Arbitrum

Overview

Arbitrum is a suite of Layer-2 scaling solutions for Ethereum, with two live and operational Layer-2 blockchains (Arbitrum One and Arbitrum Nova), Arbitrum Orbits, and the BOLD Protocol among other scalability solutions specialized in fostering the adoption of Ethereum L2 rollups.

Arbitrum One

Arbitrum One was introduced in 2018 as a cryptocurrency system designed to address the scalability and privacy limitations of previous systems like Ethereum. It enables smart contracts by allowing parties to create virtual machines (VMs) that execute contract functionality. The protocol incentivizes off-chain agreement on VM behavior through mechanism design, reducing the need for on-chain verification and offering scalability improvements. The system also supports the advancement of VM states on-chain for honest parties in case of off-chain disagreements.

Arbitrum contracts are designed to be managed by a set of verifiers, representing the underlying consensus mechanism. Participants are incentivized to follow the protocol’s rules, as verifiers only need to verify a few digital signatures for each contract if parties adhere to their incentives. Even if participants act counter to their incentives, the Arbitrum protocol efficiently handles disputes without extensively examining contract execution.

Arbitrum introduces the “any-trust” guarantee, enabling any honest manager to ensure that a contract behaves according to its code. Parties involved in a contract can serve as managers themselves or appoint trusted individuals to manage the contract on their behalf. The simplicity of the any-trust guarantee allows for efficient contract management.

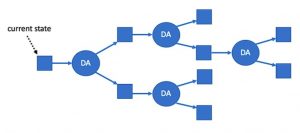

Instead of requiring every verifier to emulate the execution of every contract, Arbitrum relies on designated managers to manage a contract’s virtual machine (VM). Verifiers track only the hash of the VM’s state, reducing the cost for verifiers significantly. This design encourages managers to agree on VM behavior off-chain, and if unanimous agreement isn’t achieved, a bisection protocol is used to resolve disagreements efficiently.

Arbitrum is designed to work with various consensus mechanisms. While it assumes the existence of a consensus mechanism for publishing transactions, its design remains adaptable to different types of consensus, including centralized publishers, quorum-based consensus systems, or Nakamoto consensus as seen in Bitcoin.

The Arbitrum Protocol

Arbitrum employs a framework that enables the creation and operation of Virtual Machines (VMs) with diverse functionalities. VMs are software programs operating within the Arbitrum Virtual Machine Architecture. The protocol distinguishes between two primary actors: “keys” and “VMs.”

- Keys are identified by the cryptographic hash of their public key and can take action by signing them with the corresponding private key.

- VMs, on the other hand, execute actions by processing code.

- Both keys and VMs can possess currency, and the protocol tracks their respective currency holdings.

Creating a VM involves a specific transaction type that includes a cryptographic hash of the initial VM state and relevant parameters, such as challenge period duration, payment amounts, and a list of VM managers.

For each VM, the Verifier monitors the hashed state, currency holdings, and inbox hash. Changes to a VM’s state are enabled through assertions about its execution. These assertions specify executed instructions, resulting state hash, and actions taken (like payments), along with preconditions indicating the prior state, time bounds, balance, and inbox hash. The protocol dictates the conditions for accepting an assertion. Upon acceptance, the VM’s state is considered changed, and the stated actions are carried out.

Assertions come in two forms: unanimous and disputable.

- Unanimous assertions are signed by all VM managers and are accepted by miners if eligible. They are relatively straightforward to verify, incurring minimal transaction fees.

- Disputable assertions, however, are signed by only one manager and require an accompanying deposit. Such assertions are initially published as pending, and a challenge window is provided for other managers to contest the assertion. If no challenge arises during this interval, the assertion is accepted, and the VM’s state is updated. The asserting manager regains their deposit.

These mechanisms ensure the secure execution of VMs, even in cases where only one manager is involved or disputes arise, with a careful balance of incentives and safeguards.

System Roles

The Arbitrum protocol involves four distinct roles that play integral parts in its functioning:

| Role |

Description |

| Verifier |

The Verifier is responsible for verifying transaction legitimacy and publishing accepted transactions. It can be a central entity, a distributed multi-party consensus system (like a quorum system or a collection of miners using Nakamoto consensus), or even a smart contract on an existing cryptocurrency platform. |

| Key |

A Key represents a participant in the protocol with currency ownership and transaction proposal capabilities. Each Key is identified by a public key or its hash. It can propose transactions by digitally signing them using its private key. |

| VM (Virtual Machine) |

A VM is a virtual participant with defined behavior according to the Arbitrum Virtual Machine (AVM) Specification. VMs can own currency, conduct transactions, send/receive messages. They are created via a dedicated transaction type. |

| Manager of a VM |

Managers supervise a specific VM’s progress and functionality. Managers are designated during VM creation and identified by the hash of their public key. |

Lifecycle of a VM

The life cycle of an Arbitrum Virtual Machine (VM) involves distinct stages and interactions that ensure the VM’s integrity and execution.

- Creation of VM: An Arbitrum VM comes into existence through a dedicated transaction. This transaction includes critical details such as the initial state hash of the VM, a list of managers assigned to oversee the VM, and specific parameters. The initial state hash acts as a cryptographic commitment to the VM’s state, encapsulating its code and initial data. Multiple VMs can coexist simultaneously, often with different groups of managers.

- State Change by Managers: Once a VM is created, its assigned managers possess the authority to initiate changes in the VM’s state. The Arbitrum protocol guarantees that a single honest manager has the power to ensure that state changes align with the VM’s code and existing state, ensuring valid execution based on the Arbitrum Virtual Machine (AVM) Specification.

- Assertions and State Changes: Managers can assert the execution of specific actions that alter the VM’s state, provided certain conditions are met. These assertions predict how the VM’s state will evolve if specific prerequisites are satisfied. For an assertion to be eligible, specific criteria must be met, including the assertion’s preconditions, the VM not being in a halted state, and the assertion not overspending the VM’s funds. Assertions entail details like the new state hash and the actions performed by the VM, such as sending messages or currency.

- Unanimous and Disputable Assertions: Unanimous assertions are endorsed by all managers linked to the VM. If an eligible unanimous assertion is made, the Verifier swiftly acknowledges it as the new VM state. In contrast, disputable assertions are backed by a solitary manager who attaches a currency deposit to the assertion. If an eligible disputable assertion is made, it becomes pending. If the assertion remains unchallenged within a designated timeframe, it is accepted by the Verifier, and the asserter retrieves their deposit. If another manager challenges the assertion, a bisection protocol is triggered. This protocol determines which party is truthful. The one found to be dishonest forfeits their deposit.

- Advancing State and Halted State: The VM’s state evolves following the processes described earlier, and this continues until the VM reaches a halted state. At this stage, further changes to the state are impossible. Both the Verifier and managers can consider the VM’s lifecycle complete.

The Bisection Protocol

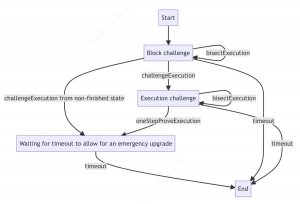

The Bisection Protocol within Arbitrum is a vital mechanism designed to resolve disputes arising from a manager’s disputable assertion and another manager’s challenge. The protocol ensures a fair and efficient process for determining the truthfulness of assertions within the system.

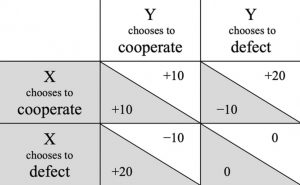

When a manager challenges an assertion, the challenging manager is required to deposit funds as a commitment. Subsequently, a game ensues between the asserter and the challenger, conducted via a public protocol to determine the incorrect party. The winner of the game recovers their deposited funds and claims half of the losing party’s deposit. The remaining half of the loser’s deposit is awarded to the Verifier as compensation for overseeing the game.

The game progresses through alternating steps. After a challenge is raised, the asserter is allotted a specific time window to bisect their preceding assertion. If the initial assertion encompassed N steps of VM execution, the two new assertions must involve bN/2c and dN/2e steps respectively, while collectively remaining equivalent to the original assertion. Failure to present a valid bisection within the stipulated time results in victory for the challenger. Once a valid bisection is offered, the challenger must challenge one of the new assertions within their designated time frame.

The two players – asserter and challenger – take turns making moves within the allotted time intervals; failure to make a move within the time limit results in a loss. Each move requires a small additional deposit, which contributes to the game’s stakes.

After a logarithmic sequence of bisections, the challenger will eventually challenge an assertion centered around a single step of execution. At this juncture, the asserter must provide a one-step proof. This proof establishes that, given the initial state and assuming the preconditions, executing a single instruction within the VM will lead to the intended final state and trigger any specified public actions. The Verifier verifies this one-step proof, sealing the game’s outcome.

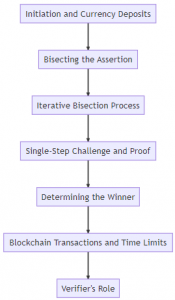

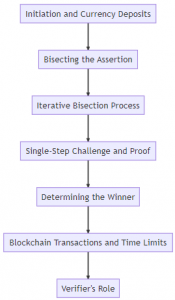

- Initiation and Currency Deposits: The Bisection Protocol is initiated when a manager makes a disputable assertion, and another manager challenges it. Both the asserter (the one who made the assertion) and the challenger place a currency deposit as part of this process.

- Bisecting the Assertion: In each step of the Bisection Protocol, the asserter divides the initial assertion into two separate assertions. Each of these new assertions involves half the number of steps of computation performed by the VM. The challenger then selects one of these halves to challenge.

- Iterative Bisection Process: The asserter and challenger continue this bisection process iteratively. They refine the assertion by halving its complexity with each step, allowing the dispute to be focused on a smaller and more specific aspect of the original assertion.

- Single-Step Challenge and Proof: The bisection process ultimately reaches a point where the assertion revolves around a single step of computation executed by the VM (e.g., the execution of one instruction). At this stage, if the challenger disputes the single-step assertion, the asserter must provide a one-step proof to the Verifier for validation.

- Determining the Winner: If the asserter successfully provides correct proof for the one-step assertion, they win the dispute. In case of failure, the challenger emerges victorious. The winning party retrieves their deposit and takes half of the loser’s deposit, with the other half going to the Verifier.

- Blockchain Transactions and Time Limits: The Bisection Protocol is executed through a series of blockchain transactions made by both the asserter and the challenger. Each party has a limited timeframe to make their next move within the protocol. Failure to meet deadlines results in the losing party’s disadvantage.

- Verifier’s Role: The Verifier’s role is to verify the validity of each move within the protocol. They check the facial validity of moves, ensuring that assertions are correctly bisected, and the resulting assertions align with the original one.

The Verifier’s Role

In the Arbitrum protocol, the Verifier plays a pivotal role in ensuring the validity of transactions and the smooth operation of the system. Its responsibilities include:

- Verification and Publication: The Verifier is a mechanism that verifies transactions and subsequently publishes verified transactions. This mechanism can take the form of a distributed protocol involving multiple participants. Its primary task is to verify the legitimacy of transactions and make them publicly accessible.

- Tracking VM Information: The Verifier maintains crucial information about each Virtual Machine (VM). This includes storing parameters like the list of VM managers, as well as three dynamic pieces of information that change over time:

- Hash of VM State: Represents a cryptographic commitment to the current state of the VM, which includes its code and data.

- Currency Amount: Tracks the amount of currency held by the VM.

- Hash of VM Inbox: Holds messages directed to the VM.

- State Advancement and Assertions: The state of a VM advances through the execution of its program. This progress is facilitated by the Verifier’s acceptance of assertions made by the VM’s managers. An assertion is a statement about the change in the VM’s state based on certain preconditions.

- Handling Challenged Assertions: If an assertion is challenged by another party, the Verifier does not accept it, even if the asserter eventually wins the challenge. Instead, the challenged assertion is considered “orphaned.” After the challenge concludes, the asserter has the option to resubmit the same assertion, although this would be unwise if the assertion is incorrect.

- Ensuring Correctness and Progress: The protocol is designed to empower a single honest manager to prevent incorrect assertions from being accepted by challenging them. Additionally, an honest manager can ensure VM progress by making disputable assertions. However, malicious managers can exploit a bisection protocol loophole to delay progress temporarily at the cost of half of their deposit.

Key Assumptions and Tradeoffs

The design of the protocol involves a set of key assumptions and tradeoffs that shape its functionality and effectiveness. These assumptions and tradeoffs contribute to the protocol’s security, efficiency, and overall feasibility.

- VM Initialization and Stake: Arbitrum enables the creator of a VM to define its code, initial data, and managers. The Verifier ensures that a VM can spend currency only if it was previously sent to it. Therefore, parties who are unfamiliar with a VM’s state or disapprove of its attributes can safely disregard it.

- Parties are expected to engage with and trust VMs that were correctly initialized and have a stake in their proper execution.

- The protocol accommodates the creation of obscure or unfair VMs, with other parties having the freedom to ignore them.

- Trustworthy managers are key to ensuring proper VM behavior.

- Trust and Managers: Trust in a VM’s managers is pivotal. A party can trust a manager by becoming a manager themselves. A mature Arbitrum ecosystem is anticipated to feature “manager-as-a-service” entities, incentivized to maintain reputations for honesty and potentially assuming legal responsibilities for manager duties.

- Time Window Assumption: Arbitrum assumes that managers can send challenges or responses to the Verifier within specified time windows, akin to getting transactions included in a blockchain. While common in blockchain contexts, it is a crucial assumption that can be addressed by extending challenge intervals, a configurable parameter for each VM.

- Denial of Service Attacks: Denial of service (DoS) attacks against honest managers are addressed through several factors:

- Uncertainty of Prevention: If a DoS attacker can’t ensure prevention of honest manager challenges, but only reduce challenge probability, the risk of penalty might deter false assertions, especially if deposit amounts increase.

- Replication for Availability: Managers can improve availability using replication, including undercover replicas that attackers aren’t aware of.

- Stalling VM Progress: A malicious manager can stall a VM by continually challenging assertions. However, the attacker loses at least half of each deposit and delays the VM only for one bisection protocol run. It’s assumed that substantial deposit amounts will discourage this attack strategy.

The design aims to strike a balance between enabling flexibility, ensuring proper behavior, and mitigating potential vulnerabilities.

Design Benefits

- Scalability: One of the most prominent features of Arbitrum is its scalability. Managers can continuously execute a virtual machine without incurring substantial transaction fees. These fees are not only minimal but remain independent of the complexity of the executed code. In an optimal scenario where participants act in line with incentives, disputes are rare. However, even in the event of a dispute, Arbitrum’s Verifier can efficiently resolve it with minimal impact on honest parties, while imposing significant costs on dishonest actors.

- Privacy: Arbitrum’s design is well-suited for private smart contracts. Unless a dispute arises, the internal state of a virtual machine remains hidden from the Verifier. Even during disputes, only a single step of the machine’s execution is revealed to the Verifier, maintaining the majority of the machine’s state in obscurity. In fact, the protocol’s privacy attributes are a direct outcome of its model. Unlike systems aiming for “global correctness,” Arbitrum’s Verifier does not need to execute a VM’s code, eliminating the necessity to expose the code and state for public verification. This contrast with other systems like Ethereum, which require public code and state for verification, showcases Arbitrum’s privacy advantages.

- Flexibility: Arbitrum introduces flexibility through unanimous assertions. Managers possess the ability to reset a machine to any desired state and take actions, even if these actions are invalid according to the machine’s code. However, unanimous agreement among managers is crucial for such actions. This flexibility allows for diverse scenarios, such as restoring a machine to a functional state after a software bug or winding down a machine’s operations. The presence of honest managers ensures that such actions align with the overall system’s integrity.

VM Architecture

The Arbitrum Virtual Machine (AVM) is designed to facilitate efficient verification of one-step proofs and to enable the creation and execution of Virtual Machines with bounded space and time complexities.

VM Types and Values

- The AVM employs a type system that includes various data types such as null, booleans, characters, 64-bit integers, 64-bit floating-point numbers, byte arrays (up to 32 bytes), and tuples.

- Tuples are a fundamental type that can hold up to eight Arbitrum values, including other tuples recursively, allowing for complex tree data structures.

- All values are immutable, and the system computes the hash of each tuple when created, allowing for constant-time computation of value hashes.

VM State

- The VM state is organized hierarchically, which enables incremental updates and efficient computation of the state hash using Merkle Tree structures.

- The state includes elements such as an instruction stack, a data stack for values, a call stack for procedure call information, a static constant for immutable data, and a mutable register that holds a single value.

- The state is organized such that instructions can only modify items near the root of the state tree, ensuring efficient updates and verification.

Instructions and Control Flow

- The AVM uses a stack-based architecture for its instructions.

- Instructions include manipulating the top of the stack, arithmetic, and logic operations, type conversions, hashing values, computing subsequences of byte arrays, and concatenating byte arrays.

- Control flow instructions include conditional jumps, procedure calls, and returns.

- Tuple-related instructions involve creating new tuples, reading slots from tuples, and copying tuples while modifying slot values.

Instruction Stack

- Instead of a traditional program counter, the AVM uses an “instruction stack” that holds instructions for the program’s remainder.

- Instructions are popped from the stack for execution, and certain instructions, like jumps and procedure calls, modify the instruction stack.

- This approach ensures constant space usage and allows for constant-time verification of instruction and instruction stack values.

Assembler and Loader

- The Arbitrum assembler translates programs written in the Arbitrum assembly language into executable files.

- The assembler offers syntactic sugar for control structures, supports library file inclusion, and provides convenience features for programming.

Standard Library

- The standard library contains essential facilities written in Arbitrum assembly code.

- It includes data structures like vectors and key-value stores, memory space abstractions, time handling, and message management.

Interacting With Other VMs or Keys

- VMs interact by sending and receiving messages.

- Messages contain values, currency amounts, and sender/receiver identities.

- The send instruction is used to send messages, and the inbox instruction copies the VM’s message inbox to the stack.

Preconditions, Assertions, and One-Step Proofs

- An assertion is a claim about a VM’s execution interval and includes preconditions.

- Precondition elements include the VM’s state before execution, inbox hash, lower bound on currency balance, and lower/upper bounds on time.

- An assertion contains the VM’s state after execution, the number of instructions executed, and the emitted messages.

- A one-step proof is a correctness proof for an assertion covering a single instruction, assuming a set of preconditions.

- The proof expands needed parts of the state tree for verification, enabling the Verifier to emulate the instruction’s execution.

- One-step proofs require providing values consistent with hash values, facilitating constant-time verification.

Messages and Inbox

- Messages can be sent to a VM through message delivery transactions or the send instruction.

- Messages include data, currency, and sender/receiver identities.

- Each VM has an inbox tracked by the Verifier, and messages can be appended to it.

- The inbox instruction pushes the inbox’s state onto the VM’s stack.

- VM managers track the inbox state, and Verifiers only track inbox hashes for efficient verification.

Extensions

Extensions demonstrate how Arbitrum’s design can be adapted and enhanced to accommodate various scenarios and requirements, such as off-chain communication, improved privacy, and direct blockchain reading.

Off-Chain Communication

While Arbitrum significantly increases computation capacity within existing cost structures, communication between VM managers and the VM itself often relies on on-chain interactions. Off-chain progress involves using state-channel and sidechain techniques to enable managers to communicate with VMs and advance their state off-chain.

Zero-Knowledge One-Step Proofs

Despite its privacy advantages, there is a scenario where a small privacy leak might occur during the submission of one-step proofs. Managers providing a proof reveal a portion of the state as part of the proof. To enhance privacy, extensions could implement one-step proofs using zero-knowledge protocols like Bulletproofs.

This involves encoding a one-step VM transition as an arithmetic circuit and proving the validity of the transition. While Bulletproofs offer benefits by not requiring a trusted setup, they may lead to linear verification time in the circuit size. However, for one-step transitions, this is expected to be manageable due to their small size and infrequent occurrence.

Blockchain Reading

The original Arbitrum VM design does not allow VMs to directly read the blockchain. For Arbitrum to be launched as a public blockchain, an extension is added to the VM instruction set to enable direct blockchain reading.

This involves encoding blocks as Arbitrum tuples, where one field of the tuple contains the representation of the previous block, allowing a VM to read earlier blocks. The precondition of an assertion would specify a recent block height, and a VM instruction pushes the associated block tuple onto the stack.

The Verifier only needs to track the hash of each block’s tuple to verify this instruction’s one-step proof. As a result, reading the blockchain does not require loading large amounts of data onto a VM’s data stack. Instead, it involves putting the top-level tuple of the specified block on the stack, allowing for lazy expansion when needed.

Arbitrum Nitro

Arbitrum Nitro is a second-generation Layer 2 blockchain protocol designed to enhance throughput, finality speed, and dispute resolution efficiency compared to previous rollup solutions. The protocol implements various design principles to achieve these properties. To achieve that, Arbitrum Nitro supports the execution of smart contracts, operating as a “Layer 2” solution built on top of the Ethereum network. It maintains compatibility with Ethereum by running smart contract applications through the Ethereum Virtual Machine (EVM) and providing a familiar API.

As an optimistic rollup, the protocol relies on the safety and liveness of the underlying Ethereum chain, as well as on the assumption of honest participation by at least one Nitro protocol participant. The protocol’s optimistic nature emphasizes efficient execution when participants act in line with their incentives.

Nitro has been deployed on the Arbitrum One chain since August 31, 2022.

Design Approach

Nitro’s design focuses on four distinctive features that organize its architecture and functionality:

- Sequencing Followed by Deterministic Execution: Nitro processes transactions in two main stages to ensure consistent and predictable outcomes.

- The first stage involves arranging transactions in the order they will be executed and then committing to this sequence.

- The second stage applies a deterministic state transition function to each transaction, one after the other.

- Geth at the Core: Nitro leverages code from the open-source go-ethereum (Geth) package, which is a widely used Ethereum execution layer node software. By integrating Geth’s core execution and state maintenance functions as a library, Nitro ensures compatibility with Ethereum’s existing infrastructure.

- Separate Execution from Proving: This dual-target approach optimizes execution speed and ensures that the code used for proving is structured and machine-independent.

- Nitro’s state transition function code is compiled for two different targets. One version is compiled for native execution within a Nitro node during regular operations.

- The same code is also compiled into portable WebAssembly (wasm) code, which is used for the fraud-proof protocol.

- Optimistic Rollup with Interactive Fraud Proofs:

- Nitro builds upon the optimistic roll-up concept introduced in the original Arbitrum design.

- It employs an improved optimistic roll-up protocol that incorporates an optimized dissection-based interactive fraud-proof protocol.

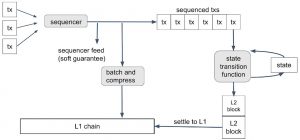

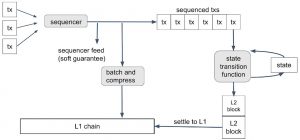

Sequencing Followed by Deterministic Execution

The concept of “sequencing followed by deterministic execution” in Nitro refers to the two-step process of handling submitted transactions within the system. This approach ensures that transactions are processed in an orderly manner and that their execution outcomes are predictable and consistent.

- The first phase involves a component known as the “Sequencer.” This component is responsible for organizing the submitted transactions into a specific order or sequence.

- The Sequencer arranges the transactions in the order they will be processed, essentially creating a queue of transactions.

- Once the transactions are arranged in the desired order, the Sequencer commits to this order. This commitment helps ensure the integrity of the chosen sequence.

- Deterministic State Transition Function:

- In the second phase, the transactions are processed one by one in the sequence established by the Sequencer.

- A deterministic state transition function, which defines how the system’s state evolves based on the execution of transactions, is applied to each transaction.

- The deterministic nature of this function means that given the same initial state and the same transaction, the outcome will always be the same. This ensures that the state transitions are predictable and consistent across all nodes in the network.

The Sequencer

In Nitro, the Sequencer plays a critical role in ordering incoming transactions honestly, based on a first-come, first-served policy. While the Sequencer’s task is central to the system’s operation, it is important to note that its role is limited and specific.

- Ordering Transactions Honestly: The primary responsibility of the Sequencer is to arrange incoming transactions in the order they are received. This is achieved by following a first-come, first-served policy, where the earliest submitted transaction is placed first in the sequence, followed by subsequent transactions in the order they arrive.

- Trust and Future Plans: Currently, the Sequencer is operated by Offchain Labs, and it is considered a centralized component. However, there are plans to transition to a committee-based sequencing protocol in the future. This approach aims to distribute the responsibility of sequencing among multiple participants, enhancing decentralization and reducing reliance on a single entity.

- Limited Authority: The Sequencer’s authority is limited to ordering transactions. It does not possess the power to prevent the overall progress of the Nitro chain, nor does it have the ability to prevent the inclusion of any specific transaction. Its role is solely to establish the order in which transactions are processed.

- Transaction Ordering Publication: The Sequencer makes the transaction ordering information available to the public through two methods:

- Real-Time Feed: The Sequencer publishes a real-time feed of the transaction sequence. This feed represents the Sequencer’s commitment to recording transactions in a specific order. Parties can subscribe to this feed to monitor the sequence.

- Ethereum Calldata: The Sequencer also posts the transaction sequence as Ethereum calldata. It compiles a batch of consecutive transactions, compresses them using a compression algorithm, and sends the compressed result to the Nitro chain’s Inbox contract on the Ethereum Layer 1 (L1) chain.

- Finality and Authoritativeness: Batches of transactions sent to the Nitro chain’s Inbox contract represent the final and authoritative transaction ordering. Once the transaction sent by the Sequencer to the Inbox achieves finality on the Ethereum Layer 1 chain, the transaction sequence on the Nitro chain is considered finalized.

The Sequencer and Censorship Resistance

The Sequencer in the Arbitrum ecosystem plays a pivotal role in processing and ordering transactions on the layer 2 network. While the Sequencer operates with certain security assumptions, it is essential to maintain censorship resistance and trustless security within the Arbitrum Rollup protocol, even in the presence of a malfunctioning or malicious Sequencer.

The core Inbox, represented by the sequencerInboxAccs byte array in the Bridge contract, is central to the transaction processing in Arbitrum. Transactions included in the core Inbox have fixed ordering, deterministic execution, and trustless finality (see “Transaction Lifecycle”). The role of the Sequencer revolves around how transactions enter this core Inbox, while subsequent stages ensure the security and reliability of transactions.

- Happy/Common Case – Sequencer Is Live and Well-behaved: In this scenario, when a user initiates a transaction, they can either send the signed transaction directly to the Sequencer via an RPC request or submit an L1 transaction to the Sequencer on the underlying layer 1. Upon receiving the transaction, the Sequencer executes it and promptly provides the user with a transaction receipt. The Sequencer then includes the transaction in a batch and posts it on layer 1, confirming its finality.

- Unhappy/Uncommon Case – Sequencer Isn’t Doing Its Job: If the Sequencer is unresponsive or malicious, a user can ensure their transaction’s inclusion in the core Inbox through the following steps:

- The user submits their L2 message via an L1 transaction into the delayed Inbox (represented by delayedInboxAccs in the Bridge contract).

- After a certain time delay (currently around 24 hours), the user can use the forceInclusion method in the SequencerInbox contract. This method allows any account to move a message from the delayed Inbox to the core Inbox, effectively finalizing the transaction.

While the force inclusion path introduces uncertainty in transaction ordering during the waiting period, it guarantees eventual inclusion in the core Inbox, ensuring trustless security. Although the force inclusion route is slow and considered an “unhappy” path, its availability ensures that Arbitrum Rollup maintains censorship resistance and security even in scenarios where the Sequencer is uncooperative.

The Delayed Inbox

The “Delayed Inbox” is a feature within the Nitro system that serves as an alternative method for submitting transactions to the Nitro chain. While most user transactions are submitted directly to the Sequencer and included in its batches, the Delayed Inbox offers a way to submit transactions for specific purposes.

- Purpose and Use Cases: The Delayed Inbox serves two main purposes:

- Transactions from L1 Ethereum Contracts: The Delayed Inbox allows transactions to be submitted by Layer 1 (L1) Ethereum contracts. These contracts are unable to generate the digital signatures required for direct submission through the Sequencer.

- Backup Submission Method: The Delayed Inbox also acts as a backup method for transaction submission. If the Sequencer begins censoring valid transactions, the Delayed Inbox provides an alternative channel to ensure transaction inclusion.

- Adding Transactions to the Delayed Inbox: Transactions are added to the Delayed Inbox by invoking a specific method on the Nitro chain’s inbox contracts. These contracts maintain a queue of transactions that are timestamped.

- Sequencer Inclusion: The Sequencer has the ability to include the first message from the delayed inbox queue in its transaction sequence. An honest Sequencer does this after a short delay to ensure that the arrival of the message in the delayed inbox is not invalidated by a potential reorganization of the L1 chain. This delay is typically set to a duration that would prevent such issues, often around 10 minutes.

- Forced Inclusion: If a message has been in the delayed inbox for a period exceeding a certain threshold (usually 24 hours), any participant can force the inclusion of that message as the next transaction in the chain’s inbox. This ensures that the message will be executed without relying solely on the Sequencer’s actions.

- Preventing Censorship: The concept of forced inclusion serves as a safeguard against censorship by the Sequencer. By allowing any participant to trigger the inclusion of a message that has been delayed for an extended period, censorship attempts by the Sequencer can be mitigated.

- Malicious Sequencer or Downtime: The need for forced inclusion typically arises in situations where the Sequencer behaves maliciously by censoring transactions or is experiencing prolonged downtime. In such cases, participants can take action to ensure that important transactions are included in the chain.

Deterministic Execution

After transactions have been ordered by the Sequencer, they move into the execution phase of Nitro, where they are processed by the chain’s State Transition Function (STF).

The STF takes two main inputs:

- The current state of the chain (represented by the root hash of an Ethereum state tree). This state encapsulates the current state of all accounts, smart contracts, and data on the chain.

- Incoming messages (transactions).

In terms of execution, the STF is designed to be fully deterministic. This means that executing the STF on a given transaction will produce the same result every time, as long as the input state and the transaction remain the same. The execution process of the STF emulates the state changes that occur due to the transaction’s execution. It calculates how the transaction affects the account balances, contract storage, and other aspects of the state.

The STF then produces two key outputs:

- An updated state: The STF produces an updated state, which reflects the changes that occurred due to the execution of the incoming transaction. This updated state is used as the basis for processing subsequent transactions.

- A new block header that is compatible with Ethereum. This block header includes relevant information about the state changes that occurred due to the transaction.

The deterministic nature of the STF ensures that the outcome of executing a transaction depends only on the transaction’s data and the state before the transaction was executed. This means that the result of a transaction can be calculated using the genesis state of the Nitro chain, the sequence of transactions leading up to the current one, and the transaction itself. The history and state of the chain can be determined without the need for communication or consensus among nodes because it is solely dependent on the visible transaction sequence.

While Nitro ensures determinism and maintains its own execution state, it also interacts with the Layer 1 (L1) Ethereum chain using a rollup sub-protocol. This sub-protocol confirms and records the results of transactions to the L1 Ethereum chain. However, it’s important to note that this sub-protocol does not decide the outcome of transactions but rather confirms the results that were already known to honest participants in the Nitro protocol.

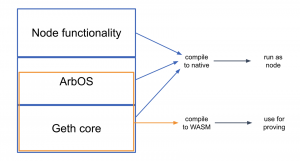

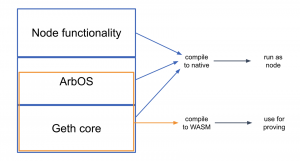

Software Architecture

The software architecture of Nitro is built upon the concept of “geth at the core,” referring to the integration of the go-ethereum (geth) software, which is widely used as the execution layer node software for Ethereum. Nitro’s architecture is organized into three main layers, each serving distinct functions:

- Base Layer – Geth Core: The foundation of Nitro’s architecture incorporates the core functionality of go-ethereum (geth). This includes components responsible for emulating the execution of Ethereum Virtual Machine (EVM) contracts and maintaining the data structures that constitute the Ethereum state. Nitro integrates this code by compiling it as a library, with some minor adaptations to add essential hooks.

- Middle Layer – ArbOS: The middle layer, known as ArbOS, is custom software designed to provide additional features associated with Layer 2 functionality. This layer handles tasks such as decompressing and parsing the data batches produced by the Sequencer, accounting for Layer 1 gas costs, collecting fees to reimburse for gas costs, and supporting functionalities related to cross-chain bridges. For instance, ArbOS facilitates the deposit of Ether and tokens from Layer 1 (L1) to Nitro and the withdrawal of these assets back to L1.

- Top Layer – Node Software: The top layer primarily consists of node software, largely derived from geth. This layer manages connections and incoming Remote Procedure Call (RPC) requests from clients. It also provides other high-level functionalities necessary for operating a blockchain node compatible with Ethereum. This includes handling communication with clients and executing various network-related tasks.

The overall architecture is often referred to as a “geth sandwich” due to the interweaving of the geth components at the bottom and top layers of the architecture, with the custom ArbOS layer situated in the middle. This structure leverages the proven capabilities of geth while enhancing its functionality to suit Nitro’s requirements.

The State Transition Function (STF), which forms a crucial part of Nitro’s operation, spans the lower geth layer and a portion of the middle ArbOS layer.

ArbOS

ArbOS is a custom software layer within the Nitro architecture that serves as a crucial component for managing the operations and functionalities of a Layer 2 (L2) blockchain. ArbOS is responsible for implementing various features responsible for ensuring efficient bookkeeping, cross-chain communication, and L2-specific fee tracking and collection.

- Bookkeeping Functions: ArbOS facilitates the maintenance of accurate and up-to-date records of transactions, states, and other data relevant to the operation of the Layer 2 chain. This bookkeeping ensures the integrity and consistency of the blockchain’s state transitions and transaction history.

- Cross-Chain Communication: One of the important aspects of Layer 2 chains is their ability to interact with the Layer 1 (L1) Ethereum blockchain. ArbOS handles cross-chain communication, enabling the exchange of information, assets, and data between the Layer 2 chain and the L1 Ethereum blockchain.

- L2-Specific Fee Tracking and Collection: As a Layer 2 solution, Nitro aims to optimize and reduce transaction fees compared to on-chain transactions. ArbOS is responsible for tracking and collecting fees that are specific to the Layer 2 environment. These fees may be used to cover the cost of executing transactions on the Layer 2 chain and compensating participants for their role in the network.

By including ArbOS functionality in the STF, Nitro ensures that the execution of transactions takes into account Layer 2-specific operations and requirements.

In the context of the Layer 2 Nitro chain, all the state is stored using Ethereum’s Merkle Patricia state trie data structure. This encompasses the state of ArbOS, which can be modified as part of the State Transition Function (STF).

ArbOS utilizes Ethereum’s storage slots in a specialized Ethereum account with an undisclosed private key. The selection of these specific slots is driven by several objectives:

- Single Ethereum Account for ArbOS State: All the state information of ArbOS is kept within the storage of a single Ethereum account. This helps in centralizing and managing ArbOS’s state-related data efficiently.

- Independent Sub-Components: To avoid data collisions and conflicts, sub-components within ArbOS are allowed to manage their respective states independently.

- Maintaining Locality: To ensure efficient data retrieval and storage, reasonable locality is maintained within each sub-component.

- Future Extensibility: The chosen structure doesn’t hinder the incorporation of future additions to the state.

The Nitro chain’s state representation adheres to a hierarchical structure composed of nested “spaces.” Each space is a mapping from a 256-bit index to a 256-bit value. All values within these spaces are initially set to zero. This hierarchical structure is mapped onto a single flat key-value store, which serves as the storage for the specialized Ethereum contract.

Each space is associated with a key. The key of the root space is designated as zero. For a subspace named “n” within a space with the key “k”, the key used to access it is calculated using Ethereum’s Keccak256 hash function: H(k||n).

Within a space keyed by “k,” the item with index “i” is stored at location H'(k||i) in the underlying flat storage. Here, H’ represents a locality-preserving hash function. Specifically, H'(x) takes the hash of all but the last 8 bits of “x,” truncates the result to 248 bits, and then appends the last 8 bits of “x.” This approach ensures that groups of 256 indices are kept contiguous by the hash function, thus maintaining the integrity of data even as it’s stored and retrieved.

The use of this locality-preserving hash function contributes to reducing the cost of state access and storage, especially when Ethereum adopts a state representation that rewards data contiguity in the future.

Cross-chain Interaction

- Outbox: The Outbox in Nitro is a way to enable Layer 2 (L2) to Layer 1 (L1) contract calls. When an L1 contract wants to interact with Nitro, it creates a message on the L2. This message is like a “ticket” that gets redeemed on L1. The ticket contains information about the L2 sender, the L1 destination, and data for the call. The L1 execution only happens after the message’s dispute period passes and its Rollup Block is confirmed.

- Inbox: The Inbox is managed by L1 Ethereum contracts and records messages sent to a Nitro chain. There are two parts: the main Inbox and the Delayed Inbox.

- The main Inbox receives messages from the Sequencer and merges them with messages from the Delayed Inbox.

- The Delayed Inbox is for L1 contracts to submit messages to Nitro and provides an alternative to the Sequencer, ensuring messages are not lost even if the Sequencer misbehaves.

- Retryable Tickets: Retryable Tickets allow Layer 1 transactions to be designated as retryable, meaning if they fail, a ticket is created for the transaction. This ticket can be redeemed later by providing gas funds for a retry. This is useful for cases where Layer 1 contracts need to ensure that a deposit transaction runs on Layer 2. The submitter pays a fee, which is refunded if the transaction succeeds, or used to cover costs if a retryable ticket is made.

- Token Bridge: Nitro’s cross-chain messaging allows for the creation of a Token Bridge, an application for transferring assets between Ethereum and Nitro. It enables depositing and withdrawing tokens between the chains. When tokens are deposited, they’re minted on L2, and when withdrawn, they’re burned on L2 and released on L1. A Token Bridge contract handles these operations. Different types of token bridge features are possible, including bridging non-fungible tokens, atomic swaps, and bridging custom tokens.

Gas and Fees

Nitro handles gas fees in a way that’s similar to other blockchains. It collects fees from transactions to cover operational costs and incentivize proper resource usage.

Gas Fees on Nitro

- Nitro charges fees in NitroGas, which is the Layer 2 gas unit specific to Nitro chains. Ethereum’s Layer 1 gas unit is referred to as L1Gas.

- Each EVM instruction costs the same in terms of NitroGas and L1Gas.

- Transactions on Nitro specify a gas limit, which is the maximum NitroGas they can use. Transactions also indicate a maximum base fee they’re willing to pay.

- The transaction’s actual NitroGas usage cannot exceed the product of its gas limit and maximum base fee.

- The transaction’s sender authorizes a deduction from their $ETH account for gas costs, up to a certain limit.

- This approach maintains a familiar user experience for developers and users using standard tools and wallets.

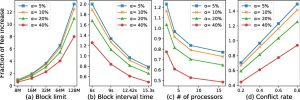

L2 Gas Metering and Pricing

- Nitro tracks NitroGas usage and adjusts the base fee accordingly to balance demand and capacity.

- Nitro’s basefee adjustment algorithm operates at one-second granularity, as opposed to Ethereum’s one-block adjustment.

- A chain’s speed limit reflects its sustainable capacity. NitroGas usage can temporarily exceed the speed limit but must average within the limit over time.

- Nitro uses a backlog parameter to track usage relative to the speed limit.

- The base fee calculation formula ensures the backlog remains bounded and the system remains balanced.

- Nitro’s base fee growth helps keep the backlog in check, even in high-demand scenarios.

L1 Gas Metering and Pricing

- Transactions also use Layer 1 resources on Ethereum, which are charged in NitroGas. However, these charges are not considered in the backlog since they don’t consume Nitro chain resources.

- The Sequencer, responsible for submitting Ethereum transactions to post data batches, incurs L1 costs.

- Nitro approximates how transactions contribute to the compressibility of batches to distribute costs among transactions.

- Data pricing adapts to minimize the difference between collected data fees and Sequencer’s data costs, avoiding sudden fluctuations.

- The pricer algorithm tracks owed amounts, reimbursement funds, recent data units, and L1 data unit prices.

- The pricer algorithm adaptively adjusts the price based on surplus, equilibration, and smoothing parameters.

Compiling for Execution Versus Proving

In the design of a practical roll-up system like Nitro, a key challenge is finding a balance between optimizing regular execution performance and ensuring reliable results for proving purposes. Nitro addresses this challenge by utilizing the same source code for both execution and proving, but compiling it into different forms for each scenario.

Compiling for Execution

- When preparing the Nitro node software for regular execution, the conventional Go compiler is employed.

- This process generates native code that is specific to the architecture of the target deployment environment.

- The node software is distributed in source code format, and also as a Docker image containing the compiled binary.

- The goal of this compilation is to ensure efficient and high-performance execution of the Nitro node software.

Compiling for Proving

- The section of the code responsible for the State Transition Function (STF) is separately compiled by the Go compiler into WebAssembly (wasm).

- WebAssembly is a typed and portable machine code format that is used for its reliability and portability in the context of proofs.

- The wasm code then undergoes a straightforward transformation to a format referred to as WAVM.

- In the event of a dispute over the accurate outcome of executing the STF, an interactive fraud-proof protocol is employed, referencing the WAVM code for resolution.

WAVM

The wasm (WebAssembly) format possesses several advantageous characteristics that make it suitable for facilitating fraud proofs. It is portable, structured, well-defined, designed for secure execution of untrusted code, and comes with robust tooling and support. However, to fully serve its purpose, wasm requires specific adjustments. Nitro introduces a modified version of wasm known as WAVM (WebAssembly for Verifiability), achieved through a straightforward transformation process that takes wasm code from the compiler and adapts it for proving purposes.

WAVM differs from wasm in three primary ways:

- Removal of Unnecessary Features:

- Certain features of wasm that are not generated by the Go compiler are eliminated in WAVM.

- During the transformation stage, a check ensures that these irrelevant features are absent.

- Feature Restriction:

- Specific features in wasm are restricted in WAVM. For instance, WAVM omits floating-point instructions.

- In cases where floating-point instructions are present in the original wasm code, the transformer replaces them with calls to the Berkeley SoftFloat library.

- Nested control flow structures in wasm are flattened in WAVM, simplifying them to jumps without nesting.

- Instructions in wasm that have variable execution times are transformed into constructs that employ fixed-cost instructions in WAVM, streamlining the proving process.

- Additional Opcodes for Blockchain Interaction:

- WAVM introduces new opcodes that allow the WAVM code to interact with the blockchain environment.

- These additional instructions enable WAVM to read and write the blockchain’s global state, access messages from the chain’s inbox, and signal the successful conclusion of the execution of the State Transition Function.

Within WAVM, there’s a capability that enables the virtual machine to combine multiple wasm binaries, referred to as modules. Each module retains its own distinct code, globals, and memory.

- Isolated Modules:

- Each module operates independently with its own code and memory space.

- Modules can be implemented in different programming languages or have diverse functionalities.

- Inter-Module Communication:

- The modules can communicate with each other through a dedicated WAVM instruction called CrossModuleCall.

- This instruction allows one module to invoke functions or code within another module.

- The called module can access and modify the memory of the calling module, facilitating the exchange of data between modules.

- Practical Example:

- In the context of Nitro, the State Transition Function (STF) written in Go, the bootloader written in Rust, and libraries written in C can all coexist and operate within the same WAVM machine.

- Without the module system, potential memory management conflicts between different programming languages could arise.

- However, by using the module system, these components can maintain separate and isolated memory spaces, avoiding interference.

WAVM custom opcodes not available in WASM

WAVM floating point implementation

WAVM modules

Optimistic Rollup Protocol

The optimistic roll-up protocol implemented in Nitro is the method by which the L2 (Layer 2) chain’s states and associated data are confirmed on the L1 (Layer 1) Ethereum chain. This protocol is designed to allow L2 transactions to be processed with a high degree of efficiency while maintaining the security and integrity of the system.

- The roll-up protocol involves the creation of Rollup Blocks (RBlocks), which are distinct from L2 blocks and encapsulate sequences of L2 blocks.

- RBlocks are created less frequently compared to L2 blocks, resulting in a much lower number of RBlocks.

- An RBlock contains key information, including the L2 block number, header hash for the corresponding L2 block, the number of incoming messages processed, a digest of outbox messages, a pointer to a predecessor RBlock, and additional necessary data.

An RBlock is considered valid if it meets certain criteria. This validity can be achieved through confirmation by the protocol.

- Correct execution of the L2 chain based on the RBlock’s L2 block number, header hash, number of incoming messages, and digest of message output.

- Absence of any older sibling RBlocks that are invalid.

- Validity of the RBlock’s predecessor.

A valid chain of RBlocks is formed over time, with confirmed RBlocks constituting the initial section of this chain. Any party can stake on a specific RBlock, asserting its validity and the validity of its predecessor and the chain of predecessors back to the genesis RBlock.

The protocol’s design ensures that the RBlock chain remains a single chain, and the set of valid RBlocks constitutes a prefix of this chain. By staking on an RBlock, a party asserts not only the validity of that RBlock but also the validity of the entire chain leading back to the genesis RBlock.

In Nitro, the optimistic roll-up system operates in a way that encourages parties to only stake on valid RBlocks, ensuring the security and reliability of the system. Honest parties, which always make valid claims, are guaranteed to win challenges.

Honest parties engage in challenges against parties with differing claims, ultimately eliminating the parties with false claims.

As false claims are eliminated, the overall protocol can make progress and maintain the integrity of the RBlock chain.

The Base Case

- Parties are incentivized to stake only on valid RBlocks due to the potential loss of their stake if they stake on an invalid one.

- Valid RBlocks, which have been confirmed, form a continuous chain that extends from the confirmed RBlocks.

Challenge Mechanisms

- If two parties stake on different successors of the same RBlock, a challenge is initiated to resolve the disagreement.

- The challenge aims to determine the validity of the RBlock claimed by each party and identify any false claims.

- The challenge sub-protocol ensures that a party with a valid claim can always win a challenge by presenting valid evidence at each stage of the challenge.

Challenge Resolution

- The party that loses the challenge has its stake removed from all RBlocks.

- Half of the losing party’s stake is given to the winning party, and the other half is added to a public goods fund.

- This mechanism incentivizes parties to only stake on valid RBlocks and penalizes those making false claims.

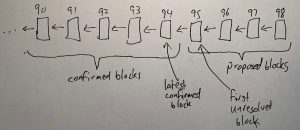

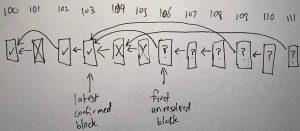

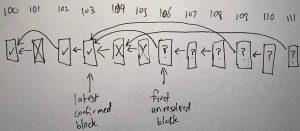

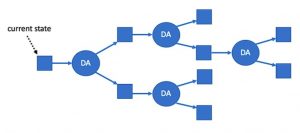

The image below shows an example of what the chain state looks like if several validators are being malicious.

- RBlock 100 has been confirmed.

- RBlock 101 claimed to be a correct successor to RBlock 100, but 101 was rejected (hence the X drawn in it).

- RBlock 102 was eventually confirmed as the correct successor to 100.

- RBlock 103 was confirmed and is now the latest confirmed RBlock.

- RBlock 104 was proposed as a successor to RBlock 103, and 105 was proposed as a successor to 104. 104 was rejected as incorrect, and as a consequence 105 was rejected because its predecessor was rejected.

- RBlock 106 is unresolved. It claims to be a correct successor to RBlock 103 but the protocol hasn’t yet decided whether to confirm or reject it. It is the first unresolved RBlock.

- RBlocks 107 and 108 claim to chain from 106. They are also unresolved. If 106 is rejected, they will be automatically rejected too.

- RBlock 109 disagrees with RBlock 106, because they both claim the same predecessor. At least one of them will eventually be rejected, but the protocol hasn’t yet resolved them.

- RBlock 110 claims to follow 109. It is unresolved. If 109 is rejected, 110 will be automatically rejected too.

- RBlock 111 claims to follow 104. 111 will inevitably be rejected because its predecessor has already been rejected. But it hasn’t been rejected yet, because the protocol resolves RBlocks in RBlock number order, so the protocol will have to resolve 106 through 110, in order, before it can resolve 111. After 110 has been resolved, 111 can be rejected immediately.

Staking

Staking ensures the integrity and security of the network. Similar to PoS networks, validators referred to as stakers deposit funds to participate in the validation process and maintain the accuracy of the chain.

- Stakers deposit funds that are held in the Arbitrum Layer 1 contracts.

- A single stake can cover a sequence of RBlocks, representing a coherent claim about the correct history of the chain.

- Each staker is staked on the latest confirmed RBlock, and they can also stake on one successor RBlock of their currently staked RBlock.

This arrangement ensures that validators are invested in the validity of the RBlocks they participate in, as they have something to lose if a block is rejected.

To create a new RBlock, a validator must already be staked on the predecessor RBlock. This requirement ensures that block creators have a stake at risk, incentivizing them to propose valid and accurate RBlocks.

If a validator is staked on an RBlock, they can add their stake to any one successor RBlock of that Block. Note that this process does not require placing a new stake; the validator’s existing stake is extended to cover the successor RBlock.

- If a staker is only staked on the latest confirmed RBlock (and possibly earlier RBlocks), they can request to have their stake refunded.

- Refunding the stake involves returning the staked funds and ending their staker status.

- If a staker loses a challenge, their stake is removed from all RBlocks, and they forfeit the staked funds.

- This provides an incentive for stakers to ensure their claims and contributions are valid and secure.

- The current minimum stake amount is typically the base stake amount, a parameter of the Nitro chain.

- In cases where RBlocks are not being confirmed quickly, the minimum stake amount temporarily increases to discourage malicious parties from attempting to delay progress

- The escalation is exponential and based on the time since the deadline of the first unresolved RBlock passed. This prevents delay attacks by increasing the cost of false stakes.

Rules for Confirming and Rejecting RBlocks

- The first unresolved RBlock can be confirmed if certain conditions are met, including staker presence and adherence to the sequence of confirmed RBlocks.

- The first unresolved RBlock can be rejected if the predecessor RBlock has been rejected or if specific criteria, such as staker presence, are not met.

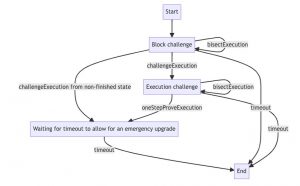

Challenges

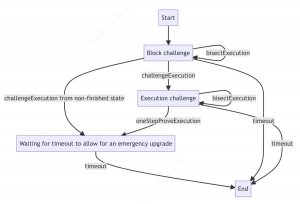

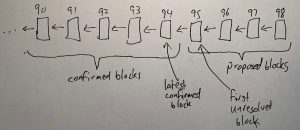

Assuming the rollup chain shown below:

RBlocks 93 and 95 are siblings (they both have 92 as predecessor). Alice is staked on 93 and Bob is staked on 95.

Since we can see that Alice and Bob have conflicting claims about the correctness of RBlock 93, a challenge can be initiated to determine the accurate state of affairs. Alice believes RBlock 93 is correct, while Bob asserts it’s incorrect due to his stake in RBlock 95 (which implies that RBlock 93 must be wrong if RBlock 92 is the last correct block).

- When two stakers are staked on sibling RBlocks (blocks that share the same parent), and neither is already in an active challenge, anyone can initiate a challenge between them.

- The Nitro roll-up protocol will handle and referee the challenge, ultimately deciding a winner and confiscating the losing party’s stake. The loser will then be removed as a staker.

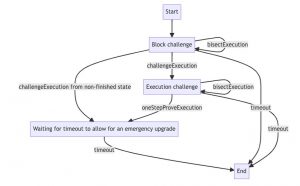

The challenge process operates in two phases: dissection and one-step proof. In the dissection phase, the dispute is gradually narrowed down until it becomes a disagreement about a single execution instruction. This is achieved through a back-and-forth game played by Alice and Bob, with an Ethereum contract acting as the referee. Alice, the defender, makes the first move.

By systematically dissecting the claims and executing a challenge game, Nitro can reach a resolution and maintain the integrity of the network. The winner’s claim is validated, while the losing staker’s stake is confiscated, discouraging false claims and enhancing the overall trustworthiness of the blockchain.

- Alice’s correct claim:

- If Alice’s initial claim is correct, she can offer a truthful midpoint claim, which would have two half-size claims, both of which will also be correct.

- At each stage, Alice defends a correct claim, leading to her having a correct one-step claim at the end of the protocol. This claim can be proven, allowing Alice to win the challenge.

- Bob’s corrective claim:

- If Alice’s initial claim is incorrect, her claimed endpoint after N steps is incorrect.

- When Alice offers her midpoint state claim, it can be either correct or incorrect.

- If Alice’s midpoint claim is incorrect, Bob can challenge her first-half claim, which will also be incorrect.

- If Alice’s midpoint state claim is correct, her second-half claim must be incorrect. Therefore, Bob can challenge that claim.

- At each stage, Bob identifies an incorrect half-size claim to challenge, leading to a sequence of challenges on incorrect claims.

- At the end, Alice has an incorrect one-step claim, and she cannot prove it, allowing Bob to win the challenge.

The dissection protocol begins with dissection over Layer 2 blocks, narrowing the dispute down to a single Layer 2 Nitro block. It then further dissects down to a single execution of the State Transition Function.

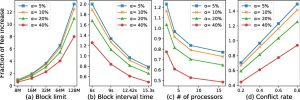

Instead of dividing the claim into two segments of size N/2, the K-way dissection divides it into K segments of size N/K. This reduces the number of rounds significantly. The protocol also handles cases where the AVM might halt or wait due to an exhausted inbox. Additionally, time limits are introduced for each player to ensure the game progresses and concludes in a reasonable timeframe.

Validators

Validators are nodes that actively participate in the rollup protocol and help advance the state of the chain. Offchain Labs provides open-source validator software to facilitate this process, but validators have the flexibility to choose their own strategies. There are three common validator strategies:

- Active Validator Strategy: Active validators propose new RBlocks and actively participate in the rollup protocol.

- They are always staked because creating an RBlock requires being staked.

- Generally, a chain only needs one honest active validator to efficiently function.

- Offchain Labs, for example, runs an active validator for the Arbitrum One chain.

- Defensive Validator Strategy: Defensive validators monitor the roll-up protocol and intervene if an incorrect RBlock is proposed.

- They do not stake when things are going well, but they stake or post a correct RBlock if someone attempts to propose an incorrect one.

- This strategy defends the correct outcome in case of dishonest behavior.

- Watchtower Validator Strategy: Watchtower validators do not stake but act as observers.

- They raise the alarm if they detect an incorrect RBlock being proposed.

- This strategy assumes that other staked validators will intervene to challenge incorrect behavior.

Under normal conditions, defensive and watchtower validators mainly observe the network. This creates uncertainty for malicious actors, as they won’t know the number of defensive and watchtower validators operating in incognito. Some validators might announce themselves, while others remain hidden, making it challenging for attackers to predict the response.

Validators can be motivated by various factors:

- Financial Incentives:

- Some validators are paid by the chain creators or other parties. Funds from user transaction fees can be used to compensate validators.

- Validators can earn rewards for their participation and contribution to the network’s security.

- Protecting Investments:

- Parties with significant assets at stake on the chain, such as dApp developers, exchanges, and liquidity providers, may choose to validate to safeguard their investments.

- Personal Interest:

- Individuals who are power users, early adopters, or simply value the security and integrity of the network might choose to validate.

Full Nodes

Full nodes in Arbitrum serve a similar role to full nodes in Ethereum. They are responsible for maintaining the state of the Arbitrum chain and providing an interface for users and applications to interact with the chain.

- Maintaining State: Full nodes keep track of the current state of the Arbitrum chain. This includes information about account balances, smart contract states, transaction history, and more.

- Inbox Messages: Full nodes receive and process inbox messages generated by the rollup protocol. These inbox messages are used to advance the state of the Layer 2 chain. Full nodes focus on the Layer 2 processing without directly participating in the rollup protocol itself.

- API Access: Full nodes expose an API that allows external applications, users, and other nodes to interact with the Arbitrum chain. This API enables developers to retrieve information from the chain, submit transactions, query contract states, and more.

The Sequencer

The Sequencer helps provide faster confirmation times for transactions and enhances the user experience by allowing immediate result guarantees.

The Role of the Sequencer

- Immediate Confirmation: The Sequencer is a specially designated full node that has the power to control the ordering of transactions within the Arbitrum chain’s inbox. This control allows the Sequencer to guarantee the results of user transactions without waiting for Ethereum’s block confirmations.

- Transaction Ordering: By influencing the ordering of transactions, the Sequencer ensures that users receive instant confirmation of their transactions’ results. This is in contrast to the uncertainty that arises from not knowing the exact order of transactions submitted by different users.

- API Interaction: Clients interact with the Sequencer in the same way they interact with any full node. Wallet software can be configured to use the network URL pointing to the Sequencer, enabling users to seamlessly enjoy the benefits of immediate confirmation.

Inboxes and Transaction Ordering

- Sequencer’s Control: Only the Sequencer can directly add new messages to the main inbox. It tags these messages with Ethereum block numbers and timestamps. This control over ordering gives the Sequencer more influence over determining the results of transactions.

- Delayed Inbox: Messages submitted by non-Sequencer nodes are placed in the “delayed inbox” queue. These messages wait until the Sequencer releases them into the main inbox. A well-behaved Sequencer typically releases these messages after about ten minutes.

- Prompt Release: A well-behaved Sequencer minimizes delay for non-Sequencer transactions by releasing delayed messages promptly. This ensures that messages waiting in the delayed inbox can achieve finality relatively quickly.

Tradeoffs and Trust

- Trade-off with Finality: The presence of the Sequencer introduces a trade-off between transaction finality and delay. Transactions that use the Sequencer experience faster finality, while those going through the delayed inbox have slightly slower finality due to the two-step process.

- Trust in Sequencer: Trust is essential when using a centralized Sequencer like the one currently operated by Offchain Labs. Users must trust that the Sequencer will behave correctly and fairly.

Decentralized Fair Sequencing

- Long-Term Solution: The goal is to transition from a centralized Sequencer to a decentralized and fair sequencing mechanism. This would involve a committee of nodes working together to achieve transaction ordering that is both decentralized and trustworthy.

- Research and Development: Research conducted by Cornell Tech, including Offchain Labs’ CEO, has developed algorithms for decentralized fair sequencing. These concepts form the basis for the longer-term solution, which aims to ensure transaction ordering integrity without relying on a centralized entity.

Bridging

Bridging involves asynchronous cross-chain calls. These calls are used for contract-to-contract interactions between the L1 and the L2, allowing transactions to be submitted on one chain and that will be executed on the other chain.

L1 Contracts Submitting L2 Transactions

- Direct L2 Transaction Submission: An L1 contract can submit an L2 transaction by calling the Nitro chain’s inbox contract on Ethereum. This triggers an L2 transaction that will execute later. However, the L1 caller won’t be able to see the results of this L2 transaction.

- Advantages and Disadvantages: This method is relatively simple and low-latency. However, the L2 transaction may revert if the L1 caller doesn’t provide the correct L2 gas price and maximum gas amount. Since the L1 caller can’t see the L2 transaction’s result, it can’t be certain of its success.

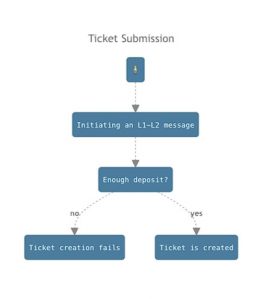

- Alternative Ticket-Based System: An alternative method is to use a ticket-based system for L1-to-L2 calls. In this approach, an L1 contract submits a “retryable” transaction. If the L2 transaction fails, a “ticketID” is created, representing the failed transaction. Later, anyone can redeem this ticket and re-execute the transaction on L2.

- Retrying Failed Transactions: When a ticket is redeemed, the saved transaction is re-executed on L2 with the original sender, destination, call value, and calldata. If the redemption succeeds, the ticket is canceled; if it fails, the ticket remains available for redemption.

L2 Contracts Submitting L1 Transactions

- L2-to-L1 Calls: L2 contracts can call a method in the precompiled ArbSys contract, which triggers an L1 transaction. Once the execution of the L2 transaction containing the submission is confirmed on L1, a ticket is generated in the L1 outbox contract.

- Ticket-Based Redemption: Any user can trigger the ticket by calling a specific L1 outbox method and submitting the ticketID. If the L1 transaction doesn’t revert, the ticket is marked as redeemed.

- Lifetime of Tickets: L2-to-L1 tickets have an unlimited lifetime until they’re successfully redeemed. They don’t require rent and are recorded in Ethereum storage.

L1 to L2 Messaging

Arbitrum uses retryable ticks for L1 to L2 messaging. This is a mechanism for creating cross-chain messages and ensuring the atomicity of the operations between the L1 and the L2.

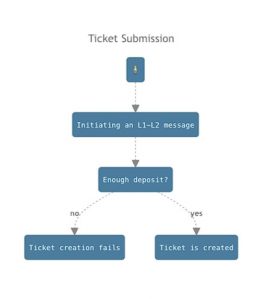

1. Submission: Users initiate the creation of a retryable ticket by calling the createRetryableTicket function of the inbox contract on L1.

- Parameters need to be set carefully, including destination L2 address, L2 call value, maximum submission cost, gas limit, and more.

- The user’s deposit must cover the L1 submission and L2 execution costs.

- If successful, a new ticket with a unique TicketID is created on L2, and funds are deducted from the user and placed into escrow.

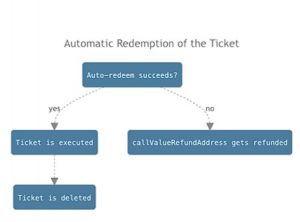

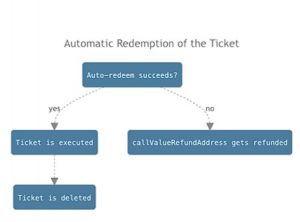

2. Automatic Redemption: If conditions are met (user’s L2 balance and gas price), the ticket is automatically redeemed on L2, executing the L2 message.

- If successful, the submission fee is refunded to the user, and the ticket is deleted from the retryable buffer.

- If unsuccessful, the submission fee remains in escrow for a future redemption attempt.

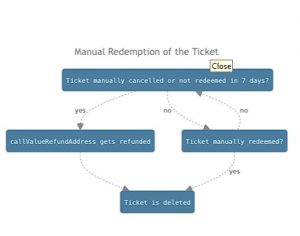

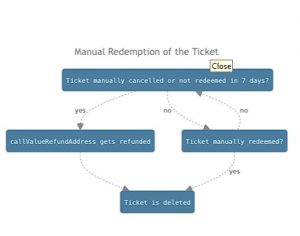

3. Manual Redemption: If the automatic redemption fails, anyone can manually redeem the ticket by calling the redeem precompile method.

- Redeem attempts are scheduled to be executed as soon as possible on L2, ensuring eventual redemption.

- If a ticket is not redeemed within a fixed period (one week), it expires and is automatically discarded unless renewed.

- Funds in the escrowed call value are paid out to the callValueRefundAddress specified during ticket submission.

- Redeeming the cost of a ticket doesn’t increase over time; it depends on the current gas price and required gas for execution.

At the end of the lifecycle, Two types of L2 transaction receipts are emitted:

- Ticket Creation Receipt: Indicates successful creation of a ticket, with a TicketCreated event containing the TicketID.

- Redeem Attempt Receipt: Represents the result of an attempted L2 execution of a ticket (success/failure), with a RedeemScheduled event and TicketID.

L2 to L1 Messaging

Contract calls can also be initiated on the L2 for execution on the L1.

From the protocol perspective:

- An L2-to-L1 message is part of the L2 state in an Arbitrum chain.

- Upon the confirmation of an RBlock (typically about 1 week after its assertion), the Merkle root of all L2-to-L1 messages in that RBlock is posted on L1 in the Outbox contract.

- The Outbox contract enables users to execute their L2-to-L1 messages by validating Merkle proofs of inclusion and tracking spent messages.

From the client perspective:

- To initiate an L2-to-L1 message, a client calls the L2 ArbSys precompile contract’s sendTxToL1 method.

- After inclusion in an assertion (typically within an hour) and assertion confirmation (typically about 1 week), any client can execute the message.

- Clients retrieve proof data through the Arbitrum chain’s “virtual” NodeInterface contract’s constructOutboxProof method.

- The returned data is used in the Outbox’s executeTransaction method to perform the L1 execution.

This design ensures that the overhead for confirming nodes remains constant and that they only update the constant-sized outgoing message root hash. Unlike Retryables, L2-to-L1 messages can’t provide in-protocol automatic L1 execution due to Ethereum’s lack of scheduled execution affordances.

- A week-long delay before executing outgoing messages is inherent to the nature of Arbitrum Rollup and Optimistic Rollup L2 solutions.

- It allows time for Arbitrum validators to detect and prove faults before Ethereum accepts the results.

- This delay ensures the protocol’s security by providing a window for detecting and handling any issues.

Lifecycle of an Arbitrum Transaction

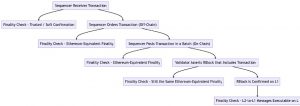

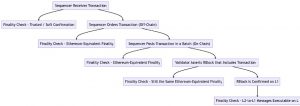

- Sequencer Receives Transaction: The transaction lifecycle begins with the Sequencer, responsible for ordering transactions and receiving a transaction from a client. Transactions can be received either directly from the client or from layer 1 via the Delayed Inbox.

- Finality Check – Trusted / Soft Confirmation: At this point, the client relies on the Sequencer’s soft confirmation, assuming a degree of trust in the Sequencer’s transaction processing.

- Sequencer Orders Transaction (Off-Chain): The Sequencer orders the transaction in its off-chain Inbox and executes it using the Arbitrum Nitro VM. It provides the client with an instant transaction receipt.

- Finality Check – Ethereum-Equivalent Finality: The client’s transaction’s finality is now equivalent to a regular Ethereum transaction, provided there’s at least one well-behaved active Arbitrum validator.

- Sequencer Posts Transaction in a Batch (On-Chain): The Sequencer posts a batch of transactions, including the client’s transaction, to layer 1 as calldata. The Sequencer typically posts batches every few minutes.

- Finality Check – Ethereum-Equivalent Finality: The client can treat their transaction’s finality as equivalent to an ordinary Ethereum transaction since the batch is posted on layer 1, ensuring security and reliability.