Published: August 12, 2024

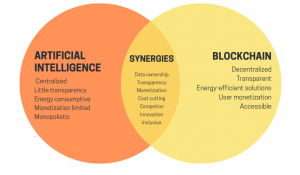

Two forces stand out as the most disruptive and transformative of this decade: crypto and AI. Crypto is all about enabling permissionless, decentralized, and trustless systems, while AI is all about the concentration of power to reshape industries at scale with exponential improvements over existing workflows and human productivity levels. The convergence of these two technologies offers a unique opportunity to capitalize on an unprecedented market opportunity.

In order to take advantage of this intersection it becomes critical to identify the fastest horse in this race—one that the majority of market participants will use as a proxy to get exposure to this nascent sector. Our view is that $TAO is in a very favorable spot to be the most efficient vehicle for capitalizing on this outlook given the right set of circumstances.

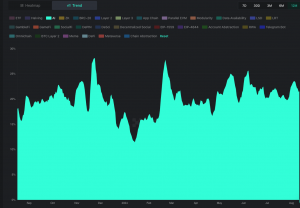

Source: Kaito.ai – The AI narrative has dominated Kaito’s narrative mindshare with a consistent dominance between the 15% and 25% of the total market share, being the fastest growing and strongest narrative in crypto over the last year.

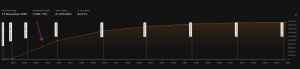

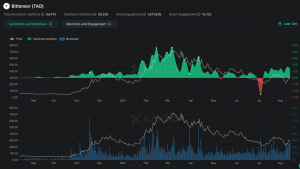

While some may argue that all catalysts have played out and the thesis is exhausted, we disagree. Recent milestones, such as the establishment of a Grayscale-dedicated trust, Binance listings, and significant capital inflows from liquid funds on the secondary market, have only strengthened our conviction. These accomplishments create an implicit price floor, capping downside risk. The strong price action so far has made it challenging to find good entry points, but the recent correction and distance from all-time highs present a timely opportunity to build a position.

Source: TradingView – Since the initial repricing started in October 2023, $TAO has been on a steep uptrend that made it very challenging to find opportune entries. The most recent correction and V-shape recovery finally offers an entry where we can limit its downside with a stop-loss around the $200 support level.

We believe $TAO can be the leader and fastest horse in the Crypto x AI race. Given that both crypto and AI are the most disruptive technologies of the decade, it’s conceivable that the strongest AI-related token could eventually secure a spot among the top crypto assets by market cap—only behind majors like $BTC, $ETH, $SOL, and stablecoins. Regardless, our investment thesis does not rely on that outcome. Our focus is on capturing upside and building strength in the portfolio, regardless of $TAO’s market cap ranking. This approach allows us to benefit from the narrative while others may use the token’s valuation as a psychological benchmark.

Intersection of Crypto and AI: Bittensor’s $TAO stands at the convergence of two of the most disruptive technologies of this decade, offering a unique opportunity to capitalize on the rapidly growing AI narrative within the crypto space.

Strategic Positioning: $TAO is well-positioned to become the primary proxy for investors seeking exposure to the decentralized AI sector, with recent catalysts like Grayscale Trust and Binance listings reinforcing its market relevance.

Decentralized AI Marketplace: Bittensor aims to democratize AI by decentralizing the creation, and sharing of machine learning models, transforming AI into a community-driven, open-source ecosystem.

Strong Community and Ecosystem: Bittensor’s engaged and rapidly growing community, along with its expanding ecosystem of Subnets and applications provides a solid foundation.

Sustainability Challenges: Despite its potential, Bittensor faces significant sustainability challenges due to high operational costs, reliance on speculative demand, and the dilution of rewards among participants.

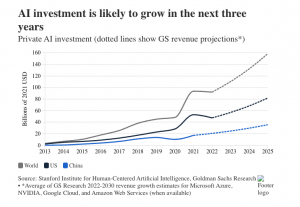

Market Opportunity: With AI investments expected to exceed $150 billion by 2025, Bittensor’s decentralized approach offers a compelling alternative to centralized AI giants, positioning $TAO as a valuable asset considering that there is no clear way to invest in the AI narrative through public markets.

Long-Term Horizon: While risks exist, Bittensor represents a long-term bet on the future of decentralized AI and open-source development, offering substantial upside potential for those willing to engage with the complexities of this emerging market.

Understanding the historical development and context behind Bittensor is crucial, especially for those with a long-term horizon. By grasping the project’s origins and evolution, it becomes much easier to assess Bittensor’s unique edge and moat. This background also provides valuable insights into potential risks and invalidations, helping us to stay ahead of the curve when evaluating competitors or identifying what could go wrong in our investment thesis.

Source: taostats.ai – $TAO has a total supply of 21M tokens. Blocks are mined every 12 seconds with an even split of 1 $TAO per block between miners and validators. There is a halving approximately every 4 years.

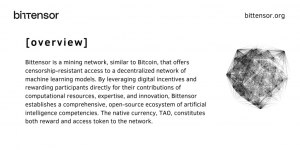

Bittensor was founded in 2019 by AI researchers Jacob Steeves and Ala Shaabana, along with a pseudonymous whitepaper author, Yuma Rao, who sought to create a system where AI models could continuously improve by learning from each other. They realized that crypto-economic incentives could provide the solution by incentivizing a global network of machine learning (ML) nodes to collaborate on specific problems, allowing the collective intelligence of the network to grow as more resources are added.

Source: Bittensor Whitepaper – “We propose a market where intelligence is priced by other intelligence systems peer-to-peer across the internet. Peers rank each other by training neural networks which learn the value of their neighbors.”

Initially aiming to become a parachain on Polkadot, Bittensor instead opted for its own standalone L1 blockchain due to concerns over Polkadot’s development speed. The journey began with the launch of ‘Kusanagi’ in January 2021, marking the network’s activation and the first $TAO rewards. However, Kusanagi faced consensus issues, leading to a fork into ‘Nakamoto’ in November 2021. On March 20, 2023, Nakamoto evolved into ‘Finney’ to enhance performance, and the network recently underwent the ‘Revolution’ upgrade, which introduced the concept of Subnets—self-contained incentive mechanisms that define the rules for interactions between miners and validators focused on a specific use case or task, such as the Text Prompting Subnet, the Image Generation Subnet, the Prediction Subnet, the Healthcare Subnet, etc.

Source: Bittensor.org – “Bittensor establishes a marketplace that transforms machine intelligence into a tradable commodity.”

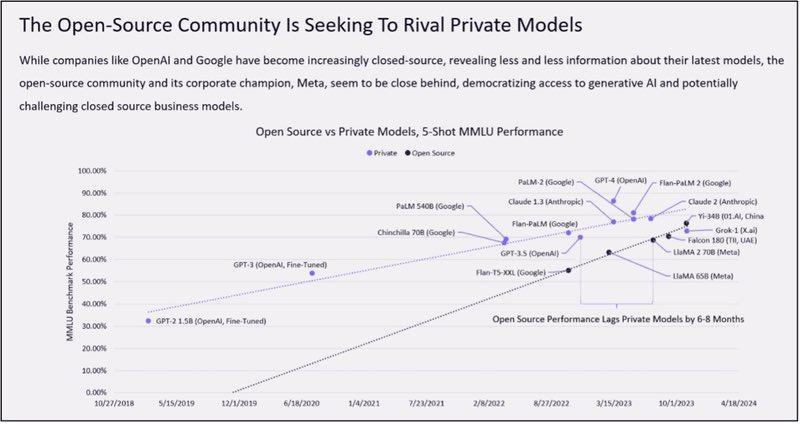

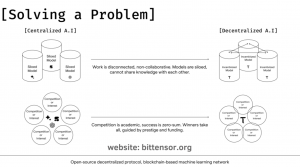

As a protocol, Bittensor embraces open-source development and open participation in a decentralized blockchain-based machine learning network. The market Bittensor operates in has historically been dominated by a few tech giants who controlled access to essential digital commodities like computing power and data. Bittensor challenges this centralized model by introducing a decentralized marketplace where developers worldwide can access resources previously monopolized by Big Tech. This democratization of AI resources positions Bittensor as a disruptor, aiming to create a more equitable and accessible technological ecosystem.

Source: ARKInvest – Open-source local models are on the rise, led by companies like Meta, Nous Research, and Mistral, which prioritize open-source collaboration versus closed-door development.

From a token economy standpoint, the supply distribution of $TAO was modeled after that of Satoshi’s $BTC, built on the principles of decentralization and fair distribution. Unlike most projects in crypto, there has never been an ICO or private sale. This absence of privileged distribution is key for avoiding supply concentration. Every circulating token must be earned through active participation in the network. New $TAO tokens are produced only through mining and validation, ensuring that acquisition is merit-based.

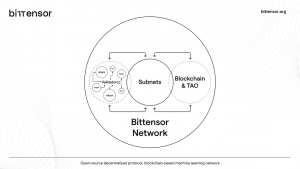

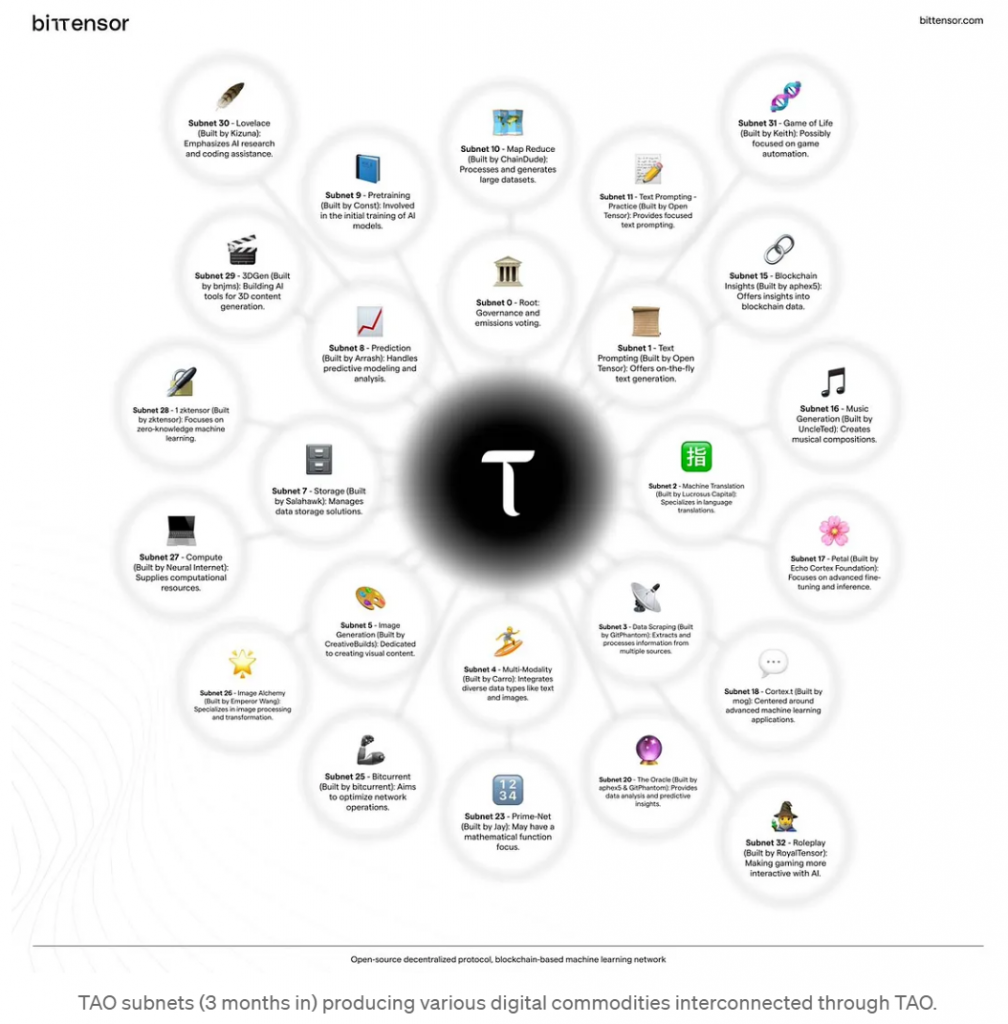

Bittensor’s $TAO is the native token of the network, powering the blockchain that underpins a system of crypto-economic incentives for the creation and sharing of AI models. The network encompasses an ecosystem of Subnets, each optimized for specific data or tasks (pre-training, prompting, transcription, prediction, data scraping, etc).

Source: Bittensor.org – “Bittensor enables the collective intelligence of AI models to come together, forming a digital hive mind.”

The protocol operates as a peer-to-peer marketplace for machine intelligence, where each node in the network represents a distinct Machine Learning (ML) model. These models can collaborate to process information collectively, yet they also compete in the marketplace. This dual nature of collaboration and competition incentivizes the creation and distribution of intelligence across the network.

What sets Bittensor apart is its ability to decentralize the production of machine intelligence while fostering transparent competition among different models. This environment encourages the development of open-source models, allowing them to experiment with new algorithms and techniques that can be monetized based on the value they contribute. This not only democratizes AI development but also ensures that innovation is rewarded fairly.

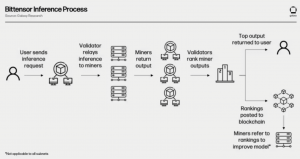

Source: Galaxy Digital Research – The network involves three participant roles: miners, who train and maintain machine learning models; validators, who verify model accuracy; and queryors or users, who use these models. Miners operate off-chain, fulfilling user requests and are rewarded in $TAO based on model performance, while validators assess miner outputs to maintain quality and prevent centralization. Users access the network through APIs that support multiple programming languages or other frontend interfaces.

This coordination is achieved by leveraging cooperative game theory to distribute rewards among network participants, aligning incentives with contributions. The ultimate vision is to create a “cognitive economy,” where knowledge producers can sell their work, and consumers can purchase this knowledge to enhance their own AI models. This transforms AI from a centralized, resource-intensive activity into a decentralized, community-driven ecosystem where value is created and shared among all participants.

Many projects in crypto are now jumping on the AI bandwagon, most of them exploring concepts like Decentralized Physical Infrastructure Networks (DePIN), Layer 1 blockchains, off-chain co-processors, AI agents, and even proof-of-humanity protocols. However, Bittensor’s $TAO stands out for being uniquely positioned at the intersection of crypto and AI, acting as the most direct proxy to the AI narrative within the crypto space.

Since the release of ChatGPT, the hype around AI has propelled $TAO to the forefront—a token that had barely any exchange listings one year ago. Bittensor’s journey from a fair launch, with Bitcoin-like tokenomics, to its current status as a highly sought-after asset, underscores the market’s recognition of this market opportunity.

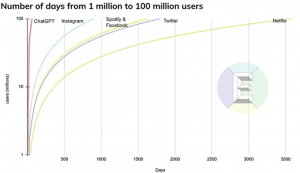

Source: Medium, Stateless Ventures – OpenAI’s ChatGPT became the fastest growing application in history, reaching 100M users in 3 months.

AI is increasingly centralizing, while crypto is inherently decentralizing. Both technologies are built on open-source principles and have dominated the tech landscape over the last decade. The likelihood of their convergence grows stronger as they mature. For crypto, AI brings a new level of sophistication, enabling blockchain platforms to enhance user experiences and create more complex on-chain applications. Conversely, crypto offers AI solutions to critical challenges like data and model authenticity. The transparency and immutability of blockchain technology provide a secure way to track and verify the origin of AI data and models, enhancing credibility and trust. Additionally, crypto promotes coordination among open-source models and datasets, facilitating a more collaborative approach to AI development.

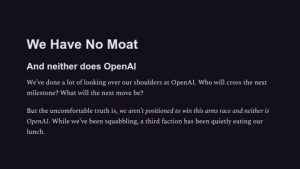

Source: Semianalysis Substack – Leaked Internal Google Document Claims Open Source AI Will Outcompete Google and OpenAI.

While AI has historically emerged from top-down initiatives within prestigious research labs, and crypto has grown from the grassroots with a bottom-up approach, both have become equally significant in the tech world, albeit through different paths. AI, which is largely probabilistic, complements the deterministic nature of crypto. AI creates digital abundance, generating vast amounts of data and models, while crypto enforces digital scarcity, ensuring authenticity and value. In this way, AI generates, and crypto authenticates, making them complementary technologies that can coexist and enhance each other.

Source: Vitalik.eth.limo, The Promises and Challenges of Crypto x AI Applications – “Now that both blockchains and AIs are becoming more powerful, there is a growing number of use cases in the intersection of the two areas. However, some of these use cases make much more sense and are much more robust than others.”

Bittensor exemplifies this synergy better than any other project in crypto. It can even leverage decentralized physical infrastructure networks (DePIN) to serve AI inference by connecting and coordinating compute power across the globe. This ensures that network ownership and rewards flow to all operators across the stack, aligning incentives and fostering a more equitable and efficient system. The use of crypto-economic incentives, such as block rewards and proof-of-work mechanisms, enables Bittensor to operate without a central authority, accurately compensating participants for their contributions to the network.

Our investment thesis is long-term oriented and anchored in the potential to democratize AI by decentralizing the creation and distribution of AI models. This approach challenges the traditional AI development model, which is often centralized and controlled by a few large entities. By leveraging open-source principles, Bittensor can offer more cost efficiency for researchers, and foster innovation with a more collaborative approach. The open access to the network ensures that anyone anywhere in the world can contribute to and improve the machine intelligence of the network—iterating rapidly without asking for permission. This collaborative approach can outpace the slower, more siloed development processes of centralized incumbents. Also, open-source projects inherently offer greater transparency, as their code and development processes are publicly accessible. This transparency builds trust among users and developers, which is crucial for achieving network effects and exponential growth as a result.

Source: Bittensor.org – Centralized siloed models cannot learn from each other, and third-party integrations require permission; Bittensor seeks to facilitate knowledge sharing among researchers creating transparent and fair peer-to-peer marketplace for AI.

Bittensor’s potential for disruption is also magnified by its Subnet architecture, which allows for specialized AI models tailored to specific tasks or data types. This approach embraces specialization and attracts the most advanced researchers in that specific field, with use cases ranging from healthcare research to natural language processing, image recognition, or predictive use cases. The outcome is a highly competitive environment that scales with more participation and ever-expanding opportunities, attracting talent across the globe to continue driving innovation. Bittensor ensures that AI resources are more equitably distributed and accessible, disrupting the status quo and empowering a broader range of contributors.

We have already seen examples of this, and the number and rapid growth of different subnets already speaks for itself (see Nous Research Subnet leaderboard). The strength of Bittensor’s community and ecosystem growth is a key factor in its long-term success. From the very beginning, the $TAO community has been characterized for being highly engaged and adopting a “cultish” behavior. This has been key to attracting more eyeballs and pushing AI people to start paying attention to the project. With significant interest and contributions from reputable teams and projects, this has led to the development of numerous subnets and applications, further solidifying Bittensor’s position in the decentralized and open-source AI space.

Source: Const, Bittensor Blog – Bittensor Ecosystem 3 months in, composed of 32 Subnets covering use cases such as data scraping, storage, model training, or ML inference.

Successful startups often resemble cults, with intense engagement and a shared sense of mission among their members. This deep commitment turns users into evangelists, driving growth, innovation, and resilience. A passionate community not only attracts attention from investors and institutions but also creates a strong psychological moat, making it hard for competitors to lure away loyal members. For Bittensor, this cult-like following has been crucial in building its ecosystem and securing its position as a leader in the decentralized AI space. Whether this community emerged out of love for open-source AI and Bittensor, or from a deep dislike for closed-source AI and centralized giants like OpenAI and Google, remains an open question.

The buzz surrounding the project has even captured the attention of Silicon Valley, where influential figures and AI researchers are increasingly discussing Bittensor as an alternative to centralized AI giants like OpenAI and Google. This growing recognition is also reflected in its inclusion in the Grayscale Decentralized AI Fund and the dedicated Grayscale Bittensor Trust, which signals substantial institutional interest.

With Bittensor decentralizing AI, making it open-source, composable, and uncensorable, it is actually turning intelligence into a commodity accessible to anyone. As AI demand grows, Bittensor’s blockspace becomes a valuable resource. With AI investment expected to surpass $150 billion by 2025, the rise of large language models (LLMs) will lead to AI agents outnumbering humans online, necessitating blockchain-based financial and legal infrastructure to control and audit AI, which the crypto industry has been building for a decade.

Source: Goldman Sachs AI Investments Forecasts – Goldman Sachs forecasts that global AI investment will exceed $150.0 billion by 2025.

Our view is that Bittensor currently offers one of the best risk-reward opportunities to bet on Crypto x AI, particularly as there is no clear way to invest in the AI narrative through public markets. The value of $TAO, Bittensor’s native token, is tied to the AI services it powers rather than just selling block space, making it intrinsically linked to the network’s utility. As demand for AI services grows, so does the demand for $TAO, driving its value. Similarly, just like Bitcoin miners, Bittensor participants may sell $TAO to cover expenses, with the token’s price ultimately determined by supply and demand dynamics within the ecosystem and the addition of a speculative price premium.

Source: Kaito.ai – Price has been falling along with sentiment. Most recently we observed a bottom with negative sentiment in July caused by a security breach that resulted in the loss of $8M worth of tokens. Price was suppressed weeks later with the overall market dump on Monday August 5 caused by fears of a US recession and the unwind of the popular Yen Carry Trade.

While Bittensor offers exciting potential at the intersection of AI and blockchain, there are significant risks that could undermine the investment thesis. Currently, the price of $TAO seems driven more by speculation than by organic demand for AI services. For the network to truly succeed, it must attract real users who are willing to pay for AI predictions and services, not just speculators.

Additionally, the tokenomics, while designed to encourage competition and quality improvements, could backfire if rewards diminish to the point where they no longer incentivize high-quality participation, although this is more of a long-term issue that we will be able to monitor over time.

Integrating economic incentives into a network of decentralized AI models is complex and susceptible to exploitation, as has been evidenced by incidents where incentives were gamed or practices like relay mining. While the network aims to address these through adjustments and research, the most recent proposal of dynamic $TAO also comes with its own challenges. Currently, the network scales horizontally by adding more subnets, but this competition for rewards among subnets complicates the issue of distributing value, making it difficult for TAO holders to fairly compare vastly different AI services.

Bittensor Subnets compete for inflation rewards, but with the introduction of dynamic $TAO, token holders now will be faced with the difficult and subjective task of comparing and valuing subnets that serve entirely different purposes. For instance, what is more valuable, a very accurate $BTC price prediction algo? or a computer vision model that screens and analyzes scanners to identify disease? This diversity and ambiguity in value generation complicates decisions and may not align with long-term strategic development, as relying solely on market forces to allocate rewards can end up being arbitrary.

Furthermore, it is also worth noting that Bittensor might face sustainability issues due to the high costs of running its intelligence network. The network’s operation relies heavily on its native token, $TAO (with an associated price dependence), with miners participating primarily when the rewards outweigh their computational costs (i.e. when there is a window for arbitrage). Meanwhile, the demand for $TAO is driven largely by speculators and the expansion of Subnets, which can dilute incentives for existing participants. If the price of $TAO drops, the unit economics for miners and validators become less favorable, leading to a decrease in network activity. With daily $TAO emissions amounting to ~$3.2 million, or $1.2 billion annually, maintaining the network’s sustainability under these conditions poses a substantial risk, especially if demand does not keep pace with the inflation of new tokens.

Finally, when investing in a token that has experienced such a drastic price increase and many catalysts have now been realized, it is worth keeping an eye on early buyers realizing profits, as that could lead to significant selling pressure during a market downturn. It’s important to understand that purchasing $TAO does not entitle holders to any USD-based yield from the network’s economic activity. Instead, rewards come in the form of additional token emissions, which can be staked to earn more $TAO. While there are clear analogies with Bitcoin, including the use of $BTC to incentivize network operation, Bitcoin’s unique value proposition is its scarcity, with a capped supply of 21 million coins. In contrast, $TAO still has over 70% of its tokens unissued, raising a dilemma for investors about whether to prioritize the decentralization of the network or the scarcity of the asset. This dynamic adds a layer of complexity when assessing the risk/reward profile of $TAO as an investment.

Building a large position in $TAO requires a clear understanding of how the network operates and what challenges remain unsolved. This position should be built up and timed at your own risk depending on your level of conviction on the Crypto x AI narrative as well as in your belief that $TAO is the most direct proxy to capitalize on it. While the project has ambitious goals and shows promise, it is still early in its development, much like many other projects. Progress in this field is a marathon, not a sprint.

Revelo Intel has never had a commercial relationship with Bittensor and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.