Published: May 20, 2024

Ethena has been in the spotlight of crypto’s public opinion, sparking debates around its impressive growth. For some, Ethena’s ability to tokenize a carry trade is putting an end to DeFi’s ongoing cycle of pseudo-innovation. For others, the ambition to continue growing into the billions might introduce systemic risks for the entire industry. Regardless of these polarizing views, Ethena boasts one of the most ambitious roadmaps in DeFi and has already climbed to the top of the leaderboard in terms of revenue generated.

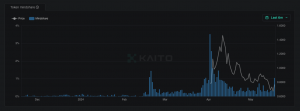

Source: kaito.ai – Ethena’s mindshare has been an effective leading indicator of $ENA’s price action.

Critics often draw attention to the risks associated with Ethena, yet we argue that this perspective overlooks the broader picture. In assessing Ethena, it is essential to adopt an expected value (EV) framework, considering both potential risks and rewards.

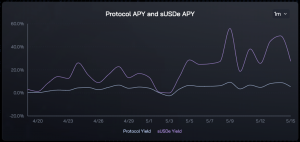

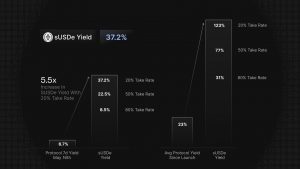

Source: Ethena Yield Dashboard – The yield of $sUSDe has consistently outperformed the returns of DeFi competitors like Maker’s $sDAI as well as TradFi venues for short-term US Treasuries.

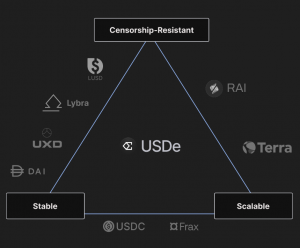

Pragmatism is what allows Ethena to scale, offering an alternative to fiat-backed stablecoins like $USDT and $USDC, which aren’t risk-free (as they are dependent on the traditional banking system) nor offer high-yield opportunities to token holders. Like any other solution, Ethena’s design involves a lot of tradeoffs, but it is the transparency and simplicity that makes it different from previous attempts in DeFi.

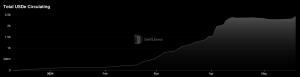

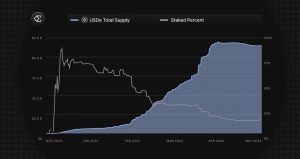

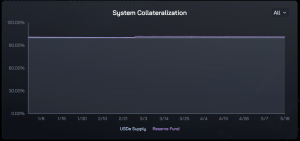

Source: Ethena Solvency Dashboard – The growth in $USDe supply has been exponential, followed by a gradual increase in the size of the insurance fund while keeping stable prices around the target $1 peg.

Looking ahead, Ethena’s supply expansion has catalyzed the development of a liquidity moat that will be extremely hard to disrupt down the road. Its first-move advantage and execution are setting a robust foundation that will likely deter competitors. A tokenized carry trade is an idea that seems obvious in hindsight, but if Ethena manages to sustain its market dominance, it can definitely change the market structure of crypto as an asset class as well as rates dynamics both on-chain (DeFi) and off-chain (CeFi).

Source: DefiLlama – Ethena’s $USDe has rapidly grown and entered the top 5 of stablecoins by market cap in a matter of months.

For all of those reasons, even though there are certain blockers and invalidations to be aware of, we believe that building a position on $ENA is currently the best way to express our view on the market that Ethena will become one of the highest revenue-generating DeFi protocols in history, and that $USDe can challenge $DAI to eventually approach market leaders such as Tether and Circle.

Source: Tradingview – Despite a successful launch and initial demand, $ENA has struggled to sustain its price action, underperforming relative to $BTC

In the past we have seen previous cycles where people liked to bet on exchange tokens like $BNB, $BIT (now $MNT) or $FTT, as well as on DeFi tokens like $MKR, $SNX, $UNI, or $AAVE among others. With $ENA we can get a proxy to the success of DeFi while simultaneously betting on a basket of leading CEXs like Binance, Bybit, or Deribit. Furthermore, we might as well expect a valuation premium that is attached to Ethena’s upcoming L2 chain.

The debacle of Terra’s $UST has taught us valuable lessons about the illusion of “risk-free” returns. Ethena, however, approaches risk transparently, prioritizing scalability and operational simplicity—a strategy that has enabled it to rapidly escalate total value locked (TVL) from zero to over two billion dollars in a matter of months.

Source: DefiLlama – $USDe revisited all-time-highs in TVL, hovering around the $2.3B mark.

Although there are clear tradeoffs involved, such as the use of centralized exchanges (CEXs) for execution and custodians to safeguard collateral, this pragmatic outlook, when coupled with clear communication, resonates well with most market participants. This approach is “sufficiently decentralized” and offers outsized returns that aren’t achievable with fiat-backed stablecoins where issuers like Tether or Circle keep all the yield for themselves, or decentralized alternatives that require excess levels of overcollateralization and cannot scale.

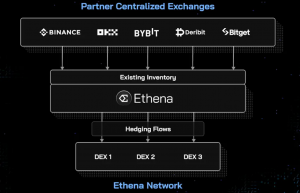

Source: Ethena positions dashboard – Ethena tokenizes a carry trade to capture the basis spread across a variety of CEXs and using collateral assets like $ETH, $stETH, $BTC, and $USDT

Furthermore, it is also worth noting that leading fiat-backed stablecoins like $USDT and $USDC occupy almost 90% of the market share, and they are not risk-free either. Importantly, Ethena leverages crypto-native derivatives instruments like perpetual futures to avoid the reliance on the traditional financial system and banks. Even if these operations are conducted on centralized exchanges, these are entities that have skin in the game and are committed to the success of the industry. Additionally, the funds are held with trusted custodians, rather than on exchange accounts.

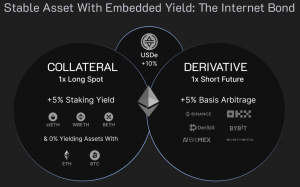

The original idea was conceived by Arthur Hayes in his article titled “Dust on Crust”. The piece advocates for a stablecoin backed by derivatives rather than traditional financial mechanisms, aiming to eliminate the reliance on the banking system by using crypto assets as collateral. This process involves using assets like $ETH and $BTC as collateral and hedge on perps (by opening a short of the same notional amount) to create a delta-neutral position that can be tokenized as a synthetic dollar. As a result, this method also takes advantage of positive market funding rates, passing that yield to token holders.

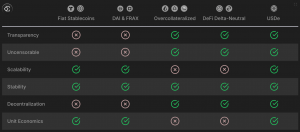

Source: Ethena Docs – Ethena’s $USDe aims to solve the stablecoin trilemma of resistance to censorship, easy scalability, and price stability.

The driving force behind bringing this idea to reality was a critical examination of existing stablecoins. The current market leaders are predominantly reliant on traditional financial infrastructure. Not only do companies like Tether or Circle rely on the banking system, but they also keep all the revenue for themselves, failing to share profits with the token holders who contribute to their growth. Meanwhile, overcollateralized stablecoins like $DAI are capital inefficient and cannot scale to reach parity with fiat-backed contenders.

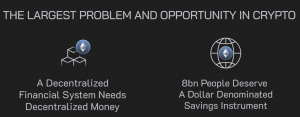

The necessity for USDe arose from the limitations seen in conventional dollar-linked assets, whose collateral often hinges on the real economy—either through bonds, promissory notes, or deposits in traditional banks. These ties create vulnerabilities due to their dependence on off-chain dynamics, compromising their resistance to censorship.To address this, Ethena was envisioned to become the first globally accessible, permissionless crypto savings instrument – untethered from traditional banking structures.

Source: Ethena Docs – Ethena believes that if DeFi’s endgame is to create a parallel financial system, then stablecoins are the most important instrument, and they must provide a scalable crypto-native form of money that doesn’t rely on the legacy financial system.

This idea is not necessarily something new and there have been previous attempts to build stablecoins backed by delta-neutral positions. However, previous projects like Lemma or UXD failed, primarily due to the illiquidity of perpetual DEXs, which could not support the scaling of collateral and short positions as demand increased. They were also exposed to smart contract risks. For that reason, Ethena accepts the tradeoffs of opening positions on CEXs while keeping collateral assets with custodians.

Source: Ethena Docs – Stablecoins are a $1 trillion opportunity in this space, with an immediate ~$5bn+ addressable market by embedding $USDe into exchanges and capturing market share within DeFi as a reserve asset.

Ethena’s journey began with a successful seed funding round in July 2023, led by DragonFly Capital and raising $6.5 million. This round saw investments from prominent figures like Arthur Hayes and entities such as Deribit, Bybit, and Gemini, alongside market makers like GSR and Wintermute. Collectively, Ethena has secured $14 million in funding with a seed extension round, valuing the company at $300 million, and currently ranking as the fifth-largest stablecoin by market capitalization behind $USDT, $USDC, $DAI, and $FDUSD. This robust backing underscores the market’s confidence in Ethena’s approach to redefine the stablecoin domain.

Ethena is a protocol that issues $USDe – a synthetic dollar-denominated asset that is detached from the traditional banking system or real-world assets (RWAs). By tokenizing a delta-neutral carry trade, Ethena is backed by tokens and positions on crypto-native derivatives instruments like perps. The advantage of this approach is that it can generate a yield-bearing synthetic dollar without the need for overcollateralization.

Source: Ethena Docs – Through the use of derivatives in deeply liquid centralized venues while keeping collateral with custodians, Ethena’s $USDe directly addresses the stablecoin trilemma by 1) not relying on traditional banking infrastructure, 2) not requiring overcollateralization, and 3) sharing revenue with token holders.

$USDe is the flagship product of Ethena, and represents a synthetic dollar asset that is issued by the protocol utilizing a blend of crypto assets and perps positions as collateral. It can be minted by whitelisted market makers by depositing supported assets like $ETH, $stETH, $BTC, or $USDT. This collateral is held with independent custodians such as Copper, CEFFU, or Fireblocks, none of which are US-based. The use of these custodians, which are called Off-Exchange Settlement Providers (OES Providers) is in place to safely manage collateral on CEXs, providing an additional layer of security known as Bankruptcy Remoteness. This ensures that, in the event of a custodian’s bankruptcy, the assets remain protected for the beneficiary and are not considered part of the custodian’s bankruptcy estate. Meanwhile, normal users can buy $USDe with other stablecoins using Ethena’s UI, and the swap will be routed through Cowswap.

Source: Ethena Docs – Ethena employs a delta hedging strategy to keep the peg intact, also deriving its profitability from this mechanism.

Once in circulation, price stability is achieved with a similar mechanism to other stablecoins, leveraging arbitrage opportunities. If $USDe’s value dips below $1, holders can purchase it at a discount, redeem it for its equivalent in collateral, and sell the received assets—this arbitrage can be repeated until the peg is restored. Conversely, if $USDe trades above $1, users can mint new $USDe, sell it at a premium, and use the proceeds to mint more $USDe, thereby applying downward pressure on its price until equilibrium at the $1 peg is achieved.

Source: Ethena Docs – Collateral assets are not held in CEX accounts, but rather in off-exchange MPC vaults secured by trusted custodians.

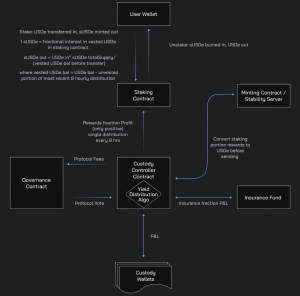

One method used by DeFi protocols to amplify yield and that is highly effective for tokens like stablecoins or $ETH is to implement a dual-token model. This mechanism ensures that all units of the token are generating yield, but that yield is only distributed to those who stake the token. Since not all units will be staked (or at least it is very unlikely due to the opportunity costs of using the asset with other integrations), the portion of users who stake will earn amplified returns.

Source: Ethena on X – Once users stake their $USDe for $sUSDe, they begin to accrue value without any further action or cost.

Making the analogy to an “Internet Bond”, Ethena sends the message that there is a system in place for $USDe to mimic the function of Treasury Bills in TradFi. This mechanism is enabled through $sUSDe, which is the staked representation of $USDe – it is the reward-accruing token that distributes yield.

Source: Ethena Docs – When staking, a user transfers $USDe into the contract and receives $sUSDE (staked USDe), which represents a fractional interest in the USDe in the contract.

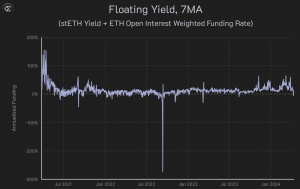

Unlike traditional bonds that earn through governmental interest payments, the yield on $sUSDe stems from multiple sources: predominantly the collateral used for backing $USDe, like $stETH’s staking rewards ($ETH inflation, network fees, and MEV) as well as funding fees and the basis spread in perps. By tokenizing a perps position, Ethena can capture the difference between perpetual futures prices and the spot prices of the underlying assets, creating an opportunity to earn from funding costs exchanged between long and short positions. Since there is a natural skew or bias to traders being long, the funding rate is often positive, which means that Ethena collects these fees (since it opens a short position on perps).

Source: Ethena Docs – The image above represents the historic implied yield that the protocol would have earned in various market conditions on an annualized basis.

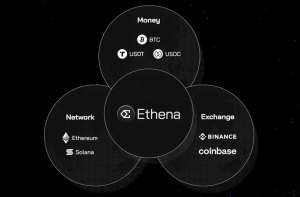

Ethena’s roadmap reveals that “the holy grail of crypto has always been achieving the status of money”. Bitcoin started as peer-to-peer electronic money but evolved into a digital store of value. Ethereum brought programmable smart contracts and decentralized applications to life, with $ETH also converging towards use as money with EIP-1559. Despite these advancements, the most widely used asset for transactions within crypto capital markets remains the digital dollar, evidenced by transaction volumes on both on-chain and centralized exchange venues.

Ethena’s ambition is to be that native digital dollar that dominates the crypto economy, independent of the legacy financial system. If the goal is to establish a native form of money within crypto, then Ethena’s mission is crucial, even if the current design is incomplete.

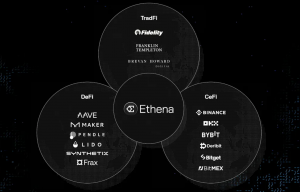

Source: Ethena 2024 Roadmap – $USDe is intended to become the connective tissue that ties DeFi, CeFi, and TradFi together.

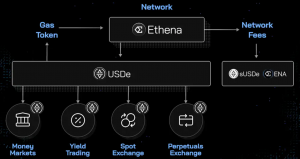

Ethena aims to reshape and drive the convergence of DeFi, CeFi, and TradFi with $USDe acting as the connective tissue. This will be enabled by building an entire network around $USDe, acting as an aggregated liquidity layer that will foster deeper markets and reduce transaction costs across crypto.

Source: Ethena 2024 Roadmap – Ethena’s Endgame goes beyond the widespread adoption of $USDe, aiming to become a dominant leader across the following 3 verticals: money ($BTC, $ETH), network (Ethereum, Solana), and exchange (Binance, Coinbase)

Most chains launch without an actual product or dominant protocol on top, forcing them to compete for liquidity and drive trading volume through highly inflationary token incentives. Ethena, however, won’t need to face that cold start problem, as it already boasts more than $2B in TVL and trades billions in notional value – it can skip a lot of steps to bootstrap a new DeFi ecosystem.

Source: Ethena 2024 Roadmap – With its own chain, Ethena will incubate an ecosystem that is optimized for the use cases of money and finance.

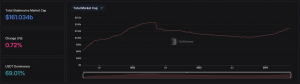

Stablecoins represent one of the most impactful breakthroughs in crypto behind $BTC and $ETH. Due to their price stability and exchange reference to the US dollar, the current market capitalization of stablecoins has been on a steep upwards trend. Not only are they largely used for monetary transfers, but they are also the most widely accepted collateral on centralized exchanges and DeFi, currently exceeding a market capitalization of $160B.

Source: DefiLlama – The total market cap of stablecoins exceeds $160B, gradually recovering from the 2022 downfall after the collapse of $UST and the bear market that followed.

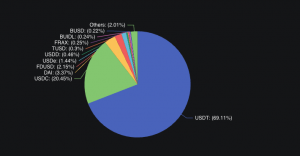

User demand for stablecoins is already provable. However, existing stablecoins such as $USDT and $USDC, which dominate 69% and 20% of the market respectively, come with significant limitations. They are fundamentally tied to the banking system, making them centralized, non-transparent, susceptible to censorship, and reliant on numerous trust assumptions. Moreover, these centralized stablecoins retain all generated revenue, failing to share profits with the token holders who fuel their growth.

Ethena seeks to emulate the scalability of fiat-backed stablecoins while overcoming the shortcomings that come with being tied to traditional financial rails. Unlike stablecoins like $USDT and $USDC, Ethena’s $USDe is a synthetic dollar asset, entirely detached from the traditional banking system. The distinction of being backed by crypto assets and crypo-native derivatives allows Ethena to provide a permissionless savings return.

Source: DefiLlama – Leading fiat-backed stablecoins, $USDT and $USDC, represent almost 90% of the market share, with $DAI in third place and $USDe in fifth, demonstrating a 3.37% and 1.44% dominance respectively.

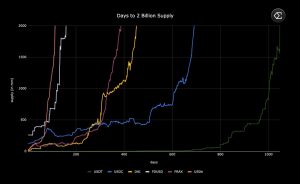

For many, this can potentially represent the largest market opportunity within crypto. Despite being labeled a “synthetic dollar,” the ambition is to capture a significant market share within the stablecoin sector, challenging the dominance of $USDT and $USDC. This is evident when we consider $USDe’s impressive growth, having crossed $2B in circulating supply within just two months of its public launch.

Source: Ethena on X – Ethena’s $USDe is the fastest-growing stablecoin in history.

Another crucial advantage of Ethena is its revenue model. The protocol passes generated revenue to token holders, contrasting sharply with the centralized approach of $USDT and $USDC, where issuers keep all the earnings from yield-generating activities for themselves. For reference, Tether reported a record net profit of $4.52B in the first quarter of 2024, mostly driven by interest earned from its holdings of US Treasuries, as well as some appreciation in its $BTC and gold reserves.

Ethena has garnered attention both positive and negative for its reliance on centralized providers like CEXs and custodians but also for its transparent documentation and clear communication about the design tradeoffs involved. By clearly outlining the counterparty and market risks involved in tokenizing the carry trade, the team is being proactive at addressing these concerns, unlike other examples of the past that took a more opaque approach. Often haunted by the $UST depeg some “community members” have compared $USDe with $UST, and even $LUNA with $ENA. This comparison is a significant misjudgment and shows a lack of understanding of how the protocol works.

Source: Ethena Solvency Dashboard – Ethena enables users to independently verify and prove the solvency and collateral of the protocol as well as the protocol’s derivatives positions.

Unsurprisingly, when people think of decentralized stablecoins, Terra’s failure often comes to mind. $UST was once the third most used stablecoin, following $USDT and $USDC, and ranked within the top 10 cryptocurrencies globally by market cap. Unlike $USDT and $USDC, which are centralized and backed by fiat, Terra’s algorithmic approach was touted as innovative—until it failed catastrophically. This event has since cast a shadow over algorithmic stablecoins, making them a relic of the past.

Source: Chainalysis – Over the course of a week’s time in 2022, the collapse of the $UST stablecoin and $LUNA wiped out almost an estimated half-a-trillion USD from the market.

It’s important to understand that risk in financial systems can never be entirely eliminated, only transformed. For instance, a project like Ethena is making some compromises and introducing counterparty risk from custodians as well as taking market risk from funding rates. However, unlike the Terra community, which falsely believed it was “too big to fail” and often obscured the inherent risks, Ethena openly acknowledges its risks, allowing participants to make informed decisions based on their own risk-reward calculations. This transparency is critical—there is no such thing as a risk-free investment.

Source: Ethena Docs – In order to scale Ethena needs to access centralized liquidity and, therefore, explicit trade-offs are required.

For that reason, we argue that looking at Ethena’s risk in isolation is a myopic view that misses the forest for the trees. As a protocol, Ethena offers a clear risk-to-reward payoff, and you are being compensated for the risk you are taking. Depending on your time preferences and appetite for risk, investors can make an independent decision on their own about how much exposure they want to have.

Source: Ethena Yield Dashboard – Staking $USDe currently yields a 37.2% APY.

Furthermore, we reiterate that many still overlook the risks of fiat-backed or centralized stablecoins like $USDT and $USDC. These stablecoins are heavily dependent on the traditional financial system and retain all profits, leaving token holders with nothing despite their role in driving growth. The collapse of $UST ironically strengthened the dominance of $USDT and $USDC, but this does not negate the need for alternative on-chain dollar assets. Reliance on just these two stablecoins ignores their potential risks.

Both $USDT and $USDC hold reserves in American banks, and this is not synonymous with “risk-free”. For instance, $USDC temporarily lost its $1 peg when a portion of its reserves, held in Silicon Valley Bank, faced insolvency, causing a market sell-off. Similarly, $USDT faced scrutiny over rumors that Tether held commercial paper from the troubled Evergrande Group, leading to a price drop below $1.

Source: Coinmarketcap – The Silicon Valley Bank fallout caused $USDC to depeg from $1 over the weekend, hitting a low of $0.88

These incidents highlight the need for stablecoin alternatives that are not dependent on traditional financial institutions. While Terra advocated for decentralized stability, Ethena offers a more rational solution: a safe, on-chain dollar asset not linked to traditional banks. By using crypto-native instruments like derivatives, Ethena aims to avoid the pitfalls of the traditional financial system – trusting that CEXs have skin in the game and it is in their best interest for the industry to thrive.

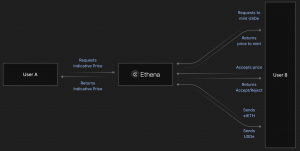

Source: Ethena Docs – The Hedging System relies on off-chain application services that calculate and publish indicative minting and redemption prices for $USDe, ensuring the integrity of the system in real time.

Meanwhile, decentralized stablecoins like $DAI or $FRAX still struggle to scale. Others like $GHO or $crvUSD also face this problem, mostly due to the need for overcollateralization (rather than taking advantage of the capital efficiency that comes with using derivative instruments like perps).

Source: DefiLlama – Excluding the top 5, all other stablecoins have a circulating supply and market cap below $1B.

From a pragmatic point of view, the ideal stablecoin would be decentralized—not for decentralization’s sake but to remain independent from traditional financial assets—and offer 1:1 liquidity transparently on-chain. This is precisely what $USDe aims to achieve, sharing revenue with token holders and overcoming the scalability problems of overcollateralized models.

The thesis for Ethena is simple: it has the potential to become the third largest stablecoin only behind $USDT and $USDC, simultaneously becoming the highest revenue-generating protocol in all of DeFi.

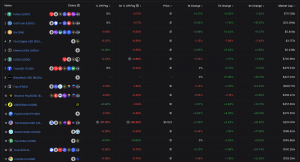

Source: Token Terminal – Ethena ranks in the top 10 protocols by revenue. Despite being launched only months ago, it is already competing against L1s like Solana or Avalanche, and DeFi leaders like MakerDAO.

Despite being on the radar as one of those tokens with a low float and high FDV, Ethena’s market entry coincided with a market uptrend and bullish momentum following the approval of the $BTC ETF. The implications of this go beyond $ENA’s price action. In fact, they are relevant because they will dictate the growth rate for $USDe.

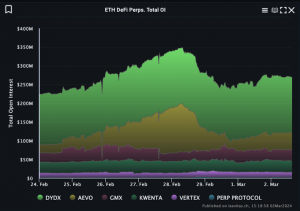

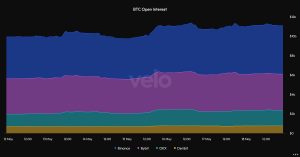

The current open interest (OI) on $ETH ranges between $10-12B, and excluding the $10B on the CME, BTC’s OI stands at about $25B. This indicates roughly 2.5x growth potential, prompting Ethena to expand its collateral asset base beyond staked $ETH to include $BTC (which has already been done) and $SOL (which will be coming up).

Even though Ethena is implementing a rather simple idea, it is worth highlighting that, while anyone can do the carry trade on their own, what makes the protocol so powerful is the role that it plays on DeFi. By tokenizing a carry trade at scale, Ethena can help make markets more efficient, ultimately resulting in the convergence of DeFi and CeFi rates (and TradFi?). We have already seen the first signs of this, as Ethena started growing and pushed Maker DAO to raise the DSR rates, which further pushed interest rates in Aave, Compound, Morpho etc. to the upside, finally setting DeFi rates above TradFi yield from T-Bills.

Source: Laevitas – The supply of $USDe is more than double the total open interest of $ETH on perpetual DEXs.

As Ethena scales, it is set to become the de facto yield rate across DeFi, lowering leverage costs and enhancing market access – making it cheaper to long crypto and setting a benchmark for the cost of money on-chain.

Ethena’s ability to quickly integrate with other DeFi platforms is quite noteworthy as well. Examples include Maker’s credit line to mint and back $DAI, Pendle’s yield trading, Morpho vaults with $USDe and $sUSDe collateral, perps platforms accepting $USDe as collateral like IntentX or Synthetix, and many others. Unlike other protocols, Ethena can complete integrations in a day or two, focusing more on risk analysis to ensure security and stability. Rather than competing with protocols like Maker’s DAI and Frax’s FRAX, Ethena collaborates, promoting positive-sum games that boost its adoption and demand.

Source: Ethena on X – Currently only 15% of $USDe is staked in $sUSDe

From the start, Ethena stands out as one of the few DeFi protocols generating actual revenue – and $ENA is the proxy to get exposure to that revenue. The $ENA token serves as the governance token, enabling decisions on collateral assets, custodians, cross-chain implementations, grants, exchanges, and more. This governance structure combined with the project’s profitability make $ENA an attractive asset to have in a portfolio, potentially resulting in significant upside as adoption increases, even if price does not go up several orders of magnitude from the current levels.

Ultimately, the major risks and rewards for Ethena are rooted in game theory. Initially, exchanges and investors benefit from Ethena’s TVL and user base. However, as Ethena grows, it could shift capital flows, potentially causing disruptions. There is also the possibility of exchanges colluding against Ethena if it becomes too powerful. Everyone wants their own share of the pie, and if they are enabling this growth, exchanges might as well want to play the role of being the main character. Nonetheless, we could also argue that, in theory, Ethena could eventually offer its own perpetual futures on its own chain, further expanding its TAM (Total Addressable Market).

Moving forward, despite the negative sentiment towards low float and high FDV tokens, Ethena’s ambitious roadmap and recent strategic moves can have a substantial impact on its valuation. Arguably, Ethena boasts one of the most ambitious roadmaps that we have seen in crypto in a long time – aiming for $USDe to be present and widely adopted on CEXs while also bootstrapping a DeFi ecosystem on its own dedicated chain.

Source: Ethena 2024 Roadmap – Money, network, exchange.

After the most recent partnerships with several CEXs to accept $USDe as collateral for margin trading and to be used as a quote asset, more partnerships are in the pipeline. Achieving this blue-sky scenario quicker than expected underscores Ethena’s potential and the trust that big players in the space put on the core team.

Source: Ethena 2024 Roadmap – The existing backing of $USDe can enable a liquidity aggregation layer adjacent to Ethena’s exchange partners, bootstrapping new DEXs on the Ethena network.

Despite announcing a detailed and promising roadmap a few weeks ago, $ENA did not experience a significant rerating. Initial price spikes were followed by sideways movement and a downturn in the overall market, preventing a sustained upward trend. This suggests the actual upside might not be fully priced in just yet, and $ENA could be one of the fastest runners as $BTC starts printing green candles.

Source: TradingView – $ENA underperformed along with the overall market despite the announcement of its 2024 roadmap.

Ethena’s plan to launch its own chain, which would capture ecosystem value, was announced during a market downturn, resulting in muted price reaction. For reference, the cost to short $ENA on perps exceeded 200% at times, suggesting an overall negative market sentiment (and also hedging future unlocks by some participants). This creates a scenario where any positive news or developments could trigger a short squeeze, leading to a “hated rally” and rapid price increase.

Source: Velo Data – Funding Rates have tended to be negative on $ENA on Binance and Bybit.

We have briefly touched on this topic already: Ethena has risks but there is also a reward that needs to be considered.

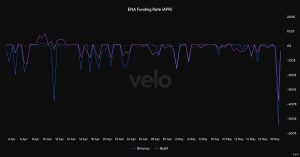

There are inherent risks in tokenizing Ethena’s carry trade, particularly if funding rates go negative for extended periods – even if this is unusual. Note that backtesting on past data completely overlooks the effect of a large player in the market like Ethena, who is shorting the market with a very large size. This could certainly lead to depegging incidents and financial strain on the protocol, although we would expect that holders exit their positions as the yield turns negative.

Source: Velo Data – Bull markets tend to exhibit positive funding rates.

Critics also worry about a centralized exchange (CEX) going insolvent, which could impair one of the short legs of the protocol, as well as about the custodial risk that comes with trusting the security practices of Off-Exchange Settlement Providers (OES Providers) for managing collateral assets.

Importantly, Ethena’s growth is constrained by its contribution to the total derivatives market. Centralized exchanges may cap Ethena’s open interest at around 20-25%, beyond which it could pose systemic risks. However, the team has publicly stated many times that they won’t be targeting those limits and that they will avoid pushing growth to extremes, maintaining a balance that is crucial for sustainable expansion.

Source: Velo Data – $BTC open interest excluding the CME fluctuates between $10B and $15B across Binance, Bybit, OKX, and Deribit.

In fact, our view is that critics often overstate the impact of negative funding rates. Ethena can unwind positions or use other stablecoins as collateral, minimizing the impact. The protocol also has a growing insurance fund to buffer against bearish market conditions. The use of liquid $USDT buffers and an insurance warchest are key for ensuring liquidity and minimizing redemption queues.

Just like investors and the average market participant are aware of these risks, so is Ethena’s core team of contributors and risk managers. The protocol’s approach to product construction suggests that Ethena is built to last and that they will do what’s in their hand to change to market conditions. It is Ethena’s transparency, strategic risk mitigation measures, and adaptive responses that position it well to navigate these challenges and create a moat against which copy-cats will have a very hard time competing.

Currently the consensus is that institutions are entering the space, but they are isolated to the spot ETFs. Meanwhile, new retail participants are not here yet. Therefore, the majority of current market participants are in their second or third cycle already, suggesting that they are already familiar with how money flows. Most recently, the topic of low-float and high-FDV tokens has been on the covers and headlines of crypto media outlets and crypto twitter.

The substantial FDV of $ENA, coupled with the anticipated launch of several other projects at multi-billion dollar valuations, could lead to an overheated market. As a result of negative market sentiment, this scenario might prompt a correction in the prices of low float and high FDV tokens, including $ENA.

Source: Coingecko – Ethena features a 9% mcap/fdv ratio, making it a victim of the negative sentiment surrounding the low-float and high-fdv trend.

Eventually, as more projects launch with significant VC backing, the broader market may develop a skepticism towards VC-influenced tokens, potentially affecting $ENA’s price and adoption. That is to say that retail feels like it is very difficult for them to make money. Because of that, buyers might be reluctant to step in and buy spot $ENA, as they fear to be dumped on by insiders once tokens start unlocking. If demand dries out and supply grows significantly, everything points at downwards price action.

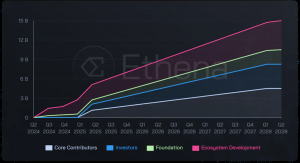

The total supply of $ENA is 15 billion, with an initial circulating supply of 1.425 billion. The distribution of tokens over time and among different stakeholders is the key that will influence market dynamics.

Source: Ethena Blog — Unlocks will start to be more aggressive as we approach Q1 2025

Therefore, potential market corrections are likely to occur as a result of “overvaluation risk”. If the broader market corrects due to the influx of high FDV projects, $ENA could experience a significant price drop. For that reason we will monitor the reception and market sentiment and new token launches like LayerZero ($ZRO), ZkSync ($ZKS), EigenLayer ($EIGEN), etc. This risk is compounded by the potential for rapid supply increases as various lockups and vesting periods end.

Ethena stands out as one of the fastest-growing protocols in the history of crypto, distinguished by its transparency in addressing the risks involved. Unlike many other projects, Ethena does not claim to be risk-free but instead presents a compelling risk-reward ratio. The potential upside is undeniable, capturing the interest of both crypto-native and traditional finance investors.

Source: kaito.ai – $ENA’s price action lags behind the amount of mindshare and mentions in the crypto community.

Revelo Intel has never had a commercial relationship with Ethena and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.