Published: September 14, 2023

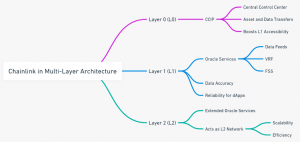

Over the past year, Chainlink has undergone a transformation, marked by the introduction of Chainlink Economics 2.0. This strategic shift has elevated Chainlink to a pivotal position within the web3 landscape, spanning critical layers such as LayerZero (interoperability), L1s, and L2s.

With the successful implementation of the Cross-Chain Interoperability Protocol (CCIP), Chainlink has cemented its role as the foundational infrastructure supporting cross-chain decentralized applications (dApps) and services. Notably, the recent release of Staking v0.2 has further strengthened its position by enhancing the staking ecosystem, thereby ensuring long-term economic sustainability.

This multifaceted approach, bridging L0, L1, and L2 layers, uniquely positions Chainlink to capture user fees across the entirety of the cryptocurrency ecosystem. Its unwavering commitment to security adds an extra layer of trust, making Chainlink a preferred partner for projects seeking reliable and robust solutions for a variety of services.

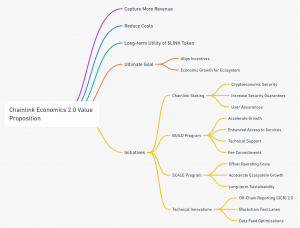

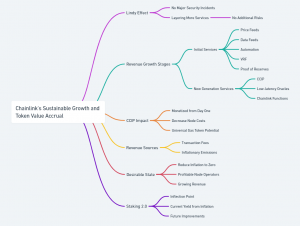

Chainlink’s economic framework is a comprehensive strategy aimed at fostering sustainable growth and financial viability within the Chainlink ecosystem. It encompasses a range of initiatives designed to boost revenue generation while optimizing operational costs. By aligning economic incentives among participants, these initiatives aim to secure the network, expand its utility, and ensure long-term success.

Chainlink Economics 2.0 is the cornerstone of the economic framework. It introduces a comprehensive set of initiatives designed to increase revenue while reducing costs.

First of all, there is a fundamental distinction between staking $LINK tokens within the Chainlink ecosystem and staking tokens in a Proof of Stake (PoS) blockchain. In the context of Chainlink, staking $LINK involves locking up these tokens to provide a service-level guarantee for the network’s performance, thereby enhancing the security and reliability of Oracle services.

Launched in December 2022 with a 25M $LINK pool, staking plays a critical role in the development of Chainlink Economics 2.0. Formally known as staking v0.1, this ensures that $LINK token holders have the ability to lock up their $LINK tokens to secure the performance of the services offered by the network and earn rewards.

After almost 1 year of running in production, Chainlink is now introducing staking v0.2. The goals of this new release include offering greater flexibility for the community and node operators, improving the network’s security guarantees, and introducing a modular architecture that will support the expansion to more services.

The migration from staking v0.1 to v0.2 will take place on a phased rollout that involves 3 stages.

The v0.2 upgrade also includes an expanded pool capacity, accommodating up to 45M $LINK, an 80% increase compared to the previous 25M capacity in v0.1. This expanded capacity represents approximately 8% of the current circulating supply of $LINK. As the ecosystem evolves and additional services are integrated, this capacity is expected to grow further.

Given the sudden increase in cumulative deposits after general access was enabled, it is reasonable to expect that the Staking Pool will get filled up pretty quickly as well. This size is relatively small compared to the positions that institutional players can leverage.

During the initial launch of Staking v0.2, existing v0.1 stakers will be offered a 7-day Priority Migration window. This phase enables v0.1 stakers to either migrate their v0.1 stake and accrued LINK rewards to v0.2 or choose to withdraw their assets. Within this period, v0.1 stakers can opt to migrate all or a portion of their v0.1 stake and rewards. Should they decide to migrate only a portion, any remaining v0.1 stake or rewards will be withdrawn.

After the Priority Migration period concludes, v0.1 stakers retain the ability to migrate or withdraw during subsequent Early Access and General Access phases. However, due to a limited pool size in v0.2, entry isn’t guaranteed beyond the Priority Migration phase.

Following the conclusion of the Priority Migration phase, individuals holding $LINK tokens can participate in the Early Access phase of Staking v0.2 if they fulfill at least one predefined criterion on the updated Early Access Eligibility List.

This phase extends an opportunity for $LINK token holders to stake in v0.2, subject to the per-wallet maximum. It’s important to note that being on the eligibility list grants the chance to participate in v0.2 but does not guarantee entry due to the limited pool size.

Upon the conclusion of the Early Access phase, the v0.2 staking pool opens its doors to General Access. During this phase, individuals from all walks of the community have the chance to stake up to the per-wallet maximum, contingent on the availability of space within the v0.2 pool. It’s important to note that the pool size dictates participation in this phase.

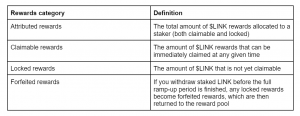

Attributed Rewards constitute the cornerstone of this new mechanism, encompassing both Claimable Rewards and Locked Rewards.

The ramp-up period starts at 0% when stakers begin, and it increases to 100% over time. As the ramp-up progresses, more Locked Rewards turn into Claimable Rewards. For instance, if a staker is halfway through the ramp-up, they can access 50% of their Attributed Rewards.

Through an iterative approach and modular architecture, Staking v0.2 will set the foundational principles for subsequent module additions in future upgrades.

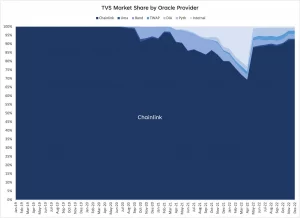

By the end of 2022, Chainlink dominated the Oracle services sector with ~90% market share. As time goes by, the product stickiness and network effects of its oracle services will get harder and harder to disrupt. However, a bull case for $LINK needs to account for a much larger addressable market than the current winner-takes-all oracle landscape. Given that adding more products and services to the platform does not increase the trust assumptions of the network, Chainlink can manage to build a moat such that it becomes the de-facto infrastructure of DeFi, NFTs, gaming…

While the recent staking upgrade has opened new avenues for token holders to earn yields and profit from Chainlink’s growth, the broader landscape reveals an even more compelling narrative. Chainlink is in the process of extending its reach beyond the realm of data oracles, positioning itself as the linchpin connecting all blockchains and bridging the on-chain and off-chain worlds. This comprehensive approach encompasses an array of services, including Oracle price feeds, data feeds, proof of reserves, Chainlink functions, VRF, CCIP, and Automation.

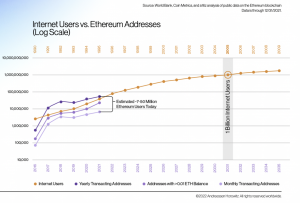

As an interoperability layer, one of the best metrics to measure the adoption rate is TVE, which stands for Total Value Enabled. TVE quantifies the economic activity that is dependent on Chainlink, measured as the total US dollar-volume of transactions facilitated by Chainlink. Growth in Chainlin’s TVE is relevant because it involves growing the industry as a whole. Hence, maximizing TVE is of paramount importance to increase the overall adoption of blockchain technology.

At the beginning of the year, Chainlink Labs reported TVE of ~7tn YTD across 12 blockchains. However, research shows that there are concerns about the methodology that was used, since one should expect similar ratios of Chainlink TVE / TVS (Total Value Secured measured as the total USD value deposited into protocols secured by Chainlink oracles) to DeFi volume / TVL (Total Value Locked).

The reason for that is because TVE should be proportional to DeFi volume since it reflects the aggregate sum of volumes for transactions invoking Chainlink oracles. Also, TVS should be roughly equal to DeFi TVL since it is the aggregate sum of TVL for applications using Chainlink.

This might have happened due to errors accounting for the whole suite of Chainlink services, which includes more than Oracle price feeds and often accounts for activities such as liquidity rebalancing, automated yield farming, etc. Other sources of error could include overestimating or underestimating DeFi volume, which can be skewed when accounting for derivatives platforms, CEX spot and futures volume, and NFT sales volume.

Regardless of the accuracy of the data, it is possible to estimate Chainlink TVE by calculating Chainlink TVS x DeFi Capital Efficiency, where DeFi Capital Efficiency = DeFi Volume / DeFi TVL. If the adoption of Chainlink services continues or increases, even up to the point of becoming a monopoly in some market sectors, this might be the more representative metric to keep track of.

Moreover, the fact that Chainlink services span multiple market sectors implies that it will greatly benefit from any uptick in Web3 adoption. Besides, because of its strategic position as the middleware layer for blockchains, Chainlink can leverage its broad ecosystem and avoid excess concentration or dependence on any specific vertical (DeFi, NFTs, a specific chain…)

In Q2 2023, the Chainlink ecosystem boasted over 1,800 projects with 2,000+ integrations. This unique position in the market unlocks potent network effects and economies of scale. Chainlink’s established relationships with these projects give it a competitive edge. Projects already utilizing Chainlink’s services can seamlessly add more, reinforcing Chainlink’s first-mover advantage.

For instance, if a project is already using 2 or 3 services by Chainlink, adding extra services is a frictionless process. Considering Chainlink’s first-mover advantage, this moat can only grow larger over time.

With its suite of services, Chainlink has the potential to become an industry standard for middleware software solutions. For instance, instead of using Pyth for data fees, API3 for randomness, LayerZero for cross-chain communication or Gelato for automation, projects can get all of those services out of the box with Chainlink.

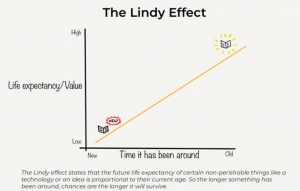

Additionally, Chainlink happens to be the most battle-tested protocol among its competitors. The protocol went live in 2019, when it only offered price feeds. Over time, as the number of price feeds increased, Chainlink continued adding other services in the fields of randomness, automation, proof of reserves, etc.

Chainlink’s Lindy effect gains significance with time, especially considering its track record of security. The introduction of additional services doesn’t introduce new trust assumptions or attack vectors beyond what existing apps already accept. For instance, dApps using Chainlink price feeds can instantly access cross-chain connectivity via CCIP without introducing additional risks, thanks to Chainlink’s secure decentralized Oracle network model.

It is largely known that most chains and DeFi protocols in crypto generate very little revenue, especially when compared to the inflation rate of their native token. This is unsustainable and causes the token to depreciate in value over time.

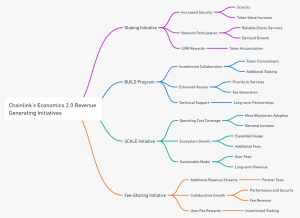

For Chainlink, we can analyze its revenue growth in two distinct phases. Initially, Chainlink embarked on generating revenue through services like price and data feeds, automation, VRF (Verifiable Random Function), and Proof of Reserves. As we move forward, a new generation of Chainlink services will step into the spotlight, further bolstering earnings. These upcoming services include CCIP (Cross-Chain Interoperability Protocol), low-latency oracles, and Chainlink functions.

Significantly, the launch of CCIP stands out as a pivotal milestone. It is set to be monetized right from the start, concurrently reducing operational costs for network nodes. With CCIP, gas costs will be shifted to end users, potentially positioning $LINK as the universal gas token for multiple blockchains.

Crucially, users pay transaction fees to the network, which in turn compensate the nodes providing data and computational resources. These services actively generate revenue with usage. Importantly, this revenue flows to node operators, who receive compensation in the form of transaction fees and inflationary emissions, akin to block rewards on standalone blockchains. The more substantial the transaction fees, the more sustainable it becomes to reduce the inflation rate, ultimately trending towards zero.

As a result, the most desirable state for Chainlink if to reduce inflation down to zero while making its node operators profitable and keep revenue going up. This would result in a profit surplus that could be passed down to token holders. As Chainlink launches more and more services, expands across more and more chains, and reaches more and more users, its revenue will continue to grow. This is what will allow node subsidies to taper down towards zero.

The launch of Staking 2.0 serves as an invaluable indicator for determining the inflection point and anticipating when it will be achieved. Currently, with Staking v0.1, stakers earn an annualized effective reward rate of 4.75%, primarily for securing the ETH/USD price feed. However, this yield originates from inflation, suggesting that we are still some distance away from the inflection point. Nevertheless, subsequent versions of staking will continue to enhance security, encompassing all price feeds and additional services such as VRF, Proof of Reserves, and CCIP.

As Chainlink Staking evolves over time to support a greater scope of oracle services, a portion of the fees from this proposal are planned to be sent directly to stakers as user fee rewards for increasing the cryptoeconomic security of Chainlink services used by GMX.

— Chainlink (@chainlink) April 25, 2023

The Chainlink BUILD initiative, featuring over 40 projects, is another critical component in reaching this milestone. Think of it as the blockchain technology equivalent of YCombinator, nurturing new projects to bootstrap their decentralized applications (dApps) using Chainlink’s technology and expertise. In return, these projects allocate a portion of their token supply, typically ranging from 3% to 7%. Consequently, $LINK stakers not only receive compensation in $LINK but also benefit from token airdrops from partner projects, further enhancing the value proposition.

1. Estimate Chainlink’s potential future revenue

As a B2B service provider, Chainlink can capture a portion of its customers’ revenue through a take rate. The take rate is the percentage of a customer’s revenue that a service provider charges.

For a ballpark figure, we can estimate Chainlink’s potential future revenue by assuming a similar take rate to services in Web2, such as Stripe (2.9%), Visa (2.29%), Paypal (3.49%) or Mastercard (2.24%). This gives us a range of potential take rates for Chainlink of 2.5% to 3.5%.

Additionally, one could expect the take rate to increase in the future, as Chainlink expands its product offerings and upsells to its existing customer base. This implies that as Chainlink’s product portfolio grows and more services are adopted by customers, the take rate could be higher than the initial 2.5% conservative estimate.

For example, if Chainlink’s total customer revenue in 2024 is $10 billion, then its potential revenue would be between $250 million and $350 million.

2. Consider the role of staking

In the future, $LINK token holders will be able to stake their tokens and earn a share of profits. The amount of profit that a staker earns will depend on the amount of tokens staked and the amount of revenue generated by Chainlink.

We can estimate the staker’s profit by subtracting the supply-side costs from Chainlink’s revenue. The supply side costs are the costs incurred by Chainlink to provide its services, such as the cost of operating nodes and paying node operators.

Staker’s profit = Chainlink Revenue – Supply Side costs

For example, if Chainlink’s total revenue in 2024 is $10 billion and its supply-side costs are $9.5B, then the staker’s profit would be $500M.

3. Apply a valuation multiple to the projected cash flow

To estimate the potential future value of $LINK, we can apply a multiple to the projected staker cash flow. The multiple is a factor that reflects the risk and growth potential of the investment.

A higher multiple indicates a higher valuation for the token, while a lower multiple indicates a lower valuation.

For example, if we apply a multiple of 10 to the projected staker cash flow of $500 million, then the potential future value of $LINK would be $5 billion.

4. Acknowledge the speculative nature of the model

All things considered, such a model would rely on estimating revenue through a take rate, factoring in potential growth in the take rate, considering staking-related profits, and applying a multiple to project future token value.

For this to be effective, it is important to acknowledge the speculative nature of the model and consider a range of sensitivity analyses to account for different assumptions and scenarios. For example, we could vary the take rate, the staker’s profit, and the multiple.

As a result, $LINK derives its value from its utility within the Chainlink ecosystem and the broader blockchain ecosystem. Unlike traditional financial assets, the value of the $LINK token is not solely based on ownership but is intricately tied to its role and function within the network.

It is worth noting that, even if Chainlink does not achieve a state of profitability and share revenue with stakers yet, it still benefits $LINK token holders, since nodes are getting closer to a state of profitability without excess dependence on token subsidies. Over time this will bring down the inflation rate as well as reduce the overall selling pressure.

To conclude, forecasting long-term metrics in terms of network fees, active users, protocol integrations, and chain deployments… is undeniably challenging due to the fast pace of the industry. The dynamic nature of use cases, evolving fee structures, shifting valuation methodologies, and the ever-present obsolescence risk all contribute to this complexity.

Finally, as with any other token, the ability to adapt and refine assumptions as the ecosystem evolves will be paramount for making informed investment decisions.

Revelo Intel has never had a commercial relationship with Chainlink and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.