Disclaimer: Please note that Alluo has shown signs of inactivity, with no updates or communications on both Discord and Twitter since August 2023. In January 2024, a contributor of Alluo has mentioned in the project’s discord that the project is ongoing and mentioned efforts that do not reflect in the current on-chain liquidity, alongside plans for new product offerings and an upcoming announcement for the 2024 roadmap. However, as of March 18th, 2024, there have been no updates from the team regarding the roadmap or any social media activity. This document exists for historical reference and educational purposes. Readers should proceed with caution and consider this context when exploring the information provided below.

Alluo is a DAO, it is a decentralized finance (DeFi) project that is democratizing access to financial services. The protocol utilizes web3 and DeFi to achieve this goal and aims to find a sweet spot between traditional fintech and DeFi.

Alluo gives all customers access to personal finance tools, great rates and full ownership of their funds while taking away all the complexity of DeFi and delivering a seamless user experience.

The key elements of Alluo include a non-custodial mobile app, a decentralized web app (dApp), an $ALLUO token and governance process to determine the yield generation strategies and rates offered to customers, and the Alluo Protocol.

The Alluo Protocol that powers the mobile app and dApp is a cross-chain Yield Optimization that facilitates the decentralized and autonomous execution of the governance process. It can exchange tokens and execute cross-chain fund deployment in a variety of DeFi yield farming strategies in a fully trustless and automated manner.

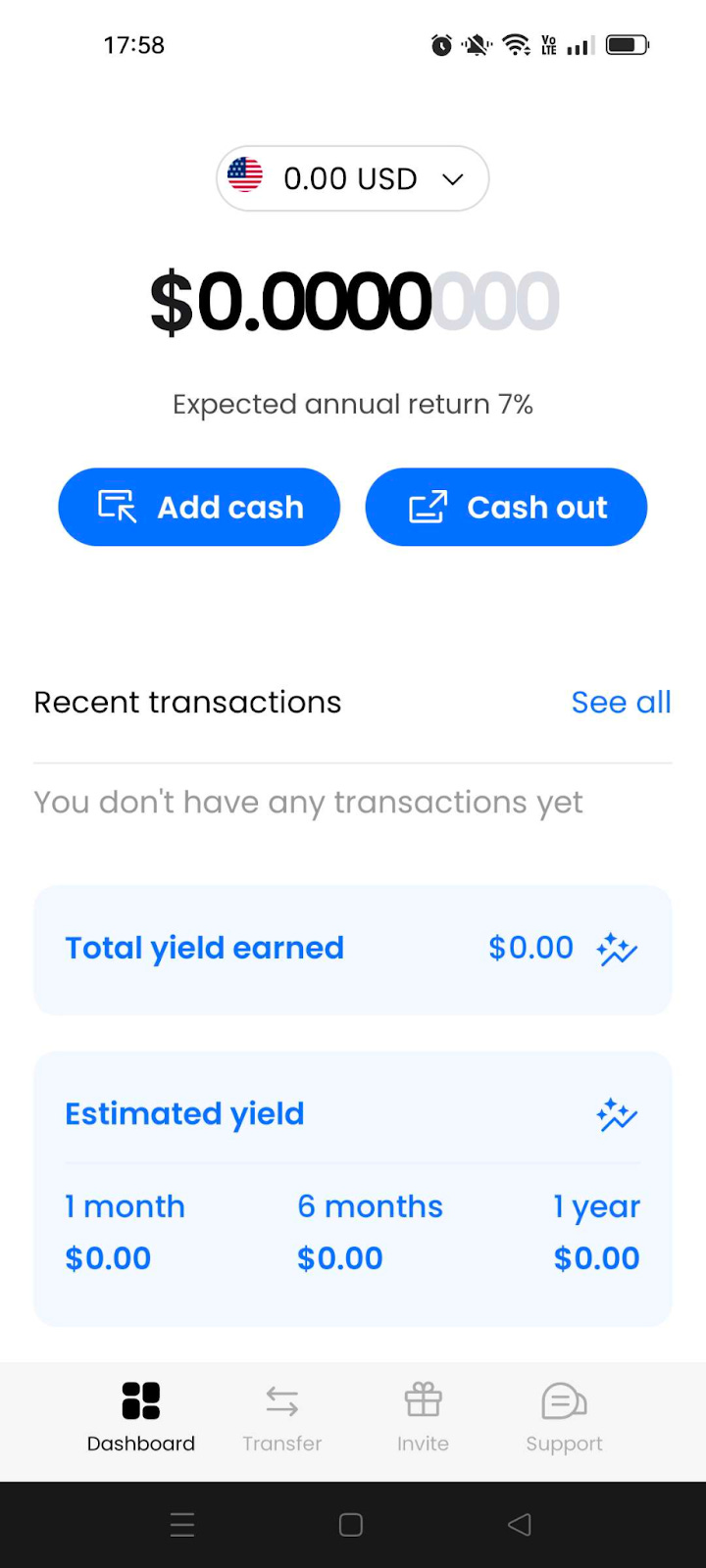

At its simplest, anyone with an internet connection can get an account that generates 7% yield per year on the money they deposit on the Alluo Mobile or Web App. Anyone can send money to their family and friends globally. Anyone can withdraw anytime for free – no lockups. Anyone can enjoy the benefit of no minimum deposits. Anyone can have an account. That’s what makes Alluo, for everyone.

Mobile app users can easily deposit fiat and earn DeFi yields or stream interest bearing $USD globally in an instant with zero crypto knowledge.

Alluo Pro users can also deposit a variety of crypto assets to access more complex boosted DeFi strategies that are typically out of reach for even proficient DeFi users given the cost and time taken to run such strategies. The Alluo ‘Pro’ dApp also offers additional enhanced features such as earning yield whilst Dollar Cost Averaging into ETH and BTC.

The mobile and web apps allow both experienced DeFi enthusiasts and less experienced retail users to access the DeFi features they want, with a Fintech-like user experience, in a decentralized and non-custodial manner. Users can interact with the protocol at the smart contract level, via the web interface or the non-custodial mobile app wallet deployed.

Alluo was created with the purpose of liberating users from the constraints and limitations of traditional financial services. The DAO is designed to democratize financial services and make it possible for people worldwide to access the benefits of decentralized finance (DeFi) without specialized knowledge.

Alluo’s goal is to provide a user experience that enables individuals to save, spend, and invest, regardless of their location, financial status, wealth, or technical knowledge. When the team set out to build Alluo, they envisioned a fair and democratic financial system where, for example, a student in a developed country could have access to the same financial services as a millionaire in a wealthy country. This vision makes it accessible for people to save, spend, and invest wherever or whoever they are. This would give users all the benefits of having access to a permissionless blockchain while enjoying the convenient user experience of their favorite banking or investment apps.

Current Fintech applications provide a user-friendly experience but remain geographically siloed. However, DeFi, while available to anyone with an internet connection, is often exceedingly complex and technical to access. Even technically proficient users are often faced with a frustrating user experience and high costs that can lead to financial loss.

Alluo is looking to create a world where users can benefit from DeFi with the same ease of use as Fintech applications. Users should not be burdened with technical complexities, and everyone should have access to complex or costly strategies without requiring advanced knowledge or financial resources.

At Alluo, the goal is for the underlying protocols, technologies, and complexities involved in traditional DeFi experiences to be abstracted away from end-users, providing an easy and intuitive experience. This is similar to sending emails or card transactions today, where most people do not worry about the underlying technology facilitating these services. This is the key value proposition of Alluo, to offer a product that brings DeFi to the masses through a friendly user interface.

Ultimately, Alluo hopes to offer a full suite of financial products ranging from simple to complex, that provides equal financial opportunities to everyone worldwide. The protocol aims to provide a simple and straightforward way for users to access the benefits of DeFi without requiring significant technical knowledge or experience.

Alluo is a multinational team with 15 members residing in countries such as the United Kingdom, Portugal, Uzbekistan, Russia, South Korea, and South Africa. All team members have background experiences working in the FinTech industry.

The team has extensive experience working in startups as well as a proven ability working together already to build businesses from scratch. Alluo stands out for its ability to find the right mix of Fintech/Banking and Blockchain in order to bridge the TradFi and the DeFi realms.

Alluo is a Decentralized Finance (DeFi) protocol. It is a cross-chain yield optimizer that was built to manage the process of yield farming in a user-friendly way. Its web and mobile applications also allow users to DCA into different assets, stream payments, or send assets across the world in a fully decentralized and permissionless manner.

There are a number of obstacles impeding DeFi from reaching mass adoption at a global scale, such as confusing wallet setups, industry jargon and the pseudonymous nature of blockchains. To a crypto native, yield farming across multiple protocols, transferring assets cross-chain, earning fees by providing liquidity, (etc.) might not seem like a big deal. However, DeFi can be a daunting space for newcomers before they even start (hexadecimal addresses, gas fees, browser extensions. This complexity is further exacerbated when terms like “yield farming” are used interchangeably to refer to multiple different things, like providing liquidity, lending assets and staking.

Tooling and accessibility are still the missing gaps for onboarding a new wave of users to DeFi. For instance, in the traditional world, there is a clear distinction between retail and institutional investors (capital, accessibility to financial instruments, sophisticated trading and research tools). However, in DeFi, both groups suffer from the same problem: lack of tooling and user-friendly applications. As an example, most people understand what a savings account interest rate is, but many understand what “yield farming” means.

One of success stories for bringing DeFi to the masses was popularized by Reddit, which introduced “digital collectible” (NFTs) by removing all the crypto jargon and offering a crypto wallet that is easy to use.

Alluo is taking a similar step applied to use cases such as investing, saving, and money transfers. Besides, by offering yield with a simple gateway through US dollars, the on-ramp and off-ramp features of Alluo make it more attractive for users. Thanks to these services, there is no need for users to even convert fiat to stablecoins on centralized exchanges. It is also a bad user experience to create an account on a centralized exchange just to withdraw funds to a non-custodial wallet a few minutes later.

Failures of CeFi

The failure of CeFi companies like Celcius that marketed themselves as decentralized impacted many users, who believed that the funds they had deposited to earn yields, or to take loans on, would be safe. Users also did not have control of their funds after depositing into Celcius and had no access to the real-time balance sheet of Celcius.

That said, despite all the failings listed above, the rapid rise of CeFi (Blockfi, Celsius, etc.) proved that there is strong retail demand for consistent rates with a great user experience.

Making DeFi accessible to everyone

One of the most recurrent themes since the inception of DeFi has been its potential to revolutionize the traditional financial system. However, the industry has not experienced mass adoption yet. The most important reason for that is because of the complexity and bad user experience by most applications. As an example, the majority of dApps are only accessible on websites and desktop applications, completely ignoring the importance of a mobile experience.

Among the primary challenges for reaching mass adoption we find:

How Alluo is attempting to fix it

Alluo is targeting an unexplored territory by most DeFi applications. Primarily, its services provide significant benefits for underserved or poorly served consumers. Anyone with an Internet connection, wherever they are located, can start saving, earning, and transferring assets with whoever they want in a permissionless manner.

Alluo believes that users should always be in control of their funds and their keys, and that organizations should never be able to block deposits/withdrawals unless it was via a democratic, decentralized and transparent process. It does this via a decentralized decision-making process.

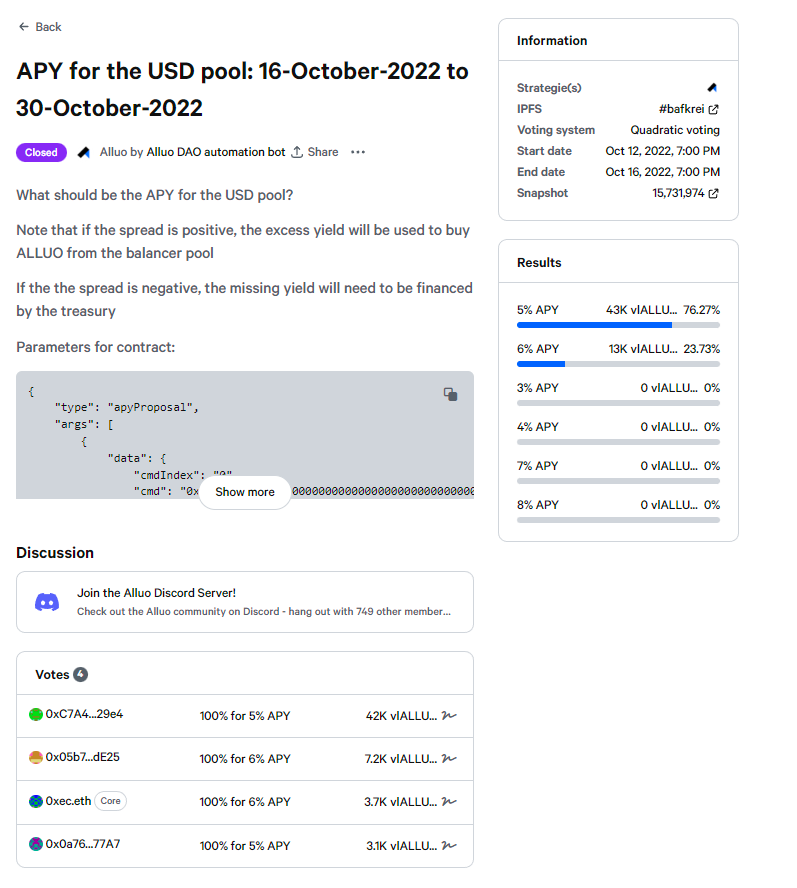

The community gets to vote with their $vlALLUO (ALLUO token that is vote-locked) in the fortnightly governance rounds, which is currently executed by the Gnosis multisig owners. This however, is dependent on the owners, can be time-consuming and is not transparent. As such, Alluo has designed a process that executes the change of APY after a governance vote.

The process allows anyone in the community to trigger a vote and run the execution in a very simple and transparent way, even if no one in the core team is available.Alluo is also attempting to improve their attractiveness in the sector by focusing on:

The liquidity buffer refers to the amount of funds that are immediately accessible

Competitive landscape

As a cross-chain yield aggregator, Alluo stands out by providing a friendly user interface for DeFi users of all levels. The protocol is currently present on Ethereum and Polygon. By concentrating on the most liquid layer 1s, Alluo has access to farms high TVL and sticky liquidity. This liquidity is unlikely to leave the ecosystem in the short term and allows Alluo to provide a sustainable APY that will not experience sudden increases or drops in TVL. Also, Alluo leverages highly established protocols that have stood the test of time and have been a long standing source of liquidity for DeFi, such as Curve and Convex.

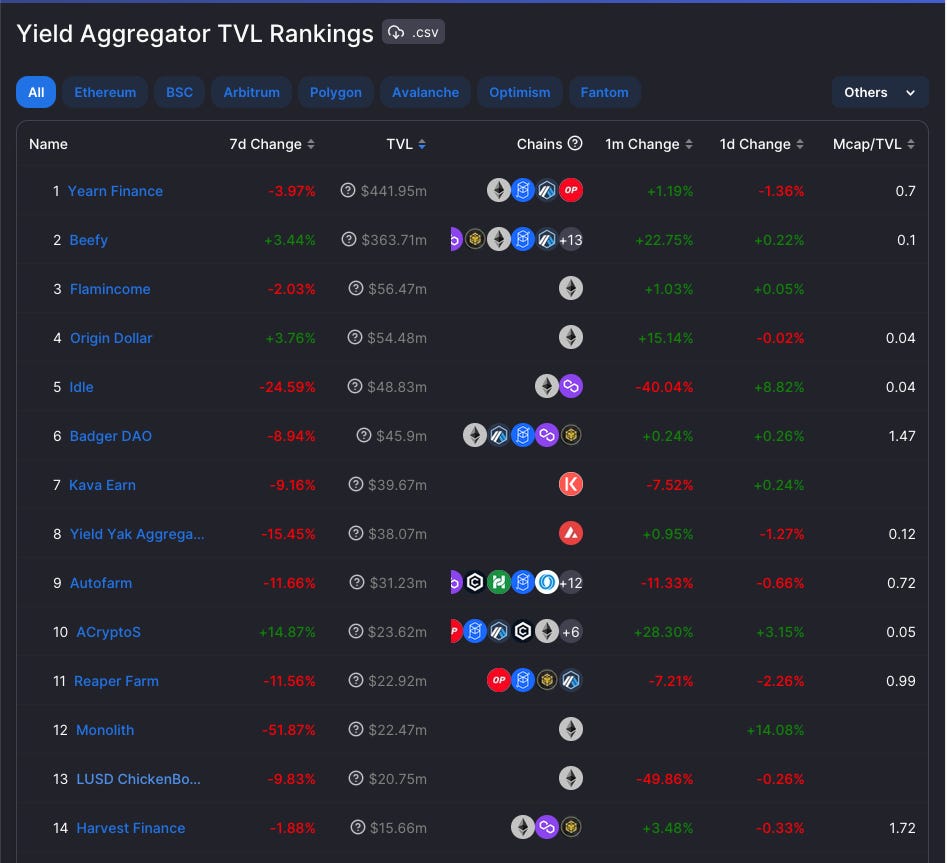

When it comes to yield aggregators, Yearn Finance still remains the leader with ~440M in TVL and being deployed on Ethereum, Optimism, Arbitrum, and Fantom. Yearn is followed by Beefy Finance, a cross-chain yield aggregator deployed on more than 10 chains. Other notable competitors in the yield aggregation space include Flamincome, Origin Dollar, Idle, Badger DAO, Kava Earn, Yield Kak, or Autofarm among others.

Yield aggregators play a key role in DeFi by building on top of existing protocols to create strategies and optimize the returns that users can get. The process of yield farming usually requires locking up or staking funds in return for a variable or fixed ROI (Return On Investment).

When it comes to cross-chain expansion, there are emerging protocols that will integrate with bridges and cross-chain messaging platforms in order to broaden the scope of yield opportunities. Cross-chain yield aggregation can help to diversify risk and increase returns by combining yield-generating strategies across multiple blockchain networks. This allows investors to potentially reduce the impact of market fluctuations on their overall portfolio.

Although the protocol was initially launched on Polygon, the Alluo ecosystem is adopting a multi-chain strategy and expanding its product offerings to other chains. As of 2023, Alluo is deployed on Polygon, Ethereum and Optimism.

Each launch on a different chain is performed by deploying the smart contracts on that specific chain. Although the protocol relies on a different handler for each deployment, there is no difference when it comes to the amount of yield that the user can earn in the fixed rate pools.

Deposited funds on Polygon and Ethereum are treated equally when used in the same yield farming position. However, even though there is no difference in terms of user experience, it is worth noting that there are differences that apply:

The Alluo mobile app is for retail customers looking for a simple way to earn a sustainable bank beating yield and those looking to transfer funds globally in seconds for free.

The ‘Pro’ decentralized web app is aimed at customers familiar with non-custodial wallets (such as Metamask) and web3 native protocols looking for a simple way to earn a sustainable yield in the fixed rate farms or access to complex (and usually expensive) DeFi Strategies that even proficient users would be unable to access.

Alluo Pro allows single-sided deposits on a variety of crypto assets in both fixed rate and Boosted yield farms. It also offers additional enhanced features such as earning yield whilst Dollar Cost Averaging (DCA) into ETH and BTC Users can also buy and stake the $ALLUO token and transfer the yield bearing asset to other non-custodial wallets.

Web3 native protocols and institutions can take advantage of Alluo’s guaranteed fixed-rate farms for earning low-risk sustainable yields on treasuries and also use the streaming interest bearing tokens for highly capital efficient payment of their contributors. Those protocols wishing to gain exposure to $ETH and $BTC over time in a Dollar Cost Average strategy can do so in a highly capital efficient manner (through earning fixed rate yields) also.

Protocols wishing to direct liquidity to their protocol or specific yield farms can purchase and stake the $ALLUO token to participate in governance and direct the vote towards pools and strategies of their choice.

The mobile app provides users who have less experience interacting with DeFi with a more user-friendly interface. Customer accounts will grow in value every second and the funds can be withdrawn at any time.

Alluo’s mobile app is a non-custodial wallet deployed on Polygon. Therefore, the private keys of the users remain under the own custody of the user and there is no way possible for Alluo to access user funds.

To set up an account, users provide information such as their name, phone number, and email. After receiving a verification code, users will approve permission for the application to access the user’s Google Drive or iCloud instance (depending on whether Android or Apple is being used), where the private key will be encrypted.

There are four main sections of the mobile app.

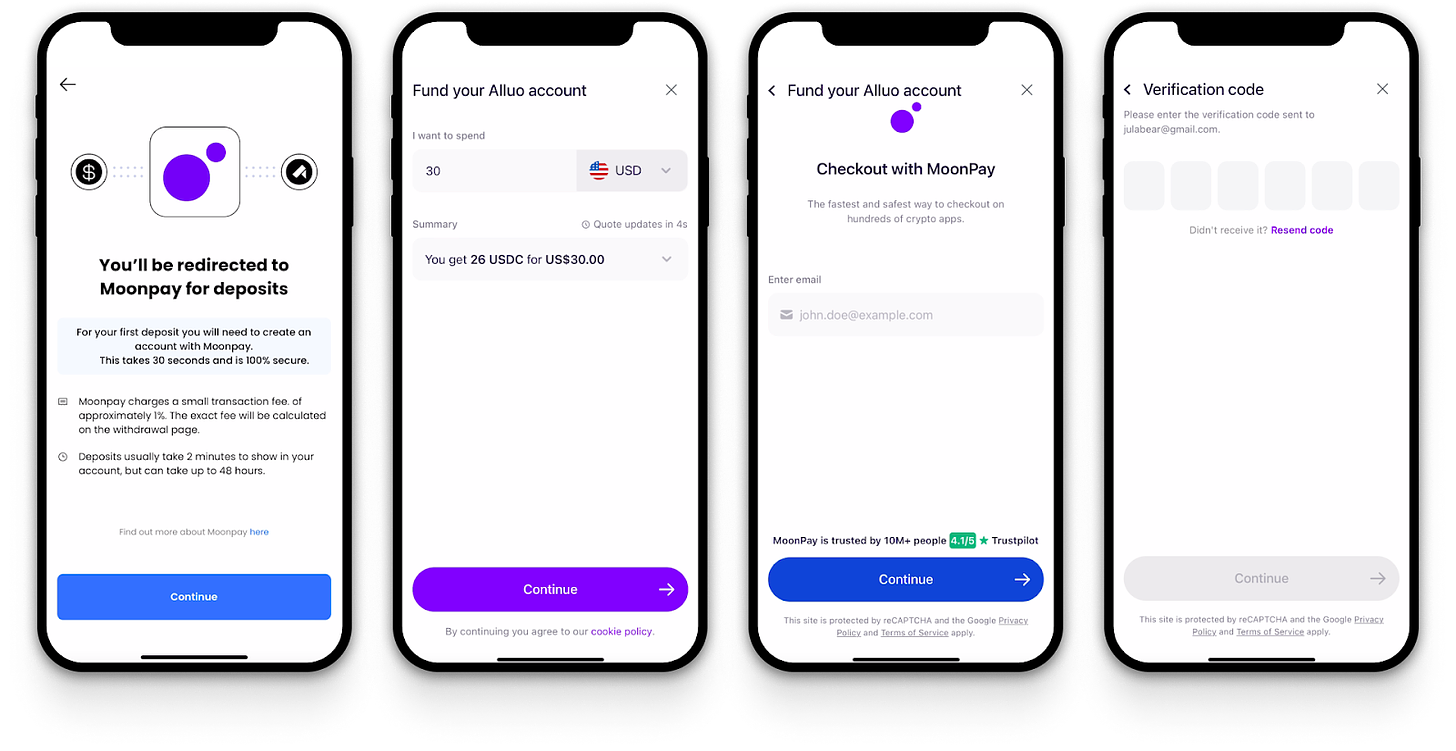

Once the account is set up, users can deposit funds. Since Alluo has partnered with local money transfer agents around the world, there is a list of supported regions and partners that can facilitate this step. This normally takes about two minutes and the user only needs to provide an email address in order to receive and confirm a verification code.

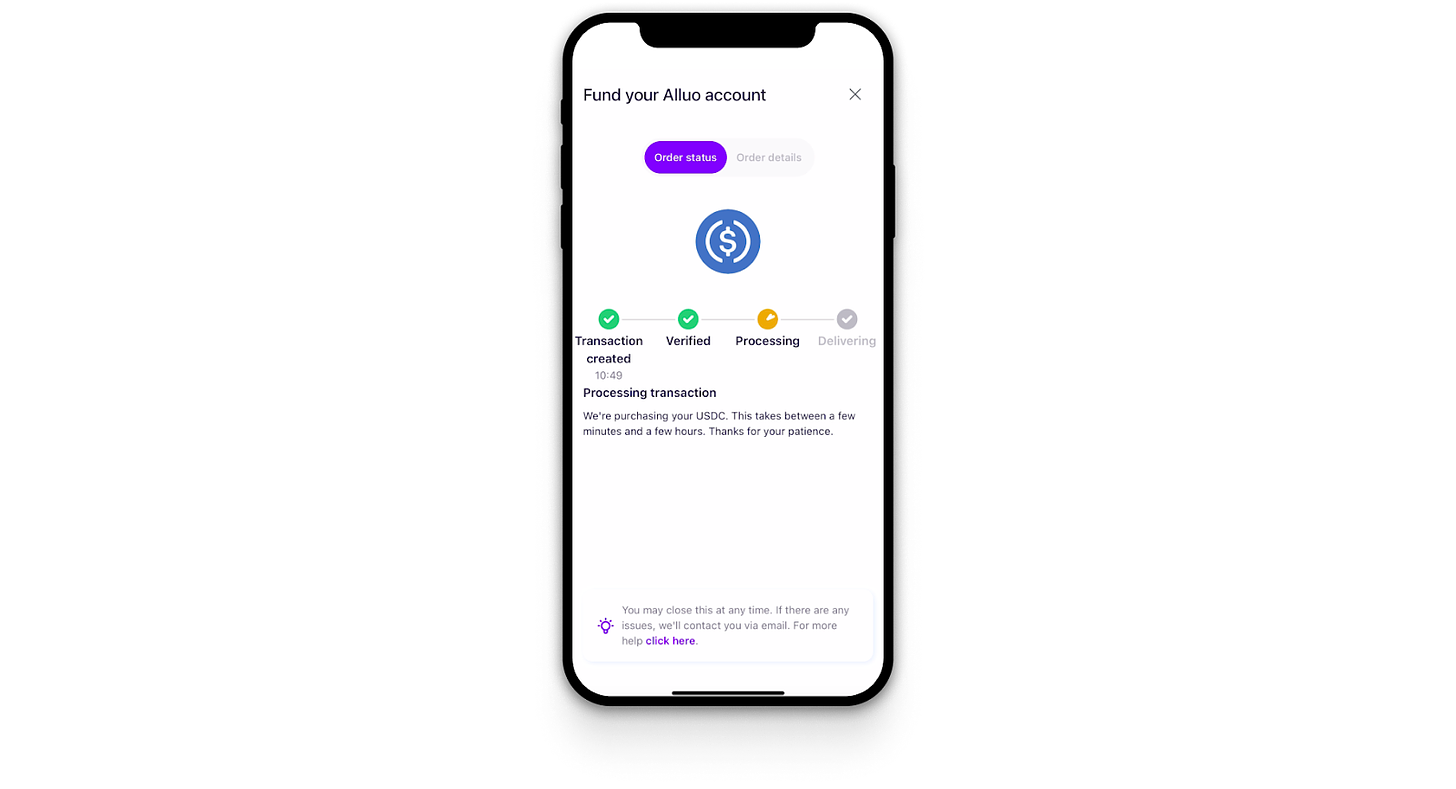

Deposits are often completed in a few minutes and the user will receive an email update confirming the status of their deposit. From there on, the user will be able to track the progress of their orders in the app.

Under the hood, when the fiat transfer is confirmed, Alluo converts the deposit into a dollar-backed stablecoin, USDC. Because of this, there is a conversion rate when users need to transfer currencies such as GBP or EUR to USDC (similar to the exchange rate as if they were converting to $USD).

Partners may charge a small fee for the currency conversion service (about 1.5%). However, this fee will depend on the payment method as well as the currency being converted.

Once the user has created an account and deposited funds into it, it is possible to add your device’s contacts in order to send funds with those who are already Alluo users, and to send an invite link to those not yet Alluo users.

Alluo are migrating to a new on-off ramp provider (https://getunblock.com) in Q1 that will enable free on-ramp and off-ramping as well as making it even faster and easier to on and off ramp.

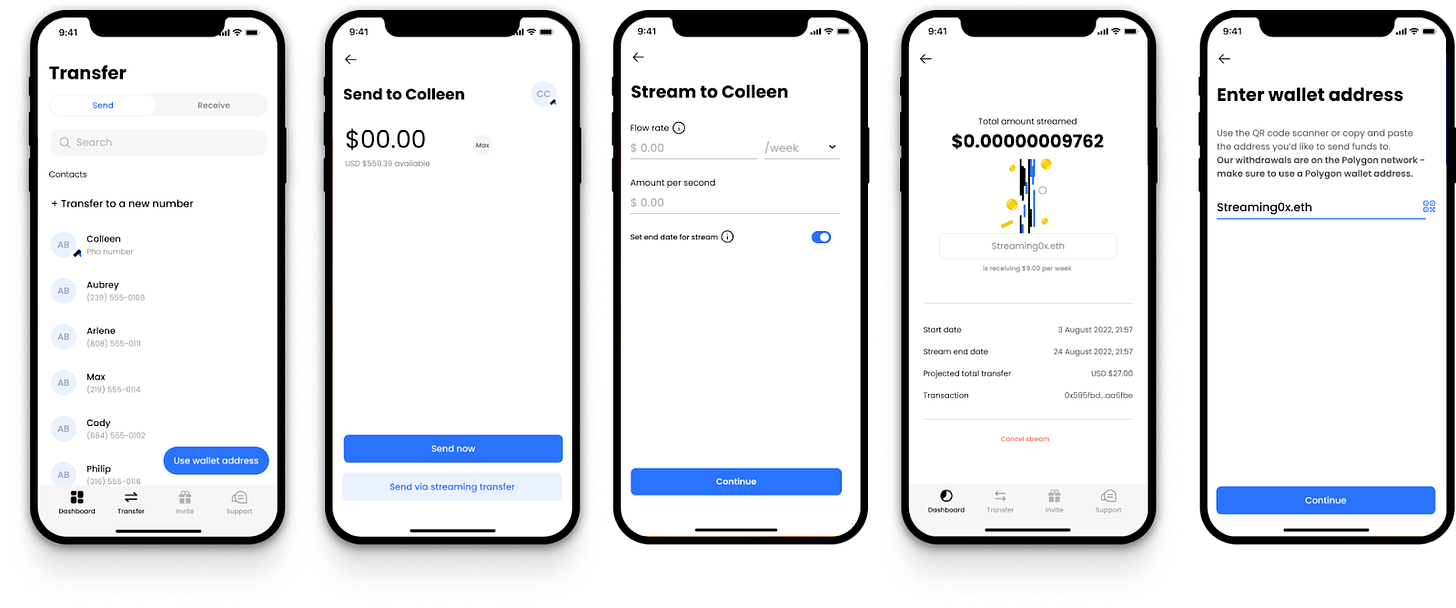

Alluo allows users to send money to other users via their mobile app, with either an Apple or Android phone with access to their respective app stores. In the mobile app you can send IBAlluoUSD to another address in your address book or another polygon address. This can be a one off payment or a streaming payment

When choosing to send money to a contact that isn’t using Alluo, or to a completely new number, the App will send them a link to download the Alluo app for their device

More advanced users can also transfer funds to other web3 wallets that they own.

After finishing the setup process, users are able to deposit funds into their wallets and start transferring money to other users. The process is relatively simple, with users simply selecting the contact in the App, entering the amount to be sent, and selecting confirm.

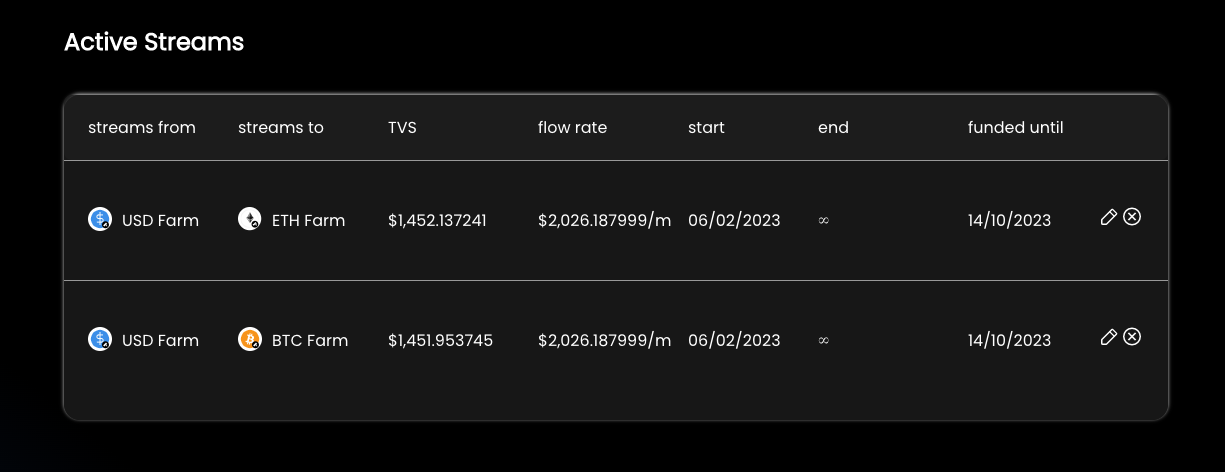

Users who are looking to utilize recurring transactions, like a standing order, can make use of the streaming payments function. Streams can be used to describe cash flows and execute them automatically on-chain over time with just a single transaction.

Alluo, with its partnership with Superfluid (an asset streaming protocol that brings subscriptions, salaries, vesting, and rewards to DAOs and crypto-native businesses worldwide), enables users to create streamable yield bearing Alluo tokens.

This means that, as funds are being streamed from wallet A to wallet B, they continue to compound at a given APY and remain invested during the entire streaming process until the moment the user wants to convert some or all of the stream back to a stablecoin.

Essentially, this allows the payer to deposit less than the required amount to the payee, with the remaining balance being made whole with the interest yield by the end of the period.

Some of the use cases enabled via the Superfluid integration include:

Those that want to, can export their Alluo App mobile wallet to an existing browser based wallet such as Metamask. This allows management of the mobile app funds in Alluo Pro and onward usage of the Alluo non-custodial wallet in other DeFi applications.

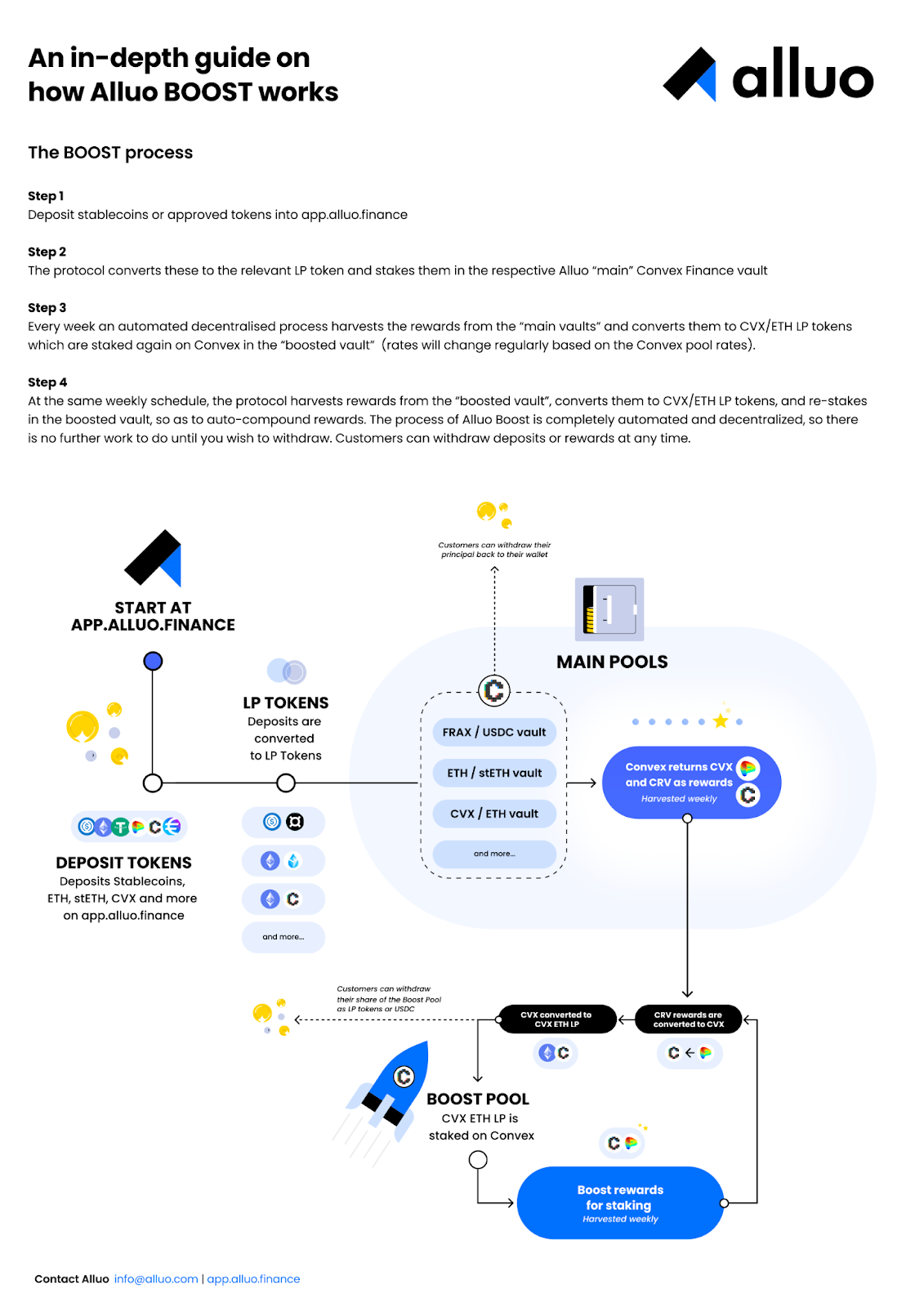

Step 1

Step 2

How to export your private key: https://docs.alluo.com/alluo-explained/understanding-alluo/faq#how-can-i-use-my-alluo-app-mobile-wallet-in-alluo-pro-and-other-defi-applications

The Alluo dApp is a web application intended for crypto native users and it has more complex features than the mobile application. Users can access fixed rate farms, variable yield boosted farms (increasing their yield without increasing their risk profile) and earn yield whilst DCAing into ETH or BTC. They can also buy and stake $Alluo.

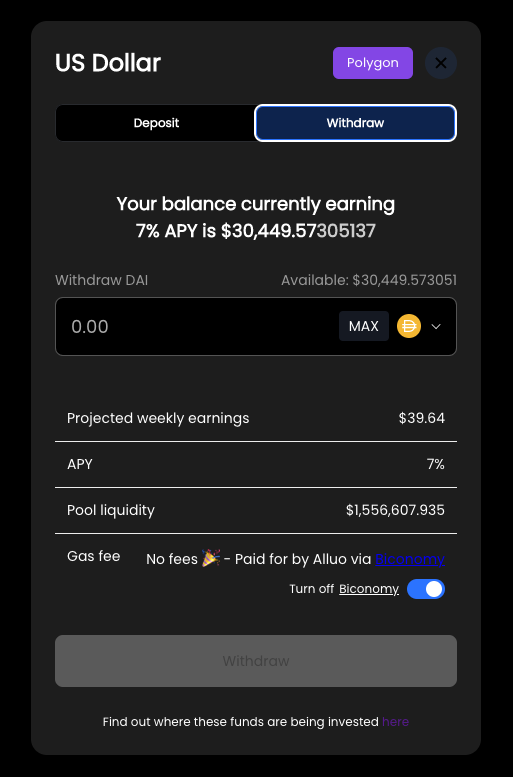

Alluo fixed-rate farms have a guaranteed rate or return for 2 weeks until the next liquidity governance vote takes place. Once customer funds are deposited, they start earning yield immediately and can be withdrawn at any time with no fees and no lock-in period.

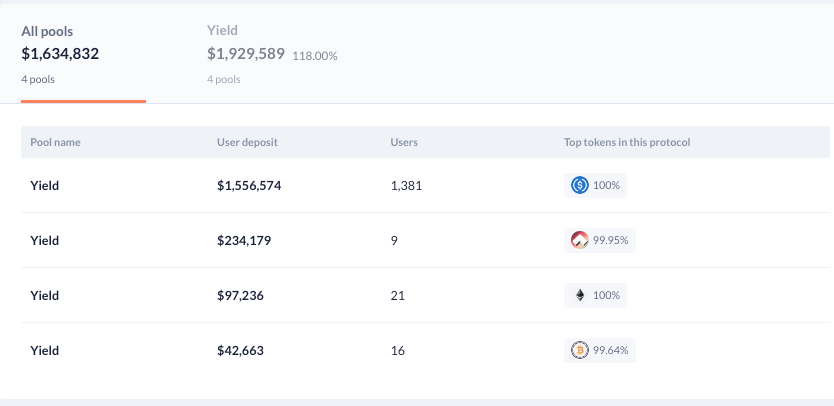

Users can invest stablecoins or assets like WETH or WBST on both Polygon and Ethereum mainnet. These funds are then deployed to Convex and Curve to generate yield between 3-7% depending on the asset being farmed.

Once the funds are deposited, the protocol creates LP tokens and stakes them in the relevant farms. The returns go back to ALLUO token stakers as CVX/ETH LP tokens. Every two weeks, ALLUO stakers will engage in a vote to deploy the protocol funds in the best pools.

Figures as of January 2023

Like any other dApp, users need to connect a non-custodial wallet, like Metamask, Wallet Connect, Coinbase Wallet, Unstoppable Domains… Afterwards, in order to interact with the platform, they will need to hold stablecoins like DAI, USDC, and USDT on the Polygon blockchain. Once the connection to the site has been made, users will have access to a series of yield farming opportunities that will show up on a dashboard.

The user can then choose the farm of their preference and deposit their assets in order to start farming rewards.

Before starting to earn, the user needs to approve the smart contract. Afterwards, the user can proceed to deposit funds. After the initial deposit, the user will observe how the balance increases as their position accrues yield from rewards. Since Alluo auto-compounds the rewards, there is no additional action for the user to take in order to optimize their returns.

Upon a deposit, the user will receive an IBAlluo token that will represent a yield-bearing version of their initial deposit.

To withdraw, users will simply go to the withdraw section and select the amount they wish to withdraw. Behind the scenes, the protocol will burn the IBAlluo tokens and return to the user the underlying asset with the yield that has been accrued during that specific period of time.

Users wishing to withdraw from farms can use the withdraw button after selecting the desired amount of tokens.

It is worth noting that Alluo has integrated the Biconomy SDK into its application so that users don’t have to pay for transaction fees across all farms. Instead, these funds will be covered by the Alluo treasury

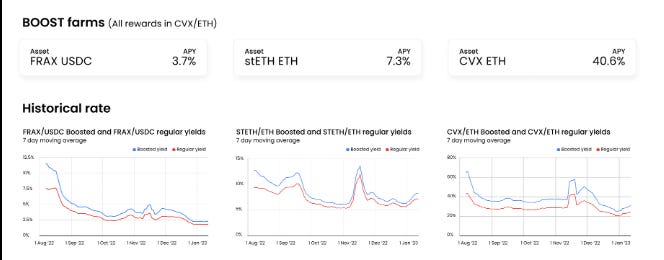

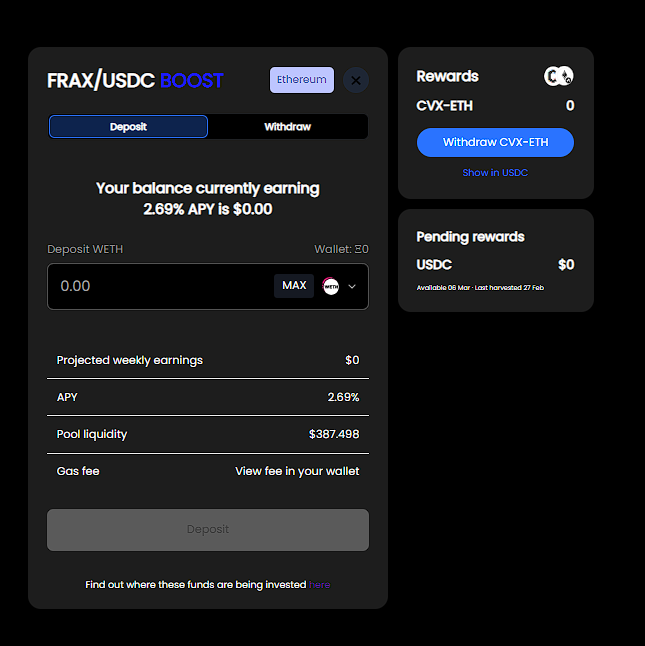

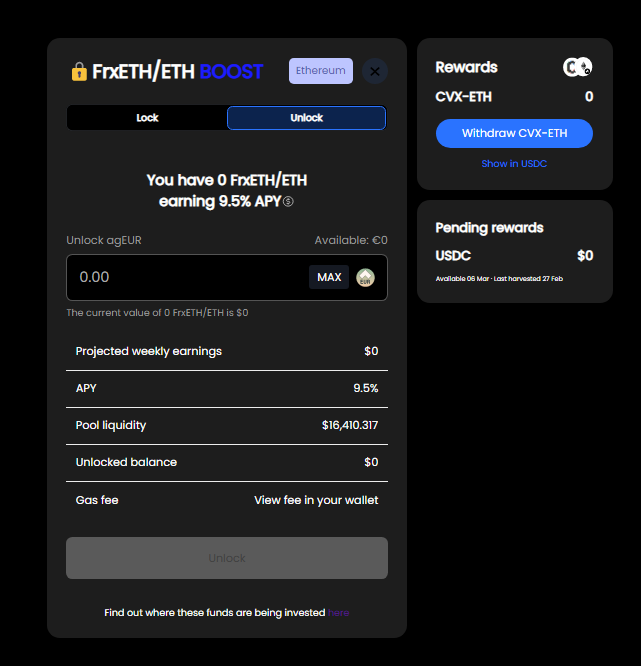

Boost farms are multi-pool auto-compounding strategies that give access to more complex boosted yields. The rates of return from these strategies are variable and investors earn CVX/ETH rewards that can be claimed in USDC (or the underlying LP token).

All rewards associated with these strategies are harvested on a weekly basis. By automatically claiming and reinvesting rewards into a separate higher-yielding pool, the boost increases the total yield whilst maintaining the same risk profile for deposits. Users can deposit any of the 10 supported assets (USD/EUR stablecoins, WETH, WBTC, CRV, or CVX) and choose to boost one of the 7 LPs.

Alluo boost had its roots from the initial idea of the protocol reinvesting and compounding their ALLUO locker’s farmed rewards back into Convex to boost their potential returns, instead of selling them. As a result, Alluo decided to come up with a similar system that was slightly different and was even more usable and accessible.Alluo Boost increases returns on customer deposits by automatically claiming and reinvesting rewards as auto-compounding CVX/ETH LP tokens, all without the customer doing anything after their initial deposit.Users would enjoy benefits in the form of:

Boost pools also differ from standard (non-boost) pools in the following ways:

Boost smart contracts create the LP tokens, and deposit them into Convex or Frax to automatically claim the rewards every week and reinvest them into the strategy.

Figures as of January 2023

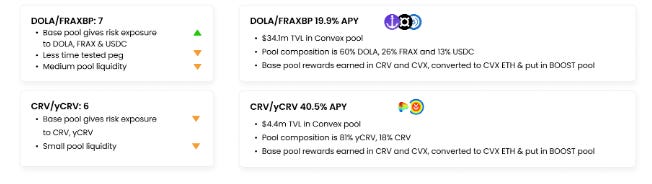

In 2023, two additional standard boost farms were added: the DOLA/FRAX BP, and CRV yCRV.

Rates are variable and will change regularly based on the Convex pool rates

Boosted farms are currently available only on Ethereum mainnet. Users can select a farm, which will bring them to the Deposit page.

Users can then choose to deposit any of the 10 assets available.

Users can withdraw their funds by selecting the Withdraw tab.

Note that withdrawing in any token other than FRAX/USDC increases slippage.

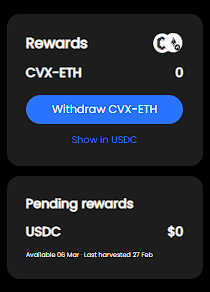

Customers can claim rewards for Boost farms from the “your farms” view on the main dashboard, or by clicking into each individual farm.

Rewards are claimable either in CVX-ETH LP tokens or USDC.

Customers will be able to claim rewards from all Boost farms in one transaction from the “your farms” view on the main dashboard by the end of February 2023, representing a significant saving in gas fees for those with deposits in several boost farms.

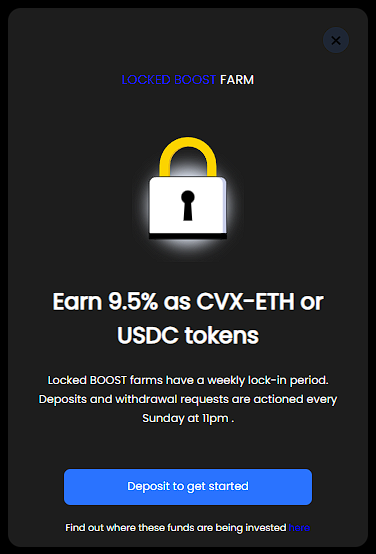

On 23rd February Alluo introduced their first LOCKED Boost pools which marked their first Boost farm deployment with Frax.convex ecosystem with some enhanced blue-chip yields

These two new pools are locked pools🔒 with a 1-week locking period. Customers can still withdraw rewards at any time, but whilst they can request to withdraw deposits at any point in the cycle, customers will only be able to access them when the harvest runs — weekly on a Sunday

In return for doing so, you get access to higher returns.

The deposit process is extremely similar to standard Boost farms, however the user is informed of the locking period and when the next harvest is

The withdrawal process is different for locked boost pools. Users are able to withdraw their rewards at any point in the cycle. Besides, users are able to request withdrawals at any time. However, they will only be able to access the underlying rewards when the harvest runs, which happens every week on a Sunday.

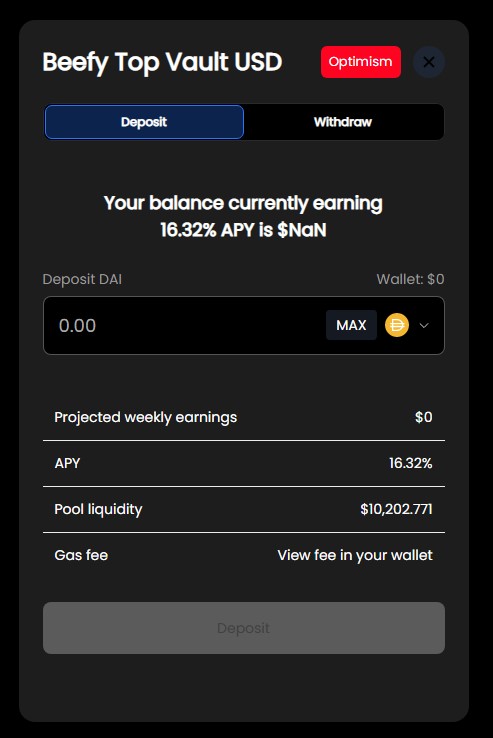

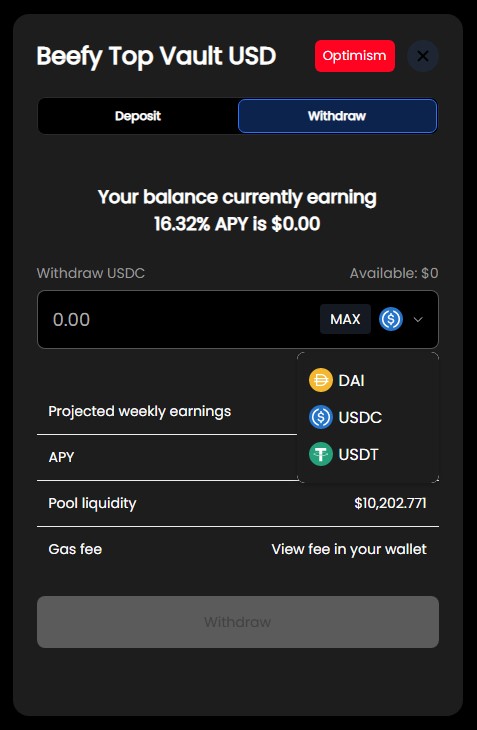

On May 19 2023, Alluo expanded to the Optimism chain and launched their optimised farms vault.

These farms available on the Alluo Pro dApp allows you to optimise Beefy and Yearn strategies so you’re always in the best pool for the chosen asset.

Users can simply choose the aggregator and asset, deposit funds, and let the protocol manage from there. It automatically creates LPs, stakes in the top farm, and moves funds to maintain your position in the top farm if this changes. Rates are variable, and benefits are auto-compounded.

Users can choose the asset they wish to deposit in the deposit page and will be able to view the projected weekly earnings and APY.

Users can choose to withdraw from the farm into their desired asset.

Overall, the process for using the optimised farms is actually quite simple.

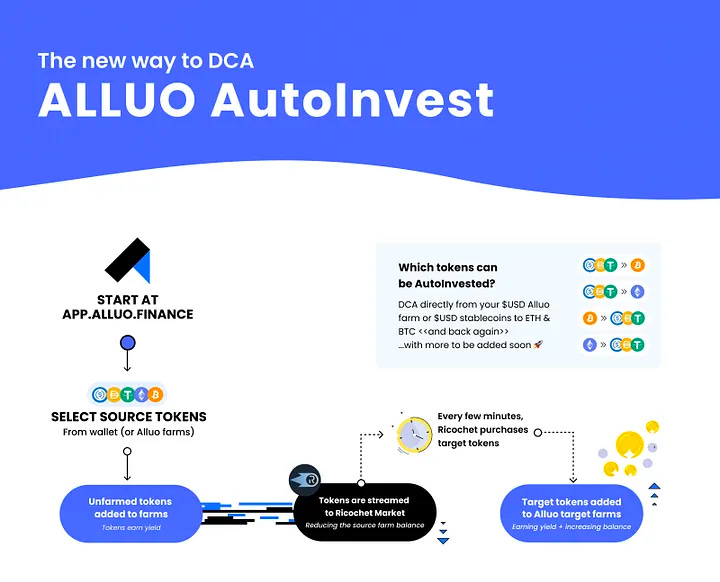

Alluo AutoInvest is a Dollar Cost Average (DCA) feature built on top of Ricochet Exchange, which uses Superfluid. Users can DCA in and out of assets, one way at a time whilst earning yield on their deposit and the purchased asset so as to maximize capital efficiency.

The process with AutoInvest goes:

What makes this experience different from the Ricochet Exchange is that users earn yield on the purchased asset and the deposited funds (even while waiting to DCA into the desired asset).

When creating the DCA stream, users can choose an end date or choose to keep the DCA stream going indefinitely (assuming there are sufficient funds to cover at least one month of the stream).

The first time users will go through 4 steps:

Once streams are set up, users can view them under the AutoInvest tab with information such as source of stream, total value streamed, and flow rate.

Alluo has plans to integrate Unblock, their on-off ramp service platform, to allow users to create a standing order from their bank account to Alluo for seamless DCA-ing.

Alluo’s transfer function allows users to transfer funds to their selected recipients, either via their wallet address or through their Unstoppable domains (customized Web3 domains), with gas fees paid by Alluo.Users have the choice of utilizing USD, EUR, ETH or BTC via the Polygon network.

Users can select the token that they wish to transfer and then input the recipient’s wallet address or Unstoppable domain.

The ALLUO token’s liquidity pool is held on Uniswap on the Ethereum network. This pool allows users to buy and/or sell the ALLUO token.

Users can click on buy at the top of the website, which will take them to the respective Uniswap pool.

Users can then choose to buy the ALLUO token with their desired base token (see example above with ETH).

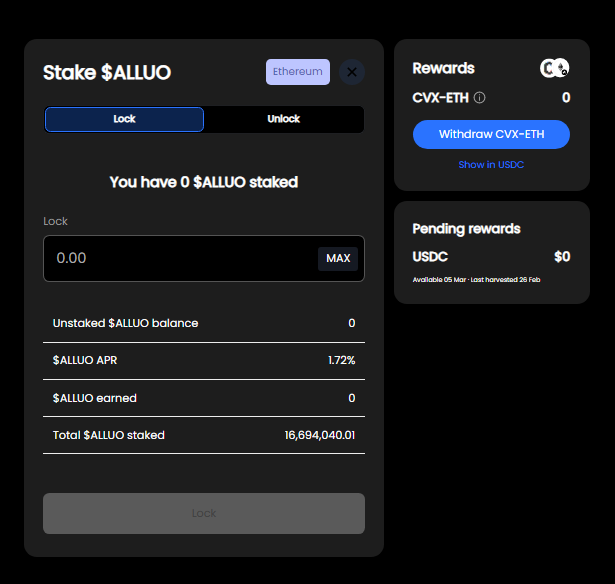

ALLUO holders are able to stake their tokens and receive vlALLUO (vote-locked ALLUO) in return, similar to the Curve Finance mechanism where tokens are locked in exchange for veTokens that allow stakers to vote and earn rewards.

By locking their tokens for a period of at least 1 week, vlALLUO holders also earn the spread between that is given to depositors in the mobile and web apps and the realized APY of those assets.

Users wanting to stake can select the stake button at the top of their website, which will bring them to the next interface.

Users can select the amount of ALLUO they wish to stake and click on the lock button.

Similarly, users wishing to unlock their staked ALLUO can click on the unlock button and choose the percentage they want to unlock by using the slider.

Alluo offers fixed rate farms on a variety of assets (e.g. USD and EUR Stablecoins, ETH and BTC). All of these are single-side deposit farms that can be entered into using a wide range of crypto assets (WETH, BTC, DAI, MIM, USDC, USDT, agEUR, CRV FRAX…).

Every two weeks, the ALLUO token lockers (those who bought and locked ALLUO tokens), vote on where to deploy the funds for each fixed rate farm from a variety of DeFi strategies. The protocol is currently able to deploy on Polygon and Ethereum mainnet in Aave, Harvest Finance, Curve, Convex.finance, Frax.convex.finance and soon Velodrome on Optimism. Today, the strategies are all deployed in Curve, Convex and Frax.Convex liquidity pools.

Once deposited into the pools, the funds will start earning yield and rewards that will be claimed by Alluo to pay the advertised APYs and any spread between the earned and advertised rate is returned to the original Alluo depositors.

Alluo is not a bank, and all funds invested on Alluo are not protected by a government-backed scheme such as FDIC, FSCS, or other such schemes.

The yield comes from depositing the funds in yield farms where returns generated come from 3 sources:

All investments in the protocol are classified by asset, and for each asset there are several investment strategies where funds can be allocated. These change all the time, any can be suggested or built by the community and voted on as part of the liquidity direction vote.

Funds will be deployed proportionally to any strategy that receives 5% or more of the LD votes. For example if 90% of the USD farm vote is for the mim/3crv convex pool and 10% is for the Frax/USDC frax.convex finance pool, the liquidity will be deployed 90% to mim/3crv and 10% to Frax/usdc providing opportunity for the voters to manage risk and reward accordingly.

Current fixed rate pool strategies are laid out below as an example:

For the Curve, Convex, and Frax-Convex strategies below, it is worth noting that customers cannot deploy LP tokens (unless they interact with the smart contract). Everything in Alluo is single-side staking. The protocol splits the original deposit into the relevant tokens at the corresponding ratio to create the LP position. This LP token is then staked in the respective farm so that Alluo can harvest and reinvest the rewards.

Alluo is currently able to deploy strategies on both Polygon and Ethereum mainnet. These integrations can deploy funds in Aave, Harvest Finance, Curve, Convex.finance, Frax.convex.finance and soon Velodrome on Optimism as well. As of Q1 2023, Alluo strategies deploy funds in Curve, Convex and Frax.Convex liquidity pools.

Alluo Boost increases returns on customer deposits by automatically claiming and reinvesting rewards as auto-compounding CVX/ETH LP tokens. All without the customer doing anything after their initial deposit.

Users who deposit LP tokens into an Alluo vault can get their rewards compounded. This is achieved with Alluo vaults that follow the ERC-4626 standard. These tokenized vaults accept LP tokens such as ETH/USD LP, FRAX/USDC LP from Curve and stake them into Convex to earn additional rewards.

As the amount of CVX and CRV rewards (and other tokens from external protocols participating in bribes) start accumulating, they are swapped by Alluo for CVX/ETH LP and staked in the vault’s respective Alluo pool. Rewards then start accumulating from the underlying LP tokens and they will be swapped for more CVX/ETH LP tokens that are then looped again.

When holders of the ERC-4626 vault shares wish to withdraw, they receive the vault’s underlying LP token back and they are then eligible to claim any accumulated rewards in the form of CVX/ETH LP tokens.

In Alluo, there is only one underlying LP token per vault, and Alluo will allow users to deposit and withdraw any supported asset. There are two ways to deposit into Alluo’s vaults:

Withdrawals only refer to the principal amount and do not take into account the rewards that have been earned

Similar to deposits, withdrawals can be done in two ways:

There are two ways to claim the rewards that have been accumulated by a user’s principal

The process of rewards boosting is achieved by staking the underlying LP deposits into the Alluo vault and looping all the rewards in a separate vault. This means that, by using the rewards from the underlying LP deposit, Alluo swaps the rewards to CVX and then adds the liquidity to the Curve pool to get CVX/ETH LP tokens that are then staked back in order to boost the yield.

This is done by a Gelato resolver that calls the stakeUnderlying() function so that any accumulated LP deposits can be staked back into Convex, and the farm() function, which claims all the rewards accumulated in the boosted rewards pool and all the rewards in each vault connected to it. After that, it distributes CVX/ETH LP tokens amongst the protocol vaults.

Every vault has a corresponding amount of shares in the boosted pool. This ensures that all rewards are distributed fairly.

Since multiple vault rewards are simultaneously converted to CVX/ETH LP tokens and then staked into Convex all in one transaction, the protocol reduces its costs significantly by optimizing its gas savings.

As of the end of Febrary 2023, Alluo has recently launched locked Boost Vauts using frax.convex.finance. These two new pools are locked pools🔒 with a 1-week locking period. Customers can still withdraw rewards at any time, but whilst they can request to withdraw deposits at any point in the cycle, customers can only access them when the harvest runs — weekly on a Sunday. In return for doing so, you get access to larger returns

The process of depositing into the Frax Convex Vault is different from other vaults due the 7 days locking period.

Deposits work in the same way as they do in other vaults. However, to withdraw funds, the user will need to go through two steps:

If there was a prior withdrawal request, the rewards will stop accumulating after the funds are unlocked.

Since shares are minted 1:1 on deposited assets, the total supply of shares should always be equal to the total amount of assets in the vault. This total of assets can be made out of: LP tokens, wrapped LP, or funds locked in Frax Convex

The StIbAlluo (Streaming Interest Bearing Alluo) is a wrapper contract that allows IbAlluo to integrate features provided by Superfluid. This enables use cases such as Constant Flow Agreements and Instant Distribution Agreements.

Whenever tokens are burnt or transferred (any deduction from a user’s IBAlluo balance), the IBAlluo token contract makes a check to see if the amount that is going to be moved is greater than the current user balances. The contract also checks whether it is possible to unwrap the difference from the stIBAlluo balance.

For instance, if a user with 50 IBAlluo tokens and 50stIBAlluo tokens wanted to transfer 70 IBAlluo tokens to another user, the IBAlluo token contract would unwrap 20stIBAlluo tokens and carry out the transaction.

This process is achieved thanks to the ERC777 standard that is implemented in the Super Token interface (through an integration of Superfluid).

Users can also interact with IBAlluo tokens directly in order to create streams. In these situations, the user is also protected against liquidation. A series of Gelato resolves will add the user address into a registry list and will either resolve or pause any stream that is close to running out of funds.

For example, a user with 100 IBAlluo tokens and 100 stIBAlluo tokens with an outgoing stream of 20 IBAlluo / hour is approaching a state liquidation. The Gelato resolver will detect this account and realize that the user has 100 IBAlluo tokens that it can use to continue the stream. The resolver will then wrap the IBAlluo tokens and the stream will continue, leaving the user with 0 IBAlluo tokens and 200 stIBAlluo tokens.

A user with 0 IBAlluo tokens and 100 stIBAlluo tokens with an outgoing stream of 20 IBAlluos / hour will see its streaming process being closed prematurely. The Alluo protocol will detect the lack of liquidity and close the stream to prevent the user’s remaining 80 IBAlluo tokens from being taken as a liquidation fee.

The protocol relies on Snapshot in order to vote on proposals and execute them fully on-chain in a decentralized manner. This way, user funds are handled in a transparent and open manner accessible to anyone.

Every 2 weeks, snapshot votes are created automatically by the DAO bot in order to allow voters to choose:

The vote executor contract (voteExecutor.sol) allows the multisig signers to execute the strategies that have been voted on by the ALLUO lockers as part of the weekly voting round that takes place at https://vote.alluo.com.

The vlAlluo.sol contract is the contract that enables users to lock their ALLUO tokens and start participating in governance, which primarily consists in participating in a weekly vote about what strategies to deploy the funds to. The current locking period is currently set for 7 days and there is a 5 days withdrawal period.

For a user to participate in voting, they will need to lock their ALLUO tokens before the snapshot vote is live.

In the future, the cooldown withdrawal period of 5 days will be replaced with an automatic slashing mechanism that will disincentive harmful voters and protect the protocol against governance attacks.

See Governance section for more details

The Liquidity Direction Protocol refers to the building blocks that allow the protocol to generate yield and offer a wide range of financial services to users, such as streaming money in real time, dollar cost averaging, yield farming.

Yield farming is the term used in DeFi to refer to the generation of yield denominated in a particular asset or assets as a result of supplying liquidity into a protocol

When users deposit capital into the fixed rate farms in the protocol, they receive IBAlluo tokens that denote the receipt of the deposit. For instance, if the user deposits USD, they will receive IBAlluoUSD. Similarly, someone who deposits EUR will receive IBAlluoEUR.

IB stands for interest bearing, meaning the deposit will be used across a series of DeFi strategies to generate yield. This interest that is earned is paid in the underlying asset – IBAlluoUSD earns USD yield, IBAlluoETH earns ETH yield…

The deposit will be used in a series of DeFi strategies but the interest rate is fixed for 2 weeks at a time, removing complexity from the user’s perspective.

The protocol then aggregates all those deposits and sends them to a single Liquidity Handler contract, which will move the capital into their respective adapter. These adapters are a series of modular contracts that will hold onto a buffer of tokens to redeem withdrawals or act out of custom logic requested by other protocol contracts.

This step ensures that there are readily available funds at a withdrawals buffer, as well as in the treasury to be invested into strategies.

Deposits are invested automatically by sending funds to the vote executor contracts. When 5% over the liquidity buffer of any asset is reached, a gelato resolver will trigger the bridging of the funds from the deposit chain to the L1 where it automatically gets invested into the current votes. This step uses the Across bridge.

There are two types of adapters:

If there is insufficient funds in the buffer and the user requests to withdraw in a non-supported token (e.g. withdraw ETH from IBAlluoUSD), instead of being added to a queries, the transaction will revert due to price fluctuations making it not possible to predict the actual withdrawal redemption amount at a later date (the user would get less/more tokens than originally expected)

The Alluo Exchange (exchange.sol) is the smart contract that the rest of the protocol contract uses in order to swap between different tokens. It is a liquidity-optimized routing engine that enables the protocol to swap any pair of assets through the shortest route possible across liquidity pools. This is achieved using:

The routes used by the contract are manually set, which prevents the protocol from accidentally entering depleted pools. These routes are constantly monitored by the core team as well.

Alluo has built an exchange to allow the protocol to optimize the different exchange routes for maximum liquidity and smallest slippage possible across multiple exchanges (Uniswap V2 and V3, Curve, etc.). This is because aggregators like 1Inch are not fully accessible by smart contracts.

vlALLUO holders (users who have locked ALLUO tokens) earn revenue from the difference between the APY given to depositors and the actual APY realized from the investments in the liquidity pools.

For example, if the realized APY on the stablecoin deposits is 15% and the advertised APY in the mobile app is 8%, vlALLUO holders will earn the difference (7%) in CVX/ETH LP tokens

By locking ALLUO tokens, users can earn passive income paid out in CVX/ETH and, the longer they lock, the higher the amount of rewards they will compound.

The DAO makes money by investing its treasury in the fixed rate farms and by collecting fees from Boost farms.

Each governance round, the DAO votes on how much of the DAO treasury should be invested in the protocol. This has typically ranged from 60-70% of treasury for the last 9 months.

When it comes to boost farms, the DAO makes revenue by taking a 1% fee on the rewards generated.

This fee is likely to be increased to 5% in the near future.

Alluo’s business model has the core objective to make DeFi accessible to anyone.

In the initial stages, all protocol revenue (which is equal to the difference between the advertised APY for each asset and the actual realized APY by those assets) as well as the yield that is generated with the treasury funds, were used directly to add ETH into the ALLUO/ETH balancer pool.

Whilst this has some impact on the token price, this also means that both, users who lock their ALLUO and those who don’t, have the same incentive. A proposal to upgrade the tokenomics to v2 was published on August 29, 2022, with changes including:

A snapshot governance vote was started on September 14 2022 and ended on September 21 2022 with 99.31% voting to support the proposal.

Ethereum mainnet boosted pools

The Alluo protocol makes money in the difference between the advertised APY and the realized APY, and that is redistributed to Alluo Lockers.

The DAO makes money from investing its treasury in the fixed rate farms and the fees collected from Boost farms.

The % to be invested is voted on as part of the governance every 2 weeks and has consistently been 60-70% of the treasury for the last 5-6 months.

The current fee % on Boost is set to a very low 1% but will likely move to 5% over time.

There are different fees for the different products offered:

The operating expenses for Alluo range between $80k – $100k per month. This includes salaries and all other fixed and variable costs.

All expenses can be seen on-chain by tracking the treasury wallet.

All expenses can be seen on-chain by tracking Alluo’s treasury wallets:

The total $ALLUO token supply is currently 95,048,000 tokens and there is a maximum cap set at 200,000,000 tokens. In February 2023, 85% of the minted supply were held in the protocol smart contracts.

The ALLUO token was first launched on Balancer as a way to reduce impermanent loss. There was a 80/20 ETH/ALLUO pool where ALLUO lockers used to lock their tokens.

Over time, since locking ALLUO simply removed tokens from circulation instead of adding them as liquidity, and both lockers and non-lockers were essentially receiving the same benefit, a decision was made that the DAO treasury would provide liquidity for the ETH/ALLUO tokens on Uniswap and only lockers would receive a share of any rewards allocated.

The Initial DEX Offering started on April 28 2022 via a Gnosis auction (platform for conducting fair, transparent, and decentralized token price discovery) and ended on May 4 2022.The Gnosis auction was chosen over a Copper (now known as FjordFoundry) auction as the team felt it was a fairer way to discover the right price for the ALLUO token. Gnosis Auction uses batch auctions, which enables the matching of limit orders of buyers (maximum price the buyer is willing to pay) and sellers with the same clearing price for all participants. That means that once the auction is over, all the participants whose bids can be fulfilled will pay the same price per token.Funds raised in the auction would be used as Protocol Owned Liquidity and would be locked in the protocol’s treasury and controlled by the community through governance.

The tokens would be allocated as follows:

The minimum price per token was set at 0.00008759 ETH per token, or $0.25 on 28 April 2022, with a total of 4,000,000 tokens up for sale which represented 2% of the maximum supply. The team managed to raise 63.5 ETH during the auction, with the final price being 11,428.5 ALLUO tokens per ETH, which is equivalent to $0.256 per ALLUO.

All participants were also eligible for a share of a future airdrop.

ALLUO is the native token of the protocol. ALLUO holders can stake their ALLUO tokens in order to be able to participate in protocol governance. Upon staking, they will receive vlALLUO, which is a locked representation that grants the right to participate in weekly voting rounds to determine what strategy to allocate funds to.

By locking tokens for a minimum period of 1 week, vlALLUO holders also earn the spread between the fixed-rate farm rewards distributed to the application users (web or mobile), and the realized APY on those assets.

Unrealized APY is distributed in CVX/ETH LP tokens.

When claiming rewards, both ALLUO and CVX/ETH LP are transferred

vlALLUO is the contract that grants voting power to the participants of the Alluo ecosystem. It is a requirement for every ALLUO user to lock their tokens in order to be able to cast votes on the DAO’s Snapshot space.

Depending on the results of the votes that happen every 2 weeks, ALLUO tokens can also be minted and distributed between lockers. For the last few months, this has been voted to be 0% in order to avoid token inflation

As users lock their tokens, they will be able to submit withdrawal requests after 7 days. When the user submits the request, that user will only be able to receive ALLUO after 5 days.

All rewards are distributed on Ethereum mainnet (on a block by block basis) and are available to claim immediately.

When users deposit capital into the protocol, they receive IBAlluo tokens that denote the receipt of the deposit. For instance, if the user deposits USD, they will receive IBAlluoUSD. Similarly, someone who deposits EUR will receive IBAlluoEUR.

IB stands for interest bearing, meaning the deposit will be used across a series of DeFi strategies to generate yield.

Since the original funds that have been deposited will be deployed across a series of DeFi strategies, IBAlluo tokens will represent an ever-increasing amount of capital. This way, the value of IBAlluo token will grow at a rate that is the equivalent of the APY of the current strategy (voted by vlALLUO holders in weekly voting rounds).

IBAlluo tokens have a value called the growing ratio that increases over time at the interestRatePerSecond of any given strategy. This growing ratio is routinely updated by an integration that uses Gelato as an automation framework that will ensure that user balances are being continuously updated.

Alluo has partnered with Superfluid (a leading asset streaming protocol that enables Web3 native subscriptions, salaries and rewards for DAOs and crypto-native businesses) to create streamable yield bearing Alluo tokens. This integration allows for Yield-Bearing Streams, which means that yield-bearing assets can be sent by the second from one wallet to another

With Yield-Bearing Streams, as funds are being streamed from wallet A to wallet B, they continue to compound at a given APY and remain invested during the entire streaming process until the moment the user wants to convert some or all of the stream back to a stablecoin.

Because the stream is interest-bearing, the sender of the stream can reduce the amount of money they need to send to the recipient. Yet, the stream recipient will still receive the full amount owed.

For example, if a DAO wants to pay a contributor $5,000 a month, today they only need to deposit $4,971.89 into the Alluo USD farm each month. They can then stream this IBAlluoUSD to their contributor and their $4,971.89 will continuously compound at 7% throughout the month. At the end of the month their contributor can withdraw $5,000 USDC.

This saves the DAO approximately $28 each month for each contributor, simply by benefitting from the future yield that will be generated by the protocol.

Streaming is the practice of producing on-chain cash flows in real-time with just a single transaction. For example, you can create a stream in one transaction that will send someone $1,000 over the next 100 days and it will stream the funds to them by the second at a rate of $10/day

Alluo Boost provides rewards in CVX/ETH LP tokens.

Each boost farm (including locked boost farms) boost their respective rewards in the same CVX/ETH Alluo vault. The rewards are tokenised as an ERC20 token representing the relevant customer’s share of the principal in the vault.

For example if the vault TVL is $100,000 and the customer had deposited $10,000 they would have a 10% share. This share may go up or down as each customer’s proportional share changes. The ERC20 rewards token represents each customer’s share of the respective LP and is transferable (as with any other ERC20 token).

This token is therefore a liquid representation of the underlying LP staked in convex or frax.convex (so convex staked stETH/ETH for example). This could present future opportunities for someone willing to trade that token and or use it further in other DeFi applications based on its future value.

Alluo follows the principle of trustless governance and execution. These principles state that organizations should never be able to lock deposits/withdrawal unless it is done in a democratic and transparent manner.

Alluo governance aims to improve above other practices that often rely too heavily on multisig setups. As such, governance execution takes place on-chain by allowing users to make the decision of locking their ALLUO tokens in return for having a say in governance decisions.

The protocol relies on Snapshot in order to vote on proposals and execute them fully on-chain in a decentralized manner. This way, user funds are handled in a transparent and open manner accessible to anyone.

Every two weeks, a governance round is conducted at https://vote.alluo.com/ in order to vote on 3 types of votes:

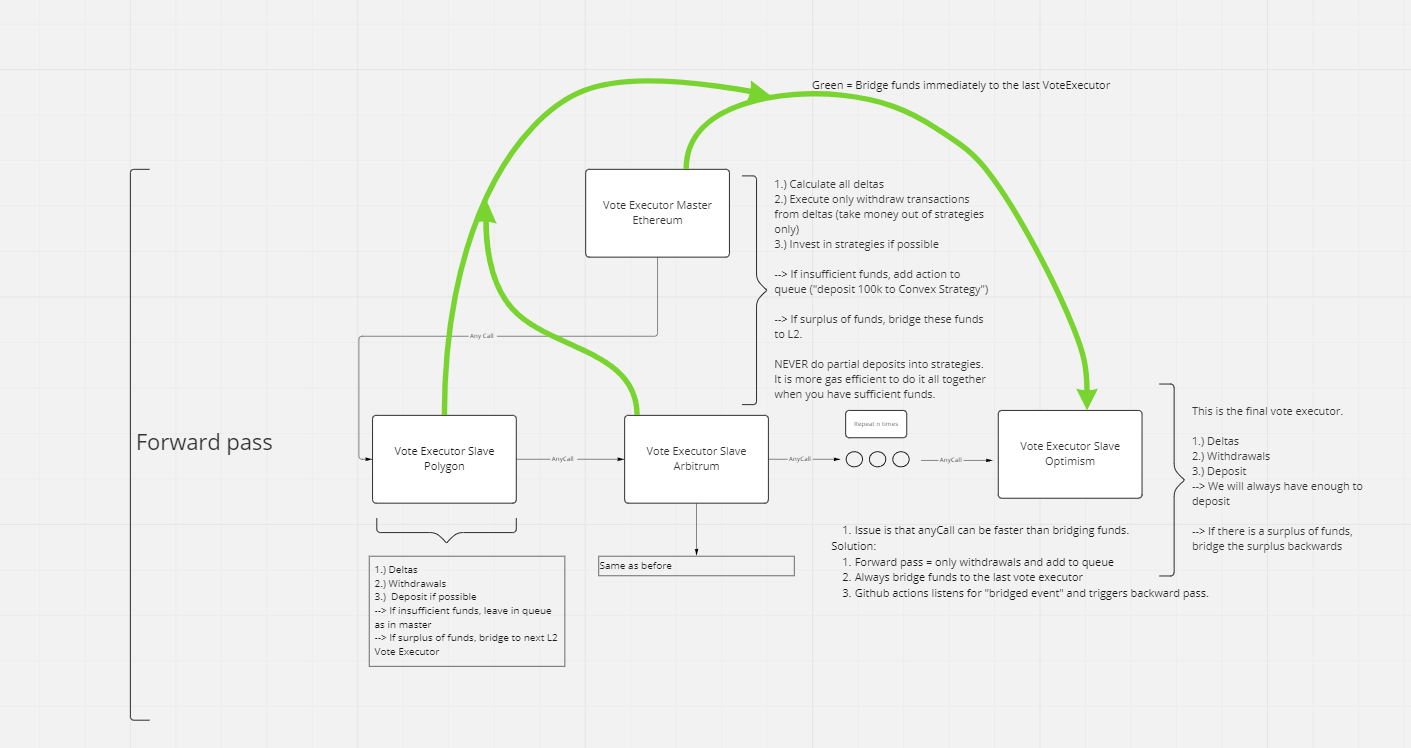

This is achieved via a fully automated software architecture that allows the vote executor contract to go from an off-chain voting round on Snapshot to a full execution on-chain in a decentralized fashion.

For a user to participate in voting, they will need to lock their ALLUO tokens before the snapshot vote is live.

The process is automated using a Github action that decodes and parses the result from Snapshot and submits the results on-chain.

Once the data has been submitted on-chain, the DAO will receive a hash of the data and confirm that it reflects the outcome of the votes that were executed off-chain. Next, the DAO will sign the hash in order to verify its correctness and submit the signed hash to the vote executor contract on-chain.

At least two multisig signers are required.

Once the data has been verified by the DAO, the proposal can proceed to be executed on-chain. This is done by the vote executor contract as well. Once this vote is submitted, everything is automated down the line.

At this point, any action that must occur on a chain different than Ethereum mainnet is passed on through multichain crosschain messaging. Alluo uses the Anycall feature from Multichain (a cross-chain router protocol) to communicate with the vote executor deployed on different chains. When it comes to actual transfer of assets, Alluo relies on the Uma optimistic bridge.

A series of satellite contracts will receive the actual data through cross-chain messaging and execute the results.

In this process, the protocol makes sure that the data can be parsed and that the multichain call has originated from the original protocol contract on Ethereum.

Anyone with an Ethereum address can verify the results of governance proposals on-chain. To do that, the user will need to encode the individual vote results, collate them, and finally encode the sum of the individual results. After that, the user will receive a hash of the message, an array of encoded messages, and a byte-encoded version of the array of encoded messages. This byte-encoded version of the array is then used as input data to verify the results.

If anyone outside of the core team chooses to perform these steps, the hash of the messages should then be posted on Discord and / or passed to the DAO multisig owners to be approved. This step serves as confirmation that the submitted data actually reflects the results of the original snapshot vote.

Currently, Alluo allows for the permissionless submission of governance votes and the DAO pays for the infrastructure costs. The next steps will remove the need for multisig owners to step in and manually sign to verify the transaction hash. In the future, this will be done with an integration of Uma’s optimistic oracle.

The action of locking ALLUO tokens also plays a role in terms of risk management by protecting users against black swan events. These events can be associated with:

Having the vlALLUO tokens in the contract itself rather than sent back to the user’s wallet also acts as an extra layer of protection, since the attacker will not be able to sell their vlALLUO allocation on the secondary market.

Alluo builds on top of protocols like Convex and Curve, which have been battle tested for years and audited by several companies. Nevertheless, any code vulnerability in the underlying contracts that back Alluo’s strategies could result in the loss of user funds.

All contracts are open source and verified in Solidity.

Alluo has an on-going bug bounty program that is accessible to users with the capabilities to do so. The bounty tiers are separated into the following tiers:

The bug bounty program has been live since day one and has been honored 3 times.

The team is in the process of setting up a more structured open bounty program with Immunefi.

Alluo completed IDO on May 6, 2022 for a total token valuation basis of $50M. A total of 63.5 ETH was raised during the auction, with the final price being 11,428.5 ALLUO tokens per ETH, which is equivalent to $0.256 per ALLUO.

Alluo has raised a total of $5M in funding over 1 round, which was the Pre-Seed round on November 1, 2021 by Shima Capital.

Summary:

Step 1

Step 2

Step-by-step guide:

Step 1

Step 2