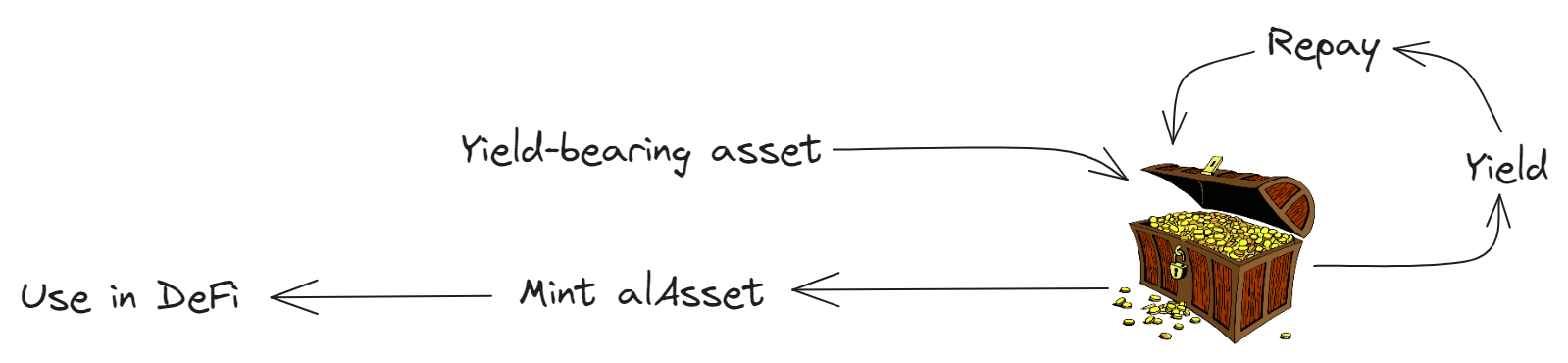

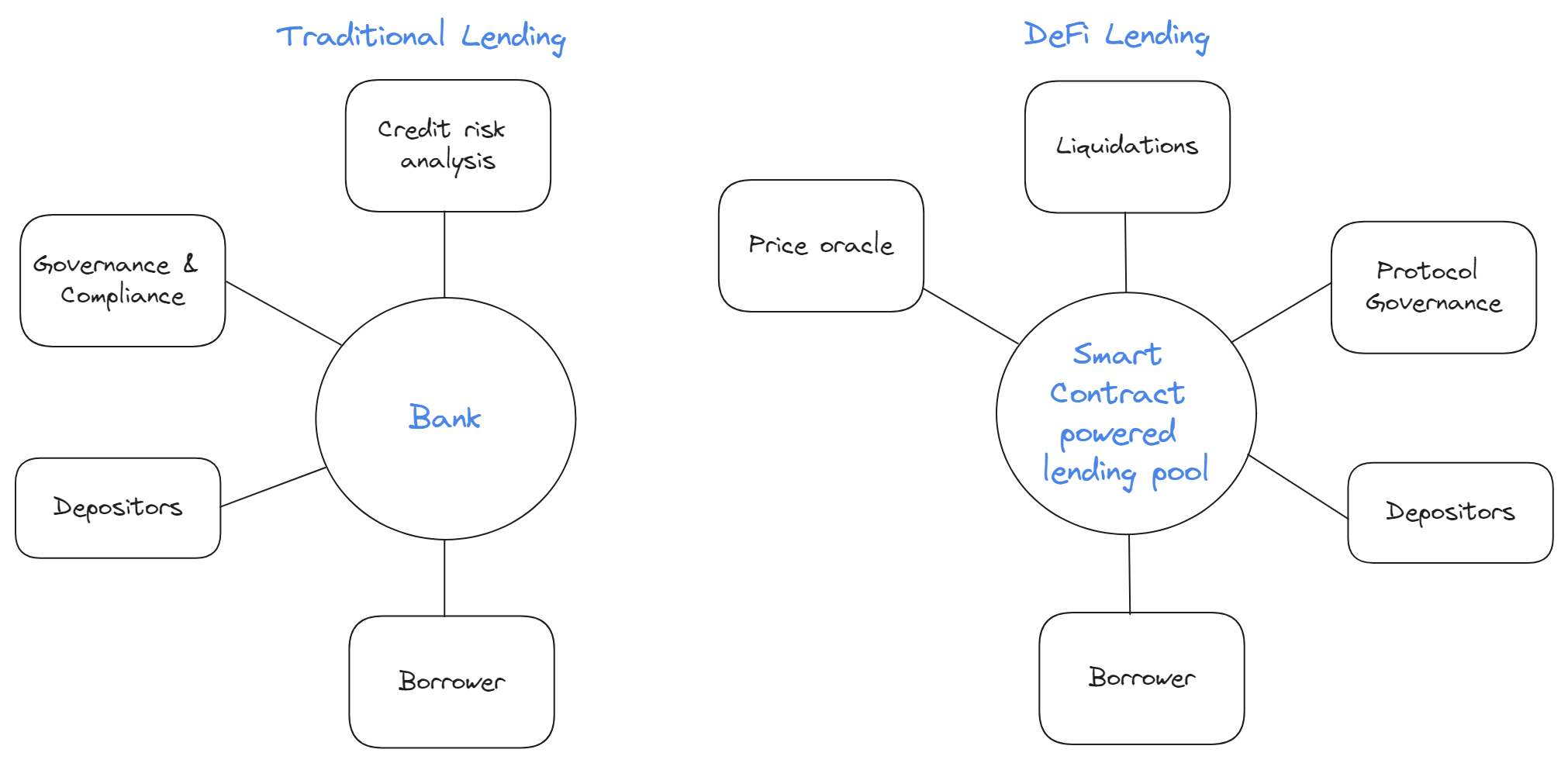

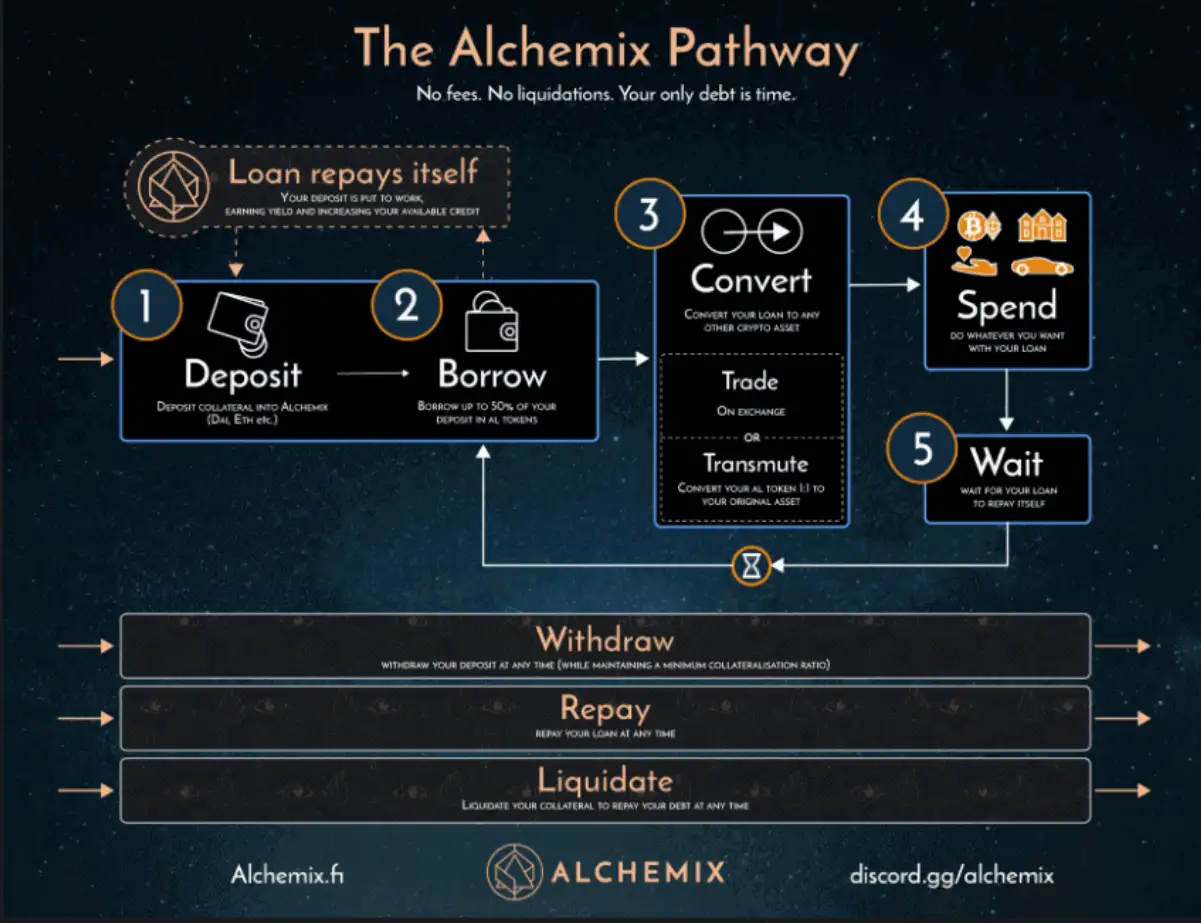

Alchemix is a DeFi protocol and community-owned DAO that introduces the concept of future-yield-backed synthetic assets. This allows users to take out self-repaying loans with no interest or risk of liquidation.

As a protocol, Alchemix empowers users allowing them to perform more advanced yield farming strategies. Users can take out self-repaying loans in a synthetic asset that represents a fungible claim on the user’s collateral. Unlike traditional loans, Alchemix offers a unique approach: Self-Paying, Interest-Free, Non-Liquidating Loans.

This means users can access a line of credit equivalent to a portion of their deposited assets without incurring interest or facing liquidation risks.

To access this credit, a small fee is levied from the yield that is earned.

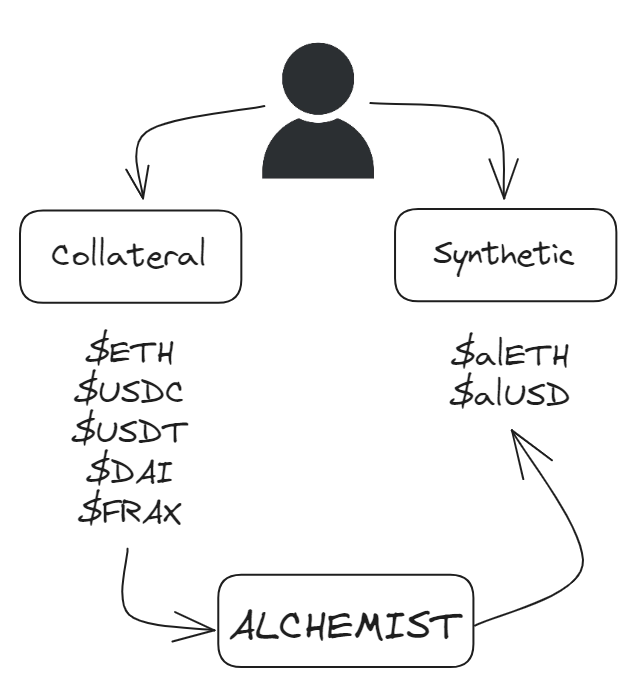

The protocol is architectured comprising 4 primary components: Alchemists, Transmuter, Elixir AMO, and alAssets.

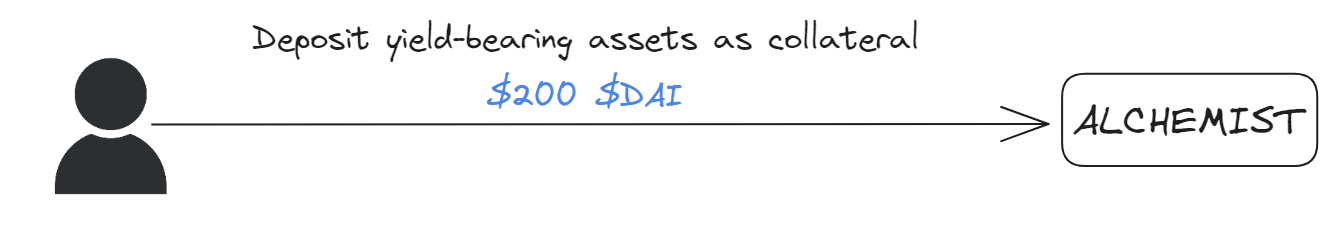

Alchemists serve as the smart contract hub responsible for generating yield and yield advances. They accept yield-bearing assets as collateral and have the capability to convert underlying collateral into yield tokens.

They share similarities with collateralized lending platforms like MakerDAO and AAVE. Accepted collateral types include $ETH, $DAI, $USDC, $USDT, and $FRAX, along with their respective yield-bearing tokens for each strategy.

Users borrow funds in the form of synthetic alAssets, with $alETH for ETH-denominated yield token deposits and $alUSD for $DAI, $USDC, $USDT, and $FRAX-denominated yield token deposits.

Alchemists provide users with a flexible line of credit for their future yield. Users can enter/exit at any time without committing to long lockups, and the collateral assets will never be liquidated.

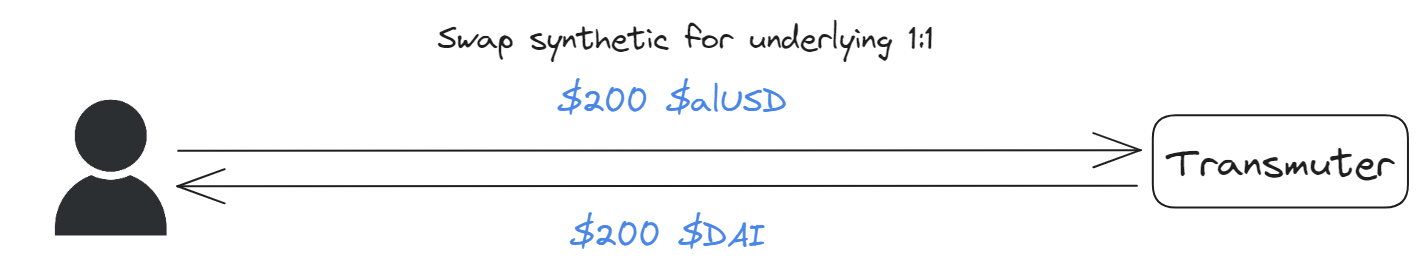

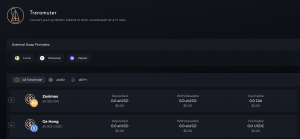

The Transmuter functions as a price stability module, allowing users to stake their synthetic alAssets for gradual conversion into their corresponding base assets at a 1:1 ratio over time.

Users can deposit alAssets into the Transmuter (e.g. $alUSD), and as yield, self-liquidations, and loan repayments occur, users are credited with an equivalent amount of the underlying asset (e.g $DAI), relative to the quantity of $alUSD they have staked in relation to the total $alUSD staked.

Similarly, when a user decides to withdraw the converted $DAI, an equal amount of $alUSD is burned to maintain a balanced ratio.

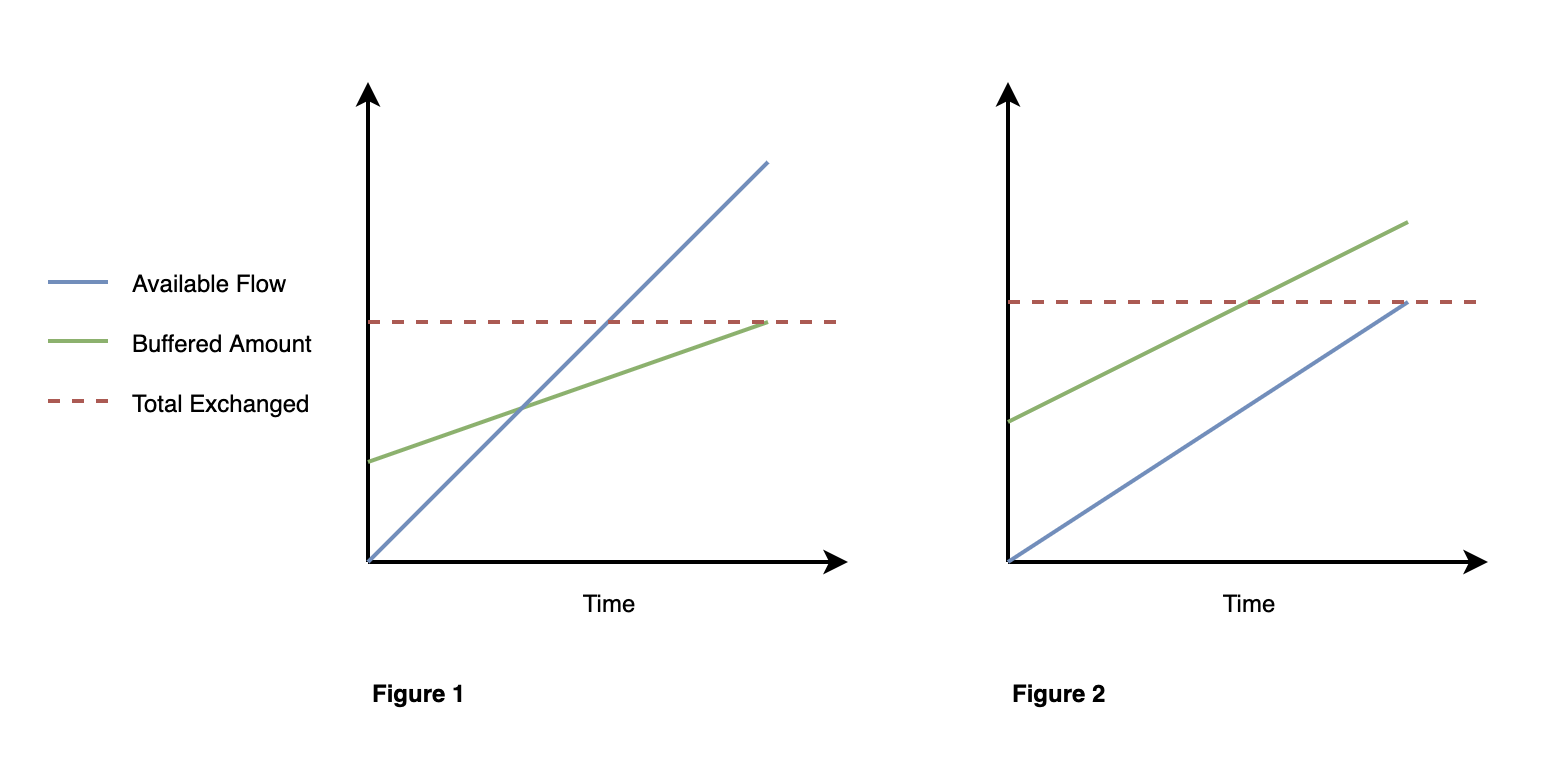

The rate at which funds can be converted into their underlying collateral depends on the flow rate of the TransmuterBuffer, which is governed by predefined parameters. This limit ensures that the Transmuter is not rapidly drained by small-scale arbitrage activities (e.g., 0.1% arbitrageurs). It also creates an excess pool of funds that remain idle until they are allowed to be transmuted.

Harvested yield, as well as funds from liquidation events, flow directly into the Transmuter Buffer. The Transmuter Buffer then transfers funds to the Transmuter based on specific rates and limits set by the protocol’s governance.

These tokens are gradually released according to a time-based formula, serving as a backstop to ensure the redeemability of synthetic alAssets.

Note that the available-flow for a given underlying token can exceed the total amount of funds denominated in that underlying-token (across all strategies) held by the Transmuter Buffer in the Alchemist. However, when this is the case, the Transmuter will only be able to access the actual funds held by the transmuter-buffer in the Alchemist.

In Figure 1, there will be an excess of available flow. If the flow of the underlying asset to the Transmuter were to increase beyond the defined flow-rate, then the excess available would be used to absorb the faster rate.

This mechanism ensures that Transmuter depositors are eventually guaranteed a 1:1 redemption of alAssets for their underlying collateral, reinforcing the price between alAssets and their respective collateral.

Since many users seek to estimate the conversion rate of the Transmuter, it is worth noting that, assuming a sufficient balance flow, funds enter the Transmuter whenever there is a yield harvest. Hence, the minimum flow to the Transmuter can be estimated based on the average yield earned by all depositors for the corresponding alAsset. Next, yield is distributed proportionally among all Transmuter depositors.

Additional funds are sent to the Transmuter when users repay or liquidate their loans, further contributing to the Transmutation process. Therefore, using the average yield as a basis in addition to the total TVL earning yield vs the amount of TVL in the Transmuter provides a conservative estimate of the flow to the Transmuter and the rate at which conversions occur.

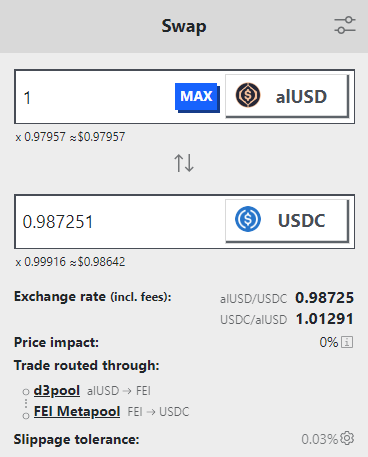

Note that, while the Transmuter provides this safety net, users typically prefer instant swaps of alAssets on decentralized exchanges and AMMs like Curve. Hence, the Transmute exists primarily to serve an arbitrage function, allowing people to buy alAssets below their 1:1 conversion rate and eventually redeeming 1:1 over time.

The Elixir AMO (Algorithmic Market Operator) plays a pivotal role within the Alchemix ecosystem, leveraging the front-stop resources that can accumulate in the protocol.

Essentially, it manages the surplus of alAssets that can be converted into underlying collateral. In fact, the front-stop refers to a pool of unused assets that can accumulate within the Alchemix protocol. When this front-stop becomes substantial in size, it can be deployed to the Elixir AMO for each alAsset.

Once deployed, the front-stop collateral is used to deposit assets into the corresponding Curve liquidity pool. These assets are used to provide liquidity for their corresponding alAssets. Similarly, liquidity can be withdrawn single-sided in the form of alAssets, mimicking the Transmuter’s effect but with the added benefit of positive slippage.

Liquidity deposits in the pools increase the price of alAssets and earn yield. Hence, this action has several significant effects:

The Elixir AMO also has the flexibility to withdraw the alAsset itself (rather than the underlying collateral) from circulation at any time. This withdrawal action effectively mimics the Transmuter’s effect of converting $alUSD into collateral assets, serving as a second instance of increasing the price of the alAsset.

For example, if there’s an imbalance where there are more alUSD tokens than the underlying assets, Alchemix can perform single-sided withdrawals of $alUSD to rebalance the pool, increasing the $alUSD price.

Therefore, the Elixir offers faster-acting control over alAsset pricing compared to other mechanisms. It also serves as an additional revenue stream for the Alchemix DAO, enhancing the sustainability of the protocol.

In addition to that, the Elixir AMO can match the Transmuter’s role by reducing the alAsset supply when necessary to maintain price stability.

In accordance with AIP-100, which supersedes AIP-80, farming rewards generated by the Elixir AMO are 100% allocated to the treasury in the form of stables and $ETH, while the remainder of assets may be used for liquidity-driving assets. The rationale behind this is that the treasury is currently over-balanced to locked liquidity-driving assets, and the intent of AIP-100 is to extend the runway and favor the accumulation of $ETH and stables.

It is also worth mentioning that this is a temporary measure to help with the recovery process after the multichain and Vyper exploits which occurred in 2023.

Note that the Alchemix DAO is authorized to spend up to $450k per quarter, as dictated by AIP-40. This limit has never been exceeded since inception, and audits are the only reason why spending might get closer to the limit.

The current status of the stolen multichain assets remains unknown. If these funds are eventually recovered or lost forever, then the L2 AMO can be converted back to protocol-owned liquidity, and the treasury would be well funded.

In summary, the Elixir AMO is a mechanism that deploys excess resources to enhance alAsset pricing, generate yield, and contribute to the protocol’s sustainability.

alAssets are synthetic debt assets within the Alchemix protocol that represent a user’s future yield.

alAssets are designed to provide users with a convenient means of utilizing their future yield generated from deposited assets within the Alchemix protocol. They allow users to access liquidity without the need to sell their yield-bearing assets or wait for yield to accrue naturally.

alAssets typically trade at a market price that may be slightly less than the underlying asset’s value. For example, 1 $alETH may be worth slightly less than 1 $ETH. This discount reflects the cost associated with accessing future yield ahead of time.

However, the governance frameworks established by the Transmuter, Elixir AMO, and DAO Treasury are expected to work to minimize this discount for each alAsset.

Users may acquire alAssets through various means, such as borrowing or purchasing them. They can then use alAssets for on-chain activities, similar to how they would use the underlying assets. Common use cases include:

Altogether, alAssets provide users with flexibility and accessibility to their future yield, allowing them to enter and exit positions without long lockup periods.

Alchemix was initially named “CheeseFi” with a focus on yield derivatives. However, due to concerns about MEV and the evolving DeFi landscape, the project pivoted to become Alchemix, offering self-repaying loans.

Alchemix was developed by a team led by the pseudonymous Scoopy Trooples, and emerged as a unique DeFi project that allowed users to take self-repaying loans. At its core, Alchemix aimed to provide a way for users to take on liquidation-free loans and mint synthetic assets (such as alUSD and alETH) against their collateral, offering a more flexible and sustainable borrowing experience.

The primary motivation was to introduce a new DeFi primitive that showcased the power of DeFi composability, as well as empower individuals by allowing them to access the future earnings generated by their assets in the present. This allowed users to access liquidity without selling their assets, avoiding potential capital gains taxes and preserving their long-term investment positions.

The core team of contributors favors a stream of communication that prioritizes already launched products and discussions about the current state of the project’s development.

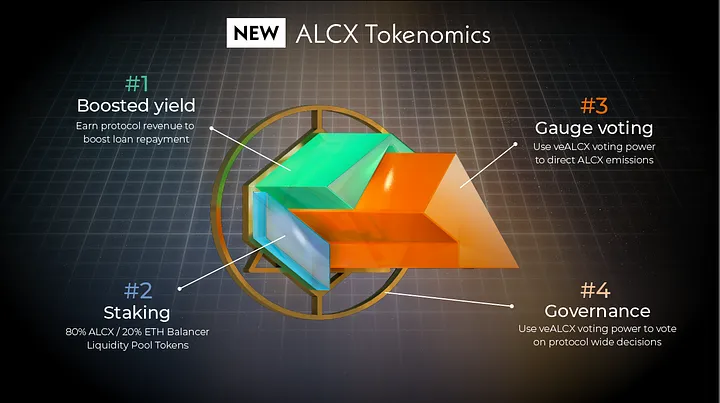

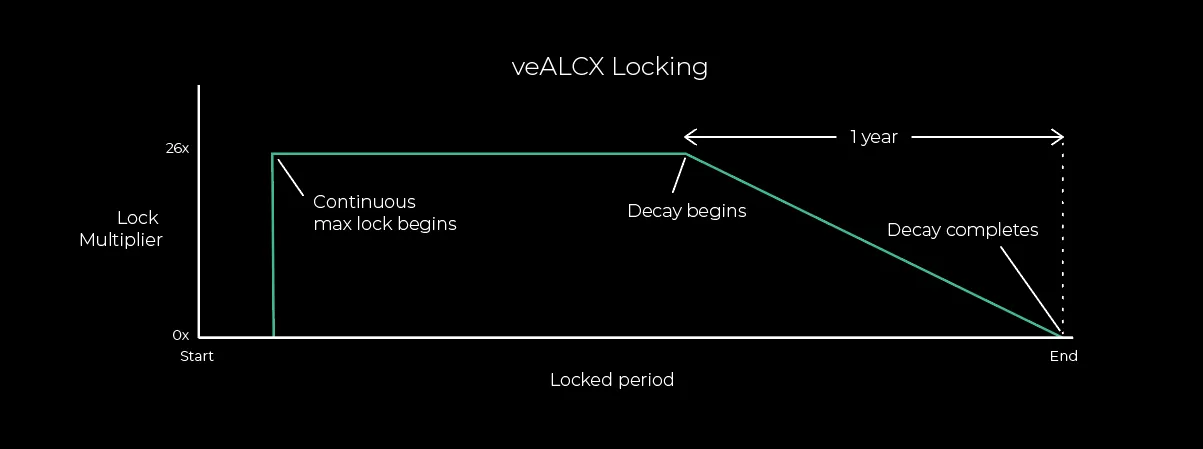

Even though there is no official roadmap, the main item to be released in the near term is the veALCX system.

veALCX was introduced on May 20, 2022, but will be released in 2024.

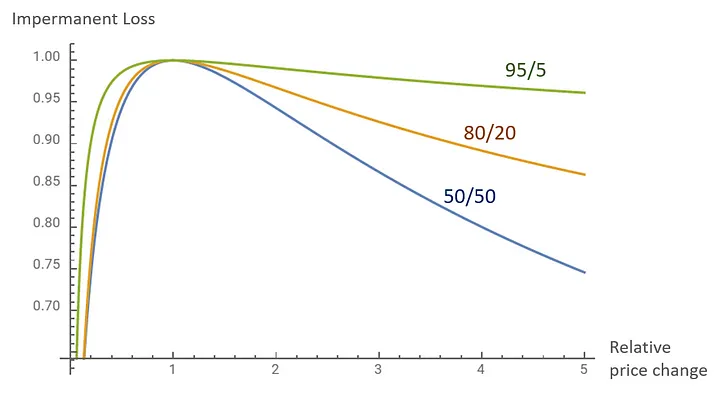

It is a governance model for Alchemix that is still in progress and will be based on the 80/20 liquidity model by Balancer. This means users will have to provide liquidity in the form of 80% $ALCX and 20% ETH into a Balancer pool in order to obtain Balancer Pool Tokens (BPTs), which are then locked up for specific periods in order to obtain veALCX. veALCX provides the holders governance and gauges voting power in the DAO as well as boosted yield.

Additionally, Alchemix will be issuing a new token to be used as a part of the veALCX system. This token is called FLUX and will be used to boost voting power and make it possible for users to unlock their positions early or sell it on the open market.

Alchemix allows users to borrow assets without the risk of liquidation, which is a common concern in traditional lending protocols. Unlike other DeFi platforms where borrowers need to constantly monitor their positions to avoid liquidation, Alchemix borrowers can enjoy effectively negative interest rate loans without this worry. This feature provides peace of mind to borrowers, as they don’t have to set up alerts or actively manage their positions.

Alchemix’s self-repaying loans enable individuals and organizations to interact with their assets and cryptocurrencies in a new and innovative way. Instead of spending their crypto holdings, depositors can utilize Alchemix vaults to act as their own financial institutions. This unique dynamic opens up a range of possibilities for users, allowing them to leverage their assets without the traditional risks associated with borrowing.

The value proposition for Alchemix is more appealing during bull markets and seasons where on-chain yields are high. Similarly, the adoption might slow down during periods of time where DeFi yields trend lower and might even become lower than the off-chain yield you can get on TradFi.

Alchemix started out experiencing remarkable success within its first months of inception, managing to attract close to $1B in TVL. Even though these numbers are now much lower, the project has made a name for itself and is recognized among investors and builders as one of the first DeFi projects.

That being said, Alchemix’s model hinges on the concept of self-repaying loans, where borrowers effectively borrow from themselves using deposited collateral. As a result, the success of Alchemix depends on the sustainability of the yields generated from staking the collateral. If these yields remain attractive, the concept becomes viable and can gain significant traction .

Alchemix’s no-liquidation feature removes a significant barrier that exists in traditional lending platforms as well. Users can borrow without the fear of being liquidated, which makes the platform more user-friendly and appealing to a broader audience.

Future expansions of collateral assets can also attract new users and communities. The same idea applies as the project expands its activity across multiple chains, tapping into the liquidity of new ecosystems.

It will also be critical for the project to continue adding strategies to ensure that users can get the highest risk-adjusted yield available in the market.

Another thing that is worth noting is that the protocol has accumulated revenue from fees and managed to grow and diversify its treasury with tokens like $CVX, $CRV, $ETH, stablecoins, and LP positions in different protocols. This allows the team to be more strategic about their asset allocation instead of selling $ALCX on the open market to fund operations.

Alchemix is deployed on multiple chains, including Ethereum Mainnet, Optimism, and Arbitrum. Each deployment has its unique technical specifications and differences.

Note that loans on Mainnet and Layer 2 chains have similar behaviors but there are unique yield strategies specific to each chain. Each chain has its unique yield strategies, impacting the behavior of Alchemists and the Transmuter.

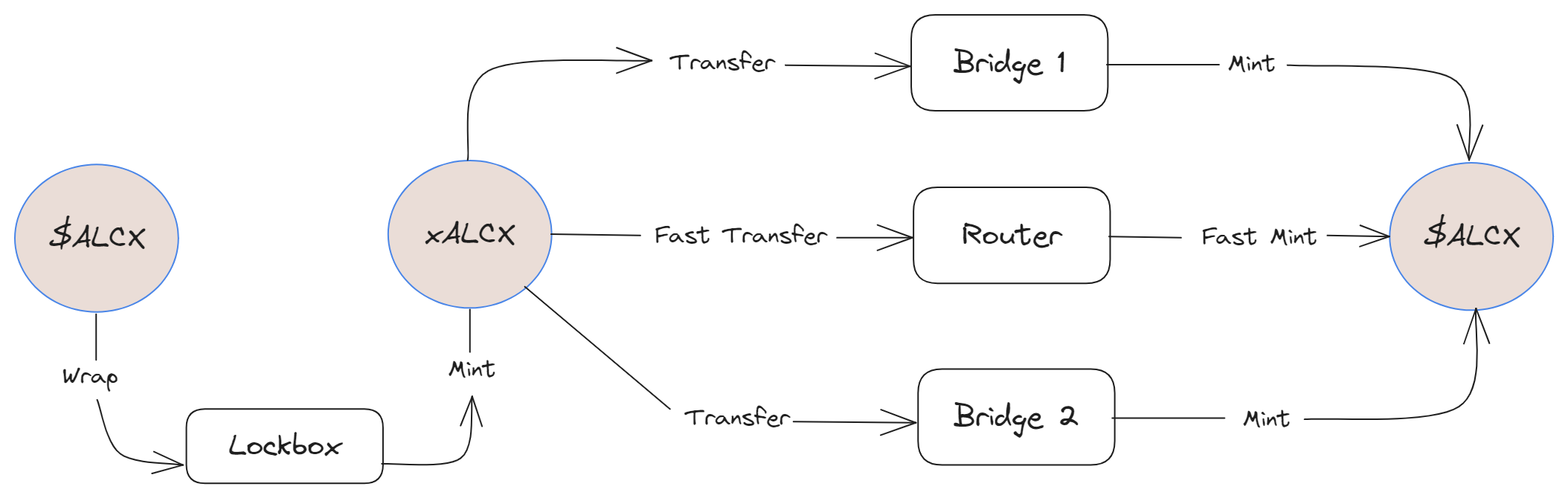

On Layer2, $ALCX is technically referred to as an xAsset – an asset that is minted by Connext. As for alUSD and alETH, they are represented as canonical assets on both chains, since they can be issued by the Optimism and Arbitrum Alchemists. To be exact, Connext mints xalUSD and xalETH, which are then automatically converted into the canonical versions (the nextalAssets are placed into the canonical contracts and a new canonical token is minted).

The Transmuter operates similarly on Layer 2s, interacting with the xERC20 implementation of alUSD and alETH. The Elixir AMO also functions in the same manner on Layer 2 chains as it does on Mainnet. It holds backing in the alAsset liquidity pool and can be withdrawn single-sided as alAssets to increase the price. Nonetheless, you should note that the current DEXs being used on L2s (Velodrome on Optimism and Ramses on Arbitrum) do not allow single-sided liquidity withdrawals.

Alchemix offers an innovative DeFi solution that allows users to access Self-Paying, Interest-Free, Non-Liquidating Loans.

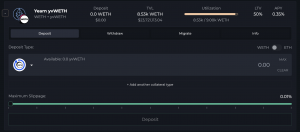

For example, the Yearn yvWETH vault accepts WETH or yvWETH. There’s a conversion tool built into the WETH vault that allows you to convert your ETH to WETH during the deposit.

The debt limit indicates the total amount you’ll be able to borrow.

You can see how much you have available to borrow by clicking the Vaults page, and looking at the ‘Available Credit’ amount.

If you have positions across several vaults, you can use the filters to see individual credit available on each vault.

Debt will need to be repaid either automatically over time or sooner by manual repayment using the repay function.

Alchemix does not charge any fees or penalties for repaying a loan early. Loans can be repaid via the following process:

You can only withdraw funds that exceed the collateralization requirements of any outstanding loans you have. This can be done by:

Alchemix maintains a 1:1 equivalence between alAssets and their underlying assets (e.g., 1 alUSD = 1 DAI) for borrowing, self-liquidation, and loan repayment purposes.

Note that you can also migrate between vaults. Migration can be done via the following steps:

Alchemix allows users to leverage their assets without incurring interest costs, making it an attractive option for those looking to access liquidity while maintaining financial stability.

Whether you have an existing loan or not the vaults page will display the current available strategies.

This page will display the full range of supported assets, and the list will grow longer over time.

Each vault listed will show the collateral assets you can deposit and the current APY.

On the Transmuter page, you can also swap alAssets at a guaranteed 1:1 ratio for equal-value tokens with no slippage (unlike swapping through a DEX on the open market. However, the drawback is that it might take longer.

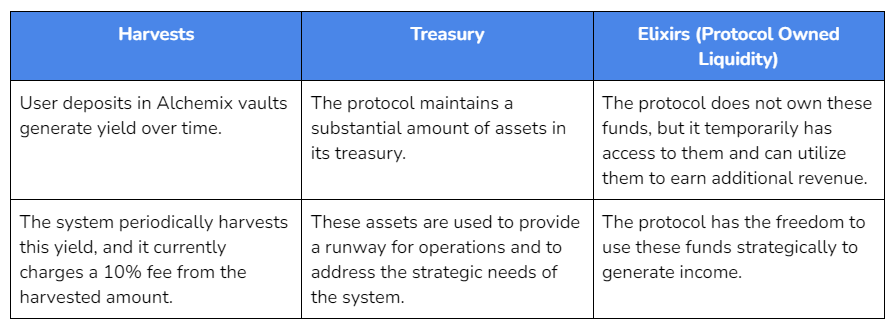

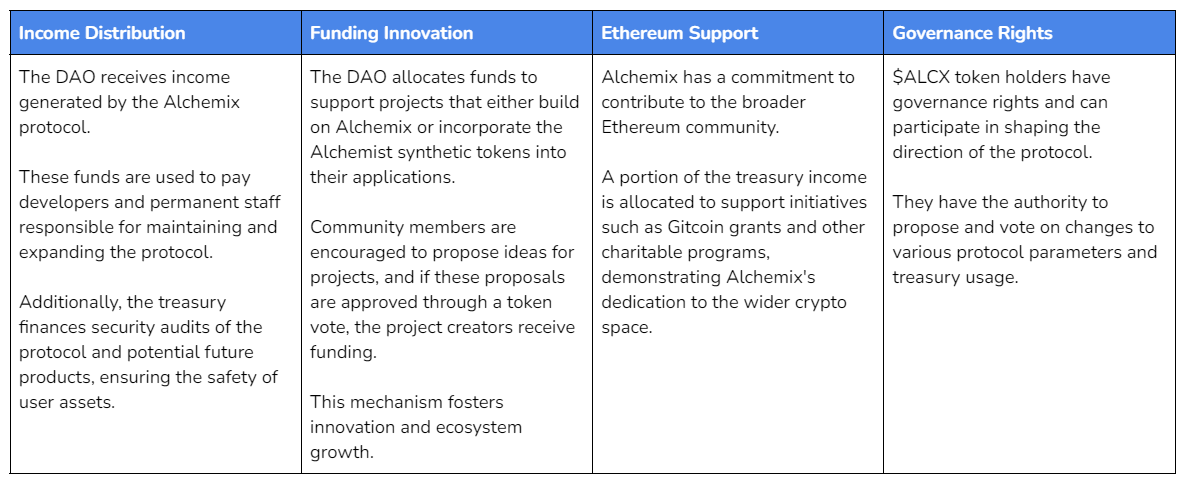

Alchemix’s business model revolves around creating sustainable opportunities for depositors and allowing them to take on self-repaying loans while using their collateral assets to generate revenue from various sources.

Users who deposit their assets into Alchemix’s vaults earn interest over time through yield-generating strategies, and Alchemix charges a 10% fee on the yield harvested from user deposits.

Hence, when the system periodically collects the yield generated by the assets in the vaults, it retains a portion of it as a fee. This fee serves as an additional revenue stream for Alchemix.

Additionally, Alchemix maintains a treasury containing a significant amount of assets. This treasury is used for operational expenses and strategic purposes. The assets in the treasury can be strategically deployed to generate income, which contributes to the sustainability of the platform.

Similarly, the platform temporarily has access to Elixirs, which are funds that belong to the protocol-controlled value (PCV). These funds can be used to generate additional revenue. This way, Alchemix has the flexibility to employ various strategies to earn income on these assets.

Finally, Alchemix has its governance token, $ALCX. While not directly a source of revenue, it plays a vital role in the governance and decision-making process of the platform. Holders of $ALCX can participate in governance proposals, influencing the direction of the platform.

Alchemix generates revenue from three primary sources:

Alchemix charges a 10% service fee on all generated yield, which is directed to the DAO treasury.

$ALCX is the governance token of Alchemix, with its initial supply and emissions distributed among developers, the DAO, and the broader community.

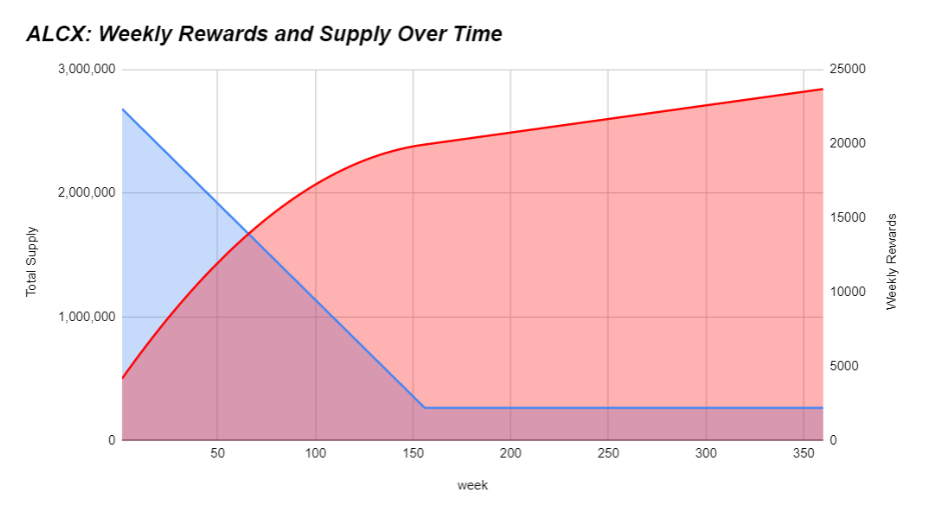

The initial token supply is distributed accordingly. An estimated 2,393,060 $ALCX tokens will be emitted over 3 years, with a fixed amount thereafter.

Emissions began in February 2021.

The original distribution consisted of an 80/20 split.

$ALCX was designed to slowly reduce emissions over the first 3 years, followed by fixed weekly emissions thereafter.

An initial supply of 478,612 $ALCX was minted as a pre-mine. Alchemix calculated that there would be 2,393,060 $ALCX in circulation after 3 years, in the following distribution:

The staking pools distributed approximately 22,344 $ALCX tokens in its first week, with a decrease of 130 $ALCX every week for the next 3 years. Calculations are approximate as $ALCX rewards are calculated per block, and network conditions although negligible may slightly affect the schedule.

At the end of the 3 years, a fixed 2200 $ALCX would be emitted weekly, increasing the total supply by 114.400 $ALCX annually. This will lead to a gradual decrease of inflation over time beginning from the third year.

Alchemix’s staking pools are powered by the StakingPools.sol contract, whose purpose is to distribute $ALCX tokens to the community and provide liquid pairs for tokens in the Alchemix ecosystem.

The emissions distribution is modified through governance proposals.

The various types of pools include the following:

These pools and the weights thereof will be adjusted as Alchemix brings more synthetic tokens to the market. The priority will be incentivizing synthetic pairs with their base asset.

veALCX represents an upgraded version of the original tokenomics, implementing a ve token model where users can benefit from:

veALCX stakers will need to provide liquidity on Balancer first. This is done in a pool that is 80% $ALCX and $20% ETH.

Note that the 80/20 liquidity pool and veALCX will only be available on Ethereum Mainnet, where there is also an Aura gauge for the ALCX/ETH pool. This allows the pool to be bribed and also makes it possible for the protocol to collect $BAL and $AURA emissions.

There will be a one-epoch cooldown period between unlocked tokens and being able to claim them to the user’s wallet. The user will have no voting power and will earn no rewards during this cooldown time. Locked tokens can become eligible for unlocks by burning $FLUX tokens.

In addition to the implementation of ve tokenomics with veALCX, Alchemix also introduces an extra ecosystem token called $FLUX. It offers benefits such as boosted voting power, the possibility to unlock early, and the ability to trade it on DEXs.

Other features include:

veALCX stakers will receive yield in $ALCX subject to the same locking terms as their veALCX BPT token — ie, unlocking BPT will also unlock $ALCX with no penalty.

Users can claim their $ALCX rewards immediately at any time, but in doing so they will need to take a 50% penalty, which will be redistributed to other veALCX lockers.

It is also possible for users to immediately compound rewards into their locked veALCX position with no penalty, as long as they bring their own $ETH to pair with $ALCX.

Note that veALCX is currently intended to replace gALCX, meaning gALCX APR would be reduced to 0% when veALCX launches.

Users can also purchase $FLUX or use their accrued $FLUX to fully unlock their veALCX position early, claiming both the underlying BPT and the $ALCX that gets unlocked.

veALCX stakers will receive a proportional split of a percentage of AMO and Alchemist revenue for each alAsset (for now, alETH and alUSD). This percentage will be determined by governance.

Revenue sharing will be applied as credits to user accounts, offsetting debt if the user’s account has any debt, or allowing users to mint alAssets without incurring debt. Note that the credit can be delegated to accounts owned by different addresses than the veALCX position.

The DAO is responsible for determining what share of total revenue is sent to veALCX stakers.

veALCX stakers may vote on governance proposals and bi-weekly emissions gauges with their vote multiplier.

Gauges will be a list of liquidity pools approved by governance and that accept direct $ALCX incentives or bribes, where at least one of the assets is an alAsset. Gauges can additionally pay incentives (to the approved liquidity pools) in other tokens, and receive bribes (for veALCX voters that select that gauge) in any token.

Note that veALCX voting power only accounts for BPT tokens, not unclaimed $ALCX rewards.

There are 6 main treasury addresses of the Alchemix protocol:

Treasury Wallet 1, Treasury Wallet 2, sdCRV Controller, Optimism Multisig, Arbitrum Multisig, and Base Multisig.

There are 5 addresses for the alUSD and alETH Elixirs: alUSD-FRAXBP Elixir, alUSD-3CRV Elixir, alETH-frxETH Elixir, Optimism Elixir, and Arbitrum Elixir.

More statistics about the core holdings of the protocol can be found in its dedicated statistics page.

Governance of Alchemix Finance is overseen by the DAO, which holds the liquid governance token, $ALCX.

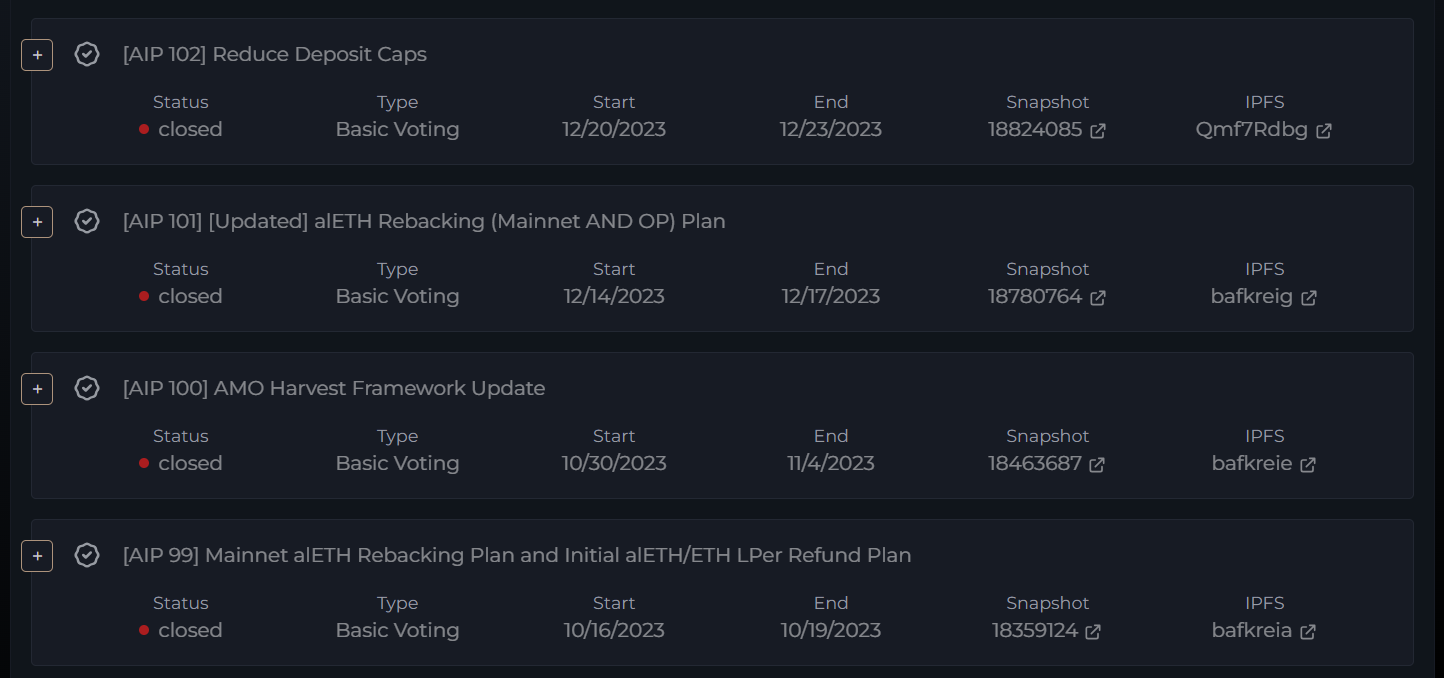

At present, the Alchemix DAO operates through a developer multisig, which holds certain administrative powers. Signal collection for governance decisions occurs through the Snapshot app, which allows $ALCX token holders to express their preferences.

Holders of the $ALCX token possess governance rights, which enable them to influence the protocol’s trajectory and treasury management. They can participate in voting on proposals that impact the protocol.

Community members are encouraged to actively participate in the governance process. They can propose changes, improvements, or initiatives by following the Community Governance Process.

As the Alchemix DAO matures and evolves, the development team plans to propose a vision for transitioning to full on-chain governance. This shift would grant the community complete control over numerous protocol parameters and decisions. The development of this on-chain governance system will be an open and collaborative process, with the community’s feedback and input playing a crucial role in shaping its design and direction.

The governance process includes the following steps.

Step 0

It is recommended you gather sentiment for your proposal idea through discussion with the community in the discord server, fireside chats, DMs with other community members, and/or writing a draft document to share.

Step 1

Post your proposal to https://forum.alchemix.fi/public/ with the tag “Ecosystem Development”.

Step 2

Share the Alchemix forum link to your proposal in the #governance-proposals channel in the Alchemix discord server.

Step 3

After a minimum of 5 days have passed since completing Step 1 AND Step 2, you may post your proposal to the “Alchemixed Opinions” Snapshot (the platform for Alchemix governance temperature checks).

Step 4

If greater than 50% of the non-abstain vote is “For”, and a quorum of 5k $ALCX voting is met, the proposal will move to the official Alchemix Proposal Snapshot as an AIP (Alchemix Improvement Proposal).

Step 5

Official AIPs will have a quorum of 35k $ALCX. If the quorum is met, then the multisig will be directed to execute the most popular voting option unless directed otherwise by the voting parameters.

Supplementary Information

The following are common proposal types:

What Makes a Good Proposal?

While Alchemix offers ongoing bug bounties and exposes its codebase to recurrent security audits, it also implements risk management practices to prevent the accumulation of bad debt in the protocol.

Depositors in the Alchemix system provide collateral to the yield strategies in order to borrow alAssets (e.g., $alUSD or $alETH). They typically swap their alAssets to another asset shortly after taking the loan, so they are not always exposed to the price of alAssets over time.

The primary risk for depositors is related to the yield strategies where they deposit their funds. If a yield strategy experiences a loss that exceeds the maximumLoss, as set by governance, the strategy will be paused. This means users cannot make new deposits, liquidate, repay, or take new loans with this strategy. Harvests will also be disabled. However, users can still repay their loan and withdraw the yield token.

In extreme cases, if an underlying strategy suffers a significant loss (greater than 50%), users may have bad debt with Alchemix, where the value of their debt exceeds the value of their collateral. Despite this, users may still experience a smaller loss compared to other scenarios.

It’s important to note that some yield strategies may require selling yielded tokens to harvest yield. If the value of the harvested token temporarily depegs, users may experience reduced yield during that period.

Liquidity providers for alAssets are exposed to price fluctuations of alAssets, since they are implicitly allowing users to trade alAssets at a price determined by the underlying DEX pool.

AlAssets can be redeemed for underlying collateral in three ways: loan repayment, selling through a liquidity pool (with price fluctuations), or depositing in the Transmuter (timeline uncertain).

Hence, liquidity providers must consider:

If the balance of the pool moves favorably for liquidity providers over time, they can earn yield along with net positive slippage. However, if the balance moves unfavorably, net negative slippage may offset the yield.

To hedge this exposure, users can use the Transmuter or be depositors within Alchemix. They can withdraw $alUSD for a bonus positive slippage and repay their debt if the alAsset pool shifts less favorably. However, using the Transmuter involves waiting for collateral to flow in.

In the event of bad debt due to a significant loss in a yield strategy, the Alchemix DAO may be required to take action. However, it cannot slash stakers to cover the loss because $ALCX liquidity and single staking pools are not locked.

To make the protocol whole, the treasury may sell $ALCX or other assets if decided by governance. This action would dilute $ALCX holders, potentially affecting their holdings.

Alchemix has undergone multiple audits and carries ongoing bug bounties

Alchemix V2 – February 19, 2022 – Runtime Verification

Alchemix – May 19, 2022 – code4rena

Alchemix has a bug bounty with Immunefi.

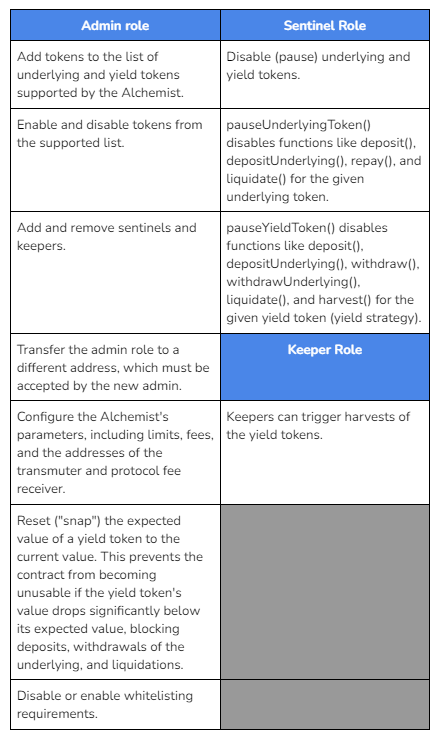

Various contracts and components are governed by different privileged roles under a multisig setup. The Alchemix Developer Multisig serves as the admin for Alchemix contracts and manages the operational budget for the protocol.

All major contracts in Alchemix v2, including AlchemistV2, TransmuterV2, and TransmuterBuffer, are designed to be used via upgradeable proxies. This allows the Alchemix DAO to upgrade the functionality of these contracts as needed.

Sentinels can pause yield tokens and underlying tokens in the event of issues, and admins can subsequently unpause these tokens.

When an underlying token is disabled, users can still settle their debt and withdraw yield tokens or underlying tokens.

Each accepted yield token has a configured maximum loss that it can experience while still functioning normally. If the yield strategy loses more than the specified maximum loss, it is automatically paused. This pause disables certain functions and prevents users from making deposits, liquidating, or taking new loans with these strategies. Harvests are also disabled, but users can still repay their loans and withdraw the yield token.

A separate timelock multisig holds the majority of DAO-owned $ALCX tokens and controls 2 of the AMOs, the minting of $ALCX emissions and a few Alchemist functions.

The timelock has a delay of 600 seconds (reduced from 24 hours) to increase security and speed up reaction times. This timelock may be retired in the future, with admin controls shifting to a combination of veALCX (voting-weighted ALCX) and the developer multisig, aiming to decentralize governance over time.

There are 6 main treasury addresses of the Alchemix protocol.

Liquidity risk can manifest in situations of vault losses and collateral depeg scenarios.

As an example, assume a yield-bearing asset (e.g. a $DAI deposit into the yvDAI vault) experiences a loss in the underlying collateral that is unrecoverable.

For the resolution, to re-enable the disabled functions, the following steps need to occur:

The maximum damage in this scenario is the total amount of funds lost from the vault. alUSD will still be overcollateralized, and depositors will experience the loss, similar to how they would experience it if they held the tokens outside of Alchemix or if they used withdraw() after maxloss() was triggered. It may also result in a slower effective rate of yield flow to the Transmuter buffer.

While the risk of a vault losing collateral is low, the damage is still significant. Minimizing this risk involves carefully considering which yield-bearing strategies are added to the protocol.

The response time for this scenario does not need to be necessarily fast because the affected functions are automatically disabled. Therefore, the team and the DAO should assess the loss to ensure it’s unrecoverable before taking the governance steps to remedy the situation by calling snap().

In this scenario, one collateral token used by the Alchemist experiences a severe de-pegging against other collaterals. Let’s assume $DAI drops to 80 cents compared to $USDC and $USDT, while $alUSD maintains its peg against $USDC and $USDT.

The consequence is that this depeg opens up arbitrage opportunities:

In this case, the resolution aims to stabilize the peg of the de-pegged asset ($DAI in this case).

In this example, the depegging of $DAI results in the price of the $alUSD dropping towards the de-pegged asset.

Sentinels exist to disable underlying tokens as soon as they experience a depegging event. This way, the repay, liquidate, and mint caps limit the amount of depegging of the synthetic asset that can occur before sentinel action.

There is some risk that the repay/liquidate/mint caps may get reached during significant depegging events, especially during high volatility. If the peg does not restabilize, $DAI would remain paused, and there will be a loss in the backing of $alUSD, requiring a decision by the DAO on how to proceed.

Unlike in the previous example of a vault loss, the faster a sentinel can respond by disabling the depegged underlying token, the less the price of $alUSD will be arbitraged down. Hence, a timely response is crucial to mitigate the impact of the de-pegging event.

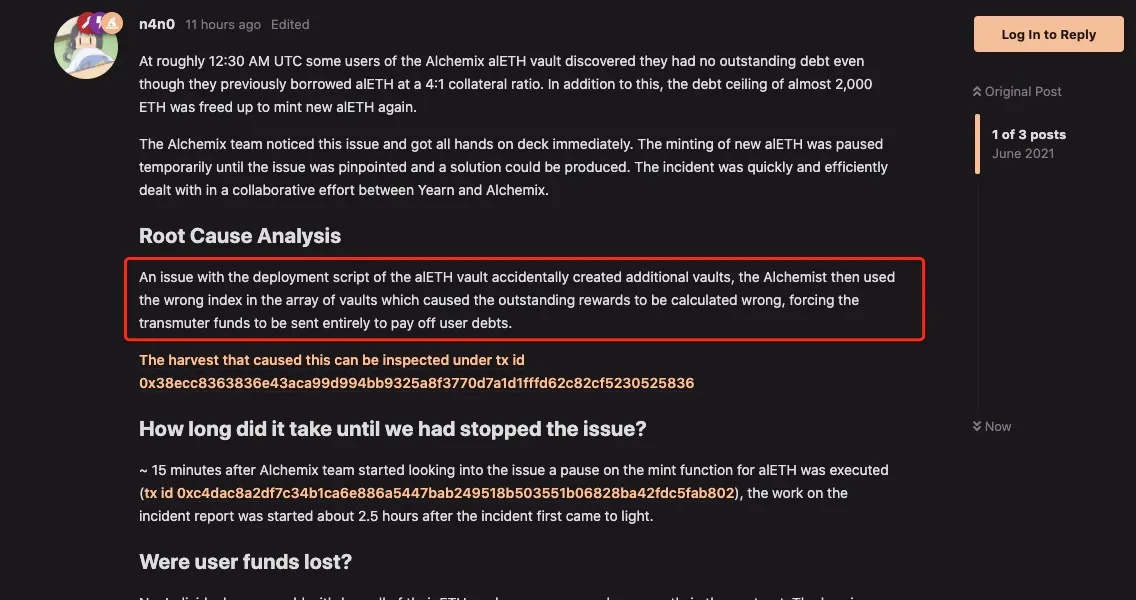

On June 16, 2021, Alchemix faced a significant challenge shortly after its launch when a vulnerability in the $ETH vault allowed users to withdraw collateral without repaying their loans, resulting in a substantial loss of $ETH. This exploit left the project undercollateralized by 2,688 $ETH, or $6.4M at the time.

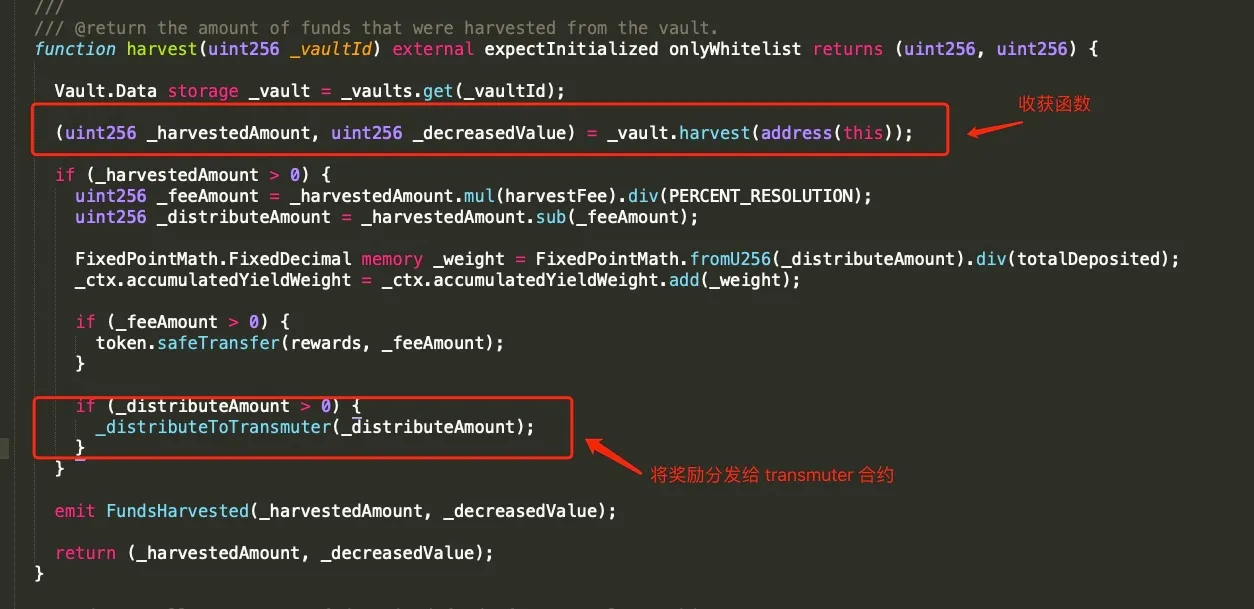

The root cause of the exploit was related to the addition of three vaults through the Transmuter, which led to incorrect revenue recording. When the harvest function of the Transmuter was called, the correct index value was not passed in, resulting in the selection of the wrong element for revenue distribution.

The official Incident Report stated that the accidental creation of additional vaults during the alETH deployment script led to the use of the wrong index in the vaults array. This incorrect index calculation caused the Transmuter to distribute all rewards to repay user liabilities.

To delve deeper into the exploit, it was crucial to understand AlchemistEth’s fund storage process. In the AlchemistEth contract, the total recharge status was recorded using the Data structure of the Vault library. However, an issue arose when it was discovered that the adapter (strategy pool) had other income channels, which caused the user’s principal to generate an additional 4300 ETH in income.

The problem was traced back to the harvest function of the Transmuter, where the totalDeposit of the vault became 0 during revenue distribution. This resulted in the distribution of 4300 ETH directly to the adapter, causing the totalValue obtained by the adapter to be incorrect.

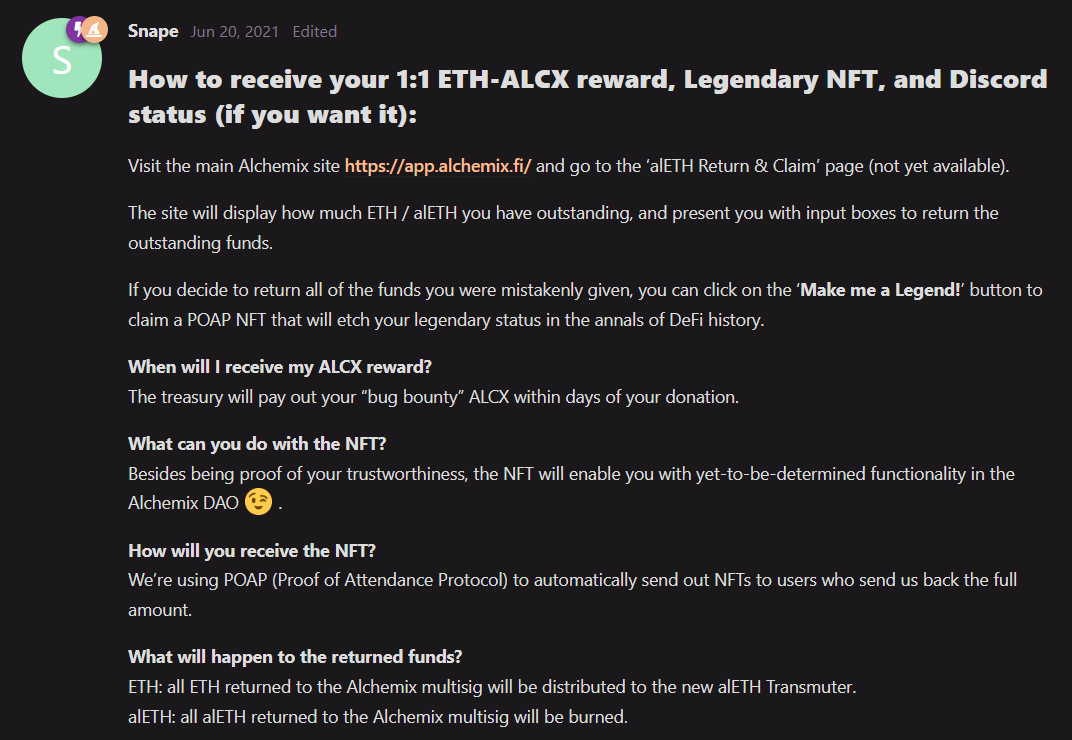

Following the discovery of the vulnerability in the alETH vault, the team paused the minting function. In response, the Alchemix team also took a proactive approach by organizing a campaign to encourage users to return the lost $ETH. Those users who returned the funds earned an NFT with yet-to-be-determined functionality in the Alchemix DAO.

In order to restore the solvency of the alETH vault, the protocol fee was temporarily increased to generate additional revenue. Additionally, $DAI was sold from the protocol treasury to address the solvency gap

This incident highlighted the team’s commitment to its community and the importance of building trust and transparency within the DeFi space.

Multichain was the bridging solution for alAssets on Arbitrum, Optimism, and Fantom for alETH, alUSD, and gALCX (not all assets were deployed on all chains). On each non-mainnet chain, the Alchemix multisig deployed an upgradeable version of each asset – this is the Canonical asset on that chain.

When a user bridged from the mainnet to another chain, they would lock their asset within the multichain contract on the mainnet, and then the multichain asset would be minted to the user on the destination chain. The user could then deposit the multichain asset to the Canonical asset contract, which would allow them to mint an equivalent amount of the canonical asset.

When multichain was exploited, the DAO disabled the ability for multichain assets to mint canonical assets. However, someone with key access at multichain was able to steal the funds the multichain contract held on mainnet. Because of this, many of the assets on Arbitrum, Optimism, and Fantom are no longer able to bridge back to the mainnet and are therefore no longer backed.

Additionally, Fantom $USDC, $DAI, and $USDT all originated via the multichain bridge. This means the collateral in the Alchemists on Fantom is also worth less than the loans they originated.

A proposal seeking to restore the backing of all Fantom assets affected by the multichain exploit using the DAO treasury was put up on July 26, 2023. The plan was to create a refund distribution system funded from the treasury (~$150k of alUSD and 5,590 gALCX) to refund 0.909 OP-alUSD per 1 ftm-alUSD and 1.289 OP-ALCX per 1 ftm-gALCX, with refunds available to be claimed on Optimism. This plan has been executed already.

On July 30, Alchemix’s alETH/ETH pool on Curve lost $13.6M worth of $ETH and $8.4M in alETH tokens as a result of a reentrancy vulnerability that was exploited due to a bug in the Vyper compiler. This exploit impacted Curve pools, affecting not only Alchemix’s pool but also other pools like JPEGd’s pETH-ETH and Metronome’s sETH-ETH, resulting in over $73.5M of total losses.

In response to the attack, Alchemix, Curve, and Metronome jointly offered a bug bounty of 10% of the stolen funds (approximately $7 million) to the attacker. They appealed to the hacker to return the remaining 90% of the stolen assets.

Surprisingly, the attacker began returning the stolen funds shortly after the bug bounty offer was made. The attacker initially returned 4,820.55 alETH to the Alchemix team.

We are extremely happy to announce that all funds stolen by the hacker of the Alchemix @CurveFinance pool have now been returned.

Full post mortem coming.

— Alchemix (@AlchemixFi) August 5, 2023

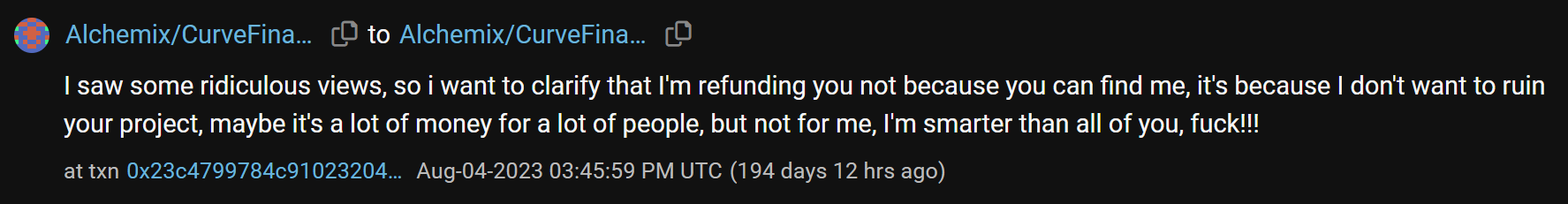

The attacker also left an on-chain message, indicating that they were returning the funds not because they feared being caught but because they did not want to “ruin” the projects involved.

Compensation

A compensation plan was introduced under AIP 95a, AIP 99, and AIP 101.

AIP 95a was to withdraw 507k alUSD and 382 alETH from the mainnet AMO Elixirs and bridge it to Optimism via Connext. This would then be paired with additional treasury assets obtained from the dev multisig on Arbitrum and Optimism to provide a total of 1.764m of alUSD liquidity and 882 alETH liquidity on Velodrome. Eventually, this would transition the liquidity to a Velodrome AMO and/or an AMO of a partner DEX on Arbitrum.

AIP 99 was due to the situation that all LPers will be able to be made as close to whole as possible through a combination of recovered alETH and $ETH from the exploit, as well as CRV tokens from Curve DAO. The $CRV tokens would be vested over the course of 1 year. However, Alchemix would have the option to pursue a veCRV whitelist and receive the full amount of AMO-allocated CRV up-front, so long as they were immediately max-locked in veCRV(precedent being set by JPEG’d).

Eventually, this was approved under AIP 100, which allowed affected alETH/ETH LPers to claim their pro-rata share of recovered funds in the form of alETH and wETH. Additionally, they will be able to claim further recompensation in the form of CRV on a 1 year linear vest.

Refunds for the exploit were compensated on December 21, 2023.

Alchemix was created by a group of pseudonymous developers, including individuals with aliases such as Scoopy Trooples, Dr. Derivative, Nomad, Snape, technocratic, Gorby and Nano.

These developers entered the crypto space at various points in time, with Scoopy Trooples, the protocol spokesperson, starting his journey in 2016. He became a founding member of the project that eventually became Alchemix in 2020.

Over time, the Alchemix team has grown to include not only the core developers but also part-time staff members and community contributors. They emphasize the importance of community involvement and engagement and encourage anyone interested in the project to join their Alchemix Discord, where they have an active and supportive community.

Alchemix has garnered support from a list of reputable early backers and strategic partners, including eGirl Capital, DCV, Alameda Research, Weak Simp Capital, Immutable, LedgerPrime, Orthogonal Trading, Magic Ventures, The Spartan Group, Delphi Digital, CMS Holdings, GBV, Maven 11 Capital, Fisher8, Protoscale Capital, and Nascent.

The investment round was led by CMS, Alameda Research, and Immutable Capital, resulting in a total of $4.9M in funding for the project. This funding was conducted in an OTC deal between founders and investors at an $ALCX price of $700.

The funding round was used for audits, consultants, recruiting, marketing, and community activities and allowed the founders to devote full-time to production.

What is an Alchemix Vault?

An Alchemix Vault is a DeFi smart contract that allows users to take out loans denominated in synthetic assets against yield-bearing assets used as collateral.

Users start by depositing collateral into the Vault to mint a synthetic asset that they can borrow and use across DeFi. The key feature of the Alchemix Vault is that it generates yield from a series of whitelisted strategies.

Over time, as the yield is harvested, the user’s debt decreases, effectively paying for itself. This is made possible because the debt position is backed by a yield-bearing asset.

How much can I borrow against my deposited collateral?

When you deposit collateral on Alchemix, you can borrow up to 50% of the corresponding synthetic alAsset value against your deposit. For example, if you deposit $ETH, you can borrow alETH worth up to 50% of the value of your deposited $ETH.

Note that the LTV of each loan varies from one asset to another.

Is it possible to exit or repay my loan before it is fully repaid?

Alchemix allows you the flexibility to exit or repay your loan at any time, even before it is fully self-repaid.

Alchemix offers a self-liquidation feature that can only be triggered by the depositor that enables you to repay outstanding loans by using a portion of your deposited collateral.

Once the loan is repaid, you can withdraw the remaining collateral.

There are no lock-in periods or penalties at all with Alchemix.

How long will it take for my loan to fully repay itself?

The repayment timeline for Alchemix loans is subject to the variable nature of DeFi yields. As such, it is challenging to provide an exact timeframe for when the loan will be able to fully repay itself. However, a rough estimate can be determined by considering the Loan-to-Value (LTV) ratio and the interest rate. For example, a 50% LTV loan at 10% APR would take 5 years to repay.

0xDefi has a tool to calculate how long your loan will take to repay here. This is a third-party tool, so please use it at your own risk.

Can I be liquidated?

No, you cannot be liquidated by third parties on the Alchemix platform. Your debt is denominated in the same currency as the collateral, which means that the price fluctuations of the asset do not impact your vault position. Regardless of market volatility, your vault positions remain secure, and you can have peace of mind knowing that your assets are protected from liquidation.

Can I borrow any token against my Alchemix deposit?

The short answer is no. When you make a deposit into an Alchemist contract in Alchemix, you can only borrow the corresponding synthetic alAsset against your deposit (e.g., alETH against $ETH). However, you can take your alAsset and swap it in the market for whatever tokens you want.

When will Token X be available as collateral on Alchemix? When will you be on Chain X?

New collateral and new chains are subject to governance approval as well as technical, financial, operational, and partnership hurdles and therefore do not have timelines. Security and following the correct processes will always take precedence over timelines.