Published: December 11, 2023

Coinbase is building the crypto economy – a more fair, accessible, efficient, and transparent financial system enabled by crypto. The company started in 2012 with the radical idea that anyone, anywhere, should be able to easily and securely send and receive Bitcoin. Today, Coinbase offers a trusted and easy-to-use platform for accessing the broader crypto economy.

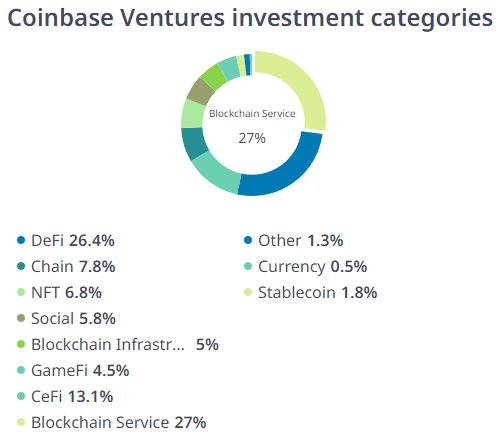

Coinbase Ventures invests in exceptional founders who share Coinbase’s mission of creating more economic freedom for the world. They strive to be strategic partners for founders and take a collaborative approach to investing. They support founders through operational experience, distribution, strategic partnerships, and more.

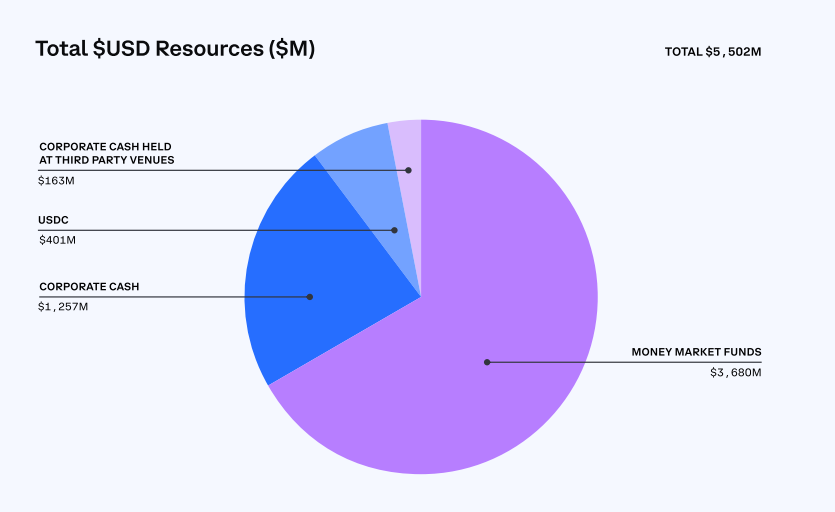

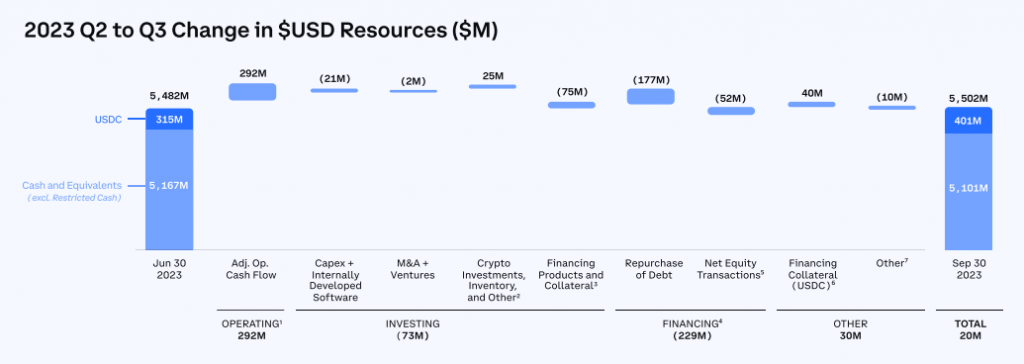

According to Coinbase’s Shareholder Letter released on November 2, 2023, they ended Q3 2023 with $5.5 billion in total available $USD resources which they define as cash and cash equivalents, USDC, and custodial account overfunding. This represents an increase of $20 million Q/Q.

In addition to their $USD resources, they also consider their crypto assets held as investments as other unencumbered and liquid resources available to them. The fair market value of their crypto assets held as investments was $572 million as of 9/30 and had an impaired cost basis of $311million.

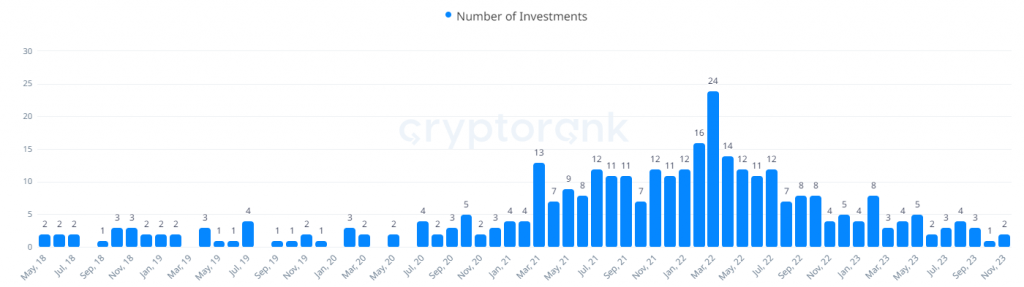

Coinbase Ventures’ total number of investments is 340 and the accumulated amount they have invested is $6.5B with some projects having an undeclared amount of investments. The tables below show all the projects they have invested in and acquired:

| Airtm | Coinfeeds | Hidden Road | OneKey | TaxBit |

| Alto | Coinmine | Hyperithm | Parcl | Tesseract |

| Amber Group | CoinSwitch | InvestaX | Pintu | Tetra Trust |

| Architect | Custodia Bank | Ippopay | Protego Trust | Tokensoft |

| Bitnomial | Daffy | Jambo | Qredo | Tribal |

| Bitso | Eco | Lemon | Rain | Umoja Labs |

| Bitwise | FalconX | Mara | Reku | Valkyrie |

| Block Earner | Flint | Meow | Ridian | Valr |

| CLST | ForUsAll | Merge | Seashell | Wave |

| CoinDCX | Hashdex | On Deck | Talos | Yellow Card |

| 0x | DerivaDEX | Mirror | RealtyBits | Umee |

| Acala | DFlow | MoHash | Reserve | Uniswap |

| Affine | DODO Exchange | Moonwell | Ribbon Finance | Variational Research |

| Alkimiya | Dolomite | Morpho | Risk Harbor | Vauld |

| Alliance DAO | Endaoment | Mountain Protocol | Rocket Pool | Vega |

| Alongside | Euler | Naos | Router Protocol | Vertalo |

| Arcadia Finance | Fei | Nayms | Rysk | Voltz |

| Aurigami | Folks Finance | Neptune Mutual | Saffron Finance | DeBank |

| Block.Green | Francium | Notional | Satori | Maverick |

| Bounce | Gauntlet Network | Omni | Securitize | Raydium |

| Cega | Goldfinch | Opyn | SEDA | Tokemak |

| Centrifuge | Harpie | Orca | Sei | Data Mynt |

| Charm Finance | Hashflow | Panoptic | Set Labs | Linen |

| ClayStack | HXRO Network | Parallel Finance | Slingshot | Portal |

| CoFiX | Immuna | Paxos | Solend | Term Labs |

| Compound | Instadapp | Percent | StableHouse | |

| Contango | Ledn | Perennial Finance | Synquote | |

| Cozy | Lemma | Persistence | Synthetix |

| Alchemy | Consensys | Kurtosis | Questbook | Unstoppable Domains |

| Amberdata | Covalent | Macro | Radicle | Utopia Labs |

| AwesomeQA | Demox Labs | Messari | Rally | WalletConnect |

| Blocknative | Dfns | Metrika | Samudai | Web3Auth |

| Bonfire | Dune Analytics | Momentum Safe | Sardine | Coin Metrics |

| Certik | Etherscan | Moralis | Shinami | Integral |

| Certora | Eventus | Mysten Labs | Simplehash | Pine Street Labs |

| ChainPatrol | Fleek | Nansen | Spruce | Turnkey |

| Chaos Labs | Flipside Crypto | Nomics | Stader | |

| CloudBurst | Hyperspace | OneSafe | Syndicate | |

| Coherent | Incode | OpenZeppelin/Forta | Tenderly |

| (O)1 Labs | Brydge | Farcaster | Mina | Snapshot |

| Aleo | Casa | Flowdesk | MobileCoin | Socket |

| Alluvial | Cashmere Finance | Foxchain | Moonbeam | Spacemesh |

| Alta Labs | Celestia | Galxe | Multis | Spindl |

| Anoma | Celo | Gnosis Safe | NEAR | SSV Network |

| Aptos | Ceramic Network | Graph Protocol | Obol | Starkware |

| Arbitrum | Chainflip | Hop Protocol | Optimism | Subspace Network |

| Arweave | Commonwealth | HypeLab | Otterspace | Sunscreen |

| Astar Network | Composable Finance | ImmutableX | ParaSpace | SupraOracles |

| Audius | Connext | Keep Network | Pinata | Taki |

| Axelar | Crusoe Energy | KYVE | PIP | Textile |

| Aztec | DeSo | LayerZero | Polygon | Thirdweb |

| Backdrop Labs | Disco | Li.Fi | Polymer Labs | Titan |

| Biconomy | EigenLayer | Liquality | Rain Card | Uma |

| bloXroute | Entropy | Livepeer | RedStone Finance | Unlock Protocol |

| Braintrust | Espresso | Massive | RSS3 | Violet |

| Brave | EVMOS | Milkomeda | Sealance | Worldcoin |

| XMTP | Zapper | zCloak | Zebec | Zerion |

| zkSync |

| Ancient8 | Collective | Highlight | Nifty’s | Venly |

| Anima | Curio | Horizon Blockchain Games | NiftyApes | Yo |

| Animoca Brands | Cymbal | Jadu | OpenSea | Yoz |

| Arkive | Dapper Labs | Joyride Games | Pawnfi | Yuga Labs |

| Avalon | Everyrealm | Limit Break | Rarible | Zora |

| Azra Games | Fancraze | Magic Eden | Royal | Clockwork Labs |

| bitsCrunch | FirstMate | MakersPlace | ScienceMagic.Inc | GuildFi |

| Bitski | Fractal | Massina | SkateX | Nfty Chat |

| Bling Financial | Friends With Benefits | Mintbase | Sound.xyz | Third Time Games |

| Branch | Gallery Labs | MIRA | Sturdy Exchange | |

| Bridgesplit | Genies | Neynar | Summoners Arena |

| Dharma | Katana | Interchange | Blockrize | Altered State Machine |

| One River Digital Asset Management |

Staked | Nova | Diem | Eternal |

| Onramp Invest | Bison Trails | Nxyz | Elph | Mint Songs |

| Tuned | Curv | Tactic | Namebase | WENEW |

| Avantis |

| BSX |

| Onboard |

| Open Cover |

| Truflation |

| Paragraph |