Published: November 11, 2023

Ethos Reserve is a Collateralized Debt Position protocol where users can mint $ERN on the Optimism network. $ERN can be traded on 6 networks.

This report covers the period 09 October 2023 to 08 Nov 2023

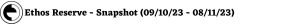

Key Performance Highlights

Key events – $wBTC and $OP collaterals reach new ATH, while overall TVL almost reaches previous ATH of $10.31M.

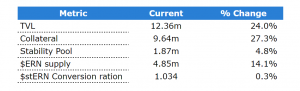

Ethos Reserve opened at $10m and closed at $12.4m, a $2.4m (24%) increase over the period.

The 60-day rolling average has a decreasing trend.

TVL is split into 3 components:

At a network level, Optimism had an increase of 6.1% in TVL.

Events Impacting TVL

The increase in collateral TVL is most likely correlated to the price increase during this period. $BTC and $ETH saw an increase of ~30% and ~23% respectively.

Similarly, staked bOATH TVL’s increase is also correlated to its increase in price amounting to ~34%.

Source: Ethos Dune Dashboard

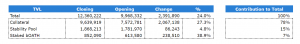

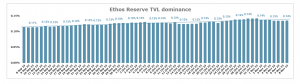

Ethos Reserve ranks 26th of all the Collateralized Debt Positions.

Sector dominance opened with 0.13% and increased over the period, closing at 0.14%.

Source: DeFiLlama

Source: DeFiLlama

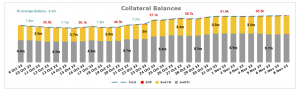

In order to mint $ERN a user can use up to 3 collateral types.

Collateral opened at $7.6m and closed at $9.6m, a $2m (27%) increase over the period.

The $wBTC represents 60.6% of the total protocol collateral.

Events Impacting Collateral

Collateral TVL increases of $wBTC, $wETH, and $OP were in line with their price increase during the period.

Both $wBTC and $OP collaterals reached new ATHs this period.

Source: Ethos Dune Dashboard

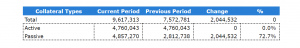

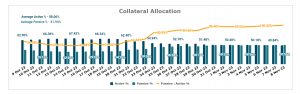

Ethos Reserve uses a percentage of collateral in order to earn additional yield for Stability Pool depositors

Active collateral – refers to balances added to a vault in order to earn yield

Passive collateral – refers to balances held in reserve on Ethos

Over the period Active collateral averaged 58.06%, while Passive collateral averaged 41.94%.

The stability pool is a core component of Ethos Reserve.

It is used to process liquidations and serves as a safeguard to prevent the protocol from going into bad debt.

Users deposit their $ERN into the pool and in return, they get a liquidation bonus.

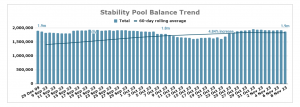

The stability pool opened at $1.8m and closed at $1.9m, a $0.1m (4.8%) increase over the period.

Events Impacting the Stability Pool

The increase in TVL from October 25 onwards could be due to the increase in the underlying collateral prices, allowing users to mint more $ERN without having to increase their collaterals.

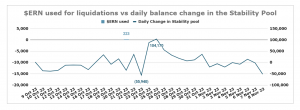

During the period there was 1 liquidation, totaling $0.25k. These events generated a profit of $0.02k, shared among all users in the Stability Pool.

There was also a total of 235.73k $OATH tokens ($241.05k) given as rewards. The average balance of the Stability Pool over the period was $1.78m, and total rewards to depositors amounted to an annualized yield of 159.55%.

The chart below shows the relationship of balance changes in the stability pool with liquidations processed.

Events Impacting Liquidations

The period from October 23 to 24 saw large volatility in the markets, with $BTC increasing by ~17% in a single day, followed by a ~7% pullback before consolidating.

As a result, users may have removed $ERN from the stability pool in order to pay off their debts, unlocking their collaterals to take profits.

With the consolidation beginning on October 25th, existing users may have deposited an additional $ERN into the pool with their collateral has increased in value.

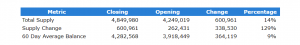

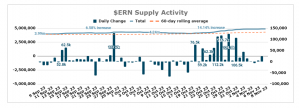

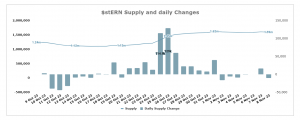

$ERN experianced a $601k increase in the period. This is a continuation of the $262.4k increase from the previous period.

The 60-day rolling average has an increasing trend.

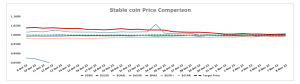

For most of the period, $ERN traded above the target price of $1.

The high for the period was $1.041 recorded on Oct 10, while the low of $1.003 was on Nov 06.

The chart below shows how $ERN traded against competing stablecoins, please note that the prices are all taken at midnight UTC.

Events Impacting $ERN and Competitors

$MAI has continued to trade below the peg this period, seeing a further downtrend.

With the exception of $MAI, $ERN and its competitors have trended toward the $1 peg.

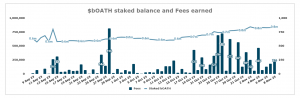

$bOATH stands for bonded Oath. It is an 80:20 ($Oath:$ETH) LP token that can be obtained by adding liquidity to Beethoven X

There was an increase in the total Staked $bOATH balance. It opened with $620.5k and closed at $844.1k, a change of 36%.

Over the last 30 days, stakers have earned $6.9k in fees from mints and redemptions.

Using the closing $bOATH balance this gives an annualized APR of 9.88%.

Events Impacting $bOATH and the Fees

Apart from volatile market action movements correlating with the increase in fees earned, there were no other significant events.

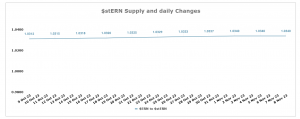

Users staking $ERN into the stability pool receive $stERN. This allows them to earn yields from the underlying collateral and liquidation income.

$stERN opened at $1.24m and closed at $1.59m, a $0.4m (28.79%) increase over the period.

The closing 30-day average APY was 3.29%. At this rate, if a person minted $ERN and staked immediately it would take approximately 6 days to earn back the mint fee.

Events Impacting $stERN

Apart from volatile market action movements correlating with the increase in fees earned, there were no other significant events.

There were no significant governance proposals passed during this period.

Digit by the OATH Foundation launches with support for $ERN as a deposit.

For more information, you can read about it here.

Revelo Intel has a commercial relationship with Ethos Reserve and this report is part of that relationship.

The Revelo Intel team members, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.