Published: March 25, 2024

Despite the most recent market correction, we have observed relative outperformance in Aptos and Sui, suggesting that this trend might persist as we approach notable catalysts in April. Some might be tempted to chase beta and play the rotation game, for example trying to find “the $THL (outperformer in the Aptos ecosystem) of Sui”. However, this report will make the case for using $SUI as the proxy to get exposed to its ecosystem, as all it takes is one killer app to really kick things off and join the likes of Bitcoin, Ethereum, and Solana.

With momentum building towards Sui’s Basecamp event in Paris on April 10-11, we approach this opportunity with caution. The optimal window of opportunity to capitalize on such an event has already passed, as the market front runs the news and the actual event might as well signal a local peak. Between conferences, announcements, comparisons to other ecosystems, etc., this is just a reminder that there will be a lot of noise in this race.

In parallel, attention is currently split between modularity and parallelization, with debates heating up as ecosystems fight for mass adoption. Drawing from our analysis, the monolithic architecture of chains like Sui can facilitate quicker mass adoption, offering a more optimized and cohesive user experience. If this were to successfully unlock powerful consumer use cases, the underlying L1 chain could see an exponential influx of new active wallets, transaction volume, and renewed attention.

Pre-halving dips could present potential buying opportunities to get exposure to the growing Sui ecosystem, although we highlight the presence of large and upcoming unlocks in May and June. These unlocks could exert downward pressure on prices, primarily if the tokens are allocated to investors inclined to sell. There is no way to precisely tell whether this will be the case or not, so we will monitor the market and adjust position size accordingly.

To keep things simple and before we dive into the thesis, our case for Sui is that consumer use cases for crypto will eventually spring up. We don’t know how this will materialize, or whether $SUI will be the $SOL of this cycle. However, what we do know is that in a bull market, we want to spend as much time as possible riding the fastest horse.

Launched amidst a bear market, Sui’s potential was initially constrained by the cold start problem characteristic of Layer 1 (L1) blockchains, which necessitates a period for onboarding developers and acclimatizing them to the new technology and toolset. As Sui nears its first year in production, it is increasingly recognized alongside giants such as Ethereum, Solana, and Avalanche as a leading platform for smart contract development. Despite its nascent stage, Sui has demonstrated remarkable growth metrics, boasting a validator set of over 100 just 9 months following its launch and having been operational for less than 300 days with no downtime.

Sui’s origins trace back to June 2019, when Facebook (now Meta) unveiled plans for a permissioned blockchain and a digital wallet aimed at supporting a global payment network. These initiatives, under the Diem Association (originally called the Libra Association) and its Novi Finance (originally called Calibra) subsidiary, were eventually discontinued due to regulatory challenges and strategic realignments, selling the entirety of its assets in January 2022. From these endeavors, two distinct blockchains emerged: Aptos and Sui, with the latter being developed by Mysten Labs, which was founded by former leaders of the Novi project.

Mysten Labs has successfully secured significant funding to back Sui’s development, raising $36 million in its Series A funding round, which was led by a16z and saw participation from notable firms such as Redpoint, Lightspeed, and Coinbase Ventures. The Series B round, completed in September 2022, brought in $300 million at a valuation exceeding $2 billion, with FTX Ventures leading and contributions from a16z, Jump Crypto, and Binance Labs, among others. Following FTX’s operational issues, Mysten Labs reacquired the equity and warrant rights initially held by FTX.

The founding team of Mysten Labs possesses exceptional credentials and a proven track record of innovation and leadership. Co-founder Evan Cheng, who previously worked at Apple, Meta, and Chainlink Labs, is known for his seminal contributions to the LLVM compiler technology, which is used in most Apple and Google devices. Evan is also an ACM Software System Award recipient, underscoring his impact on software systems with lasting global influence. Sam Blackshear and Adeniyi Abiodun, each with significant contributions to the development of the Move programming language and blockchain technology at Facebook, bring a wealth of experience and a pioneering spirit to the project alongside other core contributors of the caliber of George Danezis and Kostas Chalkias.

We won’t go into details about whether a monolithic or modular approach is more suitable for approaching the blockchain trilemma. Instead, we look at Sui from the lens of a chain in which the only bottleneck boils down to the business decisions made by each individual project.

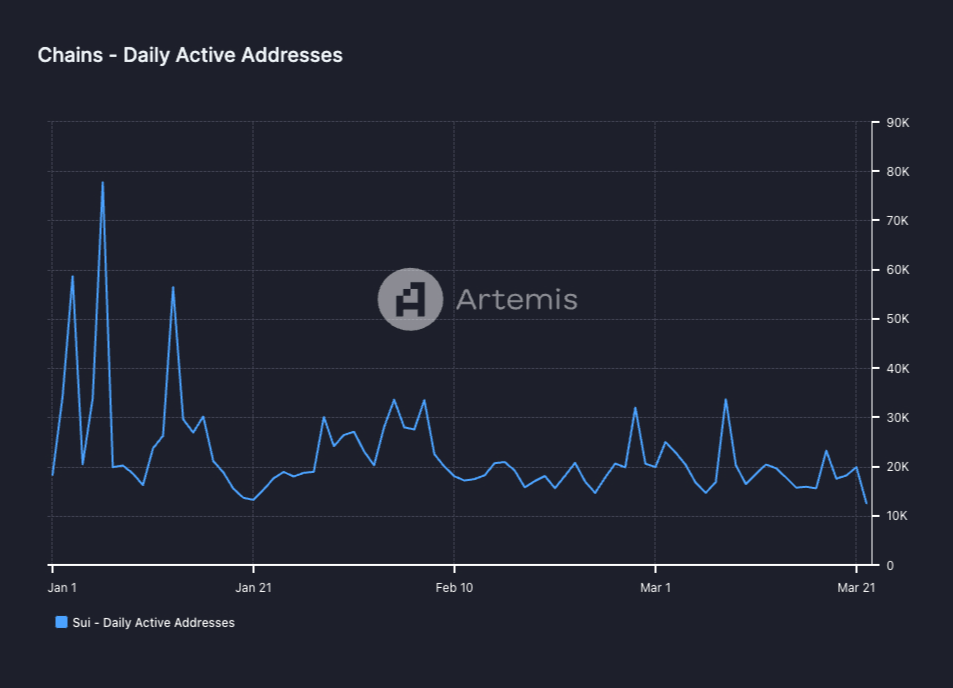

From our perspective, the number of active wallets and their growth over time can be one of the most significant leading indicators to anticipate price action. In that regard, Sui stands out as an exceptionally attractive platform for developing consumer applications. This sets the scene where the chain can host unique use cases that are “only possible on Sui”, aligning with the vision of “delivering the benefits of Web3 with the ease of Web2”. We have not reached that inflection point in daily active wallets yet.

The chain is still in a nascent stage, and a lot of the infrastructure has not been built yet, such as native stablecoins, more mature developer tooling, indexing like The Graph, funds tracing solutions like Chainalysis, DAO tooling, custody and MPC providers like Copper and Fireblocks, etc. These solutions will eventually be built and enter the market, and we want to get ahead of that curve.

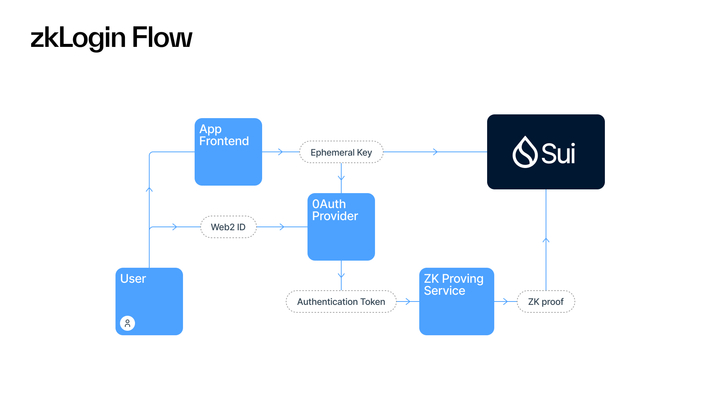

Sui’s potential hinges on the introduction of a breakthrough “killer app” that diverges from the redundant replication of existing primitives found in other ecosystems. Enhancing user experience, Sui introduces innovations like native account abstraction and zero-knowledge (ZK) login, enabling users to create wallets with web2 credentials without necessitating a seed phrase. Sui also embeds a protocol-level mechanism allowing gas fees to be paid with alternative tokens, significantly lowering entry barriers for new users by potentially subsidizing initial transaction costs.

Sui’s allure also extends to developers, particularly those intrigued by the safety of the Move programming language or eager to explore unique blockchain applications that simply cannot be built elsewhere. Unlike the common account-based models, Sui employs an object-based model, resonating more closely with contemporary programming paradigms. This model not only enhances asset control and security but also facilitates parallel execution of transactions, as operations on distinct objects proceed independently.

thought I’d share the thinking behind @suilendprotocol publicly since people have been asking pic.twitter.com/5JRuiHyf99

— Rooter (@0xrooter) January 13, 2024

Source: 0xrooter (founder of Sollend and Suilend) on X

In a world where Ethereum is scaling with a broad range of L2s and Solana continues to struggle with downtime and liveness issues, Sui emerges as a formidable contender to allocate capital during a prolonged bull market. After all, mass adoption boils down to scalability. This implies that “the tech is not ready yet” is no longer an excuse.

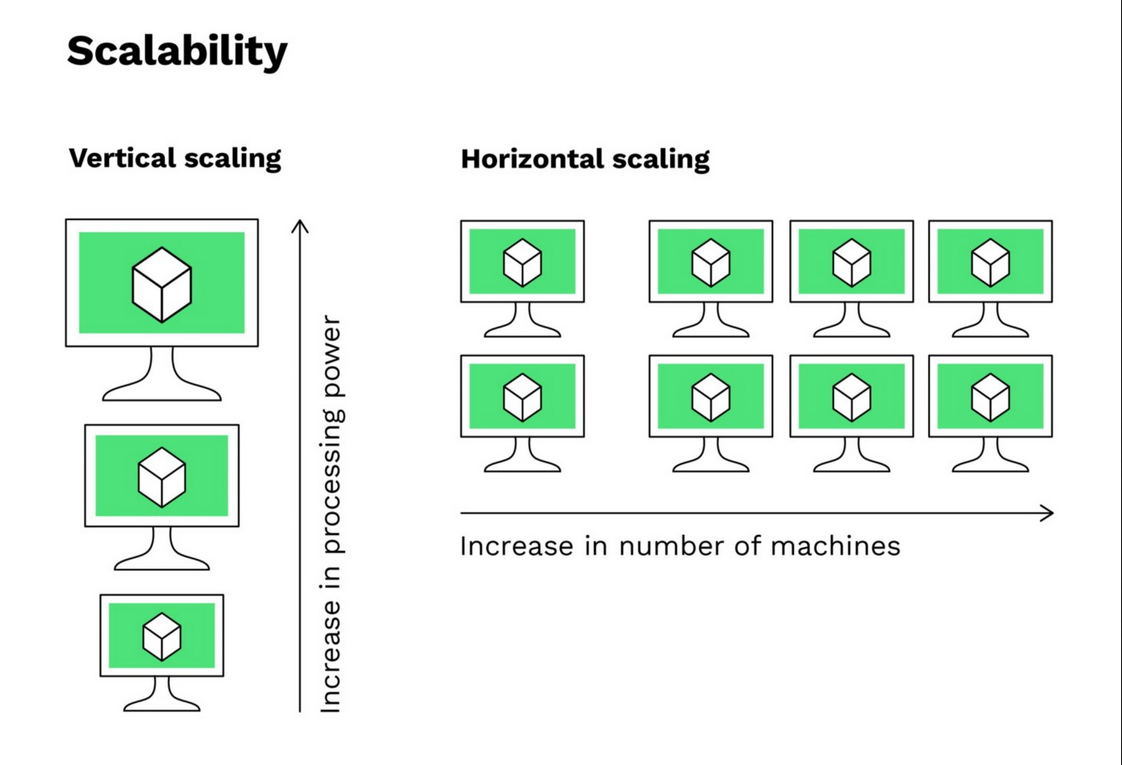

Other blockchains tackle scalability via vertical scaling, which involves scaling up resources. For a validator, this translates into increasing CPU, RAM, storage, and bandwidth requirements. However, one can only go so far with vertical scaling. Most high-performance blockchains recommend 32-64 CPU cores and 128-256GB of RAM for validator nodes, and even then the mainstream retail adoption wave hasn’t even started yet.

While there is still more room to go, with most providers topping out at 128-256 CPUs and 768GB-1TB of RAM, these are super high-end configurations that require weeks to provision and are only used for super niche use cases. Additionally, the cost per core doesn’t always scale up linearly, i.e., $1,000 for 32 cores doesn’t necessarily mean $4,000 for 128 cores, due to the concept of “chip binning” and the economies of scale for silicon. The TLDR; is that vertical scaling has a built-in hardware cap and is expensive to provision on demand. In other words, a blockchain that only relies on vertical scaling is doomed.

The alternative approach is to go horizontally instead of vertically, adding more machines to the pool of resources instead of adding more power to the existing machine. Through horizontal scaling, Sui aims to become the premier chain for consumer applications. The most recent introduction of Pilotfish technology exemplifies this approach and strengthens our conviction. This advancement makes it possible for validators to enhance throughput by integrating additional more cost-effective machines – i.e. increasing throughput via having more, cheaper machines per validator instead of making a single machine more powerful. The outcome not only surpasses the limitations of vertical scaling but also allows for a dynamic adaptation to fluctuating network demands.

For Sui validators, Pilotfish makes it possible to spin up additional servers on demand. For example, consider a new consumer dApp that launches and suddenly receives a huge influx of traffic. In that situation, validators can instantly spin up more machines on a cloud provider like AWS or Google Cloud to keep up with the demand. Once the initial traffic dies down, they can eliminate the additional machines to reduce costs. This simply isn’t practical in vertical scaling environments.

To summarize, a pivotal yet overlooked aspect of Sui’s scalability solution is its intra-validator design, which contrasts sharply with traditional inter-validator approaches. By allowing each validator to access the entire global state and perform sharding within their own hardware cluster, Sui minimizes latency issues that are prevalent in networks where validators are responsible for different segments of the blockchain. This is critical for supporting mainstream consumer applications without compromising on the composability and integrity of the L1.

Sui has emerged as one of the fastest-growing non-EVM chains. It recently recorded its first consecutive 7-day period of at least $100M in daily volume. This was accomplished in approximately 300 days since mainnet went live.

In the short term, April is poised to be a pivotal month for the network. With multiple hackathons and events taking place, we can expect more eyeballs tracking price action as $SUI approaches the $2 mark. While Sui’s Basecamp in April can turn out to be a “sell the news” event, we cannot underestimate the chain’s growing adoption. Speakers include Balaji Srinivasan, Nikola Plecas from Visa, Arianna Simpson from a16z, Benoît Pellevoizin from Coinshares, and more.

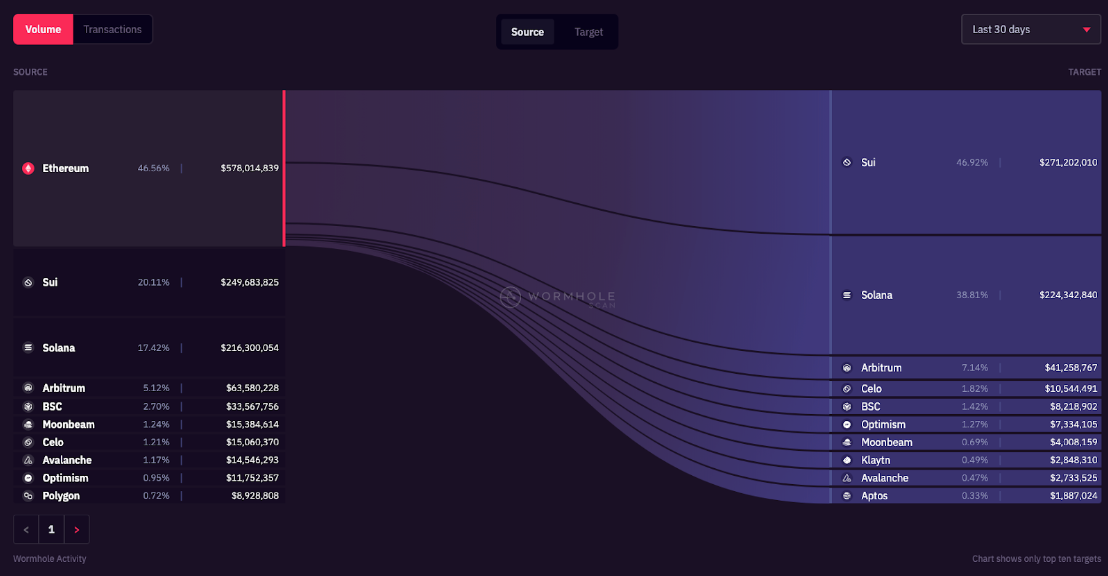

In parallel, Sui has recently been the most popular destination for bridged assets via Wormhole, and Sui’s main DEX, Cetus, has outperformed entire L1 ecosystems in terms of transaction volume.

The current ecosystem is dominated by platforms like Scallop and Suilend in lending, Cetus and Aftermath in DEXs, Bluefin in derivatives, and Karrier One in DePIN. Most recently, Folks Finance, Algorand’s main DeFi protocol, announced its expansion to Sui. Scallop also raised a strategic funding round and was recently accepted into AWS’s Active Startup Program.

Furthermore, the user-centric design of the chain has also made it an appealing destination for gaming. Leading worldwide professional esports team TeamLiquid announced that they will build their own fandom platform on Sui. There was a lot of excitement at the Play Beyond Conference held on March 19 in San Francisco, which featured a broad range of Indie and AAA games with workshops and keynotes by Andrew Chen, Team Liquid, Animoca Ventures, Mirror World, Shrapnel, and CCP Games among others.

Gaming has long been touted as a perfect use case for blockchain, as few users are better positioned to care about digital assets and ownership than the gaming community. Yet, the intersection of blockchain and gaming has progressed slowly, hindered by challenges due to limited scalability, slow transaction speeds, high costs, and a failure to prioritize the gaming experience – all problems that Sui solves. As a side effect, an allocation in $SUI also gives us indirect exposure to this narrative right after the Game Developer Conference of 2024, which took place on March 18.

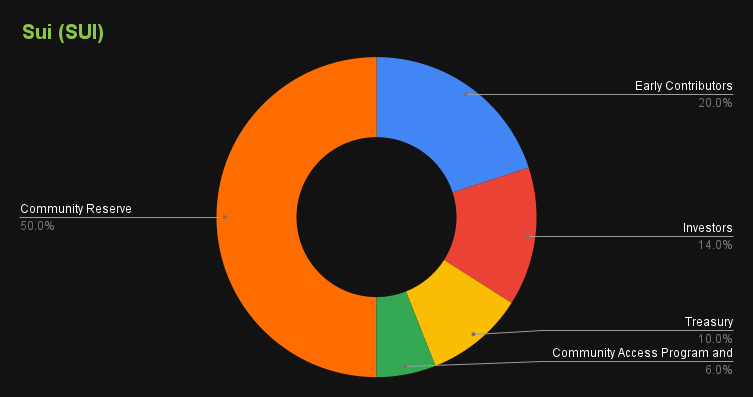

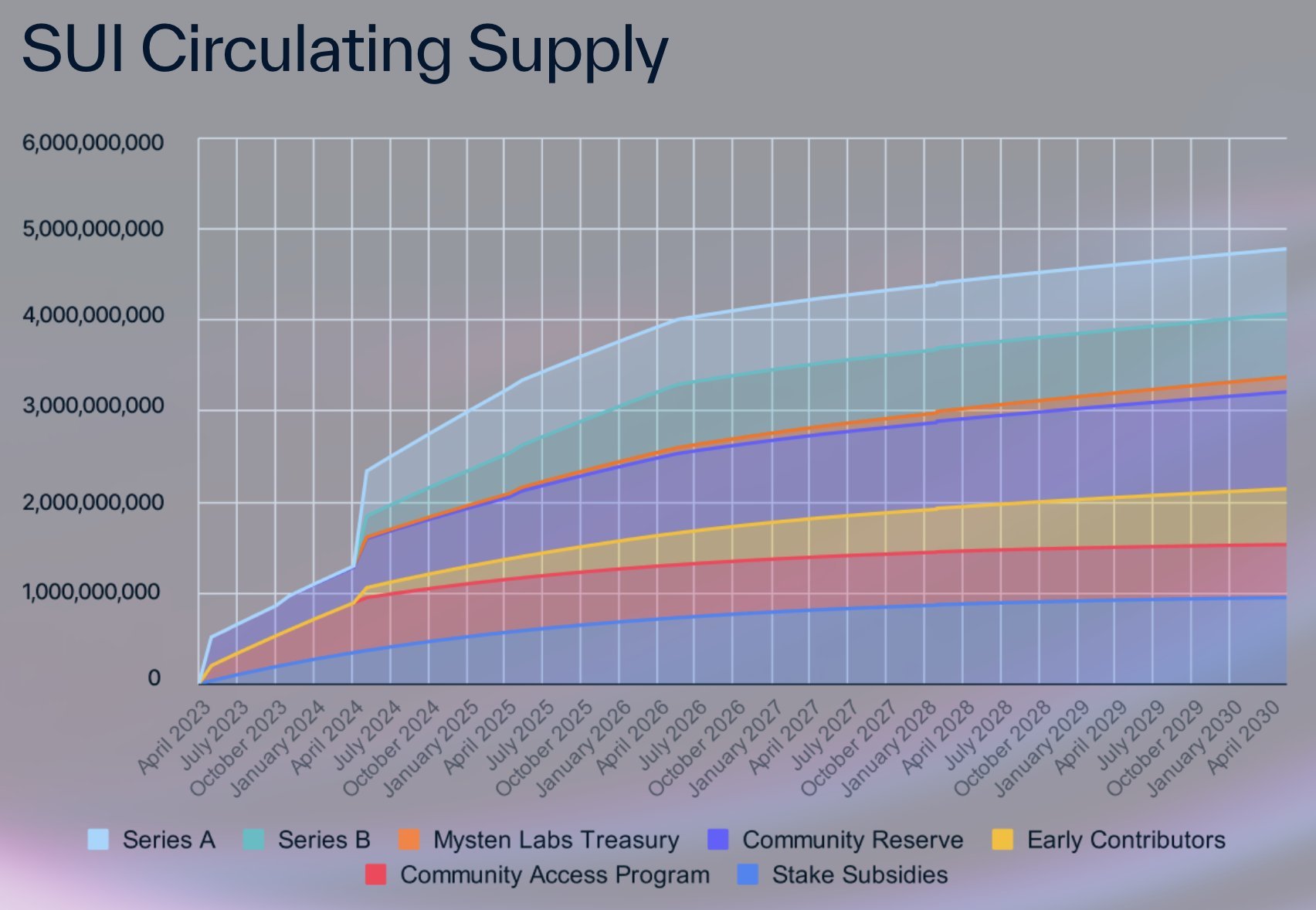

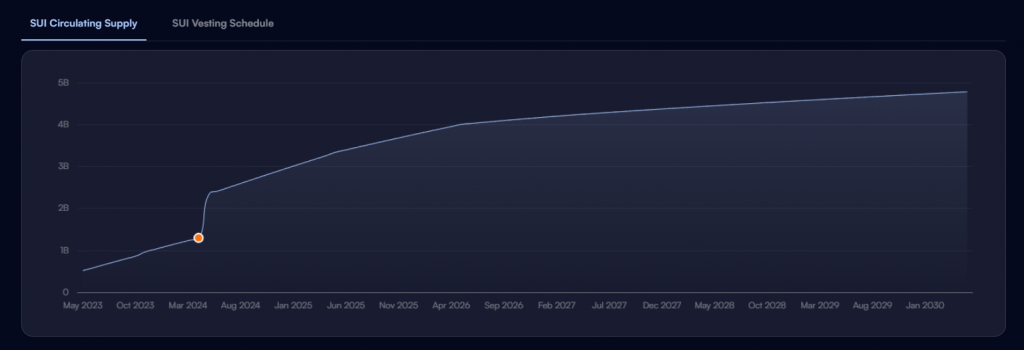

While Sui demonstrates strong signs of growth and outperformance, we also need to address the elephant in the room. For many, Sui’s tokenomics might pose a challenge and present a meaningful concern for building a solid allocation in their portfolio. Nonetheless, remember that we are advocating for riding the fastest horse during a bull market. This view necessitates continuous monitoring and active management of the position, as half of the total supply belongs to a Community Reserve. Note that we might not see all tokens in circulation and the float will remain low in the years to come.

Sui and Aptos are now facing increasing competition from L2s on Ethereum that also use the Move VM and the Move programming language for their execution environments, such as Lumio and Movement. In addition to that, Monad and Sei v2 might as well present further challenges with their parallel EVMs, although they technically offer a different value proposition. This adds optionality for projects that might want to expand their operations across multiple chains. This diversification could dilute Sui’s developer engagement and mindshare, impacting its unique value proposition and ecosystem growth.

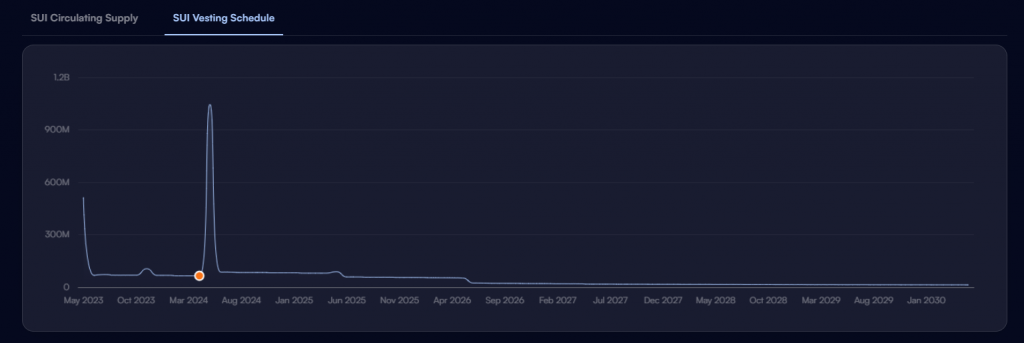

With significant token unlocks scheduled for May and June, the circulating supply of Sui tokens is set to approximately double, introducing over 1 billion new tokens into the market from the current liquid stash of 1.23 billion out of a total of 10 billion. In a bull market and with the ability to hedge on perps, it is hard to accurately estimate what % of the token FDV will eventually qualify as unrealized profits for investors. As a rule of thumb, the higher that % is the more dilutive it is for existing token holders, although this ignores OTC transactions.

Despite the potential bearish sentiment this increase in supply might evoke, it is worth assessing the nature of the unlock. Given that the bulk of these tokens are allocated to VCs and we are in a bull market, they might want to mitigate sell-off impacts through measures such as over-the-counter (OTC) sales or hedging on perps, for which $SUI markets are deeply liquid. After the event, the likelihood is that any negative price impacts may have already been anticipated and accounted for in the market.

As Sui continues to outperform and the market keeps looking for reasons to find out why that is, we seek to build out a position to capitalize on this trajectory towards the higher market cap ranks (the upcoming unlock will double the supply), approaching the likes of Avalanche, Tonchain, Polkadot, Tron, and Cardano.

In the short to mid-term, we can expect deviations from its correlation with the overall market and $BTC price action. This would result from “sell the news” events and potential “bullish unlocks” – both of which will dislocate market sentiment and remind us about the importance of adding on dips and adjusting our size periodically.

Dilutive concerns can partially be alleviated by participating in staking, as the ecosystem offers plenty of yield opportunities through $SUI Liquid Staking Tokens (LSTs). This will be our preferred way to hedge against potential inflationary pressures from token unlocks.

In bull markets like the one we are in, speculation thrives as investors chase promises, often valuing the allure of potential over quantifiable metrics. This frenzy is often fueled by stories of integrations and partnerships, of which there will be many for Sui. This can artificially elevate ecosystem projects with minimal actual revenue or user activity to astonishing valuations. Embracing speculation, rather than dismissing the lack of immediate revenue or a working product, can unlock significant opportunities in the next months.

We don’t think that this optimism is unfounded; it’s grounded in $SUI’s unique value proposition, innovative technology, and strategic positioning within consumer use cases for blockchains. This under-the-radar growth story is precisely the kind of contrarian bet that discerning investors seek — a narrative not yet fully appreciated or priced into the market.

As with all contrarian views, the power lies in being right when the consensus is not, recognizing that by the time a narrative becomes universally accepted, its market advantages are often fully realized. In the case of $SUI, the time to consider acting is now, with a balanced approach that accounts for potential headwinds in the short to medium term.

Revelo Intel has never had a commercial relationship with Sui or Mysten Labs and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.