Bumper is a novel DeFi protocol that enhances traditional derivatives markets by providing a simple, fair, and decentralized approach to hedging price risk. The protocol leverages a loss prevention tool that provides price protection against market crashes and downside volatility.

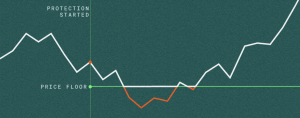

The underlying mechanisms share similarities with stop loss orders, options desk, and insurance policies. What differentiates Bumper is that the protocol protects the user’s crypto assets by preventing losses when the price goes down, while still enjoying the profits when the price bounces, even if it previously dropped below the chosen floor level.

When you use Bumper to protect your assets, they become “bumpered assets.” Bumpered assets represent your original asset with the downside volatility removed while your position remains open. In other words, Bumper eliminates the risk of losses resulting from market downturns or price drops. This protection allows you to maintain the value of your assets even if the price decreases.

Bumpered assets are represented by composable tokens (NFTs for v1.0 and NFTs + ERC20s for v2.0). For example, these tokens can be used as collateral for obtaining a loan. By using composable tokens as collateral, borrowers can access funds while reducing the risk of forced liquidation. Forced liquidation occurs when the value of the collateral falls below a certain threshold, leading to the lender seizing and selling the collateral to recover the loan amount. Bumper’s price protection mechanism removes the likelihood of such forced liquidations, making it an attractive option for borrowers.

To provide price protection, Bumper charges premiums based on the measured volatility of the underlying asset over the duration of a position. Volatility refers to the degree of fluctuation in an asset’s price over time. Bumper measures the actual volatility of the asset whilst the protection position is open and calculates the premium accordingly alongside the protocol’s internal liquidity ratios. As a result, premiums act as the cost of obtaining protection against downside price movements.

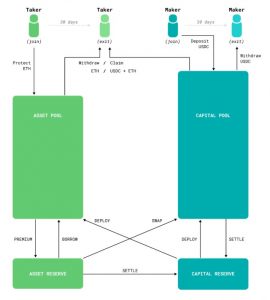

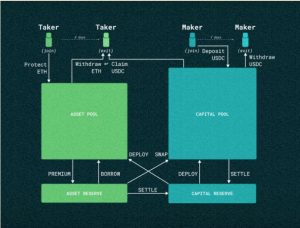

Bumper operates through a straightforward process that allows users to protect their assets (takers) or deposit stablecoins to earn yield (makers). The example below will delve into how Bumper works using $ETH as the protected asset and $USDC as the backing stablecoin.

When participating in the protocol as a taker, users are buying protection against downside price volatility. To do so, they must make 3 decisions:

Additionally, takers must hold a minimum amount of $BUMP tokens as bonding while using the protocol. Incidentally, both takers and makers are incentivised with $BUMP tokens for interacting with the protocol and doubly during the initial 3 month bootstrapping period.

After performing the necessary actions, the taker receives a Bumpered Asset token representing their protected position. This token can be traded, transferred, or used as collateral in other DeFi protocols.

Taker positions incur a dynamic premium, which is the cost of protection. This premium is deducted from the amount returned when the taker’s position closes.

Makers participate in the protocol by providing $USDC in their selected risk tranche, which will be used for underwriting taker liquidity. As a result, stablecoin depositors assume taker price risk but can earn rewards to compensate for the risk they are taking.

To open a position, a depositor must make the following decisions:

Similar to takers (users who want protection for their assets), depositors must also bond a certain amount of $BUMP tokens to the protocol.

Once the position is open, they receive a yield-bearing asset back from the protocol representing their position as a $USDC liquidity provider.

When a taker’s position ends, they return their Bumpered Asset token to the protocol, leading to one of the following outcomes:

Notably, even if the price of $ETH falls below the floor price and then suddenly rebounds above it, the taker continues to benefit from the upside potential of $ETH’s value going up.

Bumpered Assets have two crucial properties: they are tradable tokens and have a guaranteed minimum value due to their floor price. This makes Bumpered Assets valuable for use in other DeFi protocols, such as for collateralizing loans. Since their minimum value is guaranteed, they are not subject to forced liquidation if the market continues to drop. In essence, Bumpered $ETH NFTs on v1.0 can wrap the whole position, and that NFT can be rewrapped to mint out $bETH, which is equivalent to $ETH but with the downside volatility removed.

Bumper utilizes pools to collect and manage deposits within the protocol. User interactions within the Bumper protocol occur between users and the pools, eliminating the need for direct matching between buyers and sellers as seen in centralized exchanges.

Bumper employs four liquidity pools in total: two pools for each asset type (e.g., $ETH and $USDC). This allows Bumper to calculate premiums efficiently based on internal liquidity, manage beneficial ownership transfers between stablecoins and assets, and improve overall market depth for participants.

This pooling mechanism helps facilitate efficient price protection and yield generation. Additionally, Bumper incorporates pool rebalancing to ensure the proper maintenance of asset-to-stablecoin ratios within the pools.

The ratio of the total value of assets to the number of stablecoins held in the protocol naturally fluctuates as the price of the protected asset changes and as takers and makers asynchronously open and close positions. Rebalancing is performed by a keeper bot that sends transactions via a dark pool. Whenever a position is opened or closed, Bumper recalculates premiums and incentives based on the aggregated liabilities of takers and makers.

Arbitrage refers to the practice of taking advantage of price discrepancies between different markets or assets to make a profit. In the context of the Bumper protocol, arbitrage is used to rebalance the value between the protocol’s pools in situations where there is insufficient liquidity or a significant deviation from the target liquidity ratios.

When there is high volatility in the price of the protected asset, the Liquidity Ratios in the Bumper protocol may deviate from their target values. If the ratios change too rapidly for the protocol’s incentives to restore the balance, arbitrage is triggered to “hard” rebalance the pools.

There are two scenarios where arbitrage occurs in the Bumper protocol:

External actors, known as arbitrageurs, have the opportunity to execute these trades with the protocol. They assess the quantity available for trade and the discount or premium applied by the protocol to determine whether the trade would be marginally profitable. By engaging in arbitrage, these actors help the protocol rebalance its pools and simultaneously profit from the price discrepancies.

All value within the system ($ETH and $USDC) is controlled between four pools:

Bumper’s Reserves are a novel construct in DeFi. They serve multiple purposes, including covering short-term liquidity needs (BORROW, SETTLE), as well as providing a convenient method for measuring liquidity adequacy.

To understand the role of Reserves, let’s consider an example involving $ETH and $USDC. In the presence of price volatility, having Reserves of $ETH and $USDC can help mitigate the need for frequent swapping between the primary pools. For instance, instead of immediately swapping $ETH for $USDC when there is a demand for stablecoin liquidity, the protocol can utilize the Reserve of $USDC. This approach allows the protocol to provide time for the effects of protocol incentives to take place and assist in rebalancing.

By activating the Capital Reserve and temporarily providing $USDC liquidity to the Capital Pool, the need to perform a swap of $ETH to $USDC from the Asset Reserve is minimized. This strategy of utilizing Reserves helps prevent frequent and rapid rebalancing trades, which can lead to a lack of opportunity for actors to take advantage of incentives and result in undesirable slippage costs.

Within the protocol, all user interactions occur between the user and a pool, rather than directly between users. The balance of each pool is determined based on the current state of the pools, the prevailing price, and new user interactions that either increase or decrease the pool balances. While the outcome of a single operation on the protocol’s state can be determined in advance, future states depend on the behavior of future users. All inputs to the protocol come from on-chain sources or user interactions, allowing for a probabilistic estimation of the protocol’s future state based on assumed future volatility and the effectiveness of incentives over time.

Whenever a stablecoin depositor initiates a position or a taker initiates a position (by selling risk, supplying assets, or paying premiums), the position is associated with the respective pool. Assets or stablecoins are debited from the user’s wallet and credited to the corresponding protocol pool.

Monitoring and addressing liability is a fundamental aspect of Bumper’s mechanics. When a taker enters the protocol, dual liabilities are created—one for $ETH and another for $USDC. However, while more liabilities are generated than there are assets to simultaneously service them, the same principle applies when a taker exits. A taker can only perform either a withdrawal of $ETH or a claim of $USDC, thereby eliminating both the $ETH and $USDC liabilities associated with that taker. This emphasizes the importance of maintaining balance between the pools in Bumper, as the target balance is determined by the expected liabilities between $ETH and $USDC within the protocol.

When a user deposits $USDC into the protocol, a single liability is recorded. The cumulative liabilities of all $USDC deposits are termed the “Debt.” Similar to taker liabilities, the value of the debt decreases as depositors exit the protocol with their respective positions. The debt also serves as a mechanism to gradually convert the value of accumulating $ETH premiums to $USDC in the Capital Pool. This is achieved by incrementally adding a “Yield Factor” to the Debt each time the Premium is calculated. As the value of the Debt increases for depositors, the protocol’s incentives and mechanisms work to rebalance the pools over time, ensuring sufficient $USDC liquidity for withdrawals.

Within the Bumper protocol, there are three distinct liabilities:

The protocol has two sets of liquidity, which are the Asset Pool and Reserve, and the Capital Pool and Reserve. To meet these liabilities, Bumper dynamically shifts $ETH and $USDC liquidity to align with a pair of liquidity targets for $ETH and $USDC. These targets are internally calculated based on the probability of the Book and Liability materializing in a user payout. The liquidity targets are used as an input in calculating premiums.

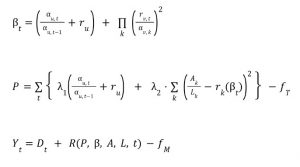

The premium is determined by:

In the implementation of Bumper, the premium is calculated incrementally triggered by changes in asset price. On average, premiums are calculated and applied every 15 minutes. The premium calculation is performed in aggregate for all takers at the same time, and at the end of a taker’s term, their individual share of the accumulated premiums is calculated. The premiums are payable from the value of the taker’s initial deposit. The Premium is denominated in the protected asset currency ($ETH) and is charged against the Asset Pool, accumulating in the Asset Reserve. This provides convenience to takers as they do not need separate currencies to pay their premiums.

Bumper achieves pricing efficiency by dynamically charging premiums in response to measured risk. Unlike traditional European Put Options where the premium is agreed upon upfront, the cost of protection with Bumper is unknown ahead of time. However, the formula for calculating the premium is known. This transparency sets Bumper apart from options where the pricing method is opaque to the buyer, including the seller’s profit.

With Bumper, the guesswork is eliminated, and premiums are charged only when necessary in response to price volatility. While there may be some uncertainty in the premium to be paid for users of the protocol, the benefit lies in the transparent calculation method, ensuring clarity between market participants about the fair value of their interaction.

The Network Bond is a requirement for both interacting users to create new positions in the Bumper protocol. When initiating a position, users must provide a certain amount of $BUMP tokens to the protocol as a bond. This bond is calculated based on the value of the position being taken. The larger the position, the higher the bond required.

The purpose of the bond is to ensure that users have a stake in the protocol and to incentivize responsible behavior. By requiring users to bond $BUMP tokens, it creates a financial commitment and aligns their interests with the protocol’s success.

At the end of the user’s position, their bond (along with any earned $BUMP incentives) is returned to them. However, if a user decides to cancel their position early, the bond is forfeited, and the earned $BUMP tokens are used to increase the incentive pool for new maker and taker positions. This encourages users to fulfill their commitments and discourages premature cancellations, as forfeiting the bond can result in a loss of value for the user.

Bumper’s philosophy revolves around establishing a fair procedure for the distribution of gains and losses in a risk market. Unlike traditional adversarial markets, where there is typically a winner and a loser, the motivation of Bumper is to create a system that promotes fairness and just distribution of resources.

The project draws inspiration from the Rawlsian theory of Distributive Justice, which posits that responsible individuals within a group will naturally establish a fair procedure for determining the equitable distribution of primary goods and resources. Bumper applies this concept to the crypto market, where it seeks to provide a fair and transparent mechanism for risk management.

Bumper’s purpose is to provide a mutual price risk facility, prioritizing the minimization of individual losses over maximizing individual profits. By focusing on risk management and protection, Bumper aims to create a more secure and reliable environment for participants in the DeFi ecosystem.

Bumper’s philosophy is underpinned by the Rawlsian theory of distributive justice. John Rawls, a prominent philosopher, proposed the concept of “Justice as Fairness” in his book “A Theory of Justice“. Rawls aimed to address the competing claims of freedom and equality by presenting an alternative to utilitarianism, which focused on maximizing the overall happiness of society.

Rawls argued that behind a hypothetical “veil of ignorance,” individuals would design a fair and just society without knowing their own personal circumstances or advantages. They would prioritize minimizing the risk of living in excessive hardship rather than maximizing individual advantage or privilege. Rawls believed that people would choose to spread opportunities widely to minimize the risk of starting in an unfair or disadvantaged position.

Bumper’s market design aligns with Rawlsian principles by striving for fairness and efficiency. Unlike traditional markets where participants compete against each other, Bumper aims to create a pool where risks and rewards are distributed across all participants proportionally to their deposits and chosen settings. This approach minimizes individual risk and ensures that no participant receives special treatment based on their wealth or status.

The Premiums and Yields in Bumper’s protocol are not predetermined but determined by the market based on real-time volatility. This eliminates the need to set prices in advance and allows for a fair and transparent pricing mechanism. The protocol calculates Premiums fairly, incentivizing liquidity providers (makers) while ensuring that takers are not penalized excessively in the event of market surges.

Furthermore, Bumper incorporates decentralized governance through its $BUMP token holders. Participants can propose and vote on changes to the protocol, allowing for collective decision-making and avoiding unilateral decisions by a central authority. The governance structure considers factors beyond token ownership, such as length of token holding, to ensure a more equitable representation of the community’s interests.

An updated roadmap is set to be published after the Layer-2 migration.

In the context of risk management in cryptocurrency markets, the existing methods of price protection have their limitations.

In this landscape, Bumper introduces a novel approach to price protection in decentralized finance (DeFi). By leveraging blockchain technology, Bumper aims to provide a more efficient and user-friendly solution for managing price risk. The protocol’s innovative design enables users to protect the value of their assets without relying on traditional stop-loss orders or complex options markets. Bumper pools play a crucial role in facilitating liquidity management and ensuring that market participants can freely deposit and withdraw their assets and stablecoins. This is achieved through the use of dynamic premiums calculated based on internal liquidity ratios in order to enhance the efficiency and effectiveness of price protection.

| STOP LOSS ORDER | OPTIONS CONTRACT | BUMPER | |

| Loss prevention | Yes | Yes | Yes |

| Upside exposure | No | Yes | Yes |

| User experience | Simple | Complex | Simple |

| Relative cost | Cheap | Expensive | Cheap |

| Pricing method | Spread and slippage | Fixed, but complex and time-consuming | Variable – Algorithmic |

While most DeFi protocols typically feature two pools, Bumper stands out with its four liquidity pools. This design allows Bumper to calculate premiums based on internal liquidity more efficiently and dynamically control the ownership of stablecoins and assets. Additionally, the quadrature liquidity pools enhance market depth and ensure participants have the flexibility to deposit or withdraw assets without encountering liquidity issues.

Bumper’s two additional pools, known as reserves of assets and capital, play a vital role in managing the risk of price volatility. These pools are used to monitor asset prices, liquidity levels, and balance the protocol’s assets and capital against its liabilities. By adjusting internal liquidity targets based on price behavior and liquidity, Bumper optimizes risk transfer pricing. The protocol shares risk among liquidity providers and distributes the cost of risk among protection buyers, ensuring fairness and efficiency in the risk management process.

In the context of pricing, Bumper deviates from the opaque pricing models commonly found in options markets. Instead, it charges premiums based on the real-time volatility of the crypto market. By aligning the cost of protection with the actual risk faced by liquidity providers at any given time, Bumper ensures that the pricing is directly proportional to the level of risk involved. This approach enhances transparency and ensures that users are paying a fair price for the protection they receive.

Currently, there is a growing need for a risk market that addresses both upside risk and downside risk in DeFi. Traditional measures of price volatility used in structured finance consider both types of risks, assuming market actors have a profit-maximization motive. However, in DeFi, participants have diverse motives, strategies, and levels of sophistication, requiring a flexible and efficient risk management solution.

A risk market is a marketplace where investors can buy and sell financial products that provide protection against potential losses. These markets allow investors to transfer risk from one party to another through the trading of risk management instruments such as options and derivatives.

In a risk market, investors can hedge against potential losses or gain exposure to potential returns by taking on or transferring risks based on their risk preferences and investment strategies. This provides a way for investors to manage and mitigate potential losses while also offering opportunities for others to earn returns by assuming that risk.

The benefits of using risk markets include a more efficient allocation of risk, as investors who are better equipped to bear certain types of risk can take on more of it in exchange for earning a premium. This allows for a diversification of risk and helps to ensure that risk is held by those best suited to manage it.

Decentralized risk markets differ from traditional financial products in that they operate on a decentralized network using blockchain technology and smart contracts. This eliminates the need for a central intermediary or third-party custodian, reducing counterparty risk and ensuring the terms and conditions of the financial products are enforced effectively. Decentralization also brings transparency, security, and lower transaction costs to the market.

Examples of risk markets include options and derivatives markets, where investors can purchase contracts that give them the right to buy or sell an asset at a certain price or benefit if the price of the asset moves in a particular direction. These markets provide investors with the flexibility to tailor their risk exposure to their specific needs and objectives.

There are potential risks associated with using risk markets. Buyers of options contracts and other risk market products pay a premium upfront, and if the price does not meet the specified strike price, the option may expire worthless, resulting in a loss of the premium. However, if the price moves in their favor, buyers can make a profit.

Pooling liquidity is a common approach in DeFi to match buyers and sellers. Bumper protocol follows a similar approach by collecting deposits into protocol-controlled pools, eliminating the need for intermediaries between mutually untrusting parties. This pooling mechanism offers two key advantages:

The flexibility of Bumper’s design allows for the incorporation of various risk factors. It can accommodate derivatives, concentration risk (related to protection or asset concentration), operational risk, liability risk over time, external market prices, sentiment measures, and real-world information external to the blockchain. By considering a wide range of risk vectors, Bumper aims to provide a comprehensive risk management solution within the DeFi ecosystem.

A stop loss is an order placed on an exchange that is designed to limit potential losses for an investor or trader. It is commonly used by both long buyers and short sellers in the financial markets.

In the case of a long position, this is likely to be a sell order if the price falls to a certain level, and the inverse is true for short sellers.

The types of advanced Stop Losses include:

While stop losses are an important part of a good trader’s tools, it is important to acknowledge that there are unintended consequences that can arise from employing such orders.

Bumper provides an alternative that preserves the upside while still providing you with protection from downside moves in the highly volatile crypto market, protecting the value of your crypto from downside moves, even while it simultaneously allows you to ride the rips.

The innovative architecture of the Bumper protocol allows users to take price protection but negates concerns about whether a stop loss is a good idea or not.

It does this by allowing you to deposit crypto into the protocol’s smart contracts, and in return, you are given a ‘Bumpered’ asset which represents the crypto you have locked up. The Bumpered asset has baked into it a protection floor which acts as a minimum value level for that asset. If your position closes and the price of your asset is under the floor, you get stablecoins to the floor value, but if the price is higher, you simply get your original token back (minus the premium of course).

While both Bumper and put options are hedging strategies, there are key differences such as:

| Price Protection | Premiums | Renewal | Participant Interaction | |

| Put Options | Buyers don’t have to own the underlying token, and are a gamble on the future price.

Options either expire profitably “in-the-money’ or are worthless “out-of-the-money” |

Premiums are determined by the seller and always paid in full when the contract is opened.

On some platforms, premiums may be calculated by the protocol, often using a standard model such as the Black Scholes method. |

Options cannot be renewed | Almost all Options contracts are adversarial between two individual participants, a buyer and a seller. |

| Bumper | Bumper protects the value of tokens owned by the user. | Bumper calculates premiums incrementally when the protocol’s state changes (normally as a result of volatility or change in the balance of locked assets).

Premiums are deducted when a position is closed. Agent Based Modelling projects 4.5pp lower premiums compared to Black-Scholes option pricing. Additionally, unlike Options, Bumper premiums reduce as the asset price rises above the protected floor. |

Positions can be automatically renewed at any point before the position is closed. | All interactions are between the user and either the protocol’s Asset pool or Capital pool. Users are never matched directly. |

| Token Bonding | Yields | Tokenized Primitive | Settlement | |

| Put Options | Almost all crypto Options desks do not require users to bond or even hold the protocol’s native token to participate | Contract sellers earn a yield derived from premiums levied on buyers | Not available | Almost all in-the-money crypto options contracts are cash-settled either at the point of expiry, or when the buyer exercises early (if available). |

| Bumper | Users opening positions must hold, and bond, BUMP tokens.

The specific amount required is determined by the system based on the size (value) of the position being opened. |

Liquidity providers earn yield derived from premiums AND automated yield farming. | When a position is opened and the user deposits their asset into the protocol, a tokenized asset is returned to them which represents their protected asset with the downside volatility removed (due to the protection floor level).

This asset, called a Bumpered Asset, is composable. |

Settlement occurs when a protection takers position is closed, with the form of settlement varying depending on whether the closing price is below or above the floor.

Option sellers are subject to lower haircut risk, compared to Black-Scholes option pricing, with Agent Based Modelling projecting 6p.p improved yield during 2022 pronounced bear market. See the table below for different modes of settlement. |

The table below outlines the different methods of settlement.

| Below floor or in the money | Above floor or out of the money | Premium | |

| Crypto put option | Normally cash-settled in stablecoins | No settlement | Paid in full when the contract is opened |

| Bumper | Protected asset + profit in stablecoins or entire settlement in stablecoins. | Closes and retrieves the protected asset | Deducted from protected assets over the position lifetime. |

One of the challenges of crypto options trading is its inherent complexity, which can deter many newcomers to the crypto space. Bumper addresses this challenge by providing a user-friendly interface and eliminating the need to navigate the nuances of options contracts, strike prices, and expiry dates. Instead, users can set a desired price at which they wish to protect their assets and choose a term length. If the market crashes, the asset’s value will not sink below the protected price, while still allowing potential gains if the market surges.

Another disadvantage of traditional crypto options platforms is the cost associated with options contracts, especially in volatile markets. Bumper offers a more cost-efficient solution by providing a safety net for crypto investments without the substantial expenses typically incurred in options trading. This can make it a more attractive option for investors looking to manage their risk without incurring high costs.

Furthermore, Bumper operates as a decentralized protocol, allowing global accessibility without being restricted by regulatory limitations faced by traditional options platforms. This makes it accessible to users worldwide, providing them with an alternative that is not constrained by geographical boundaries.

Bumper also introduces a unique feature that allows users on the other side of the market to earn a yield by assuming some of the risk from those seeking asset protection. This creates a balanced ecosystem where participants can both protect their assets and earn a yield by providing pooled liquidity.

While Bumper may not fit the conventional definition of a crypto options platform, its simplicity, accessibility, and cost-effectiveness make a strong case for it being considered the ultimate platform for trading options. By offering a user-friendly interface, cost efficiency, and global accessibility, Bumper can disrupt the crypto options market and provide a more inclusive and efficient trading experience for users.

Bumper is available on the following chains:

Bumper involves two market participants: takers and makers.

On the one hand, takers decide on the amount of their asset they wish to protect, the floor price at which protection activates, and the duration of the protection. On the other hand, makers deposit stablecoins into the protocol and assume taker price risk while benefiting from the advanced price protection ecosystem.

When a taker’s position ends, the outcome depends on whether the current asset price is above or below the chosen floor.

Takers are users who deposit assets into the Bumper protocol to obtain a protected price position. They have the following responsibilities and options:

Makers are users who deposit capital in stablecoins into the Bumper protocol and assume the risk associated with providing liquidity. They have the following responsibilities and options:

By involving both makers and takers, the Bumper protocol disperses liquidity risk and allows participants to segment themselves into different risk categories based on their chosen parameters. This segmentation enhances the overall efficiency and resilience of the protocol by attracting participants with varying risk preferences and investment strategies.

Makers earn yield not only from premiums paid by Takers but also from potential profits and automated yield farming through external DeFi protocols.

The yield earned by makers can vary over time based on the volatility of asset prices and the liquidity available within the Bumper protocol. For instance, as market conditions change, the yield generated through automated yield farming may increase or decrease.

The price protection aspect of Bumper is suitable for a variety of usages and strategies, and can be utilized for the following user base:

Premiums, fees, and incentives are calculated at the pool level and change over time based on asset price volatility and liquidity coverage.

Premiums represent the cost of protection for takers and are incurred when opening a position. They are calculated at the pool level and change over time.

Premiums accumulate over time as the position remains active and are calculated based on two sets of risk measures: asset price volatility and liquidity coverage:

Takers pay the premium when they close their position, and it is deducted from the amount they receive back.

Bumper imposes a “Network Fee” at the start of a taker’s term. The Network Fee is calculated based on the value of the taker’s deposit.

This fee is levied to support the protocol’s Treasury and ensure sustainable operation and development of the Bumper ecosystem.

To bootstrap liquidity and incentivize the growth of the protocol, $BUMP tokens are issued as incentives to users when they take out a position.

The $BUMP token plays a crucial role in the protocol by serving as a utility and governance token that incentivizes participation and supports the network effect of the marketplace. Participants in the Bumper market are required to bond $BUMP tokens in escrow for the duration of their engagement with the protocol. In addition to that, they can also participate in governance decisions.

The utility of the $BUMP token is closely tied to the demand for using the protocol. As more actors seek price protection for on-chain assets or are willing to buy asset price risk in exchange for collecting premiums, the demand for $BUMP tokens increases. This creates a direct link between the utility value of the Bumper protocol and the market value of the token.

This way, by aligning protocol utility with token demand, the BUMP token’s market price becomes a reflection of the value and adoption of the Bumper protocol. This incentivizes real-world actors to interact with the protocol as they recognize the benefits and economic incentives associated with participating in the marketplace.

Voting in the Bumper governance system is designed to be time-weighted, which means that the voting power of token holders is determined based on the duration of time they have held their BUMP tokens. This time-weighted approach helps to prevent the disproportionate influence of wealthy individuals or groups who may temporarily acquire tokens to manipulate the voting process.

Bumper’s DAO (Decentralized Autonomous Organization) allows $BUMP token holders to participate in the governance of the protocol by obtaining voting power, represented by vBUMP tokens. To gain voting power, token holders need to stake their $BUMP tokens into Bumper’s DAO contract.

Users have the option to lock their staked $BUMP tokens for a certain period, up to 1 year, and earn bonus vBUMP tokens. The bonus vBUMP tokens gradually decrease over the lock period and eventually reach a 1:1 ratio with the staked $BUMP tokens at the end of the lock period. This incentivizes users to lock their tokens for a longer duration and rewards them with additional voting power.

Furthermore, users can delegate their base vBUMP voting power (excluding bonus vBUMP) to other users who can vote on their behalf. Delegation can be done and revoked at any time, allowing token holders to appoint someone else as a proxy for their vote.

Bumper’s DAO has established governance thresholds to ensure that a minority of users cannot disproportionately influence decision-making. These thresholds include a minimum level of vBUMP required to create a proposal, a quorum requirement (minimum level of participation), and supermajority acceptance levels for a proposal to be approved.

Proposed changes to the protocol are submitted as Bumper Improvement Proposals, following a common practice among established decentralized protocols. These proposals are raised and published for review and discussion by the community. Token holders then have the opportunity to vote on these proposals, with the weight of their votes determined by the duration of their $BUMP token holdings.

Once the voting period concludes, there is a final approval and deployment process based on the outcome of the voting. This ensures that changes to the protocol are implemented in a decentralized manner, taking into account the preferences of the $BUMP token holders who actively participate in the governance process.

The protocol is built on 3 core assumptions that form the foundation of its market design and risk management approach.

Bumper has gone through audits with Block Hunters, Chainsulting, Sigma Prima, and Watchpug.

There are currently no bug bounty programs available.

LinkedIn indicates that there are 13 employees. Some of them include:

There were 4 raises held by Bumper. These include:

Bumper has the following partnerships and integrations.