Published: September 29, 2023

Aave is a Lending Market that operates on 9 networks. This report covers the period from August 27th, 2023 to September 26th, 2023.

A market-wide decrease in volume was seen after Uniswap’s competitor Curve Finance was exploited on July 29th.

The TVL for a lending market can be viewed in two ways:

TVL = Total Value Supplied OR

TVL = Total Value in Net Deposits

The difference between the two is that Net Deposits look at the Total Supplied less the Total Borrowed.

Our view is that Net Deposits are a fairer reflection of TVL unless specifically stated otherwise, TVL references refer to the net number.

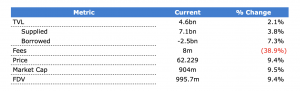

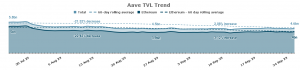

Aave opened at $4.5bn and closed at $4.6bn, a $0.1bn (2.1%) increase over the period. However, the 60-day rolling average shows a decreasing trend. The $4bn on Ethereum represents 86.4% of total protocol TVL.

At a network level, Ethereum had a decrease of 4.8% in TVL.

There were no significant events affecting TVL. TVL of Aave on the specific chains was in line with the overall TVL movement of the chains itself.

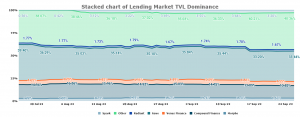

Aave ranks 1st of all the Lending Markets. Sector dominance opened with 36.06% and decreased over the period, closing at 33.44%.

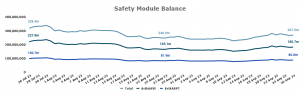

The Safety Module acts as an insurance fund against potential shortfall events. If an event like this occurs, 30% of the tokens staked could be slashed and used to repay everyone affected.

The Saftey Module consists of two tokens:

You can read more on the Safety Module in our Aave Breakdown.

There was an increase in the total Safety Module balance. It opened with $247.6m, and closed at $267.5m, a change of 8%.

Following a successful temp check, the snapshot vote for Aave V3 deployment on GnosisChain passes. You can read the full details here.

A proposal to further transition the DAO’s expenses towards being nominated in $GHO passes, beginning with a conversion of $1.6M in stablecoins in the treasury to $GHO. You can read the full details here.

A proposal for Aave V3 deployment on zkEVM L2 passes. You can read the full details here.

A proposal to for the treasury to improve $GHO’s peg and diversify liquidity across multiple exchanges passes. You can read the full details here.

A proposal to acquire $AURA from Olympus DAO passes, as the most efficient way for Aave DAO to bootstrap $GHO is via vlAURA relative to veBAL. You can read the full details here.

The Metis DAO incentive program goes live on Aave V3. 100K $METIS tokens are made available. You can read the full details here.

New Aave features introduced, Debt Switch and Withdraw & Switch. You can read the full details here.

As of September 26, 2023, the treasury amounted to $104.26m, consisting of the following:

While the treasury has increased by ~$4.5m, the stablecoin percentage has decreased by around 4.5%

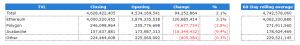

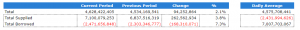

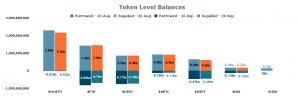

Total Supplied balances opened the period at $6.8bn and closed at $7.1bn, a $0.3bn increase. Total Borrowed balances opened the period at $-2.3bn and closed at $-2.5bn, a $0.2bn increase.

Supply-side deposits of $7.1bn is largley driven by $wstETH. $wstETH contributes $2.3bn (32.3%) to total deposits, while $ETH contributes $1.4bn (19.9%).

Borrowing activity of $2.5bn is largley driven by $ETH and $USDC. $ETH contributes $0.83bn (33.6%) to the total borrowed, while $USDC contributes $0.77bn (31%).

Notable events: On 28 August $sDAI deposits were opened and attracted $127.6m in TVL.

You can now use your DSR yielding DAI as a collateral in Aave V3 https://t.co/AH1uwTFUE0

— Stani^ (@StaniKulechov) August 28, 2023

The chart below represents 90.68% of total supplied and 94.56% of total borrowed.

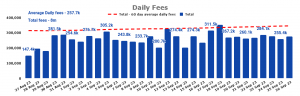

The total fees generated during the period were $8m. The highest daily total was $350k on 18 Sep and the low of $150 on 27 Aug. There was a $5.1m (38.9%) decrease from the $13.1m of the previous period. Aave ranks 1st of all the Lending Markets.

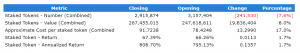

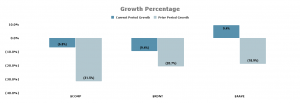

$AAVE opened the period at $56.872 and closed at $62.229, a 9.4% increase. The high for the month was $65.4 recorded on 21 Sep, while the low of $52 was on 12 Sep. Compared to its host network, performance was better than $ETH, which had a 3.9% decrease over the period.

There was an esitmated 35.2k ($2.03m) $AAVE given out as rewards. All $AAVE rewards are distributed to depositors into the Safety Module.

$AAVE outperformed its competitors. It was the only token to experience positive growth and a reversal of the previous cycle trend, while its competitors had a continuation of their downtrends. There we no significant events that contributed to the increase in price.

Revelo Intel is the recipient of a grant from the Aave GrantsDAO, this report is part of that grant allocation.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.