Vertex’s Queen Move

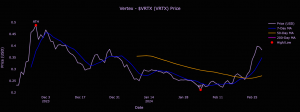

Published Feb. 29, 2024

The trend is clear in DeFi: protocols are migrating beyond the confines of the application layer, venturing into the creation of moats by either constructing their own bespoke infrastructure or laying down a foundational base for others to innovate upon.

This evolution is illustrated by the moves of Derivatives DEXs such as dYdX and stablecoin issuers like Maker, who have ventured into building their own chains. Similarly, Synthetix has redefined itself as a liquidity layer, enabling a new wave of derivatives offerings ranging from options and perps to prediction markets, while Morpho has evolved from a lending optimizer to a cornerstone for new lending market architectures. Furthermore, Uniswap’s decision to delegate market-making to specialized off-chain entities marks another step in this strategic realignment.

Amidst this backdrop, we find it very attractive to identify projects building such moats that are inaccessible to others, almost as if they became “unforkable” codebases. It gets even more interesting when the project belongs to a fast-growing market sector that has already found product-market-fit and that can easily take away market share from both centralized and decentralized incumbents.

We find in Vertex and the $VRTX token an opportunity that checks most of the boxes we are looking for. Currently sitting under $100M in market capitalization, Vertex’s strategic advantage lies in its off-chain orderbook, allowing for high-speed and low-latency trading through a vertically integrated platform that can be seamlessly ported across chains.

Vertex was originally conceived in response to the pervasive centralization risks of CEXs. Initially, it sought to leverage the network effects of $UST, and the team started off building a forex trading platform on Terra. However, the trajectory of Vertex took a decisive turn following the collapse of the Terra ecosystem in May 2022.

Against the backdrop and eventual collapse of both $UST and $LUNA, the mission remained the same: to bridge the gap between the control offered by DEXs and the performance of CEXs. Leveraging its team’s expertise in trading and risk management, Vertex navigated the turmoil by safeguarding its treasury and rapidly pivoting its focus towards a solution that could address the market’s growing demand for non-custodial trading platforms.

The pivot led Vertex to the Arbitrum network, marking a strategic departure from its original decentralized forex trading model towards a more vertically integrated platform.

Initially, Vertex secured $8.5 million in seed funding with the ambition to develop on the Terra ecosystem. However, after the pivot to develop on Arbitrum, the project received an undisclosed strategic investment from Wintermute Ventures in June 2023. Other participants in this round include Jane Street, GSR, Hack VC, Dexterity Capital, Big Brain Holdings, and HRT.

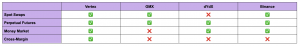

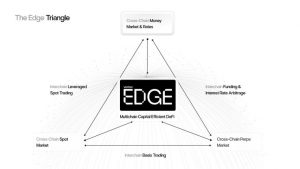

Vertex is a vertically integrated trading platform that offers spot swaps, perpetual contracts, and an integrated money market with margin capabilities within a single application. The exchange provides a Universal Margin Account, enabling users to manage their risk by utilizing their entire portfolio as margin (Portfolio Margin).

This universal margin account system simplifies the trading process, consolidating multiple open positions into a single account for streamlined management and improved capital efficiency. Universal cross-margining by default means that liabilities across various positions are consolidated, optimizing capital efficiency, reducing initial margin requirements, and improving risk management capabilities. For example, traders can hedge their risk across spot and perps, capture basis, earn yield on their collateral deposits, or borrow assets against their margin all within a single platform.

The platform’s integration of multiple DeFi services into a single, cohesive environment not only simplifies the trading experience but also enhances capital efficiency for its users. By eliminating the need to navigate between disparate DeFi applications for various trading activitiesVertex significantly reduces operational complexity and costs. This integrated approach allows for better liquidity conditions, tighter pricing, and narrower spreads, directly benefiting the end user.

In analyzing the trajectory of DeFi’s evolution, we observe a clear pattern of protocols extending their influence downwards into becoming foundational layers. This move is driven by the quest for a more substantial competitive moat—a concept that is paramount in the pursuit of value capture. This shift is particularly evident in the derivatives market, where protocols are evolving from being applications with limited control over their environment to being able to dictate the terms of engagement (fee discounts, revenue share, incentive campaigns…).

Building derivatives in a pre-L2 world was extremely challenging due to the high gas costs of Ethereum. Once Arbitrum and Optimism entered the stage, options and perpetuals on-chain became a reality, with projects like GMX, Kwenta, Dopex, Lyra, and others taking the lead. However, while they were worthwhile and kicked off an offspring in the middle of the 2022 bear market, the flaws in their design started to show.

Pricing derivatives instruments is extremely challenging. Even with the lower transaction costs of L2s, building an on-chain order book is not always feasible or a viable alternative to compete for market share versus CEXs like Binance or Deribit. While AMMs proved to work, they were capital inefficient and created a peer-to-peer environment. Pools like $GLP got a lot of traction due to the real yield that was offered to liquidity providers, who acted like the house of the casino by charging excessive fees to traders. Additionally, such efforts lacked pricing power, as their price discovery came from CEXs like Binance, Coinbase, Bybit, and even FTX back then.

The aforementioned problems are solved with a common denominator, which is an orderbook that can offer a CEX-like UX with minimal latency – still allowing users to retain custody of their funds. Unlike competitors such as dYdX or Aevo, Vertex acknowledges that rollups and application-specific chains are becoming a commodity, with RaaS providers making it possible to deploy a custom L2 with just one-click.

However, most solutions still rely on off-chain software components for the actual matching and liquidation engines. This is where Vertex has found an edge, optimizing its off-chain orderbook to be competitive against CEXs by offering 5-10ms latency. Instead of having to rely on external RaaS providers or building a blockchain from scratch, Vertex can deploy its risk engine on top of any existing EVM blockchain or L2 rollup – all it takes is to deploy a smart contract on the underlying chain for settlement.

It is a misconception that DeFi platforms need to build their own application-specific rollups in order to become foundational layers that can leverage their own stack to further expand its network effects. In fact, the crux of the challenges in building decentralized solutions lies in achieving a balance between two often conflicting goals: maintaining decentralization, and achieving high performance.

Solana’s approach, which prioritizes performance, underscores the difficulty of this balancing act. However, even in a high-performance ecosystem like Solana, dYdX’s decision to move away due to the persistent costs associated with high-frequency trading activities (such as setting and canceling orders) illustrates the complexity of optimizing both axes simultaneously.

dYdX’s shift away from a model that incurs gas fees for high-frequency trading activities, regardless of how minimal those fees might be, signals a broader industry recognition that performance optimizations must not come at the expense of incurring prohibitive costs to users. This shows that 1) building a decentralized and high-performance solution is a very hard problem to solve, 2) and there is not a critical need or demand for it. For a DEX to be competitive and attractive for market makers to offer deep liquidity and tight spreads, ultra-low latency and high throughput remain the most dominant demand and expectation.

Blockchain users often value the assurances of decentralized solutions to protect against custody risk. At the same time, they are comfortable accepting the tradeoff of the incremental performance gains that can be offered by a centralized sequencing mechanism, such as Vertex’s off-chain orderbook. In fact, Ethereum’s approach with its rollup-centric roadmap, embracing a model where block production can be centralized (as managed by a sequencer) while ensuring that block validation remains decentralized, already embodies this pragmatic compromise. This model allows for the performance benefits of centralized processing without compromising the core values of blockchain technology—security, transparency, and decentralization.

Now that we have cleared up all doubts about why building your own application-specific rollup is not equivalent to “owning the stack”, it is time to delve into the reasons why Vertex has an edge by virtue of owning its “proprietary” stack.

Vertex’s off-chain order book is called the Sequencer. This is their strategic weapon to build a moat that makes their DEX highly competitive in terms of liquidity depth, while still playing infinite positive-sum games with underlying L1 or L2 chains like Arbitrum or Blast.

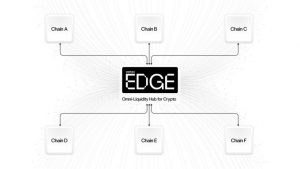

Most recently Vertex published documentation informing about an upgrade to this Sequencer, turning it into a Swiss-Knife that can unify liquidity from multiple chains into a single off-chain orderbook. They call this Edge (powered by Vertex). By extending its functionalities across any supported chain, it effectively enables cross-chain trading and order matching without the historical necessity of transferring assets across chains.

While there is a lot of experimentation going on when it comes to orderflow auctions and intents, they result in additional latency and throughput, which are detrimental for high-frequency trading. Additionally, all solutions and years of experience in TradFi have converged in using Central Limit Order Books (CLOBs). This is why Vertex is doubling down on their off-chain orderbook efforts. Conceptually, Edge operates akin to a virtual market maker that synchronizes DEXs across various blockchains. It matches incoming orders from one chain against the pooled orderbook liquidity of all base layers integrated with the Vertex sequencer, thus optimizing liquidity utilization and enhancing trading efficiency.

Vertex transcends the common pitfalls associated with liquidity fragmentation. Instead of further dividing liquidity across different pools or markets, Vertex’s Edge mechanism facilitates the aggregation of liquidity across multiple chains, effectively enhancing the depth and accessibility of markets for users – all in a single shared orderbook. This single and unified liquidity hub eliminates the complexities and inefficiencies associated with siloed liquidity.

Vertex recently deployed Blitz on Blast, which is effectively an exchange for spot and perpetual futures that uses Vertex’s Sequencer to achieve sub 10 milliseconds latency. It is essentially a deployment of Vertex on another chain with a different branding (more details on branding later).

This approach not only challenges the myth that projects must own their application-specific rollups to control their stack but also exemplifies a positive-sum game in the DeFi ecosystem. Unlike platforms where interactions may either add to or draw from the existing value in a zero-sum manner (e.g. deposit or withdraw to the dYdX chain), Vertex contributes positively to each chain it operates on by settling orders directly on the underlying chain.

This is a highly attractive value proposition to onboard market makers. Efficient markets usually converge to an equivalent solution. One mental model to understand this is the example of a market maker who is arbitraging price discrepancies across Binance or Bybit. This mechanism is already built into Edge, making it possible to match orders between Arbitrum and Blast, settling each of them on the underlying source chain. This ensures that every transaction executed through Vertex’s Edge inherently adds value to the chain, enriching the ecosystem as a whole.

Contrast this with how trading on other rollups or application-specific chains works, which usually involves depositing assets that are withdrawn from another chain (e.g. withdraw from Arbitrum to deposit into Aevo – stealing both users and liquidity from the original source).

By mimicking the operations of a market maker that captures arbitrage opportunities across different exchanges, Vertex’s Edge seamlessly matches orders from one chain with those on another, thus embodying the unification of liquidity.

The $VRTX token is the vehicle to own a portion of this moat and capture the upside of the only vertically integrated platform in DeFi that can unify liquidity across disparate ecosystems. Up to 50% of all trading fee revenue, excluding sequencer fees, is allocated to the Protocol Treasury for rewards distribution.

To pigeonhole Vertex merely as a perps DEX overlooks its intrinsic value as an app layer that can integrate a broader suite of derivatives instruments. Our view is that the market’s myopic focus on price is failing to capture the value embedded in $VRTX, paradoxically expecting diminishing returns and lower value capture in the future.

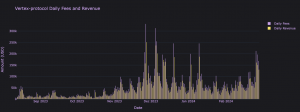

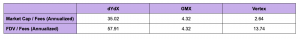

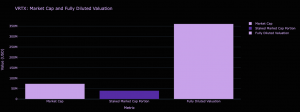

Looking at the current amount of fees being generated since the original deployment on Arbitrum and comparing the valuation of market leaders like dYdX or Aevo, we find that $VRTX is sitting on a very attractive P/E ratio, currently at a 10x lower market cap. Compared to an appchain like dYdX we observe a similar story, with dYdX trading at $2,5B FDV ($1.5B market cap) and Aevo trading at $777M FDV ($717M market cap) vs Vertex’s ~$380M FDV ($73.6M market cap).

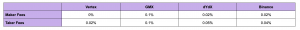

When analyzing fee and volume ratios in the context of perpDEXs, it’s also essential to differentiate between the mechanics of orderbook-based exchanges (Central Limit Order Books, or CLOBs) and virtual Automated Market Makers (vAMMs). In orderbook systems, there are distinct roles for makers—who provide liquidity by placing orders not immediately filled—and takers—who consume liquidity by placing orders that match existing ones. Typically, CLOBs generate fees from takers, and these fees are considered protocol revenues. Makers, on the other hand, are not usually rewarded with fees; instead, they might receive incentives or rebates under certain programs to encourage liquidity provision. Conversely, vAMMs like GMX operate on a different principle where the liquidity pool acts as the maker, and all users are essentially takers. This model often results in vAMMs presenting more favorable fee-to-volume ratios, as the fees shown encompass both the rewards distributed to liquidity providers (LPs) and the protocol’s earnings. This aggregation can give the impression of higher operational efficiency or profitability compared to CLOBs, where only the fees accruing to the protocol are typically displayed.

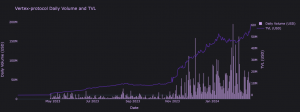

This is noteworthy considering the low fees that are charged: 0% maker fees and 0.02% taker fees. On the flipside, these incentives for market makers might be the reason for the increased volume. That being said, Vertex’s liquidity depth stands out for offering consistently one of the lowest spreads across perp DEXs. While the marketing efforts might not have been as aggressive as some might expect, evidence shows that the Vertex team has done a great job on the Business Development front to onboard market makers to their platforms. This is attributed to the team’s background and connections with their investors, which also pushed them to develop easy-to-integrate APIs and SDKs supporting multiple languages (Python, Typescript, and Rust). The importance of this cannot be understated, since it offers a venue for market makers and HFT prop firms to plug-and-play their existing systems, speeding up the onboarding process and driving more volume to the exchange.

One feature that is critical for gaining adoption is asset listings. In the case of Vertex, the bottleneck for listing new assets is a matter of market making deals. Considering this strategy to onboard market makers continues to play out, Vertex can get an extra edge in terms of speed for listing new assets that might be trending at any given time.

The recent surge in the market capitalization of Uniswap ($UNI) by $4 billion, following the proposal to switch fees, underscores the potential for significant re-rating within the Perp DEX sector. Moreover, the reflexivity inherent in bull markets plays to the strengths of perp DEXes. In such market conditions, increased trading volumes lead to higher DEX fees, which can trigger a positive feedback loop: as token valuations are re-rated upwards, the incentives for trading on these platforms become even more attractive, thereby fueling further increases in trading volume.

Achieving feature parity with centralized exchanges (CEXs) in terms of user experience (UX) is a significant milestone for DEX platforms. Vertex, for instance, has made notable strides in this regard by integrating notifications through Notifi and developing a mobile application.

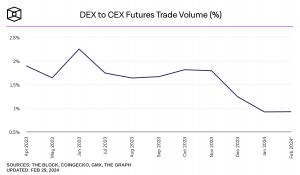

This market sector as a whole is unlikely to grow in a linear fashion. The ratio of perp DEX/CEX volume share continues creeping up over the past few months as liquidity returns to DeFi. Not only that, but Vertex’s Sequencer is effectively a parallel VM written in Rust. Considering the power of narratives in crypto, it might as well catch a bid on the run-up of parallel VM chains like Sei (FDV at $8.7B) or Neon (FDV at $1.2B).

Unlike other competitors, whether they are simple DEXs or standalone appchains, Vertex can deploy on multiple chains more efficiently. Since the Sequencer lives off-chain, all that’s required is a risk engine encoded into a smart contract on the destination chain. Since this risk engine already exists for Solidity smart contracts, Vertex can easily deploy on EVM-compatible chains. Starting with Blast, we expect Mantle to be next, as evidenced by Range’s integration – a Mantle project that also participated in Blast’s Big Bang competition to offer automated liquidity strategies (perpetual vaults) on top of Blitz.

The centralized liquidity layer enabled by Edge can simultaneously improve the liquidity of the original chain (Arbitrum) and the target chain to achieve a net-positive effect, driving more volume and capturing more value as more chains are added. The demand for cross-chain DeFi is also evident, with the total volume of bridged assets surpassing $9B in the past 30 days alone. Edge lowers these barriers to entry, enabling a DEX with proven product-market fit on Arbitrum and deep cross-chain liquidity out of the box on supported chains – alleviating the burden of costs for cross-chain bridging solutions and launching a successful DEX. Instead of liquidity fragmentation between the Blitz on Blast and Vertex on Arbitrum, liquidity between the chains is fused together and displayed as a singular, unified orderbook – accessible to both Blitz and Vertex users (and more chains in the future).

Although the team has not clearly stated the value capture between Edge implementations and the Vertex protocol, we believe that this has a potential improvement in the value capture of the $VRTX token: as Edge extends its reach across multiple networks, $VRTX is poised to emerge as a pivotal “shovel” asset within the ecosystem.

This can significantly bolster the current value proposition of $VRTX. The current revenue-sharing mechanism rewards stakers with $USDC yield, consistently above 20% and currently averaging a 23% APY. Adding to the token’s appeal is its limited liquid supply, with more than 50% of $VRTX tokens staked, currently standing at 55%. This “tiny float” scenario implies a reduced circulating supply, potentially leading to increased scarcity and demand having a larger price impact for $VRTX – currently only listed on low tier CEXs with the exception of HTX (former Huobi).

In the short term, the synergy between Vertex and Blitz, particularly through the Blast rewards mechanism, presents a substantial tailwind for both platforms and their communities. Vertex was a winner in Blast’s Big Bang competition for the perp DEXs category and will be sharing 100% of the $BLAST Dev allocation with the community.

Combined with the native yield mechanisms on Blast, derived from a mix of Ethereum staking and Real World Asset (RWA), onboarding users to Blitz is the equivalent of offering a diversified and attractive yield landscape. Specifically, yields of approximately 4% from staked $ETH on Lido and 5% for stablecoins through Maker’s Dai Savings Rate (DSR) will complement the yield of new Blitz’s $USDC depositors thanks to Vertex’s integrated money market. This high yield, coupled with an easy process for compounding rewards—claiming $USDC, staking $VRTX, earning $USDC, and repeating—enhances the attractiveness of this opportunity.

Remember that one of Edge’s biggest innovations is the ability to standardize deposit APRs with a single, cohesive interest rate across all Vertex instances. This approach facilitates smoother capital flow and encourages active utilization of the lending market, addressing one of the key challenges in a fragmented DeFi ecosystem: disparate interest rates across different platforms and chains.

The integration of native yields from platforms like Blast into Vertex’s broader ecosystem showcases the platform’s ability to aggregate and distribute yields in a manner that benefits all participants. For instance, the native yield generated from $ETH staking and Maker’s DSR on Blast, which would typically be exclusive to that platform, is shared across the Edge network. This redistribution mechanism fundamentally elevates the base deposit rate for Vertex users, irrespective of the chain they are on.

While the investment thesis for going long on $VRTX is compelling in the current bullish environment, several factors could potentially invalidate this positive outlook.

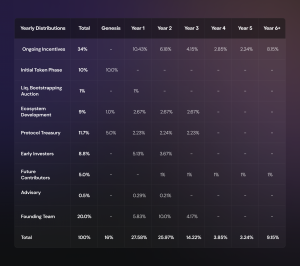

The scheduled token unlocks and the prospect of more inflation could pose headwinds down the road. As more tokens enter circulation, VC selling and the potential for a volume overhang exist, where early investors might liquidate their holdings, further impacting the market negatively.

The success of Blitz and its relationship with $VRTX are also critical. While there is a soft confirmation from the team that the separate brands will maintain a synergistic relationship that enhances the value and utility of $VRTX, this might as well change later on. If this promise turns out to be less impactful than anticipated, or if it fractures the brand and holder base, it could undermine confidence in $VRTX’s long-term prospects.

Even though the potential for synergies and a cross-chain expansion is intended to recycle value back to $VRTX stakers, the details and effectiveness of these mechanisms remain to be determined (TBD).

There is also a bottleneck for listing new assets and keeping market depth. Challenges or possible conflicts with market makers could limit the platform’s growth and the diversity of trading pairs.

Additionally, we cannot overlook the role of incentives in driving trading volume. If trading volumes have been artificially inflated due to rewards programs that incentivize trading activity, this could lead to concerns over the sustainability of such volumes in the absence of these incentives.

Trying to get this right is going to be impossible in the current market. Our approach is to start a position at current prices ($0.30 – $0.35) and then look to get bigger as the market develops. Trimming on big green days and adding on big red days while we monitor the data and movements by competitors is a prudent strategy.

Revelo Intel has never had a commercial relationship with Vertex to be commissioned for this work, and this report was not paid for.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.