Published: September 06, 2023

Aave is a Lending Market that operates on 9 networks. This report covers the period 27 July 2023 to 26 August 2023.

A market-wide decrease in volume was seen after Uniswap’s competitor Curve Finance was exploited on July 29th.

The TVL for a lending market can be viewed in two ways:

TVL = Total Value Supplied OR

TVL = Total Value in Net Deposits

The difference between the two is that Net Deposits look at the Total Supplied less the Total Borrowed.

Our view is that Net Deposits are a fairer reflection of TVL unless specifically stated otherwise, TVL references refer to the net number.

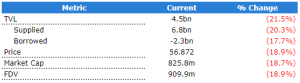

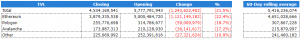

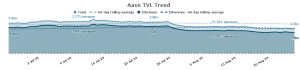

Aave opened at $5.8bn and closed at $4.5bn, a $1.2bn (21.5%) decrease over the period. The 60-day rolling average is similar in showing a decreasing trend. The $3.9bn on Ethereum represents 85.6% of total protocol TVL.

At a network level, Ethereum had a decrease of 13% in TVL.

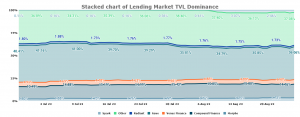

Aave ranks 1st of all the Lending Markets. Sector dominance opened with 39.37% and decreased over the period, closing at 36.06%.

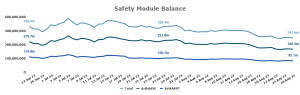

The Safety Module acts as an insurance fund against potential shortfall events. If an event like this occurs, 30% of the tokens staked could be slashed and used to repay everyone affected.

The Saftey Module consists of two tokens:

You can read more on the Safety Module in our Aave Breakdown.

There was a decrease in the total Safety Module balance. It opened with $318m and closed at $247.6m, a decrease of 22.1%.

A temperature check for the deployment of an Aave V3 pool on GnosisChain passes. The assets considered for this deployment include wETH, wstETH, GNO, USDC, wxDAI, and EURe. You can read the full details here.

A proposal to gradually wind down the CRV market on Aave V2 Ethereum via a series of LT reductions pass You can read the full details here.

A temperature check for deployment on Aave V3 on Celo, an emerging L2 on Ethereum 3, passes. You can read the full details here.

A proposal for Aave V3 Deployment on Base passes. You can read the full details here.

Aave deploys to Base Chain. Base is a new Ethereum L2, incubated by Coinbase and built on the open-source OP Stack. You can read the full details here.

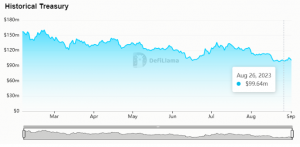

As of August 26, 2023, the treasury amounted to $99.64m, consisting of the following:

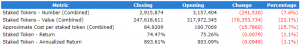

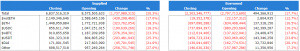

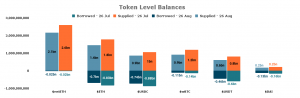

Total Supplied balances opened the period at $8.6bn and closed at $6.8bn, a $1.7bn decrease. Total Borrowed balances opened the period at $-2.8bn and closed at $-2.3bn, a $0.5bn decrease.

Supply side deposits of $6.8bn are largely driven by $wstETH and $ETH. $wstETH contributes $2.1bn (31.4%) to total deposits, while $ETH contributes $1.4bn (21.2%).

Borrowing activity of $1.2bn is largely driven by $USDC and $ETH. $USDC contributes $0.74bn (32%) to total deposits, while $ETH contributes $0.7bn (30.3%).

The chart below represents 89.78% of the total supplied and 93.63% of the total borrowed.

$AAVE opened the period at $70.082 and closed at $56.872, an 18.9% decrease. The high for the month was $74.5 recorded on 30 Jul, while the low of $54.8 was on 23 Aug. Compared to its host network, performance was worse than $ETH, which had an 11% decrease over the period.

There was an estimated 35.2k (2248.5k) $AAVE given out in rewards.

There was an estimated 35.2k (2248.5k) $AAVE given out as rewards. All $AAVE rewards are distributed to depositors into the Saftey Module.

Revelo Intel is the recipient of a grant from the Aave GrantsDAO, this report is part of that grant allocation.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.