Published October 3, 2024

INFINIT is a DeFi Abstraction Layer designed to substantially reduce the complexities of initiating and expanding DeFi ecosystems. The platform enables the swift deployment of DeFi protocols across various EVM-compatible chains including L1s, L2s, and modular blockchains. It allows developers to create DeFi applications using TypeScript, removing the requirement for expertise in more complex smart contract languages like Solidity.

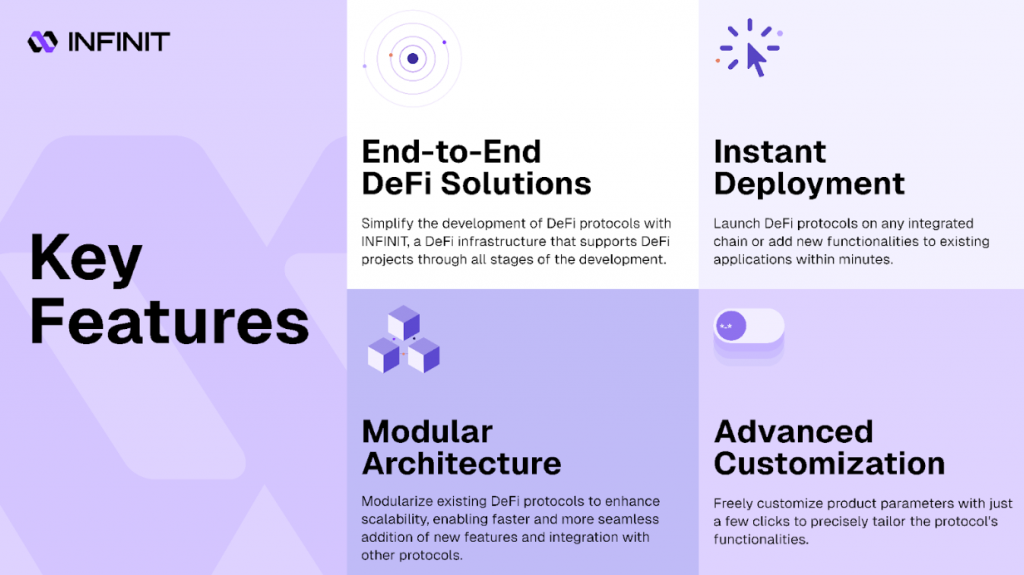

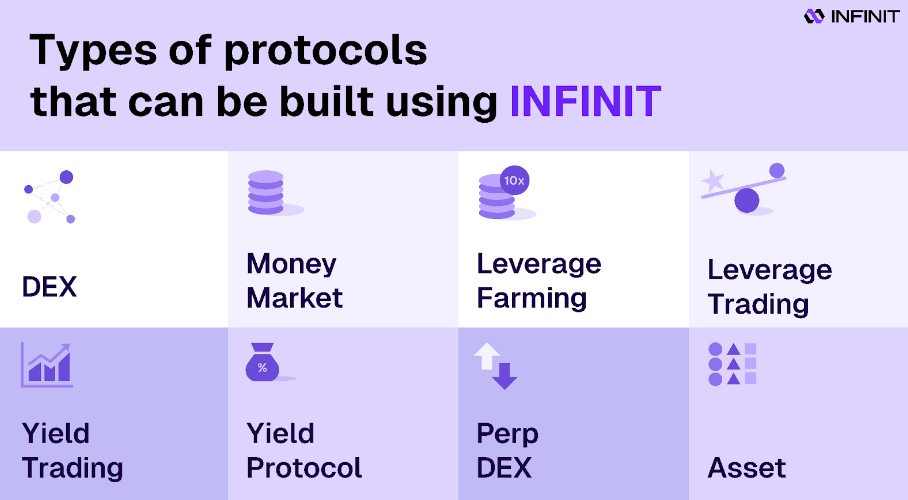

The protocol offers comprehensive tools necessary for developing a wide range of DeFi applications such as money markets, decentralized exchanges (DEXs), perpetual DEXs, leveraged trading, and leveraged yield farming—all of which are necessary for composability and achieve network effects and adoption on any given chain. Hence, INFINIT serves as an intermediary layer between blockchain networks and DeFi protocols, delivering multiple benefits:

In the later phase, INFINIT will provide a simple and user-friendly web interface that lets non-developers build and customize DeFi protocols directly from the INFINIT frontend, with no coding required. This further streamlines the development process, making it more accessible and efficient for builders.

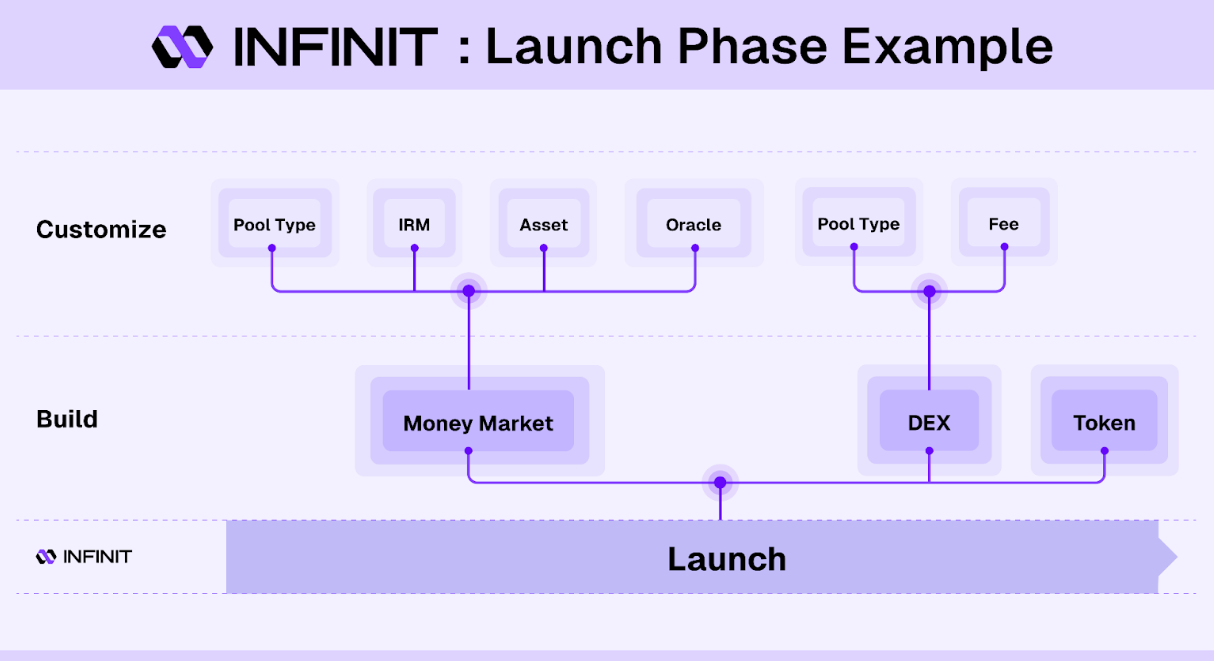

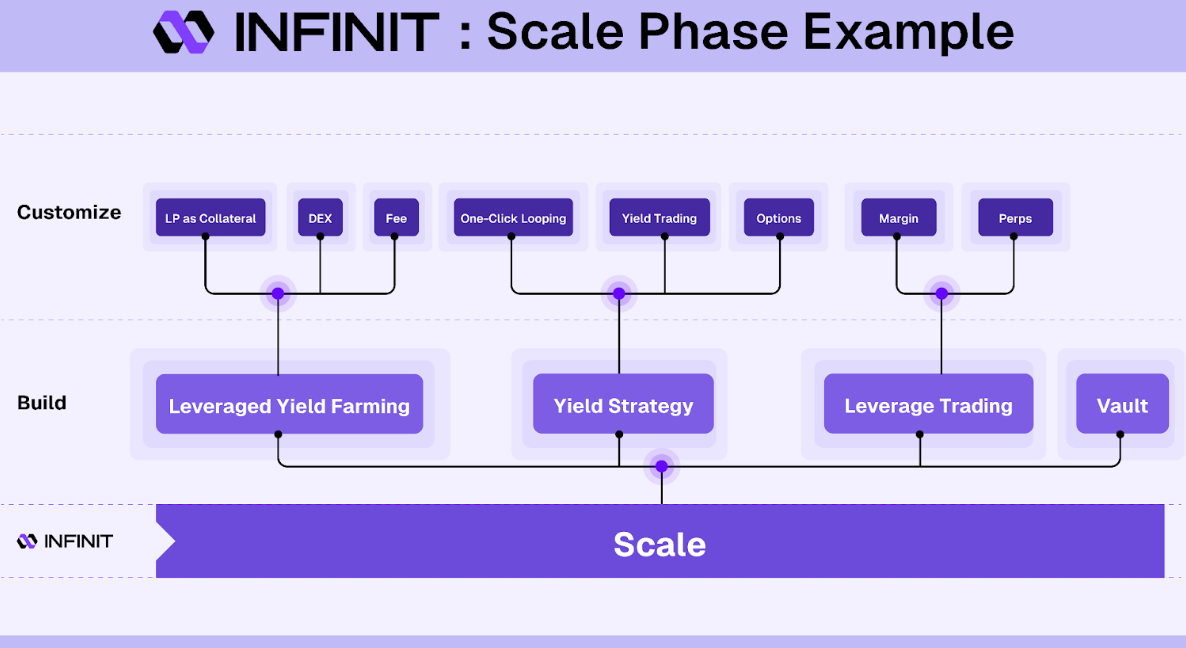

INFINIT enables the fast development of both foundational and advanced DeFi protocols with high customization by removing complexities associated with developing DeFi applications. It simplifies the process of building DeFi projects by supporting developers through two main phases of the product life cycle: Launch and Scale.

Launch Phase: INFINIT provides fundamental building blocks allowing developers to quickly and safely create new DeFi protocols with tailored features. This phase is geared towards developers initiating new projects, helping them progress from concept to initial launch.

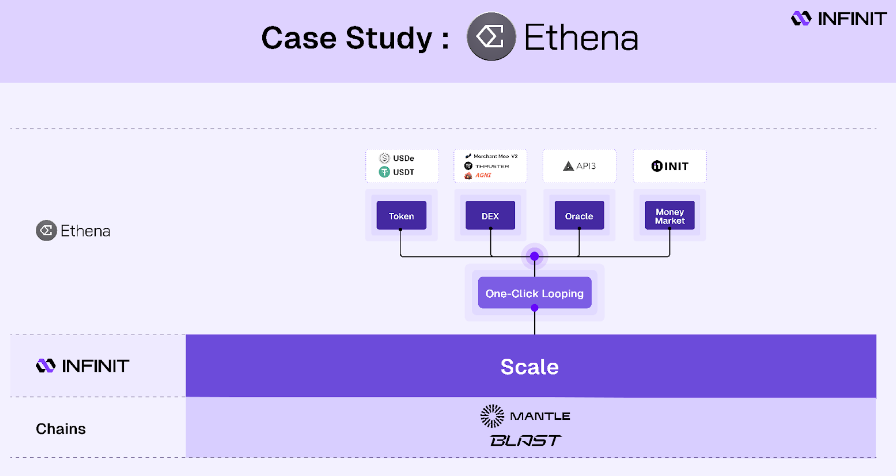

Scale Phase: INFINIT aids in the effortless integration of new features or functionalities into existing protocols. This phase supports the expansion of projects, such as incorporating advanced DeFi strategies like leveraged yield farming, to enhance product functionality and scale the protocol’s development further.

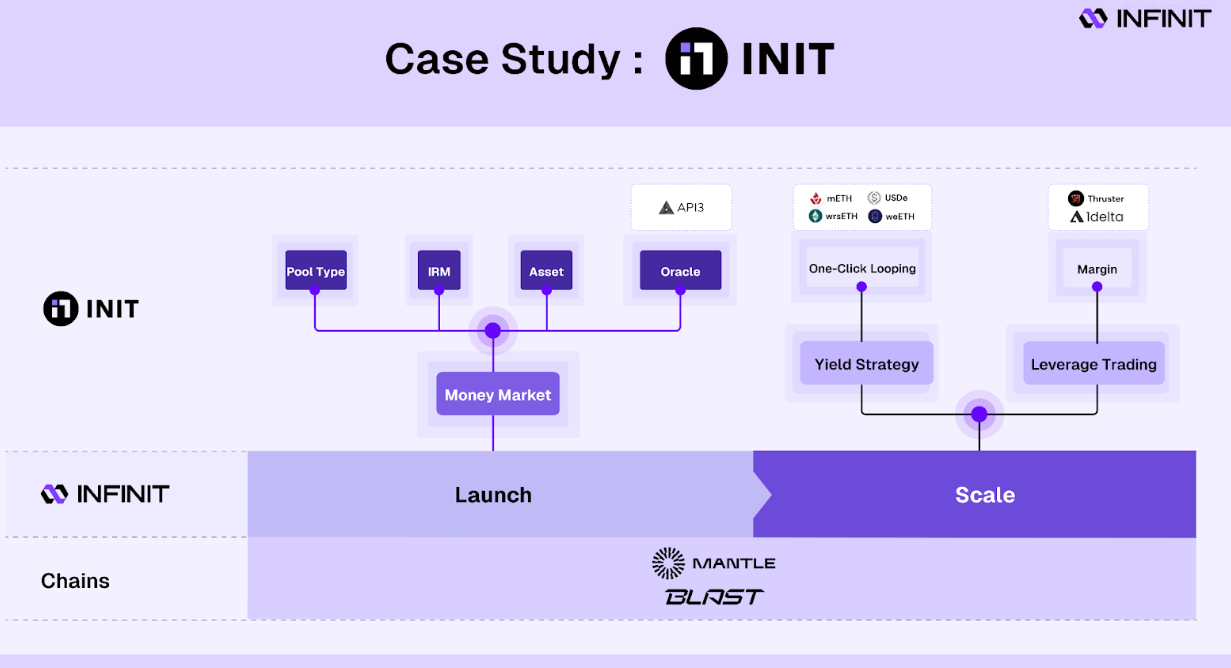

These are two examples of real crypto projects leveraging INFINIT’s DeFi Abstraction Layer.

INIT Capital is a Liquidity Hook money market developed using the INFINIT DeFi abstraction layer. This platform facilitates the creation and scaling of INIT Capital, supporting its evolution through both the Launch and Scale phases.

INFINIT allows INIT to offer functionalities such as flash borrowing and multi-silo positions, enabling it to support various DeFi strategies, such as 1-click looping and margin trading. These features allow INIT to provide customized financial products, adapt efficiently to changing market conditions, and become the largest money market on Mantle within just two weeks of its launch.

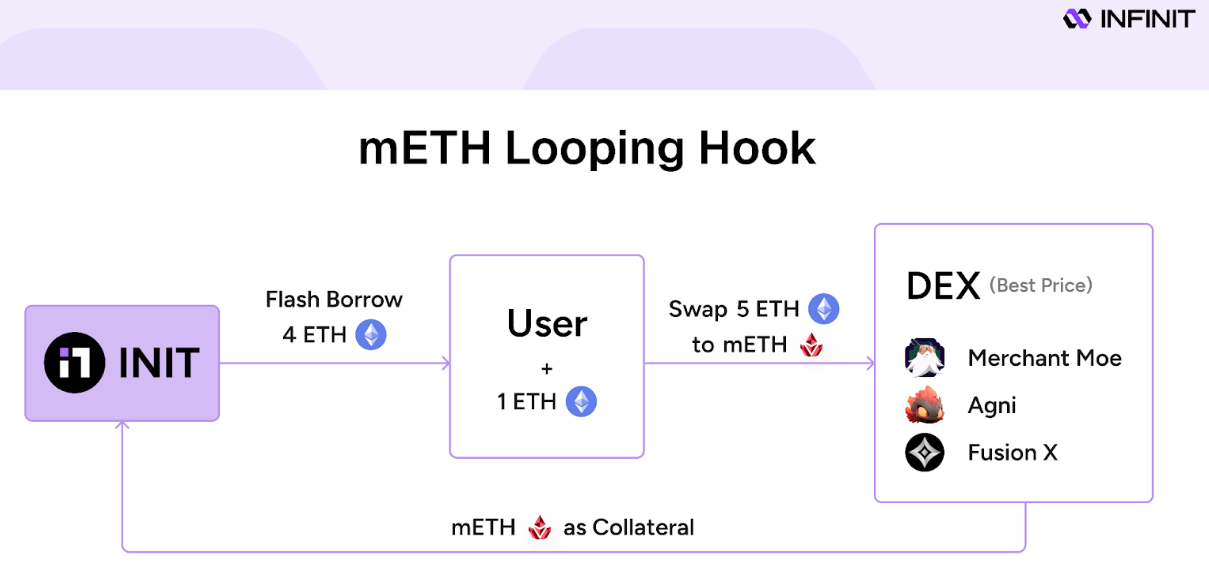

One of the examples is $mETH Looping Hook. This strategy focuses around $mETH and INIT Capital on Mantle and allows users to have greater exposure on $mETH and earn bigger rewards such as airdrops. This is what the one-click loop features does for users:

Users can do this with just one click.

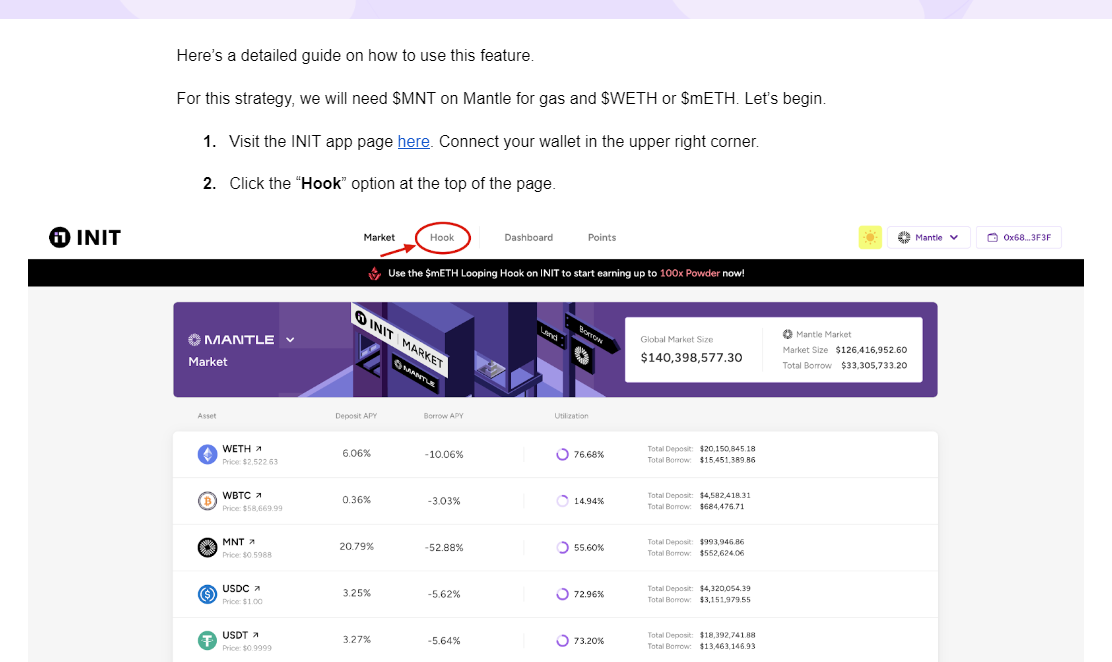

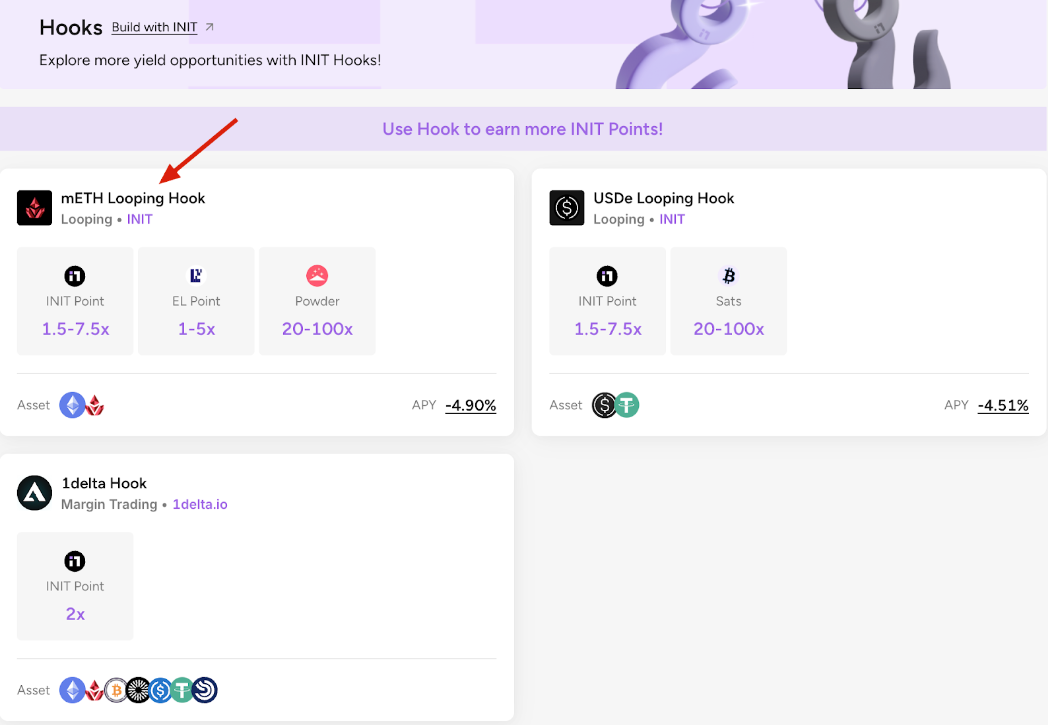

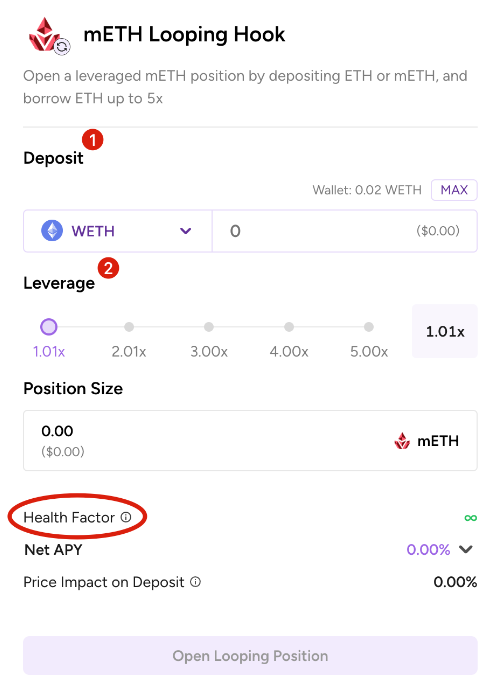

Here’s a detailed guide on how to use this feature.

For this strategy, we will need $MNT on Mantle for gas and $WETH or $mETH. Let’s begin.

This strategy is ideal for users who want leverage exposure to $mETH and Mantle ecosystem airdrops.

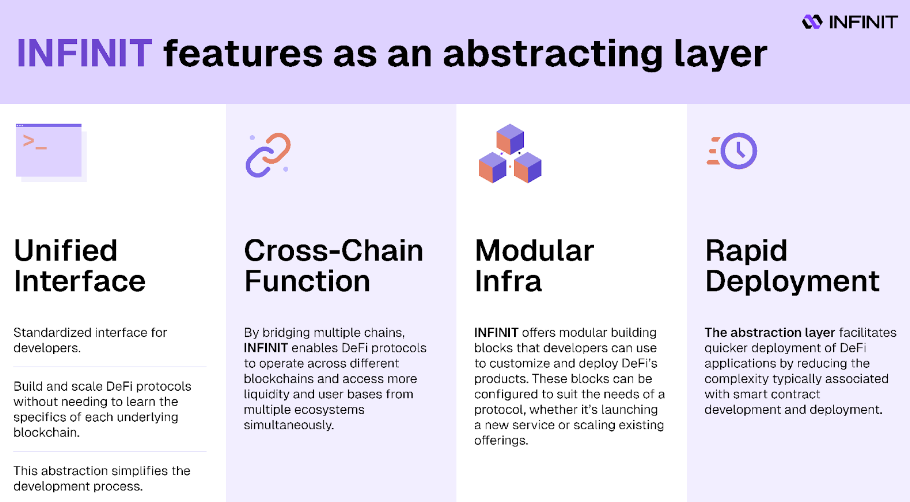

INFINIT builds its ecosystem by acting as a DeFi Abstraction Layer that sits between underlying chains and DeFi protocols. This positioning allows it to serve as a mediator that simplifies interactions and integrations across different blockchain platforms. INFINIT achieves this based on four aspects:

INFINIT has established a notable ecosystem by powering an expansive number of DeFi dApps across multiple blockchain networks, facilitating a combined $630M+ TVL. This portfolio includes protocols such as INIT Capital, Ethena, ZeroLend, Ether.fi, and Renzo, among others.

Looking forward, INFINIT is set to expand its ecosystem by partnering with several other ecosystems. These include Mantle, Berachain, Sonic, Monad, and Arbitrum, among others. By facilitating the development of DeFi applications on these chains, INFINIT aims to diversify across the whole crypto ecosystem.

The creation of INFINIT was driven by the inherent complexities and challenges within the DeFi development setting. Traditional methods of developing and scaling DeFi protocols require specialized knowledge and involve a steep learning curve, which often leads to high entry barriers for new developers. These complexities not only increase development time but also introduce significant risks, as even minor errors can lead to severe vulnerabilities.

INFINIT aims to transform DeFi development by offering a simplified and secure infrastructure. It offers pre-defined customizable building blocks that enable developers to easily plug-and-play different components to build a new protocol or add new features/functionalities to an existing protocol. Moreover, INFINIT does not require any complex coding languages like Solidity; all that is needed is TypeScript. This approach addresses several critical pain points in the industry. Firstly, it significantly reduces the complexities involved in building and scaling DeFi applications, making it accessible to a broader range of developers. Secondly, it aims to mitigate the risks associated with protocol development by providing a controlled environment with standardized building blocks.

The economic model of growing DeFi ecosystems on specific chains is both costly and unsustainable in the long term. INFINIT addresses this for integrated chains by offering a modular and robust infrastructure to growing DeFi ecosystems supporting their growth and scalability. This model is designed to be more sustainable for chains, helping them build a solid DeFi ecosystem without prohibitive costs.

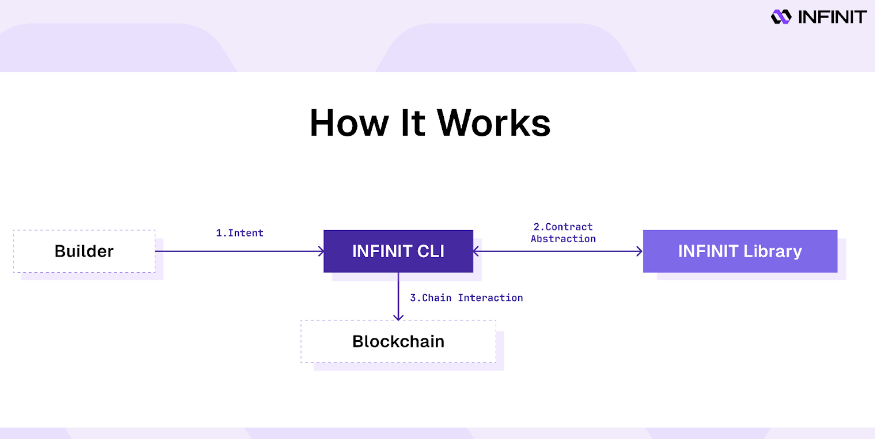

INFINIT CLI is the developer version of the DeFi abstraction layer that lets developers launch and scale DeFi applications in minutes using TypeScript coding language. It allows builders to use TypeScript to define the functionality of their DeFi applications, bypassing the need for more complex smart contract languages like Solidity. This script-based approach enhances flexibility and customization, enabling easy integration with external APIs.

INFINIT CLI also manages all the interactions between INFINIT and the underlying blockchain and automates the entire process of smart contract deployment. Developers are only required to input the RPC URL and deploy a private key within the INFINIT configuration file to facilitate these interactions.

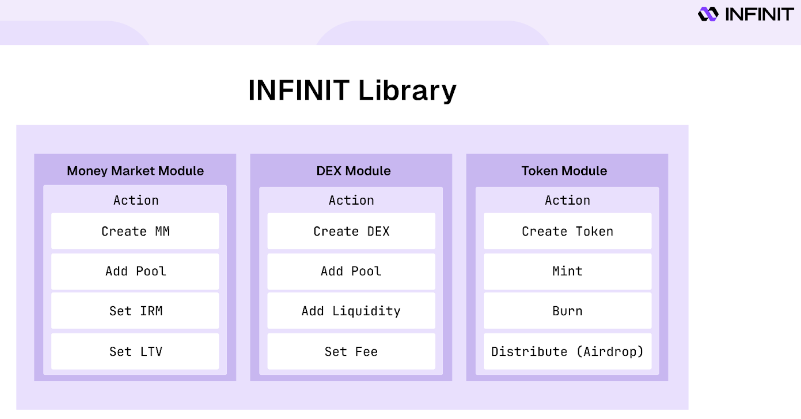

INFINIT Library features a comprehensive library of dApp modules that facilitate the development of various DeFi protocols such as money markets, DEXs, and the creation of ERC-20 tokens. These blocks are composed of Actions and Parameters that collectively determine the nature and functionality of the resulting DeFi protocol, with all elements being fully customizable.

The dApp modules in the INFINIT Library are the foundational elements that define the type of DeFi protocol being developed. For instance, protocols can range from money markets to token-based systems. Within each module, Actions serve as the specific components; for example, a lending pool is an Action within the money market module.

Parameters are critical as they define the behavior and constraints of an Action. Taking the lending pool as an example, Parameters might include the types of tokens involved, collateral tokens, borrowable tokens, and the collateral ratio. These Parameters are essential in shaping the operational dynamics of the DeFi protocols created using INFINIT.

INFINIT CLI operates through 3 key steps to create a set of smart contracts that fulfill the intended technological and product requirements of those DeFi protocols:

Step 1: Intent

Step 2: Contract Abstraction

Step 3: Chain Interaction

With the INFINIT CLI, users can launch new products or scale their existing protocols in a few minutes using TypeScript. Currently, the INFINIT Library offers 3 key dApp modules that users can build and customize: the Money Market module, the DEX module, and the Token module with ERC-20 tokens, which includes an airdrop distribution feature (Merkle).

In the future, additional dApp modules will be added to the INFINIT Library, allowing users to create and customize even more types of dApps, as illustrated in the image below.

The process for developers who want to launch a protocol using INFINIT CLI is simple and requires only a few steps.

Here’s a guide with all the steps to guide you through setting up a new project, writing a script, and deploying a project. You also check out the official docs for full details.

You can learn more about Module & Action & Script.

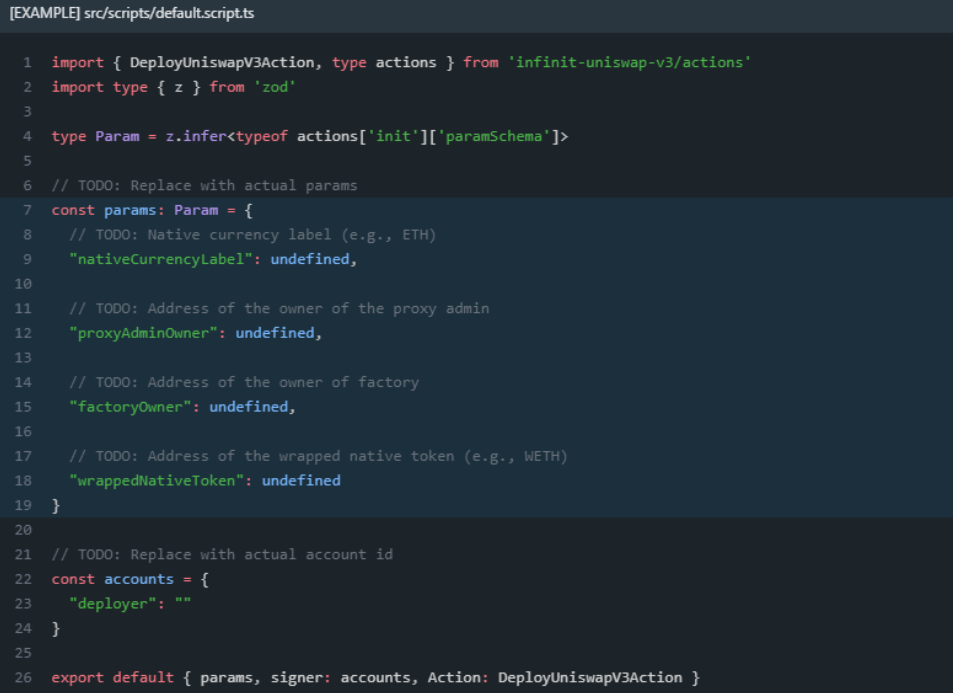

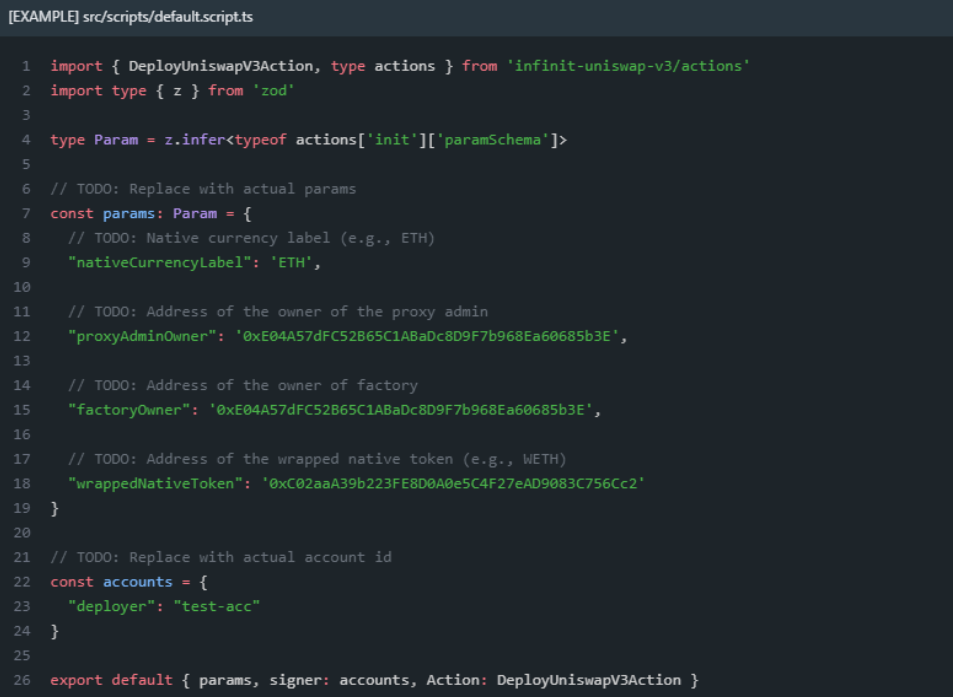

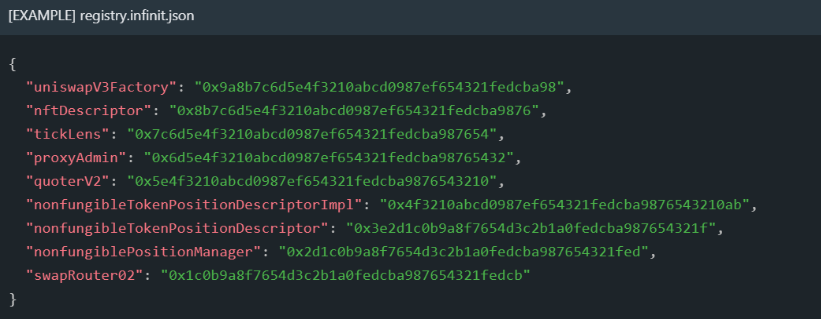

Also, here’s an example script from the @infinit-xyz/uniswap-v3 module. This script uses DeployUniswapV3Action to deploy the whole Uniswap V3 smart contracts.

The two main parts of the script that need to be filled in are:

Before filling out the script.

And the final script after filling the lines that deploy the Uniswap V3 smart contract on Ethereum.

The future of the DeFi sector, with platforms like INFINIT, points towards an increasingly accessible, integrated, and abstracted landscape that allows every developer to successfully launch and scale its protocol using a single interface with all the tools available.

Platforms like INFINIT lower the barriers for new developers to start developing by providing all the necessary blocks and tools to streamline the development process and abstract away complexities. These offerings facilitate the broader adoption of the crypto sector which often feels too complicated to new users and developers.

Lately, we have seen a shift toward chain abstraction and protocols that help address the fragmented Web3 user experience caused by the growth of blockchains, including L2s and even L3s. This fragmentation is harmful to Web3’s adoption because it necessitates highly proactive and technical users with liquidity spread across multiple blockchains, siloing dApps within an increasing number of ecosystems, and causing multiple user experience (UX) problems for users, such as expensive and time-consuming cross-chain operations, the need to hold multiple gas tokens, etc.

Similarly, an abstraction layer between chains and DeFi protocols has the same goal but mainly for developers and their dApps. Building a DeFi protocol requires extensive knowledge of the underlying tech, code language, and as the space progresses, additional tools and expertise to safely develop a protocol. This complexity hurts innovation and doesn’t allow developers to build high-quality dApps that differentiate from the current solutions.

Respectively, many protocols are unable to gain or retain traction. Scaling a protocol requires an extensive amount of effort in multiple directions and still sometimes might not be enough due to other factors. These protocols often don’t have access to enough liquidity, a long user base, and connections to more chains. Even innovative protocols cannot scale if they are not utilized and supported properly.

The DeFi space evolves at breakneck speed, with new cutting-edge innovations constantly emerging to disrupt traditional systems. To remain competitive, every dApp must continually reinvent itself, hence, it requires a robust infrastructure to support rapid scaling and ensure security efficiently. Without a solid foundation, dApps risk falling behind as the industry advances.

The adoption case of INFINIT as a DeFi Abstraction Layer is driven by several key factors around its value proposition as a platform for developers and protocols looking to launch or scale within the DeFi.

One of the primary adoption drivers for INFINIT is its ability to simplify the development process for DeFi applications. By abstracting the complexities of blockchain-specific developments, such as smart contract programming in languages like Solidity or Rust, INFINIT allows developers to use more familiar and widely used languages like TypeScript. This reduction in complexity lowers the barrier to entry for new developers and allows experienced developers to expedite the launch and iteration of their projects.

Another aspect that favors INFINIT’s adoption is the capability for cross-chain interoperability, which is increasingly important as the DeFi ecosystem becomes more fragmented with numerous chains launching their own DeFi ecosystems. By enabling protocols to easily operate across multiple chains, INFINIT not only increases the potential user base for a given protocol but also improves the liquidity pools available to them. This interoperability is a major incentive for protocols that aim to scale their services and products.

Moreover, the modular infrastructure of INFINIT allows it to meet the needs of various DeFi applications, from money markets and DEXs to complex derivative platforms. This modularity means that projects can be more agile, adapting and scaling their offerings with greater ease than if they were to develop these solutions from scratch. For developers, the appeal lies in the ability to plug into an existing framework that assures both stability and customization, allowing them to focus more on product differentiation and less on underlying infrastructure challenges.

Finally, the growth of the INFINIT ecosystem itself can serve as a catalyst for adoption. As more developers and protocols utilize the platform, it inherently becomes more valuable due to the network effects generated by increased activity and diversity of protocols. Additionally, INFINIT could offer financial incentives such as reduced fees, grants, or funding for projects that commit to building on its platform. Also, the success and growth of protocols building on INFINIT is a factor that may attract others to do the same.

INFINIT operates on a business model that revolves around facilitating the launch and scale of DeFi protocols by abstracting the complexities associated with DeFi development. This model allows for greater access to users and liquidity by simplifying the technical barriers that typically delay the adoption and growth of decentralized finance applications. Think of INFINIT as the Shopify of DeFi, providing a platform where developers can launch their protocol or use its features to scale their offerings.

The core of INFINIT’s offering is its comprehensive DeFi infrastructure support, which serves protocols at any stage of development, from inception to expansion. By providing a seamless interface for deploying and managing DeFi applications, INFINIT enables developers to focus on innovation and user engagement rather than the difficulties of blockchain technology.

INFINIT’s abstraction layer significantly reduces the entry threshold for new developers and projects, enhancing the overall growth potential within the crypto space. This approach drives innovation and creates a more inclusive and expansive DeFi ecosystem. As a result, INFINIT’s business model is not only about technical facilitation but also about creating a more accessible and robust market for DeFi products.

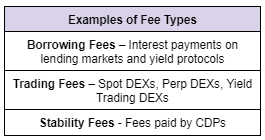

INFINIT does not charge any initial fee for launching or integrating on the platform but collects a percentage of fees generated by protocols launched and scaled from the platform.

INFINIT generates revenue primarily from taking a percentage of fees generated by protocols and functionalities powered by INFINIT. As more protocols get integrated the revenue sources increase and diversify, generating a significant amount for INFINIT.

In addition to supporting the launching and scaling phases of DeFi protocols, INFINIT will extend its infrastructure services to abstract away the complexities of managing and maintaining these protocols. These managed services will be offered through a subscription model.

The $IN token is expected to be launched in 2025. By staking $IN, holders can earn a share of the revenue generated by integrated protocols. Holders who stake $IN can also get airdrops from protocols and chains that integrate with INFINIT. Lastly, staking $IN will grant certain discounts on various ecosystem partners to use exclusive features and services. More details on $IN tokenomics will be released in the future.

INFINIT, like any platform built on blockchain, faces a range of potential risks that could impact its operation but since INFINIT is a tool that facilitates the development of protocols it doesn’t face the same risks as a typical DeFi protocol. Users interact with apps built from INFINIT but do not interact with INFINIT directly, and no funds are being deposited into INFINIT. The development and security of these protocols are their responsibility after launch. INFINIT on the other hand serves as a development toolkit to help build protocols easier and more efficiently.

INFINIT offers a variety of dApp modules consisting of smart contracts that enable developers to launch or scale their DeFi applications on various blockchains based on their intents. However, there are inherent risks associated with smart contracts, including potential vulnerabilities in the code that could be exploited by malicious actors. To mitigate these risks, INFINIT exclusively uses smart contracts that have been audited by leading auditors and contracts from battle-tested protocols, ensuring their security and reliability before incorporating them into the dApp modules.

INFINIT’s business model heavily relies on fees collected from the DeFi protocols utilizing its platform. If these protocols fail to attract enough users, funding, and transaction volume, INFINIT’s revenue and, ultimately, its success, will be negatively impacted. Nonetheless, INFINIT also has another revenue stream coming from offering infrastructure services to abstract away the complexities of managing and maintaining any DeFi protocols, and these managed services operate on a subscription basis.

The ability of INFINIT to offer a plug-and-play platform for protocols to launch in minutes is an important advantage that attracts many developers. Using Typescript as a coding language is also a valuable feature for developers with no Solidity experience.

However, many developers may still choose to build their protocols themselves without integrating with INFINIT and using their own tools. Another factor that might disinterest teams from partnering with INFINIT is the percentage of fees they have to share.

Providing a secure environment for protocols and partners is essential for INFINIT. This is done through a multi-layered approach that involves audited smart contracts from credible third parties and the development of a solid technological framework that supports the entire operation. These security measures protect DeFi protocols that integrate with INFINIT to launch and scale their products.

INFINIT uses a plug-and-play model that is based on audited contracts from some well-known protocols such as Uniswap and AAVE. Specifically, these contracts apply to INFINIT’s module architecture to support numerous functions of the platform. These implementations ensure maximum security.

INFINIT’s success heavily depends on its adoption by developers and teams. If the platform fails to attract and retain a substantial and active developer community, its growth and viability could be affected.

Moreover, the premise of INFINIT relies on seamless integration with a range of blockchains and external APIs. Any disruptions or inconsistencies in these integrations can impair functionality, degrade performance, or lead to vulnerabilities. Moreover, as blockchain technology evolves, keeping the platform compatible with new developments or standards without introducing risks can be challenging.

Lastly, INFINIT’s operational efficiency and functionality depend significantly on the interplay between the INFINIT CLI and the INFINIT Library. Both serve a distinct but interconnected role in the platform’s ecosystem, creating dependencies that are critical for the smooth operation of INFINIT.

The founding team behind INFINIT has more than 4 years of experience in the DeFi space with several contributions and a history of projects. In 2020 the team created Alpha Finance which was awarded the Binance Launchpad Award of the Year in 2021. The team has also built Alpha Homora, the first leverage yield farming platform that grew to a peak of $1.9B TVL.

Since 2020, this team has successfully helped incubate five DeFi protocols, all of them received funding from well-known investors, and some of them got listed on major exchanges.

These are the founders of INFINIT:

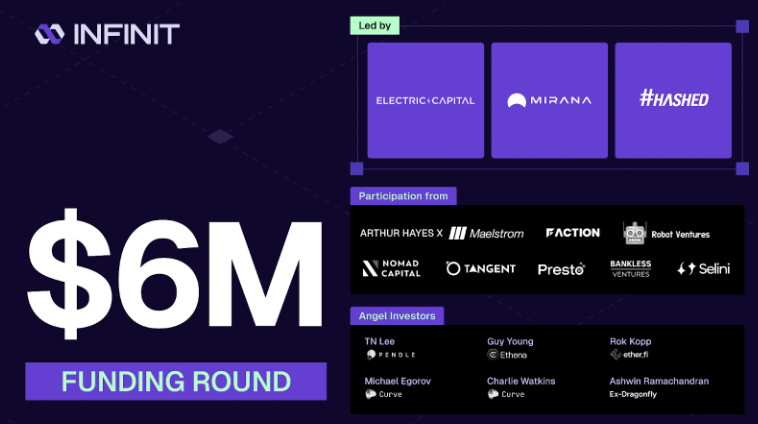

INFINIT has raised $6M in a funding round. The investment round was co-led by Electric Capital, Mirana Ventures, and Hashed. Additional investors include Arthur Hayes’s family office, Maelstrom.fund, alongside Robot Ventures, Nomad Capital, Tangent, Bankless Ventures, Selini Capital, and Lightspeed Faction.

The project also benefits from the support of several prominent angel investors. These include TN Lee, founder of Pendle Finance; Guy Young, founder of Ethena; Julian Koh, founder of Aevo; and Ashwin Ramachandran, a former member of Dragonfly Liquid.

What is INFINIT?

INFINIT is a DeFi Abstraction Layer that simplifies the process of launching and scaling DeFi protocols across multiple blockchain environments. It enables developers to use TypeScript to build DeFi applications without needing in-depth knowledge of blockchain-specific programming languages.

Can developers use INFINIT without blockchain experience?

Yes, one of INFINIT’s main advantages is its ability to allow developers who may need blockchain-specific experience to build and scale DeFi protocols using TypeScript, making the entry barrier much lower than traditional DeFi development platforms.

Is INFINIT compatible with all blockchains?

INFINIT is designed to support a variety of blockchain layers, including L1s, L2s, and modular blockchains, enhancing its utility in creating cross-chain compatible DeFi applications.

What does it mean that INFINIT uses an abstraction layer?

The abstraction layer in INFINIT provides a simplified interface that hides the underlying complexity of blockchain technology. This allows developers to work with high-level constructs without dealing with the intricacies of each blockchain network directly.

Can existing DeFi protocols be migrated to INFINIT?

Yes, existing DeFi protocols can be migrated and further developed on INFINIT. The platform’s modular design and abstraction capabilities allow developers to scale existing protocols by integrating new features or extending their operations across additional blockchain networks.