Published: September 8, 2023

In recent years, the ever-growing demand for blockspace has propelled the Web3 application layer across an array of blockchains, layer-2 networks, and app-chains. This evolution has introduced new terminologies – cross-chain and multi-chain – each addressing the challenges and opportunities posed by this diverse landscape.

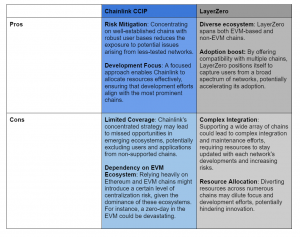

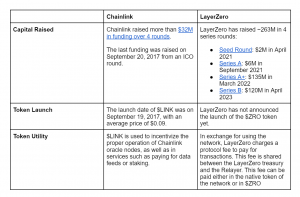

In this report, we dive into the intricacies of Chainlink’s CCIP and LayerZero, dissecting their mechanism designs, strengths, and trade-offs. However, before embarking on this journey, let’s first establish a foundational understanding of cross-chain and multi-chain concepts, setting the stage for our analysis.

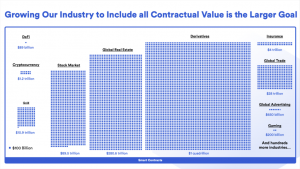

The DeFi landscape is undergoing a monumental transformation, transitioning traditional capital markets into the realm of on-chain finance. This shift, poised to disrupt over $867 trillion in global asset value, is fueled by cross-chain protocols like Chainlink’s CCIP and LayerZero. These protocols facilitate seamless interactions across diverse blockchain networks, enabling DeFi applications to function harmoniously and offering users access through a unified interface. Beyond enhancing DeFi, these protocols bridge the gap between conventional financial systems and both public and private blockchains, facilitating the migration of assets and services to the blockchain. This potential influx of trillions of dollars into blockchain ecosystems reflects a monumental impact.

Drawing parallels to the early internet days, where TCP/IP revolutionized communication, CCIP and LayerZero could become the bedrock of the unified Internet of Contracts. Just as TCP/IP connected the world, these protocols aim to enable the frictionless movement of value across networks, positioning them as integral components in shaping the Internet of Contracts. As blockchain diversity grows with various networks, the imperative for interoperability intensifies. Similar to how TCP/IP united previously isolated networks, CCIP and LayerZero are ushering in a new era of blockchain interoperability, unlocking the Internet of Contracts. This report offers a comprehensive exploration of these protocols, detailing their mechanisms, strengths, and challenges, illuminating how they empower developers and users to pave the way for a cohesive and interconnected blockchain ecosystem.

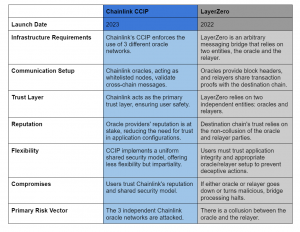

|

|

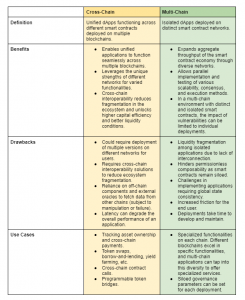

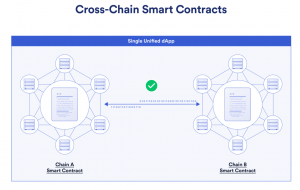

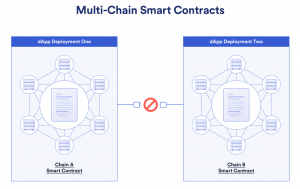

Cross-chain dApps function across multiple different smart contracts deployed across multiple different blockchains, while multi-chain dApps are deployed in multiple individual versions across distinct networks.

There are more than 100 layer-1 blockchains, an increasing number of l2s keep entering the market, and eventually layer-3 networks will exist on top of base-layer blockchains. Layer-2 and layer-3 networks are essentially separate blockchains that anchor part of their security to a base layer (e.g. rollups).

The proliferation of these base layers and layered networks shows how unbounded the design space for decentralized applications actually is. With such a broad competitive landscape, each individual chain strives to captivate developers and applications by shaping their protocols to cater to specific features, often necessitating trade-offs with other capabilities.

This competitive nature prompts experimentation around factors such as cost, performance, liveness, data availability, security, cryptoeconomics, values, programming languages, etc., making it complicated for development teams to anticipate what the most appropriate solution will be at any given time.

In this intricate ecosystem, a paramount necessity emerges – the ability for these distinct on-chain environments to seamlessly interoperate. This opens up the doors for application developers to embrace the unique aspects of each chain while upholding a unified global state and liquidity across diverse on-chain domains.

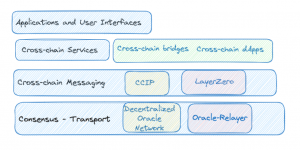

Blockchain interoperability protocols like Chainlink’s CCIP or LayerZero become the bedrock of this imperative. They play a pivotal role in constructing blockchain abstraction layers that alleviate the burden of resource-intensive and time-consuming tasks to tailor each deployment to the characteristics of each individual chain.

First of all, there are two main objectives that both CCIP and LayerZero will attempt to tackle:

On the one hand, LayerZero employs two separate oracle and relayer entities for cross-chain messaging, requiring independent messages for verification. On the other hand, Chainlink CCIP utilizes decentralized oracle networks (DONs) to validate cross-chain messages across multiple tiers.

Because of the underlying architecture and mechanism design, in LayerZero users trust the chosen application to manage security and the integrity of oracle-relayer setups, whereas in the case of Chainlink’s CCIP there is an implicit agreement by which users place trust in Chainlink’s reputation and shared security model.

Each with its own design, both solutions enable a cross-chain smart contract stack, with either CCIP or LayerZero at the center enabling communication

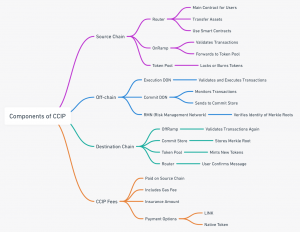

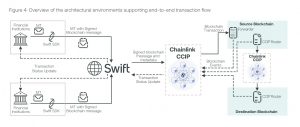

Developed by Chainlink Labs in collaboration with SWIFT, CCIP employs a three-layered design with on-chain and off-chain components to ensure the security and decentralization of its cross-chain transactions.

When it comes to on-chain, there is a Router in the source chain, which is a smart contract that is required to send messages cross-chain. Messages sent to the router are then forwarded to the OnRamp, which validates the transactions and messages. Next, transactions and messages are sent to the token pool, which will either lock or burn the tokens depending on the nature of the messages it has received.

On the off-chain side, there are 3 components involved:

The Risk Management Network, unique to CCIP, involves independent nodes that monitor and verify Merkle roots, ensuring security and decentralization across the cross-chain process. This architecture introduces novel security guarantees by separating roles and responsibilities among different oracle groups, mitigating shared vulnerabilities.

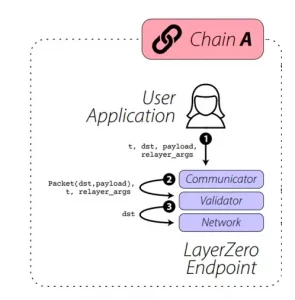

LayerZero facilitates secure message transmission between different chains through a series of steps:

1. Message Transmission: An application on Chain A sends a message over LayerZero as part of a transaction T, including transaction details and payload.

2. LayerZero Packet Construction: The Communicator module constructs a LayerZero packet, along with transaction details, and sends it to the Validator module.

3. Network Interaction: The Validator module informs the Network module to send the current block header of Chain A to Chain B.

4. Relayer Module: The Validator module instructs the Relayer module to prefetch and send the transaction proof for T to Chain B.

5. Oracle and Relayer Interaction: The Network module instructs the Oracle to fetch the block header for the current block on Chain A. The Relayer reads the transaction proof associated with T from Chain A and stores it off-chain.

6. Validation and Delivery: The Oracle verifies the block’s commitment on Chain A and sends the block header to Chain B. The Validator module ensures the validity of the transaction using received proofs and block headers. The Communicator module delivers the message to the destination application.

LayerZero has a substantial head start in terms of chain availability, currently supporting more than 25 chains. These supported chains encompass a wide range, from highly adopted chains like Ethereum, BNB Chain, and Ethereum Layer 2 solutions to non-EVM chains like Aptos. This extensive approach is poised to foster adoption and offers the potential for interconnecting various ecosystems, creating a more cohesive network of interconnected chains.

In contrast, Chainlink CCIP adopts a more focused approach, primarily targeting the Ethereum and EVM ecosystem. It is available on Ethereum mainnet, Optimism, Avalanche, Arbitrum, Polygon, BNB Chain, and Base. This concentrated approach streamlines development efforts and aligns with the networks that currently boast significant user bases and application adoption.

Both CCIP and LayerZero show similarities in terms of their modular architecture, where each aspect of the communication is managed independently by a specific component.

This offers two benefits:

In terms of adoption, we can clearly differentiate two different strategies. Chainlink is more focused on bringing institutions on-chain while LayerZero is taking a more DeFi-native approach and closely collaborating with projects on multiple chains.

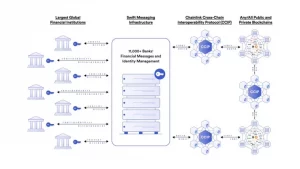

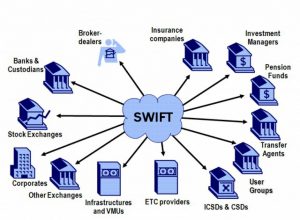

Swift’s recent collaboration with Chainlink and more than 12 major financial institutions marks a significant milestone in the realm of blockchain interoperability. The collaboration centers around the use of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to establish connectivity and interoperability between public and private blockchains.

Through this collaboration, Swift successfully connected its existing infrastructure to multiple public and private blockchains, demonstrating the potential for tokenization and asset development in a streamlined manner. This breakthrough showcases the ability to provide a unified access point to various networks using secure infrastructure, thereby reducing operational complexities and investment requirements for institutions aiming to support tokenized assets’ development.

The participants in this collaboration include prominent financial entities such as DTCC, Clearstream, Euroclear, Citi, BNY Mellon, BNP Paribas, Lloyds, ANZ Bank, and SDX, among others. These institutions collectively represent some of the largest financial institutions and market infrastructure providers worldwide, underscoring the significance of the collaboration.

Swift’s emphasis on fostering tokenized asset development aligns with their ongoing dialogue with the financial community to identify robust use cases. The focus will be on streamlining secondary trading of non-listed assets and private markets, which are anticipated to be the most compelling near-term applications for the technology. This collaboration showcases the potential for CCIP to enable enhanced connectivity between traditional financial systems and blockchain networks, paving the way for a more integrated and accessible financial ecosystem.

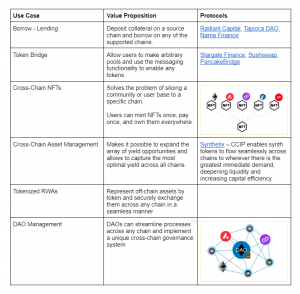

Message passing protocols like CCIP and LayerZero transcend the concept of merely bridging assets by not just linking chains, but also enabling the execution of complex logic that spans chains in a seamless manner. This makes it possible to come up with unique use cases such as: one-click cross-chain swaps, use of collateral assets to borrow across chains, universal liquidity pooling and lending, open gaming, decentralized cross-chain governance, etc.

This offers notable advantages relative to the single-chain equivalent, such as:

Among the most popular applications of cross-chain communication, the following implementations stand out:

With so many L1s, L2s, L3s, and app-chains, interoperability solutions like Chainlink’s CCIP and LayerZero become the layer of abstraction that enables cross-chain composability. As an extreme example, neither users nor projects themselves will need to care where their contracts are deployed.

Ultimately, the expectation of this statement is that interoperability protocols will accrue more value than L2s or even L1s themselves. Furthermore, the greater the number of different chains, the higher the expected value.

This would flip the current state of the market on its head, putting an end to the valuation premiums that L2s enjoy nowadays.

Moving forward, the interplay between LayerZero and CCIP promises to be a captivating narrative. While LayerZero has secured an early advantage, the long-term security proposition that CCIP brings to cross-chain applications presents an intriguing dynamic. As the industry continues to evolve, the competition and collaboration between these protocols will be a focal point, ultimately determining the trajectory of seamless cross-chain communication and its transformative impact on the broader DeFi landscape.

Revelo Intel has never had a commercial relationship with Chainlink or LayerZero and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.