments and take part in the achievements of the startups you support.

- Become a Business Angel: Learn and master the skill of recognizing promising ventures.

- Invest in Founders: Engage with leaders who drive change in the world and whose vision resonates with how you view the world.

- Diversification: Go beyond investing solely in public companies and integrate startups into your portfolio for enhanced diversification and more optimal returns.

Why Choose Arcton

Arcton’s innovative platform offers an array of features that set it apart from conventional crowd-investing solutions. It empowers investors with continuous trading opportunities, liquidity through a secondary market, and flexibility in investment methods.

- Buy & Sell Startup Shares 24/7

- A Liquid Secondary Market

- Invest Using Fiat or Stablecoin

Potential Adoption

Unlike the predominantly crypto-focused DeFi landscape, Arcton is ushering in real shares from genuine companies, augmenting DeFi’s scope and security. This step opens doors for a larger DeFi ecosystem, safeguarding investors and diversifying their investment opportunities. By using blockchain technology, Arcton is solving the liquidity problem and flipping the VC script.

Traditionally, VCs provide capital to startups and accept it to be locked up for 7-10 years until they can cash out their initial capital. In the meantime, retail investors are left in the cold. This model favors the wealthy but sidelines retail investors, who miss out on massive value creation. The reason for that is that they cannot afford long-term lock-ins. Not only that, but this setup often leaves startups on the whims of VCs, missing out on the chance to raise funds from the community.

Arcton’s commitment to granting investors autonomy over their shares without intervention sets a new standard in share investing. Besides, the permissionless secondary market ensures equal opportunities for all investors to trade shares at will. This is possible thanks to DEXs, which make it possible to bootstrap liquidity and pool capital together from different sources or individuals. This is not the case in traditional startups, whose shares are often highly illiquid and it becomes difficult to find an exit at a fair valuation.

Because of how this innovative approach reshapes investment paradigms, Arcton introduces a liquidity mechanism that fosters greater accessibility, liquidity, and security within the current DeFi landscape. Now startups can directly raise funds from the community, sidestepping VC gatekeepers and amplifying the earnings potential of individual investors. This is a win-win approach that reduces risks for retail investors and enables quicker access to capital flows.

It is also worth noting that a large amount of TVL could flow into DeFi as a result of this. For reference, consider the size of the equity market today. This has grown from $65T in 2013 to $112T in July 2023. The total crypto market cap is just over $1T.

Not only that, but to understand the size of the opportunity it is also important to consider game-changing factors such as:

- Settlement Speed: Traditional securities settlements are plagued by outdated processes that can take up to three days. With blockchain, this is instantaneous, offering a substantial edge to TradFi.

- Cost-Savings & Efficiency: Traditional securities issuance involves a labyrinth of intermediaries, each skimming off a fee. With blockchain, this process becomes streamlined, directly linking issuers to buyers, which results in significant fee reductions.

- Reclaiming Ownership: Blockchain bestows financial sovereignty, allowing investors to have true ownership of their assets, reminiscent of the times when shares were physically held.

The illiquidity problem of RWAs is well-known, and DEXs offer a viable solution to the outdated infrastructure and legacy costs of TradFi. As a matter of fact, major institutions like JP Morgan, DBS Bank, and SBI Digital Assets Holdings have already started experimenting with the codebases of major DeFi protocols such as Aave and Uniswap. Not only that, but the World Economic Forum has also endorsed DEXs as a viable solution to the illiquidity challenge.

Total Addressable Market

The advent of Real World Assets (RWAs) on-chain presents a transformational shift in the asset management landscape. The magnitude of this transition offers an unprecedented investment opportunity, primarily evidenced by the burgeoning interest in tokenizing startup equities.

For reference, the crypto industry has a total market that barely exceeds $1T, while traditional securities currently hold a market cap of $112 trillion. This enormous pool has barely scratched the surface of its potential, with projections from reputable institutions like CitiBank forecasting the on-chain RWA market to reach $4-$5 trillion by 2030, while Boston Consulting Group predicts a whopping $16 trillion by 2023.

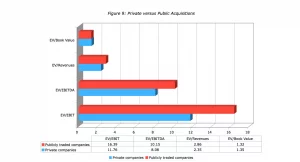

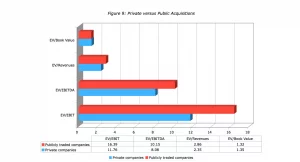

In Switzerland, only around 300 LLCs are listed on the stock exchange. The resulting illiquidity discount for the remaining LLCs (more than 100,000), which can be as high as 30%, translates to trillions of dollars in untapped potential.

Portfolio Diversification

Tokenized startup shares offer a compelling diversification strategy. With these shares coming on-chain, investors can diversify beyond traditional crypto tokens and penetrate the expansive world of RWAs.

These assets can easily weave into existing DeFi strategies, opening the gates to more intricate and potentially more rewarding investment avenues (i.e. lending, providing liquidity…). Moreover, they can significantly impact token values due to their sheer volume.

Tokenizing startup shares and integrating them on-chain is not merely a passing trend; it’s a transformative shift that will inevitably dominate the investment landscape. For crypto enthusiasts and investment analysts, this move offers an unparalleled opportunity to diversify, optimize returns, and capitalize on a largely untapped market.

Chains

Arcton uses the Arbitrum blockchain to issue digital shares, utilizing the ERC20 standard.

For example, for their first IPO candidate Money Masters, liquidity will be seeded on the Camelot DEX, which is a native DEX on the Arbitrum chain.

How It Works

Arcton offers an operational framework that provides the liberty to trade at your convenience, transforming the traditional investment landscape:

- Global Accessibility: Engage in trading unrestricted by geographical barriers. Arcton facilitates trading interactions worldwide, enabling seamless transactions with diverse counterparts.

- Unrestricted Trading: Experience the freedom of trading unshackled by constraints. Prices are governed by the interplay of supply and demand, offering opportunities to buy at low points and sell when values peak.

- Continuous Trading: Arcton operates around the clock, available 24/7. The market’s perpetual accessibility empowers you to execute sales whenever you deem fit.

- Rapid Transactions: Efficiency is paramount. Arcton enables swift sales, with transactions often concluding within minutes, enhancing your ability to respond promptly to market dynamics.

How To Sell

Arcton greatly simplifies the process of selling. Historically, startup investors endured long waits, averaging around seven years before selling shares and recovering funds. These users are locked with their investments and cannot sell if they were to need money. As a result, only about the wealthiest 3% of the population can afford to invest in startups. Arcton revolutionizes this by allowing you to sell whenever you choose. This is possible because the shares are tokenized and can be traded on DEXs.

Upon participating in a crowd-investing campaign, your startup shares transition into digital tokens. These tokens are effortlessly transferable across the globe with just a few clicks.

By leveraging the liquidity of decentralized exchanges, Arcton enhances the trading process by leveraging the 24/7 availability, security, and transparency of trading startup shares in a DEX.

Because DEXs operate independently and set prices through a deterministic formula, the value of your shares is dictated by market dynamics, with supply and demand influencing prices.

How To Invest

With just six straightforward steps, Arcton simplifies the investment journey, enabling you to swiftly invest in startups aligned with your passions and aspirations.

- Registration: Join as an investor by completing a swift 1-minute signup process.

- Exploration: Browse through a collection of investment opportunities, delving into the details of various startups.

- Startup Selection: Identify a startup that resonates with your interests and ambitions. Specify your investment amount.

- Verification Completion: Engage in a fully digitized verification process that only takes a few minutes.

- Payment Method: Opt for your preferred payment type from the available options: Swiss Francs, Euro, or Crypto.

- Final Verification: Upon the successful culmination of the crowd-investing campaign, you’ll receive digital shares representing your stake in the selected startup.

Getting Set Up

Arcton’s streamlined setup process allows you to efficiently embark on your investment journey, ensuring seamless account creation, secure wallet connection, effortless start-up investment, KYC compliance, convenient payment selection, and ultimate ownership of tokenized shares.

- Step 1: Account Creation: Begin by visiting the marketplace and creating your Arcton account.

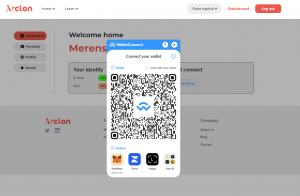

- Step 2: Connect Your Wallet: Link your preferred wallet, the destination for your distributed shares.

- Step 3: Initiating Your First Start-up Investment: Choose your favorite start-up and specify the number of shares you wish to acquire.

- Step 4: KYC Completion: Upon selection, you’ll be directed to Sumsup, a partner for automated KYC processing.

-

-

- KYC aligns with legal requirements set forth by our collaborating banks, establishing a secure, regulated environment for IPO participation.

- Successful KYC completion, alongside your interest, makes you eligible for IPO participation.

- The KYC process gathers information including name and nationality.

- Authorized entities with access to KYC data include Sumsub, Arcton, and a Swiss-regulated bank.

- Post-IPO, Sumsub, and Arcton erase the collected data. The Swiss bank retains the data in accordance with regulatory standards, ensuring the Swiss Banking Secret safeguards privacy.

- Step 5: Payment Method Selection: Choose your payment method from the available options, which include Swiss Francs, USD, USDC, Euro, credit cards, Twint, and cryptocurrency transactions.

- Step 6: Receipt of Tokenized Shares: Following the IPO, you can claim your tokenized shares using the wallet address you provided during the process.

How Arcton Selects Startups

Investors directly contribute to the success of startups they believe in, aiding their growth trajectory. Rigorous selection processes ensure you can invest confidently.

The curated selection of startups by Arcton spaces various market sectors, including:

- Web: Apps, Web Applications, and Platforms

- Sustainability: Clean Energy, CO2-Reduction & Removal

- Gaming: Gaming and Virtual Reality

- Deep–Tech: Internet of Things, Artificial Intelligence, Machine Learning, Robotics

- Fintech: Investing, Payment, Savings

- E-commerce: Innovative Online Stores and Platforms

The startup selection process consists of the following stages:

- Phase 1 – Pre-screening

- Founders evaluations: Assessment begins with understanding the founders. A startup’s team is pivotal, requiring experience, adaptability, visionary leadership, and the capacity to attract top talent. Factors like communication skills, emotional intelligence, and diversity also influence the assessment.

- Market analysis: A startup’s scalability hinges on the market. A burgeoning and expansive market is crucial for long-term success. Arcton seeks startups with an addressable market of at least CHF 100 million.

- Product assessment: A startup’s product drives its success. Questions like product demand, problem-solving capacity, user base, metrics progression, differentiation from competitors, and unique value proposition shape the evaluation.

- Phase 2 – Due diligence

- Business model: Evaluation of the startup’s revenue generation strategy and potential profitability.

- Technological assessment: Scrutiny of the technology employed, focusing on its distinctiveness and replication potential.

- Terms analysis: Evaluation of offering terms, including valuation cap and other conditions, ensuring alignment with startup stage and traction.

- Fact verification: Validation of key pitch facts to ensure accuracy.

- Competitive landscape: Examination of the competitive environment, identifying existing players and potential differentiators.

- Phase 3 – Decision

- Final review: Based on the comprehensive evaluation, a decision is reached regarding the startup’s suitability for fundraising on Arcton.

- Documentation and campaign launch: If selected, necessary documents are prepared, and the campaign is launched on the platform. Support and information are provided to investors during the fundraising journey.

For Investors

1. Discover and invest in startups: Browse a curated selection of high-quality startups. When you are ready, invest seamlessly by acquiring your stake with CHF, EUR, or USDC.

2. Redeem tokenized shares: After the fundraise, transfer your tokenized shares to your digital wallet. Swiss legislation ensures that these tokens represent actual ownership in the startup.

3. Buy and sell at any time: Users can trade their tokenized shares on the Camelot DEX.

For Startups

Arcton’s fundraising approach empowers founders by assisting them in fundraising, community engagement, and preparing for future growth. Reasons for choosing Arcton include:

- Enhanced Capital Acquisition: Arcton offers a superior capital-raising avenue marked by speed and effectiveness. Campaigns can commence within minutes, with the potential to conclude fundraising rounds in as little as 8 weeks.

- Holistic Support: Arcton goes beyond financial support. Numerous companies will be able to expand their user bases, have the potential to generate significant product revenue, gain media exposure, form connections with venture capitalists, and have an opportunity to secure follow-on funding at favorable terms through Arcton campaigns.

- Compatibility with Venture Capital: Arcton’s Crowd SAFE framework aligns with venture capital practices. It serves as a complementary tool rather than a substitute, allowing startups to conduct crowd rounds alongside traditional VC fundraising.

The fundraising process ensures the following:

- Comprehensive Campaign Creation: Start with a teaser campaign, rallying your community to generate traction.

- Campaign Launch: Attract investments from thousands of investors, maintaining a clean cap table.

- Marketing Assistance: Leverage Arcton’s comprehensive marketing solution to amplify your campaign’s reach.

- Efficient Round Closure: Confidently close your fundraising round in just 8 weeks, securing capital while cultivating community engagement.

- Investor Engagement: Foster investor engagement by keeping them informed about your progress.

- Investor Management Tools: Utilize tools for managing investors and providing campaign updates.

- Expert Marketing and Exposure: Benefit from Arcton’s marketing expertise to craft compelling pitches and attract traffic.

- Dedicated Legal and Onboarding Support: Engage with Arcton’s onboarding and legal teams for efficient campaign launch.

- Network Access: Gain access to Arcton’s network of founders, partners, and VC funds after campaign closure.

- Success-Based Fees: Fees are linked to campaign success, ensuring alignment with your goals.

- Smooth Payment Process: Arcton supports various payment methods, including stablecoin, credit card, debit card, ACH, and wire transfer.

- Community-Centric Features: Invite customers and fans to your cap table, turning them into brand advocates.

- Flexibility and Reward: Design your campaign configuration, including equity campaigns with no limits.

- Unique Benefits: Arcton’s features include sharedrops and white-label campaigns, offering exclusive rewards and branded experiences.

Business Model

Arcton operates at the intersection of cutting-edge blockchain technology, start-up investment democratization, and regulatory compliance. The business model is designed to transform the landscape of start-up investments and provide an accessible and efficient platform for investors and entrepreneurs.

- Tokenized Shares and IPOs:

- Arcton introduces a next-generation crowdfunding platform focused on tokenized start-up shares.

- Investors can participate in start-up Initial Public Offerings (IPOs) by purchasing tokenized shares of promising companies.

- By leveraging blockchain technology and Swiss legal frameworks, Arcton facilitates the issuance, trading, and ownership of digital shares.

- Investment Accessibility:

- Arcton addresses the challenges of traditional start-up investments, offering a lower barrier to entry for investors.

- Investors can participate in IPOs with smaller investment amounts, democratizing access to start-up investment opportunities.

- Liquidity Provision:

- Arcton offers a Liquidity Providers Incentive that allocates 12.5% of shares to those who contribute liquidity to the ecosystem. This incentivizes participants to engage actively and contribute to liquidity, enhancing the secondary market’s vibrancy.

- Secondary Market Dynamics:

- Arcton’s secondary market enables investors to buy and sell tokenized shares 24/7, providing unprecedented liquidity.

- The open and permissionless secondary market empowers investors to transact shares with flexibility, free from traditional lock-up periods.

- Revenue Generation:

- Arcton generates revenue through a success-based fee structure that is between 4 and 7% of the funds raised, depending on the outcome of fundraising campaigns.

- This way, Arcton’s financial interests are aligned with the success of start-up campaigns, fostering a cooperative relationship with entrepreneurs.

- Partnerships and Ecosystem:

- Collaboration is pivotal to the business model. Arcton collaborates with partners like Camelot to facilitate liquidity and token trading.

- By partnering with reputable organizations and startups, Arcton enhances the reliability and robustness of the ecosystem.

- Legal and Regulatory Compliance:

- Arcton operates within the bounds of Swiss legal frameworks, ensuring compliance and protection for investors and entrepreneurs.

- An integration of the Swiss DLT Bill allows us to tokenize shares securely, providing a clear legal framework for stakeholders.

- Investor Engagement:

- Arcton emphasizes ongoing investor engagement, ensuring that participants are well-informed and involved in the fundraising process.

- The marketing support and investor relations teams collaborate to drive awareness and engagement.

Risks

While Arcton is committed to providing a secure and accessible platform for start-up investments, it’s important to acknowledge the potential risks and challenges associated with investing in this dynamic ecosystem.

- Market Volatility: The value of tokenized shares can be subject to significant market volatility. Fluctuations in demand and supply can impact share prices, leading to potential investment losses.

- Regulatory Changes: The regulatory environment for blockchain-based assets and tokenized shares is evolving. Changes in regulations could affect tokenization, trading, and investor rights.

- Startup Risks: Investing in early-stage start-ups involves inherent risks. New businesses may face challenges in execution, competition, market adoption, and financial sustainability.

- Liquidity and Price Discovery: The secondary market for tokenized shares may experience liquidity fluctuations and challenges in price discovery due to factors like trading volume and investor sentiment.

- Technical Vulnerabilities: Blockchain technology is not immune to technical vulnerabilities, including hacks, smart contract bugs, and security breaches that could compromise investor assets.

- Investor Education: Investing in tokenized shares requires a certain level of understanding of blockchain technology and the investment landscape. Lack of investor education may lead to uninformed decisions.

- Dilution and Governance: Additional issuance of shares by start-ups may lead to dilution of existing shareholders’ ownership. Investors should consider the impact on their stake and voting rights.

- Exit Strategies: Start-up shares’ exit strategies, including mergers, acquisitions, or public listings, might vary and can influence the timing and potential returns for investors.

- KYC and Regulatory Compliance: Adhering to KYC and regulatory compliance is crucial. Failure to complete KYC or comply with regulations might lead to limitations in participation or fund withdrawals.

- Third-Party Dependencies: Arcton’s operations involve collaboration with partners and third-party service providers. Dependence on external parties introduces operational risks.

Security

There are currently no audits or bug bounties for Arcton.

As Arcton is a facilitator for IPOs, audits will most likely be from the IPO candidates themselves, or the secondary markets.

Team

| Name |

Role |

Former Positions |

Notable Studies |

Social profiles |

| Merens Derungs |

Co-founder and CEO |

Former Capital Market Lawyer at Backer McKenzie |

PhD on Digital Shares and DLT Law |

LinkedIn

Twitter

|

| Francesco Biviano |

Co-founder and COO |

Former Data Analyst at eBay |

Certificate of Advanced Studies in Blockchain at University of Geneva |

LinkedIn

Twitter |

Project Investors

Arcton has secured CHF 350,000 in a pre-seed investment round with notable investors such as Prof. Aleks Berentsen from the University of Basel, a renowned expert in Distributed Ledger Technology (DLT), Blockchain, and Crypto assets. Another investor is strategically affiliated with Camelot, a decentralized exchange on Arbitrum, reinforcing the existing collaboration between Arcton and Camelot. Also joining the round is Francesco Illy, former co-owner Gruppo Illy and president of the board of Amici Caffè.

Additional Information

Partnerships

- CamelotDEX – Custom-built liquidity infrastructure to support builders & generate real yield.

Product Lineup

- Money Masters (EdTech & Gaming) – Money Masters is an app that gamifies financial knowledge, making it fun to learn about personal finance.

- Kompotoi (CleanTech) – Swiss made, elegantly crafted wooden toilets that contribute positively to the environment by being odorless and chemical-free.

- DePoly (CleanTech) – Pioneering a Revolution in plastics recycling. They convert all types of PET waste into high-quality raw materials via an innovative recycling process.

- Alogo (Sport Tech) – Developed by a team of Swiss riders and engineers. Alogo is a cutting-edge equine sensor designed to enhance horse performance and prevent injury.

- Pier Wallet (Blockchain) – Pier is a user-friendly Web3 wallet developed in Switzerland.

- Autonomyo (MedTech) – A wearable exoskeleton to facilitate home rehabilitation.

FAQ

Investment

- Who can invest?

- Arcton’s mission is that everyone can invest. However, for regulatory reasons during an IPO people from restricted countries cannot invest.

- What do I get in return for my investment?

- You receive digital shares of the company according to the Swiss DLT Bill.

- How long does an IPO take?

- Typically, an IPO takes 5 full working days.

- How can I invest?

- Arcton accepts the following

- Currencies: Swiss Franc, USD, USDC, or Euro.

- Methods of payment: Credit Card, Wallet transaction, or Twint.

- Why do I need to do a KYC?

- Your money will flow into the bank account of the Swiss start-up. These banks require a KYC.

- Is there a minimum I need to invest?

- Typically yes, but very low. The minimum investment is made available before each raise.

- What is the Soft Cap?

- For each start-up, Arcton defines the minimum to be raised for an IPO. If the soft cap is not reached, the funds are fully reimbursed to the investor.

- What is the Hard Cap?

- For each start-up, Arcton defines the maximum amount to be raised (e.g. USD 1,200,000). After this hard-cap is reached, you won’t be able to invest.

- How do I get my money back, if the Soft Cap is not reached?

- The funds will automatically be returned to the payment provider you used during the investment process. You don’t need to do anything. The transaction costs will be borne by Arcton.

Shares

- What is a Digital Share?

- A digital share is a share of a company issued according to the DLT Bill.

- How do I become a shareholder of the Company?

- After having invested via Arcton in one start-up, and having claimed your tokens, you automatically become a shareholder of the Company.

- What rights do I have as a Shareholder?

- You have exactly the same rights as any other shareholder of a Swiss company. The most important ones are voting and dividend rights.

- What Obligations do I have as a Shareholder?

- The only obligation you have is to pay the purchase price for the share. Apart from that you have no obligations. For instance, you don’t need to participate in a shareholders meeting (but of course you can).

- In addition, you are not liable in any way for the actions of the company.

- Can I claim my money back from the Company?

- No, shares are an equity investment, hence not repayable. In return, you benefit from an unlimited upside potential.

- How can I earn a return?

- There are five sources of return:

- Dividend Payments

- Sale of shares

- Exit

- Liquidation Proceeds

- Incentive Program

- When are dividends paid, and who decided on this?

- Two conditions need to be met for a dividend payment:

- Decision by the shareholders meeting approving the dividend payment

- Meeting of legal requirements to issue dividends.

- Please note that start-ups typically don’t pay dividends, but instead focus on investing money, to achieve an exit.

- Where can I sell my shares?

- Shares can be freely traded on Camelot.

- What is an Exit?

- In an Exit the whole start-up gets either acquired by another company, or the start-up shares get listed on a traditional stock exchange. In case of an acquisition, shareholders receive the purchase price in return for their shares.

- What are Liquidation Proceeds?

- In case the start-up gets liquidated, shareholders receive liquidation proceeds. In such a scenario, typically proceeds are very low.

- What is the Incentive Program

- As part of Arcton’s secondary market, they offer people the option to earn additional start-up shares by providing liquidity to their official liquidity pool.

Secondary Market

- Where can I trade my shares?

- As you have control over your tokenized shares, you can trade them however you want. On top of each IPO a liquidity pool is created on Camelot.

- Is there a trading venue, where I can trade my shares?

- Yes, Arcton has a partnership with Camelot, a decentralized exchange on Arbitrum. For every start-up there is a liquidity pool, where you can trade your shares.

- What is Camelot?

- Camelot is a trading venue for tokens, which uses the Arbitrum blockchain. Camelot uses liquidity pools to make tokens tradable.

- When can I trade my shares on Camelot?

- As the secondary market is completely permissionless, you can trade your shares whenever you want.

- How can I access Camelot?

- You can access Camelot via their website. To use Camelot you need to connect your wallet to their website.

- What do I need to trade on Camelot?

- You need two things:

- A wallet & a little bit of Ether (worth some dollars). You need the Ether to pay transaction fees. If you have neither a wallet nor $ETH don’t worry: if you are an ordinary internet user it’s super easy, everyone can do it (and also learn about technology).

- If you want to buy start-up shares you need USDC.

- If you want to sell start-up shares you need the start-up shares.

- How much does it cost to trade on Camelot?

- To trade your tokens, you need to pay a transaction fee, which is around 1%. In addition, you need to pay the so-called gas fee to use the infrastructure, which is typically quite low. The majority of the fees are received by liquidity providers.

- What is a liquidity pool?

- A liquidity pool enables users to constantly trade their start-up shares. It acts as a counterparty if a seller wants to sell his start-up shares, or if a user wants to buy start-up shares.

- Who controls the liquidity pool?

- According to Arcton’s design principles, they want to have a secondary market as permissionless as possible. The liquidity pool is entirely controlled by smart contracts, and fully permissionless.

- How do you ensure that there is liquidity in the pool?

- The seed liquidity provided by the start-up is locked. The locking duration is communicated before each IPO and typically is 4 years.

- What is in it for me if I become a liquidity provider?

- Liquidity Providers earn a portion of the fees, which users need to pay to trade. In addition, each start-up has an incentive program.

- Do I receive dividends if I become a liquidity provider?

- No. Only people registered in the share book of the company can earn a dividend. LPs cannot register in the share book.

- Before each dividend payment users are informed about this process and hence can withdraw their liquidity. In addition, dividend payments are rare in start-up investments.

- Do I receive the payment price in case of an exit?

- Yes. You are the shareholder of the shares in the liquidity pool and hence benefit from the purchase price.

- How do you prevent insider trading?

- Insiders (the team, and existing investors), don’t own any tokenized shares. In addition, Arcton makes sure in contracts that they cannot buy them.

- Because of the due diligence process, Arcton is an insider at the time of the IPO. They believe in the start-ups offered on the platform and hence regularly participate in the IPOs on our own. After the IPO Arcton does not possess any confidential information, and its co-founders are simple investors in the start-ups offered on our platform. Should they in any way obtain any preferential information (e.g. the company wants to do another raise), they will not be active in the secondary market.

Arcton

- How are you different from other crowdinvesting platforms?

- Today, there are a lot of platforms where you can buy start-up shares. However, there is no platform where you can also sell your start-up shares. Empowering investors to not only buy but also sell their shares, is what makes Arcton unique.

- How are you regulated?

- The shares offered on the platform are tokenized according to the Swiss DLT bill. Arcton is subject to Swiss financial market regulations.

- Who is behind Arcton?

- Arcton is a Swiss-based start-up, co-founded by Francesco Biviano and Merens Derungs. The company name is MetaOne AG, incorporated in Switzerland.

- How do you make money?

- For their services, Arcton charges the start-up a commission of 5-7% of the total funds raised. These fees are paid by the start-up and not by the users. Arcton doesn’t earn anything from the secondary market.

- What happens with my investment if Arcton goes bust?

- Nothing. You still have control over your tokens via your wallet. Your investment is not affected by this.

Community Links