Pendle is a DeFi yield-trading protocol that allows users to execute yield management strategies in order to increase or decrease exposure to sources of yield. By creating a market for DeFi yield, Pendle enables users to long assets at a discount, hedge against yield downturns, long yield, or fix yield rates for stable growth among other strategies.

Pendle consists of two main components:

As a yield-stripping protocol, Pendle innovates by introducing the concept of Standardized Yield Stripping, a composable and permissionless mechanism that splits a yield-bearing asset into its yield and principal components.

When users deposit assets into a DeFi protocol, they often can get an APY on their deposit. This return is variable and fluctuates over time. Most often, this position is represented with a yield-bearing asset For example, a user can lend DAI on Compound and will receive cDAI, a yield-bearing asset that entitles them to an APY based on the DAI interest rates on Compound, which determines how much interest borrowers will pay to lenders.

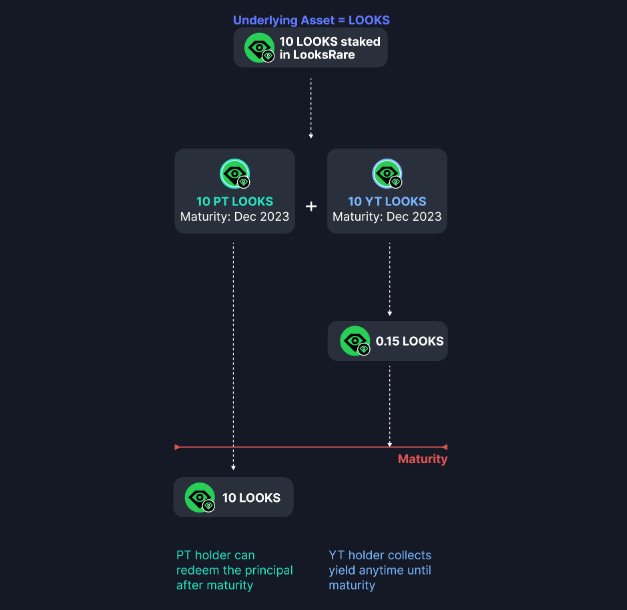

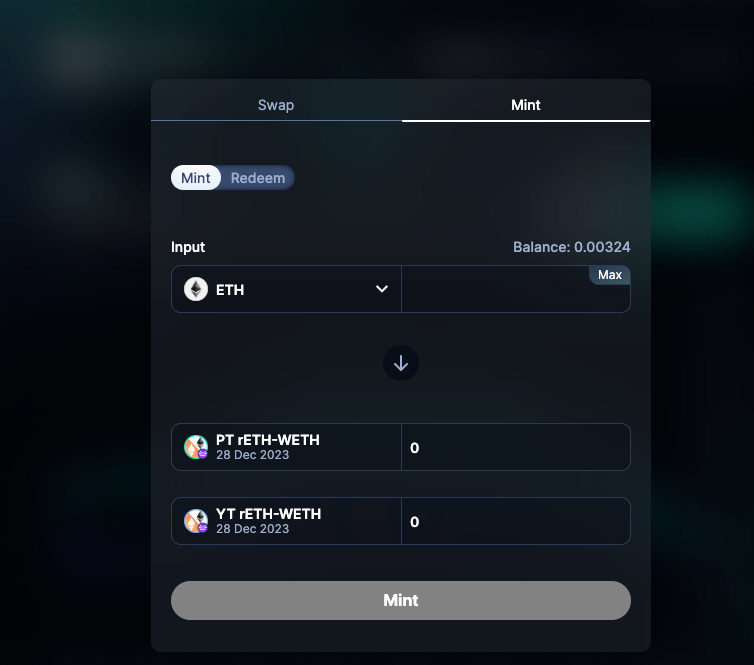

Nearly every protocol returns the user a yield-bearing token for staking or depositing assets into their protocol. This yield-bearing position can then be wrapped into an SY (standardized yield) position. With Pendle, this SY position can be split into two components: the principal (PT) and the yield (YT).

When this yield is tokenized and split into a PT and a YT, there is a maturity associated with the tokenization of the position.

In Pendle, yield-stripping takes place in the context of an SY token and a maturity date. First, Pendle wraps yield-bearing assets into SY tokens (standardized yield tokens). Next, the SY token is split into its principal and yield components: PT (principal token) and YT (yield token) respectively. Finally, PTs and YTs can be traded via Pendle’s custom AMM.

SY is a token standard for yield-bearing assets that are wrapped within smart contracts. All yield-bearing assets can be wrapped into SY tokens in order to have a common interface that favors composability across DeFi applications in a permissionless manner.

This allows yield-bearing assets like stETH, cDAI, or yvUSDC to be wrapped into SY-stETH, SY-cDAI, and SY-yvUSDC respectively.

The conversion from the underlying yield-bearing asset to the SY asset and vice-versa is handled by Pendle automatically and users do not need to take any actions on their end.

Pendle introduced the SY standard to be used by other protocols and created a common interface for interacting and building on top of yield-bearing assets. This resulted in EIP-5155, which standardizes yield-generating mechanisms beyond the capabilities enabled by the ERC-4626 standard for vaults.

The ERC-5155 is an extension of the ERC-4626 that is achieved by covering:

SY tokens can wrap over most yield-generating mechanisms in DeFi, including ERC-4626 vaults.

Examples:

| Yield generating mechanism | USDC lending in Compound | Stake LOOKS in Looksrare | Stake 3CRV in Convex |

| Asset | USDC | LOOKS | 3CRV pool’s liquidity |

| Shares | cUSDC | Shares (in contract) | 3CRV LP token |

| Reward tokens | COMP | WETH | CRV + CVX |

| Exchange rate | Increases with USDC lending yield | Increases with LOOKS rewards | Increases due to swap fees |

A Principal Token (PT) is a unit that can be created (minted), destroyed (burned), or transferred between users and that represents the principal component of an SY token.

1 PT gives the holder the right to redeem 1 unit of the underlying asset after maturity.

At a time t, a user u has a balance of ptBalanceu(t), and the total PT in existence at a time t is ptSupply(t).

uptBalanceu(t) = ptSupply(t)

A principal token, therefore, allows users to get back 1 unit worth of the underlying asset after expiry. Since the final value of the PT is known, PT holders receive a fixed yield on expiry. Because of this, buying PTs is the equivalent of shorting yield, which allows users to make a profit if there is a decrease in the underlying yield.

A Yield Token (YT) is a unit that can be created (minted), destroyed(burned), or transferred between users, and that represents the yield component that is stripped from a SY token.

1 YT gives the holder the right to receive a yield on 1 unit of the underlying asset from the current time until maturity. This yield is claimable in real-time.

At a time t, a user u has a balance of ytBalanceu(t), and the total YT in existence at a time t is ytSupply(t).

uytBalanceu(t) = ytSupply(t)

The Pendle AMM is designed specifically for trading yield and allows users to take advantage of the behaviors of PTs and YTs. It is a Principal token AMM that allows users to buy or sell PTs against the underlying asset.

The curve of the AMM changes in response to the amount of yield that is earned over time and narrows the price range of PT as it approaches maturity.

As the possible price range narrows down the closer the pool is to reaching maturity, this results in more capital efficiency from concentrated liquidity in a specific price range.

Inspired by Notional’s AMM, Pendle’s AMM is able to facilitate swaps between PT and YT using a single liquidity pool. This is achieved with a single PT/SY pool, where PTs can be traded with SY tokens, while YT trades take place via flash swaps in the same pool.

The Pendle AMM supports auto-routing, allowing anyone to trade PTs and YTs with any major asset.

Flash swaps are possible due to the relationship between PTs and YTs with respect to the underlying SY (wrapped yield-bearing token).

PT + YT = SY

The Pendle AMM takes advantage of the negative price correlation between YTs and PTs in order to use the PT/SY pool for YT swaps.

Because of this AMM design, there are minimal effects from impermanent loss. This is because the AMM accounts for the natural price appreciation of PTs by shifting the AMM curve in order to push the price of PTs towards the price of the underlying asset as the maturity date approaches.

The impermanent loss that results from swaps is mitigated as well due to the high correlation that exists between PTs and SY tokens (e.g. PT-stETH / SY-stETH). For instance, if the liquidity is provided until maturity, an LP position will be the equivalent of holding the underlying asset, since the PT will appreciate towards the value of the underlying asset as it approaches the maturity date.

Prior to maturity, PTs trade within a yield range and don’t fluctuate as much as an asset’s spot price. For example, Aave’s USDC lending rate might fluctuate between 0%-15% for a reasonable timeframe. This premise ensures low impermanent loss at any given time, as the price of PTs will not deviate too far from the time of liquidity provision.

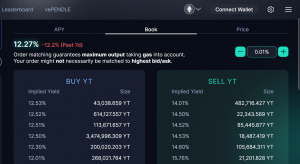

Pendle’s Order Book system is designed to work alongside the Pendle AMM to facilitate peer-to-peer trading of PTs and YTs. The combination of the Order Book and AMM aims to enhance market liquidity and ensure smoother trading experiences for users.

A limit order is a buy or sell order at a specified implied APY, allowing you to trade PT or YT at your precise price points. Limit orders executes if the implied APY of the AMM approaches your specified order APY. When this happens, any further swaps (also known as taker orders) that push the implied APY towards your order will fill the limit order first before interacting with the AMM.

Orders on Pendle can have various statuses:

The protocol also features a flash swap capability between PT and YT in its order book. This means a buy YT taker order can be matched with a buy PT limit order, and a sell YT taker order can be matched with a sell PT limit order. This broadens the potential trading matches, making the trading process more flexible and efficient.

The Pendle AMM is also customizable to support tokens with varying yield volatilities. In general, yields are cyclical and swing between range highs and range lows. This creates a floor and a ceiling for the yield of a liquid asset that is much easier to predict than the spot price.

For instance, the annual yield of staked ETH is likely to fluctuate between 0.5% to 7%. Knowing this data, it is possible for the AMM to concentrate the liquidity within that specific range in order to allow for larger trade sizes with minimal slippage.

The AMM design stands out in terms of capital efficiency:

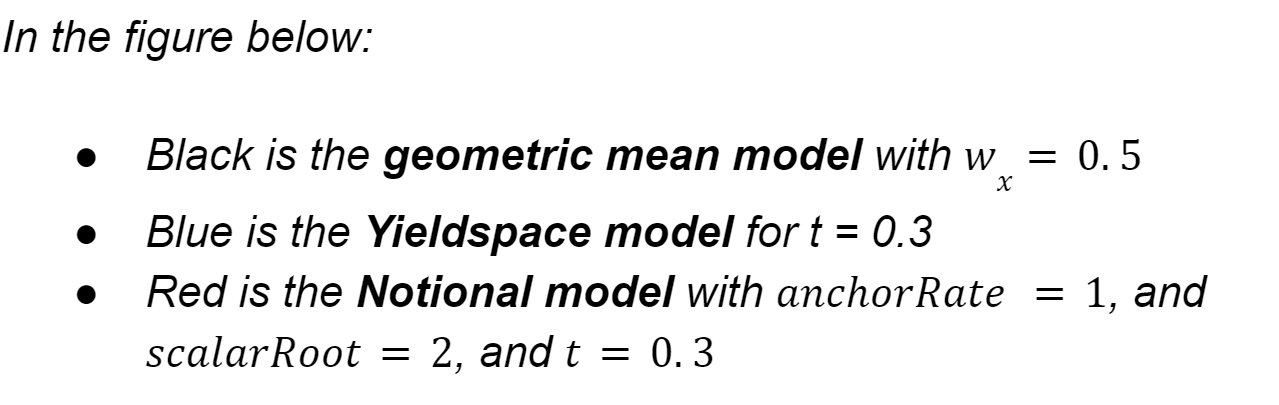

Other yield-stripping AMM models, such as Pendle V1 (based on a constant geometric mean formula) or Yieldspace (based on a constant power sum formula) are not customizable, which means that the AMM is forced to use the same curve for every yield-bearing asset. However, the Pendle V2 AMM was modeled after Notional’s AMM and allows for two custom parameters to be set for each pool: the scalar root and the initial rate anchor. This greater customizability means that the curve for each pool can be more specific to the asset it supports. Read below to learn more about the formulas used by Pendle and other yield-stripping AMMs.

The constant geometric mean AMM trades PTs with the underlying asset based on a constant geometric mean formula.

This model is used in Pendle V1, and APWine, where:

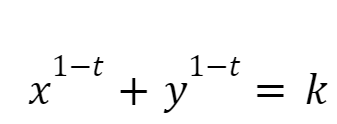

The constant power sum formula used in the Yieldspace AMM trades PTs against the underlying asset based on a constant power sum formula that changes over time.

This model is used in Yield Protocol, Element Finance, and Sense Finance, where:

The Pendle V2 AMM is inspired by the Notional AMM, which is not defined based on a formula on the PT and asset reserves.

![]()

Where rateScalar(t) at a time t is a parameter used to calculate the price at that time

The scalarRoot is a fixed parameter for each AMM pool in order to adjust the trade-off between the capital efficiency of the market and the tradeable range of interest.

And the rateAnchor(t) parameter is used to adjust the interest rate around which trading will be most effective at a given time t. The rateAnchor(t) is, therefore, adjusted before every trade, such that the pre-trade implied interest rate is the same as the implied interest rate after the last trade.

For all 3 models, the asset price in principal at a time t can be written as a function of proportion f(p). Plotting this proportion, it is possible to see how the price (of asset / principal token) moves when users buy/sell principal tokens (hence changing the proportion).

The y-axis represents the implied interest rate (e.g. a value of 1.13 represents a 13% implied interest from the current time to expiry).

The slope of the curve represents how much price (and hence the implied interest rate) is moved by a certain change in the proportion. A gentler slope represents greater capital efficiency, which is achieved by the blue line that represents the Notional model.

The Pendle V2 AMM whitepaper proposed a heuristic in setting the scalar root and initial rate anchor parameters in a Notional AMM pool in order to maximize the capital efficiency for trading a particular yield-bearing asset. This takes the following assumptions:

To compare the capital efficiency between the geometric mean, the yieldspace, and the Notional AMM, the Pendle V2 AMM whitepaper also assumes a fixed amount of liquidity in an AMM and measures how much a user can trade (in terms of principal token amounts) to move the implied rate by a certain amount. This study runs 3 test cases where it simulates fixed yield trading for cUSDC, fixed yield trading for an asset with a very high yield, and fixed yield trading for stETH. From this study, the following conclusions are drawn:

Pendle Earn was introduced on July 18, 2023.

In comparison to the “Trade” view, Earn provides a simpler user experience that is more accessible to new users. It has the same pools, tokens, and contracts, with a streamlined dApp for two main functions:

Pendle Earn is also intended to make integrations easier, with its simpler UI resembling a plug-and-play module for institutional entities to centralized exchanges.

Yield-generating assets are the bedrock of any financial system, both in Traditional Finance (TradFi) and Decentralized Finance (DeFi). Pendle is tackling this vertical with a novel mechanism, standardized yield stripping.

In DeFi, users can put their assets to work and earn yield. The APY they get often fluctuates over time in an unpredictable manner that responds to market forces. By facilitating yield trading, Pendle allows users to maximize their returns, fix their exposure to variable rates, and speculate on where they think the yield of an underlying asset is going to go.

The team has mentioned that there are no fixed roadmaps. However, the following have been mentioned:

The Pendle team consists of the following known members, with some that are anonymous:

Pendle is bringing the TradFi interest rates derivatives market into DeFi. This is a market worth over $400T in notional value in traditional finance. Fixed-yield products play a key role in any financial system. They are critical for providing certainty to withstand market volatility. In DeFi, fixed-yield products allow users to speculate on fixed-yield rates.

Despite the recent development of new protocols tackling this vertical, fixed-income protocols were largely unexplored prior to Pendle’s launch on the Ethereum mainnet in June 2021. Since then, many fixed-income solutions have come to the market in order to provide predictability in yield rates in some way or another. Fixed rates are essential for both individuals and DAOs in order to bring some certainty to their financial planning.

In DeFi, the largest money markets offer exclusively variable rates (e.g. Compound, Aave, Euler, Venus…). They still rank at the top of borrowing and lending protocols in terms of TVL even though fixed-rate protocols like Notional or Yield have entered the market. Fixed-rate products in DeFi, however, can be developed using multiple designs: zero coupon bonds, yield stripping, or interest rate swaps.

Some examples of protocols using zero-coupon bonds include Notional, Yield, or HiFi. These protocols are used to borrow money and provide only one payment (principal + interest) at maturity.

Lending at a fixed rate is equivalent to buying a zero-coupon bond. For example, buying 100 tokens trading at 0.95 USDC/unit is the equivalent of lending 95 tokens at 5.3%. At maturity, the zero-coupon can be redeemed for the value of 1 unit and the user would receive 100 USDC.

Borrowing at a fixed rate is equivalent to minting and selling a zero-coupon bond. If you want to borrow 95 USDC at a 5.3% with a 140% collateralization ratio, then you would need to put at least 95 * 1.053 *1.4 = 140 USDC to mint 100 zero-coupon tokens and sell them at 0.95 USDC/unit to get 95 USDC.

Another alternative for hedging exposure to variable rates is through interest rate swaps. This is being worked on by protocols such as Voltz and Ipor.

With interest rate swaps, a fixed taker can bring in an interest-bearing asset with a variable rate and swap the variable rate for a fixed rate at a given maturity or expiration date. Similarly, a variable taker can provide an initial margin in order to receive the difference between the cash flows of the interest-bearing asset and the fixed rate.

Pendle is a yield-stripping protocol that differentiates itself by proposing a standard method to split a yield-bearing asset into two components: the principal component, and the yield component. This method is known as Standardized Yield Stripping and builds upon the core principles of composability and permissionless use. Other protocols that use a yield stripping model are Element, APWine, Sense, Tempus, Timeless, or Swivel.

To lend at a fixed rate, a trader buys a PT

To borrow at a fixed rate, a trader could borrow on a money market (e.g. Aave, Compound) and buy the corresponding YT so that the cash flows from the YT offset the interest payments on the borrowed side. Hence, the price of the YT reflects the cost of borrowing.

Fixed-rate markets are still in a phase of growth and each one of these designs comes with a series of benefits and tradeoffs for hedging exposure to an underlying source of yield. Overall, the thesis behind these protocols is to achieve a more stable and predictable flow of earnings over a period of time. This is an alternative for users to hedge their exposure to volatility and that provides a viable solution for fixed-income products.

Pendle is deployed on the following networks:

While there is the Avalanche expansion (legacy v1), liquidity for the $PENDLE token there is considerably off-pegged due to the Multichain exploit.

vePENDLE voting is also done only on the Ethereum mainnet, due to its superior security guarantees.

Different strategies exist for different types of users. How each user perceives the future yield payout is what determines what action they will take on the protocol.

As a result, Pendle allows users to maximize their yield even in highly volatile markets.

Since 1 unit of the underlying asset mints 1 PT + 1 YT and 1 PT + 1 YT redeems 1 unit of the underlying asset, there is an obvious price relationship such that:

PT price + YT price = underlying asset price

Limit order function was introduced on January 12, 2024.

It allows users to place buy/sell orders for PT and YT at a specific Implied APY. These swaps can be matched and filled partially or completely through limit orders via the most optimal route after taking swap and gas fees into account. As a result, the Pendle yield market can now function much more efficiently and cost-effectively.

Limit orders are only available on Arbitrum now, and will be supported on other chains soon.

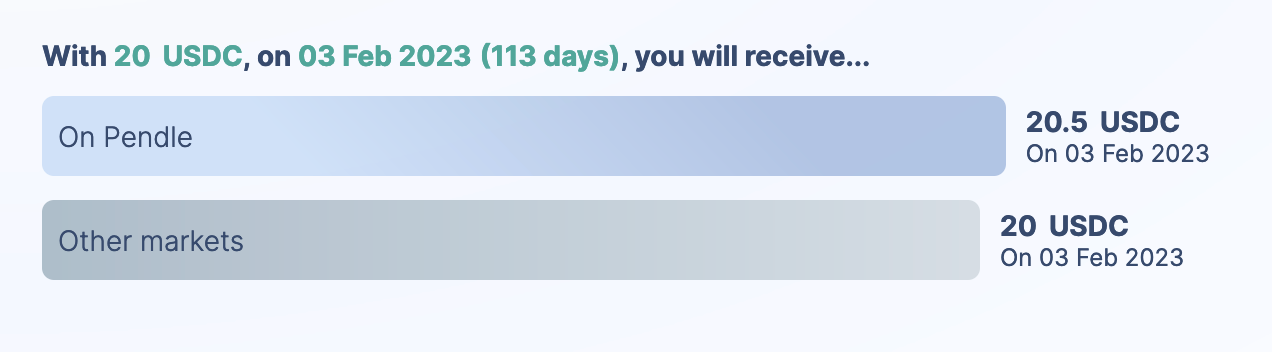

Pendle allows users to buy assets at a discount relative to their market price. This is achieved by splitting yield-bearing tokens into their principal and yield components until a fixed maturity date, represented by a PT and a YT respectively.

For example, if ETH is being sold on Pendle at a 5% discount with a 1-year maturity, a trader can purchase the right to claim 100 ETH in one year for the price of 95 ETH. Once a year goes by, the trader will own 100 ETH. However, the trader can also choose to exit their position before their PT matures by selling the underlying ETH at a discount.

By providing liquidity, users can earn revenue from swap fees. Different pools have different APYs due to the differences in trading volume and PENDLE incentives allocated to each pool (determined via governance and voting).

Liquidity providers have access to the following sources of yield:

When providing liquidity, users have the option to enable the zero price impact mode feature.

When a user provides liquidity on Pendle, a portion of the underlying is used to purchase PTs from the PT/SY pool, and the rest is wrapped into an SY token. This purchase of the PT causes a price impact.

Instead, when the user enables zero price impact mode, the underlying asset is fully wrapped into an SY token, a portion of which is used to mint both PT and YT. The PT and the remaining SY are then used to provide liquidity, with the YT returned to the user’s wallet.

Since there is no purchase of PT, the AMM avoids any kind of price impact. However, the LP will be exposed to price impact if the initial input asset they are providing needs to be swapped into the underlying asset of the pool.

Overview

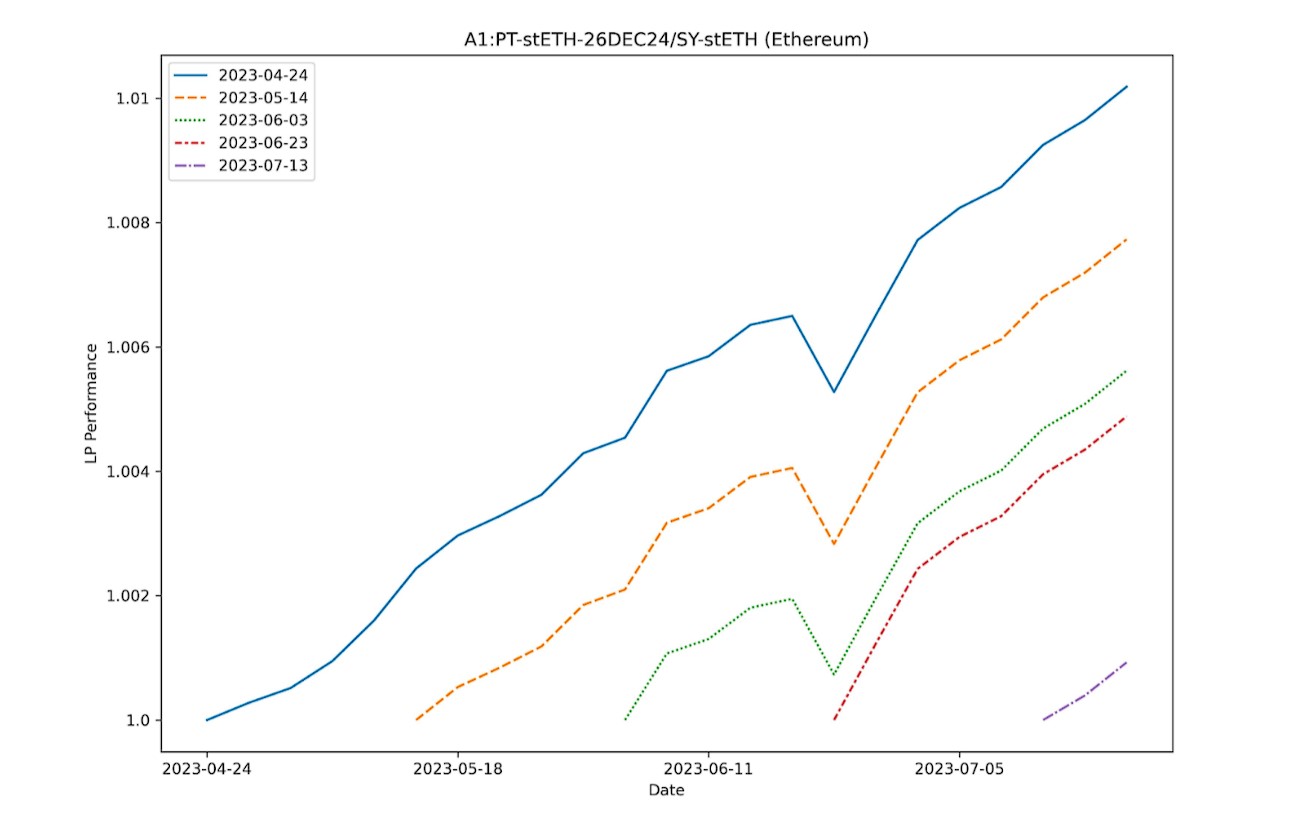

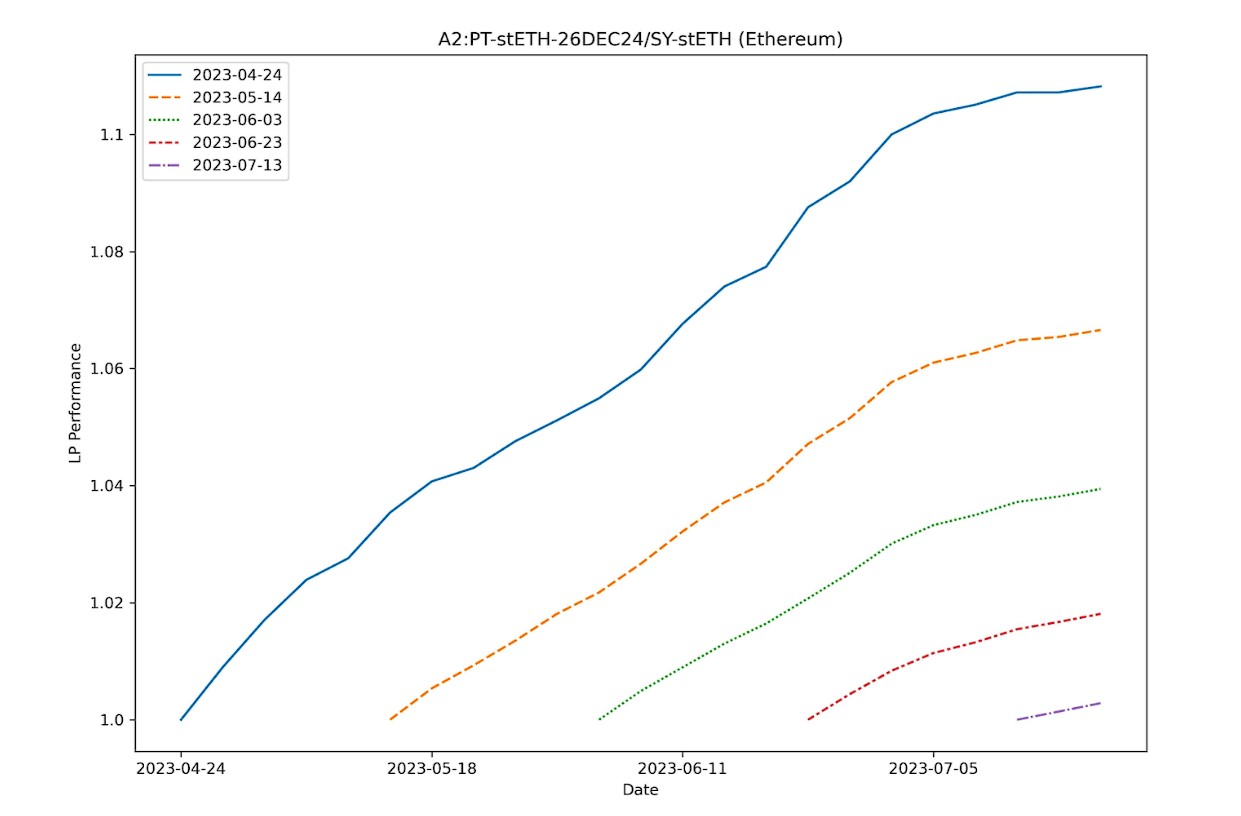

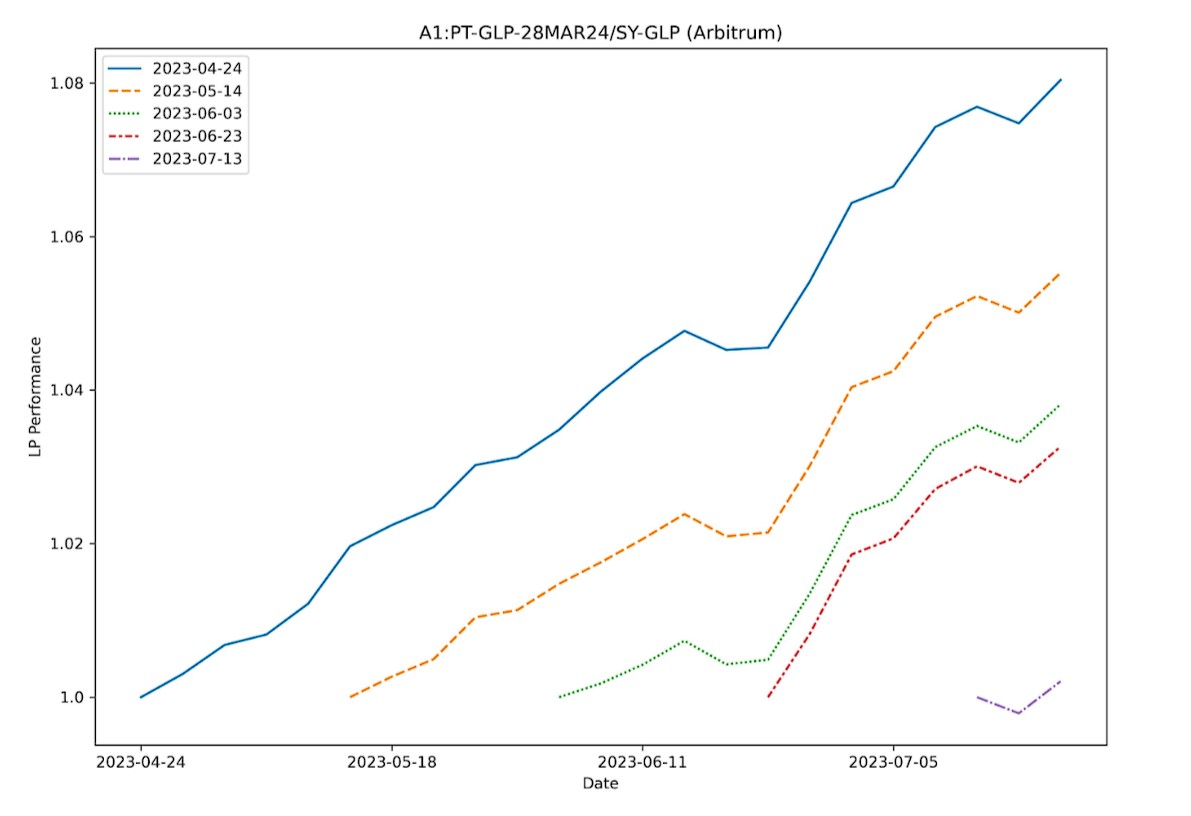

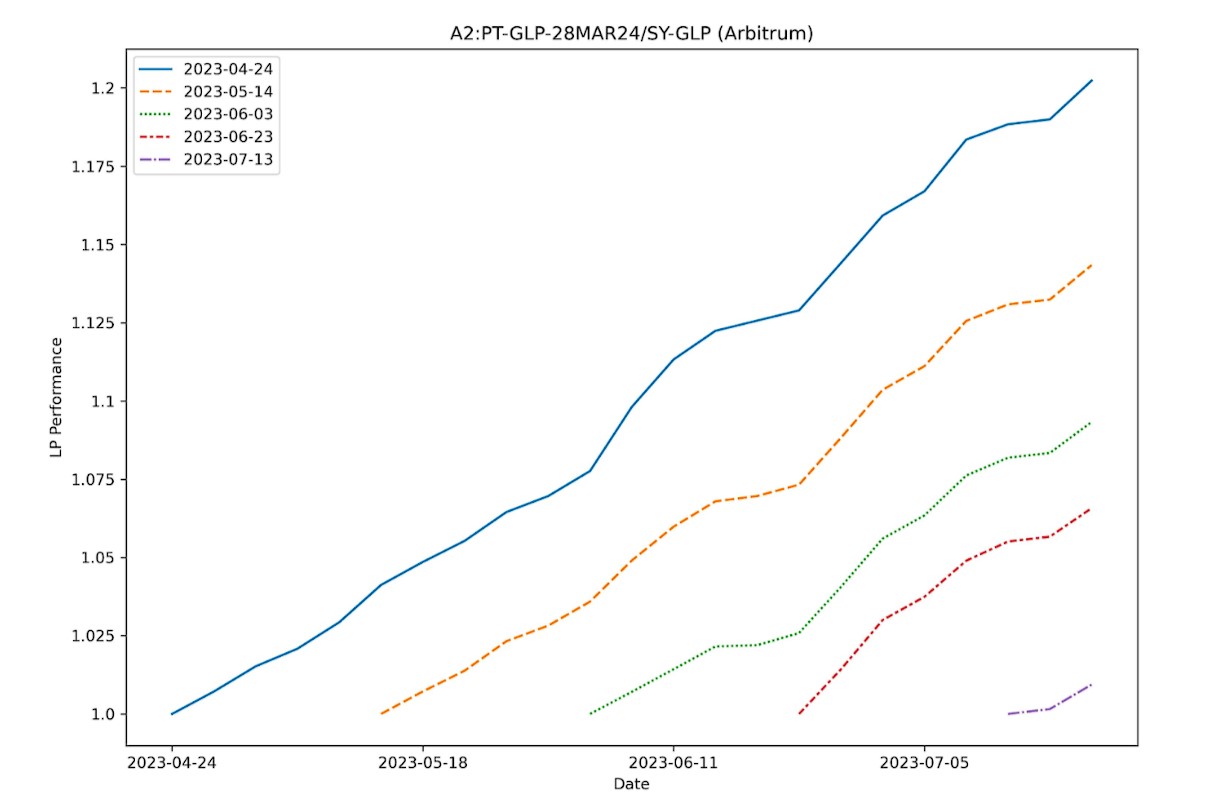

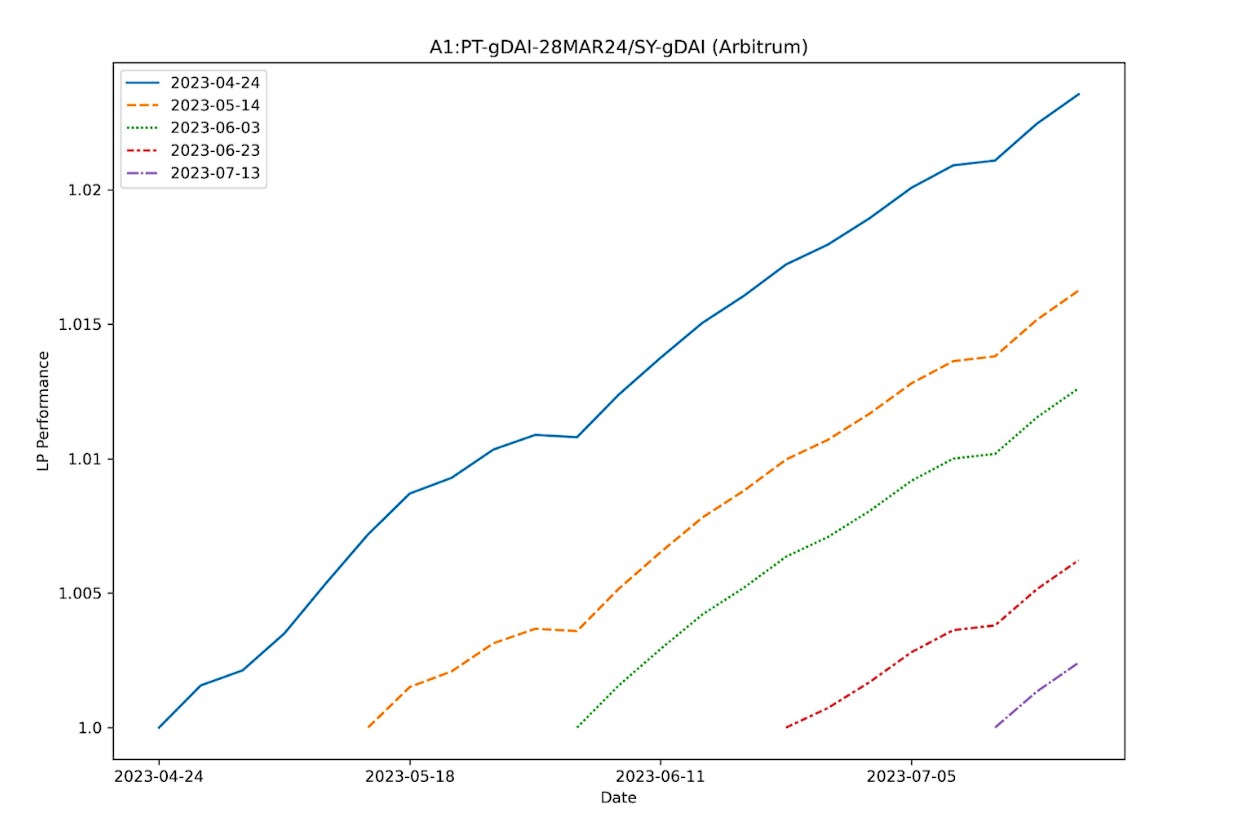

On August 31, 2023, Pendle released its study on the performance of selected pools against the underlying assets. This was done in order to assess whether the single-asset composition of Pendle’s PT/SY LPs is the best form of LPing.

The study was performed on the following pools:

The following approaches were used to evaluate the performance of Pendle’s LPs, with the current study only focusing on approach 1.

The yield of an LP on Pendle was compared against a holder of the underlying assets without receiving any yields.

The performance of a $stETH liquidity provider on Pendle was compared against a naked $ETH holder.

In all cases, $stETH LPs on Pendle outperformed naked $ETH holders even without $PENDLE incentives. There was found to be a positive correlation between a longer deposit duration and outperformance, in this case, an outperformance of 1.02%.

When $PENDLE incentives are included in the scenario, the outperformance increases to 10.82%.

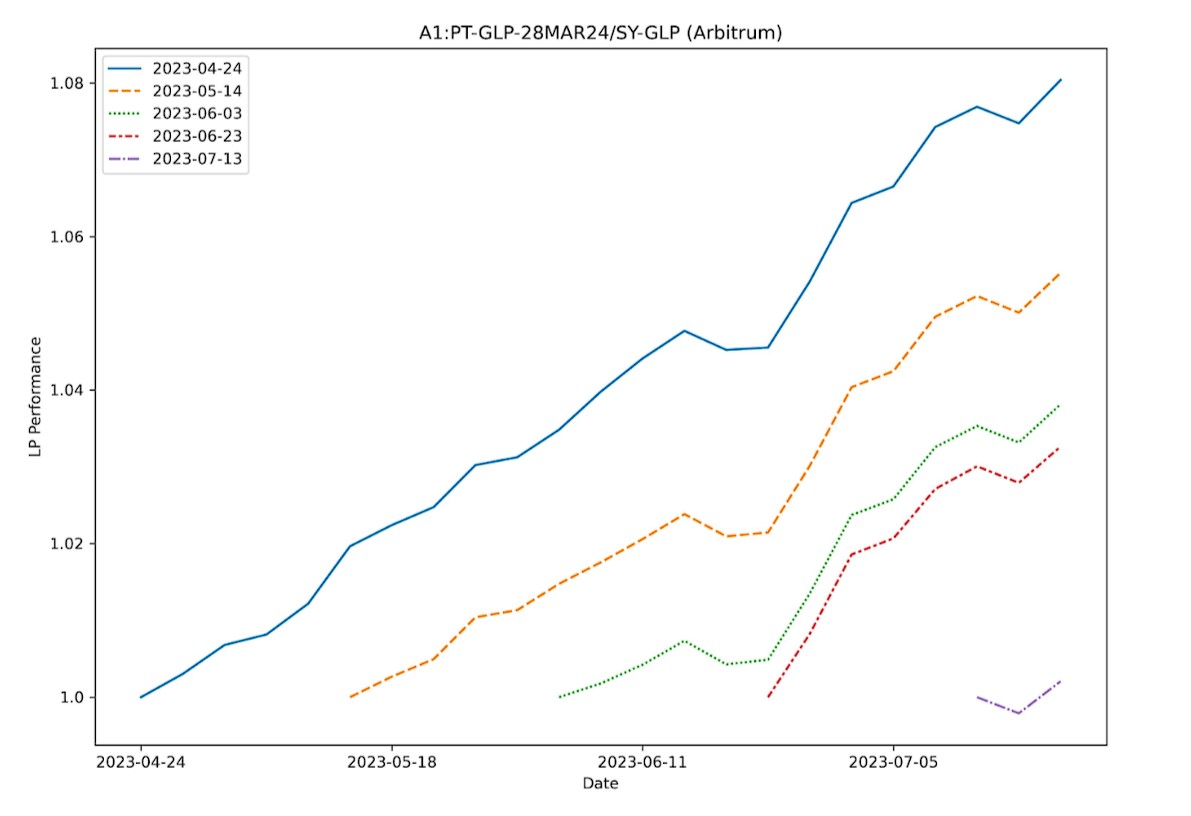

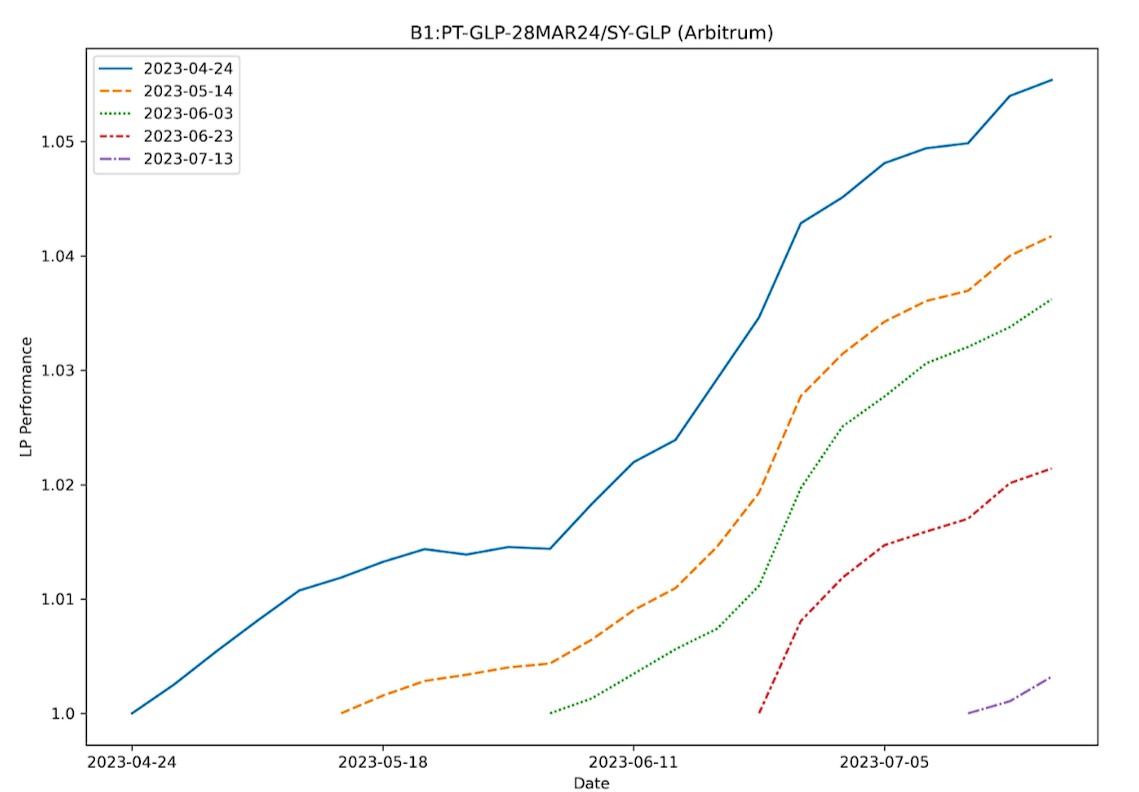

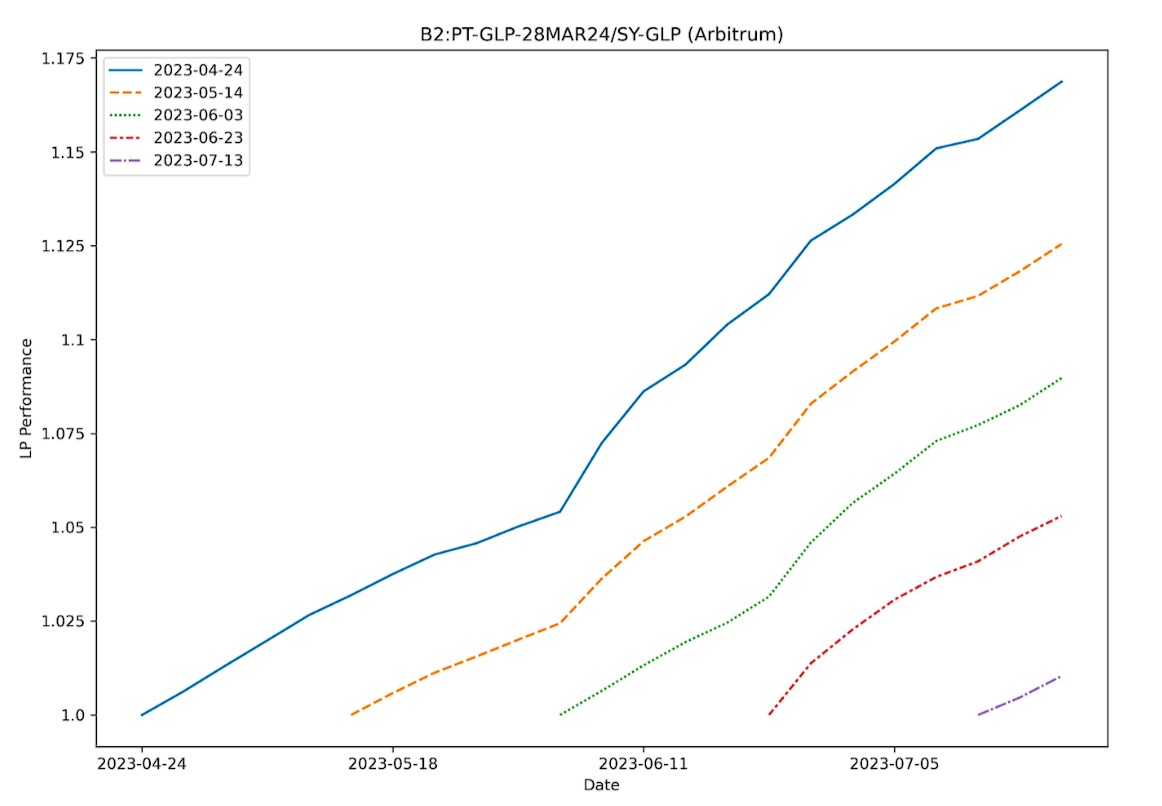

The performance of a $GLP liquidity provider on Pendle was compared against a naked $GLP holder without yield.

In most cases, $GLP LPs on Pendle outperformed naked $GLP holders even without $PENDLE incentives. There was found to be a positive correlation between a longer deposit duration and outperformance, in this case, an outperformance of 8.04%.

When $PENDLE incentives are included in the scenario, the outperformance increases to 20.23%.

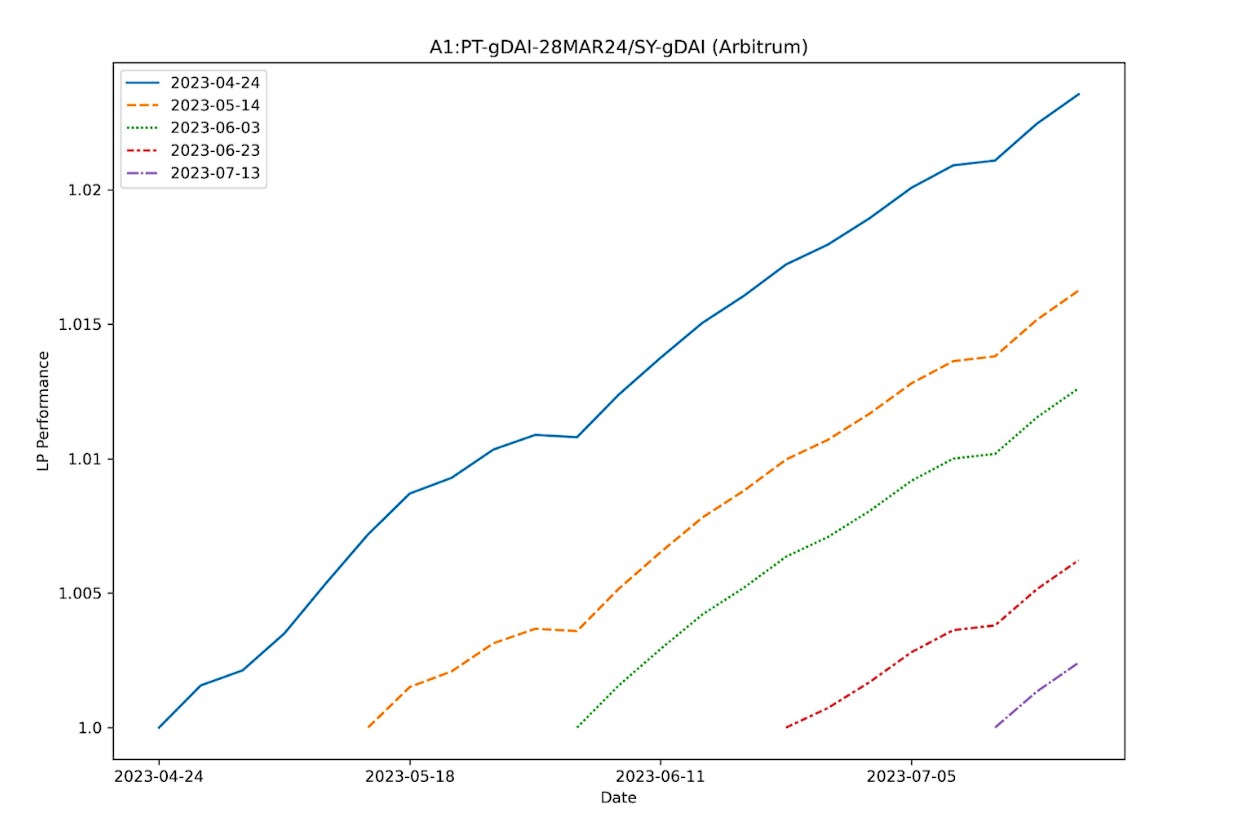

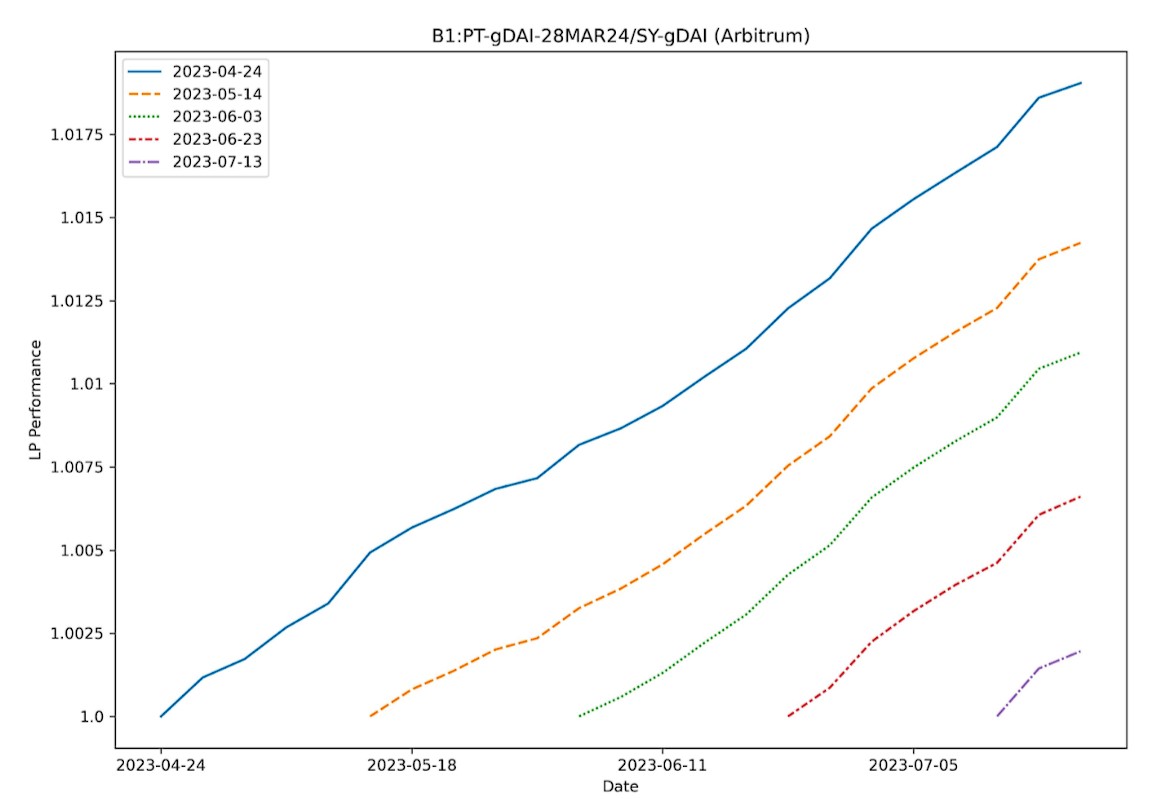

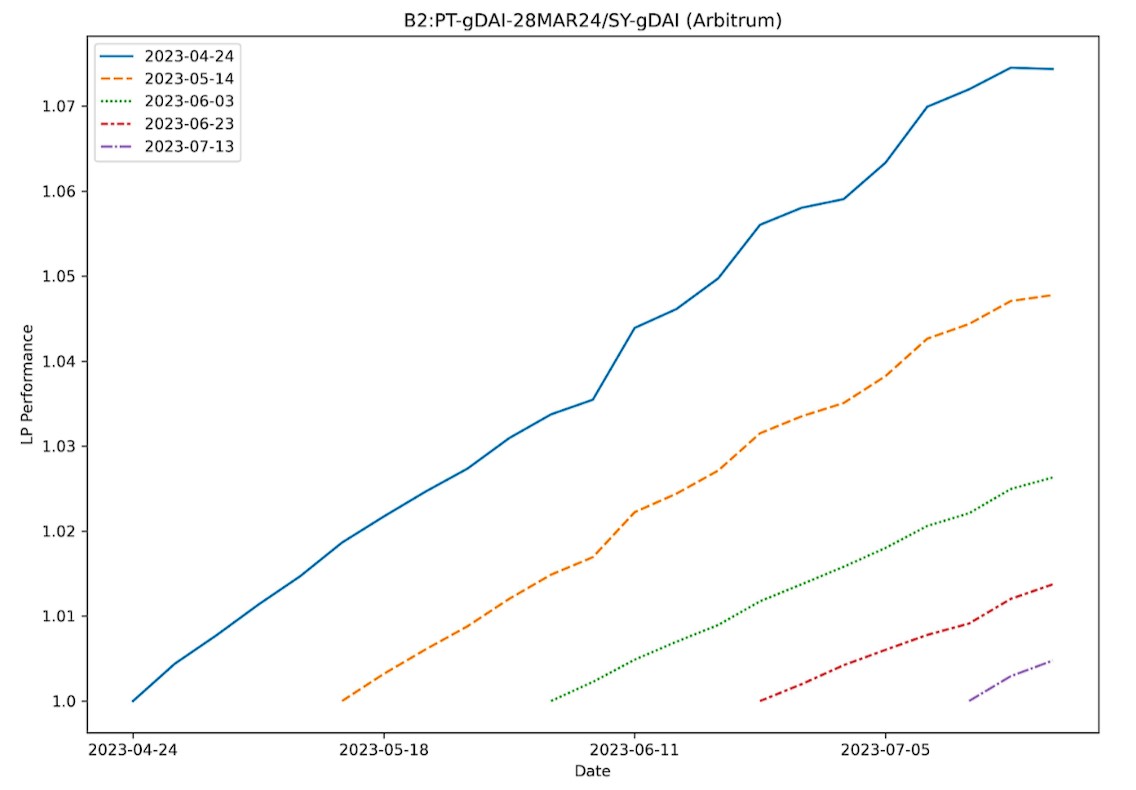

The performance of a $gDAI liquidity provider on Pendle was compared against a naked $DAI holder without yield.

In most cases, $gDAI LPs on Pendle outperformed naked $DAI holders even without $PENDLE incentives. There was found to be a positive correlation between a longer deposit duration and outperformance, in this case, an outperformance of 2.36%.

When $PENDLE incentives are included in the scenario, the outperformance increases to 8.03%.

The Dashboard gives you a holistic view of your entire portfolio. From the Dashboard, you can do the following:

1. Go to the Dashboard page.

2. Click “Claim Yield and Rewards”.

3. Use the slider in the top right to filter for balance value.

4. Select which rewards you would like to claim.

5. Check your gas and swap fees, and hit Claim.

While vePENDLE locking happens only on the Ethereum mainnet, the information about each locked position is shared across all supported chains.

The campaigns are intended to provide existing users a chance to earn rewards and to onboard new users via the utilization of Pendle through the different quests.

Season 1 began on August 1, 2023, and featured 3 different campaigns.

The Pendle Academy was introduced on October 10, 2023.

It is a comprehensive, one-stop shop for all of Pendle’s yield trading information, with 3 courses tailored for the following knowledge levels:

The telegram bot was introduced on November 20, 2023.

It enables users to keep track of the latest yield movements, bargain opportunities, and set notifications on target APY.

Users can deposit yield-bearing assets into Pendle and mint Principal tokens (PT) and Yield Tokens (YT), where PT represents the principal portion of the underlying yield-bearing asset and YT represents the entitlement to all of the yield produced by that asset. Both PT and YT can be traded on Pendle to execute yield strategies.

The TradFi analogy of what Pendle does is called bond stripping. This is a process where the principal and interest of bonds are separated. Because of that, PTs are the equivalent of zero-coupon bonds and YTs are the detached coupons.

Buying PT allows users to hedge their exposure to yield rates. When a user believes that the yield of an asset is going to fall, they can buy PT to lock their APY at the current implied yield. This way, the user is fixing their yield at the current implied yield, since they are guaranteed to get the underlying asset after maturity.

PTs are tradeable on the Pendle AMM and their price is determined by supply and demand.

For example, if a user buys PT-cDAI for DAI lent in Compound then because PT-cDAI does not include the yield component, PT-cDAI will trade at a discount to the underlying and will always be cheaper than 1 DAI.

This is true for all PT.

After buying 1 PT-cDAI at a discounted price (0.9DAI), the user can redeem the PT for 1 unit of the underlying upon maturity. This way, the user is earning a fixed return, since the amount of DAI that they can redeem at maturity is fixed.

Buying and holding a PT until maturity entitles the user to a fixed yield.

The fixed yield from buying and holding a PT is dependent on the market and current price. Intuitively, the cheaper the user can buy the PT the higher the fixed yield they can earn. To make that decision, the trader will need to account for their own prediction on where they believe the average future yield is going to be at maturity relative to the current yield.

For example, if the trader predicts that the average future yield until maturity for stETH is 5%, but PT-stETH is priced at a 6% fixed rate, the user should then buy and hold PT-stETH.

As people buy and sell PTs in Pendle, the price will change, meaning that the fixed rate you can get will fluctuate up and down.

As another example, a user that holds 1 PT-stETH with a 1-year maturity will be able to redeem for 1 unit of stETH after 1 year.

In the example above, a user could pay 0.94 stETH to buy 1 PT-stETH that they can redeem for 1 stETH one year later.

The underlying APY means that stETH is currently generating a 5% yield from staking rewards.

The implied APY means that the fixed APY for buying and holding PT-stETH until maturity is 6.4%.

If the user bought PT-stETH and thinks that, at best, the future yield that stETH can generate is 6%, then locking a 6.4% fixed yield would be a good decision for the trader. In this scenario, the trader would purchase 100 PT-stETH (94 stETH). This entitles the user to a redemption of 100 stETH after the PT matures in 1 year, giving them a 6.4% APY.

Instead of waiting until maturity to redeem the underlying asset, the user can also choose to sell their PT prematurely. By doing that, the user can unlock access to their capital and use it somewhere else. Another reason to sell is when the user believes that the PT price is overvalued and that there is an opportunity to take profits early.

Buying YT allows users to bet on yield rates. When a user believes that the yield of an asset is going to increase, they can buy YT to increase their exposure to the yield of the underlying asset. This way, the user returns will be determined by fluctuations in the underlying APY.

As a YT holder, the user receives all the yield generated by the underlying asset up until maturity, and it can be sold at any time. The underlying APY represents the yield that is accrued to your position at the current time. On the other hand, the implied APY represents the price that the YT is trading at. As such, a trader can use the implied APY as an indicator on where they think yield rates are going to go:

The trader will make a profit as long as the future yield collected by the YT (the average underlying APY) is greater than the cost of buying the YT.

Profit = totalYieldCollectedByYT – CostOfYT

Profit = ( totalYieldCollectedByYT + revenueFromYT) – CostOfYT

The implied APY can move independently from the underlying APY. One way to estimate the average future APY is by using the current underlying APY, which is the APY generated by the underlying asset. If all conditions were to stay the same until maturity, then the future APY should be the same as the underlying APY.

In a bull market, there is a high demand for money. This results in increased borrowing activity, which translates to higher interest rates and higher APY for lenders. The opposite happens in a bear market.

For instance, taking the example of a stETH pool with a 1-year maturity on Pendle, a holder of YT-stETH would be entitled to collect the yield generated by stETH for the next year.

By trading at the price shown in the screenshot, the market is valuing future APY from stETH to be 4.2% in the next year. The underlying 5% APY reflects the current APY being generated by stETH. A user that predicts that the future yield will be above 5% could buy the YT at a 4.2% implied APY and they will receive 5stETH worth of yield netting the user a 25 % APY.

If, for example, the average APY increases to 5.5% within the next year, the user ends up receiving an even higher amount of yield.

Buying YTs is more capital efficient than buying the underlying asset, meaning that for the same amount of capital, you can purchase a much larger quantity of YT. This allows users to compound their exposure to yield.

For example, if the price of YT is 5% of the price of the underlying asset, any increase in the underlying yield will result in a 20x increase in your returns since you are able to purchase 20 units of YT.

When implied APY > underlying APY, the long yield APY will be negative. This means that assuming that the underlying APY remains constant, the cost of buying YT would be more than the average future yield collected. In this scenario, it would not be a good choice to buy YT unless you believe that the underlying APY will increase significantly in the short term.

By actively yield trading, users can maximize their APY on the underlying asset by switching between holding the PT (short yield) and holding the YT (long yield).

Since yields in DeFi fluctuate all the time, the market will swing between two modes that will change the perception of whether the yield from an asset is overvalued or undervalued.

A user who can time the market well and alternate between selling and buying PT and YT will be able to achieve potentially greater profits by swing trading for yield.

Since the implied APY estimates the average future APY, yield trading boils down to predicting what the average future APY of an asset will be.

Assuming a stETH yield market with a 1-year maturity as the one in the image below.

Imagine a user who believes that the future APY for stETH for the coming year will be 5.5%. Looking at the market, the user believes that YT-stETH is cheap and that the implied APY of 4.5% is undervalued. For that, the user buys 100 YT-stETH at the cost of 4.3 stETH.

Next, 3 months go by and, so far, the average APY has been stable at 5% and the user has received a yield of 1.23 stETH from holding YT-stETH.

Looking at the market, the user reconsiders his prediction of an average future APY of 5.5%. Now the user believes that this APY will be 5.3% instead. With the implied yield being higher than his prediction and the long yield APY being negative, the user sells his YT-stETH for PT-stETH.

First, the user sells 100 YT-stETH for 3.93 stETH and their position is now worth 3.93 + 1.23 (yield) = 5.15 stETH in total, which is a 107% in the first quarter due to the price increase of YT-stETH from an increased implied APY as well as the higher average APY compared to the implied APY when the user made the first purchase.

Next, the user converts their 5.15 stETH to 5.37 PT-stETH.

At the beginning of the last quarter, the user maintained their prediction of a 5.3% average, and looking at the implied APY, the market is in equilibrium (even though the implied APY is greater than the underlying APY). As a result, the user chooses to exit their PT-stETH position and simply hold the underlying asset, stETH.

The user sells 5.37 PT-stETH for 5.301 stETH. Since April, this resulted in a net gain of over 0.15 stETH, which translates into a 6% APY thanks to the PT being priced higher at a lower implied APY.

In total, after 9 months, without having to wait until maturity, the user ends up with 5.301 stETH from a starting principal of 4.3 stETH, which translates into a 32.2% APY.

Users who believe that the yield of an asset is unlikely to fluctuate significantly can provide liquidity to Pendle pools in order to earn extra revenue from swap fees and incentives.

In Pendle V1, users faced impermanent loss because the value of YTs is not constant. In V1, liquidity providers deposited YT into a liquidity pool in order to allow users to trade YT against an asset such as USDC. Since the value of YT is not constant due to supply and demand forces, liquidity providers could suffer losses from price fluctuations.

With Pendle V2, the impermanent loss of liquidity providers is negligible. This is because liquidity providers do not deposit YTs into the pool. Instead, Pendle’s v2 AMM only allows LPs to provide PTs and the yield-bearing asset, both of which are closely correlated.

In Pendle V2, there is no impermanent loss from price fluctuations of the underlying asset. The reason for that is that the price of PT and YT are linked to the price of the underlying such that the sum of their prices equals the price of the underlying.

The only risk of impermanent loss comes from fluctuations in the demand for PT and YT. If the liquidity is provided until maturity, the impermanent loss is capped and minimized. The reason for that is that both assets have the exact same value at maturity. Because of this, providing liquidity can also be a hedge for existing PT and YT positions.

Even though holding PTs can be a relatively low-risk strategy that eliminates fluctuations in the user’s returns due to variable APYs, it is possible for holders of PT to increase their returns. They can use their PTs to provide liquidity and start earning the swap fees that take place on the pool, as well as the PENDLE incentives that are distributed to that pool via vePENDLE.

The PT that is deposited in the liquidity pool can be withdrawn at any time and sold for profit or redeemed for the underlying token after maturity.

In order to maximize profits, it is important to zap into the LP when the implied yield is high. This means that the PT will be cheaper relative to the underlying and your resultant yield will be higher, hence why you are partially shorting.

When it comes to unwinding the position, the best is to do it when the implied yield is low. Otherwise, you can hold the LP and continue earning yield from the pool until maturity, after which the PT can be redeemed for the underlying.

Pendle collects 80% of swap fees as protocol revenue and distributes the remaining 20% to liquidity providers.

All protocol revenue is distributed pro rata to vePENDLE holders who voted for the pool, based on their vote weight.

Pendle also collects 3% from all yield accrued from tokenized yield positions and all yields after maturity from unredeemed PTs. This revenue is also shared pro-rata among vePENDLE holders.

There are two main sources of revenue, both of which are redistributed to vePENDLE holders, with the protocol collecting no revenue for itself (this is subject to change in the future).

For example, matured PT-aUSDC is equivalent to aUSDC. If left unredeemed, all of its yields will be converted to a stablecoin and collected as protocol revenue that will be distributed to vePENDLE holders.

All of these rewards are converted to USDC before being distributed via a disbursement contract.

The vePENDLE whitepaper introduces two major factors that will allow the protocol to increase its revenue in the long term. This envisions an incentives alignment system where the protocol development will be funded by a developer fund that takes a fixed % of the protocol revenue.

The team has mentioned that salary is the biggest expenditure, followed by office rental, which is quite modest as most are operating from their own homes. There are 22 members drawing salaries spread across Asia and Europe. Pendle also pays for Chainlink Keepers to automate the broadcast of weekly voting results, which costs around $250 a month.

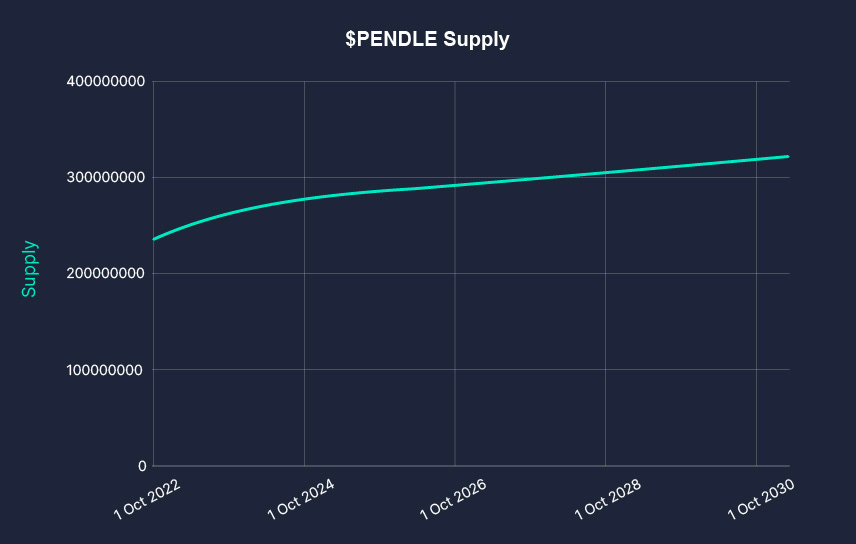

PENDLE is the native token and value accrual mechanism for the users of the protocol. It acts as the governance token of the protocol by being staked and locked into vePENDLE.

The demand for PENDLE is mostly driven from the utility derived by locking into vePENDLE, which can then be used to boost LP APY, receive a share protocol revenue, direct protocol incentives, and swap fees from the pools you are voting on. The more demand there is for PENDLE, the more vePENDLE holders will be able to benefit from the growth in the utilization of the protocol.

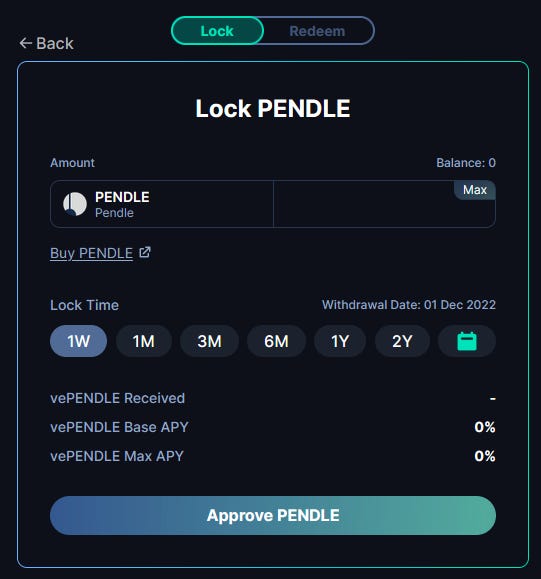

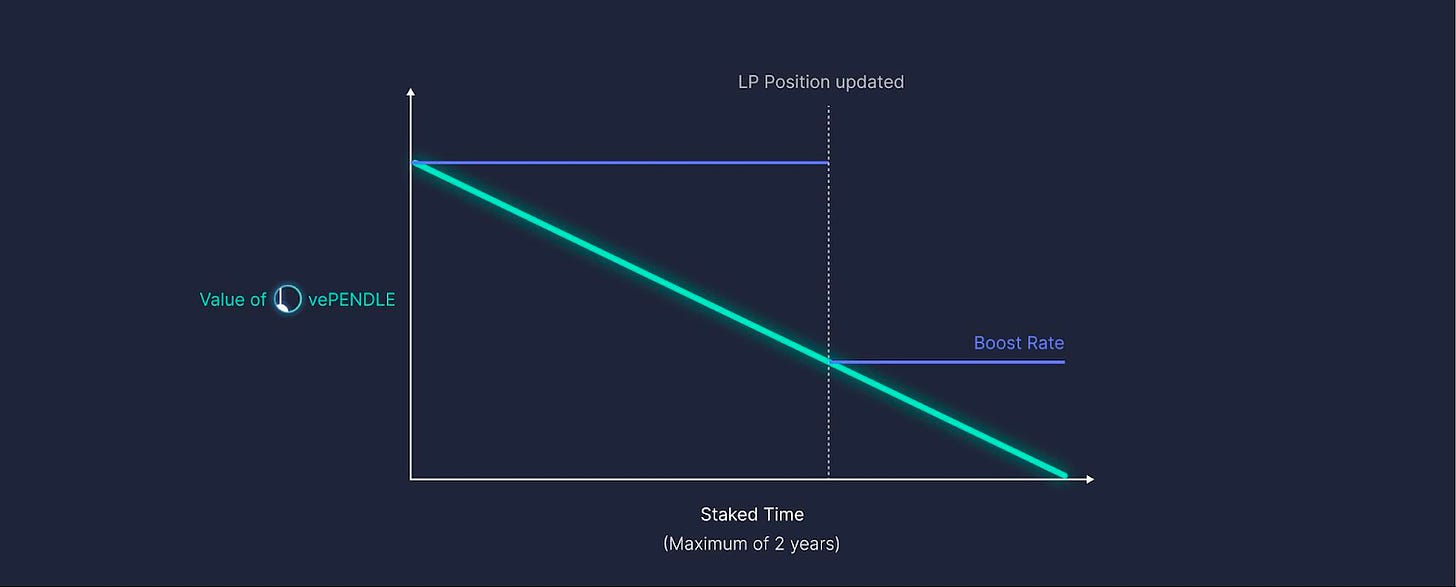

Users can lock PENDLE for vePENDLE, where the allocation will depend on the amount of tokens that are locked as well as the time duration they have been locked for (up to a maximum of 2 years). As time goes by, the voting power, determined by the vePENDLE balance, will linearly decay over time.

vePENDLE holders are entitled to a cut of the protocol revenue, which includes a volume-weighted share of the swap fees collected from the voted pools (i.e. 80%), 3% of the fees collected from all the yield accrued by YT, and a portion of the yield from matured and unredeemed PTs.

The lock position of a user is calculated using the amount of tokens they have locked, and the lock expiry, which is the timestamp until which the user tokens will remain locked.

Users can increase their vePENDLE balance either by extending their lock or by staking and locking more PENDLE.

There are 3 ways for a user to increase their locked position:

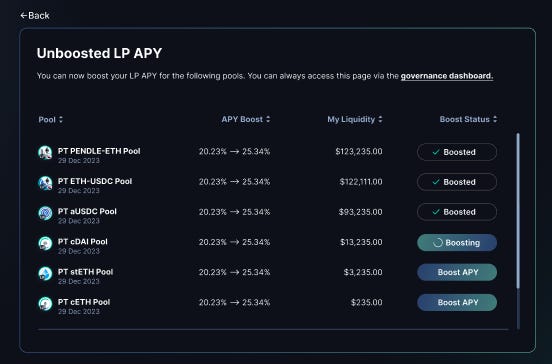

vePENDLE holders vote for pools in order to direct protocol incentives. By doing this, they are incentivizing liquidity for the pools they are voting in favor of. As Pendle is an AMM and its revenue comes from fees generated by trading, profit-oriented lockers are incentivized to vote for the pools that drive the most volume for that pool.

Voting for a pool also entitles vePENDLE holders to 80% of the swap fees collected by that pool. This revenue is collected pro-rata between all vePENDLE voters of the pool.

The higher your vePENDLE allocation, the more incentives you can forward to the pools of your choice.

A snapshot of all votes is taken at the start of every epoch on Thursday at 00:00 UTC.

Liquidity providers who are holding vePENDLE can boost their PENDLE incentives by up to 250% based on the vePENDLE amount.

Even though vePENDLE balances decay over time, the LP boost rate is calculated at the time when the boost is first applied. This boost rate remains constant until the user updates their LP positions, in which case the rate will change based on the value of their vePENDLE balance at that time.

If you are already an LP and want to boost your rewards, you have to manually apply the boost after voting for the pool.

PENDLE is the governance token of the protocol. By staking and locking into vePENDLE, users can boost their LP returns and receive a share of the protocol revenue, vote for pools to direct incentives, and receive swap fees from the pools they are voting for.

Pendle is a protocol that interacts with third-party protocols and contracts. As a result, Pendle inherits the smart contract risk from the underlying protocols it builds on top of.

Pendle has had the following audits done:

Pendle Finance Security review – September 13, 2022 – 0xleastwood

Pendle V2 – May 24, 2022 – Ackee Blockchain

Pendle V2 – Main contracts – August 25, 2022 – Christoph Michel

Pendle V2 – Liquidity Mining – August 15, 2022 – Christoph Michel

PendleV2 Part 1 Yield Tokenization & Trading Audit – July 1, 2022 – Dedaub

Pendle V2 Part 1 – November 29 2022 – Dingbats

Pendle V2 Part 2 – November 29 2022 – Dingbats

Pendle V2 Part 1 Audit Report – June 28, 2022 – WatchPug

Pendle V2 Part 1 (Follow-up 1) Audit Report – July 15, 2022 – WatchPug

Pendle V2 Part 1 (Follow-up 2) Audit Report – July 22, 2022 – WatchPug

Pendle V2 Part 2 Audit Report – August 2, 2022 – WatchPug

The following are some dependencies that users may be exposed to:

There was a $3.7m raise in a private round led by Mechanism Capital.

The investors’ tokens have been completely vested, with the team vesting to be done by April 2023.

Pendle has the following partners and integrations:

On August 31, 2023, Pendle released its study on the performance of selected pools against the underlying assets. This was done in order to assess whether the single-asset composition of Pendle’s PT/SY LPs is the best form of LPing.

The study was performed on the following pools:

The following approaches were used to evaluate the performance of Pendle’s LPs, with the current study only focusing on approach 1.

The yield of an LP on Pendle was compared against a holder of the underlying assets without receiving any yields.

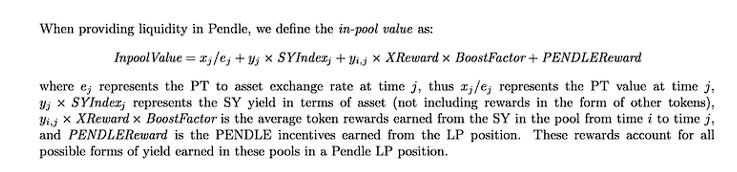

Both the in-pool and out-pool values are used to assess performance when LPing on Pendle vs holding the underlying assets.

In-pool values are defined as the following.

Out-pool values are defined as the following.

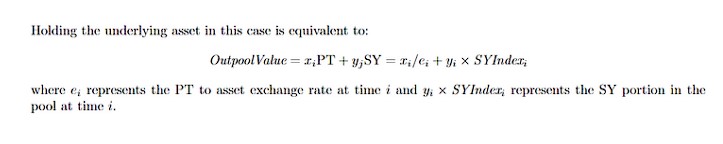

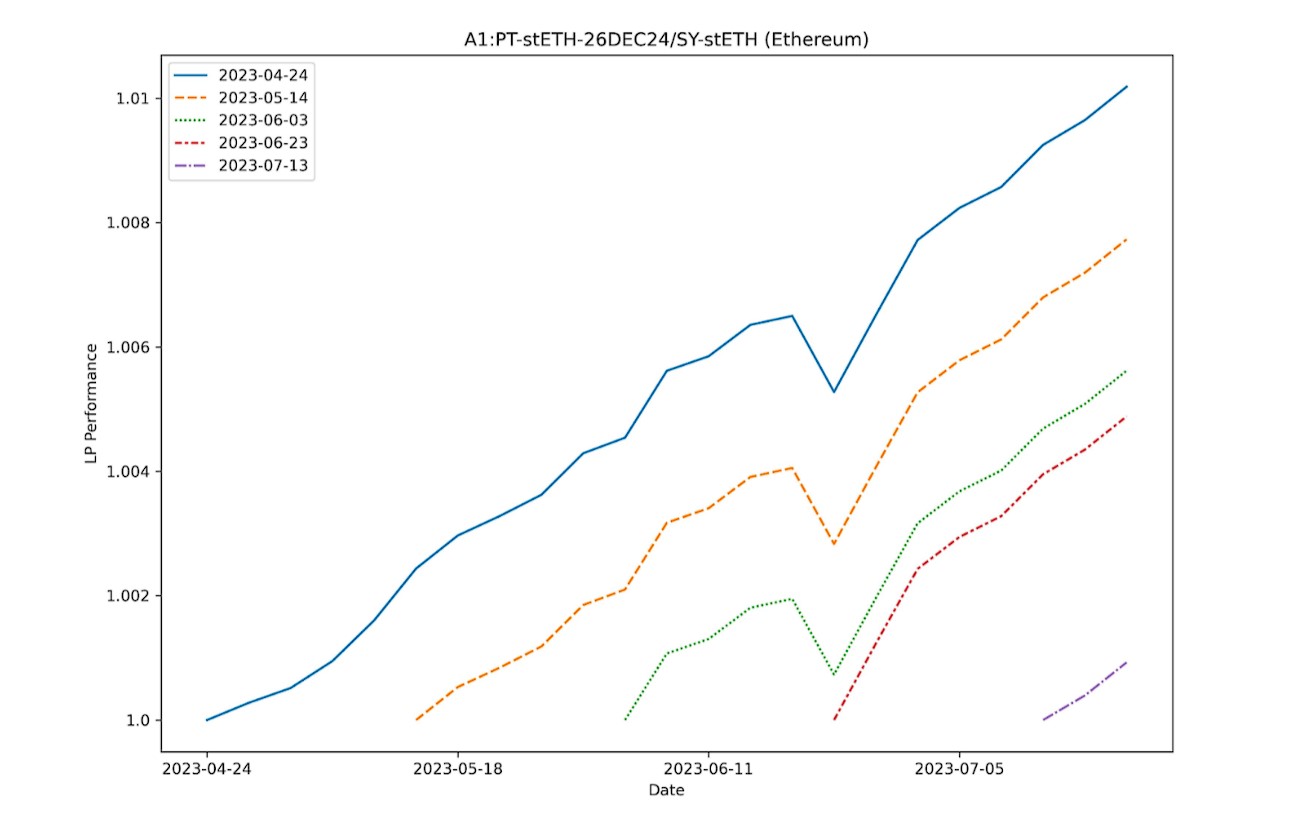

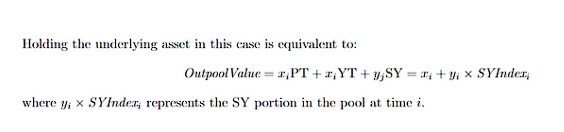

The performance of a $stETH liquidity provider on Pendle was compared against a naked $ETH holder.

In all cases, $stETH LPs on Pendle outperformed naked $ETH holders even without $PENDLE incentives. There was found to be a positive correlation between a longer deposit duration and outperformance, in this case, an outperformance of 1.02%.

When $PENDLE incentives are included in the scenario, the outperformance increases to 10.82%.

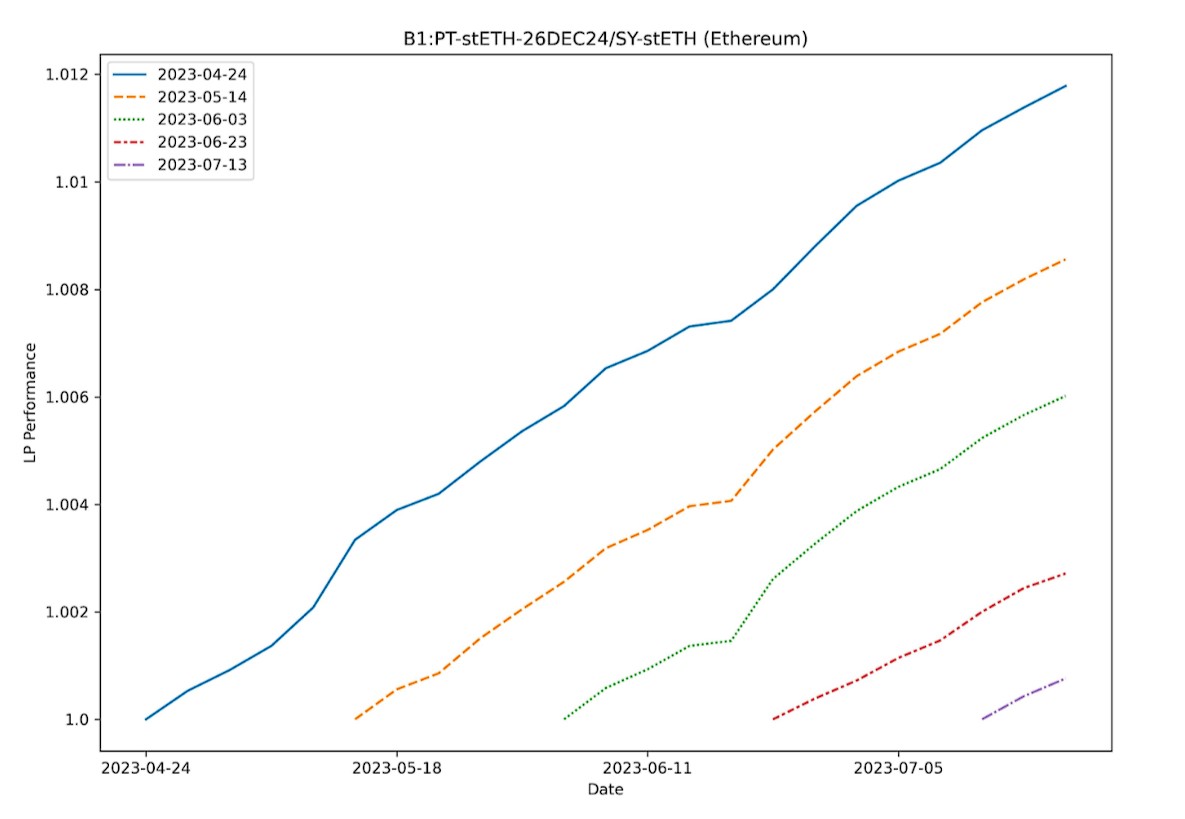

The performance of a $GLP liquidity provider on Pendle was compared against a naked $GLP holder without yield.

In most cases, $GLP LPs on Pendle outperformed naked $GLP holders even without $PENDLE incentives. There was found to be a positive correlation between a longer deposit duration and outperformance, in this case, an outperformance of 8.04%.

When $PENDLE incentives are included in the scenario, the outperformance increases to 20.23%.

The performance of a $gDAI liquidity provider on Pendle was compared against a naked $DAI holder without yield.

In most cases, $gDAI LPs on Pendle outperformed naked $DAI holders even without $PENDLE incentives. There was found to be a positive correlation between a longer deposit duration and outperformance, in this case, an outperformance of 2.36%.

When $PENDLE incentives are included in the scenario, the outperformance increases to 8.03%.

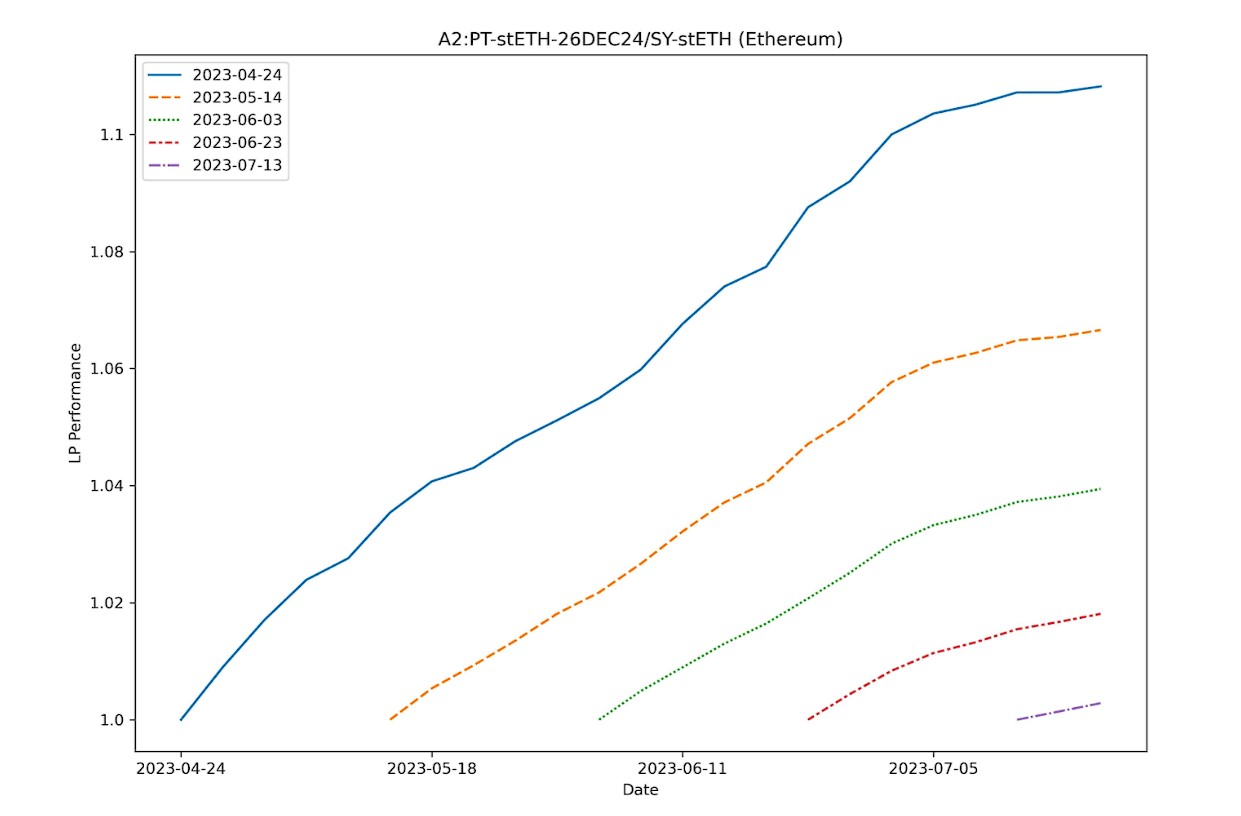

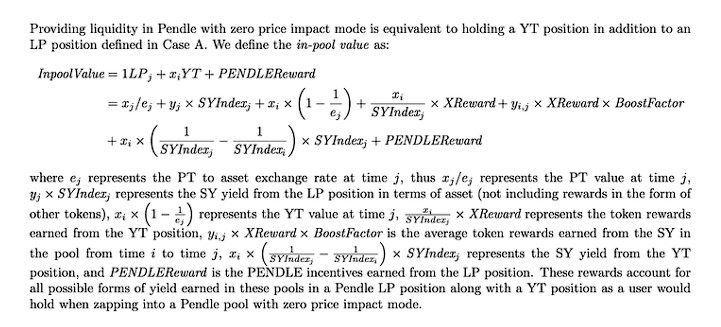

Both the in-pool and out-pool values are used to assess performance when LPing on Pendle vs holding the underlying assets, using the zero price impact mode.

In-pool values are defined as the following.

Out-pool values are defined as the following.

The performance of a $stETH liquidity provider on Pendle was compared against a naked $ETH holder, using zero price impact mode.

In all cases, $stETH LPs on Pendle outperformed naked $ETH holders even without $PENDLE incentives. There was found to be a positive correlation between a longer deposit duration and outperformance, in this case, an outperformance of 1.18%.

When $PENDLE incentives are included in the scenario, the outperformance increases to 10.89%.

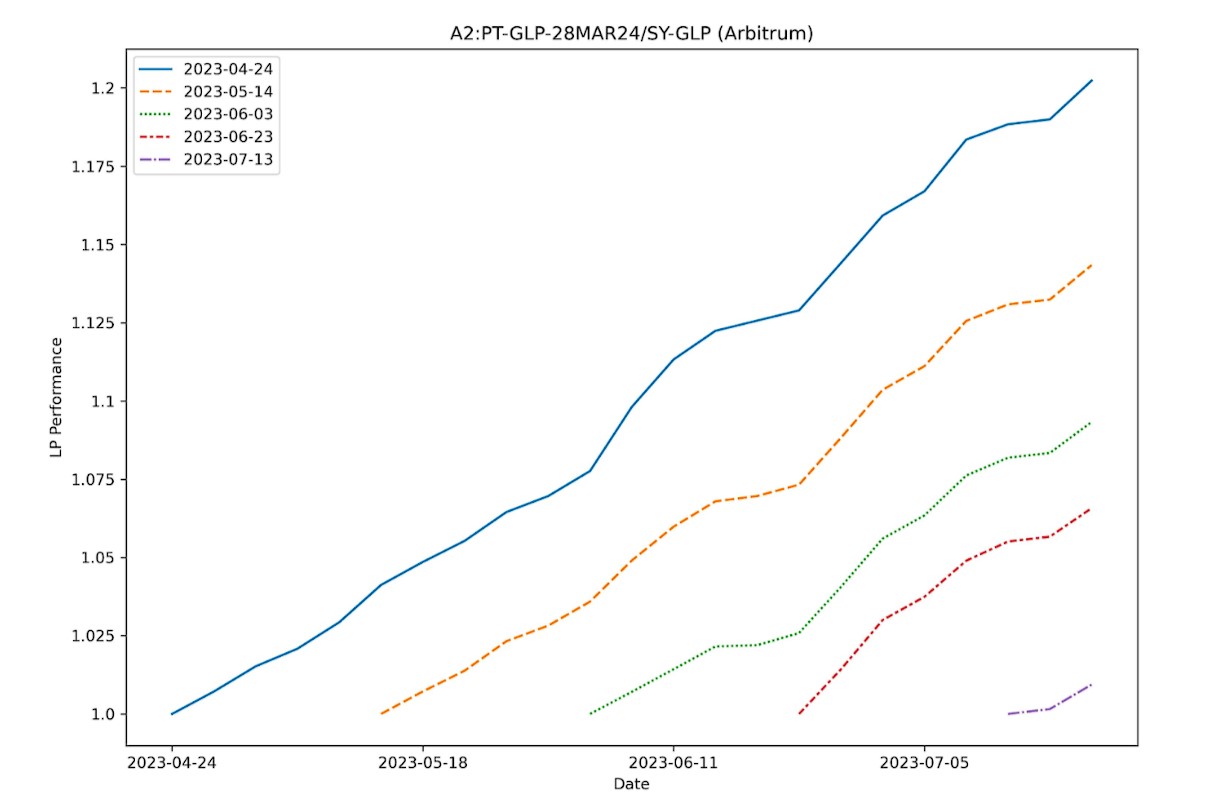

The performance of a $GLP liquidity provider on Pendle was compared against a naked $GLP holder, using zero price impact mode.

In all cases, $GLP LPs on Pendle outperformed naked $GLP holders even without $PENDLE incentives. There was found to be a positive correlation between a longer deposit duration and outperformance, in this case, an outperformance of 5.54%.

When $PENDLE incentives are included in the scenario, the outperformance increases to 16.87%.

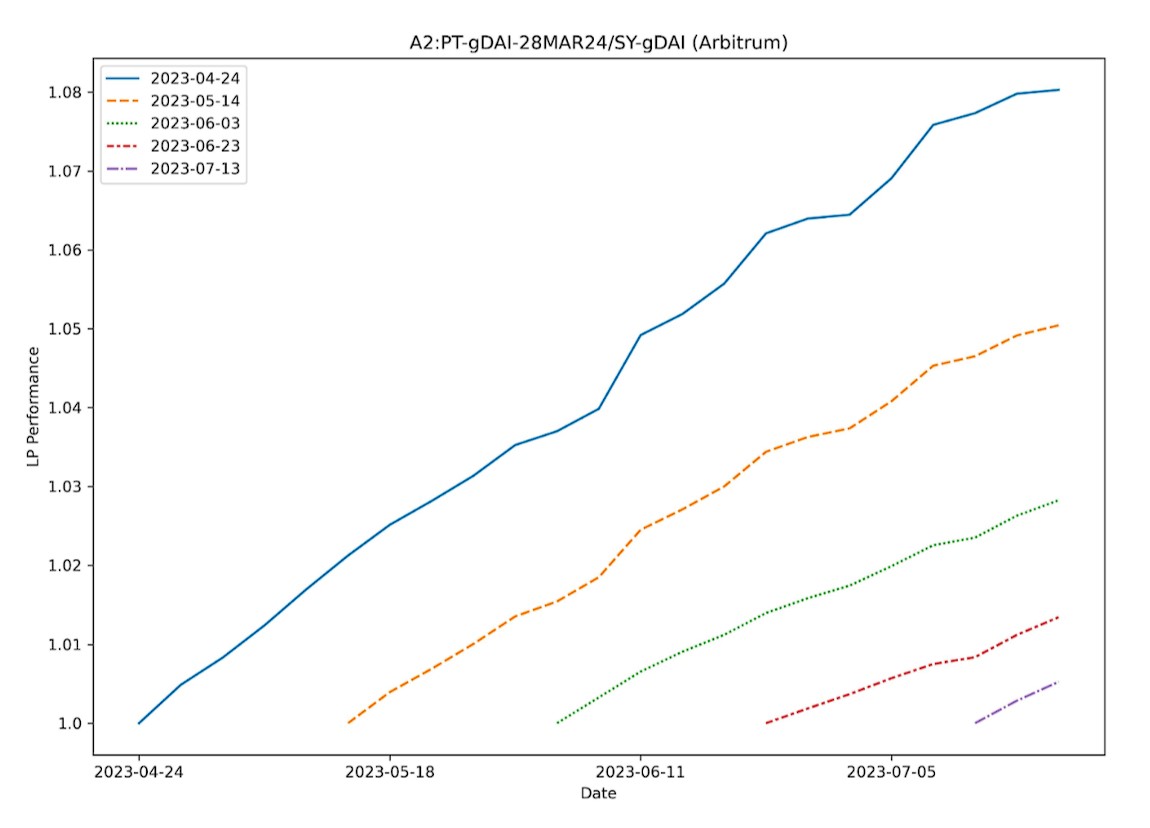

The performance of a $gDAI liquidity provider on Pendle was compared against a naked $DAI holder, using zero price impact mode.

In all cases, $gDAI LPs on Pendle outperformed naked $DAI holders even without $PENDLE incentives. There was found to be a positive correlation between a longer deposit duration and outperformance, in this case, an outperformance of 1.9%.

When $PENDLE incentives are included in the scenario, the outperformance increases to 7.44%.

Pendle came to a conclusion of their study for the 3 pools used, which were that:

PTs serve as valuable assets in the money market due to their fixed-rate nature, resembling a zero-coupon bond tied to an asset.

Integration of PT as collateral requires 2 prerequisites:

There 5 risk analysis for integrating PT as collateral:

The LP tokens from Pendle pools prove to be valuable assets in a money market due to their yield-bearing nature tied to the asset.

Integration of LP as collateral requires 3 prerequisites:

There 5 risk analysis for integrating LP as collateral: