Published: August 10, 2023

In this report, we provide an in-depth analysis of GMX v2 and its associated token, $GMX. With a primary goal of forecasting the token’s future price directionality, we will examine the factors that may influence its performance after the stealth launch of the protocol’s most recent upgrade.

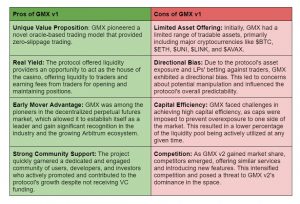

With v1, GMX has demonstrated extraordinary performance, surging from $20 in January 2022 to an all-time high of $90. Amidst the downfall of prominent DeFi giants, GMX has carved out its own narrative, showcasing an appetite for leverage in both bullish and bearish market conditions.

During its early days, GMX experienced rapid success and managed to capture a significant portion of the decentralized perpetual futures market, reaching up to 90% market share. However, as the protocol attracted more attention, its weaknesses started to become more apparent.

As a result of the protocol’s success, more eyeballs looked at the project and its weaknesses were highlighted. At this point, the team recognized the importance of addressing these issues to maintain its competitive edge and sustain its position as a leading player. Consequently, the protocol underwent significant upgrades and improvements in its latest version, GMX v2.

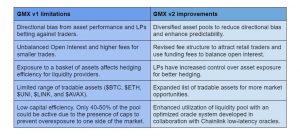

The limitations of v1 stemmed from the underlying mechanism design, where $GLP represented a basket of assets that would attempt to self-rebalance while being the active counterparty to traders. This introduced a series of limitations:

We can observe how there is an unpredictable Risk-Reward Balance based on whether you are a liquidity provider or a trader. While earning fees can be attractive, it also involves potential losses if traders consistently outperform the market.

While the GLP model had its merits and unique features, the transition to GMX v2 intends to offer a more capital-efficient and flexible way to get exposure to decentralized perpetuals trading.

From a user’s perspective, this translates into key improvements in the following areas:

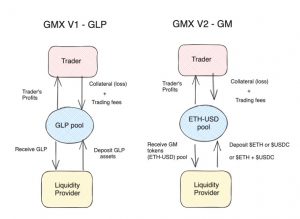

Unlike in GMX v1, where traders swapped against a basket of assets that would self-rebalance in the form of $GLP, in GMX v2 liquidity is provided through individual GM pools, also known as GMX Market pools. These pools enable users to engage in leverage trading, borrowing, and swaps.

Note that some markets will be labeled as SWAP-ONLY or SPOT-ONLY markets.

Each GM pool will consist of 3 components:

Let’s consider an example market, ETH/USD (ETH-USDC):

As a result, liquidity must be provided in GM tokens. This means that in order to become a liquidity provider, users must buy GM tokens. This purchase may have a positive or negative price impact depending on the pool’s token balance. Because of that, it is recommended to use the “Pair” option and buy GM tokens with equal USD amounts of long and short tokens.

Note that since liquidity providers are dealing with GM tokens with their respective prices, they must be aware of the following properties in order to properly assess their exposure:

Notably, there is no guarantee that long and short positions will always be balanced, and sudden price spikes may cause temporary imbalances. However, the shift to isolated markets represents a significant improvement:

It is also worth noting that GM (liquidity) tokens automatically compound, unlike GLP.

Isolated markets replace multi-asset trading through the GLP pool. This offers benefits such as:

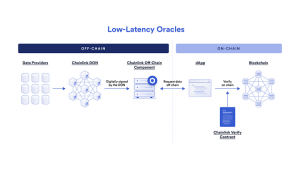

In v2, GMX continues to operate on an Oracle-based model, relying on external oracles to fetch prices from centralized exchanges. This ensures zero-slippage trading, executing trades at the market price determined by low-latency Chainlink oracles. The major difference is that, through this partnership with Chainlink, this new solution provides a pull-based that is much more likely to fulfill limit orders at the exact specified price.

Unlike standard Chainlink price feeds, the pull-based model of low-latency oracles generates Oracle reports on a per-block basis. This adds an extra degree of confidence since users can now retrieve these reports and ensure that the off-chain data objectively represents the on-chain execution price.

This partnership entails the following conditions:

By introducing funding fees, GMX addresses the criticism of slippage-free trading in GMX v1.

While this offers better risk management for liquidity providers (especially when they lose against traders), this carries on additional costs for traders. Regardless, the reason behind introducing funding fees is to redistribute risk more equitably.

In practice, trading on the non-dominant Open Interest (OI) side significantly reduces fees.

The trading experience has improved significantly thanks to the support of new order types. With v2, GMX will support the following orders:

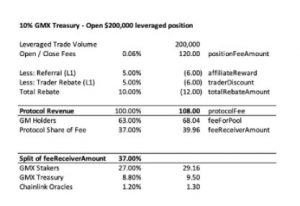

The fee structure is designed to incentivize liquidity providers and ensure a fair distribution of fees among users in the GMX ecosystem. What’s most relevant for v2 is that the spot and perpetual trading fees have been halved from 0.1% to 0.05%, making trading more cost-effective for users.

The fee reduction compensates for the introduction of price impact and funding fees, reducing risk for liquidity providers. Traders can view the fee details on the interface when making a trade and be aware of the potential costs associated with their transactions.

Even though some users have already expressed concerns about how this might affect GMX’s profitability, others believe lower fees will attract more users, boosting long-term protocol success.

Below you can find an example of the fee distribution applied against a $200,000 open position:

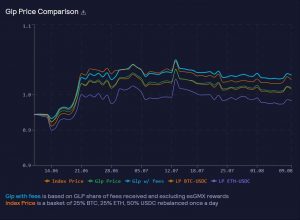

$GLP continues to be one of the most widely adopted “money legos” in all of DeFi. The composability of GMX v1 has enabled the development of multiple protocols that would not have been possible otherwise (vaults, auto-compounders, delta-neutral or hedging strategies…).

Even though the yield that one can get on $GLP has decreased in expectation of v2, it has consistently delivered >20% returns. This adoption, especially on the Arbitrum ecosystem, is one of the reasons why $GLP will not be phased out. Instead, both v1 and v2 will run in parallel, and each will have its own integrations built on top.

In v2, funding fees will replace $GLP as the “money lego” of choice. In the past, dYdX was the primary on-chain venue offering sustained Open Interest levels. With dYdX now moving to Cosmos, GMX (along with Kwenta) can offer an alternative to centralized exchanges to facilitate funding rate arbitrage opportunities.

At the same time, the ability for protocols like Lyra to hedge their exposure will still be possible on v2. With the launch of many new projects working on volatility strategies and structured products on Arbitrum, like Opyn, Rysk, Smilee, and Gammaswap… it is reasonable to expect an increasing number of integrations. This will drive more volume and open up a constant flow of capital into the protocol.

With v2, GMX has addressed the limitations of its previous version by introducing isolated markets, low-latency Chainlink oracles, funding fees, and a more user-friendly fee structure. These improvements have enhanced capital efficiency, reduced risk for liquidity providers, and improved the overall trading experience for users.

Revelo Intel has never had a commercial relationship with GMX and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.