Published Oct. 6, 2023

Frax v3

This research report delves into the upcoming developments of the Frax Protocol, specifically focusing on Frax V3 and its foray into the Real-World Asset (RWA) business through FinresPBC.

We also highlight how Frax is positioning itself to become a dominant stablecoin issuer that can thrive in both high and low-interest rate environments.

In traditional finance, banks stand as intermediaries that facilitate economic activity by safeguarding deposits and channeling funds to borrowers. However, this credit intermediation process carries inherent risks, prompting regulators to enforce prudential measures such as capital requirements to ensure banking stability.

Recently, a convergence between traditional finance and decentralized finance (DeFi) has emerged, driven by innovations such as the integration of Real-World Assets (RWAs). This makes it possible to measure the capital reserves required to cover potential losses of on-chain protocols and stablecoin issuers, thereby facilitating risk management.

By using RWAs, DeFi projects and stablecoin issuers like MakerDAO or Frax can demonstrate their commitment to prudential risk management, attracting mainstream investors. RWAs aid in calculating capital reserves, margin requirements, and investment portfolio riskiness, contributing to the ecosystem’s safety and soundness. Additionally, publishing RWA holdings on-chain promotes transparency, reducing information asymmetry.

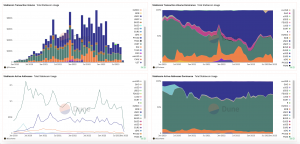

The relentless rise of stablecoins, fueled by an insatiable worldwide demand for US dollars, is underpinned by multiple factors, including the dollar’s unrivaled dominance in global trade, the vast stockpile of physical dollars held abroad, and the significant dollar-denominated credit extended by non-US banks.

Central to this evolution is the pivotal role that stablecoins play, acting as the on-chain equivalent of euro-dollars. Over the last five years, the value of stablecoins in circulation has soared from under $3 billion to a staggering $120 billion today. The recent introduction of PayPal’s stablecoin, PYUSD, underscores the growing recognition of stablecoins’ potential and their potential to reshape global financial services.

Right after the protocol’s launch in December 2020, Frax deliberated on the possibility of seeking yield off-chain. This is what MakerDAO set out to do at the time, seeking Real World Asset partners to invest a portion of its substantial treasury.

During this period, projects like Centrifuge showed their interest in whitelisting the Frax DAO to engage in RWA investments. However, the prevailing high yields in the DeFi space and the booming crypto market made off-chain fund deployment unnecessary for Frax. Instead, Frax introduced its Algorithmic Monetary Operations (AMOs), focusing on accumulating $CRV and $CVX and engaging in yield farming activities.

Even though RWAs are becoming more popular nowadays, there wasn’t a clearly defined strategy back at the time Frax launched. Bringing US Treasury bond yields on-chain proved to be a complex endeavor, requiring the cooperation of various stakeholders, including issuers, underwriters, fund managers, auditors, buyers, sellers, brokers, and banks.

The move to participate in the Curve flywheel proved highly successful until a significant setback occurred with the decline of Luna. Since then, yields across the DeFi space witnessed a sharp decline, leading to a mass exodus of capital.

As a result, the once-lucrative strategies that had generated substantial profits for Frax began to lose their effectiveness and started to compress. At the same time, global bond yields experienced a rapid and dramatic rise. Within a few months, the 30-year bond yield surged from 1.60% to over 5%, marking a remarkable shift in market dynamics. In this transformed environment, investors increasingly sought the risk-free rate offered by short-term US treasuries with zero smart contract risk.

Consequently, $FRAX faced a notable decline in market share in comparison to $DAI as Maker began offering a 5-8% yield on the Dai Savings Rate (DSR). Frax had not introduced single-sided deposit vaults, prioritizing liquidity for its assets. Frax v3 is the catalyst that aims to correct this issue in yield distribution.

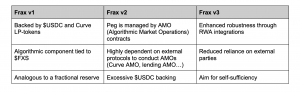

Frax V1, the initial iteration, backed its stablecoin with a combination of hard assets such as $USDC and Curve LP tokens, alongside an algorithmic component tied to the governance token $FXS. This made the mechanism analogous to a fractional reserve, hence the name Frax.

Frax V2 brought about significant changes through the introduction of Algorithmic Market Operation (AMO) contracts. These automated market operations set the stage for novel approaches, ensuring a stable peg to the dollar. While innovating in its operational mechanisms, Frax maintained its core stability. However, this exposed the protocol to external dependencies, as it was highly dependent on Curve and Convex among others. This became obvious when $USDC depegged earlier this year.

AMOs introduce different risks depending on the actual strategy that is used by the protocol to mint new units without collateral: the riskier their exposure, the bigger the threat. As an example, consider a lending AMO where $FRAX is minted by the AMO and deposited into a money market. Now if there is an issue in the lending pool, that would result in an increase in the overall circulating supply, and the minted amount will be unbacked.

The concerns of v2 are now addressed in the latest iteration of $FRAX. Frax v3 is the biggest upgrade since the launch of the protocol in late 2020. In Frax v3, the focus is on enhancing robustness by simplifying processes and reducing reliance on external platforms. This approach aligns with the aim of self-sufficiency, allowing Frax to control its destiny.

Frax will remain a dollar-pegged stablecoin, using a permissionless monetary policy enforced by smart contracts and managed by non-custodial subprotocols. These subprotocols can be either internal, like FraxLend and FraxSwap, or external, like Curve. Future subprotocols and AMOs can be added via governance. This way, the primary function of the Frax Protocol is to stabilize the FRAX price to $1.000 using AMO contracts, real-world assets (RWAs), and governance actions through frxGov, with USD oracles as a reference.

RWAs refer to off-chain assets such as real estate, loans, T-bills, mortgages… Essentially, RWAs make it possible to bring off-chain yields on-chain, which is critical during times when the TradFi yields exceed DeFi yields; DeFi yields also carry extra smart contract risk. However, Frax’s solution has a much longer-term outlook than simply capitalizing on a short-term window of opportunity.

On August 4th, Sam Kazemian, founder of Frax, posted a forum post to outline the protocol’s RWA strategy. This business plan would become effective by first establishing a formal relationship with FinresPBC (see FIP-277), a non-profit organization that will be dedicated to managing assets held by the Frax Protocol. As time goes on, Frax can onboard other custodians as well.

The RWA strategy is not unique to FinresPBC. However, the current partner custodian primarily concentrated on short-dated US treasury bills, Federal Reserve Overnight Repurchase Agreements, USD deposits at Federal Reserve Bank master accounts, and select shares of money market mutual funds. These RWA partners have the obligation to report the custody, broker, banking, and trust arrangements employed in the course of holding the assets for Frax v3 no later than monthly.

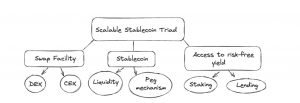

In fact, a fundamental premise shared by the most scalable stablecoins is a triad: the stablecoin itself, a swap mechanism, and access to risk-free yield. Notably, the US Dollar Coin (USDC) leverages this model, tethering its value to the US dollar and acquiring risk-free yield from US Treasury Bills.

The purpose of this expansion is to provide the Frax Protocol with access to secure cash-equivalent assets and near Federal Reserve rate yields. Without profit-seeking motives, FinresPBC is positioned to hold, manage, and optimize the utilization of Frax’s collateral. More specifically, FinresPBC has partnered with Lead Bank to provide compliant financial services. These activities encompass a range of operations such as:

It is important to note that FinresPBC is designed as a non-profit entity, ensuring that profits derived from assets held by the Frax Protocol are directed back into the protocol after covering operational costs. This ensures operation independence, such that FinresPBC maintains a clear separation from the development, operation, and governance of the Frax Protocol.

Frax V3 also introduces FraxBonds (FXBs), a novel concept where the Frax Protocol will offer elevated yield opportunities by issuing bonds. FXBs are tokens that resemble a zero-coupon bond and represent debt tokens. They are not a claim on any other asset or collateral. They also do not guarantee $FRAX peg, $FRAX value, or yield/interest denominated in any other asset except $FRAX.

These bonds can be purchased by individuals and will automatically convert into units of the $FRAX stablecoin upon maturity. Put simply, FraxBonds are utility tokens that denominate $FRAX debt at a point in time. This allows $FRAX holders to buy discounted $FRAX at a later date in the form of FraxBonds.

Hence, it will be possible to buy discounted $FRAX that will be redeemable at a later date. For instance, one could buy $1 worth of $FRAX two years from now for $0.90. When users swap $FRAX for FraxBonds, Frax will earn yield by taking the collateral backing and then using FinresPBC to swap the collateral into cash that is invested into treasuries with the nearest date to expiration. In addition to that, even other yield markets like Fraxlend, Aave, or Compound might be used as well, provided that the yields are high enough.

The idea is that once users swap $FRAX into the bond, the protocol becomes the owner of the collateral and can deploy it where it deems appropriate in order to ensure that sufficient income is earned to pay the debt by the maturity date of the bond.

As a result, Frax Bonds emerge as an autonomous solution to manage protocol debt and provide an on-chain yield curve. These bonds, auctioned through gas-efficient on-chain auctions, mature on a predetermined schedule. This should directly address the near-zero duration part of the yield curve similar to the $DAI DSR.

The motivation for introducing the Frax Staking Rate (FSR) is to offer a single-sided yield for depositors. Similar to Maker’s DSR, this involves a zero-duration yield vault where anyone can deposit $FRAX to start earning yield on $FRAX. This initiative will allow the protocol to offer a shorter-duration yield option for users while mitigating risks associated with longer-duration on-chain strategies.

Thanks to exceptional MEV performance & the Frax Ether two token design, sfrxETH holders still earn APRs near 5% while other major LSDs yield significantly below 4%. That’s 20% more annual revenue to sfrxETH users 💪

stake: https://t.co/ilNiotBs9k

stats: https://t.co/GYJlnz6Ule pic.twitter.com/dWr0B5S161— Frax Finance ¤⛓️¤ (@fraxfinance) September 17, 2023

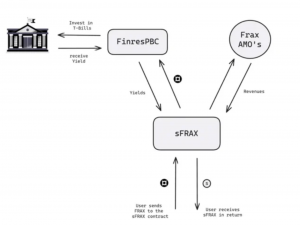

Building upon the dual token model established with $frxETH and $sfrxETH, the concept is extended to the stablecoin realm through $FRAX and $sFRAX. This mechanism enables users to deposit $FRAX into a smart contract vault, allowing them to earn yield denominated in $FRAX.

Thanks to exceptional MEV performance & the Frax Ether two token design, sfrxETH holders still earn APRs near 5% while other major LSDs yield significantly below 4%. That’s 20% more annual revenue to sfrxETH users 💪

stake: https://t.co/ilNiotBs9k

stats: https://t.co/GYJlnz6Ule pic.twitter.com/dWr0B5S161— Frax Finance ¤⛓️¤ (@fraxfinance) September 17, 2023

The initiative addresses $FRAX’s low-duration yield curve, offering users passive earnings while contributing to $FRAX supply growth. sFRAX operates under the ERC-4626 token standard, facilitating integration into various protocols and applications. This should enhance composability and the yield opportunities that contribute to expanding the circulating market cap of $FRAX.

Participants deposit $FRAX into the $sFRAX contract, earning Annual Percentage Rate (APR) yield in newly minted $FRAX stablecoins. In return, depositors receive $sFRAX tokens representing their pool share, which is tradable or transferrable. This minted FRAX is, therefore, fully backed at a 100% collateralization ratio (CR).

Every Wednesday at 11:59:59 UTC, generated yields are deposited into the $sFRAX Vault, ensuring steady APR accrual. Hence, even though $FRAX is minted into the vault, $sFRAX yield originates from protocol revenue through strategies like AMOs and RWAs.

Ultimately, the protocol seeks to softly align the “Frax Staking Rate” with the Federal Reserve Interest on Reserve Deposit Rate, but without guaranteeing a fixed yield. For instance, one of the ways to earn yield is that users deposit $FRAX into $sFRAX, FinresPBC then takes the $FRAX deposit, swaps into $USDC, off-ramps the $USDC and puts it into US treasuries. However, it is worth noting that $sFRAX is not a legal right to redeem assets of the Frax balance sheet, like T-Bills.

As an analogy, one can think of sFRAX as Frax’s IORB (Interest on Reserve Balances). On this point, it is worth noting that sFRAX tries to target close to the IORB of the Fed; the overnight lending rate. Another way to think about it is by comparing sFRAX’s yield to a 1-day bond (i.e., lending to the Fed for 1 day).

The sFRAX vault’s Annual Percentage Yield (APY) is determined by a utilization function that can be set by the frxGov governance module. It starts at a maximum of 10% APY and theoretically has no lower limit.

As more $FRAX is staked in the vault, the protocol aims to deploy that staked $FRAX into sources that yield as close to the Federal Reserve Interest on Reserve Balances (IORB) rate as possible. This strategy is employed to keep the bottom APY of the sFRAX vault close to the IORB oracle rate.

As a consequence of this implicit revenue generation process, the cost of $FRAX is prone to naturally gravitate towards that yield, similar to how mortgage markets adjust to the new cost of borrowing when the Fed itself raises the IORB.

Later this year or early 2024, along with the launch of Fraxchain, Frax V3 will also introduce the Borrow AMM (BAMM) system as its collateralization and lending method. This is an Oracle-Free Borrow-AMM (BAMM) design that eliminates the need for oracle price feeds, thereby mitigating potential oracle risks associated with price manipulation and data inaccuracies.

Unlike conventional Collateralized Debt Position (CDP) systems, BAMM backs the stablecoin with crypto assets without relying on oracles or encountering bad debt risk. The idea of BAMM is to build liquidity for any asset and allow users to borrow it as the liquidity for the assets rises. Even though it is still unclear how the exact implementation will be embedded into $FRAX’s or $frxETH’s monetary policy, there are some predefined mechanism built into this core primitive, such as:

Acknowledging the need for enhanced decentralization, Frax V3 employs the frxGov on-chain governance system. To minimize reliance on a multisig system, every action and permission within the protocol requires approval from $veFXS voters. This commitment to decentralization fosters trust and ensures a more democratic decision-making process.

The adoption and growth of the industry requires new capital inflows. This advent of new users is likely to be driven by stablecoins, which greatly benefit from network effects. Given the large difference in market cap and adoption, this market sector is taking the shape of a winner-takes-all market, with $USDT and $USDC taking the lead.

After the collapse of UST, we could discard algorithmic stablecoins and categorize stablecoins into two primary categories: fiat-backed stablecoins (like $USDT or $USDC) and Collateralized Debt Positions or CDPs (like $DAI, $LUSD, $crvUSD, or $GHO). Both of these operating models have proven to be resilient to all market conditions and scale to a certain extent.

Frax, however, works in a very specific way and does not belong to either of those categories. The key property is that the protocol owns and manages PoL (Protocol Owned Liquidity) and enforces a monetary policy through AMOs (Algorithmic Market Operations). The reason why it is not an algorithmic stablecoin is that it is not backed by endogenous collateral (where a governance or volatile token is used to back the underlying stablecoin and enable arbitrage opportunities). Instead, the fact that the protocol owns a portion of the supply makes it such that under no circumstances will the full circulating supply of the stablecoin be exposed to selling pressure. This was evidenced during the collapse of $UST, where Frax prevented a death spiral by owning its liquidity, as well as incentivizing locked liquidity on Convex.

On the one hand, looking at the adoption of fiat-backed stablecoins, we can see that even though they pass zero yields to token holders, they are by far the most liquid. All while collecting risk-free yield from T-Bills for their own treasuries. On the other hand, CDPs require overcollateralized positions, and they typically charge fees and interest rates after the minting of debt.

Frax Protocol’s entrance into the RWA business comes at a time when Maker has been actively promoting its own RWA strategy and reached all-time highs in terms of profitability. This brings the protocol operations closer to the risk-free yield for USD, and unlike fiat-backed stablecoins, the protocol now gains the ability to pass yield to its token holders, similar to Maker’s DSR, which has grown ~30% MoM.

Moreover, lower operational costs could contribute to long-term competitiveness and market share growth for the $FRAX stablecoin. Altogether in a rising rate environment with a lower speculative premium, the revenue for stablecoin issuers increases significantly. This explains the most recent interest of protocols like Aave or Curve to issue their own stablecoins.

However, due to the nature of this business model, only the largest and most liquid stablecoins can benefit from organic demand. In the end, all issuers are competing against each other by giving users a specific reason why they should both mint and hold their stablecoin. And while adding incentives may seem a necessary bid, they can cut into profits as well.

Despite fiat-backed and centralized stablecoins being so liquid, the core problem of censorship resistance still remains. Not only that, but there are also multiple reasons why one might want to adopt long-tail stablecoins, such as demand for leverage, or more favorable borrow rates (fixed or low). One example of that is $crvUSD, which offers a soft liquidation mechanism that can be used with yield-bearing collateral assets. Another example is $DAI, where MakerDAO’s DSR allows users to deposit $DAI to earn 5%. The list goes on if we take the composability of DeFi into account. Aave recently enabled sDAI as collateral to mint $GHO, which creates an opportunity to arbitrage the low borrow rate of $GHO (2.5% or lower if you stake $AAVE) and the DSR yield.

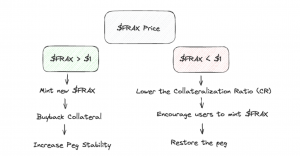

In the context of Frax, it’s crucial to emphasize the significance of organic demand and peg stability for the sustainable growth of its ecosystem. Ultimately, the success of FRAX v3 depends on maintaining a stable peg to the dollar, which can only be achieved when demand outpaces supply.

Frax v3’s growth strategy centers on organic demand, not just the supply side. The peg mechanism functions effectively when there’s more demand than supply for the stablecoin, driving its price to $1 or slightly above, encouraging minting.

Frax Bonds and RWAs are the first step in aiming for organic, unincentivized demand where users hold the stablecoin for its utility. Besides, the foundation of organic demand is trust and liquidity. A trusted stablecoin commands a lower implicit risk premium. These factors enhance the attractiveness of $FRAX without resorting to incentives.

Currently, the balance sheet of $FRAX and the operations of the AMO can be tracked at https://facts.frax.finance/. For v3, the off-chain component will be tracked and updated in real-time through a combination of bank APIs and custom tools. This will allow users to track the RWA strategy in real-time, potentially setting a new standard for transparency and balance sheet reporting.

Once the FSR goes live, we could expect it to have the same positive effects that the DSR increase on Maker had on $DAI. Therefore, it is reasonable to expect a proportional growth in the supply of $FRAX.

With Frax proposing to set the initial interest rate at 10% (and then decrease it over time like the DSR), it is also possible that some capital flows from $DAI into $FRAX, especially considering that the maximum offered rate of the DSR was 8% and was quickly decreased due to the maximum utilization rate being reached. This could be a good start to kick off the adoption of FraxBonds.

However, net positive effects for the industry don’t occur when capital flows from one protocol to another (from Maker’s DSR to Frax’s FSR), but when new capital is brought on-chain to capture opportunities that are not available off-chain. The 10% mentioned previously is the maximum achievable rate and, eventually, the base rate will be set to 5%, which is still a great spot for $FRAX to scale and grow its supply into billions of dollars on-chain.

Frax v3 positions itself as a protocol suitable for both bull and bear markets by offering yield opportunities on both stablecoins and Ethereum ($ETH), making it adaptable to varying market conditions.

In bear markets, where most participants prefer a risk-off strategy and opt to hold stablecoins, Frax v3 caters to this demand by providing opportunities to earn yield on stablecoins. By offering yield on stable assets like $FRAX, the protocol allows users to park their capital in a low-risk environment while still earning a return. This aligns with the preference for risk mitigation during bearish phases.

Conversely, during bull markets, when investors are more inclined to be risk-on and hold Ethereum ($ETH) to capitalize on market growth, Frax v3 accommodates this sentiment. The protocol’s ability to provide yield on Ethereum positions it as an attractive option for users seeking to benefit from market upswings while also earning a yield on their $ETH holdings. This caters to the risk appetite of investors looking for growth opportunities.

The risk-free rate is highly relevant in the context of Frax because it plays a crucial role in the protocol’s stability, attractiveness to users, and its ability to provide yield on various assets. Frax’s unique design allows it to access the risk-free rate on both stablecoins and Ethereum (ETH) through assets like $FRAX, $sFRAX, $frxETH, and $sfrxETH.

The risk-free rate reflects market dynamics and the prevailing interest rates in traditional finance. Frax’s ability to align its yield offerings with this rate allows it to adapt to changing market conditions. This is the only way to scale any USD-pegged stablecoin, by being able to function in the entire spectrum of possibilities.

Progressively, this monetization system, along with the issuance of other pegged assets like FPI or frxETH, builds up a monetary premium that is impossible to ignore. Whether users prefer a risk-off strategy with stablecoins or a risk-on approach with Ethereum, Frax can offer yield opportunities that are influenced by the risk-free rate of the respective asset.

One of the bear cases for RWAs is not the fact that, at some point, the yield on DeFi native use cases will be higher than the US risk-free rate, but that the revenue-sharing structures might not be as sustainable as they seem right now.

Since Maker DAO raised the DSR (DAI Savings Rate) to 3% and later on increased to 5 and up to 8% with the eDSR (Enhanced DAI Savings Rate), there has been a trend where stablecoin issuers have come up with their own “Savings Rate”. After the enhancement to the DSR by Maker, other protocols followed, raising their savings rate to 8% as well, just to revert and roll back their decision weeks later, realizing that it is not sustainable given their low revenue.

Every time some concept from TradFi is brought on-chain it is important to consider the implications and incentives that drive that decision. In this case, it obviously attracts more holders to that stablecoin enticing them with higher yield. However, it is often the case that this practice proves unsustainable in a couple of weeks. Just like governments can choose to change the rules at will whenever they want, these protocols can do exactly the same.

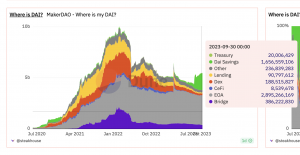

In the end, it is hard to expect different results when others are copying the same strategy as the current largest non-fiat stablecoin, $DAI. Time and time again, whenever the DSR goes down, so does TVL and circulating supply. In fact, the latest adoption of the DSR has been quite muted considering it is offering 8% in yield. The majority of the activity was driven by a few whales who borrowed on Spark at 3% and carried over to deposit and earn 8%, effectively arbitraging a risk-free rate offered by Maker. As an example, see below the trajectory of the market cap of $DAI after Rune published the proposal to enhance the risk-free yield to 8% on July 25th.

Nonetheless, the fact that the yield is not shared across the entire supply (only to those who stake or deposit in a specific module) makes it possible to offer higher rates than the US risk-free rate. At the same time, to sustain that rate, most protocols continue to expand their risk exposure, increasing fees or chasing riskier collateral. The second-order effect is that the markets adjust to match this rate, increasing borrowing costs as a result (i.e. borrow rates increasing in Aave/Compound as a result of the DSR increasing).

Given the nature of Frax’s collateral, we believe it is unlikely that the Frax DAO will move forward chasing riskier collateral. Given the absence of endogenous collateral and the most recent integration of RWAs, Frax has already proven that it can operate on many adversarial conditions and generate revenue. Not only that, but most Frax subprotocols are already in production, the collateral ratio is being increased to 100%, and the deployment of Fraxchain will enhance the robustness of the protocol.

In the case of Frax, one of the advantages is that it will not be exposed to multiple counterparties (as in the case of Maker with all of its RWA vaults and its system of Arrangers). Instead, Frax will integrate everything vertically with FinresPBC. This way, instead of introducing additional actors or third parties with an associated fraud/execution risk, Frax is recycling “key man risk” and the existing trust in the core development team.

Overall, Frax v3 represents a significant departure from traditional models and is designed to enhance trustlessness, decentralization, and resilience. With sFRAX, the protocol is now introducing a dual token model for its stablecoin, maximizing the overall yield of token holders and enabling them to get access to USD risk-free yield.

Revelo Intel has never had a commercial relationship with Frax and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.