Published: September 26, 2023

Despite many crypto natives spending hours every day on Telegram, the sudden surge in the price of $TON has caught many by surprise. It wasn’t until it flipped Solana in market cap that people started paying attention and keeping a close eye on what was going on with the TON project, originally developed by Telegram.

Behind the scenes, The Open Network (TON) is ushering in a new era of decentralized Internet infrastructure. This report provides a concise overview of TON’s components, its mission, and its potential impact on the digital landscape.

The Open Network (TON) is a multifaceted ecosystem comprising four key components: TON Blockchain, TON DNS, TON Storage, and TON Sites. At the heart of this ecosystem is the underlying L1 blockchain, which aims to onboard the next generation of users thanks to a strategic relationship with Telegram – that is 800M+ users around the world.

2017: Inception and Vision

2018: Record-Breaking ICO

2019: Documentation and Testnets

2020: Regulatory Challenges

2020-2021: Community-Driven Development

2021: TON’s Resurgence

2022: Building the Ecosystem

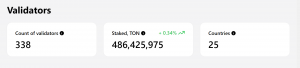

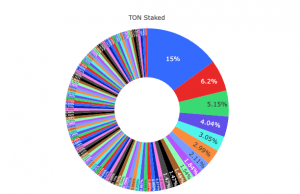

TON is a Proof of Stake (PoS) blockchain where validators are compensated with staking rewards for securing and maintaining the integrity of the network.

Currently, there are 551 apps in the ecosystem, 75 utilities, 56 Telegram channels, 51 NFT collections, 46 exchanges, 32 wallets, 32 gambling apps, 29 community chats, 16 block explorers, 16games, 10 decentralized exchanges, 10 social networking apps, 8 NFT marketplaces, 7 staking apps, and 7 VPNs.

Recently, liquid staking has become more important and started to grow after the launch of BEMO. Like Lido on Ethereum, BEMO can capture the majority of the market share with its first-mover advantage.

However, if Ethereum targets power users, TON is the infrastructure for apps that target the masses. Like Telegram, it emphasizes consumer-facing applications, often via mobile applications and Telegram bots.

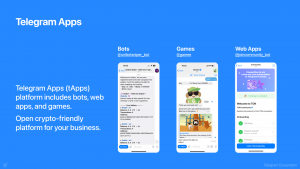

Most crypto users are probably familiar with the recent craze of Telegram bots, which have greatly simplified the process of buying/selling tokens. Instead of using Metamask or any other Desktop wallet, users are only a click away from executing a transaction when using Telegram bots. Data conducted by Binance Research shows that the cumulative volume of Telegram trading bots has exceeded $190M, with a record high of $10M in daily trading volume recorded in July 2023.

Besides trading bots, other types of bots stand out as well, such as chatbots used for customer support or automated replies. Other use cases include online stores, content creation tools, news sharing, weather forecasting apps, payments…

Recognizing the demand for these Apps, the TON Foundation introduced the Telegram Apps Center, effectively bootstrapping a new ecosystem native to TonChain. Similar to an App Store, this offers a catalog of applications that put user experience at the forefront by providing users with an interface similar to the ones they are used to interacting with on a daily basis.

But Telegram’s App Center is not restricted to TonChain. Instead, applications from other chains are welcome as well. By embracing community spirit, Telegram is uniquely positioned to draw the attention of a much broader audience.

To understand the potential of any given Layer 1, we must consider what makes that specific blockchain unique. For that, we must answer the question: what are the unique use cases that are only possible on this chain? From that point, it then becomes much easier to apply other rules such as Metcalfe’s Law.

First movers are rarely overthrown. Bitcoin and Ethereum are unlikely to be displaced. By analogy, TON’s unique value comes from being the first to tap into a new and uncharted market: blockchain for the masses.

In the case of TON, developers have an incentive to start building applications, whether it is web apps, GameFi, or DeFI in order to scale up their products thanks to Telegram’s massive audience. Not only that, but it is very easy for existing Solidity developers and web developers to get started building applications.

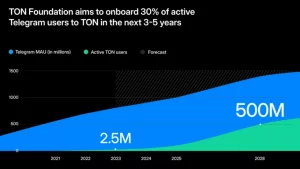

On September 14 the TON Foundation announced an official partnership with Telegram to integrate and promote the TON ecosystem. This partnership explicitly targets a 3,300% increase in active Web 3 users by 2028 – that is 30% of Telegram’s active users or ~500M users. While this feature will start only being available to a limited number of users, a large-scale rollout is planned for November 2023.

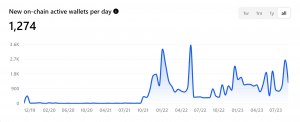

To put things into perspective, the latest a16z State of Crypto report puts monthly crypto active users at 15M across all chains, with TON being the most active chain. In fact, Telegram’s initiative to put digital ownership in their user’s hands cannot be underestimated, and we have already seen how far social apps like FriendTech or more speculative tools like Telegram bots can go.

It is also worth noting that, while many have praised the easy onboarding into apps like friend.tech, this process will be even more seamless in the TON ecosystem. Not only that, but users will be onboarded to the ecosystem as a whole, rather than to specific applications.

Another step forward is Telegram App’s Center, which has fully integrated the Wallet in Telegram and does not require users to download the applications in order to interact with them. Users can make transactions and move capital with a couple of clicks without ever leaving the tApp itself.

On the tApp, users can find applications for translation, trading bots, games, payment infrastructure, wallet trackers, file organizers, alerts, and reminders. This offers a unique user experience where everything lives inside one single app, creating a SuperApp akin to WeChat or Elon’s vision of X. The key differentiator, however, is the alignment of incentives with crypto users, with Tonchain offering security and ensuring the privacy of user data.

A standout feature of TON is its close alignment with Telegram, a platform deeply integrated into the crypto community. Telegram boasts a vast user base spanning alpha groups, business development, trading, and news updates. TON seeks to bridge the gap between traditional Telegram users and the world of blockchain. This means bringing non-crypto Telegram users into the world of decentralized finance and applications, a move that could catalyze blockchain adoption.

Historically, Telegram has espoused core crypto principles like open-source code, privacy, and freedom of speech. But not all users are familiar with the values that characterize the culture of crypto. The integration of a wallet within Telegram, known as the TG Wallet, has simplified the onboarding process. All types of users can now easily start a wallet and engage in crypto activities, including depositing funds, making credit card purchases, and participating in peer-to-peer marketplaces.

One of TON’s greatest assets is its strategic alliance with Telegram, a social network with over 800 million users worldwide. This partnership positions TON to tap into a massive user base and onboard the next generation of blockchain enthusiasts.

When comparing The Open Network (TON) to counterparts like Ethereum and Solana, it becomes evident that TON should not be underestimated. It goes far beyond being a simple chain associated with Telegram. TON has a Turing-complete design and supports dynamic sharding, making it stand out as a scalable solution that can support millions of transactions per second through its workchains and shardchains (technical details in whitepaper).

For instance, TON excels in terms of transaction speed, generating new blocks approximately every 5 seconds. This near-instant block generation ensures rapid money transfers and smart contract execution. In contrast, Ethereum’s slot-based system results in a time-to-finality of at least 12.8 minutes, while Solana, despite its quick block generation, has a time-to-finality of 6.4 seconds.

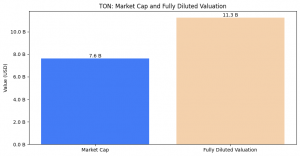

The total supply is uncapped, and the network started with an initial supply of 5B $TON, which inflates annually at a 0.6% rate. Inflationary emissions are allocated to reward validators, currently offering ~6% APY.

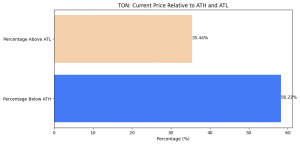

Out of the top 20 tokens in market Cap, $TON is the only one that is not currently listed on Binance. As of today, $TON is tradeable on exchanges like Bybit, Bitget, OKX, Kucoin, and Gate as well as decentralized exchanges on Ethereum and Tonchain. Potential catalysts might be a Coinbase or Binance listing.

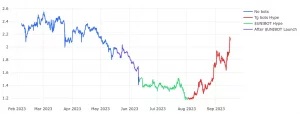

The announcement of an official partnership with Telegram on September 14 increased the price of $TON by 40% on the weekly, officially flipping $SOL by market cap and entering Coingecko’s TOP 10.

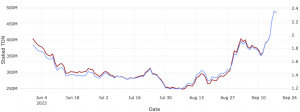

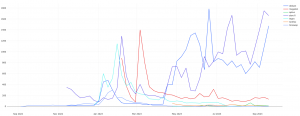

There is a correlation between the activity of trading telegram bots and the $TON price

Main DEXs TVL

Main DEXs TVL

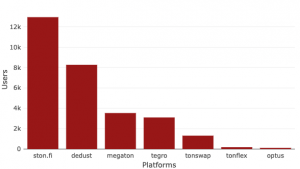

The total TVL of the chain is ~$10M. However, it is not valuable to assess this number and compare it to other L1 or L2 chains. Tonchain is a chain that is focused on consumer products and payments, necessitating very little liquidity for its applications to scale. The majority of the TVL is concentrated in 2–3 large pools on each DEX.

Total Amount of Holders

Total Amount of Holders

In conclusion, The Open Network (TON) represents a remarkable journey from its inception in 2017 to its current position in the blockchain landscape. Despite facing regulatory challenges and a change in leadership, TON has displayed resilience and community-driven development, evolving into a robust and scalable blockchain ecosystem. Its unique integration with Telegram and emphasis on user-friendly applications make it a potential catalyst for blockchain adoption among the masses.

As TON continues to build its DeFi ecosystem and collaborates with Telegram, it stands poised to usher in a new era of decentralized internet infrastructure and redefine the blockchain experience for a broader audience, regardless of how overvalued it might seem to be after ranking in the top 10 by market cap.

Revelo Intel has never had a commercial relationship with Tonchain and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.