Published: August 9, 2023

The Pendle protocol enables permissionless tokenization and trading of yield. Pendle allows anyone to purchase assets at a discount, and obtain a fixed yield, or long DeFi yield.

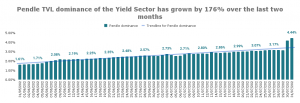

In the yield sector, Pendle currently has the fourth-largest Total Value Locked (TVL).

This report takes a look at the performance of Pendle over the period July 1 to July 31.

It covers the key metrics of the protocol, the yield sector, the $Pendle token, trading metrics, and other events.

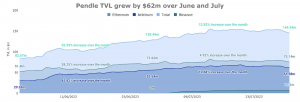

Pendle opened the period at $128m in TVL and closed at $144m, representing a 12.83% increase. This is in addition to the 55.4% growth seen in June.

Pendle’s TVL on Ethereum opened the month at $71m and experienced a $3.5m (4.92%) increase, closing at $75m. On Arbitrum, balances opened at $56m and closed at $62m, a $6m (11%) increase. The new deployment on Binance Smart Chain closed at $7m.

The graph below is a representation of TVL changes over the last two months:

The drivers for the increase were:

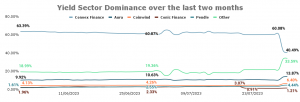

The Yield dominance sector saw significant changes in the month. The two notable events were:

These two events did benefit Pendle’s dominance, however, it has been on a steady increase for a few months already.

The graph below illustrates how sector dominance has grown since May 31.

The volume in the month was $30.3m, a $6.5m (27.5%) increase from June.

At a network level, Artitrum had the highest volume ($20m) representing 67% of protocol volume. This is consistent with June

The average Capital Efficiency Rate* for the protocol over the period was 0.7%, with the daily high of 1.59% and a daily low of 0.18%

The graph below illustrates the daily volume (at a network level) and the capital efficiency of the protocol.

*Capital Efficiency is an indicator of how efficiently TVL in liquidity pools generates volume. It is calculated by taking the volume divided by TVL and converted to a percentage. It is a measure of how productive funds are at generating volume, but it is not a direct indicator of revenue. Higher capital efficiency does not mean higher revenue

On June 30 the largest liquidity pools were:

Holding the Principal Token (PT) enables you to redeem the principal amount after maturity; one PT can be redeemed for one underlying unit at maturity.

When it comes to trading PT tokens:

It is important to remember that, while the implied yield for PT changes, you lock in the rate at the time of purchase.

You can find out more about PT tokens in our Pendle Breakdown.

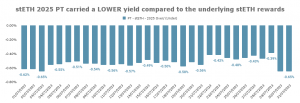

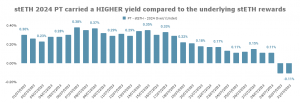

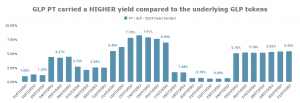

The chart below illustrates your position if you acquired a PT token on the respective day for each of the three largest pools.

A positive percentage: means that the implied yield was greater than the underlying yield, therefore traders would have been better off purchasing the PT compared to the underlying asset. The opposite is true for negative percentages

Please note: The profit and loss spreads only apply if traders hold until maturity.

The key takeaways are:

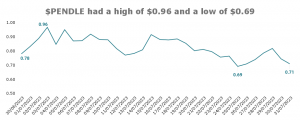

The $PENDLE token opened the month at $0.78 and closed at $0.71, a 9.0% decrease.

A Binance listing drove the price to a high of $0.96 on July 05. The low for the month was $0.69 recorded on July 25.

The circulating market cap followed the same trend as the price, opening at $75m and closing at $68m. Pendle holds the 332nd rank for circulating market cap on CoinGecko.

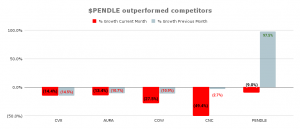

Of the top five protocols in the Yield Sector, $Pendle had the best price performance for the month. Some potential consolidation after the strong performance in June.

The month of June saw 2m $PENDLE issued as reward incentives, with an approximate value of $1.6m

Pendle has implemented a vote escrow model, where $PENDLE holders can lock tokens for up to two years. The longer the lock duration the more $vePENDLE a user gets.

For more information on locking $PENDLE, you can read about it in our Pendle breakdown

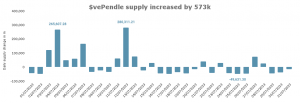

The recent expansions and product releases have resulted in more $PENDLE being locked. At the end of June, the $vePENDLE supply was 28.5m.

$vePENDLE holders benefit from the various revenue streams of the protocols. Over the month of July, $25k in $ETH was distributed.

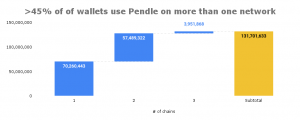

Since its launch, Pendle has had 131m in trading volume. As the protocol has expanded, many users have followed them and use Pendle across multiple networks.

Over 45% of Pendle users are active on the protocol on more than one network, an indicator of a loyal userbase.

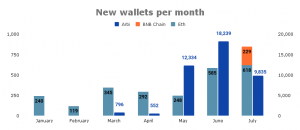

In addition, Pendle has been able to capture new wallets. Since the start of the year 44k new wallets have engaged with the protocol. The graph below illustrates how strong user adoption has been since May.

There were no significant governance proposals during the period.

There was four notable news event that was published in the period.

A $PENDLE-$BNB pool was deployed on Pancakeswap. This enables users to stake LP tokens for $Cake and build $PENDLE liquidity on the chain.

For more information, you can read about it here.

For more information, you can read about it here.

For more information, you can read about it here.

A streamlined experience that helps you earn and grow the Pendle way, without getting lost in the technicalities.

For more information, you can read about it here.

With this, they aim to bring the power of yield management to Mantle,

For more information, you can read about it here.

This report has highlighted the pricing trends and metrics for the period.

Pendle is the fourth-largest yield protocol and is experiencing a period of growth and increased user adoption. This would be growth in terms of TVL, product offerings, price appreciation, and user statistics

We hope this report provides valuable insights into the performance.

Revelo Intel has a commercial relationship with Pendle and this report is part of that relationship.

The Revelo Intel team members, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.