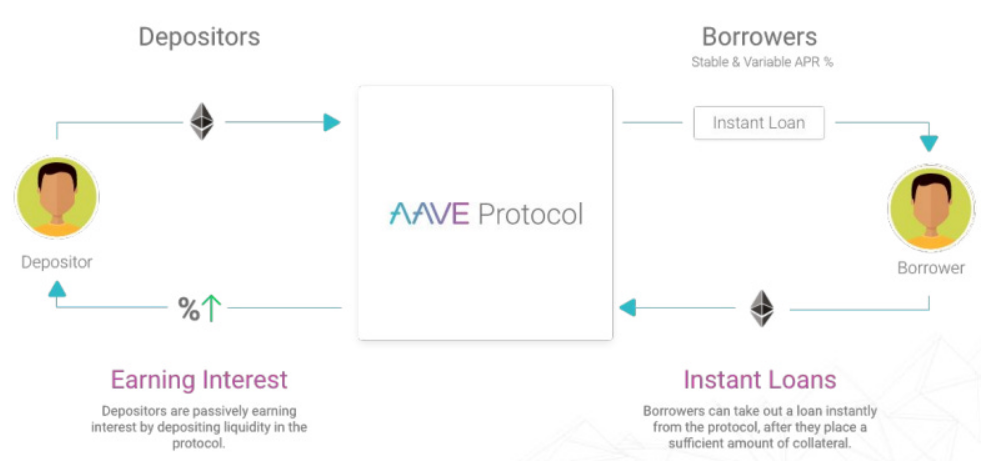

Aave has historically been the largest money market in crypto. Its decentralized borrow-lending peer-to-pool model has proven to be the most capital-efficient way for DeFi users to earn interest on their deposits, or to gain immediate access to an asset’s liquidity.

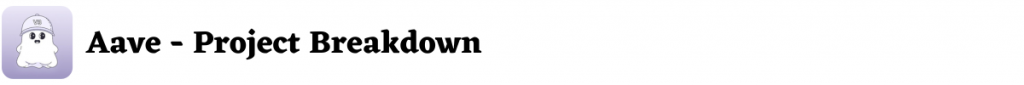

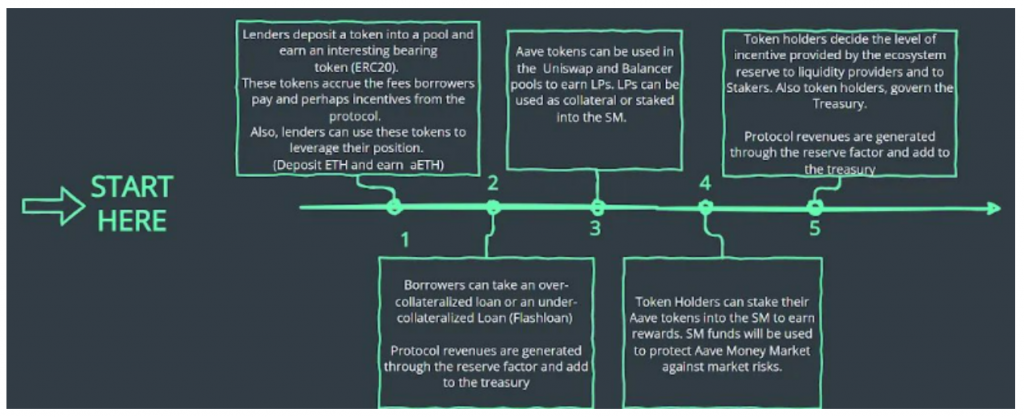

Users deposit assets into a lending pool and make them available for others to borrow. In exchange, borrowers will pay back their debt plus extra interest. By using a liquidation bonus, the protocol ensures that liquidators always have the incentive to close undercollateralized loans and ensure that the protocol remains solvent. All loans on Aave are overcollateralized by default.

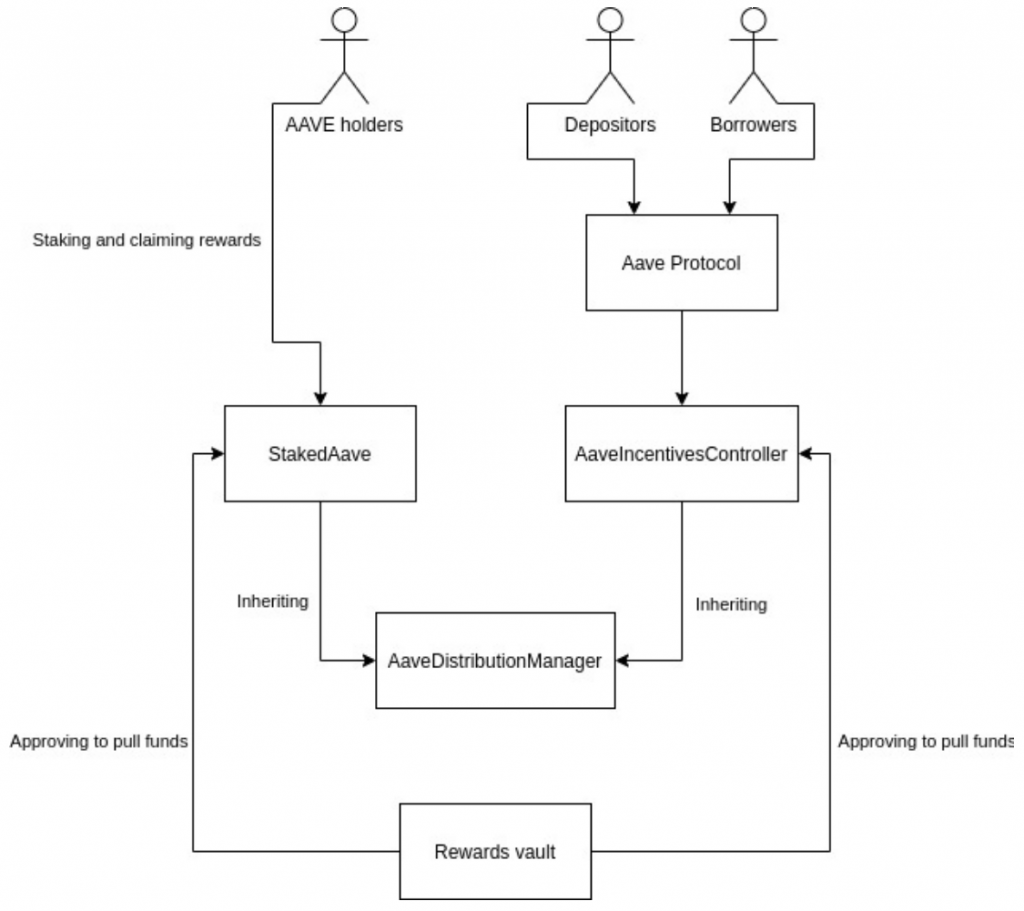

As an extra layer of protection, the protocol’s Safety Module shares protocol revenue and incentives with its governance token, $AAVE. When staked, stkAave holders provide a safety net in extreme situations where the protocol could accrue bad debt due to untimely or inefficient liquidations. As a reward for this service, these stakeholders are rewarded with $AAVE tokens, which grant governance power.

The protocol’s Governance structure runs a Decentralized Autonomous Organization that leads proposals and ensures that they are put into practice by the core team. After years of running in production and gaining traction with an effective product-market fit strategy, Aave is now seeking to expand its business operations with a multi-chain strategy and the launch of its own stablecoin, $GHO. Aave also provides pools for real-world assets like real estate, cargo, and freight invoices. It also has an institutional branch, Aave arc, where institutional investors can use these RWAs (Real World Assets) as collateral to conduct business operations or borrow extra cash.

Aave is also branching out beyond DeFi with the launch of Lens Protocol, a decentralized social media platform where users can own their own social graph. This social graph is personal and can be ported to all platforms that integrate the Lens protocol within it. This allows for use cases such as bringing your own friends and connections from one social media to another (take your Youtube subscribers to Twitch, your Twitter followers to Facebook…)

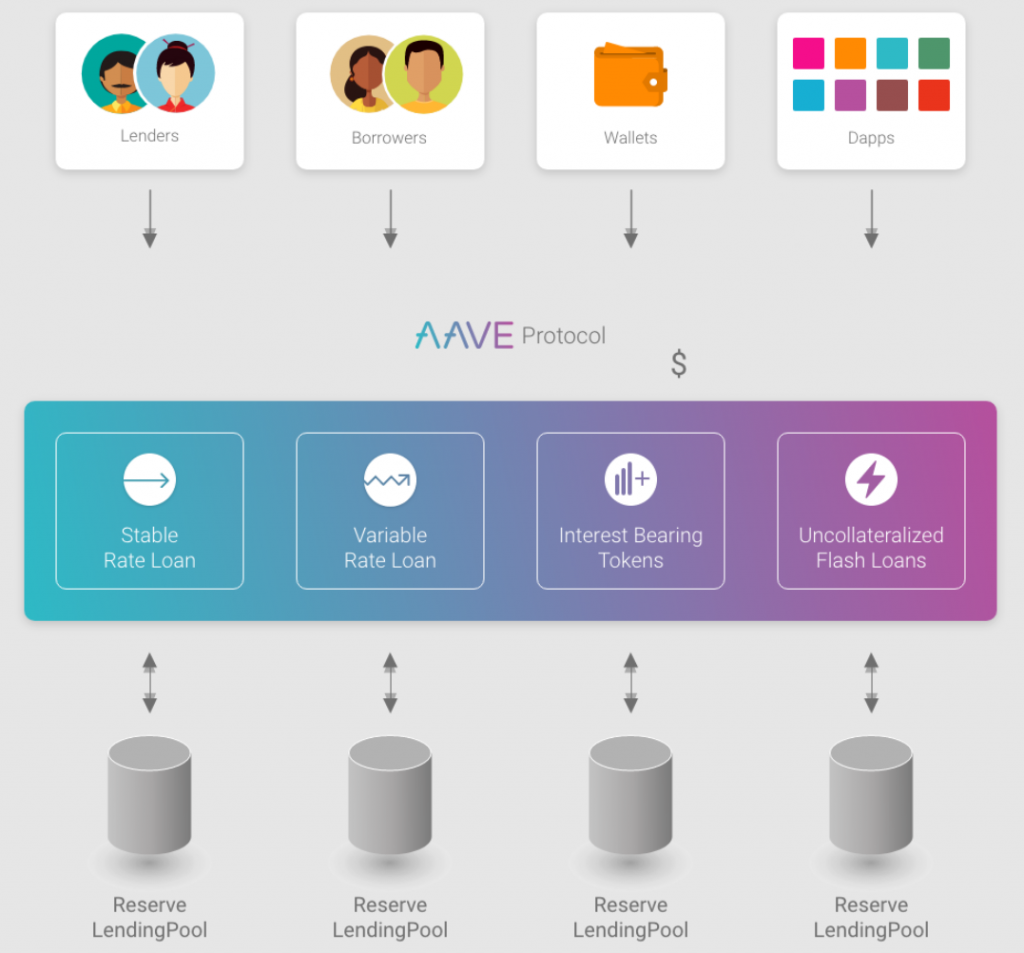

The Aave Protocol is a decentralized borrow-lending market that follows a peer-to-pool model where people can borrow and lend money without a third-party financial intermediary, like in TradFi. Because of this model, loans do not need to be individually matched between participants. Instead, all the liquidity remains in a pool from which borrowers can borrow by depositing collateral. This enables instant loans in a decentralized manner.

As a money market, Aave enables the permissionless lending and borrowing of assets. It allows users to lend or borrow a variety of cryptocurrencies without the need for intermediaries like banks. This is because Aave operates through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Aave offers two types of interest rates for borrowers: variable and stable. Variable rates fluctuate based on supply and demand dynamics in the market, while stable rates are fixed and provide more predictable borrowing costs.

Lenders earn interest on the funds they deposit into the liquidity pools. The interest rates vary based on the utilization rate of the pool, which reflects the ratio of borrowed funds to available funds. Aave charges borrowers a fee, which is a percentage of the borrowed amount, and this fee is distributed to the lenders as an incentive to provide liquidity.

Aave utilizes a unique interest rate model that dynamically adjusts borrowing and lending rates based on the supply and demand of each asset in its liquidity pools. The interest rates on Aave are determined by a mechanism known as the “Interest Rate Model,” which aims to achieve a balance between the supply of funds from lenders and the demand for funds from borrowers.

The following factors impact Aave’s interest rates:

In the borrow rate technical implementation, the calculateCompoundedInterest method relies on an approximation that mostly affects high-interest rates. The resulting actual borrow rate can is:

The model parameters for each asset in Aave are set based on the asset’s risk profile, its role as collateral, and its liquidity within the Aave ecosystem:

By taking into account the risk profile, collateral role, and liquidity characteristics of each asset, Aave’s interest rate parameters are calibrated to ensure efficient and stable lending and borrowing operations within the protocol. These parameters help in maintaining appropriate levels of liquidity, managing risk, and aligning the interest rates with the unique characteristics of each asset.

aTokens, also known as Aave interest-bearing tokens, are tokens that represent a user’s share of a particular asset’s pool in Aave’s lending protocol. These tokens are generated when users deposit their assets into Aave’s liquidity pools and are minted in a 1:1 ratio with the deposited asset.

The valuation of aTokens is closely tied to the underlying asset and its interest-earning potential within Aave:

It’s worth mentioning that aTokens can be redeemed at any time, allowing users to convert their aTokens back into the underlying assets. When a user redeems their aTokens, they receive the underlying asset plus the interest earned during the holding period. The redemption value is based on the total interest accrued and the prevailing interest rates at the time of redemption.

Aave’s borrowing interest rates are determined by a combination of factors, including the asset’s utilization rate, the interest rate curve, and the choice between variable and stable rates:

It’s important to note that Aave’s interest rates are determined algorithmically based on the protocol’s rules and the behavior of users. They are not influenced by a centralized authority. Instead, the rates respond to changes in supply and demand dynamics within the Aave ecosystem, promoting an efficient allocation of funds.

Aave was formerly known as ETHLend and came into existence in 2017. The rebranding happened in September 2018. In the beginning, the project was founded by Stani Kulechov, a law graduate student from Finland who envisioned the protocol as a peer-to-peer lending protocol. Without a lot of upfront capital compared to other ICOs (Initial Coin Offering) that were launching back in the day, Stani still decided to raise money via the traditional ICO way and managed to raise $16.2M. This funding allows the protocol to expand its team of developers, which soon realized that, due to the low liquidity in DeFi back in the day, a peer-to-pool lending model would be more appropriate.

In the peer-to-peer model, users would interact with each other via smart contracts. However, this was not capital efficient, since there needs to be someone else on the other side of the loan.

Similar to how other projects like Uniswap or Compound managed to use a peer-to-contract model, the team realized that this contract could act as a lending pool that would accumulate all user deposits and eliminate the need to find a counterparty.

Aave comes from the Finnish language, where it means “ghost”.

After a couple of years, the protocol managed to capture attention at the beginning of 2020, and the growth quickly escalated in May of that same year, when a period known as DeFi summer started.

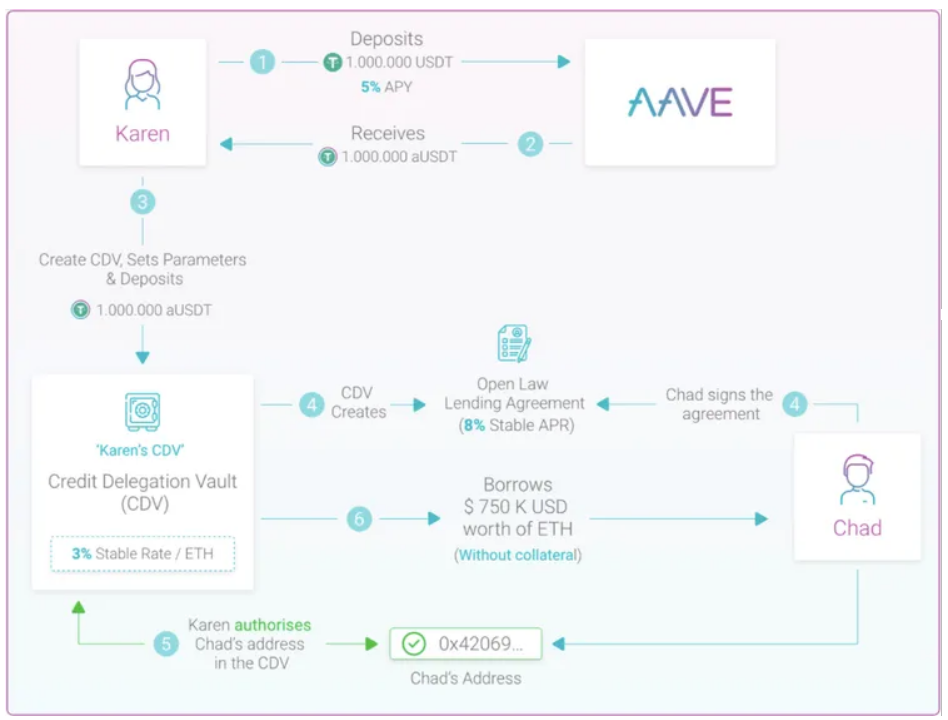

At the time of launch, Aave and Compound were the only way for users to provide and obtain access to liquidity in an autonomous manner. In December 2020, a second version of Aave was deployed, featuring credit delegation, stable rates, gas optimizations… Around the same time, Aave Governance gained traction, and in November 2021, the first ARC with respect to Aave V3 was announced.

Aave V3 represents a technological improvement that will introduce features such as:

Although the Aave protocol has been functional for years, the design of Aave v3 aims to create a Layer-0 optimal borrow-lending platform. This will provide users with key advancements on:

The core concepts of the protocol will remain working without changes. There will continue to be aTokens, stable borrowing rates, credit delegation…

Portals allow users to move their own assets seamlessly from one Aave deployment on one chain to another. This is possible by allowing users to supply liquidity on one chain and transfer it to another chain by burning aTokens on the original source network and minting them on the destination network.

Portals can help bridging protocol Connext, Hop Protocol, Anyswap, or xPollinate

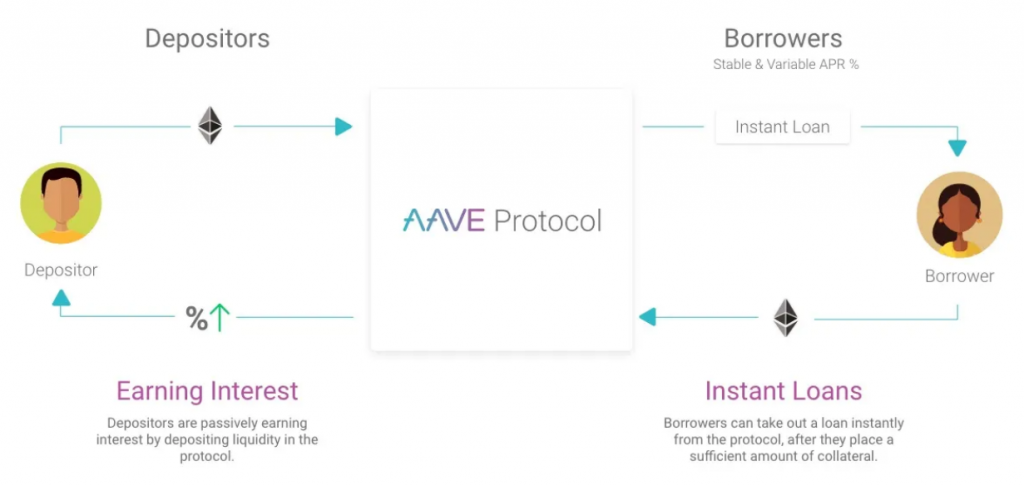

High Efficiency Mode or eMode allows borrowers to ensure they are able to get the highest borrowing power for their collateral. This is possible by classifying the user assets based on LTV, liquidation threshold, liquidation bonus, and a custom price oracle. In eMode, borrowers can choose the category of assets they want to borrow. A category refers to a set of assets pegged to the same underlying asset (e.g. stablecoins pegged to USD, assets pegged to $ETH.

If a user selects to use the protocol in eMode, when that user supplies assets of the same category as collateral, then the borrowing power (given by the LTV), and the maintenance margin (given by the liquidation threshold) are overridden by the eMode category parameters in order to improve capital efficiency.

For example, assuming a category for stablecoins with a 97% LTV, a 98% liquidation threshold, and a 2% liquidation bonus, a user could supply $DAI and, instead of having a 75% LTV, the user could borrow other stablecoins with the borrowing power defined by the eMode category, which is 97%. Because of this, the user has access to 22% more capital-efficient liquidity.

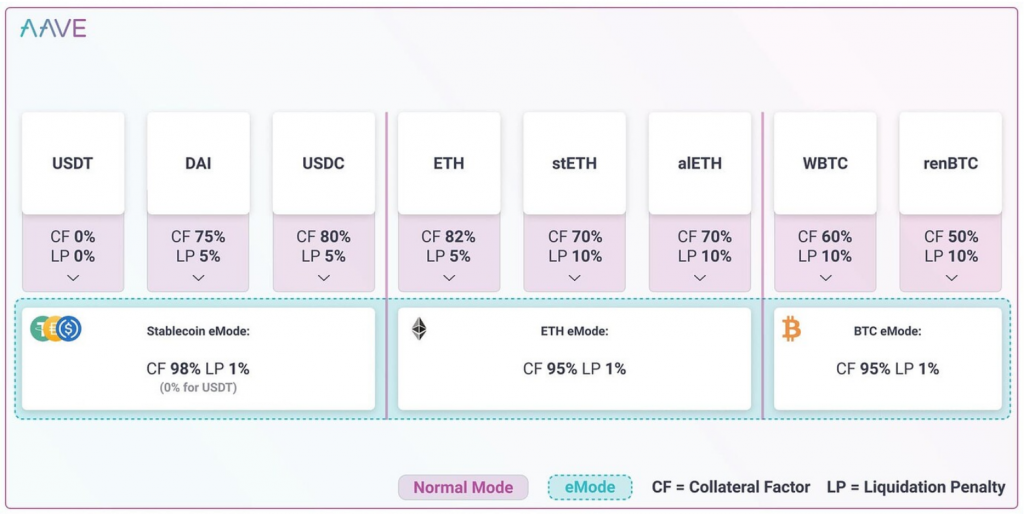

Isolation mode to enact risk mitigation features when a new market for newly listed assets is created. For example, a proposal could suggest listing an asset under isolation mode such that the isolated asset can only borrow stablecoins against it up to a specific debt ceiling. Therefore, users can only use that asset as collateral.

Supply and Borrow caps

Granular Borrowing Power Control by granting Aave Governance the power to change the collateral factor for future borrow transactions without affecting existing borrow positions or triggering liquidations.

Risk admins allow Governance to register entities that have the ability to alter certain risk parameters without the need for a governance vote.

Price Oracle sentinel to allow Layer 2 protocols to handle eventual downtime of the sequencer and disable borrowing under specific circumstances.

GHO is intended to be a decentralized, overcollateralized, and configurable token designed to maintain a stable value pegged to 1 USD. The mechanism design includes emission and destruction of GHO to maintain stability while allowing for the participation of Aave Governance and Facilitators to manage protocol parameters. Therefore, the market efficiency is the key driver that will programmatically align the value of $GHO with the US Dollar.

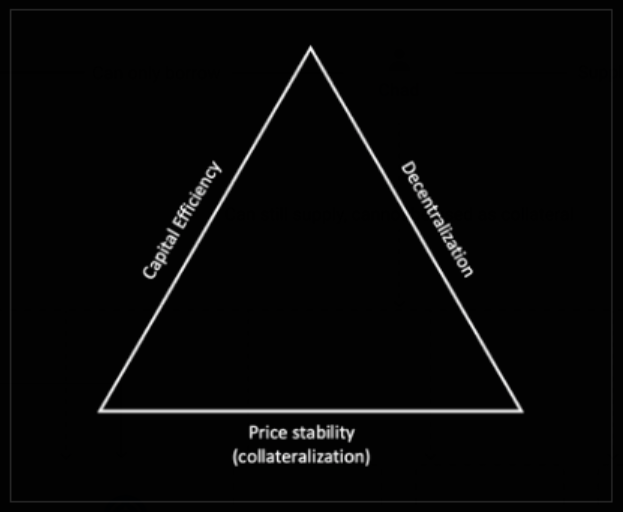

Stablecoins are digital assets pegged to a reserve asset by a stabilization mechanism that prevents fluctuations in value.

As a decentralized stablecoin, $GHO is minted by users in order to borrow against supplied collateral on Aave. Like other assets on Aave, the users supply collateral (at a specific collateral ratio) in order to be able to mint $GHO. Afterwards, when the debt is repaid by the borrower or the position is liquidated, $GHO is returned to the protocol and burnt.

All interest payments accrued by minters of $GHO go directly to the Aave DAO treasury (in contrast to the standard reserve factor collected when users borrow other assets and the principal is burned).

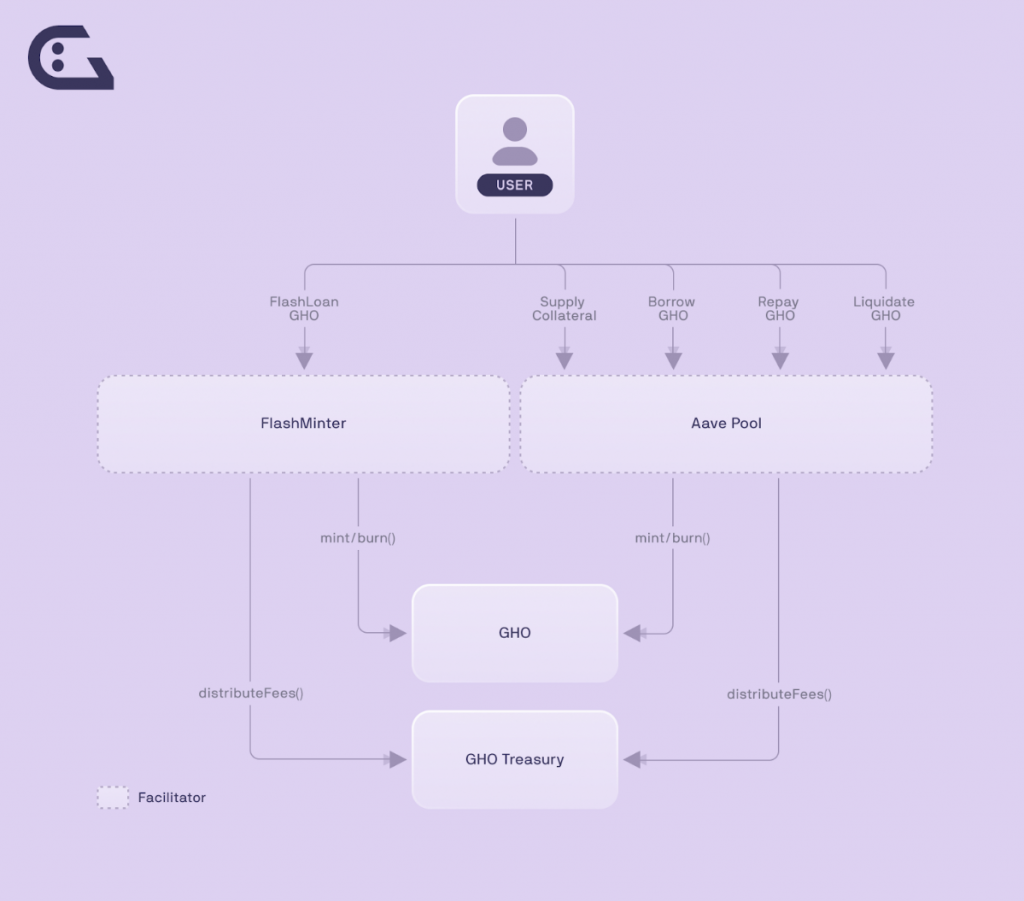

GHO is designed to reduce exposure to volatility as an ERC20 token that is minted/burned through different strategies. These strategies can be enacted by different entities known as Facilitators.

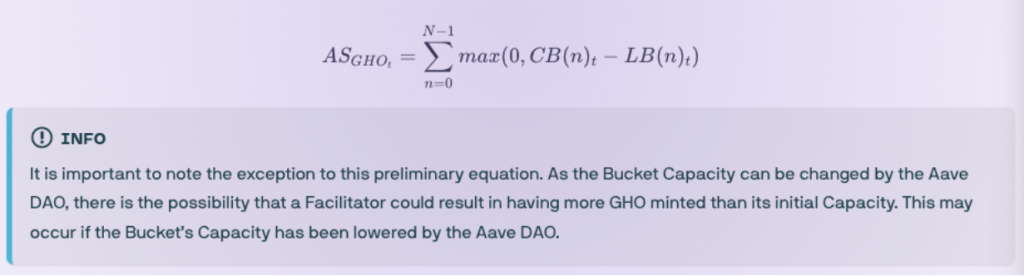

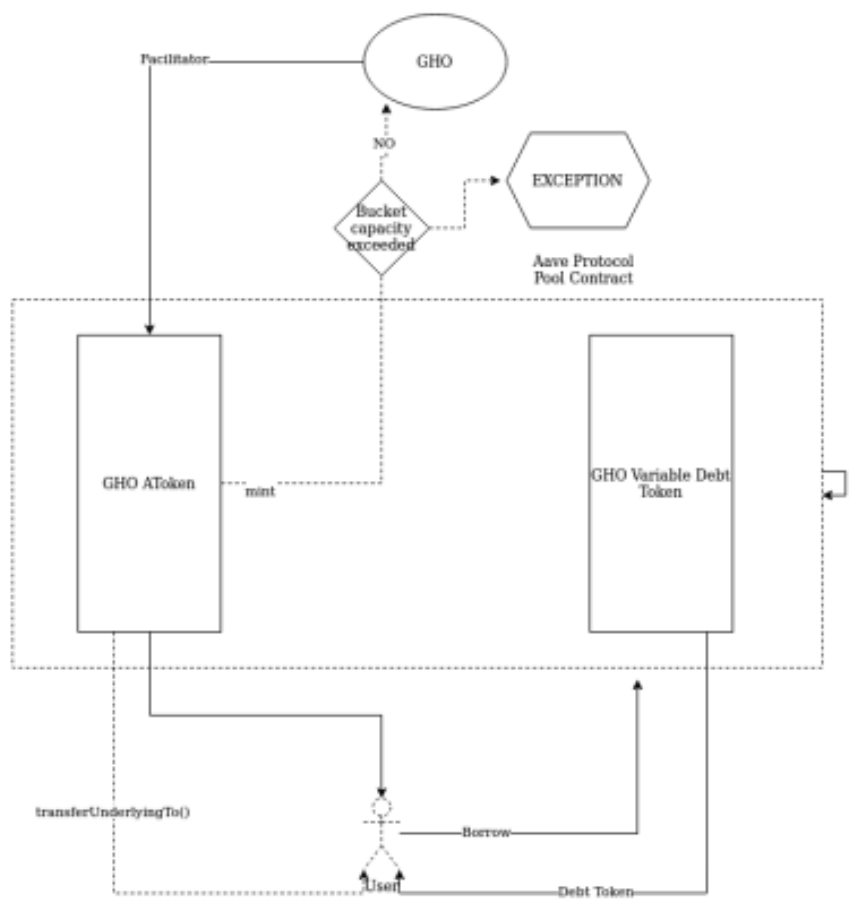

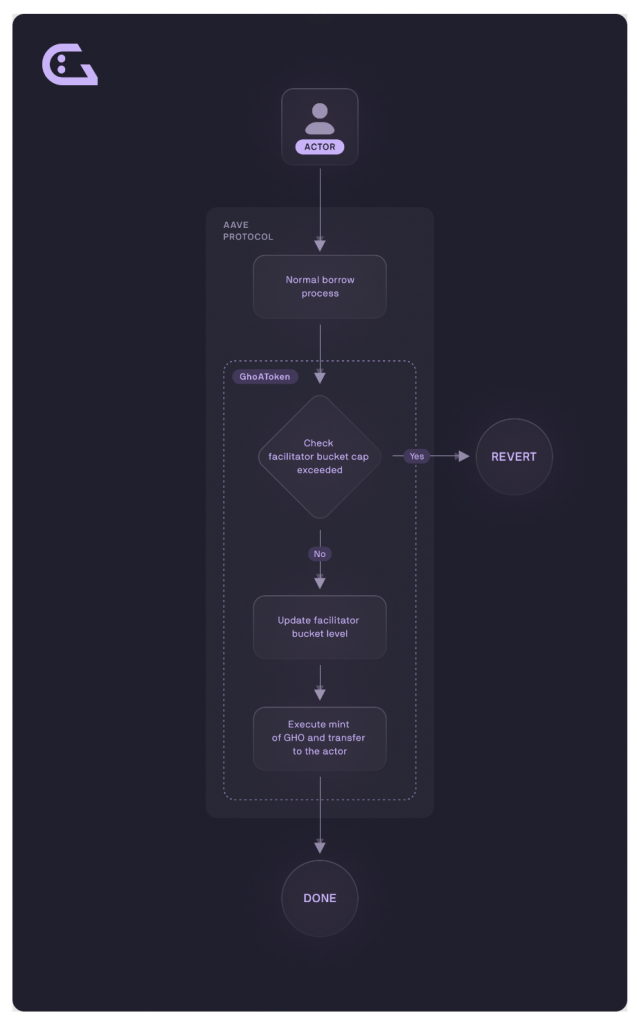

A Facilitator can truthfully mint and burn $GHO tokens. Each Facilitator (F) is assigned a Bucket with a specified capacity, (CB) and has a current bucket level (BL) at any given time. The Bucket represents the upward limit of $GHO that a Facilitator can mint of $GHO. These Facilitators can be different in technical nature based on the stabilization mechanism they use.

The available supply of $GHO (AS) is calculated as the maximum amount of $GHO available for minting through all facilitators at a given time.

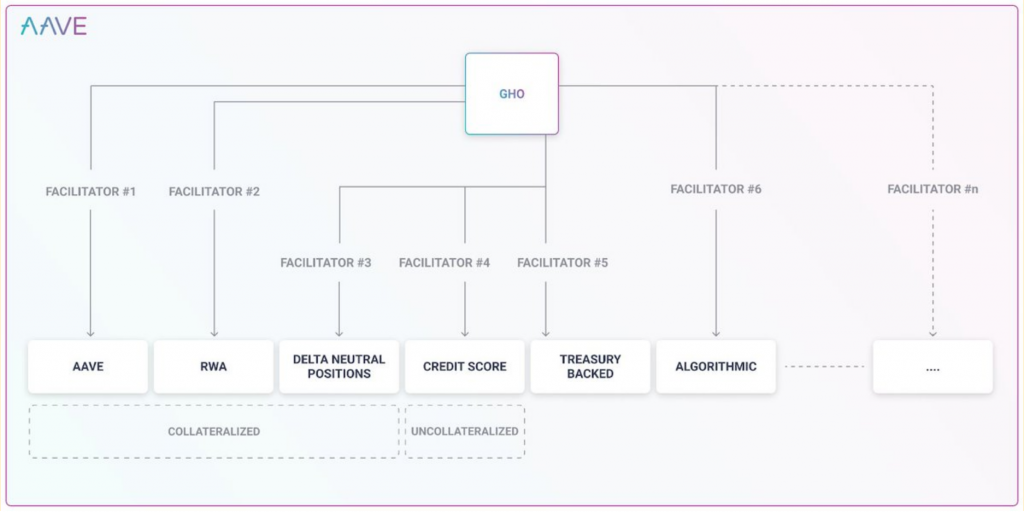

Facilitators are expected to be different in technical nature. As stablecoins can differ in the stabilization mechanisms they use, the idea is to employ multiple stabilization mechanisms in a controlled fashion orchestrated by the Aave DAO. This is achieved by balancing each bucket’s capacity to avoid compromising the overall stability and collateralization of the system.

$GHO is designed to accrue interest when supplied to a liquidity pool. The interest rate is determined by Aave Governance. The Aave protocol will be the first Facilitator.

A facilitator is an entity that can trustlessly mint and burn $GHO tokens.

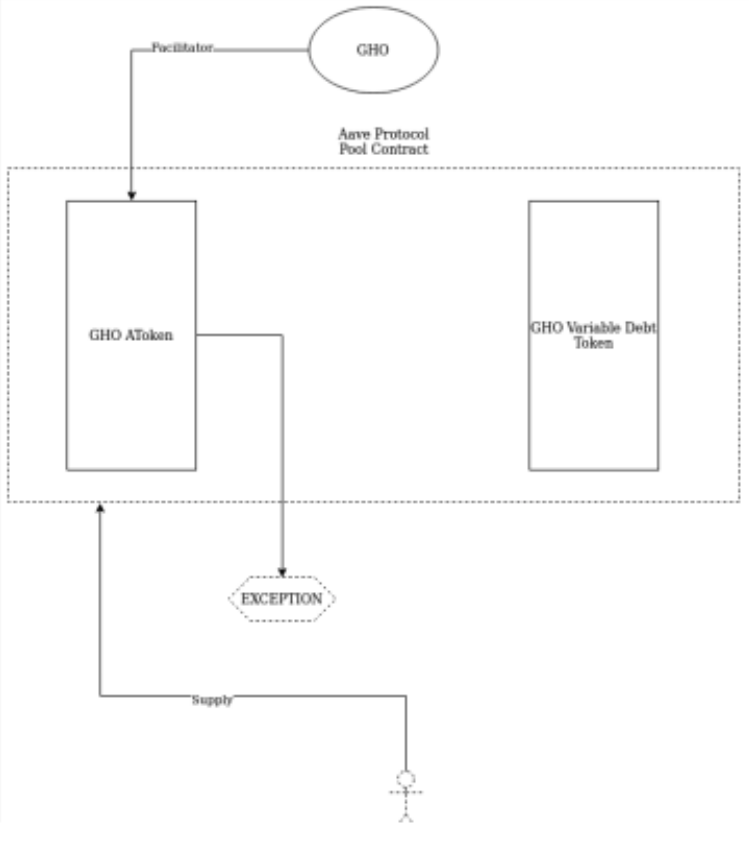

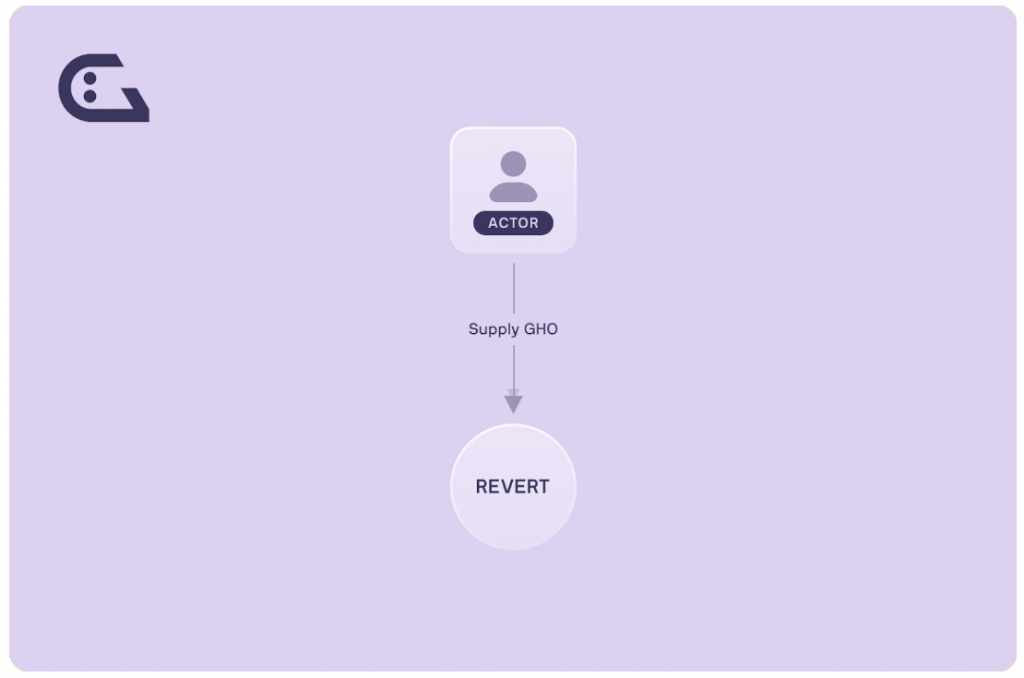

Given how $GHO interacts with the Aave protocol, it cannot be supplied on the Aave Ethereum market. Similarly, when $GHO is borrowed from the Ethereum market, new $GHO and $GHO debt tokens are minted and transferred to the users based on the collateralization requirements.

The initial facilitators are the Aave V3 Ethereum Pool and the FlashMinter Facilitator. Over time, $GHO will be minted through a series of different strategies. This will allow the Aave Governance to manage its exposure to different asset management strategies across the ecosystem in order to strengthen $GHO’s peg. Every Facilitator is responsible for providing its own strategy.

FlashMinting is especially important for $GHO, as it will help to facilitate arbitrage, provide instant liquidity, and have the ability to liquidate users.

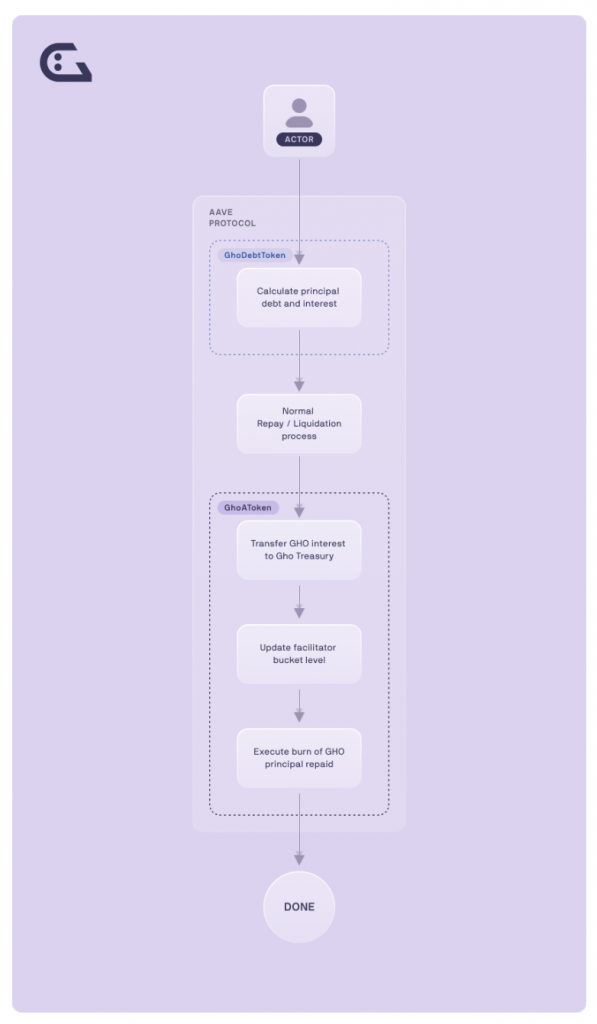

Repayments and liquidations also play an important role in providing stability.

$GHO’s stability relies heavily on the interest rate, which is built into the code. When it comes to interest rates, these don’t follow supply/demand dynamics. Instead of being set algorithmically based on utilization, the Aave DAO Governance will statically adjust interest rates depending on the need for $GHO to expand or contract in value. The reason for this is due to the presence of the Borrow Discount Model implemented in the Safety Module. The goal of this module is to give additional utility to $stkAAVE holders. A maximum amount threshold and borrow discount rate will be set by Governance. This threshold determines the maximum amount of $GHO that can be minted at a discount per stkAave that the user holds.

Each time a user’s $GHO debt balance is updated, the protocol checks whether the user should receive a discount. If this is the case, the user’s interest is accumulated and their discount is applied to their balance increase.

Price stability is also achieved by arbitrage. Initially, the protocol has set the price of 1 GHO to $1 (there is no market pricing via oracles). Users can always borrow, repay, and liquidate GHO at $1.

Here are some of the initial threshold details so far:

Discounts are available to borrowers by staking AAVE in the Safety Module, which is a smart contract-based risk mitigation tool used in shortfall events (when the protocol accumulates bad debt). To incentivize users to participate in stalking and reward them for assuming the risk, users who stake $AAVE can receive a discount on their interest rate.

For each unit of $stkAAVE, there will be a discount on the borrowing rate of 100 $GHO. For example, for each $stkAAVE token, a user can receive a 50% discount on interest for 1000 $GHO. If the interest rate is 3% and they stake 1 $AAVE and borrow 100 $GHO, they have then borrowed the maximum amount of $GHO available to them at a discount. In this situation, their interest rate goes from 3% to 1.5%. If the user borrows 200 $GHO, 100 $GHO will be at a 1.5% interest rate and the other 100 $GHO will be at a 3% interest rate. This would give an effective interest of 2.25%

The discount rate model can be updated easily as well. This discount rate is always available to users but can only be locked for a certain period of time. When a user receives a discount, this discount is assigned to them and can be locked for a certain period of time (e.g. 6 months). After that period has passed, if Aave Governance has set a new discount strategy and the user receives another discount rate, it may not be the same as before. This may also happen if a user triggers a discount update, such as borrowing and repaying $GHO and updating their $stkAAVE balance.

Contrary to most stablecoins implemented as CDPs ($LUSD, $DAI…) where the stablecoin is minted via single asset vaults, $GHO is a multi-collateral-backed asset. This means that users can mint $GHO based on their entire set of supplied collateral assets across the Aave Protocol.

Using multiple different assets within the same borrowing position creates more flexibility for a user and allows for greater control over exposure to price fluctuations. This added flexibility brings in benefits for users who want to increase their health factor and not have to balance multiple positions and health factors.

In Aave, all assets that are borrowed must have been supplied by other users. This means that, only when an asset is supplied, can it be borrowed from the reserve. For example, if a user deposits $UDSC to borrow $LINK, another user must have supplied $LINK for the user to be able to borrow. This is not the case with $GHO. If a user deposits $USDC and would like to borrow $GHO, there is no requirement for a user to have supplied $GHO before. Instead, the Aave protocol calls the $GHO contract and mints $GHO on demand. Next, when the $GHO debt is repaid, $GHO tokens are burnt (rather than going back to suppliers).

When a user supplies collateral to Aave, other users borrow against the supplied assets. When this happens, interest will be earned on the supplied collateral, which effectively reduces the interest that a user is paying on their borrowed positions.

The $GHO Oracle Price is fixed at $1, regardless of the market price. This helps to maintain stability by favoring arbitrage opportunities. As the price is fixed, the opportunities to make a profit are immediate as soon as the peg breaks above or below.

Aave Governance is responsible for statically setting interest rates, instead of following the usual supply and demand dynamics. Any changes to interest rates require a governance proposal.

$GHO was built due to the market demand for a decentralized, and overcollateralized stablecoin that gives users the opportunity to transfer stable value in a fast, transparent, and censorship-resistant way. Due to the limited adoption of decentralized stablecoins and the current infrastructure that Aave provides to the Ethereum ecosystem, the protocol is aiming to capitalize on the opportunity of generating extra revenue for the Aave DAO by sending 100% of the interest payments accrued by minters of $GHO directly to the treasury.

Besides, there is a large opportunity to favor GHO’s expansion on different layer 2s (given their lower fees). This will increase the number of onboarded users as well as the number of transactions processed.

Lending and borrowing in traditional finance is one of the most important elements to build a sustainable financial system. Lenders (a.k.a depositors) provide funds to borrowers in return for interest on their deposit and borrowers pay interest on the amount of money they borrowed in exchange for having access to the money immediately.

One of the most common questions is, why would someone overcollateralize a borrowing position? There are a few reasons for this. For example, users may not want to sell their tokens because they need funds to cover unexpected expenses. Other reasons include delaying paying capital gain taxes on their tokes or using borrowed funds to increase leverage in a certain position

Aave is available on the following chains:

In its V3 version, the protocol provides new features such as Portals, which will allow for interoperability and liquidity flows between Aave V3 markets across different networks. This will also introduce governance-approved bridges to burn aTokens on the source network while instantly minting them on the destination network.

Aave is a decentralized non-custodial protocol where users can deposit or borrow assets. Depositors provide liquidity to the market to earn passive income from loan repayments, while borrowers borrow assets in an overcollateralized and perpetual manner.

When it comes to how the protocol works, users can become depositors or borrowers.

For example, a user can deposit a stablecoin like DAI to earn interest on it according to DAI’s algorithmically set supply interest rate. This algorithmic rate is determined by the reaction between supplied and borrowed $DAI on Aave. This deposit of $DAI goes to a lending pool and can then be used by borrowers who want to borrow $DAI as a loan. In order for borrowers to access the funds, they have to deposit overcollateralized, or excess collateral.

In Aave, depositors who provide funds to a smart contract receive aTokens, whose value is pegged 1:1 to the underlying token. The difference is that the balance of aTokens will represent the deposit amount plus the accrued interest. Therefore, this balance keeps increasing according to the current borrowing rate of the protocol. You can think of this as similar to liquid staked tokens, such as $stETH, in that both of these tokens become worth more (in terms of the original token like ETH) over time.

All standard loans are overcollateralized, which means that the value of supplied collateral is higher than the amount that can be borrowed. This protects the protocol from the insolvency of borrowers repaying depositors while guaranteeing that there will always be enough liquidity to satisfy depositors’ withdrawals.

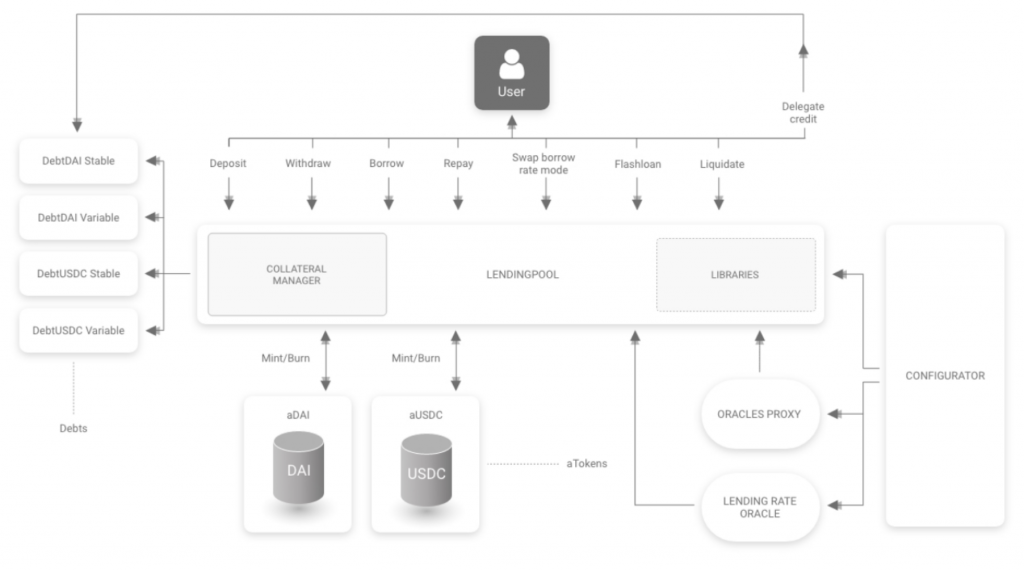

Users should be familiar with the following concepts:

Lending Pool: Protocol pool where users can deposit, withdraw, borrow, or repay their loans

aTokens: Yield-generating tokens that represent user deposits in the Aave protocol. They implement most standard functions of ERC20 tokens with additional functionality.

Stable and Variable debt tokens: Tokenized borrowing positions on the protocol. These debt tokens are not transferable and they represent the debt owed by the token holder.

AAVE token is the ERC20 governance token of the protocol.

Interest rate strategy to calculate and update the interest rates of specific reserves and optimize the base yield curve parameters for each asset. This is basically a mathematical function that determines the interest rate of each asset pool where the interest rate changes based on the amount of borrowed funds and the total liquidity (i.e utilization) of the pool for that asset

Price oracle to provide a price feed using Chainlink and an alternative fallback price oracle

Users deposit the asset/s of their preference and, once the transaction is confirmed, they will receive aTokens which allow them to start earning continuous interest. How much depositors earn is based on:

The calculation of interest rates accounts for:

To come up with its rates calculation, Aave keeps track of two values:

The protocol also features credit delegation, a method that allows a depositor to deposit funds to earn interest, and delegate borrowing power (their credit) to other users. The enforcement of the loan terms is agreed upon between depositor and borrower either via off-chain legal agreements or on-chain smart contracts. This enables:

The maximum borrowing power of a specific collateral is given by the LTV (Loan to Value) ratio. For example, if a loan has a 75% LTV, then for every 1 $ETH worth of collateral, the user will be able to borrow 0.75 ETH worth of the principal currency. The loans are always overcollateralized, meaning that you always have to deposit more than what you are borrowing.

Based on the number of funds in the lending pool, which is measured by the utilization rate, the interest rate model can manage liquidity risk through user incentives such that:

The debt switch function was introduced on September 5, 2023.

It allows users to seamlessly switch their borrow positions, without having to manually repay and borrow.

The withdraw & switch function was introduced on September 5, 2023.

It allows users to withdraw their assets into another token of their choice.

A loan with a stable rate behaves like a fixed rate loan with the difference that it is subject to being rebalanced by the DAO upon market fluctuations in the medium/long term.

Flash loans were first introduced in Aave V1 as a tool for developers with technical knowledge of the Aave protocol. To do a flash loan, the user needs to build a smart contract that requests a flash loan. The contract will then need to execute the steps required to perform a particular action, such as paying back loans, liquidating others’ positions…

Change collateral from one or multiple assets to another without closing the current debt positions:

Partially or fully repay a loan with the existing collateral in the protocol:

The following are the fees involved in using Aave.

As $GHO is not supplied, there are benefits to how $GHO works compared to other assets

When borrowing $GHO, new $GHO and $GHO Debt TOkens are automatically generated and transferred to the user. During this borrow transaction, the Bucket level for each Facilitator is updated in order to reflect the new amount of GHO that has been minted. Because of that, the borrow transaction could fail if the amount requested exceeds the Bucket capacity assigned to the Facilitator.

Example:

As with any other asset, changes in collateral prices will impact the user’s health factor (and if it drops below 1, their collateral will be liquidated).

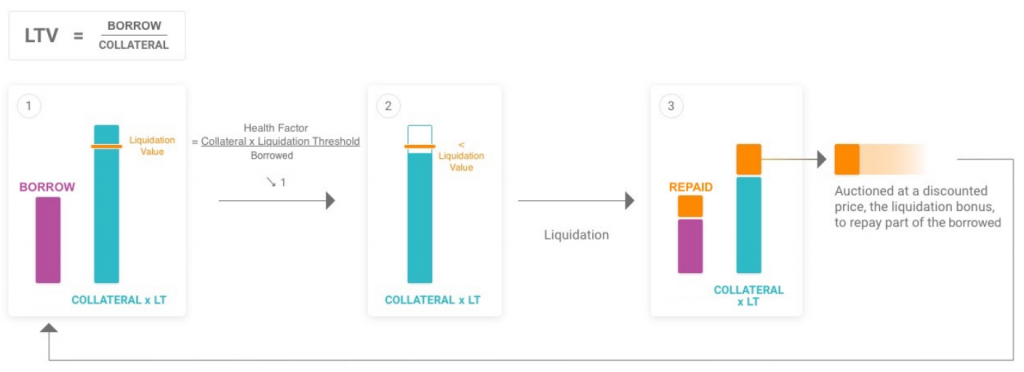

The Aave protocol is built on the over-collateralization of loans. Users lock assets in the protocol and borrow up to 75% of their current value. Because of this, the health of the Aave Protocol is dependent on the health of the loans within the system. This is coordinated by the ‘health factor’ of all open positions.

When a user’s deposit devalues significantly, a liquidation event can be triggered. When this happens, any third-party liquidator can pay back the user’s debt on their behalf and get paid a liquidation bonus for their service.

The liquidation bonus is the reward received by liquidators in exchange for their service for purchasing collateral assets that have a health factor below 1.

Liquidation processes occur when a borrower’s health factor goes below 1 due to their collateral value not properly covering their loan/debt value. This might happen when the collateral decreases in value or the borrowed debt increases in value against each other.

The collateral-to-loan value is represented as a ratio called the health factor, calculated by:

When the health factor drops below 1 the position may be liquidated to maintain the solvency of the protocol. This incentivizes third parties to safeguard the protocol’s health by acting in their own interest (to receive a loan’s collateral at a discount).

When the health factor ratio goes below 1, the loan becomes undercollateralized and can be liquidated

Examples of liquidations

In order to avoid liquidation, as the health factor declines, users can lower their risk by depositing more collateral assets or repaying a part of the loan. There are tools that help users to track their positions, such as DeFi Saver and HAL.

The health factor of a user is calculated from the user’s collateral balance (in $ETH) multiplied by the current liquidations threshold for all the user’s outstanding assets, divided by 100, divided by the user’s borrow balance and fees. This calculation can be performed both on-chain and off-chain

Due to the importance of liquidations for the whole DeFi ecosystem, liquidators are important to the safety of Aave. With the introduction of flash loans, liquidators do not need upfront capital to provide their service. In a single transaction, liquidators can borrow funds from Aave, pay back users’ debt, collect their deposit, trade it for the best available market price, and return the assets to Aave with a small fee while keeping the remaining assets as a reward for their service. Anyone can be a liquidator in a permissionless manner. The most accessible way of doing that is by developing custom software solutions and bots, with the goal to be the first ones liquidating loans to get the liquidation bonus.

Since setting up bots programmatically is the most efficient process, liquidators must take into account the following:

When repaying or liquidating $GHO, the $GHO tokens are sent back to the smart contract (pool) and are burnt and removed from circulation.

Example:

Aave is a pioneer in offering a DeFi exclusive product for RWAs (Real World Assets) in a permissioned and compliant platform for institutions, Aave ARC. Not only that, but thanks to its new social primitives, such as lens protocol, Aave is creating an ecosystem that stands out against its competitors because of its innovation and diversification.

Since its launch in January 2020 and outstanding growth in TVL (Total Value Locked) with peak liquidity and over 1M total users, Aave quickly set itself up as the leading non-custodial liquidity protocol for institutional fintechs, hedge funds, family offices, and asset managers interested in Decentralized Finance.

Aave ARC provides institutions ranging from investment banks to pension funds and even central banks with the transparency, decentralized governance, and rapid innovation that comes from automated smart contracts execution, liquidity, and programmability. This comes at the expense of compliance and KYC enforcement policies for onboarding entities that must take AML regulations into account.

This integration was led by Fireblocks LLC, a registered money services business in the United States with money transmission licenses in several states. Fireblocks submitted an Aave Improvement Proposal to become the first whitelisted entity on Aave ARC for its leading MPC (multiparty computation) wallet product that would end up processing more than $1.5TN in transactions to date. This AIP was approved by Aave Governance.

Value Creation and Value Capture

As a protocol, Aave has come up with multiple DeFi primitives that allow for high capital efficient operations, such as Rate Switching, Flash loans, aTokens… By being a pioneer in borrowing/lending, Aave set itself apart from the competition and took advantage in the development of its multichain strategy.

Compared to other protocols such as Balancer, Curve, or GMX, the protocol does not bring in excessive protocol revenue to its own native treasury, In fact, its evolving ecosystem is still too dependent on its well-designed economic incentive program. Combined with its decentralized distribution, long-term AAVE holders end up being rewarded for staking their tokens to secure the protocol while earning more governance tokens as a reward. This is crucial for maintaining the alignment between Aave and its community and agreeing on critical decisions that concern risk parameters, economic investments, asset listings, new chains…

The governance and staking utilities of the token define the main use cases of $AAVE tokens inside its own ecosystem. However, other protocol integrations such as LP collateral assets on Balancer and Uniswap also bring in extra protocol revenue in the form of trading fees.

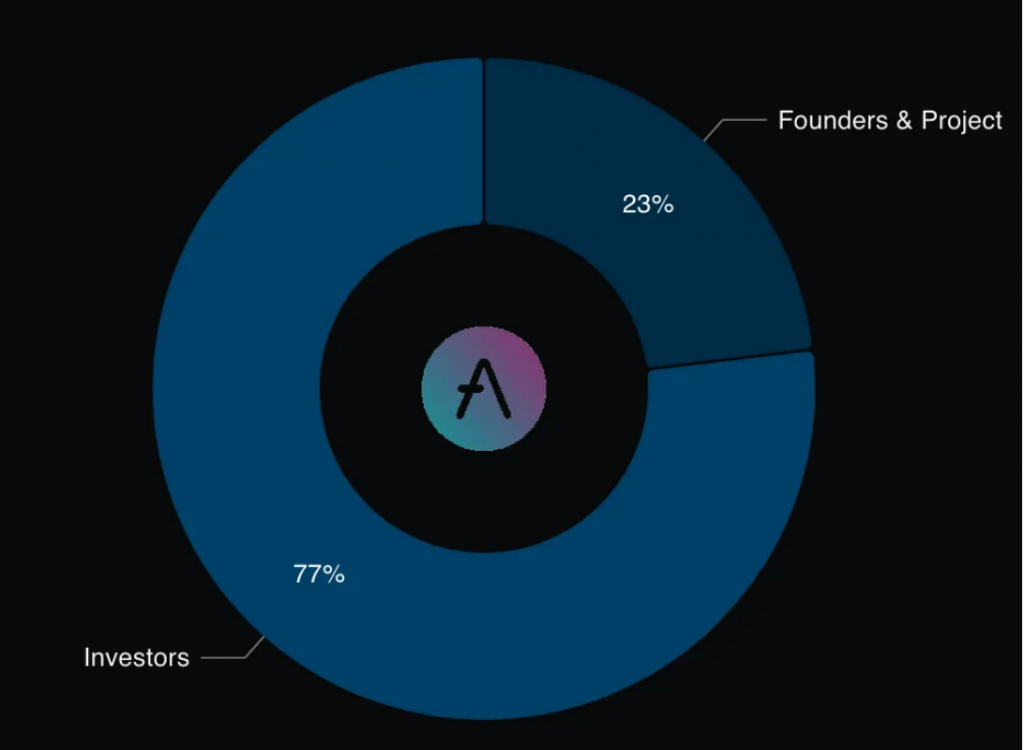

The migration of $LEND to $AAVE tokens after the protocol’s rebranding was executed at a 100:1 ratio.

The $AAVE token utility serves two purposes: governance and staking.

The $AAVE token can be staked in the Safety Module to earn rewards from helping the protocol in situations where a shortfall event might occur. When a user stakes $AAVE in the Safety Module, the user receives an equivalent amount of $stkAAVE in return. These assets entitle the user to claim rewards at any time and redeem them for the underlying $AAVE tokens.

The Safety Modules acts as an insurance fund against potential shortfall events. If an event like this occurs, 30% of the tokens staked could be slashed and used to repay everyone affected.

To calculate the APR:

emissionsPerSecond * secondsPerYear / balanceOfStkAave

To convert from APR to APY, the compounded per second formula is:

APY = (1 + (APR / secondsPerYear))^(secondsPerYear) – 1

To convert from APY to APR, the compounded per second formula is:

APR = ((1 + APY)^(1 / secondsPerYear) – 1) * secondsPerYear

The APR or Annual Percentage Rate is the interest after a year without taking compounding effects into account

The APY or Annual Percentage Yield is the interest after a year, which includes compounding interest

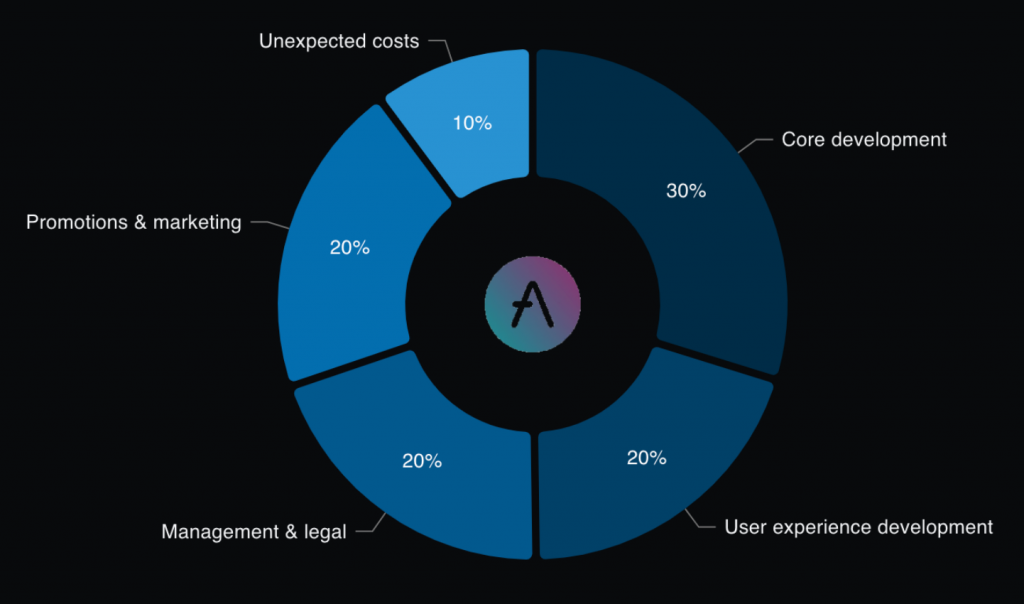

Liquidity mining incentives were introduced via AIP-16 for both depositors and borrowers. Attracting liquidity is important for borrowing/lending protocols in order to provide utility to its users. Aave distributes liquidity mining rewards to incentivize protocol usage. These tokens are currently estimated as 3 million tokens from the Genesis supply allocated to the ecosystem reserve fund.

In addition to its token incentive programs, Aave has facilitated the LP tokens of Uniswap and Balancer to be used as collateral in the protocol.

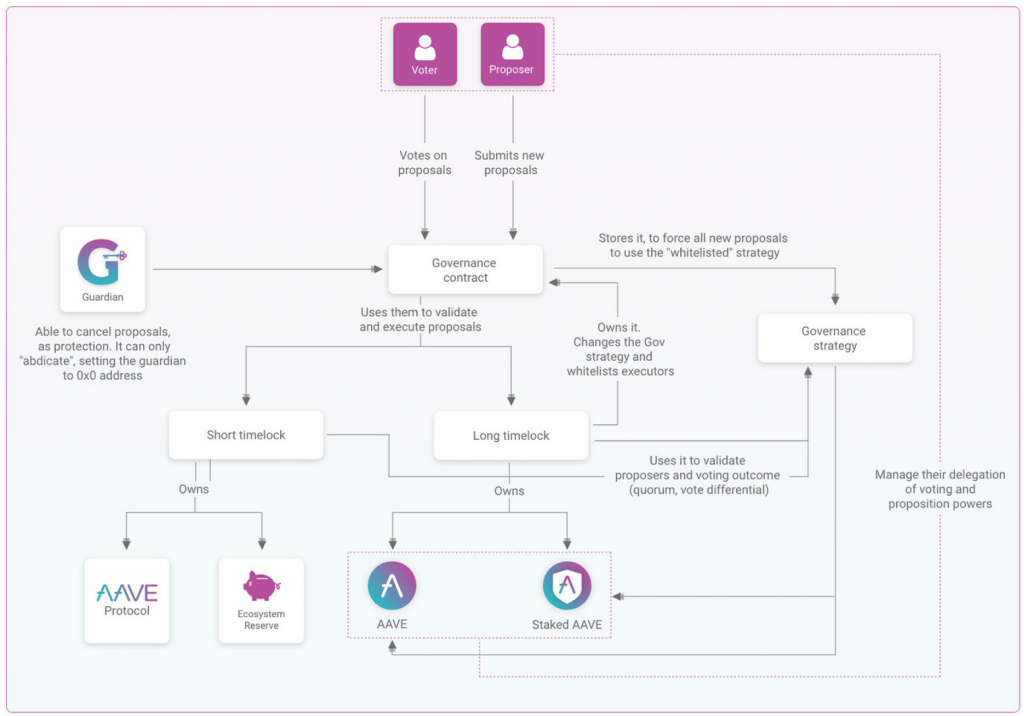

Governance is defined by the mechanisms and financial incentives described in the Aavenomics whitepaper. To participate in governance, users need $AAVE or $stkAAVE tokens to vote on proposals. For votes to be valid, the balance of voting tokens ($AAVE or $stkAAVE) must be the same or greater throughout the entire proposal voting and validating period. Reducing the amount of tokens you own would cancel your vote.

$AAVE and $stkAAVE token holders receive governance power in proportion to the sum of their balance. There are 2 powers associated with each governance token:

Any user can choose to delegate one or both of its governance powers associated with a token. Users that have received delegated power cannot forward this delegated power to another delegate.

An account’s voting power at a given block is given by its AAVE/stkAAVE balance plus the balances of all delegators. A user can only vote once.

Off-chain process

The AIP is submitted on-chain for governance voting by a community member with enough proposition power. The AIP should be merged into the AIP repository with an associated IPFS hash of the parsed AIP file.

Proposal creation

Proposal voting

End of proposal

Proposal queuing and execution

Proposal canceling (optional)

If the creator’s proposal power decrease and no longer meet the PROPOSITION_THRESHOLD, anyone can cancel the proposal.

As a safeguard mechanism, there is a guardian account controlled by a 6/10 community multisig. This account can cancel a proposal before execution. The goal is to:

There are 2 types of proposals with different parameters which affect the length and execution of a proposal. For example, proposals that are critical for the protocols require more voting time and higher bote differential than proposals that only affect some protocol parameters.

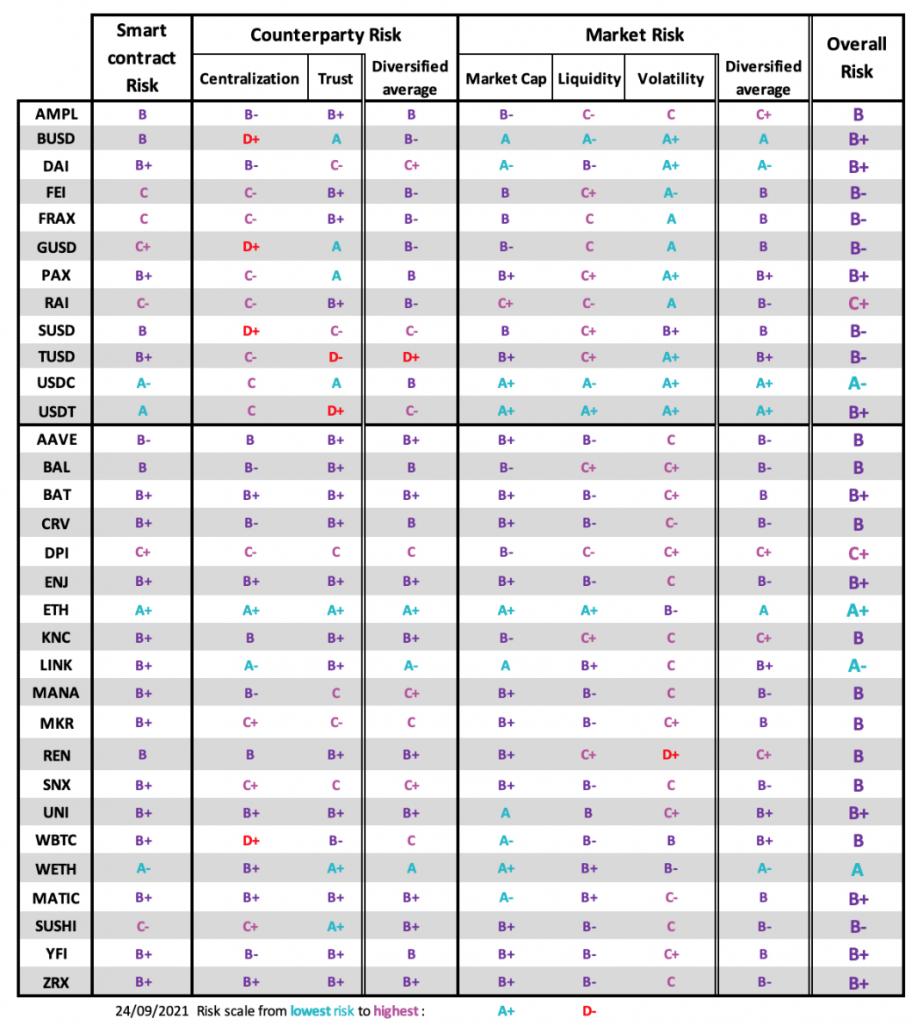

New Asset Listings are one of the most important protocol operations since Aave can support many different assets in many different markets. Each market operates as a separate risk pool. Adding a new asset influences the overall risk of that particular market. For a new asset to be added to the protocol, there needs to be a discussion and proposal process where the following factors are analyzed:

In addition to the ARC, AIP process, one of the risk analyses to be taken into account is the submission of the Aave Risk Score

V3 was implemented on December 26, 2023, and is the next iteration of the Aave decentralized governance to control the whole ecosystem: multi-chain native and minimizing voting cost.

V3 was conceived in order to improve non-optimal aspects of V2, such as the cost of voting and the coupling between governance and tokens.

Governance power in v3 is given to Aave itself, stkAAVE and $AAVE deposited on Ethereum V3.

The following are differences from V2:

New features on V3 includes:

Aave Governance has full control over the entities that are added or removed as Facilitators. Every Facilitator will be subject to review by the DAO before receiving mint permissions and will have a governance-defined limit on how much GHO they can mint.

By attracting a diverse set of Facilitators, Aave Governance can manage the DAO’s exposure to multiple stabilization strategies. This could also include strategies for non-Aave users. For instance, the opportunities for non-Aave Facilitators are endless (e.g use within payment applications, e-commerce solutions, purchases of GHO on DEXes, use as a store of value during market volatility…).

Aave Governance can also set the interest rates of GHO, the discount threshold (the maximum amount of GHO that can be minted at a discount), and the discount rate to stimulate the expansion or contraction of the GHO supply. These interest rates can be set based on supply-demand parameters by the DAO as well.

The primary security mechanism for the Aave Protocol is incentivizing $AAVE token holders to lock their tokens in a Smart Contract-based component known as the Safety Module (SM). These locked $AAVE tokens act as a safety net in case of a Shortfall Event within the Aave ecosystem’s money markets. A Shortfall Event (SE) occurs when there’s a deficit, and the determination of such an event is subject to a vote in the Protocol Governance, as detailed in the governance rules.

In the event of a Shortfall Event, a portion of the locked $AAVE tokens is auctioned on the market to be sold for assets needed to cover the deficit. The SM has an in-built mechanism to prevent an excessive flood of $AAVE tokens into the open market, which could further devalue $AAVE itself. Participants choose to lock their AAVE into the SMe, understanding that this action secures the protocol and, in return, they receive rewards in the form of Safety Incentives (SI).

To contribute to the protocol’s safety and earn incentives, AAVE holders deposit their tokens into the SM, receiving a tokenized position in return. This tokenized position can be freely moved within the underlying network, and the holder can redeem their share from the SM at any time. However, this triggers a cooldown period of one week, which can be extended by governance if needed.

SI rewards have a cooldown period during which they cannot be claimed, and this period is set at seven days. Nonetheless, fees generated by the protocol are continually distributed to users participating in the SM and can be withdrawn. These fees are redistributed to SI participants. The SI reward plan is designed to encourage early-stage contributors to the protocol’s safety. The emission of SI rewards is controlled by governance and can be adjusted according to the protocol’s requirements. All fee distribution mechanisms are potential until they go through the AIP process and a governance vote.

In the event that the SM is unable to cover the entire deficit incurred, Protocol Governance has the authority to initiate a special Recovery Issuance event. In this scenario, new $AAVE tokens are created and sold in an open auction at market price, with priority given to the Backstop Module.

The issuance of AAVE tokens during a Shortfall Event is mitigated by the presence of the SM, which covers the protocol’s deficit before any new tokens are issued.

The Safety Module is defined by the following components:

Users interact with the Safety Module by locking $AAVE and/or $ETH into the Safety Module contract. The interaction with the SM is facilitated by a UI that clearly explains the SM dynamics, its purpose within the Aave ecosystem and the risks involved. Users will have the choice of locking $AAVE directly or providing liquidity shares from the 80/20 AAVE/ETH Balancer Pool.

Using Balancer instead of other AMM solutions has a clear advantage with the ability to change how much is focused on $AAVE. This allows Aave to create a market and offer liquidity while still having a significant stake in $AAVE. Holding $AAVE/ETH liquidity with uneven weights is almost the same as just holding $AAVE, but with the added benefit of earning trading fees.

The Aave Governance can adjust the weights in the Balancer pool to better match the protocol’s and stakers’ needs as the market changes.

Since Balancer Labs is giving $BAL governance tokens to liquidity providers, having the Safety Module (SM) liquidity in Balancer lets users get $BAL tokens along with trading fees, protocol fees, and SI rewards.

By also allowing users to simply lock $AAVE, we make it easier for less experienced users to participate in staking without needing two different assets. The Safety Module will offer special incentives to attract liquidity if there’s an imbalance in the AMM.

The Safety Module and Recovery Issuance safety mechanisms are made stronger with a built-in Backstop Module. This module is like a deposit pool in a smart contract that lets the Aave Community deposit stablecoins and ETH. It acts as a buyer of last resort for AAVE tokens at a price agreed upon by the protocol governance in case of a deficit event.

Backstop participants are encouraged to have liquidity in the Backstop because they share in protocol fees. If a backstop event happens, the AAVE tokens bought by the backstop are distributed proportionally to backstop providers, or they can choose to deposit them back into the staking module.

The main role of the Safety Module is to protect the protocol against unexpected loss of funds stemming from:

In case of loss of capital, the SM uses up to 30% of the assets locked to cover the deficit. If the amount seized from the SM is not enough to cover the whole debt, an ad-hoc AAVE issuance event is triggered called Recovery Issuance. The issued AAVE are used, together with the amount drawn from the SM, to cover the deficit.

The auction module oversees the market emission of the seized funds. The Auction module follows a Dutch auction scheme, where the AAVE and the ETH collected from the SM are auctioned in lots, with their size depending on the deficit to be covered. The Backstop Module triggers whenever a lot is about to be sold at a price that is below the backstop price.

A Shortfall Event has certain governance implications. Users with locked liquidity in the Safety Module will still be able to vote on that matter using their tokenized version of their locked assets. Conceptually, $AAVE holders participating in the SM will have to vote to safeguard the integrity of the protocol. Their choice to seize their own funds will need to take into account the long-term stability of the protocol and the future value of AAVE.

This poses certain limitations on the amount of funds that can be seized in the case of a Shortfall Event. A percentage that is too high might bring conflicting sentiment in the $AAVE holders participating in the SM, potentially compromising the long-term stability of the ecosystem. The protocol governance will always need to consider these implications whenever proposal discussing the SM funds management are submitted.

The composability of DeFi implies that risks from an individual component can flow into all dependent systems. Since assets are at the core of the Aave Protocol, each of them must be carefully audited before being supported. Risk assessments are periodically conducted for all assets. These assessments consider market, counter-party, and smart contract risk.

Aave selects eligible assets based on the following:

Counter-party risk assesses qualitatively how and by who the currency is governed. There are different degrees of governance decentralization that may give direct control over funds (as backing, for example) or attack vectors to the governance architecture which could expose control and funds. The counter-party risk is measured from the level of centralization corresponding to the number of parties that control the protocol as well as the number of holders and the trust in the entity, project or processes.

Market risks are linked to the market size and fluctuations in offer and demand. These risks are particularly relevant for the assets of the protocol: the collateral. If the value of the collateral decreases, it might reach the liquidation threshold and start getting liquidated. The markets then need to hold sufficient volume for these liquidations – sells which tend to lower the price of the underlying asset through slippage affecting the value recovered.

Aave is open source and has been audited. No protocol, no matter for how long it has been running, can be considered entirely risk-free. The risks associated with Aave come from smart contracts (risk of bugs within the protocol’s code). This risk has been minimized by making the code open source and conducting multiple security audits.

The liquidity of the protocol is the availability of the capital within the protocol to face business operations (e.g. borrowing and redeeming aTokens) is a key metric to analyzing protocol risk

Over time, firms like PeckShield, SigmaPrima, Consensys, Certix, Certora, OpenZeppelin, Trail of Bits… have conducted thorough security reviews

With Aave Governance making all decisions related to GHO, there is increased transparency when it comes to making decisions in comparison to other stablecoins in the market. All GHO code is open source and has been audited extensively before its launch.

Aave has 2 bug bounty programs.

The safest assets in the protocol are ranked on the risk scale from A+ (safest assets) to D- (highest risk).

Among the risk factors that stand out:

Protocol composability implies risks from system dependencies and operations derived from assets and liabilities held with other protocols. For example, Aave enables users to deposit/borrow assets by pooling funds in the lending pools. In exchange, depositors receive aTokens that account for deposits and interest.

Since each loan on Aave is secured by a collateral asset, the selection of currencies must take into account the following constraints:

aToken Valuation

Since aTokens are deposit certificates of an underlying token that accrues interest from being borrowed on the Aave protocol, theses tokens are redeemable for the underlying 1:1 as long as there is available liquidity in the lending pool

The price of aTokens can be approximated as the net present value of the discounted cash flows between the present time and the end of the loan period. Since aTokens incur cash flows, it’s APY discount should be offset by the tokens’ value accrual.

Even though 1 aDAI is redeemable for 1 DAI at any time in Aave, the market price of aDAI is still volatile in the market relative to the price of DAI. For instance, it is possible to redeem aDAI for more DAI in the open market than on Aave, which represents an opportunity for users. This valuation allows aDAI holders to access alternative sources of liquidation with some profit margin on the token’s price.

The liquidations threshold of borrow positions is the price at which a borrow position will become undercollateralized and, therefore, subject to liquidation. For example, a liquidation threshold of 80% means that when the debt value is worth 80% of the collateral value, the position will be open for liquidation