Published: June 28, 2023

Curve Finance continues to grow as a DeFi powerhouse.

At the time of writing, it is DeFi’s 2nd largest DEX in terms of TVL with $3.79bn of deposits and accounts for 5.72% of total volume. This report takes a look at the performance of Curve Finance over 31 days from May 22 to June 21.

It will cover the key metrics of the protocol, the $CRV token, $crvUSD, and other events.

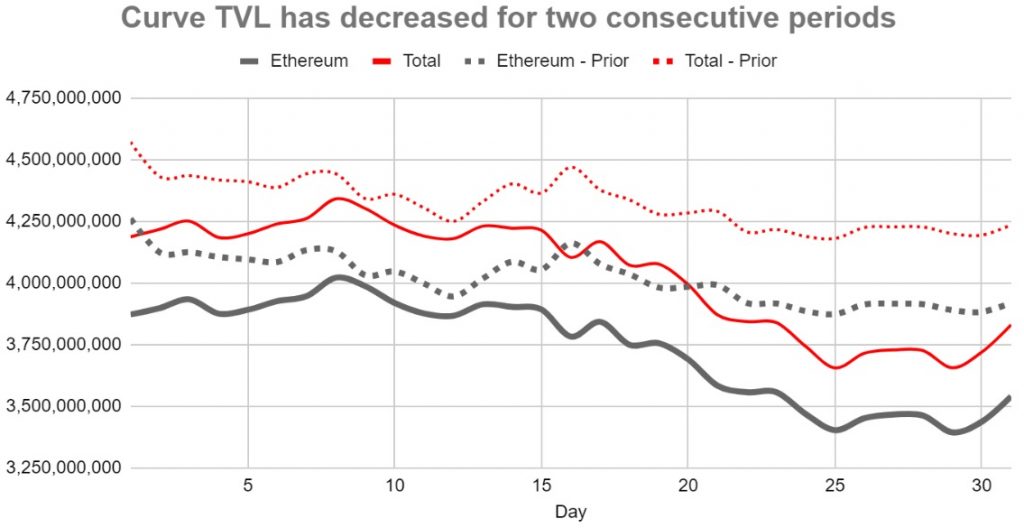

Curve Finance opened the 31-day period with $4.24bn in TVL and closed at $3.83bn, representing a 9.56% decrease. This decreasing trend was a continuation of the previous period which experience a similar 7.02% decrease.

The protocol operates on 11 networks. The contribution to the $3.83bn of TVL on the DEX is as follows:

While the DEX itself is available in 11 different chains, the 92.43% TVL concentration on Ethereum makes it the dominant network.

TVL on Ethereum opened the period at $3.92bn and experienced a 9.66% decrease, closing at $3.54bn. This decrease was higher than that of the network, which over the same time period decreased by 4.19%.

The graph below shows the declining trend of TVL for both the current and previous 31-day periods.

All the other networks combined only contribute 7% of the total Curve TVL. The largest change in these chains was Arbitrum. Over the course of the 31-day period, its network TVL decreased by $11m (11.89%). This was possibly driven by capital rotating protocols offering better incentives.

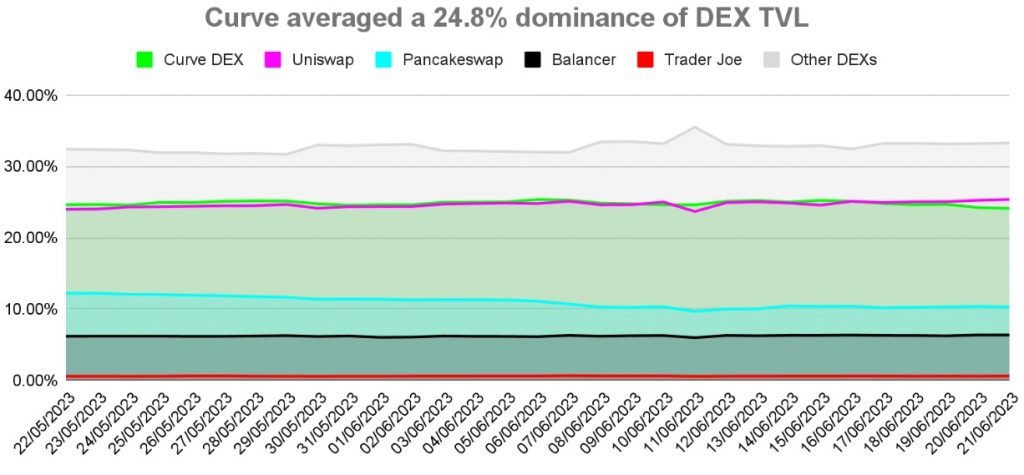

Over the period, Curve saw a minor decrease of 0.5% in TVL dominance of the DEX sector.

It opened the period at 24.64% of the total DEX TVL and closed at 24.13%. Pancakeswap swaps the largest decrease in dominance, losing 1.95%. Uniswap, on the other hand, increased its dominance by 1.39%. This increase led to Uniswap closing the 31-period as the no.1 dominant DEX with a 25.37% market share.

During the period, the total volume on Curve was $5.86bn, and increase of $1.96bn (50.47%) from the previous 31-day period

The highest volume was achieved on June 15, reaching $1.27bn. This was driven by the $USDT going off peg.

In general, there was an increase in volume from June 5 onwards.

The average Capital Efficiency* rate was 4.85%, if we remove the activity of June 15 the Capital Efficiency achieved was 3.85%

*Capital Efficiency is an indicator of how efficiently TVL in liquidity pools generates volume. It is calculated by taking the volume divided by TVL and converted to a percentage. It is a measure of how productive funds are at generating volume, but it is not a direct indicator of revenue. Higher capital efficiency does not mean higher revenue

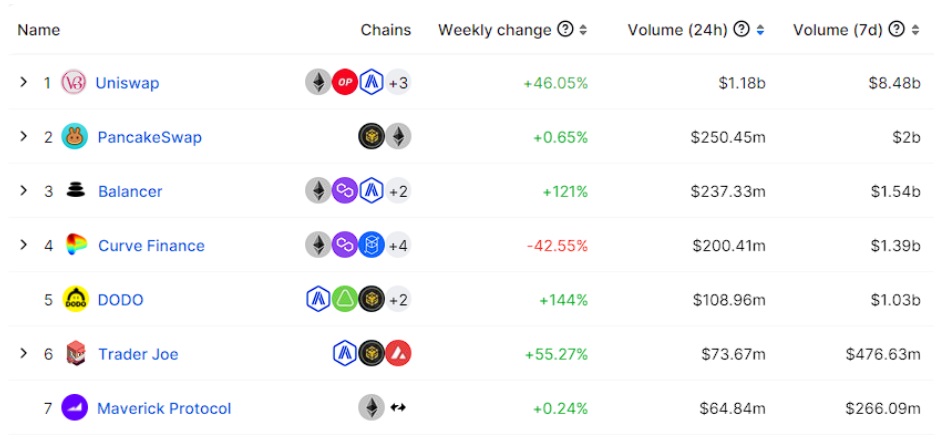

Over the last 7 days of the period, Curve ranked 4th for 7-day volume generated, seeing a decrease of 1 rank compared to its 3rd position in the previous snapshot.

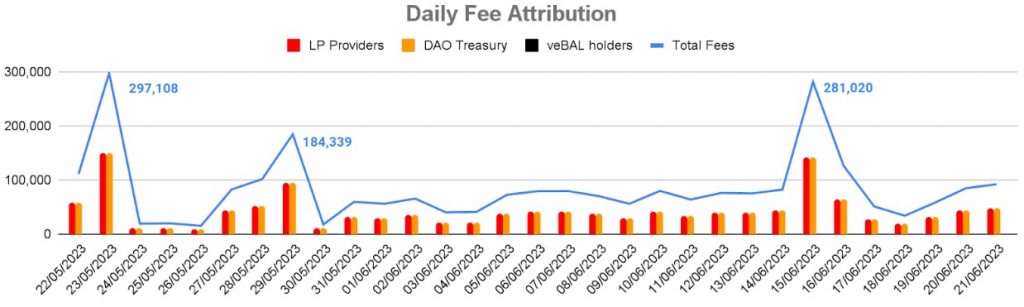

Curve generated $2.58m of fees in the 31-day period and include three high-fee-earning days. The total fees represent a 35% increase from the previous period.

These fees are attributed as 50% to Liquidity Providers and 50% to veCRV holders.

Compared to its competitors, Curve ranked 4th among DEXs for the highest amount of fees generated in the last 31 days. Consistent with the previous 31-day period.

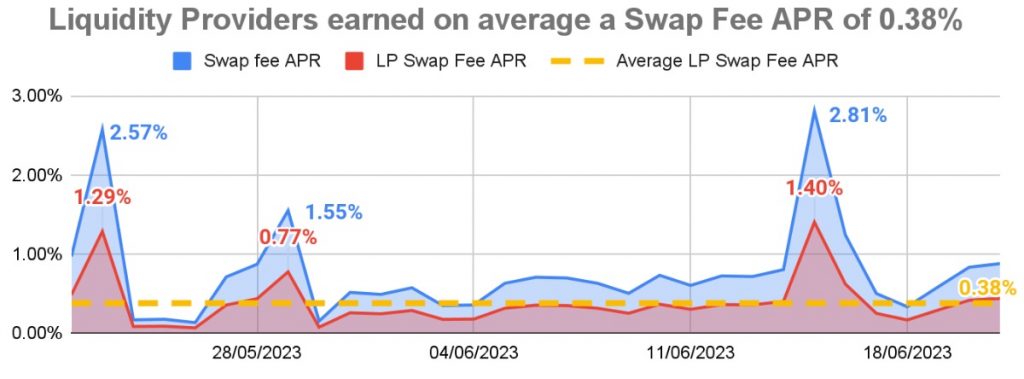

The Swap Fee APR (Annual Percentage Rate) is calculated by taking the annualized swap fees generated and dividing it by the TVL.

The Fee and TVL data reveal that the Total Swap Fee APR had an average of 0.37%, and the Liquidity Provider Swap Fee APR had an average of 0.47%.

The graph shows the different swap fee returns, as expected, the peaks follow the same pattern as the fees.

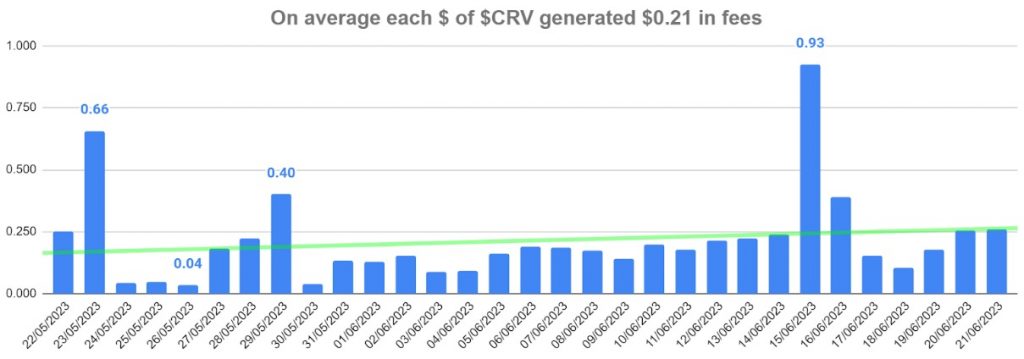

Return on Emissions is a metric that indicates the efficiency of emission allocation, calculated by dividing swap fees by the USD value of emissions. It informs us of the value of fees generated per dollar of emissions. A positive return is when the value is > $1.

The total return on emissions over the period was an average of $0.21. A 176% increase from the previous 31-day period.

The highest return of emissions was June 15 ($0.93) and the lowest was $0.04.

Over the 31-day period, there has been a positive trendline of the Return on Emissions, this trend exists even if we exclude the three highest earning days. This indicates that the second half of the period was more productive than the first. A similar pattern can be seen in the volume charts.

Curve does not take any of the fees generated, all protocol fees are allocated to $veCRV lockers

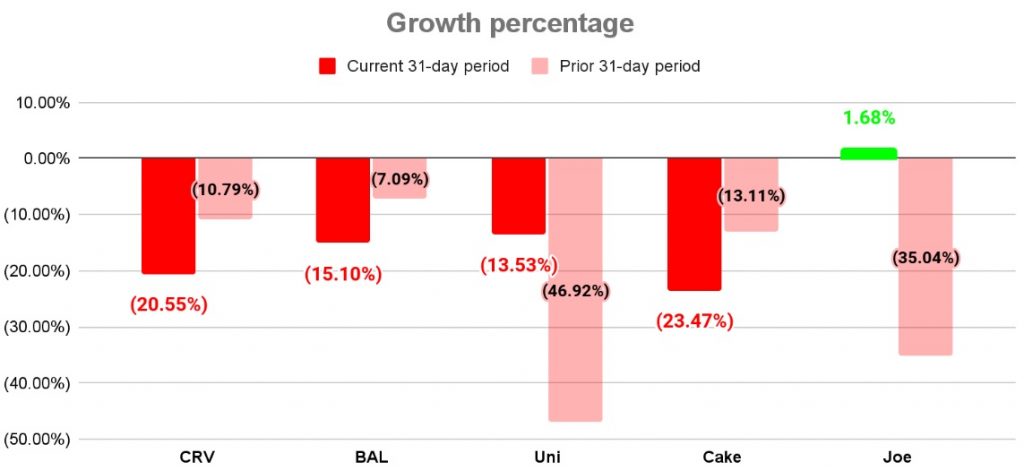

During the period, the $CRV token opened at $0.8353 and closed at $0.6637. The total movement for the 31-day period was a decrease of 20.55%.

The circulating market cap followed the same downtrend as the price, opening at $678m and closing at $565m. Curve holds the 74th rank for circulating market cap on CoinGecko.

$CRV and most competitors all saw declines in both the current and the prior 31-day period. The only exception was the $Joe token from Trader Joe. It experienced positive price impacts around the launch of its Auto-pools on June 1, a product that could accrue more fees to $JOE stakers.

The “Curve Wars” has developed into a mechanism for $veCRV holders to earn additional rewards.

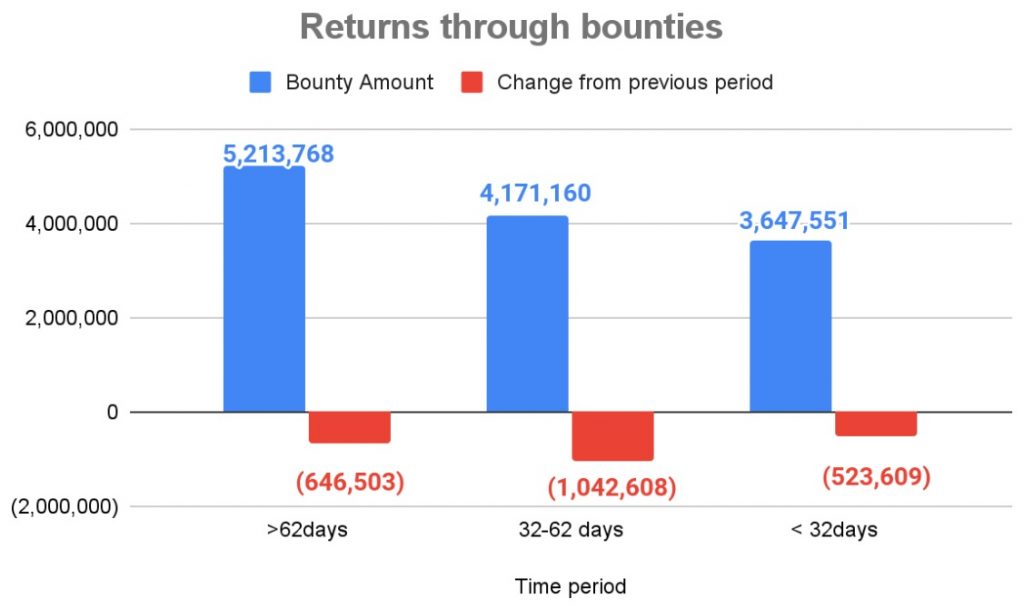

In the current period, a total of $3.6m in bounties have been offered, a decrease of 12.6% from the previous period.

There has been a declining trend over the reporting cycles. However, the decline was slowed by about half as compared to the previous period.

In terms of distribution, with ~48.6% Convex remains the biggest holder of $veCRV. This percentage of holding has been consistent since the start of the year.

$crvUSD is a CDP (Collateralized Debt Position) that allows users to borrow against a volatile asset.

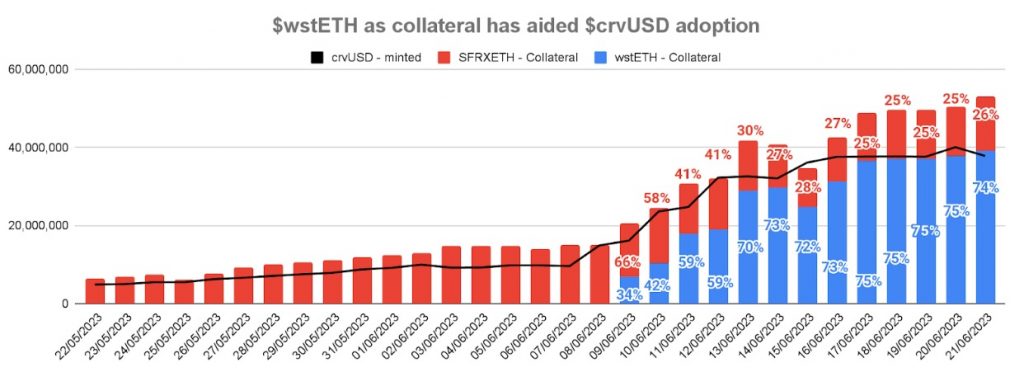

Initially only Staked Frax Ethereum ($sfrxETH) could be used as collateral. During the current 31-day period wrapped staked Ethereum ($wstETH) was added.

While $wstETH was only enabled as collateral on June 9, it quickly overtook $sfrxETH as the largest collateral deposited on 11 June 2023. The day deposits opened 3,359 $wstETH ($6.98m) was added as collateral which grew to to 19,335 $wstETH ($39.25m) at the end of the 31-day period.

The graph below illustrates the amount of $crvUSD minted compared to the underlying collateral. It also indicates the percentage dominance of each collateral type, highlighting the preference for using $wstETH.

Since June 21 until now two additional collateral types have been added, they are, wrapped Bitcoin ($wBTC), and wrapped Ethereum ($wETH).

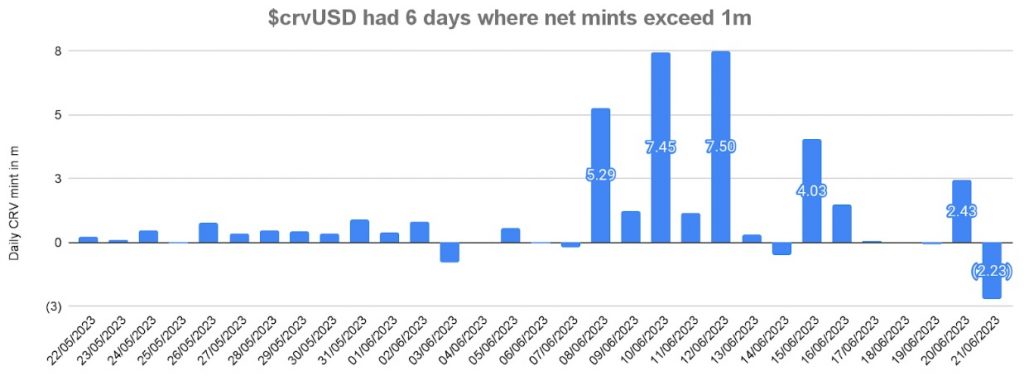

In the 36 days that the product has been available a total of 38.6m $crvUSD has been minted, and 33.1m net mints took place in the current 31-day period.

This is an indicator that adoption levels are growing and accelerated with the introduction of new collateral types.

The two largest mint days of 7.4m and 7.5m occurred soon after the addition of $wstETH.

The uncertainty around $USDT was a factor behind the 4m mint of June 15.

$crvUSD is unlike other CDPs available on the market. It uses three concepts that are not unique compared to the market, those are:

If you would like to learn more about the $crvUSD token and its design, you can read about it in our Curve Breakdown Report

There were six significant governance proposals during the 31-day period

1) Deployment of Tricrypto-ng, with three following votes.

Tripcrypto-ng (new generation) pools are tricrypto pools with significantly lower gas and swap fees. The deployment of Tricrypto-ng pools required the standard ownership and gauge infrastructure to be set up.

The three votes were:

The votes closed in favor of the proposal.

You can read the full details here

2) Vote for wstETH collateral for $crvUSD

The proposal aims to create a 150M market with Lido Finance’s wstETH collateral, allowing users to mint crvUSD with wstETH deposits, and to increase PegKeepers limits to 25M crvUSD each.

The vote closed in favor of the proposal.

You can read the full details here

3) Vote to add burner for $crvUSD and Peg Keeper’s profit

Burners are contracts for specific tokens whose job is to swap and send 3CRV to a fee distributor. Those need to be voted in by the dao and added to the curve.fi pool owner contract (0xecb)

The vote closed in favor of the proposal.

You can read the full details here

4) Vote to set new Controller Implementation for $crvUSD

The controller contract in $crvUSD (the one which handles borrows and returns) has several minor bug fixes. They are not affecting any funds, however, the new implementation will make the life of frontend devs better.

The vote closed in favor of the proposal.

You can read the full details here

5) Vote for WBTC collateral for $crvUSD

A vote to deploy $wBTC market with 200m $crvUSD debt ceiling. The full proposal can be found here.

The vote is still in process.

You can read the full details here

6) Vote for WETH collateral for $crvUSD

A vote to deploy $wETH market with 200m $crvUSD debt ceiling. The full proposal can be found here.

The vote is still in process.

You can read the full details here

For the period there were four notable news events:

1) Tricrypto-ng deployed

A new generation of tri-crypto pools that are cheaper in gas and swap fees.

For more information, you can read about it here.

2) Burners added for crypto pools and $ETH derivatives

Burners are contracts for specific tokens whose job is to swap and send 3CRV to a fee distributor.

For more information, you can read about it here.

3) $wstETH market deployed for $crvUSD

Users are able to mint $crvUSD with $wstETH as collateral.

For more information, you can read about it here.

4) Curve UI updated to include graphs

Graphs will be integrated into the UI, allowing users a more intuitive visual of price actions and positions.

For more information, you can read about it here.

This report has highlighted the pricing trends and metrics for the period.

Curve Finance is the 2nd largest-ranking DEX by TVL and ranked 3rd for volume.

Both the Curve DEX and the $crvUSD benefitted from the de-peg.

The $CRV token saw a downtrend in the period similar to most of its competitors.

The success story for this 31-day period has been the adoption of $crvUSD. As more collateral options get added there is a potential for continued growth.

We hope this report provides valuable insights into the performance of Curve Finance and the $CRV token.

Revelo Intel has never had a commercial relationship with Curve Finance and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.