Kujira is a decentralized ecosystem for protocols and developers seeking to build applications that offer a sustainable, real yield. The protocol’s vision aims to provide equal opportunities to every DeFi user. Under this premise, Kujira enables innovative use cases that allow retail investors to go beyond the traditional use cases of blockchain technology, such as asset exchanges, staking, ICOs… This is achieved by building tools that provide easy and cost-effective access for market participants, ranging from seasoned professional traders to novice retail investors.

To fulfill its mission, Kujira is a decentralized sovereign layer 1 ecosystem. Its value proposition is derived from FinTech solutions and financial instruments that seek to revolutionize the current payment infrastructure. They hope to do this with innovative and revenue-generating products that provide equal opportunities for all market participants regardless of their investment skillset.

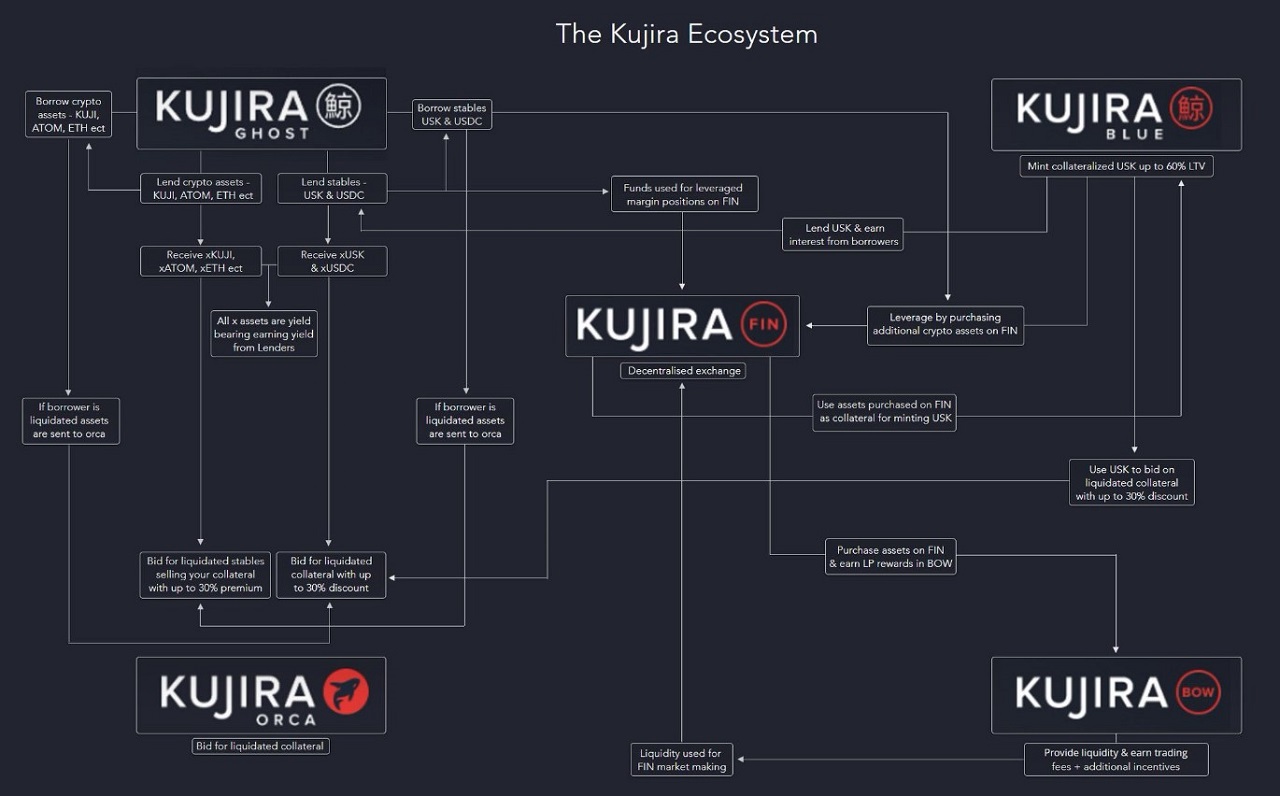

The Kujira ecosystem is powered by a suite of synergistic decentralized applications built on top of a common layer 1 infrastructure built with the Cosmos SDK.

The vision is to provide all market participants with a level-playing field where all users can access large amounts of funds to profit from strategic market information, regardless of whether the user is an institutional or a retail investor. This product offering is reinforced by an ecosystem of interconnected dApps that provide detailed analytics and automated solutions to empower DeFi investors.

The story of Kujira began in May 2021, after a liquidation cascade on Anchor caused a massive drop in the price of Terra LUNA, from $16 to $4 in just one week. On the one hand, this event had a large impact on investors who had leveraged their exposure to the Terra ecosystem. On the other hand, a small group of elite investors was responsible for executing the liquidations. This allowed a minority of sophisticated market participants to acquire the liquidated assets at a significant discount. By running expensive systematic bots, over a billion dollars worth of LUNA were wiped out from the Cosmos ecosystem.

As a response to the market weaknesses and immaturity of the ecosystem going through this systemic crisis, the Kujira team started building a platform for decentralized liquidations. This software implementation would be available for all market participants and would provide an equal opportunity for everyone to profit from liquidations. By making this a permissionless process, both institutional and retail investors could compete in a level playing market that would not allow for paying higher prices in order to get faster executions.

Within a period of 4 months, the team managed to build and launch the protocol, which opened up liquidations on Anchor to over 50,000 users who did not need to run any specialized code or advanced automated systems. This was the first realization for the team that a robust infrastructure would be highly valued by all ecosystem users. The platform gained a lot of traction on Terra, where ORCA managed to process $250M of LUNA an bETH liquidations over 6 months.

The core vision of the protocol was then further strengthened by the shortfall events that took place in 2022, including the collapses of Terra, the downfall of 3AC, or the bankruptcy of established CeFi players like Celsius, BlockFi, or Voyager. In response to this event, FIN was built as the first decentralized and permissionless on-chain non-FIFO order book exchange.

A FIFO orderbook exchange implements a First In First Out matching algorithm that uses price and time as the only criteria for filling an order. In this algorithm, all orders at the same price level are filled according to time priority: the first order placed at a given price is the first order marched.

When the Terra blockchain was halted as a result of LUNA’s death spiral, the Kujira team went on to launch their own semi-permissioned Cosmos sovereign chain. In a matter of 6 weeks, the team managed to deploy a layer 1 and relaunched FIN on it.

The full series of events that have had an impact on the protocol’s development can be observed in the official Kujira timeline, known as the Shipping Lane: https://docs.kujira.app/kujira-ecosystem/shipping-lane

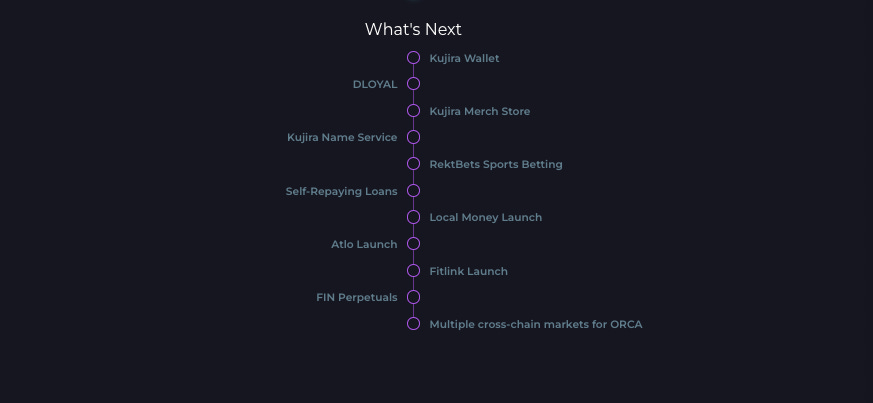

Implemented features

Upcoming features

Some members of the team operate anonymously, but the protocol enjoys a high reputation among the Cosmos community for their ability to deliver products that are highly demanded.

Members of the team includes:

One of the core tenants of the Kujira team is to build the next evolution of Decentralized Finance where “the secret of change is to focus all energy, not on fighting the old, but on building the new”.

To realize its full potential, the team has made explicit to abide by the following principles:

Smart Stake is a member of Kujira’s validator set that also provides validator services on other chains. Smart Stake Kujira provides helpful analytic for all chains they validate on. This includes the status of validator nodes, network analytics, governance breakdowns… This kind of third-party community network analytics is critical for promoting decentralization and raising awareness about the overall status of the chain.

https://kujira.smartstake.io/

Capybara Labs are also one of the largest community validators on Kujira. These nodes are run by Spacey (@Spaceyisawe), who has received funding from Kujira’s community pool to provide useful services and analytics for the community. Its most used tool is the Telegram notification bot, which allows users to interact in order to receive information such as status updates on ORCA liquidation bids, status updates on the execution of FIN limit orders, Governance announcements… Capybara Labs also helps to run Dale the Mail Whale (@DaleMailWhale), a Twitter bot that informs about liquidations on ORCA

Kuji Kast is also a community initiative that features various types of in-depth content including interviews with other projects building on Kujira.

Kujira stands out from its competitor because of:

Inter Blockchain Communication, or IBC for short, is an interoperability protocol that facilitates the communication between different Cosmos Zones. The core functionality relies on a messaging method that allows for sending packets of information from one zone to another by posting Merkle-proofs as evidence that the information was sent and received

One of the most astonishing accomplishments of Kujira was the recovery after the collapse of Terra, where the Kujira team managed to build its own chain and relaunch the ecosystem within 6 weeks. As a reward for the fast recovery, each of the 75 Genesis validators of the Kujira chain were delegated 200,000 KUJI tokens, for a total of 15M KUJI.

One of the reasons why the fall of Terra did not bring Kujira to an end, is because the Kujira team had anticipated issues that would show up in the future. Prior to these events, Kujira held long discussions about their suite of products. The launch of FIN indicated what some of the technical limitations would be. Scaling was one concern since each dApp needs to share the entire bandwidth of the chain with other protocols. Similarly, before deploying its own chain, Kujira also lacked the ability to design automated actions into any future product – for example liquidations on a margin trade on FIN – without the reliance of third-party bots and financial incentives to run them.

As an application-specific chain (read more here) built on Cosmos, Kujira leverages the Tendermint consensus, uses ABCI, and is built on top of the Cosmos SDK. This gives the protocol a competitive advantage over-generalized applications built on top of monolithic chains. Instead of paying for blockspace alongside a myriad of other different applications, the Kujira chain avoids network congestion by having its own validator set. This means that the application itself is able to better control the amount of fees that are paid by end users. Furthermore, as a result of the application being the owner of the chain it inhabits, Kujira can also enforce its own governance of fee structures while retaining composability between chains in the wider Cosmos ecosystem. This helps the chain to leverage its native cross-chain messaging system without requiring any extra trust assumptions with the destination chains it connects to.

An airdrop is an incentive mechanism by which protocols distribute their native tokens to its most valuable or active users as a way to bootstrap the protocol’s liquidity in its early stages.

When decentralized exchanges came to fruition in 2018, they rose to prominence because of the value proposition of peer-to-peer trading without intermediaries. However, the product-market-fit of DEXs was questioned due to the fact that the liquidity (capital available to trade) was often thin. This produced excessively large spreads (differences in price) between the lowest sell order and the highest buy order. To solve the liquidity issue, AMMs (Automated Market Makers) were introduced. However, this came at the expense of having to use incentives in order to encourage market participants to provide liquidity. This resulted in a practice known as “yield farming”, where liquidity providers deposit their tokens into the liquidity pool for others to execute trades. In exchange for providing liquidity, protocols encourage these users to keep the liquidity in the pool by rewarding them with incentives from emissions of inflationary tokens.

By providing an order book, FIN offers users a better option than most AMMs. While AMMs have been successful at allowing for trading activity in a decentralized manner, they force protocols to create inflationary tokens in order to attract liquidity providers. This leads to an unsustainable model in the long term since nothing guarantees that those excess emissions can make up for the losses coming from Impermanent Loss.

Order-book Decentralized Exchanges like FIN do not rely on inflationary incentives while still offering a superior trade execution to its users. They also have a more intuitive interface that results in a better user experience for traders who are already familiar with trading in traditional financial markets or centralized exchanges. As FIN grows, liquidity will increase as traders move from AMMs to order books due to their simplicity and higher capital efficiency. In turn, there will be more buys and sell orders in the market that can satisfy the market orders demanded by users.

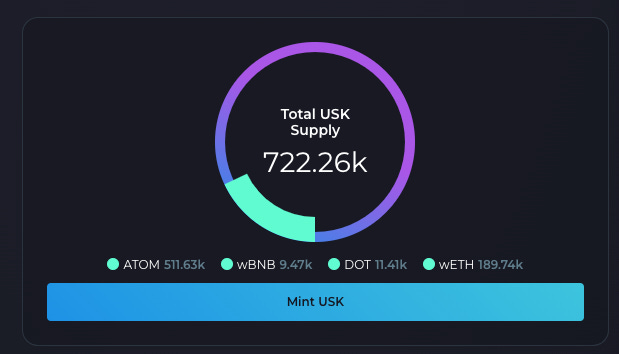

One of the biggest opportunities in DeFi is to fight against the dominance of centralized stablecoins, such as USDC and USDT. After witnessing the collapse of US Terra, Kujira realized that there was a need to come up with a more sustainable model to set a new foundation for what decentralized money should look like. Thought leaders like Vitalik Buterin have already mentioned that “while there are plenty of automated stablecoin designs that are fundamentally flawed and doomed to collapse eventually, and plenty more that can theoretically survive but are highly risky, there are also many stablecoins that are highly robust in theory and that have survived extreme tests of crypto markets conditions in practice”. For this reason, USK was modeled drawing inspiration from MakerDao and DAI. However, rather than using Solidity, USK is written in Rust and, instead of being 50% backed in USDC, it is backed by uncensorable assets such as ATOM, DOT, wETH…

Kujira has been built upon the lessons of the failure of UST and is focusing on transparency, solvency, and community involvement through sustainable governance practices. For example, projects such as Local Money and Calc Finance are working on real-world cases such as p2p asset transfers, or DCA (Dollar Cost Averaging). Ultimately, the volume of USK in DeFi combined with real-world integrations will drive higher demand for the stablecoin and more rewards for KUJI stakers, since minting, burning, and liquidations will all contribute to such fees.

The Kujira chain is one of the fastest chains on the Cosmos ecosystem, with a block time of around 2.2 seconds, which makes it among the fastest on Cosmos alongside Evmos (1.9 seconds) and Injective (2.4 seconds), while the rest of the Cosmos blockchains achieve between 5 and 7 seconds.

Having a fast block time is important for Kujira, especially for FIN due to its order book model. Furthermore, the low latency of the chain reduces the opportunities for validators to front-run transactions. The Kujira chain, via Tendermint, performs transactions on a first-in-first-out basis by default, and can only be front-run by validators via transaction reordering during blocks for which they are the proposer.

Kujira is built on top of the Cosmos SDK and utilizes CosmWasm for its smart contracts deployments. This allows for a modular design that favors horizontal scaling without compromising security or decentralization.

The Kujira chain was launched as a result of the halting of the Terra blockchain. The team believes that everyone has the opportunity to be a “whale” – to have access to large amounts of funds, strategic market information, and time.

Users utilizing the Kujira ecosystem may be interested in its:

The Kujira dApps ecosystem consists of the following:

ORCA is the first public marketplace for liquidated collateral. Users can liquidate multiple assets across the whole Cosmos ecosystem at the click of a button, without the need to code or set up any specialized bot.

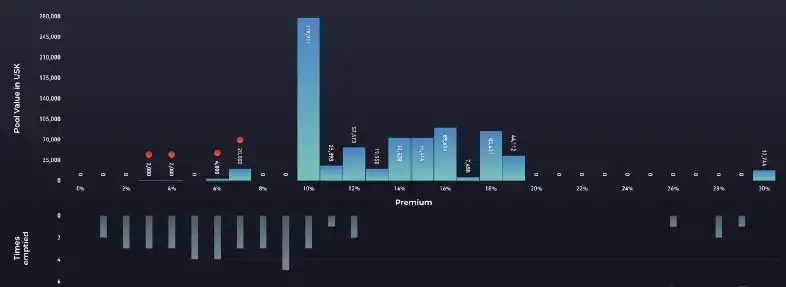

ORCA is the first public marketplace to have ever been built for allowing users to place bids on liquidated collateral. This is achieved by a Dutch auction where users can obtain liquidated collateral at up to a 30% discount.

In order for someone to mint USK on Kujira, they need to deposit collateral. This creates a loan called CDP, which stands for Collateral Debt Position. This collateral is used to provide a backstop for the USK overcollateralized stablecoin on Kujira. In order for this position to remain solvent, the value of the collateral must never drop below the value of the minted UK. When this is about to happen, a liquidation occurs. The way this works on ORCA is that, in the event of a liquidation, the collateral gets put up for auction on ORCA, where users can bid to get the assets at a discount. By doing so, users are helping to protect the stablecoin and keep it solvent as well.

The size of the user’s bid is at the user’s discretion. There are no minimum or maximum requirements. The discount at which the collateral is recouped by liquidators is called the premium. It starts at 0% and goes up to 30%, with the smallest premium being filled first. This way, assuming there are enough loans to liquidate, all the bids at the lowest premium are filled before the next highest is activated, causing a steady upward move until there is no more collateral left to liquidate or there are no more bids.

Liquidations describe the act of selling a borrower’s collateral when the value of this collateral significantly decreases versus the amount of funds being borrowed.

In DeFi, taking out a loan means providing collateral on volatile assets. This risk is held by borrowers, who are directly exposed to this volatility. This is also a bigger risk for lending protocols. For instance, it is not ideal for a lending protocol to be left with collateral assets to sell – there is always a risk that nobody will want to buy those assets, leaving the protocol unable to recoup their loan.

To get around this risk of insolvency in a decentralized and transparent manner, lending protocols will auction off liquidated assets at less than their real market value – allowing third parties to bid on the assets for a quick sale.

The marketplace operates using a queue-based and anti-bot approach filling bids from the smallest to the biggest discount. This helps the protocol find an optimal discount rate. This is also the mechanism that prevents bot operators from causing further damage to the market. The reason for that is that the liquidated assets are purchased by community members who often have a stake in the long-term success of partner platforms. Because of that, these users may want to increase their ownership of tokens from ecosystem partners rather than immediately selling them for a profit.

The bids are filled equally and proportionally between everyone bidding at the same discounted rate. There is no first-come first-serve advantage or larger bids being filled first. The only sequence in which the bids are filled is based on the discounted rate – i.e the lower-discount pool gets filled first.

The mechanism of evenly distributing liquidation assets among each bidder ensures the fairest allocation to every participant. By evenly distributing the proceeds of liquidations amongst a greater majority, the collateral is not going into a centralized point but back into the hands of the protocol users.

By providing this service, ORCA offers several benefits to its ecosystem partners, whose users can now access a user-friendly interface and a transparent bidding process with near-instant settlement of liquidations.

FIN, ORCA and USK all have co-integrations, meaning that USK relies on ORCA as a liquidation settlement layer. Similarly, FIN will be using ORCA in order to support Futures trading on its platform.

FIN is Cosmos’ first decentralized and permissionless fair matching order book exchange. The product allows for trading assets on different blockchains as well. It provides a fully decentralized trading experience that removes the risk of impermanent loss and does not require inflationary incentives to subsidize those losses. Its order book model provides a scalable and efficient exchange rate with low fees and improved trade execution that helps both experienced and less advanced traders.

Impermanent loss happens when you provide liquidity to a liquidity pool, and the price of your deposited assets changes compared to when you deposited them. The bigger this change is, the more the liquidity provider is exposed to suffering from impermanent loss.

As an orderbook-style exchange, FIN’s potential is derived from helping Kujira to become a more sustainable ecosystem in the long run:

Most AMMs follow Uniswap’s model, where each pool needs to have enough liquidity in order to support a decent volume of trading activity. Because of that, these protocols need to attract liquidity, and the revenue for LPs comes from trading fees. Liquidity is so important that projects are willing to pay very large yields for the pools where there is low liquidity. While this can be very lucrative for traders, the design favors inflationary tokens. At the same time, traders cannot directly access features such as limit orders

FIN uses a matching algorithm that executes orders in the same amount of time regardless of the number of users operating in the order book. This is a huge accomplishment even when compared to order books in traditional markets, where the time taken to match orders increases either linearly or logarithmically as more orders enter the market.

AMMs handle all transactions automatically. Liquidity providers deposit assets to a liquidity pool in exchange for earning trading fees proportional to the amount of liquidity they have provided. Upon user requests, the smart contract automatically delivers the assets to the traders by quoting the asset price based on the ratio of the assets in the pool. One of the most well-known problems of being a LP in an AMM is Impermanent Loss, which is a temporary loss experienced when the deposited tokens lose value when compared to just holding them in your wallet. This is due to the price fluctuations of the two assets in the pair.

Sellers, arbitrage traders, and market makers are responsible for providing liquidity for the market, not partisan farmers. This makes FIN more capital efficient, and farmers can deploy their capital elsewhere. In fact, there is no reliance on bots to execute trades. Similarly, there is no need for additional fees to incentivize them:

Order book models are often used by centralized exchanges, but tooling around the Cosmos SDK solves some of the limitations of the EVM (where AMMs are the predominant DEX). Because of this, it is possible to build decentralized order books that allow users to place orders while the platform keeps a record of all the ongoing trading activity and matches buyers and sellers at a given price point. When traders submit orders, these are organized around the desired price. Therefore as long as there is supply demand, any trader will be able to trade the asset at the desired price.

When it comes to order book exchanges, there are two types of auction models to fulfill bids: Continuous Double Auction (CDA) and Frequent Batch Auction (FBA).

FIN offers a separate interface to allow community members to propose the launch of a new token pair on FIN. Users are only required to connect their wallets, and create a proposal specifying the base asset and the quote asset for that pair. For example, if the base asset is KUJI and the quoted asset is USK, the price of KUJI would be given in USK.

A currency pair is a quotation of two different assets, where one (the base asset) is quoted against the other (the quote asset). The first listed asset is called the base asset, while the second listed asset that is used as the benchmark for price is called the quote asset

After a listing proposal is submitted, it will enter the deposit phase, where a minimum deposit must be provided by one or more addresses in order to allow the proposal to move forward to the next stage, the voting phase.

Once the community approves the proposal and the voting phase is successful for listing that pair, the Kujira team will set up a token pair user interface on FIN and begin allowing limit buy and sell orders in order to gather initial liquidity. Once enough liquidity has been gathered, trading will commence.

Listing tokens: https://fin.kujira.app/listing

Access FIN:

BOW is Kujira’s latest product. It is a market-making framework that ensures optimal trading conditions for assets supported on FIN, Kujira’s on-chain orderbook. The goal is to attract liquidity to the ecosystem by offering deep liquidity for all trading pairs. This will narrow the price spread for traders, which will attract more volume from trading activity and will result in more revenue for liquidity providers. At the same time, BOW also enables protocols to further incentivize pool depth by allocating token rewards to liquidity providers.

BOW uses an internal market-making algorithm to place orders on FIN based on its internal token balances. As market orders for buying and selling start to come in, these orders are filled, causing the contract’s internal price calculation to move and re-submit orders at the new mid-market rate. This behavior is similar to Uniswaps’s constant product formula. Because of this internal accounting, BOW behaves as a 100% on-chain market maker for the FIN order book.

Markets are made up of makers and takers. The makers create buying and selling orders that are not executed immediately (e.g. limit orders), while the takers are the ones who execute their orders immediately thanks to the liquidity provided by makers, whose orders will be filled.

After connecting their wallet, users can choose the pool they would like to participate in, and deposit the desired amount of tokens they would like to provide liquidity for. Once the assets have been deposited into the pool, liquidity providers will earn their share of the fees earned from transactions using that fair. This revenue can be increased by staking the LP tokens on the Stake tab.

On the Kujira network, makers and takers pay different fees, with makers paying a lower amount. A maker is referred to as the trader who places limit orders on the order book, while a taker is the trader who takes those orders (i.e. executes market orders from the order book). Makers typically pay lower fees because they add liquidity to the orderbook, while takers do the opposite.

BOW offers several benefits to the ecosystem. It provides an on-chain solution for market-making that does not rely on third parties while still having the ability to incentivize ecosystem protocols through fees and rewards. By providing a stable and deep order book for traders, BOW will attract more trading volume to fee and help to support the price stability of its supported assets.

The depth of the market, or DOM, is a measure of the number of buy and sell orders for a particular asset at different price levels. It is a good indicator to measure the liquidity of the market and assess the willingness of buyers and sellers to transact at different price levels.

Access BOW:

https://bow.kujira.app/

BLUE is the go-to place for all things related to the Kujira ecosystem, such as KUJI staking, governance voting, KUJI swapping, Kujira network bridging, rewards claiming, analytic dashboards…

BLUE is known as the hub of the Kujira protocol. This is where users can go to access an all-in-one dashboard for the entire ecosystem. Users can also bond KUJI, vote on governance, swap KUJI, and claim staking rewards.

The main dashboard features metrics such as:

The Wallet tab has several helpful features as well, including the ability to:

The Swap Interface allows users to perform simple swaps between any tokens on Kujira. This is achieved by placing market orders in FIN. Because of that, swaps are currently limited to market pairs supported by FIN. However, it is also possible to trade between two assets without a direct pair in FIN. This can be achieved by first trading for USK or axlUSDC depending on the target asset selected on the BLUE swap UI. This means that, at most, the user will execute 3 trades.

The IBC Bridge tab is where users can connect to other networks on the Cosmos ecosystem and transfer assets between them

Users can also mint USK, which is a stablecoin pegged to the value of the US Dollar on the Kujira blockchain

Access BLUE:

https://blue.kujira.app/

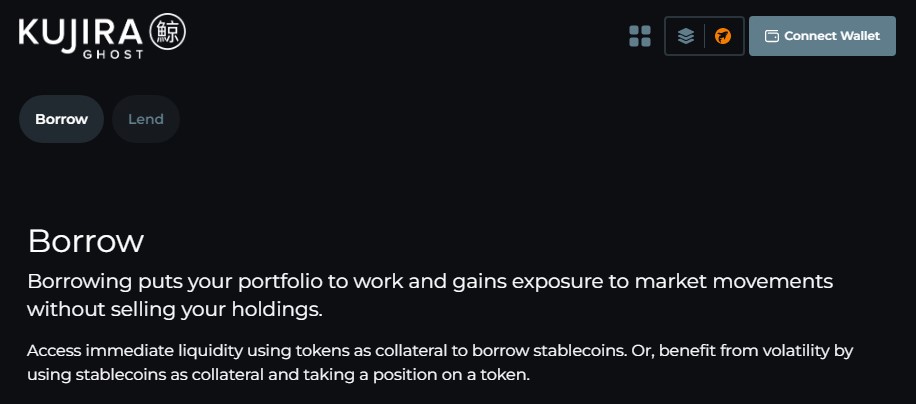

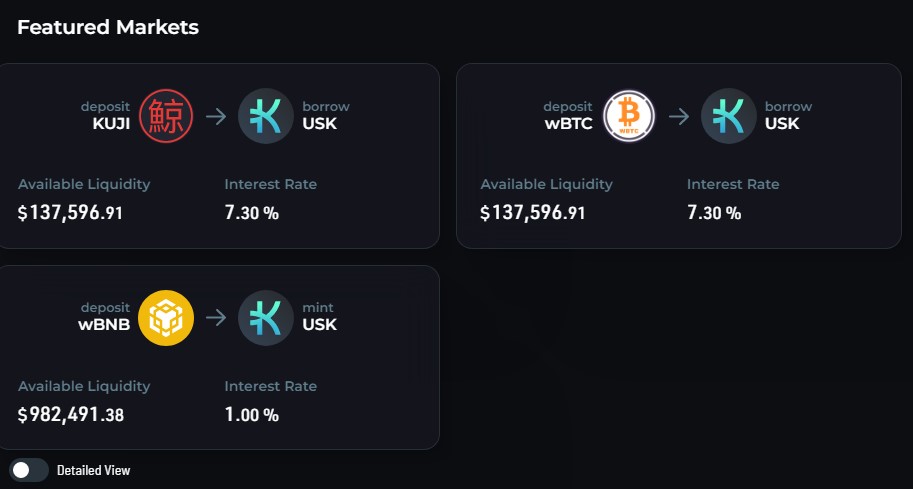

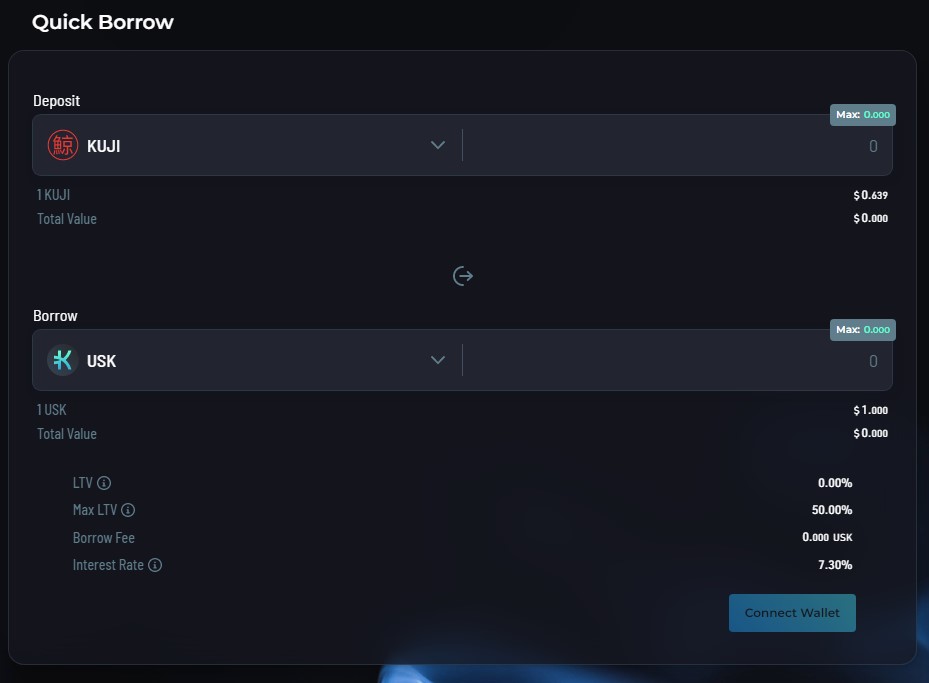

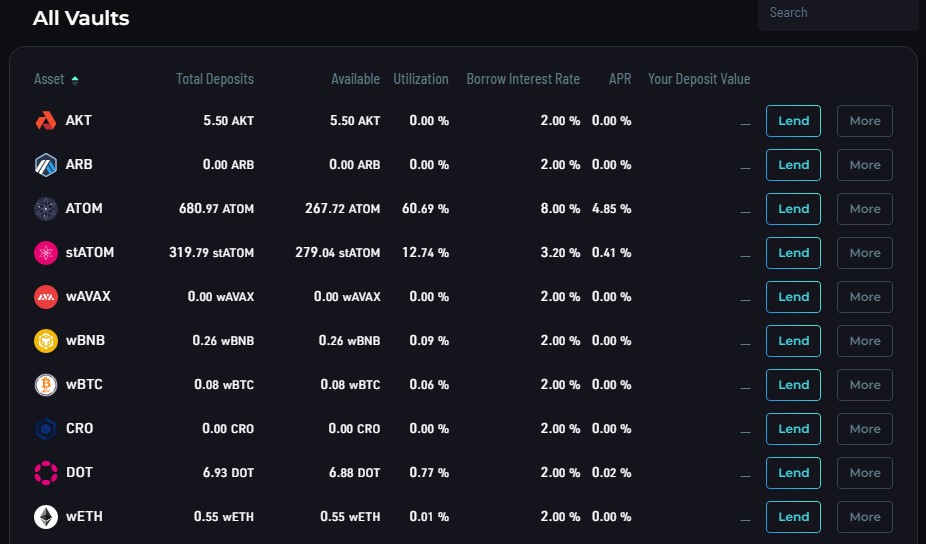

GHOST, Kujira’s Money Market, is a tool that will work in concert with FIN, BOW, ORCA, USK, and BLUE to make leverage an option for all community members.

GHOST is fully integrated into the Kujira product suite, and will bring next level efficiency to FIN markets. It will also finally give Kujirans the ability to finally leverage their KUJI to long or short it.

GHOST sets the groundwork for higher ORCA volumes, FIN perpetuals (as well as FX trading), FIN margin trading (both long and short), and bootstrapping BOW and FIN liquidity.

GHOST has the following features:

GHOST provides the following benefits:

Users can choose to borrow their desired assets by selecting the relevant market, or make use of the quick borrow function.

Interest rates are dynamic while borrow fees are currently set at 0.2% to encourage early growth.

Users can choose to lend their tokens, earning interest based on the borrowing interest rate.

The funds also enable traders to open margin positions on FIN, offering lenders additional avenues of interest.

USK is an over-collateralized Cosmos stablecoin that is soft-pegged to the value of 1 USD. At the beginning, USK will be backed by ATOM, DOT, wBNB and wETH. At a minimum, USK will remain 166% overcollateralized in order to ensure price stability and reduce the risk of liquidation.

A soft-pegged stablecoin refers to a mechanism that ensures that the value of a currency remains fixed against an exchange rate or reserve currency. The difference with a hard-pegged stablecoin is that a soft peg allows for minor fluctuations in value.

Once funds are deposited into Kujira’s smart contract and a position is opened, the protocol monitors the borrower’s loan-to-value ratio (LTV) in order to keep track of the user’s solvency. This is done by comparing the principal value of the borrowed assets against the value of the deposited assets. The close a borrower is to the maximum allowed LTV, the closer they are to default on the loan. In the case of Kujira, ATOM (or any other accepted collateral) lenders are simultaneously USK borrowers and are consequently susceptible to liquidation risk if the price of collateral drops.

The loan-to-value ratio is a financial indicator used for measuring the level of risk of a loan. In general, high LTVs are associated with riskier lending positions. By definition, the LTV of a loan is the ratio of a loan’s value relative to the value of the collateral.

USK follows a sustainable, robust, and battle-tested overcollateralized model. These characteristics are critical in order to achieve mass adoption as the go-to stablecoin in the Cosmos ecosystem.

USK’s codebase is written in Rust and is integrated into ORCA to grant users access to a seamless liquidation experience. The USK mechanism is intended to be sovereign, decentralized, censorship-resistant, and revenue-generating.

Users stake collateral to mint USK and users would burn USK to redeem their collateral. If the value of a user’s collateral were to fall too low, it would be liquidated. USK has also been integrated into ORCA to allow for the seamless execution of democratized liquidations that are publicly accessible to all users in equal conditions. Therefore, USK is minted by locking crypto assets on smart contracts. For instance, users can mint USK by depositing ATOM as collateral. In this situation, the ATOM lenders are also USK borrowers. This allows borrowers to go long on the assets they deposit as collateral while also freeing up liquidity to buy other tokens. This is known as a Collateral Debt Position.

USK borrowers have one of two eventual outcomes:

Given these parameters, if a default were to occur, the protocol would seize and liquidate the locked collateral (ATOM or any other supported collateral asset) to cover the underlying debt (USK). Before paying out the remaining collateral to the borrower, a penalty fee of 1% is charged against the debt along with a 0.5% withdrawal fee that will be distributed proportionally amongst KUJI stakes. Finally, the underlying USK minted from the original collateral is burned.

Mint USK: https://blue.kujira.app/mint

FINDER is a block explorer that facilitates the research process for on-chain transactions by providing visualizations and records for historical data. This is an essential piece of infrastructure that allows users to track addresses, follow transactions, verify information…

Unlike most block explorers, FINDER has a bookmark feature where users and developers can save addresses. Saved addresses correspond to cookies in the web browser. This means that, if the browser cookies are deleted and there is no backup, the list of bookmarks will have to be recreated.

Cookies are pieces of that data stored by the web browser to remember frequently used information, such as login credentials.

Access FINDER: https://finder.kujira.app/kaiyo-1/

SONAR is a custom wallet for the Cosmos ecosystem that is available on various desktop and mobile platforms. By creating a custom native wallet app, Kujira aims to provide its users with a seamless and intuitive user experience.

Sonar is more than just a customized wallet for sending tokens and submitting transactions to the Kujira blockchain. Instead, it is a payments platform for on-the-ground vendors, e-commerce merchants, and everyday users. It is integrated into the most relevant protocols on Kujira, with an emphasis on those focused on payments and commerce.

POD is a decentralized custom staking User Interface built for the Cosmos Network.

While it is common to assume that validators with larger delegations are better for delegating assets to, this can lead to security issues and undermine decentralization. For that reason, POD has designed a system that highlights validators with a disproportionate amount of voting power when compared to others. Validators with voting power equal or above the maximum threshold are highlighted in red, with a bar indicating their percentage of the overall voting power. Validators with medium voting power are highlighted in yellow, and validators with voting power below the threshold are colored in blue.

Blockchain oracles are third-party services that provide smart contracts with external information. Blockchains and smart contracts cannot access off-chain data outside their own network. However, most DeFi applications need to access information such as price feeds. This is where price oracles come into play. A blockchain oracle is not the data source itself, but rather the layer that queries, verifies, and relays that information on-chain

Kujira’s price oracle receives updates from all 75 active validators as part of the chain’s consensus mechanism. The prices are measured by at least 3 different sources of information to guarantee their reliability, stability, and performance over long periods of time. Ecosystem protocol developers also have direct access for querying the oracle on-chain, which gives them a solid edge over the developer experience of other blockchains.

The way Kujira’s price oracle works is that every 30 seconds, all 75 active validators are required to post a transaction containing the current price for a range of assets, aggregated from a number of sources. This creates an on-chain source of truth that can be queried by front-end interfaces and command-line interfaces.

Kujira’s Token Factory allows anyone to create native tokens supported by the Cosmos SDK Bank Module. This allows protocols to issue their own token without needing to support the CW20 standard. This means that all tokens on the Kujira network are compatible for gas payments and can be collected as protocol revenue that can be distributed to KUJI stakers.

The Cosmos SDK is a software development kit used by developers in the Cosmos ecosystem to connect their custom application-specific chains with other blockchains in the Cosmos ecosystem and communicate with them through IBC (Inter Blockchain Communication).

The CW20 standard is CosmWasm’s equivalent of the ERC-20 standard on EVM chains. It is a smart contract specification for fungible tokens and that is responsible for handling balances tracking and asset transfers.

CosmsWasm bindings: https://docs.rs/kujira/0.7.5/kujira/msg/enum.KujiraMsg.html

Kujira’s on-chain scheduler allows for the scheduling of tasks executed by smart contracts. This provides developers with a way to hook automated smart contract execution into the end of every given number of blocks.

Current scheduled tasks: https://lcd.kaiyo.kujira.setten.io/kujira/scheduler/hook

Entropy Beacon is a source of entropy that provides access to a decentralized source of randomness. Beacon gives access to secure random number generation processes in trustless on-chain environments.

Cryptographically verifiable randomness is possible on the Kujira ecosystem thanks to collaborative work with Entropic Labs. Using this solution, projects building on Kujira can access a cheap solution to generate unpredictable and random numbers on-chain.

Every time smart contracts need on-chain entropy, they send a request to the Beacon. Upon this request, off-chain workers will generate entropy by calling the Beacon contract. At this point, the Entropy BEacon requires gas to call the callback function on the requesting contracts. However, developers do not need to provide this extra cost, since Kujira has set up a fee grant paid from a protocol wallet in order to incentivize off-chain workers to call the function and cover the gas fees incurred by the Beacon. Because of that, Beacons provides a comfortable developer experience with no complex tokenomics or subscription models.

An on-chain entropy beacon opens up a plethora of use cases: lottery systems, tamper-proof giveaways, complex DeFi games… The Beacon works by using VRF Cryptography to enforce generated random numbers that are verifiably unbiased.

The Entropy Beacon uses Verifiable Random Functions to generate provably random numbers with entropy generated by a Beacon smart contract. Third-party entities can then use the worker’s VRF public key to verify that the pseudorandom number was generated without tampering. Since only the public key is used to verify proofs, the worker’s private key is not exposed and therefore no one can steal the identity of the worker.

In order to maintain high levels of quality and sustainability for incentivizing decentralization, Kujira has a long-term plan in place to gradually open-source its core applications. For instance, FIN is the first example of an open-source decentralized order book exchange built on Cosmos.

Validators on the Kujira chain have their own unique commission rates, which represent a percentage of staking rewards set aside to cover the costs of running and securing the validator and Kujira network. On the Kujira chain, staking rewards are paid out in the tokens used on the chain (though they can also be converted to KUJI tokens when withdrawing).

For example, a validator with a 5% commission, 1M in KUJI in total delegations, and a 1-year forward-looking APR of 10%, the validator would earn approximately 1M KUJI * 10% rewards * 5% commission = 5,000 KUJI per year in revenue (if these conditions remained constant).

A delegator staking 1,000 KUJI with this validator would then earn approximately 1,000 KUJI * 10% staking rewards * 95% (the portion not taken as commission) = 95 KUJI per year in revenue.

In general, a lower commission rate means a greater share of staking rewards for delegators, while a higher commission means more funding for the validator.

The commission rate of a validator is just one of the factors to be considered when delegating funds to a validator. It is also relevant to consider the validator’s technical expertise and any additional contributions they make to the chain. Note that if a validator is slashed, its delegators may lose a portion of their delegated tokens.

The 75 Genesis Validators were rewarded with 200,000 KUJI tokens each, for a total of 15M KUJI tokens. These delegations allow for Genesis validators to generate extra revenue indefinitely, as long as they continue to support and validate the Kujira chain.

For instance, a Genesis validator with a 5% commission and a 10% staking APR would receive approximately 1,000 KUJI worth of extra funding annually from this 200,000 KUJI delegation.

As the ecosystem grows and the value of KUJI increases, these Genesis validators will see even greater rewards for their contributions. However, it is important to note that, while most of these initial delegations have not been removed, the core team reserves the right to do so in extreme cases where the validator fails to uphold its duties or acts in a way that goes against the values of the community. This is a last-resort alternative and will only be used in extreme scenarios.

The difference between running a node and creating a validator is that a node contains all the data but does not participate in block creation, whereas a validator creates blocks and validates transactions.

Validators are required to submit price feeds for the on-chain oracle. This is possible thanks to the price-feeder app, which can get price data from multiple providers and submit oracle votes to perform this duty. For this to work, the price-feeder needs access to a running node’s RPC and gRPC ports. For that matter, the best practice is to run node software on an isolated unprivileged user in that server.

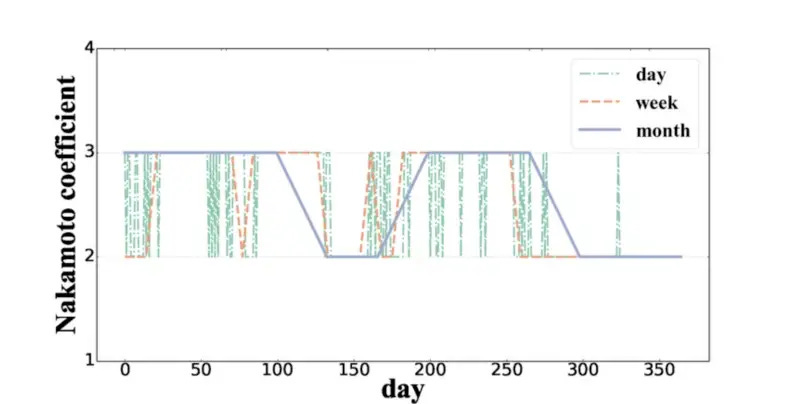

Kujira has a Nakamoto coefficient of 5 and 75 validators. This is a metric used to measure the decentralization of a blockchain network. The coefficient itself represents the minimum number of nodes required to disrupt the network.

The higher the coefficient, the more decentralized a chain is.

Staking is a core component of the Kujira blockchain, since part of its security is derived from bonding KUJI to validator nodes on the chain. Kujira is a Proof of Stake chain secured by Tendermint Consensus and powered by the Cosmos SDK.

Tendermint Core is a consensus engine and BFT (Byzantine Fault Tolerant) consensus algorithm. Any application-specific chain can be built on top of it using any programming language, since it is a generic application-agnostic framework responsible for handling blockchains’ networking and consensus layers.

As a blockchain, Kujira has taken a hybrid approach, where the blockchain’s application layer is primarily driven by a series of natively built synergistic applications, while the protocol layer relies on Cosmos’ modular software suite.

The following is the sequence of events followed by the chain’s consensus mechanism:

As this process repeats, new blocks are added to the chain. Each validator contains a copy of all transactions made on the network. Every chain of blocks is compared to the new proposed block of transactions before voting. This is done by multiple independent validators that participate in the consensus process, making it infeasible to accept invalid blocks.

Staking is, therefore, the process of bonding KUJI to a validator in exchange for staking rewards generated from the chain’s revenue. Validators can then use these bonded tokens to secure the network. Meanwhile, every KUJI staked captures a proportional share of the entire revenue generated by Kujira from the use of its applications.

KUJI can be staked to any validator of the chain within the staking tab on BLUE. Delegators or stakers are the community members who bond KUJI with a validator (and also receive rewards for helping secure the network). These users, as well as the validators they stake with, can also use their staked KUJI tokens to vote in Governance decisions.

The main difference between validators is given by their level of technical expertise, which is often correlated with their nodes’ uptime and the likelihood of getting slashed. Other differences to be taken into account by delegators are the commission rate and governance values. Users are encouraged to do their own research before bonding their tokens with any specific validator. The simplest alternative for users is to use Kujira’s Staking UI and delegate to every validator that is participating in Kujira’s consensus at once.

Technical concepts:

In Kujira, slashing can occur under the following circumstances:

Kujira offers several key first-party product offerings for users to participate in the ecosystem. However, the reach of Kujira is not just limited to its own set of first party dApps, but also hosts a series of third-party projects that help to grow the ecosystem.

There are multiple ways by which protocol teams and developers can create new products on the Kujira blockchain. Developers who want to build on Kujira can apply to participate in Kujira Labs. The team also hosts a virtual and in-person accelerator program in Lisbon, Portugal. There are also opportunities for validators to run their own nodes and secure the network, community members who get engaged in governance decisions by voting on-chain, and also for partnerships with other projects in the Cosmos ecosystem.

The Kujira blockchain can integrate ORCA with EVM-compatible and Cosmos money markets. This brings in benefits such as increased capital efficiency and reduced risk of solvency. This would allow for use cases where liquidators on Kujira can also bid on the liquidations of those money markets to purchase discounted collateral.

New projects can also apply to be listed on FIN to improve their tokenomics and lower the necessary liquidity requirements for their token supply. Similarly, projects can also advertise to the entire Kujira community by providing incentives on BOW

Public projects building on Kujira:

Partnerships and integrations:

Thanks to all the opportunities and integrations available in the ecosystem, KUJI stakers can collect a diversified portfolio of popular assets based on their popularity on Kujira dApps, as a portion of total protocol revenue. For example, FIN allows for up to 10x margin that can be used for leveraged long/short positions. As a matter of fact, USK minting is a way to go long on deposited collateral, such as ATOM, DOT, nBTC, and axlETH.

There are also products offering product offerings such as AI-boosted dollar cost averaging, peer-to-peer off-ramp services, and community-owned market-making bots.

Depending on their level of expertise in DeFi and where the original funds are located, users can choose among the following options:

The Kujira Academy sets out to achieve 3 core aims, which are:

Kujira Academy is held up by 4 separate beams, or verticals, that will all play a vital part in achieving the core aims stated above.

These are:

The Kujira Academy will emerge as a promising solution to the current challenges that characterize the Web3 space, presenting a blueprint for bridging the gap between universities and blockchain technology.

Business Model: Staking KUJI

PoS validation

As a PoS (Proof of Stake) network, token holders are active participants in securing the chain. This is achieved by staking the native token, KUJI. Validators and delegators secure the chain by participating in network consensus by operating validator nodes (validators), or delegating KUJI tokens to node validators (delegators).

KUJI stakers receive rewards for participating in the network, regardless of which dApp they use.

100% of the dApp revenue is shared with KUJI stakers, and all staking rewards from our 13.8 million KUJI staked with genesis validators are redistributed back to stakers.

KUJI is a bet on the revenue made by the Kujira network and all the dApps deployed on it. All yield from staking is the result of user adoption and economic activity that generates fees. These fees are redirected to KUJI stakers.

The Kujira Treasury is a collection of tokens that the Kujira Senate uses to fund projects, partnerships, and other initiatives that benefit the community. It is replenished through the community fund, which accumulates 2% of network fees from gas and transactions on the Kujira network, as well as from revenue share on third-party dApps deployed on Kujira. These funds are transferred to the treasury through governance, ensuring that the ecosystem has a sustainable source of funding for the long run.

As the fees are paid in native assets on the Kujira network, the Treasury is able to accumulate a diversity of tokens, which gives it more flexibility for allocating funds based on the use case of the specific project requesting a grant from the ecosystem.

Kujira’s Venture Builder program

Kujira Labs runs a Venture builder program. This is a semi-permissioned accelerator program that requires a governance vote in order for the applicant to receive support. The Kujira Senate is constantly on the watch out for new projects and funding proposals that can help to support the consistent growth of the ecosystem.

The Venture builder program has two parts, the first of which requires in-person work. This is due to the competitive advantage obtained by being able to interact with applicants in real time and in-person. Currently, these meetings take place in Lisbon, Portugal. Builders work directly with the Kujira team in order to receive advice.

Due to geographic complications, Kujira is also working on a virtual accelerator program. This decision was inspired by Near’s Open Web Collective, Binance Most Valuable Builders and Polygon’s PolygonLeap program. Experts from business development, engineering, marketing, and product design will assist, guide, and mentor other teams to introduce them to investors and coach them about fundraising.

Apply to participate in Kujira’s Venture builder program: https://docs.google.com/forms/d/e/1FAIpQLScW9f20rZS96869U1mMJPkjJ59SuAXvUeVeFTYkfuQke7KUMw/viewform

Note that all tokens in Kujira are considered native tokens by the protocol. This means that gas fees can be paid in any token.

Maker and taker fees on KUJI are lower when compared to other AMMs, which most often charge a 0.3% flat fee. Besides, gas fees in Kujira are also cheap and can be paid on any native assets. This is especially beneficial when asset prices increase since this gives the optionality for users to use the cheapest asset at a time.

The cost of operating as a validator ranges from about $50-200 a month.

One of the features of the Kujira Network is that no KUJI is emitted as rewards for LPs or stakers. Yields to KUJI stakers are taken from the fees of the protocols utilizing the network.

KUJI is the native token on the Kujira Network. KUJI is not an inflationary asset. Instead, it relies on the adoption of its dApp and products to generate fees. This model ensures that KUJI stakers are rewarded from protocol revenue instead of from inflationary rewards. This allows KUJI to be sustainable without needing to pivot its mechanism while still allowing developers to focus on building out the best products possible.

The Total supply was reduced from the original 150M tokens to 122.4M tokens through a governance vote on January 18, 2022, which resulted in the burning of liquidity pool rewards.

KUJI drives its utility from being used as the token to pay network and dApp fees, all of which are distributed to KUJI stakers. Another utility of KUJI is that by staking it, KUJI can be used in governance to help shape the future of the network. KUJI stakers can vote on new Senators as well as participate in other general aspects of KUJI governance.

KUJI was released through a token generation event in November 2021, and follows a specific release schedule as detailed below:

Private Sale

27.975M

12 months vesting

Public Sale

21M

6 months vesting

Liquidity

6M

Advisors

7.5M

12 months vesting

Team

27M

24 months vesting

Operational

11.025M

24 months vesting

Marketing

6M

24 months vesting

Airdrops

500K

* Adjusted after burn

Treasury

6.75M

24 months vesting

Rewards

8.648M

* Adjusted after burn

The release schedule will conclude on November 9, 2023 at 12pm UTC, when all tokens will be fully vested.

Staking Kujira on a network’s validator allows users to earn a basket of assets over time in exchange for their contribution securing the network. All fees collected on the network are paid directly to stakers through validators, rather than being converted to KUJI first. The revenue collected by the network comes from ecosystem dApps such as ORCA, FIN, as well as a portion of revenue from each external protocol that launches on the Kujira chain. This makes it easy for users to accumulate a diversified staking yield rather than just KUJI tokens. Kujira is also considering adding the option to redeem all staking rewards as KUJI, based on popular demand.

When it comes to staking, users of Kujira’s ORCA, FIN, and BLUE may see some symbols located at the top right corner of each app.

These symbols are tied to the amount of KUJI tokens that a user has staked across all Kujira validators on mainnet:

The significance of these symbols has not been revealed yet, but the team has reassured that more symbols may show up in the future.

Stake KUJI: https://blue.kujira.app/stake

Governance proposals are submitted by members of the Kujira community and can cover a wide range of topics, including updates to the Kujira platform, changes to network parameters, and new features or services. All of these proposals are discussed between community members and then put to a vote for approval or rejection.

Every KUJI token holder has the right to vote. In order to cast votes, users must stake their KUJI tokens with a validator. It is worth noting that if a user chooses not to vote on a given proposal, this vote will be deferred to the validator it has delegated its tokens to. Because of this, it is important that users choose a validator that they trust and whose interests are aligned with those of the user.

Once a proposal is submitted, there is a 24-hour deposit window during which a threshold of 10,000 votes must be reached from the proposer’s or any other community member’s wallet in order for the proposal to be submitted to the chain and start a 48-hour voting period. The KUJI tokens deposited into a proposal must be liquid (not staked) and will be returned to the depositor wallet after the threshold is met. If the threshold is not met during the deposit period, the deposited tokens will be burned.

Proposal submissions: https://blue.kujira.app/govern

Due to its convenience, Discord is also used as a platform to hold open discussion with other community members and engage with the Senate. The forum provides a democrats space for members to collaborate on proposals before they are submitted on chain. This process ensures that proposals are carefully drafted and have the support of the community before they are put to a vote.

In order to participate in Discord’s Governance Forum, every user will need to join the appropriate channels on Kujira’s Discord server.

The Kujira Senate is a novel on-chain governance mechanism that allows for decentralizing governance decisions without it making a negative impact on the speed of development. This is a new governance structure for the Kujira blockchain that aims to facilitate and simplify the process for validating transactions on the platform and support the growth of the ecosystem.

Winding Down

The Kujira Senate was wound down on September 27, 2023.

This was due to the core team failing to clearly define the objectives and remit of the initial senate.

The core team works in a very agile manner and the desire for the initial term was for the Senate to take a very light touch approach to governance and proposal review. What they failed to recognize was that the senate had highly skilled individuals from across a variety of industries, many of which are much more regulated and prescriptive than crypto tends to be.

The Kujira Senate Constitution v0.1

The Constitution’s draft was published on on February 12 2023, outlining the:

The Senate is composed of experts elected by the staking community. This entity is held accountable for its decisions, which must be taken in the most democratic and transparent way possible. The role of the Senate is to cast votes on proposals related to grant requests. These grants are paid from the community fund.

A proposal requires a quorum of 75% participation and an approval rate higher than 50%. Senators are expected to engage in public discussion and debate with each other, the public, the validators, and grant applications during their deliberations.

In the beginning, access to the Senate will be limited to just community spending proposals, such as grants for research, development, marketing, and community incentives. The Senate will also review and make decisions about the allocation of resources and distribution of funds. However, the Senate will have no involvement whatsoever in making decisions related to the core of the protocol and its most relevant parameters.

The protocol will follow a process of progressive decentralization by allowing those with knowledge and experience to participate and make an impact once they have gained the trust of the community, even if they do not have a large stake of KUJI. This will also help to streamline the governance process by bringing together community and team values. Similarly, the governance role of validators will evolve to include participation in governance discussions, voting on proposals, and interacting with the Senate.

At the technical level, the Kujira Senate is implemented through 2 smart contracts: a CW-4 “Group” contract and a CW-3 “Multisig” contract. The next steps include building out the technical infrastructure and onboarding the first Senators.

A CW-4 contract stores a set of members along with an admin, who has the permission to update the state of the contract. Members are defined by an address and an allowed weight that represents that member’s voting rights.

CW-3 is a CosmWasm specification for voting contracts. It is an extension of cw1 (a 1 of N multisig spec) where no key can immediately execute, but only propose a set of messages for execution after an on-chain signature aggregation with the required number of approvals.

Access the Kujira Senate: https://blue.kujira.app/senate

Kujira smart contracts are fully enabled with CosmWASM v1.0 and support IBC v3. CosmWasm is a smart contract platform built for the Cosmos ecosystem. It is written as a module that can be plugged into the Cosmos SDK and that allows anyone to build a blockchain on Cosmos using Rust as the programming language of choice while still adding support for other programming languages like AssemblyScript.

The CosmWasm architecture provides multiple benefits in terms of security. For example, well-known issues that often negatively affect Solidity smart contracts, like reentrancy attacks, are prevented by the framework. CosmWasm protects against reentrancy attacks by design. For instance, the approach taken with CosmWasm is to allow any contract to return a list of messages to be executed in the same transactions. This means that a contract can only request a send to happen after it has finished. This provides several security guarantees with the only real downside being not being able to view the results of executing another contract.

Beyond common exploits like reentrancy attacks, another common attack vector for smart contracts is DoS (Denial of Service) attacks, where a malicious actor could run a smart contract that executes an infinite loop to halt the chain or write tons of data to fill up the maximum disk capacity. Web Assembly protects against these attacks by providing a sandbox with no default access to the underlying operating system of a node.

A Denial of Service Attack is an attack that attempts to disrupt the typical traffic of a targeted node by flooding its server and surrounding infrastructure with network traffic.

How CosmWasm compares to Ethereum for a series of common vulnerabilities:

USK, ORCA, and the Kujira Senate contracts have undergone thorough audits

Kujira USK Stablecoin Contracts Audit by SCV

Kujira is a semi-permissioned chain, which means that protocols have to be approved via governance voting before being deployed to the network. The primary concern with this design is the potential centralization vectors, especially due to the centralization of stake across validators. Although it is not feasible from a liquidity standpoint for an individual to hold enough voting power to have a majority in governance decisions, this centralization risk can pose a threat if a group of well-funded validators decides to collaborate on control over which protocols are approved. This is a hypothetical scenario and can be resolved through governance changes on voting conditions.

Liquidity risk

Due to the lack of shared security amongst chains built on Cosmos, Kujira is responsible for securing its own chain with its native token and validator set. The issue with this design shows up when Cosmos chains start to interact with each other. For instance, if chain A decides to connect with chain B through IBC, then chain A is trusting the security assumptions of chain B and vice-versa. If the chain was attacked, then the synthetic representation of its native assets would become worthless on chain B. The concerns of this security model were manifested during the collapse of Terra, whose native token crashed and dragged down the price of OSMO and other assets with high amounts of shared liquidity in pools with UST and LUNA.

Kujira launched on Terra Classic via an IDO on the StarTerra platform, and their backers include Do Kwon, GT Capital, and Qi Capital among others.

How to withdraw assets from FIN: https://medium.com/team-kujira/withdrawing-assets-from-fin-a3e6e3e53709