Canto is a permissionless general-purpose Layer-1 chain that runs on the Ethereum Virtual Machine (EVM). The blockchain uses Tendermint consensus and is secured by Canto validator nodes. The execution layer is powered by the EVM via the Cosmos SDK.

Canto is designed to support the Free Public Infrastructure (FPI) with core financial primitives such as decentralized exchange, a lending market, and a fully collateralized unit of account token among others.

As a layer 1 blockchain, Canto’s infrastructure was built with decentralization in mind. There are no official communication channels or branding assets. Any Canto community member can create resources, distribution channels, imagery, and discussion.

Tendermint is a consensus framework that provides a Byzantine-Fault-Tolerant (BFT) Proof of Stake (PoS) infrastructure that facilitates the operational efficiency and interoperability of independent chains in the Cosmos ecosystem.

The Cosmos SDK is an open-source framework for building multi-asset public Proof of Stake (PoS) or permissioned Proof of Authority (PoA) networks. The Cosmos SDK provides developers with a series of custom modules that they can use to implement custom functionality for their own chain in a scalable, secure, and interoperable manner.

Canto is a sovereign chain built using the Cosmos SDK. It is an EVM-enabled chain that uses the Ethermint module in order to deploy an EVM execution environment that enables Solidity code to be deployed directly on the chain.

Canto enables a native bridge between CosmWasm tokens and ERC-20 tokens using the ERC-20 module.

Canto uses the Gravity Bridge as its bridge provider. The Gravity Bridge is a trustless, neutral bridge built on the Cosmos SDK that connects the Ethereum and Cosmos ecosystems. It consists of a Solidity smart contract on Ethereum, and a Cosmos SDK module on the Gravity Bridge blockchain. The bridge locks up native tokens on one side of the bridge and mints a representation of that token on the other side. This is achieved with a validator set responsible for signing transactions, instead of a multi-sig or permissioned set of actors.

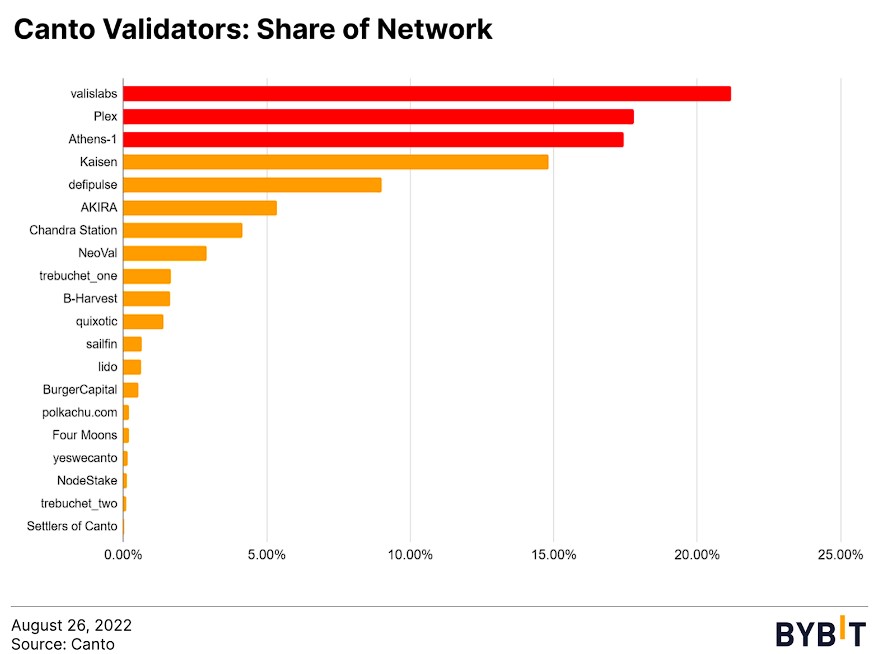

Anyone can become a validator on Canto. In return for securing the network, validators can charge a percentage fee of their choosing on the staking rewards they distribute to delegators.

Canto realizes its vision by promoting a free public infrastructure built around the core primitives and principles that are required for a decentralized ecosystem to thrive: DEX, lending market, overcollateralized stablecoin.

Instead of launching a governance token to drive the decisions that will determine the future of the protocol, Canto will launch these core DeFi primitives as public goods. By giving governance power to the base layer chain, Canto’s public goods will seek to naturally align the incentives that result from public interest.

Canto implements a fee split method called Contract Secured Revenue, or CSR. This allows developers to claim a percentage of all transaction fees paid by users when interacting with smart contracts on Canto.

CSR was introduced in the Canto v5.0.0 upgrade with an initial split fee of 20%.

CSR is an opt-in fee splitting model that relays to developers a percentage of any transaction fee paid to the network whenever users interact with any dApp on the Canto chain. This provides smart contract development teams with a new alternative to earn from their work without having to rely on extracting protocol fees from users. Also, developers may reduce their exposure to regulatory risk while reaching economic sustainability without relying on traditional token designs, application fee structures, or vesting token economics.

In order to start earning from CSR, developers must register their smart contracts with the CSR Turnstile smart contract deployed at 0xEcf044C5B4b867CFda001101c617eCd347095B44. This way, the CSR fees for all registered contracts will accrue inside the Turnstile contract.

Upon registration, a transferable NFT will be minted. It is also possible to assign a contract’s revenue to an existing CSR NFT. In order to withdraw, the token ID of the CSR NFT must be specified.

All attempts to register an EOA (Externally Owned Account) will not revert and will mint a CSR NFT. However, no fees will be distributed to this NFT when the EOA transacts and all additional contracts assigned to this NFT will not generate CSR fees either.

Because a CSR NFT is composable, complementary protocols can use them to be traded, wrapped, staked, used as collateral for loans, and fractionalized…

For instance, Canto Splits distributes a project’s accumulated CSR revenue from the NFT to multiple recipients.

The Canto Cluster Protocol was deployed on August 22, 2023.

It is an onchain registry to optimize the coordination and management of contributing clusters within the Canto Commons.

The main contract, known as ‘ClusterRegistry’ serves as an onchain registry of new and existing Canto Clusters. In step, the protocol gathers and maintains the information required for the optimal coordination and management of contributing groups.

As shared on the Canto Commons forums, the contract is responsible for the following functions:

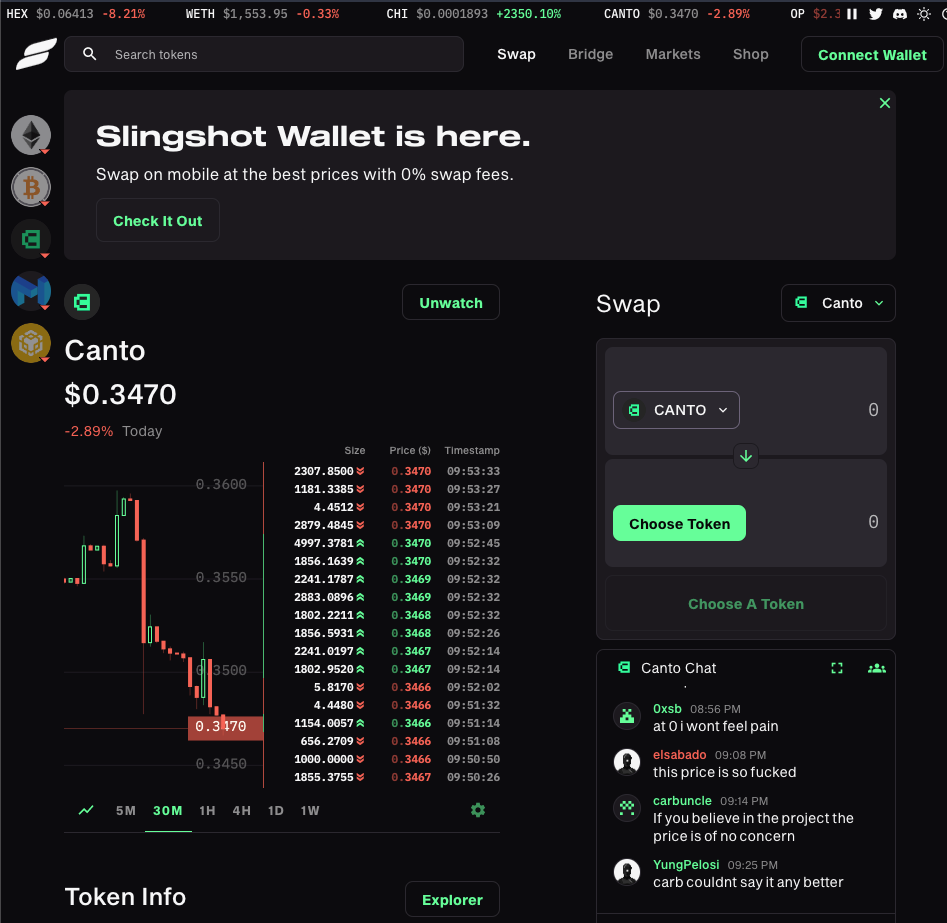

Canto’s decentralized exchange cannot be upgraded, has no official interface, and will not have a governance token. It will also run in perpetuity without ever charging fees. At launch, the main avenue to access the DEX is through Slingshot, a DEX aggregator platform.

The Canto DEX uses an AMM (Automated Market Maker) to price assets and facilitate token swaps. The liquidity is provided to trading pairs by users who supply both tokens in an equal ratio to liquidity pools. At launch, two types of liquidity pools are supported:

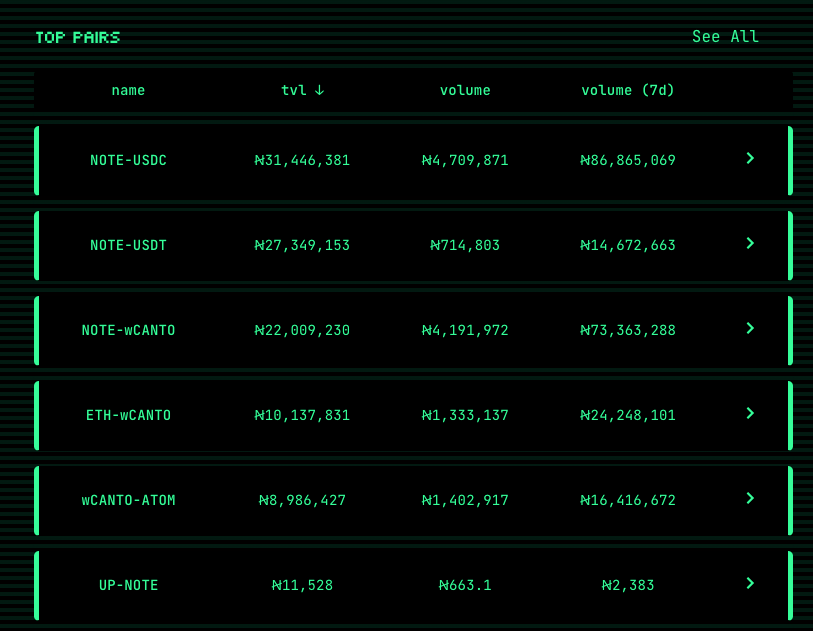

To participate in Canto’s liquidity mining, users can provide liquidity to the Canto DEX at canto.io/lp. These users receive LP tokens that can be supplied to Canto’s Lending Market to borrow against them.

As of Q1 2023, 5 pools are being incentivized:

It is not possible to provide liquidity through the main Canto LP interface. To do so, users must visit a third-party DEX aggregator, such as Slingshot.

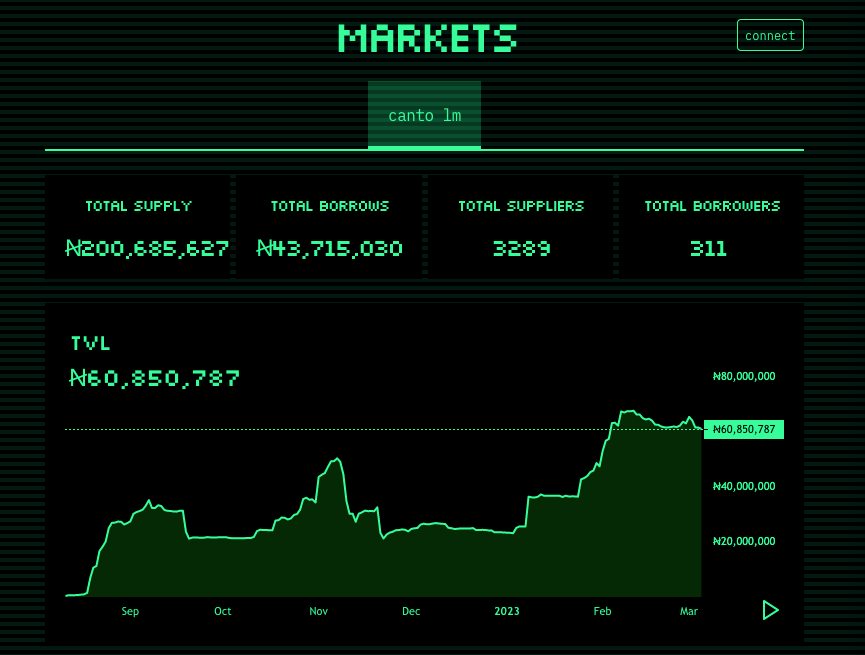

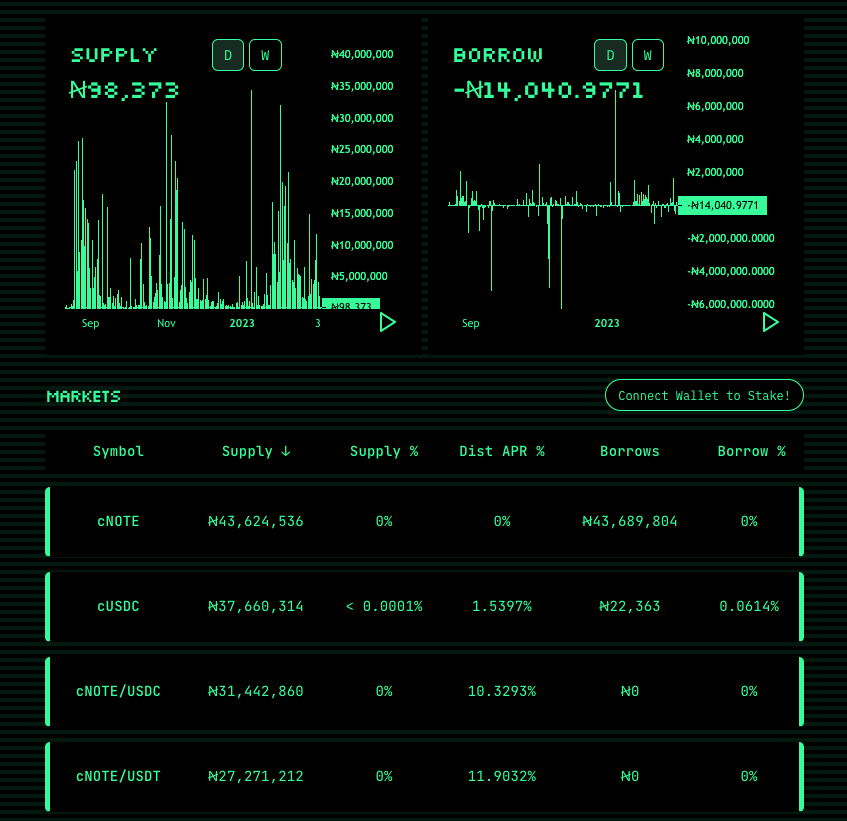

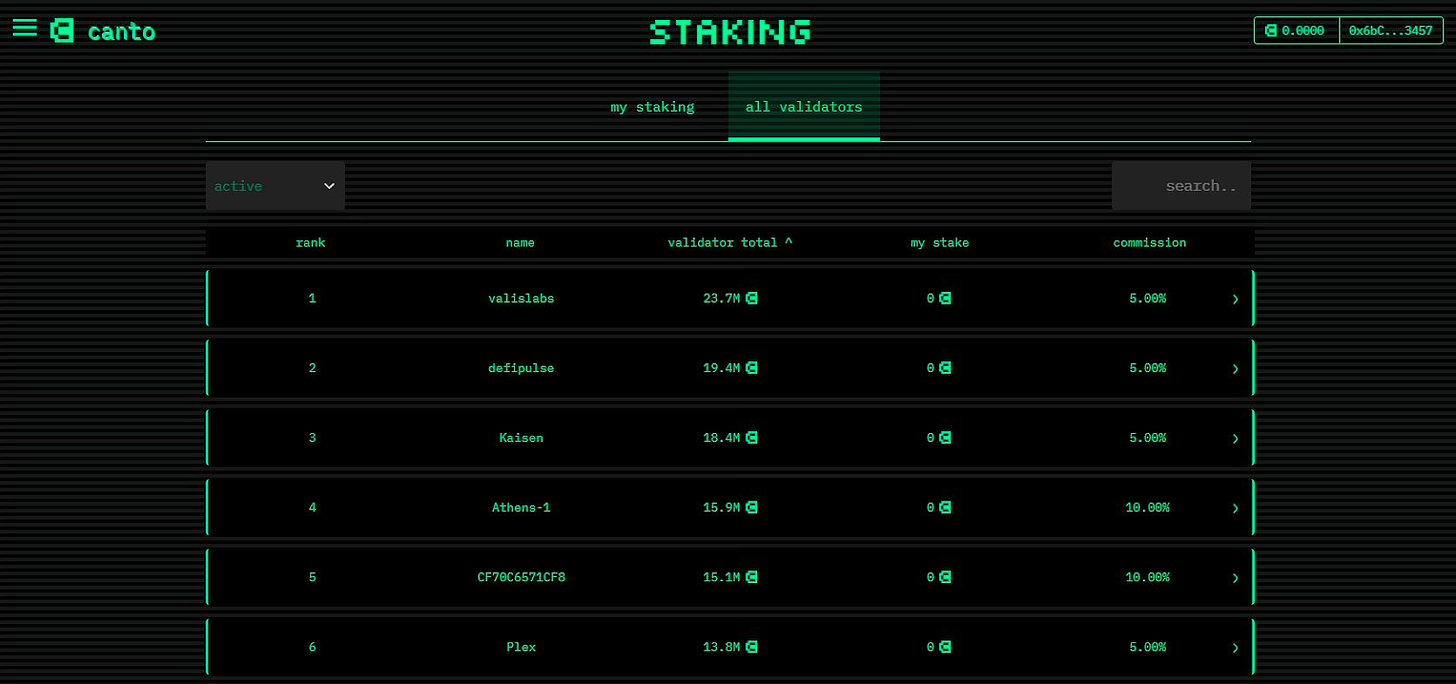

CLM is a fork of Compound V2 whose governance is controlled by Canto stakers. There is no CLM-specific token. Instead, the CANTO native token is used as the incentive token. This is done by the Comptroller smart contract.

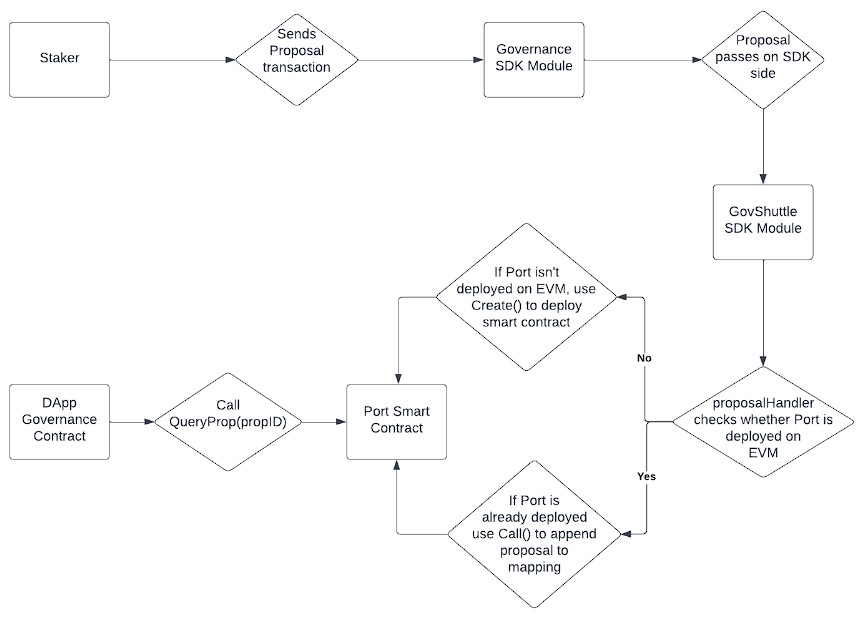

Since there is no protocol-specific governance token, Canto stakers are responsible for initiating proposals and voting on them. All proposals are initiated on the Cosmos runtime environment and voted on by network validators, as specified in the SDK governance module. Once a proposal is approved, it is sent to the EVM module, where it is retrieved and stored to be executed in the same manner as outlined in Compound’s Governor Bravo governance framework.

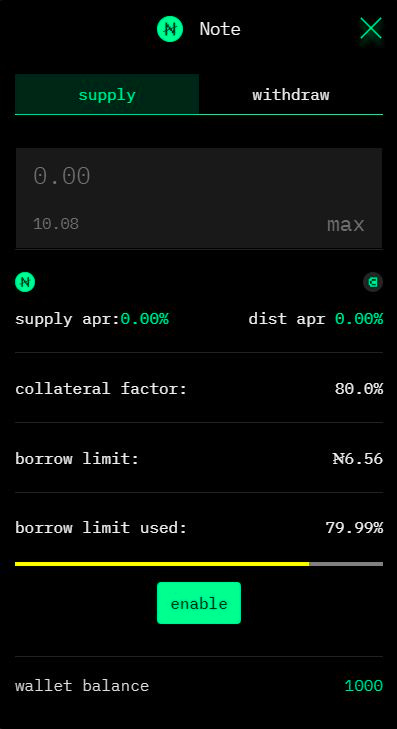

CLM allows LP tokens from Canto’s DEX to be used as collateral, along with USDC and USDT. The collateral supplied in LP tokens is supplied in a lending market but cannot be borrowed by users.

In order to borrow, the user must deposit a valid collateral asset to collateralize their borrowing position. The amount that the user can borrow will be directly related to the collateral factor of each specific token and how much of it has been supplied on the market.

The collateral factor represents the maximum amount a user can borrow based on the total value of the collateral assets supplied by that same user. This is represented as a percentage or loan-to-value ratio (LTV) that reflects the risk associated with borrowing a token against the supplied collateral.

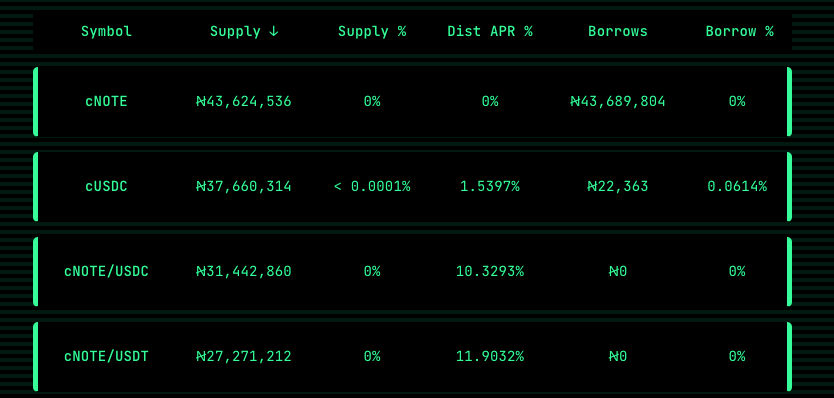

NOTE is the unit of account on Canto. It is an overcollateralized and fully decentralized token that is soft-pegged to the US dollar.

NOTE cannot be minted – it must be borrowed from the Account, which is a smart contract that implements an algorithmic monetary policy via the Canto Lending Market (CLM). All interest charged by the Accountant is directed towards funding public goods. These funds will be held in the Community Treasure and governed by the Canto DAO.

NOTE’ interest rate = max(0, (1-price(NOTE)) * AdjusterCoefficient + priorInterestrRate)

For example, if the current interest rate is 4 and NOTE’s average price over the last 6 hours is 1.04, then the new interest rate will be:

NOTE’ interest rate = max(0, (1-1.04) * 0.25+4%)=3%

This means that the interest rate decreases to weaken NOTE’s price.

NOTE cannot be minted, only borrowed, and the supply rate is the same as the borrow rate. This is achieved by supplying and redeeming liquidity during every action taken by an external user of cNOTE:

cNOTE is the NOTE-equivalent cToken. cTokens are tokens that can be used to mint, redeem, borrow, repay or liquidate an outstanding loan.

As a result of this mechanism, there is never any NOTE present in the cNOTE market other than during function calls, but there is an infinite amount of NOTE that can be borrowed or redeemed.

This mechanism also prevents supply inflation, since idle NOTE in the lending pool would be otherwise earning interest despite not being lent out.

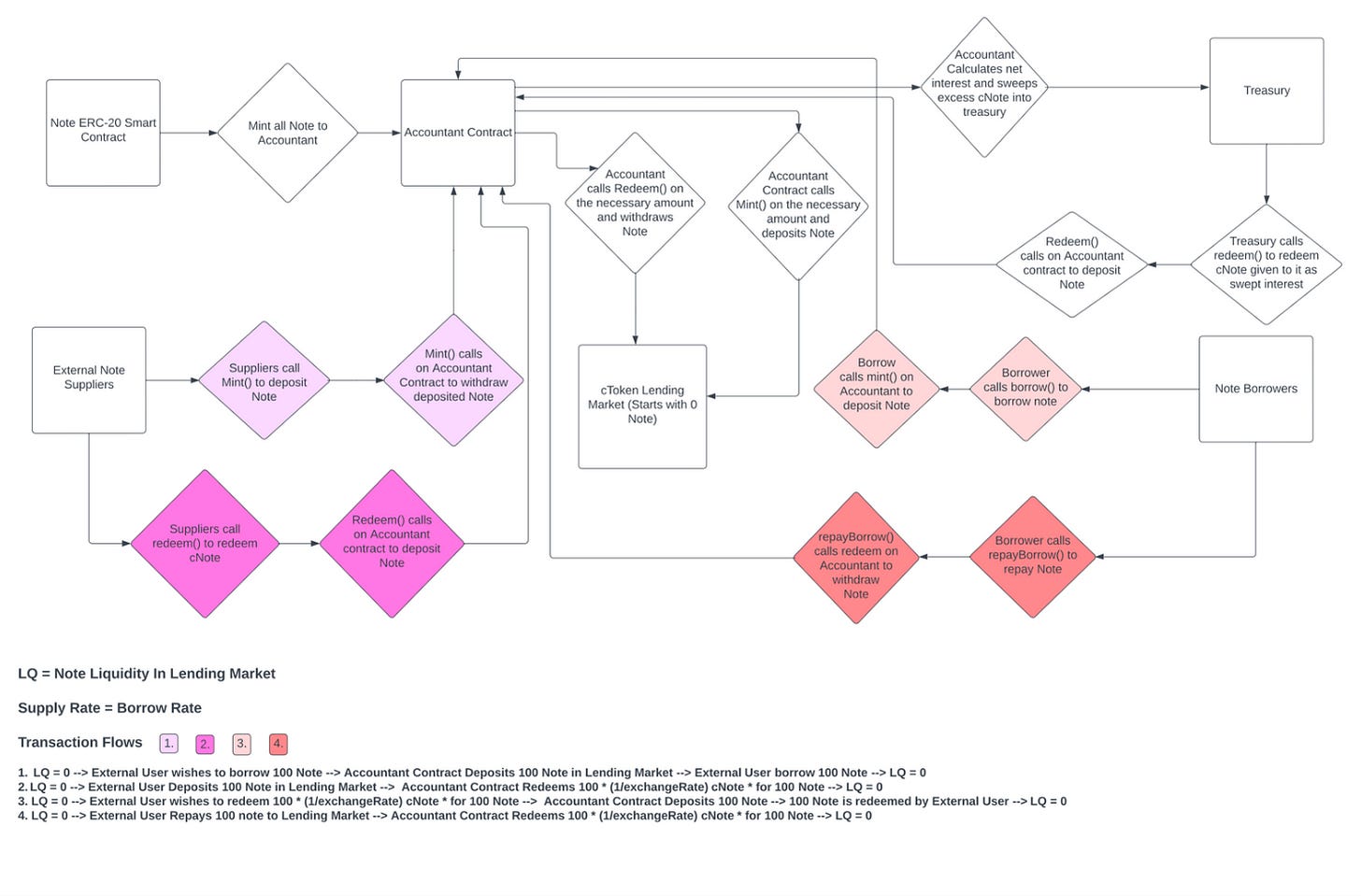

Staking, also known as delegating, allows users to lock up CANTO tokens for a period of time in order to participate in securing the network. In return for locking up CANTO, stakers earn rewards in the form of additional CANTO as well as voting power that they can use to vote on governance proposals.

Staked tokens are subject to a 21-day unbonding period.

Users can choose what validator they want to stake with.

It is possible for users to move their stake between validators without going through the unbonding period. This is done by redelegating your stake.

Canto was built to deliver on the main value proposition of DeFi – that financial transactions will become more accessible, transparent, decentralized, and free. Canto’s ambition is to provide the best execution layer possible for original work. This is accomplished with features such as:

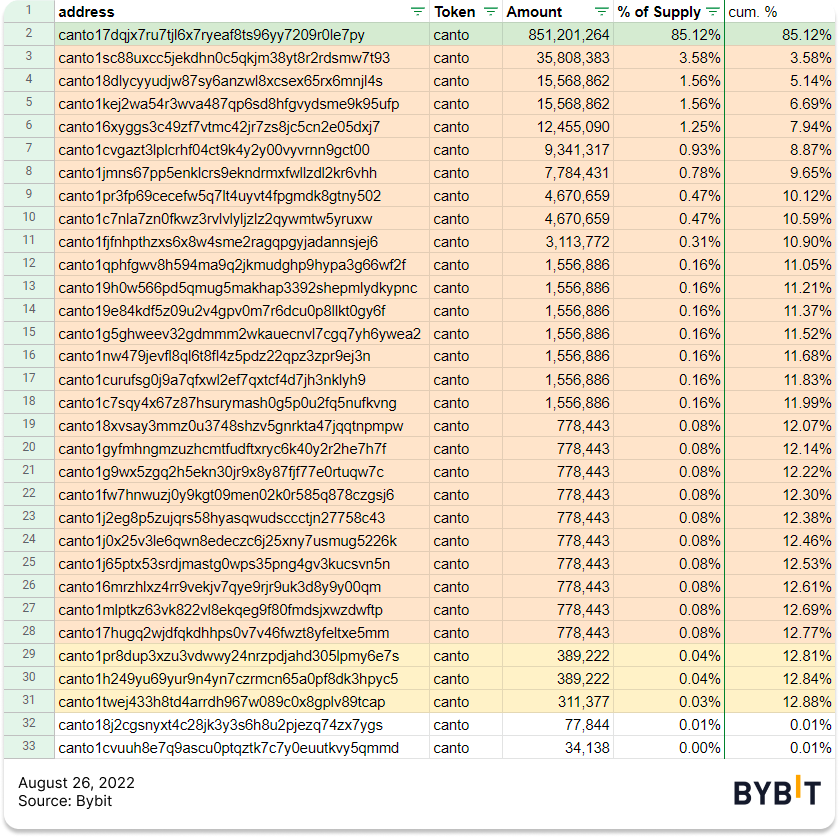

Canto launched its public testnet on July 15, 202 and, over the next 30 days, early testers that used the network and provided feedback became known as the Settlers of Canto. One month later, in August 15, 2022, the network went live and airdropped 2% of the total supply (1B CANTO) to eligible settlers. A 13% of the total supply was distributed to core contributors with no vesting as well. The remaining tokens are allocated to public goods funding via grants (5%), short-to-medium term liquidity mining (35%), and long-term liquidity mining (45%).

The following are the known upcoming features and/or upgrades:

Canto is a permissionless network, without an official team and foundation. Some of the more well-known contributors are:

There are also communities and groups, with the known ones being:

The Canto layer 1 chain was built with just 3 core DeFi primitives: a DEX, a lending market, and a native unit of account. These primitives are public goods and, at the technical level, barely innovate over prominent DeFi projects like Uniswap, Aave, Maker…

With low transaction fees and EVM compatibility, Canto can be the base layer of vertically integrated DeFi stack where DEXes, money markets, governance, and staking protocols coexist with each other under one roof.

Canto’s main goal is not to innovate on the underlying L1 technology. In fact, it was built with open source components, such as the Cosmos SDK. Most L1s differentiate themselves by using a novel tech stack or consensus algorithm, but Canto is barely different from Evmos, another EVM L1 on Cosmos. However, its primary innovations come at the socioeconomic level, specifically through mechanisms for funding public goods and compensating developers building applications on the network.

Thanks to Canto’s CSR, developers are able to opt-in to earn a percentage of the gas payments made by users interacting with their smart contracts. This revenue accrues to an NFT that can be minted by the wallet that deployed the original contract. This is completely different from the value accrual of other layer-1 chains. While most chains only route fees to block builders, Canto allocates a portion of its token emission to those who are directly responsible for generating transactions – application developers.

Canto is an attractive chain for developers to deploy their smart contracts on. This allows them to launch, grow, and sustain a protocol while earning revenue without having to launch a token or come up with any rent-seeking behavior that ends up being value-extractive for users. Being an EVM chain is also an advantage, due to the widespread adoption of Solidity among blockchain developers. One side-effect is that developers might choose to deploy on Canto in order to test the product-market fit of their applications instead of solely relying on token incentives as they would on another chain. At the same time, a concentrated token distribution and excessive reliance on CANTO liquidity mining could hinder the long-term growth of the network.

For instance, roughly 129M of the130M CANTO reserved for early contributors was distributed to only 29 addresses after the Settlers of Canto event took place. Since there was no vesting, this concentrated a large amount of voting power, staking influence, and selling pressure into very hands.

However, it can also be argued that the rewards going to developers might be seen as a tax on users, and that efficient markets will result in that revenue being arbed out by competitors eschewing it or passing it through end users. Nonetheless, Canto is still in a bootstrapping stage and there is still room for market inefficiencies. It is also worth noting that there was no presale or venture funding, and that 80% of the genesis token supply is allocated to medium and long-term liquidity mining. At the same time, aside from Hackathons, there is little activity in terms of business development.

Historically, DeFi applications have been built as businesses with decentralized ownership structures. Under this umbrella, the protocol would extract value from its users and redistribute it to the owners of the protocol governance token. Instead, Canto does not rely on a similar pay-to-use model and seeks to offer a free public structure.

In addition to the main public goods, there are a number of early DeFi projects building on Canto, such as Forteswap, CantoSwap or Y2R. The same applies to NFTs ,where two marketplaces stand out: Alto Market and Provenant. Other novel applications include Canto Splits, which enables on-chain revenue sharing, Canto Name Service, or Canto Public Messenger Service. There is also a Pokemon-themed slot machine game, Kanto Game, and a handful of NFT projects, like Canto Long Necks, Magnet, and Prompt.

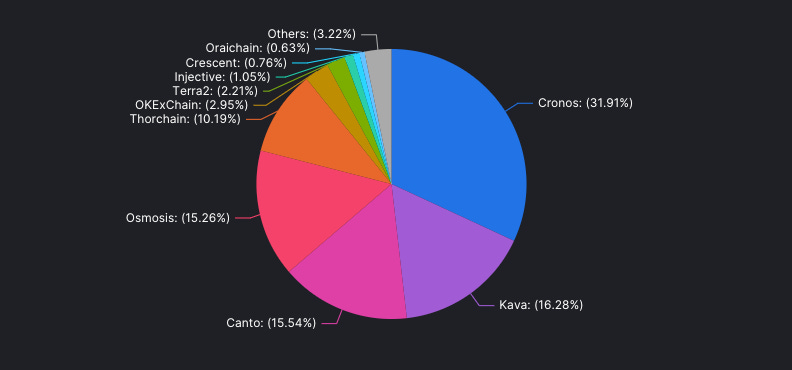

By the beginning of 2023, Canto had surpassed a total of 60,000 wallet addresses and had attracted ~100M in TVL, ranking the 5th largest Cosmos chain by TVL. In March 2023, Canto sits in rank #3 in TVL on all Cosmos chains, even surpassing Osmosis and Thorchain.

While EVMOS was the first EVM-compatible chain on the Cosmos ecosystem, it quickly lost its liquidity and users due to a mainnet delay, multiple chain halts, the Nomad bridge hack… Evmos currently has a Mcap/TVL ratio of 94.36

The value bridged to Canto has been in an uptrend since launch

At launch, Canto’s execution layer is EVM-equivalent. However, smart contract developers must account for faster block times. While the Ethereum PoS chain has a block-time of 12 seconds, this is approximately 6 seconds on Canto.

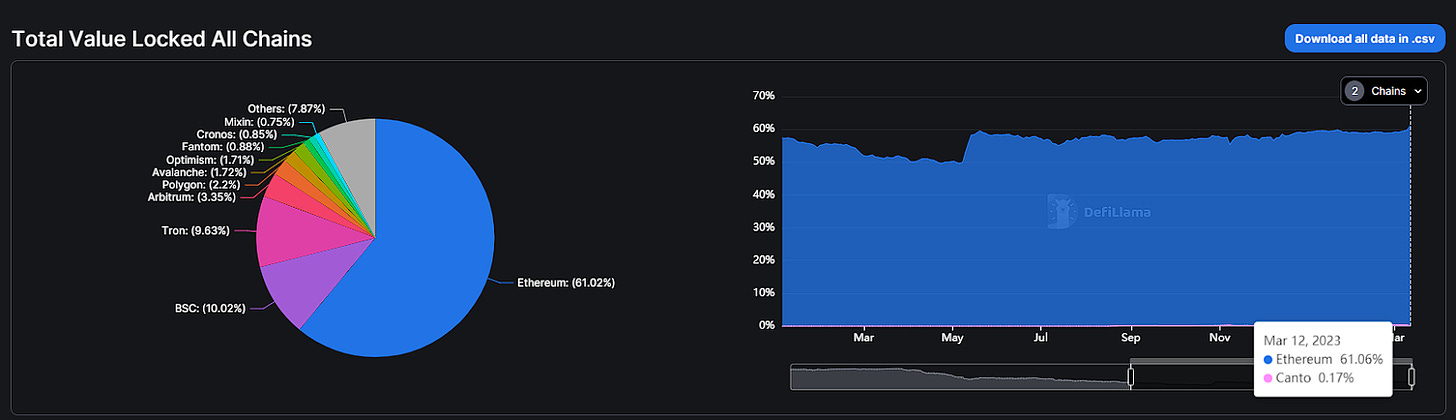

Canto is a much smaller chain TVL-wise compared to Ethereum, with Ethereum being around 342 times larger. It also holds 0.17% of all total chains value compared to 61.06% by Ethereum.

There are 9 dApps on the Canto chain, with Canto Dex and Canto Lending having the majority of the TVL, most likely due to the on-going liquidity mining incentives program.

Last updated: March 2023

Canto is an EVM-compatible chain that runs on the Geth client. Users can connect to it with any Etherum wallet, deploy the same smart contract as they would on Ethereum, use the same tools (Hardhat, Foundry, Remix, ether.js, web3.py….)… Enkrypt is Canto’s native wallet, which is already configured with Canto as default blockchain.

Geth (Go-Ethereum) is a Go implementation of Ethereum. It is an execution client responsible for handling transactions, deployments, and the execution of smart contracts within an embedded computer, the Ethereum Virtual Machine.

In order to add the network, users can configure their wallets with the default RPC settings:

There are alternative RPC URLs such as:

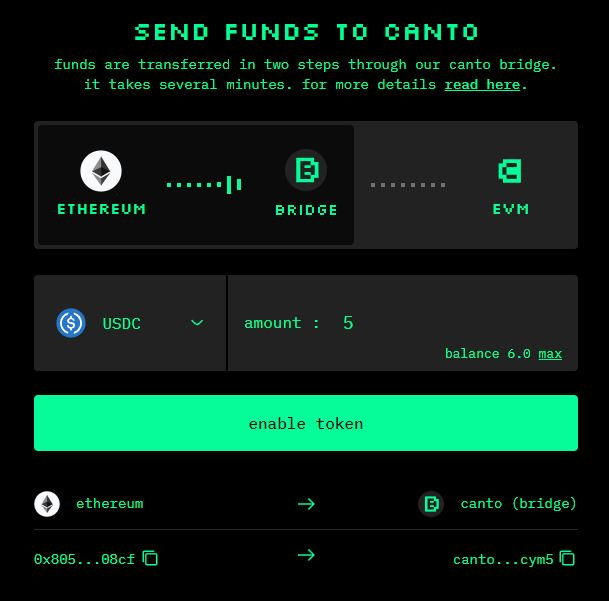

The Canto bridge allows for asset transfers from Ethereum or the Cosmos Hub. It also supports asset bridging back to Ethereum.

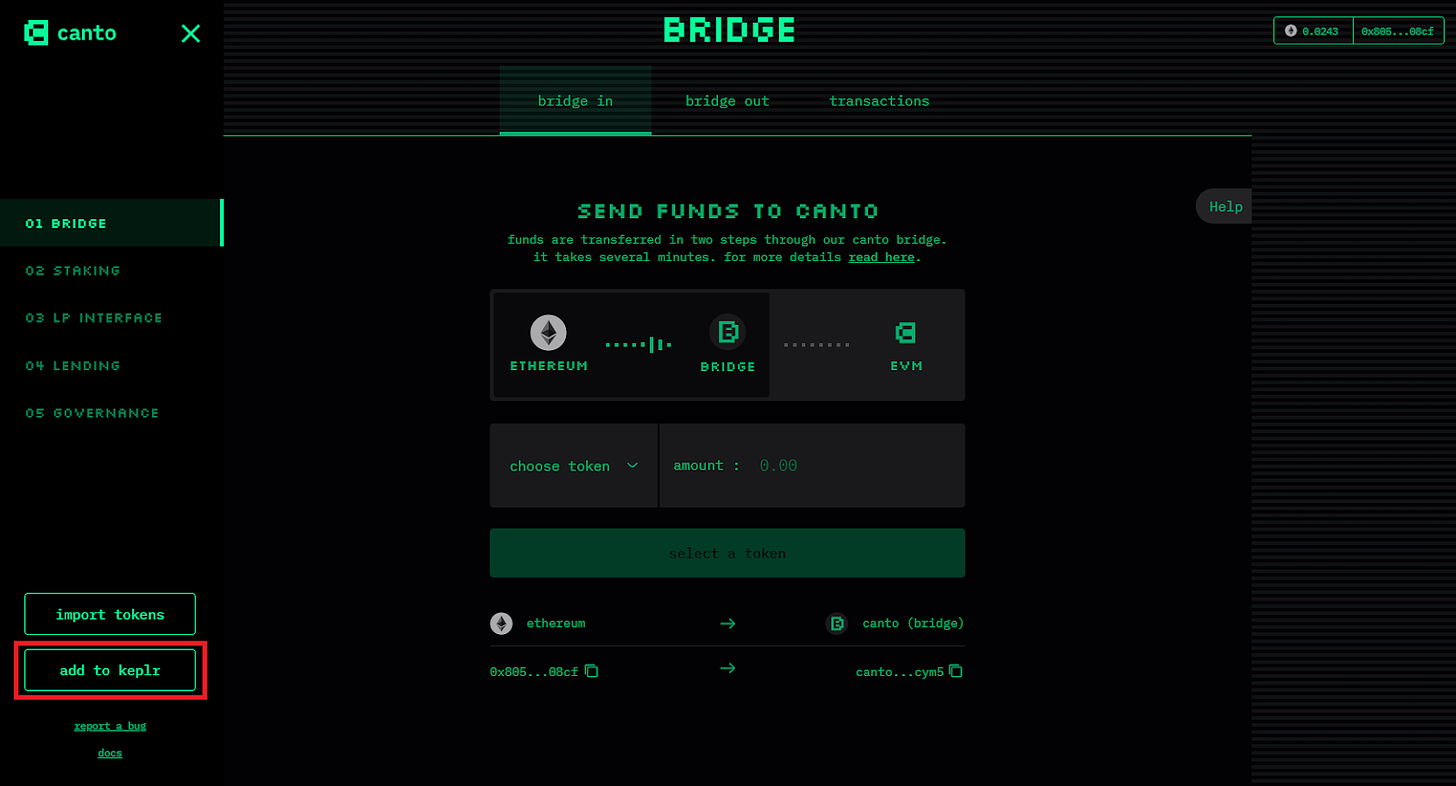

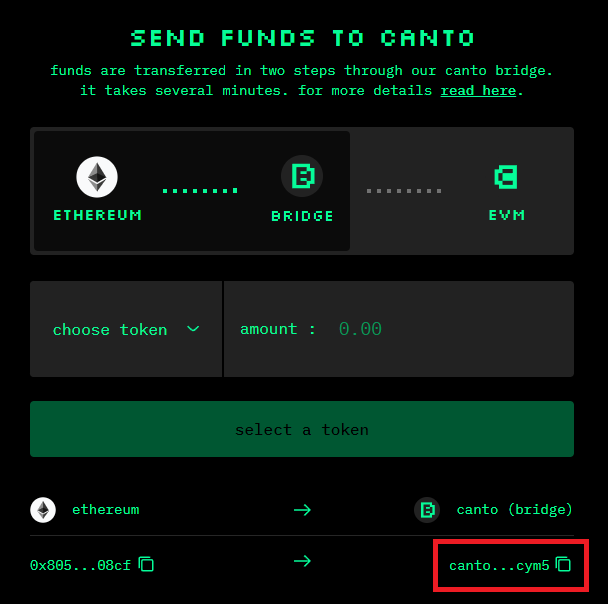

At the present, the Ethereum to/from Canto bridge supports ETH, USDC, and USDT transfers. To bridge assets from the Ethereum network to the Canto network, follow these steps:

Assets bridged to Canto will arrive on the native Canto blockchain 96 ETH blocks (20 minutes) after the Ethereum transfer is confirmed. If you want to use the Canto Lending Market, Canto DEX, and other DApps, you must bridge your assets to the Canto EVM next.

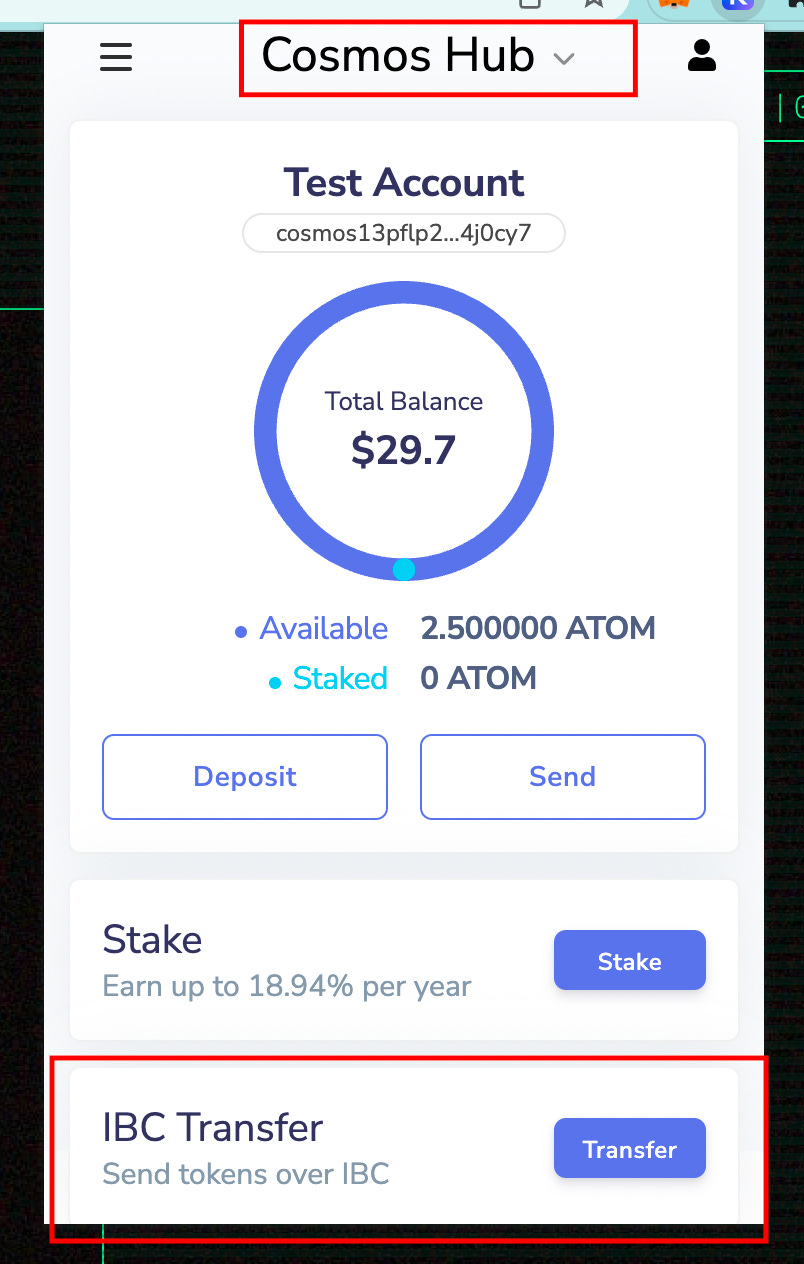

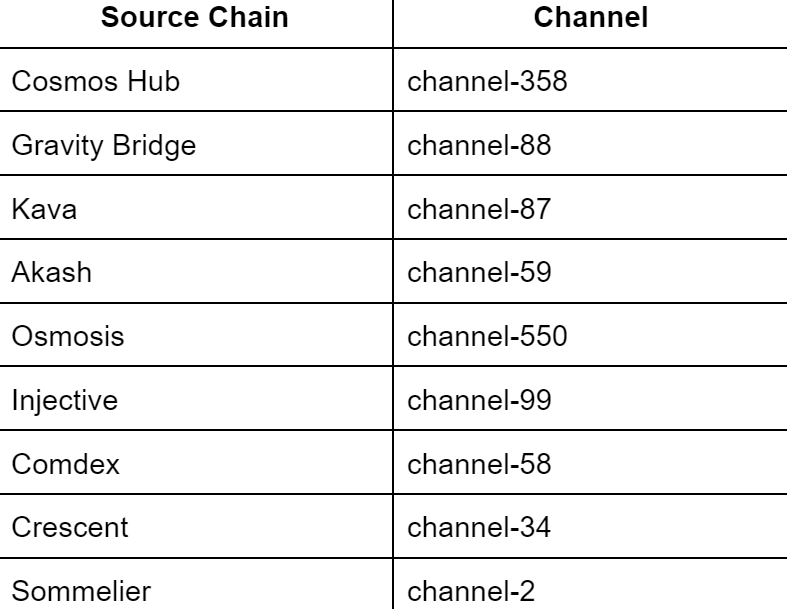

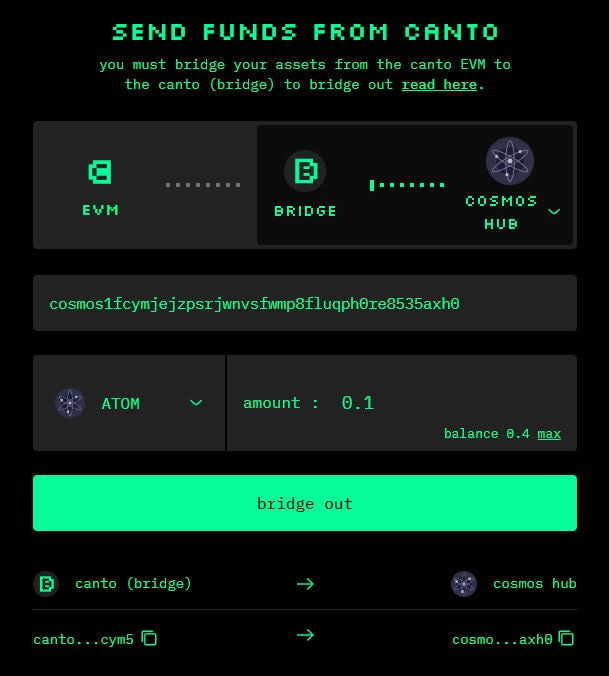

While ATOM from the Cosmos Hub is used as an example this guide will also work for SOMM, GRAV, AKT, OSMO, INJ, CMDX, KAVA, and CRE.

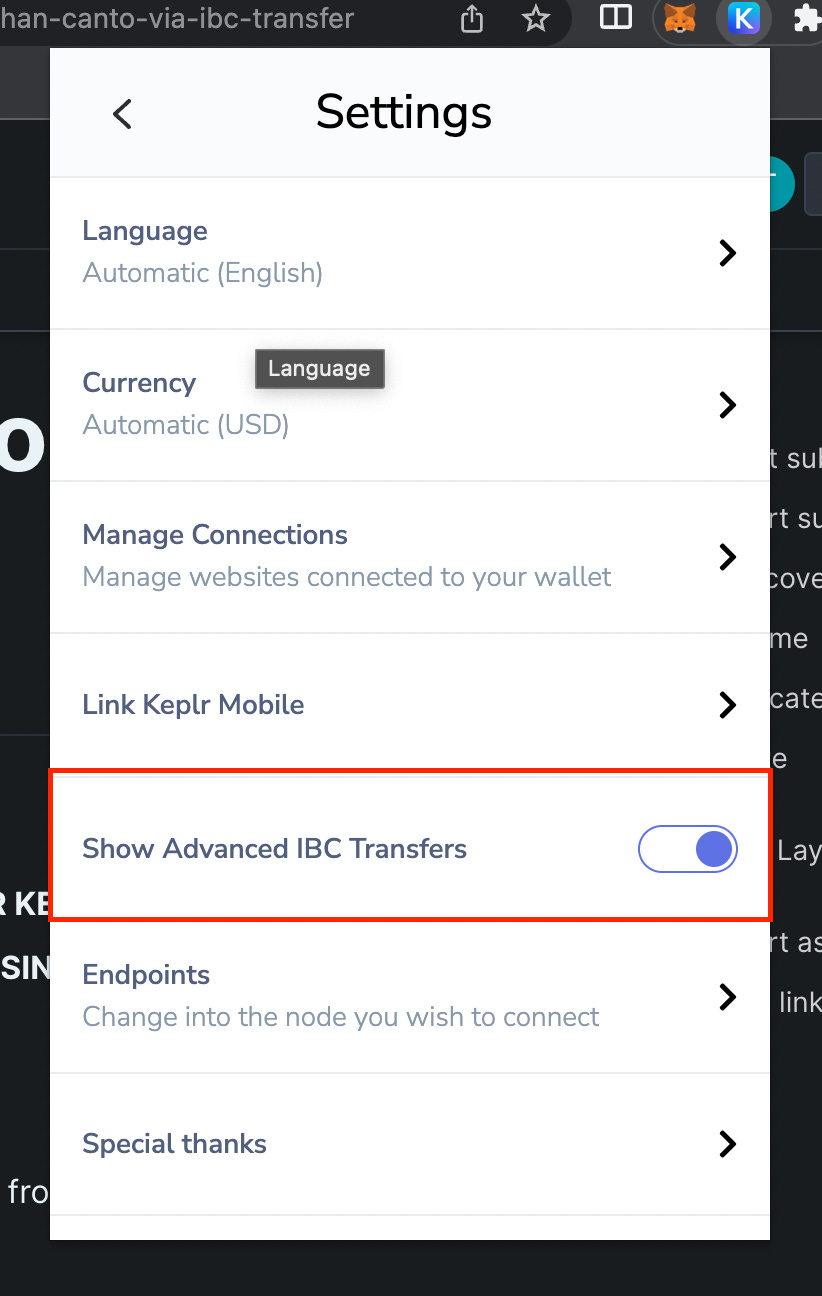

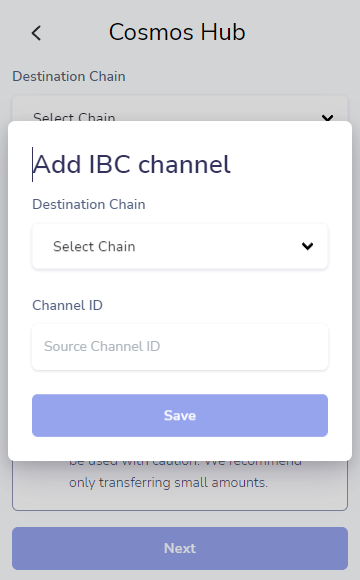

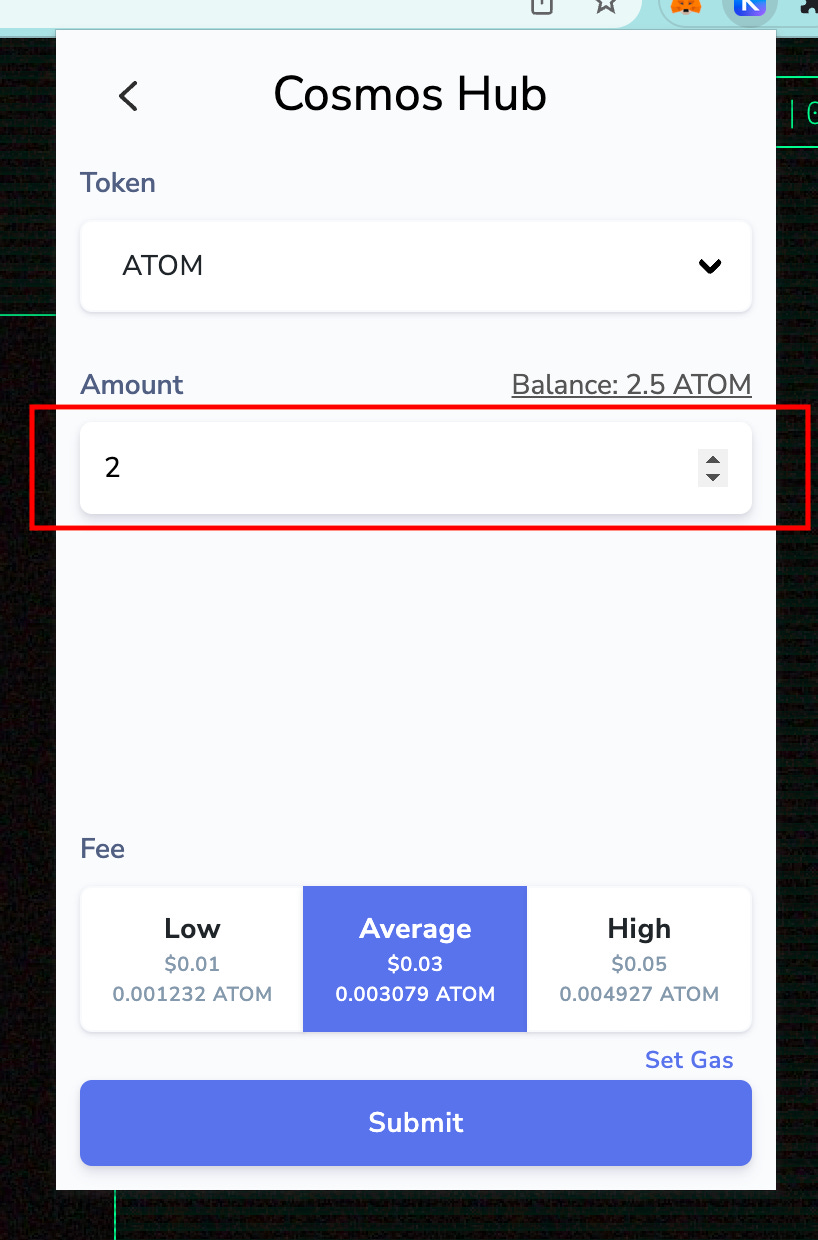

To bridge ATOM from the Cosmos Hub network to the Canto Network, follow these steps:

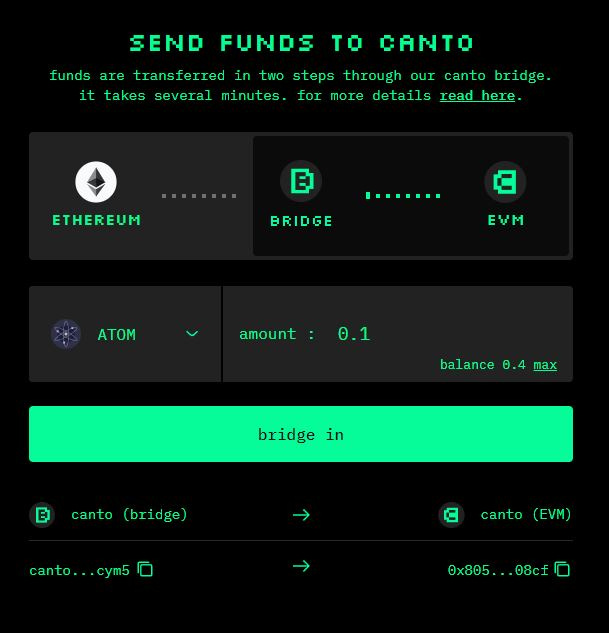

Assets bridged to Canto will arrive on the Canto Bridge blockchain. If you want to use the Canto Lending Market, Canto DEX, and other DApps, you must bridge your assets to the Canto EVM.

There are two Canto ledgers: the Canto bridge, and the Canto EVM. Depending on the actions you want to take, you may need to convert assets from one chain to the other.

In order to bridge assets between the Canto bridge and the Canto EVM, you must have at least 2.3 CANTO in your wallet.

To bridge in this manner:

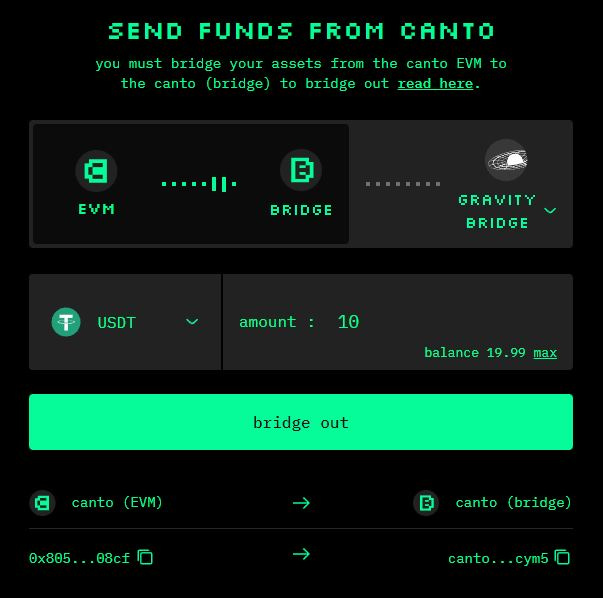

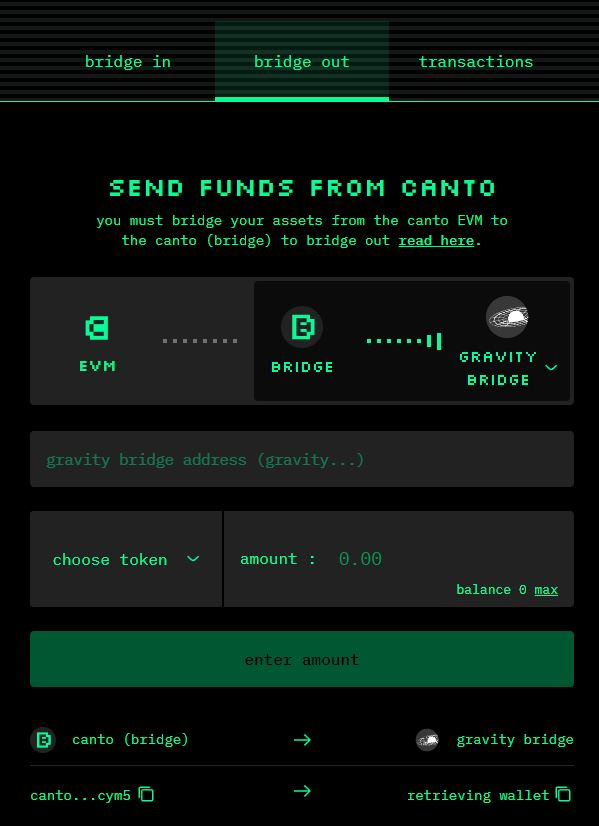

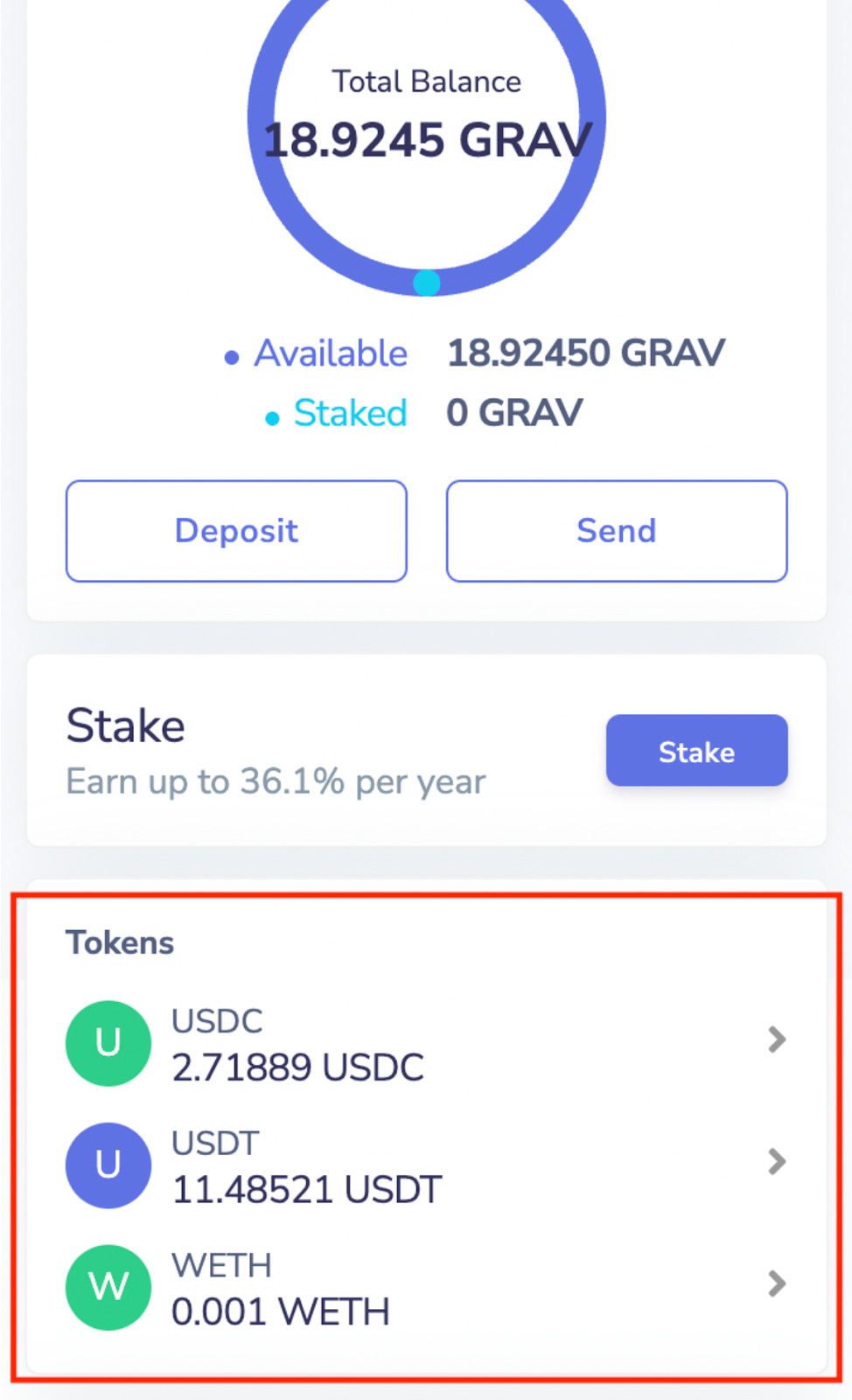

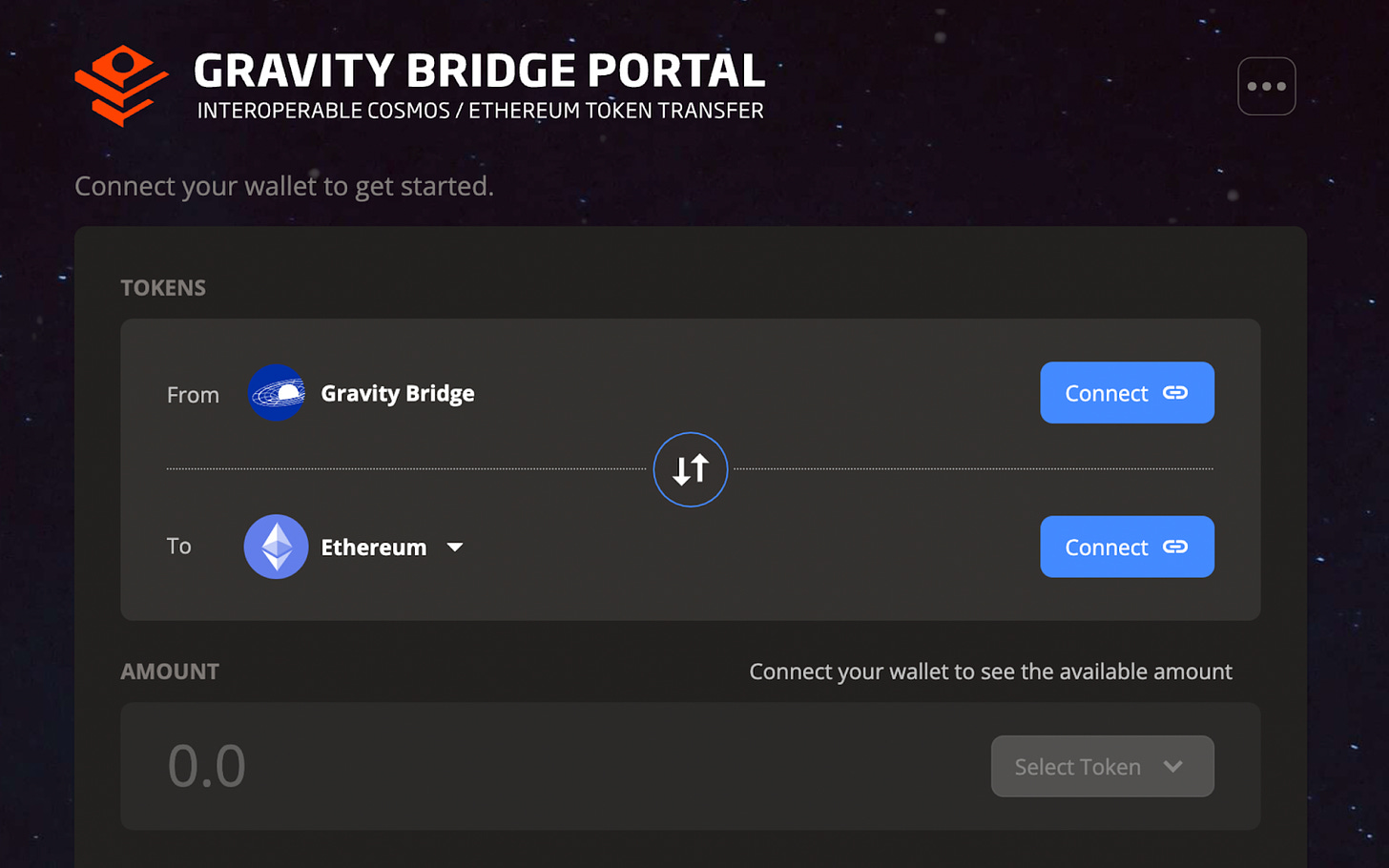

Bridging from Canto to Ethereum is possible via the Gravity Bridge. To bridge assets on Canto back to Ethereum, you must have:

Once you are ready to bridge from Canto to Ethereum, follow these steps:

To bridge from Canto to Cosmos Hub, follow these steps:

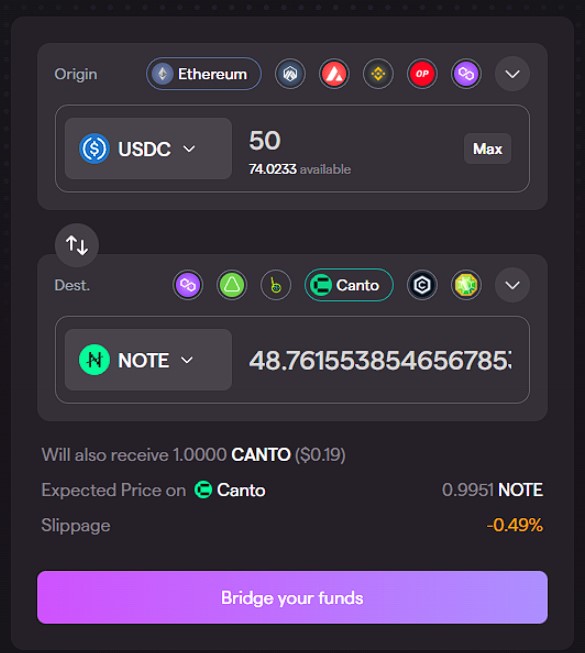

Synapse Bridge is a multichain bridge that enables on-chain asset swaps between Canto and 10+ other blockchains, including Ethereum, Polygon, Optimism, Arbitrum, Avalanche, BNB Chain, and others.

The Synapse bridging process is identical regardless of whether you are bridging to or from Canto. To use the bridge, follow these steps:

Supported Assets

The Synapse Bridge supports the following assets on Canto:

Swap Routing

To ensure deep liquidity when bridging to and from Canto, the Synapse Bridge performs direct cross-chain swaps for just two assets:

To send and receive other stablecoins on Canto, the Synapse Bridge swaps to and from nUSD using chain-specific stableswap pools on the origin and destination chains.

Synapse’s Canto Stableswap Pool consists of nUSD and NOTE, enabling users to bridge stablecoins across chains and swap to and from Canto’s native unit of account in a single interaction.

Additionally, the Synapse Bridge integrates the Canto DEX for its feeless USDC <> NOTE and USDT <> NOTE liquidity. This means that users can bridge to and from USDC and USDT on Canto in a single interaction, via nUSD and NOTE.

For more information about how the Synapse Bridge works, see the Synapse Protocol documentation.

Daily value bridged to Canto from Ethereum: https://dune.com/queries/1182395/2023715

Cumulative value bridged to Canto from Ethereum: https://dune.com/queries/1182395/2023776

There are zero fees for Liquidity Providers (LPs). Canto makes liquidity free for protocols, arbitrageurs and traders.

The Synapse Bridge integrates the Canto DEX for its feeless $USDC <> $NOTE and $USDT <> $NOTE liquidity.

Contract Secured Revenue (CSR)

Canto implements a fee split model called Contract Secured Revenue, or CSR, by means of the x/CSR module. CSR allows owners of smart contracts to claim a percentage of all transaction fees paid by users when interacting with their smart contracts.

To earn CSR fees, the owner must register their contracts with the CSR Turnstile smart contract deployed on Canto mainnet.

Upon registering a contract, a transferrable NFT representing the right to claim that contract’s revenue is minted to an address of choice. Alternatively, the owner can assign a contract’s revenue to an existing CSR NFT.

CSR fees for all registered contracts accrue in the Turnstile contract. To withdraw fees from the Turnstile contract, the owner must specify the token ID of a CSR NFT they hold.

In order to compensate LPs for providing capital to Canto’s zero LP fee DEX and, in order to distribute CANTO in a fair manner, a liquidity mining program will linearly release tokens to liquidity providers.

Canto’s incentives program is split into different phases.

The Canto DAO has on-chain control over all liquidity mining schedules.

Canto also bootstraps the security of the network through a policy of minimum viable issuance. This releases a flat amount of tokens on a linear inflationary basis.

The Canto liquidity mining was initiated to compensate LPs for providing capital to Canto’s zero LP fee DEX and to help distribute CANTO in a fair manner. The first block of tokens will provide incentives for LPs for the first six months after Canto launches and the second block will provide incentives for a longer term multi-year period.

The medium-Term Liquidity Mining was expected to consist of six month-long epochs. The first epoch started at launch and distributes 5.83% of the token supply. The Canto DAO has on-chain control over all liquidity mining schedules. As the first epoch concludes, the DAO may choose to pass a proposal to begin a second epoch.

Long-Term Liquidity Mining is expected to continue liquidity mining after the Medium-Term Liquidity Mining allocation is emitted. The Long-Term Liquidity Mining reserves may be emitted over the course of 10 years, or any other schedule the DAO chooses.

Initial distribution

The initial tokens distribution were as follow:

Of that initial amount, the distribution were as follow:

Subsequent DAO proposals

As each month of the LM program ends, a DAO proposal would be put forth for the next month of the program. The proposal so far are listed below.

Of that initial amount, the distribution were as follow:

The distribution were as follow:

CANTO is the native token of the Canto network. It is used for gas payments for transactions and can be staked with network validators in order to secure the chain. It serves 4 core purposes on the ecosystem:

At Genesis, the initial total supply of CANTO is 1,000,000,000 (1 billion) tokens, with an initial circulating supply of 150,000,000 tokens.

In order to maintain the security of the network, the total maximum supply of CANTO inflates over time at a decreasing rate. All tokens from inflation are distributed to CANTO stakers proportional to their stake in the network.

Early CANTO contributors proposed these emissions to be structured over 30-day periods, with rewards distributed daily such that:

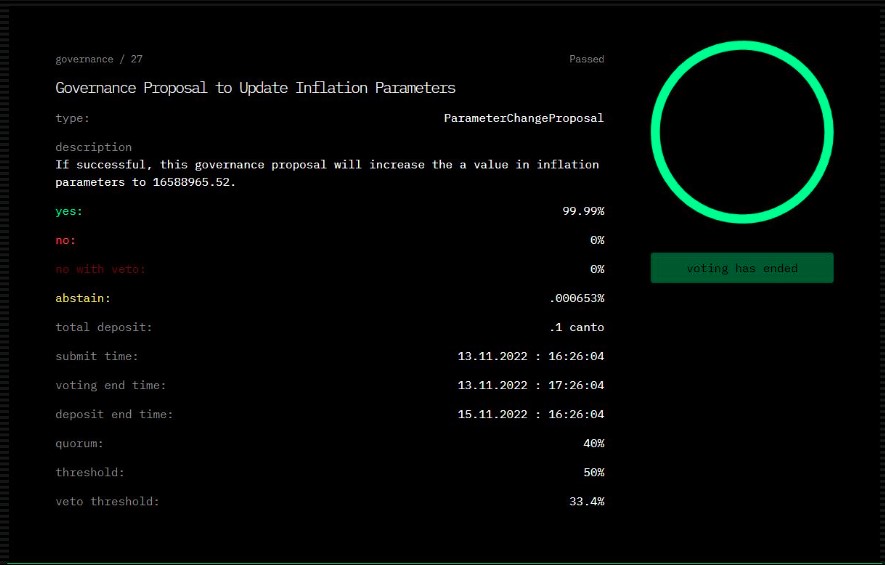

Following Canto’s first epoch (30 days), the DAO voted to reduce inflation emissions by 70%, bringing the annualized inflation rate down to ~5% for stakers and reducing liquidity mining incentives by 50%, resulting in a total issuance decrease of ~54%. Over time, the inflation of CANTO should tend to zero.

The token allocation to liquidity mining and public good grants is subject to change via governance.

Canto introduces a new paradigm for governance: unified governance. This means that both the network itself and its FPI applications are controlled by sakers of the network token, CANTO.

Canto Governance is based on the Cosmos SDK governance module with the addition of a custom-built module named GovShuttle. This module is responsible for pushing passed proposal data from the governance module to a storage smart contract in the Canto EVM so that it can be read by other dApps in the network.

In Canto, only stakers have the right to vote on governance proposals. However, CANTO holders and other users can still submit and deposit on proposals.

Some participants can be forbidden to vote on a proposal under a certain validator if:

If a delegator does not vote, it will inherit the vote of its validator.

Currently, validators are not punished for failing to vote.

The Cosmos SDK governance x/gov module is what allows CANTO stakers to vote on proposals, where their voting power is proportional to their stake. This module also supports the following features:

Proposals must be submitted with a deposit in order to prevent spam. This deposit is kept in escrow and held by the governance account module until the voting period finishes and the proposal is either approved or rejected.

When a proposal is finalized, the tokens from the deposit are either refunded or burned based on the outcome:

Proposals can be voted on with one of the following choices: No, Yes, NoWithVeto, Abstain.

NoWithVeto counts as No but also adds a Veto vote

The Abstain option allows voters to signal that they do not intend to vote in favor or against the proposal and that they will simply accept the outcome of the vote.

A quorum must be reached for every proposal. This is defined as the minimum percentage of voting power that needs to be cast on a proposal for the result to be valid. At launch, the quorum is set at 40%.

A threshold is used to define the minimum proportion of Yes votes (excluding Abstain votes) that must be achieved for a proposal to be accepted. At the beginning, the threshold is set at 50%.

It is possible to Veto a proposal if more than ⅓ of all votes are NoWithVeto votes.

Overall, a proposal can only be accepted if:

The Canto governance site is where CANTO stakers can vote on proposals and take part in governance decisions.

Users will be able to see the title, start/end dates, and results of any governance decision. For ongoing proposals, stakers are able to choose one of the following options: yes, no, veto, and abstain.

Canto has gone through multiple audits by Code4rena, in the form of C4 audit contests, in which community participants, referred to as Wardens, review, audit, and analyze smart contract logic in exchange for a bounty provided by sponsoring projects.

Canto Open Audit Contest 1 – June 22 2022 – Code4rena

Canto Open Audit Contest 2 – July 3 2022 – Code4rena

Canto Solo Audit – July 10 2022 – Ghoul.sol from Code4rena

Gravity Bridge – May 11 2021 – Code4rena

Chainlink does not exist in the Cosmos ecosystem, which might be prevent some DeFi protocol from porting their applications to Canto.

The top validators control the majority of the delegations from stakers, which can cause problems around the centralization of governance and security. As the chain grows, there should be a focus on splitting delegations among a wider range of validators.

Staking CANTO with a validator does not come without risk. By delegating CANTO to a validator, you are implicitly assuming some responsibility for their behavior, proportional to the size of your stake. Any validator that misbehaves and does not follow the rules of consensus will be slashed.

Due to inherent slashing risk that comes from participating in a Proof of Stake chain, it is recommended for users to split their staking allocations across multiple validators.

Aside from slashing, users must keep in mind that unstaking tokens is subject to a 21-day unbonding period.

Canto did not hold a pre-sale and has no venture backers. However, Venture Capital funds like Variant Fund have bought an undisclosed sum of CANTO in an OTC deal with early contributors.

Canto has the following partnerships and integrations.

Who governs NOTE?

Is NOTE a stablecoin?

I bridged my CANTO and it says the transaction was completed successfully, but I don’t see them in my wallet. What do I do now?

The faucet requirements for requesting CANTO for user’s address:

I keep getting an error message when I try to generate a public key. What should I do?

How do you generate a public key?

Why do I need to generate a public key?

How do you stake CANTO tokens?

When you stake CANTO, you can unstake your CANTO whenever you want. However, there is an unbonding period – 21 days – before your unstaked Canto returns to your account.

How do you unstake CANTO?

To undelegate your staked CANTO from a validator:

You can only unstake 7 times from a given validator in a fixed interval of 21 days.