Published: June 9, 2023

PancakeSwap is the leading decentralized exchange on Binance Smart Chain, with both the highest total value locked and trading volume on the network.

At the time of writing, it is DeFi’s 3rd largest DEX in terms of TVL with $1.6bn of deposits (20.97% decrease over 30 days) and accounts for 6.76% of total volume. This report takes a look at the performance of PancakeSwap over 31 days from May 5 to June 4.

It will cover the key metrics of the exchange, the $CAKE token, and other events.

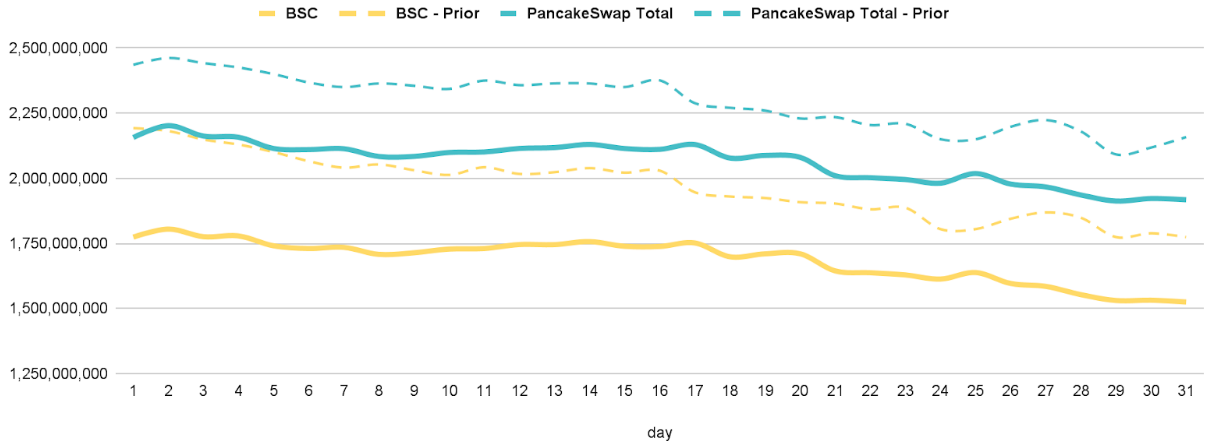

PancakeSwap opened the period with $2.1bn in TVL and closed at $1.9bn, representing an 11.15% decrease in TVL for the 31-day period. This decreasing trend was a continuation of the previous period which experience a similar 12.51% decrease.

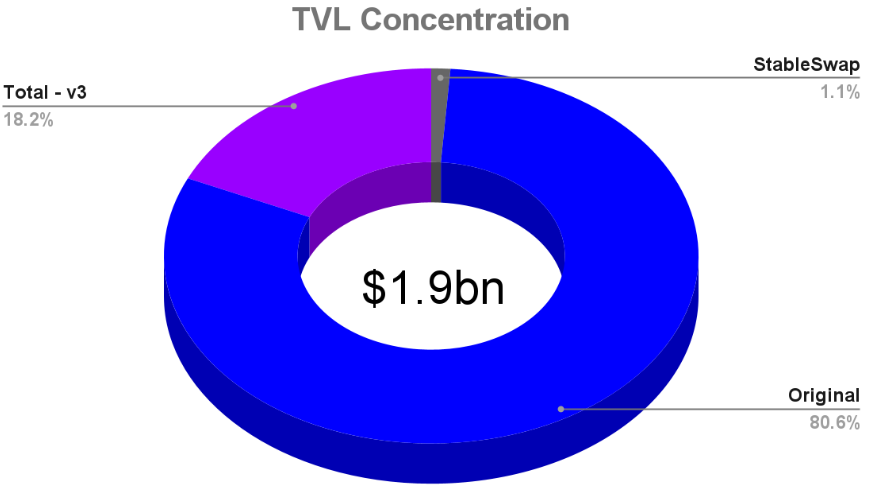

The protocol has its TVL allocated between three versions of the exchange: Original AMM, StableSwap, and the v3 AMM

PancakeSwap has a few versions and operates on multiple networks. The contribution to the $1.9bn of TVL is as follows::

TVL of the original AMM on BSC opened the period at $1.7bn and experienced a 14.04% decrease, closing at $1.5bn, which was the primary driver for the overall TVL reduction.

The graph below shows the change in TVL balances for both the protocol as a whole and the original AMM on BSC compared to the previous 31-day period.

Potential drivers for the decrease in TVL would include:

1. Price of $CAKE and $BNB

The price of $CAKE decreased by 30.91% while the price of $BNB decreased by 5.94%. As around 25% of PancakeSwap’s TVL is driven by these two tokens.

2. ChainTVL

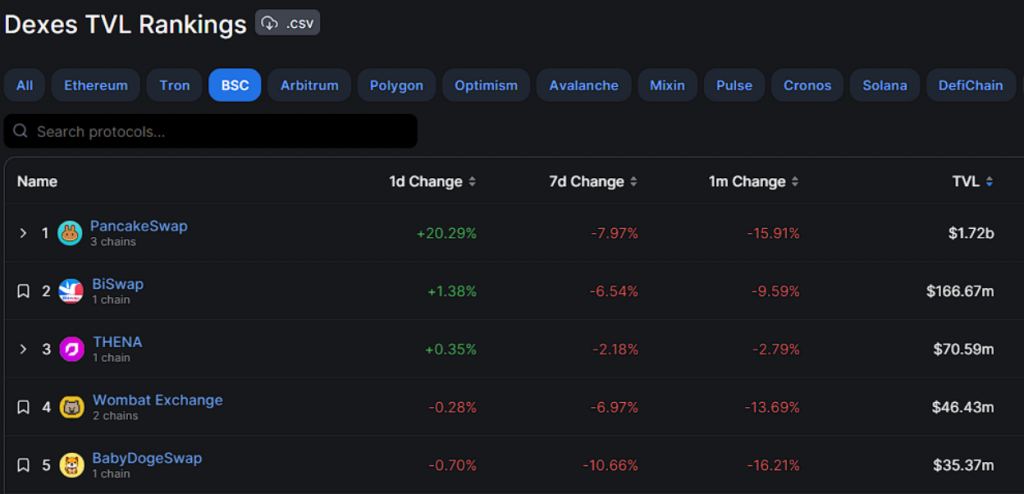

PancakeSwap is the largest protocol on BSC, the TVL of the network decreased by 7.55% over the 31-day period.

As per DeFiLlama, we can see that all of the top 5 DEXs on BSC lost TVL.

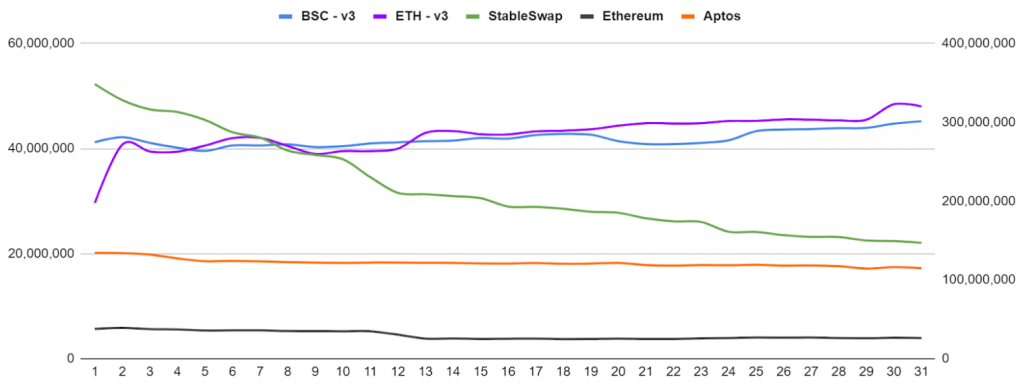

The chart below shows the TVL activity for the remaining networks over the period Notable changes in balances were:

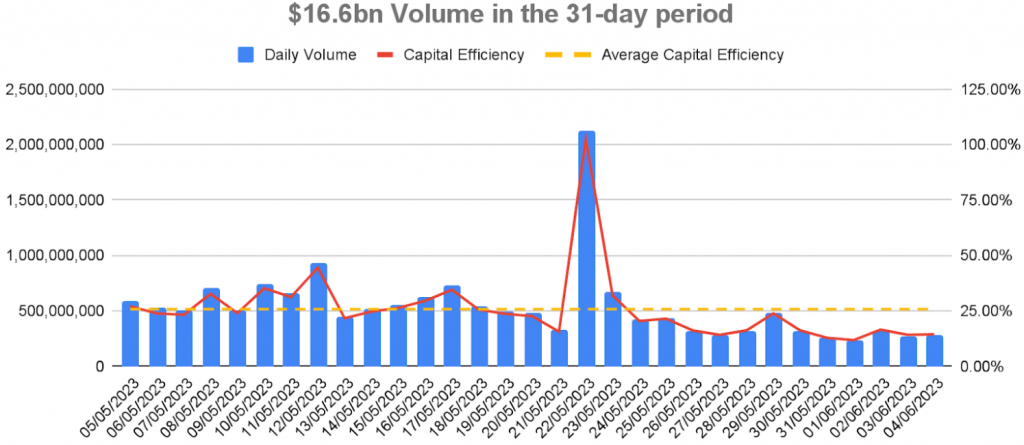

During the period, the total volume on PancakeSwap was $16bn, and the highest volume was achieved on 8 May, reaching $926m.

Volume increased by $6.2bn compared to the previous period, a 59.82% increase. This increase is primarily due to activity on the original AMM on BSC.

22 May saw the volumes totaling over $2.1bn, this was driven by significant activity on the $BNB-$BUSD pair where it’s TVL dropped by $80m.

The Exchange remains one of the most used places for trades and averages a Capital Efficiency* rate of 25.75%.

*Capital Efficiency is an indicator of how efficiently TVL in liquidity pools generates volume. It is calculated by taking the volume divided by TVL and converted to a percentage. It is a measure of how productive funds are at generating volume, but it is not a direct indicator of revenue. Higher capital efficiency does not mean higher revenue

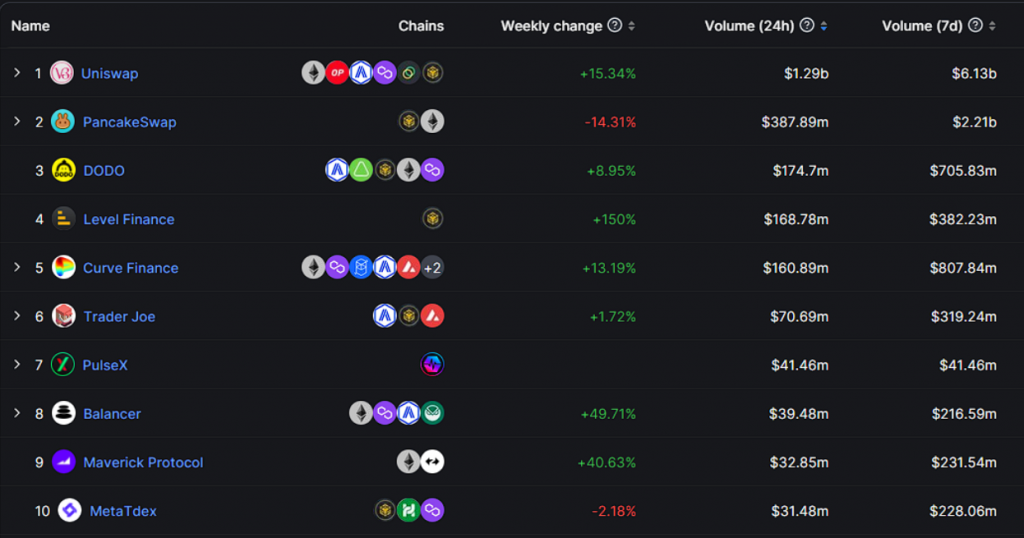

Over the last 7 days of the period, PancakeSwap ranked 2nd for 7-day volume generated.

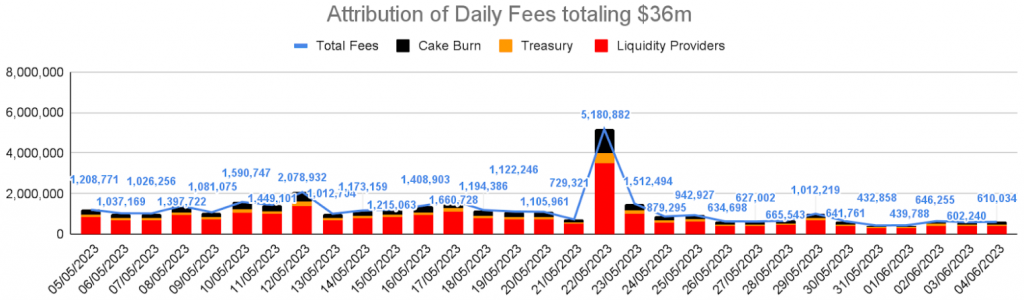

PancakeSwap generated $36m worth of fees over the period, 68% of which goes to Liquidity Providers, 23% goes towards burning $CAKE, and 9% to the treasury.

Compared to its competitors, PancakeSwap ranked 1st among DEXs for the highest amount of fees generated in the last 31 days.

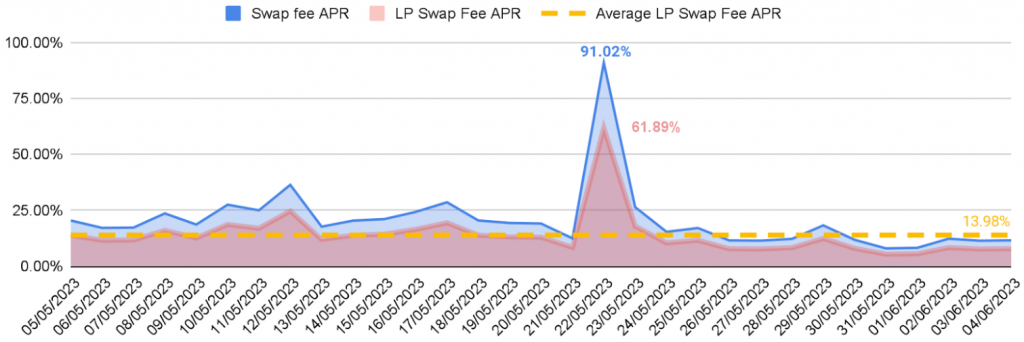

**The Swap Fee APR (Annual Percentage Rate) is calculated by taking the annualized swap fees generated and dividing it by the TVL.

The Fee and TVL data reveal that the Total Swap Fee APR had an average of 20.93%%, and the Liquidity Provider Swap Fee APR had an average of 14.23%

The graph shows the different swap fee returns

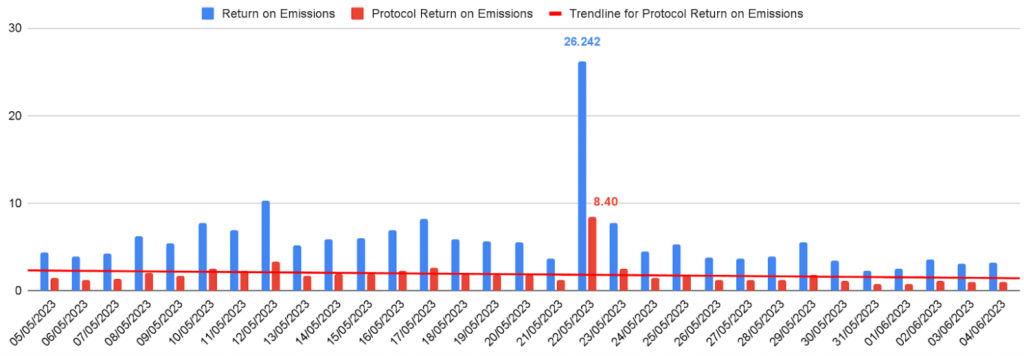

**Return on Emissions is a metric that indicates the efficiency of emission allocation, calculated by dividing swap fees by the USD value of emissions. It informs us of the value of fees generated per dollar of emissions. A positive return is when the value is > $1.

The total return on emissions over the period was $5.83

The protocol return (using protocol fees only) on emissions was $1.87

These numbers are significant in that majority of protocols do not achieve a positive return on total returns, but here, PancakeSwap does this on a protocol level.

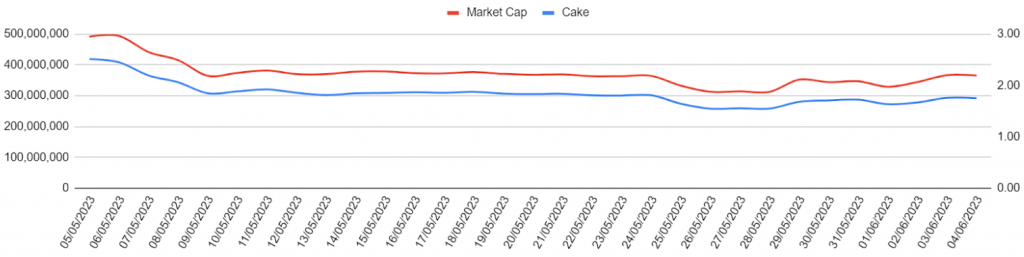

During the period, the $CAKE token opened at $2.5368, its highest point, and closed at $1.7528. The total movement for the period was a decrease of 30.91%.

The circulating market cap followed the same downtrend as the price, opening at $494m and closing at $365m. PancakeSwap holds the 111th rank for circulating market cap on CoinGecko.

The graph below illustrates the correlation between the price and market cap for the period, indicating that there were no significant supply-driven events and that the changes in the market cap were driven by token price volatility.

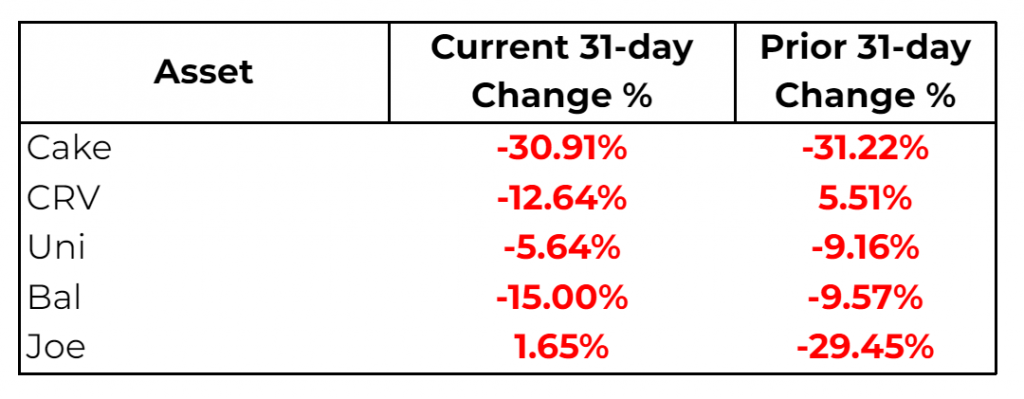

While $CAKE may have decreased in value by approximately 31%, with TraderJoe being the exception, all DEXs experienced downward price pressure over the past 31 days.

This could be due to both $CAKE having flexible stake/ locking options included in its tokenomics and the uncertainty surrounding Binance.

The $CAKE token can be either paired with popular tokens for traditional LP farming or single staked in various farms called “Syrup Pools”

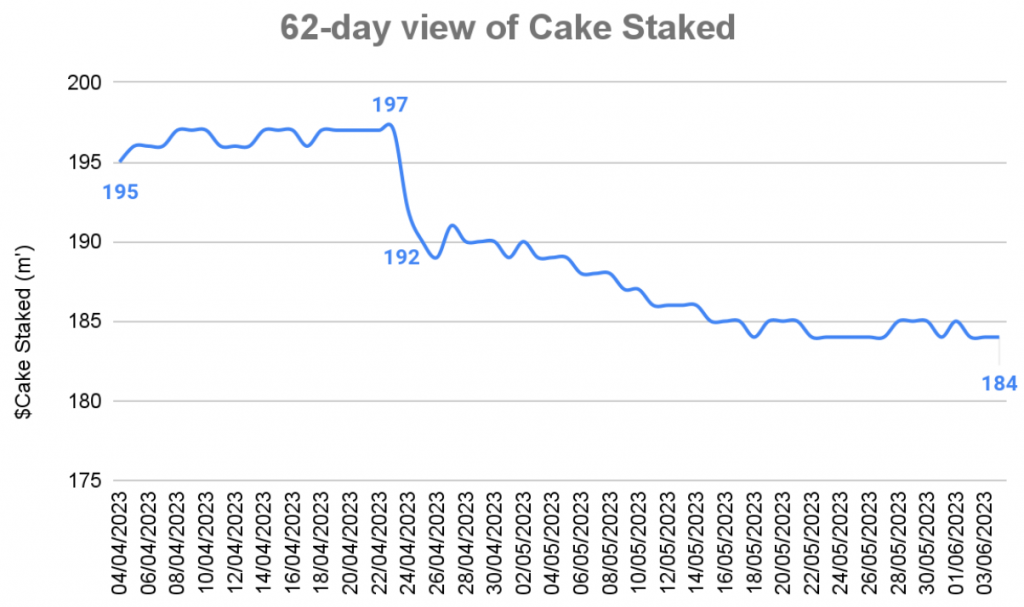

Over the last 62-day period, over 11m $CAKE has been unstaked, with 5m being unstaked on 24 April. Since then daily staked numbers have been largely negative.

This could be due to locking APR being not substantially higher compared to flexible limited Syrup Pools, which also allows users to earn other tokens. The current APR for a max lock of 52 weeks is 18.38%, while time-limited flexible pools that do not require locking have an average of 7-9% APR, with one pool at 22.99%.

PancakeSwap emissions were 109,172 per day, resulting in $6.2m in emissions over the 31-day period.

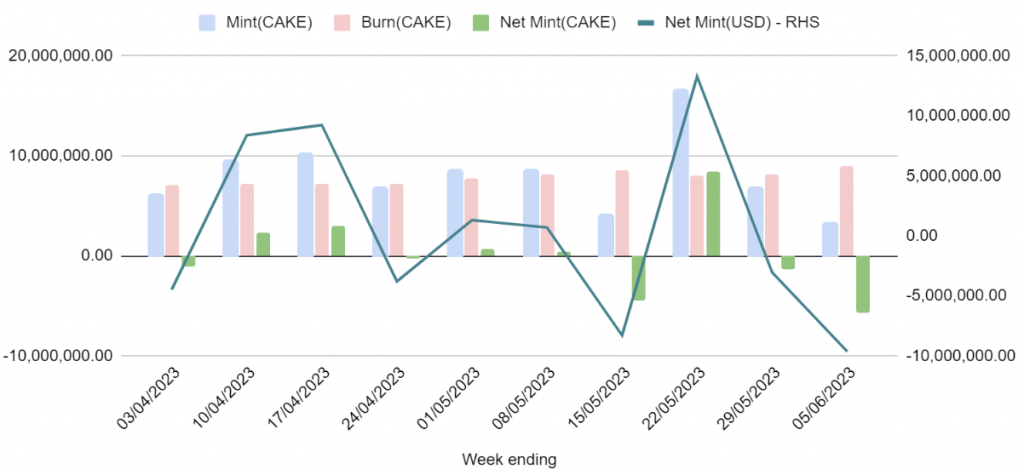

With this high inflation deflationary mechanisms are required, the protocol has been successful in implementing gamification measure. The graph below shows the net mint of $CAKE per week.

Since the beginning of May, a net of 1.8m of $Cake has been taken out of supply, amounting to $5.6m in USD.

There were two significant governance proposals that closed during the 31-day period

1. Proposal for New Updates to PancakeSwap Farm Auctions.

A core proposal to adjust Farm Auction parameters for maximum $CAKE burn and market competitiveness.

The plan is to re-launch farm auctions with the following changes (parameters in bracket), in order to kick-start the project with the required flexibility for success.

The vote closed in favor of the proposal.

You can read the full details here

2. Proposal to reduce Farm Emissions for PancakeSwap v3.

The proposal aims to remove an additional 0.04 CAKE/block emissions on v2 farms on the following pairs which are already fully supported by v3

Additionally, due to the out-performance of v3 Farms, the proposal aims to reduce v3 BNB Farm Emissions from 0.78 CAKE/block to 0.75 CAKE/block immediately.

The 0.03 CAKE/block reduction will apply to the following farms.

The vote closed in favor of the proposal.

You can read the full details here

For the period there were two notable news events:

1. Trading Reward Program

The first campaign under this Trading Reward Program, exclusively for users with Pancake Profile and fixed-term CAKE staking position, offering an opportunity to enhance their trading experience while rewarding their loyalty.

Benefits include:

For more information, you can read about it here

2. PancakeSwap Teams Up with Squid and Axelar for Effortless Cross-Chain Swaps

PancakeSwap announced a partnership with Squid and Axelar to facilitate cross-chain swaps through the app.

It aims to reduce processing times and remove the complexity of wrapped assets bringing seamless, secure, and enjoyable trading experiences.

For more information, you can read about it here

This report has highlighted the pricing trends and metrics for the period.

PancakeSwap is the third largest ranking DEX by TVL and ranked second for volume.

During the 31-day period it had very good results for capital efficiency, Swap Fee APR and Return on Emissions.

Even with the strong performance, the $CAKE underperformed against it’s competitors. While their are multiple gamifications to create supply pressure on the token, it is hard to look past the current environment surrounding Binance.

We hope this report provides valuable insights into the performance of PancakeSwap and the $CAKE token.

Revelo Intel has never had a commercial relationship with PancakeSwap and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.