Osmosis is a fair-launched, customizable Automated Market Maker (AMM) that enables the exchange and management of assets in the Cosmos Interchain ecosystem. Through IBC (Inter Blockchain Communication), the protocol achieves interoperability with other app chains in the Cosmos ecosystem. Besides, its customizable AMM built using the Cosmos SDK allows developers to come up with new use cases by dynamically adjusting the pool’s parameters and settings.

By allowing developers to design and deploy custom AMMs, liquidity pools can quickly adjust to changing market conditions, allowing market participants to make decisions on what the optimal outcome would be, rather than relying entirely on the protocol’s logic. This is possible because Osmosis allows users to launch liquidity pools with unique parameters, like bonding curves, multi-weighted asset pools, and liquidity mining rewards for specific pools.

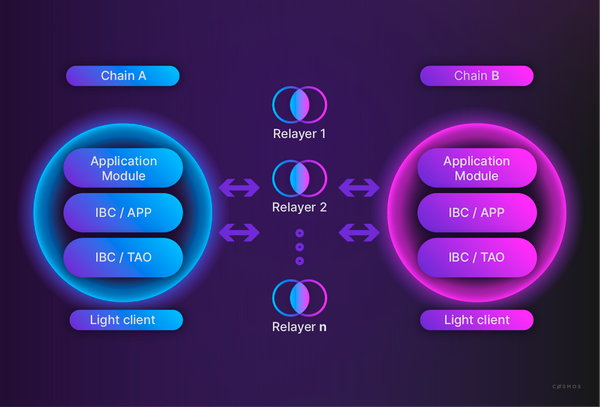

Inter Blockchain Communication is a protocol that allows two blockchains to communicate by transferring assets and data from one to another. IBC solves the problem of bridgeless and trustless communication by providing the necessary infrastructure to establish secure connections and authenticate data packets between Cosmos Zones.

Liquidity mining (also known as yield farming) is the process by which users earn tokens for providing liquidity to a DeFi protocol. This mechanism is used as an incentive to offset the Impermanent Loss experienced by LPs. This is an additional incentive that protocols provide to users to bootstrap the initial liquidity.

Osmosis attempts to solve the shortcomings of traditional AMMs by allowing for innovative use cases in the Cosmos ecosystem. From a design perspective, the protocol optimizes for a more advanced trading experience and better incentives for liquidity providers. This is achieved due to its deep level of customization for parameterizing bonding curves, dynamic swap fees, and multi-asset liquidity pools, all of this achieved using the Cosmos SDK.

Osmosis was designed following the core principles of heterogeneity and sovereignty that the many app chains in the Cosmos ecosystem also represent. Rather than aiming for a rigid and monolithic approach, the protocol seeks to offer AMM designers a variety of tools to customize liquidity pools. By using Cosmos and its cross-chain communication capabilities as a base, Osmosis can offer far broader swapping options to users.

The protocol makes no assumption about the underlying AMM structure. In fact, key parameters such as swap fees and token weights are fully parameterizable for each liquidity pool. The same applies to the bonding curve algorithm and TWAP (Time-Weighted Average Price) calculations of each pool.

It is worth noting that Osmosis is not only a DEX, but an AMM blockchain in the Cosmos ecosystem. Because of that, any IBC-enabled Cosmos Zone can add its token as a tradeable asset on Osmosis. This is a permissionless process that does not require that the token is issued on the Osmosis Zone.

How to ensure that an asset is supported by Osmosis: https://docs.osmosis.zone/overview/integrate/token-listings

Osmosis was heavily inspired by Balancer. The project also takes the concept from Sunny Aggarwal’s paper titled DAOfying Uniswap Automated Market Maker Pools. Rather than aiming for a one-size-fits-all AMM model, Osmosis was designed to offer deep customizability to AMM designers and allow liquidity providers to vote on the governance decisions of their pools.

The goal of Osmosis is to provide the necessary tools to extend the use cases and functionality of AMMs within the Cosmos ecosystem. This vision aims to offer more features than simple asset swaps. Among these features stand out customized pricing curves and pool compositions that allow for dynamic fee adjustments, multi-token liquidity pools, interchain staking, and options markets among others. This challenges the simplicity of other AMMs such as Uniswap and signals a desire to iterate in the design to enable more specialized use cases.

Sunny Aggarwal’s paper titled DAOfying Uniswap Automated Market Maker Pools introduced the first principles of how the AMM should behave. This vision proposed that Uniswap liquidity pools should behave like DAOs where the LP token holders are the DAO members. This would enable the LP token holders to use governance structures to parametrize and customize their “Uniswap instance” to provide the best service for its users.

The scope of governance (what can be voted upon) would affect the following:

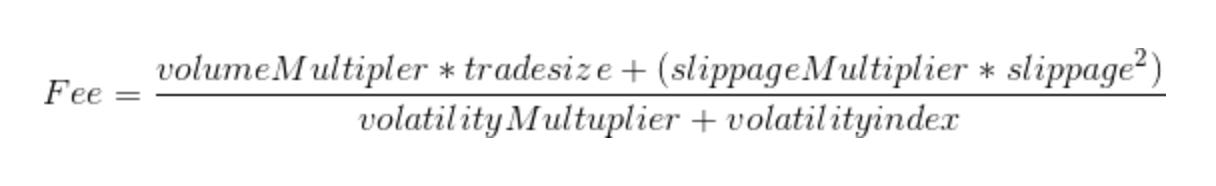

It is mathematically provable that, without fees, market makers would always be less profitable than if they just held the assets in their wallets. This effect is amplified when the asset pair is more volatile. In Uniswap V2, the impermanent loss is offset by charging a trading fee of a fixed 0.3% of the trade size. While Uniswap V3 solves the limitations of having a fixed constant (0.3%), this model can be improved by taking into account more variables, especially volatility, and slippage.

Slippage is the difference between the expected price of a trade and the price at which the trade is executed

One example of this new dynamic model could provide better incentives for liquidity providers by calculating fees as follows:

When it comes to interoperability, Osmosis leverages the Cosmos SDK to allow it to operate across chains and unlock access to all the TVL available on the Cosmos ecosystem. By integrating IBC (Inter Blockchain Communication) from day one, the protocol can onboard native Cosmos assets in a seamless manner.

Besides, contrary to other Cosmos Zones that have focused their incentive programs on delegators, Osmosis is an attempt to align the incentives of multiple stakeholders beyond delegators, such as LPs, DAO members, stakers… One example of this is that staked liquidity providers have sovereign ownership over their pools. Because of this, the governance of the pools allows liquidity providers to adjust parameters depending on the pool’s competition and market conditions. This is a key differentiator with respect to other application-specific chains in Cosmos since Osmosis derives its sovereignty not only from its architecture but also from the collective sovereignty of the LPs that align their interest to the different tokens that they are providing liquidity for.

Cosmos Zones are application-specific blockchains in the Cosmos ecosystem such that each Zone is connected to a Hub in order to achieve interoperability.

With all of these objectives, core developers Sunny Aggarwal, Josh Lee, and Dev Ojha set out to create Osmosis as the first AMM protocol using the Cosmos SDK. The project was announced in October 2020 and launched on June 19th, 2021.

Osmosis was also the first Cosmos-based chain to popularize IBC transfers. IBC transfers had been available for months before the protocol launch but there was no demand for interoperability

The Osmosis team is currently focused on the development of interfluid staking, and mesh security.

Osmosis is a product deployed by Osmosis Labs, a company incorporated in Singapore and founded by Sunny Aggarwal and Josh Lee.

Some of the well-known contributors include:

While Osmosis Labs is responsible for most of the protocol development, the Osmosis project is actually run by a decentralized validator set where every upgrade is voted on and carried on by the community of OSMO token holders. As such, there is no single entity liable for claims or damages to the Osmosis decentralized protocol.

The Osmosis codebase is open source and available on Github.

Contributor’s Guide to Osmosis Chain Repository

As a DEX (Decentralized Exchange), Osmosis allows users to exchange assets using the protocol. However, until now, most Dexes have been very limited by the underlying blockchain they are deployed on. Besides, most Dexes have historically imitated the Uniswap constant product formula. This is not the case with Osmosis, which can be analyzed both as an independent Layer-1 network as well as a separate DeFi Protocol.

By building on the Cosmos ecosystem, Osmosis can leverage interoperability at the protocol level. This means that Osmosis can execute transactions across different networks in a seamless manner. For users, it means that they can access a bigger market for trading: the market cap of all projects in the Cosmos ecosystem provides a multibillion-dollar marketplace.

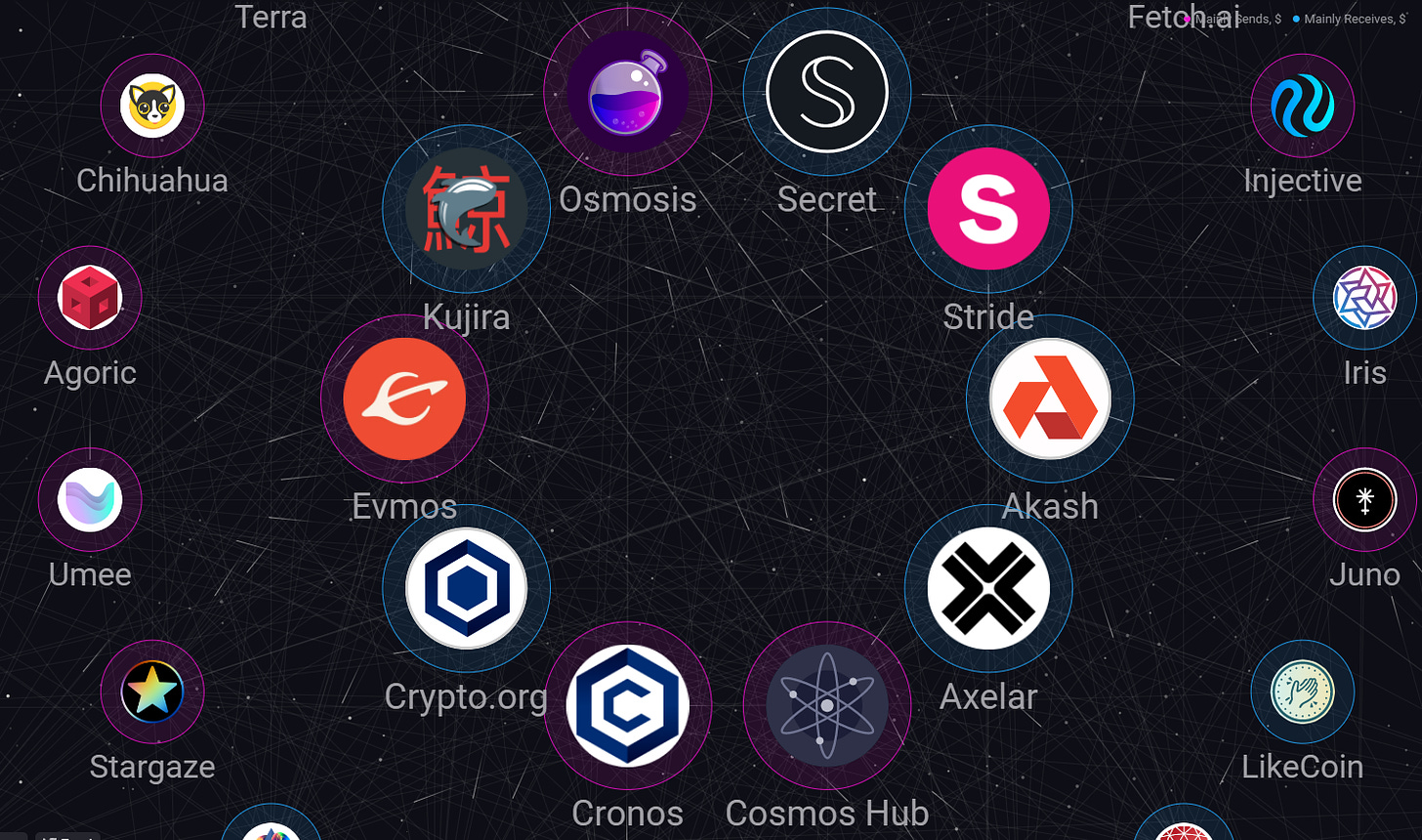

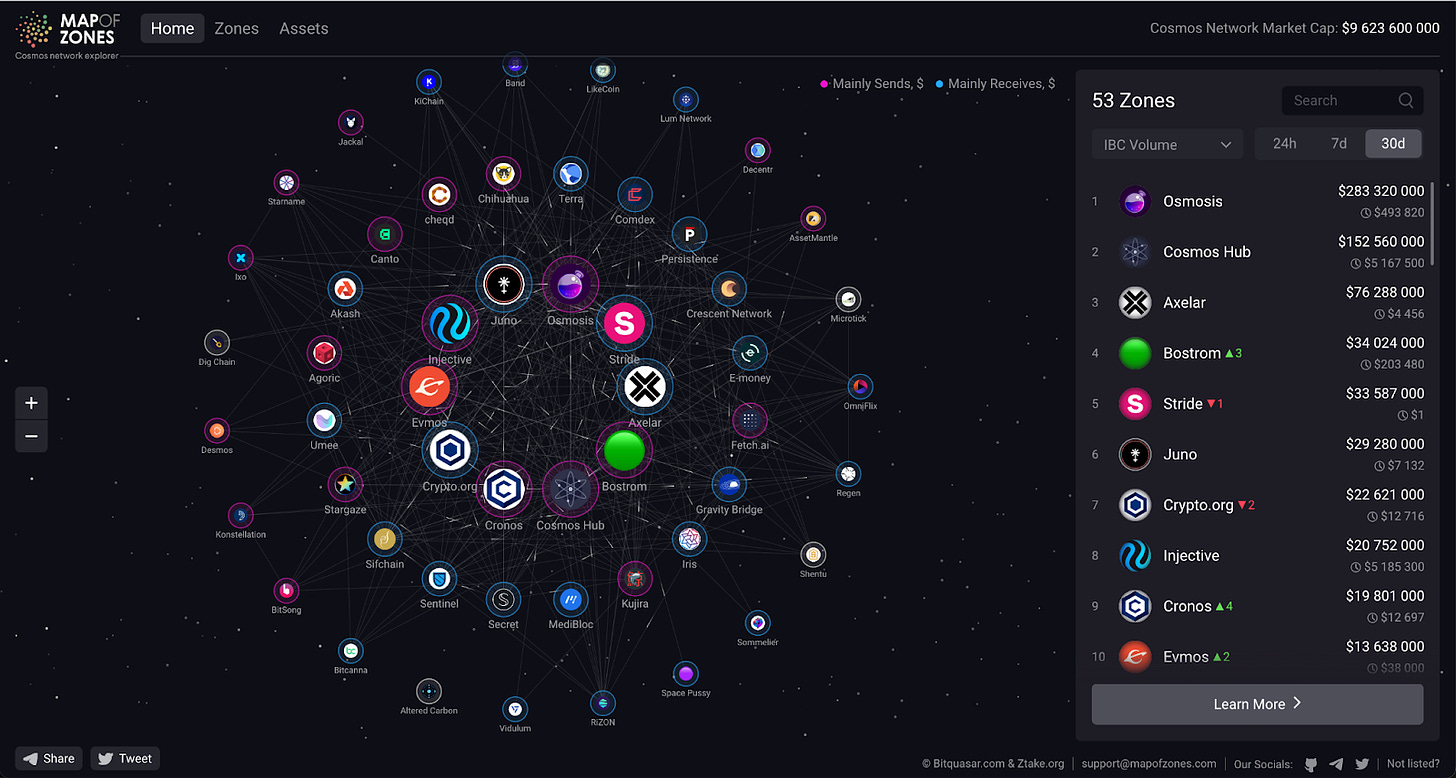

Cosmos Map of Zones reveals that Osmosis occupies a bright spot thanks to its connectivity with other Cosmos chains. In fact, it has been the leader chain by volume on a consistent basis. Notably, Osmosis was the first IBC-enabled DEX in the Cosmos ecosystem. Although now there are alternatives such as Injective Protocol or the Gravity DEX, Osmosis continues to rank first in IBC transactions thanks to its first-mover advantage.

Osmosis also has a competitive advantage over other AMMs due to its custom features. By allowing the AMM to quickly adapt to changing market conditions, Osmosis offers a competitive advantage for developers to come up with innovative use cases since they have the freedom to change key protocol parameters like swap fees, token weights, TWAP calculations, price curves, etc., This is often not the case in the majority of competitors, which must hard-code their protocol parameters.

Taking Uniswap V3 as an example, its AMM allows users to create liquidity pools with different sizes ranging from 0.3% to 1%. While this might be flexible enough for most users, most sophisticated traders demand additional parameters such that, for instance, fee structures respond to changes in volatility or account for slippage conditions. Osmosis’s original vision (inspired by Sunny Aggarwal’s paper titled DAOfying Uniswap Automated Market Maker Pools) aimed to adapt the Uniswap AMM model to become a more versatile tool by:

Currently, there are 53 projects building on Osmosis that will bring in decentralized perpetual futures, CDP-based composable collateral, money markets, yield aggregators, etc.

Osmosis also has the potential to deliver potential returns as a result of its first-mover advantage in deploying safe and low-fee access to cross-chain asset swaps. This allows the protocol to acquire users, volume, and liquidity ahead of its competitors.

Furthermore, cross-chain swaps are only the first cross-chain offering provided by Osmosis. Apps that adopt Osmosis as their back-end will also benefit from the generic interchain messaging, interchain NFTs, and the full spectrum of DeFi use cases enabled through IBC and Axelar.

Also, Osmosis announced the integration of Kado as a fiat on-ramp, which will improve the user experience by providing a similar experience to a CEX while still maintaining the permissionless and censorship-resistance properties of the blockchain.

As of now, no competing cross-chain liquidity service provider can offer similar levels of security and decentralization as the combination of Osmosis and Axelar.

The Osmosis co-founder Sunny Aggarwal has also publicly mentioned that he does not see Cosmos and Polkadot as competitors. In fact, Osmosis will enable swaps between Cosmos, Polkadot, and Ethereum. Osmosis aspires to become more than just a DEX on Cosmos and, thanks to its integration with Axelar, it hopes to become the core infrastructure layer for cross-chain interoperability.

Osmosis is known as the number one source of liquidity in the Cosmos ecosystem. Its primary function is an AMM, meaning it functions as a DEX for users who wish to trade and swap between assets, and as a place for investors to deposit liquidity for these swaps to earn a yield. In addition, users can also create their own liquidity pools permissionlessly, and customize the parameters as they see fit. This makes for more possibilities for users and investors.

In Osmosis, AMM pools are permissionless and any user can make a pool for any asset. Pool creators are responsible for setting swap and exit fees paid by traders and liquidity providers. The AMM offers the following features:

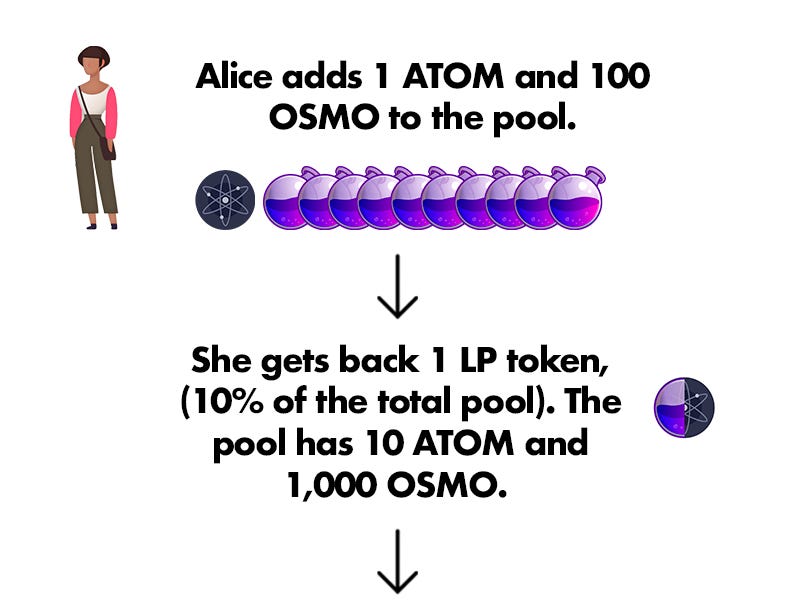

Similar to other AMMs, when users deposit assets into a liquidity pool, they receive LP tokens that represent their share of the total pool (these tokens do not correspond to an exact quantity of the tokens provided, but rather to the proportional ownership of the pool). When users remove the liquidity, they get back the percentage of the liquidity represented by their LP tokens. Since buying/selling removes/adds tokens to the pool, it is unlikely that users withdraw the same amount of each token they deposited. They will usually receive more of one asset and less of another, based on the trades executed in the pool.

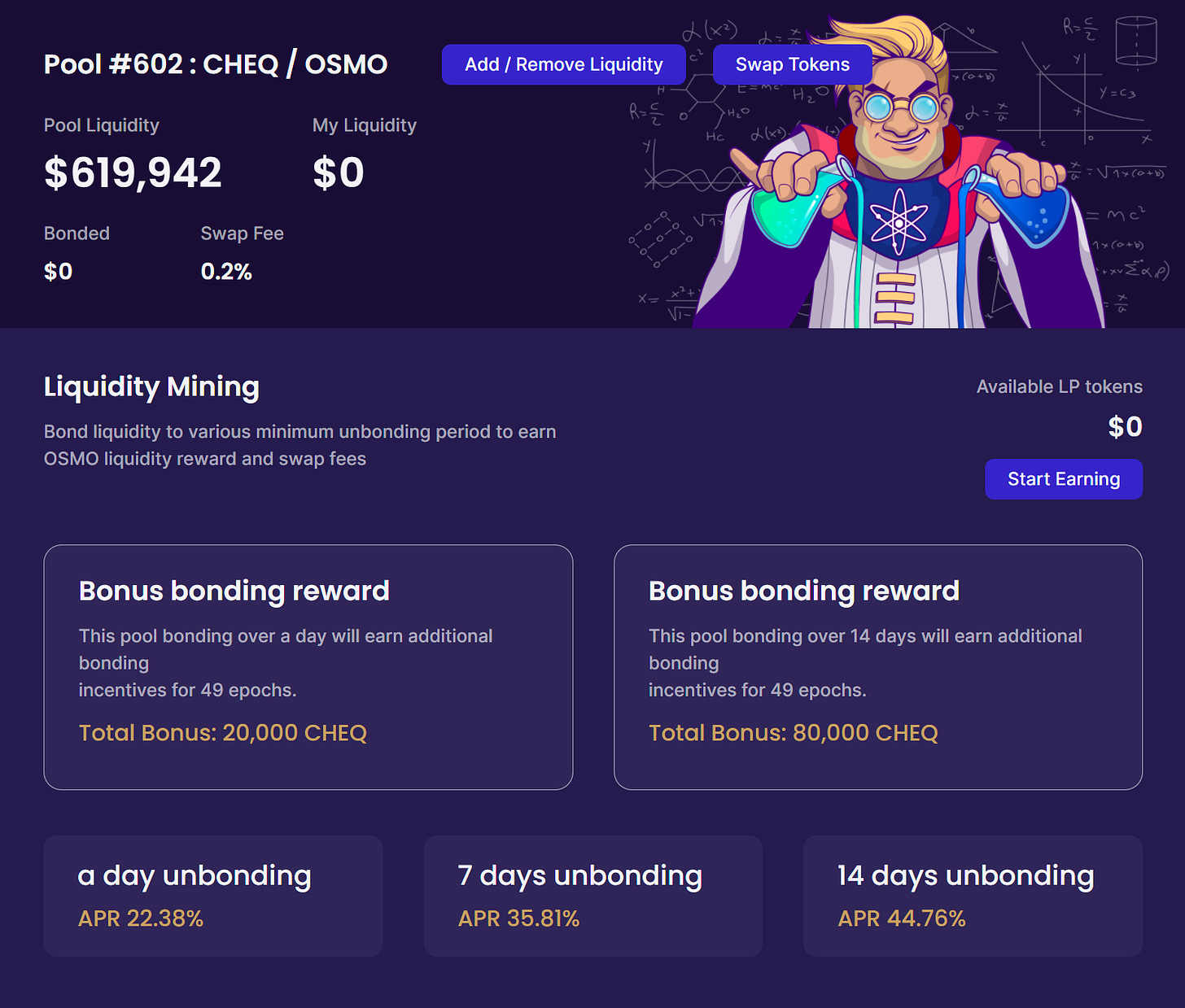

Osmosis resorts to liquidity mining (also known as yield farming) to incentivize liquidity providers to deposit their assets in the protocol during its early stages of development and growth. These rewards come from the $OSMO token inflation and are meant to offset the impermanent loss experienced by LPs. This represents an extra incentive beyond the earnings that result from trading fees.

Volume splitting present a novel mechanism to divide incentives between pools in proportion to the trades they facilitate, marking a departure from traditional incentive models where incentives are manually allocated. The following are features of this method:

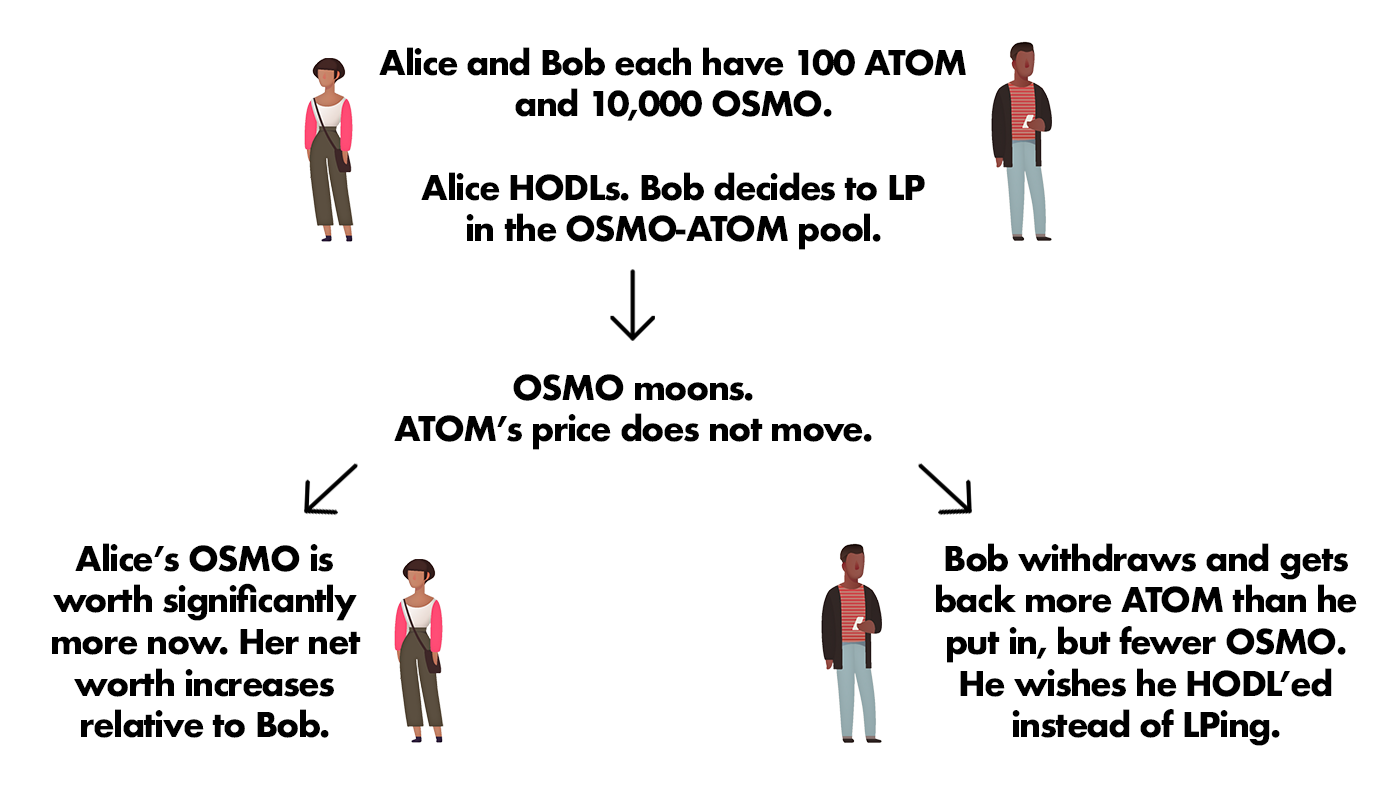

Regardless of the bonding curve of any given pool, liquidity providers are exposed to impermanent loss. Impermanent loss is the difference in net worth between HODLing and LPing. This occurs when LPs would be better off in dollar terms holding their assets instead of depositing them as liquidity.

When the price of the assets in the liquidity pool changes at different rates, LPs end up owning larger amounts of the asset that increase in price less. While this is mitigated in part by distributing swap fees with LPs, liquidity mining rewards also act as an additional incentive

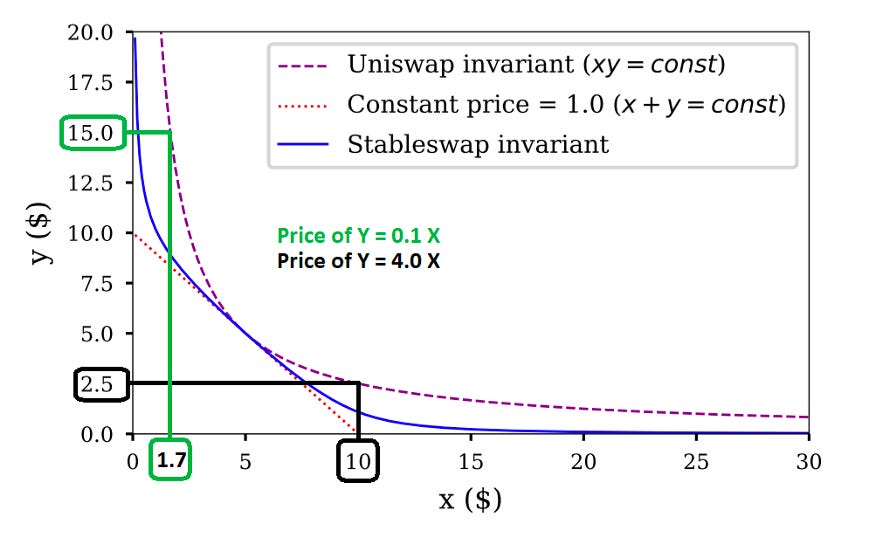

Osmosis’ design accounts for the rapid increase in the number and complexity of financial instruments in the market, such as options, pegged asset swaps, tokenized leveraged positions… Each of these instruments has its own set of characteristics that produce optimal market efficiency when paired with the correct bonding curve.

By providing an “AMM as a serviced infrastructure”, Osmosis avoids compromising efficiency and can offer a flexible value function whose parameters can be adjusted to work for the majority of decentralized instruments. Since Osmosis provides the creator of the pool with the ability to define its bonding curve value functions while reusing the majority of the key AMM infrastructure, the barrier to creating a tailor-made and efficient automated market maker is significantly reduced.

To ensure abundant liquidity at all times, the DEX implements two mechanisms to support the long-term viability of the project: bonded liquidity gauges, and exit fees.

Not all pools receive $OSMO incentives, since this decision is up to governance. Certain pools receive “allocation points” and subsequent $OSMO rewards are issued proportionally based on each pool’s points count. For pools that do not get to earn from $OSMO emissions, external incentive providers may step in to distribute their own rewards and designate the eligibility requirements.

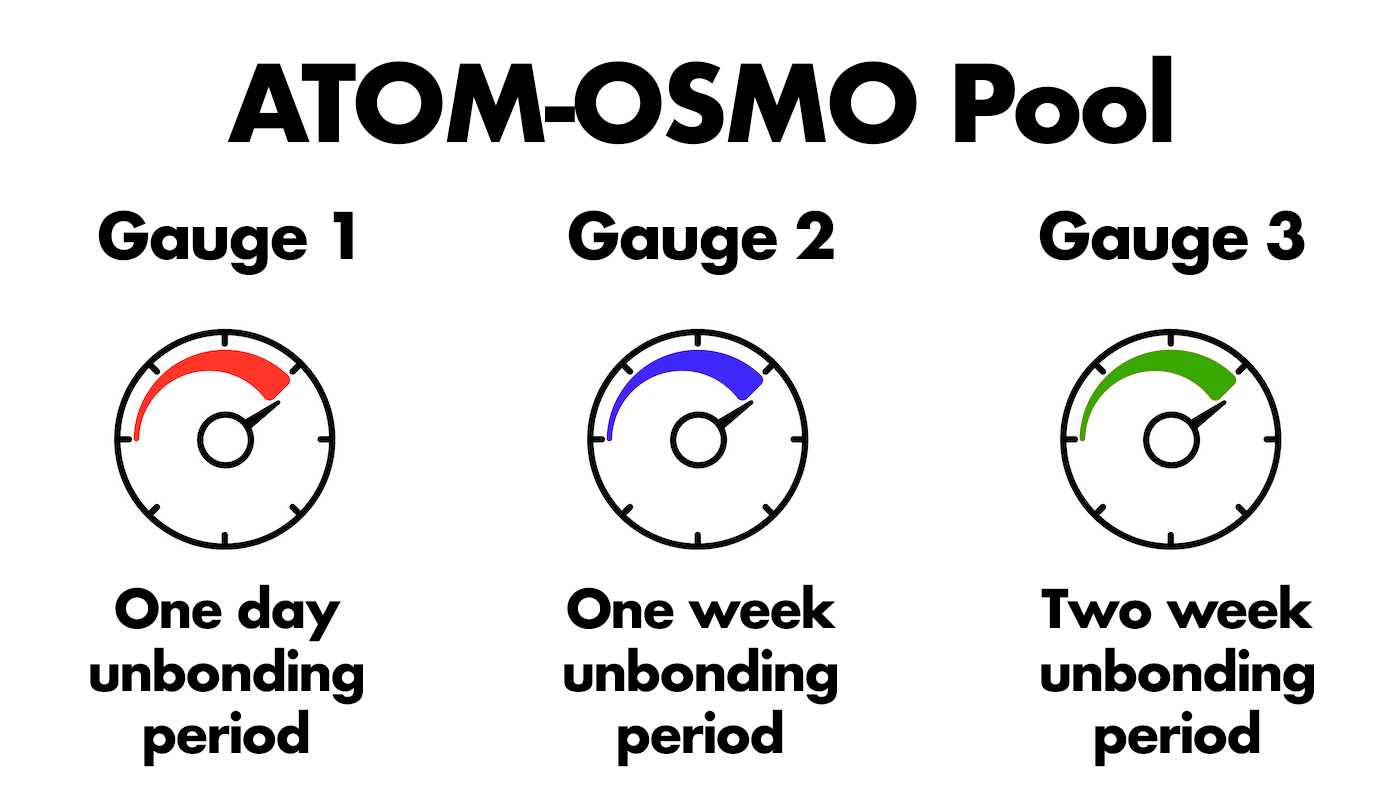

Bonded Liquidity Gauges are a mechanism that enables the distribution of liquidity incentives to LP tokens that have been bonded for a minimum period of time.

Osmosis stableswaps facilitate deep liquidity and trades with minimal price impacts for stablecoins and correlated assets. This is beneficial for all ecosystem participants:

Despite the high inspiration from Curve’s concentrated liquidity AMM, Osmosis implements additional features to improve in terms of capital efficiency.

Osmosis stableswap is built using a generalization of Andre Cronje’s Solidly curve: f(x, y) = x*y*(x^2 + y^2) = k

Having a simpler equation than Curve’s design improves the efficiency of on-chain computation of prices, swaps, tokens in/out… This was achieved as a convex optimization algorithm that attempts to equally balance speed, precisions, and computation efficiency.

Beyond the consolidation of one main pool for deep stablecoin liquidity, choosing an initial tripool for incentives would lead to Osmosis’ equivalent of Curve’s 3crv, the LP token that represents a claim on Curve’s 3pool made out of DAI, USDC, and USDT. These “3osmo tokens” could help stabilize other stablecoins in the ecosystem and might perhaps become the meta-stable of the interchain.

You can find a more complex breakdown of the stableswap formula here.

The Interchain is a term used to refer to the way blockchains can communicate and interoperate with each other.

The Osmosis chain was designed to be cross-chain native. Because of that, the chain was built to be IBC-compatible from the beginning. This also allows the protocol to, later on, integrate other non-IBC enabled chains such as EVM-based chains (via the Gravity bridge), Bitcoin-like chains, or other alternative smart contract platforms.

As an application-specific chain, Osmosis is unique within the Cosmos ecosystem because it aligns liquidity providers, DAO contributors, and delegator incentives. For instance, staked liquidity providers have sovereign ownership over their pools. On top of that, they can adjust parameters based on the competition across pools and the state of the market. Since nothing in the Osmosis AMM is hard-coded, LP providers can vote to change pool parameters, swap fees, token rates, rewards, incentives, or curve algorithms.

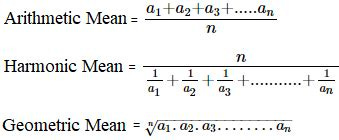

The TWAP package is responsible for serving a TWAP indicator for every AMM pool. This time-weighted average price calculation takes in a sequence of timestamps and prices as inputs and returns a price that represents the average price over that entire period of time. Osmosis currently implements an arithmetic mean (instead of a geometric or harmonic mean).

An asset’s time-weighted average price (TWAP) is the measure of its average price over a predetermined period of time. This indicator is often used by traders as an algorithmic trading indicator that allows them to minimize the impact of large orders on the market (by dispersing the large order into smaller quantities that are executed at regular intervals over time).

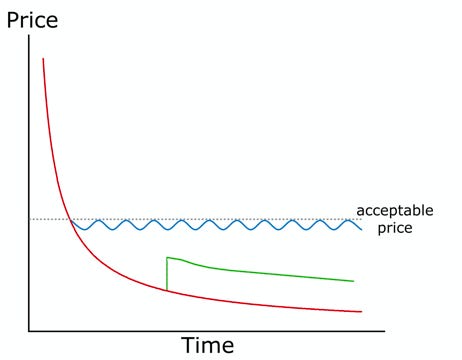

Liquidity Bootstrapping Pools (LBPs) are a special type of AMM designed specifically for token sales. This is a feature that can be sued by other protocols to distribute their native tokens and achieve initial price discovery.

LBPs are different from other liquidity pools in the ratio of assets within the pool. In an LBP, this ratio changes over time (duration of the token sale). To do that, LBPs set an initial ratio, a target ratio, and an interval of time over which the ratio will adjust. These parameter values are customizable before the token launch. For example, one project could set an initial 90-10 ratio with the goal of reaching a 50-50 ratio over a month. Doing this, the ratio will gradually adjust until reaching the target ratio within the pool.

Similar to other liquidity pools, the prices of the assets are based on the ratio at the time of the trade. Finally, once the LBP period ends, or the final ratio is reached, the pool converts into a traditional liquidity pool.

LBPs find its product-market fit to be an effective use case to facilitate price discovery. This is achieved by demonstrating what the acceptable market price of an asset is over a period of time. Ideally, there will be few buyers at the beginning of the sale. Next, the price will start to slowly decline until traders start stepping in and buying the asset. As the ratios adjust and the price declines, buyers will step in until an acceptable price is reached again.

Projects must be aware of the parameter values they set to facilitate the price discovery of the pool:

How to create an LBP: https://docs.osmosis.zone/overview/integrate/lbp

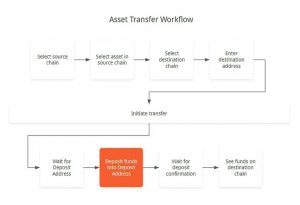

In IBC, blockchains do not pass messages directly from one chain to another over the network. Therefore, the protocol uses a relayer that monitors and processes message updates on open paths between sets of IBC-enabled chains. The relayer submits these updates in a specific message type that the destination chain can then use to verify the state of the consensus.

In addition to relaying data packets across the chain, the relayer can also open up new paths of communication by creating clients, connections, and communication channels

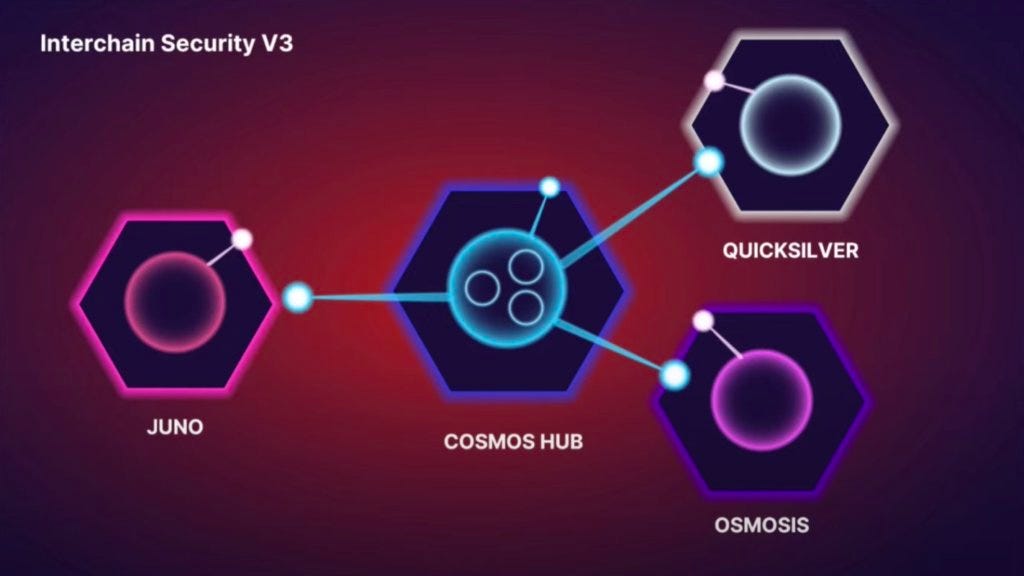

For a full consolidation and adoption of Mesh Security, Osmosis follows a multi-stage process:

The solution to the centralization issue of version 3 is to allow chains like Osmosis to also validate the Cosmos chain via a subset of Osmosis validators. Under this architecture, all Cosmos chains are going to be both provider and consumer chains.

The Osmosis Grants Program (OGP), in partnership with Axelar, Akash Network, the Osmosis Foundation, and the ATOM Accelerator, will fund an initiative to complete the development of Mesh Security and bring it to mainnet across the Cosmos ecosystem. Mesh Security will be developed as a public good by a team composed of organizations and contributors from across the Cosmos ecosystem. In addition to these initial funding partners, a number of additional chains have verbally committed to support future phases of development including EVMOS, Stargaze, Sei, and Stride.

While the core components of the initial version will be reusable for any CosmWasm-enabled chain, they plan on expanding support for any Cosmos SDK chain in the future. The front-end team will also build 1) an independent web application that is designed to scale to support any mesh-enabled chain; and 2) a UI kit that allows developers to easily embed cross-staking functionality into their application.

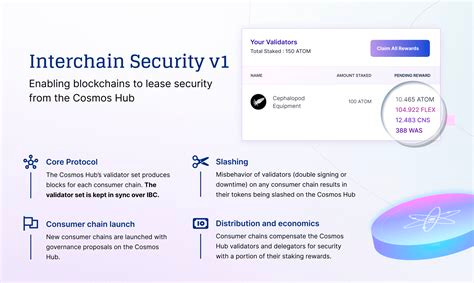

In models like Interchain Security (ICS), security flows in one direction: down from a parent chain in a hub-and-spoke fashion. In contrast, with Mesh Security, chains combine their market caps for added (bi-directional or multi-lateral) security.

Unlike ICS, Mesh Security partnerships do not require validators to run additional nodes, nor do they require the sharing or cross-chain linking of validators on each chain. Mesh Security simply allows delegators with staked tokens on one chain to restake their bonded tokens to validators of their choice on the partner chain. If the validator they choose to restake on the partner chain misbehaves, the staked tokens will be slashed on both chains. In return for taking on this additional slashing risk, delegators will receive staking rewards from the partner chain in proportion to the amount of CometBFT (Tendermint) power that their home chain is securing for the partner.

The Mesh Security initiative will be completed over three phases, each representing roughly three months of development work.

Phase 1

Phase 2

Phase 3

As a result of the rapid adoption of Axelar as a bridge service provider for application-specific chains in the Cosmos/IBC ecosystem, Osmosis can provide deep liquidity on liquidity pools that allow for swapping assets on any chain supported by IBC.

One of the key differentiators of Osmosis cross-chain swaps is the deep liquidity that the protocol provides for all ecosystem chains in Cosmos. Compared to other applications on Ethereum, like Compound, which had to recalibrate its strategy, dYdX, Synthetix, or Yearn, Osmosis is a sovereign chain instead of an L2 and does not need to pay taxes to the main chain.

Ethereum tokens are available on Osmosis as well, including $WETH and $WBTC. Different wrapped tokens may be listed, but with Axelar playing the role of being the canonical bridge provider. Besides, incentives will be allocated towards AXL-wrapped token pairs. Since Axelar supports many networks, the tokens can be bridged through many different routes. Benefits could be lower transaction fees, increased liquidity across larger or multiple pools for less slippage, or quicker transfer time. However, the downside is that this process adds extra complexity and the user will be subject to swap fees as they trade one wrap-variant for another to jump between certain chains.

Supercharged Liquidity (SL) is Osmosis’ customized implementation of the concentrated liquidity mechanism, which was introduced by Uniswap with their UNIV3 implementation. SL will provide liquidity providers and users a 200-300x increase in capital efficiency, significantly improving swap fee collection. Traders on Osmosis will also experience significantly reduced price impacts with large trades.

Liquidity providers will be able to supply liquidity at their own custom trading ranges in the pool.

By supplying liquidity within a range where more trading activity takes place, a liquidity provider can significantly enhance the fees they generate. This increase in fees is magnified as long as the trading pair stays within this designated range.

Should the trading price move beyond the range set by the liquidity provider, their ability to earn fees is halted, and the entirety of the provided funds is converted to the lower value between the two assets. To prevent this scenario, liquidity providers can actively modify the price range of their supplied funds to ensure that the trading price remains within the desired range. A narrower range leads to higher earnings but also requires more frequent adjustments.

Only manual pools are available for now, with actively managed pools deployable in the future.

SL can also be used to place “ranged limit orders” that earn swap fees while your limit order is pending execution.

For instance, a user wishes to place a limit order for purchasing $OSMO using $DAI. In this scenario, they can initiate a position with $DAI within the $DAI / $OSMO pool. This involves setting a range below the present trading price.

As the value of $OSMO decreases and starts moving within the predetermined range, the $DAI position will swap into $OSMO and will begin to accumulate swap fees through this liquidity position. If the value of $OSMO keeps dropping to the extent that it exits the defined range on the opposite side, $DAI will be entirely converted into $OSMO. The execution price will be calculated as the geometric mean between the minimum and maximum prices that are established within the specified range.

The CosmWasm pool module enables the creation and management of liquidity pools backed by CosmWasm smart contracts. The feature enables developers to build and deploy custom smart contracts that can be integrated with the rest of the pool types on the Osmosis chain.

The advantage of smart contract pools is that, unlike traditional pools, they can be upgraded and iterated upon without the need for an Osmosis chain upgrade. The module allows for the creation of unique and innovative pool types.

Osmosis supports the payment of transaction fees in any whitelisted asset. Currently, assets need to be added to the fee whitelist via governance individually, making it difficult to add or remove additional fee assets quickly.

Following the v16 upgrade, multiple fee assets can be whitelisted using a single governance proposal. Shortly after the upgrade, a governance proposal is expected on chain to whitelist a large number of additional fee denoms, improving the onboarding experience for Osmosis users.

Most AMMs have strict parameters that limit the customizability of relevant parameters such as the bonding curve and pool composition. For example, Uniswap only allows two-token pools of equal ratio with a swap fee of 0.3%. This simplicity was very useful for users who had little to no experience in market-making.

However, as the DeFi market size started to increase and market participants became more sophisticated, the need for adaptable liquidity pools became more obvious. This customizability would allow higher-level traders and arbitrageurs to adjust their strategies by interacting with a liquidity pool that would react to market conditions. As an example, the optimal swap fee to charge for an AMM pair may depend on various factors, such as block time, slippage, transaction fees, market volatility…

By making decisions on swap fees, token rates, and reward incentives in a flexible way, liquidity pools can respond to market changes in a way that ensures their success. Nothing in the Osmosis AMM is hard-coded: LP providers can vote to change pool parameters, swap fees, token rates, rewards, incentives, or curve algorithms.

Osmosis provides a protocol that allows market participants to self-identify opportunities in the market and react to market conditions by adjusting various parameters of the pool. For instance, an optimal equilibrium between fee and liquidity can be achieved through an iterative process instead of a centralized one-time decision. This further increases the total addressable market for AMMs and bonding curves that go beyond simple token swaps.

As more liquidity becomes available to users, either through liquidity mining incentives or airdrops, it could be strategic to incentivize market participants to add more liquidity to a pool. This ensures that the pool remains at a healthy and consistent rate for the asset.

The pool governance feature of Osmosis allows for a diverse spectrum of liquidity pools with different risk tolerances and strategies. In Osmosis, liquidity pools are self-governing and completely customizable through governance. This is an innovative and differentiating feature as well since the liquidity pool shares are not only used to calculate the fractional ownership of a liquidity pool but also to provide the right to participate in the strategic decision-making of the liquidity pool.

To incentivize long-term liquidity commitment, shares must be locked up for an extended period of time. Longer-term commitments are awarded by additional voting power or additional revenue from liquidity mining. This long-term commitment helps to prevent the impact of potential vampire attacks, where the ownership of the pool shares is delegated and potentially used to migrate liquidity to an external AMM. Besides, this mechanism provides equity of power amongst liquidity providers, where those with greater skin in the game are given higher voting power to steer the strategic direction of the pool they are taking risks on with their own assets.

The idea behind a vampire attack is to lure users away from a protocol or liquidity pool by forking or incentivizing them to migrate the liquidity to an identical or similar pool that is empowered with a more profitable and attractive incentive mechanism.

One of the most famous vampire attacks was performed by Sushiswap, which offered better liquidity provider rates than its main competitor, Uniswap. This pushed many investors to move their liquidity away from Uniswap and transfer it to Sushiswap instead.

In Osmosis, the liquidity providers who may disagree with the changes made to a pool are able to withdraw their funds with little to no loss. Since Osmosis expects the market to self-discover the optimal value of each adjustable parameter, users will be able to start a competing liquidity pool with their own strategy whenever they disagree with a governance proposal applied to a pool they are in.

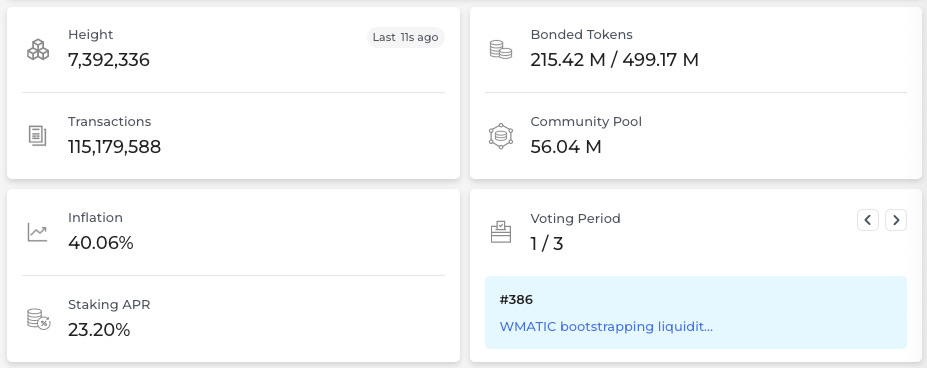

As a PoS (Proof of Stake) network, token holders are active participants in securing the chain. This is achieved by staking the native token, $OSMO. Validators and delegators secure the chain by participating in network consensus by operating validator nodes (validators) or delegating OSMO tokens to node validators (delegators).

By delegating to a validator, the user is giving permission to that node to use their delegated stake to participate in the consensus of the network. To do that, validators must garner enough stake (self-bonded + delegated) to become active and earn rewards.

While operating a validator requires a level of technical competency, there is no need for delegators to have that knowledge. Any token holder can stake and delegate $OSMO tokens. These tokens will be locked by a validator to start earning rewards. Whenever the delegator wants to recover its liquid tokens, it will start an unbonding process and it will no longer be entitled to staking rewards.

The following requirements are recommended for validators:

How to validate the Osmosis blockchain (mainnet)

How to validate the Osmosis blockchain (testnet)

The Gini coefficient is a measure of the reward distribution across the validators in the network (the higher the Gini coefficient, the greater the inequality).

The Nakamoto coefficient measures the degree of decentralization of a blockchain and represents the minimum number of nodes required to attack the network (the higher the Nakamoto coefficient, the more decentralized a blockchain is).

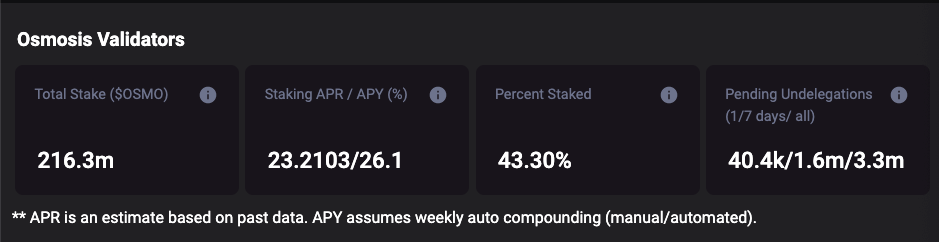

Staking is the process by which users or delegators delegate and bond their $OSMO tokens to an active validator in the Osmosis network in order to receive rewards from inflation (token emissions). The bonded tokens are part of a validator’s stake server as collateral for participating in the network’s consensus process. For this participation, validators earn rewards, but they can also be slashed if they misbehave.

Alongside Mesh Security, cross-staking will also be prioritized in the Osmosis roadmap. In Cosmoverse 2022, Sunny Aggarwal, founder of Osmosis, pointed out that roughly 75% of validator sets on Osmosis also run validators on Juno, while 72% of Juno validators also validate Osmosis. The impact of this does not result in an increase in centralization, but rather in the form of a ‘shared security’ model whereby malicious actors on one chain would be slashed on another chain through governance.

In this context, Sunny Aggarwal presented the concept of cross-staking within the Cosmos ecosystem. This would allow validators to boost their rewards across the Cosmos ecosystem using IBC and to submit transactions across more than one chain.

In order to avoid centralization, all delegators choose the validator with the highest rewards due to their participation in cross-staking. Besides, smaller chains would be able to cap the voting power of their chains to protect against 67% attacks.

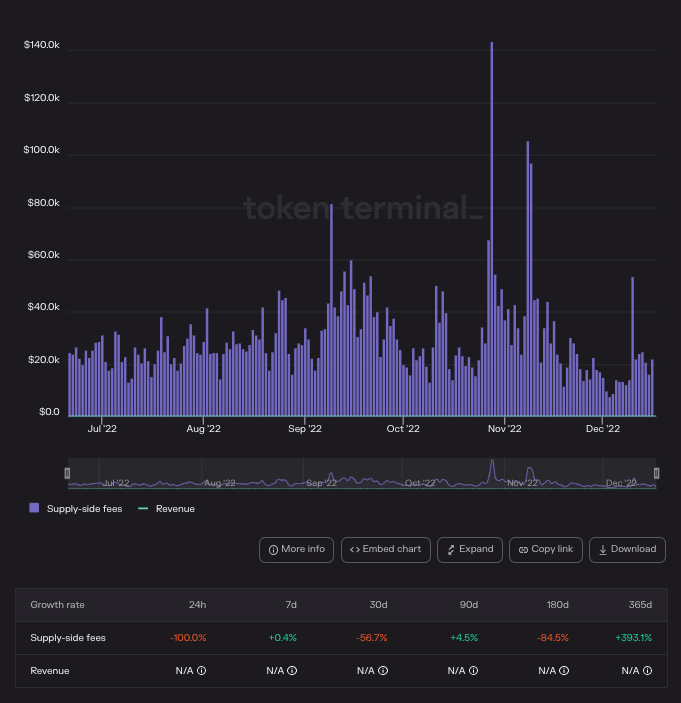

In addition to liquidity mining, Osmosis provides 3 sources of revenue:

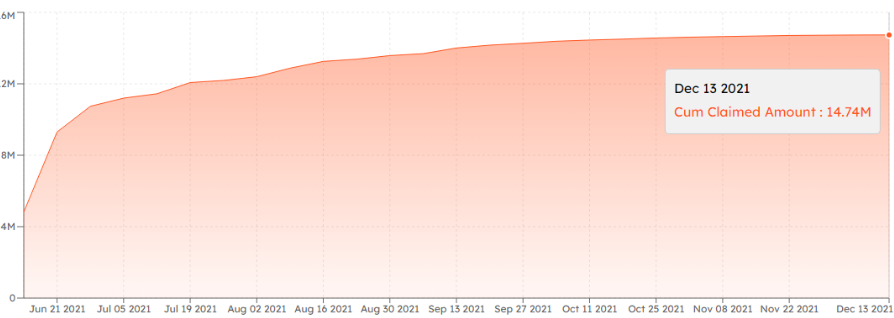

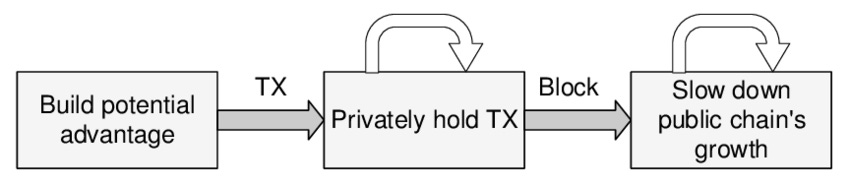

The Osmosis Protocol Revenue Module came about as a solution to combat MEV (Maximum Extractable Value) searchers capturing millions of dollars through arbitrage on Osmosis (almost $7m), without paying fees to the network in proportion to their profits ($46k in transaction fees).

The module was enabled in the Sodium upgrade on March 16, 2023.

The module was proposed by Skip Protocol (a sovereign MEV infrastructure for sovereign blockchains and protocols), to capture arbitrage opportunities on Osmosis, redirecting proceeds back to the community instead. It is expected to produce an additional $50-150k revenue for the community per month, increasing proportionally with trading volume.

The module works by:

The Osmosis DAO will be able to use this revenue however it sees fit, with examples such as:

The Osmosis txfees modules allow nodes to support multiple assets being used to pay for transaction costs. Because of this, node operators can specify their fee parameters for a single base asset.

$OSMO is the native token of the protocol, which is used for both governance and staking. For instance, token holders can delegate $OSMO to validators in return for staking rewards and voting rights.

$OSMO is the governance token and allows staked token holders to make decisions on the future of protocol (proposing, vetting, and passing proposals):

$OSMO token holders determine which pools are eligible for liquidity rewards with the goal of aligning stakeholders and LPs with the longevity of the protocol.

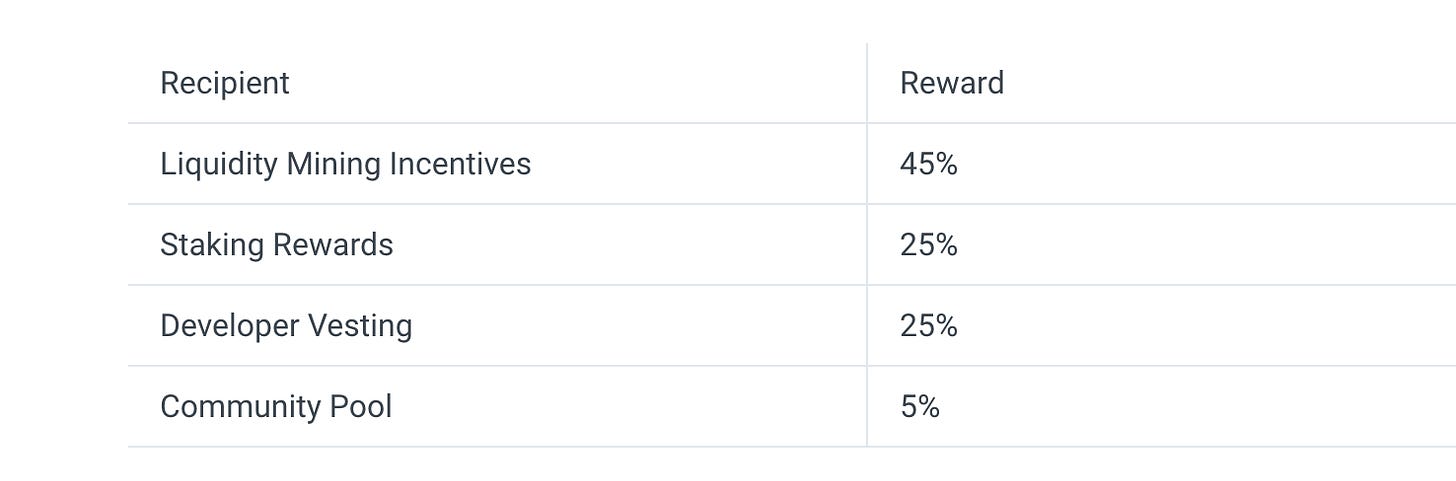

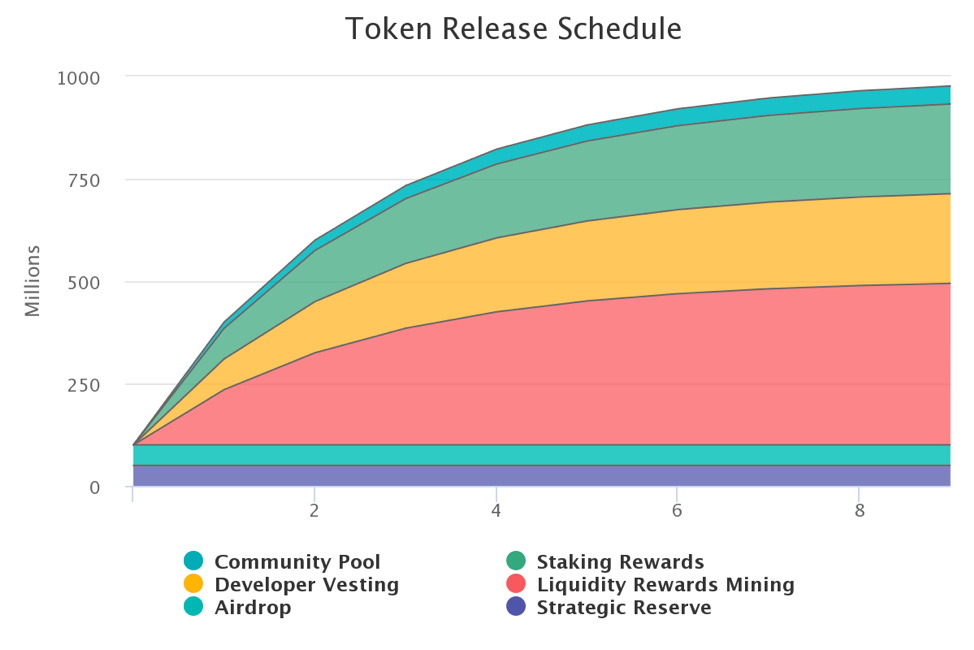

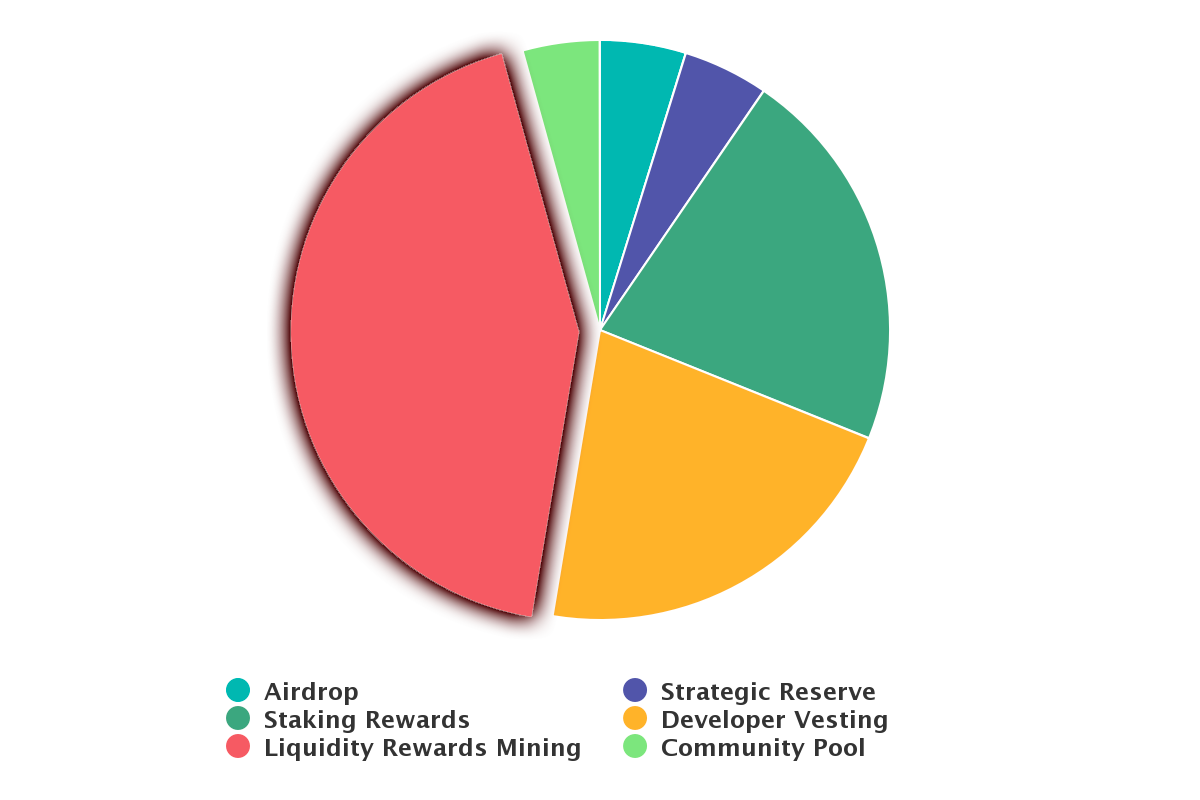

The maximum supply of $OSMO is capped at 1,000,000,000 and follows a 9-year distribution schedule. The distribution emphasizes both staking and liquidity mining rewards, which all together make up 70% of the distribution. This is the result of a strategic decision by the core team to bootstrap the network and gain traction as the go-to Dex in the Cosmos ecosystem.

As the protocol gets more product-market fit, the amount of staking rewards and token emissions will flatten over time to reduce the dilution of the token (but also reduce the incentives for token holders). As an example, the inflation of $OSMO during Q1 2022 was 92%. Currently, the inflation rate has decreased to ~40%.

The initially released supply of 100M $OSMO was split evenly between Quadratic Fairdrop recipients and the strategic reserve. After launch, the newly released tokens will decrease the inflation rate following the distribution below.

$OSMO was highly inflationary in the beginning and, over time, the initial released supply will only account for a small percentage of the total supply.

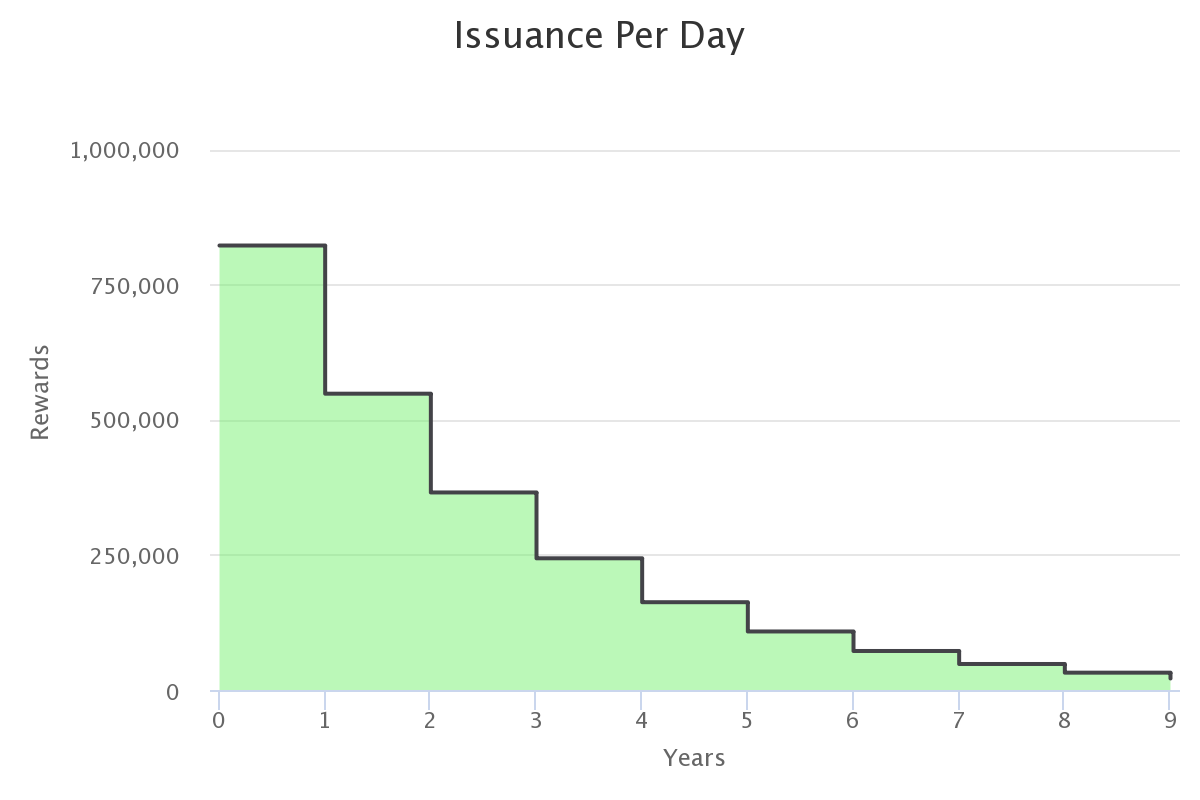

After the genesis supply, additional tokens are issued at the end of each epoch (one day). This is different from the majority of other Cosmos chains, where the issuance is distributed on a per-block basis.

Osmosis’ token issuance follows a thirdening schedule, similar to Bitcoin’s halving (where issuance is reduced by half every 4 years). Due to this issuance cycle, Osmosis token releases are cut by one-third every year.

In the first year, 300M new $OSMO will be issued. In the next year, 200M tokens will be used and in the third year the amount will be 133M tokens. This process continues until Osmosis reaches an asymptotic maximum supply of 1B.

There was no pre-mine and the $OSMO token was daily distributed to network participants, such as stakers, liquidity providers, and developers. The first half of the genesis supply was distributed in a Quadratic Fairdrop.

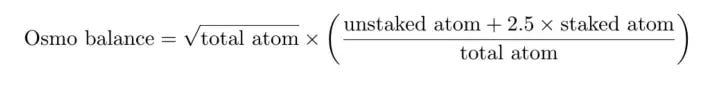

Since the $OSMO token was deployed during a time when the Cosmos Shared-Security model was not yet implemented, Osmosis allocated its genesis supply to the Cosmos Hub through a Quadratic Fairdrop.

The Quadratic Fairdrop distribution draws its inspiration from quadratic voting, a distribution and incentives alignment scheme that is meant to decrease the inequality in the governance set while still recognizing the most valuable contributors and largest stakeholders. This mechanism rewards Cosmos Hub accounts that actively participate in staking while reducing the amount of $OSMO tokens that are allocated to big players such as exchanges or whales. Through this formula, an address’s potential $OSMO allocation will be proportional to the square root of its $ATOM balance with a 2.5x multiplier applied to staked ATOM tokens:

The snapshot for the Quadratic Fairdrop was taken on February 18, 2021, at 6:00 UTC during the Cosmos Hub Starship Upgrade. Besides, to ensure that users are incentivized, there was a requirement to participate in several on-chain activities in order to earn the airdrop allocation, such as governance, or staking on the Osmosis network. The goal of the quadratic fairdrop ensures that all members of the Cosmos Hub are given an opportunity to participate in Osmosis.

The other half of the genesis supply was set aside for the Strategic Reserve. These funds are reserved (will not be sold on the market) and controlled by a multi-sig DAO initially controlled by the development team. This reserve will be used to align the incentives of long-term stakeholders of the protocol through grants and strategic fundraising. The funds may also be delegated to stakeholders who provide unique value to the ecosystem, such as open-source resources like block explorers, wallets, relayers…

Strategic fundraising rounds are subject to vesting periods that will linearly decrease over two years with a one-year cliff.

Osmosis has integrated with Skip Protocol, a protocol that brings sovereign MEV infrastructure to blockchains. It currently supports a number of blockchains in the Cosmos ecosystem, including Osmosis, Juno, Injective, and Evmos. Skip Protocol aims to reduce the impact of MEV on blockchain ecosystems. MEV in the context of blockchains has several negative implications. For one, UX can be negatively impacted, as automated bots arbitrage trades happening on the chain. MEV can also have centralizing effects on a blockchain.

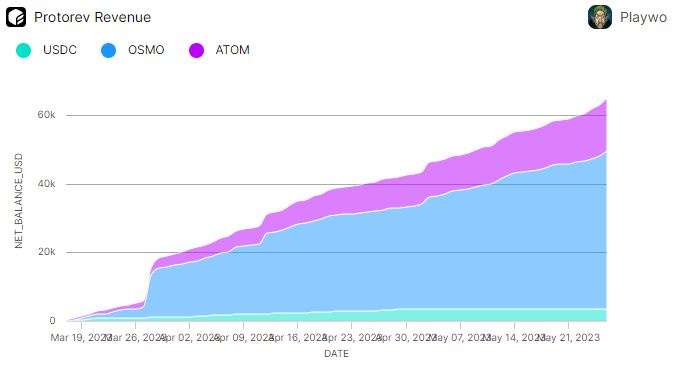

ProtoRev, a recent initiative from Skip Protocol aims to help solve this issue of Osmosis. ProtoRev returns revenue previously lost to MEV back to the chain. This MEV recapture is given in the form of $USDC, $OSMO, and $ATOM.

As you can see, the majority of the real yield being earned from ProtoRev is in $OSMO. This is because most of the trading volume that takes place on Osmosis involves the $OSMO token since it’s used in many LP pairs.

The community is still discussing what productive use cases exist for this real yield that is now being generated for Osmosis. Multiple proposals have been put forward, with some being rejected or receiving criticism.

There are two ways by which Osmosis pools can earn rewards from liquidity mining incentives:

Osmosis relies on Bonded Liquidity Gauges to distribute its liquidity mining rewards to LPs that have been bonded for a duration of time. 45% of the daily issuance of $OSMO tokens goes towards these incentives.

Whenever a pool is onboarded to receive Liquidity Mining Incentives, it will be assigned a number of allocation points that will entitle that pool to a specific percentage of the daily $OSMO issuance.

The OsmoIncentives github repo is actively maintained and is responsible for creating a new proposal that adjusts the incentives allocation on a weekly basis. The distribution is exported to a CSV file that is attached to the current voting proposal and the prospective proposal spreadsheets.

The category of a pool determines the ratio of incentives:

Qualification for Major is determined by governance based on a combination of factors:

External incentives are an effective way for other projects to incentivize users to deposit liquidity in the pool of their native tokens. This is a permissionless process where anyone can deposit any amount of token into a gauge to start bonding rewards to the users of that pool.

In fact, to attract more projects to the ecosystem, Osmosis Governance voted to add the External Incentive Matching program.

The External Incentive Matching program dictates that, if on-chain governance votes in favor of matching external incentives to a pool, then the amount of incentives is measured in dollar value to match the value in $OSMO tokens and release that $OSMO as extra liquidity mining rewards to all bonding gauges of the pool. This has the potential to double the rewards of a project’s external incentives. However, there are certain limitations:

It is also possible to add incentives to any combination of 1-day, 7-day, and 14-day gauges:

Currently, the only way to create a gauge for external incentives is by running the create-gauge command using the CLI (Command Line Interface)

Current incentives distribution

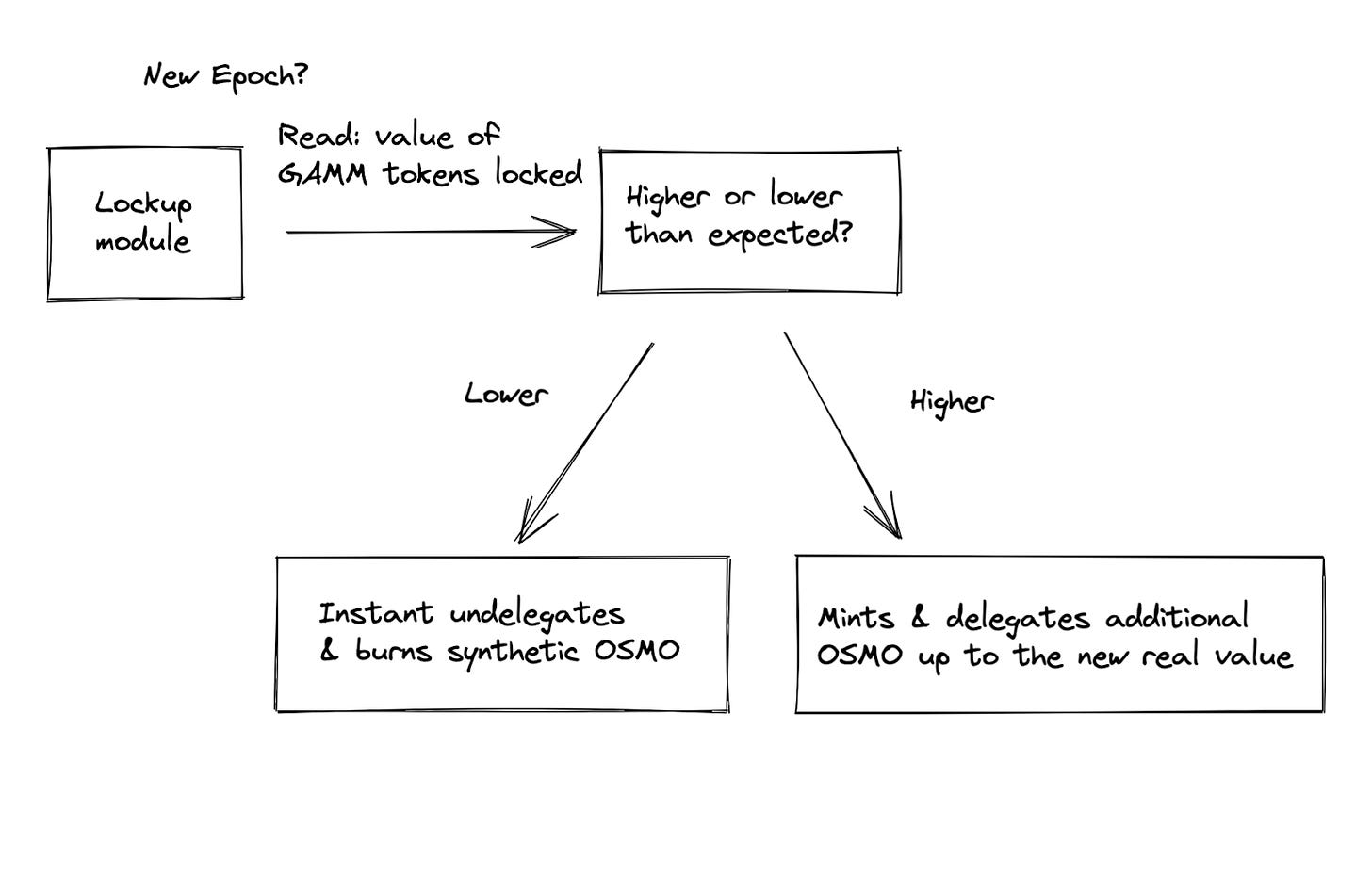

The $OSMO token is also minted and burned in the context of Superfluid Staking. This is an Osmosis-specific feature that provides the base consensus layer with an extra level of security that it gets from a sort of “Useful Proof of Stake”. By participating in Superfluid Staking, each participant gets an amount of $OSMO representative of the value of their share of liquidity pool tokens staked and delegated to validators. This results in a greater degree of security since this process allows AMM LP shares to be used in the consensus layer of the chain.

Superfluid Staking requires minting $OSMO. These newly created tokens are then staked on the Osmosis chain and used as collateral. To represent the value of each superfluid stakers’ LP tokens, an equivalent amount of Synthetic $OSMO is minted. Every epoch, the protocol will read the number of locked tokens in the superfluid model to determine the representative price of the LP token shares in order to increase or decrease the $OSMO delegation by minting/burning $OSMO tokens.

There are now over 35 million OSMO securing the chain thanks to superfluid staking.

Intermediary accounts establish the connections between the superfluid staked locks and the delegations to the validator. Intermediary accounts group the locked assets for the same validator selection.

The Superfluid Staking module mints an equivalent (of the $OSMO tokens that are locked) amount of $OSMO and sends it to the intermediary account, which will delegate the tokens to the specified validator.

Osmosis Superfluid Staking can further incentivize users to provide liquidity to a pool since they will be able to stake their LP tokens for extra rewards. The extra incentives come from the $OSMO in the pool being staked. Because of this, only pools that use $OSMO as the base asset can participate in superfluid staking.

Currently, there are no strict criteria as to which pools are eligible for participation in Superfluid Staking. Because of that, this is a governance decision.

There are also slashing mechanics in place to punish dishonest validators. When this happens, the amount of tokens that are slashed is calculated and removed from the underlying and synthetic lock. Because of this, it is important for users to do their due diligence before delegating their assets. All slashed tokens go to the community pool (instead of being burned).

Beyond the immediate relocation of incentives and the distribution across multiple pools, Osmosis has managed to gather ~150 validators that provide security to the chain and grant the chain a Nakamoto coefficient of 8. This is a low number in comparison to other Cosmos chains such as Thorchain, which has a coefficient of 28, or even outsider chains such as Solana and Avalanche which, despite being criticized for being too centralized, have coefficients above 30.

Low decentralization remains one of the weaknesses of most chains developed with the Cosmos SDK. Solutions that bring in additional incentives for users, such as superfluid staking, will improve the level of decentralization and network security.

The Nakamoto coefficient is a metric used to gauge the decentralization of a blockchain.

The Nakamoto coefficient represents the number of validators (nodes) that would have to collude together to successfully slow down or block the functionality of a blockchain.

It is also worth noting that, as more chains enter the Cosmos ecosystem, their projects might want to airdrop some of their tokens to Osmosis accounts. To do that, they will follow the steps indicated in the Osmosis Airdrop Guide:

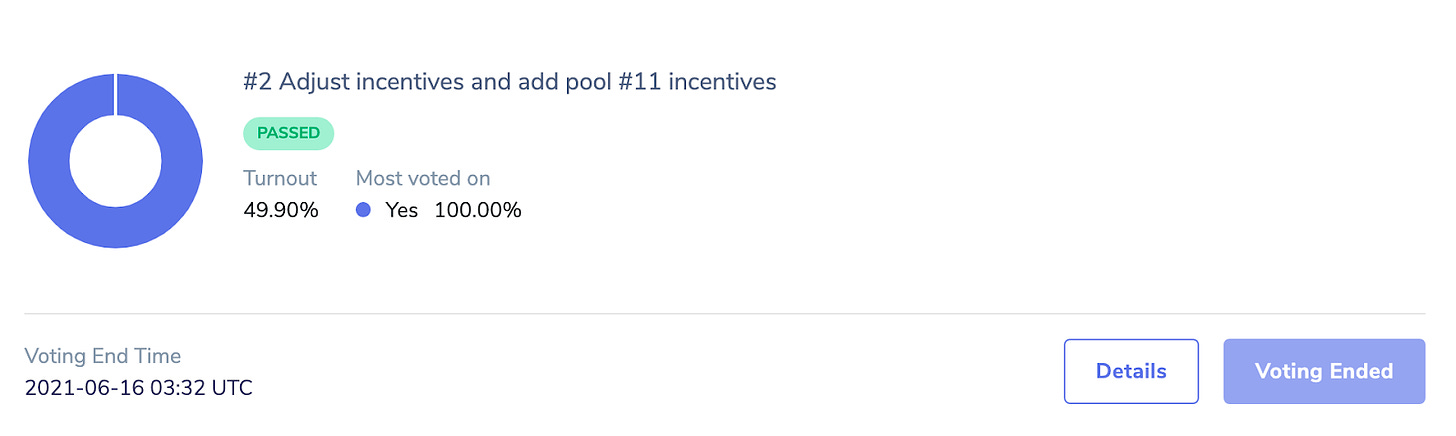

Protocol users can delegate $OSMO to validators in order to be able to participate in governance by making proposals and voting on different aspects of the protocol, such as upgrades, fee distributions, allocation of mining rewards…

While most AMM protocols have the same global parameters for all liquidity pools, Osmosis governance makes token holders responsible for selecting which liquidity pools should receive liquidity mining rewards. More specifically, the pools eligible for liquidity rewards are selected by $OSMO token holders, allowing liquidity providers to formulate an incentivization strategy that best aligns with the long-term interests of the protocol.

Since not all pools have incentivized gauges, Osmosis relies on staked $OSMO holders to choose which pools to incentivize via on-chain governance.

Allocation points are used by governance modules to allocate rewards to specific gauges and incentivize those pools. Since 45% of the daily $OSMO issuance is assigned to liquidity incentives, the newly released $OSMO is distributed proportionally to the allocation points of each gauge.

The percent of the $OSMO liquidity rewards that each gauge receives is calculated as its number of points divided by the total number of allocation points.

For example, for a distribution of 20 allocation points towards 3 pools with 10 allocation points, 5 allocation points, and 5 allocation points respectively, the pool with 10 allocation points will receive 50% of the incentives that are minted, while the other two pools will receive 25% each.

Governance can also pass a UpdatePoolIncentives proposal to edit the existing allocation points of any gauge. For instance, by setting the allocation points to zero, a pool can be removed from the incentives gauges directly.

Proposals can also set the allocation points of new gauges. For example, when a new gauge is added, the total number of allocation points increases and will dilute the existing incentivized gauges.

Gauge #0 is a special gauge whose functionality is reserved for sending incentives directly to the chain community pool. By assigning allocation points to gauge #0, governance can save the current liquidity mining incentives ($OSMO inflation) to be spent at a later time.

Besides allowing the community to add incentives to gauges, Osmosis also allows anyone to deposit tokens into a gauge for distribution. This feature makes it possible for other projects to augment Osmosis’ own liquidity incentives program.

Projects can add additional incentives to pools paired with their own native token over a period of time that they choose (e.g. a one-month liquidity program).

It is a requirement for pools to be voted in order to be onboarded to receive Osmosis Liquidity Mining incentives. Therefore, to increase the chances of a pool being accepted, it is recommended:

Governance is currently responsible for making decisions about which pools are eligible for participation in Superfluid Staking.

The reason why not all $OSMO pools are allowed to enable Superfluid Staking is that in the case of the asset paired with $OSMO suddenly losing its value, the amount of $OSMO in the pool would shrink significantly. This would be a security concern to the chain since $OSMO is required for validating transactions.

The outcome of Proposal 251 was the formation of the OMM (Osmosis Ministry of Marketing). Through this initiative, the team ensures that the community and official social media platforms are maintained and informed in collaboration with the support of the Osmosis Lab Support Team. The OMM has worked to standardize the public content and reach out to other communities for collaboration and partnerships.

Contact email: marketing@OsmosisDao.zone

Before being recorded on-chain, a governance proposal is first presented in the governance forum. Once on-chain, the proposal will enter a deposit period. If the deposit is not filled before two weeks, the deposit amount will be burned and the proposal will never be voted on.

Requiring a deposit for making a proposal is a mechanism intended to discourage spam proposals. Similar to how voting works in Cosmos, stakers can vote Yes, No, NoWithVeto, or Abstain. Any individual vote can be modified during the voting period.

For a proposal to be valid, there must be enough voting power participating in order to reach the quorum of 20% of the total staked OSMO being active in that proposal. Voting “Abstain” is counted towards the quorum but has no impact on the direction of the vote. The “NoWithVeto” option is typically reserved for spam or malicious proposals. There is a requirement of 33.4% of the voting power to be in the “NoWithVeto” option in order to reject a proposal and burn the deposit.

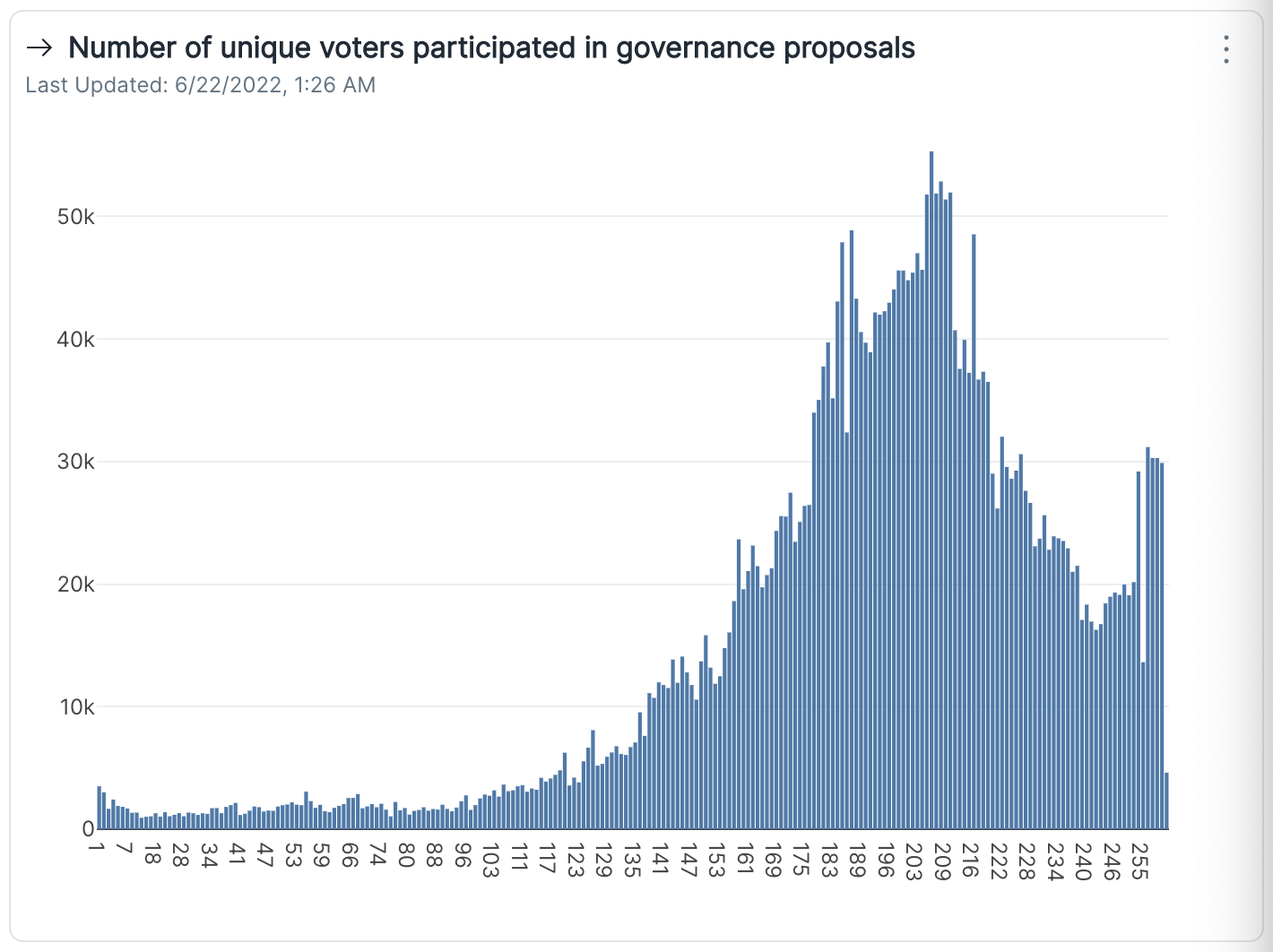

Data from Flipside Crypto reveals that it takes about 23 days on average for a wallet to engage with governance, and only 7% of wallets on Osmosis have never participated in governance voting. By the end of 2022, 228 proposals have been actively voted.

Jay Jeong wrote a 48-page Osmosis Annual Governance Report 2022.

The report included:

Key Insights of the report were:

Conclusion of the report:

In order to keep validators honest in running the consensus of the chain, there is a slashing mechanism that is used to disincentivize bad behavior. Whenever a slashing incident occurs, a portion of the validator’s stake will be burned (the amount depends on the severity of the misbehavior). Examples of misbehavior include node downtime or double-signing.

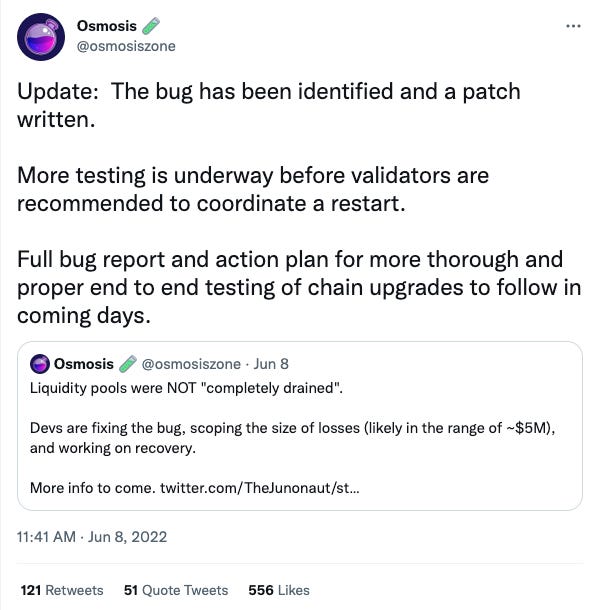

On June 8, 2022, the Osmosis Chain was halted after suffering a $5M exploit that allowed malicious attackers to withdraw 50% more tokens from liquidity pools than they had originally deposited.

Developers were able to halt the chain 12 minutes after the discovery of the bug by a community member under the name Straight-Hat3855 on the Osmosis subreddit (now deleted). The pseudonymous Osmosis senior analyst RoboMcGobo disclosed the information to the chain’s validators on Discord, which were able to react fast and coordinate an emergency response that prevented the attackers from draining more funds.

In total, over $5M was exploited out of the most liquid tokens, where $ATOM, $OSMO, and $USDC added up to 90% of the extracted capital. While $WETH and $WBTC were also targeted, this did not cause significant losses due to the liquidity not being deep enough. Two wallets took the large majority of tokens in the exploit, with one of them being responsible for more than 60% of the total funds stolen.

In the aftermath of the event, the damage was not significant. Aside from the temporary halt of the chain, Osmosis did not have to revert any transaction or fork the chain.

In July 2022, a malicious actor attempted to halt the Osmosis chain by creating over 20,000 incentive gauges with the intent of overloading validator nodes at the Osmosis epoch block. Although this attempt cost the attacker 20 $OSMO and wasn’t successfully executed, this resulted in Osmosis users being dusted with a small number of tokens that revealed a potential attack vector.

A dusting attack consists in sending small amounts of tokens to thousands of wallet addresses. While sending tokens is not a harmful action per se, this is a technique used by attackers to deanonymize users and break their privacy.

To mitigate the potential attack vectors from this event, the Scambuster Upgrade went live on August 3 introducing the following changes:

This resulted in an increase in costs for attempting similar attacks in the future.

The Oxygen Upgrade was implemented in Q3 2022 as a prevention mechanism.

Osmosis was not audited at launch, and the first round of audits took place shortly after. In February 2022, Osmosis managed to hold $1.17B in TVL without being audited.

As the pioneer of Superfluid Staking and the use of $OSMO in DAO-selected LPs to bolster the chain’s security, the superfluid-staked $OSMO helped to protect the Osmosis chain from a liveness attack during the Terra collapse.

A liveness attack is a 3-step attack that can delay the confirmation of transactions being submitted to a chain,

Because of how critical Superfluid Staking is to keep the chain secure, its LPs receive extra staking rewards on top of the regular LP incentives.

When it comes to cross-chain security and trust assumptions, Osmosis seeks to prevent failures and well-known hacks that affected other protocols, such as the $650M Roning bridge hack, the $320M Wormhole bridge attack, or the $100M Harmony bridge exploit.

When assets are on the Axelar and Osmosis chains, they are secured by their respective validator sets. Upon every transfer of assets or messages with other chains in the Cosmos ecosystem, they have all the security benefits from IBC.

With the integration of the Axelar chain, Osmosis can surpass the limitation of not being able to other external chains outside of the Cosmos ecosystem. By currently being secured by more than 40 independent validators, Axelar, and the $AXL token can securely verify the block headers of other chains as if they came from light clients on Cosmos. While it is possible that the gateway smart contracts on various chains could be hacked (as with minting-and-burning bridges), the contracts have been audited and tested in production. Furthermore, if validators notice any unusual activity, one-third of the validating power can be used to halt the bridge and execute an emergency shutdown.

Another attack could be a one-third (liveness) or two-thirds (safety) attack. However, these attacks are less likely to happen, since the colluding validators would be slashed and lose the future earnings they would make if they were to collude.

Additionally, interchain security will make it even harder to perform this type of attack.

Interchain security consists of renting validator power from other chains to increase the amount of staking power that an attacker would need to control and attack a chain.

The security of the chain is also taken into consideration when it comes to making governance on what pools are eligible for Superfluid Staking. For instance, not all pools that have $OSMO as the base asset are eligible. This is a security concern controlled by Governance and seeks to avoid scenarios where the asset paired with $OSMO rapidly decreases in value and shrinks the amount of $OSMO in the pool, which has an impact on the security of the chain.

The superfluid staked $OSMO is meant to be safely staked and remain untouched for at least 14 days (the duration of the unbonding period). If the amount of $OSMO in a pool suddenly shrinks, it has the same effect as releasing the staked $OSMO before the 14 days period. This is why Governance is involved in making decisions about tokens and projects that are legitimate to the community.

Osmosis also inherits liquidity risks from its integration with bridge providers, with the Axelar network being the major provider. While cross-chain bridges allow users to access tokens on other blockchain networks and make it easier to onboard new communities of users, wrapped assets on non-native chains have 4 significant limitations:

While Axelar’s General Message Passing (GMP) allows any payload to move securely between chains – not just wrapped tokens – it cannot be considered a truly interoperable solution until it is widely adopted. Nonetheless, its bridge infrastructure is permissionless and maximizes security through decentralization (quadratic voting). As a result, Axelar’s dynamic validator set minimizes potential exploits by making it harder for any given node to gain outsized control over the network.

Osmosis raised $21M in an October 2021 token sale led by Paradigm. This was the last funding round to date and took place as an Initial Coin Offering round. Among other investors who participated in this round, one can find Robot Ventures, Nascent, Do Kwon, Figment, and Ethereal Ventures.

On October 1, 2020, Osmosis raised an undisclosed amount from Bossanova Investimentos

Osmosis has partnered with the blockchain developer tool Confio to integrate the CosmWasm inter-blockchain smart contract engine into the Osmosis protocol. This allows Osmosis to host one of the largest developer ecosystems outside of the Ethereum and Solana communities.

CosmsWasm provides access to a WebAssembly Virtual Machine for developers familiar with Go and Rust. This will allow them to boost interoperable functionality between various Cosmos appchains.

Wasm is a compiler target in a binary format that is platform-agnostic. Wasm allows the fast execution of Rust, C, and C++ code by running the same set of instructions regardless of the machine it is operating on. This helps nodes in a peer-to-peer network to run state transition updates without forcing every peer to run the same hardware.

Quasar is a DeFi vault appchain that makes it easier for passive investors to earn a yield on Cosmos. These vaults can be used to run automated strategies that earn yield anywhere in the Cosmos interchain. For example, users would be able to access decentralized hedge funds, custom ETFs, VC DAOs, and treasury management solutions for DAOs… This allows retail users to access yield opportunities without having to understand advanced finance and blockchain concepts. More advanced users can also benefit by creating strategies that they can run on-chain in a fully automated manner.

Quasar iterates over well-known yield farming models, such as Yearn. This is achieved with distinctive features such as:

Quasar users, as liquidity providers, will deposit assets into the vault of their choice. Each vault will run a different yield aggregation strategy, which is curated by the vault’s creator or governors. All decisions within the vault can be collective as well — administrators alongside liquidity providers — by using a vault-specific token for governance. The same token is then used to track pro-rata shares of the vault’s returns. By default, there are no deposit or withdrawal fees, but each vault can have custom asset management fees set by the strategy creator.

Official Links