Published: May 4, 2023

Key Points

Long $RDNT against a short $ETH, $ARB, or $AAVE position depending on how you wish to isolate risk exposure.

Radiant is an omnichain money market (provide collateral on one chain and borrow from another) that aims to aggregate fragmented liquidity across multiple chains.

Our interest in RDNT derived from the anticipated launch of V2 where an improved tokenomics design has changed how value flows through the protocol, and how users get rewarded for their interactions. V2 went live towards the end of March and was followed by Binance listing RDNT on March 30th.

The chart below shows the positive price action into that period, as demand for the RDNT token skyrocketed. We will attempt to explain the dynamics of why demand skyrocketed and what we think happens next.

The tokenomics of Radiant V1 resembled what you would see from other Geist forks in that it relied on high inflation, low barriers to entry and exit for mercenary capital and ultimately unsustainable emissions.

History has shown us that users see more value in the instant returns high APRs provide through emissions vs the longer-term commitment required to lock tokens for protocol fees. Farming those emissions and dumping the rewards while ignoring the protocol fees, is the standard operating procedure for large pools of capital, which results in negative outcomes for the protocol.

Basically, mercenary capital can extract value from the protocol without ever taking a position in the token, while at the same time negatively affecting anyone who does take a position.

Rewards Dumped >> Lower Token Price >> Lower APRs >> Lower TVL >> Lower Fees >> Lower Token Price

Investors and users will (and rightly so) always act in their best interest and aligning the incentives so that both users and the protocol can benefit is the challenge all teams in DeFi face.

Radiant V2 revamped the tokenomics with the goal of enhancing the utility of the RDNT token to align user behavior with the protocol and potentially place all the value in the hands of holders.

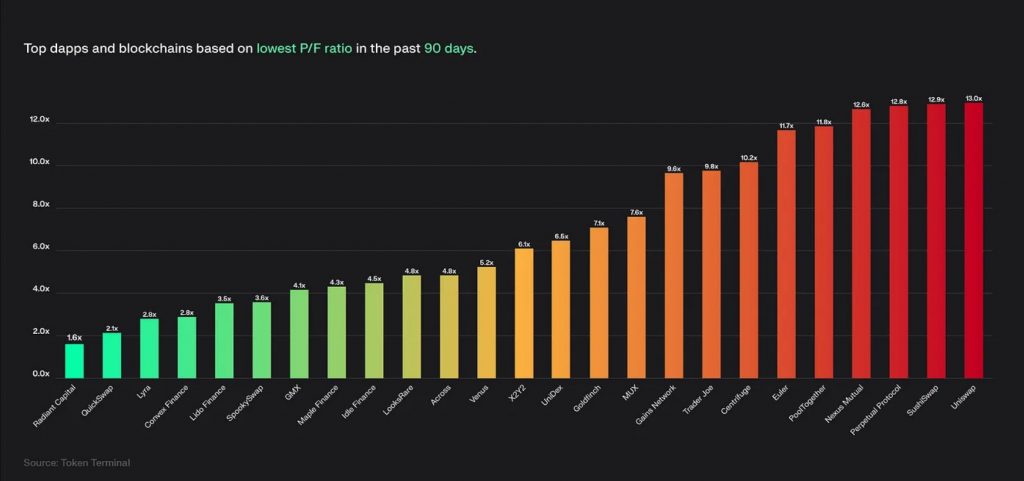

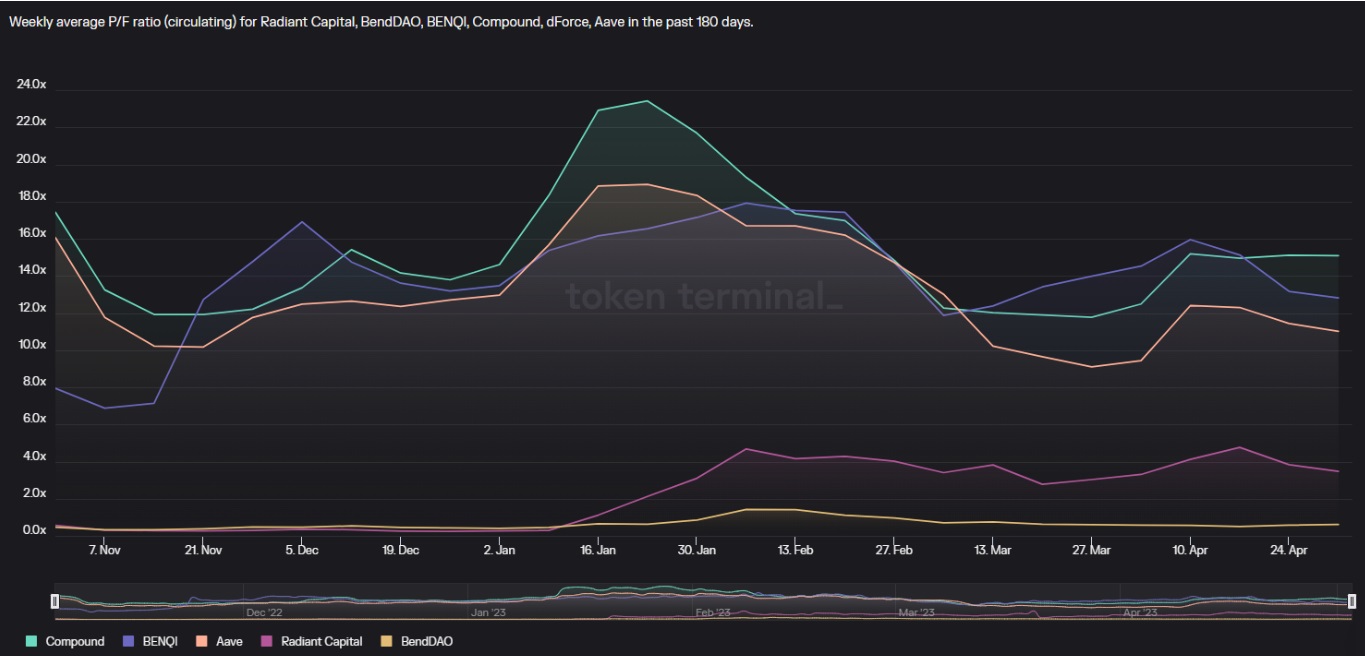

Token Terminal shows us the Price to Fees ratio from major DeFi protocols. This ratio could be loosely compared to a PE ratio when evaluating the price one pays for the earnings of a publicly listed equity. It compares protocols through the lens of how much investors are willing to pay for its fee-generating potential.

Token Terminal shows us the Price to Fees ratio from major DeFi protocols. This ratio could be loosely compared to a PE ratio when evaluating the price one pays for the earnings of a publicly listed equity. It compares protocols through the lens of how much investors are willing to pay for its fee-generating potential.

In Jan RDNT Price/Fees ranged between 1 – 1.6x.

If we were to use this as a valuation metric, RDNT would appear ‘cheap’ to the rest of DeFi. There are several reasons that this could occur such as:

In the markets, you usually get what you pay for, and undiscovered gems are rare, so when you see a low valuation metric you should always ask ‘why is this so?”. Am I the only one who see’s this? If not, then what do others see that I don’t?

It is our opinion that in Jan the market assigned a low value to the fees Radiant generated because under V1 tokenomics the entire system was unsustainable. There was no reason to hold the view that Radiant would end up any different from the other Geist forks that implemented the same system.

Two months later, the Radiant DAO implemented Governance Proposals RFP-3, RFP-4, RFP-5, RFP-6, RFP-7 and RFP-8. What does this mean?

This resulted in an expansion in the valuation where the market viewed the quality of the fees generated through a different lens.

In our opinion, the market started to value the fee-generating potential of Radiant more positively, primarily because the fees being generated were part of a more sustainable system that could also gain share from its competitors. Investors want to pay a higher price for a better business, and Radiant V2 started shaping up to be a much better business than its predecessor.

In Radiant’s original design, protocol fees generated from borrowers were emitted equally between RDNT lockers & lenders (50% to lockers of single-sided RDNT, and 50% to lenders). V2 now allocates 60% of protocol fees to lockers, 25% to lenders, and 15% to a DAO-controlled operating expenses wallet. So we can instantly see that those holding the RDNT token get a larger share of protocol fees, while lenders are worse off.

In V1, emissions were available to any users who provided liquidity, and they were free to take those rewards and do with them as they see fit. These users could extract value from the protocol without ever holding the RDNT token.

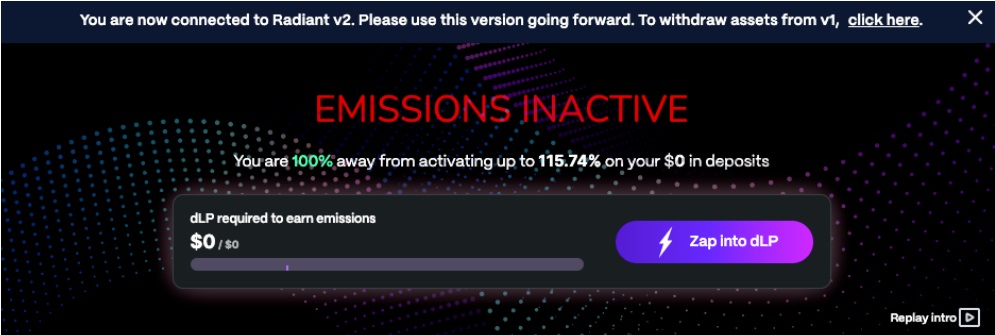

The party is over for these users because in V2, only users who hold and lock up the RDNT token via the dLP system are eligible for any emissions.

That’s right, the only way to get emissions is to buy some RDNT and lock it up via the dLP. Users that simply deposit but don’t add value to the protocol will have exposure to natural market rates, but won’t be eligible for RDNT emissions.

The dLP consists of an 80/20 RDNT/ETH Balancer BPT on Arbitrum or a 50/50 RDNT/ETH Pancakeswap LP on BNB Chain.

By locking this LP token, users unlock access to 2 primary rewards:

In order to activate RDNT emissions on deposits and borrows, users must provide a minimum of 5% locked dLP tokens relative to the size of their deposits (in USD terms). A deposit of $1M USDC onto the platform requires $50K worth of dLP to earn emissions on that position. That creates demand for the RDNT token.

If someone drops under the 5% and you notice it on-chain, you can “report them” and collect a bounty from their lost rewards.

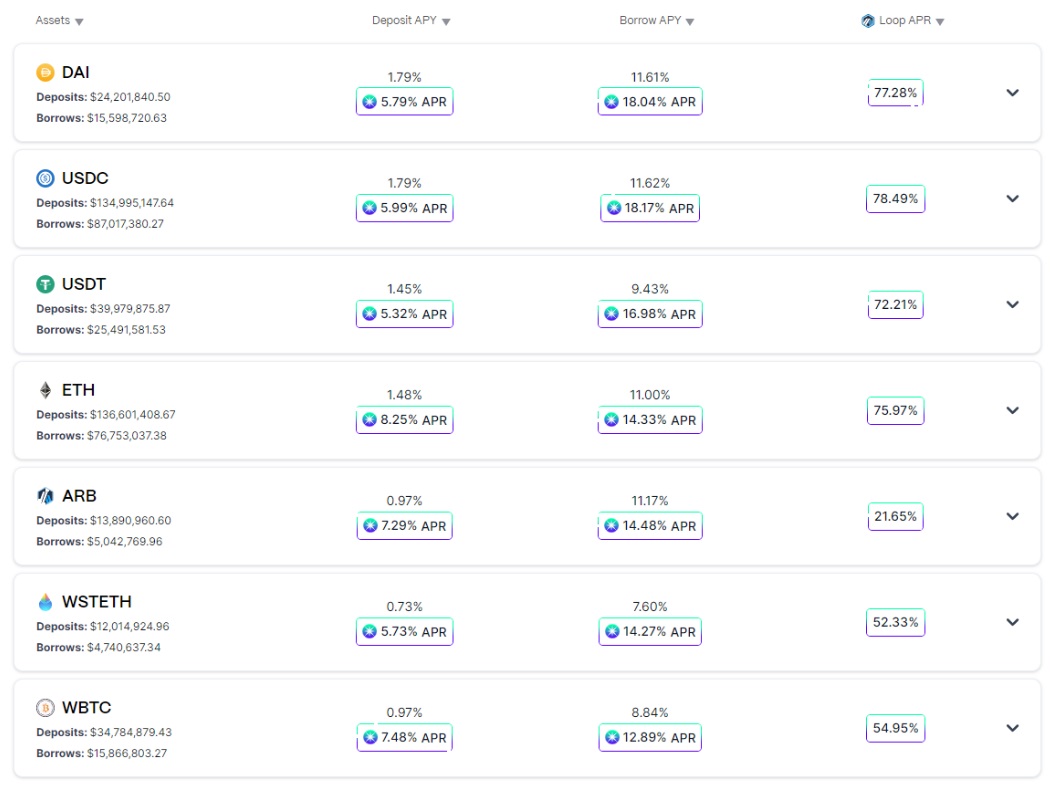

We can see below the delta between the standard emissions and the boosted emissions if you have a locked position, and it’s significant.

So the idea is fairly simple in that users who are attracted to higher yields will decide to take 5% of their position’s value, buy some RDNT and lock it up. If they view the extra yield and share of protocols fees as being worth the 5% lock-up risk, then they will pile into the lending market.

Now we all know that in DeFi what a protocol expects to happen isn’t all that relevant and that focusing on what actually happens once an idea is out in the wild is what is important.

Such ideas have been floated before and they all hinge on the assumption that users will play ball and start to buy and lock the token in order to get access to XYZ incentives. What sometimes happens is that users take their TVL and move on to greener pastures.

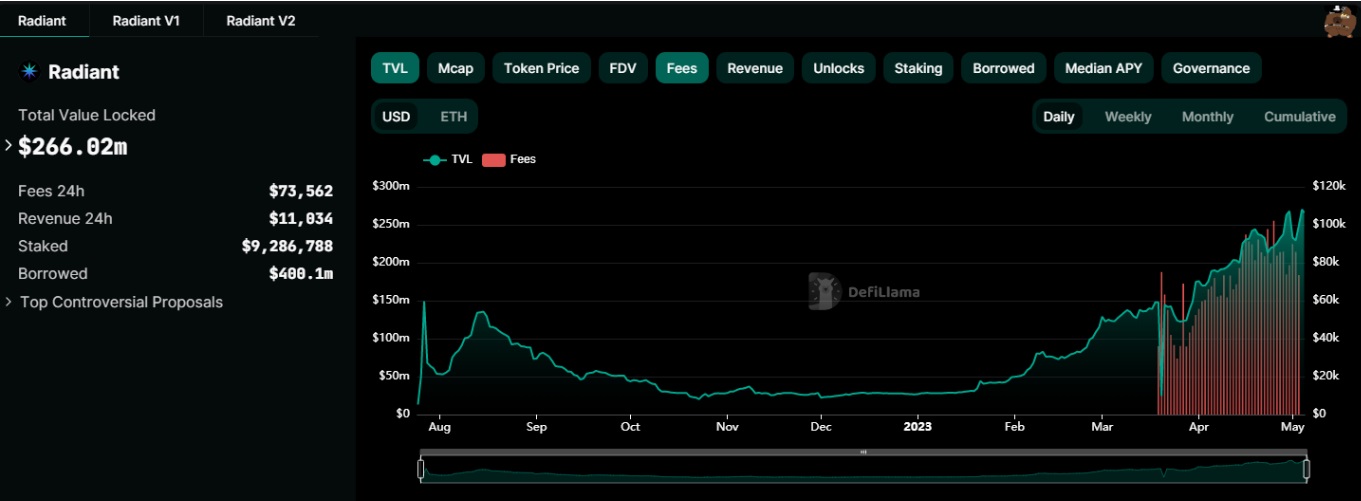

The below chart shows us the positive effect V2 has had on TVL & fees. Not only did TVL not move on, but it has grown 10x since Jan. We do not need to guess as to whether or not users will play ball in this case because we have real-time data to guide us.

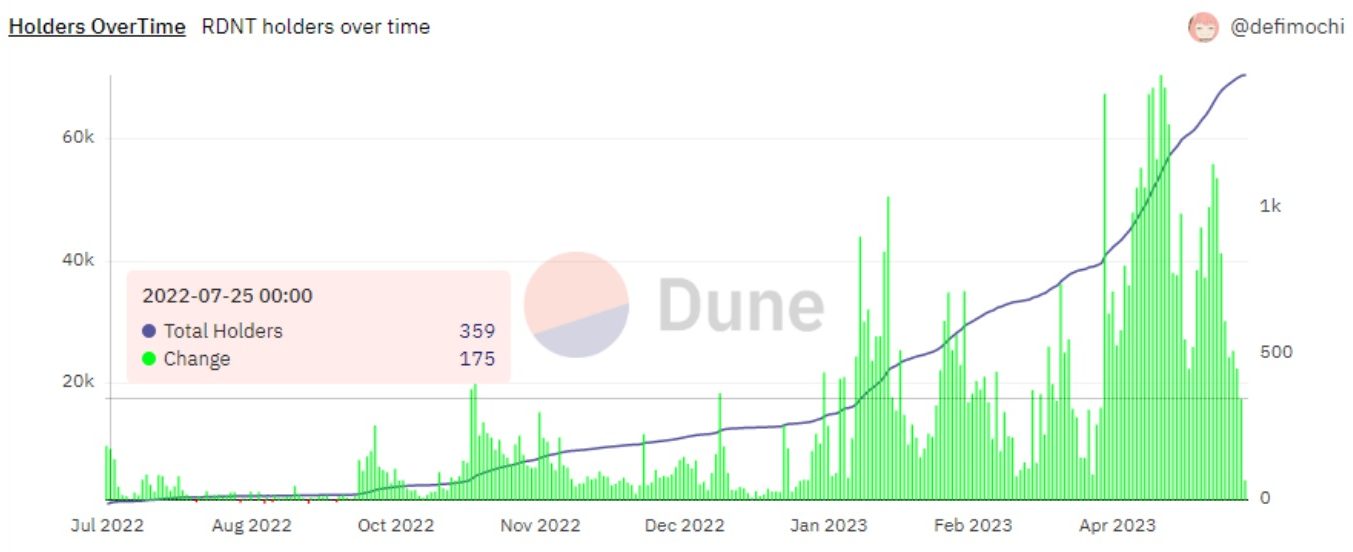

This chart shows us the number of RDNT holders increasing both leading to V2 and then shooting up post its launch.

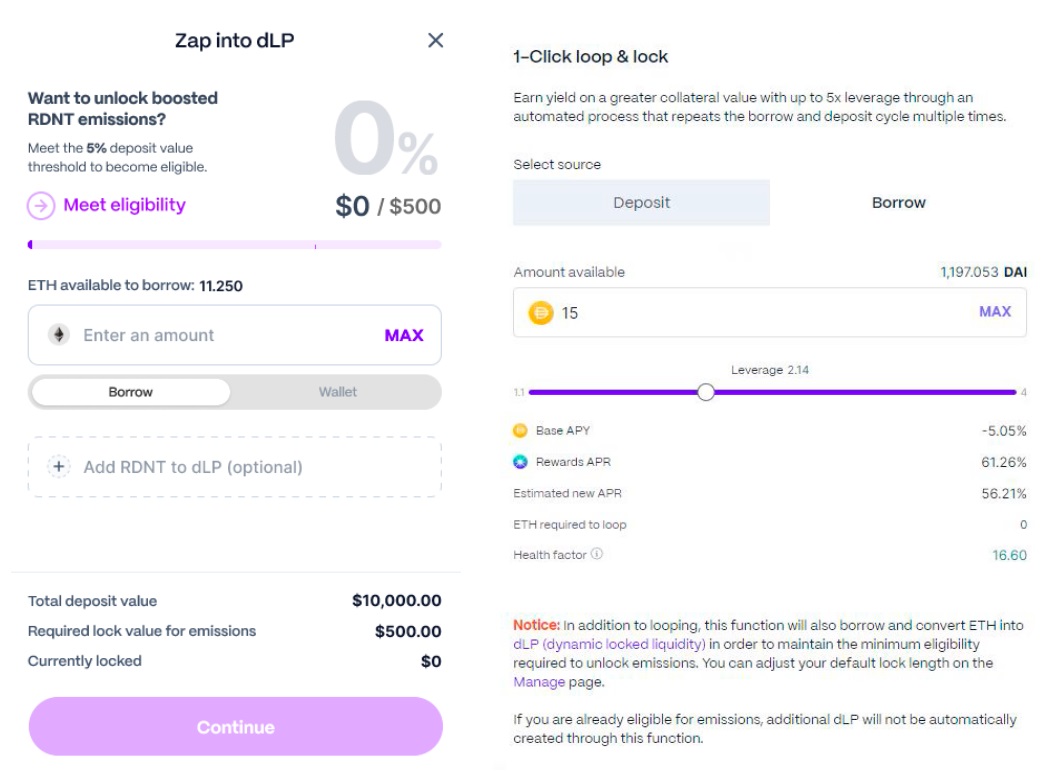

Once you have a system that aligns incentives and behaviors it is important to make it as easy as possible for users to interact with that system. Radiant does a fantastic job of this via their ‘zap into dLP’ feature and the ‘1 click loop’ functionality.

On the surface, creating a separate LP token and then locking it up seems tedious and creates friction. The implementation that Radiant has chosen is intelligent in that it makes it extremely easy for a user to ‘zap’ into the dLP in 1 click.

Why is this a big deal? Well, it takes ETH from the users’ wallet or borrows ETH from the protocol, sells 80% of it to buy RDNT, and then locks it up in the dLP. The users never see this process take place as all they see is their APR getting boosted. The user is going short ETH and long RDNT and may not even be aware of it due to the seamless UX. This is a fantastic result for the protocol.

In addition to the zap, the UX and associated mechanism for single asset looping is implemented intelligently with a view of making it as easy as possible for users to leverage up their size. The team recognizes that single asset looping makes up a significant part of the activity on the protocol, and as a result, they have intentionally set out to take advantage of that fact.

In 1 click, borrowers can execute a leverage-looping strategy. This easy leverage increases borrowing activity on the protocol and the fees that come with it, so making this a 1 click journey makes a lot of sense.

The price for looping and getting access to leverage is that the rewards from lopping are not automatically available. They are auto-locked into the dLP which again suits the protocol because it reduces immediate selling pressure on the RDNT token. Again, another fantastic result for the protocol.

All in all, the dLP metagame capitalizes on the fact that the vast majority of the protocol’s borrowing activity is tied to single-asset max looping. When the price of RDNT goes up, yields for dLP lockers go up too, which increases the ratio of dLP they hold in relation to their deposits. If their dLP ratio goes from 5% to 7% then they can deposit more capital that is eligible for the boosted emissions and bring the ratio back down to 5%.

On the other hand, if the price drops, some of these users would fall below the 5% threshold and be forced to buy more RDNT and lock it up to bring their ratio back up to ensure they are eligible for emissions.

Our view is that these UX elements and associated mechanisms will continue to drive activity and buying pressure on the RDNT token. We have the opportunity to front this activity.

So we now have a situation where all emissions are placed in the hands of users who are already holders of the RDNT token. These users have already entered the Hotel California and are playing the game. It follows that they are much less likely to exit the game and much more likely to keep playing it by locking up more and more RDNT, so they can keep receiving emissions and protocol fees.

In Jan the Price/Fees ratio for RDNT was around 1x and it peaked around 5x in mid-April. We can see directly the effect that the new system is having on the valuation of the business. The market views these fees as being more sustainable and that Radiant has the opportunity to grab share from its competitors by growing TVL further. The performance of Arbitrum at the chain level is not to be dismissed here as that has and will certainly play a part.

The chart below tracks the Price to Fees ratio of major DeFi money markets. A low ratio is indicative of a protocol with high revenue from fees and a low market cap which may indicate that the market views the earnings as weak, or that the earrings are being undervalued. In any event, we can see that ratio expansion since V2 was launched and it currently sits around 3.5x.

Compound (15x), Benqi (13x), and Aave (11x) are all trading at much higher ratios and there may be good reasons for that. The trade here is simply that Radiant continues to bridge the gap between its ratio and that of its peers.

Compound (15x), Benqi (13x), and Aave (11x) are all trading at much higher ratios and there may be good reasons for that. The trade here is simply that Radiant continues to bridge the gap between its ratio and that of its peers.

Our thesis is that the V2 mechanisms will continue to work as they are, and that over time more TVL will be drawn to Radiant as the value of the emissions continues to rise. This will continue until competition enters with competing tokenomics models.

RDNT Price Up >> Value of Emissions Up >> APR for Borrowing & Lending Up >> TVL UP >> Fees Up >> Buy Pressure for RDNT Up >> RDNT Price Up

Where will this extra TVL come from? Who are the losers?

There is no doubt that if Radiant continues to gain traction it will attract TVL and users from other protocols and chains.

So our trade is simply that RDNT will outperform other lending markets while the current status quo is intact. We will track this by monitoring the spread between the PF ratio of RDNT and the other large lending markets. We want the ratio for RDNT to go up, while the ratio for the others goes down, as this indicates that the market is expanding the value it sees in RDNT while compressing the value it sees elsewhere.

To explain further, if the RDNT ratio doubles but the AAVE ratio triples then we have been wrong and made a losing trade and should have bought AAVE instead. We want the PF ratio of AAVE to decline while the PF ratio of RDNT increases.

The addition of new markets for large-cap and highly liquid tokens such as stETH and ARB are positive catalysts bringing more TVL and new users to the protocol which can further accelerate the PF ratio expansion.

Holders of ARB and stETH are now offered the option to increase the yield they can earn on their existing holdings by as much as ~50% via a looping strategy, as long as they lock dLP (80-RDNT/20-ETH) equivalent to 5% of their deposit for a minimum of 30 days.

For example, someone with $1M of stETH who wants the extra 50% yield will max loop at 3.33x leverage. That equates to a $3.33M stETH deposit which requires around $167K (5%) of dLP to be eligible. 80% of that $167K is $133K of buying pressure for the RDNT token.

Due to the absence of single-sided staking yields (no impermanent loss) for ARB and stETH holders, we expect some of that TVL to move into Radiant and take advantage of the extra yield on offer by entering Hotel California.

Currently, looking at pools with more than $10M in TVL, the stETH-WETH pool on Convex provides the highest yield on stETH with an APY of ~5% and $52M in TVL. This is followed by Aura’s wstETH-cbETH pool with an APY of about 4.5% and $38M in TVL. Assuming $30M of stETH looping at 3.33x leverage in Radiant would be the equivalent of $4M of $RDNT buying pressure.

This concept applies to the recently added ARB token as well as to other assets added on Arbitrum and BSC. The rollout of more chains as part of the omnichain strategy is a significant driver of positive momentum and is to be monitored carefully.

The Radiant DAO received 3.3M $ARB tokens valued at roughly $4.5M recently as part of the Arbitrum airdrop to protocols. It will be responsible for allocating these tokens over the coming weeks and months and the vast majority of it will flow through to stakeholders of the protocol in one way or another.

The DAO is actively discussing the allocation of these ARB tokens in the forum. Given the current discussions, it can be expected to see a distribution such that 40% of ARB goes to borrowers, 40% to dLP lockers, 10% to depositors, and 10% to the Starfleet Treasury with a 12-month horizon for the current grant.

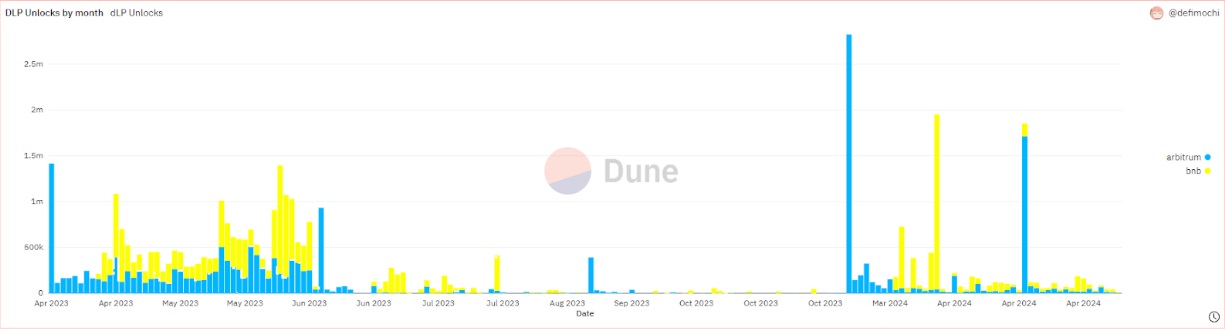

It is important to keep track of relevant dLP unlock dates as that will test the veracity of the thesis in terms of users’ propensity to continue playing the game. Monitoring carefully what happens as these unlocks roll over is going to be key in terms of managing the trade and potentially closing it out or even turning bearish. The nature of these systems is that they can unwind very quickly and when they do there is a short window to exit and not be left holding the bag.

So far the unlocks which have occurred have had little effect on the RDNT token price.

Key upcoming dates at this stage are May 18th and 23rd as well as June 19th. Note that these numbers change daily so if you are going to be involved it is mandatory that you continually evaluate the state of unlock dates.

Tokenomics are not proprietary.

From a technological standpoint, the closest competitor to Radiant is Tapioca, which aims to become a full-fledged omnichain money market that will introduce its own stablecoin (USD0) as well as support for cross-chain borrow and lending for long-tail assets. No doubt that the Tapioca team is observing Radiant’s moves carefully and using what they see as a basis for their own token launch.

The problem with competing on tokenomics and not having a significant edge technologically is that other protocols can easily adjust their own systems to make themselves more competitive. The competitive landscape is dynamic with developments occurring rapidly, so whenever in a trade one must be prudent and flexible in their views. We fully expect other protocols to learn from the positive results Radiant has put up and that competition will increase. As that develops it would be a potential trigger for exiting the position and maybe even flipping to bearish RDNT and bullish another competing token.

Aside from competition in improved tokenomics, any significant technological advances elsewhere could significantly impair the RDNT steamroller from continuing.

For now, the game appears to be working for Radiant and we are bullish about its relative performance over the coming weeks and potentially months. Observing the behavior of the PF ratio is one way we will be evaluating the strength of our bullish thesis over time.

If the spread between the PF ratio of RDNT vs other lending markets widens the view loses strength. It signals that we are wrong and that Radiant is not gaining share vs the field.

If the gap between the RDNT PF ratio and the field narrows then the view gains strength and it signals Radiant is gaining share.

Increase position size as your view strengthens and reduce or eliminate the position as it weakens.

We elect to express our view in a pairs trade consisting of a Long $RDNT position against a short $ETH, $ARB, or $AAVE position. We do not like this as a naked long position because we do not have a crystal ball and have no idea what the macro market will do.

The short leg of the trade is quite flexible and can be any token you feel is a good hedge against certain risks you do not want exposure to. This may be new to some of you so here is some basic commentary around why you might choose one over the other.

To be clear, the above 3 are just examples to frame your thinking in terms of how to select the short leg of the trade and are not indicative of our specific views.

The information in this report is fluid and changes daily. We can not stress enough that if you elect to be involved that you remain diligent and informed. The Revelo Discord server is a good place to ignite and participate in conversations.

Stay in motion.

Revelo Intel has never had a commercial relationship with Radiant Capital and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.