Velvet Capital is a DeFi operating system aimed at democratizing asset management. The platform enables the creation of diversified financial products on-chain that are accessible to a wide variety of users, including asset managers, hedge funds, banks, fintechs, family offices, DAOs, traders, and any other type of investment communities. With Velvet, these individuals and organizations can easily launch and manage tokenized funds, portfolios, yield farming strategies, and other structured products.

Velvet’s intent-based architecture and integrations with major aggregators, solvers & market makers enable smart routing across on-chain sources (AMMs and DEXes) as well as other OTC-style venues to ensure the best execution & MEV protection.

Velvet provides convenience and ease of usage for both farmers and vault managers alike.

The ability for one-click allocation into DeFi pools to earn additional yield from lending, staking, or providing liquidity batches all necessary actions (e.g., trading, token approval, staking, minting) together so that you can seamlessly go from any token or pool to a different one. This also includes rebalancing of the whole portfolio in one click.

An API layer with an end-point structure similar to well-known CEXes helps seamlessly use existing trading algorithms or create new ones automating on-chain interactions.

Every vault is deployed on-chain with its own series of smart contracts and access controls:

While every vault is non-custodial by default, the protocol architecture also allows to setting up of multi-sig vaults (and MPCs in the future versions) for large clients separating custody from asset management functionality (reach out to the team to learn more).

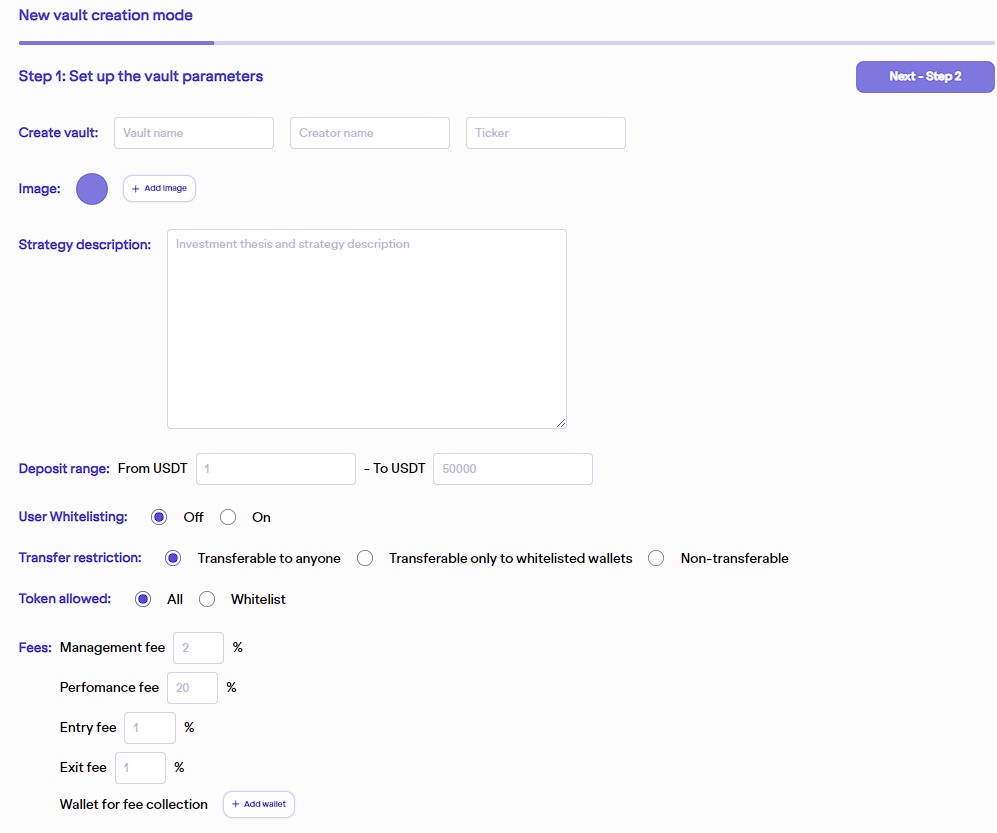

Velvet allows vault managers to have flexibility in the customization of their vaults. In terms of vault permissions, this includes:

In future versions, Velvet aims to be the first DeFi protocol to provide omni-chain asset management capabilities so that vault managers are not constrained within a single chain and can execute complex strategies across multiple ecosystems.

In future versions, Velvet aims to partner with on-chain derivative protocols & borrowing functionality to broaden the asset management toolkit on Velvet and allow it to run delta-neutral strategies.

Velvet’s flexible architecture & customizable permissions capabilities make the protocol suitable for real-world assets tokenization, and the first RWA product on Velvet is currently in private beta, which can be participated in by reaching out to the team.

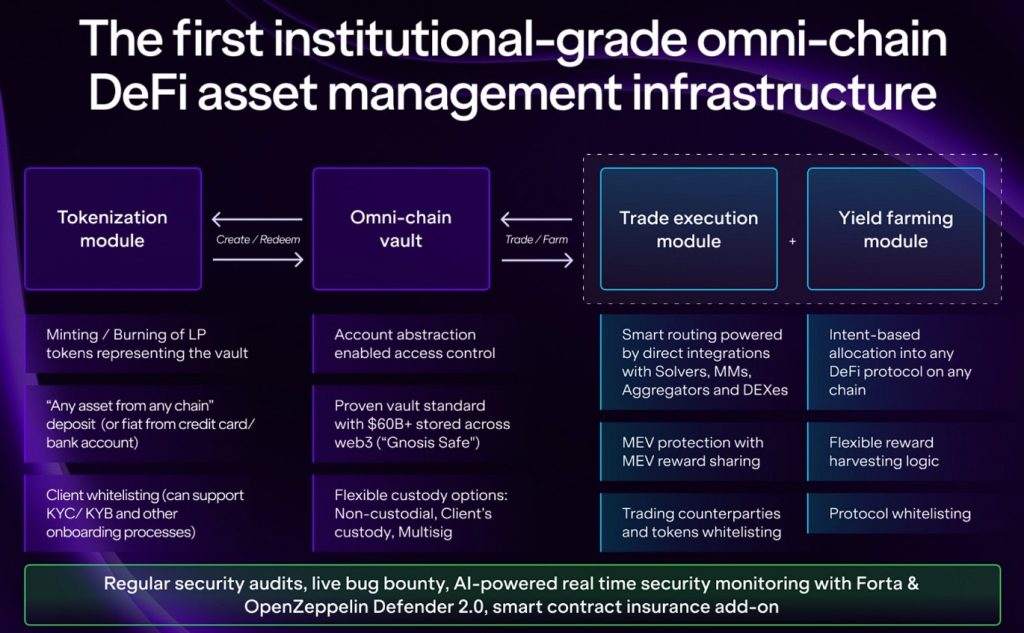

The core tooling and infrastructure of Velvet Capital revolves around making it possible to integrate with AMMs, lending protocols and other DeFi primitives. Velvet relies on a modular architecture that enables all this functionality while also making it possible to fetch prices from an oracle module or set custom parameters to run a strategy.

This module facilitates the creation and redemption of tokens from the Omni-chain vault, with the minting and burning of LP tokens representing the vault. It technically allows the depositing of any assets from any chain, or FIAT from a credit card or bank account, within the allowance of Velvet as the protocol progresses.

The Omni-chain vault enables account abstraction-enabled access control. Vault managers also have flexibility in the customization of their vaults according to their needs. Safety is enhanced via the usage of the multi-sig Gnosis Safe standard.

This module enables the smart routing of funds by integrating liquidity sources and functionalities of existing infrastructures, such as Solvers, MMs, Aggregators, and DEXes. This allows Velvet to enhance its trade execution process. MEV protection with MEV reward sharing via a partnership with bloXroute helps to protect users against disadvantageous transactions.

The yield farming module allows vault managers to access additional yields from the underlying tokens in their vaults. These could be integrated DeFi protocols such as PancakeSwap, Beefy, and more. Velvet allows this to be done multi-chain and also enables a flexible reward harvesting logic along with protocol whitelisting capabilites.

Velvet Capital was created in response to the failures of centralized finance (CeFi) platforms and the complexities involved in using decentralized finance (DeFi) platforms. As a DeFi operating system, Velvet Capital aims to solve the problem of credibility loss in CeFi platforms and the difficulty of using DeFi platforms, especially for professional investors.

After multiple failures of centralized platforms like BlockFi or Celsius and the collapse of FTX, fund managers no longer trust CeFi. Even though DeFi presents an alternative for fund managers, there are multiple layers of complexity that must be overcome first: funds would need a separate team of smart contract engineers, liquidity is fragmented across multiple chains, they would need to do security audits for every protocol they plan to use, the difficulty of setting up the fund structure, admin keys, KYC/AML requirements for onboarding clients, custody… This results in a long and expensive process to set up a fund structure that is capable of tracking NAV (Net Assets Value), managing expenses, tracking performance, and reporting results to satisfy regulatory and legal requirements.

To solve this problem, Velvet Capital addresses the complex, lengthy, and expensive process of launching and distributing a new fund or structured product. This often involves multiple intermediaries and creates high barriers to entry for all types of market participants.

Velvet Capital is on track for its roadmap progression, having completed its checkpoints for 2022, and Q1 -Q3 2023.

The checkpoints for Q4 2023 are still in progression and include the following:

Velvet Capital also has the following features planned for its next iteration:

Additionally, in order to enable themselves to become the first Institutional DeFi Asset Management protocol, Velvet Capital has taken in feedback from fund managers and studies on competitors. As such, they are working on the following professional grade tooling for fund managers, with key features such as:

The adoption of institutional DeFi is a ~$300-700B market opportunity. Velvet’s MVP has already managed to gain traction with 550+ active investors, 12+ crypto hedge funds, and digital asset managers in the pilot, averaging $10-100M AuM (Assets under Management) per fund.

By providing DeFi-as-a-Service, Velvet Capital is positioned to capitalize on the growth of this sector by capturing value across multiple layers of the financial stack. With V2, Velvet will prioritize development operations that meet institutional needs.

In this sector, some of the known competitors are Enzyme, TokenSets, Nested and Mayfair, with a comparison below that highlights the difference in features and capabilities.

| Protocol | Velvet Capital | Enzyme | TokenSets | Nested | Mayfair |

| Chains | Ethereum, Optimism, Arbitrum, Base, Mantle and BSC | Ethereum, Polygon | Ethereum, Polygon, Optimism, Avalanche | Ethereum, Polygon, Optimism, Avalanche, Arbitrum, BSC | Arbitrum |

| Fees | Customisable by vault manager | Customisable by vault manager | Customisable by vault manager | 0.3% fee on each operation that doesn’t reduce TVL.

0.8% fee on each operation that reduces TVL. |

1% entry fees

1% streaming fees ~1% network keeper fees |

| Yield farming while in portfolio | Yes | Yes | No | No | Yes |

| Fund tokenization | Yes | Yes | Yes | No | Yes |

| Direct creation & redemption according to the strategy | Yes | No | Yes | Yes | Yes |

| Smart execution management | Yes | No | No | No information yet | No information yet |

| Meta-aggregator with smart routing | Yes | No | No | Yes | No information yet |

| Custody flexibility | Yes | No | No | No | No information yet |

Velvet Capital is currently available on BSC and will deploy on Ethereum mainnet and L2s like Arbitrum, Optimism, Base, and Mantle.

The fee mechanisms for Enzyme and TokenSets are customisable by the vault managers, similar to Velvet Capital. Nested has fixed fees that either go entirely to Nested Finance Ltd or are split between them and the vault creator but will be continually adjusted once the DAO is live.

Both Enzyme and Velvet Capital vaults have the capability to be deposited into external protocols, allowing extra yield for investors. However, this comes at the risk of tokens being exposed to external smart contract risks.

Both Velvet Capital and Nested have aggregated routes for swapping, allowing for more efficient swaps and rebalancing.

Velvet Capital provides multiple custodial solutions depending on the vault manager’s needs. While tokens are held in the user’s custody for its competitors, they do not provide the same flexibility as Velvet Capital.

Velvet Capital is currently available on the following chains:

Users can utilize Velvet easily without having extensive knowledge of smart contracts, as all the necessary infrastructure to create and manage the products all available via the UI.

Every time a vault manager creates a vault, a new series of smart contracts with the architecture below gets deployed, each product is independent and is entirely created & managed by the vault manager.

There are 2 types of vaults available for creation, depending on the requirements and safety measures needed.

Users can create their own portfolios by clicking on the Create button, which brings them to the creation menu.

The following options will be made available:

Once the vault is created, you can interact with it using its address. Depending on the modules used, you can trade assets, rebalance the portfolio, and manage fees and other configurations. The vault creator needs to enable $USDC/$USDT deposits to allow users to invest using stablecoins.

After that step, the vault creator needs to initialize tokens into the newly created vault according to their strategy. After this step, the vault is ready for users to interact with.

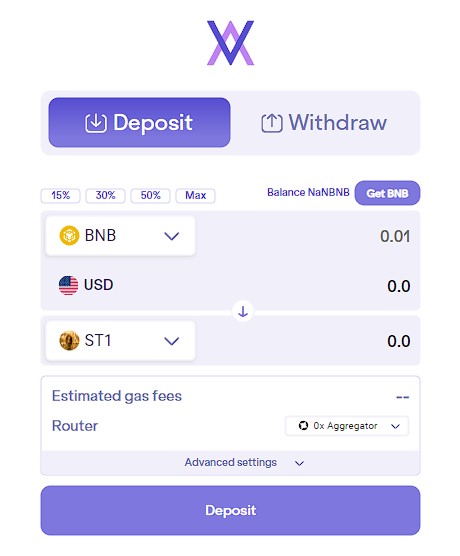

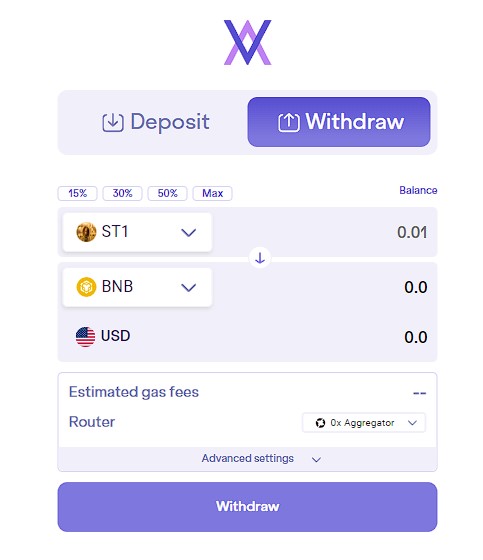

Depositing can be done via the $BNB, $USDC or $USDT tokens, which will automatically be swapped into the tokenized representation of the underlying AUM.

Similarly, if the investor chooses to withdraw, the tokenized representation of the vault will be swapped into $BNB, $USDC or $USDT tokens, or via a multi-token withdrawal option that will provide the user with their share of the underlying tokens.

Trading is performed by the vault manager, utilizing assets within the vault. Trading includes the following actions:

After all trading operations, any leftover funds are returned to the user to ensure that there’s no loss of funds. Throughout the process, there are various checks and guards in place, including reentrancy guards, access controls, and validations, to ensure that the operations are secure and that only authorized entities can trigger certain functionalities.

The Rebalancing contract provides functionalities to maintain and adjust the portfolio weights of tokens in a “vault”. This allows a vault manager to ensure the portfolio adheres to its target allocations.

The rebalancing process ensures the portfolio remains aligned with its strategic objectives by adjusting token weights and certain operations, such as rebalancing or updating weights, are restricted to the asset manager role. The system can be paused or unpaused during the rebalancing to avoid incorrect deposit/withdrawal calculations.

Off-chain functions also have a revert function mechanism to protect funds from being stucked in contracts during rebalancing.

As a part of the vault strategy vault managers can use integrations of other DeFi protocols to earn additional yield from the underlying tokens. The vault managers can allocate assets into different protocols in one click:

Vault admin allows the vault creator to assign different roles, allowing addresses different abilities as required. These includes:

Velvet Capital is a DeFi operating system that covers all DeFi needs for institutional investors. It provides DeFi-as-a-Service for asset managers, hedge funds, fintechs, family offices, DAOs, traders, and banks. Using Velvet Capital, users can access a variety of services to:

Users can choose to invest in a variety of products depending on their investment strategy.

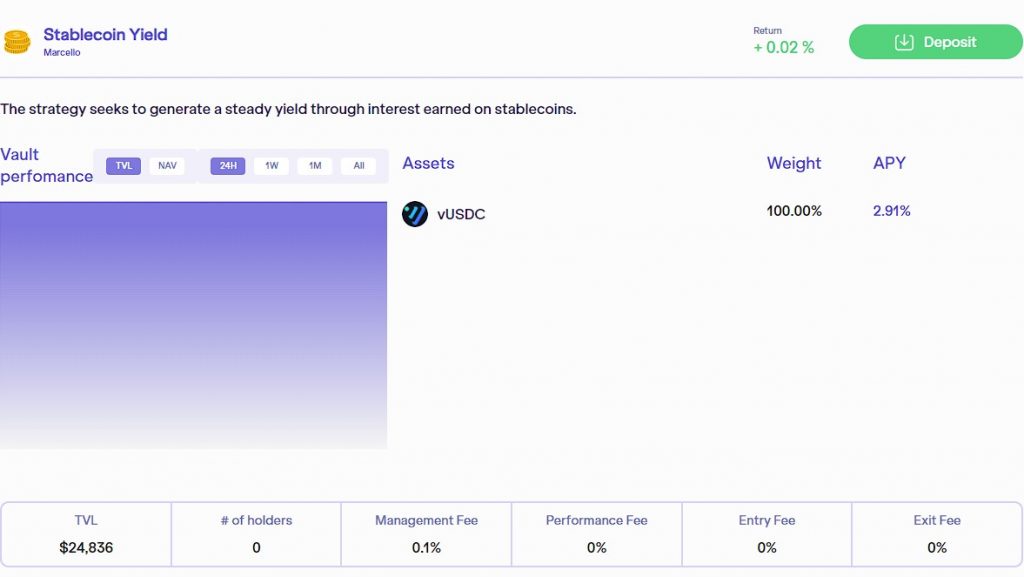

Stable vaults are ideal for users wanting to seek yield without being exposed to the price action of volatile tokens. However, yields will be lower compared to vaults containing volatile tokens and users may find it much slower to break even on their initial investment after accounting for fees.

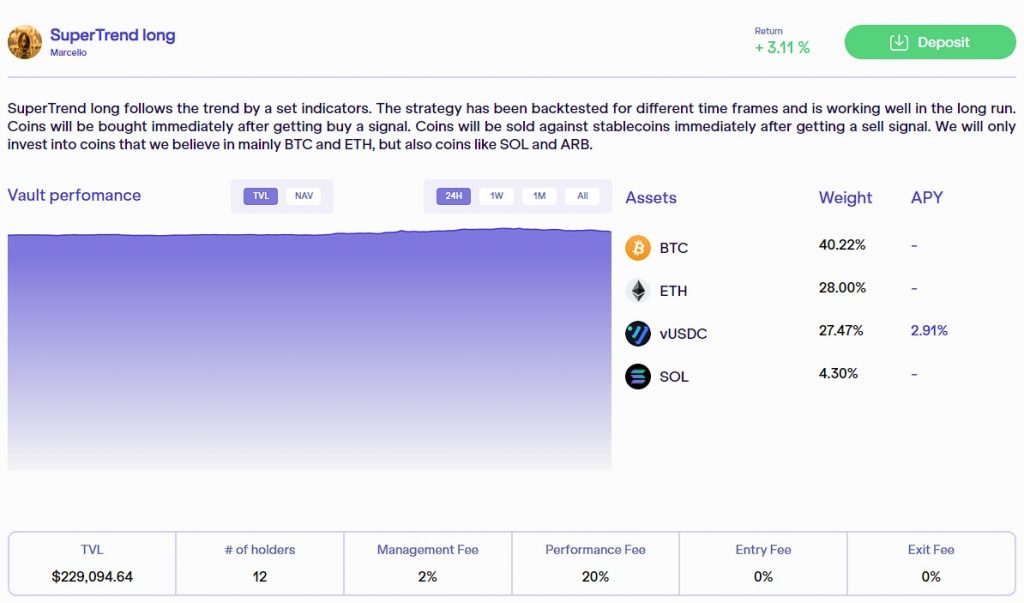

These are vaults containing tokens that are more volatile in price action compared to stablecoins. These vaults will be appealing to investors looking for higher returns but it also comes with higher risks. The tokens that make up the vaults depend on the goal of the vault managers.

To support further development of the platform Velvet Capital takes Administrative Fees on the vaults created on the platform.

The $VLVT token is yet to be launched.

The difference in fees for each product in the marketplace can be customized based on the vault manager’s preference.

These include three types of fees for the vaults:

To support further development of the platform Velvet Capital takes Administrative Fees on the vaults created on the platform. The fees range between 10% and 25% of the total fees earned by the asset manager. The larger the vault, the smaller the percentage taken.

The minimum amount of administrative fees is a 0.3% annualized fee of the total TVL that will be deducted even if the asset manager doesn’t set up any fees. The fees are charged in the form of newly minted vault tokens based on the above calculation and sent to the project treasury.

Fee Module

These are custom fee structures that institutional clients will be able to set up for their funds and products, which include:

These fees are embedded in the smart contract logic and deducted automatically.

veVLVT Holders

A share of the protocol fees will be given to veVLVT holders depending on the fund that they voted for.

Velvet Founders Club NFT

NFT holders will earn royalty fees from secondary sales.

Gas Reimbursement Promotion

There is currently a reimbursement promotion, where gas fees for deposits above $500 are reimbursed at the end of the month.

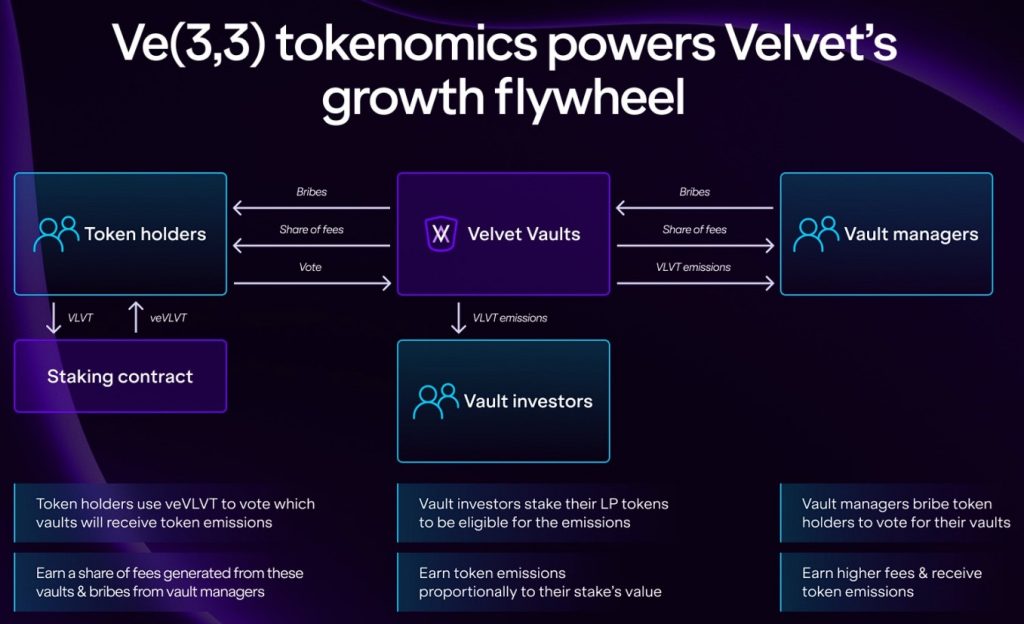

$VLVT is the native token of the protocol. Its token utility is designed to incentivize beneficial behavior from stakeholders for the benefit of all participants. This will also have the effect of increasing the degree of decentralization over time as the number of community contributions increases.

In order to incentivize user growth and encourage participation in decentralized governance, the Velvet DAO operates under a ve-token model. The veVLVT token is a vote-escrowed representation of $VLVT, which can be locked to gain increased voting power.

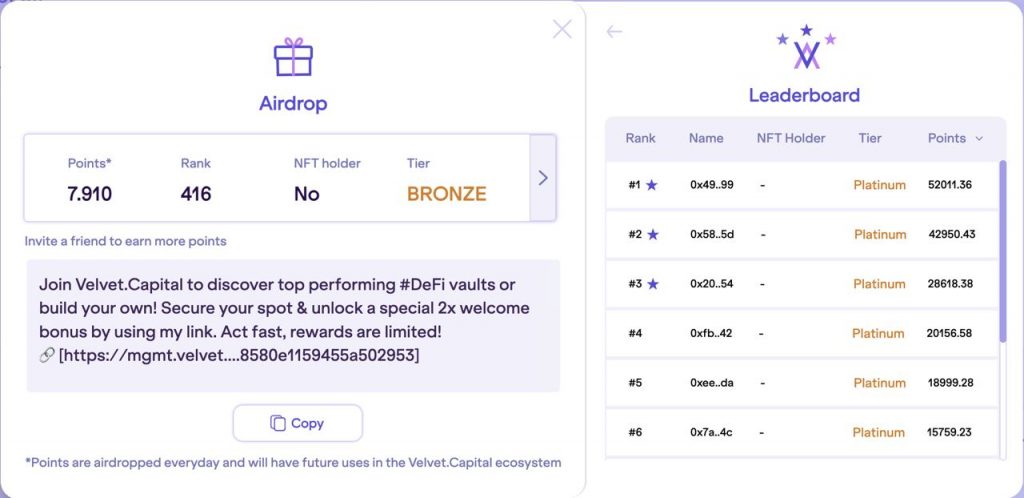

In addition to the ve token model, the Velvet Founders Club NFT provides additional benefits to early contributors, including doubling the airdrop amount, increasing voting power, earning royalty fees, and more.

$VLVT is the token which is used in emissions, and its use cases include:

veVLVT is the vote-escrowed version of $VLVT. Users can lock their $VLVT tokens for up to 5 years to get veVLVT, with veVLVT voter power scaling with the length of time locked.

To incentivize ongoing engagement and participation from stakeholders, the veVLVT balance gradually decreases over time until it reaches zero at the end of the initial locking period. However, it can be increased by initiating a new locking period.

The veVLVT tokens have multiple uses within the Velvet ecosystem, including:

When participating in voting, veVLVT holders also become eligible to receive a portion of the protocol fees generated by the specific fund they voted on. This allows them to earn additional staking rewards, providing an extra degree of protection against dilution.

These NFTs are only granted by the Core Team and are the highest recognition for early contributors, confirming their OG status.

Velvet Founders Club NFTs have the following utility:

The NFTs can only be minted before the $VLVT token airdrop. Some methods of obtaining them include:

Tokens are allocated according to the following:

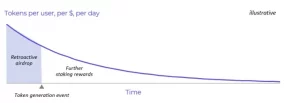

Airdrop and Staking Rewards

5% of the supply is reserved for the initial airdrop & staking rewards for veVLVT holders to bootstrap initial decentralization and incentivize stakeholders to lock their tokens.

After the initial 5% is distributed, the DAO will be deemed to be sufficiently decentralized in making future decisions regarding staking rewards, and allocation of additional amounts to the ecosystem or treasury fund when needed.

Growth Fund

5% of the supply is reserved to incentivize contributions towards ecosystem growth, including a Referral program to attract new users to use the platform.

Ecosystem Fund

25% of the supply is reserved for an ecosystem fund, which will be used to support and incentivize developers, partners, and projects that contribute to the Velvet DAO ecosystem.

The DAO community will manage the funds, via a transparent and democratic community voting process required for allocations of funds.

DAO Treasury

20% of the supply is reserved for the DAO Treasury, which will be managed by the community through the DAO.

Treasury tokens will be used to fund the DAO’s operating expenses, including:

Liquidity Pool

5% of the supply is reserved for the initial liquidity pool, which will be used to provide liquidity for the Velvet DAO token on decentralized exchanges, ensuring sufficient liquidity for trades by users.

Core Team

20% of the supply is reserved for the team to engage them in the long-term success of Velvet DAO.

The tokens have a monthly vesting over 6 years, with the team receiving ~0.28% of the supply each month.

Initial Backers

20% of the supply is reserved to be distributed to the earliest backers to bring top-tier partners to support the launch and scaling of Velvet DAO. These include:

The tokens have monthly vesting over 5 years, with the backers receiving ~0.33% of the supply each month.

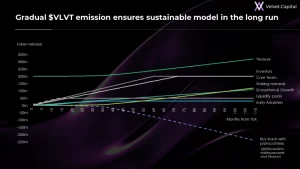

The total supply of $VLVT tokens is capped at 1 billion, with no emissions above the cap.

Emissions are designed such that the cap will not be reached for the next 10 years or longer, with scheduled releases to ensure that supply growth does not outpace usage growth.

The team aims to ensure a self-sustainable state with the schedule as follows:

The airdrop will be the initial step taken to ensure a decentralized community-managed ecosystem.

50,000,000 $VLVT tokens will be allocated to early adopters via retroactive distribution & further staking rewards, with the three main parameters in determining the allocation being:

In addition, users will also have to hold Velvet products during several snapshot dates prior to the token launch in order to be eligible for retroactive distribution. The snapshots will be shared publicly for user’s verification of their eligibility. Additionally, airdrop points will be doubled on the first $5 million in TVL as part of a limited-time Velvet Liquidity Mining Program.

You can use the airdrop tracker within Velvet.Capital to monitor your progress.

Staking rewards model

The model follows an exponential decay function, benefitting the following with more tokens:

The Velvet DAO governance model builds upon the $VLVT token. $VLVT is the native governance token of the platform and grants its token holders voting power over the decisions made by the DAO.

The DAO will follow a process of progressive decentralization whose efforts will be led by the token holders who stake the $VLVT token with Velvet. This will allow the core team of contributors to focus on lean development, tight execution, and quick iterations that help validate product-market fit as the protocol grows.

As a token holder, users have the opportunity to drive Velvet’s development & growth by submitting proposals that can range from new integrations and protocol upgrades to new product proposals and earning more tokens especially if they are actively participating in the overall governance.

Velvet’s contracts are non-upgradable, meaning that, once deployed, the code is immutable. It is also worth noting that the team does not have any special authority or privileges to edit the contract’s logic and is only able to suggest transitions to a new version. Only the asset manager, who is the vault deployer, can make the decision on upgrading.

There will also be a “security module” (an insurance fund) once the token is launched.

Velvet has gone through audits conducted by Peckshield and Shellboxes.

V1

Smart Contract Audit Report – March 25, 2023 – PeckShield

Shellboxes noted that the smart contracts were well-designed and constructed, but could be improved by fixing the discovered flaws. In the conclusion, it was noted that the Velvet Capital team addressed 20 issues raised in the initial report and implemented the necessary fixes while classifying the rest as a risk with low probability of occurrence.

Smart Contract Security Audit – August 23 2022 – PeckShield

PeckShield noted that the smart contracts were well-designed and engineered, but could be improved by fixing the identified issues. In the conclusion, it was noted that the current code base was clearly organized and that identified issues were promptly confirmed and fixed.

V2

Smart Contract Security Audit – August 7, 2023 – ShellBoxes

ShellBoxes noted that the smart contracts were generally well-designed and constructed.

Smart Contract Audit – October 9, 2023 – PeckShield

Peckshield noted that the smart contracts are well-designed and engineered, altough the implementation could be improved by resolving the identified issues.

There is a bug bounty program in collaboration with Hats Finance, with the following reward tiers:

There is also a bug bounty program with Immunefi:

Velvet has collaborated with the following in order to enhance its real-time security.

According to the LinkedIn profile, the team consists of 17 employees.

Velvet Capital was one of the selected projects under Binance Lab’s Most Valuable Builder (MVB) Accelerator Program, an accelerator program co-led by Binance Labs and BNB Chain to offer mentorship and funding to emerging projects built on top of the BNB Chain.

Throughout the 3-month incubation period, Binance Labs provided coaching, network assistance, and ecosystem integration support.

Other backers include:

The team has also won various awards at hackathons and bounties: