Ankr is a Web3 infrastructure company that offers a set of different products, such as liquid staking, appchain services, RPC endpoints, and developer APIs and SDKs.

The goal of the Ankr Network is to become the gateway through which developers and protocols connect to the node infrastructure and development tools they need in order to build secure, scalable, and decentralized applications.

Ankr aims to enhance the adoption of Web3 technology by offering a platform where users can easily deploy nodes or interact with PoS chains in order to stake their PoS tokens or access their respective DeFi applications.

In theory, anyone can run a node and support the ecosystem of any given blockchain. However, the economic and time costs, as well as the necessary expertise and skills, make it difficult for the average user to set up their own nodes. Ankr aims to solve this pain point with its suite of blockchain products and infrastructure tools:

Whether developers wish to build a dApp or deploy a new layer one blockchain, Ankr can offer the infrastructure to make it happen. Its product suite aims for developers to not have to worry about the management and overhead of spinning up and maintaining the underlying infrastructure when building their products.

The functioning of the Ankr Network relies on dependable and high-quality node providers who handle RPC requests for supported blockchains. To ensure the reliability of the system, each node provider is required to have a significant deposit of $ANKR tokens, including their own self-stake.

Furthermore, token holders have the opportunity to express their support for specific node providers on the Ankr Network by staking $ANKR tokens to back those providers’ nodes. By delegating their $ANKR tokens, community members actively participate in evaluating the reputation and performance of service providers. In return, $ANKR token stakers receive a share of the rewards earned by the node providers they support.

$ANKR staking also grants delegators the ability to allocate voting power to node providers. This power allows them to contribute to decisions such as determining which independent node providers will be admitted in the near future to handle traffic on the Ankr Network.

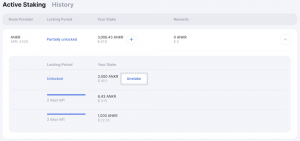

Unlike Liquid Staking, tokens that have been delegated are not liquid and no actions can be performed until the end of the lock period. While staked, delegated tokens earn a yield. There are currently 2 tokens that can be delegated on Ankr, which include:

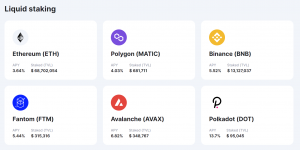

Liquid Staking offers a solution to the issue of liquidity being locked up when staking assets in PoS networks.

While staking rewards in these networks can provide a stable and reliable income stream, typically you have to wait until the staking period concludes to access your rewards.

Liquid Staking addresses this problem by introducing Liquid Staking Tokens (LSTs), which provide immediate liquidity for staked assets. These tokens represent the value of your staked assets and can be easily transferred, accessed, and utilized in various ways across DeFi. This newfound liquidity allows for greater flexibility and the ability to leverage your staked assets in different applications and transactions.

Liquid staking is currently available on the following platforms:

A unique feature of Ankr is offering developers the ability to spin up a dedicated appchain for their dApp. With crypto evolving and more users transacting on-chain as opposed to through a centralized exchange, the competition for blockspace has increased significantly.

Appchains are blockchains that provide exclusive services to developers for building their custom dApps. In the process of building on top of their own application-specific chain, Ankr will provide their expertise in supporting the development, launch, and operation of the chain.

This service provides developers with an easy plug-and-play tool to build their dApps efficiently, providing scalability without competition from other projects causing traffic and increased gas fees. It also offers customization features for developers by allowing them to make decisions on what consensus mechanism, development framework, or programming language to use. This allows teams to determine what their own fine-tuned balance between speed and security is.

AppChains are especially useful for developers who:

Starting an AppChain requires 6 main technical features, which are:

Ankr’s AppChain program provides developers multiple choices for these components for the self-sufficient builders, or with instructions and support provided for the newer developers. Ankr also provides access to its Exchange-Readiness program, which supports developers who are interested in applying for token listings on major exchanges with Ankr’s industry experience.

AppChains on Microsoft Azure provides enterprises and developers with a comprehensive solution for building, scaling, and achieving widespread adoption for their Web3 initiatives. The platform offers a dedicated blockchain environment, facilitating the seamless launch of blockchain nodes and their connection while Ankr’s team provides complete maintenance and support for the blockchain nodes on Microsoft Azure, ensuring a smooth and hassle-free experience for users.

Ankr currently offers three package plans for enterprises:

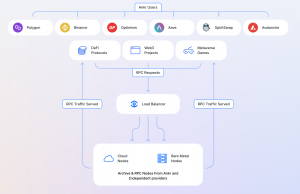

Ankr’s blockchain RPCs enable users to connect to Ankr’s distributed network of full nodes. These RPCs act as gateways that enable crypto wallets, dApps, DEXs, NFT platforms, and open-source software to communicate with on-chain data and perform tasks such as retrieving balances, and executing transactions.

Think of RPCs as portals that facilitate connections with different blockchain networks like Ethereum, the BNB Chain, or Avalanche. They provide the necessary infrastructure for developers and users to interface with these networks and leverage their functionalities.

Apart from development use cases, many users of Web3 wallets, including popular ones like MetaMask, utilize Ankr’s RPC endpoints to customize their connections. By doing so, they can enhance privacy, avoid data and address collection, and maintain greater control over their wallet interactions.

The platform has the following functionality to offer:

Node operators in Ankr’s network must stake 100,000 ANKR to their node and actively maintain the node to avoid slashing penalties similar to validator penalties on Ethereum. Maintaining the node means ensuring the node is synced, updating the node as network upgrades come out, and any other general maintenance.

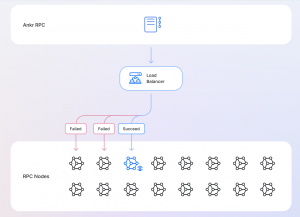

Node operators on the network are indexed and RPC request traffic is assigned through a load balancer. The load balancer takes into account the node health, the geographic location and node’s workload to determine which node is best suited to handle any given RPC request.

Nodes that are not synced with the current state of the chain, geographically distanced from the user, or overloaded with requests from other users would not be selected. In its current state, the centralized nature of the load balancer is an area where Ankr can improve on its quest to decentralize.

This decision-making process is carried out by a load-balancing algorithm that uses a scoring system to determine the best possible node . The load balancer scores nodes on a scale of 1-10 based on how synced they are with the blockchain. If the node is a few blocks behind or does not respond to the block height queries, traffic will not be routed through it.

There is a failover mechanism in place to ensure that all requests are served rapidly. If a request reaches a node that experiences an outage or an error, the load balancer will automatically re-route the request to another node.

Every failover response will depend on the error, and depending on what type of error occurs, the request will either be sent to another node or be nullified (if there is missing transaction information – such as an unknown block hash or block does not exist).

A monitoring system observes the performance of all nodes with very high regularity and will disconnect nodes that are not in a performant state.

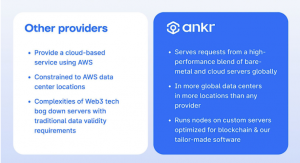

Load balancer requests are routed through a hybrid infrastructure of cloud and bare-metal servers running on multiple chains. This provides a unique combination of benefits in terms of decentralization, redundancy, speed, and reliability.

Ankr’s nodes are spread across the globe in multiple data centers and cloud regions, like North and South America, Europe, the Middle East, Asia, Oceania, and Africa.

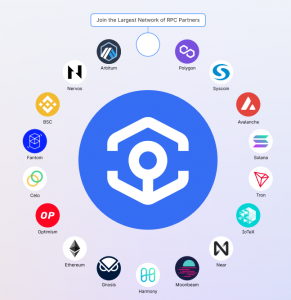

Ankr offers RPC endpoints that can be accessed via HTTPS or WebSockets in order to interact with 35+ supported blockchains

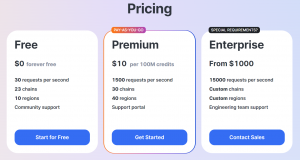

Ankr offers three different plans for RPC users:

The following table shows the differences in features

| Feature | Public | Premium |

| Full and Archive Data | ✅ | ✅ |

| Global node coverage | ✅ | ✅ |

| Usage stats and reports | ❌ | ✅ |

| Private endpoints | ❌ | ✅ |

| Support Polkadot, Kusama, & HECO | ❌ | ✅ |

| Batch requests | ✅ | ✅ |

| eth_getLogs batch size | 10 per batch | up to 1000 per batch |

| Priority order | Limited during high traffic | Prioritized during high traffic |

| Connection | HTTPS | HTTPS and WebSocket |

| Support | Discord and Support Portal | Direct Email Support |

| Terms | No Contract | Both Contract and No Contract |

| Cost | Free | Pay-as-you-go |

The following table shows the difference in rate limits

| Service | Public | Premium |

| RPC Service

(EVM-compatible chains) |

Requests across all endpoints:

≈1800 requests/minute — guaranteed; >1800 requests/minute — possible (depends on the load) |

Requests per endpoint:

Up to ≈1.5k requests/second |

| RPC Service

(Solana) |

Requests across all endpoints:

≈1800 requests/minute — guaranteed; >1800 requests/minute — possible (depends on the load) |

Requests per endpoint:

Up to ≈4k requests/second |

| Advanced APIs | 50 requests/minute | 1k+ requests/minute |

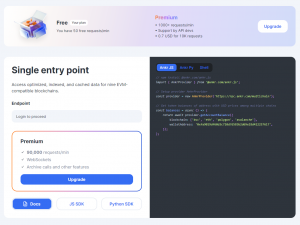

Public plans are free to use, but have limitations compared to the paid plans.

Its features include:

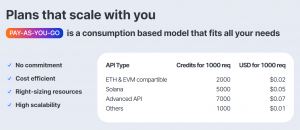

Premium plans are priced according to the Pay-As-You-Go (PAYG) model.

Its features include:

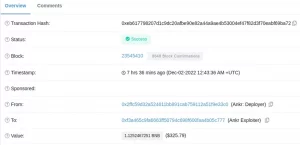

Users are charged based on the number of requests they make, rather than subscribing to a fixed plan. Users are not required to commit to any subscriptions. Instead, they can access the Premium features by depositing a minimum of 1000 ANKR tokens and creating an Ankr Premium account.

Usage is measured in API Credits. Each method used in a request carries a specific credit value, which is determined by the intensity of usage and various factors such as

It’s important to note that charges are applied for each request, regardless of whether it is successful or not. This means that even if a request does not receive a response from the underlying node, a charge will still be incurred for the request that reaches Ankr’s worker.

Below you can find the summary on PAYG charging:

The cost of API Credits is pegged to USD. When using $ANKR tokens for PAYG, the conversion into API Credits is calculated based on the most recent ANKR/USD exchange rate.

For example, if the exchange rate is 0.10 $USD per 1 $ANKR token, then 1 million API Credits would be equivalent to $0.10 USD.

| API Type | Method | API Credits | in USD |

| Ethereum | all methods | 200 | $0.00002 |

| EVM compatible | all methods | 200 | $0.00002 |

| Solana | all methods | 500 | $0.00005 |

| Advanced APIs | all methods | 700 | $0.00007 |

| Other | 100 | $0.00001 |

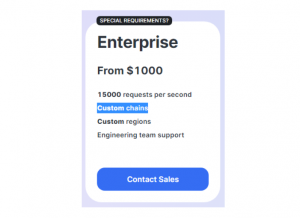

Its features include:

Businesses interested in the enterprise plan will have to contact Ankr’s Sales team in order to obtain further information, as it is customized accordingly.

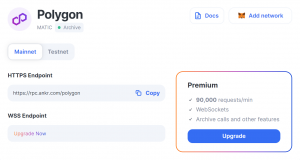

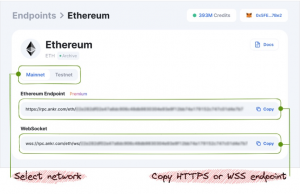

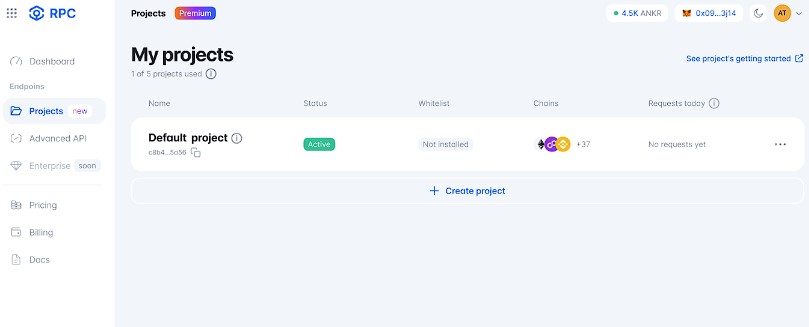

Developers can add the blockchain’s endpoint into the project’s library or config file in order to enable their project to interact with a blockchain.

After selecting their desired network, they can choose either the Mainnet or Testnet function, and then copy the “Endpoint” field into their project’s library or config file.

Getting started with the premium plan requires the user to do the following in this order:

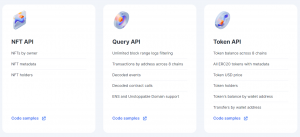

Advanced APIs are a carefully designed set of JSON-RPC API endpoints that are optimized to cater to the most commonly used Web3 scenarios across multiple blockchain networks. These APIs are built with the aim of providing fast and efficient support for various interactions in the Web3 ecosystem.

There are multiple types of APIs:

Ankr’s Advanced APIs work with the following EVM-compatible chains:

There will be more EVM and non-EVM chains in the future.

All supported methods are available in the generated swagger.json in the OpenAPI format.

The user must register an account at Ankr AAPI to get a unique API key to begin queries.

The following is a list of methods that can be used:

As this is a premium plan feature, Advanced APIs usages are priced under the PAYG model, with all requests costing 700 API credits, or $0.00007 USD per request.

Ankr.js SDK contains a compact JavaScript library that enables users to interact with Advanced APIs.

Users can install the latest package that is stored on npm.

| # with npm

npm install @ankr.com/ankr.js # with yarn yarn add @ankr.com/ankr.js |

Then they can initialize the provider.

| import { AnkrProvider } from ‘@ankr.com/ankr.js’;

const provider = new AnkrProvider(); // or if you have a premium account const provider = new AnkrProvider(‘YOUR_API_KEY’); |

And finally use the provider to call either of the supported methods.

| await provider.getNFTsByOwner({

blockchain: ‘eth’, walletAddress: ‘0x0E11A192d574b342C51be9e306694C41547185DD’, }); |

The chains that support ankr.js interaction are:

The following are methods that are available to users:

Users can install the latest package that is stored on PyPi.

| pip install ankr-sdk |

Initialize the SDK.

| from ankr import AnkrWeb3

ankr_w3 = AnkrWeb3() # Or, if you have an Ankr Protocol premium planankr_w3 = AnkrWeb3(“YOUR-TOKEN”) |

Use the SDK to call the methods supported:

| eth_block = ankr_w3.eth.get_block(“latest”)

bsc_block = ankr_w3.bsc.get_block(“latest”) polygon_block = ankr_w3.polygon.get_block(“latest”) |

| from ankr.types import Blockchain

nfts = ankr_w3.nft.get_nfts( blockchain=[Blockchain.ETH, Blockchain.BSC], wallet_address=”0x0E11A192d574b342C51be9e306694C41547185DD”, filter=[ {“0x700b4b9f39bb1faf5d0d16a20488f2733550bff4”: []}, {“0xd8682bfa6918b0174f287b888e765b9a1b4dc9c3”: [“8937”]}, ], ) |

| assets = ankr_w3.token.get_account_balance( wallet_address=”0x77A859A53D4de24bBC0CC80dD93Fbe391Df45527″

) |

| logs = ankr_w3.query.get_logs(

blockchain=”eth”, from_block=”0xdaf6b1″, to_block=14350010, address=[“0xc02aaa39b223fe8d0a0e5c4f27ead9083c756cc2”], topics=[ [], [“0x000000000000000000000000def1c0ded9bec7f1a1670819833240f027b25eff”], ], decode_logs=True,) |

The chains that support ankr.py interaction are:

The following are methods supported by ankr.py:

Users can install the package.

| # with npm

npm install ankr-react # with yarn yarn add ankr-react |

Then wrap the app with the “<Provider />” component.

| import { Provider } from ‘ankr-react’;

function MyApp({ Component, pageProps }) { return ( <Provider> <Component {…pageProps} /> </Provider> ); } export default MyApp; |

Then use the React Hooks.

| import { useNFTsByOwner } from ‘ankr-react’;

const Page = () => { const {data, error, isLoading} = useNFTsByOwner({ walletAddress: ‘0x0ED6Cec17F860fb54E21D154b49DAEFd9Ca04106’, blockchain: [‘eth’, ‘polygon’], }) return ( … ) } |

The following are hooks available for usage:

Gaming SDKs are done via the Mirage Platform, with the option of choosing either Unity or Unreal Engine SDK. Engine. This enables developers to build and scale Web3 games on all EVM-compatible blockchains. Using these SDKs, developers can integrate Web3 wallets and smart contract interactions into their games. Combined with the appchain product, a Web3 gaming developer has all the tools required to build a successful game with Ankr’s product offerings.

Gaming SDKs provide the following functionality:

They are compatible with all EVM-compatible blockchains and supports the following platforms along with their corresponding Web3 wallet solution:

Developers wishing to utilize the Gaming SDKs can take a look at the guides provided on the Mirage Docs.

Ankrscan is a comprehensive multi-chain explorer that offers users access to data from eight different blockchain networks. This powerful tool allows users to effortlessly browse and interact with a wide range of blockchain data without the need for login credentials.

One of the key features of Ankrscan is its interoperability, which enables seamless interaction with various blockchains. It provides a convenient and accessible solution for projects looking to engage with multiple blockchains using a single request.

With Ankrscan, users can take advantage of the API query functionality, which streamlines the process of interacting with multiple blockchains. By indexing data from all eight supported chains, Ankrscan allows for quick and efficient searching through large volumes of blockchain data.

The 8 supported chains are:

Ankr provides a multitude of full-scale solutions to power enterprise-level needs. These services include:

Developers who wish to utilize Ankr’s enterprise solutions may choose to contact their sales team for customized solutions.

Ultra-Sound Infrastructure (USI) was introduced on July 25, 2023.

USI will soon launch a Node Partner Program to improve performance and efficiency for blockchain RPC connections across 30+ blockchain ecosystems. The program will see Ankr’s existing cloud provider partnerships beginning with Microsoft and Tencent Cloud, joining the network to offer our users the highest-quality and most distributed node network ever created.

Unlike other node partner programs, USI will deliver the highest performance possible by only deploying archive nodes. These nodes are specifically designed to handle high traffic volumes and ensure our customers can access the fastest and most reliable infrastructure possible. By utilizing archive nodes, Ankr can provide the highest level of performance without sacrificing security or stability.

The program was built so that those leveraging the external nodes within the USI network benefit from the archive nodes’ increased performance, reliability, and efficiency.

With this improved infrastructure, developers and enterprises can build complex and resource-intensive applications without worrying about slow or unstable network connections. By utilizing the archive nodes, developers can also ensure that their applications are accessible to a broader audience, as the nodes will be distributed across multiple regions. Additionally, Ankr’s focus on creating a sustainable and efficient network means that developers can have confidence in the long-term viability of their applications.

By participating in the program, future node providers can earn a steady revenue stream by servicing paid traffic from Ankr’s RPC customers.

By allowing node providers to choose where to place their nodes, the Ankr Network is creating a mutually beneficial relationship. Node providers can earn more rewards and increase their profitability, while Ankr’s customers can benefit from having access to a more distributed and reliable infrastructure network. This approach promotes a win-win situation where both parties can benefit from working together towards a common goal – to create the highest quality and most distributed blockchain infrastructure network for all of Web3.

The $ANKR token plays a significant role in the USI program, adding new layers of utility for the token.

New Utility for $ANKR: The $ANKR token’s utility as a payment for RPC customers to access blockchain data will be expanded to provide payment to the new node operator partners. The $ANKR token will effectively become the only gateway token for accessing the highest tier of infrastructure: archive nodes on USI.

A Critical Component of Web3 Access: As the ANKR token’s new attributes make it a necessity for accessing USI, the token will claim a critical role in facilitating Web3 operations for enterprises, dApps, and developers.

The ANKR token Receives a Revamped Utility:

Ankr Automate was introduced on July 6, 2023.

Automate allows developers and users to streamline their project’s operations and efficiency while unlocking the true potential of decentralized applications, and is a a decentralized, error-free solution to automate smart contracts across platforms and protocols.

Automate provides the following benefits to developers and users.

In a few simple steps, developers can automate their project’s smart contracts by using the Ankr Automate platform.

Automate opens up a variety of use cases.

Ankr Verify was introduced on December 13, 2023.

It offers any blockchain or decentralized application the ability to define requirements for entry or use thanks to zero-knowledge user identity verification. The product has launched with clients Eclipse and Mina Protocol, already using the technology to advance user experience and compliance for Web3 apps deployed to their networks. As a tool for Web3 user authentication, Ankr Verify will be important for enterprise compliance when rolling out blockchain initiatives, as it allows organizations to meet the KYC requirements of their country or jurisdiction without sacrificing user privacy.

Unlike traditional KYC methods, Ankr Verify allows blockchains and Web3 apps to verify customer data and satisfy regulations without access to sensitive user data – made possible by zero-knowledge cryptography. Users will access Ankr Verify to prove attributes about their identity by providing proof to Ankr’s KYC partner, Synaps. Synaps will be the only party to ever see, verify, or hold user data as a trusted and regulated KYC company – Ankr, nor any other company, protocol, or app will have access. From there, blockchains and web3 applications will be able to verify that a user meets requirements such as citizenship by only receiving “yes/no” answers, without needing them to upload an ID or disclose all of the sensitive information that comes along with it.

Ankr Verify provides seamless identity verification for every blockchain or Web3 application, enabling them to enhance user experiences and attract enterprise development. Ankr Verify creates the ultimate builder environment for businesses and developers with:

Ankr was founded in 2017 as an infrastructure project that would harness idle computing power from data centers all over the world and repurpose that energy to power bitcoin mining operations, host validator nodes for PoS, or use it in IoT (Internet of Things)… At that point in time, Ankr accumulated a globally distributed supply of dedicated servers that positioned it for the upcoming industry shift to Proof-of-Stake (PoS) blockchains. As PoS blockchains began to offer smart contract capabilities, Ankr shifted its focus to providing developer and staking infrastructure by running full nodes and validator nodes.

During its early days, Ankr used its infrastructure to provide services like node hosting and API access. Since then, the number of PoS blockchains started to grow considerably. In response to the adoption of new decentralized technologies, Ankr took advantage of the opportunity and started servicing the needs of multiple emerging dApps. As a result, Ankr combined developer infrastructure (full nodes) with staking infrastructure (validator nodes).

Over time, as Ankr began to specialize in PoS infrastructure, its business operations started to expand, covering a variety of use cases within the Web3 industry, such as RPC services, SDKs and APIs, liquid staking solutions, and more. The first iterations were highly scalable and performant, even comparable to the likes of well-established infrastructure providers like Alchemy or Infura.

However, the first version of Ankr was launched in a centralized manner. At the time, the goal was to address the crucial need for node infrastructure in the industry. Since then, the protocol would prioritize a process of gradual decentralization by geographically distributing nodes across the globe and concurrently running its operations with independent node providers.

Despite experiencing enormous growth over the past years, the vision of Ankr remains the same: reducing the dependence on centralized infrastructure providers will help the industry to increase its resilience against single points of failure, unexpected downtimes, and censorship resistance.

The evolution of Ankr now includes not only free and public RPC endpoints but also premium and enterprise plans packed with advanced developer tools – all powered by a globally distributed and decentralized network of nodes. Ankr V2 also introduces a new pay-as-you-go payment model for developers to access on-chain data and for node providers to serve on-chain requests and earn $ANKR tokens. Additionally, $ANKR holders can stake their tokens in full nodes to secure the network and earn their share of rewards.

Initially, only projects that pass KYC and meet the designated hardware and $ANKR token collateral requirements can become node providers. However, future iterations of the node provider program will eventually incorporate individual node operators that can run nodes from anywhere as long as they meet the performance requirements. This new business model will allow Ankr to scale its services exponentially across the board and increase decentralization.

There is no public roadmap available for Ankr. However, Ankr has published a blogpost that includes the resolutions for 2023, which are:

Node infrastructure is fundamental for the blockchain industry as a whole: layer1 blockchains, DeFi protocols, virtual experiences, NFT projects… all rely on the security and scalability of a reliable and efficient node infrastructure. By providing developers with a set of multi-chain tools and node infrastructure, Ankr acts as the gateway through which developers and nodes are connected.

At the user level, running a node for a PoS blockchain is often perceived as an attractive way to earn income while contributing to the security of the respective network. However, there are multiple hardware and technical requirements involved in that process. These are seen as barriers to entry for getting started. With its services, Ankr addresses these challenges by simplifying the node creation process to just a few clicks for dozens of blockchains. Node operators only have to pay a monthly fee to Ankr in return for the various services the platform provides.

Ankr also has a significant presence in the liquid staking sector, with 9 tokens available for staking over 8 chains. The introduction of Liquid Staking tokens expands the utility of staked assets, allowing users to maximize their potential and explore various financial opportunities. This innovation enhances the flexibility and accessibility of PoS networks, providing stakers with greater control over their assets and the ability to make immediate use of their holdings.

Ankr has multiple competitors in both sectors that it offers products in, being node and related infrastructure, and liquid staked tokens. Competing with the likes of Infura, Alchemy, and Pocket, Ankr’s unique pay-as-you-go (PAYG) model and plethora of services are its unique differentiators. Additionally, revamped $ANKR tokenomics and the introduction of the Ankr DAO have elevated Ankr as a key Web3 infrastructure provider.

It is worth noting that Ankr believes that it isn’t in direct competition with other node infrastructure providers, but it is here to make existing node infrastructure more resilient, secure, and decentralized. For example, a project exclusively using Alchemy for its node infrastructure can be more robust by leveraging Ankr Network’s decentralized node infrastructure in conjunction, for added redundancy and security.

Ankr Network users with Premium Plans pay under a pay-as-you-go model that ensures that developers don’t overpay for their subscriptions. The cost of an individual request averages to about $0.00004, with certain types of requests costing more or less based on their requirements. In turn, these fees are used to incentivize independent node operators and are redistributed amongst node providers and stakers. All things considered, this pricing is drastically cheaper than popular centralized node providers like Infura or Alchemy.

When paying for network fees with $ANKR tokens, users receive an additional discounted rate. Besides, certain features may only be accessible to users who use $ANKR to access the services.

Additionally, Ankr understands that its performance as a provider is directly responsible for its rapid growth. As such, Ankr constantly ensures that its services to developers are as competitive as possible, in areas such as:

The following table showcases the differences between Ankr and its competitors.

| Name | Ankr | Alchemy | Infura | OMNIA | Quicknode |

| Chains | 22 (including testnets) | 7 | 11 | 8 | 6 |

| RPC | Yes | Yes | Yes | Yes | Yes |

| Products | RPC Service, Advanced APIs/SDKs, Gaming SDKs, AppChains, Liquid Staking, Ankr Scan, Enterprise Solutions. | Supernode, NFT API, Webhooks, Custom tbhooks, Token API, Transfer API, Transact, Transaction Simulation, Account Abstraction, Websockets, Spearmint. | Networks, NFT API+ SDK, Trace API. | API, Front-running protection. | Core API, Token API, NFT API, QuickAlerts, Graph API |

It can be seen that Ankr leads the way in terms of the number of chains supported, and also has the most number of unique product offerings.

The following image showcases the ranking of Ankr in the Liquid Staking sector.

Out of the top 10 protocols by TVL, Ankr has the most number of liquid staked token choices, with 7 offerings. The majority of liquid staking protocols are focused only on staked $ETH.

Ankr has also made progress in creating liquidity for its liquid staked tokens on DEXes, with $ankrBNB being its most widespread token, and $ankrFTM and $ankrMATIC coming in after.

Node infrastructure still has plenty of space to grow, especially as adoption and infrastructure becomes more palatable and widespread in the traditional markets. Ankr’s expertise and reputation in this sector has already managed to transfer over to deals with names that are well-known outside of the crypto markets.

While Ankr has had prior partnerships with such entities in the past, it has seen a steady rise in the external market in 2023.

Ankr’s portfolio includes:

In the liquid staking sector, Ankr already has the widest options available in DeFi for liquid staking. As it continues to prove its reliability and versatility in this sector, more token options should also be made available in the future.

Ankr services expand over 21 blockchains, handling over 2 billion RPC requests daily.

Liquid staking is available on the following chains:

Delegated staking is available on the following chains:

The following are the AppChains available:

The list of all chains available on RPC Service is as follow:

Currently, Advanced APIs work with the following EVM-compatible chains:

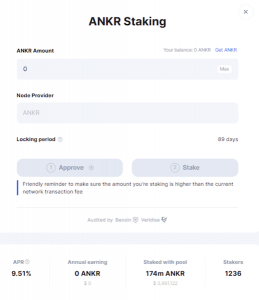

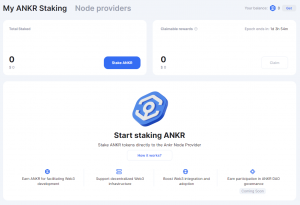

The tokens can be delegated on the Ankr site itself.

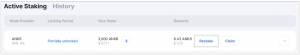

The UI will present information such as the APR, number of tokens already staked as while as the number of stakers. Users can select the amount they wish to stake, which is locked for a period of 84-91 days for the $ANKR token.

If the user wants to stake more tokens after already staking, a new locking period will apply to the new stake.

Rewards accumulate on a weekly basis and can be claimed beginning after the epoch following the first stake. Rewards will also continue to accumulate even if the user does not unstake after the locking period is over.

Users can also choose to restake their rewards by clicking on “Restake”

While the locking period is expressed in days, it is actually counted in epochs, where the locked period is 12 epochs with each epoch lasting 7 days. Hence, the total locking period depends on which day the user stakes in their first epoch.

Users can click on the “Unstake” button in order to withdraw their staked tokens. This will start the Undelegate period which lasts a week. After the period ends, the user can repeat the process to withdraw their staked tokens.

Users can get liquid-staked tokens by either staking with Ankr on the respective chains or by buying them on DEXes.

The UI will present information such as the APR, number of tokens already staked as well as the number of stakers. Users can select the amount they wish to stake as there is no minimum amount required.

Liquid-staked tokens provide yields depending on the token staked.

Users can also choose to deposit their liquid-staked tokens into DeFi protocols or pair them with other tokens on DEXes to earn additional rewards. However, this comes with the risk of exposing the assets to additional risks such as smart contract risks.

Unlike delegated staking which has a fixed locked period of epochs required to unlock the tokens, liquid staked tokens do not.Instead, staked tokens can be unstaked with the following methods:

For example, at the time of writing, the standard unstaking period is 6-15 days for $ankrETH, but does not penalize the user with any fees.

Users can also choose to use the Flash unstake function, which has the following limitations:

Otherwise, the user can choose to sell their $ankrETH for other tokens on DEXes with liquidity, according to the market prices, but usually at a discount due to the unlocking time premium.

Developers wishing to integrate Ankr staking into their projects can do so via the following integrations:

The following documents will be useful for the respective chains:

The Projects feature was introduced on November 22, 2023, and is designed to cater to the intricate demands of businesses and developers in managing their Web3 initiatives.

It is an advancement for managing endpoints with Ankr and includes the following:

Liquid staking allows users to stake their tokens without having to meet either the minimum size requirement, hardware requirements or lock their tokens up for a certain period. For example, staking Ethereum directly as a validator requires at least 32 $ETH, a dedicated computer connected to the internet ~24/7, and some technical know-how.

However, staking with Ankr as ankrETH allows users to still obtain the staking yield less Ankr’s fees, while not having to provide the minimum size of 32 $ETH, dedicated hardware, and remaining liquid in order to participate in DeFi strategies.

AnkrETH can then be paired with $ETH in DeFi protocols to earn yields as a liquidity provider.

The business model of Ankr relies primarily on 2 different areas, its Liquid Staking fees and infrastructure provider services.

Ankr charges technical service fees for Liquid Staking, amounting to the following:

Ankr charges for requests from its RPC and Advanced API users, and also its enterprise plans. The following are the fees that Ankr charges.

Ankr generates revenue by collecting fees on the rewards of the Liquid Staked Tokens. This fee amount varies depending on each PoS network.

The following are the rewards that are distributed back to stakers, providers, and the DAO, after accounting for technical fees:

The fees are then split into the following allocation:

Passive holders receive the underlying staking yield minus the fee. This allows users to earn additional yield by participating in the PoS validation of different chains to earn block rewards. Besides, they can also use the unlocked liquidity and use their yield-bearing assets across DeFi to generate additional yield.

Ankr charges technical service fees for Liquid Staking, amounting to the following:

The $ANKR token is the native token of the protocol. It can be used for multiple purposes as a user, provider or staker.

$ANKR token holders can stake their tokens to earn 70% of rewards from all Ankr network fees – 49% to individual stakers, and 21% to node providers. The remaining 30% of fees go to the Ankr Treasury controlled by the Ankr DAO.

Ankr Network Premium Plan users are incentivized to pay for services with $ANKR tokens in order to take advantage of discounted rates and earn rewards for serving network traffic.

Notably, by introducing a staking system that incentivizes node independent node operators, $ANKR provides a solution for bootstrapping a distributed network of independent node providers serving the development layer (rather than validator nodes serving the consensus layer), which solves a fundamental problem that Web3 developers face.

In order to be eligible to serve traffic and earn rewards from the Ankr Network, independent node providers will need to provide a self-stake of 100,000 $ANKR per node. This self-stake serves as an insurance policy that ensures that node providers act in the best interest of the protocol users and meet their performance and uptime requirements. If a node provider fails to meet these requirements, their node will be slashed and funds will be removed from their self-stake and, in some cases, from the delegators who have staked $ANKR with that particular provider.

The Ankr Network requires each node provider to be backed by a large quantity of $ANKR tokens in order to maintain the quality of node providers, ensuring that RPC requests on supported networks are processed. This includes $ANKR tokens staked by the node providers themselves, which are subjected to slashing in the event of malicious acts or poor performance by the provider.

Additionally, token holders will be able to stake $ANKR tokens to back their nodes and act as an indicator of the service provider’s reputation, performance, and worthiness of a reputation boost. Stakers then get to share a portion of the yield earned by the node providers they have staked with but also bear part of the slashing risk. Lastly, staking $ANKR will also allow delegators to allocate voting power to node providers to decide on certain actions, such as which independent node providers to be admitted in the near term to service traffic on Ankr Network.

The initial $ANKR taking pool will have the following limitations:

A fair entry mechanism will also be used to fill a portion of the initial allotment, ensuring participation from a range of stakeholders.

Ankr will partner with other blockchains, projects, and foundations to conduct audits to ensure that node providers are kept to the highest standards, with assisting partners receiving payment in the form of $ANKR tokens.

This is required as independent nodes can apply to join Ank network, and will have to be vetted to ensure that KYC, equipment, and performance requirements are satisfied.

The total number of $ANKR tokens is 10 billion and there is no inflation built in.

There was an initial token supply of 40%, with an additional unlocked supply of 60% over 36 months between August 2019 to August 2022, and all tokens have been fully unlocked. The allocation is as follows:

Approximately 2% of Ankr tokens were burned, and it’s unlikely that more burns will occur.

Ankr plans to move to a DAO governance system utilizing staked $ANKR tokens. The system is still in progress and an announcement will be made by Ankr when finalized.

According to the current documents, the governance would be according to a proposal model that is seen in the majority of protocols, where a proposal is submitted before being voted on by the community.

The steps for governance participation are:

The Ankr DAO is still in the midst of being designed.

On July 21, 2022, Ankr had published a post detailing the Ankr 2.0 upgrade which also detailed the Ankr DAO governance that was targeted to be established in 2023.

The system of community governance over Ankr Network would be formalized, with an initial focus on three core areas:

Voting would be done with staked $ANKR tokens.

Ankr has been expanding its suite of products since 2017, and provides services to help its users manage their risks and monitor the different attack vectors that might negatively impact their products:

Liquid staking has become one of the most popular ways to engage with staking services. All liquid staking services are exposed to a series of common risks and it is up to the users to make a decision about which solution minimizes most of them.

The most significant risk associated with liquid staking is security. When assets are staked, they are typically locked away in a smart contract or another secure environment where they cannot be easily stolen or misappropriated. Depending on the liquidity staking provider, the smart contract risk will vary, however, all smart contracts holding the original unstaked assets may have bugs or be susceptible to attacks. Because of that, it is worth keeping in mind that, when liquid staking, the original assets are in the hands of a third party, which increases the exposure to counterparty risk.

A risk associated with liquid staking is low liquidity risk. One of the benefits of Liquid Staking Tokens (LSTs) is that they can be swapped for their base asset counterpart instantly in Dexs without having to wait for the lengthy unbonding period that comes with staked assets. That being said, if the TVL in the liquidity pools runs dry, then the token can lose its peg, which also causes a high slippage when trying to swap between the assets.

One of the ways that liquid staking tokens hold their peg is because of arbitrage mechanisms in Dexs. Therefore, if the TVL in the liquidity pools drops dramatically this could alter the arbitrage incentives and spiral into a situation where the token doesn’t hold its peg. Arbitrageurs can then buy the discounted tokens in liquidity pools and unstake them for full price, making a premium.

Liquid staking providers are responsible for maintaining the infrastructure and technology that supports the staking process. If there are any operational issues, such as system downtime, network outages, or other technical problems, the staked assets could be at risk.

More specifically, the assets that were originally provided to the liquid staking protocol have to be staked with validators. Because of that, if the protocol chooses untrustworthy or validators that underperform, then the staked assets could get slashed. Therefore, one should carefully consider the operational risks associated with liquid staking and only invest with trusted and reputable providers.

There have been multiple audits done by Beosin, Veridise, Peckshield, and Salus.

A bug bounty program with Immunefi has been live since July 21 2022.

Rewards are distributed according to the impact of the vulnerability based on the Immunefi Vulnerability Severity Classification System V2.2. This is a simplified 5-level scale, with separate scales for websites/apps, smart contracts, and blockchains/DLTs, focusing on the impact of the vulnerability reported.

Payouts are handled by the Ankr team directly and are denominated in USD. However, payouts are done in $ANKR, $USDT, and $USDC, with the choice of the ratio at the discretion of the team.

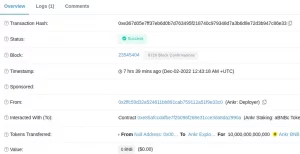

On December 1, 2022, an ex-employee caused a $5M exploit on the Ankr protocol. The announcement was made by the Ankr team in a December 20 announcement explaining that they were in touch with the relevant authorities and seeking to prosecute the attacker while also shoring up their security practices. Previously, the team had announced that the exploit was caused by a stolen deployer key that was used to upgrade the protocol’s smart contracts. But at the time, they had not explained how the deployer key had been stolen.

The ex-employee conducted a “supply chain attack” by putting malicious code into a package of future updates to the team’s internal software. Once this software was updated, the malicious code created a security vulnerability that allowed the attacker to steal the team’s deployer key from the company’s server. With this key, the attacker funded themselves by the deployer. Next, the deployer was manipulated to publish a malicious fake token contract, disguised as the original aBNBc token. That contract was then upgraded to replace the existing aBNBc implementation, and included a new function that allowed the attacker to bypass caller verification and mint unlimited tokens to their own wallet, resulting in a $5M theft. The attacker was then able to bridge funds to Ethereum, and launder the stolen loot through Tornado Cash. As the word spread, other users joined and minted aBNBc to their wallets. Two of these users used this money to manipulate Helio Money for an extra $18M loss.

Upgradeable contracts, like those used in Ankr, rely on the concept of an “owner account” that has sole authority to make upgrades. Because of the risk of theft, most developers transfer ownership of these contracts to a gnosis safe or other multisignature account. However, the Ankr team was not using a multisig account for ownership in the past. This created a single point of failure in the developer key.

Since then Ankr also vowed to improve their human resources practices and require escalated background checks for all employees, including those who work remotely. The team also implemented additional monitoring and notification alerting systems to make sure that sensitive data can only be accessed by those employees who need it.

Immediate action was taken to minimize any damage from the exploit. The exploit was communicated to the public and off-ramps were alerted to implement their emergency plans and halt trading. The smart contracts were also temporarily paused to prevent the movements of the underlying collateral ($BNB) within the liquid staking product.

No other liquid staking tokens or Ankr products were affected. Ankr’s validators, RPC, APIs, and Appchain services continued to operate without disruption.

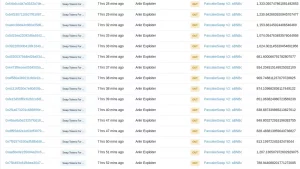

The team used their own Advanced API Tool to find every aBNBc token holder in 10 seconds – a task that would have taken several hours to complete using normal query methods on a dedicated node. A snapshot was taken and a new ankrBNB token was minted and airdropped to the affected token holders.

A reimbursement plan was drafted to fix the damage caused to Helio by re-stabilizing $HAY’s price with a commitment to continue purchasing $HAY if the token remains unpegged until all funds are spent. $BNB was also airdropped to all affected liquidity providers. Finally, Ankr reached an agreement to reimburse Wombat stkBNB Lps and provide 100% coverage of the $BNB Wombat LPs.

Ankr’s LinkedIn lists a total of 129 employees.

Some of their employees include:

There were 4 different investor rounds held.

Ankr has a grants program that provides up to $10M in grants, over two years, for developers and node operators to build on Ankr Protocol. Additionally, Ankr provides other benefits such as:

Grant fundings are directed by The Ankr DAO, empowering Ankr stakeholders to choose how grants are best served for the community.

Developers who wish to apply for the grants can check for their eligibility which include: