SYMMIO is a permissionless protocol enabling leveraged asset trading. It employs an intent-driven liquidity engine, reducing counterparty risk and allowing users to express trading preferences.

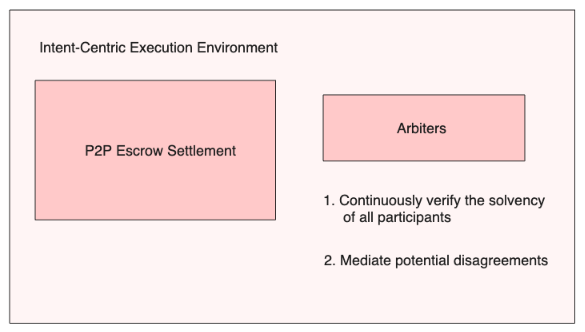

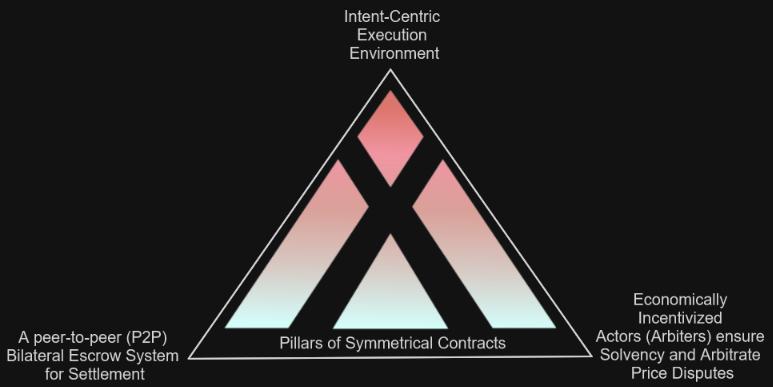

The protocol enables OTC derivatives trading on-chain through an Intent-Centric execution environment, a P2P bilateral escrow system, and economically motivated actors called “Arbiters” – all of which will be described in detail later in the report.

SYMMIO operates as a trustless layer, such that Arbiters verify solvency and mediate parameter disputes, enabling automated “Symmetrical Contracts.” These contracts allow for the trustless and permissionless settlement of synthetically created digital derivatives among multiple parties.

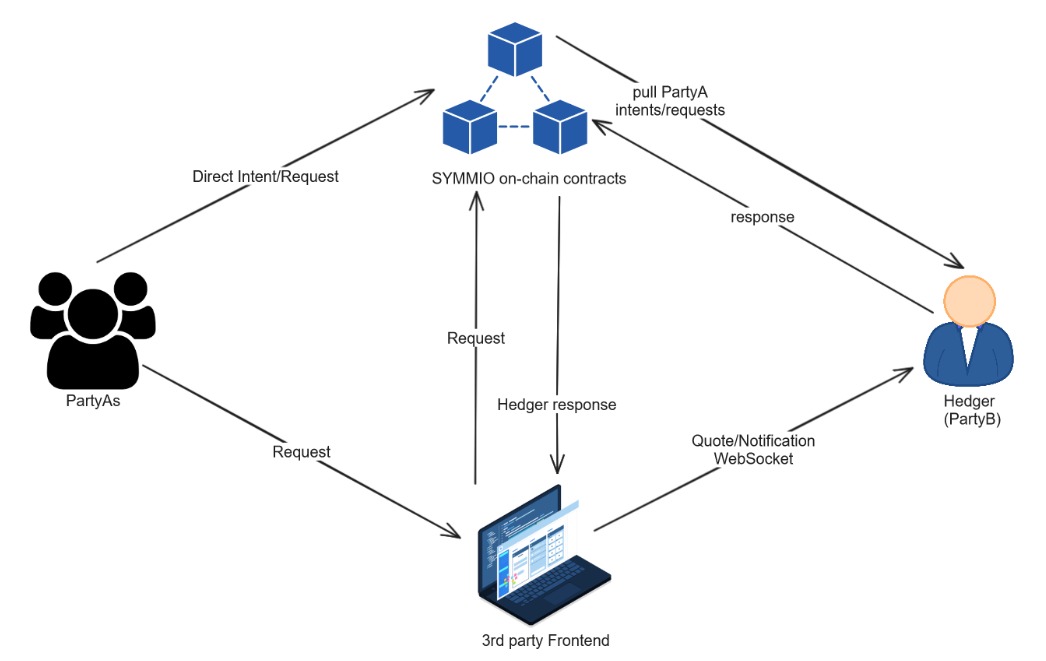

SYMMIO acts as core infrastructure, and it is meant to be integrated into existing or newly built decentralized exchanges. Therefore, all interactions take place through third-party frontends.

SYMMIO aims to bridge the efficiency gap between centralized and decentralized platforms. It provides a trustless, self-custodied experience while offering a product range similar to centralized exchanges. This is achieved via peer-to-peer OTC deals referred to as Symmetrical Contracts.

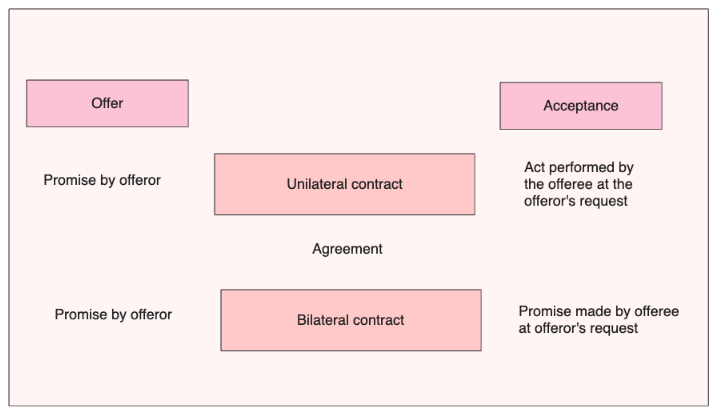

Symmetrical Contracts are a novel financial trading primitive inspired by traditional finance’s “Bilateral Agreements”. The idea behind them is to circumvent the liquidity fragmentation across multiple liquidity pools on different DEXs and chains.

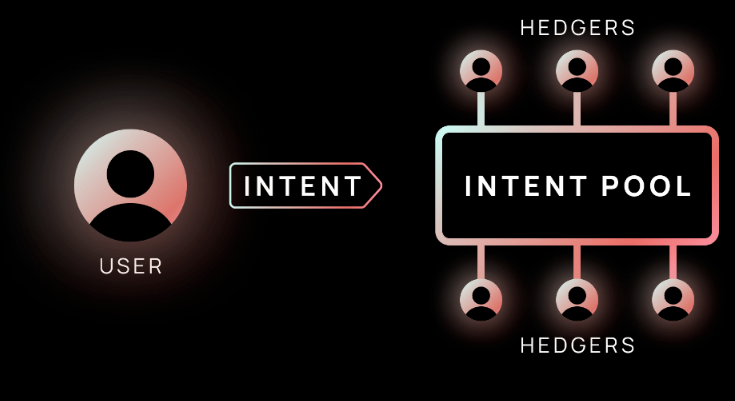

The protocol employs an Automated Market for Quotation (AMFQ), allowing users to request quotes, reducing the complexity of on-chain orderbooks in a trust-minimized way. On the other side of the trade, market actors called “Hedgers” will provide the necessary liquidity to fill users’ orders.

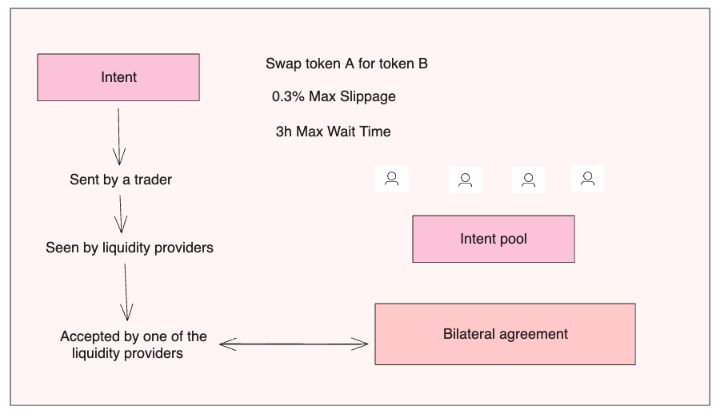

The protocol differentiates between two parties, and facilitates a trustless disintermediation between them through an off-chain peer-to-peer communication system and intent-based execution environment. This results in a better user experience and helps to aggregate liquidity instead of fragmenting it even further.

In this framework, one party (trader) initiates a trade, and another party (liquidity provider or Hedger) responds to the original request. Both parties must contribute collateral for trade execution, hence the bilateral agreement.

Post-trade, third party liquidators and monitoring tools self-regulate the exchange to ensure solvency for all participants. This way, the system is peer-to-peer (P2P), offering equal treatment for both parties (traders and liquidity providers).

By isolating the capital requirements of both parties, the system can eliminate the need for oracles, optimizing capital efficiency. With this approach the protocol can match bids and asks in the market, allowing for true price discovery and trade settlement directly on-chain.

The SYMMIO whitepaper outlines the concept of SYMMIO, a protocol for digitizing bilateral over-the-counter (OTC) derivatives in a permissionless on-chain manner. It introduces “Symmetrical Contracts” as a novel architecture for trustless and permissionless settlements of digital derivatives.

As a protocol, SYMMIO aims to enhance market diversity and competition by allowing for the trade of derivatives tailored to any market demand with minimal trust. For that, SYMMIO incorporates an intent-centric execution environment, a peer-to-peer escrow system for settlements, and involves economically motivated actors (Arbiters) for verifying solvency and mediating disputes.

SYMMIO enables virtually anything to be traded synthetically by allowing a trader and counterparty pair to match and have their agreement verified by a collective of neutral observers (Arbiters). This capability is rooted in the protocol’s intent-based, permissionless framework for derivatives, which supports a wide range of customizable trading parameters.

Such a system can significantly broaden the scope of tradable derivatives, extending beyond the price of crypto assets. The architecture is designed to accommodate diverse market demands and rule sets, providing flexibility to liquidity providers and traders alike. This adaptable approach encourages the creation and trade of bespoke financial instruments tailored to specific market needs, leveraging blockchain technology for transparent and secure settlement.

Different market participants use derivatives for different purposes, whether it is for hedging risk, speculation, or profit from arbitrage and yield opportunities. They are an excellent tool for market participants to get exposure to a wide range of instruments that contribute to making markets more efficient, also encouraging price discovery and improving liquidity conditions.

SYMMIO facilitates secure and flexible trading of derivatives that settle on-chain using a combination of features and mechanisms which are presented below:

| Feature | Description |

| Intent-centric Execution Environment | Traders express their trading intentions through “Intents”, which are immutable once submitted. This environment ensures that trading parameters are clear and enforceable, allowing for precise matching of counterparties based on a wide range of criteria beyond price, such as duration, leverage, and underlying assets. |

| Peer-to-Peer Bilateral Escrow System for Settlement | Trades are settled directly between counterparties without intermediaries. This P2P escrow system ensures that assets are securely held and only released upon meeting agreed conditions, reducing counterparty risk and enhancing trust in the platform. |

| Economically Incentivized MEV Researchers (Arbiters) | Arbiters play a crucial role in maintaining the integrity of the platform by verifying solvency and resolving disputes. They are incentivized through economic rewards to ensure their motivations align with the platform’s smooth functioning and the fair settlement of trades. |

| Decentralized Oracles for Dispute Resolution | SYMMIO utilizes decentralized oracles to provide reliable and tamper-proof external data for settling disputes, especially in the valuation of underlying assets. This mechanism ensures fair resolution based on real-world market data. |

| N-dimensional Orders | The platform supports orders with multiple dimensions, allowing for the creation of complex derivatives contracts tailored to specific needs. This feature significantly expands the versatility of the derivatives that can be traded, catering to a broader range of market demands. |

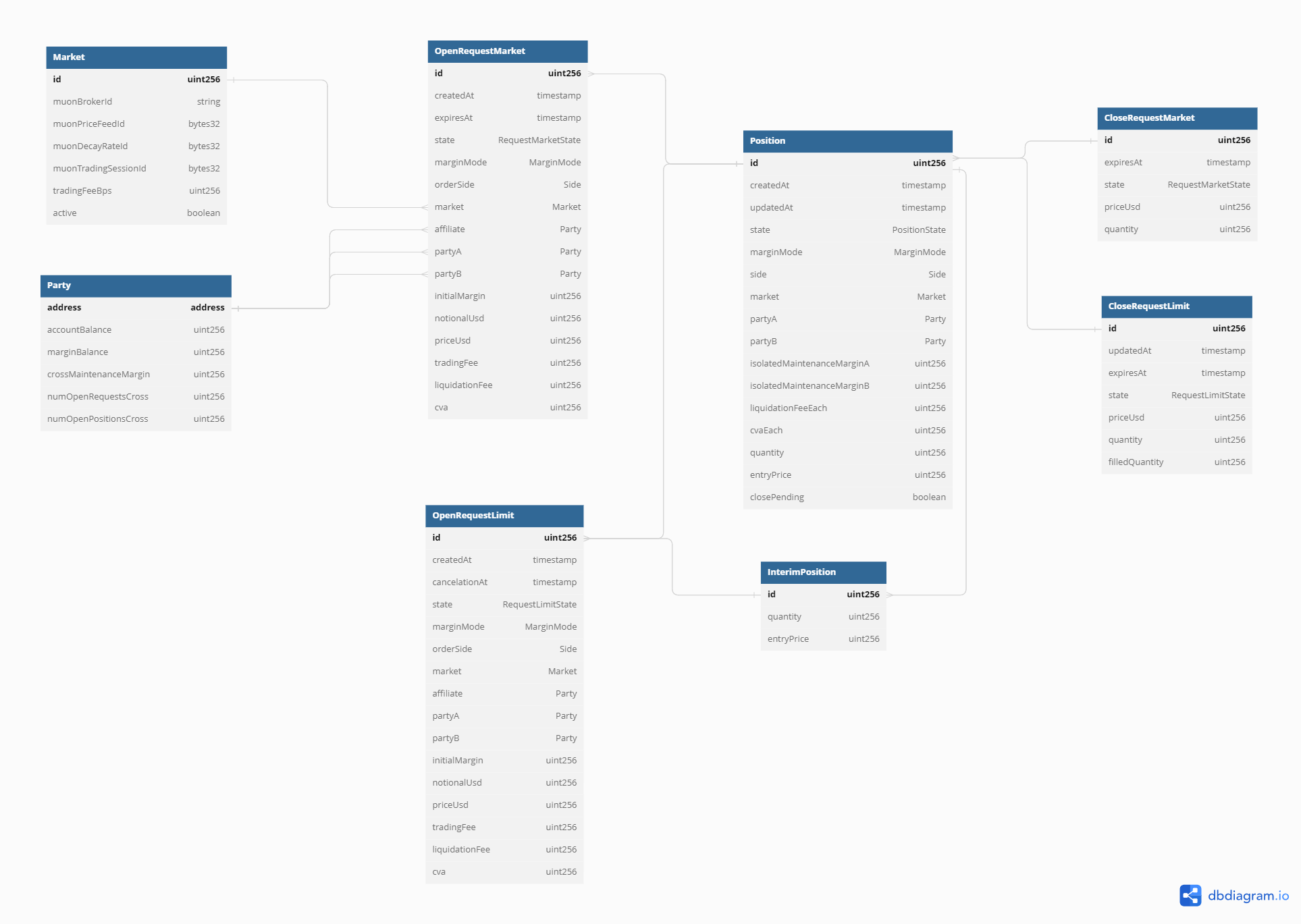

SYMMIO isolates trades by treating each trading pair as a separate entity, ensuring that the profits and losses of one trade do not impact another. The system operates by isolating trades between two parties, PartyA and PartyB, within a peer-to-peer trading environment. This ensures that each trade is treated as a distinct and independent transaction.

Both parties contribute collateral and represent one side of the transaction, with one taking a long position and the other a short. This structure ensures that both parties are treated equally and maintain equal rights throughout the trade.

A trade is executed only when a suitable counterparty is found, ensuring that both parties agree to the terms of the trade. This process prevents losses from impacting external parties, as profits and losses are contained within the agreement between PartyA and PartyB.

SYMMIO is designed specifically for trading Symmetrical Derivatives and sets a communication standard for various actions in the trading process, including the formulation, sending, receiving, reading, reserving, canceling, accepting, or rejecting of Intents (Quotes).

As a derivatives protocol suite, SYMMIO establishes rules for on-chain communications related to Symmetrical Trading, making use of Intents and automated Markets for Quotes (AMFQ). This framework creates a request-based trading system for permissionless on-chain derivatives.

In SYMMIO, when two parties interact, each side of the trade counterbalances the other – ensuring the losses of one side are the gains of the other, and vice versa.

All trades on the platform are isolated from one another. This creates a closed-loop between parties such that losses cannot extend between the participants involved.

In SYMMIO, Symmetrical Contracts are described as n-dimensional orderbooks. They allow for the creation of derivatives with multiple, customizable parameters beyond just price. This enables liquidity providers to offer derivatives tailored to diverse market demands and rulesets, thus expanding market diversity and competition.

Consider the example below:

Traditional orderbooks match orders based on a single parameter (price), but symmetrical contracts’ n-dimensional framework allows matching based on a multitude of parameters, offering unprecedented flexibility for crafting derivatives. This approach not only broadens the scope of market possibilities but also enhances the competitive landscape for market makers by allowing them to offer innovative products tailored to specific needs or market conditions.

In SYMMIO, the term Hedger is used to refer to a Market Maker that provides liquidity on the protocol. The reason behind using this system is to achieve on-chain settlement with maximum settlement and as minimal trust assumptions as possible. AMFQ is a modified version of standard Request For Quote (RFQ) systems used for OTC trading.

By leveraging off-chain technology, SYMMIO provides the required infrastructure to third-party market makers and decentralized derivatives exchanges. This way, the protocol does not have to rely on a virtual AMM or on-chain orderbook. Instead, it can facilitate peer-to-peer symmetrical agreements for derivative contracts.

The process is disintermediated via off-chain trustless infrastructure and on-chain settlement of derivative contracts. For this, the SYMM derivatives engine operates on the principle of isolating trades between parties.

An example of the entire lifecycle is shown below:

The engine isolates market participants In a peer-to-peer trading environment, ensuring that participants in the agreement are treated equally. This way, both parties must contribute collateral to ensure that the transaction can be finalized. The long position of one party corresponds to the short position of the other, and a trade can only be executed upon finding a suitable counterparty.

Makers and takers are treated identically – if one of them lacks sufficient collateral, they will be liquidated. Similarly, profits and losses are contained within this dual agreement between the two parties.

While this approach does not require the use of an oracle for pricing, SYMMIO uses a threshold signatures to help solve disputes between parties. Each of these signers is a third-party observer of the market (Arbiter) and ensures that the system functions in a trustless manner whenever the two parties involved in a trade don’t agree on the preset rules or exchange prices.

The idea of using intents is to achieve a trustless architecture, ensuring that users do not need to rely on trust or faith in counterparties, particularly Hedgers. This is a fundamental aspect of the protocol design, since many actions take place off-chain, making it necessary to resolve disputes between Hedgers and counterparties with as little trust assumptions as possible. In this setting, trustlessness means that users don’t have to rely on the good faith or intentions of another party, ensuring that they can transact or interact securely.

There are four key pillars in place within the system to sustain this premise:

These mechanisms ensure that users can engage in on-chain derivatives trading with confidence, knowing that the system is designed to prevent and address potential issues without relying on trust assumptions.

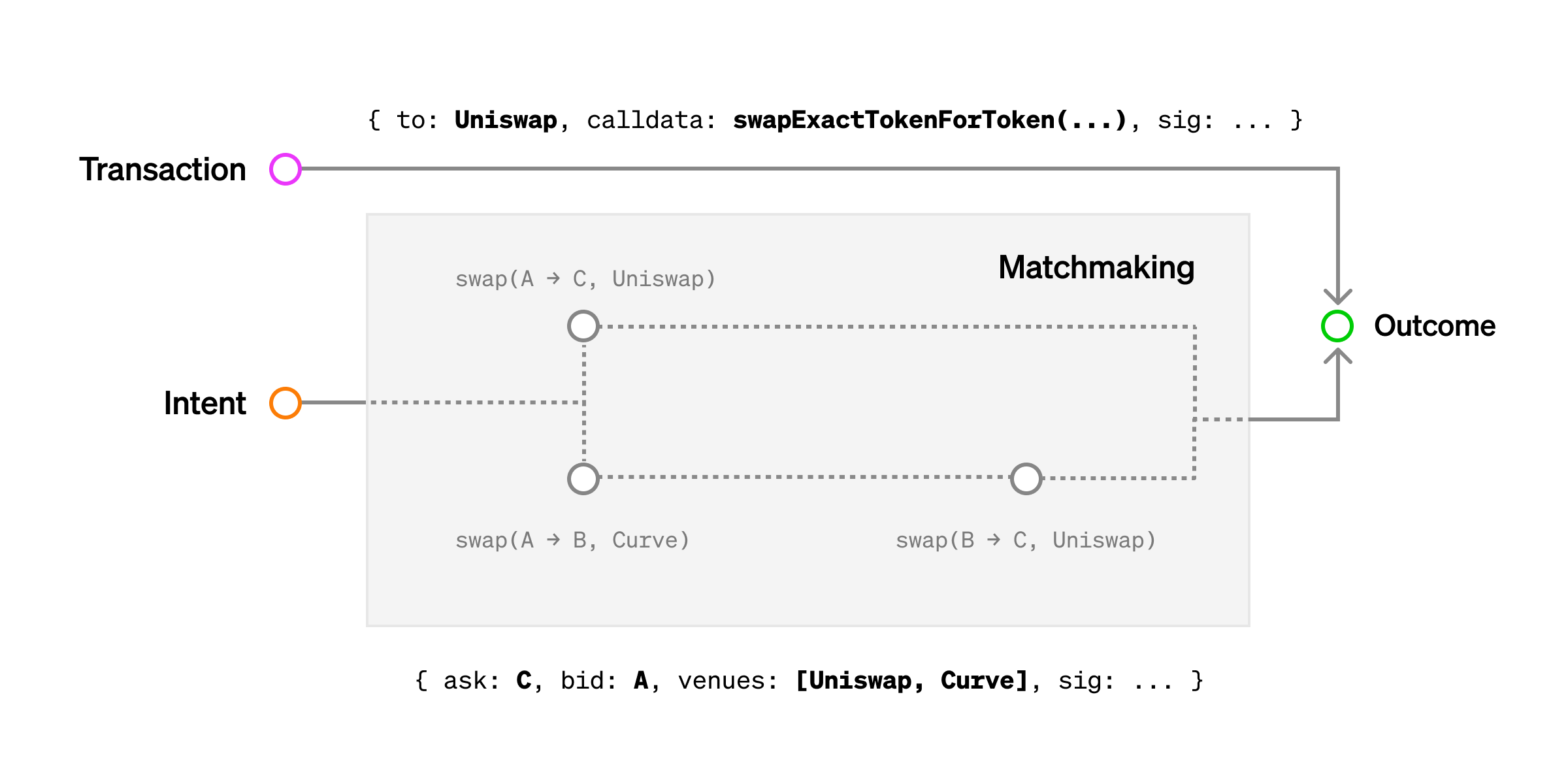

In a non-blockchain setting, intents are a concept that refer to the desire or want for something to happen. The ending is likely to be specified, but not the how and where to find it. Applied to blockchain terms, there is a desired end state (the user wants to buy a certain number of tokens) but the exact path or trace to follow about how to reach that end is not specified.

More specifically, the difference between a transaction and an intent is that a transaction explicitly refers to “how” an action should be performed while an “intent” refers to “what” the desired outcome of that action should be. For instance, if a transaction says “do A then B, pay exactly C to get X back”, an intent says “I want X and I’m willing to pay up to C”.

As an example, a user may express their intent to buy X amount of tokens with a specific slippage tolerance and they don’t care about how they get those tokens as long as they get them (whether it is through a single DEX pool, using an aggregator across multiple pools, jumping through an intermediary asset to complete the swap…).

An example of an intent in SYMMIO is shown in the table below:

| Field | Description |

| partyA | The address of the user who made the request |

| quoteId | The unique identifier of the quote, which must be referenced in all further requests |

| partyBsWhiteList | The whitelist of the hedgers who are allowed to take action upon this intent. If it is empty, it means that all hedgers are allowed |

| symbolId | The symbol identifier of the symbol that the user has sent an intent for |

| positionType | The position type: LONG or SHORT (It would actually be 0 and 1 in the data) |

| orderType | The order type: Limit or Market (It would actually be 0 and 1 in the data) |

| price | The price that the user has requested |

| quantity | The quantity of the requested position |

| cva | In case of liquidation, this is a penalty that the liquidated side of the trade must pay to the other side |

| mm | The maintenance margin of this intent |

| if | The liquidation fee which is going to be paid to the liquidator |

| deadline | Specifies the period in which hedger is allowed to open this position |

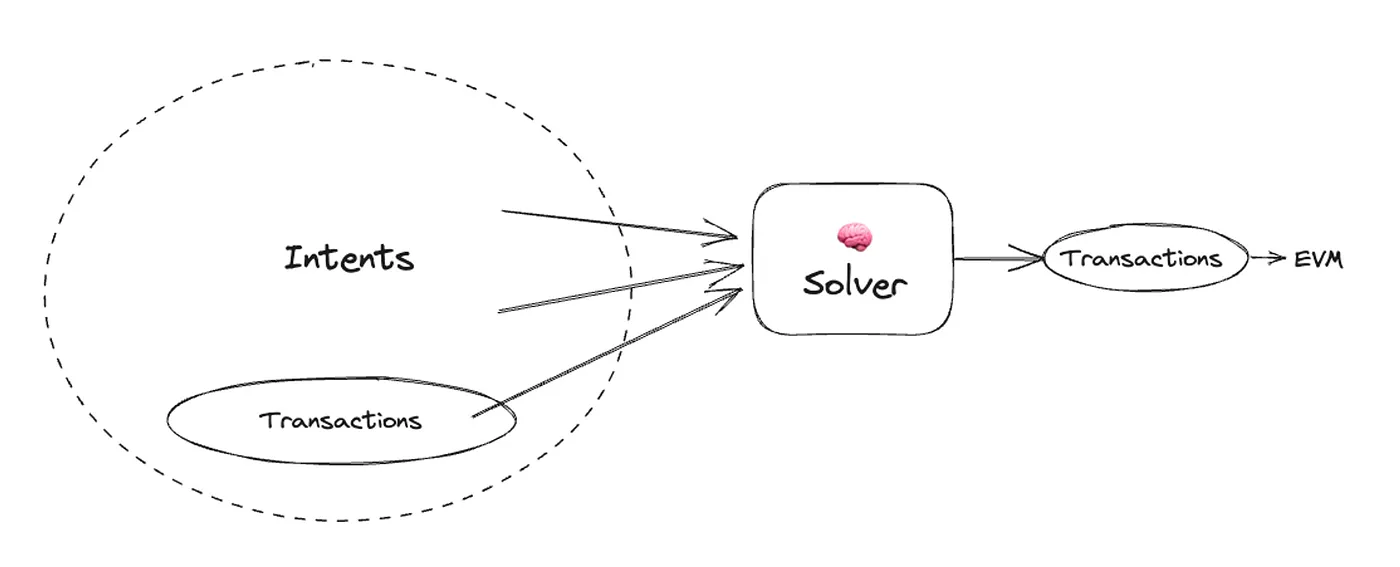

Once an intent is expressed, the ending is reached through specialized parties called solvers (Hedgers in the case of SYMMIO) who are responsible for finding routes, coincidence of wants, liquidity across different venues, and hedging inventory. This happens in SYMMIO through an off-chain execution environment where traders submit their “intents” and they are then matched with other orders.

This is achieved without paying for gas, signing approvals, or experiencing a UX with failed transactions. All the user needs to do is express a goal, and the most sophisticated off-chain actors attempt to find a path to fulfilling it. No on-chain expertise is required to achieve such complex procedures. This eliminates the need for users to have expertise about building transactions on-chain while still allowing them to tap into off-chain liquidity.

The reason why it is important is because intents make it possible to go from extraction to satisfaction. For instance, consider arbitrageurs extracting value out of the passive liquidity of Uniswap LPs, and compare it with a system where Hedgers fill user orders by hedging their inventory off-chain, ultimately fulfilling the user’s desire according to their exact specification.

This design allows for more customization for end users, curation and ease of UX, with a higher degree of modularity and cross-domain venues. By having Hedgers fill orders being matched off-chain, the system can avoid costs for failed transactions while abstracting away complexities and allowing users to express their preferences. One extra benefit of this is that, since trade execution happens off-chain, users are not required to pay for gas; they can simply sign a message on their wallet to express their intent.

For example, if a market maker is able to get you a better price on an $ETH-$USDC swap on Binance than on-chain, this liquidity is now accessible in DeFi while maintaining the benefits of permissionlessness and self-custody.

Streamlining disputes is central to SYMMIO’s trustless design, ensuring that the system remains secure and resilient even in cases where trust might be challenged. This is critical to address scenarios where for example a Hedger might fail to respond to a user’s request.

While the peer-to-peer nature eliminates most trust assumptions, the potential for abuse by certain players, like Hedgers, necessitates a robust dispute resolution mechanism. SYMMIO achieves this by breaking down disputable actions into manageable components and automating resolution where possible.

For instance, an unresponsive hedger during a trade closing request is a critical and disputable action. This scenario locks the user into a trade, highlighting the importance of resolving disputes promptly. Conversely, an unresponsive hedger during a trade opening request is a minor setback, as users can easily switch to another solver.

For trading derivatives, it is critical to ensure that users will always be able to close their positions in time, even if a Hedger is not responding. SYMMIO can tackle liquidity concerns with two types of force close mechanisms, drawing inspiration from both traditional orderbooks and emerging vAMMs:

| Force Close via Oracle | Force Close via Open Market | |

| Pros |

|

|

| Cons |

|

|

Note that currently SYMMIO implements Force Close via Oracle.

A Force Close Oracle is in place to ensure seamless operations in the absence of immediate Hedger response. This operation means that when a user requests trade closure and the Hedger remains unresponsive for a set period, the system allows the user to engage a liquidator to terminate the position at the oracle price. This provides a safety net for both parties, working in line with the Credit Value Adjustment (CVA), which acts as a security deposit from both parties involved in a trade.

In scenarios where a Hedger might have an open hedging trade on an external platform like Binance, and a user faces liquidation, the Hedger aims to close their hedging trade promptly on Binance to ensure a balance between their on-chain and off-chain positions. The CVA deposit provides a buffer against potential losses that might arise during the brief period of time when the Hedger is exposed to the user’s liquidation.

In addition to offering a protection buffer for Hedgers, the CVA also offers a discount to incentivize liquidators to step in and intervene during liquidation scenarios.

However, introducing a Force Close is a deterrent and extra layer of complexity for Hedgers. The reason for that is because when this happens the Hedger losses out on the CVA intended to cover potential losses and might lead to a direct loss in revenue. In addition to that, the Force Close does not account for the exact slippage that would arise if the position was sold in a real-time market scenario. All of these ramifications serve as a deterrent for Hedgers, incentivizing them to behave in a trustworthy manner. Therefore, this mechanism ensures that only the most efficient and proactive hedger thrive in this environment.

The concept of “Open Market for Closing” is also aimed at addressing hedger non-responsiveness during user-initiated close requests. The idea is that in the event of hedger non-responsiveness, the system would trigger an automatic Dutch auction for the position closure.

CVA, or Credit Value Adjustment, in SYMMIO serves a role similar to that of Maintenance Margin on traditional exchanges. It is a crucial metric that determines when a user enters the Liquidation Process, working in line with the Force Close mechanism.

The CVA acts as a security deposit from both parties, protecting hedgers and incentivizing liquidators.

Unlike some platforms that mandate a specific amount, SYMMIO allows users to set their CVA value, offering flexibility.

Hedgers communicate their CVA requirements to frontend providers, who then provide the desired CVA to users. Next, the user can send a request with sufficient CVA to the contracts for the Hedger to accept.

Both the user (PartyA) and the Hedger (PartyB) contribute an equal Security Deposit. If the Hedger gets liquidated, the user receives this Security Deposit as compensation for the premature closing of their position.

On the other hand, if the user gets liquidated, CVA plays a role in protecting counterparties from potential losses associated with prematurely closing their Hedging Positions.

Hedger buyouts address situations where a trader defaults or wishes to terminate a trade prematurely, which can be problematic without automation and incentives.

When a trader defaults or wants to exit a trade early, their positions can be purchased by another party in exchange for a portion of their CVA (Credit Value Adjustment).

The key here is that an independent party (called driver or watchdog) verifies that the new party has sufficient maintenance margin to hold the position.

This mechanism allows the non-defaulting party to avoid force-closing their position and, in some cases, their hedge.

The primary goal is to prevent liquidation events from triggering a chain reaction of further liquidations, improving the overall stability and efficiency of the platform.

In SYMMIO, liquidations within Symmetrical Contracts are initiated when a party’s unrealized profit and loss (uPnL) deteriorates to the point where almost all the security deposit of the collateral is exhausted.

Intent-centric protocols like SYMMIO simplify the user experience by allowing users to express their desired outcome without specifying what path to follow or how the end goal should be achieved. After relaying the intent, third parties compete to find the most efficient way to fulfill the user’s intent. This approach shifts the power back to users and eliminates the need for them to navigate complex processes and fees on their own.

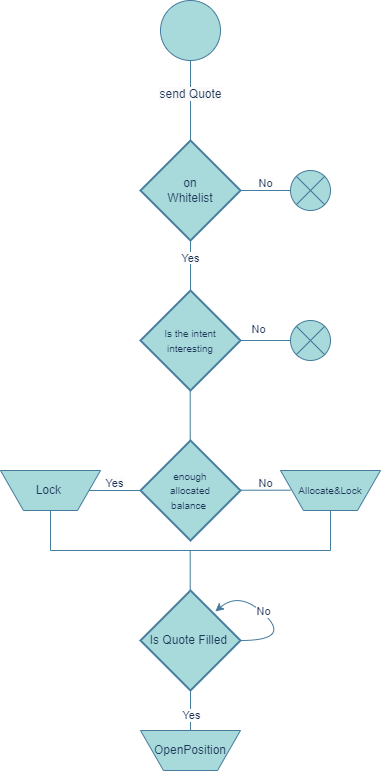

The image below shows the lifecycle of an intent in SYMMIO, with dashed arrows representing actions taken by the Hedger, and solid arrows representing actions taken by a Trader. Circles indicate the state of the intent at any given time.

Note that traders’ requests can expire or be canceled. For example, if the Hedger fails to open the position within the specified deadline, the Intent may expire. Traders can also cancel unfilled intents as well, triggering a response from the Hedger within a forced cancellation cooldown period. If the Hedger does not respond to a cancellation request, third parties may force-cancel the Intent.

From a non-technical perspective, this process is described in the steps shown below:

Once a position has been opened a trader can request to close it, either at a limit price or market price, specifying quantity and other parameters. The Hedger fills the close request by monitoring the market for the desired price level and hedging on other venues. If the Hedger fails to fulfill the close request within a set timeframe, third parties may force-close it, potentially incurring penalties. If either the trader or the Hedger faces liquidation during the position, actions are taken to close and cancel corresponding positions to mitigate losses.

| Trader Request Types | Additional Events |

| Send Quote (Limit/Market): Initiates a trade request with specific parameters. | Force Cancel: Allows forced cancellation of intents. |

| Request To Cancel: Requests cancellation of unfilled quotes. | Force Cancel Close: Allows forced cancellation of close requests. |

| Request To Close (Limit/Market): Requests closure of a position. | Force Close: Allows forced closure of unfilled close requests. |

| Request To Cancel Close: Allows cancellation of pending close requests. | Expire Quote: Marks the expiration of unfulfilled market requests. |

| Liquidate User/Position: Facilitates liquidation if balances can’t cover Unrealized Profit and Loss. |

SYMMIO’s permissionless and lightweight protocol empowers Market Makers to devise their unique Market Making and Hedging strategies, facilitated by the protocol’s minimal rules governing Intent or Quote structures and responses. This flexibility allows for infinite customization, fostering fair competition and long-term sustainability while optimizing trade executions for traders.

Market Makers, through frontends and APIs, can use their strategies by providing market lists, bid-ask spreads, and preferences in liquidation fees and funding rates. SYMMIO imposes no requirements, offering customizability to adapt to evolving market dynamics and individual preferences.

From the protocol’s perspective, virtually any custody or collateral solution can be used to interact with secondary markets. Similarly, each Hedger contributes to a vast array of potential “hedger flows,” forming a dynamic ecosystem of competing strategies and market interactions. This diversity of Hedgers underscores the protocol’s open-ended nature and the diverse approaches available within SYMMIO.

Fundamentally, the responsibilities of Hedgers in SYMMIO include the following operations:

Hedgers should prioritize a high response rate to uphold the integrity of the system and enhance user satisfaction. A typical flow for a Hedger on SYMMIO would be:

SYMMIO is a collaborative venture involving Market Makers, Exchanges, and development teams from DEUS, MUON, dSynths, and Cloverfield. Since inception, the vision has been to bridge the efficiency gap between centralized and decentralized exchanges.

The idea was conceptualized in 2020 by Lafachief, but the actual implementation involved an iterative process with almost 3 and a half years dedicated to research and development.

On-chain derivatives face efficiency issues due to the underlying limitations of AMMs (high slippage) and on-chain orderbook (high gas costs). To solve these problems, SYMMIO balances speed and capital efficiency by employing a peer-to-peer OTC system.

By using an OTC system, SYMMIO can also prevent being exposed to the challenges that result from the use of oracles, which are often used by derivative exchanges to fetch asset prices. Among these problems we find oracle manipulation attacks and front-running issues.

In addition to that, the protocol provides users with a trustless and self-custodied experience. By leveraging market makers, SYMMIO also has the potential to offer a more cost-effective trading experience than standard CEXs.

SYMMIO is presented as a solution designed to offer an unrestricted platform for creating, issuing, and trading derivatives, facilitating seamless integration between Centralized Finance (CeFi) and Decentralized Finance (DeFi), bridging diverse blockchains, and enabling trustless agreements without regulatory barriers.

The vision behind SYMMIO is to gradually transition from a reliance on external intermediaries and traditional trading platforms to becoming a self-sustaining, decentralized derivatives economy. This vision is driven by the recognition that the success of a crypto protocol depends not only on real-time effectiveness but also on a long-term perspective.

For that to become a reality, the vision can be split out into 4 stages:

Derivatives represent the majority of the trading volume for most asset classes. They are crucial for hedging risk, enhancing market efficiency, and accessing previously inaccessible assets and liquidity. However, on-chain derivatives markets have historically been subject to the risks of market manipulation and centralization, highlighting the significant volume difference between centralized and decentralized derivatives exchanges.

Traditional derivatives platforms like Binance and DyDx handle liquidity concerns when users close their trades through their orderbook models. In these systems, trading perpetual futures contracts doesn’t involve the actual acquisition of physical assets; instead, traders interact with virtual representations of assets tied to the platform. Liquidity is essential for trading derivatives like perpetuals, but it’s limited to the platform where the contracts are traded. This can create challenges for newcomers to challenge established players, as liquidity tends to concentrate on platforms with the most trading activity.

Emerging models in DeFi like Virtual Automated Market Makers (vAMMs), such as GMX, offer innovative solutions by allowing users to trade against an Oracle price combined with the liquidity pool. This eliminates the need for a concurrent buyer when selling, creating a more adaptable model than traditional order books. However, this design can be capital inefficient and lacks pricing power.

The value proposition of SYMMIO is to bridge liquidity from centralized exchanges to an on-chain environment. Traders benefit from improved liquidity and reduced trade execution costs compared to existing on-chain offerings.

We can differentiate between 3 main designs that are currently used by on-chain derivatives markets, and we will identify and define their main flaws below:

Unlike platforms offering derivatives facilitated with either an AMM or on-chain orderbook, SYMMIO introduces the concept of “Automated Markets for Quotes” (AMFQs) for derivatives DEXs, offering efficient handling of on-chain orders, particularly for derivatives, futures, and perpetual trading.

SYMMIO’s peer-to-peer system facilitates direct user trading, bypassing oracles and enabling efficient, secure, and speedy transactions. This makes it possible to achieve settlement speeds of 5-10 seconds, ensuring a seamless trading experience.

Up until now, the standard method through which users interact with smart contracts on a chain is by crafting and signing transactions, passing this data in a specific format to execute a state transition on the underlying chain. However, the advent of intents is changing this paradigm.

Nevertheless, creating transactions can be complicated, as it is a process that involves handling gas, nonces… and this gets even more convoluted in a multichain world. This leads to a suboptimal UX and users end up losing value to more sophisticated users which have more information, such as arbitrage or MEV bots (front-running, backrunning, sandwich attacks…).

Intents arose to solve those exact problems. Informally, an intent is simply a signed set of declarative constraints which allow a user to outsource transaction creation to a specialized third party. By signing and sharing an intent, a user is effectively granting permission to recipients to choose a computational path on their behalf (see figure below).

With intents, users are able to simply express a desired outcome while outsourcing the task of best achieving that outcome to sophisticated third parties. This contrasts with today’s imperative paradigm of submitting transactions on-chain, where every parameter is explicitly specified by the user and involves gas costs and slippage.

Intents shift the focus from specifying every transaction detail to defining what you want to achieve. You set the goal, and someone else figures out the best way to make it happen. This way, instead of managing every step of the process yourself, you delegate the execution details to a Solver or a third party. They handle the complexity of optimizing the outcome for you – they are responsible for aggregating intents and producing valid transactions.

SYMMIO doesn’t just compete against other DEXs on-chain, but also against CEXs like Binance or Coinbase. The competitive advantage lies in providing a highly competitive environment, with liquidity providers acting as intermediaries.

This setup where liquidity providers compete against each other in offering a better execution price (by hedging their inventory in other venues or exchanges) results in increased market efficiency and lower costs for end-users. As a result, the protocol outsources efficiency to more specialized market actors and professional market makers.

Unlike other DEXs that rely on oracle price feeds to quote asset prices on-chain, SYMMIO allows for intermediaries called “Hedgers” to offer competitive prices. These hedgers can interact with CEXs like Binance, managing risk effectively and optimizing their portfolio by capturing arbitrage opportunities.

Intent-centric protocols simplify the user experience by allowing users to express their desired outcome without specifying each step. Third parties then compete to find the most efficient way to fulfill the user’s intent. This approach shifts the power back to users and eliminates the need for them to navigate complex processes and fees on their own.

This flexibility is impossible in permissionless systems that simply fetch asset prices from an oracle, since funds in those DEXs can’t leave the contract for centralized exchange use.

Traditional crypto trading relies on orderbooks, but on-chain order books face technical constraints and front-running risks. SYMMIO takes a different approach, avoiding on-chain order books and utilizing an innovative OTC AMFQ system. By adopting a peer-to-peer OTC system, SYMMIO can sidestep the oracle problem, protecting against front-running and improving throughput.

The way this system works is very similar to how clearing houses settle trades in traditional finance. Clearing houses are financial institutions designed to reduce counterparty risk and ensure fairness in transactions. Effectively, the clearing house is the counterparty to both buyers and sellers, centralizing the settlement process and minimizing direct relationships. Once the trade is confirmed, they oversee the settlement process, ensuring the transfer of financial instruments and funds. This enhances market integrity by maintaining transparent records, managing defaults, and maintaining the stability of markets.

| Symmetrical Agreements | Isolated Trading | Capital Efficiency |

| Every SYMMIO trade forms a Symmetrical Agreement between Party A and Party B. Each side’s position mirrors and counterbalances the other, ensuring that one side’s gain results in the other’s loss, and vice versa. | In SYMMIO, all trades are isolated from each other, preventing frontrunning and MEV.

Since trades are self-contained instances, losses cannot extend beyond the involved parties |

By isolating risk between two parties, the protocol can facilitate asset swaps without relying on AMM (which causes slippage), or on-chain orderbook (which incurs high gas costs) |

SYMMIO’s core design is decentralized, ensuring a trustless environment. It avoids the pitfalls of fully centralized exchanges, where manipulation and trust issues can arise. By forcing both parties to lock collateral on-chain, SYMMIO eliminates counterparty risk, offering a hybrid model that combines the strengths of both centralized and decentralized systems.

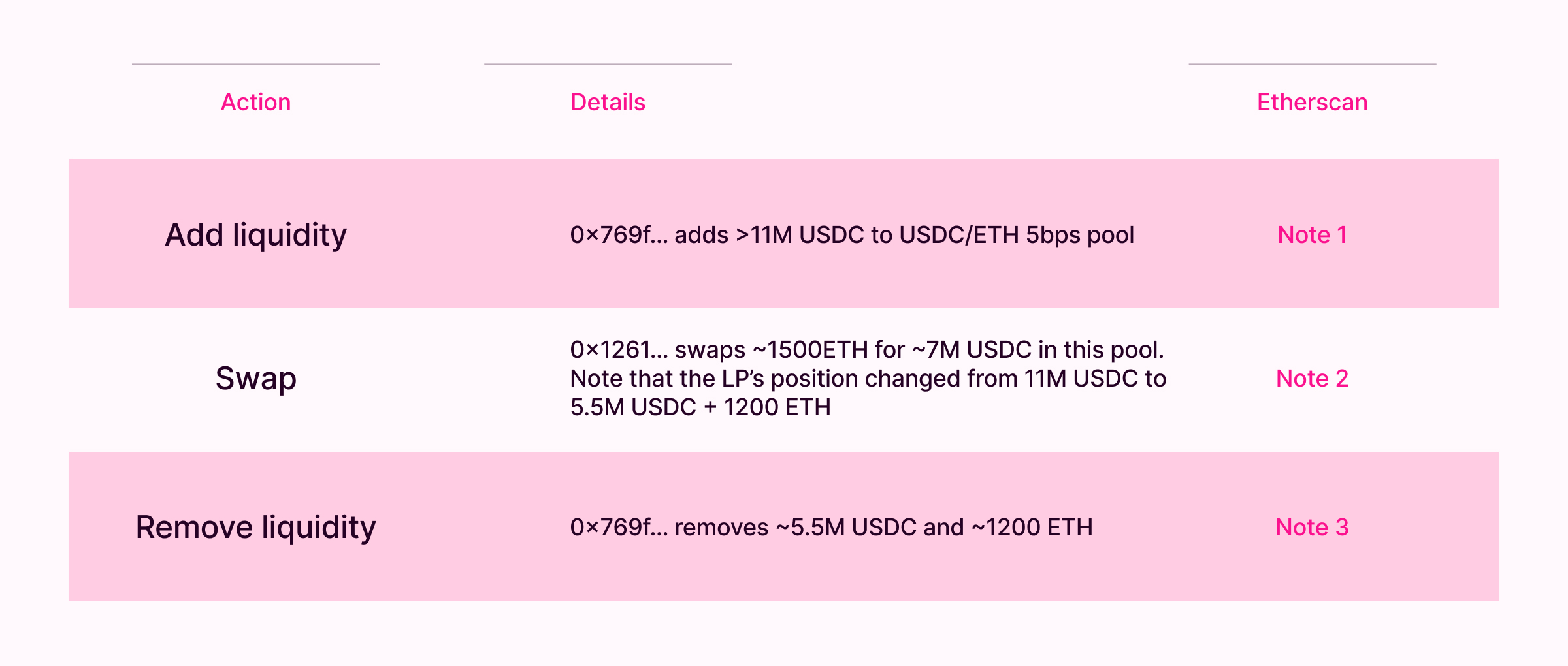

Contrast this with the toxic flow to which LPs on AMMs are subject to. As an example, consider the amount of value that is extracted from this passive liquidity with techniques such as JIT, represented below:

Just-in-time (“JIT”) liquidity refers to a specific type of LP strategy whereby an LP:

Simultaneously, the LP would complete a hedging transaction in a different liquidity venue to offset their inventory risk, earning the difference between the transaction fees associated with the hedge and the LP fee from the Uniswap pool.

In the case of SYMMIO, by moving all of this off-chain, the system protects against losses to MEV and toxic flow from arbitrage trades executed against LPs, causing them to lose capital to more informed actors. The reason for that is because in an OTC market liquidity is often provided directly and exclusively by dealers to inquiring clients as quotes.

In DeFi, capital efficiency is a critical metric defining a platform’s effectiveness. It gauges how well deposited capital generates returns or facilitates transactions.

Unlike other LP-centric models that facilitate peer-to-pool contracts, SYMMIO takes an approach where risk is isolated on a per contract basis. Therefore, each Symmetrical Agreement has its own risk profile, since they are isolated instances between two parties.

Another advantage that this approach unlocks is increased capital efficiency while bypassing the limitations of on-chain limit order books. SYMMIO’s peer-to-peer transactions are similar to order books where one party’s short position corresponds to another party’s long position.

Through an Automated Market for Quotation (AMFQ), SYMMIO can offer one of the greatest TVL to maximum Open Interest ratios in the industry.

The reason for that is because it can sidestep the throughput limitations of on-chain orderbook while providing a similar user experience.

SYMMIO removes the conventional obligation for overcollateralization to cover for potentially significant profits of successful traders. All elements are isolated, and as each short position is equally counterbalanced with long positions, tail-end risk is effectively eliminated.

For comparison, if we were to consider a peer-to-pool model and there is a large imbalance in the market (too many longs vs too many shorts), the pool that provides liquidity would need to be overcollateralized to cover potential profits.

As an example, consider a situation where long positions exceed short positions, and a surge in the overall market induces significant losses for the LP. By design, these systems necessitate substantial excess capital to alleviate these losses.

SYMMIO’s system, on the other hand, mitigates this requirement, facilitating a much larger proportion of the capital to be actively involved in trading, instead of just being a “safety cushion”

Instead of requiring overcollateralization, SYMMIO provides true leverage for both traders and market makers.

Liquidity providers (LPs) do not require overcollateralization due to the isolation of each trade, eliminating tail-end risks found in unsound systems. In SYMMIO, every long position is counterbalanced by a corresponding short position, resembling a perpetual OrderBook model.

This is possible because in SYMMIO market makers contribute a base amount of capital upfront and must provide additional collateral if the position moves against them. By operating on a peer-to-peer basis it can treat market makers like typical users if they fail to provide sufficient collateral. This incentivizes market makers to rebalance their trades quickly, significantly increasing capital efficiency.

By isolating each position, SYMMIO replicates how orderbooks work in traditional markets, such that every short position has a corresponding long position – hence the name SYMMIO.

One of the advantages of SYMMIO is that its capital efficiency is further underscored when we take into account that it can offer more “exotic” pairs than other derivatives protocols.

SYMMIO allows users to trade the entire offering of Binance’s Futures Market, which offers more than 200 trading pairs.

For long-tail assets with lower liquidity, this property highlights how can SYMMIO can maintain a consistent Open Interest to TVL ratio across different trading pairs, showcasing its ability to maintain capital efficiency regardless of liquidity.

RFQ systems can enhance the existing capabilities of DeFi, facilitating trading for less liquid assets and handling large orders with minimal price impact.

Offering RFQ as a service aligns with SYMMIO’s core focus of bridging liquidity from traditional financial markets to on-chain trading. It ensures that liquidity from traditional markets, where it is abundant and cost-effective, can seamlessly integrate into on-chain trading environments while maintaining transparency and security.

SYMMIO targets enhancing the efficiency, transparency, and accessibility of financial derivatives through its decentralized netting framework. Use cases can span across exchanges, enabling decentralized exchanges without the need for aggregated liquidity, and generalized drivers for seamless DeFi transactions. It facilitates advanced trading functionalities, including trading bots with stop limits, and supports contracts for difference (CFDs) for a more transparent market. SYMMIO can also be used for gamifying derivatives, allowing game developers or online casinos to incorporate financial elements without regulatory burdens. Additionally, it can introduce solutions for credit rating verification, interest rate derivatives, and the innovative use of portfolios as collateral through NFT tokenization.

Although request-based technologies are still in early stages, SYMMIO offers compelling advantages. It boasts lower fees, more assets, deeper liquidity, and reduced price impact compared to competitors and other DEXs on-chain.

Liquidity providers can hedge risk on centralized exchanges, achieving delta neutrality, while end-users benefit from cost-efficiency. As a result, SYMMIO thrives in a decentralized and competitive environment where liquidity providers compete against each other’s risk management techniques. This approach results in lower fees, increased asset variety, and reduced price impact for end users.

When it comes to a growth strategy, the key for SYMMIO is to increase the number of integrations, enabling other DEXs to tap into its liquidity. On this note, liquidity on SYMMIO is request-based, allowing liquidity providers to be active on multiple platforms, which promotes scalability.

Ultimately, the end goal for SYMMIO is to be relied upon as the go-to Software as a Service (SaaS) solution that powers various DEXs. For that purpose, its standout characteristics include:

By offering trading infrastructure, SYMMIO can capture large scale volume from multiple frontends. While there are similar intent-based systems like 1inch Fusion, Uniswap X or Cowswap, SYMMIO’s focus on derivatives can make it capture a larger addressable market.

SYMMIO does not host its own frontend to enhance the degree of censorship resistance at the core AMFQ technology. Instead, it provides the essential backend infrastructure that facilitates peer-to-peer (p2p) symmetrical trades.

Trading on SYMMIO markets is made accessible through third-party frontends. These decentralized frontends offer users a range of options for engaging with the SYMMIO infrastructure and utilizing its technology for on-chain derivatives exchanges.

Hence, SYMMIO is currently accessible (but not limited to) on BNB Chain, Base, and Fantom through different third-party frontends.

SYMMIO’s strict B2B model provides the infrastructure for developers and exchanges to harness DeFi opportunities without delving into backend complexities. For those looking to launch a SYMMIO frontend or create markets using the SYMMIO Tech Stack, the platform recommends integration options including forking the complete codebase or using available APIs.

Users are advised to choose frontends based on personal preference, considering factors such as UI, UX, available features, tools, and the liquidity or product offerings of the Frontend Operator.

SYMMIO contracts function autonomously within the on-chain environment, independent of any off-chain actions undertaken by hedgers. This isolation shields the protocol from any external issues that may arise from off-chain systems, centralized exchanges, or other hedging mechanisms, ensuring the integrity and reliability of the on-chain derivatives trading platform.

Trading does not take place directly via https://symm.io

SYMMIO is meant to be a protocol that provides core infrastructure for other projects and teams to build on top. This allows third-parties to build on-chain derivatives leveraging SYMMIO’s matchmaking engine.

Note that the team that built SYMMIO, Symmetry Labs AG, does not run its own frontend either, increasing the decentralization and censorship-resistance of the platform.

To use the protocol, users will directly interact with frontend interfaces run by different operators. Each of these operators will leverage the SYMMIO execution engine in a specific way to fit their particular use case (perpetuals, P2P derivatives…).

Below we provide a link to a series of frontend operators. This list is only for informational purposes – it is neither conclusive nor endorsed. Some of the currently operating frontends include IntentX, Thena, or Based Markets.

Frontend Operators: https://www.symm.io/frontends#frontends

Frontend providers offering DEXs and market markets are the main targets for onboarding. DEXs can benefit from fee generation for token holders by white labeling SYMMIO Perps, while Hedgers and market makers are attracted by the opportunity to benefit from greater turns (since they don’t need to lock their liquidity inside orderbooks and can hedge on CEXs).

SYMMIO is an intent-based permissionless derivatives trading protocol that defines how Intents and Quotes should be created, structured, requested, or accepted. It works as trading infrastructure that is needed to establish an interactive and trustless contract between two parties who interact in a permissionless manner.

This contract disintermediates between both parties by managing their collateral and regulating how third-party liquidators may intervene by using oracles and flagging parties as “liquidatable” when their collateral is insufficient to fulfill an order.

Each PartyB has the freedom to adopt their own hedging strategy or choose to remain directionally exposed. However, certain rules ensure fairness within the system.

The primary connection between PartyA and PartyB is through on-chain contracts. Hedgers must monitor requests made by PartyA on the blockchain and respond via on-chain calls to SYMMIO core contracts. Hedgers also interact with PartyA through front-end interfaces, streaming quotes, funding, collateral requirements, and other notifications to enhance user experience. These connections aim to provide real-time updates on positions, intentions, and execution statuses, reducing the time from request to execution.

While providing additional information to PartyA is optional, streaming quotes to frontends is mandatory in the current frontend architecture to ensure fast executions and improve user experience.

Traders are active participants in SYMMIO by interacting directly with frontend providers, submitting trade requests to SYMMIO through the UI of derivatives exchanges.

You can find below a comprehensive of various request types available for traders within the system and how Hedgers should address them:

| Request Type | Summary |

| Send Quote (limit) | PartyA initiates a trade request with specific price and quantity parameters, aiming for a limit trade on a symbol. They utilize the sendQuote function, providing essential details like price, quantity, Market Maker (MM), Credit Valuation Adjustment (CVA), and Liquidation Fee (LF). |

| Send Quote (Market) | PartyA requests a trade similar to limit orders but with slippage based on the current market price. This type of trade has a limited expiration time, providing the Hedger with a specific deadline to fill requests. Partial fills are not allowed in this type of request. |

| Request To Cancel | PartyA seeks to cancel their unfilled quotes. If no hedger has locked their request, it’s immediately accepted. However, if a hedger has locked their quote, the hedger has a designated period (Force Cancel cooldown) to either fill the quotes or accept the cancel requests. |

| Request To Close (limit) | PartyA initiates a request to close their position with specific parameters such as quantity and price, indicating their desire to close a position at a limit price. |

| Request To Close(Market) | PartyA requests to close a position similar to requesting a quote but with a price including slippage and an expiration time. In this type of request, requesting a market close for a part of a quote and partial filling the close request is not meaningful. |

| Request To Cancel Close | After PartyA makes a request to close, they have the option to cancel their close request before the hedger fills it. The hedger has a designated time to respond to such requests, or the cancel close requests will be enforced. |

SYMMIO operates on a top-down model, where off-chain actions by hedgers have no influence on on-chain events. This delineates a clear separation between off-chain hedging activities and on-chain protocol operations.

The role of Hedgers in SYMMIO is two-fold, encompassing the provision of liquidity on-chain and the pursuit of profit opportunities off-chain. Meanwhile, the protocol contracts function independently of any off-chain actions performed by a Hedger, and are not influenced or impacted by any of their off-chain actions.

Since quotes in SYMMIO are committed off-chain to frontends by Hedgers, Liquidity Providers don’t need to lock any capital on-chain until they receive a trade request from a user.

For those considering becoming a Hedger on SYMMIO, two options are available. Hedgers can either invest capital into existing hedger services (private loan) or establish their own hedging operations on the platform.

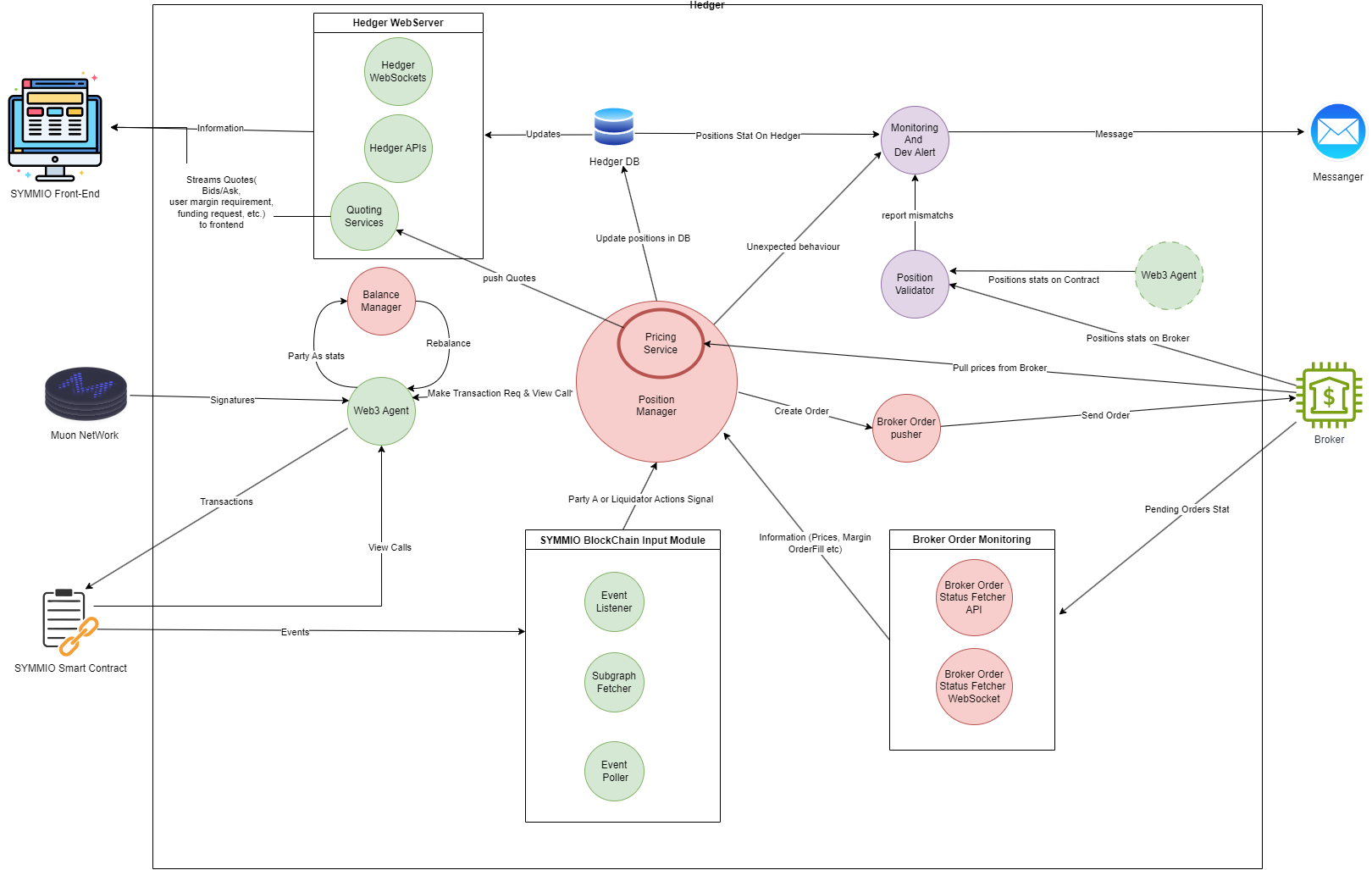

An example of a recommended architecture for a Hedger is presented in the image below to serve as a reference, although the specific implementation will vary from one party to another.

Circles represent software microservices within the Hedger system. It is recommended to have backup services and ensure maximum isolation between them, facilitating communication via message brokers like RabbitMQ and Redis. This way, any malfunction in one service will minimally impact the rest of services in the system.

While each Hedger is free to implement the strategy of their choice, an example strategy would be a delta neutral strategy that eliminates directional exposure to asset prices.

For instance, a delta neutral Hedger would initiate a trade on SYMMIO by first opening a direct countertrade on their chosen platform, such as Binance. They would then scan user requests and accept or reject to enter a bilateral agreement. Once accepted they will deposit collateral on-chain to fill a trader’s request.

Trades are executed sequentially, with the on-chain order filled only after the hedging counterpart is confirmed. Conversely, the trade is closed after the hedging trade is conclusively settled.

Market Makers in SYMMIO play a pivotal role, shouldering specific responsibilities essential for maintaining market liquidity and stability. They ensure that there is always a buy and sell price for assets, facilitating trades even in the absence of a direct counterparty, which enhances market depth and liquidity. For that, they are tasked with quoting buy and sell prices, contributing to the price discovery process and helping stabilize market prices.

Market makers are independent parties that manage their risk exposure through hedging strategies to remain solvent and continue their operations, even in volatile market conditions.

One of the keys for their profitability strategies is to offer narrow spreads (the difference between the buy and sell prices) to attract more traders and increase the trading volume that is routed through them as a result.

Note that market makers have the obligation to fulfill trade orders at their quoted prices, ensuring that trades are executed promptly and efficiently. They must manage their collateral effectively to ensure they can meet their obligations, as well as adhere to the specific rules and protocols set by the trading platform, including mechanisms for liquidations and settlements.

The SYMMIO SDK offers the necessary tools for developers to interact with SYMMIO’s contracts and integrate its trading engine into their exchanges. It provides transaction encoding, error handling, and state management.

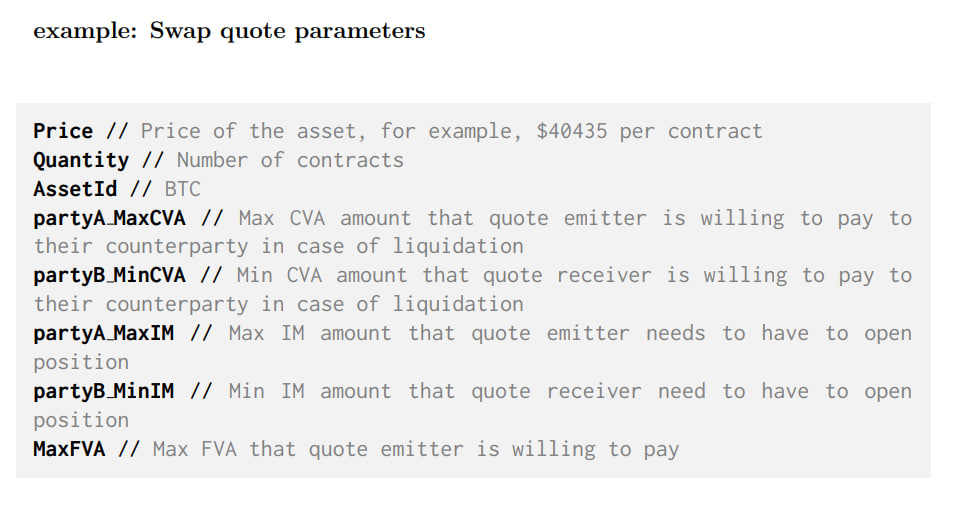

Note that SYMMIO uses what’s called an n-dimensional order system, enabling liquidity providers to offer quotes for an unlimited variety of markets.

An example of a quote is displayed below:

SYMMIO is a B2B (Business to Business) platform and does not operate or host any frontend, focusing on providing the technical infrastructure for others to build trading exchanges on top.

Interested parties can seamlessly integrate SYMMIO’s exchange infrastructure into their existing or new exchanges. This is done by using provided APIs or the SDK for the SYMM client, facilitating a smooth integration process.

Initially, SYMMIO aims to bridge liquidity from CEXs to an on-chain environment, offering premium liquidity conditions justified by a more secure on-chain setup. The goal is for SYMMIO to reach a point where it can offer liquidity conditions comparable to CEXs in a secure on-chain environment.

Utilizing AMFQ technology allows market makers to deploy liquidity more efficiently than traditional order book systems. This combination of competitive liquidity prices and additional fees justified by the secure on-chain environment aims to result in user costs similar to centralized exchanges.

| Fee Type | Description |

| Opening Fee | A fee of 3 basis points (0.03%) charged at the opening of a position. |

| Closing Fee | A fee of 3 basis points (0.03%) charged at the closing of a position. |

| Platform Fee | Fee adjusted based on global trading volumes, reducing as volumes increase. Charged when a position is initiated, supporting platform upkeep. |

| Hedger Spread & Fees | Autonomously set by hedgers, factored into quoted prices on the platform. Competition among hedgers benefits end users with competitive pricing. |

| Bilateral Agreement Funding Rate | Negotiated during the intent request phase, determined by the contract administrator. Applied at designated periods for each symbol. |

| Liquidator Fee | Compensation for risks associated with liquidation processes on the platform. |

| Counterparty Valuation Adjustment (CVA) | Penalty levied during liquidation phase, remitted to counterparty to compensate for potential losses or risks. |

| Frontend Fees | Charged by frontend providers at their discretion. Users may experience varying fee structures depending on chosen frontend. |

Opening and closing fees are set at 3 basis points each, charged at the opening. Market Makers enjoy a spread of 0, while users can utilize $SYMM tokens to reduce their fees.

Platform fees are adjusted based on global trading volumes, with reductions triggered as volumes increase.The idea behind this is to reduce fees as the protocol gains more market share. This fee is charged to traders when a position is initiated on the platform. It contributes to the upkeep and management of the SYMMIO platform.

Hedgers set their own fees and spread. They have the autonomy to set their own spreads and fees, which are factored into the quoted prices on the platform. This introduces competition among hedgers, ultimately benefiting end users by providing competitive pricing options.

Bilateral agreements also account for a funding rate. Given that external platforms impose funding rates, both parties in SYMMIO also negotiate a funding rate during the intent request phase. The contract administrator determines the period for each symbol. When this designated period arrives, the hedger may either request or disburse the funding rate.

A Liquidator Fee is also present to compensate for the risks associated with liquidation processes on the platform.

There is Counterparty Valuation Adjustment (CVA) as well. This is a penalty that is levied during the liquidation phase. The party subjected to liquidation is required to remit this fee to their counterparty as compensation for potential losses or risks incurred.

Frontend fees are charged and set by frontend providers at their discretion. Therefore, users may experience varying fee structures depending on the frontend they choose, fostering a diverse and flexible environment.

Frontend providers also have the ability to reduce the fees they pay to staked $SYMM holders keep some profit for themselves entering a profit sharing agreement with SYMMIO.

Overall, traders can expect fees of 10-12 basis points for opening and closing trades, shared between SYMMIO, hedgers, and white labeling. Additional interest rates, such as borrowing or funding costs, may be around 10% depending on the context.

The SYMMIO Fee Sharing Program is designed to support and reward frontends that build on SYMMIO by offering them fee rebates. This program is structured to encourage the holding of $SYMM tokens and increase the platform’s overall volume, contributing to the growth of SYMMIO.

Fee rebates are a return of a portion of the transaction fees to the frontends. Frontends are eligible for fee rebates based on their monthly transaction volume or their holdings of $SYMM tokens as a percentage of the total token supply, as outlined in the table below:

| Monthly Volume (or Daily Equivalent) | $SYMM Holdings (% of Total Supply) | Fee Rebate |

| $10M | 0.0625% | 30% |

| $25M | 0.125% | 40% |

| $50M | 0.25% | 50% |

| $100M | 0.5% | 60% |

| $1B (34M/day) | 1% | 70% |

| $10B (167M/day) | 2% | 80% |

| $30B (333M/day) | 4% | 85% |

These rebate thresholds are adjustable to ensure alignment with the interests of frontends and the SYMMIO network.

The first five frontends participating in the program will receive special deals through the Early Adopter Program, earning a 60% profit share from the start. The early adopters are Thena, Based Markets, IntentX, and Cloverfield. Profits generated through these third-party frontends will be collected and distributed in the first month following the TGE of $SYMM.

Trading fees are fully distributed to staked $SYMM holders.

$SYMM is the native token of the SYMMIO platform, with a total supply of 880,080,088 tokens. It is designed to incentivize participation, enhance user experience, and govern the platform’s future direction. The Token Generation Event (TGE) for $SYMM is officially planned for 2024.

Stay informed on how to get $SYMM:

Utility of $SYMM

Moreover, $SYMM ownership grants governance rights, allowing for participation in decision-making through future voting systems. This governance model aims to democratize platform development and policy-making, ensuring a community-centric approach to SYMMIO’s evolution.

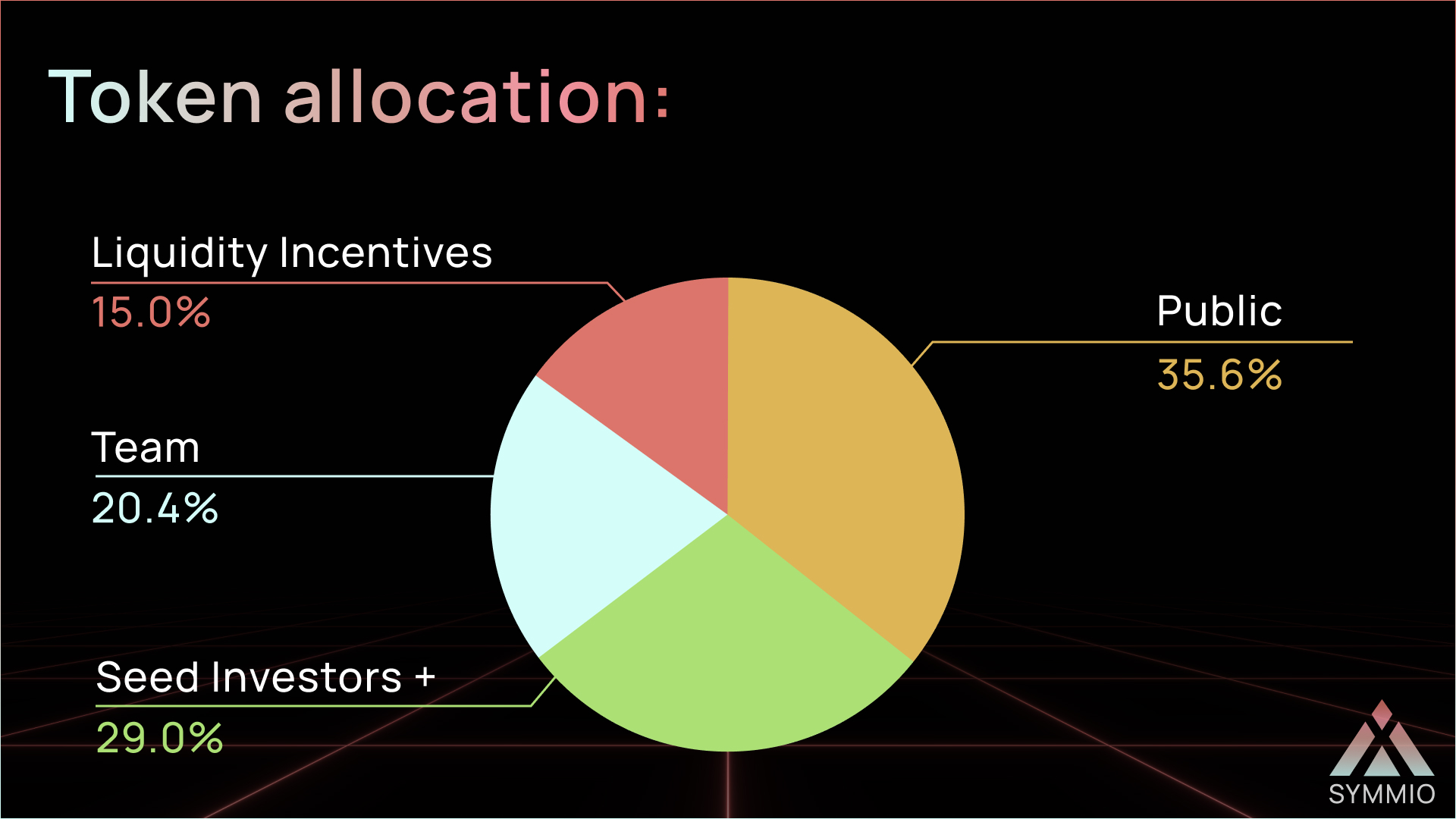

$SYMM has a defined total supply with a strategic distribution plan to support the ecosystem’s growth and ensure a balanced allocation for various stakeholders.

The total supply of $SYMM tokens is 880,080,088, and the allocation is distributed as follows:

These allocations are designed to align with SYMMIO’s long-term objectives, rewarding early backers, enabling the team, and establishing a strong community of $SYMM holders.

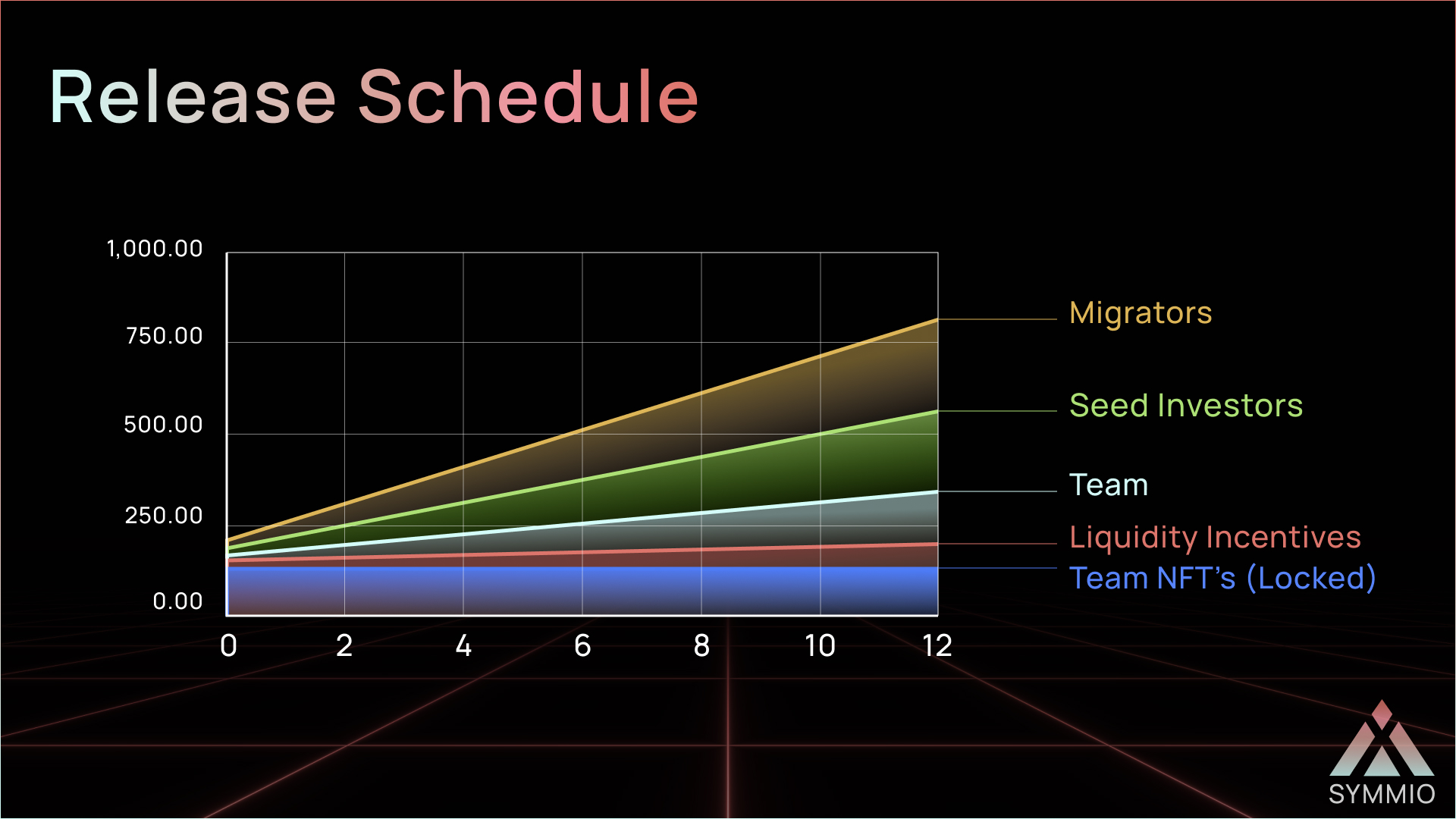

A total of 748,000,000 $SYMM tokens, representing 85% of the total supply, are allocated for distribution to Migrators (Public), Seed Investors, and the Team. This portion will vest linearly over 12 months, ensuring a steady supply entering the market.

Deflationary Measures and Inflation

The emission schedule and the interplay of high APR, deflationary token burning, and the distribution of farming incentives collectively aim to establish a sustainable and balanced economic model for $SYMM, promoting a healthy ecosystem for all participants.

By staking $SYMM, token holders can indefinitely receive a full share, which is 100%, of all protocol revenue generated across all frontends. This aligns the interests of the stakers with the overall success and growth of the platform, creating a direct correlation between the platform’s usage and the potential rewards for stakers..

SYMMIO aims for fully on-chain governance, giving token holders ultimate decision-making power.

The initial team of contributors was only involved in setting up the initial structure. Once this groundwork is laid, the SYMM DAO will take over, driving all future developments and decisions. This transition will signify the platform’s shift from its foundational stage to a community-governed entity.

The initial team will not step away entirely post-setup; instead, they will continue to actively propose enhancements and updates they deem beneficial for the platform. However, the acceptance and implementation of these proposals will be subject to the approval of $SYMM token holders.

The SYMM DAO will function as the embodiment of the $SYMM token holders’ collective will, with governance rights exercised through future on-chain and off-chain snapshot-based voting systems. This ensures that every token holder has a voice in the protocol’s direction and that the platform remains responsive to its community’s needs and aspirations.

Note that intent-based applications involve more than just a new message format for interacting with smart contracts, they also involve propagation and counterparty discovery mechanisms. Hence, it is not trivial to design a mechanism for intent discovery and matching which is incentive-compatible and not centralizing at the same time.

While intents are an exciting new paradigm for transacting, they might increase risk of centralization if improperly managed, potentially resulting in the entrenchment of rent-seeking middlemen. That being said, SYMMIO’s codebase in itself remains agnostic to the off-chain operations and actions performed by Hedgers.

From a counterparty risk perspective, the worst case scenario involves a single party executing intents, creating a monopolistic environment where the Hedger or market marker would be able to extract value from traders. This is because in the face of a monopolist, individual users end up losing negotiating power. Hedgers might also want to mitigate their counterparty risk by diversifying across multiple exchanges and OTC desks.

Like other on-chain systems, SYMMIO also exposes users to smart contract risk. Despite ongoing audits, there is no way to fully eliminate this risk. While audits aim to identify and mitigate vulnerabilities, the possibility of unforeseen issues persists.

As a Hedger, you should also be aware that the trading system responsible for scanning the chain, streaming data to frontends, and executing delta-neutral positions on Binance may encounter failures. While liquidity providers develop and maintain these systems, there’s a need for robust security measures to safeguard against potential failures. Guidance and experience gathered from previous operations can aid in implementing these measures effectively.

Insufficient liquidity in derivative markets can lead to wider bid-ask spreads, increased slippage, and reduced market depth. As a result, traders may face challenges in executing trades at desired prices, resulting in adverse selection.

SYMMIO relies on external price oracles to obtain real-time market data for derivatives. Manipulation of oracle feeds or reliance on inaccurate data sources could lead to the incorrect closing of positions.

SYMMIO’s contracts were audited by Sherlock in a contest. Sherlock operates differently compared to other auditors in the space by using both traditional audits and a competition where many security experts look for issues in code, aiming to catch as many problems as possible by offering money for finding bugs. Unlike most audit firms that rely on reputation to convince protocol teams of their value, Sherlock offers something more substantial: $USDC. If a contract audited and covered by Sherlock faces a bug bounty payout or exploit, Sherlock’s staking pool can pay out $USDC to cover the bug bounty or part of the exploit, providing a stronger incentive for thorough auditing than just relying on reputation.

In the audit contest organized for SYMMIO’s contracts, Sherlock received 51 issue submissions, with 2 classified as high severity, 5 as medium, and 39 as invalid. A total of 27,600 $USDC was awarded with 11,500 $USDC designated for the contest pool, an additional 14,500 $USDC for the Lead Senior Watson xiaoming90, and 800 $USDC each for the Judging Pool and Lead Judge 0xnevi.

Bug Bounty

SYMMIO’s bug bounty tiers are structured to address varying levels of severity, with rewards and requirements as follows:

SYMMIO classifies potential smart contract vulnerabilities across five levels, ranging from critical to none, with critical issues including governance manipulation, direct theft of funds or NFTs, and protocol insolvency. The classification extends to high, medium, and low levels, covering a spectrum from theft of unclaimed yield to contract inefficiencies without value loss, with payouts handled directly by the SYMMIO Team or DAO, denominated in $USDC or $SYMM.

The protocol was developed by Symmetry Labs A.G., and consists of about 30 contributors. The founder of the protocol is doxxed, below is the list of team members of SYMMIO:

Note that Symmetry Labs A.G does not operate or offer any frontend service in order to ensure censorship resistance.

The SYMMIO team’s experience spans decentralized stablecoins, oracles, and derivatives research during 2019-2020, aiming to develop an on-chain derivatives system, initially termed “v0.1” (a vAMM-based model). This prototype could trade up to 500 assets, with its economic structure similar to GLP, a product by GMX. A key feature was a bonding curve-based liquidity pool that balanced unrealized profits and losses (uPnL) against an ETH reserve, highlighting the variety of tradable assets and liquidity on secondary platforms.

Encountered vulnerabilities in the vAMM model pointed towards concerns over its long-term sustainability, shifting the team’s focus to quote-based bilateral OTC derivatives, leading to the development of SYMMIO. Alongside, they developed “v0.2” (vAMM-v2), enhancing the liquidity pool to support traders’ uPnL through under-collateralized minting of a stablecoin, similar to the Gains Network v1 model.

Both iterations inadvertently made token holders de facto counterparties, limiting their trade execution autonomy. This experience, inclusive of the challenges faced with platforms like GMX and the Gains Network, deeply influenced SYMMIO’s development, culminating in an Intent-Based solution for Symmetrical Contracts.

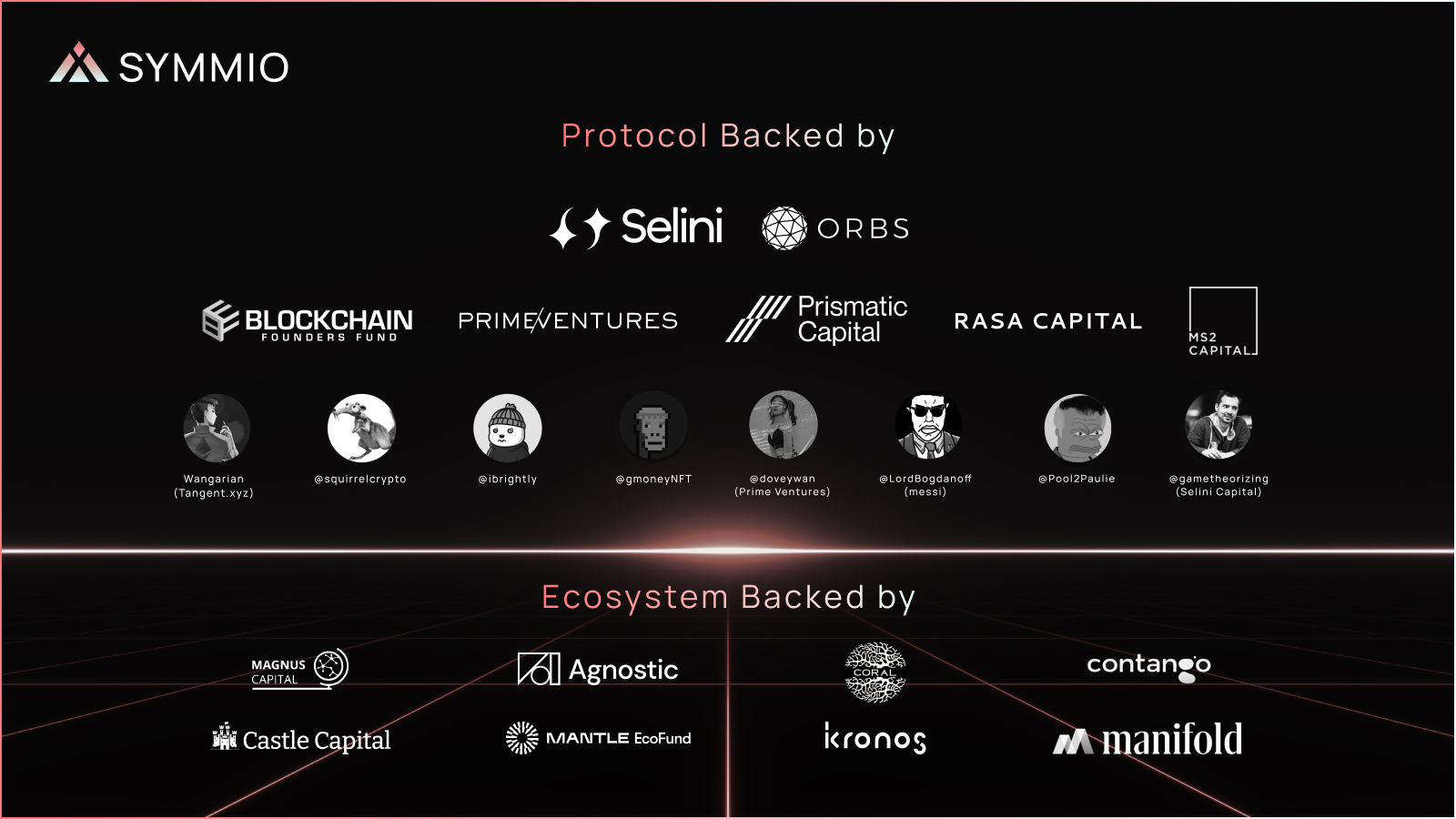

SYMMIO closed a successful $1.1M funding round led by 0x_Messi (LordBogdanoff) and a robust group of investors including MS2 Capital, Gametheorizing (Selini Capital), Wangarian (Tangent), GMoney, IvanBrightly, Pool2Paulie, Squirrel, Prime Ventures & DoveyWan, Blockchain Founders Fund, and Prismatic Capital. A significant portion of the investment ($500,000) will enhance SYMMIO’s In-House Solver, aiming to increase open-interest by $5M.

Moreover, the capital infusion is set to foster key partnerships and a token swap with IntentX, promising future collaborations that extend SYMMIO’s functionalities and industry connections. With the newly acquired funds, SYMMIO’s operational runway has been extended, providing a solid foundation for focused development and expansion efforts. The team is also engaging in negotiations with market makers and exchanges, planning to use only 4.85% of its existing token supply to minimize dilution for stakeholders. This demonstrates a commitment to minimizing dilution for existing stakeholders and token holders while strategically positioning SYMMIO in the market.

What is SYMMIO?

SYMMIO is a protocol for creating and trading digital derivatives in a permissionless, on-chain manner. It introduces “Symmetrical Contracts” for trustless and permissionless settlements of digital derivatives, aiming to enhance market diversity and competition.

How do Symmetrical Contracts work?

Symmetrical Contracts enable trading based on n-dimensional order books, allowing for customizable derivatives beyond just price. This framework supports matching orders based on multiple parameters, such as duration, leverage, and underlying assets.

What makes SYMMIO different from existing DeFi platforms?

Unlike traditional DeFi platforms that rely on liquidity pools or automated market makers (AMMs), SYMMIO uses an intent-centric execution environment, a peer-to-peer escrow system for settlements, and involves MEV researchers (Arbiters) for verifying solvency and mediating disputes.

How does SYMMIO handle market manipulation and risk?

SYMMIO addresses market manipulation and risk by using decentralized oracles for price feeds, an intent-based trading mechanism to minimize manipulation opportunities, and a P2P escrow system to manage counterparty risk effectively.

Can SYMMIO trade any type of asset?

Yes, SYMMIO is designed to allow for the synthetic trading of virtually any asset, supported by its flexible architecture that can accommodate a wide range of market demands and rule sets.

What role do Arbiters play in the SYMMIO ecosystem?

Arbiters, or economically motivated MEV researchers, play a crucial role in verifying the solvency of positions and mediating disputes, ensuring the integrity and smooth functioning of the trading platform.

Symmetrical Contracts: Symmetrical contracts are financial agreements between two parties that stipulate terms for the exchange of assets or cash flows, with both parties having equal rights and obligations.

Bilateral Agreements: Contracts made between two parties, where each party agrees to perform certain actions or fulfill specific obligations outlined in the agreement. These agreements are characterized by their dual nature, meaning they involve reciprocal commitments and responsibilities between the parties involved.

Intent: Intents are signed user requests that define a set of declarative constraints which allow a user to outsource transaction creation to a third party without relinquishing full control to the transacting party. By signing and sharing an intent, a user is effectively granting permission to recipients to choose a computational path on their behalf.

Hedger System: The system designed to facilitate derivatives trading on the blockchain by connecting traders (PartyA) with market makers or hedgers (PartyB) through on-chain contracts and front-end interfaces.

Oracles: Independent entities or servers that provide reliable external data to the blockchain, enabling smart contracts to execute actions based inputs from off-chain information.

Counterparty Valuation Adjustment (CVA): A penalty levied during the liquidation phase, requiring the party subjected to liquidation to remit this fee to their counterparty as compensation for potential losses or risks incurred.

Hedger Buyouts: Hedger buyouts refer to the process wherein a hedger, typically a market maker or liquidity provider, purchases or acquires a position or contract from another party within a trading or derivatives market. This transaction involves the hedger assuming ownership or control of the position or contract previously held by another party, often in exchange for a negotiated price or consideration.

Market Makers: Participants who provide liquidity to the market by offering to buy and sell assets at certain prices, ensuring that trading can occur smoothly.

Liquidations: The process of closing out positions that no longer meet the required margin requirements, ensuring market stability and reducing systemic risk.

Close-out Netting: A financial arrangement where offsetting positions or obligations are consolidated into a single net obligation, reducing the number of transactions needed for settlement.