Blur is an NFT marketplace and NFT aggregator for professional NFT traders. The objective behind the protocol is to provide users with better tools, more liquidity for NFTs, and a faster experience than its competitors.

One of the key features that sets Blur apart is its ability to aggregate NFT listings from various marketplaces. Users can list their NFTs for sale on multiple platforms simultaneously through Blur, saving time and effort in managing listings across different platforms. Additionally, Blur does not charge any royalties on sales, allowing users to keep more of their profits.

The platform prioritizes speed and efficiency, aiming to provide users with a seamless and fast trading experience. With its focus on professional traders and aggregation capabilities, Blur aims to cater to the needs of experienced and active participants in the NFT market.

Blur also allows users to snipe reveals, which means they can quickly acquire newly minted NFTs as soon as they are revealed by the creators. This feature gives traders an advantage in obtaining highly sought-after NFTs.

Blur’s policy with regard to royalties is to remain competitive in terms of pricing. As a trader-friendly marketplace, Blur recommends a default royalty rate of 0.5% for buyers. However, this can be customized and even set to 0 if the user wishes.

Trait bidding is similar in mechanics to Collection bids, with the difference being it checks for specific traits instead of the collection.

When a seller attempts to sell an item into a trait bid, the oracle will check that the item has the relevant trait in real time. This ensures that trait bidders on collections that have changing traits are protected.

Trait bids can also be used to earn trait bidding points on select collections. Trait floors can be less liquid and more volatile than collection floors. When you bid, only bid at prices you are truly willing to buy at.

Trait bids earn more points based on how much higher they are than the top collection bid and the supply of the trait. Note that while all collections have trait bids enabled, only certain collections have trait bidding points

The methodology behind trait bid scoring is as follows:

Trait bid points are not dilutive. If a collection received 100 bidding points per day before, it’ll still receive 100 bidding points per day. The only difference is that those points are now distributed across collection bids and trait bids.

Collections with traits that collectors are willing to pay a premium for will have more points allocated toward trait bids, while collections with traits that collectors aren’t willing to pay a premium for will have more points allocated toward collection bids.

5/ TRAIT BIDDING POINTS

You can earn more points for trait bidding on Punks, Degods, Milady’s, and 9 other collections.

Trait bids earn more points based on how much higher they are than the top collection bid.

Learn how trait bid points work in-depth https://t.co/LxZDUwODG7 pic.twitter.com/VMzdGnyDZi

— Blur (@blur_io) July 5, 2023

Example 1

There is a collection with 3 items: 2 floors and 1 rare.

If the market doesn’t value the rare such that the top bid on each item is the same as the top collection bid, then all bidding points will be allocated toward collection bids.

However, if the market values the rare item at a 2x premium, such that the top trait bid on the rare is 2x the top collection bid, then approximately 50% of the bidding points will be allocated to collection bids, and 50% of the bidding points will be allocated to trait bids (each floor item gets 1 point, so 2 points total, and the rare item gets 2 points due to having a 2x premium).

Example 2

There is a collection with 10 items: 6 floors, 3 mids, and 1 rare.

If the mids trade at a 1.5x premium and the rare trades at a 10x premium, the weights may be as follows:

In this case, the top collection bids get allocated 44% of the points, the top trait bids on the mids get allocated 33% of the points, and the top trait bids on the rare item get allocated 22% of the points. The top bids on the rare item received less points than they otherwise would have because the premium was capped at 3x.

Blend on Blur extends the functionalities of the Blur NFT marketplace by introducing a lending platform that enhances NFT liquidity and enables borrowers to access funds while retaining ownership of their NFT assets. It aims to bridge the gap between traditional finance and the NFT market, offering collectors and investors new opportunities to engage with and benefit from the growing NFT ecosystem.

More specifically, Blend (Blur-Lending) is a floating-rate and peer-to-peer perpetual lending protocol for NFTs with no Oracle dependencies. The goal behind Blend is to enhance NFT liquidity and accessibility.

Through Blend, NFT owners can unlock the value of their illiquid assets by using them as collateral for loans. This feature provides a unique opportunity for collectors to retain ownership of their valuable NFTs while accessing immediate liquidity. Borrowers can use the funds obtained from the loan for various purposes, such as purchasing additional NFTs, investing in other assets, or meeting personal financial needs.

Unlike traditional lending platforms, Blend does not rely on external oracles for price data and does not impose expiry dates on borrowing positions.

The lending process on Blend begins by matching borrowers who want to utilize their NFT collateral with lenders who offer the most competitive rates. This is achieved through a sophisticated off-chain offer protocol, ensuring optimal borrowing conditions for users.

Once a loan is established, Blend loans have fixed interest rates and do not have expiration dates.

The interest rates and loan terms on Blend are determined by market-driven rates, reflecting the supply and demand dynamics of the platform. This creates a competitive environment and allows borrowers and lenders to find mutually beneficial terms for their transactions.

Many NFT-backed lending protocols rely on oracles to determine factors such as when a position should be liquidated or to establish interest rates. However, accurately measuring individual NFT prices objectively can be challenging. Even floor prices, which represent the minimum value of an NFT, can be difficult to determine on-chain. Existing solutions often involve trusted third parties or can be susceptible to manipulation through trading strategies.

In contrast, Blend’s core protocol is designed to be independent of oracles. It avoids relying on external sources to determine interest rates and loan-to-value ratios. Instead, these terms are determined by the terms that lenders are willing to offer. This approach ensures that the protocol remains decentralized and minimizes the potential for manipulation. Liquidations in Blend are triggered by the failure of a Dutch auction, providing a fair and market-driven mechanism for handling default scenarios.

Some NFT-backed lending protocols impose expiries on debt positions, requiring borrowers to manually close or roll their positions before the expiry date. Failure to do so can result in harsh penalties, such as the confiscation of the borrower’s NFT collateral. The process of rolling positions manually incurs gas fees, reducing the overall yield from lending activities.

Blend eliminates the inconvenience of expiring debt positions by automatically rolling borrowing positions as long as there are lenders willing to lend against the collateral. Borrowers do not need to worry about expiries or remember to take action to maintain their positions. This automated rolling feature reduces the burden on borrowers and streamlines the lending process. On-chain transactions are only required when there are changes in interest rates or when one of the parties involved in the position wishes to exit, further minimizing unnecessary transaction costs.

Unlike many other DeFi protocols, Blend does not use price oracles. Most lending protocols in DeFi rely on oracles to fetch asset prices and assess the solvency of borrowers and whether they have defaulted on their outstanding loans and should be liquidated.

While Blur lists this lack of Oracle dependency as an advantage, critics point out issues around fair pricing for NFTs. The fact that the protocol does not incorporate pricing models into its operations pushes the responsibility to come up with a fair valuation to the borrowers and lenders.

Some NFT lending protocols pool lenders’ funds together and attempt to manage risk for them. This often means leaning heavily on on-chain governance or centralized administrators to set parameters. It also makes it difficult to permissionless support long-tail collateral.

To overcome those issues, Blend relies on peer-to-peer mechanisms that facilitate borrowing and lending activities directly between users, without the need for intermediaries or centralized control. These mechanisms are designed to ensure efficient matching of borrowers and lenders, optimal interest rates, and flexible terms for participants.

It is worth noting that Blend’s operations assume the existence and intervention of sophisticated lenders capable of participating and evaluating the risks associated with each specific NFT used as collateral.

Some NFT-backed lending protocols do not support liquidations before the expiration date of a borrowing position. This feature is convenient for borrowers and is suitable for certain use cases. However, it introduces potential risks for lenders. But because this effectively gives borrowers a put option, lenders need to protect themselves by demanding shorter expirations, higher interest rates, and/or lower loan-to-value ratios. These measures are meant to compensate for the risk that a borrower’s position may become insolvent before the expiration.

In protocols that rely on expiration dates, borrowers can close their positions by repaying their loan (principal + interest) to the lender. This closes the position and lets them withdraw their collateral. Otherwise, the lender can take the borrower’s collateral. In fact, the borrower may choose not to repay their loan if the value of the NFT has fallen below the repayment amount.

However, if the borrower forgets to repay, they could also lose their NFT collateral, which could be worth much more than the repayment amount. In many cases, someone else might be willing to step in and pay the lender the full repayment amount in order to take over the loan until a later expiration time, possibly at a higher interest rate.

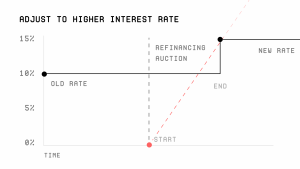

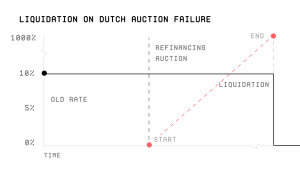

In contrast to expirable loans, Blend introduces a different mechanism for handling potential insolvency. In Blend, liquidation of an NFT collateral can occur whenever a lender triggers a refinancing auction, and no other party is willing to take over the debt at any interest rate. This means that if a borrower’s position becomes at risk of insolvency, lenders have the option to initiate a refinancing auction to find a new lender for that debt. If no other party is willing to take over the debt at any interest rate during the auction, the collateral can be liquidated.

By allowing liquidations before expiration, Blend provides an additional layer of protection for lenders. If they perceive an increased risk of insolvency, they can take proactive measures to protect their interests. This mechanism helps maintain the overall stability and security of the lending protocol, reducing the potential losses for lenders.

This way, instead of simply giving the collateral to the lender, the protocol can run a competitive process to extend the loan, using a Dutch auction.

Refinancing auctions start at 0% and will have a steadily rising rate. Once the auction hits an interest rate at which a new lender is interested in participating, the new lender can accept it by submitting their offer on-chain.

The new lender will pay the full repayment amount to the old lender, calculated as the rate at the moment when the auction completes, and take over the loan until a new expiration time (which could be calculated as the current expiration time plus some protocol-specific loan period, using the interest rate at which the auction is resolved.

Blend’s Dutch auction system creates a secondary market for NFT loans.

The success of this secondary market relies on a healthy mix of market participants. In practice, this refinancing process becomes relevant only when the number of lenders exceeds that of borrowers. In such situations, lenders can simply establish loans directly with borrowers, bypassing the refinancing process altogether.

In some cases, the same lender might be happy to continue the same loan at the same terms, and the borrower may too. In fact, this could be considered the default state. In that case, it would be wasteful to run an auction. Instead, the protocol could optimistically renew the loan. This way, at each expiration time, borrowers and lenders, by default, extend the expiration time by some predetermined loan period with the same terms. Hence, auctions would only occur if the lender seeks to terminate the loan.

One of the problems of protocols that rely on expirable loans is that if the price of the collateral falls dangerously close to the price of the repayment amount, there is no way to liquidate the position until the expiration time.

However, this is not an issue when loan periods are very short. If the lender was concerned about the safety of the collateral they could then trigger an auction at the next expiry.

Blend takes inspiration from this concept and drops the concept of expiration times and loan periods. By default, all loans continue indefinitely until some user interacts with the contract. Therefore, interest is accumulated continuously, and the repayment amount is calculated on the fly whenever it is needed.

This allows borrowers to repay at any time. If a borrower wants to change the amount they have borrowed or get a better interest rate, they can atomically take out a new loan against the collateral and use the new principal to repay the old loan.

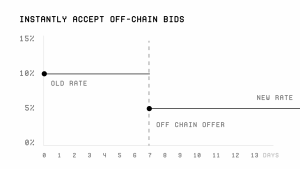

Similarly, if a lender wants to get out of a loan, they can trigger a refinancing auction. Alternatively, if there is a compatible offer available from another lender, the current lender can skip the auction by submitting the other lender’s offer to the vault to get out of their loan.

All timelines and deadlines during refinancing events can be defined relative to the time when the refinancing auction was initiated.

Liquidations are a consequence of Dutch auctions that are unable to find a willing lender, which can happen when the value of the collateral has dropped close to or below the value of the debt.

Once the auction hits some defined max rate (like 1,000%) without any new lender stepping in, the protocol infers that the position is insolvent or non-viable and liquidates the borrower. The existing lender can then submit a transaction to take over the borrower’s collateral.

It is worth noting that the protocol does not use oracles but does not rely on governance either for setting the value of collateral or managing what acceptable loan-to-value ratios are. This reduces the need for extensive and tedious governance actions or centralized decision-making altogether.

However, there are protocol-adjusted parameters where governance can intervene:

In Blur’s implementation of Blend, after a 180-day waiting period, these parameters can be managed by BLUR governance to ensure optimal performance and adapt to changing market conditions in a decentralized way.

The development of Blend also unlocked a new business vertical – Buy Now, Pay Later (BNPL). Users can buy NFTs upfront and the rest is borrowed on their half for them to pay back later with interest.

After making a BNPL purchase, users can repay their borrow at any time to take full ownership of their NFT.

Otherwise, they can list their NFT at any time and keep any profit they collect from selling.

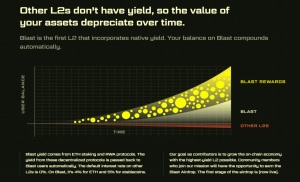

Blast was the only Ethereum L2 with native yield for $ETH and stablecoins, at the time of their launch, although other networks such as Manta that boast the same features have emerged as competitors.

Providing a native yield to user assets is its main objective and feature, while other objectives include making Blast the go-to chain for NFT trading and an NFT perpetual ecosystem.

Most of the features of Blast were a result of lessons the team had learned via managing the Blur NFT platform, such as idle $ETH that were not gaining yield in Blur’s bid pool, and expensive NFT transaction fees.

Blast takes users’ deposits and places them into trusted protocols for native yield. $ETH is deposited into Lido Finance, while $USDC and $USDT are swapped into $DAI and deposited into MakerDAO as sDAI. This allows assets to gain yield over time from the underlying protocol, which means users’ assets are always productive, even when idle.

Users bridging stablecoins will receive a token called USDB, which is Blast’s auto-rebasing stablecoin.

Developers are also able to integrate these native yield capabilities into their dApps and are encouraged to as it is a core objective of the chain.

One of the visions of Blast is to create an L2 that allows much cheaper transaction fees for NFT trading, and also build an ecosystem around the NFT perpetuals sector.

Blast incentivizes developers by routing gas fees back to them, instead of keeping it. Developers are then free to use the revenue, or to utilize it as a subsidy for their users’ gas fees.

The airdrop, or lockdrop, was introduced on November 21, 2023.

Its mechanic involves users depositing $ETH and stablecoins onto the chain to earn Blast Points, with withdrawals only enabled on February 2024, and Points only redeemable on May 2024. Despite the risks involved due to illiquidity and the potential of not being able to get their funds back, Blast still managed to obtain $1 billion TVL in just 35 days.

This was due to a mixture of a market desire for fresh options for $ETH yields, the Points loot box mechanics, and reputable backing by entities such as Blur itself, Paradigm, and Standard Crypto, along with multiple known crypto native VCs and Angels.

50% of the airdrop is also reserved for developers, which will be launched in January 2024 along with the Blast Testnet.

Users could also gain exposure to Blast by depositing $BLUR tokens, allowing them to earn points every hour based on the quantity of tokens deposited. This included a multiplier system that grew based on deposit time, with the multiplier resetting if $BLUR was withdrawn.

Blur has not yet revealed what token will be earned from this airdrop.

Blur’s vision is to empower the NFT trading community by catering to their specific needs. What sets Blur apart is its focus on advanced traders, offering features like batch transactions, portfolio analytics, marketplace aggregation, and sweeping tools.

Unlike other marketplaces that target retail users, Blur is designed to cater more to professional NFT traders. The protocol was launched on the Ethereum mainnet on October 19, 2022.

Prior to the development of borrow-lending marketplaces for NFTs, the only way to get liquidity on NFTs was by selling them. For instance, a Punk holder who wants to buy a new NFT but doesn’t have enough capital would be forced to sell their NFT to unlock more funds. This forces holders out of collections and hurts floor prices.

The motivation behind building Blend stems from the existing landscape of NFT-backed lending protocols and a desire to improve upon common design decisions to enhance the borrower experience. While there are several popular models in the market, such as perp-like protocols, pooled lending protocols like BendDAO or Astaria, and peer-to-peer protocols like NFTfi or Backed, Blend follows a peer-to-peer model with key differences to optimize user satisfaction.

With Blend, NFT holders can borrow ETH against their NFTs without needing to sell. By allowing NFT holders to use their assets as collateral for loans, NFT lending increases the liquidity within the NFT market sector.

Blast is an EVM-compatible, optimistic rollup that raises the baseline yield for users and developers without changing the experience crypto-natives expect.

It was developed in order to solve 2 main problems.

Firstly, to establish a chain that provides a chain-wide native yield on $ETH and stablecoins in the ecosystem. This is achieved by staking $ETH in Lido and depositing $DAI in Maker’s DSR (which earns yield from US short-term treasuries).

The problem that sparked this solution was the founder noticing that hundreds of millions of dollars were idle in the Blur Pool, not earning yield. Funds in Blur Pool are idle as they are either not set aside by users for future NFT bids, already allocated to bids that have not been fulfilled, or forgotten.

Hence, Blast is the first L2 with native yield, where it natively participates in $ETH staking and passes the yield back to users and dApps. This allows users’ $ETH balances on Blast to grow over time automatically. Stablecoins are also deposited in on-chain T-Bill protocols like MakerDAO. These yields are then passed back to users in the form of Blast’s auto-rebasing stablecoin, $USDB.

Secondly, to be a Layer 2 that was able to reduce transaction costs of NFT trading, and to provide institutional-grade NFT perpetuals. There is a huge problem with how expensive transaction costs are for NFTs, especially as the majority are done via Ethereum mainnet, which is known to be expensive even on normal days.

As such, Blast allows NFT trading and transactions to be done on an L2 where costs would be substantially lowered. This would, in turn, promote even more adoption from users who were priced out previously, and for existing users to be even more active. Protocols too, would be able to explore and grow within the NFT trading and perpetuals sector.

The value proposition of NFTs lies not in their intrinsic value but rather in the speculative factor that determines their pricing. This concept is not unprecedented in the crypto world, as evidenced by Bitcoin’s speculative premium driven by liquidity increases over the years.

Maximizing the speculative factor relies on growing social consensus around narratives. As social consensus increases, the price of the asset rises. NFTs are particularly suited to induce social consensus due to their visual nature, as people like and share pictures, creating narratives around their importance.

There is a distinction between aesthetics-based collections and high-functionality NFTs. Aesthetics-based collections may be seen as luxury goods, and their value is tied to social consensus and the exhibition of wealth. Fluctuating tastes can impact the value of such collections over time. On the other hand, high-functionality NFTs provide utility or are essential for specific use cases, such as in gaming. The economic value of high-functionality NFTs can increase as crypto applications attract wider audiences.

The NFT sector has experienced significant growth and attention in recent times, with Blur emerging as a prominent player in Ethereum NFT trading. The platform’s innovative approach, including incentivizing trading and conducting a token airdrop, propelled it to overtake OpenSea, a well-established competitor. As an example, when compared to OpenSea Pro, Blur updates listings 12x faster.

Further, traditional NFT marketplaces such as OpenSea cater to retail users and don’t facilitate large-volume transactions. Meanwhile, traders face minimal friction with Blur, as it keeps up with their frequency.

However, the rise of flipping NFTs on Blur has raised concerns within the industry. Flipping refers to the practice of quickly buying and selling NFTs for profit, often resulting in high trading volumes but potentially undermining the intrinsic uniqueness and value of NFTs. Critics have expressed worries about wash trading, which can artificially inflate trading activity and create an illusion of demand, also driven by expectations of an airdrop.

In Q2 2023, The NFT sector faced a challenge as NFT prices experienced a decline. Moreover, traders began questioning Blur’s approach and its influence on the market. Critics have attributed the falling NFT prices to Blur’s incentivization tactics and alleged that the platform’s strategies harm the overall market. The perception of lowering NFT prices and encouraging risky behavior has led to criticism of Blur’s impact on market dynamics. Additionally, some traders have faced losses and liquidations due to over-leveraging on Blend.

The NFT market is witnessing several trends that are shaping its evolution. One of these trends is the financialization of NFTs, where NFTs are being used as collateral for loans. Platforms like ParaSpace, Astaria, Arcade, NFTfi, BenDAO, or Blend are leading the way in NFT lending, allowing NFT owners to access liquidity without selling their assets. This trend has seen a significant increase in borrowing volume, driven by the uptick in trading activity and the growing value of NFTs. However, NFT lending carries inherent risks, and platforms often prioritize blue-chip collections as collateral due to their established reputation and perceived lower volatility.

Another trend is the emergence of innovative marketplaces, particularly in the Solana ecosystem. Magic Eden, the largest marketplace on Solana, is expanding its supported networks to compete with Ethereum-based platforms. Platforms like Blur or TensorSwap are gaining traction with their pro trader UX, feeless trading, and unique features like airdrops. However, established players like Magic Eden are also adapting by introducing rewards programs to incentivize user engagement.

The NFT market is experiencing a shift in the revenue structure of marketplaces, with many new platforms offering optional or zero-royalty fees for creators. This trend is driven by the goal of increasing trading activity and providing a better experience for NFT traders. However, this shift is disrupting traditional revenue streams for creators and has implications for the overall sustainability and competitiveness of the NFT market.

Previously, most NFT marketplaces charged two fees per sale: one for the marketplace and one for the creator. However, royalty payments are not fully enforceable on-chain, leading to variations in royalties across different marketplaces. For example, OpenSea enforces royalty fees set by creators, with up to 10% of the sale price going to the creator, while platforms like X2Y2 and LooksRare have implemented opt-in royalty structures.

The consequences of this shift in royalty fees are two-fold. First, it affects creator revenue streams, as they receive a smaller share of the overall revenue in marketplaces with optional or zero-royalty fees. Second, it impacts the perceived value of NFTs and the willingness of buyers to pay royalties. Some NFT projects have seen a decline in trading activity and community involvement, with buyers less inclined to support the community behind the collection if they don’t see long-term value in paying royalties.

The shift towards opt-in royalties may lead to fragmentation in the NFT market between platforms that enforce royalties and those that offer more flexibility. Creators may choose to delist their collections from certain marketplaces to focus on avenues that offer desired revenue streams. However, this flight could potentially erode the open market competition that has driven the growth of the NFT market. It also raises concerns about the long-term sustainability and motivation of creators if they feel they are not being fairly compensated.

Ultimately, the response of creators and the actions they take will shape the future of the NFT market. They may need to motivate their consumer base to honor royalties by creating a strong community worth investing in, or they may face reduced revenue streams and potential disincentives for producing digital art. The sustainability of the overall NFT ecosystem will depend on how creators navigate this shift and the choices they make in response to the changing revenue structure of marketplaces.

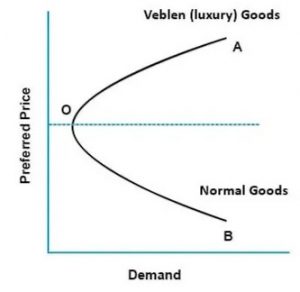

Veblen goods, named after the economist Thorstein Veblen, are a type of product that defies the typical law of demand by exhibiting increased demand as their price rises. In other words, the higher the price of a Veblen good, the more desirable and sought after it becomes.

The concept of Veblen goods challenges the conventional assumption that demand decreases as prices rise. Instead, these goods derive their appeal from their high price tag, which serves as a signal of exclusivity, luxury, or prestige. The conspicuous consumption associated with Veblen goods is driven by the desire for social status or the perception of owning something rare and valuable.

In many regards, NFTs (Non-Fungible Tokens) can be considered Veblen goods in the digital realm. Similar to traditional Veblen goods, NFTs often see increased demand as their prices rise. The perception of rarity, uniqueness, and prestige associated with owning a specific NFT can drive up its value. This demand is driven by collectors, enthusiasts, and investors who seek to own something that is considered rare and exclusive within the digital art or collectibles market.

The counterintuitive nature of Veblen goods applies to NFTs as well. If the price of an NFT artwork or collectible increases significantly, it can actually enhance its desirability and allure. The reason for that is that the high price serves as a signal of the NFT’s exclusivity and can attract attention from individuals who value the status associated with owning expensive and scarce digital assets.

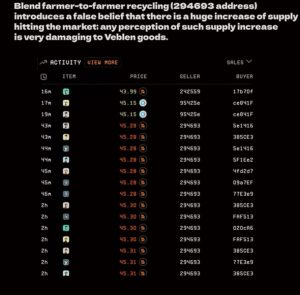

In the context of NFTs, maintaining the perception of scarcity and exclusivity is crucial for sustaining high levels of demand and preserving prices. However, when there is a continuous influx of NFTs into the market, as seen with the behavior of Blur farmers or other activities that create the perception of oversupply, it can undermine the sense of rarity and exclusivity that drives the appeal of NFTs.

The unique demand curve of NFTs, where increased prices often contribute to higher demand, relies on the perception that these digital assets are scarce and coveted. However, if the market is flooded with a seemingly abundant supply of NFTs, it can diminish the perceived exclusivity and rarity of individual tokens. This, in turn, can lead to a decline in demand and potentially drive down prices.

Most concerns among market participants arise from so-called Blur farmers. Blur farmers are participants on the Blur platform who are primarily focused on accumulating Blur Points, which are rewarded to users through the Season Airdrop program. These farmers engage in various activities on the platform to earn these points, including bidding, listing, and lending.

Bidding is a favored activity among Blur farmers because it involves lower risk, especially when they use $ETH and hedge their bets with short futures. The strategy of these farmers is to maximize their points by bidding strategically. They aim to place bids that are not too close to being filled, but close enough to earn a significant amount of points. If their bids are filled, they take advantage of the grace period to list those NFTs for sale. If the NFTs don’t sell, they simply sell them back into the bid, maintaining a continuous cycle of activity to earn more points.

Blur farmers can be seen as short-term profit seekers who actively move their assets around to chase the highest yield. They employ strategic bidding and leverage the features of the Blur platform to optimize their point accumulation and potentially generate profits from their activities.

In the Blur market-making system, the incentives for farmers are heavily influenced by various factors such as the presence of other farmers, fluctuations in the price of $BLUR token, and fluctuations in NFT prices.

The presence of other farmers plays a crucial role in determining the effectiveness of farmers’ bids and their ability to earn points. If there are too many farmers participating in the program, bids from individual farmers may be overshadowed by large blocks, resulting in fewer points earned. Conversely, if there are too few farmers, bids may get filled too frequently, leading to losses when reselling into the next bid.

The price fluctuations of the $BLUR token also impact farmers’ behavior. If there is a rapid dump in the price of $BLUR, farmers may pull their bids and even sell off their entire NFT inventory. Since farmers are primarily focused on maximizing their points rather than holding NFTs, a drop in the value of $BLUR reduces the USD per point earned, making them more risk-averse.

Furthermore, the leverage aspect of Blur liquidity adds another layer of complexity. With one Ethereum token, farmers can bid on multiple collections. However, if a significant quantity of an NFT is dumped into a major market maker (farming whale), it can quickly dry up the bids on multiple collections simultaneously. This creates additional selling pressure as farmers try to avoid being left holding NFTs that may be perceived as undesirable.

The interaction between Blur farming and NFT prices is complex and can have implications for market dynamics. Farmers on Blur adjust their strategies based on the number of other farmers participating. In addition to that, Blur’s incentives program might implicitly prompt traders to engage in the protocol with the expectation of being airdropped the $BLUR token, which they can sell later on to consolidate a profit (and offset the losses they are taking by farming the token).

To counterbalance this, farmers utilize Blend, which allows them to convert unwanted NFTs back into Blur points quickly, without the need for waiting. This feature provides liquidity for farmers, enabling them to offload NFTs that may not be desirable or profitable for them. However, this creates a cycle of dumpers selling their NFTs to other dumpers, leading to a reduction in the availability of NFTs for genuine buyers who have an actual interest in the assets.

As a consequence, the continuous offloading of NFTs by farmers through Blend might contribute to a decline in NFT prices. This accelerated reduction in supply, combined with the ongoing dumping cycle, puts downward pressure on prices and creates market volatility.

It is essential to consider that the dynamics of Blur farming, Blend utilization, and their effects on NFT prices can have both positive and negative outcomes. While they provide liquidity and opportunities for farmers, they can also disrupt the market and result in price declines. In this context, the presence of liquidity providers and stability-focused participants plays a crucial role in mitigating excessive volatility and promoting a more balanced NFT market.

I don't usually comment on these kinds of discussions but I will say this:

We launched in October 22. Since then, some floor prices have gone up, some floor prices have gone down.

One of the few times floor prices went up in concert was when we injected liquidity into nfts via… https://t.co/8bsZcvDuD9

— Pacman | Blur + Blast (@PacmanBlur) July 5, 2023

Blend, the peer-to-peer loans protocol within Blur plays a significant role in shaping farming strategies and impacting liquidity and market dynamics on the platform. Its features have unintended consequences that might contribute to the acceleration of a trending market.

Blend enables farmers to stay liquid by providing them with nearly 100% loan-to-value (LTV) loans on most available assets instantly. This allows farmers to maintain a continuous flow of bids and liquidity.

One notable advantage of Blend is its ability to facilitate quick conversions of NFTs back into bidding power, bypassing the typical one-hour grace period for reselling. Farmers can swiftly convert their “filled” bids, which consist of unwanted NFT inventory, back into farming Blur points. This allows them to sustain an aggressive bidding strategy and maximize their points by keeping bids active almost around the clock.

However, this functionality inadvertently contributes to the accelerating cycle of “dumpers dumping into dumpers.” By leveraging Blend to shorten their NFT hold times and enhance farming efficiency, farmers amplify the dichotomy between themselves and genuine NFT buyers.

The ease of offloading NFTs into the pool of mercenary liquidity bidders through Blend means that genuine buyers are sidelined and unable to purchase the inventory. The continuous flow of NFTs being dumped back into the farming ecosystem diminishes the supply available to the genuine market. Consequently, NFT prices continue to decline as farmers consistently lower their bids by small increments to avoid getting filled.

During times of incentives, this dynamic creates a challenging environment for genuine NFT buyers, as the continual dumping and decreasing supply contribute to a downward price spiral. The heavy incentivization to dump NFTs quickly, coupled with the absence of listing points for Blend-enabled collections and the lack of royalties, further exacerbates this trend.

The inadvertent creation of two markets within Blur has significant implications for the NFT ecosystem. On one hand, there are the Blur farmers, driven by short-term profit motives and focused on maximizing Blur points through bidding and blending NFTs. On the other hand, there are genuine market participants who are interested in acquiring specific NFTs for their inherent value and appeal.

The unique nature of NFTs, as non-fungible assets, means that each piece carries its own distinct value and desirability. This leads to a situation where the two markets rarely interact with each other. Genuine buyers seeking specific NFTs find it challenging to purchase them from Blur farmers, who continuously dump their NFTs into the market through Blend. As a result, genuine buyers are left on the sidelines, unable to participate in the market as they would like.

This lack of interaction between the two markets exacerbates a critical problem: the depreciation of NFT values. Despite increasing demand from genuine buyers, the continuous dumping of NFTs by Blur farmers creates downward pressure on prices. This affects not only the floor prices but also the value of traits and unique attributes that often trade at multiples above the floor. The constant depressing of bids by farmers significantly decreases the demand for NFTs with above-floor traits as well.

Every trillion-dollar market opportunity relies on financialization to scale, and NFTs are no different. However, the rise of Blur as a prominent NFT marketplace has significant implications for the broader NFT space. While the emergence of a dedicated platform for pro traders is a positive development, it also raises concerns about potential negative consequences and impacts on other marketplaces and demographics.

One concern is the potential for zero-sum competition among marketplaces, where the success of one platform comes at the expense of others. This could lead to a concentration of power and resources in the hands of a few dominant platforms, eroding the decentralization and diversity of the NFT ecosystem. Blur’s criticism of OpenSea as a centralized antagonist highlights the need to strike a balance between marketplace dominance and decentralization.

Another critical issue is the impact on royalty rights for artists. As the NFT space evolves, the pressure on royalties dynamics has intensified, and platforms like Blur and OpenSea play a role in shaping this landscape. The accelerated race to the bottom in terms of royalties and the uncertain treatment of artists in terms of payouts can have detrimental effects on creators who are integral to the growth of the NFT ecosystem.

Blur was built on the principle that tokens would dominate the market of fungible assets while NFTs would dominate the trillion-dollar market of non-fungible assets. Right after launch, Blur secured more than 50% of the NFT marketplace market share, quickly surpassing OpenSea as the market leader. This, however, was largely driven by Blur’s native token airdrop in Q1 2023.

Blur stands out for offering features like the option to not pay royalties, the fastest NFT sweeps/snipes, and zero marketplace fees. The average price suggests that most high-value trades take place on Blur instead of OpenSea.

As of last October, OpenSea was the platform that had paid out the most royalties to creators by a wide margin, but a controversial November announcement from the company sparked what essentially amounted to Web3’s unionization movement. Beyond the royalties debate, it’s not hyperbole to say that almost nobody has been pleased with the platform’s stolen items policy, the marketplace’s reputation for not working well in times of high traffic, and its seemingly centralized approach to operating the business.

The launch of Blur offered professional traders exactly what they were looking for better liquidity conditions and price execution. This, combined with the expectation of Blur’s token airdrop, significantly increased the protocol’s market share.

However, OpenSea noticed the competition and this forced the company to launch OpenSea Pro. This came after making decisions such as dropping fees to 0% for a limited period of time or moving to optional creator earnings for all collections without on-chain enforcement in order to be able to retain its market dominance.

In fact, OpenSea did not manage to lead the industry in terms of royalties as much as it did in the past, especially when its volume was being siphoned off to other platforms. There have been periods of time where Blur’s incentivization schemes managed to pay out more royalties to creators than any other marketplace.

Moving forward, Blur needs to be careful in how it manages its user base and how it perceives its loyalty. It’s not the first NFT marketplace to entice pro traders with token farming. Hence, it would be a mistake for the platform to presume that the wallets driving its phenomenal rise right now will do anything but jump ship if another offers them a better financial incentive to do so. Even though Blur has effectively leaned into the pro-trader demographic through clever airdrop mechanisms, it’s likely to hold the interest of this demographic for some time, but the challenge will be drawing out loyalty in the long term.

Token markets in DeFi exploded with the introduction of stronger financial primitives, such as borrowing and lending. Blend aims to kickstart a similar wave of adoption for the NFT market.

As an example, instead of paying $1m for a house, buyers put $100k down and pay the rest through their mortgage. Without this mechanism, almost no one would be able to afford homes.

NFTs face a similar problem, where most buyers pay the full price of the NFT upfront. Many people may want to buy into a collection, but very few can afford to pay it all at once. The solution for that is NFT lending.

From a trader’s perspective, the fact that Blur is likely to incentivize loan offers is a huge benefit to borrowers and a huge hit to lenders. Blend’s design could trigger leveraged-fueled runs in NFTs due to the fact that borrowers can acquire more NFTs on credit using limited liquidity.

In order for NFT lending to scale, it needs to be intuitive for borrowers, and safe and flexible for lenders. One of the unique aspects of Blur is the ability for lenders to exit their positions at any time. And that puts borrowers at a disadvantage.

The absence of a fixed maturity for loans allows for refinancing through Dutch auctions, where other lenders can bid on loans offered to borrowers. During this auction process, the interest rate on the loan gradually increases until a new lender accepts the loan position. This approach enables borrowers to conveniently roll over their loan positions, provided they repay the loan within 24 hours after the auction, which lasts six hours.

The use of Dutch auctions helps to reduce costs for borrowers who might otherwise need to manually roll over their positions. But the complexity of the system compounded by the high likelihood of liquidation raises concerns. Continuous loans where borrowers can be liquidated anytime are less suitable for retail borrowers. In fact, the Dutch auction liquidation model is heavily dependent on the market being efficient for it to not be a rug-pull for borrowers, i.e. there are always lenders willing to bid on these auctions.

Critics argue that Blend’s design introduces an innovative mechanism that works in principle, but that incentivizes borrowers to take out highly leveraged loans that are inappropriate due to the nature of NFTs being accepted as collateral. This is evident by high LTVs and 0% APR loans, rather than organic loan activity.

Such apprehension arises from the fact that NFTs are characterized by illiquidity and volatility, rendering even marginal price movements capable of inducing colossal liquidations. More specifically, when combined with $BLUR incentives, these loan liquidations have the potential to flush NFTs into the hands of point farmers, and in consequence, may lead to much higher market volatility.

The reason for that is that point farmers are lenders trying to earn more airdrop points on the Blur marketplace in expectation of the platform’s next token distribution. These lenders are more likely to sell the NFTs to recover their funds loaned out to borrowers, thus leading to greater volatility in NFT prices. If unchanged, the current incentive design might lead to bad outcomes for borrowers, which would come in the form of mass loan defaults and cascading liquidations of risk loans.

Such a scenario has previously played out before, involving NFT lending protocol BendDAO. A bear market for NFTs in August 2022 saw BendDAO in danger of massive loan liquidations as borrowers on the protocol racked up significant bad debt. In that scenario, BendDAO had to pass emergency changes to its protocols to reduce the risk of loan defaults.

Blast is an Ethereum L2 with native yield for $ETH and stablecoins. By allowing yield to be earned on both $ETH and stablecoins, Blast gains an attractive edge over other L2 chains where funds remain sitting idle on a bridge. This is a model that will most likely be adopted by other new chains in the future. This can already be seen by new competitors such as Manta Network, which directly compares itself to Blast’s yields as a selling point. Another example is Aevo’s aeUSD, which uses trader’s collateral to earn yield.

The potential of any users and protocols funds being able to earn yield without having to go through a staking process, and without additional gas costs, is a huge factor towards potential adoption.

Blast also intends to be the L2 for NFT perps. NFT perps allows users to trade NFTs without requiring exposure to the NFT itself, much like how a normal perpetual works. This allows users to have exposure to NFTs without having to buy an entire NFT, which may be very costly. This also allows users to have fractionalized exposures to said NFTs.

Essentially, allowing wider market access to trading NFT, especially the most costly ones, allows prices to be better assessed and market volatility to be much more naturalized.

Blur’s marketplace and its incentivization system have led to the emergence of two types of liquidity: genuine liquidity and mercenary liquidity.

While mercenary liquidity may be easier to attract in the short term through high yields or incentives, genuine liquidity provides a more stable market environment. However, establishing genuine liquidity requires building a community of participants who believe in the asset’s long-term value and are willing to hold it. The presence of both genuine and mercenary liquidity in the market can have implications for price stability, volatility, and the overall health of the NFT ecosystem.

It is important for platforms like Blur to strike a balance between attracting short-term participants for liquidity and fostering a community of genuine participants who contribute to the asset’s long-term value. The reliance on mercenary liquidity alone can lead to price instability and a lack of confidence in the market, while genuine liquidity promotes a healthier and more sustainable ecosystem.

Being already a dominant player in the NFT marketplace and NFT lending vertical, Blur can further expand its operations and end up dominating in other product lines. Each of these new business lines could increase the overall protocol revenue. For instance, Blur could enable more NFT derivatives, such as NFT perps trading, trading of NFT index funds, an NFT launchpad, an NFT OTC desk, or provide NFT trading bots on Telegram or Discord.

Blur is available on the following chains:

Moving forward the Blur team has announced the launch of Blast, an Ethereum Layer 2 that will support perpetual futures trading for NFTs.

Market dynamics in both Blur and Blend can be influenced by the balance between makers and takers. A market with a healthy mix of both participants tends to exhibit greater stability, as the presence of makers helps absorb the impact of takers’ orders. On the other hand, a market dominated by takers can experience heightened volatility due to the rapid execution of market orders.

Blur’s business model revolves around the NFT ecosystem, although it does not have a revenue stream yet due to its 0% fee mechanics. This fee switch can be turned by token holders in order to start sharing revenue.

Blur enables users to trade NFTs on its marketplace, along with a whole slew of features to improve users’ experience. It was successful in obtaining TVL from OpenSea, which was the largest NFT marketplace previously.

Its token farming mechanics via user’s points in bidding, market making, etc has also helped it to dominate the NFT marketplace and gain mass user adoption, although how it will perform once the incentives are ended is to be determined.

Its other arms such as Blend (NFT lending) and Blast (NFT Perps) also enable further utility for NFTs, allowing users to loan and borrow funds or go long/short NFTs.

Blur aims to become a vertically integrated platform for all things NFT-related, offering an NFT marketplace, borrow-lending, and perps all-in-one platform.

Blur does not have a revenue source yet as it collects 0% of revenue and fees from the marketplace. All of the fees captured by the protocol are shared with liquidity providers (0% of the revenue is allocated to token holders)

The team has mentioned that fees reported in data analytic sites such as DefiLlama are most likely attributed to creator royalties.

There is, however, an ongoing proposal discussion that intends to turn on a 1% base fee for $BLUR token buyback and burn.

There are 4 options for Creators on Blur.

Option 1 – No Block

New collections without filters are maximally decentralized, but at the same time, they do not have the ability to block zero or optional royalty marketplaces. Blur enforces a minimum of 0.5% royalties (the seller can opt-in to higher royalties as well).

Option 2 – Block Blur

It’s important to note that the blocklist disables bidding on Blur, but does not disable trading/listing. For these collections, Blur enforces a minimum of 0.5% royalties. Blur bids provide floor support, increased volume, and royalty revenue for creators. Disabling bids does not improve a creator’s ability to earn royalties.

Option 3 – Block OpenSea

Blur prefers that creators should be able to earn royalties on all marketplaces that they whitelist, rather than being forced to choose. To encourage this, Blur enforces full royalties on collections that block trading on OpenSea.

This option will only be recommended until Option 4 becomes available. It’s important to note that Creators who implement the recommended option will be eligible to receive Season 2 rewards.

Option 4 – Don’t block either

Creators that whitelist both OpenSea and Blur should be able to earn royalties on both platforms. Today, OpenSea automatically sets royalties to optional when they detect trading on Blur.

Blur Bid Points reward traders who provide liquidity to the Blur marketplace. In each collection, the bids that take the highest “risk” earn the vast majority of points.

However, Blur also recognizes that potential exploits exist, such as traders’ front-running bids in order to cancel them. This happens when traders withdraw their bids whenever someone tries to accept them, which is done by monitoring the mempool and removing $ETH from their pool, or by ensuring their cancellation front runs the acceptance.

As described in the Buy Now Pay Later (BNPL) section above, BNPL allows you to buy an NFT using borrowed funds. Once you’ve borrowed funds using BNPL, or by borrowing directly using an NFT you already own, your borrow balance will start growing at an interest rate based on your loan terms.

Eventually, you may want to repay your borrow to take full ownership of the NFT. Or, you can sell your NFT and keep any profit remaining after your borrow balance is repaid as part of the sale.

In certain cases, you may be called on to repay or refinance your loan by your lender. This can happen at any time, but it will most likely happen if the floor price of your NFT collection has fallen.

When this happens, an automatic process will kick off to find a new lender for your loan at similar terms to your existing loan. If a new lender is not found within 6 hours, you’ll need to repay or refinance your loan within 24 hours (make sure you turn on email notifications to get this alert).

If you don’t want to repay your loan, you can also refinance your loan with a new lender. This process happens automatically based on the available loan offer, which you can see on the Loans tab of the collection page. If there are loan offers available, no action is required on your part to refinance your loan.

Example 1 – Loan called due to price decreasing

If you borrow 10 $ETH when the floor price is 12 $ETH, and then the floor price falls to 10.5 $ETH, the lender may call on your loan because the floor price is too close to the amount they loaned you.

Example 2 – Loan called due to price decreasing, partial payment

You borrowed 10 $ETH and the floor price fell to 10.5 $ETH. Your lender called your loan, so you repay 1 $ETH and extend your loan with a new, lower borrowed balance of 9 $ETH.

Example 3 – Loan called due to price decreasing, refinanced

You borrowed 10 $ETH and the floor price fell to 10.5 $ETH. Your lender called your loan. There is another loan offer from another lender available for 10 $ETH at an interest rate of 50%. Your loan will be automatically refinanced with this new loan offer.

Fees are controlled by $BLUR holders and can be turned on after 180 days.

Blur has a very trader-friendly fee structure and currently operates with 0% marketplace fees.

Blend has 0 fees for borrowers and blenders. This fee-free structure is intended to attract users and provide them with a cost-effective solution for accessing liquidity against their NFTs.

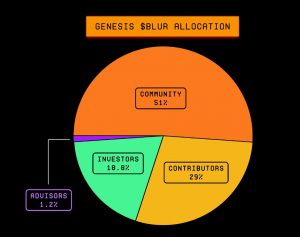

$BLUR is the ERC-20 token that provides token holders with voting power over the protocol.

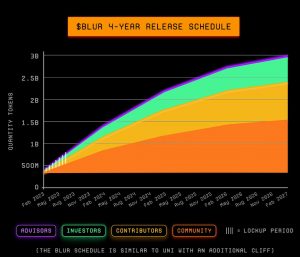

At Genesis, a total of 3 billion $BLUR tokens were minted and will become accessible over a period of 4 to 5 years.

The token airdrop serves as a mechanism to distribute $BLUR tokens to users and foster community engagement and participation in the Blur ecosystem. The distribution model works via a point system that rewards users for filling the liquidity pool orderbook. Each order is awarded a “risk” score which rewards higher bids & lower asks via airdrops. This mechanism incentivizes liquidity to fill Blur’s liquidity pool orderbooks.

Blur conducted an airdrop as part of their incentivization program after the completion of Season 1. During Season 1, users were eligible to receive “Care Packages” as rewards for their participation in providing liquidity and trading on the Blur platform. These Care Packages contained $BLUR tokens, the native token of the Blur ecosystem.

On February 14th, 2023, users were able to open their Care Packages and access the $BLUR tokens they received as part of the airdrop. The amount of tokens received varied based on the user’s activity and participation in the incentivization program. Some traders were fortunate enough to earn significant amounts, with reports of earnings reaching up to $3 million worth of $BLUR tokens.

This token airdrop contributed to the significant valuation of the Blur project, which launched with a valuation of $400 million.

Blur also has plans for another airdrop after Season 2

Blur Season 2 began in April 2023 and ended on November 21, 2023. A total of 300M+ $BLUR was allocated for the airdrop, with a focus on trader’s Points and Loyalty.

Season 2 had a huge impact on Blur, pushing it to become the #1 NFT marketplace protocol on Ethereum with $6.1B trading volume, 260k+ unique users, and 65% average market share. The launch of Blend also made Blur the #1 NFT lending protocol.

Points could be earned in 3 sub-categories, such as Bidding, Listing, and Lending points, with some collections getting more points than others. Additionally, a 24-hour rolling leaderboard granted different boosts for up to 2.5x for the top 100 point earners within the 24-hour period.

Loyalty was stated as the best way to get the most rewards in Season 2. At the end of the season, traders with 100% loyalty would have the highest chance of obtaining Mythical Care Packages, which were the equivalent of 100x Uncommon Care Packages.

The Blur team also implemented a recalculation of the Care Packages towards the end due to the previous wash trading filters alienating particularly active but legitimate traders.

Blur Season 3 was introduced on December 15, 2023, and began on November 21, 2023, and would end in May 2023, a total of 6 months.

It was stated to be angled towards traders placing bids on Blur and would be the final and largest Blur airdrop, to be around 1-2x the size of Season 2.

Season 3 is powered by Blast, a new L2 with native yield backed by Paradigm, Standard Crypto, and eGirl Capital. $REDACTED, from Blast, will be airdropped to the Blur community at the end of Season 3. 50% will be distributed to Blur community members based on their Blur Points and 50% based on their Holder Points.

Similar to Season 2, Blur points can be obtained via bidding, listing, and lending on Blur. In this season, however, holder points are introduced. Users can accumulate holder points by depositing $BLUR, earning points every hour based on the amount of $BLUR deposited.

A multiplier system is also implemented alongside the new holder point system, starting at 1x and increasing by 0.5x per month after the first deposit. Season 2 recipients will start at a 2x multiplier. The multiplier bonus will decrease proportionally to the amount of $BLUR withdrawn, with the lowest being 1x.

12% of the total $BLUR token supply, equivalent to 360,000,000 $BLUR tokens, can be immediately claimed by all NFT traders across any marketplace, historical users of Blur with Care Packages, and creators. This distribution period is scheduled from October 19, 2022, to February 14, 2023.

The remaining 39% of $BLUR tokens from the community treasury will be used for distributing to the community through contributor grants, community initiatives, and incentive programs. Out of this 39% allocation, 10% (300M $BLUR) has been allocated to the incentive budget for the next incentive release. If the entire incentive budget is utilized, more $BLUR tokens can be allocated through a governance vote.

| Year | Community Treasury | Distribution |

| Year 1 | 468,000,000 $BLUR | 40% |

| Year 2 | 351,000,000 $BLUR | 30% |

| Year 3 | 234,000,000 $BLUR | 20% |

| Year 4 | 117,000,000 $BLUR | 10% |

The vesting schedule for $BLUR tokens varies based on the specific allocations:

The vesting schedules are designed to ensure the responsible distribution of $BLUR tokens over time, aligning with the long-term goals and stability of the ecosystem.

The $BLUR token gives the community control over the DAO and allows the community to actively participate in governance. Voting is proportional to the amount of $BLUR tokens that a user owns or has delegated. These users have control over governance parameters that dictate the protocol’s value accrual and distribution.

To register their voting balance, users must delegate their token balance to a specific address, either their own or someone else’s. The governance process in Blur consists of several steps to ensure well-informed decisions and effective communication with the wider community.

Blur Improvement Proposals (BIPs) fall into three main categories: Core, Process, or Informational.

In addition, governance can perform various on-chain functions such as setting the governor timelock, timelock delay, quorum minimum, canceling timelock executions, setting the proposal threshold, voting period, and voting delay.

To streamline operations, certain activities of the Blur DAO are governed by committees. Over time, these committees work to transfer their functions to governance progressively. The committees in Blur include:

These committees play a crucial role in ensuring the smooth operation and effective governance of Blur. They work in collaboration with the broader community to make informed decisions and drive the growth and development of the protocol.

Despite Blend’s impressive market dominance, the practice of using NFTs as collateral for loans is not without its risks. While it is very attractive to be able to purchase NFTs without having the necessary funds upfront, many have already experienced the downsides of such practices. For example, when floor prices suddenly drop, those who have over-leveraged themselves using their NFTs as collateral must face margin calls. This creates a situation where lenders request additional collateral to compensate for the decreased value of the NFT but borrowers cannot provide the capital and end up being liquidated. A situation like this happened in 2022 with BendDAO when Bored Ape Yacht Club (BAYC) NFT prices dropped by 80% in six weeks.

The Blur team has completed the following audits:

Blur

Blend

Blur does not have a bug bounty program.

Blur was founded by @PacmanBlur. Pacman, whose real name is Tieshun Roquerre, doxxed himself voluntarily via an X thread on February 22, 2023.

Web2 me vs Web3 me

A thread 🧵 pic.twitter.com/9BKyNdan3x

— Pacman | Blur + Blast (@PacmanBlur) February 22, 2023

According to him, he had dropped out of high school at 17 to attend Y Combinator, an American technology startup accelerator and a very reputable program with low acceptance rates. He also studied Math with Computer Science at MIT (Massachusetts Institute of Technology). At that time he received the Thiel Fellowship to leave MIT and started Namebase, which was sold to Namecheap.

The Blur team also consists of members from across MIT, Citadel, Five Rings Capital, Twitch, Brex Square, and Y Combinator. However, there is no known information regarding these other members.

The Blur Foundation is the development and is operational team behind both the Blur marketplace and the Blend lending protocol. Regardless, the Foundation aims to facilitate community-led governance and participation in the DAO and assist contributors with the development and growth of the ecosystem.

Blend was developed in collaboration with Dan Robinson and Transmissions11 at Paradigm.

Blur:

Blast:

Why doesn’t Blur enforce full royalties on collections without filters?

When marketplaces try to enforce royalties on collections without filters, traders tend to shift to zero-royalty marketplaces. Sudoswap set a precedent for this when it launched in July 2022. Since then, new marketplaces have emerged with a zero royalty approach.

There is no on-chain filtering solution that can solve the royalty issue for existing collections.

Blur is working to maximize royalties for these collections by increasing minimum royalties while still remaining competitive in price. Maintaining price competitiveness is critical to prevent traders from shifting to marketplaces that do not enforce royalties.

Why does OpenSea set royalties to optional when Blur is whitelisted?

OpenSea benefits from having creators block Blur. Blur believes that this is not the primary motivation behind their policy. Instead, OpenSea might want to do the right thing for creators.OpenSea has primarily cited Blur’s policy on old collections without filters as the reason for why Blur should still be filtered by new collections.

How do Blur points work?

You earn points based on your wallet transaction history (year-to-date). When you invite others, you also get points based on their wallet transaction history (and anyone they invite).

Why do I need points?

Blur points determine your position on the leaderboard, which was originally used for airdrop allocation purposes.

How is the score calculated?

Your Blur score is calculated based on your wallet, the wallet of the 5 people you invited, and the wallet of who they invite too. If you have 0 points, it’s because you and those you invited have no transaction activity this past year.

How many airdrops were there?

There were 3 airdrops, with Airdrop 3 being the final one.

Airdrop 3 is for traders who place bids on Blur and will be the largest Blur airdrop (around 1-2x the size of Airdrop 2).

What is Blend on Blur?

Blend on Blur is a floating-rate, peer-to-peer perpetual lending platform for NFTs. It operates within the Blur NFT marketplace, enabling borrowers to access funds using their NFTs as collateral while retaining ownership.

How does Blend enhance NFT liquidity and accessibility?

Blend allows NFT owners to unlock the value of their illiquid assets by using them as collateral for loans. This feature enables them to access immediate liquidity while retaining ownership of their NFTs.

What sets Blend apart from traditional lending platforms?

Unlike traditional platforms, Blend operates without external oracles for price data and does not impose expiry dates on borrowing positions.

How are loan terms and interest rates determined on Blend?

Loan terms and interest rates are market-driven, reflecting supply and demand dynamics on the platform, ensuring competitive and mutually beneficial terms for transactions.

How do refinancing auctions work in Blend?

Refinancing auctions allow lenders to initiate a process to find a new lender at a revised rate. If unsuccessful, the borrower’s collateral is liquidated.

What happens if a borrower defaults on a loan?

If a refinancing auction fails to find a new lender, the borrower’s collateral is liquidated, and the lender assumes ownership of the NFT assets.

How does Blend handle the issue of fair pricing for NFTs?

Blend does not use price oracles. The responsibility for fair valuation lies with the borrowers and lenders, who negotiate terms directly.

What is the Buy Now, Pay Later (BNPL) feature in Blend?

BNPL allows users to buy NFTs upfront, borrowing the rest to be paid back later with interest. Users can repay to gain full ownership or sell the NFT and keep the profits.

What is the timeline for Blast?

Early access is ongoing. Mainnet launch is scheduled for February 2024, and Blast Point redemption is scheduled for May 2024.

What happens to assets deposited to Blast?

Your assets are locked in the contract until February 2024, while earning yield and Blast Points.

How can I gain exposure to Blast without locking up assets?

You can also stake $BLUR tokens in order to gain points for [REDACTED]. More information will be revealed by Blur.

Blur

Blast