Published: August 29, 2023

Retro is a Decentralized Exchange that operates on the Polygon network. This report covers the period July 27 to August 23, 2023, a total of 4 epochs.

Key performance highlights in the period were:

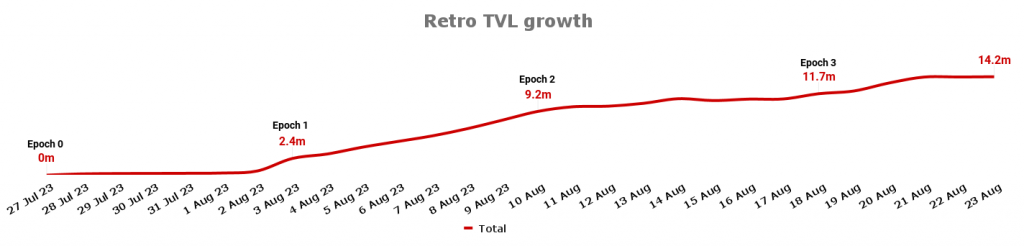

Since its launch, Retro has accumulated $14.2m in TVL.

Over this period Polygon and most of its DEXs saw a decrease in TVL in excess of 10%. A successful launch assisted it in capturing network TVL and making it the 7th largest DEX on the network.

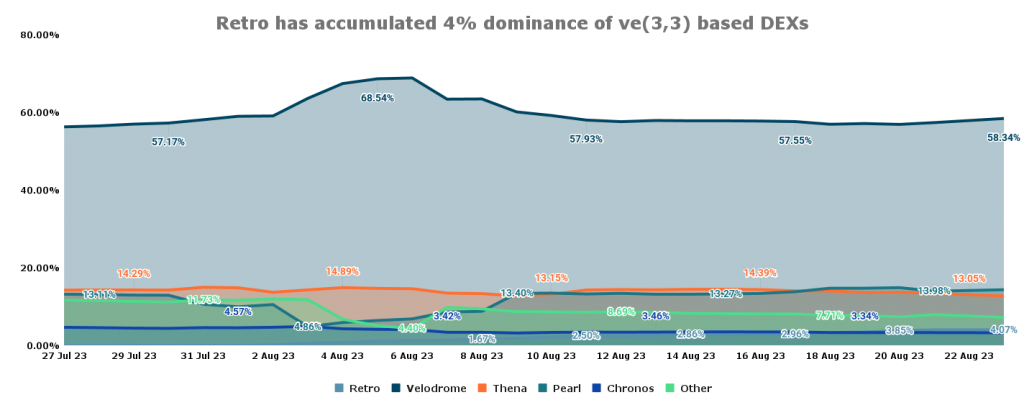

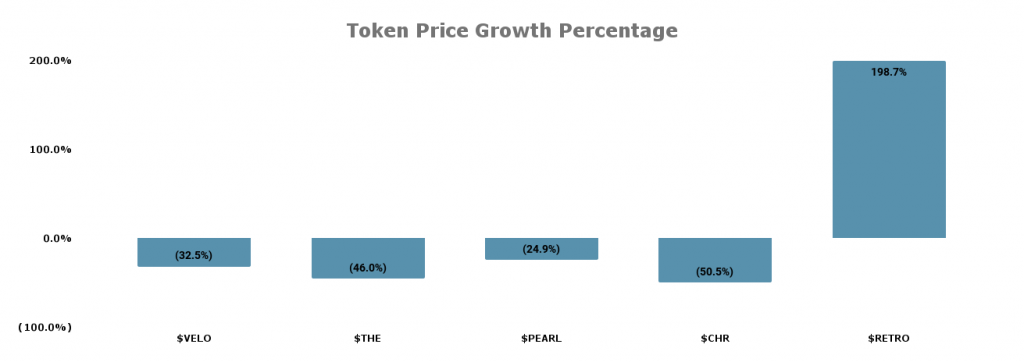

Retro uses ve(3,3) tokenomics, therefore, we have compared the performance against DEXs of the same core model.

The leader in the space is Velodrome (Optimism-based) whose dominance was consistently above 56%.

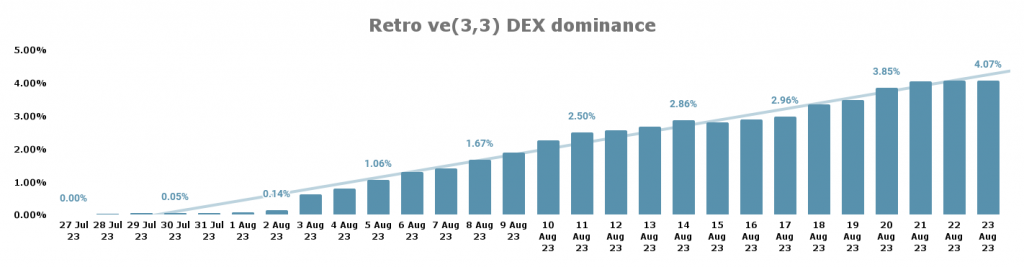

Retro’s growth to 4.07% of market share is the largest gain percentage over the period.

Chronos (Arbitrum-based) saw the largest decrease (35%) in dominance, driven by the vulnerability identified in their v2 release.

The graph below shows how Retro’s dominance has increased since its launch.

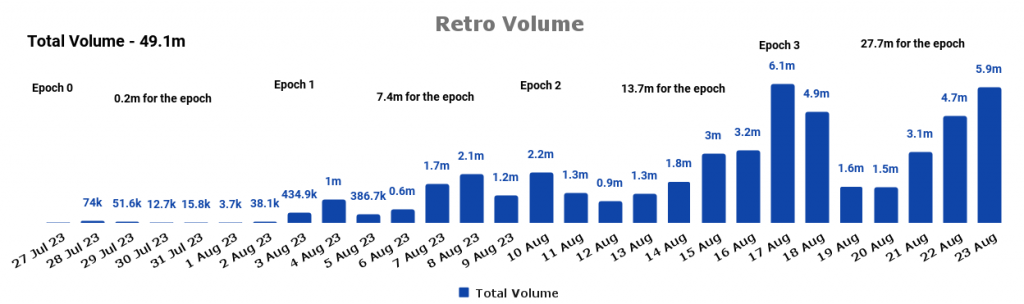

The total volume traded was $49.1m. With the highest daily volume of $6.1m which was recorded on Aug 17.

A core component of Retro is that its liquidity pools are based on the concentrated liquidity model found in Uniswap v3. They had added the option of Automated Liquidity Managers. You can read more about this in our Retro Breakdown Report.

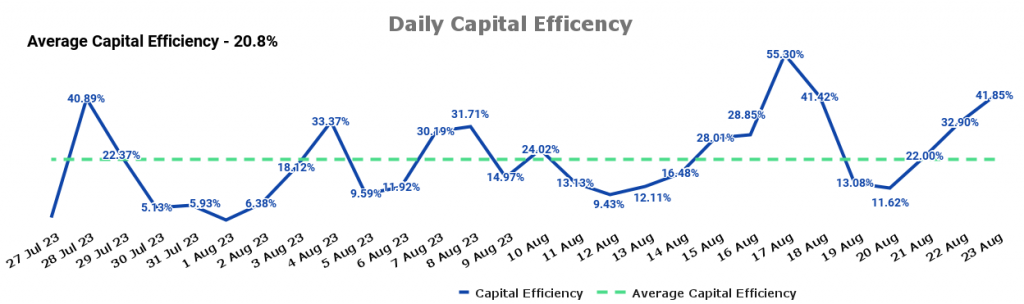

The two working together resulted in an average daily capital efficiency of 20.58%. Comparatively the more established Uniswap v3 markets on Polygon average approximately 40% for daily capital efficiency.

However, the Curve markets on Polygon average approximately 4.5% for daily capital efficiency.

*Capital Efficiency is an indicator of how efficiently TVL in liquidity pools generates volume. It is calculated by taking the volume divided by TVL and converted to a percentage. It is a measure of how productive funds are at generating volume, but it is not a direct indicator of revenue. Higher capital efficiency does not mean higher revenue

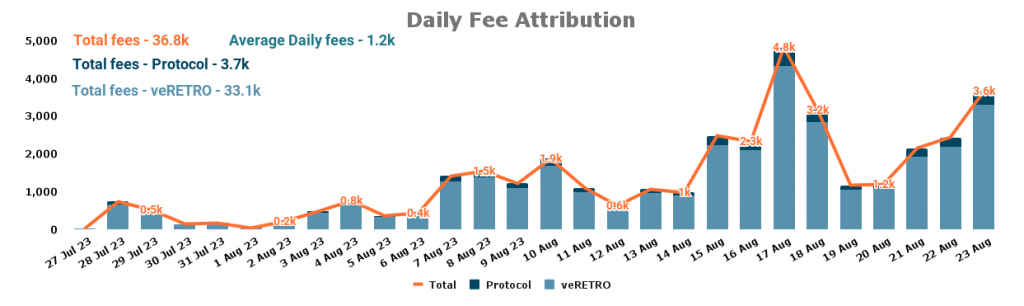

The total fees generated were $36.8k, and the highest daily total was $4.8k on Aug 17.

These fees are attributed as 90% to veRETRO holders and 10% to the protocol.

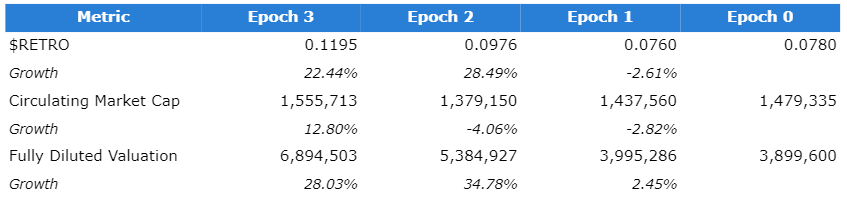

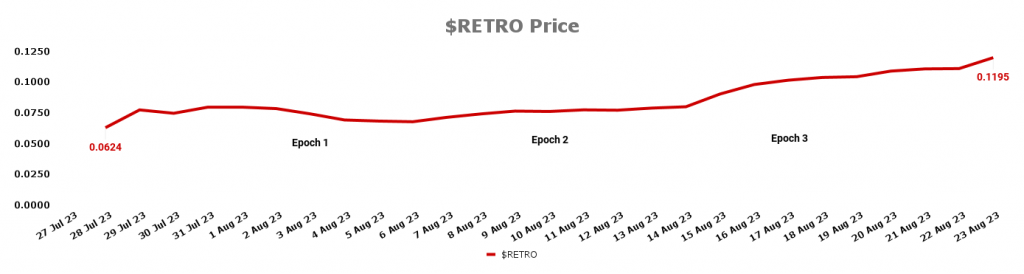

The $RETRO token was launched on Jul 28 with a listing price of $0.04, it went on to close the opening day at $0.0624. The opening day was the lowest closing price in the period with the highest closing of $0.1195 recorded on Aug 23.

The $RETRO token was launched on Jul 28 with a listing price of $0.04, it went on to close the opening day at $0.0624. The opening day was the lowest closing price in the period with the highest closing of $0.1195 recorded on Aug 23.

The successful launch was a driver behind the $RETRO price change of 198% over the period. Compared to the largest protocols using ve(3,3) tokenomics, they all experienced a decrease in price.

Users can lock their $RETRO tokens and receive a $veRETRO NFT. Lock periods offered are 2 weeks, 6 months, 1 year, or 2 years.

You can read more about ve(3,3) tokenomics in our Retro Breakdown Report.

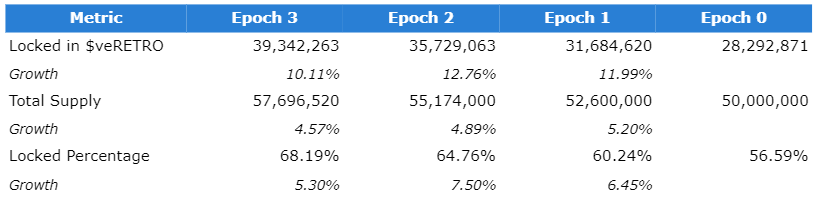

Over the 4 epochs, there has been a consistent growth in the number of $RETRO tokens locked into $veRETRO.

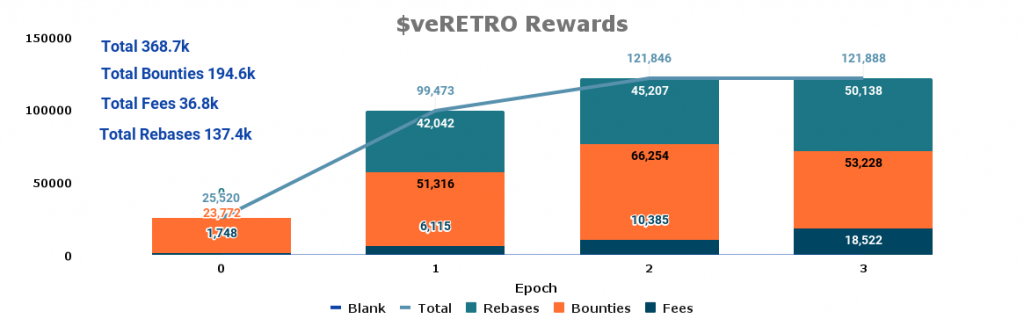

$veRETRO holders benefit from three sources of income:

Over the period, $veRETRO holders earned a total of $368.7k through incentives, an average annualized return of 147%.

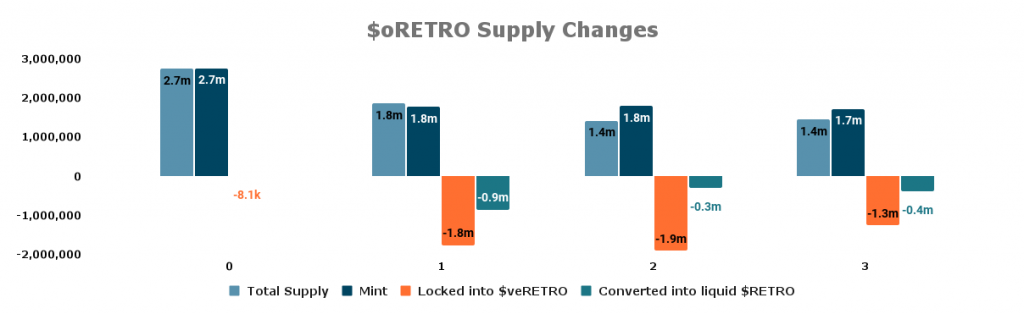

As part of the modification to the ve(3,3) tokenomics design Retro has introduced $oRETRO. It is a call option token utilized as the emission token for the Retro Finance protocol.

You can read more about ve(3,3) tokenomics in our Retro Breakdown Report.

Over the 4 epochs, a total of 7.98m $oRETRO tokens were minted through liquidity mining. Of which 4.97m (62.31%) were locked into $veRETRO while 1.5m (19.75%) was converted into liquid $RETRO.

The remaining 1.4m (17.94%) $oRETRO tokens have been minted and are awaiting user action on their options.

Except for gauge votes, there were no governance votes in the period.

These were the notable news events in the launch period:

1) Epoch 0 goes live

Retro goes live with the start of Epoch 0

2) $Retro token launches

Launches on Polygon, with Epoch 1 to begin on August 3, 2023

3) Retro ARCADE launches

ARCADE is Retro’s on-chain perps DEX, powered by UniDex. Arcade will allow $RETRO and $CASH as collateral options for users to trade blue chips, forex pairs, and commodities.

For more information, you can read about it here.

4) Merkl system introduced

Users will earn $oRETRO even if using a liquidity manager.

In addition, it allows for boosting liquidity providers’ $oRETRO rewards if they hold $veRETRO.

For more information, you can read about it here.

5) Liquidity goes live

Users can deposit liquidity

6) Transmute protocol

Transmute is an oTOKEN redemption / unlocking platform where users can exit their oTOKEN positions without the need for any upfront capital to exercise the underlying option

For more information, you can read about it here.

Revelo Intel – Retro Breakdown

Revelo Intel is the recipient of a Retro Finance ecosystem grant and this report is part of that grant allocation.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.