Published: September 22, 2023

Retro is a Decentralized Exchange that operates on the Polygon network. This report covers the period August 24 to Sep 20, a total of 4 epochs.

Key Performance Highlights

Highlights in the period:

-$bveRETRO and the veNFT automanager were released

-$liveRETRO implementation

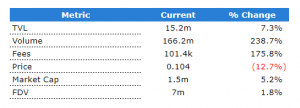

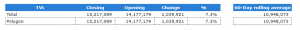

Retro opened at $14.2m and closed at $15.2m, a $1m (7.3%) increase over the period.

While the 60-day rolling average for TVL has an increasing trend.

The $15.2m on Polygon represents 100% of total protocol TVL.

At a network level, Polygon had an increase of 5.3% in TVL.

Observations:

The decrease in TVL at the end of August coincides with the launch of Aerodrome (a solidly fork) on Base

TVL outgrew that on the Polygon, resulting in an increase in network TVL dominance.

Retro ranks 59th of all the Decentralized Exchanges.

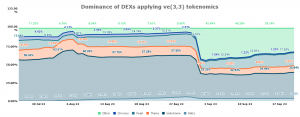

At a sector level, Retro is compared to protocols that use the ve(3,3) tokenomics model.

Sector dominance opened with 4.07% and decreased over the period, closing at 3.65%.

Events impacting TVL dominance:

The launch of Aerodrome on August 31 attracted about $180M in TVL and decreased the dominance of all the other ve(3,3) DEXs.

The total volume traded was $166.2m. The highest daily total was $10.7m on 14 Sep and the low of $1.3m was recorded on 26 Aug.

This was a $117.1m (238.7%) increase from the $49.1m of the previous period.

A core component of Retro is that its liquidity pools are based on the concentrated liquidity model found in Uniswap v3. They had added the option of Automated Liquidity Managers.

You can read more about this in our Retro Breakdown Report.

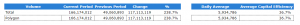

The two working together resulted in an average Capital Efficiency of 36.7%.

Observations: Retro is still a relatively new protocol and achieves similar capital efficiency results compared to the more established Uniswap v3 markets on Polygon, which averaged approximately 40% for daily capital efficiency.

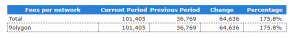

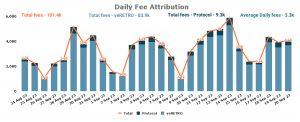

The total fees generated were $101.4k. The highest daily total was $5.9k on 14 Sep and the low of $1.1k on 26 Aug.

This was a $0.1m (175.8%) increase from the 36.8k of the previous period.

Observations:

The increase in volumes resulted in more fees being generated.

Daily fee APR for the period averaged 7.5%.

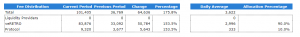

Retro uses the following allocation for fees generated.

There is no governance system implemented yet apart from epoch bribe votes.

Bribe changes to the $bve system

$bve tokens are the same as $oRETRO, but can only be exercised as a max-locked ve position.

This helps to keep bribes in the system and eases selling pressure.

For more information, you can read about it here.

Liquid Driver $liveRETRO goes live

This is Liquid Driver’s wrapped $veRETRO token.

The wrapped token allows $veRETRO users to swap their locked positions into a liquid token for a fee, while still receiving yield.

For more information, you can read about it here.

ve-Manager goes live

Retro released its automated ve-manager that can handle voting, bribes, claims, and more.

This new feature is powered by Gelato.

You can try it out here.

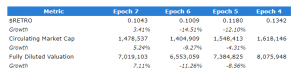

$RETRO opened the period at $0.119 and closed at $0.104, a 12.7% decrease.

The high for the month was $0.1342 recorded on 30 Aug, while the low of $0.0998 was on 12 Sep.

Compared to its host network, performance was worse than $MATIC, which had a 2.9% decrease over the period.

There was an esitmated 9.5m ($865.2k) $RETRO given out as rewards.

Comment on the performance against competitors

$PEARL was the only competitor to experience growth over the period. This was primarily driven by the integration with Impermax which allows leverage on Pearl platform LP tokens.

Users can lock their $RETRO tokens and receive a $veRETRO NFT. Lock periods offered are 2 weeks, 6 months, 1 year, or 2 years.

You can read more about ve(3,3) tokenomics in our Retro Breakdown Report.

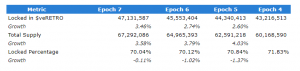

Over the 4 epochs, there has been a consistent growth in the number of $RETRO tokens locked into $veRETRO.

$veRETRO holders benefit from three sources of income:

– Fees from pools they vote on

– Bounties from pools they vote on

– $RETRO rebase

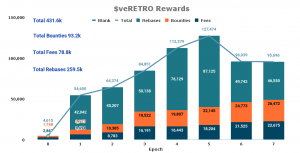

There were 4 epochs that ended in the period. A total of $431.6k in rewards was distributed

Using the closing value of $veRETRO ($41.8m), the annulaized return APR is caluclated as 13.4%.

As part of the modification to the ve(3,3) tokenomics design Retro has introduced $oRETRO. It is a call option token utilized as the emission token for the Retro Finance protocol.

You can read more about ve(3,3) tokenomics in our Retro Breakdown Report.

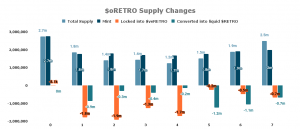

Over the current period’s 4 epochs, a total of 7.32m $oRETRO tokens were minted through liquidity mining of which 3.12m (42.61%) were locked into $veRETRO while 3.15m (42.98%) was converted into liquid $RETRO.

The remaining 2.99m (14.41%) $oRETRO tokens have been minted and are awaiting user action on their Options.

Revelo Intel is the recipient of a Retro Finance ecosystem grant and this report is part of that grant allocation.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.