Published: June 16, 2023

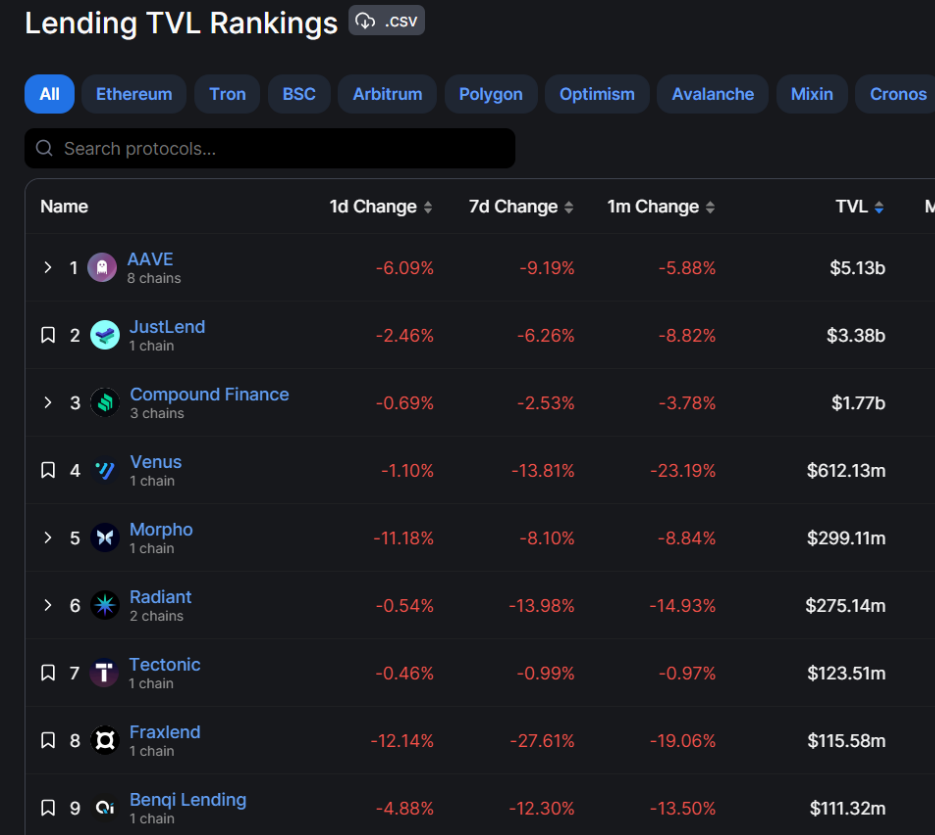

Aave is the leading lending market in DeFi generating fees almost 4 times that of its closest competitor.

This report takes a look at the performance of Aave over the 31-day period from May 10 to June 9.

It will cover the key metrics of the protocol, the $AAVE token, the safety module, and other events.

The TVL for a lending market can be viewed in two ways:

The difference between the two is that net deposits look at the total gross deposits less the total borrowed. Our view is that net deposits are a fairer reflection of TVL and unless specifically stated otherwise, TVL references refer to the net number.

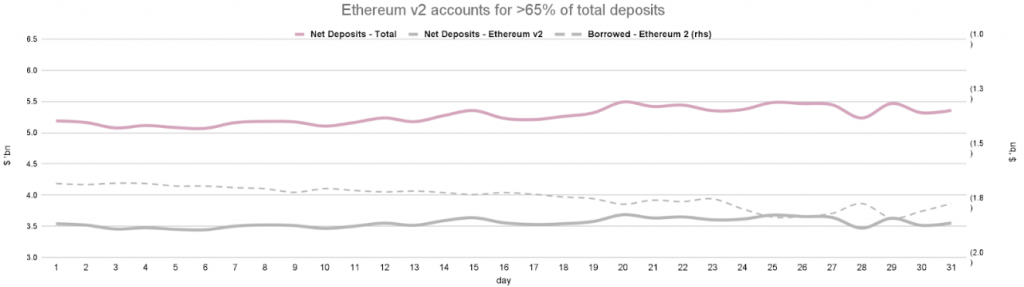

AAVE opened the period with $5.1bn in TVL and closed at $5.4bn, representing a 4.54% increase in TVL for the 31 days. This was a reversal of the previous period which saw a decrease of 9.72% in TVL

The protocol has its TVL allocated between three versions: v1, v2, and v3.

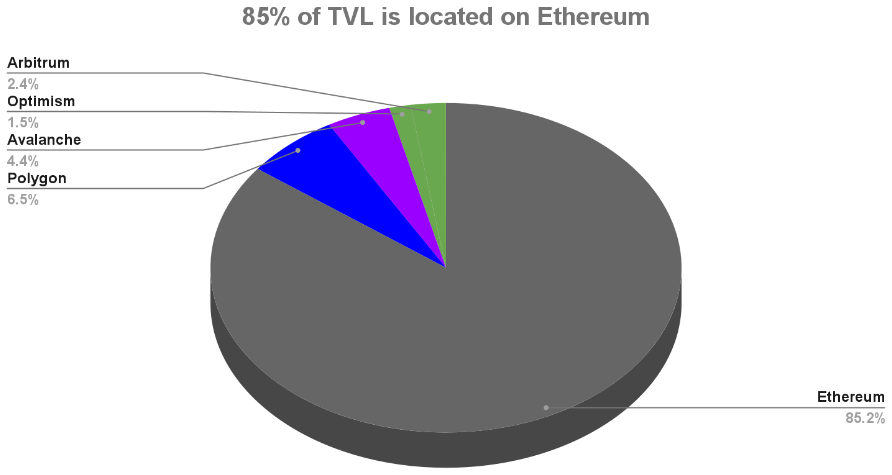

Below is a breakdown of how the TVL is allocated between both the versions and the networks that Aave exists on. The contribution to the $5.4bn of TVL is as follows:

TVL of v3 on Ethereum opened the period at $868m and experienced a $133m (15.35%) increase, closing at $1bn. The v2 on Ethereum opened the period at $3.49bn and experienced a $63m (1.79%) increase, closing at $3.55bn.

At a token level, the drivers behind the changes were:

An increase in supply caps was the main driver behind the increase in wstETH TVL.

The graph below shows the change in TVL balances for net deposits of the protocol, Ethereum v2 net deposits and Ethereum v2 borrows over the 31 days.

At the time of writing the market had moved and all the large lending markets have lost some TVL, Aave continues to perform better than its competitors.

At the end of the 31 days, Gross Deposits totaled $8.1bn, where the average balance was $7.1bn.

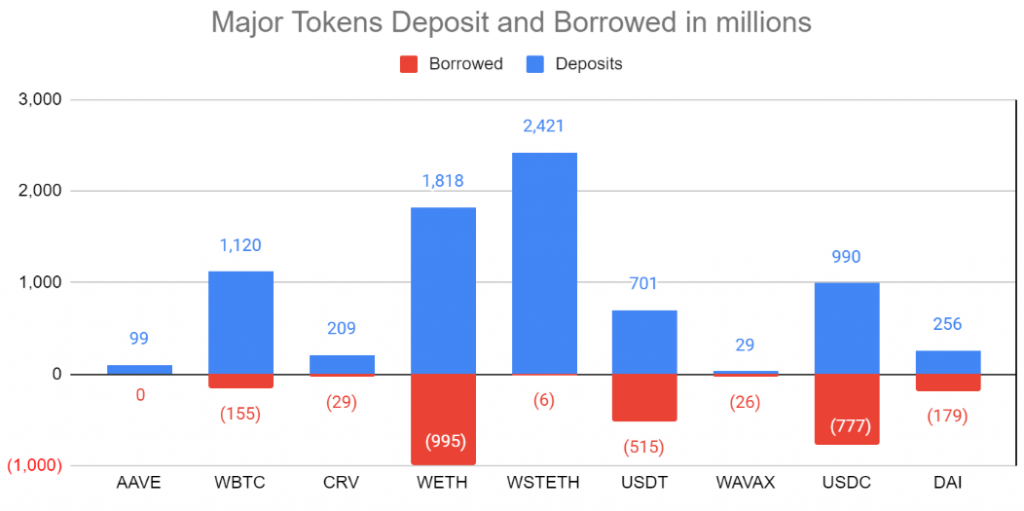

The table below illustrates the tokens that are most used on the protocol across all three versions. They account for 94% of Gross Deposits and 97% of borrowed tokens.

At $2.4bn, wstETH is the largest contributor on the supply side. The $1.8bn from ETH is the second largest and together ETH related tokens amount to $4.3bn of Gross deposits.

ETH ($1bn) and USDC ($0.8bn) are popular markets on the borrowing side.

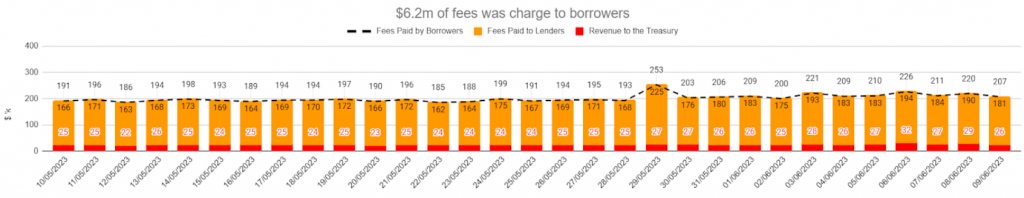

Borrowers were charged $6.2m worth of fees over the period, a small (0.65%) increase from the $6.2m generated in the previous period.

The chart below illustrates how these fees are allocated between lenders and the protocol.

Compared to its competitors, Aave ranked 1st among Lenders for fees generated in the last 31 days.

The Interest Rates represent the return you would get if the current conditions stayed constant for a full year. Interest is earned on the supply side and paid on the borrowing side. For more information on how the interest rates are determined, you can read our Aave Breakdown.

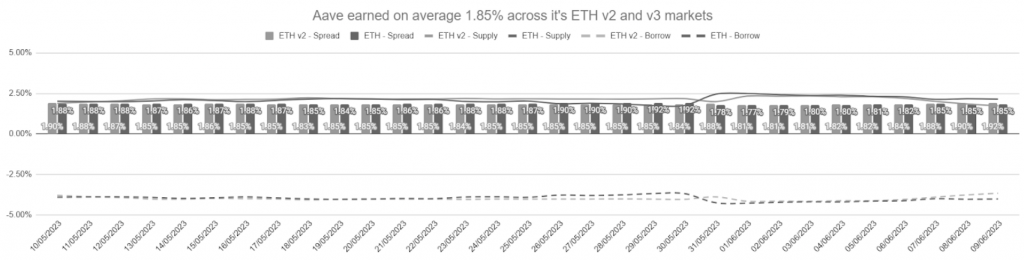

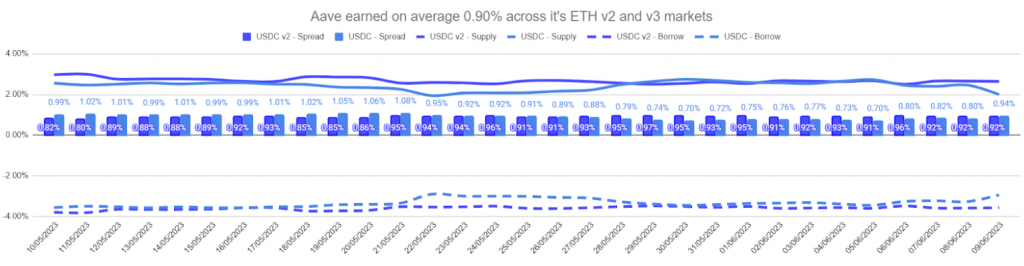

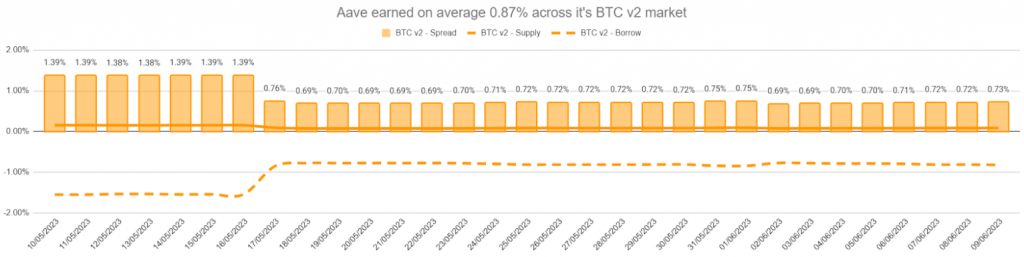

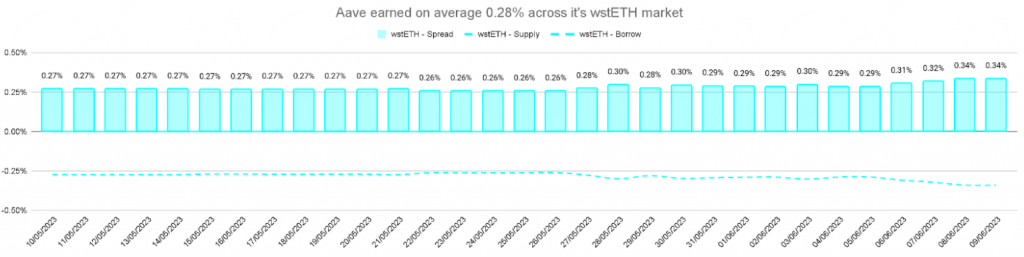

Aave generates revenue based on the spread between the borrow side interest vs the supply side interest. In other words Interest charged to borrowers less Interest paid to depositors = Interest earned.

On average the $ETH markets offer the highest returns to the protocol.

In addition to this, the returns on the other three largest supply-side markets ($USDC, $wBTC, and wstETH) are as follows:

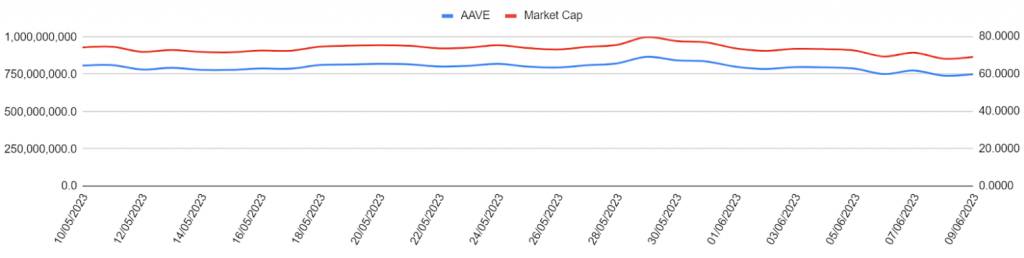

During the 31 days, the $AAVE token opened at $64.60 which was also its highest point, and closed at $59.84. The total movement for the period was a decrease of 7.37%.

The circulating market cap followed the same downtrend as the price, opening at $929m and closing at $863m, with a decrease of 7.07%. CoinGecko ranks $AAVE as the 51st largest protocol based on circulating market cap.

$AAVE has a relatively low emission rate, only 1.1k new $AAVE are minted per day and they are all allocated to the Safety Module. As a result, the protocol does not pay for the TVL in the lending market.

The graph below illustrates the correlation between the price and market cap for the period, indicating that there were no significant supply-driven events and that the changes in the market cap were driven by token price volatility.

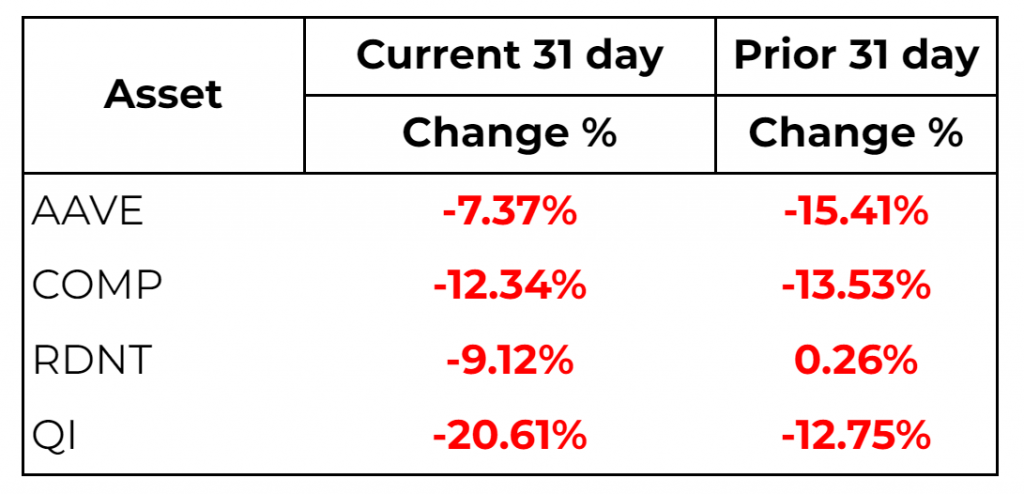

All Lending experienced downward price pressure over the 31 days, with $AAVE being the most resilient compared to its competitors.

This could be due to $AAVE being a blue-chip token.

Notably, both $AAVE and $RDNT have a form of staking a Liquidity Pool token, resulting in deeper liquidity.

One of the possible factors is why they outperformed $Qi and $Comp. Another potential reason is that $Qi is Avalanche native and $Avax has a 10% decrease in price over the 31 days.

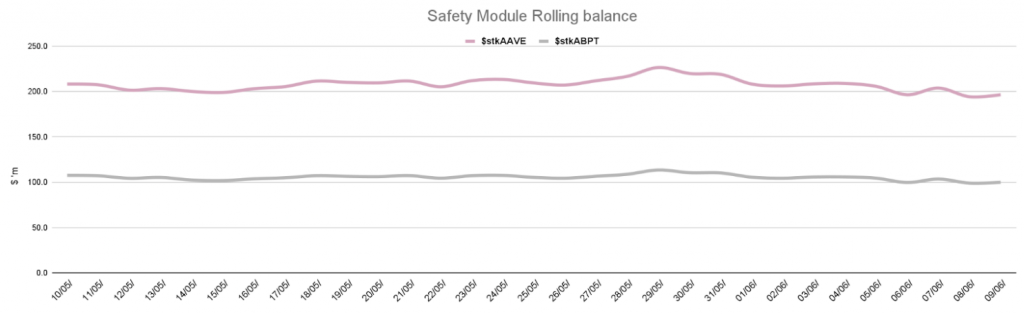

The total value staked in the Safety Module saw a decrease of $17.8m (5.59%) over the 31-day period, which is correlated to the price decrease of $AAVE during the same period.

The Safety Module consists of two tokens:

You can read more on the Safety Module in our Aave Breakdown.

Over the 31 days, the average balance of $stkAAVE was $242m and $stkABPT was $120m. In the graph below we can see there were no volatile changes in the staked balances.

Governance

GovernanceDuring the 31-day period, there were seven governance proposals that were voted on. Here are some of the most significant ones.

1. Increase Supply Caps for LSTs on AAVE V3

The proposal was for an increase in the supply caps for several Liquid Staking Tokens (LSTs) across multiple networks, including stETH, rETH, and sAVAX. The proposed changes are within the limits of the Risk Stewards and are requested for enforcement by them.

Changes included:

The vote closed in favor of the proposal.

You can read the full details here.

2. BUSD Offboarding Plan Part II

Part 2 of the [ARFC] BUSD Offboarding Plan.

In February 2023, Paxos stopped the minting of BUSD due to recent developments with the SEC, which would have resulted in the circulating supply of BUSD trending towards zero over time. Therefore, it was necessary to implement an offboarding plan for BUSD on the Aave V2 Ethereum market.

This part of the offboarding plan will be carried out with the current AIP with the following parameters:

The vote closed in favor of the proposal.

You can read the full details here.

3. Price feeds operational update

To enhance the stability of the Aave platform, it is proposed to change the price feeds for $wstETH on Optimism & Arbitrum to a custom price adapter that calculates the $wstETH / $ETH / $USD price based on Chainlink’s feeds under the hood.

The same approach is already used for the $wstETH on Polygon and $wBTC on Aave V3.

This proposal changes the following price adapters and price oracle sentinel:

The vote closed in favor of the proposal.

You can read the full details here.

4. Upgrade the safety module to v1.5 PART 2

On September 2020, the Aave Safety Module was introduced into the ecosystem, to improve the protection of the liquidity protocol, adding an extra utility for the AAVE token: AAVE or AAVE/WETH BPT holders stake their assets to act as a defensive layer in front of any shortfall event.

This AIP presents the community with the opportunity to upgrade the safety module to v1.5 which introduces:

The vote closed in favor of the proposal.

You can read the full details here.

For the period there were two notable news events:

1. Increase Supply Caps for LSTs on AAVE V3

On June 1st, the following increase in supply caps was executed.

For more information, you can read about it here.

2. Transaction history is now viewable

Users can see their transaction history on the AAVE interface, including their supply, borrow, and withdraw transactions, and more.

For more information, you can read about it here.

3. v3 lending markets go live on Metis chain

This deployment will enable efficient capital markets in Metis, a key component for building and sustaining a Web3 Economy, and also allows AAVE an additional source of fees and a foothold into the Metis ecosystem.

For more information, you can read about it here.

4. AAVE, along with GHOAave and AaveGrants offers hackathon bounties totaling $10K.

ETHPrague is a hybrid event that combines a conference and a hackathon, open to a multitude of applicants.

Bounties include:

For more information, you can read about it here.

This report has highlighted the pricing trends and metrics for the period.

The Aave protocol outperformed its competitors across most sectors and did so without having to pay for emissions.

During the 31-day period, it had very good results for net deposit growth and interest income.

Even though $AAVE had a price decrease, it outperformed its competitors. Aided by the deep liquidity generated as part of the Safety Module.

We hope this report provides valuable insights into the performance of Aave and the $AAVE token.

Revelo Intel has never had a commercial relationship with AAVE and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.