Published July 10, 2024

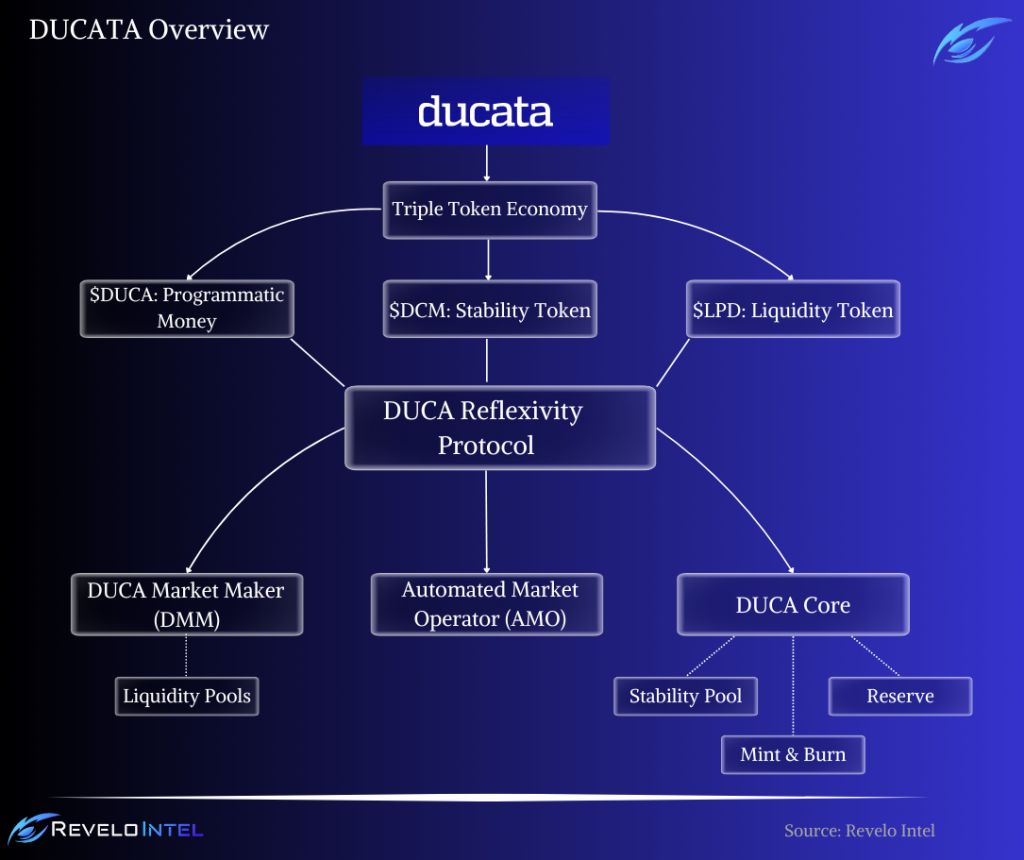

Ducata introduces a decentralized protocol enabling the circulation of programmatic money – an algorithmic approach designed to ensure a stable on-chain reference value. The approach presents a concept of programmatic money through its stable value asset, $DUCA. Programmatic money is self-regulating and adapts efficiently in real time to changes in the market.

$DUCA relies on an advanced algorithmic mechanism and market trust to maintain its value. The protocol achieves stability through a dynamic system of minting and burning $DUCA, governed by the supply and demand of its rebase token, $DCM, and the distribution of its Liquidity token, $LPD, issued to LPs (Liquidity Providers) who contribute $DCM to the protocol’s reserves helping to maintain liquidity and earning yield.

This mechanism seeks to ensure over-collateralization and adjusts the supply of $DUCA in real-time, providing users with a stable and reliable digital currency for various transactions and yield generation.

Programmatic Money is driven by autonomous operations and algorithmic adjustments. $DUCA adopts this newly introduced technology as a digital currency operating autonomously based on predefined software rules. Unlike traditional currencies, which depend on regulatory oversight and financial institutions for stability and valuation, $DUCA is self-regulated. This means it uses algorithms that continuously adjust in real time to align with market dynamics.

Fully operational on the blockchain, Programmatic Money leverages the DUCA Reflexivity Protocol to dynamically manage its supply in response to the demands and conditions of the market, establishing a fair and resilient financial system.

The current financial system’s limitations have become increasingly evident with the advancements in blockchain technology, which has introduced the potential for digital currencies that operate independently of traditional financial infrastructures. While stablecoins attempt to offer stability, they remain tied to the volatile fiat systems they aim to improve.

Programmatic Money, as exemplified by $DUCA, breaks free from these dependencies, providing a stable, reliable currency free from external manipulation. This autonomy places full financial control back into the hands of users, protecting against depreciation, preserving purchasing power, and generating yield autonomously.

$DUCA is crafted through the innovative DUCA Reflexivity Protocol, which ensures that its valuation isn’t dependent on traditional collateral forms or external valuation methods. Its value is intrinsically linked to market forces, supported by an Algorithmic Float that sets the ideal price internally.

The Reflexivity Protocol adjusts $DUCA’s supply based on its market value; it increases the supply when the value is high to bring the price down and decreases it when the value is low to stabilize the price upward. This dynamic, on-chain adjustment process guarantees that $DUCA remains untouched by external influences, maintaining its integrity and stability autonomously. In summary, the Reflexivity Protocol is directly responsible for the effective operation of the Triple Token Economy System.

Programmatic Money offers several benefits that aim to redefine the role of currency in a modern economy:

$DUCA’s approach as Programmatic Money seeks to set a new standard for currency and provide a viable, trustworthy alternative to the conventional financial system, promising a more stable, transparent, and equitable financial future.

The DUCA Reflexivity Protocol employs an algorithmic method to dynamically adjust its supply based on market conditions, ensuring stability without manual intervention. This system operates fully on-chain, aiming to provide a decentralized, algorithmically managed currency that is independent of traditional financial systems. In addition, the main core principle that drives the protocol is its triple-token system.

The protocol introduces a Triple Token Economy design that is responsible for diversifying risk and enhancing stability.

| $DUCA | $DCM | $LPD |

| Programmatic Money | Stability Token | Liquidity Token |

The protocol is the issuer of $DUCA, which is an asset with a stable value that is not pegged to fiat or commodities unlike common stablecoins, $DUCA’s value increases over time through an algorithmic float that manages supply and demand dynamics. This mechanism aims to ensure that users’ purchasing power remains stable, even as the price of $DUCA may rise. This price increase reflects the asset’s objective of preserving real value rather than maintaining a fixed nominal price. By doing so, $DUCA aims to provide a stable value asset that adapts to economic conditions and mitigates the impact of inflation.

$DUCA is a form of programmatic money designed to maintain a stable market value and preserve purchasing power over time. It is not redeemable for fiat, Bitcoin, or any other assets. Instead, it operates independently, with an elastic supply that ensures stability and growth through mechanisms embedded within the DUCA Protocol.

$DUCA utilizes an Algorithmic Float that adjusts $DUCA’s value based on the comprehensive FOREX data of the world’s most traded currencies. The term “Algorithmic Float” refers to the method by which $DUCA’s internal exchange value is calculated and adjusted. This value is determined using a combination of global FOREX data and inflation rates to ensure that $DUCA maintains real-world purchasing power. The “float” implies that this value isn’t fixed but changes over time based on economic indicators.

This method allows $DUCA to reflect a real-time value that is responsive to global financial movements, creating a currency resistant to value depreciation and inflation while maintaining purchasing power.

$DCM is a specialized utility token within the DUCA Protocol, designed explicitly to stabilize the value of $DUCA. As a stability token, it ensures that $DUCA maintains its intended value, making the entire ecosystem more reliable.

Note that $DCM is a rebase token and the supply of $DCM can adjust automatically to maintain stability for and within the DUCA Protocol. The rebase mechanism ensures that the amount (not the exchange rate) of $DCM held by users can change continuously, depending on the protocol’s needs; the protocol contracts the circulating supply of either $LPD or $DCM based on the level of demand.

$LPD plays a crucial role in maintaining the stability and over-collateralization of $DUCA, the protocol’s primary asset. Unlike typical tokens designed for payments or stable value retention, $LPD is specifically tailored to provide liquidity to the Stability Pool in exchange for $DCM. Users who wish to contribute to the Stability Pool can do so by swapping their $DCM tokens for $LPD. This action adds liquidity to the pool, which in turn helps maintain the protocol’s stability mechanisms.

$DUCA functions autonomously through predefined software rules. Known as the 7 Pillars of DUCA, these components are as follows:

| DEX Aggregators (Liquidity Pools) | Endogenous and Exogenous Liquidity Pools within the protocol. |

| DUCA Market Maker | An Automated Market Maker integrated as the liquidity hub of the DUCA Protocol. |

| Automated Market Operator | A mechanism designed to autonomously manage the supply and demand of $DUCA, ensuring its price stability and maintaining equilibrium within the protocol. |

| Stability Pool | A specialized liquidity pool designed to maintain the stability and over-collateralization of $DUCA |

| Mint & Burn Mechanism | A continuous process that balances $DUCA’s supply and demand, stabilizing its market value. |

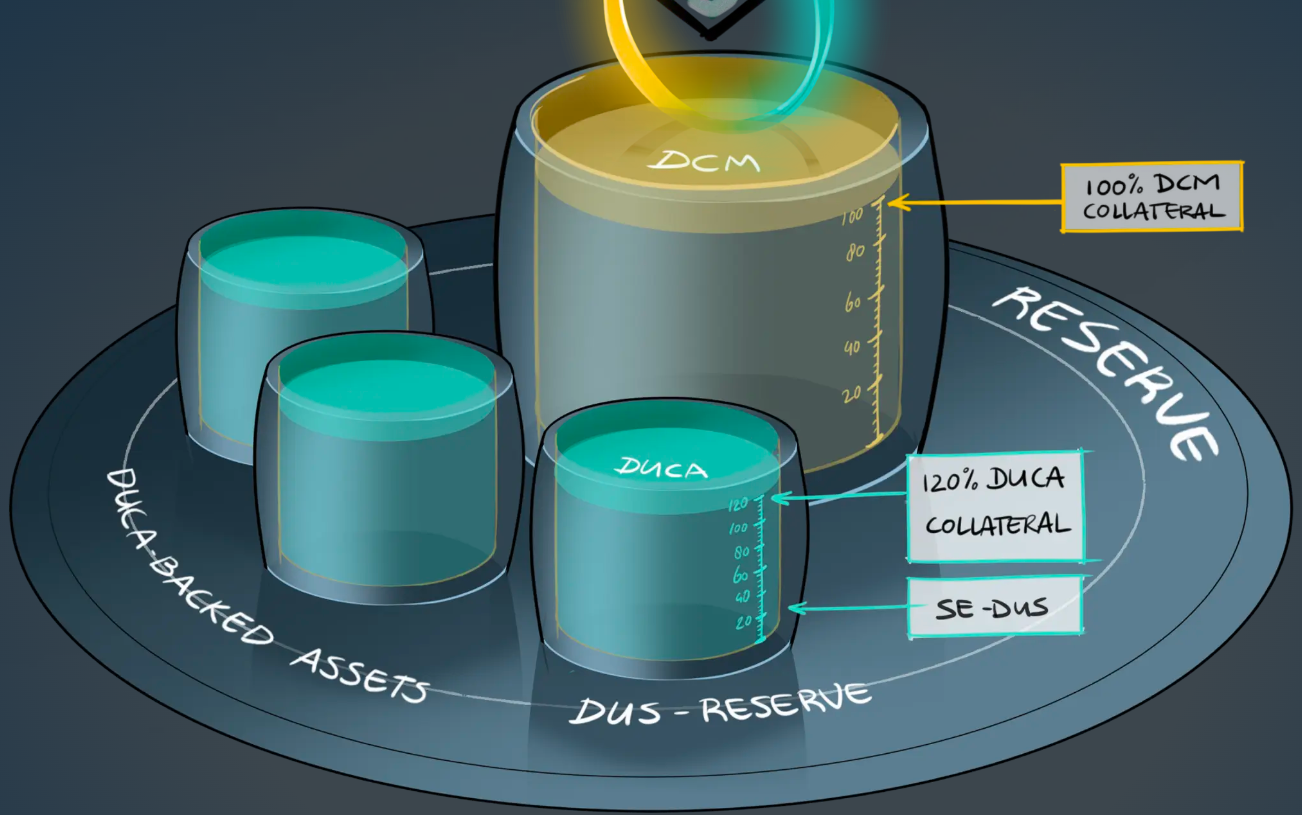

| Reserve | This acts as a financial safety net, it contains specific reserves for different tokens. It backs the protocol’s liabilities and ensures that each DUCA-backed asset has a dedicated reserve to maintain its value. |

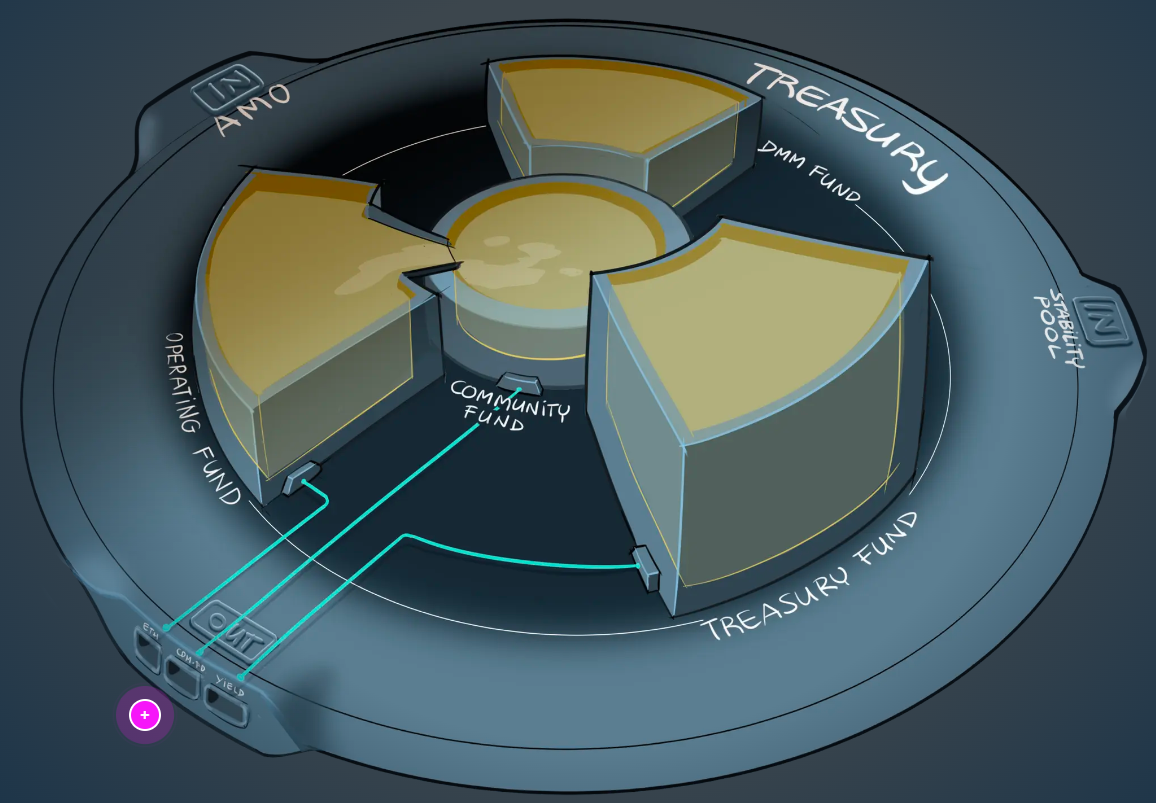

| Treasury | This comprises several key funds that work harmoniously to support the protocol’s ecosystem and its ambitions. |

These components are discussed in detail in the ‘Protocol Architecture’ section.

Furthermore, $DUCA’s value is protected with a triple-layer collateralization system.

These three layers produce a total collateralization of exactly 300%. Thus, there is no additional expense associated with minting $DUCA as its value is always minted against its exchange value.

The Incentive Structure of the DUCA Reflexivity Protocol is designed to maintain stability, manage liquidity, and adapt dynamically to changing market conditions through a set of novel mechanisms. These systems collectively contribute to the protocol’s resilience and responsiveness. It comprises the stability pool, the par value, the clean float, the stability fee, and a rebase mechanism.

| Stability Pool | a specialized liquidity pool designed to maintain the stability and over-collateralization of $DUCA and its backed assets. |

| DCM Par Value | The minimum reference value for $DCM within the Protocol |

| Clean Float | an automated mechanism that adjusts the capital flow and circulating supply of $DCM to stabilize its market value through supply and demand. |

| Stability Fee | Utilized to fine-tune the size of the Stability Pool, aligning liquidity provision with market needs and incentivizing protocol participation. |

| Rebase Mechanism | A dynamic adjustment process that modifies the supply of $DCM in response to market valuation changes, ensuring that the token’s market value aligns with its Par Value. |

In action, the Stability Pool acts as a second layer of collateral for $DUCA, regulating its supply and distributing fees and rewards based on market conditions. The DCM Par Value dynamically adjusts to market conditions, representing the 100% collateralization level of $DUCA in $DCM and anchoring its market value. This triggers stabilization mechanisms like the Clean Float, a market-driven system that adjusts $DCM’s circulating supply and demand for $LPD tokens, all without centralized intervention. To maintain financial stability and 100% over-collateralization, a Stability Fee is dynamically charged to $DCM or $LPD holders. This fee works in conjunction with the Par Value and Clean Float to achieve supply and demand balance.

Finally, a Rebase Mechanism adjusts $DCM supply based on market conditions, managed by the Clean Float to ensure alignment with the Par Value.

$DUCA Yield is designed to reward $DUCA holders simply for holding the tokens without the need for locking or staking. This yield is automatically distributed and is derived from various fees collected within the protocol, which are then deposited into the Treasury Fund. It is structured to be dynamic and sustainable, ensuring that all participants can benefit from the system’s growth and success without additional effort.

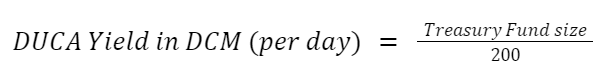

The process for calculating the $DUCA Yield is straightforward and aimed at maintaining the protocol’s health and balance. It operates daily, where each $DUCA holder’s yield is determined by the average amount of $DCM in the Treasury Fund over 200 days. This yield dynamically adjusts according to the available quantity of $DCM—decreasing when the amount of $DCM decreases and increasing when it rises.

Additionally, the yield is correlated with DUCA’s market capitalization to ensure that the distribution of the yield aligns with the overall market dynamics and the sustainability of the protocol, promoting a balanced and healthy economic environment within the system.

The incentive structure of the protocol is made up of three components directly correlated to the Treasury Fund that accumulates $DCM.

How the Yield is Balanced:

The Stability Fee within the DUCA ecosystem is a variable charge that can be positive, zero, or negative, depending on the prevailing economic conditions and the operational mechanisms of the Incentive Structure.

These incentive structures are designed to promote active participation within the DUCA ecosystem, ensuring that all stakeholders of $DUCA, $DUS, $DCM, or $LPD, benefit from a system that is both responsive to market conditions and adaptive in its growth and yield generation strategies.

The DUCA Yield is a sustainable incentive distributed to all $DUCA holders, based on the availability of $DCM in the Treasury Fund.

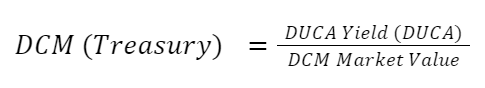

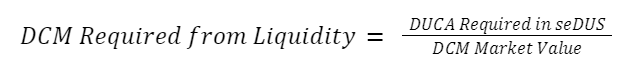

Every day, the size of the Treasury Fund is evaluated over 200 days to determine how much $DCM is available for yield distribution each day. Indicated mathematically as follows:

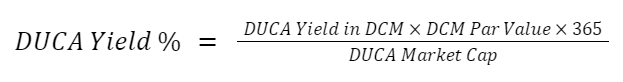

Using the daily available $DCM, the protocol calculates the potential DUCA Yield percentage for the current $DUCA Market Cap. $DCM is valued against its Par Value in this calculation.

This percentage reflects how much yield can be distributed to $DUCA holders, with a maximum cap of 100%.

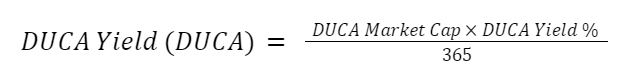

The next iteration involves minting the $DUCA to be distributed as yield. This uses the available $DCM from the Treasury Fund, but this time the $DCM is valued at its current Market Value instead of the Par Value.

This formula calculates the amount of $DUCA to be distributed daily as yield.

Finally, the protocol determines how much $DCM from the Treasury is needed to mint the calculated DUCA Yield. This involves adjusting the amount of $DCM by its market value.

This yield is not a fixed or guaranteed amount, but a variable percentage that relies on market conditions and dynamics. It is fully programmatic, predetermined, transparent, and credibly neutral. The yield is not produced through supply inflation but created using $DCM in the Treasury Fund – derived from the protocol’s incentive structure to ensure stability.

The DUCA Yield is a product of the interplay between market dynamics and the protocol, orchestrated by the AMO. It is designed to dynamically reflect how the market perceives the value of $DUCA. As the demand for $DUCA increases, yield decreases, eventually leading to a lower demand for $DUCA, prompting a reduction in its supply, which, in turn, increases the yield again.

$DUS is a utility token designed to maintain a value based on the US dollar. Unlike traditional stablecoins that are pegged to the dollar, $DUS functions as its own price oracle. Its value is maintained by the protocol through mechanisms that determine and uphold the price indication within the USDC/DUS pool. This approach ensures that $DUS consistently reflects a stable value aligned with the US dollar. It is also 102% backed by $DUCA. $DUS has a fixed exchange value to the USD, which the protocol consistently honors, regardless of its market value. This ensures that 1 $DUS is always treated as equivalent to 1 USD within the protocol. It does not require the backing of fiat currency or other exogenous assets and is not redeemable for fiat or other cryptocurrencies.

$DUS offers a stable and reliable medium of exchange within the DUCA Protocol. $DUCA can be swapped for $DUS against its fixed exchange value and has a guaranteed over-collateralization of 2% that is safeguarded by the Stability Pool. The Protocol creates a separate and fully siloed Reserve Pool, the DUS Reserve. When $DUS is minted the $DUCA used to mint $DUS is added to the DUS Reserve. Whenever $DUS is sent in to swap the received $DUS is burnt and the corresponding $DUCA is taken from the DUS Reserve to return with the swap. This process will always happen against the DUCA Exchange Value.

The Funding Ratio Requirement (FRR) ensures that the $DUS is over-collateralized by 2%, maintaining a total collateralization of 102%. This safeguards $DUS by ensuring there is always sufficient collateral, particularly when USD temporarily outperforms $DUCA. The FRR also provides additional yield to DUS holders, particularly during times of high redemptions.

Collateralization:

Stability Pool Safeguard:

Dynamic Adjustments:

Calculation of Collateral Needs:

![]()

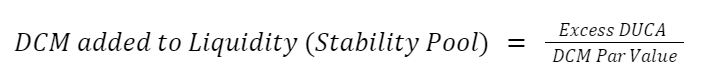

That Excess $DUCA is converted back into $DCM and added into the Stability Pool ;

Front Runner Mechanism:

Additional Yield:

This yield reflects a growth percentage by which the supply of $DUS appreciates daily, aligning $DUS with $DUCA and effectively hedging against USD. It is a mechanism within the DUCA Protocol that allows the creation and distribution of additional $DUS tokens to its owners based on their proportional stake. The yield is not a guaranteed return or investment promise but rather a reflection of the protocol’s growth and collateral dynamics.

Appreciation here means an increase in the supply of $DUS tokens. The protocol evaluates the $DUS Reserve’s collateral value daily, influenced by the DUCA Exchange Value and DUCA Yield.

If the collateral value exceeds the Funding Ratio Requirement, additional $DUS tokens are minted based on the excess collateral value and distributed proportionally to all $DUS holders.

The DUCA protocol consists of seven main parts or pillars. Every part of the protocol is developed to provide accessibility while preserving DUCA’s constant value.

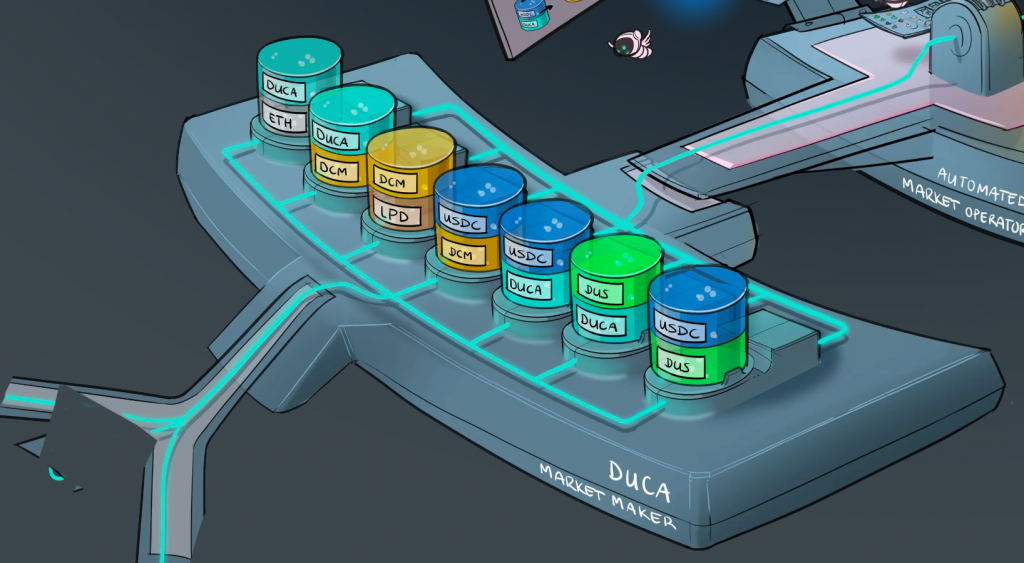

The DUCA Market Maker (DMM) is an Automated Market Maker integrated into the DUCA Protocol. It manages the protocol’s liquidity pools and facilitates the exchange of the protocol’s native tokens: $DUCA, $DCM, $LPD, and $DUS. Users interact with the protocol exclusively through these tokens, influencing their supply dynamics directly through actions such as buying, selling, or holding. The DMM contains 7 liquidity pools, providing access to all DUCA-native tokens. Transactions in the DMM are facilitated through the DUCA Swap Function. The DMM is designed to be self-sufficient, growing from within the protocol, based on its total market cap.

The DMM ensures Deep Liquidity so trades are smoothly executed without significant price impact. It means better prices and more confidence for everyone who trades. It is self-sustaining—growing with the community and securing assets against market volatility. All liquidity within the DMM is owned and managed by the protocol itself. The funds required to establish and maintain this liquidity are sourced from $DCM distributions and are stored in the DMM Fund. This setup prevents users from providing liquidity directly, allowing the protocol to manually adjust liquidity levels to respond to market needs. At first, the liquidity levels aim to match between 50% and 100% of the $DUCA market presence, with adjustments made as the market cap changes.

The TVL in the DMM starts at a high percentage (potentially over 100%) and is designed to scale down to a minimum of 20% of the $DUCA market cap. This liquidity setup includes a significant portion of $USDC, which acts as excess collateralization, enhancing the stability of the $DUCA tokens and providing a stable cash reserve that supports the protocol’s financial structure.

The inclusion of $USDC in the DMM not only provides deep liquidity but also enhances the over-collateralization of the tokens within the protocol. With a minimum collateralization rate of +200%, the addition of $USDC boosts this rate to over +300% for $DUCA and +302% for $DUS.

Endogenous Pools: These are the liquidity pools within the DUCA protocol that are only composed of the protocol’s native assets or tokens.

| Pool | Attributes |

| DCM / DUCA POOL |

|

| DUCA / DUS POOL |

|

| LPD / DCM POOL |

|

Exogenous Pools: These are the liquidity pools within the DUCA protocol that are also composed of tokens outside the protocol.

| Pool | Attributes |

| DCM / USDC POOL |

|

| DUS / USDC POOL |

|

| ETH / DUCA POOL |

|

Swaps within the DUCA protocol allow users to exchange one token for another via a third-party interface like a DEX Aggregator, subject to a capped maximum of 3% of the total balance of the input token of the target pool. All routed swaps incur the highest transaction fee applicable among the pools involved.

Fees vary by pool but are always added to the Operating Fund, enhancing the protocol’s financial operations.

$DUCA utilizes Time Weighted Average Pricing (TWAP) based on data from the last five blocks or approximately one minute to generate price feeds essential for its Automated Market Operator (AMO) and core protocol functionalities. These feeds include various market values such as $DCM in $DUCA and $DUS in $USDC.

TWAP Price Feeds

Oracles

Oracles provide these price feeds:

DUCA Core

The following data is provided to the DUCA Core:

Rate providers update rates in liquidity pools whenever deviations exceed threshold values to ensure accurate pricing and stable operations within the protocol. In scenarios where the $USDC value diverges from its peg, a circuit breaker is activated, suspending $USDC as an input token until stability is restored, though it can still be outputted valued at 1 $DUS.

Dubbed the orchestrator of the DUCA Protocol, the Automated Market Operator (AMO) primary objective is to ensure stability within the protocol by managing liquidity and intervening when necessary. It ensures the correct balances of the various liquidity pools within the DMM. It maintains balance in the various liquidity pools within the DMM and operates based on transparent rules. The AMO can directly influence the supply and demand of $DCM tokens, working with the DCM Stabilizer to correct market imbalances. It continuously gathers and analyzes market data to make informed decisions, ensuring the protocol remains stable and responsive to market dynamics.

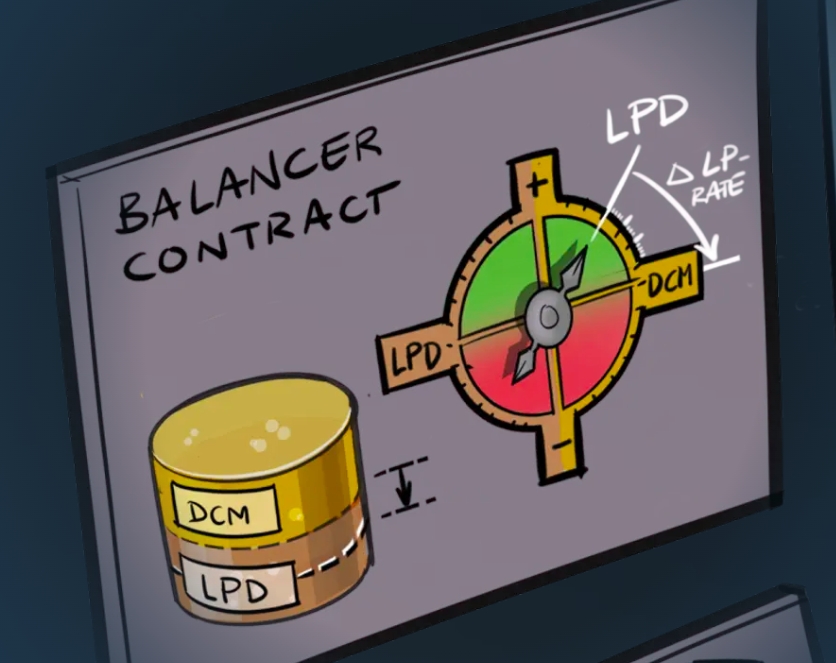

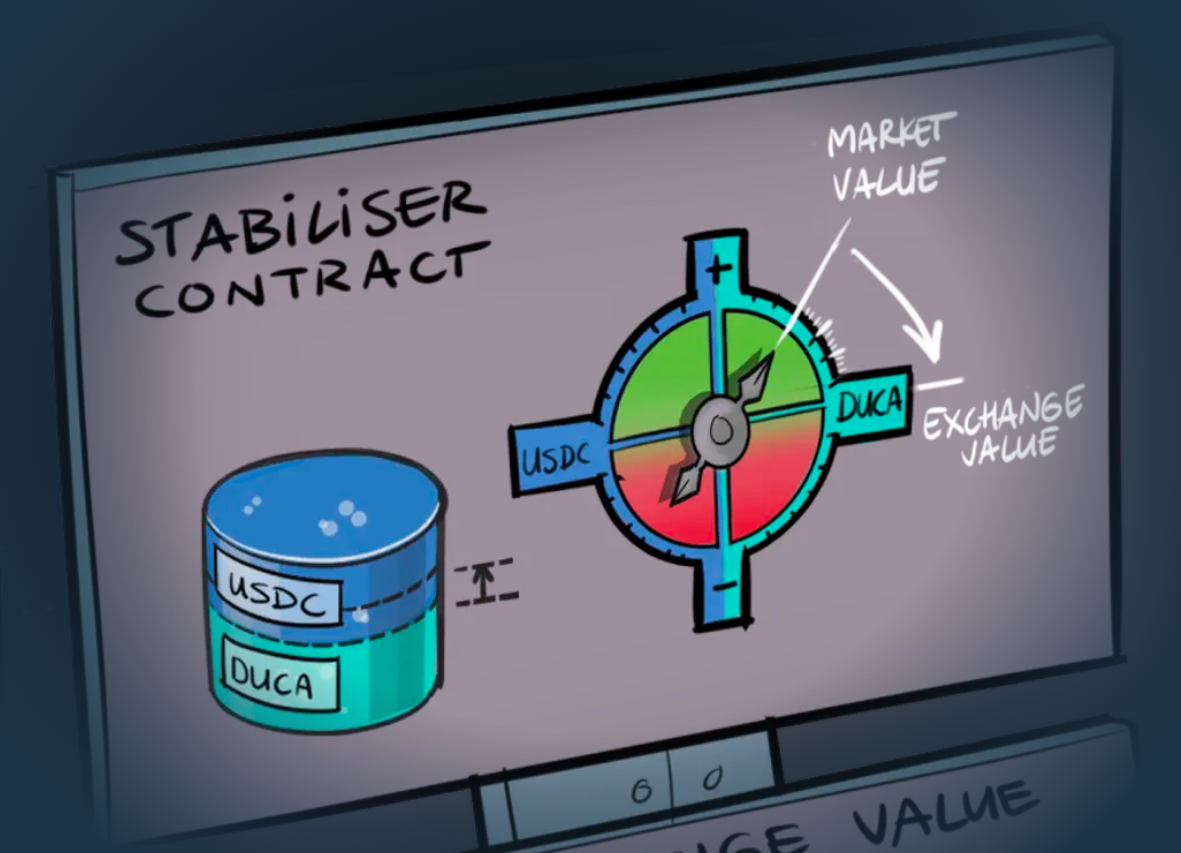

The AMO will have contracts to support the health of the DUCA Market Maker and the stability of the Protocol. This can be divided into 2 categories: the Balancer Contract and the Stabiliser Contract.

These fine-tune the supplies in each native token pool in the DMM to maintain perfect balance. Balancer contracts rebalance the supply within individual endogenous pools with minimal slippage by executing 1:1 with the Core, without affecting the total pool value.

| Balancer Contract | Attributes |

| DUCA Balancer Contract |

|

| DUS Balancer Contract |

|

| LPD Balancer Contract |

|

The Stabiliser Contract stabilizes the market value $DCM to match its target values.

The DCM Stabilizer Contract stabilizes $DCM when its market value drops below the Par Value. It activates if the TWAP(Time Weighted Average Price) of the DCM/USDC Pool shows a value 1% or more below Par Value for at least 5 blocks (1 minute), and the contract hasn’t been executed in the last 8 blocks.

Verification Steps

Contraction Process

The DCM Stabilizer Contract ensures the token values are reflected correctly in the pools by bringing $DCM back to the Par Value when it is valued below its Par Value.

The core and heart of the protocol consists of the Stability Pool, the Reserve, the Mint & Burn mechanism, and the Treasury.

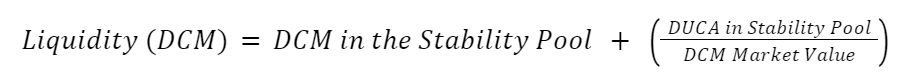

The Stability Pool functions as a specialized liquidity pool designed to maintain the stability and over-collateralization of $DUCA and its backed assets. At the basis, it forms the second layer of endogenous collateral for $DUCA, and while it is a pool, it does more than hold liquidity.

By depositing $DCM, LPs are rewarded with $LPD tokens relative to their share, tracked by the lpRATE. This pool is incentivized through various mechanisms and fees.

$DCM and $LPD owners pay a stability fee to facilitate liquidity. For $LPD holders, it means receiving $DCM distributed from the Stability Pool. When $DCM owners pay the fee, it’s rebased and added back to the Stability Pool.

When providing liquidity in DCM the liquidity provider gets $LPD in return following this calculation:

![]()

The lpRATE will represent the value of $LPD in relation to $DCM, it has a starting value of 1 and is denominated in $DCM. When withdrawing liquidity, the calculation is as follows:

![]()

Where:

The pool size must always be at least 100% of the DUCA Market Cap, based on the $DCM Market Value, but cannot exceed 98% of the net circulating supply of $DCM. Guardrails are in place to ensure the pool never falls below 75% of its target minimum size. If it does, a 5% rebase is instantly added to the pool. Additionally, if the net circulating supply of $DCM is less than 2%, the minimum size requirement is turned off.

Guardrails:

Only $DCM and $DUCA can be contained in the Stability Pool. Whenever the DCM Market Value is below the Par Value the $DUCA will be calculated against the Par Value as follows:

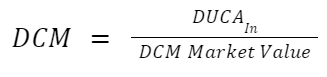

The Mint and Burn Mechanism is a continuous process that balances DUCA’s supply and demand, stabilizing its market value.

When demand for $DUCA rises and the Stability Pool lacks sufficient $DUCA, the protocol mints new $DUCA. This minting process involves using $DCM tokens. The value of $DCM tokens, determined by their exchange value, dictates the amount of $DUCA created. Through the DMM, the market value of $DCM is assessed, and the Stability Pool receives these $DCM tokens, adding them to the Reserve.

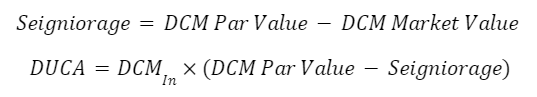

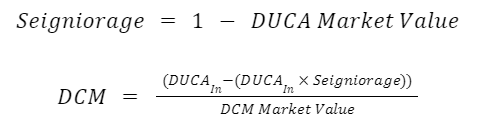

The minting formula is as follows:

![]()

Conversely, when $DUCA supply surpasses market demand, a $DUCA burn event is triggered. The protocol executes a burn event to decrease the $DUCA supply. In this process, $DUCA present in the Stability Pool is swapped for $DCM from the Reserve at Par Value. The acquired $DUCA is then burnt, reducing the overall supply.

This burn process is automated and occurs every 24 hours. During each event, 10% of the DUCA in the Stability Pool is burnt, with a minimum of 10,000 $DUCA per event. If the pool contains fewer than 10,000 $DUCA, all available $DUCA are burnt. Additionally, if $DUCA in the Stability Pool exceeds 10% of the total liquidity, a contraction event burns 10% of DUCA, ensuring a minimum of 10,000 $DUCA is burnt per contraction. Operating autonomously, the Mint and Burn Mechanism is isolated from external market influences, guaranteeing that DUCA’s supply and demand are always aligned with its true market value. This autonomous operation is key to DUCA’s promise of stability.

Liquidity swaps are actions performed by the Automated Market Operator (AMO) within the Stability Pool to maintain $DUCA’s stability.

But how is the DCM Exchange Value derived,

DCM Market Value > DCM Par Value: DCM Exchange Value is set to the higher market value.

DCM Market Value < DCM Par Value: DCM Exchange Value is set to the stable Par Value.

If the market value of $DCM is higher than its Par Value, the exchange value of $DCM is set to its current market value. This means $DCM tokens are valued at the higher market price during swaps and other transactions, reflecting their true market worth.

Conversely, If the market value of $DCM falls below its Par Value, the exchange value of $DCM is set to its par value. This ensures that $DCM tokens are not undervalued during swaps and other transactions, maintaining stability and preventing a negative impact on the protocol’s operations.

As a result, DCM / DUCA swaps are given as:

Where: DCMIn represents the amount of $DCM tokens sent in to swap.

Also, DUCA / DCM swaps are given as:

Where: DUCAIn represents the amount of $DUCA tokens sent in to swap.

These swaps help stabilize $DUCA within the protocol.

The Reserve is where native assets of the Protocol are stored. The Reserve consists of the DCM Reserve, the DUS Reserve, and the Stake Escrow Reserve each of which contains a supply of tokens that form the underlying value within the Protocol for a specific token or purpose. It backs the protocol’s liabilities and ensures that each DUCA-backed asset has a dedicated reserve to maintain its value.

DCM Reserve

The DCM Reserve contains all the $DCM that mints $DUCA with its collateral backing. The size of the Reserve always represents 100% of the $DUCA Supply as indicated through the Par Value.

DUS Reserve

The DUS Reserve contains all the $DUCA tokens that provide the collateral backing for $DUS. $DUS has a Funding Ratio of 102% and whenever this reserve has a lower Funding Ratio available in $DUCA, the Stability Pool provides the additional $DUCA in the Stake Escrow Reserve, seDUS so that the 102% Funding Ratio is present under all circumstances. $DUS is the first DUCA-Backed Asset, each future DUCA-Backed Asset will have its own siloed DUCA Reserve and accompanying Stake Escrow Reserve.

Stake Escrow Reserves

The Stake Escrow Reserves are the reserves per DUCA-backed asset, which contain the $DUCA tokens provided by the Stability Pool as a guarantee to maintain the 102% Funding Ratio. Each DUCA-backed asset has its own siloed ‘seRESERVE’ to ensure the 102% Funding Ratio.

The final pillar is the Treasury that holds all funds and assets of the Protocol which are allocated for various purposes. It supports the health and daily functioning of the Protocol.

This is a tax applied during swaps involving $DUCA and $DCM tokens to prevent value extraction that could destabilize the protocol. This tax helps maintain stability when the tokens are trading below their minimum values. Here’s how it works:

DCM / DUCA

In swapping $DCM for $DUCA the protocol looks at the market value of $DCM. Let’s say $DCM is worth $0.90, but its standard value (Par Value) is $1.00.

The difference between the standard value and the market value is calculated. Here, it’s $1.00 – $0.90 = $0.10. The protocol reduces the value of $DCM by this difference before the swap.

For example, swapping 100 $DCM will get them 90 $DUCA after applying the seigniorage.

DUCA / DCM

In swapping $DUCA for $DCM the protocol checks $DUCA’s market value. Let’s say $DUCA is worth $0.95.

The protocol calculates the seigniorage as 1 – $0.95 = 0.05. It reduces the amount of $DUCA by this percentage before the swap. For example, swapping 100 $DUCA will be adjusted to 95 $DUCA, which then converts to approximately 105.56 $DCM.

This process helps keep the values stable and prevents people from taking unfair advantage of price differences. The seigniorage collected (in $DCM) goes into the DUCA Treasury, which helps keep the system healthy and running smoothly.

The Protocol uses Chainlink Price Feeds to obtain accurate and reliable price feeds for both $DUCA and $USDC. Using Chainlink oracles, the protocol ensures that the exchange value of $DUCA in USD is always up-to-date, providing stability and reliability for users. Similarly, the market value of $USDC is also monitored through Chainlink oracles. If the oracle indicates a break in the $USDC peg, the protocol will temporarily suspend accepting $USDC as an input token until the peg is restored. However, users can still swap tokens to receive $USDC as an output token, with the value maintained at 1 $DUS. This integration of Chainlink oracles is essential for maintaining the stability and integrity of the DUCA ecosystem, ensuring accurate price data, and safeguarding user assets.

The advent of DeFi has completely changed the financial landscape, enabling the creation of digital currencies that operate without mediation by third parties. Nonetheless, even as it is now present, the digital currencies in use are still inherently dependent upon traditional fiat. These stablecoins which are pegged to fiat currencies are still subjected to economic policies and manipulations like their fiat counterparts.

Given these constraints, the creators of DUCATA aimed to develop a truly independent and stable digital currency. Their goal was to establish $DUCA as a strong currency with a stable value, serving as a reliable unit of account. They envisioned an asset that is entirely on-chain, protected against depreciation, and immune to external factors and inflation. This approach ensures that $DUCA maintains its purchasing power across all economic conditions, providing a dependable alternative to traditional currencies.

$DUCA’s core proposition is to provide a stable value without relying on external collateral or reserves managed by DUCATA. Its supply is flexible and adjusts according to market conditions, allowing the protocol to mint and distribute additional $DUCA to holders as yield. This yield is proportional to each holder’s share and represents a daily appreciation in $DUCA’s supply, rather than a guaranteed return on investment.

$DUCA distinguishes itself as a platform with a triple token economy and an algorithmic stable value currency. Uniquely, the protocol empowers users with full autonomy over their assets, free from the constraints of staking or locking funds.

It is important to note that DUCATA positions itself as a “next-generation stablecoin” developing a new approach to achieving stability through programmatic mechanisms. This distinction ensures the protocol operates within the appropriate legal boundaries while still conveying the core value proposition of $DUCA.

The Ducata roadmap outlines a comprehensive plan for the development and launch of the DUCA Protocol and associated projects.

| Q1 – 2024 | Q2 – 2024 | Q3 – 2024 | Q4 – 2024 |

|

|

|

|

Although stablecoins are pegged to the value of a fiat currency or another underlying asset, there are several methods to achieve this price stability. These methods include over-collateralization, where assets exceed the value of the issued stablecoins; fiat backing, where each stablecoin is directly backed by an equivalent amount of fiat currency; and algorithmic minting and redemptions, where supply and demand are automatically adjusted through smart contracts.

These are the most prominent stablecoins due to their 1:1 issuance being backed by fiat reserves in a bank account. The direct backing of fiat provides an extra layer of protection as a store of value to hedge the volatility of the crypto markets. However, this comes at the expense of transparency and censorship-resistance.

Source: stablecoins.wtf

The ability to create units of the stablecoin is dependent on the underlying issuer, such as Tether, which issues $USDT. A centralized structure underpins the model, usually imposing requirements to ensure that customers comply with KYC (Know Your Customer) and AML (Anti Money Laundering) policies.

With fiat-backed stablecoins, there is low transparency and a high need for trust in the underlying centralized issuer. For example, users need to trust that the information on Tether’s transparency site is factually correct. Over time, more users are raising awareness against the threat of censorship. Concerns increased after the popular cryptocurrency mixer Tornado Cash was added to the OFAC sanctions list. The SEC also blacklisted wallets interacting with Tornado Cash smart contracts. Despite what happens, the future of fiat-backed stablecoins will remain highly dependent on the regulatory approaches and jurisdictions of entities such as the United States and the European Union.

These solve the shortcomings of centralized fiat-backed stablecoins at the expense of lower capital efficiency. These assets are backed by volatile tokens such as $BTC, $ETH, or even fiat-backed stablecoins like $USDC.

Source: stablecoins.wtf

Decentralized protocols, while boasting censorship resistance through decentralized governance voting, suffer from slow decision-making and capital inefficiency. To ensure protocol stability in volatile markets, users must lock up excess collateral (e.g., 150% for a $100 $DAI loan in Maker) which reduces capital efficiency. Lowering these ratios risks price instability, and critics argue that relying on centralized stablecoins as collateral undermines the very decentralization these protocols strive for.

These stablecoins avoid relying on both fiat-backing and over-collateralized crypto assets backing. A balancing algorithm dynamically adjusts the supply and demand forces by minting/burning units of the stablecoin. This is achieved by introducing a secondary token that ensures that investors can always swap one unit of the stablecoin for $1 worth of the secondary token. These coins use complex code to adjust their supply based on demand. When demand for the stablecoin rises and its price goes above the peg, the algorithm mints new coins, increasing supply and driving the price back down. Conversely, if demand drops and the price falls below the peg, the algorithm burns existing coins, decreasing supply and pushing the price back up.

Source: stablecoins.wtf

Algorithmic stablecoins rely on a two-token model where market arbitrageurs keep the peg stable by buying the cheap stablecoin and selling it for the price-fluctuating secondary token when the peg dips, and vice versa. However, critics argue this system creates value from nothing and hinges entirely on investor trust in the algorithm. Events like UST’s collapse highlight the vulnerability to crashes. Orchestrated attacks could trigger a death spiral where excessive minting of secondary tokens to maintain the peg hyperinflates their price, ultimately bringing the whole system down.

| Governance | Pros | Cons | |

| Centralized (Fiat-Backed) | Traditional legal entity. |

|

|

| Overcollateralized (Crypto-Backed) | DAOs deciding on collateral assets and protocol parameters. |

|

|

| Algorithmic Stablecoins | A predefined algorithm dictates the monetary policy and governance is minimized to autonomously manage the peg. |

|

|

| DUCATA’s Programmatic Money (Next Generation Stablecoin) | Initially centralized maintenance with DUCATA as the Maintainer having multi-sig access to the codebase, aiming to reach full decentralization where the community governs protocol updates through unanimous decision-making, ensuring operational transparency and autonomy. |

|

|

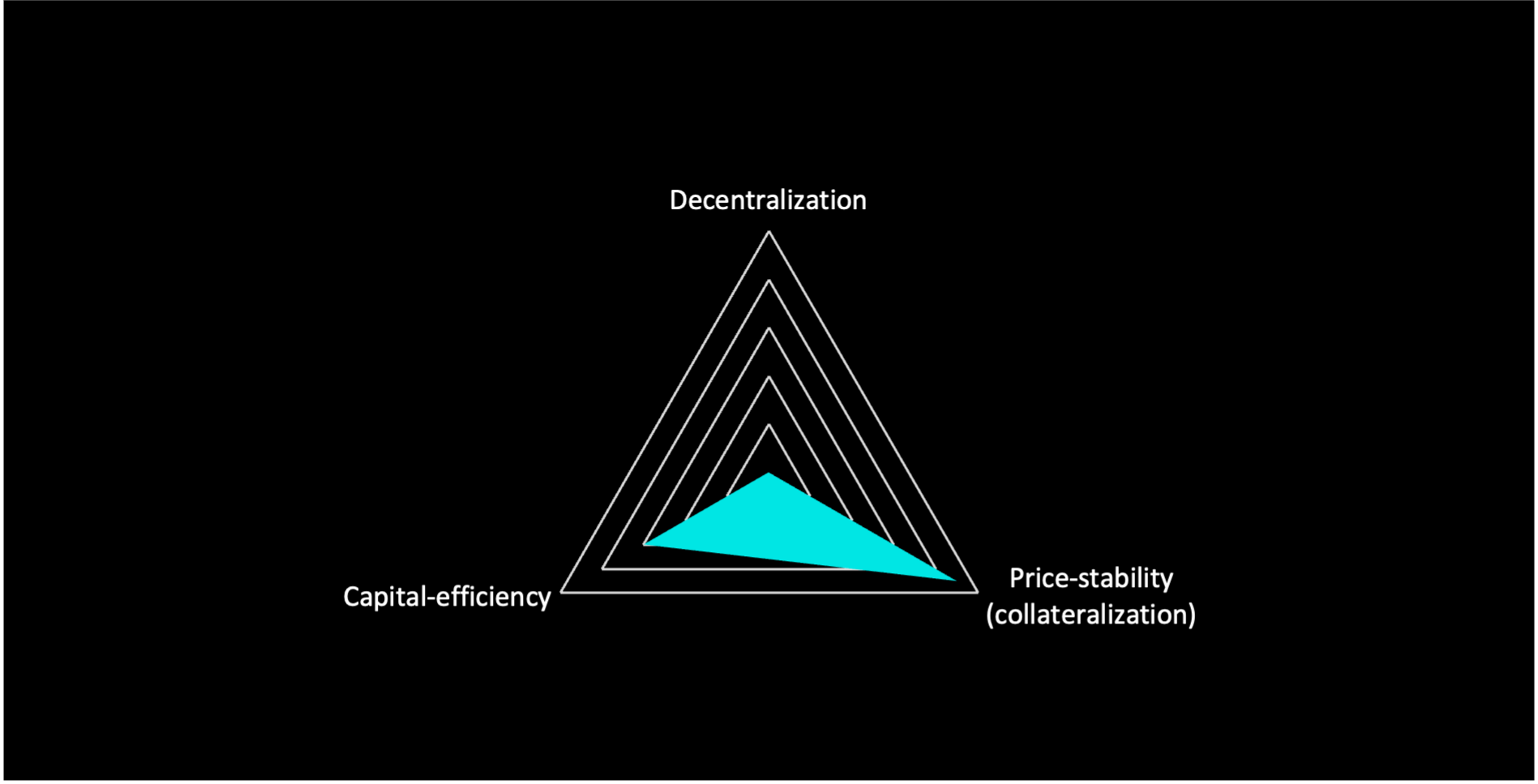

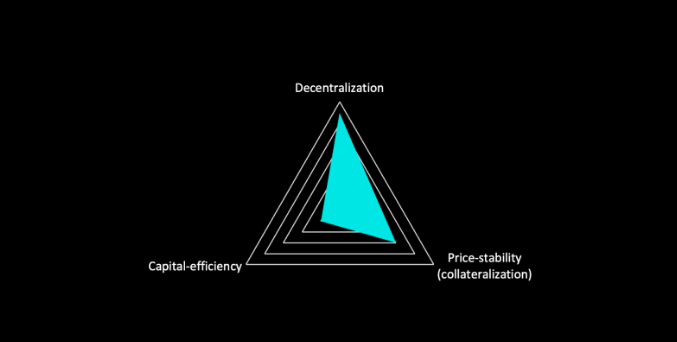

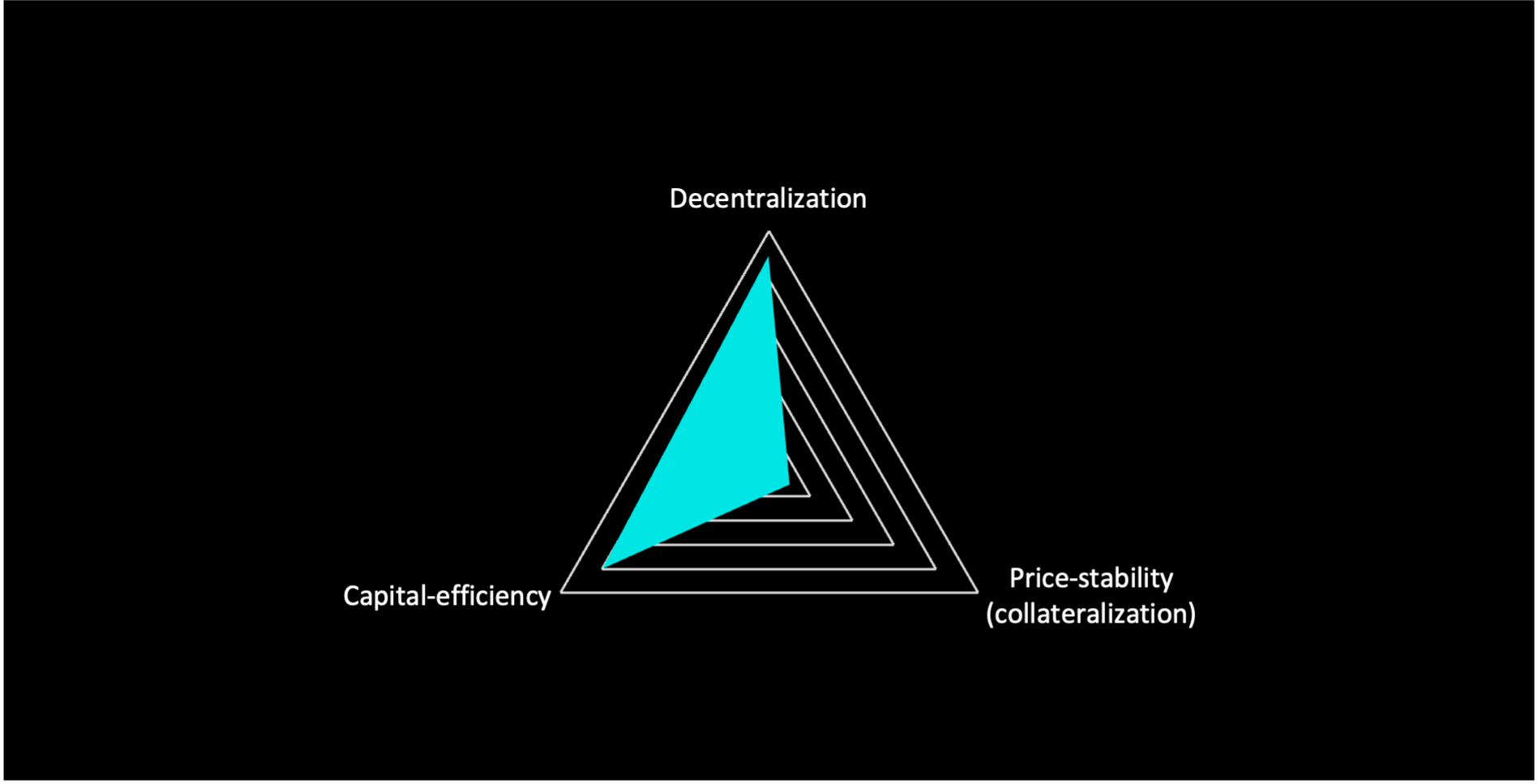

The primary goal of a stablecoin is to maintain a stable value tied to the value of another asset, such as a fiat currency. This price stability can be achieved through different mechanisms. Often, the issuer of the stablecoin asks for collateral that could be either real fiat currency or digital assets. The more minor the stablecoin’s volatility, the better it serves its objective. However, in most stablecoin designs, the goal to achieve high price stability comes with a tradeoff in either the decentralization of the system or its capital efficiency. This trilemma highlights the difficulty in achieving the three main goals simultaneously: price stability, capital efficiency, and decentralization.

The primary objective of stablecoins is to maintain a stable value, typically pegged to a fiat currency like the USD. To achieve this, stablecoins must be backed by assets of equivalent value. For instance, a USD-pegged stablecoin should have 1:1 collateralization with USD to ensure stability even during market fluctuations. Investor trust and effective collateral management are crucial in maintaining this stability.

This measures the amount of value required to issue one unit of the stablecoin. A capital-efficient stablecoin needs less than or equal to one dollar to issue one unit of a USD-pegged stablecoin. Optimally a stablecoin collateral should be pegged 1:1.

This efficiency is vital for scaling demand and supply, as more efficient systems facilitate growth and stability within the stablecoin ecosystem.

Decentralization is the third dimension of the trilemma and plays a crucial role in any token and protocol design. Stablecoins have become an important and integral part of DeFii and the Web3 ecosystem. Thus, decentralization of the governance and the systems of stablecoin issuers help to mitigate centralized single points of failure and risks. Stablecoin issuers aim to follow the properties of the base layer. Thus, they aim for censorship resistance and transparency and to be permissionless through decentralization.

Traditional stablecoins like $USDT and $USDC maintain a 1:1 peg with another asset, typically through reserves or algorithms. They offer stability but little to no returns, as the issuer of these assets takes home the yield instead of the token owner. Yield-bearing stablecoins, on the other hand, aim to generate interest for holders.

Yield-bearing stablecoins offer the stability of traditional stablecoins with the added benefit of generating passive income. They provide a way to earn interest on idle crypto holdings, hedge against inflation, and potentially offer better returns than traditional savings accounts.

The specific mechanism behind yield generation varies by project. Some issuers employ complex algorithms to generate returns through automated trading strategies while others opt for backing their stablecoins with real-world assets like bonds or commercial paper. The interest earned on these assets is then distributed to holders. There is also a subset of protocols that create a dual-token system to achieve what’s known as “yield amplification effect”: one token represents the stablecoin, while the other captures the protocol’s profits (seigniorage). Owning these shares can entitle holders to a portion of the yield generated. This way, as not all tokens are staked to capture the profits, those who stake can capture the returns generated by the entire supply.

The protocol’s design is EVM-compatible. However, $DUCA will initially run on Arbitrum’s scalable network and progressively expand to other chains.

Individuals and institutions looking for a stable store of value or an asset to hedge against volatility in other investments can hold $DUCA and $DUS for stability and may engage in yield farming to maximize their profits.

On the one hand, stablecoin holders (individuals and institutions) looking for a stable asset to hedge against market volatility may hold $DUCA for its stable value and earn yield through holding $DUS. This aims to be a safe store of value for investors looking to balance their portfolios. On the other hand, Yield farmers and Liquidity Providers may participate with the aim of maximizing their returns by providing liquidity to the Stability Pool by purchasing $LPD. In return for their contributions, liquidity providers earn transaction fees and additional incentives, which can include yield farming rewards or other token-based incentives specific to the protocol.

Speculators also play a role in this. They may trade $DUCA and $DCM to profit from price movements and arbitrage opportunities. Day traders and arbitrageurs may actively exploit price discrepancies for potential gains.

Finally, DUCATA’s product may be an attractive option for many DeFi enthusiasts who want to interact with a complex and sophisticated platform.

Ducata’s business model revolves around three revenue streams:

Operating Fund: This fund collects income from protocol fees, DMM profits, and yield generation. It covers operational costs and transfers excess funds to the Community Fund for development. An operating fee is applied only when the fund dips below a specific threshold.

Stability Pool: While not a direct revenue source, the Stability Pool contributes to the protocol’s health by attracting users and liquidity providers. A portion of its liquidity can also support the Operating Fund when needed.

DCM Sale – Distribution: Revenue is generated through pre-sale and post-launch $DCM distribution. This includes direct sales to users and using $DCM as part of yield and reward programs to incentivize participation.

Whenever a user decides to withdraw liquidity from the Stability Pool, an exit fee is applied. This fee is set at 2% and is deducted in $LPD. 2% of the $LPD you send in gets burnt and you receive $DCM for the remaining 98%. This means the 2% burn has a positive impact on the lpRATE that all $LPD owners benefit from.

The Operating Fee is calculated as 4.0% of the difference between the target size of the Operating Fund (covering 60 days of costs) and the current size of the fund, plus an additional 1%. This calculation is done once every 24 hours. The fee is collected from the Stability Pool, which holds liquidity in the form of $DCM.

This ensures the DUCA protocol’s financial health and stability. The fee consists of two parts: a fixed rate and a variable rate.

The Treasury Fee is calculated using the following formula:

Treasury Fee %=3% Base Rate+(DUCA Yield %−(DUCA Yield % × actual retracement))

This means the final Treasury Fee percentage is a combination of the fixed 3% base rate and the adjusted DUCA Yield percentage.

The Stability Fee is a fee that applies to the owners of $DCM. The fee is a percentage of the total $DCM supply on the open market excluding the $DCM within the Protocol. All wallets containing $DCM will be affected by the Stability Fee. The Stability fee can be both positive and negative. When the fee is negative $DCM will be taken from the Stability Pool and distributed pro rata to all owners of $DCM.

The Stability Fee operates based on the relationship between the net circulating supply of $DCM and the liquidity in the Stability Pool. It is applied every hour to all External Owned Accounts (EOAs). The fee is influenced by two main factors:

| Token | Supply | Value |

| $DUCA | Elastic, No Maximum | Fixed Exchange Rate Regime |

| $DCM | 3,750,000,000 | Clean Float |

| $LPD | Elastic, No Maximum | 1 LPD = 1 DCM * lpRATE |

| $DUS | Elastic, No Maximum | Fixed exchange value of 1 USD |

To understand the value and availability of $DCM we need to have an insight into the distribution model. Here are the specifics of it:

Initial Supply and Pre-Sale: The initial offering of DCM tokens in the Pre-Sale includes 7 million tokens and this will be the initial circulating supply considering all tokens have been claimed. This limited initial supply helps to manage the market entry of the tokens and prevent flooding the market all at once, which could devalue the tokens.

Post-Pre-Sale and Price Tiers: After the Pre-Sale, the distribution continues with specific price tiers. The initial price for each $DCM token starts at $7.25. For every additional batch of 10,000 tokens sold, the price increases by $0.25. The slot size will gradually move towards 250,000 tokens per price increment as the protocol grows. This is done to mitigate a price ceiling for $DCM at the start.

This tiered pricing strategy:

The scheduled release of DCM tokens, combined with tiered pricing, ensures a controlled expansion of the token supply. This method is designed to maintain stability and predictability in how DCM tokens are integrated into the market.

This structured release also allows the protocol to adapt to changing market conditions more dynamically. Instead of releasing all tokens at once, which could lead to significant price volatility, the gradual and responsive distribution aligns more closely with actual market demand and usage.

Smart Contract Vulnerability

Smart contracts are susceptible to bugs and vulnerabilities that could be exploited by malicious actors. A bug, breach, or exploit could lead to significant financial losses, loss of user trust, and potential collapse of the protocol.

FOREX and SDR Changes

Sudden fluctuations in foreign exchange rates (forex) or changes in the composition of the Special Drawing Right (SDR) basket, which defines a reserve currency used by the IMF, could disrupt these mechanisms and introduce instability into DUCA’s value.

Price Oracle Dependency

If the price oracles fail, are manipulated, or provide incorrect data, the protocol’s stability mechanisms could be compromised, leading to potential misvaluations and financial losses for users.

Peg Instability

If the complex mechanisms fail to maintain the peg, for instance, due to extreme market conditions or insufficient collateral, the value of $DUCA could fluctuate wildly, undermining user confidence and the utility of the protocol.

Regulatory Risk

Changes in regulations could impact DUCATA’s operations, limiting its ability to function or forcing it to comply with onerous requirements. This could lead to operational restrictions, legal challenges, or even forced shutdowns in certain regions.

The Protocol has had two security reviews from Hexens.io in May 2023 and March 2024.

Patrick Huisinga – Chief Executive Officer

Founder and CEO of DUCATA. Patrick has 20+ years of experience as a serial entrepreneur, he is responsible for the vision behind DUCATA and its translation into products that are market fit.

Richard van Wijk – Chief Technology Officer

Richard has 25+ years of experience in IT, from full-stack development, architecture design, (cyber)security and fraud detection to cloud engineering.

Sander Claus – Chief Operating Officer

Sander is a seasoned entrepreneur with expertise in marketing, operations, and data-driven customer experiences. He excels as a results-oriented strategist, team leader, and growth coach.

Svea Berlie – Head of Community

Svea is an experienced marketing & community professional, with an entrepreneurial mindset. She is a staunch advocate for equality, especially in the realm of finance.

Maria Navarro – Business Development

Maria brings 5+ years of crypto and blockchain experience, complimented by a background in Business Administration.

Victor de Graaff – Senior Data Scientist

Victor holds a PhD in Computer Science and has 10+ years of experience within large companies as a senior data scientist within a range of fields, including Finance, FMCG, and corporate audit.

Fabienne Mouris – Data Scientist

Fabienne’s background is in Econometrics and Applied Mathematics. Fabienne is focused on discovering patterns in the data through the application of mathematical and econometric models, aiming to deliver the sound economic value of DUCA.

Qijiong Jiang – Senior Blockchain Engineer

Qijiong has a bachelor’s in Computer Engineering and a master’s in Machine Learning. Qijiong is a seasoned software engineer with broad experience in IT and has spent the last 5+ years on blockchain development specializing in DeFi.

Enzo Evers – Smart Contract Developer

Enzo graduated with excellence at the Fontys University of Applied Sciences in ICT, focusing mainly on Embedded Systems. Enzo specializes in smart contract development.

Rick van Melis – Smart Contract Developer

Rick graduated with excellence at the Fontys University of Applied Sciences in ICT, focusing mainly on software development and Innovation.

Jasper Verbeet – Front-end Developer

Jasper graduated with excellence at the Fontys University of Applied Sciences in ICT, focussing on user experience and front-end development.

Natalia Nowakowska – Copywriter

Natalia is a senior copywriter and communication consultant with 8 years of experience in the crypto industry.

Sadri Sali – Head of Legal

Sadri’s expertise in Crypto & Blockchain regulations positions him to navigate EU crypto regulations effectively.

Antonia Eilander – Head of Tax

Antonia is a leading expert in International Taxation & Regulation of Crypto Assets and has 15 years of experience as an international corporate and tax lawyer.

After a successful Private Sale, DUCATA is currently conducting a presale with the goal of selling 7 million $DCM tokens to raise a total of $4,100,000. The presale is structured in 14 stages, with each stage having a specific fundraising target that must be met before the next stage can be opened. This presale offers a unique chance to be part of the DUCATA ecosystem from its early phases, benefiting from the protocol’s innovative approach to stable value management.

What is the difference between $DUCA and DUCATA?

DUCATA refers to the entire protocol, whereas $DUCA is a key element within the ecosystem and refers to the DUCA protocol with the $DUCA stability token.

How can $DUCA remain stable in value?

The protocol is a unique triple-token economy with multiple layers. It also takes CPI data and fiat currencies into account via a reference basket.

Is DUCATA’s Programmatic Money a Stablecoin?

$DUCA is a stable value asset. DUCATA’s Programmatic Money shares similarities with stablecoins by targeting a stable value. However, for legal reasons, $DUCA isn’t classified as a stablecoin. Think of it as a next-generation approach to achieving stability through software algorithms.

What are the advantages of DUCA’s approach to yield without locking or staking?

$DUCA allows users to earn yield on their holdings without the need to stake or lock their funds. This freedom means you can access your capital at any time while still benefiting from the protocol’s financial activities.

What measures are in place to protect $DUCA from market volatility and inflation?

Strategies such as a reserve fund, a stability pool, and smart financial mechanisms that adjust supply and demand, to protect against volatility and inflation, ensuring the Value of $DUCA remains stable.

What exactly is the $DUS Token within the DUCA Reflexivity Protocol?

$DUS is a utility token within the DUCA Reflexivity Protocol, pegged to the US Dollar and backed 102% by DUCA. It serves as a USD price oracle within the protocol, providing stability without relying on external price feeds or tangible assets.

How does the $DUS Token function and maintain its peg to the USD?

$DUS maintains its USD peg through the DUCA protocol’s automated adjustments of its supply based on demand within the DUCA Market Maker. This system ensures $DUS’s fixed exchange value of 1 USD, supported by an elastic supply and over-collateralization in DUCA, thus offering a stable and reliable digital asset for transactions and hedging in decentralized finance.

How does DUCATA prevent a scenario similar to the $UST collapse?

DUCATA avoids such scenarios through a robust triple-token economy with over-collateralization, employing an Algorithmic Float that adjusts DUCA’s value based on real-time data, not just crypto market movements. The Automated Market Operator (AMO) autonomously adjusts token supplies to respond to market demands, while the Stability Pool and DCM as a lender of last resort provide further stability. These mechanisms, combined with transparent and decentralized governance, ensure a resilient ecosystem capable of handling extreme market volatility.