Published: July 15, 2024

The current market keeps getting saturated with new tokens that often enter the market with a low float and building infrastructure rather than innovating at the application level. This infrastructure naturally commands a premium because the Total Addressable Market (TAM) is larger and it operates as a substrate for the applications that will build on top.

However, it is important to not miss the forest through the trees and complain that the market is inefficient. The reason for that is because VCs and investors want to bet on what has proven to work and, in addition to infrastructure projects and their tokens yielding the highest returns to their funds, the majority of market participants would agree that the killer applications of crypto have already been identified.

Source: Galaxy Research, VC Capital Q2 2024 – Only 4% of the capital invested in crypto in Q2 2024 has gone into DeFi, with 7% going into L2s and Interoperability solutions, and 15% into infrastructure

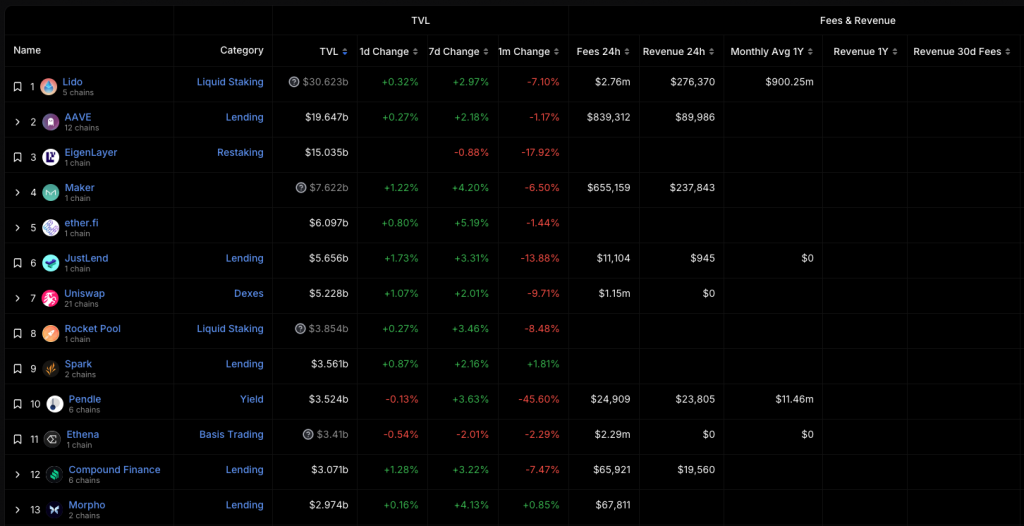

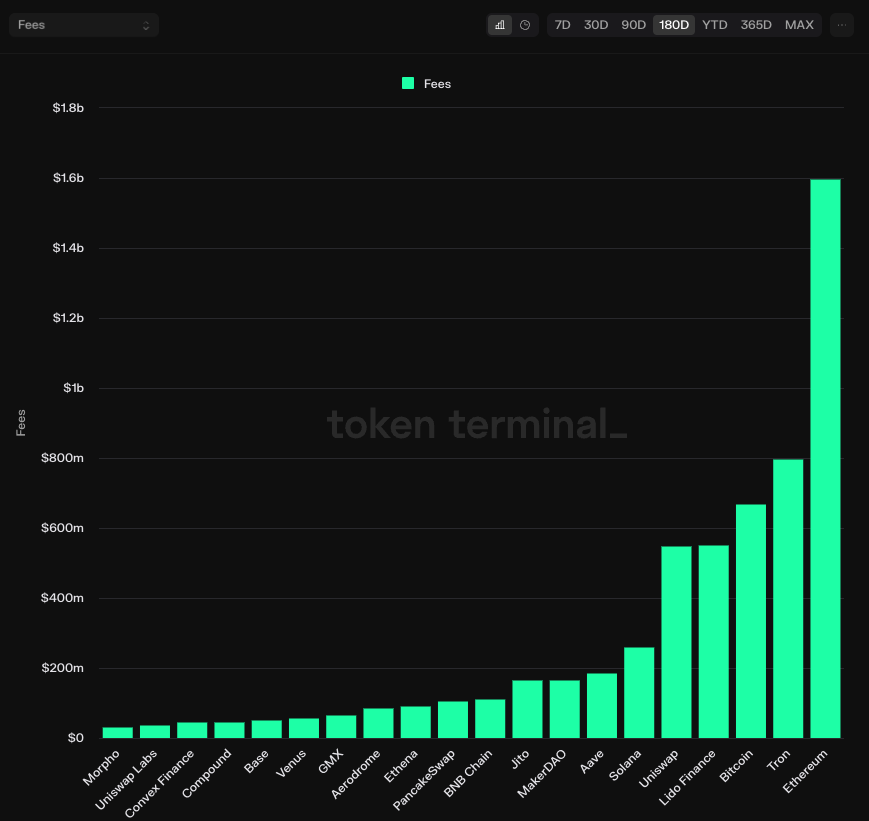

One example of a use case that has found product-market-fit in crypto is decentralized lending, which consists in using smart contracts to ensure solvency via overcollateralization and allow anyone to take out a loan at any time and from any part of the world without asking for permission. Within that market sector, Aave is the clear winner and category leader with almost $20B in Total Value Locked (TVL). That makes it the second largest dApp by TVL (only behind Lido’s $30B in TVL) and also one of the largest by fees and revenue generated.

Source: DeFiLlama – Aave is the largest lending market by TVL, followed by JustLend in second place with almost 1/4th of Aave’s liquidity

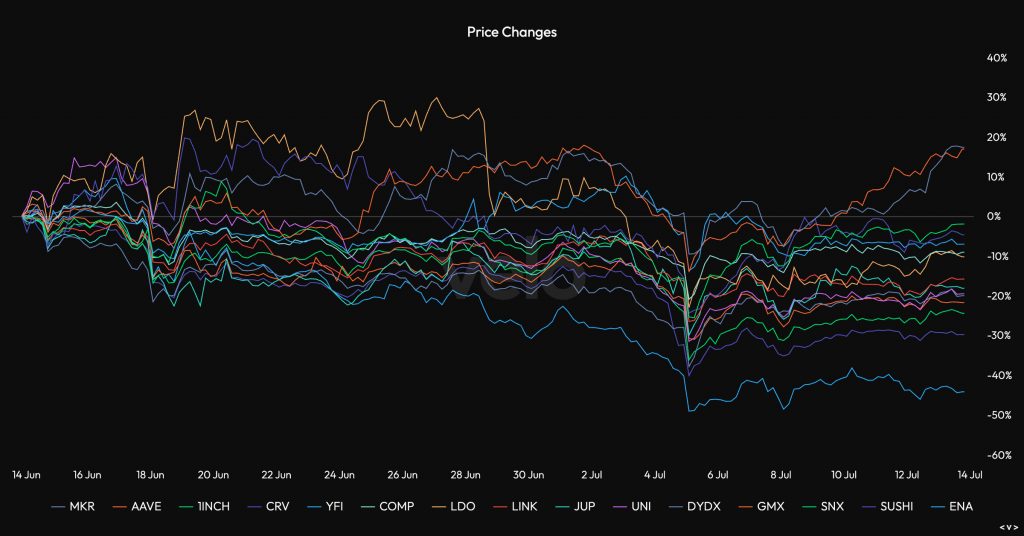

While new tokens might capture the attention for the right or wrong reasons, it is established protocols and tokens like $AAVE that may offer compelling opportunities for those with a positive outlook on what DeFi has to offer, more so in the days before we start receiving inflows to $ETH spot ETFs. We reiterate that chasing beta is a losing strategy, even more when we consider that the actual event and news are already known by all market participants – there is no catalyst to be had.

Source: TradingView – $AAVE has underperformed $ETH the majority of the year, but this trend has shifted since the start of July

Lending fuels ecosystem growth and is a core primitive that every chain wants to have. It adds value to the overall ecosystem and other protocols by boosting DEX transaction volume from liquidations and yield strategies, enhancing the value proposition of yield-bearing assets like LSTs or LRTs, or simply allowing DAOs and protocol treasuries to earn yield on their idle assets.

We are also at an inflection point where regulatory clarity, a Trump victory, and getting rid of Gensler might offer favorable conditions for decentralized protocols like Uniswap, Lido, and Aave among others. That might help protocols like Uniswap to turn on the fee switch and not be seen as securities while still passing revenue on to token holders. However, there is another angle to this, as institutions have their own kind of needs and look at crypto from different lenses. We are still in a phase where the markets in DeFi aren’t clear or strong enough for institutions to draw more attention into it. But when the time comes, Aave is one of the few protocols who is ready for this paradigm change.

Note that, while we believe that getting exposure under $100 for $AAVE can offer a good risk/reward profile if $ETH starts outperforming and moving to the upside, we underscore the importance of remaining vigilant. We definitely don’t want to get stuck or be left holding the bag if we see a continuation of this trend where DeFi tokens continue to struggle finding new buyers, regardless of how much money they make or how much they innovate on the technical side of things.

The fact that low-float-high-fdv tokens have been suffering doesn’t imply that the absence of supply overhang and staying power of protocols like Aave will be enough to attract new buyers and deter sellers from exiting their positions. For that reason it is important to note that, while Ethereum DeFi tokens might outperform if we see good numbers on $ETH spot ETF inflows, dreams and hopes of a “DeFi season” will never underwrite a winning trade on our end. The fact that tokens like $AAVE have been so static all this time (up 11% on the last 30 days and up 27% on the year) might suggest that things won’t change for no reason, although rate cuts could certainly help to attract new speculative capital on-chain.

Source: Velo – Most DeFi tokens have underperformed, with the exception of $AAVE and $MKR, which have bounced since the start of July

The vision for building a decentralized money market started out with the realization that, if you can actually swap assets on-chain in Uniswap, you could also use those assets as collateral and borrow against, as well as earn yield on your capital. That led to the creation of ETHLend, which operated as a peer-to-peer lending facility that later transitioned to a peer-to-pool model and rebranded to Aave.

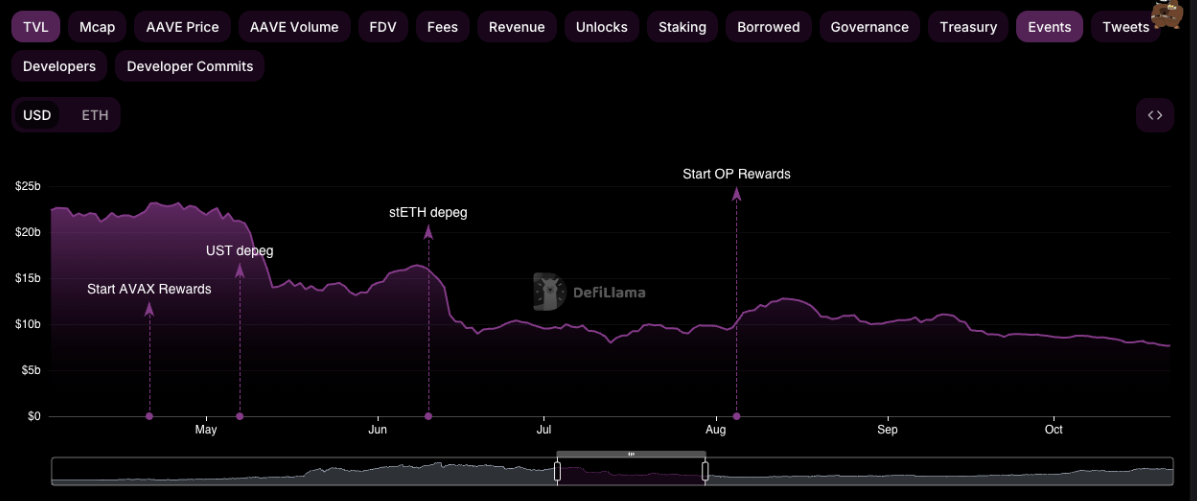

Source: DefiLlama, Aave – An all-time-high above $30B in TVL was reached in October 2021 but it has not been reclaimed since

After riding the hype wave of DeFi summer, $AAVE has been considered a blue chip and its contracts have become the backbone of Ethereum liquidity. It has been one of the most battle-tested protocols and has demonstrated staying power over the years, even managing to remove incentives and outperform competitors like Compound while they still paid users to engage with the protocol via $COMP token incentives.

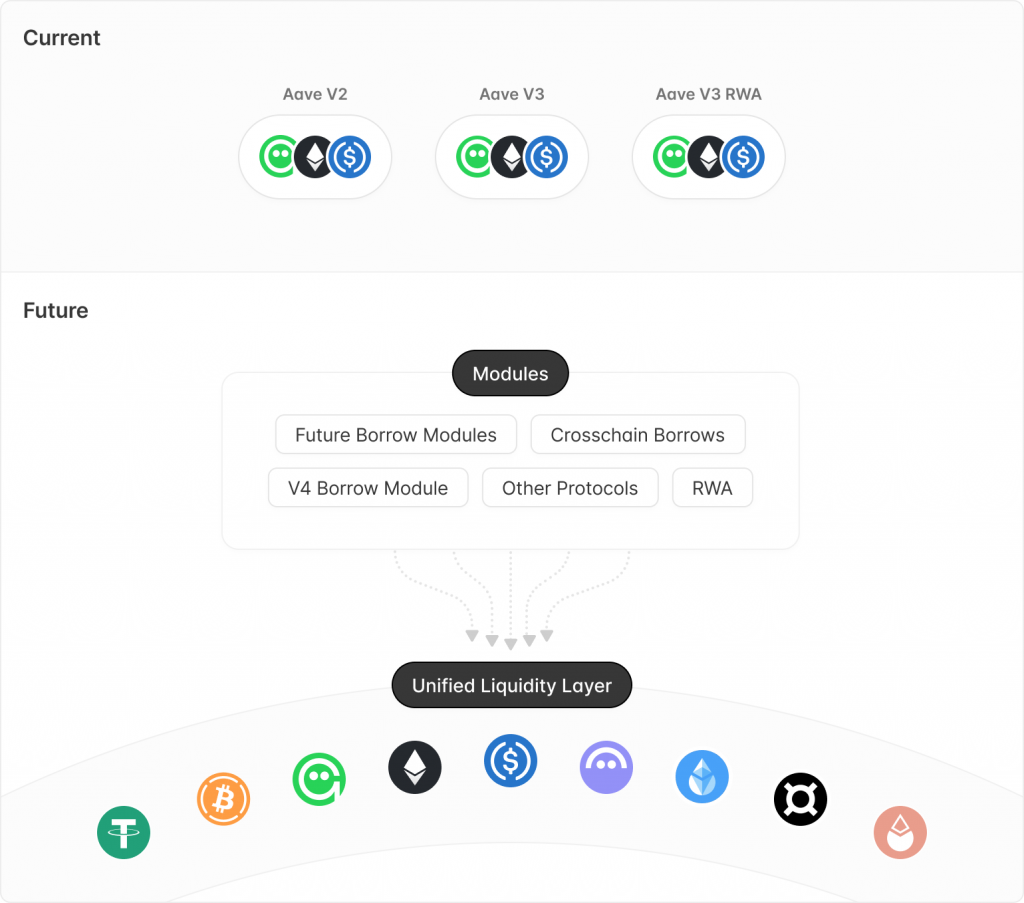

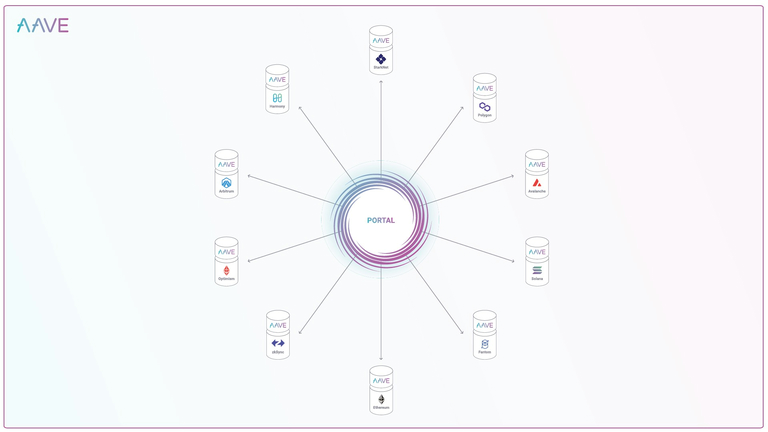

As the industry started to embrace a multichain world and Aave struggled to migrate its liquidity from Aave v2 to Aave v3, many might have thought that adding a cross-chain layer on top of a fork might be enough to remove the leader from the throne. However, that couldn’t be more far from the truth. Yes, omnichain lending will be a thing, but posting collateral on one chain to borrow against it on another chain is something that Aave had not overlooked (Aave Portals were created for a reason).

Source: DefiLlama, Lending – Aave is by far the market leader, with the closest competitors on Ethereum hovering around the $3B TVL mark

Despite new entrants on the market like Morpho, who believe in outsourcing risk management to external curators instead of dealing with it at the DAO level, and cross-chain competitors like Tapioca or Radiant, Aave remains the indisputable leader. While another blue chip and consolidated protocol like Compound seems to have stopped innovating beyond Compound v3, Aave is not staying with its arms crossed and they recently announced Aave v4, which will have far and wide implications, from stablecoins to RWAs, and from wallet abstraction to cross-chain operations.

Aave has high expectations and wants to continue leading, which underscores its resilience and Lindyness while still demonstrating that there is more room for growth. It is critical to take a step back and look at the past in order to fully grasp the rationale behind each decision backing the development of Aave v4.

Aave’s inception was driven by addressing liquidity crunches, where bear markets triggered withdrawals that created scenarios where there is not enough capital to meet borrower demand and, as a result, liquidity was depleted from the protocol. To avoid these crunches, they got to the realization that they could actually have a protocol-owned stablecoin that could be minted into these pools for users to borrow against. That realization led to the development of $GHO, but now Aave wants to go the extra mile with Aave v4 by introducing a unified liquidity layer.

Source: DefiLlama, Aave – 2022 is an example of liquidity crunches caused by the collapse of Terra $LUNA and the $stETH depeg after the collapse of Celsis, BlocFi and 3AC among others

With v4, Aave wants to build a lasting protocol that can survive any market condition while retaining the flexibility and simple UX that has characterized it since the early days. Going back to the early days, Aave is rooted in two principles: risk management and capital efficiency. Together, this creates a pricing component.

Consider users coming to Aave and supplying assets, also being able to pull whatever liquidity they may need through overcollateralized loans. Effectively, you can utilize pretty much your portfolio on whatever you need to borrow, and you can repay whenever you want, since all loans are perpetual and variable interest rates take care of incentivizing borrowers and lenders. This experience is both simple and intuitive, and since you can do it in one same market, that means that, whenever you are supplying an asset, you are earning yield on it.

As an example, let’s say you supply $USDC, which means that you are earning based on how many users are borrowing that asset out. This is where the pricing component comes in and why it is so important. This setup creates an interesting scenario for the users, because it means that $USDC is priced across the protocol as one single instance, regardless of how risky other positions are or how much extra risk they are adding. This is exactly what happened when the DAO approved the use of $CRV as collateral and then it faced the challenging situation of accruing bad debt given the liquidity conditions for that collateral asset (see Michael Egorov’s incident).

That’s a problem that Aave wanted to solve, and v4 has found an answer to it with a unified liquidity layer. Having a unified liquidity layer is an effective way to capture and aggregate liquidity, and everything else can then be connected to that liquidity. Examples of composability can range from different borrowing modules, interest rate models, or liquidation strategies. There could also be an Aave Portals module that manages the minting and burning of aTokens across chains.

Source: Aave Forum – A unified liquidity layer in Aave v4 will enable features such as isolated pools, RWA modules, and a built-in CDP

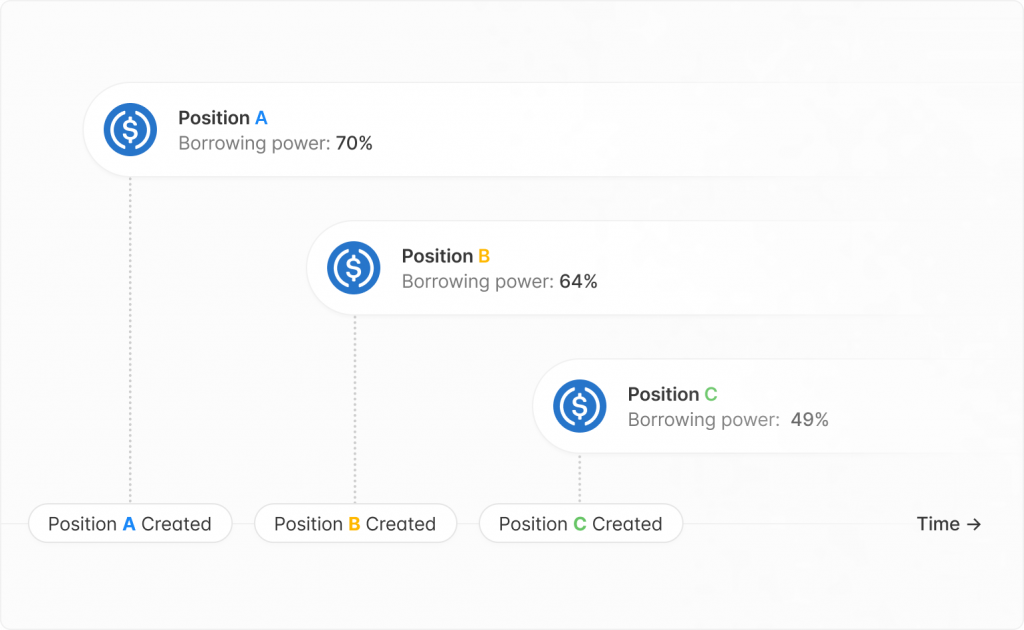

What’s so important about this unified liquidity layer is that it represents a single place to store value: the actual liquidity and the accounting of that liquidity about who and which users it belongs to. It is also the connecting tissue for different modules. For example, one could register their liquidity into this layer without having to supply it, and adjust balances while holding it on a Gnosis Safe – meaning that you won’t be able to lend out your funds, but you will be able to borrow against them directly from your wallet. And this is a quite relevant feature from an institutional perspective and mitigating lending risk.

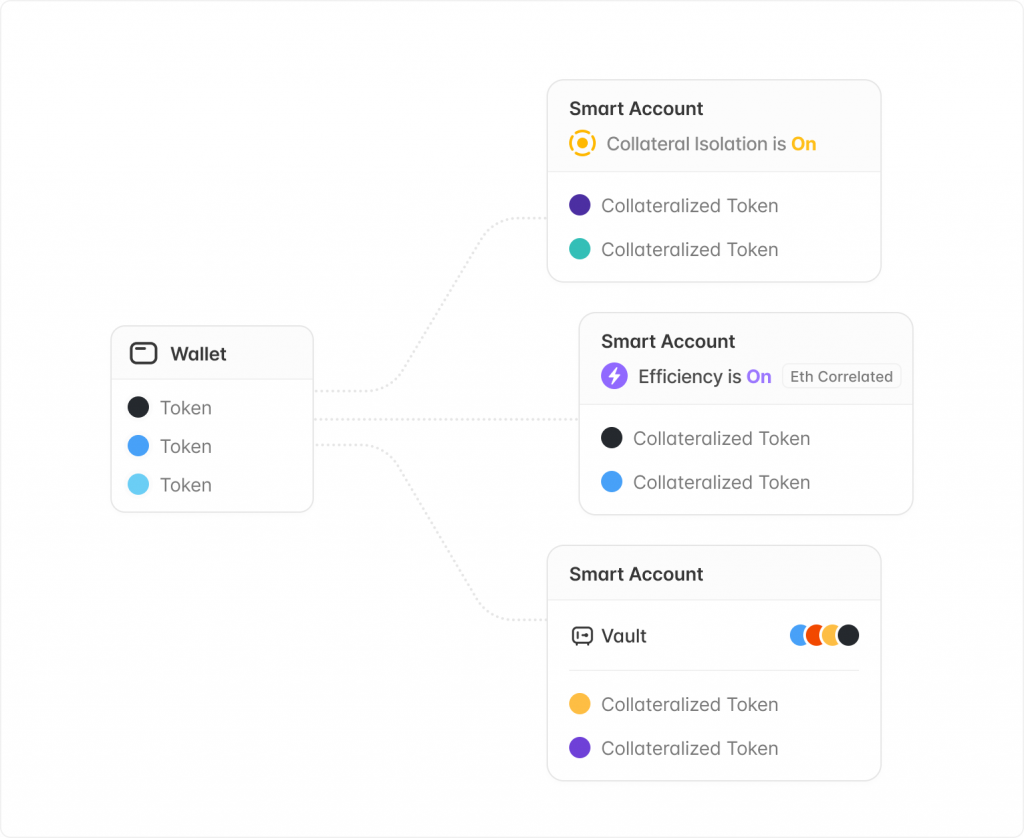

Source: Aave Forum – Vault and Smart accounts will allow users to create as many smart accounts as needed using only one wallet, greatly simplifying interactions with the protocol

Aave holds more than double the TVL of Maker, yet $AAVE trades 40% cheaper than $MKR. Despite the highly ambitious that Maker is undergoing with Endgame, we believe that the protocol still faces challenges from its tokenized treasuries strategy and rebranding efforts. In fact, we believe that Aave represents a strong alternative to eat into $DAI’s market share and position itself as one of the leading DeFi protocols in the RWA space, uniquely serving both retail and institutional needs.

Source: TradingView – The MKR/ETH pair has outperformed AAVE/ETH since the start of the year

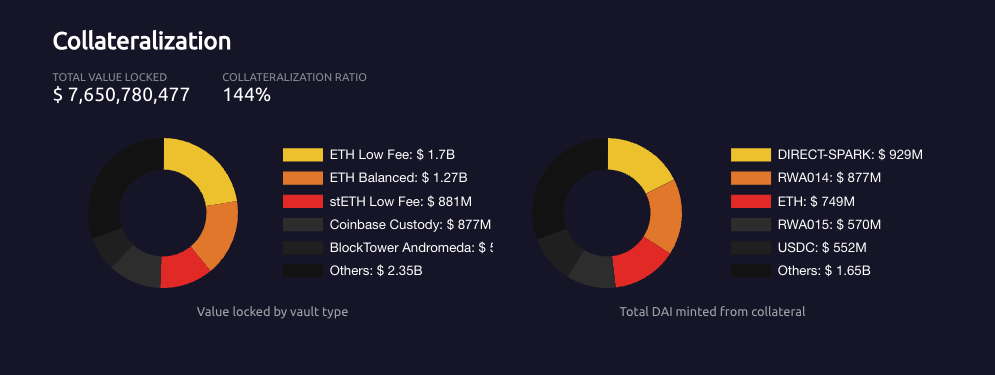

Even though Maker recently drew attention to its $1B tokenized treasury investment plan from Blackrock’s $BUIDL fund, Ondo, and Superstate, the Maker of today is quite different from what it was at the beginning. It used to be one of those protocols that showcased the capital efficiency of a CDP and issued a newly minted stablecoin against $ETH collateral (instead requiring both suppliers and borrowers), and this was a breakthrough at the time as an alternative to $USDT and $USDC. However, today $DAI is a mere $USDC wrapper with more liabilities that make it fragile such as the holding and purchases of US T-Bills that are offered on-chain to anyone around the world.

Source: Makerburn, $DAI Collateralization

While Maker has found product-market-fit and is one of the protocols generating the most revenue, it may be on the brink of losing it. The protocol is encircled by stables on one side and lending protocols on the other. We want to bet on the strength of Aave rather than be exposed to the fragility of Maker. The latter is now paying interest on deposits of their own fiat-derivative currency, while the former comes from a position of strength and a clear growth strategy for $GHO to generate more revenue and realize the original vision of $DAI. Also, if it quacks like a bank and walks like a bank, it will be considered a bank, and in most countries banks can’t issue their own notes.

Source: TokenTerminal – Aave has recently surpassed Maker in the amount of fees generated over the past 180 days

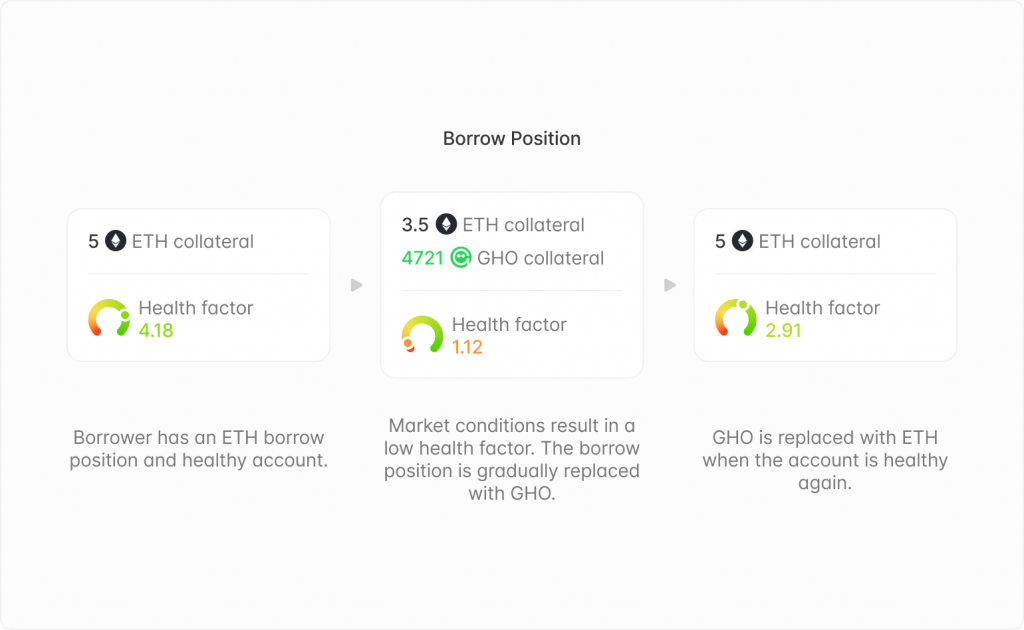

The importance of $GHO cannot be understated. It will become a core pillar and piece of infrastructure for the Aave ecosystem. To understand the significance of this we have to go back to the beginning. The reason why $GHO exists today is because Aave had liquidity crunches from time to time, and so the idea was that having a protocol-owned stablecoin could help to avoid these crunches. This stablecoin could be minted into lending pools for users to borrow against and avoid the liquidity crunches. While thinking about this idea, Aave reached the conclusion that, one main benefit of $GHO, compared to Maker’s $DAI, is that when you supply your assets to the Aave protocol, you earn on the collateral while you’re borrowing $GHO. As a result, you get an extra degree of capital efficiency and can empower borrowers with more predictable rates. From the protocol perspective, the benefit of $GHO is that, since there is no need to have liquidity providers (LPs) for it, that means that the reserve factor, which is how the DAO collects revenue from the protocol, is actually 100% instead of the 10% of current $USDC markets. To better grasp the magnitude of this opportunity, consider that $100 million worth of $GHO minted brings the same amount of revenue as $1 billion $USDC.

This concept for a lending market to issue its own stablecoin is remarkable, since that revenue stream then cascades into building and innovating more on the community side and on the technical stack, also figuring out different ways to reward users. This can be taken to the next level with v4, since the presence of different modules can allow for having different facilitators that mint $GHO directly on different layers and that can then be borrowed out. In addition to that the protocol can also support soft-liquidations similar to crvUSD and allow users to get paid interest in $GHO on any asset that they have.

Source: Aave Forum – A Lending-Liquidating AMM (LLAMM) is proposed to ease liquidations. It automatically converts collateral into $GHO as the collateral price decreases, and vice versa, converts $GHO back into the collateral asset when prices rise

Effectively, you could technically keep your $ETH collateral, for example, on Ethereum mainnet, and then draw debt denominated in $GHO on another network. Aave Portals would be used to allow for minting and burning unbacked aTokens that are then subsequently backed right away. Hence, while the original idea of Portals was to allow third parties to come and get some sort of credit line, it is also a very effective tool for bridging.

Source: Aave docs – Aave Portals allow supplied assets to seamlessly flow between Aave markets on different networks.

With account abstraction and embedded wallets you can have an experience that is really smooth for payments. Stablecoins have gained a lot of traction and been adopted in places where there’s a lot of uncertainty, and this further expands the addressable market for Aave. It is extremely convenient to send someone $GHO and then check directly on-chain that the transaction has landed without dealing with banks.

As an additional use case, remember that Aave Portals and the unified liquidity were conceptualized with institutions in mind – as a way to move liquidity very fast between networks. For example, suppose you want to supply liquidity, but you don’t want to supply the assets into the liquidity layer for some particular reason. One, you don’t want to get the funds lent out. Two, you want to see the collateral segregated from the other parts of the protocol and avoid counterparty risk. Three, you want to keep it in your wallet and see it in your smart account. What you can do is register your collateral in the protocol, but you don’t need to supply it, such that you can keep it in your Gnosis safe, and then you can draw liquidity against it. This is an interesting use case because you don’t really need to put your assets into the protocol, and you can keep different positions segregated while the liquidity remains unified. By using smart accounts the UX can be taken to another level, enabling things like gasless and signless transactions.

Source: Aave Forum – Aave v4 will allow for dynamic risk configurations per asset, where users are “hooked” to the current configuration of an asset when a borrow takes place. If a new asset configuration is required, a new configuration instance is created. Existing users remain hooked to the previous configuration.

The segregation of vaults and positions is also key for onboarding Real World Assets (RWAs), which offer an interesting value proposition when being used as collateral. Once a RWA has been tokenized, the new Aave V4 liquidation engine will set it apart from other protocols, as it allows it to have liquidation strategies. What liquidation strategies actually allow is that you can have a different type of liquidation strategy depending on what the asset is (tokenized bonds, tokenized real estate, etc). This makes sense because not all of these assets that will exist on chain will have the same liquidity profile or the same redemption time period. For some, and most of the assets that are listed today, their redemption profile is really similar, but this won’t necessarily be the case in the future. Not always will liquidators be able to intervene and swap the asset on a secondary exchange to keep protocol healthy. With v4 you can enable a time period of like two windows a day, once a day, every couple of days, etc where an asset, for example, can be redeemed for the underlying or liquidated and then take the proceeds and return them to the protocol.

These liquidation strategies are another key difference with respect to Maker, and make Aave’s value proposition much stronger beyond earning yield from T-Bills, as Aave can support strategies that weren’t possible before and where some off-chain assets might have a time-value component attached to them. Consider an institutional context where Bitcoin is kept somewhere in custody for 9 or 12 hours, so you can’t liquidate right away. Maker can’t accommodate those use cases, while Aave v4 is being designed to technically support the existing use cases in RWA operations, but at the same time innovate to support anything that is new, or assets that they don’t have yet a similar support from a technical perspective. This tokenization of money market funds is going to be a growing aspect, as Blackrock has already been taking the initiative with the BUIDL fund.

Aave is also one of the few protocols that is making a strategic expansion into non-EVM chains, contemplating deployments on Solana and other chains on the Move ecosystem like Aptos and Sui. Unlike many protocols that comfortably deploy on EVM-compatible chains because of the low effort involved, Aave is going the extra mile and chasing further growth. This is a bold move that entails writing code from scratch to integrate with distinct VMs but that will allow the protocol to engage with new communities and tap into a broader user base.

Non-EVM chains are built with specific goals, such as reducing transaction costs or enhancing transaction parallelization, allowing Aave to be used alongside more mainstream consumer applications. This is an example of a forward-thinking strategy that is meant to solidify Aave as a core protocol that is adaptable to any market condition and that is omnipresent in all blockchain environments.

One might think that it is an opportune time to pair trade by being long $AAVE and short $COMP, but we think that would send the wrong message and is definitely not a market neutral strategy. There is no mandate that pair trading should be done between competitors or tokens on the same market sector and, even if the executive team of Compound is abandoning the project (as implied by the official announcement that they are working on another project and there haven’t been any updates or significant improvements to Compound in a long time), the correlation between the two tokens and $ETH is too high. Even if we don’t see new marginal buyers for $COMP, the market might not react by selling $COMP right away (and it hasn’t). This inactivity on Compound is also priced in given how very little action there has been on it. The consensus is also that Compound has lost the lending battle to Aave. If anything, Maker now represents a more direct competitor, although we wouldn’t be short $MKR and long $AAVE simultaneously. Alternatively we could long both $AAVE and $MKR and hedge by protecting the downside with an $ETH short, or another token with a large market cap that is more representative of the overall market (if you want to avoid shorting $ETH because you expect that ETF inflows will push the price higher).

Source: TradingView – $AAVE remains relatively flat and sits at similar price levels since the start of the year, while $MKR and $ETH have demonstrated more relative strength

Aave remains the most liquid money market in DeFi, and this is a status that is likely to continue and possibly be boosted with upside price inertia. Competition from Morpho and Euler v2 could pressure TVL, but regulatory clarity can significantly uplift the DeFi sector, favorably positioning $AAVE alongside other leaders like $UNI and $LDO.

The business model is both lucrative and simple, while the growth of the $GHO stablecoin adds another revenue stream. Together, this presents an opportunity to attract institutional capital in anticipation of broader adoption of DeFi when the compliance rules are in place. When that time comes, Aave will be one of the few players that is actually positioned to ride this tailwind.

From a trading perspective, we know from experience that crypto doesn’t necessarily trade on fundamentals. In fact, the tokenomics of $AAVE make it an unattractive investment, as the token is used as a backstop mechanism against bad debt, with tokens being sold to keep the protocol solvent and protect against black swan events.

Regardless, the major downside that comes with participating in this trade is that this can take weeks or months to play out, which presents a big opportunity cost. People are very impatient and many will feel compelled to chase trendier and hotter narratives like AI – we don’t want to be in a position where everything is ripping and DeFi tokens are barely moving relative to the overall market. This problem is amplified given the association with $ETH, which has underperformed and is not close to ATHs while $BTC already has while $SOL has had its own season with memecoins and the token is already 10x higher than the FTX lows.

Aave remains the leading and most liquid money market in DeFi, poised to benefit from potential regulatory clarity and institutional adoption. Despite competition and the inherent risks in its tokenomics, Aave’s solid business model and growth expansions, including the $GHO stablecoin and a cross-chain strategy, position it as a candidate for outperformance during the second half of the year. While the trade may take time to play out, Aave’s strong fundamentals and resilience make it a compelling opportunity with a balanced risk/reward profile for the long side of the portfolio.

Revelo Intel is not currently engaged in a commercial relationship with Aave and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.